Abstract

Banks can be chosen based on multiple factors, such as location, security, and e-banking functions. The characteristics of customers such as gender and age can also affect this decision. Since the digitalization of banking sped up due to the COVID-19 pandemic, the factors that affect this decision may change as well. To assess this, a questionnaire was completed by 156 respondents, and the results were evaluated using Pearson’s correlation test. According to the results, personal visits to the banks declined after the COVID-19 pandemic started. Furthermore, the number of e-bankers rose. When choosing banks, no gender-related relationships were found based on location, while older people chose different banks than their younger counterparts. The security of internet banking functions was not associated with bank choice, while the security of the mobile banking application was. Regarding the ratings of banks, males and females did not rate banks differently, and younger people tended to be more critical in their ratings. Security, accessible location, and good customer service can lead to more positive ratings as well. The findings can be used by banks in Hungary to improve their services in order to attract customers and increase their satisfaction.

Keywords:

banking; COVID-19; electronic banking; mobile banking; online; online banking; pandemic; selection criteria 1. Introduction

The COVID-19 pandemic affected several fields of life. Humans were psychologically affected [,,], education took a blended or distance learning format [,,], and research changed as well [,]. Digital technologies were being harnessed for the public-health response to COVID-19 worldwide []. COVID-19 even impacted the environment [], energy consumption [], and shopping behavior [,]. The global economy itself was also affected [,], meaning that banking was no exception []. In accordance, their digitalization sped up. New e-banking options became available, which can be considered important from the customer’s point of view. However, do these new options affect how banks are chosen and rated?

Due to the various speed of digitalization in several countries, there is a difference in digital services among banks. In the case of Hungary, in 2021, a survey was conducted by the Hungarian National Bank for 2020 []. In this survey, the level of digitization of incumbent banking players in Hungary was measured and compared with the results of 2019. The survey covered 90% of the Hungarian banking sector’s balance sheet total proportionally, and the participating institutions had to answer a total of 270 questions in the form of a questionnaire, the aim of which was to provide an analysis of the level of digitization in the banking sector. The seven pillars examined in the survey were: Product, Customer, Partner, Management, Workforce, and Process. Based on the survey, a significant improvement in the level of digitalization of the Hungarian banking system could be identified, mainly in the previously underdeveloped pillars: in the areas describing the digitalization of communication with external stakeholders (product, customer). The pandemic situation—like the international experience—accelerated the previously planned customer-side developments in Hungary as well. The development of several institutions was catching up, so the level of digitalization of the Hungarian banking system remained moderate. The median bank scored 53 in the composite index on the 0–100 normalized scale in 2019, rising to 58 by 2020. Although the COVID-19 pandemic had a direct impact on the place and way of working—and thus on internal systems and processes (teleworking, modified processes, etc.)—less progress has been made in the latter areas, that is, fewer resources have been allocated to the development of the digitization of internal operations. The quicker digitalization due to the pandemic was also strengthened by Kovács []. Naturally, this means a change in customer experience. This fact might affect bank selection criteria.

While bank selection processes and criteria were and still are assessed in the bank marketing literature, these studies are quite rare in Europe [,]. Hungarian researchers have focused on banking unions [], bank managers [], bank ownership [], spatial distribution [], and inflation []. Even banking reform was researched []. However, no studies were found about bank selection criteria and ratings in Hungary. Thus, the objective of this research is to understand bank selection criteria and bank rating in Hungary.

In recent years, however, there has been a global pandemic that is still ongoing. This resulted in a faster digitalization process that must be considered during the study. Therefore, is the way of choosing and rating banks affected by the fast rate of digitalization? What is the situation in Hungary? The goal of the research presented here is to answer these questions.

This paper is structured as follows: a literature review is conducted in Section 2; the materials and methods, as well as the steps of the research, are presented in Section 3, while the results are shown in Section 4. A discussion of the results can be found in Section 5, while conclusions are drawn in Section 6.

2. Literature Review

Before the pandemic, banks could be chosen based on multiple factors. Several studies suggest that bank location is one of the most important factors [,,,]. While bank location is considered one of the most important factors, there are others as well. For example, in Bahrain, the most important factor in choosing banks was religion, while the second most important factor was the quality of services. Furthermore, female customers more significantly preferred convenience factors than males []. In Pakistan, religion also plays a huge role in the bank selection criteria. Other factors include profitability, recommendation of family and friends, and easy access to the branch []. According to a Pakistani study, profitability, efficiency, transaction speed, religiosity, and staff friendliness are the most important bank selection criteria []. In China, Chinese banks are chosen due to their network, while foreign banks are chosen due to their professionalism, client orientation, and innovation []. In Taiwan, no differences were found between choosing foreign and Taiwanese banks; but the location of chosen banks was considered important []. According to Mohd Suki [], bank services, influences of people, electronic services, and security significantly affect how banks are chosen. Moreover, these factors are more important to females than males. In Cyprus, quality of services, efficiency, bank image, location, parking facilities, and financial factors were considered important [].

According to a study that focuses on the bank selection criteria of customers in Romania, the number of automatic teller machine (ATM) booths was found to be the most important criterion. Besides this, mobile and internet banking, reputation, personal attention to customers, the image of banks, confidentiality, the appearance of staff, and the number of branches are important as well. However, bank selection criteria differ among cities and income groups. For Romanian people, little attention is given to bank advertisements, gifts, fast and efficient services, and people’s recommendations []. In Poland, reputation, price, and services are the most important bank selection criteria []. Convenience is quite important in the United States [].

Bank selection criteria were also investigated from the students’ point of view. In Cyprus, the number of ATM booths and the speed, as well as the quality of services, are important []. For students, the reliability of services is of utmost importance []. According to undergraduates, the pricing and product dimensions of banks are important bank selection criteria []. A study was also conducted in Bahrain, and the conclusion was that the bank’s reputation, availability of parking spaces close to the bank, friendliness of bank personnel, and the number of ATM booths are of critical importance to students when choosing a bank []. Students are generally more inclined to conduct business with more than one bank and are not particularly loyal to them [].

