A Study on Cost Allocation in Renovation of Old Urban Residential Communities

Abstract

:1. Introduction

2. Literature Review

2.1. Definition and Present Renovation of Old Residential Communities

2.2. The Application of Shapley Value in Cost Allocation

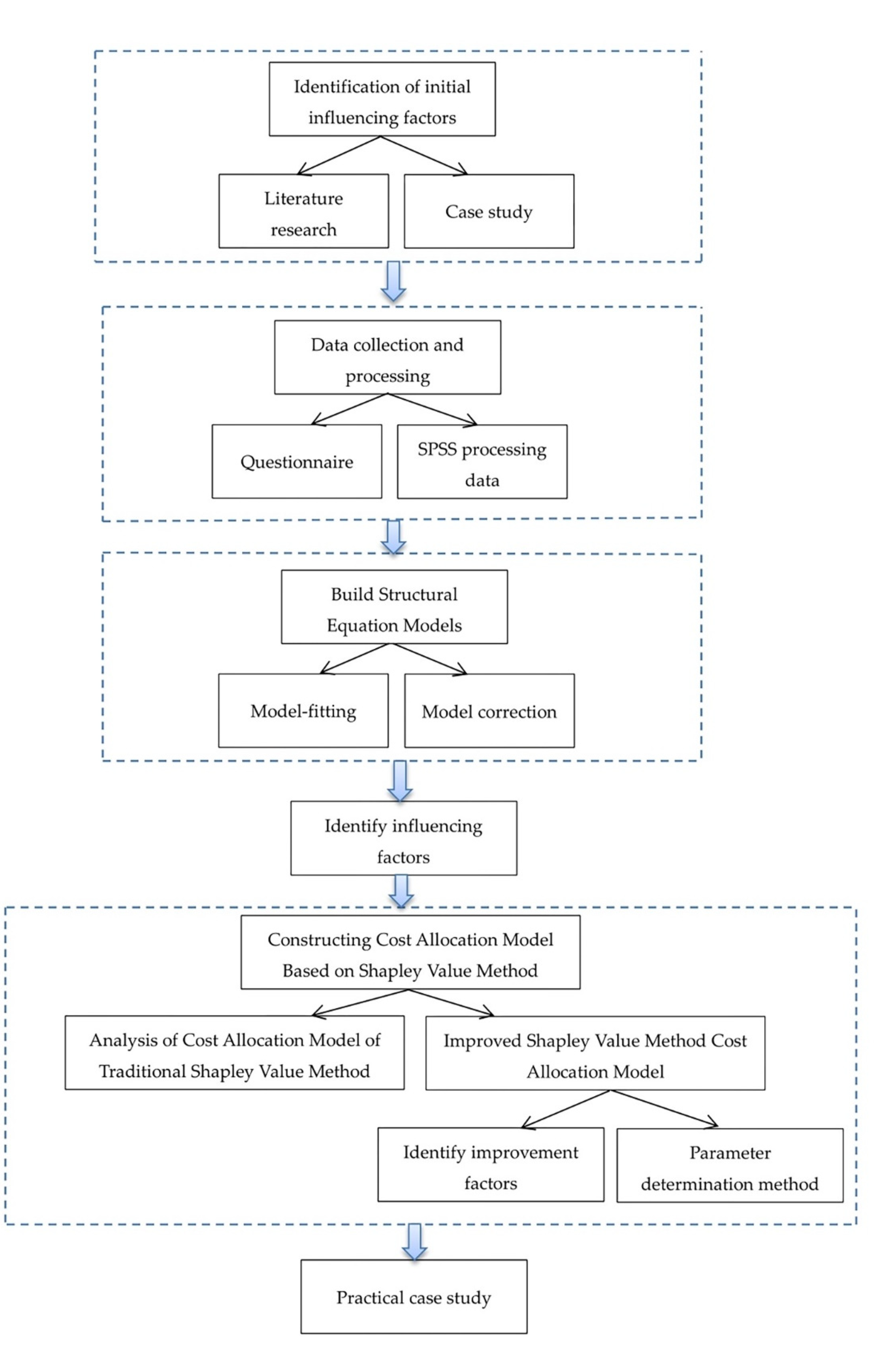

3. Materials and Methods

3.1. Analysis of Influencing Factors

3.1.1. Collection of Impact Factors

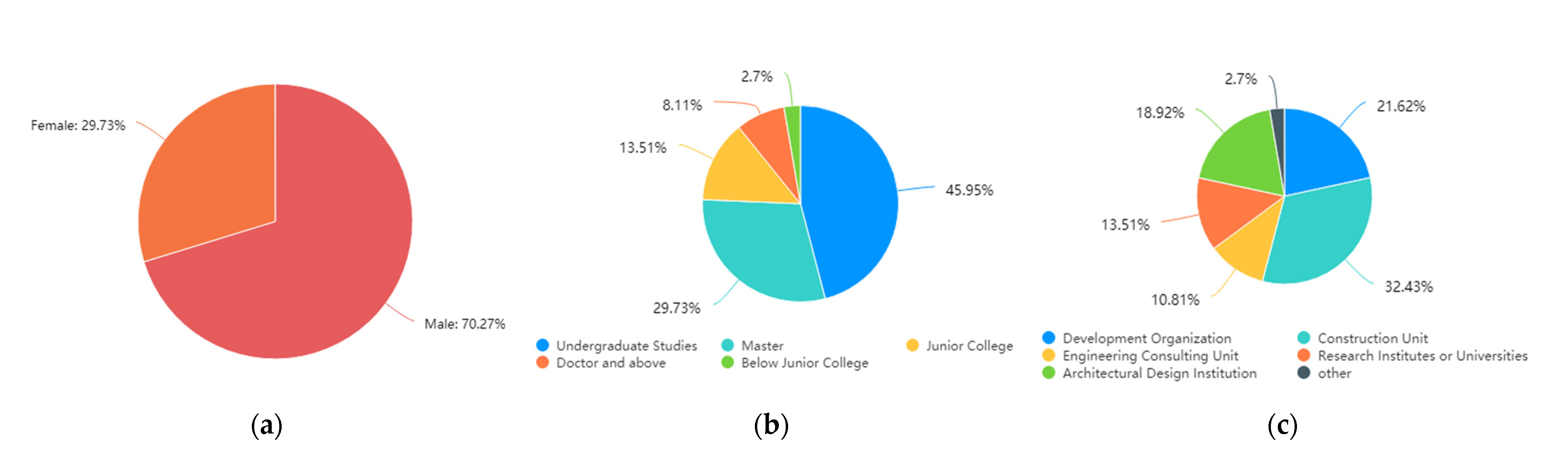

3.1.2. Collection and Processing of Data

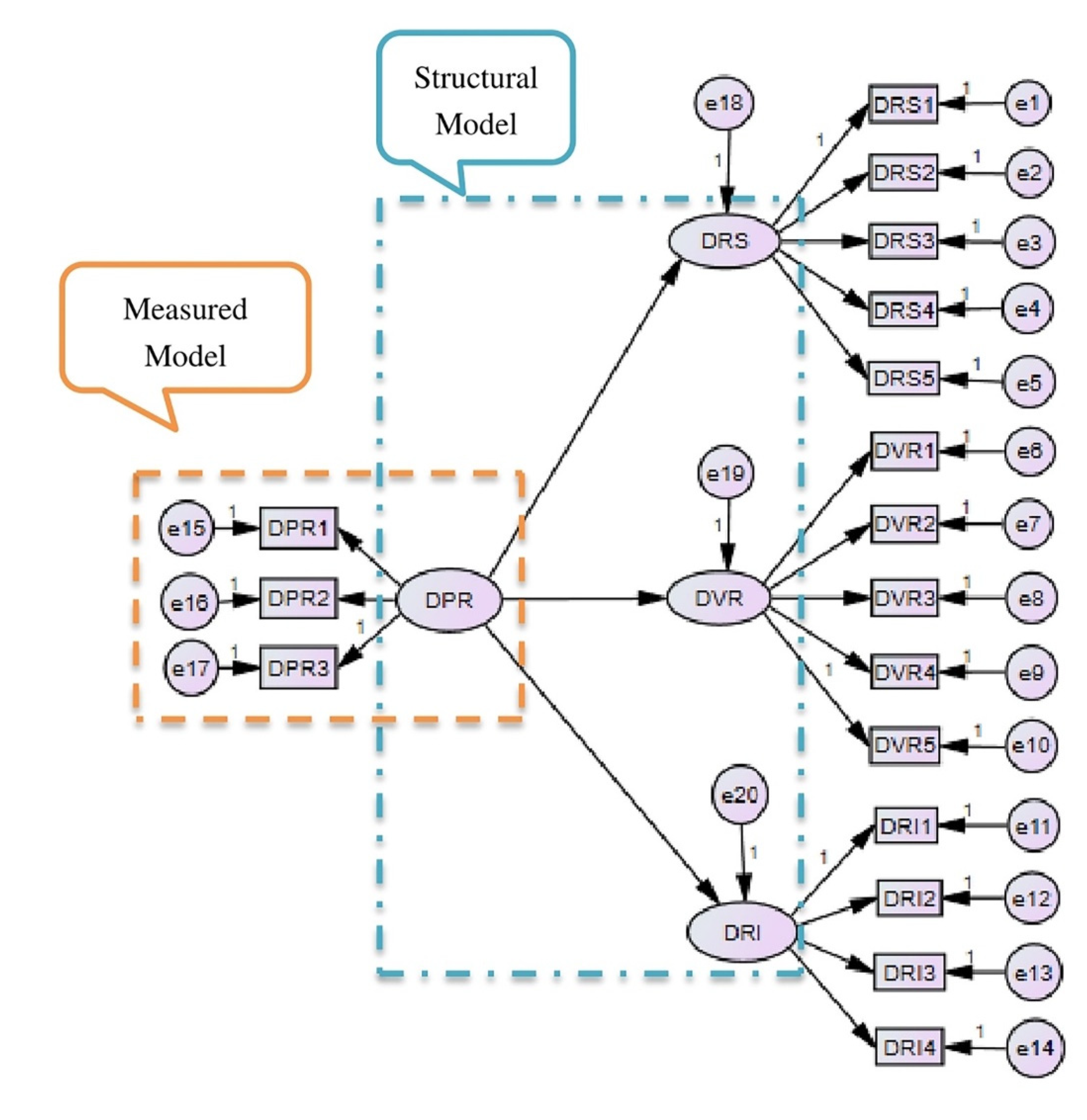

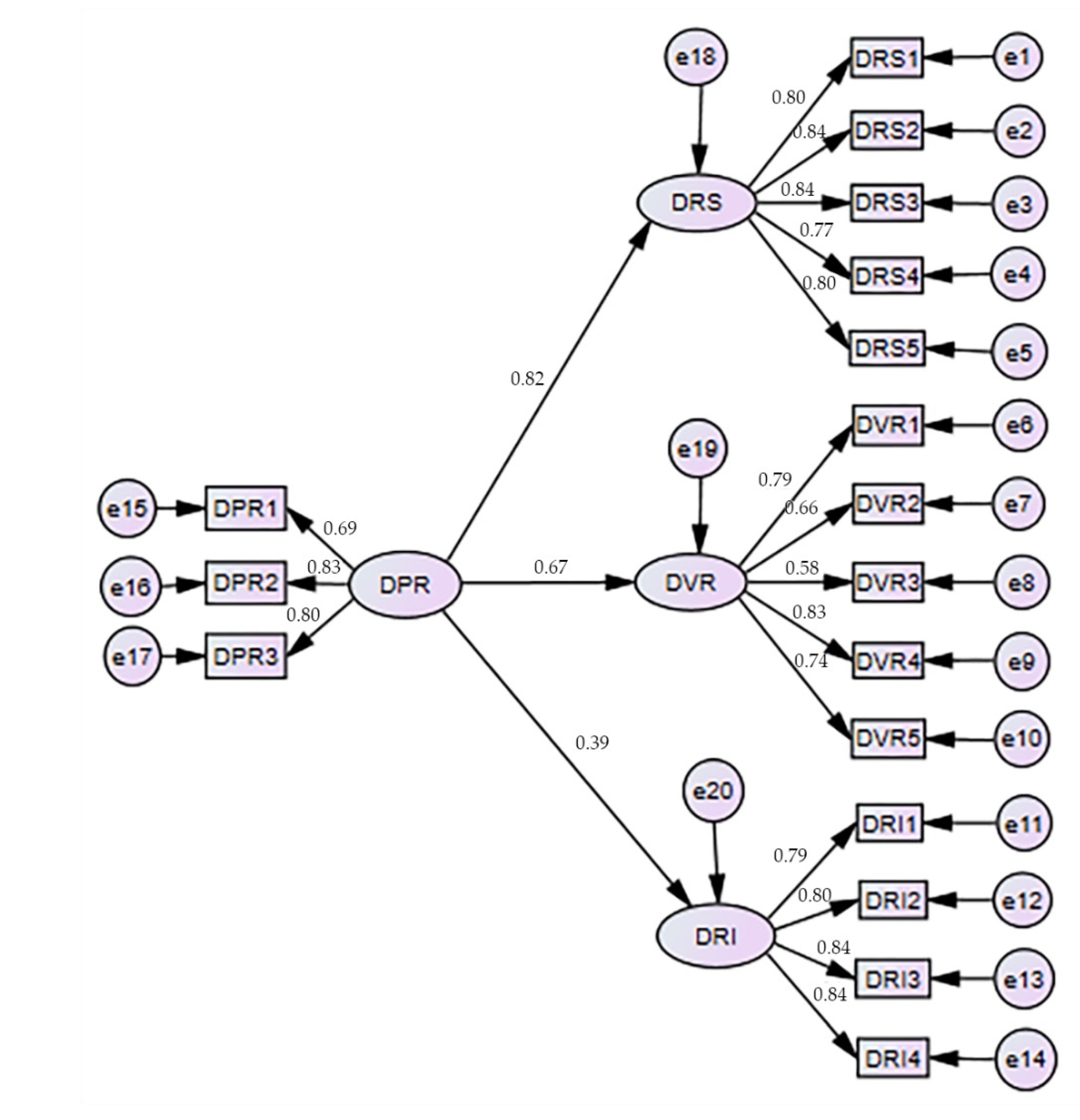

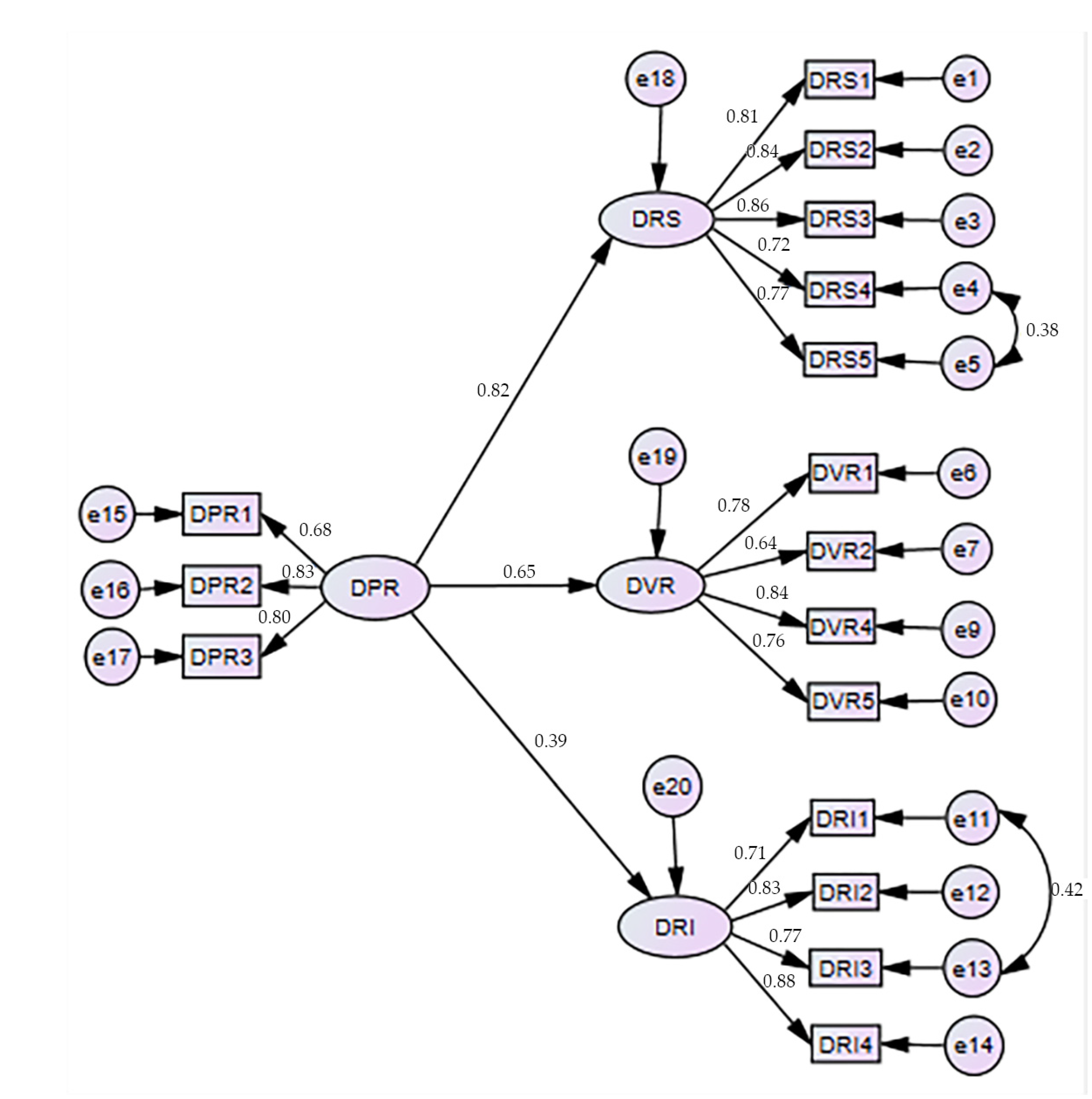

3.1.3. The Fitting and Modification of Structural Equation Model

