Nexus between Housing Price and Magnitude of Pollution: Evidence from the Panel of Some High- and-Low Polluting Cities of the World

Abstract

:1. Introduction

2. Theoretical Background behind Pollution and Housing Price

3. Brief Literature Review

4. Data and Methodology

4.1. Test for the Panel Unit Roots

4.2. Panel Cointegration Test

4.3. Vector Error Correction Mechanism (VECM)

5. Empirical Results and Discussion

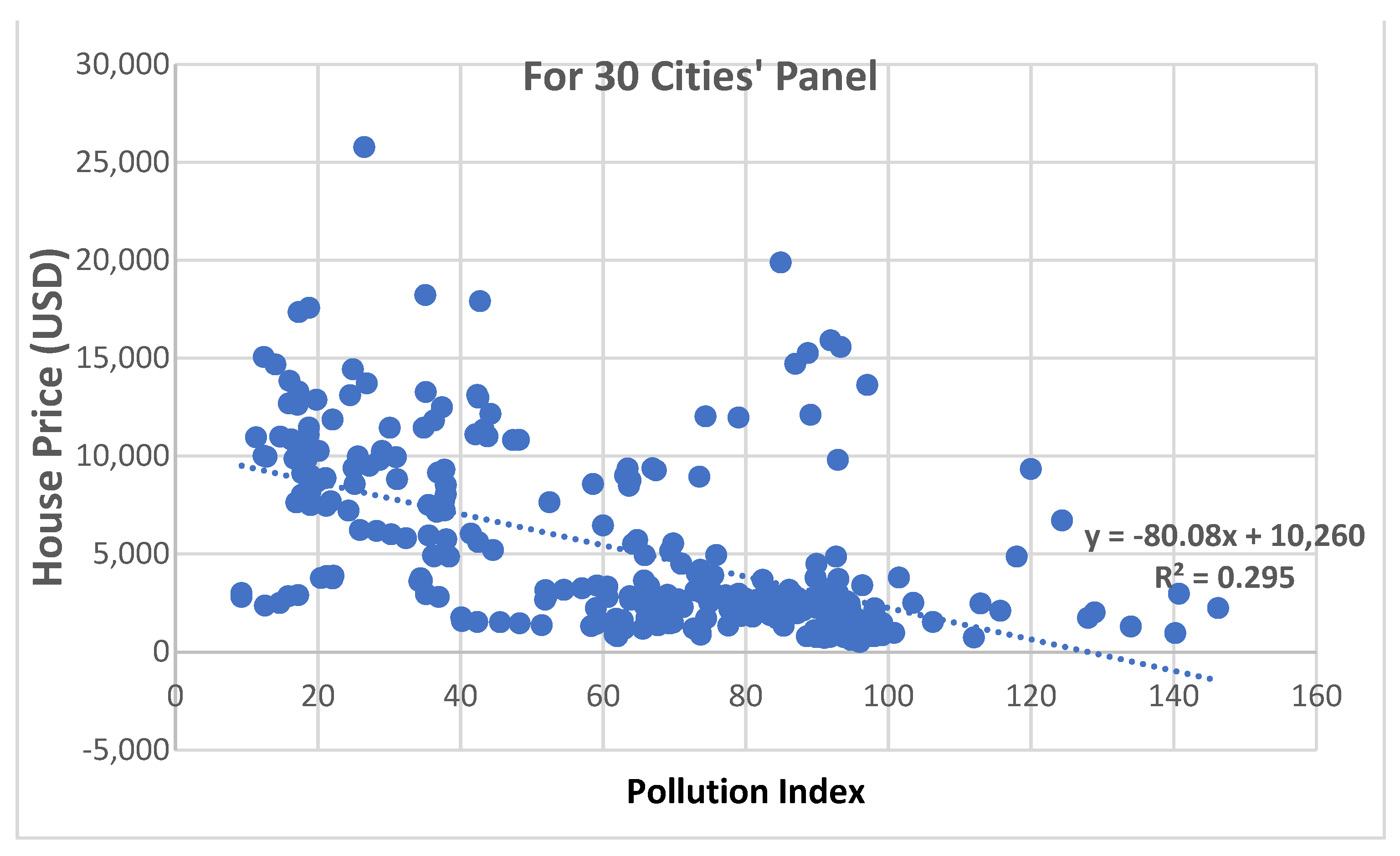

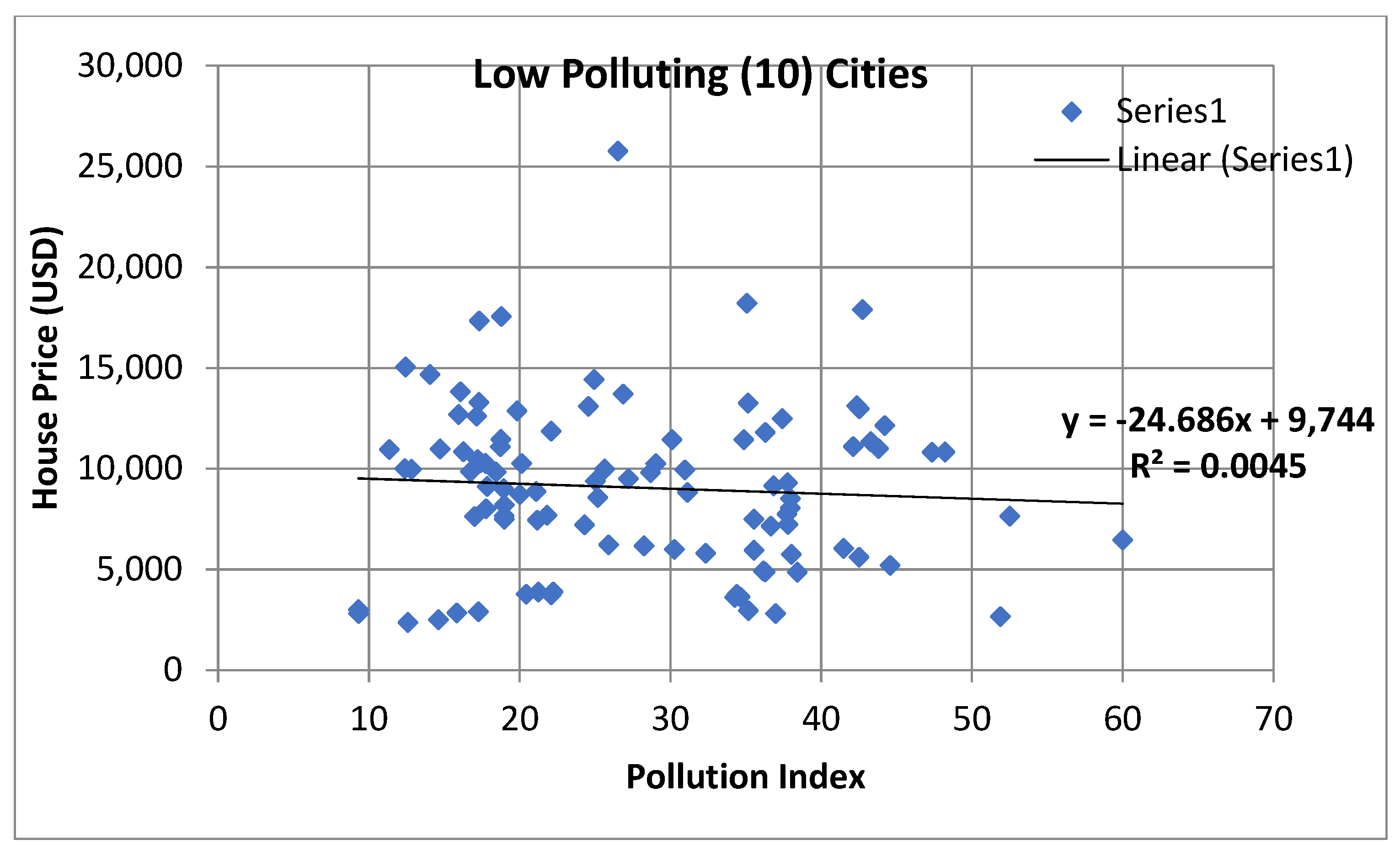

5.1. Graphical Views

5.2. Average Values of the Indicators and Their Degrees of Associations

5.3. Results of Panel Unit Root Test

5.4. Results of Panel Cointegration Test

5.5. VECM Test Results

6. Conclusions

6.1. Summary of Results

6.2. Policy Recommendations

6.3. Limitations of the Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2014: Synthesis Report Summary for Policymakers. 2014. Available online: https://www.ipcc.ch/site/a-ssets/uploads/2018/06/-AR5_SYR_FINAL_SPM.pdf (accessed on 3 July 2022).

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Brunekreef, B.; Holgate, S.T. Air pollution and health. Lancet 2002, 360, 1233–1242. [Google Scholar] [CrossRef]

- Heyes, A.; Zhu, M. Air pollution as a cause of sleeplessness: Social media evidence from a panel of Chinese cities. J. Environ. Econ. Manag. 2019, 98, 102247. [Google Scholar] [CrossRef]