In general, the literature review shows that the quality of services, convenience, efficiency, staff friendliness, innovation, influences of people, religion, and security affect bank selection. However, these selection criteria might be impacted by the COVID-19 pandemic, as it affected many sectors of life. As banks themselves were affected [], the financial application of machine learning and artificial intelligence (AI) can be considered a result of it [,], specifically concerning asset management and insurance. The majority of consumers and customers are still averse to AI-based practices and customer service structures, whether they are chatbots, customer identification, personal advice, or electronic administration [,]. This has changed as more and more banks are shifting to digital platforms to minimize face-to-face interactions. For example, major banks in India developed simple online banking tools, which enable illiterate people to perform operations any time and anywhere. Mobile banking wallets have boosted the banking sector in India and enhanced daily transactions in an efficient and safe mode [].

Digitalization is important as customers of banks were affected by the pandemic as well—according to Jindal and Sharma, people feel safer during online banking, and digitalization can help the prevention of COVID-19 []. A similar phenomenon can be observed in the case of mobile banking applications. Regardless of various financial backgrounds, the use of mobile banking applications has significantly accelerated due to the pandemic [,]. Online banking transactions have become even more acceptable to people worldwide. According to Hammed, online banking was accepted by Pakistani people []. The use of electronic channels, namely mobile banking applications and internet banks, increased in Romania []. According to a Greek study, older people and those with low salaries in Greece are likely not to be familiar with online and mobile banking. Therefore, banks should have greater appeal to people who tend to be unfamiliar with new technology innovations []. According to Karmakar, in Kolkata, not only Generation Z but also Millennials and a part of Generation X find e-banking more convenient than physical banking []. A Bangladeshi study [] found that women who are either more involved with technology or are more educated are more likely to use mobile banking.

To mitigate the negative effects of COVID-19, banks are trying to create a better banking experience for their customers, and they are also trying to reduce their operational costs [,,]. This may be possible by secure mobile banking applications and speeding up online banking services []. It is important to note that accessibility is a key issue and can vary among countries [,,]. For example, Indonesian banks use social media applications to promote the adoption of online banking []. In Nigeria, mobile money adoption and usage growth have been slow due to poor mobile networks, cost of services, and security-related concerns []. The Ethiopian banking sector has been experiencing an unprecedented period of growth before the pandemic; however, COVID-19 has started showing its effect on every banking service, especially on system security [].

As can be seen in the literature, the pandemic affected banking as well. However, did it affect how banks are chosen and rated? What is the case in Hungary? Do the e-banking habits of customers change due to the pandemic? Does this change affect how banks are chosen and rated in Hungary?

As was mentioned above, the quality of services, location, and human characteristics can affect how banks are chosen. Furthermore, the authors are interested in the effects of the pandemic regarding this decision. Thus, fourteen research questions were formed for the research. These are the following:

Research Question 1 (RQ1).

Can the use of internet banking in Hungary be associated with the COVID-19 pandemic?

Research Question 2 (RQ2).

Can the use of mobile banking applications in Hungary be associated with the COVID-19 pandemic?

Research Question 3 (RQ3).

Can the most commonly used banking method in Hungary be associated with the COVID-19 pandemic?

Research Question 4 (RQ4).

Can the frequency of personal visits to banks in Hungary be associated with the COVID-19 pandemic?

Research Question 5 (RQ5).

Can bank choice in Hungary be associated with gender?

Research Question 6 (RQ6).

Can bank choice in Hungary be associated with easily accessible banks?

Research Question 7 (RQ7).

Can bank choice in Hungary be associated with age?

Research Question 8 (RQ8).

Can bank choice in Hungary be associated with internet banking security?

Research Question 9 (RQ9).

Can bank choice in Hungary be associated with the security of the mobile banking application?

Research Question 10 (RQ10).

Can the ratings of banks in Hungary be associated with gender?

Research Question 11 (RQ11).

Can the ratings of banks in Hungary be associated with age?

Research Question 12 (RQ12).

Can the ratings of banks in Hungary be associated with security?

Research Question 13 (RQ13).

Can the ratings of banks in Hungary be associated with location?

Research Question 14 (RQ14).

Can the ratings of banks in Hungary be associated with customer services?

3. Materials and Methods

To answer the research questions, a quantitative research method—a questionnaire (see Supplementary Materials)—was used. An online questionnaire was created by all three authors using Google Forms. The questionnaire was divided into 7 main parts.

The first part was used to screen the eligible people by asking whether they use electronic channels (responses from those who do not use electronic channels have been omitted).

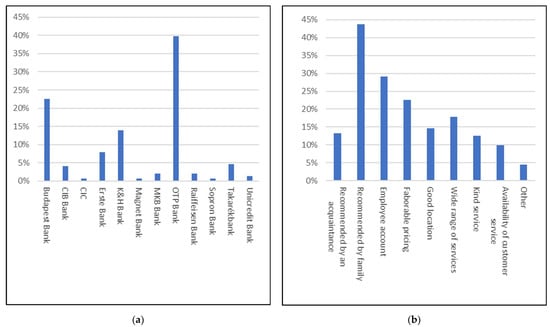

In the second part, the general banking information was asked as follows. Respondents first had to select a bank from a list of Hungarian banks that they considered their main one. In the list, they could choose from the most common banks found in Hungary (e.g., OTP Bank, CIB Bank, K&H Bank, etc.). An “Other” option was also supplemented, where they could add the name of a bank that was not included in the list. The second mandatory question of this part was, “Why did you choose this bank?”. In this case, multiple answers could be selected from the following answers: “Recommended by an acquaintance”, “Recommended by family”, “Employee account”, “Favorable pricing”, “Good location”, “Wide range of services”, “Kind service”, “Availability of customer service”, “Other” (supplemented by own comment).

In the third part, the general satisfaction was measured by several factors, e.g., “Helpfulness of advisors”, “Waiting time”, “Complaint handling”, etc., on a scale of 0–5 (0—no experience, 1—not satisfied, 5—satisfied). In the case of answer 0, the main reason was also asked.

