The Importance of Selected Aspects of a Company’s Reputation for Individual Stock Market Investors—Evidence from Polish Capital Market

Abstract

1. Introduction

- Q1

- How important is corporate reputation for investors?

- Q2

- Which aspects of corporate reputation—informational, financial and growth or social—are the most important for investors?

- Q3

- Which determinants of the informational aspect of corporate reputation are the most important for investors?

- Q4

- Which determinants of the financial and growth aspect of corporate reputation are the most important for investors?

- Q5

- Which determinants of the social aspect of corporate reputation are the most important for investors?

- Q6

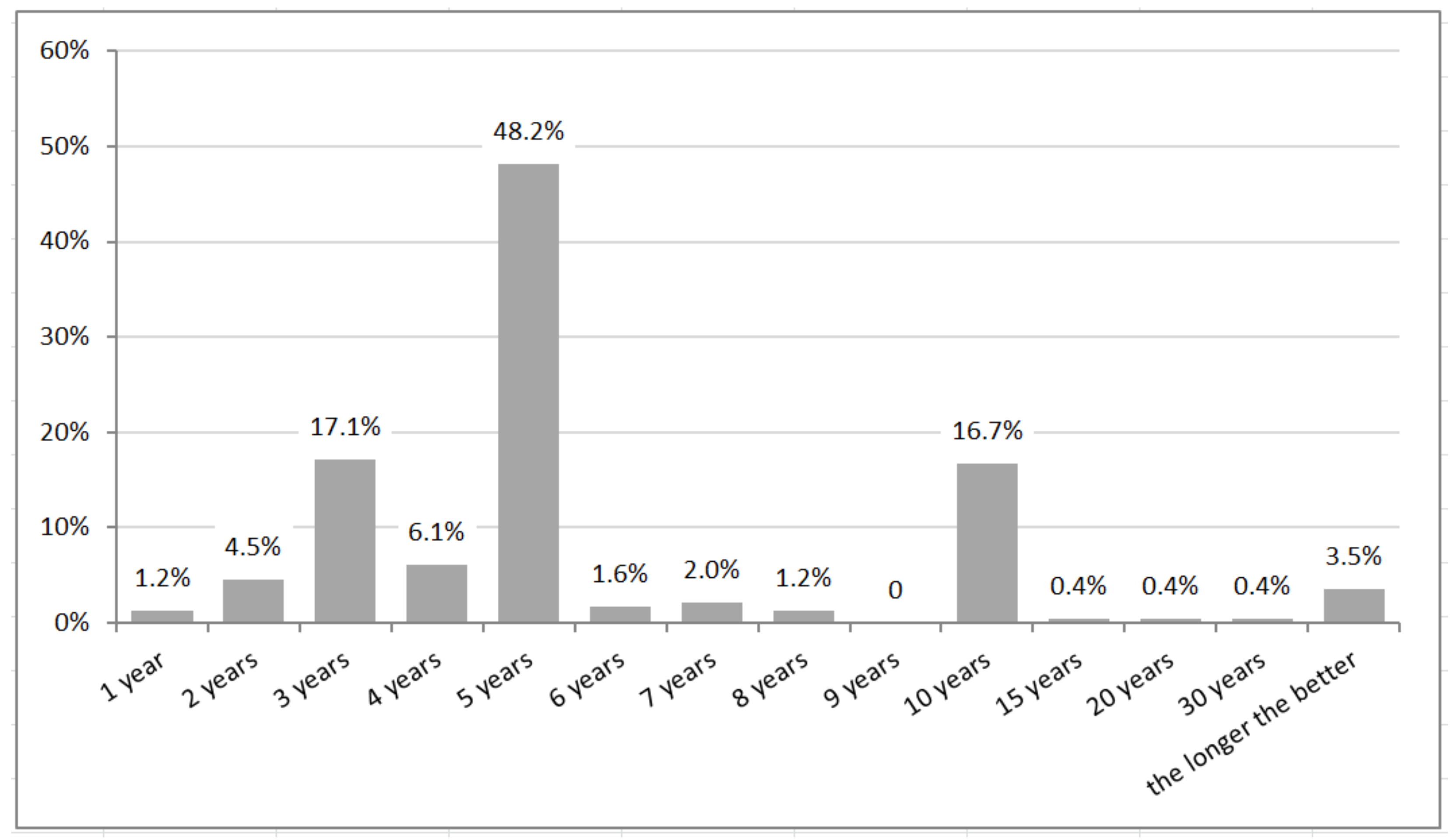

- What time horizon, according to individual investors, should be taken into account when assessing corporate reputation?

2. Literature Review

2.1. Reputation as a Multidimensional Construct

- Competence items: (1) [The company] is a top competitor in its market, (2) As far as I know, [the company] is respected worldwide, and (3) I believe that [the company] performs at a premium level;

- Likeability items: (1) [The company] is a company that I can better identify with than with other companies, (2) [The company] is a company that I would miss more than other companies if it did not exist anymore, and (3) I regard [the company] as a likeable company.