- Zhang, H.; Chen, J.; Wang, Z. Spatial heterogeneity in spillover effect of air pollution on housing prices: Evidence from China. Cities 2021, 113, 103145. [Google Scholar] [CrossRef]

- Alam, S.; Fatima, A.; Butt, M.S. Sustainable development in Pakistan in the context of energy consumption demand and environmental degradation. J. Asian Econ. 2007, 18, 825–837. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Ozturk, I.; Lean, H.H. The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat. Hazards 2015, 79, 621–644. [Google Scholar] [CrossRef]

- Zafar, M.W.; Zaidi, S.A.H.; Sinha, A.; Gedikli, A.; Hou, F. The role of stock market and banking sector development, and renewable energy consumption in carbon emissions: Insights from G-7 and N-11 countries. Resour. Policy 2019, 62, 427–436. [Google Scholar] [CrossRef]

- Anwar, A.; Siddique, M.; Dogan, E.; Sharif, A. The moderating role of renewable and non-renewable energy in environment-income nexus for ASEAN countries: Evidence from Method of Moments Quantile Regression. Renew. Energy 2021, 164, 956–967. [Google Scholar] [CrossRef]

- Pao, H.T.; Tsai, C.M. Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 2011, 36, 685–693. [Google Scholar] [CrossRef]

