The Effects of ESG Combined Score on Business Performance of Enterprises in the Transportation Industry

Abstract

:1. Introduction

2. Hypothesis Development and Proposed Model

2.1. Environmental Score and Business Performance

2.2. Social Score and Business Performance

2.3. Governance Score and Business Performance

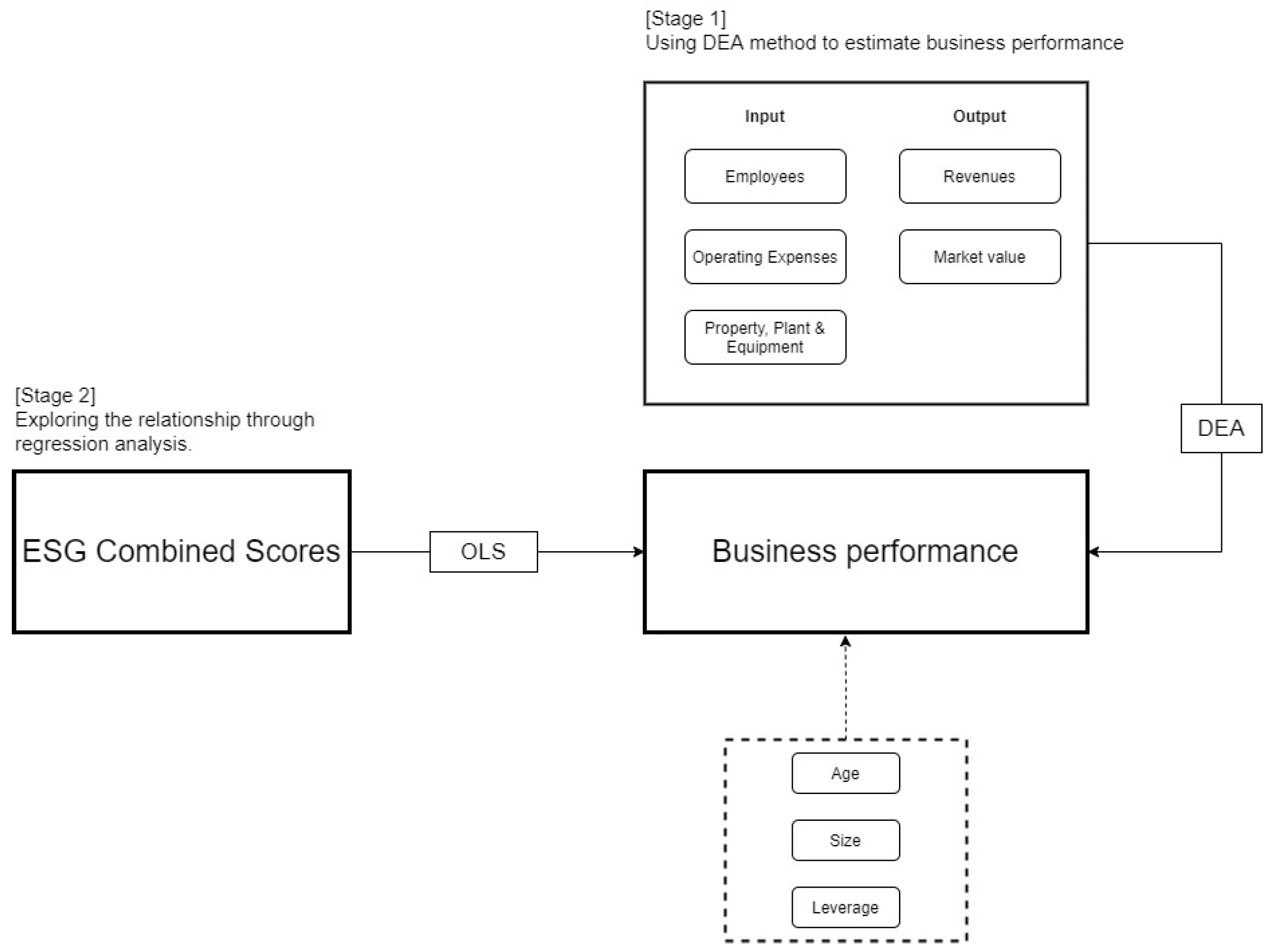

2.4. Proposed Research Framework

2.5. Control Variables

3. Research Design and Methodology

3.1. Data

3.2. Methodology

3.2.1. Data Envelopment Analysis (DEA)

3.2.2. OLS Regression

4. Results and Discussion

4.1. Business Performance in the Transportation Industry

4.1.1. DEA Result and the Creation of Reference Group

4.1.2. Proposal for Inefficient DMUs

4.2. OLS Regression

4.2.1. Variables Characteristics

4.2.2. Relationship between ESG Combined Score and Business Performance

5. Discussion

6. Conclusions

6.1. Implication

6.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| DMU | Company Name | Technical Efficiency (%) | No. of References | No. of Reference Groups | Reference Groups | Return to Scale | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| D01 | Cosco Shipping | 82.40 | 0 | 3 | D14 | D15 | D30 | Decre | ||

| D02 | Shanghai International Port | 100 | 0 | 0 | Const | |||||

| D03 | ZTO Express | 95.55 | 0 | 2 | D09 | D15 | Decre | |||

| D04 | Daqin Railway | 73.60 | 0 | 2 | D14 | D44 | Decre | |||

| D05 | China Merchants | 76.06 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D06 | Cosco Shipping Energy | 65.61 | 0 | 3 | D14 | D36 | D44 | Decre | ||

