Venture Capital and Chinese Firms’ Technological Innovation Capability: Effective Evaluation and Mechanism Verification

Abstract

:1. Introduction

2. Literature Review and Research Innovation

2.1. TIC-Affecting Factors

2.2. Effects of VC on a Firm

2.3. Effects of VC on TIC

3. Theoretical Mechanism and Research Hypothesis

3.1. Preferences and Demand

3.2. Technological Innovation Spending Choice

3.3. Enterprise Production Behavior

4. Econometric Model, Variables, and Data Specifications

4.1. Econometric Model Settings

4.2. Variable Selection and Calculation Description

4.2.1. Explained Variable: TIC (Lnpatentit)

4.2.2. Core Explanatory Variable: VC

4.2.3. Controlled Variables

4.3. Data Description

4.4. Descriptive Statistics

5. Empirical Analysis and Results

5.1. Baseline Regression

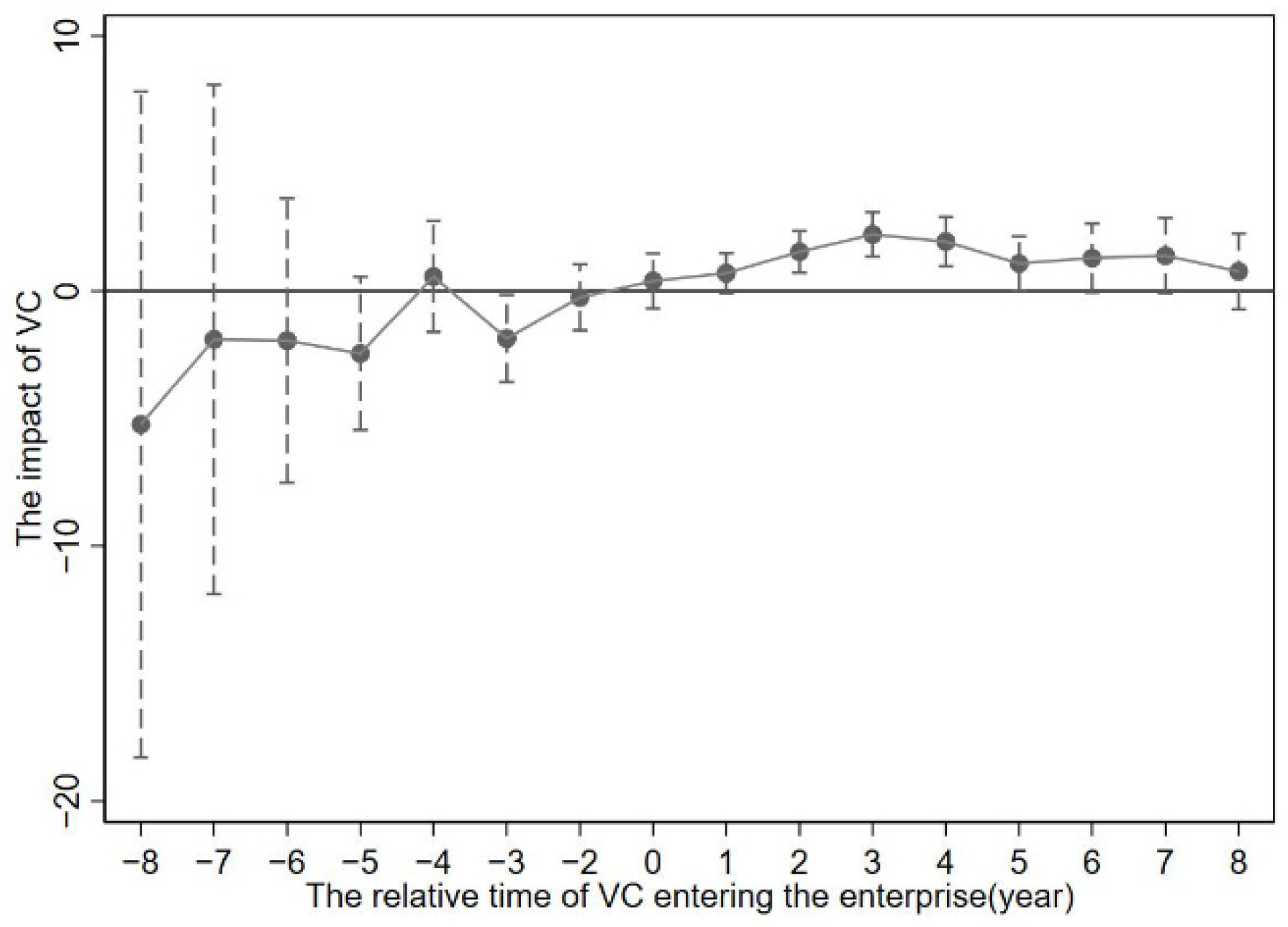

5.2. Parallel Trend Hypothesis Test

5.3. Influence Mechanism Test

5.3.1. Investment in R&D

5.3.2. Executive Incentives

5.3.3. Financing Constraint