- Baek, J. Do nuclear and renewable energy improve the environment? Empirical evidence from the United States. Ecol. Indic. 2016, 66, 352–356. [Google Scholar] [CrossRef]

- Bakhsh, K.; Rose, S.; Ali, M.F.; Ahmad, N.; Shahbaz, M. Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: New evidences from 3SLS. J. Environ. Manag. 2017, 196, 627–632. [Google Scholar] [CrossRef] [PubMed]

- Hanif, I. Impact of economic growth, nonrenewable and renewable energy consumption, and urbanization on carbon emissions in Sub-Saharan Africa. Environ. Sci. Pollut. Res. 2018, 25, 15057–15067. [Google Scholar] [CrossRef] [PubMed]

- Koengkan, M. The decline of environmental degradation by renewable energy consumption in the MERCOSUR countries: An approach with ARDL modeling. Environ. Syst. Decis. 2018, 38, 415–425. [Google Scholar] [CrossRef]

- Hu, H.; Jin, Q.; Kavan, P. A study of heavy metal pollution in China: Current status, pollution-control policies and countermeasures. Sustainability 2014, 6, 5820–5838. [Google Scholar] [CrossRef] [Green Version]

- BP. BP Statistical Review of World Energy. 2019. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-worldenergy.html (accessed on 2 July 2022).

- International Energy Agency. Global Energy & CO2 Status Report 2018. 2019. Available online: https://webstore.iea.org/global-energy-co2-status-report2018 (accessed on 2 July 2022).

