3.1. Data

PyeongChang 2018, the 2018 Winter Olympics, was held between 9 and 25 February 2018 in PyeongChang and Gangneung in the Gangwon province of the Republic of Korea. Ahead of the official selection, PyeongChang competed with two other cities, Munich and Annecy, to host the Winter Olympic Games. On 6 July 2011, PyeongChang was selected as the host city at the 123rd IOC Session in Durban, South Africa. PyeongChang Winter Olympic Games venues and infrastructure were built in two different areas: PyeongChang mountain cluster, where all the skiing event venues were built, and Gangneung coastal cluster includes indoor sports events. The Korean government spent about USD 13 billion on preparing and staging the Games [

33]. Pyeongchang Olympic Games Organising Committee [

34] noted that 77.3% of the financial spending was put into social overhead capital such as a new highway and the Korea Train Express (KTX) stations and railroad connecting Seoul, PyeongChang, and Gangneung, and the other, around 20%, was spent on building venues. This construction was planned before the official selection.

This study focuses on apartment sales in Gangneung only for following reasons. First, while Gangneung is one of the major cities in Gangwon Province and a typical mid-size city in Korea with a population over 200,000, PyeongChang is a rural mountain area with ski resorts and a population of around 40,000. Thus, apartment sales in Gangneung would be better suited to study the effect of hosting the Olympic Games. Second, the majority of Korean households reside in apartments. Moreover, while details of any unit of apartment sales (e.g., road address) are available in raw data, we have limited access to detailed data on other types of housing (e.g., a single house). Since units within an apartment complex share many amenities, it is relatively easy to control for these amenities. For this reason, previous studies on Korean housing transactions have focused on apartment sales only [

28,

35].

Within this timeline of the PyeongChang Winter Olympic Games, we divided two different events—the announcement of the Games and the actual event period—to test the effect of each event on housing prices. This approach was based on Preuss [

36] and Cashman [

37], in which they argued that investments for the Olympic Games usually happens before the opening ceremony, and regional development is conducted during the biding period. Therefore, we conducted two different sample periods; to test the effect of the announcement, we set up a sample period between 2010 and 2012, and to test the effect of the opening of the KTX station and the actual event, we set up a sample period between 2017 and 2019. Every apartment unit sale has to be reported to the Ministry of Land, Infrastructure, and Transport (MOLIT) by law, and the MOLIT collects and publishes housing transaction data on the website

http://rt.molit.go.kr/ (accessed on 30 April 2022). The data contain detailed information of every apartment transaction, such as price, transaction date, size, floor, construction year, and road address. We collected housing transaction data between 2010 and 2012 and between 2017 and 2019 from the MOLIT website.

Previous studies on the Korean housing market have identified the further determinants of housing prices such as unit-specific features (the number of bedrooms and bathrooms) and apartment-complex-specific features (the number of units in the complex, floor area ratio, building coverage, parking place, distance to closest elementary school or hospital). However, MOLIT transaction data do not cover this information. Thus, we further collected these variables in the following steps.

First, we performed a ‘naïve selection’ of cities that are comparable to Gangneung using city-level population, gross domestic product, and the number of crimes per 100,000 population, which were collected from the Korean Statistical Information Service (

https://kosis.kr, accessed on 30 April 2022) and the Korean Prosecution Service (

https://www.spo.go.kr/site/spo/crimeAnalysis.do, accessed on 30 April 2022). This naïve selection is essential for collecting further information, as raw MOLIT transaction data have too many unit transactions (around 50,000 transactions per month) and most of them are not comparable to the apartment units in Gangneung. As a result, 10 cities were selected and 78,220 transactions between 2010 and 2012 and 68,449 transactions between 2017 and 2019 remained.

Table 1 shows features of the cities compared to Gangneung.

After the naïve selection, we further collected unit-specific features (the number of bedrooms and bathrooms) and apartment-complex-specific features (the number of units in the complex, floor area ratio, building coverage, and parking place availability) by applying web scrapping from

http://kbland.kr/ (accessed on 30 April 2022). After excluding missing values on collected variables, the sample’s size reduced to 47,919 transactions in the 2010–2012 sample and 31,394 transactions in the 2017–2019 sample.

Lastly, we collected a list of elementary schools and hospitals with a road address from the Korean Educational Statistics Service (

https://kess.kedi.re.kr, accessed on 30 April 2022) and the Korean Healthcare Bigdata Hub (

http://gisopendata.hira.or.kr, accessed on 30 April 2022). After collection, we calculated the distance between every transaction unit to the closest elementary school and hospital.

Table 2 and

Table 3 show the descriptive statistics of apartment transactions in Gangneung and naïve-selected cities in the 2010–2012 and 2017–2019 samples, respectively.