- (1)

- Measured Model

- (2)

- Structural Model

3.2. Determination of Influencing Factors

3.3. Cost Allocation Model Based on Improved Shapley Value

3.3.1. Cost Allocation Model Based on Traditional Shapley Value

3.3.2. Cost Allocation Model Based on Improved Shapley Value

3.3.3. Determination of Parameters

- (1)

- Degree of Participation

- (2)

- The Degree of Risk Sharing

- ①

- Obtain the weight γi of each main risk through Table 5.

- ②

- Construct judgment matrix Ui. Set the comment set as Vi = {v1, v2, v3, v4, v5} = {high risk, relatively high risk, general risk, relatively low risk, low risk}. Then, experts in related fields are invited for scoring the risks borne by each participant. After normalization, the judgment matrix Ui is obtained.

- ③

- As Bi = γ × Ui, the comprehensive evaluation vector Bi of risk sharing of each participant is obtained. According to the principle of maximum membership degree, the comprehensive evaluation value of risk sharing K = BVT of the government, community owners, and the private sector is obtained. Finally, K is normalized, after which the risk-sharing degree measured values a12, a22, and a32 of each participant are obtained.

- (3)

- Value-added Return

- (4)

- The Degree of Resource Input

4. Case Analysis

4.1. Cost Allocation Based on Traditional Shapley Value

4.2. Cost Allocation Based on Improved Shapley Value

- (1)

- Measured value of the degree of participation in renovation

- (2)

- Measured value of the degree of risk sharing

- (3)

- Measured value of the degree of value-added return

- (4)

- Measured value of the degree of resource input

5. Discussion

- (1)

- Strengthen the awareness of cooperative games. The adoption of a cooperative game can increase the benefits of a project. Therefore, it is necessary that each participant in the renovation of old residential communities strengthen the awareness of the cooperative game, and use the cooperative game model to discuss the coordination of respective interests in the cooperation.