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar]

- Dogan, E.; Inglesi-Lotz, R. The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: Evidence from European countries. Environ. Sci. Pollut. Res. 2020, 27, 12717–12724. [Google Scholar] [CrossRef]

- Halicioglu, F. An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 2009, 37, 1156–1164. [Google Scholar] [CrossRef] [Green Version]

- Andati, P.; Majiwa, E.; Ngigi, M.; Mbeche, R.; Ateka, J. Determinants of Adoption of Climate Smart Agricultural Technologies among Potato Farmers in Kenya: Does entrepreneurial orientation play a role? Sustain. Technol. Entrep. 2022, 1, 100017. [Google Scholar] [CrossRef]

- Shahbaz, M.; Tiwari, A.K.; Nasir, M. The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 2013, 61, 1452–1459. [Google Scholar] [CrossRef] [Green Version]

- Katircioglu, S.T. Testing the tourism-induced EKC hypothesis: The case of Singapore. Econ. Model 2014, 41, 383–391. [Google Scholar] [CrossRef]

- Apergis, N.; Ozturk, I. Testing environmental Kuznets curve hypothesis in Asian countries. Ecol. Indic. 2015, 52, 16–22. [Google Scholar] [CrossRef]

- Uzar, U.; Eyuboglu, K. The nexus between income inequality and CO2 emissions in Turkey. J. Clean. Prod. 2019, 227, 149–157. [Google Scholar] [CrossRef]

- Uzar, U.; Eyuboglu, K. Do natural resources heal the environment? Empirical evidence from Turkey. Air Qual. Atmos. Health 2021, 14, 37–46. [Google Scholar] [CrossRef]

- Eyuboglu, K.; Uzar, U. A new perspective to environmental degradation: The linkages between higher education and CO2 emissions. Environ. Sci. Pollut. Res. 2021, 28, 482–493. [Google Scholar] [CrossRef]

- Miah, M.D.; Masum, M.F.H.; Koike, M.; Akhter, S.; Muhammed, N. Environmental Kuznets curve: The case of Bangladesh for waste emission and suspended particulate matter. Environmentalist 2011, 31, 59–66. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, X.; Chen, X. Happiness in the air: How does a dirty sky affect mental health and subjective well-being? J. Environ. Econ. Manag. 2017, 85, 81–94. [Google Scholar] [CrossRef] [PubMed]

- Das, R.C.; Ivaldi, E. Is Pollution a Cost to Health? Theoretical and Empirical Inquiry for the World’s Leading Polluting Economies. Int. J. Environ. Res. Public Health 2021, 18, 6624. [Google Scholar] [CrossRef]

- Chay, K.Y.; Greenstone, M. Does air quality matter? Evidence from the housing market. J. Political Econ. 2005, 113, 376–424. [Google Scholar] [CrossRef] [Green Version]

- Arya, S.P. Air Pollution Meteorology and Dispersion; Oxford University Press: New York, NY, USA, 1999. [Google Scholar]

- Seigneur, C. Air Pollution: Concepts, Theory, and Applications; Cambridge University Press: Cambridge, UK, 2019. [Google Scholar]

- Chen, X.; Ye, J. When the wind blows: Spatial spillover effects of urban air pollution in China. J. Environ. Plan. Manag. 2019, 62, 1359–1376. [Google Scholar] [CrossRef]

- Lai, Z.; Liu, X.; Li, W.; Li, Y.; Zou, G.; Tu, M. Exploring the Spatial Heterogeneity of Residents’ Marginal Willingness to Pay for Clean Air in Shanghai. Front. Public Health 2021, 9, 791575. [Google Scholar] [CrossRef]

- Bayer, P.; Keohane, N.; Timmins, C. Migration and hedonic valuation: The case of air quality. J. Environ. Econ. Manag. 2009, 58, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Zhao, D.; Sing, T.F. Air pollution, economic spillovers, and urban growth in China. Ann. Reg. Sci. 2017, 58, 321–340. [Google Scholar] [CrossRef]

- Zheng, S.; Kahn, M.E.; Sun, W.; Luo, D. Incentives for China’s urban mayors to mitigate pollution externalities: The role of the central government and public environmentalism. Reg. Sci. Urban Econ. 2014, 47, 61–71. [Google Scholar] [CrossRef]