In parts four and five, the aim was to collect information about e-banking channels. Namely, in the fourth section, there were questions about how frequently the respondents used the different channels (internet banking, mobile banking application, and in-person options) before the COVID-19 pandemic (February/March 2020), and contrary, during the pandemic (to the end of 2021). The fifth part collected information about the respondents’ opinion on their impression of the bank’s internet banking services, its mobile banking application, and its online customer service by several aspects, e.g., “Transparency”, “Availability”, “Helpfulness of advisors”, “Complaint handling”, etc., on a scale of 0–5 (0—no experience, 1—not satisfied, 5—satisfied). In the case of answer 0, the main reason was also asked.

In the sixth part, suggestions for further improvements were explored. The respondents could select from the following (multiple answers were allowed): “More transparent interface”, “Wider services”, “Instruction manual”, “Security”, “Availability”, and “Other” (supplemented by own comment).

Finally, the seventh group collected the demographic profile of the respondents in terms of gender, age, level of education, and home of residence. Regarding age, there were five groups to choose from: “18–25”, “26–35”, “36–50”, “51–65”, and “Over 65”. In the case of level of education, there were four groups to choose from: “College/University”, “High School Degree”, “Skilled worker”, and “8 grades or less”. Lastly, the home of the residence could be the following: “Capital city”, “County seat”, “City”, and “Village”.

The questionnaire was distributed in multiple ways. First, the authors posted it on social media in September 2021. Then, our acquaintances, friends, and colleagues at the university were asked to share it so that it could reach a larger number of people. It was also sent to the staff of banks in Hungary so they could share it with bank employees. The questionnaire was voluntary and anonymous. Due to its voluntary fashion, by answering the questions, respondents agreed to participate in the study. This fact was also indicated in a short sentence at the beginning of the questionnaire. The questionnaire was closed in December 2021, and a total of 156 people responded. Those who did not use electronic channels were omitted, resulting in a total of 151 respondents. This dataset was analyzed using SPSS.

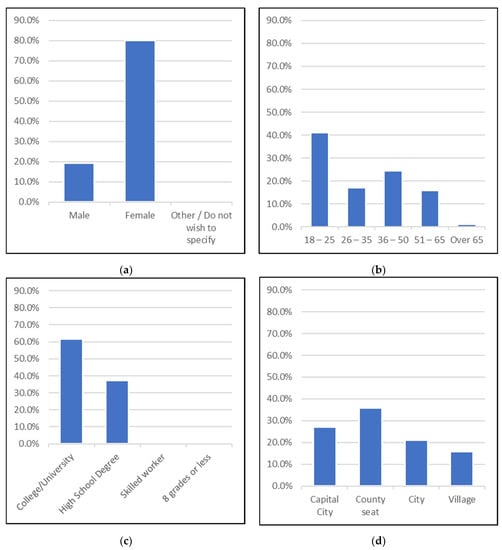

Since these people responded voluntarily, not asked to participate, their answers were considered useful for the research. Thus, the analyses were based on their responses. Their demographic data can be observed in Figure 1, and the data gathered on parts 2–5 of the questionnaire can be seen in Appendix A (in Table A1, Table A2, Table A3, Table A4 and Table A5). More than three-quarters of the respondents were female (80.1%), while only 19.2% were male. Lastly, there was only one respondent (0.7%) who classified themself as “other/do not wish to specify”.

Figure 1.

Demographic data of the respondents grouped by (a) gender; (b) years of age; (c) level of school degree; (d) hometown.

The highest number of respondents was in the 18–25 age group (41.1%), while almost a quarter of respondents was in the 36–50 age group (24.5%). Approximately two-tenths were in the 26–35 age group (17.2%), and a similar proportion of respondents was in the two oldest groups. No person under 18 completed the questionnaire. One of the main reasons for this may be that opening an account under 18 requires parental permission in Hungary. However, in most banks, this is only possible from the age of 14.

The highest level of education for most respondents was “College/University” (61.6%). The second-highest number of respondents chose “High School Degree” (37.1%). The other two categories (“Skilled worker”, “8 grades or less”) had a negligible number of completers—only 1 in both cases.

The majority of respondents live in a county seat (35.8%). Almost one-third live in Hungary’s capital city, Budapest (27.2%). Just over one-fifth live in a city (21.2%), and the rest live in a village (15.9%).

Figure 2 shows which and how main banks were chosen. According to the responses, most people chose OTP Bank as their main bank (39.7%), while slightly more than a fifth chose Budapest Bank (22.5%). K&H Bank (13.9%) was chosen by slightly more than a tenth, and 12 respondents chose Erste Bank (7.9%). The other banks had response rates below 5%.

Figure 2.

(a) Which main banks were chosen; (b) how banks were chosen (multiple answers could be selected).

4. Results

The results are split into three subsections: the reliability and distribution tests are presented in Section 4.1, while the results received on the questionnaires are analyzed in detail in Section 4.2. The implications of the results are discussed in Section 4.3.

4.1. Reliability and Distribution Tests

The reliability of the questionnaires was investigated by calculating Cronbach’s alpha values. This value can range from 0 to 1, but some suggest that only values above 0.7 are acceptable. Next, the hypotheses were investigated: first, the distributions were examined using the Shapiro-Wilk normality test. Then, analyses were performed using Pearson’s correlation test, which clarified the relationship between the variables. The results of these analyses are presented in the next subsection.

There were four categories of questionnaires in the form of 5-point Likert scales. Before the investigation commenced, the reliability of these questionnaires had to be assessed. Thus, their Cronbach’s Alpha values were calculated and are presented in Table 1. According to them, all are reliable.

Table 1.

Cronbach’s Alpha for each aspect.

4.2. Core Results

First, the effects of the pandemic on banking were assessed (RQ1–RQ4). The results of the investigation can be observed in Table 2.

Table 2.

The effects of the pandemic on banking.

The results show that there is no significant correlation between gender and pre-COVID use of internet banking functions. Similarly, there is no significant correlation between gender and amid-COVID use of internet banking functions. However, as can be seen, the negative value of the correlation coefficient, as well as the probability value, became slightly stronger. It can be seen that there is a negative, weak, significant correlation between age and pre-COVID use of internet banking functions. The correlation between age and amid-COVID use of internet banking functions is also significant, although it is weak in a negative direction.