| D07 | Guangzhou Baiyun International Airport | 70.97 | 0 | 3 | D14 | D15 | D16 | Incre | ||

| D08 | Ningbo Zhoushan Port Group | 71.19 | 0 | 3 | D14 | D15 | D30 | Decre | ||

| D09 | Shenzhen Expressway Group | 100 | 3 | 0 | Const | |||||

| D10 | Tangshan Port Group | 84.70 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D11 | Best Inc. | 83.17 | 0 | 3 | D14 | D15 | D30 | Decre | ||

| D12 | Liaoning Port Co Group | 72.04 | 0 | 3 | D14 | D16 | D44 | Incre | ||

| D13 | Sinotrans Limited Company | 80.12 | 0 | 3 | D14 | D30 | D39 | Decre | ||

| D14 | Zhejiang Expressway | 100 | 35 | 0 | Const | |||||

| D15 | Union Pacific Corporation | 100 | 31 | 0 | Const | |||||

| D16 | CSX Corporation | 100 | 3 | 0 | Const | |||||

| D17 | FedEx | 78.06 | 0 | 3 | D14 | D15 | D30 | Decre | ||

| D18 | Old Dominion Freight Line | 89.68 | 0 | 4 | D09 | D14 | D15 | D30 | Decre | |

| D19 | Kansas City Southern | 94.25 | 0 | 3 | D15 | D16 | D44 | Decre | ||

| D20 | Expeditors | 100 | 0 | 0 | Const | |||||

| D21 | J. B. Hunt Transport Services | 80.23 | 0 | 3 | D14 | D15 | D30 | Decre | ||

| D22 | Ardmore Shipping Corporation | 81.33 | 0 | 3 | D15 | D30 | D36 | Incre | ||

| D23 | C.H. Robinson | 100 | 0 | 0 | Const | |||||

| D24 | Air Transport International | 78.97 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D25 | Dorian LPG | 74.05 | 0 | 3 | D15 | D36 | D44 | Incre | ||

| D26 | Forward Air Corporation | 81.75 | 0 | 3 | D14 | D30 | D39 | Incre | ||

| D27 | Golden Ocean | 84.32 | 0 | 3 | D30 | D36 | D42 | Decre | ||

| D28 | Hub Group | 88.87 | 0 | 3 | D14 | D15 | D30 | Decre | ||

| D29 | Knight-Swift Transportation Holding | 72.14 | 0 | 3 | D14 | D15 | D30 | Decre | ||

| D30 | Landstar System Inc. | 100 | 30 | 0 | Const | |||||

| D31 | Macquarie Infrastructure Holdings | 92.63 | 0 | 3 | D15 | D30 | D36 | Decre | ||

| D32 | Matson | 87.73 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D33 | Safe Bulkers Inc | 72.92 | 0 | 2 | D14 | D44 | Incre | |||

| D34 | Saia Inc | 68.00 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D35 | Schneider National | 78.68 | 0 | 3 | D14 | D15 | D30 | Decre | ||

| D36 | SFL Corporation | 100 | 8 | 0 | Const | |||||

| D37 | Werner Enterprises | 70.89 | 0 | 3 | D14 | D15 | D30 | Decre | ||

| D38 | XPO Logistics | 75.36 | 0 | 2 | D14 | D39 | Decre | |||

| D39 | Corporacion America | 100 | 6 | 0 | Const | |||||

| D40 | Covenant Logistics | 63.99 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D41 | Daseke Inc | 75.03 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D42 | DHT Holdings Inc | 100 | 0 | 0 | Const | |||||

| D43 | Eagle Bulk Shipping | 64.19 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D44 | FLEX LNG | 100 | 7 | 0 | Const | |||||

| D45 | Heartland Express | 67.81 | 0 | 3 | D09 | D14 | D15 | Incre | ||

| D46 | Marten Transport | 70.96 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D47 | Nordic American Tanker | 99.05 | 0 | 3 | D30 | D36 | D42 | Incre | ||

| D48 | Overseas Shipholding Group | 72.80 | 0 | 3 | D15 | D30 | D36 | Incre | ||

| D49 | P.A.M. Transport | 67.11 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D50 | Radiant Logistics | 100 | 0 | 0 | Const | |||||

| D51 | Teekay Corporation | 78.49 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D52 | Textainer Group Holding | 83.39 | 0 | 3 | D14 | D36 | D44 | Decre | ||

| D53 | U.S. Xpress | 68.44 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D54 | Universal Logistics | 77.26 | 0 | 3 | D14 | D30 | D39 | Incre | ||

| D55 | Usa Truck, Inc. | 71.89 | 0 | 3 | D14 | D15 | D30 | Incre | ||

| D56 | Yellow Corp | 74.77 | 0 | 0 | D14 | D39 | Decre | |||

| DMU | Operating Expenses | Property, Plant, and Equipment | No. of Employees | |||

