A Decarbonization Roadmap for Taiwan and Its Energy Policy Implications

Abstract

:1. Introduction

1.1. Taiwan’s Energy Quadrilemma

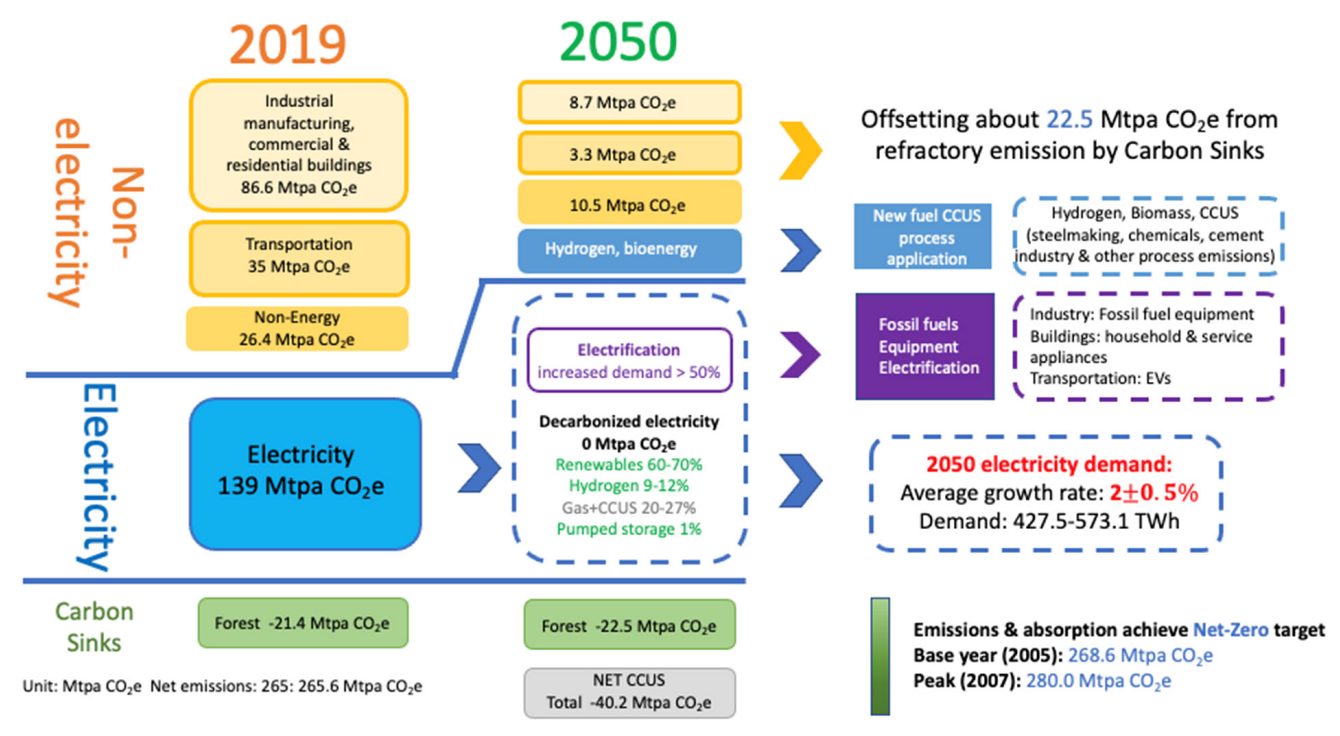

1.2. Taiwan’s Net-Zero Plan

1.3. Taiwan’s Conundrum: Balancing Energy Consumption among Industries

1.4. Liberalization of Taiwan’s Energy Market

1.5. Research on Taiwan’s Energy Transition Policy

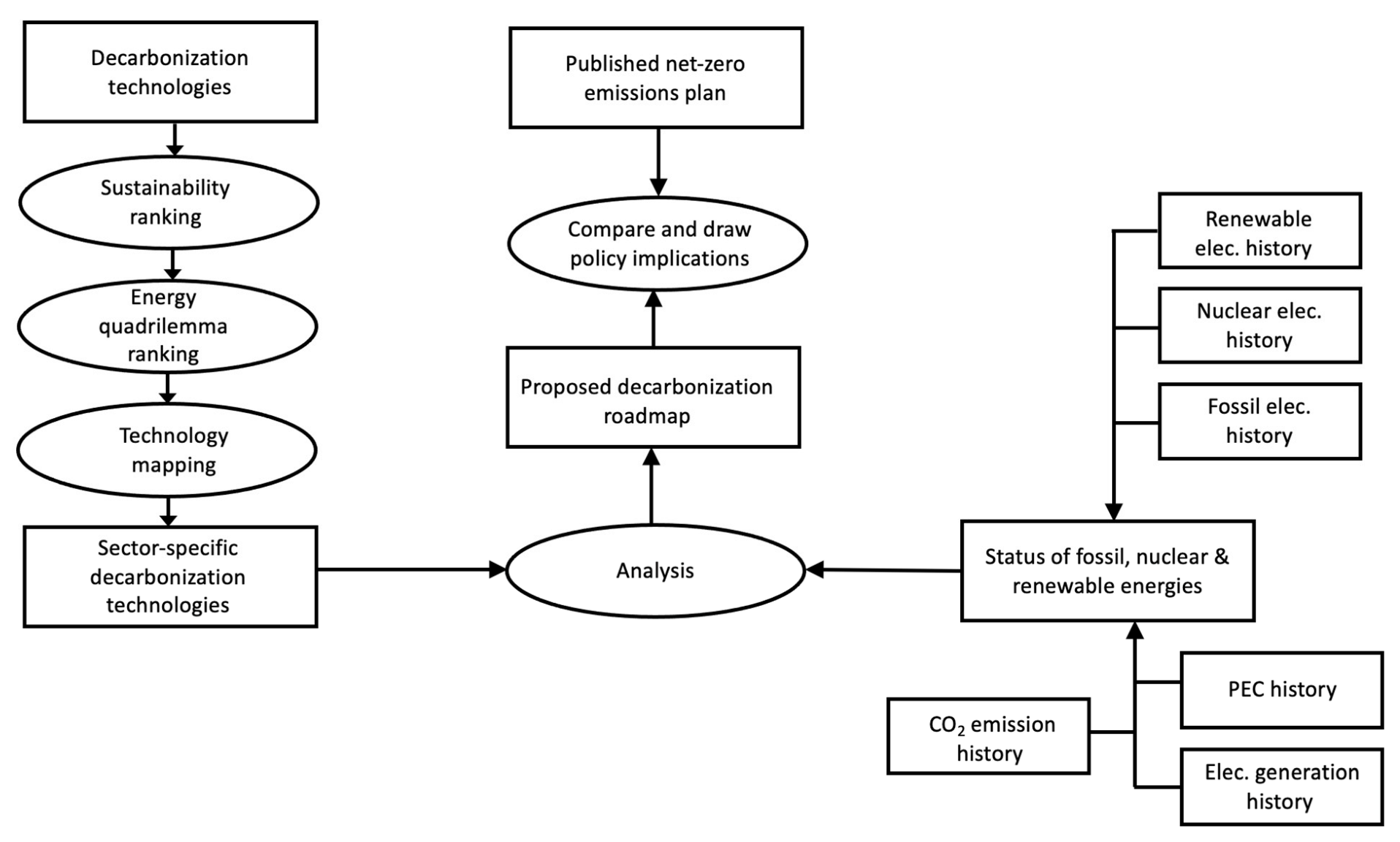

2. Objective and Methodology

3. Status of Fossil and Non-Fossil Energies

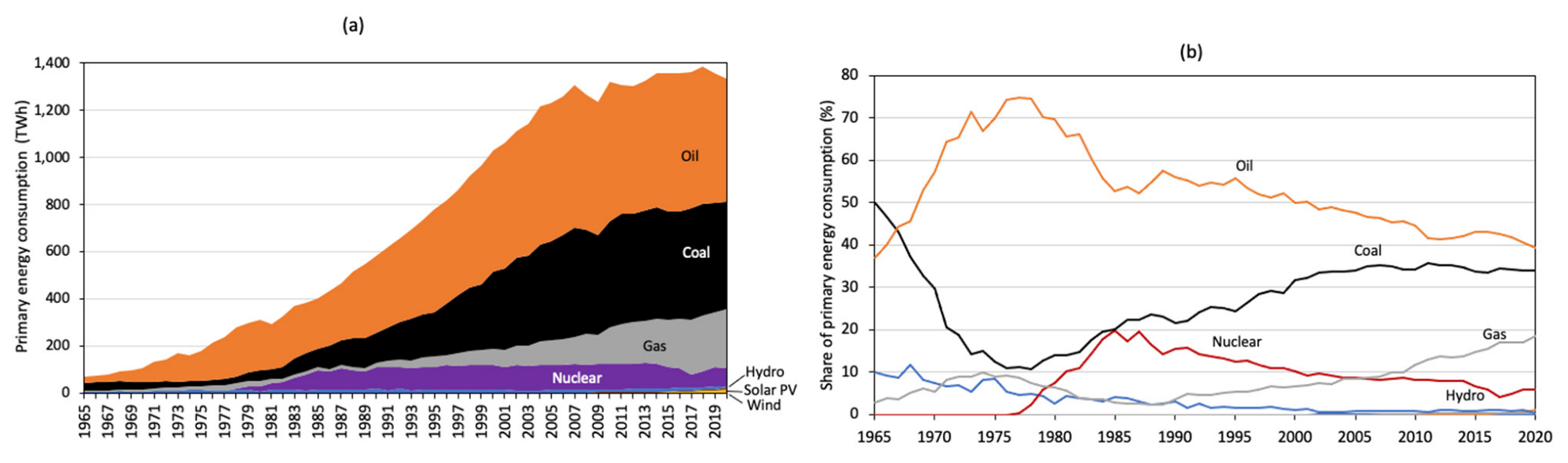

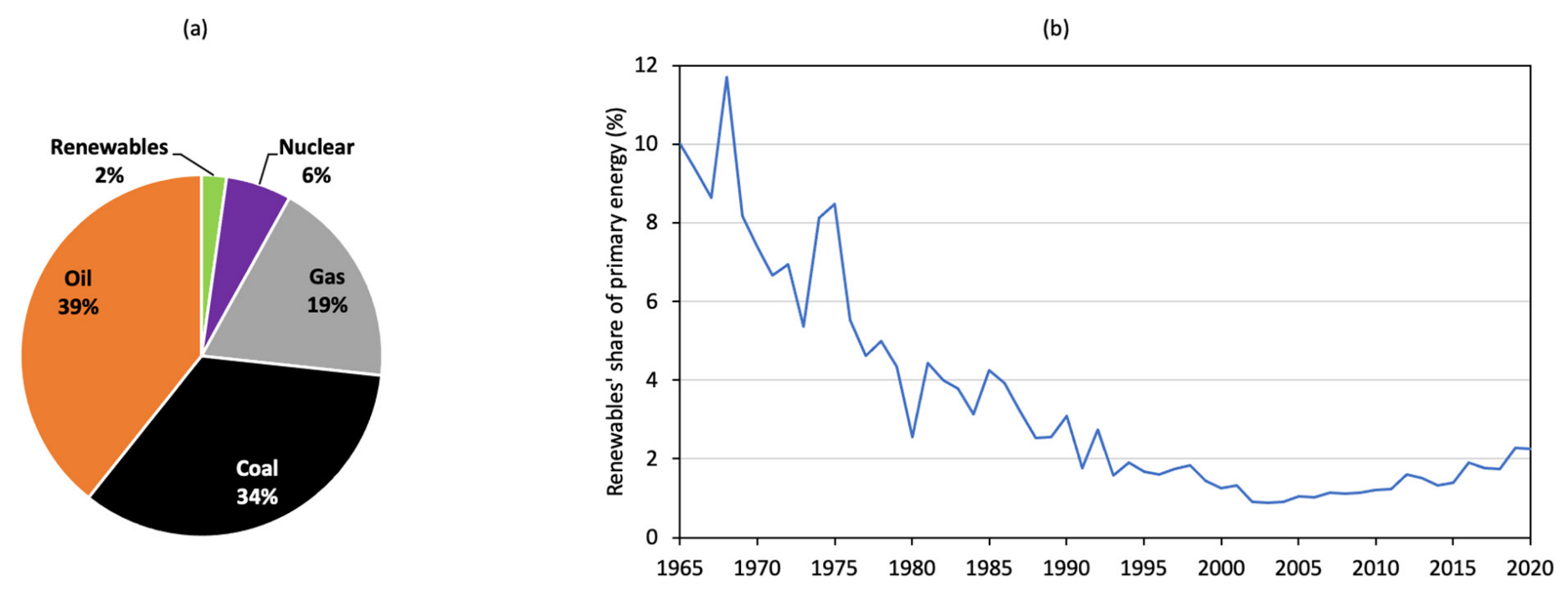

3.1. Primary Energy Consumption

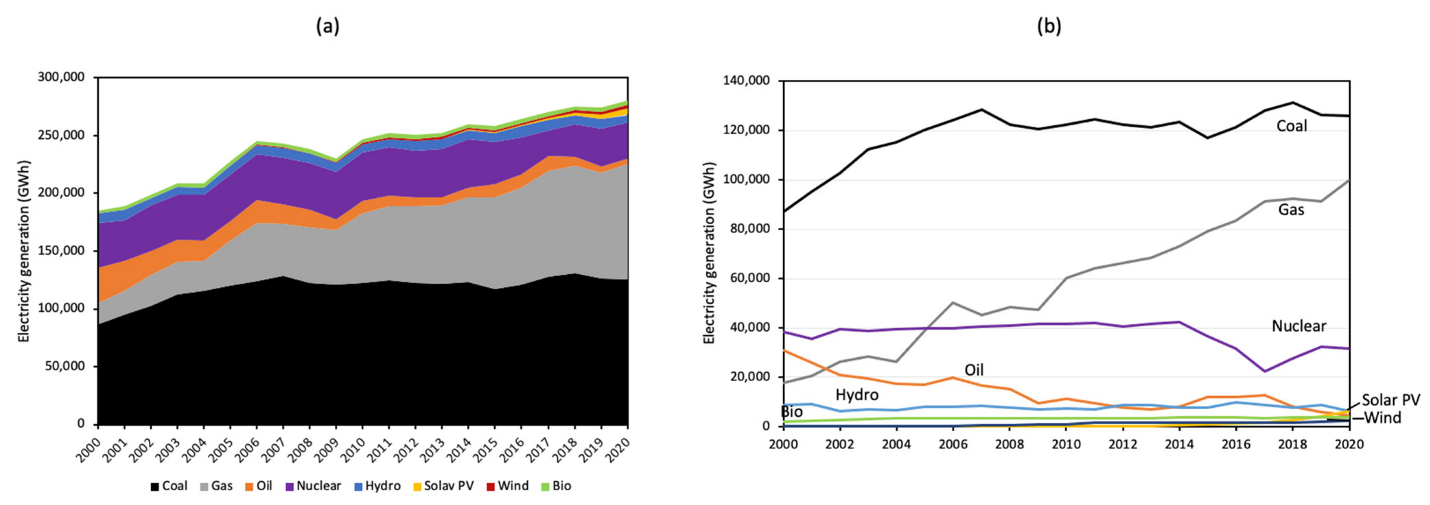

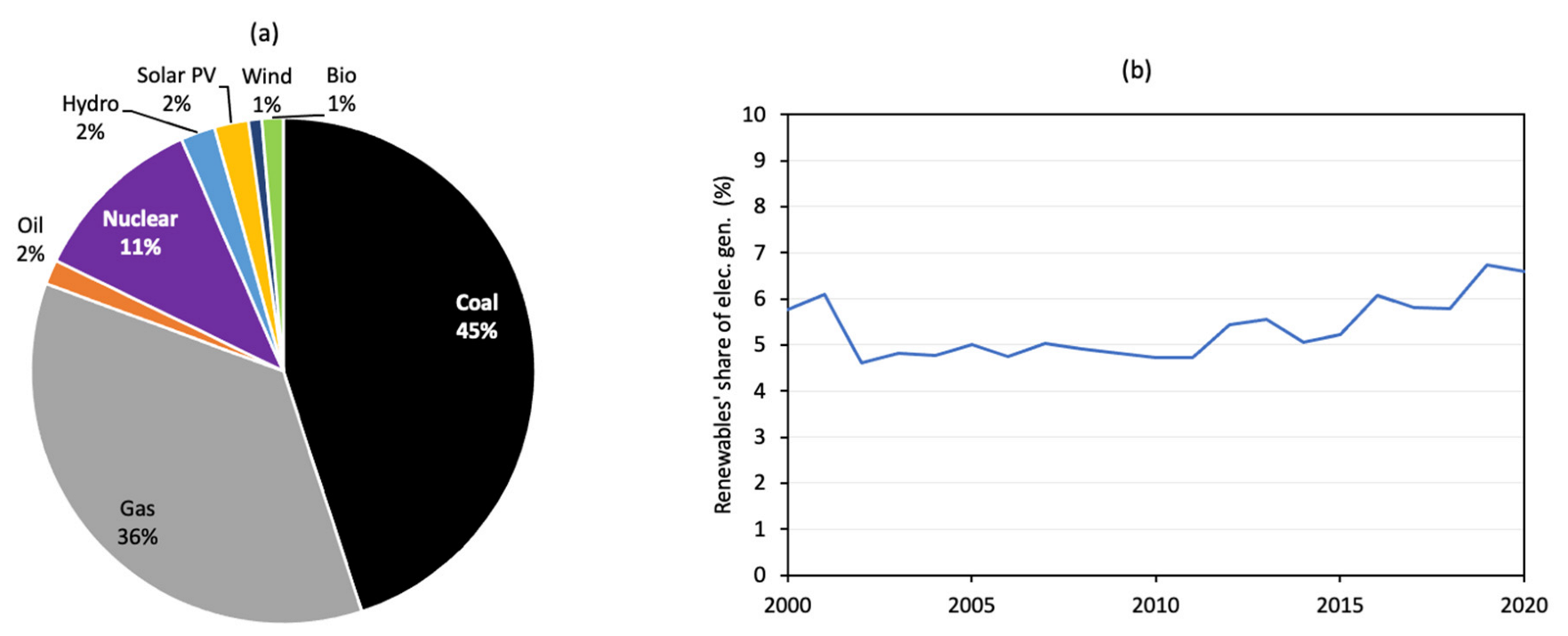

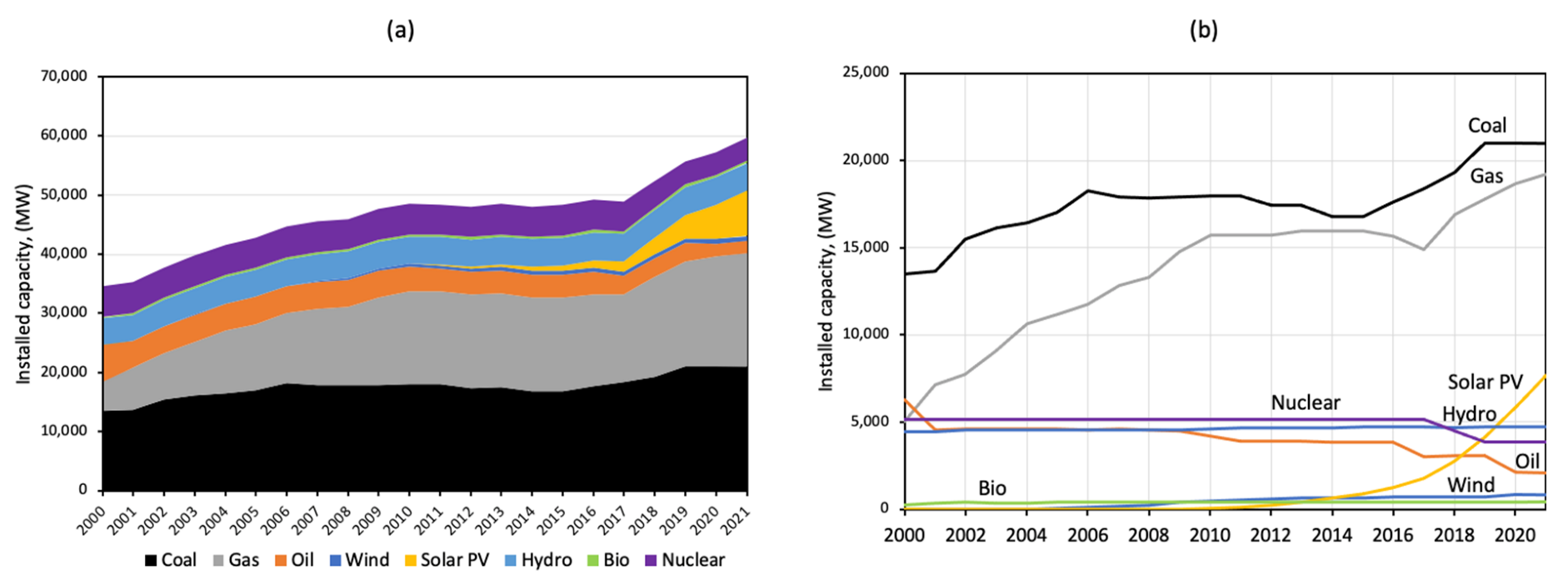

3.2. Electricity Generation

3.3. CO2 Emission

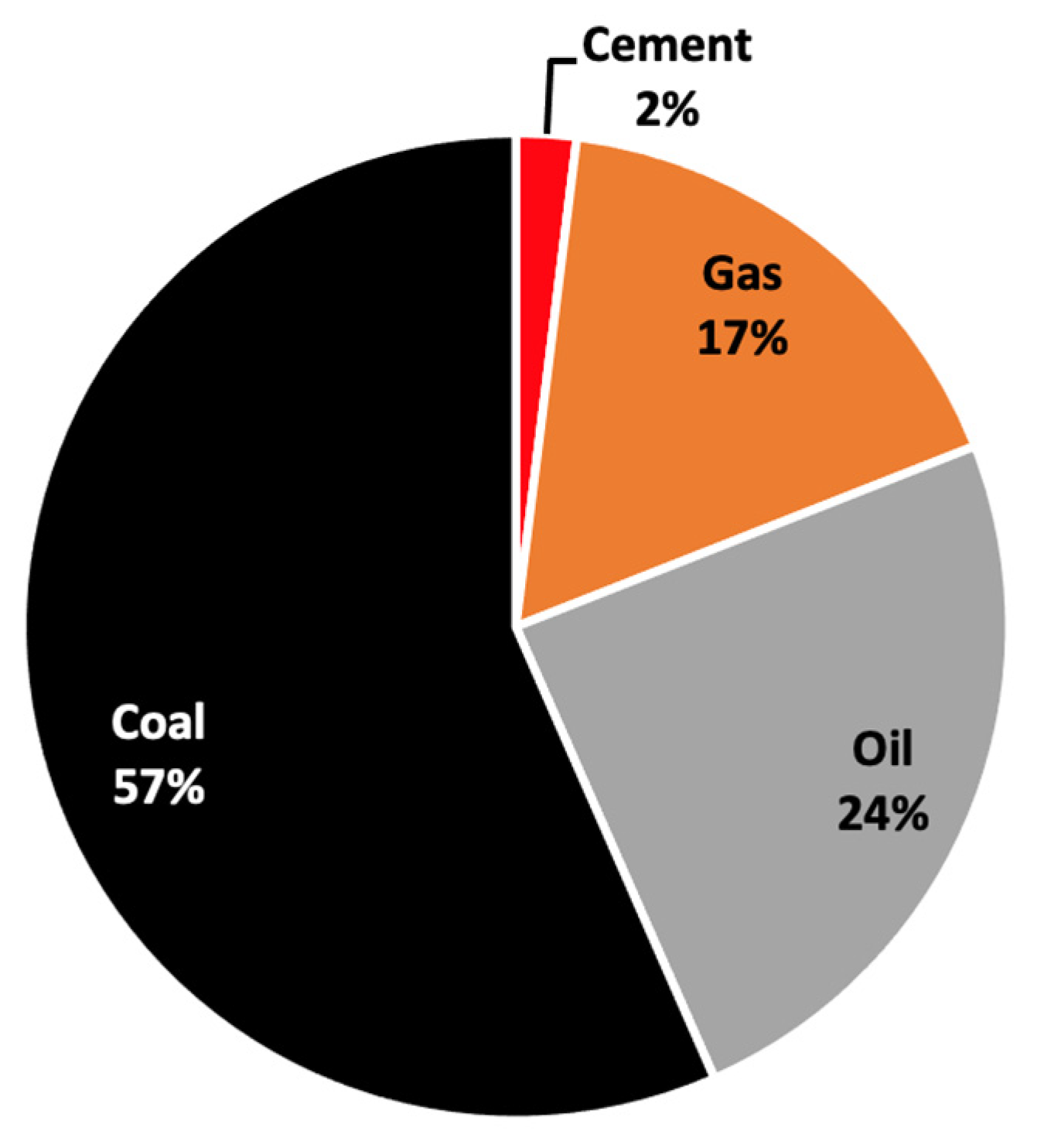