There is no significant correlation between gender and pre-COVID use of mobile banking applications. Similar results can be found when the correlation between gender and amid-COVID use of the mobile banking application is investigated. However, both the correlation coefficient and the probability value became slightly weaker in this case. Afterward, the effect of age was investigated. There is a significant, weak, positive correlation between age and the use of the mobile banking application before COVID. The correlation between age and the use of the mobile banking application during the COVID pandemic is similar, albeit weaker.

There is a significant, weak correlation in a negative direction between age and the most commonly used option before the pandemic. Similarly, a significant, weak negative correlation can be found during the pandemic. As can be seen, both the correlation coefficient and the significance became stronger. It is also clear from the analysis that there is a significant, positive mean relationship between the most commonly used option before and during the pandemic, .

The correlation between age and the frequency of personal visits before the pandemic is insignificant and shows almost no strength. Contrarily, the results show that after the pandemic started, the correlation became significant. It is also weak, in a negative direction.

The bank selection criteria were investigated next (RQ5–RQ9). The results of the analyses can be found in Table 3.

Table 3.

The effects on bank selection criteria.

According to the results, there is no significant correlation between the main bank and gender. There is no significant correlation between the main bank and whether it is easily accessible. However, there is a significant, weak correlation in a negative direction between the age and the main bank. While nowadays, security is fundamental in the case of choosing a bank as well, there is no significant correlation between the security of internet banking and bank choice. Contrarily, there is a significant correlation in a negative direction between the security of mobile banking applications and bank choice.

Next, the investigation continued to see which factors influence the ratings of banks (RQ10–RQ14). The results of this investigation can be observed in Table 4.

Table 4.

The effects on bank ratings.

The first analysis was the effect of gender on the ratings. The results show that no significant correlation occurred between gender and the rating of internet banking services; neither between gender and the rating of mobile banking applications; and nor-between gender and the overall rating of the entire bank.

The analysis continued with the effect of age on the ratings. According to the results, there was a significant, weak correlation in a positive direction between age and the rating of internet banking services. Therefore, the younger someone is, the more they prefer internet banking. A significant, weak correlation in a negative direction was observed between the age and rating of mobile banking applications. Contrarily, there was no significant correlation between age and the overall rating of banks.

There was a significant, strong correlation in a positive direction between the security of internet banking functions and the rating of internet banking services, as well as between the security of mobile banking applications and the rating of the mobile banking application. Therefore, the more secure the mobile banking application, the more satisfied the respondents are with it.

The better the location, the higher the overall rating the bank receives. This means that there is a significant, medium correlation in a positive direction. Namely, people prefer to manage their finances at a bank that is easy to access, with easy parking in the area.

Bank advisors also play an important role in customer experience. If they are kind and helpful, the customer is much more likely to go to the bank. Therefore, there is a significant, medium correlation in a positive direction between the helpfulness of the advisors and the overall rating of the bank.

4.3. The Implications of the Results

A negative answer can be given to RQ1, as internet banking did not increase or decrease as a result of COVID-19. There was no significant correlation found when this was investigated by gender. While there were significant correlations found when analyzed by age, both pre-COVID and amid-COVID, there were no differences found among the results. A negative answer was given to RQ2, and a similar phenomenon to RQ1 was found. RQ3 received a positive answer as the most commonly used options are used even more frequently. This means that those who used electronic channels before, used them more frequently amid-COVID-19. As digital solutions were becoming more widespread even before the pandemic, the situation caused by COVID-19 made an opportunity to increase them easily. Since customers already had experience with electronic channels, it was easier for them to decide which option was closest to them. A positive answer was also given to RQ4 since the frequency of personal visits to banks declined.

Negative answers were given to RQ5 and RQ6. This means that no different banks were chosen by males and females, and for them, it does not matter whether the banks are easily accessible. RQ7 received a positive answer, suggesting the fact that older people choose different banks than their younger counterparts. Choosing the main bank based on security, however, presented a mixed case; a negative answer was given to RQ8, while a positive one to RQ9. This means that the security of internet banking functions is not associated with choosing the main bank, while the security of the mobile banking application is associated with it.

A negative answer was given to RQ10, meaning that there was no difference in bank ratings among males and females. A mixed case was presented by the answers to RQ11: while there was no difference in the overall ratings of banks among younger and older people, differences existed in the case of internet banking services and mobile banking applications. Younger age groups can be much more critical than older age groups, but there are also many differences in their expectations. One of the priorities of young people is to be able to manage their aims quickly and conveniently. Due to digitalization, they have a better experience with banks. A positive answer was given to RQ12 since the more secure the mobile banking application and internet banking services are, the more satisfied the respondents are with them. RQ13 also received a positive answer because the more accessible the location is, the bank is more likely to improve its rating. Lastly, RQ14 was also given a positive answer as good customer service can increase the bank’s rating.

5. Discussion

In the literature, the location of the bank was considered one of the most important factors among bank selection criteria in multiple countries, which include the United States, Pakistan, Taiwan, and Cyprus, among others [,,,,,,]. However, this case is different in Hungary as the location does not significantly affect bank selection criteria. Contrarily, location is quite an important factor when banks are rated. A better location provides a better rating as Hungarian customers prefer to go to a bank that has easily accessible parking or is easily accessible by public transportation. The fact that the bank’s location is only important for its rating means that Hungarians tend to think about the bank’s location after it is chosen. This can also mean that Hungarians use electronic banking services more often than in-person banking.

Even before the pandemic, a faster rate of digitalization could be observed in Hungary as well as in other countries [,]. Therefore, online banking services became more popular worldwide, and more people started using them in several countries [,]. This study shows that the pandemic has led people to choose electronic banking services instead of in-person banking in Hungary. This fact presents similar results to the state of the art. In Hungary though, mobile banking applications were the main choice of the investigated electronic banking services, and the proportion of its users most often increased by 12.6% during the pandemic. Mobile banking applications also proved to be one of the most important factors among bank selection criteria in Hungary. It is also one of the main factors that could provide better ratings for banks. Internet banking services are also associated with the ratings of banks. However, they are not associated with bank selection in Hungary. The case is different in other countries, however [,,,,,].