|---|---|---|---|---|---|---|

| Actual | Expected | Actual | Expected | Actual | Expected | |

| D01 | 20,608,062 | 16,981,694.24 | 19,765,118 | 16,287,081.75 | 27,286.98 | 33,114 |

| D03 | 2,469,057 | 2,359,087.27 | 1,920,576 | 1,835,035.15 | 17,738.67 | 19,009 |

| D04 | 8,917,483 | 6,563,617.08 | 11,598,395 | 8,536,873.42 | 49,642.80 | 96,995 |

| D05 | 1,761,305 | 1,339,694.58 | 5,600,108 | 4,259,588.40 | 3574.94 | 4700 |

| D06 | 1,730,575 | 1,135,445.66 | 7,313,281 | 4,798,308.76 | 4546.18 | 6929 |

| D07 | 938,476 | 666,074.22 | 2,984,318 | 2,118,090.69 | 2924.45 | 12,888 |

| D08 | 2,924,680 | 2,081,996.97 | 5,249,638 | 3,737,068.82 | 11,944.50 | 16,779 |

| D09 | 637,542 | 637,542.00 | 425,454 | 425,454.00 | 4889.00 | 4889 |

| D10 | 1,344,583 | 1,138,891.36 | 1,884,445 | 1,596,166.34 | 3258.49 | 3847 |

| D11 | 5,145,618 | 4,279,861.85 | 1,051,037 | 874,198.82 | 7005.82 | 8423 |

| D12 | 766,149 | 551,906.10 | 3,078,197 | 2,217,422.06 | 2395.10 | 6607 |

| D13 | 10,945,314 | 8,769,756.20 | 2,363,195 | 1,893,471.86 | 27,042.44 | 33,751 |

| D17 | 64,907,000 | 50,664,111.84 | 30,429,000 | 23,751,802.72 | 186,554.96 | 239,000 |

| D18 | 3,290,405 | 2,950,964.77 | 3,034,135 | 2,721,131.75 | 18,030.96 | 20,105 |

| D19 | 1,810,900 | 1,706,854.05 | 8,964,700 | 8,449,629.73 | 4792.07 | 7040 |

| D21 | 8,431,433 | 6,764,718.94 | 3,746,366 | 3,005,789.53 | 23,312.25 | 29,056 |

| D22 | 213,875 | 173,943.86 | 663,486 | 539,611.06 | 41.48 | 51 |

| D24 | 1,275,186 | 1,007,068.17 | 1,810,322 | 1,429,687.64 | 3459.07 | 4380 |

| D25 | 158,451 | 117,325.34 | 1,478,681 | 1,094,892.16 | 51.83 | 70 |

| D26 | 1,291,572 | 1,055,837.20 | 364,688 | 298,125.97 | 4479.80 | 5480 |

| D27 | 607,226 | 512,028.83 | 2,589,593 | 2,183,612.49 | 31.20 | 37 |

| D28 | 3,515,445 | 3,124,283.53 | 704,578 | 626,180.03 | 4443.65 | 5000 |

| D29 | 4,380,126 | 3,159,955.43 | 3,020,145 | 2,178,823.98 | 17,170.04 | 23,800 |

| D31 | 1,428,000 | 1,322,758.04 | 3,538,000 | 3,277,253.47 | 842.01 | 909 |

| D32 | 2,094,800 | 1,837,862.14 | 1,854,200 | 1,626,772.96 | 1744.16 | 1988 |

| D33 | 154,039 | 112,326.92 | 963,199 | 702,375.20 | 586.76 | 952 |

| D34 | 1,634,552 | 1,111,550.70 | 1,156,489 | 786,451.67 | 7072.35 | 10,400 |

| D35 | 4,440,900 | 3,494,290.02 | 1,851,600 | 1,456,918.06 | 12,314.09 | 15,650 |

| D37 | 2,238,229 | 1,586,597.73 | 1,537,652 | 1,089,984.61 | 9028.08 | 12,736 |

| D38 | 15,679,000 | 11,816,139.36 | 4,949,000 | 3,729,706.85 | 71,669.79 | 100,000 |

| D40 | 876,794 | 561,099.57 | 517,203 | 330,981.26 | 3551.69 | 5550 |

| D41 | 1,723,400 | 1,293,110.06 | 560,200 | 420,332.05 | 4442.67 | 5921 |

| D43 | 288,925 | 185,448.59 | 857,110 | 550,142.23 | 625.17 | 974 |

| D45 | 533,881 | 362,000.08 | 526,287 | 356,850.94 | 2671.69 | 4050 |

| D46 | 775,453 | 550,238.41 | 641,572 | 455,240.43 | 2900.01 | 4087 |

| D47 | 285,249 | 236,783.72 | 901,474 | 892,906.41 | 19.81 | 20 |

| D48 | 325,615 | 237,051.88 | 1,023,681 | 745,252.84 | 519.07 | 713 |

| D49 | 501,047 | 336,228.42 | 387,275 | 259,881.53 | 1778.96 | 2651 |

| D51 | 1,558,999 | 1,223,602.23 | 5,033,130 | 3,950,322.67 | 3963.56 | 5050 |

| D52 | 493,634 | 411,625.30 | 4,168,555 | 3,476,022.08 | 141.76 | 170 |

| D53 | 1,678,222 | 1,148,618.58 | 768,401 | 525,913.54 | 5866.90 | 8572 |

| D54 | 1,446,618 | 1,117,708.87 | 427,032 | 329,940.22 | 5053.81 | 6541 |