5.4. Heterogeneity Test

5.4.1. Firm Ownership

5.4.2. Firm Size

5.4.3. Technological Sophistication

5.4.4. Area Distribution

5.5. Robustness Test

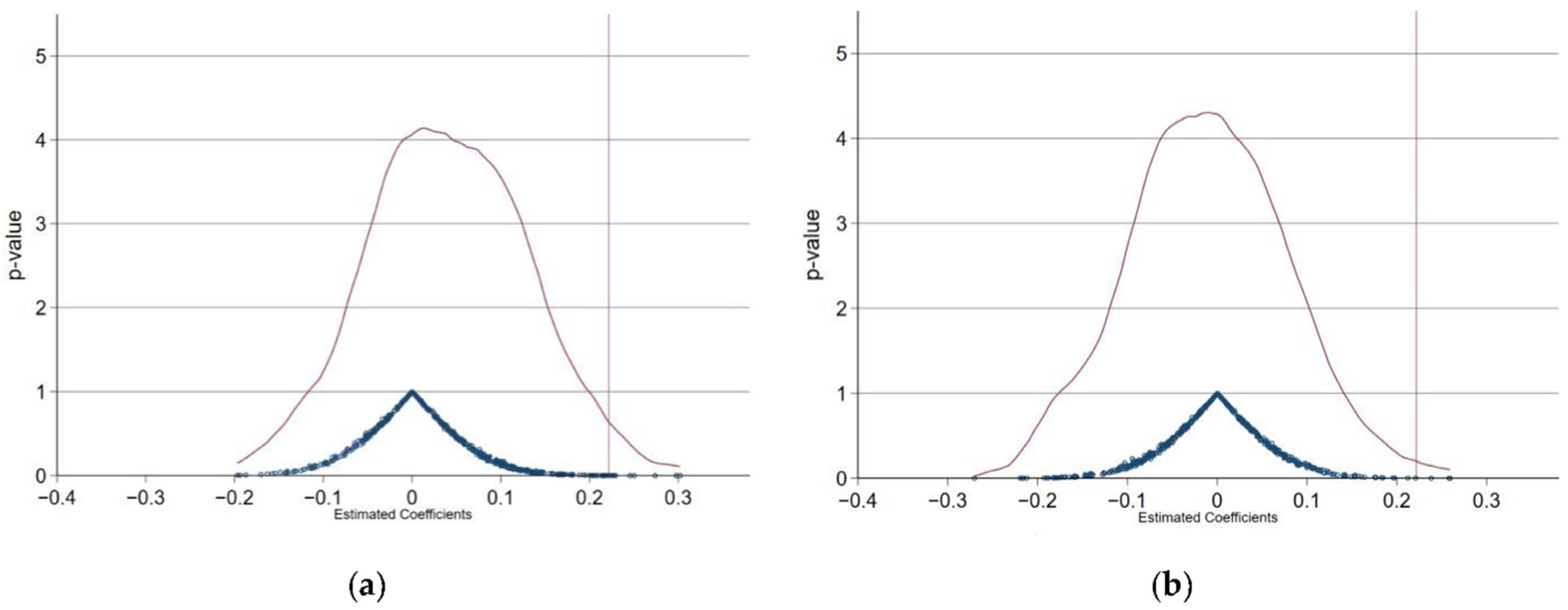

5.5.1. Placebo Test

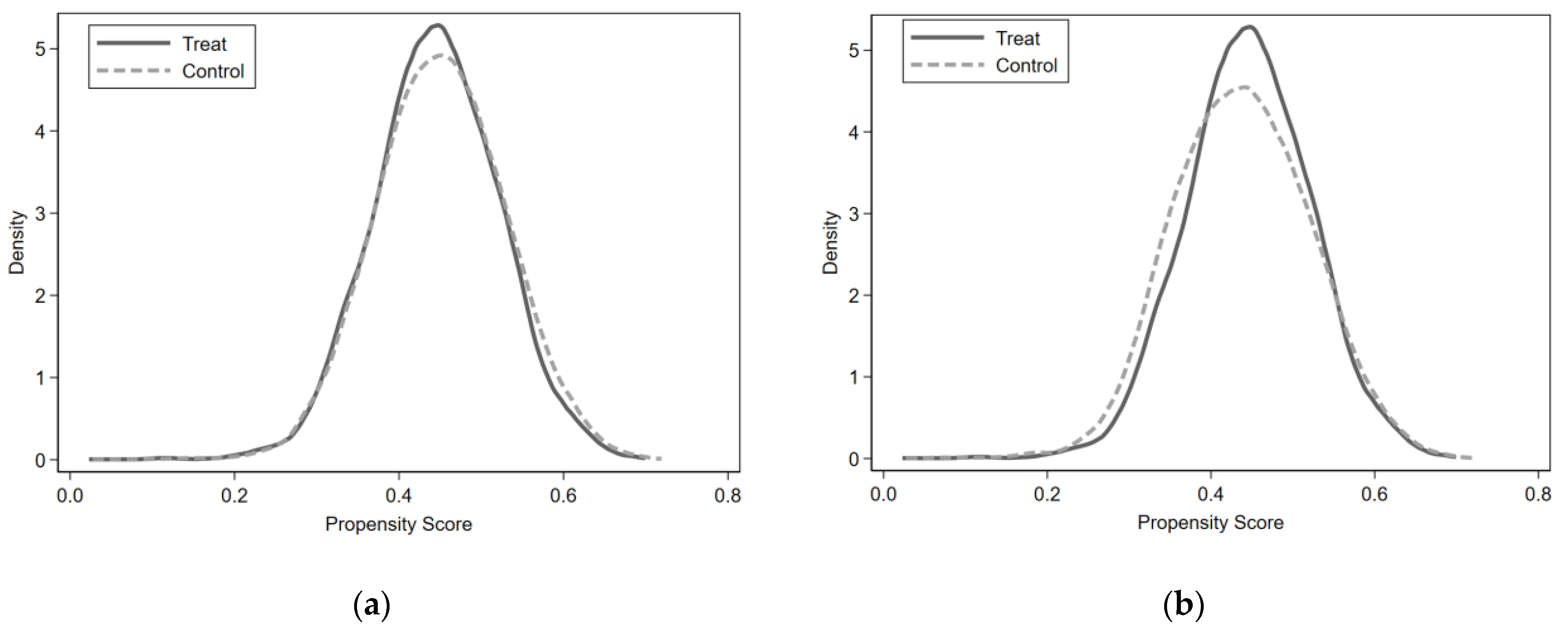

5.5.2. Propensity Score Matching (PSM) Analysis

5.5.3. Variable Substitution

5.5.4. Instrumental Variable Method

6. Conclusions and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhang, W.K.; Luo, Q.; Liu, S.Y. Is government regulation a push for corporate environmental performance? Evidence from China. Econ. Anal. Policy 2022, 74, 105–121. [Google Scholar] [CrossRef]

- Kumar, R.; Tripathi, R. Secure healthcare framework using blockchain and public key cryptography. In Blockchain Cybersecurity, Trust and Privacy; Springer: Cham, Switzerland, 2020; pp. 185–202. [Google Scholar]

- Liu, S.Y.; Du, J.; Zhang, W.K.; Tian, X.L.; Kou, G. Innovation Quantity or Quality? The Role of Political Connections. Emerg. Mark. Rev. 2021, 47, 100819. [Google Scholar] [CrossRef]

- Song, J.; Hu, G.Y.; He, Q. Venture Capital and Firm Technological Innovation: The Moderating Role of Product Market Competition. Bus. Rev. 2021, 33, 77–88. [Google Scholar]

- Wang, J.M.; Wang, X.P. Empirical Research on Venture Capital to Promote Technological Innovation in China. Sci. Technol. Prog. Policy 2011, 28, 24–27. [Google Scholar]

- Zhang, W.K.; Zhang, X.Y.; Tian, X.L.; Sun, F.W. Economic Policy Uncertainty Nexus with Corporate Risk-taking: The Role of State Ownership and Corruption Expenditure. Pac.-Basin Financ. J. 2021, 65, 101496. [Google Scholar] [CrossRef]

- Zhang, W.K.; Du, J.; Tian, X.L. Finding a Promising Venture Capital Project with TODIM under Probabilistic Hesitant Fuzzy Circumstance. Technol. Econ. Dev. Econ. 2018, 24, 2026–2044. [Google Scholar] [CrossRef]

- Bottazzi, L.; Rin, M.D.; Hellmann, T. Who are the active investors? Evidence from venture capital. J. Financ. Econ. 2008, 89, 488–512. [Google Scholar] [CrossRef]