- (2)

- Correctly deal with the relationship between cost allocation ability and cost allocation responsibility. To achieve a reasonable cost allocation, it is necessary to comprehensively take into account the relationship between cost allocation capability and cost allocation responsibility. Participants with higher cost-sharing ability should assume more cost-sharing responsibilities, so as to avoid increased renovation costs of old residential communities due to unbalanced ability and responsibility.

- (3)

- Establish a mechanism for coordinating the interests of all participants. The smooth renovation of old residential communities is critically dependent on satisfying the interests and demands of all participants. The mechanism for coordinating the interests of participants can be established vertically and horizontally. Vertically, the relationship among the government, home owners, and private sectors should be coordinated to give play to the rationality of cost allocation; horizontally, attention should be paid to the fairness of cost sharing and benefit distribution among participants.

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Huang, Y. It is just in time to carry out renovation for old urban residential communities. Hous. Ind. 2019, 9, 10–17. [Google Scholar]

- The State Council Office Held a Press Conference on “Striving to Achieve Housing for All People”. EqualOcean: Beijing, China, 2021; p. 2.

- Xu, F. Research on the participation of social capital in the comprehensive reconstruction of Shanghai old neighborhood/community. Constr. Econ. 2018, 39, 90–95. [Google Scholar]

- The General Office of the State Council. Guiding Opinions of the General Office of the State Council on Comprehensively Promoting the Transformation of Old Urban Communities; The General Office of the State Council: Beijing, China, 2020. [Google Scholar]

- Chen, X.; Su, Z. The Construction Effect and New Development Pattern of the Renovation of Old Residential Areas across the Country; China Real Estate Business: Beijing, China, 2021. [Google Scholar]

- Jiang, B. Cost Allocation: Individual Game and Public Interest Contract Formation in the Installation of Elevators in Old Buildings. Chin. Technol. Investig. 2021, 2, 50–53. [Google Scholar]

- Cai, Y.; Yang, X.; Li, D. “Micro-transformation”: The Renewal Method of Old Urban Community. Urban Stud. 2017, 24, 29–34. [Google Scholar]

- Wang, Z.; Liu, L.; Yan, J. Study on the way and countermeasure of upgrading and reconstruction of old residential area in China. Urban Stud. 2020, 27, 26–32. [Google Scholar]

- Li, Y.; Pan, Y. Research on Renovation Potential Calculation and Renewal Scheme Determination of Old Residential Quarters. Constr. Econ. 2021, 42, 92–96. [Google Scholar]

- Xu, Y.; Juan, Y.-K. Optimal decision-making model for outdoor environment renovation of old residential communities based on WELL Community Standards in China. Archit. Eng. Des. Manag. 2021, 1–22. [Google Scholar] [CrossRef]

- Li, M.; Meng, X. Livable Index System′s Establishment and Analysis of Old Community Renovation. In Advanced Materials Research; Trans Tech Publications Ltd.: Frienbach, Switzerland, 2013; Volume 671-674. [Google Scholar]

- Xu, X.; Xue, D.; Huang, G. The Effects of Residents′ Sense of Place on Their Willingness to Support Urban Renewal: A Case Study of Century-Old East Street Renewal Project in Shaoguan, China. Sustainability 2022, 14, 1385. [Google Scholar] [CrossRef]

- Shan, S.; Li, J. Market Oriented Exploration on the Profit Model of the Old Community Reconstruction: Take J Community in Beijing as an Example. Constr. Econ. 2021, 42, 88–91. [Google Scholar]

- Xu, X.; Xu, X. Research on community governance system construction of social forces participating in old community reconstruction. Urban Probl. 2020, 74–80. [Google Scholar] [CrossRef]

- Li, D.; Zhang, M.; Guan, N.; Zhang, L.; Gu, T. Research on the Influencing Factors of Residents′ Participation in Old Community Renewal: A Case Study of Nanjing. Constr. Econ. 2019, 40, 93–99. [Google Scholar]

- Fragnelli, V.; Iandolino, A. A cost allocation problem in urban solid wastes collection and disposal. Math. Methods Oper. Res. 2004, 59, 447–463. [Google Scholar] [CrossRef]

- Song, J.; Ma, X.; Chen, R. A Profit Distribution Model of Reverse Logistics Based on Fuzzy DEA Efficiency-Modified Shapley Value. Sustainability 2021, 13, 7354. [Google Scholar] [CrossRef]

- Zhou, H.; Liu, K.; Li, L.; Zhang, J.; Yang, Y. Profit Distribution of IPD Team Based on Modified Shapley Value Method. J. Civ. Eng. Manag. 2020, 37, 52–56. [Google Scholar]

