Abstract

Using the continuous difference-in-difference (DID) model, this paper analyzes the Chinese listed companies’ panel data from 2013 to 2019 by taking the rapid monetary policy easing in mid-2015 as the policy shocks to test the impact of loose monetary policy on enterprise R&D investment. The results show that loose monetary policy significantly weakened the negative impact of high leverage on enterprise R&D investment. After considering the heterogeneity and fixed effects of enterprise and industry characteristics, loose monetary policy still significantly improved highly leveraged enterprises’ R&D investment and showed a greater innovation-driving role in a competitive market environment. Based on this, this paper believes that The People’s Bank of China should continue to guide the decrease of medium- and long-term interest rates and promote benign competition among enterprises to improve the effectiveness of the monetary policy.

1. Introduction and Literature Review

There is growing evidence that both external shocks, such as the financial crisis, and ordinary recession are accompanied by permanent output losses [1]. One of the reasons for the permanent output loss may be that recessions have weakened the ability of enterprises to invest in R&D, patents, and technology, and interfere with the technology accumulation of enterprises. Existing studies show that innovation activities are closely related to the improvement of enterprises’ sustainable competitiveness, job creation, and economic growth [2]. Unlike tangible investment, intangible investment projects, such as R&D investment, cannot generally be pledged against collateral or liquidated quickly. Moreover, the uncertainty about the investment outcome of intangible assets, and the confidentiality of product and technology innovation aggravate the issues of asymmetric information and moral hazard [3]. Therefore, such investment is highly sensitive to financial indicators, such as enterprise debt burden and cash flow status, and is more vulnerable to the continuous supply of external or internal capital sources. The theoretical studies of Holmstrom and Tirole and Aghion et al. show that enterprises facing credit constraints will cut more intangible assets investments, such as R&D projects, during recessions [4,5]. In turn, more volatile R&D investment will reduce the expected return of investment. Therefore, counter-cyclical macroeconomic policies, including monetary policy, have alleviated the investment pressure of enterprises in intangible assets and weakened the negative impact of the financial crisis on the level of economic output. Therefore, this paper puts forward the following assumptions:

Hypothesis 1.

During recessions, a high asset-liability ratio will significantly inhibit enterprise R&D investment.

Hypothesis 2.

During recessions, counter-cyclical monetary policy (loose monetary policy) helps to weaken the negative impact of a high asset-liability ratio on enterprise R&D investment.

However, these studies also point out that in a recession, fierce competition in product markets may squeeze corporate profit margins, increase the vulnerability of corporate balance sheets, and have a ‘crowding-out effect’ on enterprise innovation investment [6,7]. This is a classic Schumpeterian view of innovation: competition is bad for innovation, and only monopolies have the incentive and ability to undertake innovative research and development. However, recent innovation theories have put forward different views. Innovation theory points out that the motivation of enterprise innovation is to obtain a monopoly position and charge monopoly rent under technological advantages. Therefore, competition can stimulate the innovation motivation of firms and form an ‘escape-competition-effect’. In addition, competition in the product market can stimulate innovation in a variety of ways, such as reducing agency costs or increasing market share [8,9]. In either view, however, product market competition helps counter-cyclical monetary policy work in recessions. In Schumpeter’s view, counter-cyclical monetary policy helps reduce corporate debt burdens and ‘crowding-out effects’ [10]. From a modern innovation perspective, counter-cyclical monetary policy can help reduce the external financing cost of enterprises and strengthen the ‘escape-competition-effect’. Therefore, this paper puts forward the following assumptions:

Hypothesis 3.

During recessions, product market competition has a positive regulatory effect on the effect of monetary policy.

Based on the above theoretical analysis, this paper attempts to test the above hypothesis with a continuous double difference model. This paper is divided into six parts. The second section briefly introduces the economic and policy background. The third section introduces the enterprise data and empirical strategies used in this paper in detail and the impact of loose monetary policy on Enterprise R&D investment, and the regulatory effect of product market competition on the policy effect, and further discusses the robustness and heterogeneity of the results. The fifth section discusses the conclusions and work of this paper. Section VI proposes policy suggestions.