- Song, Y.G.; Hao, X.Z.; Zheng, L. Intermediate import, independent innovation and export sophistication of Chinese manufacturing enterprises. Struct. Chang. Econ. Dyn. 2022, 60, 126–140. [Google Scholar] [CrossRef]

- Holmstrom, B. Agency costs and innovation. J. Econ. Behav. Organ. 1989, 12, 305–327. [Google Scholar] [CrossRef]

- Cuevas-Vargas, H.; Cortés-Palacios, H.A.; Lozano-García, J.J. Impact of capital structure and innovation on firm performance. Direct and indirect effects of capital structure. Procedia Comput. Sci. 2022, 199, 1082–1089. [Google Scholar] [CrossRef]

- Irwan, T.; Siong, H.L.; Weng, C.L.; Jamal, W.; Bruno, S. Effect of financial development on innovation: Roles of market institutions. Econ. Model. 2021, 103, 105598. [Google Scholar]

- Wang, X.Z.; Liu, S.; Tao, Z.Y.; Cao, Q. The impact of industrial policy and its combinations on the innovation quality of wind power enterprises: A study from the perspective of financing modes. Renew. Energy 2022, 188, 945–956. [Google Scholar] [CrossRef]

- Chen, S.; Bu, M.; Wu, S.; Liang, X. How does TMT attention to innovation of Chinese firms influence firm innovation activities? A study on the moderating role of corporate governance. J. Bus. Res. 2014, 5, 1127–1135. [Google Scholar] [CrossRef]

- Hellmann, T.; Puri, M. Venture Capital and the Professionalization of Start-Up Firms: Empirical Evidence. J. Financ. 2002, 57, 169–197. [Google Scholar] [CrossRef]

- Lockett, A.; Wright, M.; Burrows, A. The Export Intensity of Venture Capital Backed Companies. Small Bus. Econ. 2008, 31, 39–58. [Google Scholar] [CrossRef]

- Kerr, W.R.; Josh, L.; Antoinette, S. The Consequences of Entrepreneurial Finance: Evidence from Angel Financings. Rev. Financ. Stud. 2014, 27, 20–55. [Google Scholar] [CrossRef]

- Jin, Y.H.; Jiang, Y.S.; Xi, Y.Q. Venture capital, innovation investment and corporate value-adding. Sci. Res. Manag. 2016, 37, 59–67. [Google Scholar]

- Xu, H.; Wan, D.F.; Xu, J. Does venture capital investment improve startups’ IPO performance? Sci. Res. Manag. 2016, 1, 101–109. [Google Scholar]

- Hu, L.F.; Zhou, Z.J. Can Venture Capital Shareholding Relieve Corporate Follow-on Financing Constraints? Empirical Evidence from Chinese Listed Companies. Econ. Manag. 2018, 40, 91–109. [Google Scholar]

- Li, Y.D.; Yan, Q. Can venture capital “inhibit” or “indulge” the internal control weaknesses? Sci. Res. Manag. 2019, 40, 101–112. [Google Scholar]

- Wang, L.; Wang, X.W. The Impact of Venture Capital on the Total Factor Productivity of Listed Companies—Based on the Comparative Analysis of IVC and CVC. Collect. Essays Financ. Econ. 2020, 264, 55–63. [Google Scholar]

- Guo, X.; Li, K.; Yu, S.; Wei, B. Enterprises’ R&D Investment, Venture Capital Syndication and IPO Underpricing. Sustainability 2021, 13, 7290. [Google Scholar]

- Sandro, M.; Tiago, S.P.; Manuel, M.G. Trademarks as an Indicator of Innovation and Industrial Change. Res. Policy 2004, 33, 1385–1404. [Google Scholar]

- Jiang, C.; Liu, D.H. Does venture capital stimulate the innovation of China’s new energy enterprises? Energy 2022, 244, 122704. [Google Scholar]

- Engel, D.; Keilbach, M. Firm-level Implications of Early Stage Venture Capital Investment—An Empirical Investigation. J. Empir. Financ. 2007, 14, 150–167. [Google Scholar] [CrossRef]

- Wen, J.; Feng, G.F. Venture Capital and Enterprise Innovation: Trade-off between Expropriation and Value-added. Econ. Res. J. 2018, 53, 185–199. [Google Scholar]

- Melitz, M.J. The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef]

- Maria, G.; Olga, K.; Cathering, T. Innovation and Foreign Ownership. Am. Econ. Rev. 2012, 102, 3594–3627. [Google Scholar]

- Chen, S.; He, W.L.; Zhang, R. Venture Capital and Corporate Innovation: Impact and Potential Mechanisms. Manag. World 2017, 1, 158–169. [Google Scholar]