For the 2010–2012 sample, the average price was 112,851,400 KRW (around 90,000 USD) and ranged from 7,500,000 to 680,000,000 KRW. The average unit size was 72.45 square meters. The mean floor level was 7.3 and ranged from the first basement level to the 29th floor. The average numbers of bedrooms and bathrooms were 2.9 and 1.5, respectively. The average apartment age was 12.5 years old, and the average number of units in the apartment complex was 547.3. The mean of floor area ratio was 218.6%, and the building coverage was 21.42%. The mean number of parking spaces per unit was 0.937. The average distance to closest hospital and school was 3.1 km and 0.49 km, respectively.

For the 2017–2019 sample, the average price was 140,171,940 KRW (around 110,000 USD) and ranged from 9,500,000 to 788,000,000 KRW. The average unit size was 70.06 square meters. The mean floor level was 7.7 and ranged from the first basement level to the 39th floor. The average of the number of bedrooms and bathrooms was 2.8 and 1.5, respectively. The average apartment age was 18.6 years old, and the average number of units in the apartment complex was 551.1. The mean of floor area ratio was 219.3% and the building’s coverage was 21.34%. The mean number of parking spaces per unit was 0.901. The average distances to the closest hospital and school were 2.85 km and 0.48 km, respectively.

3.2. Analysis

Before estimating the treatment effect, propensity score matching was employed to construct an appropriate control group of the units in naïve-selected cities. Propensity score matching was introduced by Rosenbaum and Rubin [

38] and has been widely used to assess causal relationships with quasi-experimental settings (i.e., the lack of random assignment). The matching technique assumes that outcomes are independent of group participation (units in Gangneung, which hosted the Olympics) conditional on a set of observed variables [

38,

39]. We used variables that are likely to determine housing prices, which include unit-specific features (unit size and floor and the number of bedrooms and bathrooms), apartment-complex-specific features (age, the number of units, floor area ratio, building coverage, parking spaces, and distance to the closest hospital and school), and city-specific features (city population, GRDP, and crime rates). Following Song [

40], we use one-to-one nearest neighbor matching for each unit in Gangneung with a replacement.

As a result of propensity-score matching, 2181 unit transactions were matched for 4989 unit transactions in Gangneung for the 2010–2012 sample and 2014 unit transactions were matched for 3737 unit transactions in Gangneung for the 2017–2019 sample.