- Chen, W.; Zha, Y. Cost Allocation Methods Based on Cooperative Games. Oper. Res. Manag. Sci. 2004, 13, 54–57. [Google Scholar]

- Qu, L. Construction of Cost Sharing Model of E-commerce Logistics Terminal Joint Distribution Alliance—Taking Luquan District of Shijiazhuang City as an Example. Commun. Financ. Account. 2020, 171–176. [Google Scholar] [CrossRef]

- Yu, X. Research on Supply Chain Cost Allocation Based on Improved shapley Value Method. Jiangsu Sci. Technol. Inf. 2013, 49–51. [Google Scholar]

- Zhou, C.; Ma, X.; Liu, Y.; Wang, L.; Guo, X.; LEI, J. Cost Sharing and Income Allocation Method of Integrated Energy System in Industrial Parks Based on Cooperative Games. South. Power Syst. Technol. 2018, 12, 60–65. [Google Scholar]

- He, X.; Liu, X. Designing and Simulation Study on Regional Cost Sharing Mechanism of NIMBY Compensation for Waste Incineration Project. Collect. Essays Financ. Econ. 2020, 264, 105–113. [Google Scholar]

- Ye, Y.; Li, D.; Yu, G. EOQ Model of Joint Order Interval Value and Variable Weight Shapley Value Cost Allocation Method. Chin. J. Manag. Sci. 2019, 27, 90–99. [Google Scholar]

- Rao, W.; Zhang, Y.; Duan, Z. Cost Allocation Method of School Bus Cost in Primary and Secondary Schools. Syst. Eng. 2020, 38, 141–153. [Google Scholar]

- Wu, L. Research on Cost Sharing of Cooperative Operation of Communication Facilities in Residential District. Master’s Thesis, Jilin University, Jilin, China, 2020. [Google Scholar]

- Bae, W.; Kim, U.; Lee, J. Evaluation of the Criteria for Designating Maintenance Districts in Low-Rise Residential Areas: Urban Renewal Projects in Seoul. Sustainability 2019, 11, 5876. [Google Scholar] [CrossRef] [Green Version]

- Lee, M.A.C.; Peterson, M.E.B.; Dam, T.C.; Challa, B.A.; Robinson, P.D. Multi-generational Stories of Urban Renewal: Preliminary Interviews for Map-Based Storytelling. In Diversity, Divergence, Dialogue; Springer: Berlin/Heidelberg, Germany, 2021; Volume 12646, pp. 319–326. [Google Scholar]

- Yıldız, S.; Kıvrak, S.; Gültekin, A.B.; Arslan, G. Built environment design—Social sustainability relation in urban renewal. Sustain. Cities Soc. 2020, 60, 102173. [Google Scholar] [CrossRef]

- Lai, Y.; Tang, B. Institutional barriers to redevelopment of urban villages in China: A transaction cost perspective. Land Use Policy 2016, 58, 482–490. [Google Scholar] [CrossRef]

- Coggan, A.; van Grieken, M.; Boullier, A.; Jardi, X. Private transaction costs of participation in water quality improvement programs for Australia′s Great Barrier Reef: Extent, causes and policy implications. Aust. J. Agric. Resour. Econ. 2015, 59, 499–517. [Google Scholar] [CrossRef]

- Shahab, S. Transaction Costs in Planning Literature: A Systematic Review. J. Plan. Lit. 2021, 08854122211062085. [Google Scholar] [CrossRef]

- Mu, C. Cost-Benefit Evaluation Analysis of Comprehensive Renovation of Existing Residential Buildings in Old Districts. Master’s Thesis, Lanzhou University of Technology, Lanzhou, China, 2021. [Google Scholar]

- Chen, Y.; Yang, Y. Research on Profit Distribution of Prefabricated Construction Industry Chain: Based on AHP-GEM-Shapley Value Method. Constr. Econ. 2021, 42, 67–71. [Google Scholar]

- Wang, Y.; Tian, P.; Deng, B.; Rong, N. Benefit Distribution Model of “The Belt and Road”PPP Project Based on Modified Interval Fuzzy Shapley Value. Oper. Res. Manag. Sci. 2021, 30, 168–175. [Google Scholar]

- Song, Y.; Chen, P. Study on the Profit Distribution Model of the Senior Housing PPP Project. Constr. Econ. 2019, 40, 38–42. [Google Scholar]

- Hu, L.; Zhang, W.; Ye, X. Profit allocation of PPP model based on the revised SHAPELY. J. Ind. Eng. Eng. Manag. 2011, 25, 149–154. [Google Scholar]

- Han, J.; Xu, M.; Yan, J.; Gu, M. Research on Incremental Cost Allocation and Benefit Balance Mechanism of Integrated Energy System—Analysis of cooperation mode based on coupled thermal storage tank equipment. Price Theory Pract. 2020, 79–82. [Google Scholar] [CrossRef]

- Yang, T.; Li, Z.; Qin, J. Game model analysis of safety cost sharing in power investment project along “the belt and road”. J. East China Univ. Sci. Technol. 2019, 34, 43–50. [Google Scholar]