Due to digitalization, the security of online banking services became crucial []. Nowadays, customers rate security as the most important factor in electronic channels. This is the case in several countries [,], Hungary included. Although people feel safer during internet banking and while using mobile banking applications [], digitalization comes with possible accessibility issues [,,]. According to the literature, not only Generation Z but also Millennials find electronic banking more convenient than in-person banking []. This is also true for a part of Generation X, but older people and those with low salaries are likely not to be familiar with new technologies []. A similar phenomenon can be found in Hungary, and it is split into three parts. Firstly, the younger the customer, the more they prefer internet banking services. Secondly, older people are less likely to use mobile banking applications, and some of them do not even own a smartphone. This means that they are prevented from using electronic banking services. Thirdly, the younger the customer, the less often they visit their bank. However, by taking the results into account, it can be stated that electronic channels are more used by younger people, but these channels are becoming easier for everyone to understand. The pandemic has also had an impact, as people have been forced to open up to the digital world. This has not only increased their use of electronic services, but also the number of users. This increase can be observed in other countries as well [,,,].

Studies in the literature also show that females who are either more involved with technology or are more educated are more likely to use mobile banking []. Females also prefer convenience, such as the bank’s location []. However, the results are different in Hungary. There are no significant differences between the usage of internet banking services when males and females are compared. A similar phenomenon can be found in the use of mobile banking applications. Regarding the bank’s location, it is not a bank selection criterion when the opinions of males and females are compared.

Lastly, another important factor is the helpfulness of the bank advisors, as can be observed in several countries [,,]. Creating a positive customer experience is the responsibility of all employees. One of the biggest responsibilities in this respect falls on the people in customer service, as they are the closest contact with customers. The results presented in this study confirm this assumption, meaning that the more helpful an employee is, the more satisfied the customer will be. This also means a more positive bank rating.

6. Conclusions

According to the literature, before the pandemic, the quality of services was key in choosing banks. The location of banks, their services, and security can be considered important as well. However, during the pandemic, digitalization sped up globally. This resulted in more electronic banking services becoming available. In Hungary though, there was no significant change in electronic banking. Those who used electronic channels before the pandemic still used them during the pandemic. The number of those who transitioned from physical banking to digital banking is small.

The objectives of the study were met by the findings. According to the results, similarly to the literature, the quality of services is just as important when choosing banks. However, younger people tend to choose different banks than their older counterparts. Furthermore, the security of mobile banking applications is more important to Hungarians than internet banking services. Contrary to the literature, bank choice is not associated with accessibility and location. However, the bank’s location is associated with its positive rating. This means that Hungarians tend to think about the location of their banks after they choose them. Positive ratings are given to banks with secure internet banking services and secure mobile banking applications, as well as good customer services.

Based on the results presented in this study, the factors that are important for Hungarians in choosing and rating banks are now known. The findings presented in this study can be used by banks in Hungary to improve their services to attract customers and increase their satisfaction. Thus, our recommendations are the following: the security of internet banking services and mobile banking applications should be improved, and the customer service staff should be trained to maintain accurate, efficient, fast, and high-quality services. By following these recommendations, banks in Hungary can be rated more positively.

Naturally, this study has its limitations, and they can be filled by future studies. Firstly, other factors might affect customer selection criteria and rating of banks in Hungary, such as their reputation, size, advertising, and their number of ATM booths. Secondly, a larger sample size could lead to more accurate results. Moreover, most of the research respondents have a university degree. The bank selection criteria might be affected by the inclusion of more lower-educated customers. Thirdly, a qualitative approach was used in the study. Using other approaches and techniques could add to the value of the results. By doing so, other factors that were not discussed could be explored as well.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/su14116720/s1.

Author Contributions

Conceptualization, D.S. and J.S.; methodology, D.S. and T.G.; software, D.S.; validation, D.S., T.G. and J.S.; formal analysis, D.S.; investigation, D.S. and T.G.; resources, J.S.; data curation, D.S.; writing—original draft preparation, D.S., T.G. and J.S.; writing—review and editing, D.S., T.G. and J.S.; visualization, D.S.; supervision, J.S.; project administration, J.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Owing to the fact that the survey was anonymous, voluntary, and did not collect any data suitable for identification of the surveyees, an Institutional Review Board (IRB) approval was waived for this survey.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

The authors would like to thank Ildikó Gelencsér, Zsófia Bajnóczy, Edit Bérces, and István Joó for their help during the research.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Here, the detailed ratings of banking services can be found in Table A1, Table A2, Table A3 and Table A4, as well as the effect of the pandemic in Table A5.

Table A1.

Rating the services of the bank.

Table A1.

Rating the services of the bank.

| Mean | Standard Deviation | |

|---|---|---|

| Helpfulness of advisors | 4.19 | 1.208 |

| Waiting time | 3.64 | 1.230 |

| Complaint handling | 3.13 | 1.856 |

| Expertise | 4.00 | 1.311 |

| Discounts | 3.30 | 1.413 |

| Technology | 3.97 | 1.197 |

| Environmental awareness | 2.81 | 1.863 |

| Up-to-date | 3.89 | 1.440 |

| Innovation | 3.71 | 1.459 |

| Environment | 3.79 | 1.408 |

| Atmosphere | 3.74 | 1.458 |

| Security | 4.26 | 1.010 |

| Location | 4.33 | 1.050 |

| Range of services | 4.09 | 1.218 |

| Opening an account online | 2.89 | 2.076 |

Table A2.

Rating the internet banking services.

Table A2.

Rating the internet banking services.

| Mean | Standard Deviation | |

|---|---|---|

| Transparency | 4.11 | 1.195 |

| Availability | 4.30 | 1.052 |

| Easy to use | 4.26 | 1.124 |

| User-friendly design | 4.19 | 1.134 |

| Transfer procedure | 4.40 | 1.138 |

| Extraction of queries | 3.97 | 1.433 |

| Queries of account history | 4.28 | 1.184 |

| Setting limits | 3.97 | 1.478 |

| Security | 4.35 | 1.179 |

Table A3.

Rating the functions of mobile banking applications.

Table A3.