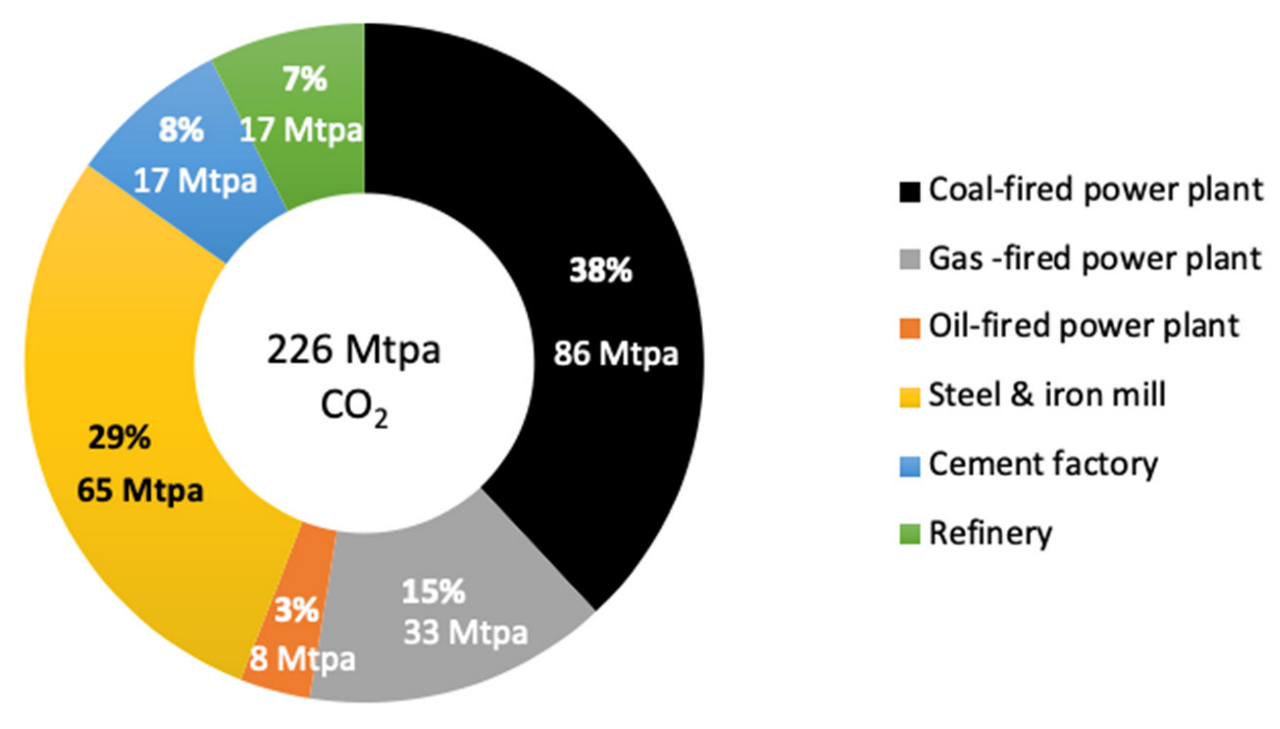

4. Status of Renewable and Nuclear Energies in Taiwan

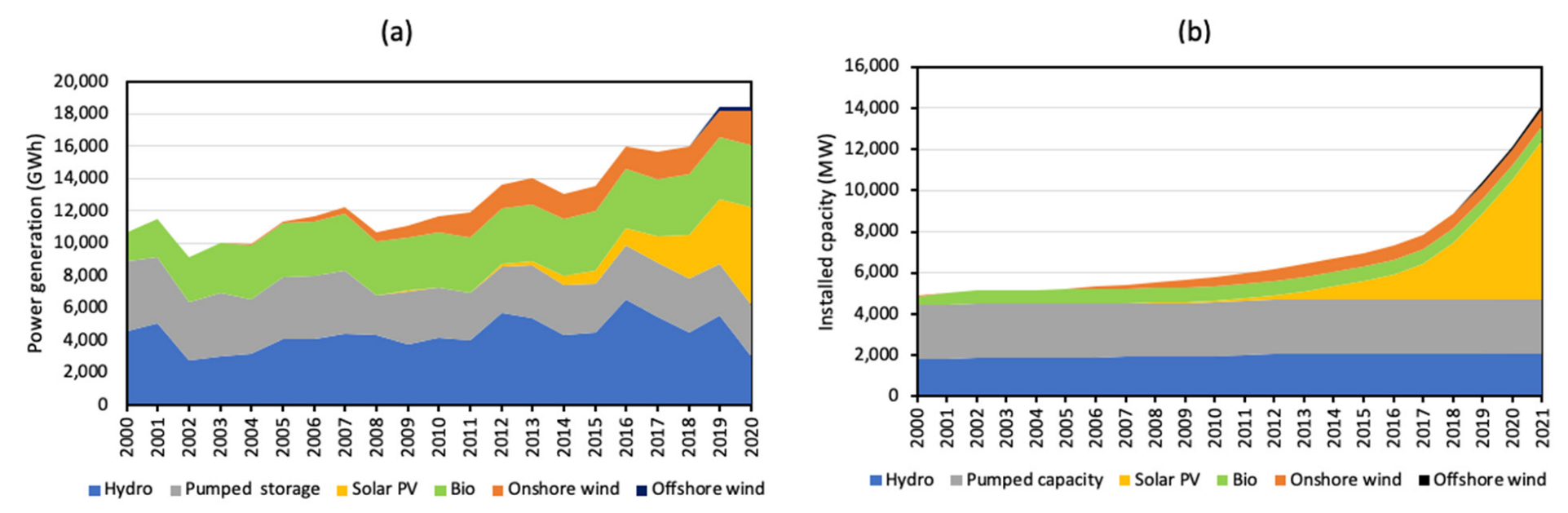

4.1. Status of Wind Energy

4.2. Status of Solar PV

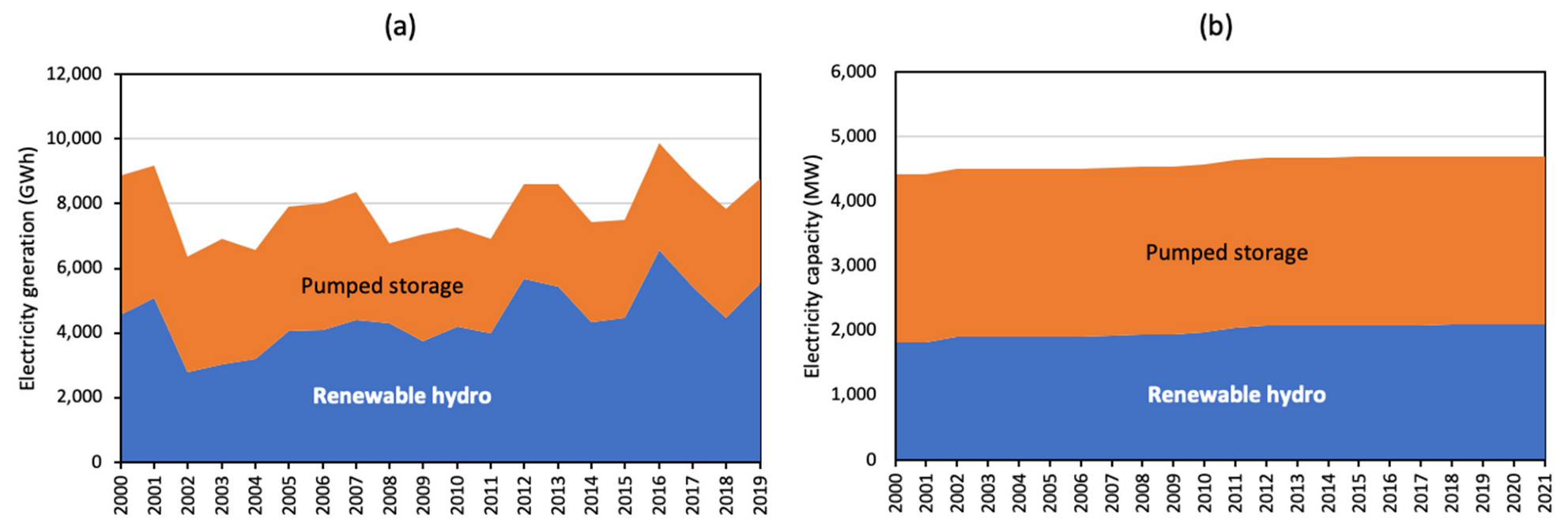

4.3. Status of Hydropower

4.4. Status of Bioenergy

4.5. Status of Geothermal Energy

4.6. Status of Nuclear Energy

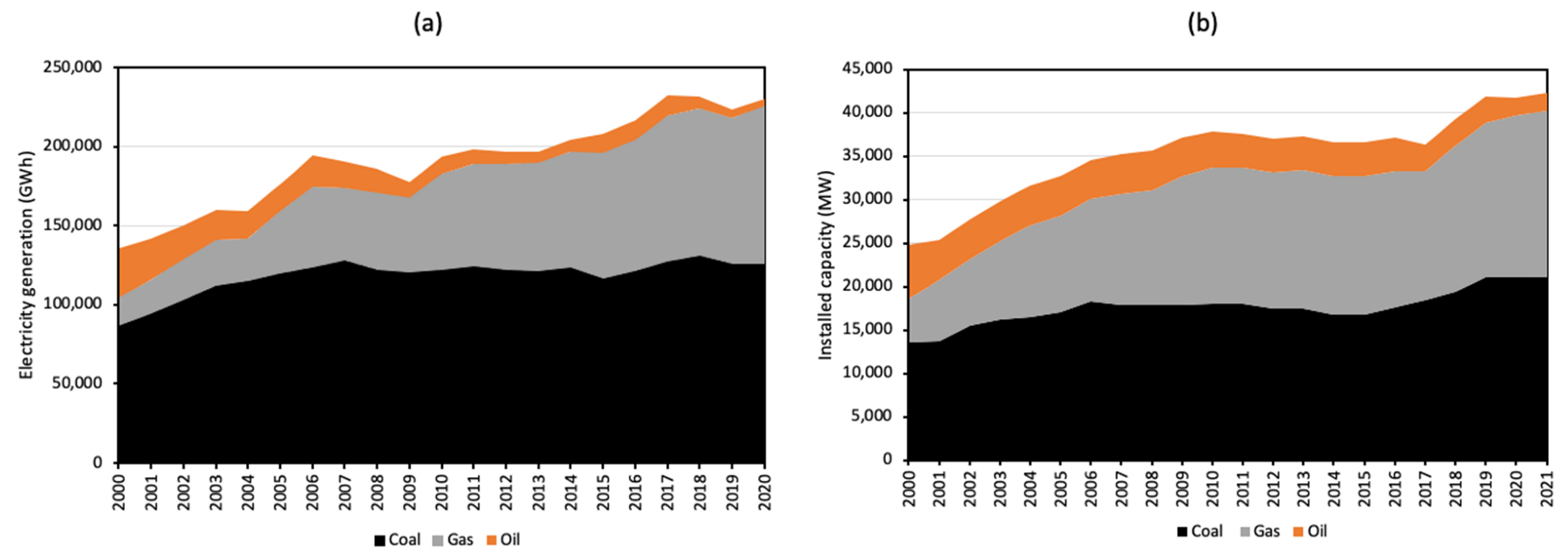

5. Status of Fossil Energies in Taiwan

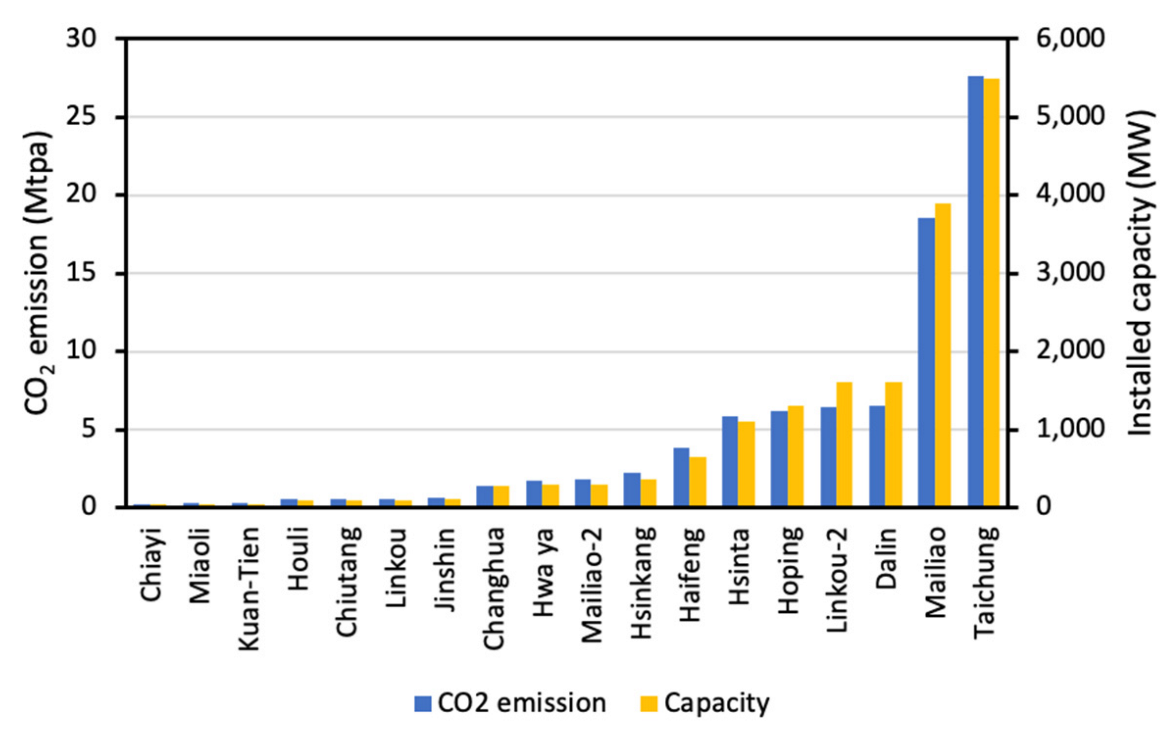

5.1. Status of Coal-Fired Power Plants

5.2. Status of Gas-Fired Power Plants

5.3. Fossil-Related CO2 Emission

6. Decarbonization Technologies

6.1. Sustainability Screening

| Sector | Technology | CO2 Emission | Material Footprint | Impact on People | Impact on Animals | Impact on Environ. |

|---|---|---|---|---|---|---|

| All | Green H2 | L | H | L | L to M | L to M |

| CCU | L | L to H | L | L | L | |

| Power | Nuclear | L | L | M | M | M |

| Hydropower | L | H | M | M | M | |

| Solar PV | L | H | L | L | M | |

| Onshore wind | L | H | L | M | M | |

| Offshore wind | L | H | L | M | M | |

| Bioenergy | L | M | M | M | M | |

| Geothermal | L | H | L | L | L | |

| Coal→gas | M | L | L | L | L | |

| CP-CCS | L | M | L | L | L | |

| GP-CCS | L | L | L | L | L | |

| Clean coal | M | M | L | L | L | |

| Transport | EV | L | H | L | L | L |

| HFCV | L | L | L | L | L | |

| H2-marine | L | L | L | L | L | |

| Bio-aviation | L | M | M | M | M | |

| Industry | Coal→H2-CCS | L | M | L | L | L |

| Gas→H2-CCS | L | L | L | L | L | |

| Ind-CCS | L | L | L | L | L |

6.2. Energy Quadrilemma Screening

| Sector | Technology | Sustainability | Security | Affordability | Reliability |