2.2. Different Dimensions of Reputation in the Context of Investor Decision Motives and Behavior Reputation as a Multidimensional Construct

- The company’s involvement in CSR (Corporate Social Responsibility) activities;

- The manner and style of reporting information;

- The opinions of other stakeholder groups and the company’s approach to other stakeholders;

- The transparency and communication.

3. Materials and Methods

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Dolphin, R.R. Corporate reputation—A value creating strategy. Corp. Gov. 2004, 4, 77–92. [Google Scholar] [CrossRef]

- Adeosun, L.P.K.; Ganiyu, R.A. Corporate reputation as a strategic asset. Int. J. Bus. Soc. Sci. 2013, 4, 220–225. [Google Scholar]

- Hall, R. A framework linking intangible resources and capabilities to sustainable competitive advantage. Strateg. Manag. J. 1993, 14, 607–618. [Google Scholar] [CrossRef]

- Brønn, C.; Brønn, P.S. A systems approach to understanding how reputation contributes to competitive advantage. Corp. Reput. Rev. 2015, 18, 69–86. [Google Scholar] [CrossRef]

- Mahon, J.F.; Wartick, S.L. Dealing with stakeholders: How reputation, credibility and framing influence the game. Corp. Reput. Rev. 2003, 6, 19–35. [Google Scholar] [CrossRef]

- Puncheva, P. The Role of Corporate Reputation in the Stakeholder Decision-Making Process. Bus. Soc. 2007, 47, 272–290. [Google Scholar] [CrossRef]

- Helm, R.; Mark, A. Implications from cue utilisation theory and signalling theory for firm reputation and the marketing of new products. Int. J. Prod. Dev. 2007, 4, 396–411. [Google Scholar] [CrossRef]

- Hetze, K. Effects on the (CSR) Reputation: CSR Reporting Discussed in the Light of Signalling and Stakeholder Perception Theories. Corp. Reput. Rev. 2016, 19, 281–296. [Google Scholar] [CrossRef]

- Roberts, P.W.; Dowling, G.R. Corporate reputation and sustained superior financial performance. Strateg. Manag. J. 2002, 23, 1077–1093. [Google Scholar] [CrossRef]

- Vig, S.; Dumičićć, K.; Klopotan, I. The Impact of Reputation on Corporate Financial Performance: Median Regression Approach. Bus. Syst. Res. 2017, 8, 40–58. [Google Scholar] [CrossRef]

- Abraham, S.E.; Friedman, B.A.; Khan, R.H.; Skolnik, R.J. Is publication of the reputation quotient (RQ) sufficient to move stock prices? Corp. Reput. Rev. 2009, 11, 308–319. [Google Scholar] [CrossRef]

- Tischer, S.; Hildebrandt, L. Linking corporate reputation and shareholder value using the publication of reputation rankings. J. Bus. Res. 2014, 67, 1007–1017. [Google Scholar] [CrossRef]

- Dowling, G. How good corporate reputations create corporate value. Corp. Reput. Rev. 2006, 9, 134–143. [Google Scholar] [CrossRef]

- Schwaiger, M.; Raithel, S. Reputation und Unternehmenserfolg. Manag. Rev. Q. 2014, 64, 225–259. [Google Scholar] [CrossRef]

- Shu, H.; Wong, S.M.L. When a sinner does a good deed: The path-dependence of reputation repair. J. Manag. Stud. 2018, 55, 770–808. [Google Scholar] [CrossRef]

- Gao, C.; Zuzul, T.; Jones, G.; Khanna, T. Overcoming institutional voids: A reputation-based view of long-run survival. Strateg. Manag. J. 2017, 38, 2147–2167. [Google Scholar] [CrossRef]

- Derevianko, O. Reputation stability vs. anti-crisis sustainability: Under what circumstances will innovations, media activities and CSR be in higher demand? Oeconomica Copernic. 2019, 10, 511–536. [Google Scholar] [CrossRef]

- Baumgartner, K.T.; Ernst, C.A.; Fischer, T.M. How Corporate Reputation Disclosures Affect Stakeholders’ Behavioral Intentions: Mediating Mechanisms of Perceived Organizational Performance and Corporate Reputation. J. Bus. Ethics 2020, 175, 361–389. [Google Scholar] [CrossRef]

- Vohra, S.; Davies, G. Investor regret, share performance and the role of corporate agreeableness. J. Bus. Res. 2020, 110, 306–315. [Google Scholar] [CrossRef]

- The State of Corporate Reputation in 2020: Everything Matters Now. 2020. Available online: https://www.webershandwick.com/wp-content/uploads/2020/01/The-State-of-Corporate-Reputation-in-2020_executive-summary_FINAL.pdf (accessed on 15 October 2021).