The research content of this paper is related to the long-term growth effect of the economic cycle and counter-cyclical monetary policy. In some macroeconomic theories, as a tool of aggregate policy, it is difficult for monetary policy to produce long-term effects, and can only be used as a means of regulating short-term supply and demand. Ramey and Ramey studied the relationship between economic fluctuation and growth and pointed out that there is a link between monetary policy, the economic cycle, and long-term economic growth [11]. Ahn, Duval, and Sever took intangible investment as a possible channel for this connection. They believed that in the case of a credit crunch, the survival pressure brought by the economic downturn cycle would force the company to reduce investment projects with long investment cycles but high expected returns (such as innovation investment) [7]. Using the panel data of multinational industries, Aghion et al. verified the role of countercyclical fiscal and monetary policy in reducing credit constraints and limiting output growth potential, and the interaction between countercyclical monetary policy and product market competition [12,13]. However, at present, the research in this field mainly focuses on output growth, and the demonstration of the effect of monetary policy; that is, the policy on enterprise innovation investment is lacking. This paper focuses on the impact of monetary policy on enterprise innovation R&D investment, which provides more direct evidence for the study of the long-term effect of monetary policy.

The empirical research conducted in this paper is related to research on the impact of monetary policy shocks on corporate behavior. Although research on the impact of monetary policy on the economy has a long history, research on the micro impact of monetary policy has only begun to rise recently. Relevant studies have mainly focused on the impact of monetary policy on the investment and financing decisions of different enterprises [14,15]. For example, Gertler and Gilchrist, and Grosse-Rueschkamp, Steffen, and Streitz proposed that the differences in the property rights, capital structure, scale, and industry characteristics of enterprises are important factors leading to the differences in the effects of monetary policy [16,17]. Shen and Yin studied the heterogeneous impact of capital supply shocks on the investment and financing decisions of Chinese real estate enterprises from the perspective of the nature of property rights [18]. Although the existing literature has conducted an extensive exploration of the enterprise characteristics that affect the effectiveness of monetary policy, no literature has studied the impact of enterprise competitive pressure on the micro effect of monetary policy from the perspective of competition. The research content of this paper fills the gap from this research perspective.

2. Policy Background

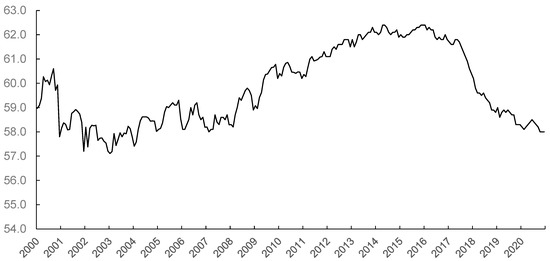

2.1. China’s Economic Downturn Cycle and Debt Risk

The 2008 financial crisis had a profound impact on the global economy. China’s four trillion-yuan stimulus plan, while maintaining growth, led to a rapid rise in macro leverage and continued accumulation of debt risks. From 2008 to 2015, China’s macro leverage ratio increased by 86.2 percentage points at an average annual rate of more than 12 percentage points. Moreover, the non-financial enterprise sector contributed 56 percentage points, which is the absolute main force that promotes a rise in the macro leverage ratio [19]. Figure 1 shows the asset-liability ratio of 5000 industrial enterprises surveyed by the Central Bank. The data is the survey data on the financial situation of more than 5000 industrial enterprises conducted by the Survey and Statistics Department of the People’s Bank of China. In the survey, the proportion of large enterprises, medium-sized enterprises, and small enterprises is usually about 30%, 45%, and 25%. The number of state-owned enterprises and non-state-owned enterprises is about 2:8. The asset-liability ratio of the surveyed enterprises increased rapidly from 58.2% in 2008 to 62.4% in 2016, with a cumulative increase of 4.2 percentage points.

Figure 1.

Asset liability ratio of 5000 industrial enterprises from 2000–2020 (%). Note: The data originated from the survey data of the Central Bank of China, Collated by The Wind Database.