- Xu, M.; Zhou, X.; Cui, L.; Liu, Y.; Yu, G. Research on joint distribution mode and profit allocation of express enterprise in low distribution density area. Comput. Integr. Manuf. Syst. 2020, 26, 181–190. [Google Scholar]

- Guo, W.; Liang, L. Research on Cooperative Game of Supply Chain Cost Sharing in Carbon Emission Reduction. Forecasting 2021, 40, 83–89. [Google Scholar]

- Xu, Y.; Wu, Y. Research on incremental cost allocation of prefabricated buildings. Friends Account. 2019, 15, 11–16. [Google Scholar]

- Cheng, Z. Research on Income Distribution of PPP Project in Sponge City based on Shapley Value. Master′s Thesis, Anhui Jianzhu University, Anhui, China, 2020. [Google Scholar]

- Wei, Z.; Han, Q.; Cui, Y.; Wang, J.; Xue, Q. Research on the Benefit Distribution Mechanism of the Participants in Urban Village Reconstruction. Constr. Econ. 2021, 42, 67–71. [Google Scholar]

- Yuan, S.; Gan, X.; Tang, Y. Increment income sharing of rural homestead withdrawal based on alliance interest distribution: A case of typical counties and cities in Zhejiang Province. Resour. Sci. 2021, 43, 1361–1374. [Google Scholar] [CrossRef]

- Ji, M.; Cao, Q.; Gao, Y. Research on Cost Sharing Mechanism of Cloud Resource Providers Based on Weighted Shapley Value Method. Qiye Jingji 2016, 66–70. [Google Scholar] [CrossRef]

- Chen, J. Evaluation of Customer Satisfaction of Third-Party Logistics Enterprises based on SEM. Master′s Thesis, Tianjin Normal University, Tianjin, China, 2010. [Google Scholar]

- Yu, Q. Research on Customer Satisfaction for the Third Party Logistics Enterprise Based on Structural Equation Model. Master′s Thesis, Hunan University of Technology, Hunan, China, 2014. [Google Scholar]

- Fan, L.; Uwe, A.; Cai, Z.; Tang, Y. State-led Urban Regeneration Through Funding Program in Germany. Urban Plan. Int. 2022, 37, 16–21. [Google Scholar]

- Zhang, W.; Liu, J.; Wang, C. The Policy System, Strategies and Enlightenment of the Public Housing Upgrading Programmes in Singapore. Urban Plan. Int. 2021, 1–27. [Google Scholar]

| Influencing Factors | Meaning | References |

|---|---|---|

| Degree of Participation in Renovation | The degree of participation refers to the extent participants participate in the renovation of old residential communities. Based on its content, it is divided into basic renovation degree, improvement renovation degree, and updating renovation degree. | Mu [33]; Chen [34]; Wang [35] |

| Degree of Risk Sharing | The degree of risk sharing refers to the proportion of risk sharing among participants in the renovation of old residential communities. | Chen [34]; Zhou [18]; Song [36]; Hu [37]; Han [38]; Yang [39]; Xu [40] |

| Degree of Value-added Return | The degree of value-added return refers to the amount of expected value-added return brought to participants in the renovation of old residential communities, or the extent to which participants create value-added return. | Han [38]; Guo [41]; Xu [42]; Cheng [43]; Wei [44]; Yuan [45] |

| Degree of Resource Input | The degree of resource input refers to human resources, materials, finance, etc., which are input in the face of abrupt situations or which are unpredictable and unmeasurable at the beginning by participants in the renovation of old residential communities. | Chen [34]; Wang [35]; Zhou [18]; Xu [40]; Yu [21]; Ji [46] |

| Latent Variable | S/N | Observed Variable | S/N |

| Degree of Participation in Renovation | DPR | Time of participation in renovation | DPR1 |

| Content of participation in renovation | DPR2 | ||

| Difficulty of renovation | DPR3 | ||

| Degree of Risk Sharing | DRS | Operation and maintenance risks | DRS1 |

| Cooperation risks | DRS2 | ||

| Construction risks | DRS3 | ||

| Economic risks | DRS4 | ||

| Policy and regulatory risks | DRS5 | ||

| Degree of Value-added Return | DVR | Social reputation | DVR1 |

| Social image | DVR2 | ||

| Social prestige | DVR3 | ||

| Money income | DVR4 | ||

| Material income | DVR5 | ||

| Degree of Resource Input | DRI | Equipment input | DRI1 |

| Intangible assets input | DRI2 | ||

| Personnel input | DRI3 | ||

| Fund input | DRI4 |

| Latent Variable | Cronbach’s Alpha | KMO Test Value | Bartlett’s Spherical Test Value |

|---|---|---|---|

| Degree of Participation in Rebuilding | 0.880 | 0.683 | <0.001 |

| Degree of Risk Sharing | 0.904 | 0.856 | <0.001 |

| Degree of Value-added Return | 0.835 | 0.822 | <0.001 |

| Degree of Resource Input | 0.888 | 0.782 | <0.001 |

| Overall | 0.906 | 0.894 | <0.001 |

| Index | Before Correction | After Correction | Evaluation Standard | Evaluation Results |