- Cui, X.; Fang, C.; Liu, H.; Liu, X. Assessing sustainability of urbanization by a coordinated development index for an Urbanization-Resources-Environment complex system: A case study of Jing-Jin-Ji region, China. Ecol. Indic. 2019, 96, 383–391. [Google Scholar] [CrossRef]

- Yu, Y.; Zhang, N.; Kim, J.D. Impact of urbanization on energy demand: An empirical study of the Yangtze River Economic Belt in China. Energy Policy 2020, 139, 111354. [Google Scholar] [CrossRef]

- Das, R.C.; Chatterjee, T.; Ivaldi, E. Sustainability of Urbanization, Non-Agricultural Output and Air Pollution in the World’s Top 20 Polluting Countries. Data 2021, 6, 65. [Google Scholar] [CrossRef]

- Xiaoyang, L.; Lu, Z.; Hou, Y.; Zhao, G.; Zhang, L. The coupling coordination degree between urbanization and air environment in the Beijing(Jing)-Tianjin(Jin)-Hebei(Ji) urban agglomeration. Ecol. Indic. 2022, 137, 108–787. [Google Scholar]

- Xie, Y.; Dai, H.; Dong, H.; Hanaoka, T.; Masui, T. Economic impacts from PM 2.5 pollution-related health effects in China: A provincial-level analysis. Environ. Sci. Technol. 2016, 50, 4836–4843. [Google Scholar] [CrossRef]

- Zheng, S.; Kahn, M.E. Understanding China’s urban pollution dynamics. J. Econ. Lit. 2013, 51, 731–772. [Google Scholar] [CrossRef] [Green Version]

- Zou, Y.H. Air pollution and housing prices across Chinese cities. J. Urban Plan. Dev. 2019, 145, 04019012. [Google Scholar] [CrossRef]

- Conceiçao, P. Beyond Income, beyond Averages, beyond Today: Inequalities in Human Development in the 21st Century; United Nations Development Programme (UNDP): New York, NY, USA, 2019. [Google Scholar]

- United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP). Report—Fourth South Asia Forum on the Sustainable Development Goals; UNESCAP: Bangkok, Thailand, 2021; Available online: https://www.unescap.org/kp/2021/report-fourth-south-asia-forum-sustainable-development-goals (accessed on 5 June 2022).

- Chopra, M.; Singh, S.K.; Gupta, A.; Aggarwal, K.; Gupta, B.B.; Colace, F. Analysis & prognosis of sustainable development goals using big data-based approach during COVID-19 pandemic. Sustain. Technol. Entrep. 2022, 1, 100012. [Google Scholar] [CrossRef]

- Jacobson, M.Z. Atmospheric Pollution: History, Science, and Regulation; Cambridge University Press: New York, NY, USA, 2002. [Google Scholar]

- Smith, V.K.; Huang, J.C. Can markets value air-quality—A meta analysis of hedonic property value models. J. Political Econ. 1995, 103, 209–227. [Google Scholar] [CrossRef]

- Zabel, J.E.; Kiel, K.A. Estimating the demand for air quality in four US cities. Land Econ. 2000, 76, 174–194. [Google Scholar] [CrossRef]

- Yusuf, A.A.; Resosudarmo, B.P. Does clean air matter in developing countries’ megacities? A hedonic price analysis of the Jakarta housing market, Indonesia. Ecol. Econ. 2009, 68, 1398–1407. [Google Scholar] [CrossRef]

- Chen, J.; Hao, Q.; Yoon, C. Measuring the welfare cost of air pollution in Shanghai: Evidence from the housing market. J. Environ. Plan Manag. 2018, 61, 1744–1757. [Google Scholar] [CrossRef]

- Carriazo, F.; Gomez-Mahecha, J.A. The demand for air quality: Evidence from the housing market in Bogota, Colombia. Environ. Dev. Econ. 2018, 23, 121–138. [Google Scholar] [CrossRef] [Green Version]

- Chen, S.Y.; Jin, H. Pricing for the clean air: Evidence from Chinese housing market. J. Clean. Prod. 2019, 206, 297–306. [Google Scholar] [CrossRef]