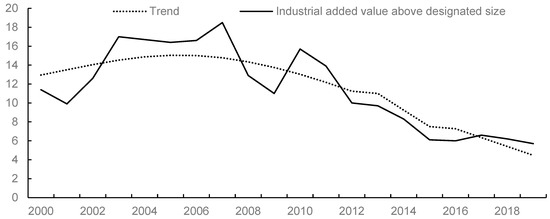

With the emergence of debt risk, the growth rate of China’s economy fell after a period of rapid growth. Figure 2 shows the annual year-on-year growth rate and potential growth trend of China’s industrial enterprises above the designated size from 2000 to 2019. According to the general processing method of total factor productivity, this paper takes the HP filter with parameter 25 to obtain the output gap and potential trend. Under the impact of the world financial crisis in 2008, China’s economy temporarily fell into a downward cycle, with rapid growth after the 4 trillion plan, and then continued to be lower than the potential trend from 2012 to 2016. It can be considered that during this period, the economy was in a downward cycle of a downward trend, and there was significant pressure on enterprises. It should be noted that some studies believe that the data quality of industrial enterprises above the designated size is higher and better reflects the actual output trend. Therefore, this paper selects the added value of industrial enterprises above the designated size instead of GDP. However, the overall trend of GNP is consistent with that of industrial enterprises above the designated size, which does not affect the conclusions and explanations of this paper. As argued earlier, the debt crisis coincided with the recession, resulting in a permanent loss of output. In general, in the time interval selected in this paper (2013–2019), China was in a stage of economic deceleration (recession), which is similar to the economic recession after the financial crisis selected in the relevant literature. Therefore, this paper studies the influence of the counter-cyclical monetary policy of the People’s Bank of China on the R&D investment of enterprises along with the ideas of the relevant literature.

Figure 2.

Real output growth of industrial enterprises above designated size (%).

2.2. Counter-Cyclical Monetary Policy and Enterprise Behavior

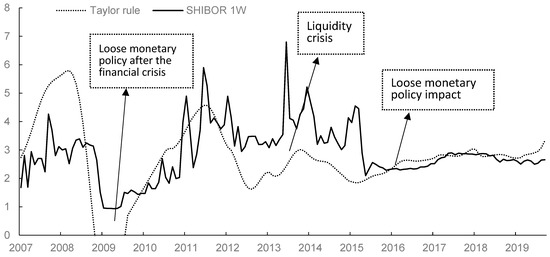

This paper focuses on the monetary policy implementation of the People’s Bank of China in the context of economic recession. Considering that after 2013, China’s monetary policy tools have been gradually enriched, the policy means have gradually changed from quantitative to price, and some common indicators have lost reference value, such as M2, the deposit reserve ratio, and the benchmark interest rate, which cannot fully reflect the actual implementation of monetary policy. This paper takes the monetary policy implementation report of the Central Bank and the one week interbank offered rate (Shibor 1W) as the measurement of monetary policy.

Economic growth and reducing leverage are two contradictory goals. At the practical implementation level, monetary authorities have also experienced the transformation from the tight policy of reducing leverage and controlling liquidity to the neutral policy of stabilizing the economy and controlling leverage, showing a trend of marginal relaxation before and after the policy. According to the monetary policy implementation report [20] issued by the Central Bank, from 2013 to 2019, the Central Bank used decreased medium- and long-term interest rates, reasonable and abundant liquidity, and stable corporate leverage as the policy directions. For example, in 2013 and 2014, when the macro leverage and market liquidity level rose rapidly, the Central Bank chose more frequent open market reverse repo to guide the interest rate upward. To address the problem of tight market liquidity, the Central Bank cut the required reserve ratio several times in 2015 and 2016, and used a combination of quantitative and price-based monetary policy tools to guide market interest rates down, appropriately replenish market liquidity, and reduce social financing costs. From 2017 to 2019, when the economic situation and macro leverage tended to be stable, the Central Bank’s policies focused on slightly adjusting market interest rates and liquidity, and continued to optimize the economic structure in coordination with other countries’ policies.

Comparison between the real interest rate and the neutral monetary policy target rate under Taylor’s rule verifies the policy implementation of the Central Bank. Referring to the practice of Chen and Chen, this paper takes the 7-day interbank offered rate as the approximation of the real interest rate [21]. The Shanghai interbank offered rate (Shibor) is an interbank lending market established by the People’s Bank of China following LIBOR (London Interbank Offered Rate). It was officially launched on 4 January 2007, and is generally regarded as the risk-free interest rate in China’s financial markets. Assuming that the inflation target of the Central Bank is 3% and the target interest rate is 3%, the output gap is estimated by the HP filtering method, and the target interest rate under Taylor’s neutral monetary policy rule can be obtained. Figure 3 shows the neutral interest rate under Taylor’s rule and the policy interest rate represented by shibor-1W. As shown in Figure 3, from 2012 to 2015, monetary policy was generally tight, but this situation improved in the second half of 2015. The policy was marginally loose in the short term and interest rates remained near neutral for most of 2016 to 2019. Among them, the most remarkable liquidity crisis occurred in mid-2013. In June 2013, the Shanghai interbank offered rate (Shibor) entered the first significant upward phase from 4th to 8th and the second upward phase from 19th to 24th. At the peak of the market fluctuation on June 20, the overnight, 7-day and 14-day weighted interest rates of pledged repo were 11.74%, 11.62%, and 9.26%, respectively, and the overnight interest rate of pledged repo once reached 30%. Subsequently, the Central Bank provided liquidity to several banks. After June 25, the interest rate gradually dropped, and the market gradually stabilized. Since then, market interest rates have gradually declined, and the monetary policy shift from tight to loose was finally completed in the second half of 2015.