- Liu, S.Y.; Du, J.; Zhang, W.K.; Tian, X.L. Opening the Box of Subsidies: Which is More Effective for Innovation? Eurasian Bus. Rev. 2021, 11, 421–449. [Google Scholar] [CrossRef]

- Zhu, W.; Li, D.; Han, L. Spatial–Temporal Evolution and Sustainable Type Division of Fishery Science and Technology Innovation Efficiency in China. Sustainability 2022, 14, 7277. [Google Scholar] [CrossRef]

- Wu, C.P.; Wu, S.N.; Cheng, J.Y.; Wang, L. The Role of Venture Capital in the Investment and Financing Behavior of Listed Companies: Evidence from China. Econ. Res. J. 2012, 47, 105–119. [Google Scholar]

- Lu, Y.; Zhang, Y.Q.; Jia, R.; Li, J.H. Venture Capital Syndication and Corporate Innovation. J. Financ. Res. 2017, 444, 159–175. [Google Scholar]

- Jacobson, L.S.; LaLonde, R.J.; Sullivan, D.G. Earnings Losses of Displaced Workers. Am. Econ. Rev. 1993, 83, 685–709. [Google Scholar]

- Song, Y.G.; Zheng, L. Does “The Belt and Road” Initiative Reduce the Recessive barriers of China’s Export? Word Econ. Stud. 2020, 11, 26–44. [Google Scholar]

- Huang, Y.X.; Yao, Z. The impact of venture capital on the R&D investment in public firms: The role of government R&D subsidies. Stud. Sci. Sci. 2015, 33, 674–682. [Google Scholar]

- Coles, J.; Daniel, N.; Naveen, L. Managerial Incentives and Risk-taking. J. Financ. Econ. 2006, 79, 431–468. [Google Scholar] [CrossRef]

- Huang, F.G.; Wang, J.Y. Venture capital, executive incentives and corporate innovation. Syst. Eng.-Theory Methodol. Appl. 2019, 28, 601–614. [Google Scholar]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Lin, T. Cleaner Production Environment Regulation and Enterprise Environment Performance—An Empirical Test based on Pollution Discharge Data of Industrial Enterprises. J. Beijing Inst. Technol. 2022, 24, 43–55. [Google Scholar]

- Lv, Y.; Chen, S.; Sheng, B. Embedding into global value chains will lead to China Manufactured “low end lock”? Manag. World 2018, 34, 11–29. [Google Scholar]

- Zhang, W.K.; Tian, X.L.; Yu, A. Is High-Speed Rail a Catalyst for Fourth Industrial Revolution in China? Story of Enhanced Technology Spillovers from Venture Capital. Technol. Forecast. Soc. Chang. 2020, 161, 120286. [Google Scholar] [CrossRef]

- Xia, Q.H.; Le, Y. Has venture capital spurred firms’ technological innovation in China? Sci. Res. Manag. 2021, 42, 189–199. [Google Scholar]

- Zhang, X.Y.; Zhang, Y.Q. Venture Capital, Innovation Capability and Post-IPO Performance. Econ. Res. J. 2016, 51, 112–125. [Google Scholar]

- Chen, S.K.; Zhao, B. R&D Investment, Venture Capital and Corporate Financing Constraints—Empirical analysis based on Chinese manufacturing listed companies. J. Manag. Rev. 2019, 31, 110–123. [Google Scholar]

| Variable Type | Variable Name | Variable Definition | Calculation Method |

|---|---|---|---|

| Explained variable | Lnpatent | TIC | The logarithm of the total patent applications |

| Explanatory variable | VC | VC | Interaction term: Treati × Aftert |

| Treat | VC entry or none | VC entry (1) or none (0) | |

| After | Pre-and-post-VC entry | Post-entry (1) or not (0) | |

| Mediator variable | RDspend | R&D spending | The logarithm of annual R&D spending |

| RDperson | R&D personnel | The logarithm of annual R&D human capital input | |

| Ave_salary | Average salary of directors, executives, and supervisors | Gross salary divided by the number of directors, executives, and supervisors | |

| SA | Financing constraint | SA = −0.737 size + 0.043 size2 − 0.04 age | |

| Controlled variable | Age | Firm age | The current year − The opening year + 1 |

| Ownership | Firm ownership | State-owned or state-controlled firm (1), or not (0) | |

| Size | Firm size | The logarithm of the gross assets of the current year | |

| ROE | Return on assets | Gross assets divided by the net profit ratio | |

| Debt | Debt-to-assets ratio | Gross assets divided by gross debts | |

| PPE | proportion of fixed assets | Net fixed assets divided by gross fixed assets | |