Rating the functions of mobile banking applications.

| Mean | Standard Deviation | |

|---|---|---|

| Transparency | 3.87 | 1.714 |

| Availability | 3.99 | 1.681 |

| Easy to use | 4.01 | 1.667 |

| User-friendly design | 3.98 | 1.647 |

| Transfer procedure | 4.06 | 1.658 |

| Extraction of queries | 3.34 | 1.936 |

| Queries of account history | 3.74 | 1.788 |

| Setting limits | 3.54 | 1.868 |

| Security | 3.91 | 1.677 |

| Paying with phone | 3.68 | 1.933 |

| Notifications | 3.77 | 1.711 |

Table A4.

Rating the functions of online customer service.

Table A4.

Rating the functions of online customer service.

| Mean | Standard Deviation | |

|---|---|---|

| Helpfulness of advisors | 2.78 | 2.169 |

| Waiting time | 2.22 | 1.869 |

| Complaints handling | 2.31 | 2.101 |

| Expertise | 2.75 | 2.110 |

| Technology | 2.70 | 2.088 |

| Up-to-date | 2.85 | 2.147 |

| Identification (security) | 2.92 | 2.238 |

| Wide range of services | 2.79 | 2.174 |

Table A5.

The effect of COVID-19 on the use of services.

Table A5.

The effect of COVID-19 on the use of services.

| before COVID-19 | during COVID-19 | |

|---|---|---|

| Mobile banking application | 56.3% | 68.9% |

| Internet banking | 38.4% | 29.8% |

| Personal administration | 4.6% | 1.3% |

| Telebank administration | 0.7% | 0% |

References

- Grover, S.; Sahoo, S.; Mehra, A.; Avasthi, A.; Tripathi, A.; Subramanyan, A.; Pattojoshi, A.; Rao, G.P.; Saha, G.; Mishra, K.K.; et al. Psychological impact of COVID-19 lockdown: An online survey from India. Indian J. Psychiatry 2020, 62, 354. [Google Scholar] [CrossRef] [PubMed]

- Dhar, B.K.; Ayittey, F.K.; Sarkar, S.M. Impact of COVID-19 on psychology among the university students. Glob. Chall. 2020, 4, 2000038. [Google Scholar] [CrossRef] [PubMed]

- Arden, M.A.; Chilcot, J. Health Psychology and the coronavirus (COVID-19) global pandemic: A call for research. Br. J. Health Psychol. 2020, 25, 231–232. [Google Scholar] [CrossRef] [PubMed]

- Adedoyin, O.B.; Soykan, E. COVID-19 pandemic and online learning: The challenges and opportunities. Interact. Learn. Environ. 2020, 1–13. [Google Scholar] [CrossRef]

- Zhou, J.; Zhang, Q. A Survey Study on U.S. College Students’ Learning Experience in COVID-19. Educ. Sci. 2021, 11, 248. [Google Scholar] [CrossRef]

- Guzsvinecz, T.; Szűcs, J. Using Analytics to Identify When Course Materials Are Accessed Relative to Online Exams during Digital Education. Educ. Sci. 2021, 11, 576. [Google Scholar] [CrossRef]

- Donthu, N.; Gustafsson, A. Effects of COVID-19 on business and research. J. Bus. Res. 2020, 117, 284–289. [Google Scholar] [CrossRef]

- Korbel, J.O.; Stegle, O. Effects of the COVID-19 pandemic on life scientists. Genome Biol. 2020, 21, 113. [Google Scholar] [CrossRef]

- Budd, J.; Miller, B.S.; Manning, E.M.; Lampos, V.; Zhuang, M.; Edelstein, M.; Rees, G.; Emery, V.C.; Stevens, M.M.; Keegan, N.; et al. Digital technologies in the public-health response to COVID-19. Nat. Med. 2020, 26, 1183–1192. [Google Scholar] [CrossRef]

- Eroğlu, H. Effects of COVID-19 outbreak on environment and Renewable Energy Sector. Environ. Dev. Sustain. 2020, 23, 4782–4790. [Google Scholar] [CrossRef]

- Aruga, K.; Islam, M.M.; Jannat, A. Effects of COVID-19 on Indian Energy Consumption. Sustainability 2020, 12, 5616. [Google Scholar] [CrossRef]

- Eger, L.; Komárková, L.; Egerová, D.; Mičík, M. The effect of COVID-19 on consumer shopping behaviour: Generational cohort perspective. J. Retail. Consum. Serv. 2021, 61, 102542. [Google Scholar] [CrossRef]

- Safara, F. A Computational Model to Predict Consumer Behaviour During COVID-19 Pandemic. Comput. Econ. 2020, 59, 1525–1538. [Google Scholar] [CrossRef] [PubMed]

- El Keshky, M.E.; Basyouni, S.S.; Al Sabban, A.M. Getting through COVID-19: The pandemic’s impact on the psychology of sustainability, quality of life, and the global economy—A systematic review. Front. Psychol. 2020, 11, 3188. [Google Scholar] [CrossRef]

- Deb, P.; Furceri, D.; Ostry, J.D.; Tawk, N. The economic effects of COVID-19 containment measures. Open Econ. Rev. 2021, 33, 1–32. [Google Scholar] [CrossRef]

- Berger, A.N.; Demirgüç-Kunt, A. Banking research in the time of COVID-19. J. Financ. Stab. 2021, 57, 100939. [Google Scholar] [CrossRef]

- Magyar Nemzeti Bank. Fintech és a Digitalizációs Jelentés. Available online: https://www.mnb.hu/letoltes/fintech-e-s-digitaliza-cio-s-jelente-s-2021.pdf (accessed on 1 February 2022).