Figure 3.

The neutral target rate (under Taylor’s rule) versus the real rate (%).

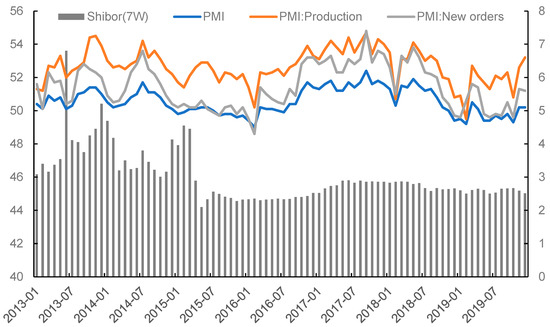

From 2013 to 2015, policy interest rates were relatively high and volatile, and the PMI trend was in the opposite direction of interest rate fluctuations, reflecting the impact of policy changes on enterprise expectations and behavior (Figure 4). However, this relationship is difficult to observe when policy interest rates were low and stable after 2015. Therefore, we tend to observe the impact of a switch in policy style on firm behavior over a broader time horizon, i.e., 2013–2015 vs. 2016–2019. Loose monetary policy has improved business expectations to some degree. In economic indicators, the manufacturing purchasing managers index slightly increased after the policy impact. The PMI’s new orders index, which represents business expectations, rose to 51.7 from 51.2. We also use the data collected from listed companies to preliminarily analyze the corporate behavior before and after the policy impact. Data sources and descriptive statistics are detailed in Section 3.2. The data (in Table 1) show that enterprises faced operating pressure in the economic downturn cycle, and the return on capital and financial health index declined significantly. We focus on companies’ return on capital, financial position, and financing constraints. Specifically, ROA (return on capital) and financial position (Z-score) have a relatively obvious decline while Z-score is a commonly used index to measure the financial status and bankruptcy risk of enterprises in the field of corporate finance research. However, corporate financing conditions improved slightly, with the FC index, a measure of financing constraints, falling slightly.

Figure 4.

China manufacturing PMI vs. policy interest rate (Shibor-1W).

Table 1.

Macroeconomy and enterprise behavior: 2013–2015 vs. 2016–2019.

3. Data and Empirical Strategy

3.1. Econometric Strategy

Currently, there is an increasing focus on the micro effects of macro policies, which leads to a related approach to the evaluation of policy effects. Policy evaluation is concerned with the treatment effect of the policy. Since policies often work on a specific class of individuals, the basic idea of policy evaluation is to compare this class of people with other individuals. DID models (difference-in-differences) are commonly used for policy evaluation, but in some special cases, such as macroeconomy, policies often work on all objects. However, the extent to which policies affect different individuals varies, so we can study the heterogeneous effects of policies without identifying their net effect. In Aghion, Farhi, and Kharroubi’s study, they used the announcement of the Outright Monetary Transactions program (OMT) by the European Central Bank as an opportunity to compare firm performance across time [13]. They included cross terms for debt and OMT in their model and identified the channels through which monetary policy improves firm performance by weakening the negative impact of corporate debt. Ioannidou, Ongena, and Peydró, on the other hand, directly investigated the effect of a lower policy rate on banks’ high-risk lending behavior using continuous DID [22]. While most studies are still focusing on the correlation and impact mechanism between the interest rate and firm performance, in our study, monetary policy is largely smooth and the monetary environment for firms was relatively stable from 2016–2019, which is not conducive for application of the usual econometric models. However, the large changes in the policy interest rates around 2015 provide a convenient experimental scenario for policy assessment using the DID model. The presence of the distinguishing feature that the policy interest rate was essentially flat from 2016–2019 allows us to circumvent the interference of frequent policy changes in policy assessment and use the DID approach to observe the impact of counter-cyclical monetary policy on corporate activity through the balance sheet channel.