| Intensity | Capital intensity | Fixed assets divided by total employees |

| Variables | Obs | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| Lnpatent | 28,892 | 3.232 | 2.145 | 0.00 | 11.03 |

| VC | 28,892 | 0.303 | 0.459 | 0.00 | 1.00 |

| Age | 28,892 | 16.882 | 6.185 | 0.00 | 62.00 |

| Ownership | 28,892 | 0.373 | 0.484 | 0.00 | 1.00 |

| Size | 28,892 | 22.117 | 1.357 | 0.00 | 28.64 |

| ROA | 28,892 | 0.041 | 0.060 | −0.24 | 0.20 |

| Debt | 28,892 | 0.415 | 0.207 | 0.05 | 0.88 |

| PPE | 28,892 | 0.212 | 0.162 | 0.00 | 0.95 |

| Intensity | 28,892 | 2.448 | 1.933 | 0.40 | 12.34 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Lnpatent | Lnpatent | Lnpatent | Lnpatent | |

| VC | 0.8930 *** | 0.2452 *** | 0.1752 *** | 0.1660 *** |

| (0.026) | (0.029) | (0.028) | (0.027) | |

| Age | 9.0409 *** | 1.0024 *** | 0.9201 *** | |

| (0.390) | (0.256) | (0.255) | ||

| Ownership | −0.0024 | 0.1647 * | 0.1687 * | |

| (0.099) | (0.096) | (0.096) | ||

| Size | 0.1426 *** | 0.0525 ** | 0.0692 *** | |

| (0.027) | (0.021) | (0.021) | ||

| ROA | −0.2966 *** | −0.2616 ** | −0.2400 ** | |

| (0.113) | (0.107) | (0.106) | ||

| Debt | 0.3561 *** | 0.2991 *** | 0.2994 *** | |

| (0.071) | (0.066) | (0.065) | ||

| PPE | 0.4710 *** | 0.3296 *** | 0.3170 *** | |

| (0.090) | (0.086) | (0.084) | ||

| Intensity | 0.0298 | 0.0026 | 0.0055 | |

| (0.026) | (0.037) | (0.037) | ||

| Constant | 2.9621 *** | −1.7581 *** | 0.7704 * | 0.3661 |

| (0.008) | (0.559) | (0.432) | (0.607) | |

| Individual FE | YES | YES | YES | YES |

| Year FE | NO | NO | YES | YES |

| Industry FE | NO | NO | NO | YES |

| Observations | 28,892 | 28,892 | 28,892 | 28,892 |

| Number of id | 3993 | 3993 | 3993 | 3993 |

| Within_R2 | 0.1276 | 0.3888 | 0.4467 | 0.4544 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| RDPerson | Patent | RDspend | Lnpatent | |

| VC | 0.1207 *** | 0.0742 *** | 0.6173 *** | 0.1628 *** |

| (0.003) | (0.013) | (0.105) | (0.013) | |

| RDPerson | 0.8365 *** | |||

| (0.024) | ||||

| RDspend | 0.0051 *** | |||

| (0.001) | ||||

| Age | −0.2553 *** | 1.2160 *** | −8.0052 *** | 0.9607 *** |

| (0.058) | (0.222) | (1.761) | (0.226) | |

| Ownership | 0.0225 * | 0.1459 *** | −0.7498 * | 0.1725 *** |

| (0.013) | (0.049) | (0.394) | (0.050) | |

| Size | 0.0479 *** | 0.0124 | 1.0136 *** | 0.0641 *** |

| (0.002) | (0.008) | (0.064) | (0.008) | |

| ROA | 0.0321 * | −0.2885 *** | 0.3016 | −0.2415 *** |

| (0.019) | (0.071) | (0.563) | (0.072) | |

| Debt | 0.0628 *** | 0.2466 *** | −3.1421 *** | 0.3153 *** |

| (0.009) | (0.034) | (0.273) | (0.035) | |

| PPE | 0.0438 *** | 0.2930 *** | 0.1558 | 0.3162 *** |

| (0.012) | (0.044) | (0.356) | (0.046) | |

| Intensity | 0.0026 | 0.0005 | −0.2030 | 0.0065 |

| (0.007) | (0.026) | (0.206) | (0.026) | |

| Constant | −1.0056 *** | 1.6116 *** | −13.6015 *** | 0.4350 * |

| (0.043) | (0.168) | (1.936) | (0.248) | |

| Individual FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| Observations | 28,892 | 28,892 | 28,892 | 28,892 |