- Helm, S.V. The role of corporate reputation in determining investor satisfaction and loyalty. Corp. Reput. Rev. 2007, 10, 23–37. [Google Scholar] [CrossRef]

- Aspara, J.; Tikkanen, H. Corporate marketing in the stock market: The impact of company identification on individuals’ investment behaviour. Eur. J. Mark. 2011, 45, 1446–1469. [Google Scholar] [CrossRef]

- Aaron, J.R.; McMillan, A.; Cline, B.N. Investor Reaction to Firm Environmental Management Reputation. Corp. Reput. Rev. 2012, 15, 304–318. [Google Scholar] [CrossRef]

- Naveed, M.; Ali, S.; Iqbal, K.; Sohail, M.K. Role of financial and non-financial information in determining individual investor investment decision: A signalling perspective. South Asian J. Bus. Stud. 2020, 9, 261–278. [Google Scholar] [CrossRef]

- Jao, R.; Hamzah, D.; Laba, A.R.; Mediaty, M. Investor Decision in Estimating the Effect of Earning Persistence, Financial Leverage, Foreign Ownership toward Company Reputation and Company Value. Int. J. Financ. Res. 2020, 11, 453–461. [Google Scholar] [CrossRef]

- Harrington, J. Investor Response to Crises ‘Led by Reputation More than Numbers’. PR Week, PR Week Global. 21 January 2019. Available online: www.prweek.com/article/1523418/investor-response-crises-led-reputation-numbers (accessed on 10 December 2021).

- Blajer-Gołębiewska, A. Do stock exchange indices based on reputational factors matter? Int. J. Acad. Res. 2014, 6, 231–237. [Google Scholar] [CrossRef]

- Fasaei, H.; Tempelaar, M.P.; Jansen, J.J.P. Firm reputation and investment decisions: The contingency role of securities analysts’ recommendations. Long Range Plan. 2018, 51, 680–692. [Google Scholar] [CrossRef]

- Barnett, M.L.; Jermier, J.M.; Lafferty, B. Corporate Reputation: The Definitional Landscape. Corp. Reput. Rev. 2006, 9, 26–38. [Google Scholar] [CrossRef]

- Worcester, R. Reflections on corporate reputations. Manag. Decis. 2009, 47, 573–589. [Google Scholar] [CrossRef]

- Rindova, W.; Williamson, I.; Petkova, A. Reputation as an Intangible Asset: Reflections on Theory and Methods in Two Empirical Studies of Business School Reputations. J. Manag. 2010, 36, 610–619. [Google Scholar] [CrossRef]

- Podnar, K.; Golob, U. The quest for the corporate reputation definition: Lessons from the interconnection model of identity, image, and reputation. Corp. Reput. Rev. 2017, 20, 186–192. [Google Scholar] [CrossRef]

- Veh, A.; Göbel, M.; Vogel, R. Corporate reputation in management research: A review of the literature and assessment of the concept. Bus. Res. 2019, 12, 315–353. [Google Scholar] [CrossRef]

- Gardberg, N.A. Corporate reputation: Fashion, fad, or phenomenon? Corp. Reput. Rev. 2017, 20, 177–180. [Google Scholar] [CrossRef]

- Money, K.; Saraeva, A.; Garnelo-Gomez, I.; Pain, S.; Hillenbrand, C. Corporate reputation past and future: A review and integration of existing literature and a framework for future research. Corp. Reput. Rev. 2017, 20, 193–211. [Google Scholar] [CrossRef]

- Wiedmann, K.-P. Future research directions based on a critical assessment of reputation management in practice: A German perspective. Corp. Reput. Rev. 2017, 20, 217–223. [Google Scholar] [CrossRef]

- Szwajca, D. Relationship between corporate image and corporate reputation in Polish banking sector. Oeconomia Copernic. 2018, 9, 493–509. [Google Scholar] [CrossRef]

- Alzola, M. Even when no one is watching: The moral psychology of corporate reputation. Bus. Soc. 2019, 58, 1267–1301. [Google Scholar] [CrossRef]

- Fombrun, C. Reputation: Realizing Value from the Corporate Image; Harvard Business School Press: Boston, MA, USA, 1996. [Google Scholar]

- Zyglidopoulos, S.C. The impact of downsizing on corporate reputation. Br. J. Manag. 2005, 16, 253–259. [Google Scholar] [CrossRef]

- Helm, S.V. One reputation or many? Comparing stakeholders’ perceptions of corporate reputation. Corp. Commun. Int. J. 2007, 12, 238–254. [Google Scholar] [CrossRef]

- Carmeli, A.; Gilat, G.; Wiesberg, J. Perceived external prestige, organizational identification and affective commitment: A stakeholder approach. Corp. Reput. Rev. 2006, 9, 92–104. [Google Scholar] [CrossRef]