Considering that enterprises are divided into two groups according to the leverage ratio or other financial vulnerability indicators, and it is impossible to build a real experimental group and control group, this paper uses the continuous difference-in-difference method (DID) for empirical analysis. Specifically, referring to Qian, and Aghion, Farhi, and Kharroubi [6,13,23], the following continuous difference-in-difference (DID) model is constructed:

In Equation (1), represents the R&D investment activities of enterprise f in year t, which is measured in three indicators: R&D investment density, R&D investment amount, and whether there is R&D investment, in the benchmark regression test. Specifically, R&D investment density (RDd) refers to the proportion of enterprise R&D investment in operating revenue. The amount of R&D investment (LNRD) is treated as a natural logarithm. Whether to carry out R&D investment is a virtual variable (RDdum): if yes, ; otherwise, the value is equal to 0. represents the leverage ratio of enterprise f in year t, measured by the enterprise asset-liability ratio, and replaces the dummy variables of the experimental group and the control group in the continuous difference-in-difference (DID) model. It can be seen from the model that the core coefficient of this paper is . It is the key result after the double difference and represents the net effect of counter-cyclical monetary policy on enterprise R&D investment in recession.

Enterprise R&D investment is also influenced by other firm characteristics, industry characteristics, and industry-specific shocks. Moreover, enterprise leverage may also be related to other factors affecting R&D investment. For example, older businesses may be more favored by banks, which also have more mature research and development experience and capabilities; low-debt enterprises include science and innovation enterprises with light assets while high-debt enterprises are usually dominated by traditional production enterprises with heavy assets; or a demand shock that happens to hit the industry in which the enterprise belongs to. Controlling these factors can help clarify the policy effect of counter-cyclical monetary policy on enterprise innovation investment. Therefore, according to the research of Dai, Yu, and Zhao, and Aghion, Farhi, and Kharroubi [13,24], this paper adds a series of enterprise-level and industry-level control variables to Equation (1), and the control variables at the enterprise level include enterprise age (calculated according to the establishment time of the enterprise), enterprise scale (logarithm of the total assets of the enterprise), total factor productivity (calculated according to the op method), and the control variables at the industry level include the natural logarithm of the total sales of the industry and the natural logarithm of the total fixed assets of the industry. and represents the control variables at the enterprise and industry levels, respectively, and is a random error term. See Table 2 for specific meanings.

Table 2.

Variables and data source.

3.2. Variable and Data

The enterprise samples used in this paper are from Chinese A-share listed companies in the CSMAR database, which is the largest accurate database of economic, financial, and securities information in China, from 2013 to 2019. The dataset covers 16 industries and includes variables from corporate balance sheets, cash flow statements, and income statements, including company code, property right nature, establishment time, total assets, operating income, and enterprise R&D expenditure in the innovation statement of listed companies. Relevant data on monetary policy come from the official website of the people’s Bank of China and public data from the National Bureau of Statistics, including the industrial added value, Shibor (1W) interest rate, and the policy summary document published by the Central Bank.

To clean the data, we follow Feenstra, Li, and Yu [25] and drop an observation if one of the following criteria is met: (1) Missing or negative values are reported for any of the following variables: property right nature, total assets, fixed assets, owner’s equity, total liabilities, and total sales; (2) ST (special treatment) stocks, that is, abnormal financial or other conditions of the enterprise; and (3) financial enterprises. The final sample for subsequent analysis consists of 1793 enterprises belonging to 16 industries, and 12,551 observations. To avoid the influence of outliers on the empirical results, Winsor tail reduction processing is carried out for some data at 1% and 99%. The descriptive analysis results are reported in Table 3.

Table 3.

Descriptive statistical results.

4. Empirical Results

4.1. Preliminary Analysis

Table 4 reports the benchmark estimation results. The columns in Table 4 gradually add control variables from left to right and report the basic regression results in detail. Column (1) to (3) is the basic result without the addition of the control variables, time fixed effect, and individual fixed effect. The estimated coefficient of Lr × Post15 is positive at the significance level of 1%, indicating that loose monetary policy weakens the negative impact of high leverage on enterprise R&D investment. To reduce the interference caused by endogeneity, column (4) to (6) takes into account the control variables designed in this paper. After adding the enterprise-level and industry-level control variables in a 2-way fixed effect model, the estimated coefficient of Lr × Post15 is still positive at the significance level of 1%. This shows that the addition of control variables can more accurately estimate the impact of loose monetary policy on enterprise R&D investment, and the estimation results are robust.

Table 4.

Basic regression results.

