1. Introduction

Environmental, social, and governance (ESG) is the value of sustainable development, which aims at a harmonious coexistence between humans and nature. With the progress made towards sustainable development, it has become the consensus of all sectors of society that enterprises need to broaden their social responsibility to a wider range. According to the Global Sustainable Investment Alliance (GSIA), the management scale of global ESG assets increased from USD 13 trillion in early 2012 to USD 35 trillion by early 2020, representing an increase of 169.2%. Currently, international interest in responsible investment is also increasing rapidly, and as of February 2022, more than 4700 institutions worldwide had joined the UN Principles for Responsible Investment (PRI), including 90 from China. The ESG rating is an important tool for assessing ESG performance and can help all participants in the capital market to judge the ESG performance of companies. The rising interest of investors in sustainable corporate performance has contributed to the rapid development of ESG ratings and by 2020, more than 600 providers had offered ESG ratings around the world, including about 20 in China. To achieve the goals of ‘peak carbon’ and ‘carbon neutrality’ in China, whether ESG ratings can provide investors with information related to an investment value has become a common concern for the capital market and other stakeholders.

Since China implemented its ‘Shanghai–Hong Kong Stock Connect Program’, which allows Hong Kong investors to trade A shares within a specified range through security companies, the inflow of Hong Kong and international capital into the stock market through the ‘Shanghai–Hong Kong Stock Connect Program’ and the ‘Shenzhen–Hong Kong Stock Connect Program’ has been called ‘Northbound Capital’. In recent years, following the initial liberalization of China’s capital market, northbound capital has continued to be dynamic, and its shareholding ratio in listed companies has gradually increased [

1]. In 2021, the total turnover of northbound capital exceeded RMB 25 trillion, with a net purchase of RMB 432.1 billion, indicating that northbound capital has gradually cemented its importance in China’s capital market. Foreign institutional investors represented by northbound capital have more advanced analytical tools, richer globalization experience [

2], more information advantages [

3], higher levels of social trust [

4], and good corporate governance structures [

5], are more willing to invest in a transparent information environment [

6], and can help to improve the performance of invested companies [

7]. ESG ratings convey non-financial information about a company to the public, and investors can assess the ESG performance of a company comprehensively. According to the

Global Institutional Investor Survey 2021 published by Morgan Stanley Capital International (MSCI), 52% of the 200 institutional investors investigated claimed to have adopted ESG investment strategies, and 73% planned to increase their scale in ESG investments by the end of 2021. This shows the importance that institutional investors attach to ESG. The existing literature indicates that responsible institutional investors tend to be more patient with high-ESG firms [

8]. Meanwhile, mutual funds with good sustainability ratings can obtain inflows and poor ratings bring about negative flows to mutual funds [

9]. Moreover, the increased focus in socially responsible institutions on ESG may influence their stock return patterns [

10] and it would be interesting to study an ESG rating and its impact on stock returns from an institutional investment perspective; however, whether ESG ratings can influence northbound capital shareholding preferences (NCSP) in China, an emerging market, is a question that has not been answered in any literature thus far.

Accounting conservatism is a fundamental principle in business accounting and aims at measuring the quality of accounting information [

11]. The existing literature shows that accounting conservatism can improve investment efficiency [

12] and limit management’s misuse of cash [

13]. Under unfavorable macroeconomic conditions and financial constraints, management prioritizes accounting conservatism instead of engaging in corporate social responsibility (CSR); however, Shen et al. showed that CSR can be effectively used to promote accounting conservatism in China [

14]. Although CSR is closely related to accounting conservatism, few researchers have investigated the overall role of ESG, rather than just its role in relation to social responsibility. The question of whether ESG ratings influence accounting conservatism and what role accounting conservatism can play in the relationship between ESG ratings and NCSP is worthy of attention.