| D55 | 519,584 | 373,528.66 | 260,444 | 187,233.05 | 1473.74 | 2050 |

| D56 | 4,859,600 | 3,633,753.60 | 1,156,300 | 864,620.40 | 20,613.89 | 29,000 |

| DMU | Revenue | Market Value | ||

|---|---|---|---|---|

| Actual | Expected | Actual | Expected | |

| D01 | 21,346,230 | 21,346,230.00 | 9,161,200.00 | 52,887,208.76 |

| D03 | 3,204,620 | 3,265,690.42 | 13,446,038.00 | 13,446,038.00 |

| D04 | 11,331,997 | 11,331,997.00 | 17,307,246.00 | 27,167,493.18 |

| D05 | 2,064,058 | 2,064,058.00 | 7,894,326.00 | 10,044,719.94 |

| D06 | 1,945,619 | 1,945,619.00 | 3,647,643.00 | 5,897,064.52 |

| D07 | 1,115,936 | 1,115,936.00 | 5,120,245.00 | 5,120,245.00 |

| D08 | 3,448,794 | 3,448,794.00 | 7,097,916.00 | 11,649,396.93 |

| D09 | 877,132 | 877,132.00 | 3,556,111.00 | 3,556,111.00 |

| D10 | 1,589,146 | 1,589,146.00 | 2,184,728.00 | 4,806,100.05 |

| D11 | 5,098,393 | 5,098,393.00 | 1,393,605.00 | 7,324,123.87 |

| D12 | 942,371 | 942,371.00 | 3,711,670.00 | 3,711,670.00 |

| D13 | 11,010,563 | 11,010,563.00 | 4,470,500.00 | 15,371,616.29 |

| D17 | 69,693,000 | 69,693,000.00 | 39,436,840.00 | 134,812,275.75 |

| D18 | 4,109,111 | 4,109,111.00 | 15,123,256.00 | 15,123,256.00 |

| D19 | 2,866,000 | 2,866,000.00 | 14,721,076.00 | 14,721,076.00 |

| D21 | 9,165,258 | 9,165,258.00 | 12,403,543.00 | 17,335,404.84 |

| D22 | 230,042 | 230,042.00 | 299,535.00 | 564,277.46 |

| D24 | 1,452,183 | 1,452,183.00 | 1,391,868.00 | 4,412,608.34 |

| D25 | 158,032 | 202,719.92 | 853,996.00 | 853,996.00 |

| D26 | 1,410,395 | 1,410,395.00 | 1,948,124.00 | 2,148,533.60 |

| D27 | 705,799 | 705,799.00 | 832,443.00 | 1,729,002.61 |

| D28 | 3,668,117 | 3,668,117.00 | 1,744,691.00 | 5,174,857.38 |

| D29 | 4,843,950 | 4,843,950.00 | 6,117,458.00 | 10,943,472.07 |

| D31 | 1,727,000 | 1,727,000.00 | 3,709,957.00 | 4,755,867.97 |

| D32 | 2,203,100 | 2,203,100.00 | 1,750,320.00 | 5,200,669.66 |

| D33 | 198,184 | 198,184.00 | 177,060.00 | 614,997.65 |

| D34 | 1,786,735 | 1,786,735.00 | 2,415,210.00 | 4,116,869.71 |

| D35 | 4,747,000 | 4,747,000.00 | 3,864,704.00 | 8,836,415.42 |

| D37 | 2,463,701 | 2,463,701.00 | 2,519,808.00 | 5,577,872.85 |

| D38 | 16,648,000 | 16,648,000.00 | 7,332,400.00 | 24,396,216.46 |

| D40 | 894,528 | 894,528.00 | 239,308.00 | 1,950,779.28 |

| D41 | 1,737,000 | 1,737,000.00 | 204,101.00 | 3,022,660.90 |

| D43 | 292,378 | 292,378.00 | 328,910.00 | 1,345,707.97 |

| D45 | 596,815 | 596,815.00 | 1,726,689.00 | 1,726,689.00 |

| D46 | 843,271 | 843,271.00 | 1,175,578.00 | 2,027,226.31 |

| D47 | 317,220 | 317,220.00 | 724,375.00 | 724,375.00 |

| D48 | 355,547 | 355,547.00 | 197,141.00 | 1,734,630.97 |

| D49 | 514,177 | 514,177.00 | 331,769.00 | 1,206,114.44 |

| D51 | 1,945,391 | 1,945,391.00 | 536,173.00 | 9,441,618.08 |

| D52 | 707,481 | 707,481.00 | 608,520.00 | 2,689,872.83 |

| D53 | 1,707,361 | 1,707,361.00 | 246,476.00 | 3,397,580.82 |

| D54 | 1,511,998 | 1,511,998.00 | 517,271.00 | 2,329,831.67 |

| D55 | 522,631 | 522,631.00 | 63,722.00 | 1,038,460.18 |

| D56 | 4,871,200 | 4,871,200.00 | 85,972.00 | 5,989,297.96 |

References

- Hub, E.S. Transport Sector Economic Analysis. 2014. Available online: https://joint-research-centre.ec.europa.eu/scientific-activities-z/transport-sector-economic-analysis_en#:~:text=Transport%20plays%20an%20important%20role,gross%20domestic%20product%20(GDP) (accessed on 6 January 2022).