- Dong, J.; Zeng, X.; Mou, X.; Li, X. Pay for clean air or not? The impact of air quality on China’s real estate price. Syst. Eng. Theor. Pract. 2020, 40, 1613–1626. [Google Scholar] [CrossRef]

- Le Boennec, R.; Salladarre, F. The impact of air pollution and noise on the real estate market. The case of the 2013 European Green Capital: Nantes, France. Ecol. Econ. 2017, 138, 82–89. [Google Scholar] [CrossRef] [Green Version]

- Kaklauskas, A.; Zavadskas, E.K.; Radzeviciene, A.; Ubarte, I.; Podviezko, A.; Podvezko, V.; Kuzminsk, A.; Banaitis, A.; Binkyte, A.; Bucinskas, V. Quality of city life multiple criteria analysis. Cities 2018, 72, 82–93. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F. Unit Root Tests in Panel Data: New Results; Discussion Paper; University of California: San Diego, CA, USA, 1993. [Google Scholar]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for Unit Roots in Heterogeneous Panels. Cambridge Working Papers in Economics, Cambridge, UK. Mimeo 1997. Available online: https://econpapers.repec.org/RePEc:cam:camdae:9526 (accessed on 5 June 2022).

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for Unit Roots in Heterogeneous Panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A Comparative Study of Unit Root Tests with Panel Data and A New Simple Test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Pedroni, P. Critical Values for Cointegration Tests in Heterogeneous Panels with Multiple Regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Pedroni, P. Panel Cointegration: Asymptotic and Finite Sample Properties of Pooled Time Series Tests with an Application to the PPP Hypothesis. Econom. Theory 2004, 20, 597–625. [Google Scholar] [CrossRef] [Green Version]

- Kao, C. Spurious Regression and Residual-Based Tests for Cointegration in Panel Data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W. Co-integration and error correction: Representation, estimation and testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Control. 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Fisher, R.A. Statistical Methods for Research Workers; Oliver and Boyd: Edinburgh, UK, 1932. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef] [Green Version]

- Esmaeilifar, R.; Iranmanesh, M.; Shafiei, M.W.M.; Hyun, S.S. Effects of low carbon waste practices on job satisfaction of site managers through job stress. Rev. Manag. Sci. 2020, 14, 115–136. [Google Scholar] [CrossRef]

- Tipu, S.A.A. Organizational change for environmental, social, and financial sustainability: A systematic literature review. Rev. Manag. Sci. 2021, 16, 1697–1742. [Google Scholar] [CrossRef]

| Mean for All Countries (30) | Mean for Highly Polluting (20) | Mean for Very Low Polluting (10) | ||||

|---|---|---|---|---|---|---|

| Pollution Index | House Price (USD) | Pollution Index | House Price(USD) | Pollution Index | House Price(USD) | |

| 64 | 5134 | 82.08 | 3172 | 27.84 | 9056 | |

| Correlation Coefficient (t values) | −0.54 (−11.16) | −0.025 (−0.435) | −0.067 (−1.16) | |||

| Variable | Breusch-Pagan LM | Pesaran Scaled LM | Pesaran LM | |||

|---|---|---|---|---|---|---|

| Test Stat. | Prob. | Test Stat. | Prob. | Test Stat. | Prob. | |

| 1487.100 | 0.00 | 04.85693 | 0.2453 | −0.85364 | 0.3125 | |

| Methods | Null Hypotheses | Test Statistics by Intercepts (Prob.) All Countries (30) | Test Statistics by Intercepts (Prob.) Highly Polluting (20) | Test Statistics by Intercepts (Prob.) Very Low Polluting (10) | |||

|---|---|---|---|---|---|---|---|

| Pollution | House Price | Pollution | House Price | Pollution | House Price | ||

| LLC | No common unit root | −38.23 (0.00) | −15.64 (0.00) | −34.55 (0.00) | −13.76 (0.00) | −13.4 (0.00) | −7.30 (0.00) |

| IPS | No individual unit roots | −21.46 (0.00) | −7.93 (0.00) | 21.27 (0.00) | −6.7 (0.00) | −7.09 (0.00) | −4.19 (0.00) |