- Carter, S.M. The interaction of top management group, stakeholder, and situational factors on certain corporate reputation management activities. J. Manag. Stud. 2006, 43, 1145–1176. [Google Scholar] [CrossRef]

- Svobodova, K.; Vojar, J.; Yellishetty, M.; Janeckova-Molnarova, K. A multi-component approach to conceptualizing the reputation of the mining industry from a stakeholder perspective. Resour. Policy 2020, 68, 101724. [Google Scholar] [CrossRef]

- Schwaiger, M. Components and parameters of corporate reputation—An empirical study. Schmalenbach Bus. Rev. 2004, 56, 46–71. [Google Scholar] [CrossRef]

- Raithel, S.; Schwaiger, M. The effects of corporate reputation perceptions of the general public on shareholder value. Strateg. Manag. J. 2015, 36, 945–956. [Google Scholar] [CrossRef]

- Lange, D.; Lee, P.; Dai, Y. Organizational Reputation: A Review. J. Manag. 2011, 37, 153–184. [Google Scholar] [CrossRef]

- Mishina, Y.; Block, E.S.; Mannor, M.J. The path dependence of organizational reputation: How social judgment influences assessments of capability and character. Strateg. Manag. J. 2011, 34, 459–477. [Google Scholar] [CrossRef]

- Andersen, J.V. Investment Decision Making in Finance. In Encyclopedia of Complexity and Systems Science; Meyers, R.A., Ed.; Springer: New York, NY, USA, 2009; pp. 15–30. [Google Scholar]

- Blajer-Gołębiewska, A. Reputacja Przedsiębiorstwa a Zachowania Inwestorów Giełdowych. Podejście Eksperymentalne; Uniwersytetu Gdańskiego: Gdańsk, Poland, 2019; p. 7. [Google Scholar]

- Clark-Murphy, M.; Soutar, G.N. What individual investors value: Some Australian evidence. J. Econ. Psychol. 2004, 25, 539–555. [Google Scholar] [CrossRef]

- Hon-Snir, S.; Kudryavtsev, A.; Cohen, G. Stock Market Investors: Who Is More Rational, and Who Relies on Intuition? Int. J. Econ. Financ. 2012, 4, 56–72. [Google Scholar] [CrossRef]

- Bennet, E.; Selvam, M.; Ebenezer, E.; Karpagam, V.; Vanitha, S. Investor’s attitude on stock selection decision. Int. J. Manag. Bus. Stud. 2011, 1, 7–15. [Google Scholar]

- Camerer, C.F.; Loewenstein, G.; Rabin, M. Advances in Behavioral Economics; Princeton University Press: New York, NY, USA, 2004. [Google Scholar]

- Lucey, B.M.; Dowling, M. The Role of Feelings in Investor Decision-Making. J. Econ. Surv. 2005, 19, 211–237. [Google Scholar] [CrossRef]

- Schloesser, T.; Dunning, D.; Fetchenhauer, D. What a Feeling: The Role of Immediate and Anticipated Emotions in Risky Decisions. J. Behav. Decis. Mak. 2013, 26, 13–30. [Google Scholar] [CrossRef]

- Nofsinger, J.R. Psychology of Investing; Routledge: New York, NY, USA, 2016. [Google Scholar]

- Cormier, D.; Gordon, I.M.; Magnan, M. Corporate ethical lapses: Do markets and stakeholders care? Manag. Decis. 2016, 54, 2485–2506. [Google Scholar] [CrossRef]

- Chadha, A.; Mehta, C.; Lal, D.; Lonare, A. Impact of Behavioural Factors on Investment Decisions Making. Int. J. Sci. Res. (IJSR) 2019, 8, 877–885. [Google Scholar] [CrossRef]

- Lin, Y.-C.; Huang, C.-Y.; Wei, Y.-S. Perfectionist decision-making style and ethical investment willingness: A two-factor causal mediation model. Manag. Decis. 2018, 56, 534–549. [Google Scholar] [CrossRef]

- Rasheed, M.H.; Rafique, A.; Zahid, T.; Akhtar, M.W. Factors influencing investor’s decision making in Pakistan: Moderating the role of locus of control. Rev. Behav. Financ. 2018, 10, 70–87. [Google Scholar] [CrossRef]

- Rahman, M.; Gan, S.S. Generation Y investment decision: An analysis using behavioural factors. Manag. Financ. 2020, 46, 1023–1041. [Google Scholar] [CrossRef]

- Qadri, U.A.; Ghani, M.B.A.; Sheikh, M.A. Role of Corporate Identity, Image and Reputation in Investors’ Behavioral Decision Making: Does Emotional Attachment Matter? Pak. J. Commer. Soc. Sci. 2020, 14, 120–142. [Google Scholar]