- Li, X.; Li, F.; Zhao, N.; Zhu, Q. Measuring environmental sustainability performance of freight transportation seaports in China: A data envelopment analysis approach based on the closest targets. Expert Syst. 2020, 37, e12334. [Google Scholar] [CrossRef]

- Stefaniec, A.; Hosseini, K.; Xie, J.; Li, Y. Sustainability assessment of inland transportation in China: A triple bottom line-based network DEA approach. Transp. Res. Part D Transp. Environ. 2020, 80, 102258. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, S.; Hao, J.; Liu, H.; Wu, X.; Hu, J.; Walsh, M.P.; Wallington, T.J.; Zhang, K.M.; Stevanovic, S. On-road vehicle emissions and their control in China: A review and outlook. Sci. Total Environ. 2017, 574, 332–349. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ruan, L.; Liu, H. Environmental, Social, Governance Activities and Firm Performance: Evidence from China. Sustainability 2021, 13, 767. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Sustainable Development and the Financial System: Society’s Perceptions about Socially Responsible Investing. Bus. Strategy Environ. 2013, 22, 410–428. [Google Scholar] [CrossRef]

- Hill, R.P.; Ainscough, T.; Shank, T.; Manullang, D. Corporate Social Responsibility and Socially Responsible Investing: A Global Perspective. J. Bus. Ethics 2007, 70, 165–174. [Google Scholar] [CrossRef]

- Anser, M.K.; Zhang, Z.; Kanwal, L. Moderating effect of innovation on corporate social responsibility and firm performance in realm of sustainable development. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 799–806. [Google Scholar] [CrossRef]

- Aupperle, K.; Van Pham, D.J.E.R. An extended investigation in the relationship between corporate social responsibility and profitability. Empl. Responsib. Rights J. 1989, 2, 263–274. [Google Scholar] [CrossRef]

- Lee, S.; Seo, K.; Sharma, A. Corporate social responsibility and firm performance in the airline industry: The moderating role of oil prices. Tour. Manag. 2013, 38, 20–30. [Google Scholar] [CrossRef]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate Social Responsibility and Firm Financial Performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar] [CrossRef]

- Riahi-Belkaoui, A. Executive Compensation, Organizational Effectiveness, Social Performance and Firm Performance: An Empirical Investigation. J. Bus. Financ. Account. 1992, 19, 25–38. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Ait Sidhoum, A.; Serra, T. Corporate social responsibility and dimensions of performance: An application to U.S. electric utilities. Util. Policy 2017, 48, 1–11. [Google Scholar] [CrossRef]

- Rodriguez-Fernandez, M. Social responsibility and financial performance: The role of good corporate governance. BRQ Bus. Res. Q. 2016, 19, 137–151. [Google Scholar] [CrossRef] [Green Version]

- Sachin, N.; Rajesh, R. An empirical study of supply chain sustainability with financial performances of Indian firms. Environ. Dev. Sustain. 2022, 24, 6577–6601. [Google Scholar] [CrossRef]

- Garcia, A.S.; Mendes-Da-Silva, W.; Orsato, R.J. Sensitive industries produce better ESG performance: Evidence from emerging markets. J. Clean. Prod. 2017, 150, 135–147. [Google Scholar] [CrossRef]

- Yoon, B.; Lee, J.H.; Byun, R. Does ESG Performance Enhance Firm Value? Evidence from Korea. Sustainability 2018, 10, 3635. [Google Scholar] [CrossRef] [Green Version]

- Lee, K.-H.; Cin, B.C.; Lee, E.Y. Environmental Responsibility and Firm Performance: The Application of an Environmental, Social and Governance Model. Bus. Strategy Environ. 2016, 25, 40–53. [Google Scholar] [CrossRef]

- Boğan, E.; Dedeoğlu, B.B. Hotel employees’ corporate social responsibility perception and organizational citizenship behavior: Perceived external prestige and pride in organization as serial mediators. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2342–2353. [Google Scholar] [CrossRef]

- Chiu, S.C.; Lin, H.C.; Wang, C.S. The impact of investments in pollution reduction on shareholder wealth: Evidence from Taiwanese manufacturing companies. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 676–691. [Google Scholar] [CrossRef]

- Liu, X.; Ji, X.; Zhang, D.; Yang, J.; Wang, Y. How public environmental concern affects the sustainable development of Chinese cities: An empirical study using extended DEA models. J. Environ. Manag. 2019, 251, 109619. [Google Scholar] [CrossRef] [PubMed]

- Feltham, G.A.; Ohlson, J.A. Valuation and clean surplus accounting for operating and financial activities. Contemp. Account. Res. 1995, 11, 689–731. [Google Scholar] [CrossRef]

- Nekhili, M.; Boukadhaba, A.; Nagati, H.; Chtioui, T. ESG performance and market value: The moderating role of employee board representation. Int. J. Hum. Resour. Manag. 2021, 32, 3061–3087. [Google Scholar] [CrossRef]

- Tang, Z.; Hull, C.E.; Rothenberg, S. How Corporate Social Responsibility Engagement Strategy Moderates the CSR–Financial Performance Relationship. J. Manag. Stud. 2012, 49, 1274–1303. [Google Scholar] [CrossRef]

- Ionescu, G.H.; Firoiu, D.; Pirvu, R.; Vilag, R.D. The Impact of Esg Factors on Market Value of Companies from Travel and Tourism Industry. Technol. Econ. Dev. Econ. 2019, 25, 820–849. [Google Scholar] [CrossRef]

- Baran, M.; Kuźniarska, A.; Makieła, Z.J.; Sławik, A.; Stuss, M.M. Does ESG Reporting Relate to Corporate Financial Performance in the Context of the Energy Sector Transformation? Evidence from Poland. Energies 2022, 15, 477. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Fernández-Izquierdo, M.; Ferrero-Ferrero, I.; Rivera-Lirio, J.; Muñoz-Torres, M. Rating the Raters: Evaluating how ESG Rating Agencies Integrate Sustainability Principles. Sustainability 2019, 11, 915. [Google Scholar] [CrossRef] [Green Version]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Estimation and inference in two-stage, semi-parametric models of production processes. J. Econom. 2007, 136, 31–64. [Google Scholar] [CrossRef]