Among all regression results in Table 4, regardless of the indicator used to measure innovation R&D investment, the coefficient of leverage ratio (Lr) is always negative and significant, indicating that in the economic downturn cycle selected in this paper, highly leveraged enterprises lost more in innovation investment. Regardless of the indicator used to measure innovation R&D investment, the regression coefficients of Lr × Post15 are positive and significant, which shows that the counter-cyclical monetary policy can improve the R&D investment of enterprises. The results in column (4) show that for every percentage point increase in the leverage ratio, the R&D investment density of enterprises will be reduced by 0.039 percentage points while the impact of loose monetary policy will weaken the reduction to 0.033 percentage points. Column (5) show that the impact of loose monetary policy weakened the reduction to −0.013. Column (6) shows that for every percentage point increase in the leverage ratio, the possibility of enterprises investing in R&D projects will be reduced by 0.2 percentage points while the impact of loose monetary policy will weaken the reduction to 0.1 percentage points.

4.2. Parallel Trend Test

The use of the difference-in-difference (DID) method requires the satisfaction of parallel trends, that is, a similar common trend between the experimental group and the control group before the policy impact. It is only when the parallel trend hypothesis is satisfied that the trend differentiation between the experimental group and the control group can be considered as the specific effect of the policy impact. If the parallel trend hypothesis is true, there should be no significant difference between the experimental group and the control group before the policy time point. Based on the practices of Dai [24], we run the following regression in a flexible specification:

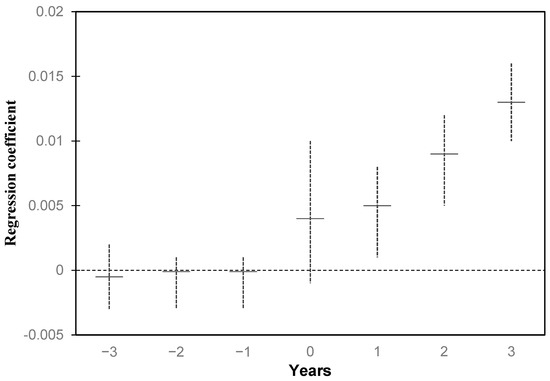

In Equation (2), is the R&D investment density of company f in t years, is the control variable, and is the error term. is a dummy variable before and after the loose monetary policy shock and political mobilization. k represents time. The year before the impact year is negative and the year after the impact year is positive. In this paper, the range is −3 to 3, representing each year before and after the impact year. To identify the difference between the experimental group and the control group (in this paper, this means companies with different leverage ratios) before the impact year, this paper focuses on . As shown in Figure 5, between −3 and −1, the estimated coefficient of is not significantly different from 0 on the 95% confidence interval, indicating that there is no significant difference between the experimental group and the control group before the loose monetary policy shock; that is, the parallel trend hypothesis is established.

Figure 5.

Parallel trend test. Note: the short dash in the figure indicates the estimated value of , indicated by the dotted line on the short dash 95% confidence interval.

4.3. The Moderating Effect of Product Market Competition on Policy Effect

In addition to the above control factors, this paper also focuses on the impact of product market competition on the effect of the policy. In a competitive market environment, does the monetary policy have a stronger weakening effect on leverage? To answer this question, we run the following regression:

In Equation (3), represents the competitive pressure of enterprise f in year t, which is measured by the Lerner Index. The calculation formula of the Lerner Index is (P − Mc)/P, where P is the product price and MC is the marginal cost of the product. The index measures the monopoly power of enterprises through the pricing ability of enterprises in the market. As a reverse measure of competition, the larger the value, the stronger the monopoly ability of the enterprise in the product market, and the smaller the value, the greater the competitive pressure of the enterprise in the product market. Because the marginal cost of an enterprise is difficult to observe directly, this paper uses [(operating revenue − operating cost − selling expenses − administrative expenses)/(operating revenue)] to calculate the approximate value. As a result of the existence of losses, the enterprise Lerner index may be negative.

The empirical analysis results are reported in Table 5. The results in column (1) show that the cross-term coefficients, including the Lerner Index (Lr × Li × Post15), are significantly negative. Because the Lerner Index is a reverse measure of competition, it can be judged that product market competition has a significant positive regulatory effect on the effect of monetary policy. For convenience, it is assumed that the Lerner Index has only two states: ‘competition’ (−0.2) and ‘monopoly’ (0.8). In Table 6, (a) for the R&D density of enterprises, competition improves the effect of monetary policy by 0.018, and the coefficient of leverage changed from −0.056 to −0.027. (b) For enterprise R&D investment, the coefficient of leverage changed from −0.035 to −0.017 in competitive enterprise but to −0.022 in monopoly. (c) For the R&D probability of enterprises, the coefficient of leverage changed from −0.004 to −0.002 in competitive enterprise but without a change in monopoly. These results indicate that competitive firms are more likely to increase R&D investment in the face of countercyclical monetary policy impact.