- Marzouk, W.G. The Role of Cognitive and Affective Corporate Reputation in Investor Behavior: An Empirical Investigation in Egyptian Stock Exchange Market. J. Res. Mark. 2016, 6, 485–509. [Google Scholar]

- Kliger, D.; Kudryavtsev, A. The Availability Heuristic and Investors’ Reaction to Company-Specific Events. J. Behav. Financ. 2010, 11, 50–65. [Google Scholar] [CrossRef]

- Dutot, V.; Lacalle Galvez, E.; Versailles, D.W. CSR communications strategies through social media and influence on e-reputation: An exploratory study. Manag. Decis. 2016, 54, 363–389. [Google Scholar] [CrossRef]

- Eccles, R.G.; Klimenko, S. The Investor revolution. Harv. Bus. Rev. 2019, 97, 106–116. [Google Scholar]

- De Miguel De Blas, M. Impact of environmental performance and policy on firm environmental reputation. Manag. Decis. 2021, 59, 190–204. [Google Scholar] [CrossRef]

- Arikan, E.; Kantur, D.; Maden, C.; Telci, E.E. Investigating the mediating role of corporate reputation on the relationship between corporate social responsibility and multiple stakeholder outcomes. Qual. Quant. 2016, 50, 129–149. [Google Scholar] [CrossRef]

- Pérez-Cornejo, C.; de Quevedo-Puente, E.; Delgado-García, J.B. Reporting as a booster of the corporate social performance effect on corporate reputation. Corp. Soc. Responsib. Environ. Manag. 2019, 27, 1252–1263. [Google Scholar] [CrossRef]

- Cormier, D.; Ledoux, M.-L.; Magnan, M. The informational contribution of social and environmental disclosures for investors. Manag. Decis. 2011, 49, 1276–1304. [Google Scholar] [CrossRef]

- Stolowy, H.; Paugam, L. The expansion of non-financial reporting: An exploratory study. Account. Bus. Res. 2018, 48, 525–548. [Google Scholar] [CrossRef]

- Odriozola, M.D.; Baraibar-Diez, E. Is corporate reputation associated with quality of CSR reporting? Evidence from Spain. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 121–132. [Google Scholar] [CrossRef]

- Lev, B. The deteriorating usefulness of financial report information and how to reverse it. Account. Bus. Res. 2018, 48, 465–493. [Google Scholar] [CrossRef]

- Du, S.; Yu, K.; Bhattacharya, C.B.; Sen, S. The business case for sustainability reporting: Evidence from stock market reactions. J. Public Policy Mark. 2017, 36, 313–330. [Google Scholar] [CrossRef]

- Luo, X.; Zhang, R.; Zhang, W.; Aspara, J. Do institutional investors pay attention to customer satisfaction and why? J. Acad. Mark. Sci. 2014, 42, 119–136. [Google Scholar] [CrossRef]

- Bayer, E.; Tuli, K.R.; Skiera, B. Do disclosures of customer metrics lower investors’ and analysts’ uncertainty, but hurt firm performance? J. Mark. Res. 2017, 54, 239–259. [Google Scholar] [CrossRef]

- Schwarzmüller, T.; Brosi, P.; Stelkens, V.; Spörrle, M.; Welpe, I.M. Investors’ reactions to companies’ stakeholder management: The crucial role of assumed costs and perceived sustainability. Bus. Res. 2017, 10, 79–96. [Google Scholar] [CrossRef]

- Edelman Trust Barometer. Investors Speak; Trust Matters. 2020. Available online: www.edelman.com/insights/investors-speak-trust-matters (accessed on 27 November 2021).

- Nabil, T.; Sebastianelli, R. Transparency among S&P 500 companies: An analysis of ESG disclosure scores. Manag. Decis. 2017, 55, 1660–1680. [Google Scholar] [CrossRef]

- Schnackenberg, A.K.; Tomlinson, E.C. Organizational transparency: A new perspective on managing trust in organization-stakeholder relationships. J. Manag. 2016, 42, 1784–1810. [Google Scholar] [CrossRef]

- Doan, M.A.; McKie, D. Financial investigations: Auditing research accounts of communication in business, investor relations, and public relations (1994–2016). Public Relat. Rev. 2017, 43, 306–313. [Google Scholar] [CrossRef]

- Brennan, N.M.; Merkl-Davies, D.M. Do firms effectively communicate with financial stakeholders? A conceptual model of corporate communication in a capital market context. Account. Bus. Res. 2018, 48, 553–577. [Google Scholar] [CrossRef]

- Jones, G.H.; Jones, B.H.; Little, P. Reputation as Reservoir: Buffering Against Loss in Times of Economic Crisis. Corp. Reput. Rev. 2000, 3, 21–29. [Google Scholar] [CrossRef]

- Harrison, K. Why a Good Corporate Reputation is Vital to Your Organization, Especially during COVID-19. Available online: https://cuttingedgepr.com/good-corporate-reputation-important-organization-especially-during-covid-19/ (accessed on 1 June 2020).