- Miller, S.R.; Eden, L.; Li, D. CSR Reputation and Firm Performance: A Dynamic Approach. J. Bus. Ethics 2018, 163, 619–636. [Google Scholar] [CrossRef]

- Cho, S.; Chung, C.; Young, J. Study on the Relationship between CSR and Financial Performance. Sustainability 2019, 11, 343. [Google Scholar] [CrossRef] [Green Version]

- Kong, D.; Liu, S.; Dai, Y. Environmental Policy, Company Environment Protection, and Stock Market Performance: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2014, 21, 100–112. [Google Scholar] [CrossRef]

- Yadav, P.L.; Han, S.H.; Rho, J.J. Impact of Environmental Performance on Firm Value for Sustainable Investment: Evidence from Large US Firms. Bus. Strategy Environ. 2016, 25, 402–420. [Google Scholar] [CrossRef]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Corporate social responsibility and resource-based perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Hu, J.; Wang, S.; Xie, F. Environmental responsibility, market valuation, and firm characteristics: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1376–1387. [Google Scholar] [CrossRef]

- Azmi, W.; Hassan, M.K.; Houston, R.; Karim, M.S. ESG activities and banking performance: International evidence from emerging economies. J. Int. Financ. Mark. Inst. Money 2021, 70, 101277. [Google Scholar] [CrossRef]

- Ferrell, A.; Liang, H.; Renneboog, L. Socially responsible firms. J. Financ. Econ. 2016, 122, 585–606. [Google Scholar] [CrossRef] [Green Version]

- Miralles-Quirós, M.; Miralles-Quirós, J. The Value Relevance of Environmental, Social, and Governance Performance: The Brazilian Case. Sustainability 2018, 10, 574. [Google Scholar] [CrossRef] [Green Version]

- Abdi, Y.; Li, X.; Càmara-Turull, X. Impact of Sustainability on Firm Value and Financial Performance in the Air Transport Industry. Sustainability 2020, 12, 9957. [Google Scholar] [CrossRef]

- Bătae, O.M.; Dragomir, V.D.; Feleagă, L. The relationship between environmental, social, and financial performance in the banking sector: A European study. J. Clean. Prod. 2021, 290, 125791. [Google Scholar] [CrossRef]

- Uyar, A.; Kilic, M.; Koseoglu, M.A.; Kuzey, C.; Karaman, A.S. The link among board characteristics, corporate social responsibility performance, and financial performance: Evidence from the hospitality and tourism industry. Tour. Manag. Perspect. 2020, 35, 100714. [Google Scholar] [CrossRef]

- Xie, J.; Nozawa, W.; Yagi, M.; Fujii, H.; Managi, S. Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 2019, 28, 286–300. [Google Scholar] [CrossRef] [Green Version]

- Jitmaneeroj, B. Reform priorities for corporate sustainability. Manag. Decis. 2016, 54, 1497–1521. [Google Scholar] [CrossRef]

- Ting, I.W.K.; Azizan, N.A.; Bhaskaran, R.K.; Sukumaran, S.K. Corporate Social Performance and Firm Performance: Comparative Study among Developed and Emerging Market Firms. Sustainability 2019, 12, 26. [Google Scholar] [CrossRef] [Green Version]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, Social and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. J. Bus. Ethics 2019, 168, 315–334. [Google Scholar] [CrossRef]

- Baldini, M.; Maso, L.D.; Liberatore, G.; Mazzi, F.; Terzani, S. Role of Country- and Firm-Level Determinants in Environmental, Social, and Governance Disclosure. J. Bus. Ethics 2016, 150, 79–98. [Google Scholar] [CrossRef]

- Govindan, K.; Kilic, M.; Uyar, A.; Karaman, A.S. Drivers and value-relevance of CSR performance in the logistics sector: A cross-country firm-level investigation. Int. J. Prod. Econ. 2021, 231, 107835. [Google Scholar] [CrossRef]

- Bayyurt, N.; Gokhan, D. Economics. Performance measurement of Turkish and Chinese manufacturing firms: A comparative analysis. Eurasian J. Bus. Econ. 2008, 1, 71–83. [Google Scholar]

- Harrison, J.; Rouse, P. DEA and accounting performance measurement. In Handbook of Operations Analytics Using Data Envelopment Analysis; Springer: Boston, MA, USA, 2016; pp. 385–412. [Google Scholar]

- Begoña, G.-N.; Carlos, S.-C.; Cecilio, C.M. Microfinance institutions and efficiency. Omega 2007, 35, 131–142. [Google Scholar]

- lo Storto, C. The analysis of the cost-revenue production cycle efficiency of the Italian airports: A NSBM DEA approach. J. Air Transport. Manag. 2018, 72, 77–85. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Wu, D.D.; Zhang, Z. Analysing firm performance in Chinese IT industry: DEA Malmquist productivity measure. Int. J. Inf. Technol. Manag. 2011, 10, 3–23. [Google Scholar] [CrossRef]

- Refinitiv. Environmental, Social and Governance (ESG) Scores from Refinitiv. 2021. Available online: https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/refinitiv-esg-scores-methodology.pdf (accessed on 15 February 2022).