|---|---|---|---|---|---|

| All | Green H2 | L | L | L | H |

| CCU | M | H | H | H | |

| Power | Nuclear | M | M | H | H |

| Hydropower | L | H | H | M | |

| Solar PV | L | H | H | L | |

| Onshore wind | L | H | H | M | |

| Offshore wind | L | H | H | M | |

| Bioenergy | M | H | H | H | |

| Geothermal | L | M | H | H | |

| Coal→gas | M | M | H | H | |

| CP-CCS | M | M | H | H | |

| GP-CCS | H | M | H | H | |

| Clean coal | M | M | H | H | |

| Transport | EV | L | H | H | H |

| HFCV | H | H | H | H | |

| H2-marine | H | H | M | H | |

| Bio-aviation | M | H | M | H | |

| Industry | Coal→H2-CCS | M | M | M | H |

| Gas→H2-CCS | H | M | M | H | |

| Ind-CCS | H | H | H | H |

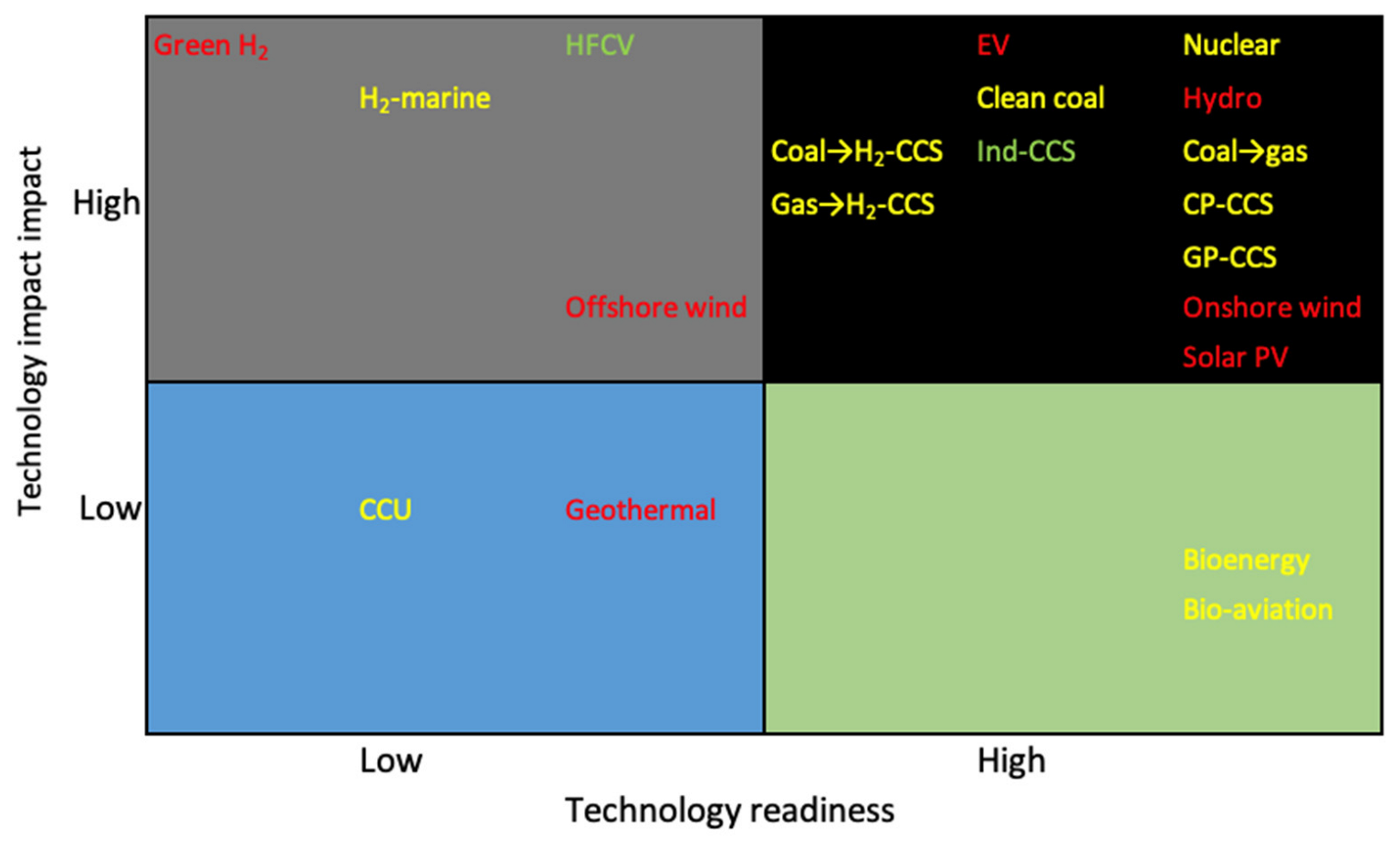

6.3. Technology Mapping

6.4. Composite Ranking

7. Proposed Decarbonization Roadmap

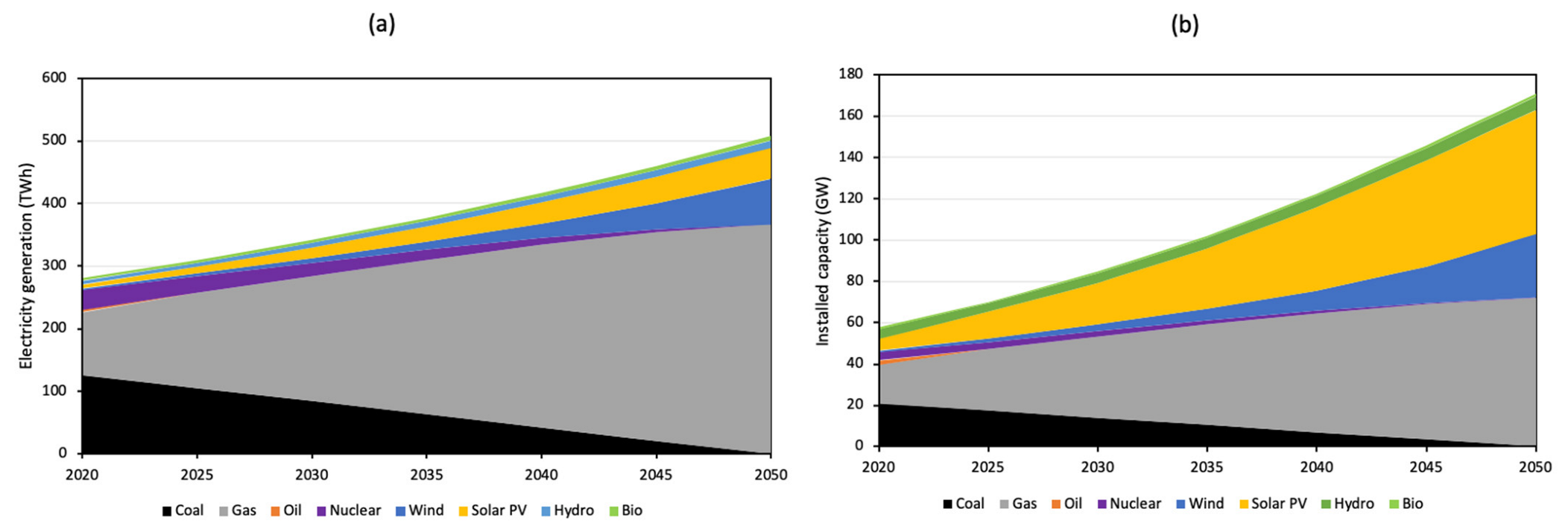

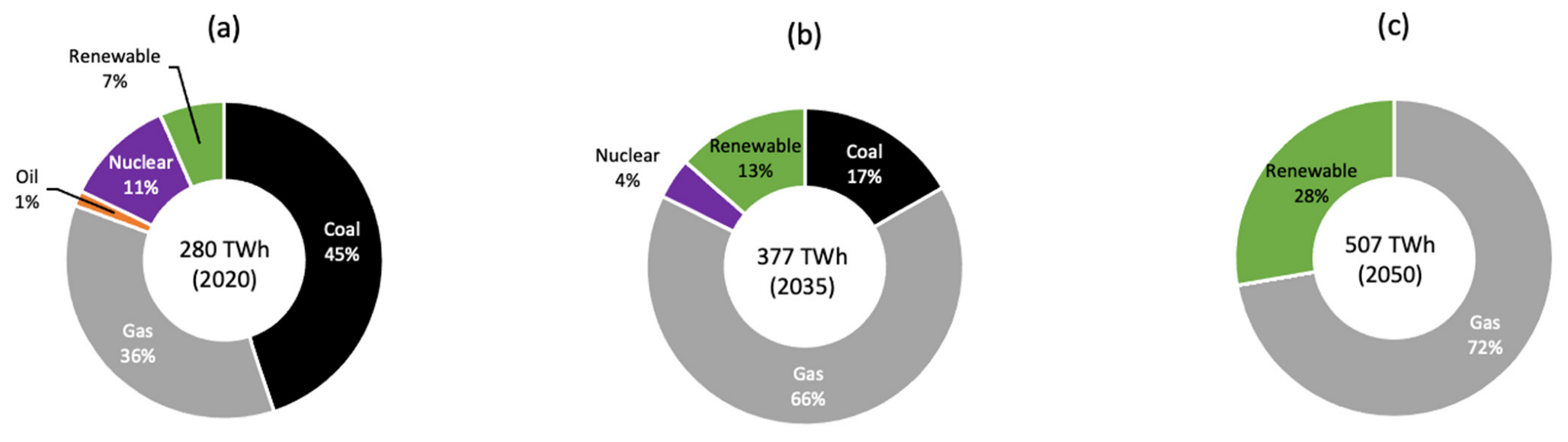

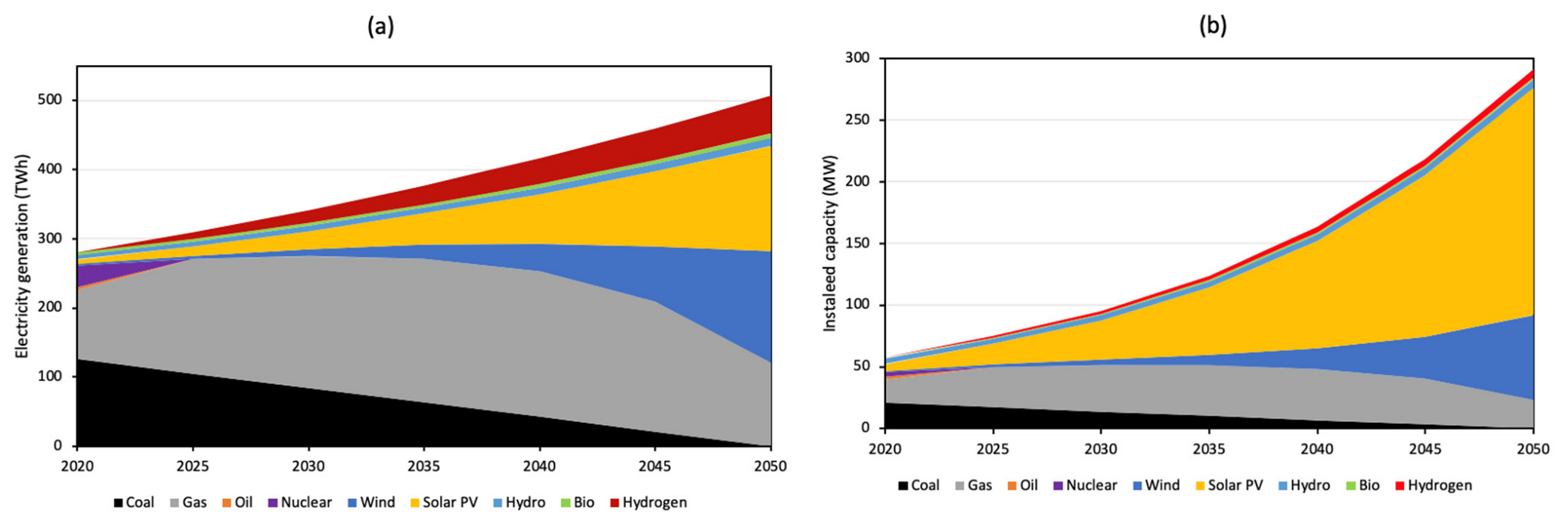

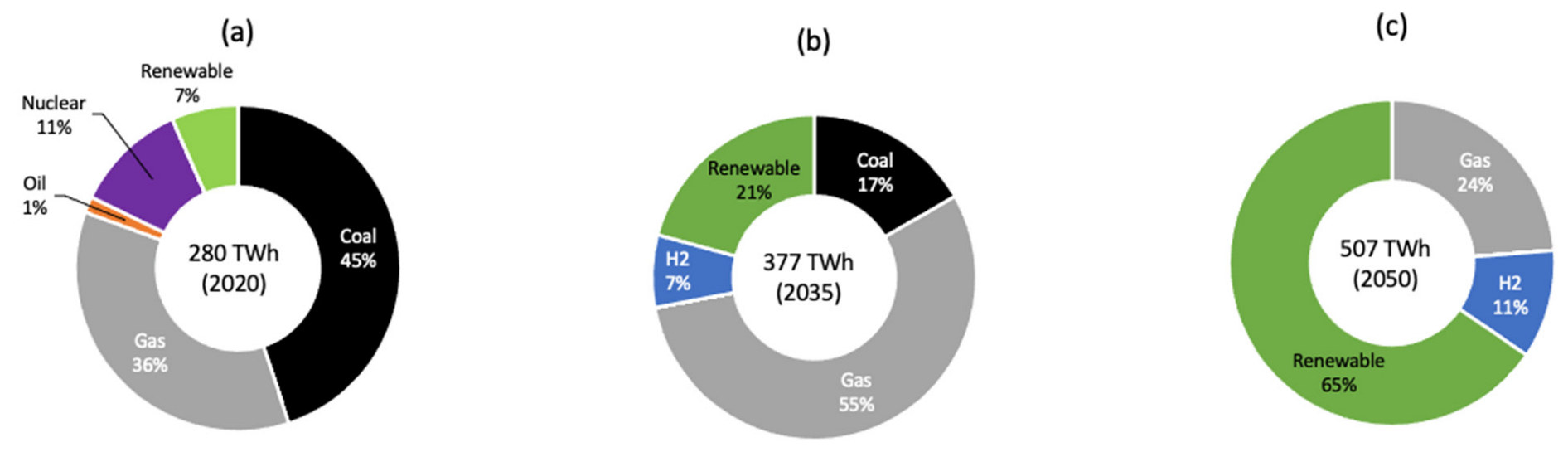

7.1. Power Sector Decarbonization

7.1.1. Clean Coal Technologies

7.1.2. CP-CCS

7.1.3. Coal→Gas

7.1.4. GP-CCS

7.1.5. Nuclear Power Plants

7.1.6. Onshore Wind

7.1.7. Offshore Wind

7.1.8. Solar PV

7.1.9. Hydropower

7.1.10. Hydrogen

7.1.11. Proposed Decarbonization Roadmap for the Power Sector

7.1.12. Comparison with Decarbonization Roadmap Announced by Taiwan’s NZE Plan

7.2. Transport Sector Decarbonization

7.3. Industry Sector Decarbonization

8. Role of CCS in Decarbonization

9. Energy Policy Implications

9.1. Promulgating a Credible Carbon Tax

9.2. Switching from Coal to Gas in Power Generation

9.3. Implementation of Clean Coal Technologies in Existing Coal-Fired Power Plants

9.4. Funding R&D in CCS

9.5. Installing CCS in Fossil Fuel Power Plants and Industrial Plants as Soon as Possible

9.6. Funding R&D in Offshore Wind

9.7. Delaying Phaseout of Nuclear Power

9.8. Formulating a Hydrogen Strategy

10. Discussion

11. Conclusions

- Twenty decarbonization technologies have been screened for sustainability, security, affordability, reliability, technology readiness, and technology impact. Results show that for the power sector, the technology with the highest potential is GP-CCS. This is followed by coal→gas, CP-CCS, clean coal, and nuclear. For the transport sector, EV has the highest potential, followed by HFCV. For the industry sector, the technology with the highest potential is Ind-CCS. This is followed by gas→H2-CCS.

- Based on these findings, a decarbonization roadmap for the power sector is proposed. This roadmap requires a 7% AAGR in renewable electricity generation, which is more achievable than the 10.1% required by the NZE plan.

- In the power sector, the proposed roadmap improves on the NZE plan in the following aspects: (1) using clean coal technologies in existing coal-fired power plants, (2) relying more on gas than solar PV and wind in replacing coal and nuclear, (3) bringing forward CCS, and (4) delaying phaseout of nuclear until 2050.

- For the transport sector, the major difference between the two roadmaps is the use of HFCV, H2-marine, and bio-aviation in the medium future in the roadmap proposed by this study. Both roadmaps advocate EVs as the major decarbonization method.