- Carroll, C. Defying a Reputational Crisis-Cadbury’s Salmonella Scare: Why are Customers Willing to Forgive and Forgot? Corp. Reput. Rev. 2009, 12, 64–82. [Google Scholar] [CrossRef]

- Fombrun, C.; Gardberg, N.A.; Sever, J.M. The Reputation Quotient SM: A Multi-stakeholder Measure of Corporate Reputation. J. Brand Manag. 2013, 7, 241–255. [Google Scholar] [CrossRef]

- Blajer-Gołębiewska, A.; Kos, M. Investors are more Sensitive to Information about Financial Rather than Ethical Reputation of a Company: Evidence from an Experimental Study. Econ. Sociol. 2016, 9, 11–22. [Google Scholar] [CrossRef][Green Version]

- Yusoff, H.; Mohamad, S.S.; Darus, F. The influence of CSR disclosure structure on corporate financial performance: Evidence from stakeholders’ perspectives. Procedia Econ. Financ. 2013, 7, 213–220. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The impact of corporate social responsibility on investment recommendations: Analysts’ perceptions and shifting institutional logics. Strateg. Manag. J. 2015, 36, 1053–1081. [Google Scholar] [CrossRef]

- Jastrzębska, E. Ewolucja społecznej odpowiedzialności biznesu w Polsce. Kwartalnik Kolegium Ekonomiczno-Społecznego. Studia Prace. 2016, 28, 85–101. [Google Scholar]

- Pawnik, W. Społeczna odpowiedzialność biznesu-trudności z implementacją w Polsce. Mark. Rynek 2018, 11, 369–378. [Google Scholar]

- Tschopp, D.; Nastanski, M. The Harmonization and Convergence of Corporate Social Responsibility Reporting Standards. J. Bus. Ethics 2014, 125, 147–162. [Google Scholar] [CrossRef]

- Aggarwal, P.; Kadyan, A. Green Washing: The Darker Side of CSR. Int. J. Innov. Res. Pract. 2014, 2, 22–35. [Google Scholar]

- Torelli, R.; Balluchi, F.; Lazzini, A. Greenwashing and environmental communication: Effects on stakeholders’ perceptions. Bus. Strategy Environ. 2020, 29, 407–421. [Google Scholar] [CrossRef]

| Stakeholder Group | Very/Somewhat Important [%] |

|---|---|

| Customers | 87 |

| Investors | 86 |

| Employees | 83 |

| Suppliers and partners | 80 |

| People in the local community | 75 |

| Government officials and regulators | 74 |

| The media | 73 |

| People and social media | 68 |

| Non-profits, advocacy groups or non-governmental organizations | 66 |

| Characteristics of Survey Participants | Research | Research of Association of Individual Investors (Poland) | |