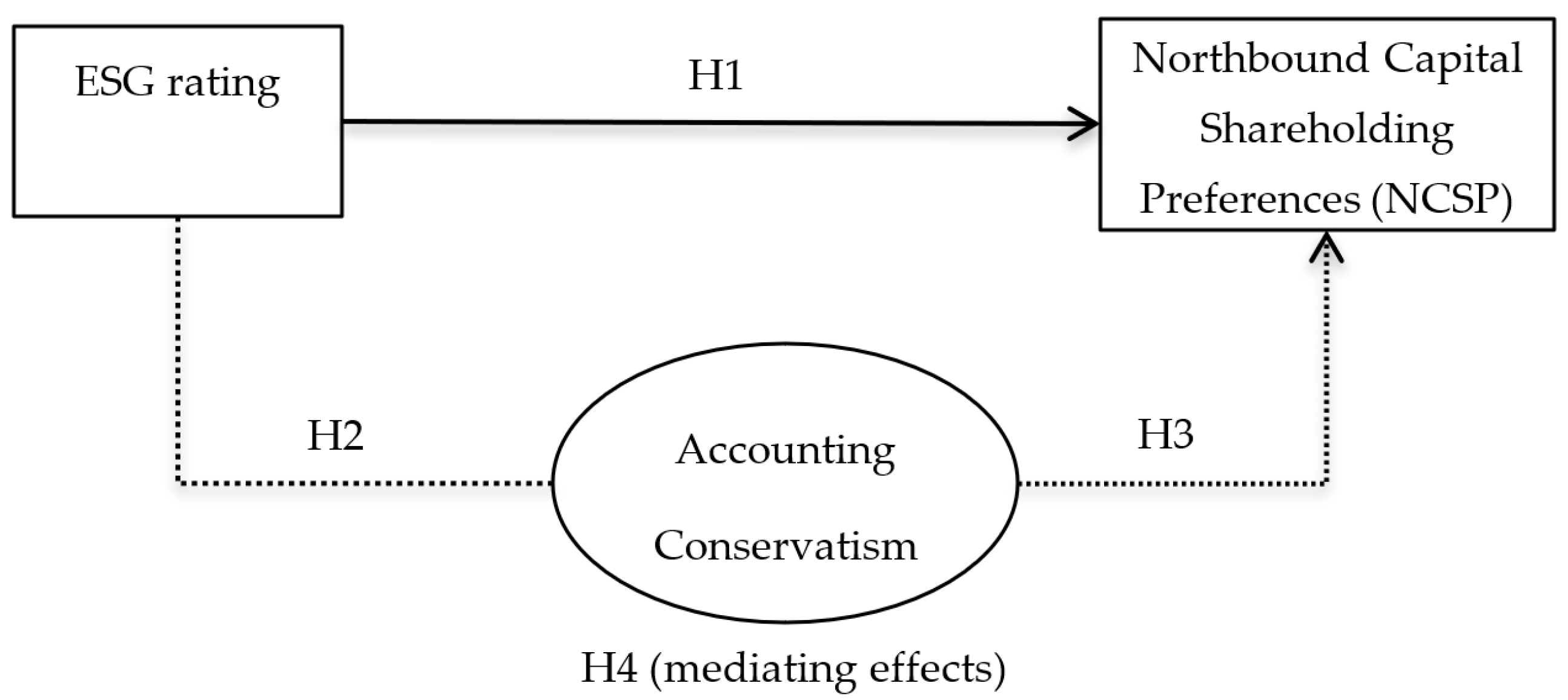

This paper investigates the effect of the ESG rating on NCSP and the mediating role of accounting conservatism based on the ESG rating data of a sample of listed companies in the CSI 300-listed companies published by SynTao Green Finance during the period 2015–2020. The results of the regression indicate that there is a significant positive relationship between an ESG rating and the NCSP. In addition, our study finds that accounting conservatism has a partial mediating effect on the above relationship. We also chose to use the Heckman two-stage approach for robustness testing, which guarantees the reliability of the results, by changing the core independent variables and lagging one period to check the robustness. Further study found that the G dimension and non-state-owned (non-SOE) companies have the largest positive effect on NCSP. Additionally, ESG ratings had a stronger impact on NCSP during the post-COVID-19 period than in the pre-COVID-19 period.