- For the industry sector, the major differences between the roadmaps are (1) bringing forward CCS to decarbonize industrial plants and (2) using blue instead of green hydrogen for long-term decarbonization.

- Energy policy implications from this study include (1) promulgating a credible carbon tax, (2) switching from coal to gas for power generation, (3) implementing clean coal technologies in existing coal-fired power plants, (4) funding R&D in CCS and offshore wind, (5) implementing CCS in existing fossil power and industry plants as soon as possible, and (6) delaying phaseout of nuclear energy until 2050.

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| AAGR | Average annual growth rate |

| Bio | Bioenergy |

| Bio-aviation | Biofuels for aviation |

| Blue hydrogen | Hydrogen produced from fossil fuels with CCS |

| CCS | Carbon capture and storage |

| CCT | Clean coal technology |

| CCU | Carbon capture and utilization |

| Coal→gas | Replacing coal by gas for power generation |

| Coal→H2-CCS | Hydrogen production by coal gasification with CCS |

| CO2 | Carbon dioxide |

| CO2-EGR | Carbon dioxide enhanced gas recovery |

| CO2-EOR | Carbon dioxide enhanced oil recovery |

| CP-CCS | Coal-fired power plant with carbon capture and storage |

| EGR | Enhanced gas recovery |

| EOR | Enhanced oil recovery |

| EV | Electric vehicle |

| Gas→H2-CCS | Hydrogen production by methane steam reforming with CCS |

| GDP | Gross domestic product |

| Geo | Geothermal energy |

| GP-CCS | Gas-fired power plant with CCS |

| Green H2 | Hydrogen produced by electrolysis with renewable electricity |

| Gt | 109 ton |

| GWh | 109 Wh |

| H2 | Hydrogen |

| H2-marine | Hydrogen as fuel for ships |

| Hydro | Hydropower |

| ICE | Internal combustion engine |

| IGCC | Integrated gasification combined cycle |

| Ind-CCS | CCS in industrial plants |

| HFCV | Hydrogen fuel cell vehicle |

| Mtpa | 106 tons per year |

| MW | 106 W |

| NZE | Net-zero emissions |

| PEC | Primary energy consumption |

| RE | Renewable energy |

| Solar PV | Solar photovoltaic |

| TPES | Total primary energy supply |

| TWh | 1012 Wh |

| Wind | Wind energy |

Appendix A. Technology Ranking Criteria

| Sector | Technology | Description |

|---|---|---|

| All | Green H2 | Hydrogen produced from electrolysis of water by renewable electricity |

| CCU | Converting captured CO2 to chemicals or products | |

| Power | Nuclear | Nuclear power plant |

| Hydro | Hydroelectricity | |

| Solar PV | Solar photovoltaic for on-grid electricity generation | |

| Bioenergy | Bioenergy for electricity generation | |

| Onshore wind | Onshore wind turbine for electricity generation | |

| Offshore wind | Offshore wind turbine for electricity generation | |

| Geothermal | Geothermal power plant | |

| Coal→gas | Switching from coal to gas for thermal power generation | |

| CP-CCS | Using CCS to capture and store CO2 emitted from a coal-fired power plant | |

| GP-CCS | Using CCS to capture and store CO2 emitted from a gas-fired power plant | |

| Clean coal technologies | Supercritical or ultra-supercritical technologies to reduce CO2 emission in coal-fired power plants | |