|---|---|---|---|

| Gender | |||

| Male | 316 | 75.8% | 90.2% |

| Female | 101 | 24.2% | 9.8% |

| Age | |||

| Less than 25 years (<25) | 161 | 38.6% | 8.0% |

| 25–45 years (25–45) | 180 | 43.2% | 60.5% |

| Above 45 years (45<) | 76 | 18.2% | 31.5% |

| Investment experience | |||

| Less than 1 year (<1) | 176 | 42.2% | 47.1% |

| 1–5 years (1–5) | 71 | 17.0% | |

| 5–10 years (5–10) | 53 | 12.7% | 18.8% |

| Above 10 years (10<) | 117 | 28.1% | 34.1% |

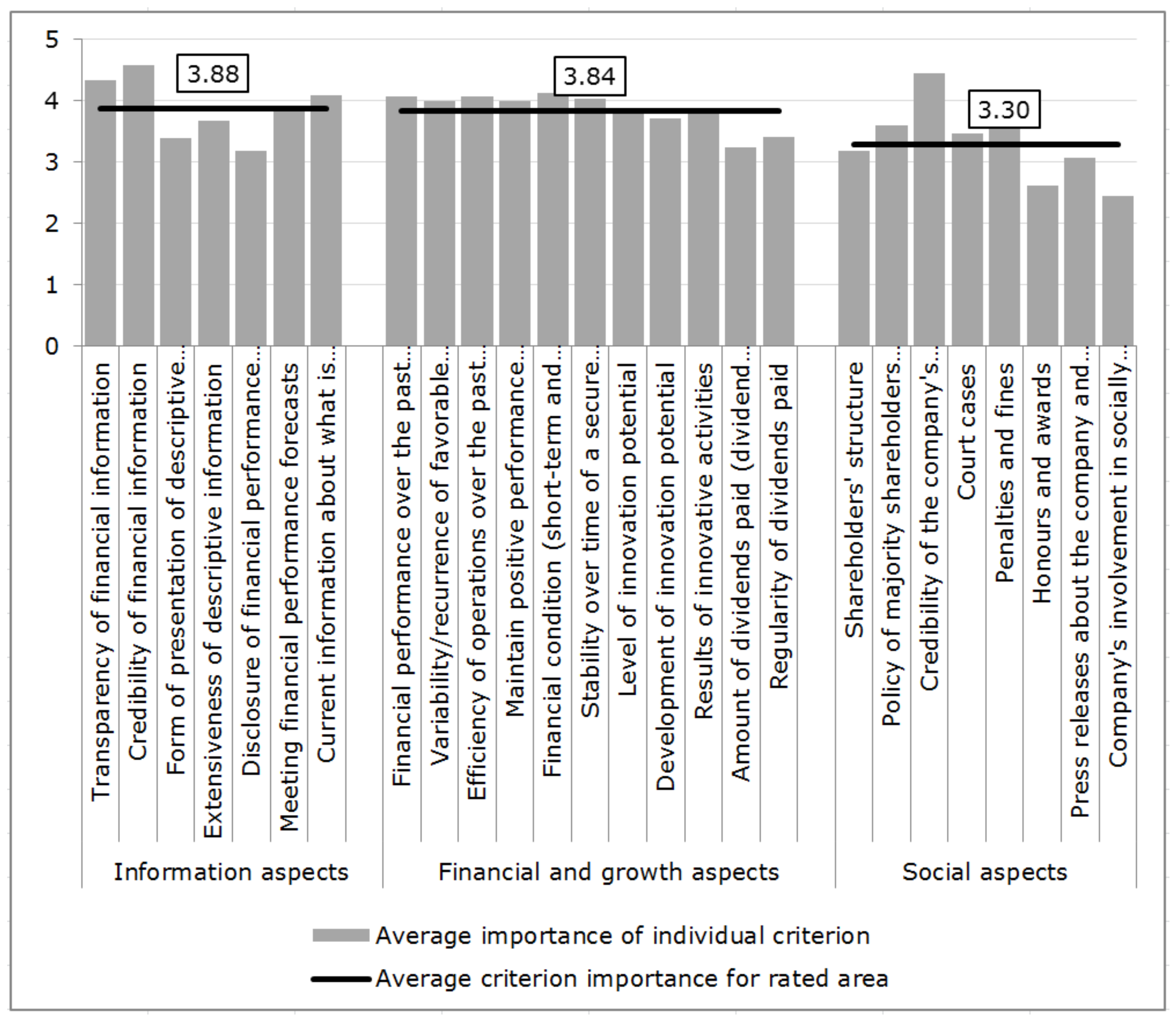

| No. | Criterion |

|---|---|

| Informational aspects | |

| 1 | Transparency of financial information (completeness of items in the financial statements, e.g., reporting of net result on sales, etc.) |

| 2 | Credibility of financial information (e.g., consistency of the data for the reference period with previously published data) |

| 3 | Form of presentation of descriptive information (e.g., photocopy scan, Word, PDF of good quality, etc.) |

| 4 | Extensiveness of descriptive information (comments on results, development plans, innovation potential, R&D and innovation results, human capital and technology) |

| 5 | Disclosure of financial performance forecasts |

| 6 | Meeting financial performance forecasts |

| 7 | Current information about what is going on in the company (e.g., publication of monthly reports, reports on new contracts, etc.) |

| Financial and growth aspects | |

| 8 | Financial performance over the past few years (dynamics at individual performance levels, the quality of net profit confirmed by operating cash flows, etc.) |

| 9 | Variability of favorable financial results over the past several years (whether there is an upward trend or whether there is a downward or unstable trend, i.e., an increase at one time and a decrease at another) |

| 10 | Efficiency of operations over the past few years (profitability, work efficiency, etc.) |

| 11 | Maintain positive performance trends/levels in efficiency of operations |

| 12 | Financial condition (short-term and long-term solvency) over the past several years (financial liquidity, debt level and debt servicing capacity, etc.) |

| 13 | Stability over time of a secure financial position (solvency) |

| 14 | Level of innovation potential (patents, licenses, qualified staff and employees, modern fixed assets, access to finance for research and development as well as innovation implementation, etc.) |

| 15 | Development of innovation potential (expenditure on patents, licenses, research and development, employee training, etc.) |

| 16 | Results of innovative activities (implementation of new product, process, marketing or organizational solutions) |

| 17 | Amount of dividends paid (dividend yield) |

| 18 | Regularity of dividends paid |

| Social aspects | |

| 19 | Shareholders’ structure |

| 20 | Policy of majority shareholders towards minority shareholders |

| 21 | Credibility of the company’s management (does what the board says/announces correspond to reality, i.e., is it realized?) |