Table 5.

The moderating effect of product market competition.

Table 6.

The policy effect in different competitive environments.

4.4. Robustness Test

The policies that took effect contemporaneously with the counter-cyclical monetary policy shocks may reduce the credibility of the above conclusions. Here, we consider the potential impact of industrial policy. In 2013, the State Council of China issued the ‘Opinions on Strengthening the Main Position of Enterprise Innovation and Improving Enterprise Innovation Ability’ [26] and proposed the policy goal of increasing the average R&D investment of large- and medium-sized industrial enterprises in the proportion of main business income (R&D investment density) to 1.5% in 2015. This policy will have had a significant direct impact on the R&D investment of enterprises. To exclude the potential effect of industrial policies, this paper uses the data of financial innovation R&D subsidies obtained by listed companies in the CSMAR database, excludes enterprises whose total subsidies account for more than 50% of the total R&D investment, and verifies Equation (3) again. If the R&D investment of enterprises does not rely on financial subsidies, it shows that enterprises are not directly affected by industrial policies. In Table 7, column (1) to column (3) report the regression results after excluding enterprises directly affected by industrial policies, and the coefficients remain significant.

Table 7.

Results of the robustness test.

Similar to the natural experiment, the difference-in-difference (DID) model identifies the policy effect by constructing an experimental group and control group. Therefore, it is required that the difference in R&D investment between enterprises with different leverage ratios will not change systematically over time before the impact of monetary policy. To verify whether the premise hypothesis is tenable, this paper selects the data from 2013 to 2015, sets the policy impact in 2014 as the counterfactual test (placebo test), and verifies Equation (3) again. The results of the placebo test are reported in column (4) to column (6) in Table 7. The results show that under the fake policy impact, although the impact of the leverage ratio on enterprise R&D investment is still significantly negative, the policy dummy variables and cross-terms are no longer significant. This result suggests that the main conclusion of this paper is not the inherent differences among enterprises with different leverage ratios, but the impact effect of counter-cyclical monetary policy.

4.5. Heterogeneity Analysis

Intuitively, R&D is more critical for competitiveness in technology-intensive industries. As Table A1 shows, technology-intensive firms have an average R&D density of 3.9%, which is higher than the average R&D density of capital-intensive industries of 3.8% and the average R&D density of labor-intensive industries of 3.7%. Therefore, technology-intensive industries should be more likely to respond to counter-cyclical monetary policy, especially under greater competitive pressure. To test whether this is true in the data, this section groups and regresses the enterprises in the sample according to technology-intensive industries, capital-intensive industries, and labor-intensive industries. Specifically, according to the general definition, technology-intensive industries include the electronic computer industry, robot industry, aerospace industry, biotechnology industry, new material industry, etc. Capital-intensive industries include basic industries, such as transportation, steel, machinery, petrochemistry, and the heavy chemical industry. Labor-intensive industries include the textile industry, service industry, food industry, daily necessities, etc. The regression results of the placebo test are reported in columns (1) to (3) of Table 8. The results show that the coefficients of the main variables remain significant, the counter-cyclical monetary policy can have a positive impact on the R&D investment density of the three industries, and the regulatory effect of the competitive environment on the policy effect is still significant. Among the two industries with higher R&D levels, capital-intensive industries are more affected than technology-intensive industries, which may be because the R&D activities of capital-intensive industries rely more on capital investment while the innovation activities of technology-intensive industries are more stable. State-owned enterprises play an important role in the economy, so the impact of property rights on the enterprise production efficiency has been a significant concern of researchers. It is generally believed that the agency problem, centralized economy, budget constraints, and bearing policy burden have led to the loss in innovation efficiency of state-owned enterprises, and the mixed-ownership reform has helped to weaken the impact of the above problems [27]. As shown in Table A1, in our sample, state-owned enterprises have a higher leverage ratio (49.9% > 38.5%) and enterprise scale (23.0 > 22.1), and lower R&D density (2.4% < 4.7%). This results in the following questions: will the counter-cyclical monetary policy also show different effects with the change similar to property rights? Does competition still regulate the effect of policy?

Table 8.

Results of the heterogeneity analysis.