| Transport | EV | Electric vehicle |

| HFCV | Hydrogen fuel cell vehicle | |

| H2-marine | Hydrogen as fuel for ships | |

| Bio-aviation | Biofuels as fuel for planes | |

| Industry | Ind-CCS | Using CCS to capture and store CO2 emitted from an industrial plant |

| Coal→H2-CCS | Blue hydrogen generated from coal gasification (with CCS) for use in heating and/or feedstock in an industry plant | |

| Gas→H2-CCS | Blue hydrogen generated from steam methane reforming (with CCS) for use in heating and/or feedstock in an industry plant |

| Category | Low | Medium | High |

|---|---|---|---|

| CO2 emission (kg/kWh) | <0.37 | 0.37 to 0.45 | >0.45 |

| Material footprint (t/TWh) | <1000 | 1000 to 2000 | >2000 |

| Consequence | Increasing Probability | ||||

|---|---|---|---|---|---|

| Severity | Impact on People | Impact on Environment | Has Occurred in Industry | Has Occurred in Taiwan | Occurred Several Times a Year in Taiwan |

| 0 | Zero injury or impact | Zero impact | Low | Low | Low |

| 1 | Slight injury or impact | Slight impact | Low | Low | Medium |

| 2 | Minor injury or impact | Minor effect | Low | Medium | Medium |

| 3 | Major injury or major impact | Local effect | Medium | Medium | High |

| 4 | Single fatality or single major impact | Major effect | Medium | High | High |

| 5 | Multiple fatalities or massive impact | Massive effect | Medium | High | High |

| Consequence | Increasing Probability | |||

|---|---|---|---|---|

| Severity | Impact on Animals | Has Occurred in Industry | Has Happened in Taiwan | Has Happened Multiple Times in Taiwan |

| 0 | Zero injury | Low | Low | Low |

| 1 | Slight injury | Low | Low | Medium |

| 2 | Single fatality | Low | Medium | Medium |

| 3 | Multiple fatalities | Medium | Medium | High |

| 4 | Single fatality to endangered species | Medium | High | High |

| 5 | Multiple fatalities to endangered species | Medium | High | High |

| Category\Ranking | Low | Medium | High |

|---|---|---|---|

| Security | Lacking in domestic energy resources | Some domestic resources but import needed | Sufficient domestic resources to be import independent |

| Affordability | Too expensive to be applied on a large scale | Due to high cost, application is limited in scope | Readily affordable for application on a large scale |

| Sustainability | Ranked high in any category in Table A2, Table A3 and Table A4 | Ranked medium in any category in Table A2, Table A3 and Table A4. No category ranked low in Table A2, Table A3 and Table A4 | Ranked low in all categories in Table A2, Table A3 and Table A4 |

| Reliability | <20% capacity factor | 20–40% in capacity factor | >40% capacity factor |

| Category | Sector\Ranking | Low | High |

|---|---|---|---|

| Technology readiness | All | Never or unlikely to be used | Used or readily used based on results from other countries |

| Technology impact | Power | Low degree of power generation | High degree of power generation |

| Transport | Usable in some vehicles, ships, or planes | Usable in most vehicles, ships, or planes | |

| Industry | Usable in some industrial plants | Usable in most industrial plants |

| Coal | Gas | Oil | Wind | Solar PV | Hydro | Bio | Nuclear |

|---|---|---|---|---|---|---|---|

| 78% | 55% | 30% | 28% | 11% | 20% | 57% | 83% |

Appendix B. Technology Ranking Results

| Materials (ton/TWh) | Gas | Nuclear | Biomass | Coal | Geo-Thermal | Wind | Hydro | Solar PV |

|---|---|---|---|---|---|---|---|---|

| Aluminum | 1 | 0 | 6 | 3 | 100 | 35 | 0 | 680 |

| Cement | 0 | 0 | 0 | 0 | 750 | 0 | 0 | 3700 |

| Concrete | 400 | 760 | 760 | 870 | 1100 | 8000 | 14,000 | 350 |

| Copper | 0 | 3 | 0 | 1 | 2 | 23 | 1 | 850 |

| Glass | 0 | 0 | 0 | 0 | 0 | 92 | 0 | 2700 |

| Iron | 1 | 5 | 4 | 1 | 9 | 120 | 0 | 0 |

| Lead | 0 | 2 | 0 | 0 | 0 | 0 | 0 | 0 |

| Plastic | 0 | 0 | 0 | 0 | 0 | 190 | 0 | 210 |

| Silicon | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 57 |

| Steel | 170 | 100 | 310 | 3300 | 3300 | 1800 | 67 | 7900 |

| Total | 572 | 870 | 1080 | 5261 | 5260 | 10,260 | 14,068 | 16,447 |

| Sector | Technology | CO2 Emission | Material Footprint | Impact on People | Impact on Animals | Impact on Environ. |

|---|---|---|---|---|---|---|

| Power | Green H2 | None | High due to power from wind or solar | Low | Low for solar power; Medium for wind power | Low for solar power; Medium for wind power; |

| CCU | Minimum | Depends on technology | Low | Low | Low | |

| Nuclear | None | Low(Table A8) | Medium (Chernobyl, 1986; Fukushima, 2011 [96,97]) | Medium (Chernobyl, 1986; Fukushima, 2011 [96,97]) | Medium (Chernobyl, 1986; Fukushima, 2011 [96,97]) | |

| Hydro | None | High (Table A8) | Medium (Teton Dam, USA, 1976 [98]) | Medium (Teton Dam, USA, 1976 [98]) | Medium (Lawn Lake Dam, USA, 1982 [99]) | |

| Solar PV | None | High (Table A8) | Low | Low | Medium (Used panels are solid waste per US EPA [100]) | |

| Onshore wind | None | High (Table A8) | Low | Medium (Avian death [45]) | Medium (Turbine blades cannot be recycled [101]) | |

| Offshore wind | None | High (Table A8) | Low | Medium (Avian death; endangered Indo-Pacific humpback dolphin [34]) | Medium (Turbine blades cannot be recycled [101]) | |

| Bio | Minimum | Medium (Table A8) | Medium (1st generation biocrop affects food security) | Medium (affects biodiversity due to changed land usage) | Medium (Clearing of forest for biocrop will have major impact) | |

| Geothermal | Minimum | High (Table A8) | Low | Low | Low | |

| Coal→gas | Medium (0.41 kg/kWh) | Low (Table A8) | Low | Low | Low | |

| CP-CCS | Minimum | Medium (Table A8) | Low | Low | Low | |

| GP-CCS | Minimum | Low (Table A8) | Low | Low | Low | |

| Clean coal | Medium (0.37–0.45 kg/kWh) | Medium (Table A8) | Low | Low | Low | |

| Transport | EV | None | High (226t of material extracted per EV battery [102]) | Low | Low | Low |

| HFCV | Minimum (assuming blue or green H2) | Low (assuming blue H2) | Low (assuming blue H2 or green H2 from solar or wind electricity) | Low (assuming blue H2 or green H2 from solar PV) | Low (assuming blue H2) | |

| H2-marine | Minimum (assuming blue or green H2) | Low (assuming blue H2) | Low (assuming blue H2 or green H2 from solar or wind electricity) | Low (assuming blue H2 or green H2 from solar PV) | Low (assuming blue H2) | |

| Bio-aviation | Minimum | Medium (Table A8) | Medium (1st-generation biocrop affects food security) | Medium (Changed land usage affects biodiversity) | Medium (Clearing of forest for biocrop may have major impact) | |

| Industry | Coal→H2-CCS | Minimum | Medium (Table A8) | Low | Low | Low |

| Gas→H2-CCS | Minimum | Low (Table A8) | Low | Low | Low | |

| Ind-CCS | Minimum | Low | Low | Low | Low |

References

- Portal of Taiwan. Economy. 2022. Available online: https://www.taiwan.gov.tw/content_7.php (accessed on 26 May 2022).

- Our World in Data. Taiwan: Energy Country Profile. 2022. Available online: https://ourworldindata.org/energy/country/taiwan (accessed on 26 May 2022).

- Our World in Data. Taiwan: CO2 Country Profile. 2022. Available online: https://ourworldindata.org/co2/country/taiwan (accessed on 26 May 2022).

- Feigenbaum, E.A.; Hou, J. Future of Taiwan’s Economic Competitiveness: Overcoming Taiwan’s Energy Trilemma; Carnegie Endowment for International Peace: Washington, DC, USA, 2020. [Google Scholar]

- Bureau of Energy (MOEA). Energy Statistics Handbook 2020. 2022. Available online: https://www.moeaboe.gov.tw/ECW_WEBPAGE/FlipBook/2020EnergyStaHandBook/index.html#p= (accessed on 26 May 2022).

- Country Economy. CO2 Emission. 2022. Available online: https://countryeconomy.com/energy-and-environment/co2-emissions (accessed on 26 May 2022).

- Wikipedia. Renewable Energy in Taiwan. 2022. Available online: https://en.wikipedia.org/wiki/Renewable_energy_in_Taiwan (accessed on 26 May 2022).

- National Development Council. Taiwan’s Roadmap to Net-Zero Emissions in 2050. 2022. Available online: https://www.NDC.gov.tw/en/Content_List.aspx?n=B927D0EDB57A7A3A (accessed on 25 May 2022).

- Bloomberg. Taiwan Vows $32 Billion Clean Energy Spree as It Lags on Targets. 2022. Available online: https://www.bloomberg.com/news/articles/2022-03-30/taiwan-vows-32-billion-clean-energy-spree-as-it-lags-on-targets#xj4y7vzkg (accessed on 26 June 2022).

- International Trade Administration. Taiwan Renewable Energy Market. United States Department of Commerce. 2021. Available online: https://www.trade.gov/market-intelligence/taiwan-renewable-energy-market (accessed on 26 June 2022).

- Chou, K.; Walther, D.; Liou, H. The Conundrums of Sustainability: Carbon Emissions and Electricity Consumption in the Electronics and Petrochemical Industries in Taiwan. Sustainability 2019, 11, 5664. [Google Scholar] [CrossRef] [Green Version]

- Yang, C.; Wang, C. The Energy Regulation and Markets Review: Taiwan. The Law Reviews 2021, Dentons. Available online: https://thelawreviews.co.uk/title/the-energy-regulation-and-markets-review/taiwan#:~:text=Taiwan’s%20electricity%20market%20has%20not,the%20future%20direction%20of%20reform (accessed on 27 May 2022).

- Taiwan Website Open Information Announcement. Promote Offshore Wind Actively. 2022. Available online: https://www.twtpo.org.tw/eng/Home/ (accessed on 27 May 2022).

- Tsay, I.; Chen, P. A Dual Market Structure Design for the Reform of An Independent Power Grid System-the Case of Taiwan. Energy Rep. 2019, 5, 1603–1615. [Google Scholar] [CrossRef]

- Huang, G.C.; Chen, R. Uncovering Regime Resistance in Energy Transition: Role of Electricity Iron Triangle in Taiwan. Environ. Pol. Gov. 2021, 31, 104–115. [Google Scholar] [CrossRef]

- Wakefield, B. (Ed.) Taiwan’s Energy Conundrum; Asia Program Special Report No.146; Woodrow Wilson International Center for Scholars: Washington, DC, USA, 2012; Available online: https://www.wilsoncenter.org/sites/default/files/media/documents/publication/SP%20Report%20146%20working%201-20-small.pdf (accessed on 6 July 2022).

- Tan, W. Overview of Wind Power Development Over the Two Past Decades (2000–2019) and Its Role in the Taiwan’s Energy Transition and Sustainable Development Goal. AIMS Energy 2021, 9, 342–354. [Google Scholar]

- Wang, C.; Lee, C.; Hong, Y.; Cheng, K. Assessment of Energy Transition Policy in Taiwan—A View of Sustainable Development Perspectives. Energies 2021, 14, 4402. [Google Scholar] [CrossRef]

- Feng, C.; Chang, K.; Lin, J.; Lee, R.T.; Lin, S. Toward Green Transition in the Post Paris Agreement Era: The Case of Taiwan. Energy Policy 2022, 165, 112996. [Google Scholar] [CrossRef]

- Chen, C.C. The Path to a 2025 Nuclear-free Taiwan: An Analysis of Dynamic Competition Among Emissions, Energy, and Economy. Energy Environ. 2021, 32, 668–689. [Google Scholar] [CrossRef]

- Kung, C.; McCarl, B.A. The Potential Role of Renewable Electricity Generation in Taiwan. Energy Policy 2020, 138, 111227. [Google Scholar] [CrossRef]

- Gao, A.M.; Huang, C.; Lin, J.; Su, W. Review of Recent Offshore Wind Power Strategy in Taiwan: Onshore Wind Power Comparison. Energy Strategy Rev. 2021, 38, 100747. [Google Scholar] [CrossRef]

- Gao, A.M.; Fan, C.; Liao, C. Application of German Energy Transition in Taiwan: A Critical Review of Unique Electricity Liberalization as a Core Strategy to Achieve Renewable Energy Growth. Energy Policy 2018, 120, 644–654. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Data & Statistics. 2022. Available online: https://www.irena.org/en/Statistics (accessed on 27 May 2022).