| 22 | Court cases |

| 23 | Penalties and fines |

| 24 | Honors and awards |

| 25 | Press releases about the company and opinions on web portals |

| 26 | Company’s involvement in socially responsible activities (activities concerning local communities, customers, employees, environment, public authorities, investors) |

| Rated Area | No. | Criterion | 5 | 4 | 3 | 2 | 1 | 0 | Average Importance of Individual Criterion |

|---|---|---|---|---|---|---|---|---|---|

| Informational aspects | 1 | Transparency of financial information | 50% | 37% | 9% | 3% | 1% | 0% | 4.33 |

| 2 | Credibility of financial information | 66% | 27% | 5% | 1% | 0% | 0% | 4.59 | |

| 3 | Form of presentation of descriptive inform… | 19% | 31% | 28% | 14% | 5% | 2% | 3.39 | |

| 4 | Extensiveness of descriptive information | 30% | 29% | 26% | 11% | 3% | 1% | 3.68 | |

| 5 | Disclosure of financial performance forecasts | 18% | 28% | 26% | 17% | 8% | 4% | 3.18 | |

| 6 | Meeting financial performance forecasts | 38% | 34% | 17% | 8% | 2% | 2% | 3.93 | |

| 7 | Current information about what is going... | 46% | 30% | 15% | 5% | 3% | 1% | 4.08 | |

| Financial and growth aspects | 8 | Financial performance over the past few… | 40% | 33% | 21% | 5% | 1% | 0% | 4.08 |

| 9 | Variability/recurrence of favorable fin… | 35% | 38% | 20% | 6% | 1% | 0% | 3.99 | |

| 10 | Efficiency of operations over the past few… | 34% | 47% | 15% | 4% | 1% | 0% | 4.08 | |

| 11 | Maintain positive performance trends… | 31% | 43% | 21% | 4% | 1% | 0% | 3.99 | |

| 12 | Financial condition (short and long-term… | 42% | 37% | 14% | 6% | 1% | 0% | 4.12 | |

| 13 | Stability over time of a secure financial… | 40% | 33% | 21% | 6% | 1% | 0% | 4.03 | |

| 14 | Level of innovation potential | 30% | 35% | 23% | 8% | 3% | 0% | 3.81 | |

| 15 | Development of innovation potential | 26% | 37% | 24% | 8% | 4% | 1% | 3.71 | |

| 16 | Results of innovative activities | 30% | 35% | 23% | 8% | 4% | 1% | 3.78 | |

| 17 | Amount of dividends paid (dividend yield | 19% | 28% | 28% | 13% | 8% | 4% | 3.24 | |

| 18 | Regularity of dividends paid | 29% | 24% | 23% | 12% | 9% | 4% | 3.42 | |

| Social aspects | 19 | Shareholders’ structure | 12% | 30% | 35% | 15% | 5% | 3% | 3.18 |

| 20 | Policy of majority shareholders towards… | 28% | 29% | 27% | 10% | 5% | 2% | 3.61 | |

| 21 | Credibility of the company’s management | 64% | 23% | 9% | 3% | 1% | 0% | 4.44 | |

| 22 | Court cases | 21% | 29% | 30% | 13% | 5% | 1% | 3.46 | |

| 23 | Penalties and fines | 24% | 32% | 26% | 12% | 5% | 1% | 3.56 | |

| 24 | Honors and awards | 10% | 18% | 29% | 18% | 15% | 10% | 2.61 | |

| 25 | Press releases about the company and op… | 17% | 23% | 30% | 15% | 11% | 4% | 3.08 | |

| 26 | Company’s involvement in socially res… | 11% | 16% | 21% | 21% | 17% | 13% | 2.44 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nawrocki, T.L.; Szwajca, D. The Importance of Selected Aspects of a Company’s Reputation for Individual Stock Market Investors—Evidence from Polish Capital Market. Sustainability 2022, 14, 9187. https://doi.org/10.3390/su14159187

Nawrocki TL, Szwajca D. The Importance of Selected Aspects of a Company’s Reputation for Individual Stock Market Investors—Evidence from Polish Capital Market. Sustainability. 2022; 14(15):9187. https://doi.org/10.3390/su14159187

Chicago/Turabian StyleNawrocki, Tomasz L., and Danuta Szwajca. 2022. "The Importance of Selected Aspects of a Company’s Reputation for Individual Stock Market Investors—Evidence from Polish Capital Market" Sustainability 14, no. 15: 9187. https://doi.org/10.3390/su14159187

APA StyleNawrocki, T. L., & Szwajca, D. (2022). The Importance of Selected Aspects of a Company’s Reputation for Individual Stock Market Investors—Evidence from Polish Capital Market. Sustainability, 14(15), 9187. https://doi.org/10.3390/su14159187