- Oxelheim, L.; Randøy, T. The impact of foreign board membership on firm value. J. Bank. Financ. 2003, 27, 2369–2392. [Google Scholar] [CrossRef] [Green Version]

- Neely, A. Exploring the financial consequences of the servitization of manufacturing. Oper. Manag. Res. 2008, 1, 103–118. [Google Scholar] [CrossRef] [Green Version]

- Hancock, J.I.; Allen, D.G.; Bosco, F.A.; McDaniel, K.R.; Pierce, C.A. Meta-Analytic Review of Employee Turnover as a Predictor of Firm Performance. J. Manag. 2011, 39, 573–603. [Google Scholar] [CrossRef] [Green Version]

- Hsiao, H.I.; Kemp, R.G.M.; van der Vorst, J.G.A.J.; Omta, S.W.F. A classification of logistic outsourcing levels and their impact on service performance: Evidence from the food processing industry. Int. J. Prod. Econ. 2010, 124, 75–86. [Google Scholar] [CrossRef]

- Činčalová, S.; Hedija, V. Firm Characteristics and Corporate Social Responsibility: The Case of Czech Transportation and Storage Industry. Sustainability 2020, 12, 1992. [Google Scholar] [CrossRef] [Green Version]

- Carmeli, A.; Schaubroeck, J.; Tishler, A. How CEO empowering leadership shapes top management team processes: Implications for firm performance. Leadersh. Q 2011, 22, 399–411. [Google Scholar] [CrossRef]

- Ling, Y.H. The influence of intellectual capital on global initiatives. VINE 2012, 42, 129–144. [Google Scholar] [CrossRef]

- LiPuma, J.A.; Newbert, S.L.; Doh, J.P. The effect of institutional quality on firm export performance in emerging economies: A contingency model of firm age and size. Small Bus. Econ. 2013, 40, 817–841. [Google Scholar] [CrossRef]

- Bhandari, L.C. Debt/Equity Ratio and Expected Common Stock Returns: Empirical Evidence. J. Financ. 1988, 43, 507–528. [Google Scholar] [CrossRef]

- Kotey, B. Debt Financing and Factors Internal to the Business. Int. Small Bus. J. 1999, 17, 11–29. [Google Scholar] [CrossRef]

- Hofmann, E.; Lampe, K. Financial statement analysis of logistics service providers: Ways of enhancing performance. Int. J. Phys. Distrib. Logist. Manag. 2013, 43, 321–342. [Google Scholar] [CrossRef]

- Zheng, Y.; Rashid, M.H.; Siddik, A.B.; Wei, W.; Hossain, S.Z. Corporate Social Responsibility Disclosure and Firm’s Productivity: Evidence from the Banking Industry in Bangladesh. Sustainability 2022, 14, 6237. [Google Scholar] [CrossRef]

- Zhao, S.; Wang, J.; Ye, M.; Huang, Q.; Si, X. An Evaluation of Supply Chain Performance of China’s Prefabricated Building from the Perspective of Sustainability. Sustainability 2022, 14, 1299. [Google Scholar] [CrossRef]

- Gholami, R.; Añón Higón, D.; Emrouznejad, A. Hospital performance: Efficiency or quality? Can we have both with IT? Expert Syst. Appl. 2015, 42, 5390–5400. [Google Scholar] [CrossRef] [Green Version]

- Noh, Y. Evaluation of the resource utilization efficiency of university libraries using DEA techniques and a proposal of alternative evaluation variables. Libr. Hi Tech. 2011, 29, 697–724. [Google Scholar] [CrossRef]

- Li, W.; Wang, L.; Wan, Q.; You, W.; Zhang, S. A Configurational Analysis of Family Farm Management Efficiency: Evidence from China. Sustainability 2022, 14, 6015. [Google Scholar] [CrossRef]

- Shang, J.-K.; Hung, W.-T.; Lo, C.-F.; Wang, F.-C. Ecommerce and hotel performance: Three-stage DEA analysis. Serv. Ind. J. 2008, 28, 529–540. [Google Scholar] [CrossRef]

- Ouenniche, J.; Carrales, S. Assessing efficiency profiles of UK commercial banks: A DEA analysis with regression-based feedback. Ann. Oper. Res. 2018, 266, 551–587. [Google Scholar] [CrossRef] [Green Version]

- Cooper, W.W.; Seiford, L.M.; Tone, K. Introduction to Data Envelopment Analysis and Its Uses: With DEA-Solver Software and References; Springer Science & Business Media: New York, NY, USA, 2006. [Google Scholar]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef] [Green Version]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis: Global Edition, 7th ed.; Pearson Education Limited: London, UK, 2014. [Google Scholar] [CrossRef]

- Abdallah, A.B.; Al-Ghwayeen, W.S. Green supply chain management and business performance. Bus. Process. Manag. J. 2020, 26, 489–512. [Google Scholar] [CrossRef]

- Rao, P.; Holt, D. Do green supply chains lead to competitiveness and economic performance? Int. J. Oper. Prod. Manag. 2005, 25, 898–916. [Google Scholar] [CrossRef]

- Johnson, G.; Whittington, R.; Regnér, P.; Angwin, D.; Scholes, K. Exploring Strategy; Pearson: London, UK, 2020. [Google Scholar]

- Brammer, S.; Millington, A. Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strateg. Manag. J. 2008, 29, 1325–1343. [Google Scholar] [CrossRef]

- Wang, H.; Choi, J.; Li, J. Too Little or Too Much? Untangling the Relationship between Corporate Philanthropy and Firm Financial Performance. Organ. Sci. 2008, 19, 143–159. [Google Scholar] [CrossRef] [Green Version]

- Godfrey, P.C. The Relationship between Corporate Philanthropy And Shareholder Wealth: A Risk Management Perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef] [Green Version]