- Power Technology. Yunlin Offshore Wind Farm, Taiwan Strait, Taiwan. 2022. Available online: https://www.power-technology.com/projects/yunlin-offshore-wind-farm-taiwan-strait-taiwan/ (accessed on 6 July 2022).

- Chong, A. Taiwan’s Biggest Offshore Wind Farm Generates First Power. Digitimes, Taipei. 2022. Available online: https://www.digitimes.com/news/a20220429VL201/offshore-wind-farm-orsted.html (accessed on 28 May 2022).

- United States Department of Energy (DOE). Offshore Wind Market Report: 2021 Edition. Office of Energy & Renewable Energy. 2021. Available online: https://www.energy.gov/sites/default/files/2021-08/Offshore%20Wind%20Market%20Report%202021%20Edition_Final.pdf (accessed on 6 July 2022).

- Harris, J. Taiwanese Offshore Wind Development Round 2021 Underway. Out-Law Analysis. Pinsent Masons. 2021. Available online: https://www.pinsentmasons.com/out-law/analysis/taiwanese-offshore-wind-development-round-2021 (accessed on 28 May 2022).

- United States Department of Energy (DOE). Wind Turbines in Extreme Weather: Solutions for Hurricane Resiliency. Office of Energy Efficiency & Renewable Energy. 2018. Available online: https://www.energy.gov/eere/articles/wind-turbines-extreme-weather-solutions-hurricane-resiliency#:~:text=Basically%2C%20the%20wind%20turbine%20is,contend%20with%20large%2C%20powerful%20waves (accessed on 28 May 2022).

- Rose, S.; Jaramillo, P.; Small, M.J.; Grossmann, I.; Apt, J. Quantifying the Hurricane Risk to Offshore Wind Turbines. PNAS 2012, 109, 3247–3252. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Matsunaka, Y. A Typhoon-Proof Wind Turbine is Generating an Energy Shift for Remote Islands. Autodesk. 2021. Available online: https://redshift.autodesk.com/typhoon-proof-wind-turbine/ (accessed on 28 May 2022).

- GE Renewable Energy. Riders On the Storm: GE is Building a Wind Turbine that Can Weather Violent Typhoons, Hurricanes. 2018. Available online: https://www.ge.com/news/reports/riders-storm-ge-building-wind-turbine-can-weather-violent-typhoons-hurricanes (accessed on 28 May 2022).

- Li, J.; Li, Z.; Jiang, Y.; Tang, Y. Typhoon Resistance Analysis of Offshore Wind Turbines: A Review. Atmosphere 2022, 13, 451. [Google Scholar] [CrossRef]

- Chung, H. Taiwan’s Offshore Wind Energy Policy: From Policy Dilemma to Sustainable Development. Sustainability 2021, 13, 10465. [Google Scholar] [CrossRef]

- Lin, S. Understanding Barriers to Solar Energy Use in Taiwan Using the Decision Making Trial and Evaluation Laboratory Integrated with the Technique of Order Preference by Similarity to an Ideal Solution. Smart Grid Renew. Energy 2021, 12, 137–162. [Google Scholar] [CrossRef]

- Asia Today. Taiwan’s Solar Power Dream Collides with Reality. 2020. Available online: http://asiatoday.com/pressrelease/taiwan%E2%80%99s-solar-power-dream-collides-reality (accessed on 28 May 2022).

- Lin, M.T. Taiwan’s Net-Zero Roadmap Promises $170 Billion in Spending, Renewable Expansion; More Could be Required. S&P Global. 2022. Available online: https://cleanenergynews.ihsmarkit.com/research-analysis/taiwans-netzero-roadmap-promises-170-billion-in-spending-renew.html (accessed on 18 May 2022).

- Jia, F.; Sun, H.; Koh, L. Global Solar Photovoltaic Industry: An Overview and National Competitiveness of Taiwan. J. Cleaner Production 2016, 126, 550–562. [Google Scholar] [CrossRef]

- Chen, C.; Yang, C. The Investability of PV Systems Under Descending Feed-In-Tariffs: Taiwan Case. Energies 2021, 14, 2728. [Google Scholar] [CrossRef]

- Liao, S.; Chang, S.; Cheng, T. Index-Based Renewable Energy Insurance for Taiwan Solar Photovoltaic Power Plants. Risk Manag. Insur. Rev. 2022, 25, 145–172. [Google Scholar] [CrossRef]

- Taipower. Overview of the Development of Renewable Energy. 2022. Available online: https://www.taipower.com.tw/en/page.aspx?mid=4495&cid=2827&cchk=ee217b56-d61e-430a-8a02-62862029bfab (accessed on 28 May 2022).

- American Institute in Taiwan (AIT). Renewable Energy Industry in Southern Taiwan 2018. United States Department of Commerce, US Commercial Service. 2018. Available online: https://2016.export.gov/taiwan/build/groups/public/@eg_tw/documents/webcontent/bg_tw_120850.pdf (accessed on 6 July 2022).

- Focus Taiwan. Taiwan’s Hydropower Plants Hard-Hit by Drought This Year. CNA English News. 2021. Available online: https://focustaiwan.tw/society/202105180028 (accessed on 28 May 2022).

- Chen, H.H.; Lee, A.H.I. Comprehensive Overview of Renewable Energy Development in Taiwan. Ren. Sustain. Energy Rev. 2014, 37, 215–228. [Google Scholar] [CrossRef]

- Boyle, G. Renewable Energy: Power for a Sustainable Future, 3rd ed.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Chang, K.; Lou, K.; Ko, C. Potential of Bioenergy Production from Biomass Wastes of Rice Paddles and Forest Sectors in Taiwan. J. Clean. Prod. 2019, 206, 460–476. [Google Scholar] [CrossRef]

- Focus Taiwan. Geothermal Power Set for New Commercial Beginning in Taiwan. CAN English News. 2021. Available online: https://focustaiwan.tw/business/202111160015 (accessed on 21 May 2022).

- Huang, T. Taiwan to See its First Geothermal Power Plant in 3 Decades. Taiwan News. 2021. Available online: https://www.taiwannews.com.tw/en/news/4346869 (accessed on 21 May 2022).

- Hanson, P. Geothermal Country Overview: Taiwan. GeoEnergy Marketing Services. 2019. Available online: https://www.geoenergymarketing.com/energy-blog/geothermal-country-overview-taiwan/ (accessed on 21 May 2022).

- Richter, A. Taiwan Geothermal Association on the Geothermal Potential of Taiwan. ThinkGeoEnergy. 2019. Available online: https://www.thinkgeoenergy.com/taiwan-geothermal-association-on-the-geothermal-potential-of-taiwan/#:~:text=The%20Geothermal%20Association%20of%20Taiwan,geothermal%20energy%20resources%20in%20Taiwan.&text=Taiwan%20is%20located%20in%20the%20middle%20of%20%E2%80%9CPacific%20Fire%20Ring%E2%80%9D (accessed on 21 May 2022).

- Song, S. The Geothermal Potential, Current and Opportunity in Taiwan. ADS. 2016. Available online: https://ui.adsabs.harvard.edu/abs/2016EGUGA..18.3376S/abstract (accessed on 21 May 2022).

- World Nuclear Association. Nuclear Power in Taiwan. 2021. Available online: https://world-nuclear.org/information-library/country-profiles/others/nuclear-power-in-taiwan.aspx (accessed on 21 May 2022).

- Nuclear Engineering International. Phasing Out Nuclear Power in Taiwan. 2021. Available online: https://www.neimagazine.com/features/featurephasing-out-nuclear-power-in-taiwan-9010839/ (accessed on 21 May 2022).

- GlobalData Energy. Power Generation in Taiwan in 2025 is Estimated to be Free from Nuclear Power. 2021. Available online: https://www.power-technology.com/comment/power-taiwan-2025-free-from-nuclear/ (accessed on 21 May 2022).

- Huang, G.C.; Chen, R. Injustices in Phasing Out Nuclear Power?: Exploring Limited Public Participation and Transparency in Taiwan’s Transition Away from Nuclear Energy. Energy Res. Soc. Sci. 2021, 71, 101808. [Google Scholar] [CrossRef]

- Shih, Y.; Shi, N.; Tseng, C.; Pan, S.; Chiang, P. Socioeconomic Costs of Replacing Nuclear Power with Fossil and Renewable Energy in Taiwan. Energy 2016, 114, 369–381. [Google Scholar] [CrossRef]

- Wu, K.; Huang, Y.; Wu, J. Impact of Electricity Shortages During Energy Transitions in Taiwan. Energy 2018, 151, 622–632. [Google Scholar] [CrossRef]

- Global Energy Monitor. Summary Tables. 2022. Available online: https://globalenergymonitor.org/projects/global-coal-plant-tracker/summary-tables/ (accessed on 21 May 2022).

- Zhang, K.; Lau, H.C.; Liu, S. Carbon Capture and Storage in the Coast Region of China between Shanghai and Hainan. Energy 2022, 247, 123470. [Google Scholar] [CrossRef]

- Worldometer. Taiwan CO2 Emissions. Available online: https://www.worldometers.info/co2-emissions/taiwan-co2-emissions/ (accessed on 21 May 2022).

- Taiwan News. World’s Worst Emissions Come from Taiwan. 2008. Available online: https://www.taiwannews.com.tw/en/news/730934 (accessed on 21 May 2022).

- Lau, H.C.; Zhang, K.; Bokka, H.K.; Ramakrishna, S. A Review of the Status of Fossil and Renewable Energies in Southeast Asia and Its Implications on the Decarbonization of Asia. Energies 2022, 15, 2152. [Google Scholar] [CrossRef]

- Lau, H.C. Decarbonization Roadmaps for ASEAN and Their Implications. Energy Rep. 2022, 8, 6000–6022. [Google Scholar] [CrossRef]

- Lau, H.C. Evaluation of Decarbonization Technologies for ASEAN Countries Via an Integrated Assessment Tool. Sustainability 2022, 14, 5827. [Google Scholar] [CrossRef]

- Lau, H.C. The Role of Fossil Fuels in a Hydrogen Economy. In Proceedings of the International Petroleum Technology Conference (IPTC-21162-MS), Virtual Event, 23 March–1 April 2021. [Google Scholar]

- International Energy Agency (IEA). Clean Coal Technologies: Accelerating Commercial and Policy Drivers for Deployment; International Energy Agency (IEA): Paris, France, 2008. [Google Scholar]

- Lau, H.C.; Ramakrishna, S.; Zhang, K.; Radhamani, A.V. The Role of Carbon Capture and Storage in the Energy Transition. Energy Fuels 2021, 35, 7364–7386. [Google Scholar] [CrossRef]

- Gas Processing News. Taiwan’s State Energy Firm to Start Building Third LNG Terminal. 2021. Available online: http://gasprocessingnews.com/news/taiwan%E2%80%99s-state-energy-firm-to-start-building-third-lng-terminal.aspx#:~:text=Taiwan’s%20state%20energy%20firm%20CPC,to%20a%20senior%20company%20official (accessed on 28 May 2022).

- Equinor. Northern Lights Project Concept Report RE-PM673-00001; Equinor: Stavanger, Norway, 2019. [Google Scholar]

- Equinor. North Lights CCS. 2022. Available online: https://www.equinor.com/energy/northern-lights (accessed on 23 May 2022).