| MW-ADF-Fisher Chi-square | No individual unit roots | 342.86 (0.00) | 189.22 (0.00) | 254.16 (0.00) | 130.15 (0.00) | 88.13 (0.00) | 58.80 (0.00) |

| MW-PP-Fisher Chi-square | No individual unit roots | 468.76 (0.00) | 230.85 (0.00) | 352.26 (0.00) | 163.12 (0.00) | 116.2 (0.00) | 67.66 (0.00) |

| Hypotheses→/Test Criteria↓ | Null Hypothesis: No Cointegration | Statistic (Prob) | Weighted Statistic (Prob) | |

|---|---|---|---|---|

| Having no deterministic trend | Alternative hypothesis: Having common AR coefficients (i.e., within-dimension) | Panel v-Stat | −0.09 (0.53) {−0.44 (0.67)} [0.04 (0.48)] | −0.57 (0.71) {−0.72 (0.76)} [0.09 (0.46)] |

| Panel rho-Stat | 0.84 (0.80) {2.14 (0.98)} [0.08 (0.53)] | 0.97 (0.83) {0.57 (0.71)} [0.93 (0.82)] | ||

| Panel PP-Stat | −1.10 (0.13) 2.44 (0.99)} [1.65 (0.05)] * | −1.02 (0.15) {−1.24 (0.10)} [0.17 (0.57)] | ||

| Panel ADF-Stat | −3.37 (0.00) * {0.60 (0.72)} [−3.26 (0.00)] * | −3.44 (0.00) * {−3.37 (0.00)} * [−1.04 (0.15)] | ||

| Alternative hypothesis: Having individual AR coefficients (i.e., between-dimension) | Group rho-Stat | 2.89 (0.99) {2.21 (0.98)} [1.86 (0.96)] | - | |

| Group PP-Stat | −1.2 (0.10) {−1.59 (0.05)} * [0.11 (0.54)] | - | ||

| Group ADF-Stat | −2.84 (0.00) * {−1.91 (0.02)} * [−2.21 (0.01)] * | - | ||

| Having both the deterministic intercept and trend | Alternative hypothesis: Having common AR coefficients (i.e., within-dimension) | Panel v-Stat | −1.02 (0.84) {3.21 (0.00)} * [−1.16 (0.87)] | −2.75 (0.99) {−2.88 (0.99)} [−0.26 (0.60)] |

| Panel rho-Stat | 1.57 (0.94) {1.16 (0.87)} [0.92 (0.82)] | 3.27 (0.99) {2.96 (0.99)} [1.28 (0.89)] | ||

| Panel PP-Stat | −6.49 (0.00) * {−3.01 (0.00)} * [−4.18 (0.00)] * | −6.15 (0.00) * {−4.69 (0.00)} * [−4.25 (0.00)] * | ||

| Panel ADF-Stat | −6.97 (0.00) * {−1.69 (0.04)} * [−4.72 (0.00)] * | −8.46 (0.00) * {−7.19 (0.00)} * [−4.29 (0.00)] * | ||

| Alternative hypothesis: Having individual AR coefficients (i.e., between-dimension) | Group rho-Stat | 4.49 (0.98) {3.89 (0.99)} [2.28 (0.98)] | - | |

| Group PP-Stat | −8.47 (0.00) * {−7.53 (0.00)} * [−4.02 (0.00)] * | - | ||

| Group ADF-Stat | −6.67 (0.00) * {−5.20 (0.00)} * [−4.21 (0.00)] * | - | ||

| Having no deterministic intercept and trend | Alternative hypothesis: Having common AR coefficients (i.e., within-dimension) | Panel v-Stat | 0.42 (0.33) {−0.12 (0.55)} [0.38 (0.34)] | −1.42 (0.93) {−1.57 (0.94)} [−0.13 (0.55)] |

| Panel rho-Stat | −5.80 (0.00) * {−5.91 (0.00)} * [−2.29 (0.00)] * | −5.68 (0.00) * {−4.89 (0.00)} [−2.65 (0.00)] * | ||