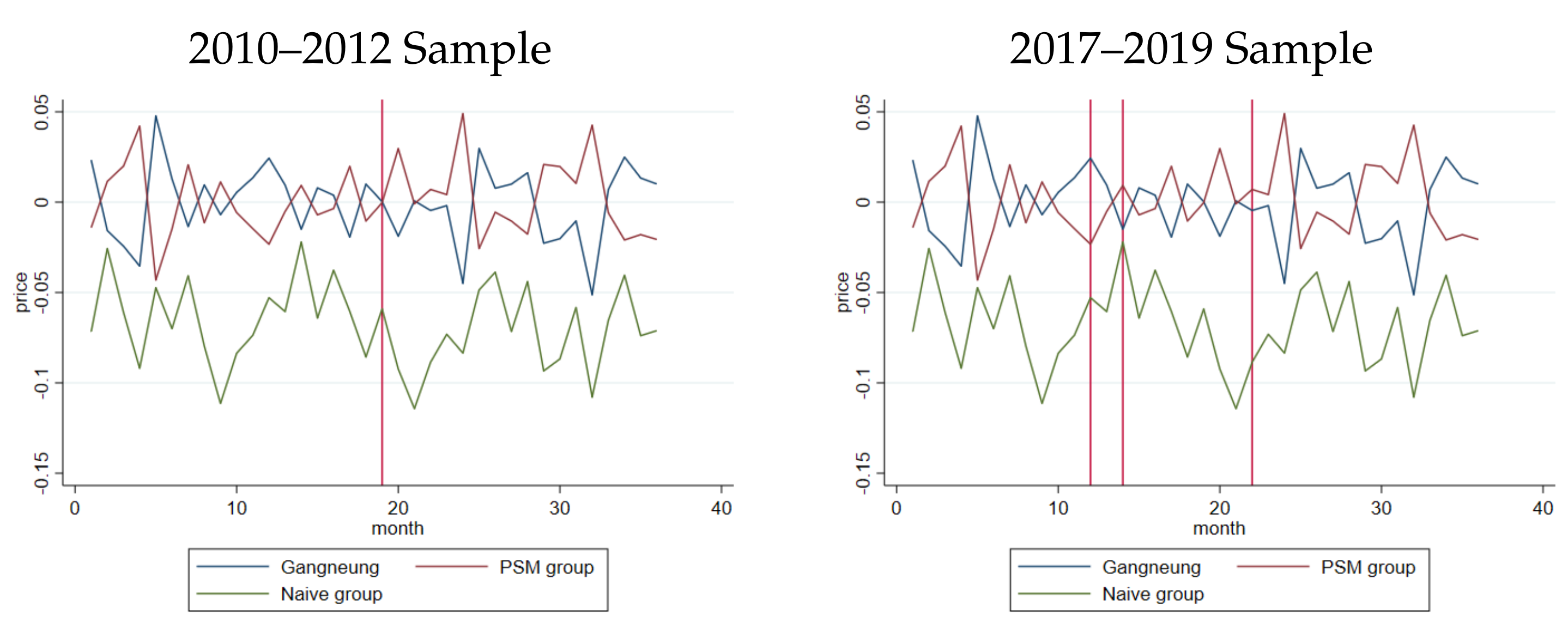

Figure 1 shows the time trends of the monthly average transaction price after controlling for unit-specific, apartment-specific, and city-specific variations for the 2010–2012 and 2017–2019 samples. The vertical line in the 2010–2012 sample in

Figure 1 indicates the month that the announcements were made, and vertical lines for the 2017–2019 sample indicate the months that KTX stations reopened, the month the Olympic Games were held, and when Athletes’ Village opened for the public. For both graphs, transaction prices of units in naïve-selected cities are quite low and show more fluctuations compared to those in Gangneung. The transaction prices of the matched units in

Figure 1 show similar trends to units in Gangneung, which supports the parallel pre-trend assumptions for applying a difference-in-difference analysis.

After applying propensity score matching, a difference-in-difference approach was used to estimate the treatment effect with the 2010–2012 sample. Since a hedonic price model was used for analyzing housing prices [

21,

28,

40], we modified the hedonic price model as follows:

where

represents the logged transformed price of sold unit

i in city

j on transaction day

t.

equals 1 for treatment city, Gangneung, after the announcement of hosting the Olympic Games was made.

is a vector of unit specific variables, such as unit size, floor number, and the number of bedrooms and bathrooms.

is a vector of apartment complex specific variables, such as age, the number of units, floor area ratio, building coverage, parking space, and distance to closest hospital and school.

and

denote city-fixed effects and year-month fixed effects, respectively.

is a heteroscedastic unobservable error term. The equation error term was assumed to be correlated within the city, and we clustered the standard errors accordingly. In this empirical setting,

captures the effect of Olympic announcements on housing prices in Gangneung. We expect positive

if the Olympic announcement increased housing prices in the host area.

Apartment complexes in Gangneung are classified into two different regions: the downtown Gangneung area and the Jumunjin area.

Figure 2 shows the distribution of apartment sales data in Gangneung in the 2010–2012 sample. Sky-blue dots show the location of sold units in downtown Gangneung and dark-blue dots show the location of sold units in Jumunjin. From 7785 transactions in the entire Gangneung area, 73% are located in the downtown area and 27% are located in the Jumunjin area in the 2010–2012 sample. As shown in

Figure 2, apartment units in Jumunjin are quite far from downtown Gangneung, around 13 km away from the KTX station. As the Olympics-related facilities are located in downtown Gangneung, we expected that the effects of the Olympic announcement would be reflected in the downtown area more clearly. Therefore, the following empirical model was derived to test this heterogeneous effect:

where

is equal to 1 for the units in downtown Gangneung after the announcement of hosting the Olympic Games was made, and

equals 1 for units in Jumunjin after the announcement of hosting the Olympic Games was made. The estimation approach and all other variables are the same as in Equation (

1). Within this setting we expected that

would be greater than

if the effects of the Olympic announcement are shown in downtown Gangneung rather than Jumunjin:

where

,

, and

equal 1 for units that are located in a 1 km radius from the Olympic arena, Athletes’ Village, and the KTX station, respectively, after the announcement date. If the effects of the announcement are shown in units close to the Olympic facilities, we expected positive

,

, and

.

In the 2017–2019 sample, there were three events that were likely to affect housing price: the KTX station opening on 22 December 2017, the Olympic Games being held between 9 and 25 February 2018, and civilian residents starting to move into Athletes’ Village on 1 October 2018. We derived a difference-in-difference model to test the effects of the opening of the KTX station, the actual event, and Athletes’ Village opening on housing prices using the 2017–2019 sample:

where

,

, and

equal to 1 for the units in Gangneung after the opening of the KTX station, the actual Olympic period, and Athletes’ Village opening. For the 2017–2019 sample, we also tested the heterogeneous effects for units close to the Olympic facilities, as shown in Equation (

3).