| Number of id | 3993 | 3993 | 3993 | 3993 |

| Within_R2 | 0.7535 | 0.4721 | 0.2479 | 0.4552 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Av_salary | Lnpatent | SA | Lnpatent | |

| VC | 0.0166 ** | 0.1651 *** | −0.5376 *** | 0.1647 *** |

| (0.008) | (0.013) | (0.194) | (0.028) | |

| Av_salary | 0.0507 *** | |||

| (0.020) | ||||

| SA | −0.0023 * | |||

| (0.001) | ||||

| Age | −0.3854 *** | 0.9396 *** | −514.9573 *** | −0.2672 |

| (0.069) | (0.226) | (21.597) | (0.617) | |

| Ownership | 0.0022 | 0.1686 *** | −5.2404 *** | 0.1566 |

| (0.034) | (0.050) | (1.394) | (0.097) | |

| Size | 0.0906 *** | 0.0646 *** | −0.3930 | 0.0683 *** |

| (0.011) | (0.008) | (0.426) | (0.021) | |

| ROA | 0.3582 *** | −0.2581 *** | 6.8886 *** | −0.2241 ** |

| (0.035) | (0.073) | (1.083) | (0.106) | |

| Debt | −0.0120 | 0.3000 *** | 2.7688 *** | 0.3058 *** |

| (0.020) | (0.035) | (0.717) | (0.065) | |

| PPE | −0.0206 | 0.3180 *** | 1.1574 ** | 0.3197 *** |

| (0.022) | (0.046) | (0.538) | (0.084) | |

| Intensity | −0.0151 ** | 0.0062 | −0.1114 | 0.0052 |

| (0.007) | (0.026) | (0.098) | (0.037) | |

| Constant | −1.7243 *** | 0.4535 * | 70.9839 *** | 0.5297 |

| (0.245) | (0.250) | (8.831) | (0.615) | |

| Individual FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| Observations | 28,892 | 28,892 | 28,892 | 28,892 |

| Number of id | 3993 | 3993 | 3993 | 3993 |

| Within_R2 | 0.2655 | 0.4545 | 0.8416 | 0.4545 |

| Variables | (1) | (2) | (3) | (3) |

|---|---|---|---|---|

| Ownership | Scale | Sophistication | Area | |

| VC_state | 0.2099 *** | |||

| (0.019) | ||||

| VC_others | 0.1504 *** | |||

| (0.017) | ||||

| VC_big | 0.2224 *** | |||

| (0.015) | ||||

| VC_small | 0.0936 *** | |||

| (0.017) | ||||

| VC_hightech | 0.2088 *** | |||

| (0.019) | ||||

| VC_lowtech | 0.1515 *** | |||

| (0.016) | ||||

| VC_east | 0.2470 *** | |||

| (0.033) | ||||

| VC_west | 0.1480 *** | |||

| (0.016) | ||||

| VC_med | 0.2275 *** | |||

| (0.029) | ||||

| Age | 1.0649 *** | 1.1776 *** | 0.9882 *** | 0.9194 *** |

| (0.228) | (0.228) | (0.227) | (0.352) | |

| Ownership | 0.1487 *** | 0.1566 *** | 0.1636 *** | 0.0125 |

| (0.051) | (0.051) | (0.051) | (0.020) | |

| Size | 0.0534 *** | 0.0412 *** | 0.0523 *** | 0.0516 *** |

| (0.008) | (0.008) | (0.008) | (0.008) | |

| ROA | −0.2660 *** | −0.2694 *** | −0.2592 *** | −0.2625 *** |

| (0.073) | (0.072) | (0.073) | (0.073) | |

| Debt | 0.3059 *** | 0.2927 *** | 0.2957 *** | 0.3019 *** |

| (0.035) | (0.035) | (0.035) | (0.035) | |

| PPE | 0.3322 *** | 0.3317 *** | 0.3291 *** | 0.3299 *** |

| (0.045) | (0.045) | (0.045) | (0.045) | |

| Intensity | 0.0027 | 0.0023 | 0.0027 | 0.0030 |

| (0.027) | (0.027) | (0.027) | (0.027) | |

| Constant | 0.7516 *** | 1.0096 *** | 0.7769 *** | 0.8426 *** |

| (0.170) | (0.173) | (0.170) | (0.169) | |

| Individual FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| Observations | 28,892 | 28,892 | 28,892 | 28,892 |