- Kovács, S.Z. Digitalizálhatók-e az alapvető pénzügyek a járványhelyzet hatására? Absztrakt/KRTK 2020, 3, 1–6. [Google Scholar]

- Denton, L.; Chan, K.A. Bank selection criteria of multiple bank users in Hong Kong. Int. J. Bank Mark. 1991, 9, 23–34. [Google Scholar] [CrossRef]

- Gerrard, P.; Cunningham, B. Bank service quality: A comparison between a publicly quoted bank and a government bank in Singapore. J. Financ. Serv. Mark. 2001, 6, 50–66. [Google Scholar] [CrossRef]

- Méró, K.; Piroska, D. Banking Union and banking nationalism—Explaining opt-out choices of Hungary, Poland and the Czech Republic. Policy Soc. 2016, 35, 215–226. [Google Scholar] [CrossRef]

- Várhegyi, É. The Selection of Bank Managers in Hungary in the 80s and 90s; Hungarian Sociological Association; 1996; pp. 1–14. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwi2k_zawob4AhWKgVYBHZhhBu8QFnoECAYQAQ&url=https%3A%2F%2Fszociologia.hu%2Fdynamic%2FRevSoc_1996_d_VarhegyiE_The_selection_of_bank.pdf&usg=AOvVaw0IXPHJDCliyNA-bcbfP_SC (accessed on 20 February 2022).

- Majnoni, G.; Shankar, R. The Dynamics of Foreign Bank Ownership: Evidence from Hungary; World Bank Publications: Washington, DC, USA, 2003; Volume 3114. [Google Scholar]

- El-Meouch, N.M.; Tésits, R.; Alpek, B.L. Measuring Spatial Distribution in the Banking System in Hungary. Mod. Geográfia 2022, 17, 25–45. [Google Scholar] [CrossRef]

- Daniela, Z.; Mihail-Ioan, C.; Sorina, P. Inflation uncertainty and inflation in the case of Romania, Czech Republic, Hungary, Poland and Turkey. Procedia Econ. Financ. 2014, 15, 1225–1234. [Google Scholar] [CrossRef]

- Bartlett, D.L. Banking and Financial Reform in a Mixed Economy: The Case of Hungary. In Capitalist Goals, Socialist Past; Routledge: New York, NY, USA, 2019; pp. 169–192. [Google Scholar]

- Boyd, W.L.; Leonard, M.; White, C. Customer preferences for financial services: An analysis. Int. J. Bank Mark. 1994, 12, 9–15. [Google Scholar] [CrossRef]

- Kaynak, E.; Kucukemiroglu, O. Bank and product selection: Hong Kong. Int. J. Bank Mark. 1992, 10, 3–16. [Google Scholar] [CrossRef]

- Laroche, M.; Rosenblatt, J.A.; Manaing, T. Services used and factors considered important in selecting a bank: An investigation across diverse demographic segments. Int. J. Bank Mark. 1986, 4, 35–55. [Google Scholar] [CrossRef]

- Al-Hadrami, A.H.; Hidayat, S.E.; Al-Sharbti, M.I. The important selection criteria in choosing Islamic banks: A survey in Bahrain. Al-Iqtishad J. Ilmu Ekon. Syariah 2017, 9, 165–184. [Google Scholar] [CrossRef]

- Farooq, S.U.; Ahmad, G.; Jamil, S.H. A profile analysis of the customers of Islamic banking in Peshawar, Pukhtunkhwa. Int. J. Bus. Manag. 2010, 5, 106–117. [Google Scholar] [CrossRef]

- Bhatti, G.A.; Hussain, H.; Akbar, Z.A. Determinants of customer satisfaction and bank selection in Pakistan. Interdiscip. J. Contemp. Res. Bus. 2010, 2, 536–554. [Google Scholar]

- Heijes, C. Culture, convenience or efficiency: Customer behaviour in choosing local or foreign banks in China. Chin. Manag. Stud. 2008, 2, 183–202. [Google Scholar] [CrossRef]

- Tu, Y.H.; Hung, K.M. Evaluating the consumer cosmopolitanism: Taiwanese consumer behavior in choosing local or foreign banks. In Proceedings of the PICMET’09-2009 Portland International Conference on Management of Engineering & Technology, Portland, OR, USA, 2–6 August 2009; pp. 2298–2303. [Google Scholar] [CrossRef]

- Mohd Suki, N. Criteria for choosing banking services: Gender differences in the university students’ perspective. Int. J. Soc. Econ. 2018, 45, 300–315. [Google Scholar] [CrossRef]

- Safakli, O.V. A research on the basic motivational factors in consumer bank selection: Evidence from Northern Cyprus. Banks Bank Syst. 2007, 2, 93–100. [Google Scholar]

- Katircioglu, S.T.; Tumer, M.; Klnccedil, C. Bank selection criteria in the banking industry: An empirical investigation from customers in Romanian cities. Afr. J. Bus. Manag. 2011, 5, 5551–5558. [Google Scholar]

- Kennington, C.; Hill, J.; Rakowska, A. Consumer selection criteria for banks in Poland. Int. J. Bank Mark. 1996, 14, 12–21. [Google Scholar] [CrossRef]

- Lee, J.; Marlowe, J. How consumers choose a financial institution: Decision-making criteria and heuristics. Int. J. Bank Mark. 2003, 21, 53–71. [Google Scholar] [CrossRef]

- Katircioglu, S.; Fethi, S.; Unlucan, D.; Dalci, I. Bank Selection Factors in the Banking Industry: An Empirical Investigation from Potential Customers in Northern Cyprus. Acta Oeconom. 2011, 61, 77–89. [Google Scholar] [CrossRef]

- Rao, S.; Sharma, D.R. Bank selection criteria employed by MBA students in Delhi: An empirical analysis. J. Bus. Stud. Q. 2010, 1, 56–69. [Google Scholar] [CrossRef][Green Version]

- Ta, H.P.; Har, K.Y. A study of bank selection decisions in Singapore using the Analytical Hierarchy Process. Int. J. Bank Mark. 2000, 18, 170–180. [Google Scholar]

- Almossawi, M. Bank selection criteria employed by college students in Bahrain: An empirical analysis. Int. J. Bank Mark. 2001, 19, 115–125. [Google Scholar] [CrossRef]

- Thwaites, D.; Vere, L. Bank selection criteria—A student perspective. J. Mark. Manag. 1995, 11, 133–149. [Google Scholar] [CrossRef]

- Sihotang, M.K.; Hasanah, H. Islamic banking strategy in facing the new normal era during the COVID 19. Proc. Int. Semin. Islamic Stud. 2021, 2, 479–485. [Google Scholar]

- Bholat, D.; Gharbawi, M.; Thew, O. The Impact of COVID on Machine Learning and Data Science in UK Banking. Bank Engl. Q. Bull. 2020, Q4. Available online: https://ssrn.com/abstract=3945570 (accessed on 11 March 2022).