Compared with the existing literature, the innovations of our study are as follows. First, the existing literature focus on the impact of one aspect of environment, society, or governance on foreign investors’ shareholding preferences, whereas we investigated for the first time the overall ESG ratings of foreign investors’ shareholding preferences in emerging markets. This not only provides recent evidence from China on the overall ESG shareholding preference effect, but also extends the literature on ESG ratings. Second, compared with most of the literature, which adopts QFII in order to evaluate foreign institutional investors, we chose to use northbound capital as the measure of foreign investors’ shareholding preferences and to test the relationship between northbound capital and the ESG rating. This further enriches the research in the field of foreign investors’ shareholding preferences and provides a reference for decision making by investors and relevant government regulators. Third, we clarified the mechanism of the influence of an ESG rating on NCSP and provided a preliminary exploration of the mediating effect of accounting conservatism. Moreover, the degree of influence of the ESG rating on NCSP was explored from the perspectives of different ownership properties and the different dimensions of E, S and G. We also considered the impact of COVID-19 on NCSP. The multi-perspective analysis provided an important addition to the study of the economic consequences of ESG ratings and provided a reference for the study of ESG ratings in the emerging market. The findings obtained will help companies to maintain a good reputation and establish a perfect investor protection mechanism.

Our paper contains a relevant literature review and develops the research hypothesis in

Section 2. Additionally,

Section 3 presents the relevant data and methodology. We provide details of our empirical results and the robustness tests used in

Section 4 and describe our extensibility analysis in

Section 5. The last section provides our conclusions and the implications of this research.

6. Conclusions

In this paper, we used 2015–2020 CSI 300-listed companies in China as our research object and analyzed the influence mechanism of ESG rating on NCSP by constructing a relationship model of ESG rating–accounting conservatism–northbound capital shareholding preferences. This study shows that the ESG rating has a positive effect on the NCSP. We found that an improvement in ESG performance not only has positive effects for companies and enhances the confidence of foreign institutional investors, but it also eases agency costs and financing constraints, thus, improving profitability. This is conducive to building a good corporate reputation and reducing the risk for foreign institutional investors. Moreover, we found that accounting conservatism plays a partial mediating role between the ESG rating and NCSP. A good company ESG performance can lead to a higher NCSP by improving the accounting conservatism. Moreover, our results remained unchanged after using the Heckman two-step method, changing the core independent variables, and introducing a lag time of one period. Furthermore, we also found that the ESG rating has a more significant effect on the NCSP among non-SOE companies and that the G dimension has the largest positive effect on this relationship. Meanwhile, compared with the pre-COVID-19 period, the ESG rating had a stronger impact on the NCSP during the post-COVID-19 period.

Our findings have important implications for company management and policy makers. Company managers should aim to enhance their ESG performance and increase their NCSP by improving their sustainability. Companies should incorporate ESG concepts into their operations to improve their performance and to allow them to better regulate their behavior. The past belief that maintaining a green environment, taking social responsibility, and improving corporate governance will only result in higher opportunity costs should be abandoned. It is necessary for companies to improve the quality of their own assets, achieve internal growth, and focus on the value created in the long term in order to boost their competitiveness in the market. Additionally, companies should make ESG information disclosures proactively to establish a good corporate image and gain more attention and support from investors. In order to improve their ESG performance, companies should aim to improve their accounting conservatism by considering their actual situation. It may be necessary for companies to mitigate their agency conflicts, solve any financing problems, improve their surplus quality, and enhance their attractiveness to investors.

In recent years, China’s ESG rating system has lacked unified rules, resulting in difficulties in comparing the ratings between different companies and between the same companies now and in the past. Rating agencies should aim to effectively capture the requirements of companies’ carbon peak and carbon neutral strategies according to the actual situation in China, build a unified ESG evaluation standard, create an evaluation system for characteristics specific to China, and guarantee the comparability of the ESG evaluation results. Relevant governmental sectors should further improve the existing ESG performance-related policies and the ESG information disclosure system. The government should actively guide the ESG performance of companies and introduce specific unified ESG information disclosure requirements and index systems. It should also consider the principle of accounting conservatism and strictly require companies to disclose their accounting information in a timely, prudent, and detailed manner. Regulatory authorities should improve the regulatory system and the legal environment and clarify the related incentives and penalties. Meanwhile, companies should be encouraged to actively fulfill their environmental and social responsibilities and improve their corporate governance.