| Number of id | 3993 | 3993 | 3993 | 3993 |

| Within_R2 | 0.4468 | 0.4480 | 0.4469 | 0.4467 |

| Variables | (1) | (2) |

|---|---|---|

| Lnpatent | Lnpatent | |

| VC | 0.8930 *** | 0.1779 *** |

| (0.026) | (0.028) | |

| yyjll | 0.0020 *** | |

| (0.001) | ||

| cqbl | 0.0012 | |

| (0.001) | ||

| zzczzl | −0.0493 * | |

| (0.026) | ||

| PPE | 0.4618 *** | |

| (0.083) | ||

| ExecutivesNumber | 0.0068 * | |

| (0.004) | ||

| Age | 13.7765 *** | |

| (0.312) | ||

| Constant | 2.9621 *** | 0.6337 *** |

| (0.008) | (0.091) | |

| Observations | 28,892 | 28,434 |

| R-squared | 0.1276 | 0.4270 |

| Number of id | 3993 | 3878 |

| Within_R2 | 0.1276 | 0.4270 |

| Between_R2 | 0.0731 | 0.0168 |

| Overall_R2 | 0.1032 | 0.0012 |

| Variables | (1) | (2) |

|---|---|---|

| Lninvent | RDSpendSumRatio | |

| VC | 0.1470 *** | 0.4122 ** |

| (0.014) | (0.160) | |

| Age | 1.0240 *** | 9.6894 *** |

| (0.233) | (2.694) | |

| Ownership | 0.2328 *** | −0.0434 |

| (0.052) | (0.603) | |

| Size | 0.0728 *** | 0.5239 *** |

| (0.008) | (0.098) | |

| ROE | −0.0391 | −8.2461 *** |

| (0.075) | (0.862) | |

| Debt | 0.3608 *** | −4.3447 *** |

| (0.036) | (0.418) | |

| PPE | 0.2110 *** | 0.1843 |

| (0.047) | (0.544) | |

| Intensity | −0.0016 | −3.6765 *** |

| (0.027) | (0.315) | |

| Constant | −0.2475 | −8.0667 *** |

| (0.257) | (2.963) | |

| Individual FE | YES | YES |

| Year FE | YES | YES |

| Industry FE | YES | YES |

| Observations | 28,892 | 28,892 |

| Number of id | 3993 | 3993 |

| Within_R2 | 0.3581 | 0.0290 |

| Variables | (1) | (2) |

|---|---|---|

| LnVC1 | LnVC2 | |

| VC | 0.0468 *** | 0.1297 *** |

| (0.003) | (0.024) | |

| Age | −0.0195 *** | 0.0348 *** |

| (0.002) | (0.013) | |

| Ownership | 0.0005 | −0.0084 *** |

| (0.000) | (0.002) | |

| Size | 0.0061 *** | −0.0194 ** |

| (0.002) | (0.010) | |

| ROE | 0.0363 *** | 0.0828 *** |

| (0.003) | (0.014) | |

| Debt | −0.0004 | 0.0151 *** |

| (0.001) | (0.004) | |

| PPE | 0.0042 *** | 0.0025 |

| (0.001) | (0.002) | |

| Intensity | −0.0000 | 0.0016 *** |

| (0.000) | (0.000) | |

| Constant | 0.0050 | 0.0453 ** |

| (0.003) | (0.020) | |

| Individual FE | No | Yes |

| Year FE | No | Yes |

| Industry FE | No | Yes |

| Kleibergen-Paap rk LM statistic | 357.273 | 28.082 |

| Kleibergen-Paap rk Wald F statistic | 184.728 | 14.055 |

| Hansen J statistic | 255.155 | 6.232 |

| Observations | 28,888 | 28,888 |

| Centered_R2 | −0.3464 | −5.4963 |

| Uncentered_R2 | 0.5885 | −0.9853 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, Y.; Jin, S.; Li, Z. Venture Capital and Chinese Firms’ Technological Innovation Capability: Effective Evaluation and Mechanism Verification. Sustainability 2022, 14, 10259. https://doi.org/10.3390/su141610259

Song Y, Jin S, Li Z. Venture Capital and Chinese Firms’ Technological Innovation Capability: Effective Evaluation and Mechanism Verification. Sustainability. 2022; 14(16):10259. https://doi.org/10.3390/su141610259

Chicago/Turabian StyleSong, Yuegang, Songlin Jin, and Zhenhui Li. 2022. "Venture Capital and Chinese Firms’ Technological Innovation Capability: Effective Evaluation and Mechanism Verification" Sustainability 14, no. 16: 10259. https://doi.org/10.3390/su141610259

APA StyleSong, Y., Jin, S., & Li, Z. (2022). Venture Capital and Chinese Firms’ Technological Innovation Capability: Effective Evaluation and Mechanism Verification. Sustainability, 14(16), 10259. https://doi.org/10.3390/su141610259