| Panel PP-Stat | −8.56 (0.00) * {−7.75 (0.00)} * [−4.70 (0.00)] * | −8.81 (0.00) * {−7.68 (0.00)} * [−3.93 (0.00)] * | ||

| Panel ADF-Stat | −2.99 (0.00) * {2.73 (0.99)} [−2.64 (0.00)] * | −3.39 (0.00) * {−2.81 (0.00)} * [−1.91 (0.02)] * | ||

| Alternative hypothesis: Having individual AR coefficients (i.e., between-dimension) | Group rho-Stat | −0.72 (0.23) * {−0.87 (0.18)} [−0.01 (0.48)] | - | |

| Group PP-Stat | −8.46 (0.00) * {−7.61 (0.00)} * [−3.88 (0.00)] * | - | ||

| Group ADF-Stat | −3.81 (0.00) * {−2.61 (0.00)} * [−2.96 (0.00)] * | - | ||

| Null Hypothesis: Having No Cointegration | All Countries (30) | Highly Polluting (20) | Low Polluting (10) |

|---|---|---|---|

| t-Stat (Prob.) | t-Stat (Prob.) | t-Stat (Prob.) | |

| ADF | −0.99 (0.16) | 1.13 (0.12) | −1.40 (0.08) |

| Hypothesized No. of CE(s) | All Countries (30) | Highly Polluting (20) | Low Polluting (10) |

|---|---|---|---|

| Fisher Stat. (Prob.) (from trace test) | Fisher Stat. (Prob.) (from trace test) | Fisher Stat. (Prob.) (from trace test) | |

| None | 361.6 (0.00) | 241.0 (0.00) | 120.6 (0.00) |

| At most 1 | 188.6 (0.00) | 113.2 (0.00) | 78.46 (0.00) |

| Dependent Variables | EC Terms (Prob.) | Whether Errors Corrected | Remarks | ||||

|---|---|---|---|---|---|---|---|

| Total (30) | High Polluting (20) | Low Polluting (10) | Total (30) | High Polluting (20) | Low Polluting (10) | ||

| D(Pollution) | −0.054 (0.03) | −0.48 (0.00) | 0.002 (0.00) | Yes | Yes | No | Long run causality from House Price to Pollution for Total Panel and the panel of high polluting cities but not for the low polluting cities |

| D(House Price) | 86.32 (0.00) | −0.002 (0.00) | −1.25 (0.00) | No | Yes | Yes | Long run causality from Pollution to House Price for the panels of high polluting and low polluting cities but not for the Total Panel |

| Dependent Variables | Chi square (Prob.) | Comments | ||

|---|---|---|---|---|

| Total (30) | High Polluting (20) | Low Polluting (10) | ||

| D(Pollution) | 6.354 (0.04) | 10.16 (0.03) | 24.02 (0.00) | House Price → Pollution for all three panels of cities |

| D(House Price) | 25.11 (0.00) | 19.17 (0.00) | 17.04 (0.00) | Pollution → House Price for all three panels of cities |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Das, R.C.; Chatterjee, T.; Ivaldi, E. Nexus between Housing Price and Magnitude of Pollution: Evidence from the Panel of Some High- and-Low Polluting Cities of the World. Sustainability 2022, 14, 9283. https://doi.org/10.3390/su14159283

Das RC, Chatterjee T, Ivaldi E. Nexus between Housing Price and Magnitude of Pollution: Evidence from the Panel of Some High- and-Low Polluting Cities of the World. Sustainability. 2022; 14(15):9283. https://doi.org/10.3390/su14159283

Chicago/Turabian StyleDas, Ramesh Chandra, Tonmoy Chatterjee, and Enrico Ivaldi. 2022. "Nexus between Housing Price and Magnitude of Pollution: Evidence from the Panel of Some High- and-Low Polluting Cities of the World" Sustainability 14, no. 15: 9283. https://doi.org/10.3390/su14159283

APA StyleDas, R. C., Chatterjee, T., & Ivaldi, E. (2022). Nexus between Housing Price and Magnitude of Pollution: Evidence from the Panel of Some High- and-Low Polluting Cities of the World. Sustainability, 14(15), 9283. https://doi.org/10.3390/su14159283