- Wang, K.; Miao, Y.; Su, C.-H.; Chen, M.-H.; Wu, Z.; Wang, T. Does Corporate Charitable Giving Help Sustain Corporate Performance in China? Sustainability 2019, 11, 1491. [Google Scholar] [CrossRef] [Green Version]

- De Grip, A.; Sauermann, J. The Effects of Training on Own and Co-worker Productivity: Evidence from a Field Experiment. Econ. J. 2012, 122, 376–399. [Google Scholar] [CrossRef] [Green Version]

- Turban, D.B.; Greening, D.W. Corporate Social Performance and Organizational Attractiveness to Prospective Employees. Acad. Manag. J. 1997, 40, 658–672. [Google Scholar] [CrossRef]

- Bénabou, R.; Tirole, J. Individual and corporate social responsibility. Economica 2010, 77, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Shi, W.; Veenstra, K. The Moderating Effect of Cultural Values on the Relationship between Corporate Social Performance and Firm Performance. J. Bus. Ethics 2021, 174, 89–107. [Google Scholar] [CrossRef]

- The Heritage Foundation. 2021 China Transparency Report; The Heritage Foundation: Washington, DC, USA, 2021; Available online: https://www.heritage.org/CTP (accessed on 18 March 2022).

| Input/Output | Factors | Definitions | Sources |

|---|---|---|---|

| Input | Employees (people) | Represents the number of both full-time and part-time employees of the company. | [45,51] |

| Property, Plant, and Equipment (in thousand USD) | Represents gross property, plant, and equipment less the accumulated reserves for depreciation, depletion, and amortization. | [51,52] | |

| Operating Expenses (in thousand USD) | Represents the sum of all expenses related to operations | [52,53] | |

| Output | Revenues (in thousand USD) | Represents gross sales and other operating revenues less discounts, returns, and allowances. | [45,54] |

| Market Value (in thousand USD) | Represents market capitalization at the fiscal year-end date plus preferred stock plus minority interest plus total debt minus cash. | [55] |

| Type | Indicator | Unit | Mean | Min. | Max. | Std. | K-S Test a |

|---|---|---|---|---|---|---|---|

| Input | Employees | Person | 16,475.18 | 8.00 | 239,000.00 | 35,897.70 | p < 0.01 |

| Input | Operating Expenses | thousands of USD | 4,383,261.05 | 61,342.00 | 64,907,000.00 | 9,314,310.26 | p < 0.01 |

| Input | Property, Plant, Equipment | thousands of USD | 4,523,949.50 | 20,127.00 | 55,728,000.00 | 9,418,345.73 | p < 0.01 |

| Output | Revenues | thousands of USD | 5,007,733.14 | 113,285.00 | 69,693,000.00 | 10,171,638.73 | p < 0.01 |

| Output | Market value | thousands of USD | 7,848,691.14 | 63,722.00 | 125,124,877.00 | 18,634,345.91 | p < 0.01 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| 1. Employees | 1 | ||||

| 2. Operating Expenses | 0.924 *** | 1 | |||

| 3. Property, Plant, Equipment | 0.488 *** | 0.551 *** | 1 | ||

| 4. Revenues | 0.361 *** | 0.407 *** | 0.934 *** | 1 | |

| 5. Market Value | 0.921 *** | 0.993 *** | 0.639 *** | 0.509 *** | 1 |

| Min | Max | Mean | Std. | VIF | |

|---|---|---|---|---|---|

| Business Performance | 0.64 | 1.00 | 0.83 | 0.12 | |

| Environmental Score | 0.00 | 83.10 | 25.54 | 22.68 | 1.696 |

| Social Score | 12.28 | 88.29 | 48.63 | 20.48 | 1.272 |

| Governance Score | 5.55 | 88.70 | 32.82 | 19.14 | 2.275 |

| Age | 1.79 | 5.64 | 3.53 | 0.83 | 1.267 |

| Leverage | 5.15 | 7.22 | 1.54 | 1.65 | 1.060 |

| Size | 2.08 | 12.38 | 8.20 | 2.33 | 1.489 |

| Variable | OLS Regression |

|---|---|

| Control Variables | |

| Size | −0.431 *** |

| Age | −0.077 |

| Leverage | −0.135 |

| Independent Variables | |

| Environmental Score | 0.342 ** |

| Social Score | 0.373 ** |

| Governance Score | −0.241 ** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pham, T.N.; Tran, P.P.; Le, M.-H.; Vo, H.N.; Pham, C.D.; Nguyen, H.-D. The Effects of ESG Combined Score on Business Performance of Enterprises in the Transportation Industry. Sustainability 2022, 14, 8354. https://doi.org/10.3390/su14148354

Pham TN, Tran PP, Le M-H, Vo HN, Pham CD, Nguyen H-D. The Effects of ESG Combined Score on Business Performance of Enterprises in the Transportation Industry. Sustainability. 2022; 14(14):8354. https://doi.org/10.3390/su14148354

Chicago/Turabian StylePham, Thi Ngan, Phung Phi Tran, Minh-Hieu Le, Hoang Nhi Vo, Cong Dat Pham, and Hai-Dang Nguyen. 2022. "The Effects of ESG Combined Score on Business Performance of Enterprises in the Transportation Industry" Sustainability 14, no. 14: 8354. https://doi.org/10.3390/su14148354

APA StylePham, T. N., Tran, P. P., Le, M.-H., Vo, H. N., Pham, C. D., & Nguyen, H.-D. (2022). The Effects of ESG Combined Score on Business Performance of Enterprises in the Transportation Industry. Sustainability, 14(14), 8354. https://doi.org/10.3390/su14148354