|---|---|---|---|---|

| CMIN/DF | 2.093 | 1.489 | <2 | Qualification |

| GFI | 0.899 | 0.928 | >0.90 | Qualification |

| AGFI | 0.867 | 0.903 | >0.90 | Qualification |

| PGFI | 0.682 | 0.685 | >0.50 | Qualification |

| NFI | 0.905 | 0.934 | >0.90 | Qualification |

| RFI | 0.889 | 0.921 | >0.90 | Qualification |

| IFI | 0.948 | 0.977 | >0.90 | Qualification |

| TLI | 0.939 | 0.973 | >0.90 | Qualification |

| CFI | 0.948 | 0.977 | >0.90 | Qualification |

| RMR | 0.033 | 0.028 | <0.05 | Qualification |

| RMSEA | 0.067 | 0.045 | <0.08 | Qualification |

| PCFI | 0.808 | 0.812 | >0.50 | Qualification |

| PNFI | 0.772 | 0.776 | >0.50 | Qualification |

| Latent Variable | Weight | Observed Variable | Weight |

|---|---|---|---|

| Degree of Participation in Rebuilding (DPR) | 0.247 | DPR1 | 0.294 |

| DPR2 | 0.360 | ||

| DPR3 | 0.346 | ||

| Degree of Risk Sharing (DRS) | 0.256 | DRS1 | 0.203 |

| DRS2 | 0.210 | ||

| DRS3 | 0.215 | ||

| DRS4 | 0.180 | ||

| DRS5 | 0.192 | ||

| Degree of Value-added Return (DVR) | 0.242 | DVR1 | 0.258 |

| DVR2 | 0.212 | ||

| DVR4 | 0.278 | ||

| DVR5 | 0.252 | ||

| Degree of Resource Input (DRI) | 0.255 | DRI1 | 0.223 |

| DRI2 | 0.260 | ||

| DRI3 | 0.241 | ||

| DRI4 | 0.276 |

| Participant | 1(DPR) | 2(DRS) | 3(DVR) | 4(DRI) |

|---|---|---|---|---|

| 1 (Government) | a11 | a12 | a13 | a14 |

| 2 (Home Owners) | a21 | a22 | a23 | a24 |

| 3 (Private Sectors) | a31 | a32 | a33 | a34 |

| S1 | {g} | {g, o} | {g, s} | {g, o, s} |

|---|---|---|---|---|

| C (S) | 270 | 300 | 570 | 600 |

| C (S − i) | 0 | 62 | 348 | 370 |

| C (S − i) | 270 | 238 | 222 | 230 |

| 1 | 2 | 2 | 3 | |

| 1/3 | 1/6 | 1/6 | 1/3 | |

| 90 | 238/6 | 37 | 230/3 |

| S2 | {o} | {g, o} | {o, s} | {g, o, s} |

|---|---|---|---|---|

| C (S) | 62 | 300 | 370 | 600 |

| C (S − i) | 0 | 270 | 348 | 570 |

| C (S − i) | 62 | 30 | 22 | 30 |

| 1 | 2 | 2 | 3 | |

| 1/3 | 1/6 | 1/6 | 1/3 | |

| 62/3 | 5 | 22/6 | 10 |

| S3 | {s} | {g, s} | {o, s} | {g, o, s} |

|---|---|---|---|---|

| C (S) | 348 | 570 | 370 | 600 |

| C (S − i) | 0 | 270 | 62 | 300 |

| C (S − i) | 348 | 300 | 308 | 300 |

| 1 | 2 | 2 | 3 | |

| 1/3 | 1/6 | 1/6 | 1/3 | |

| 116 | 50 | 308/6 | 100 |

| Participants | Cost Allocation Value of Traditional Shapley Value | Improvement of Cost Allocation Value of Shapley Value |

|---|---|---|

| Government | 243.33 ten thousand yuan | 263.33 ten thousand yuan |

| Home Owners | 39.33 ten thousand yuan | 53.93 ten thousand yuan |

| Private Sectors | 317.33 ten thousand yuan | 282.73 ten thousand yuan |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhuo, X.; Li, H. A Study on Cost Allocation in Renovation of Old Urban Residential Communities. Sustainability 2022, 14, 6929. https://doi.org/10.3390/su14116929

Zhuo X, Li H. A Study on Cost Allocation in Renovation of Old Urban Residential Communities. Sustainability. 2022; 14(11):6929. https://doi.org/10.3390/su14116929

Chicago/Turabian StyleZhuo, Xiaoyan, and Hongbing Li. 2022. "A Study on Cost Allocation in Renovation of Old Urban Residential Communities" Sustainability 14, no. 11: 6929. https://doi.org/10.3390/su14116929

APA StyleZhuo, X., & Li, H. (2022). A Study on Cost Allocation in Renovation of Old Urban Residential Communities. Sustainability, 14(11), 6929. https://doi.org/10.3390/su14116929