- Lau, H.C. Offshore Wind Energy in Asia: Technical Challenges and Opportunities. In Proceedings of the Offshore Technology Conference (OTC-30244-MS), Virtual Event, 17–19 August 2020. [Google Scholar]

- Chen, F.; Lu, S.; Tseng, K.; Lee, S.; Wang, E. Assessment of Renewable Energy Reserves in Taiwan. Renew. Sustain. Energy Rev. 2010, 14, 2511–2528. [Google Scholar] [CrossRef]

- Yue, C.; Huang, G. An Evaluation of Domestic Solar Energy Potential in Taiwan Incorporating Land Use Analysis. Energy Policy 2011, 39, 7988–8002. [Google Scholar] [CrossRef]

- Ko, L.; Wang, J.; Chen, C.; Tsai, H. Evaluation of the Development Potential of Rooftop Solar Photovoltaic in Taiwan. Renew. Energy 2015, 76, 582–595. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Special Report on Carbon Capture Utilization and Storage—CCUS in Clean Energy Transitions. Energy Technology Perspectives. 2020. Available online: https://www.iea.org/reports/ccus-in-clean-energy-transitions (accessed on 6 July 2022).

- Intergovernmental Panel on Climate Change (IPCC). IPCC Special Report on Carbon Dioxide Capture and Storage; Cambridge University Press: Cambridge, UK, 2005; Available online: https://archive.ipcc.ch/pdf/special-reports/srccs/srccs_wholereport.pdf (accessed on 6 July 2022).

- International Renewable Energy Agency (IRENA). Reaching Zero with Renewables: Eliminating CO2 Emissions from Industry and Transport in Line with the 1.5 °C Climate Goal. 2020, Abu Dhabi, United Emirates. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Sep/IRENA_Reaching_zero_2020.pdf (accessed on 6 July 2022).

- Global CCS Institute. Global Status of CCS 2020; Global CCS Institute: Melbourne, Australia, 2020. [Google Scholar]

- S&P Global. UK Government Approves BP-Led East Coast CCS Cluster. 2021. Available online: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-transition/101921-uk-government-approves-bp-led-east-coast-ccs-cluster (accessed on 25 May 2022).

- The Acorn Project. Acorn Unlocks the Carbon Capture and Storage and Hydrogen Infrastructure Essential for Meeting Our Net Zero Targets. 2022. Available online: https://theacornproject.uk/about/ (accessed on 25 May 2022).

- NS Energy. Porthos Carbon Capture and Storage (CCS) Project. 2022. Available online: https://www.nsenergybusiness.com/projects/porthos-carbon-capture-and-storage-ccs-project/ (accessed on 25 May 2022).

- Zhang, K.; Lau, H.C.; Bokka, H.K.; Hadia, N.J. Decarbonizing the Power and Industry Sectors in India by Carbon Capture and Storage. Energy 2022, 245, 123751. [Google Scholar] [CrossRef]

- Bokka, H.K.; Zhang, K.; Lau, H.C. Carbon Capture and Storage Opportunities in the West Coast of India. Energy Rep. 2022, 8, 3930–3947. [Google Scholar] [CrossRef]

- Zhang, K.; Lau, H.C. Regional Opportunities for CO2 Capture and Storage in Southeast Asia. Int. J. Greenh. Gas Control. 2022, 116, 103628. [Google Scholar] [CrossRef]

- Zhang, K.; Bokka, H.K.; Lau, H.C. Decarbonizing the Energy and Industry Sectors in Thailand by Carbon Capture and Storage. J. Pet. Sci. Eng. 2022, 209, 109979. [Google Scholar] [CrossRef]

- Lau, H.C.; Ramakrishna, S.; Zhang, K.; Hameed, M.Z.S. A Decarbonization Roadmap for Singapore and Its Energy Policy Implications. Energies 2021, 14, 6455. [Google Scholar] [CrossRef]

- Upstream Energy Explored. Reinvigorating Indonesian Giant as CCS Project: New Lease of Life under Evaluation for Arun Field. 2022. Available online: https://www.upstreamonline.com/energy-transition/reinvigorating-indonesian-giant-as-ccs-project/2-1-1190849 (accessed on 25 May 2022).

- Zhang, K.; Lau, H.C. Utilization of a High-Temperature Depleted Gas Condensate Reservoir for CO2 Storage and Geothermal Heat Mining: A Case Study of the Arun Gas Reservoir in Indonesia. J. Clean. Prod. 2022, 343, 131006. [Google Scholar] [CrossRef]

- S&P Global. Singapore’s Carbon Tax Increase of Up to 16-fold Will Make Low Carbon Technologies and Power Imports Cost Competitive. 2022. Available online: https://ihsmarkit.com/research-analysis/singapores-carbon-tax-increase-of-up-to-16fold-will-make-low-c.html#:~:text=This%20aggressive%20increase%20in%20carbon,%2FMWh%20to%20%2422%2FMWh (accessed on 25 May 2022).

- Taipower. Brief Introduction of Thermal Power Plants. 2022. Available online: https://www.taipower.com.tw/en/page.aspx?mid=4493&cid=2889&cchk=8204f7cc-51d1-41a1-bc50-fb7472d64385#b03 (accessed on 28 May 2022).

- Lau, H.C.; Piriyev, S. Decarbonizing FPSO Operations in West Africa by Offshore Wind Energy. In Proceedings of the Offshore Technology Conference (OTC-31953-MS), Houston, TX, USA, 2–5 May 2022. [Google Scholar]

- International Energy Agency (IEA). Hydrogen Report. 2021. Available online: https://www.iea.org/reports/hydrogen (accessed on 2 June 2022).

- United States Energy Information Administration (EIA). How Much Carbon Dioxide is Produced per Kilowatt Hour of U.S. Electricity Generation? 2022. Available online: https://www.eia.gov/tools/faqs/faq.php?id=74&t=11#:~:text=In%202020%2C%20total%20U.S.%20electricity,CO2%20emissions%20per%20kWh (accessed on 2 July 2022).

- United States Department of Energy (DOE). Quadrennial Technology Review: An Assessment of Energy Technologies and Research Opportunities; United States Department of Energy (DOE): Washington, DC, USA, 2015; 390p.

- Tian, D.; Yang, B.; Chen, J.; Zhao, Y. A Multi-Experts and Multi-Criteria Risk Assessment Model for Safety Risks in Oil and Gas Industry Integrating Risk Attitudes. Knowl. Based Syst. 2018, 156, 62–73. [Google Scholar] [CrossRef]

- World Nuclear Association. Chernobyl Accident 1986. 2022. Available online: https://world-nuclear.org/information-library/safety-and-security/safety-of-plants/chernobyl-accident.aspx (accessed on 2 July 2022).

- World Nuclear Association. Fukushima Daiichi Accident. 2022. Available online: https://world-nuclear.org/information-library/safety-and-security/safety-of-plants/fukushima-daiichi-accident.aspx (accessed on 2 July 2022).

- United States Department of Interior Bureau of Reclamation. Teton Dam History & Facts. 2022. Available online: https://www.usbr.gov/pn/snakeriver/dams/uppersnake/teton/factsheet.pdf (accessed on 2 July 2022).

- Baker, M.E. Case Study: Lawn Lake Dam (Colorado, 1982). Association of State Dam Safety Officials. 2022. Available online: https://damfailures.org/case-study/lawn-lake-dam-colorado-1982/ (accessed on 2 July 2022).

- United States Environmental Protection Agency (EPA). Solar Panel Frequent Questions. 2022. Available online: https://www.epa.gov/hw/solar-panel-frequent-questions#Are%20solar%20panels%20hazardous%20waste? (accessed on 2 July 2022).

- Paulsen, E.B.; Enevoldsen, P. A Multidisciplinary Review of Recycling Methods for End-of-Life Wind Turbine Blades. Energies 2021, 14, 4247. [Google Scholar] [CrossRef]

- Mills, M. Mines, Minerals, and “Green” Energy: A Reality Check. Manhattan Institute. 2020. Available online: https://www.manhattan-institute.org/mines-minerals-and-green-energy-reality-check (accessed on 2 July 2022).

| Power Sector | Transport Sector | Industry Sector | |

|---|---|---|---|

| Tier 1 technology (highest potential) | GP-CCS 2 | EV 1 | Ind-CCS |

| Tier 2 technology (high potential) | Coal→gas 1,2 CP-CCS 1,2 Clean coal 1,2 Nuclear 1,2 | HFCV 5 | Gas→H2-CCS 2,3,5 |

| Tier 3 technology (moderate potential) | Solar PV 1,4 Onshore wind 1,4,6 Offshore wind 1,4,5,6 Hydro 1,4 Bio 1,6 | H2-marine 3,5 Bio-aviation 1,3,6 | Coal→H2-CCS 1,2,3,5 |

| NZE Plan | This Study | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Unit | 2020 | 2025 | 2035 | 2050 | 2020 | 2025 | 2035 | 2050 | |

| Non-renewable generation | TWh | 262 | 279 | 299 | 175 | 262 | 283 | 326 | 367 |

| Coal | TWh | 126 | 105 | 63 | 0 | 126 | 105 | 63 | 0 |

| Gas | TWh | 100 | 166 | 209 | 121 | 100 | 152 | 247 | 367 |

| Oil | TWh | 4 | 0 | 0 | 0 | 4 | 0 | 0 | 0 |

| Nuclear | TWh | 31 | 0 | 0 | 0 | 31 | 26 | 16 | 0 |

| H2 | TWh | 0 | 9 | 27 | 55 | 0 | 0 | 0 | 0 |

| Renewable generation | TWh | 18 | 30 | 78 | 332 | 18 | 26 | 51 | 141 |

| Wind | TWh | 2 | 5 | 20 | 161 | 2 | 4 | 13 | 73 |

| Solar PV | TWh | 6 | 14 | 45 | 153 | 6 | 11 | 24 | 50 |

| Hydro | TWh | 6 | 7 | 8 | 11 | 6 | 7 | 8 | 11 |

| Bioenergy | TWh | 4 | 4 | 5 | 7 | 4 | 4 | 5 | 7 |

| Geothermal | TWh | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total generation | TWh | 280 | 309 | 377 | 507 | 280 | 309 | 377 | 507 |

| RE share | % | 7 | 10 | 21 | 65 | 7 | 8 | 14 | 28 |

| Non-renewable capacity | GW | 46 | 51 | 55 | 31 | 46 | 51 | 61 | 72 |

| Coal | GW | 21 | 17 | 10 | 0 | 21 | 17 | 10 | 0 |

| Gas | GW | 19 | 33 | 41 | 24 | 19 | 30 | 49 | 72 |

| Oil | GW | 2 | 0 | 0 | 0 | 2 | 0 | 0 | 0 |

| Nuclear | GW | 4 | 0 | 0 | 0 | 4 | 3 | 2 | 0 |

| H2 | GW | 0 | 1 | 3 | 7 | 0 | 0 | 0 | 0 |

| Renewable capacity | GW | 12 | 24 | 69 | 261 | 12 | 20 | 41 | 99 |

| Wind | GW | 1 | 2 | 8 | 68 | 1 | 2 | 6 | 31 |

| Solar PV | GW | 6 | 17 | 54 | 184 | 6 | 13 | 29 | 60 |

| Hydro | GW | 5 | 4 | 5 | 7 | 5 | 4 | 5 | 7 |

| Bioenergy | GW | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Geothermal | GW | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total capacity | GW | 58 | 75 | 124 | 291 | 58 | 70 | 102 | 171 |

| RE share in capacity | % | 21 | 32 | 56 | 89 | 21 | 28 | 40 | 58 |

| CO2 to be mitigated by CCS | Mtpa | 173 | 175 | 150 | 50 | 173 | 169 | 166 | 151 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lau, H.C.; Tsai, S.C. A Decarbonization Roadmap for Taiwan and Its Energy Policy Implications. Sustainability 2022, 14, 8425. https://doi.org/10.3390/su14148425

Lau HC, Tsai SC. A Decarbonization Roadmap for Taiwan and Its Energy Policy Implications. Sustainability. 2022; 14(14):8425. https://doi.org/10.3390/su14148425

Chicago/Turabian StyleLau, Hon Chung, and Steve C. Tsai. 2022. "A Decarbonization Roadmap for Taiwan and Its Energy Policy Implications" Sustainability 14, no. 14: 8425. https://doi.org/10.3390/su14148425

APA StyleLau, H. C., & Tsai, S. C. (2022). A Decarbonization Roadmap for Taiwan and Its Energy Policy Implications. Sustainability, 14(14), 8425. https://doi.org/10.3390/su14148425