- Malali, A.B.; Gopalakrishnan, S. Application of Artificial Intelligence and Its Powered Technologies in the Indian Banking and Financial Industry: An Overview. IOSR J. Humanit. Soc. Sci. (IOSR-JHSS) 2020, 25, 55–60. Available online: https://www.iosrjournals.org/iosr-jhss/pages/25(4)Series-6.html (accessed on 11 March 2022).

- Boustani, N.M. Artificial Intelligence Impact on banks clients and employees in an Asian developing country. J. Asia Bus. Stud. 2021, 16, 267–278. [Google Scholar] [CrossRef]

- Bagana, B.D.; Irsad, M.; Santoso, I.H. Artificial Intelligence as a human substitution? customer’s perception of the conversational user interface in banking industry based on Utaut Concept. Rev. Manag. Entrep. 2021, 5, 33–44. [Google Scholar] [CrossRef]

- Mathew, S.M.; Sunil, S.; Saleem, S. A Study on the Impact of COVID-19 Pandemic in the Adoption of Tech-Driven Banking in India (1 February 2022). Available online: https://ssrn.com/abstract=4022859 (accessed on 20 March 2022). [CrossRef]

- Jindal, M.; Sharma, V.L. Usability of online banking in India during COVID-19 pandemic. Int. J. Eng. Manag. Res. 2020, 10, 69–72. [Google Scholar] [CrossRef]

- Nair, A.B.; Prabhu, K.S.; Aditya, B.R.; Durgalashmi, C.V.; Prabhu, A.S. Study on the usage of mobile banking application during COVID-19 pandemic. Webology 2021, 18, 190–207. [Google Scholar] [CrossRef]

- Wu, D.D.; Olson, D.L. The effect of COVID-19 on the banking sector. In Pandemic Risk Management in Operations and Finance. Computational Risk Management; Springer: Cham, Switzerland, 2020; pp. 89–99. [Google Scholar] [CrossRef]

- Hameed, J. Influence of online banking on consumers and its perception and acceptance during COVID-19. KIET J. Comput. Inf. Sci. 2021, 4, 14. [Google Scholar] [CrossRef]

- Baicu, C.G.; Gârdan, I.P.; Gârdan, D.A.; Epuran, G. The impact of covid-19 on consumer behavior in retail banking. evidence from Romania. Manag. Mark. Chall. Knowl. Soc. 2020, 15, 534–556. [Google Scholar] [CrossRef]

- Anysiadou, M.; Hondroyiannis, G.; Saiti, A. Dimensions of Mobile-banking in Greece During COVID-19. Economics 2021, 10, 8–20. [Google Scholar] [CrossRef]

- Karmakar, A. Generation-Z Banking Trends—A Study Based on Kolkata. IBMRD’s J. Manag. Res. 2021, 10. Available online: http://ibmrdjournal.in/index.php/ibmrd/article/view/166805 (accessed on 24 March 2022). [CrossRef]

- Ahmed, M.; Rony, J.; Khan, S.S.; Saha, A.; Sinha, A.; Ahmed, N. Towards Exploration of the Factors Affecting Mobile Banking of Bangladeshi Women during COVID (28 February 2021). HCIXB Symposium 2021, CHI. Available online: https://ssrn.com/abstract=4029970 (accessed on 24 March 2022).

- Mew, J.; Millan, E. Mobile wallets: Key drivers and deterrents of consumers’ intention to adopt. Int. Rev. Retail Distrib. Consum. Res. 2021, 31, 182–210. [Google Scholar] [CrossRef]

- Thusi, P.; Maduku, D.K. South African millennials’ acceptance and use of Retail Mobile Banking Apps: An integrated perspective. Comput. Hum. Behav. 2020, 111, 106405. [Google Scholar] [CrossRef]

- Wiese, M.; Humbani, M. Exploring technology readiness for mobile payment app users. Int. Rev. Retail Distrib. Consum. Res. 2019, 30, 123–142. [Google Scholar] [CrossRef]

- Papadopoulou, Z.; Valsamidis, S.; Petasakis, I.; Mandilas, A. Online vs offline banking. In Contributions to Economics; Springer: Cham, Switzerland, 2021; pp. 219–235. [Google Scholar] [CrossRef]

- Kameswaran, V.; Hulikal Muralidhar, S. Cash, digital payments and accessibility. Proc. ACM Hum.-Comput. Interact. 2019, 3, 1–23. [Google Scholar] [CrossRef]

- Mathew Martin, P.J.; Rabindranath, M. Digital Inclusion for access to information: A study on banking and financial institutions in India. SAGE Open 2017, 7, 215824401772047. [Google Scholar] [CrossRef]

- Filotto, U.; Caratelli, M.; Fornezza, F. Shaping the digital transformation of the retail banking industry. empirical evidence from Italy. Eur. Manag. J. 2021, 39, 366–375. [Google Scholar] [CrossRef]

- Sudarsono, H.; Nugrohowati, R.N.I.; Tumewang, Y.K. The Effect of COVID-19 Pandemic on the Adoption of Internet Banking in Indonesia: Islamic Bank and Conventional Bank. J. Asian Financ. Econ. Bus. 2020, 7, 789–800. Available online: https://www.koreascience.or.kr/article/JAKO202032462597136.page (accessed on 20 March 2022). [CrossRef]

- Tonuchi, J.E. How to Improve Mobile Money Service Usage and Adoption by Nigerians in the Era of COVID-19. Int. J. Financ. Insur. Risk Manag. 2020, 10, 31–52. Available online: https://ssrn.com/abstract=3685255 (accessed on 24 March 2022).

- Mersha, D.; Worku, A. Effect of COVID-19 on the Banking Sector in Ethiopia. Horn Afr. J. Bus. Econ. (HAJBE) 2020, 28–38. Available online: https://ejhs.ju.edu.et/index.php/jbeco/article/download/2131/1206 (accessed on 24 March 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).