Columns (4) to (5) in Table 8 report the grouped regression results according to enterprise ownership. The results show that the main explanatory variables remain significant; that is, regardless of whether they are state-owned enterprises or non-state-owned enterprises, counter-cyclical monetary policy can affect the R&D investment density through the leverage channel. However, compared with state-owned enterprises, the leverage ratio has a greater negative impact on the R&D investment density of non-state-owned enterprises and is also more vulnerable to monetary policy and product market competition. This conclusion is similar to Yang and Yin, who believe that non-state-owned enterprises are more sensitive to the impact of tightening monetary policy [28]. Our research shows that non-state-owned enterprises are also more sensitive to the impact of easy monetary policy.

5. Discussion

The results show that in an economic downturn cycle, a debt burden (or leverage ratio) reduces the innovation investment ability of enterprises. Under the strict hypothesis test and robustness test, the loose monetary policy as counter cyclical regulation does weaken the negative impact of high leverage and promotes R&D investment of enterprises. The regulatory effect of counter-cyclical monetary policy on the economy has always been the focus of monetary economics. Compared with the existing research, the results of this paper confirm the positive role of counter-cyclical monetary policy in an economic recession and the important impact of policy on promoting enterprise innovation investment. For a long time, there has been a constant debate about whether monetary policy can have a long-term impact on the economy. In the classical dichotomy, monetary and monetary policy can only affect the rigidity of nominal variables for a short time but have no impact on long-term economic growth. A classical economics explanation is that only new products, new technologies, and more efficient organizational systems can bring long-term economic growth, which is independent of money and monetary policy. However, the endogenous growth theory emphasizes that technological progress is a purposeful economic activity that is affected by the economic environment, rather than a simple ‘fall from the sky’. Specifically, as ‘discretionary costs’, R&D spending is not mandatory but occurs because of management decisions [29]. From this perspective, the R&D investment depends on the current investment cost and future investment income. Insofar, monetary policies that promote business investment may actually promote economic growth, breaking the classical dichotomy.

Similar results have been found in relevant studies of EU countries, but they jump to positive statements, such as enterprise output, before giving any evidence about the effect of monetary policy on innovation or R&D investment [7,13,30]. Using the changes in China’s monetary policy incidence during the special economic period, this paper uses the continuous difference-in-difference (DID) model to focus on the impact of monetary policy on enterprise R&D investment through leverage channels. This is clear and intuitive and underlies the effect of monetary policy on innovation.

However, it should be noted that monetary policy reduces the current R&D investment cost of enterprises, but enterprises’ R&D investments are also related to expected returns. This is where the product market competition comes into the discussion. Further research shows that the impact of monetary policy on enterprise R&D investment may be ineffective in some cases, and monopoly is a possible factor in this result. Although there are still some disputes about how monopoly and competition affect enterprise R&D investment, the results of this paper show that monetary policy can more significantly weaken the negative impact of high leverage on enterprise R&D investment in a competitive market environment.

In addition, this paper provides the results of heterogeneity analysis. The results show that although the counter-cyclical monetary policy has a significant impact on all types of enterprises, it has a higher impact on technology-intensive enterprises and non-state-owned enterprises. Some studies believe that the nature of property rights of state-owned enterprises does not always harm enterprise innovation. In areas with low expected return on innovation, credit ownership preference and soft budget constraints have a greater compensation effect on innovation than the crowding-out effect [31]. Under the framework of this paper, this conclusion can be understood as in a monopoly market, state-owned enterprises have higher R&D investment than non-state-owned enterprises. Similarly, a study has found that in the field of natural monopoly, mixed ownership reform cannot effectively improve the total factor productivity of enterprises [32]. In the heterogeneity study, the impact of the leverage ratio, monetary policy, and product market competition on the R&D investment of state-owned enterprises is only about one-third of that of non-state-owned enterprises, which means that R&D investment of state-owned enterprises is more stable in highly leveraged and monopolistic enterprises.

Due to some subjective and objective conditions, there is still room for improvement in this paper. For a long period, the innovation quality of Chinese enterprises has been low, and systematic investigation of enterprises’ innovation activities has been also lacking until 2013, which limits the scope of sample selection in this paper to a certain extent. Moreover, compared with other enterprises, listed companies have certain particularity, especially the ownership structure and the business model of decentralized management rights and ownership, which may affect the innovation and R&D decisions. At the same time, listed companies are more closely connected with the government and banks and have lower financing costs. Therefore, research conclusions based on listed companies have certain limitations. Future research can further enrich the coverage of the sample and the influence path of monetary policy, which is not limited to the leverage ratio.

6. Conclusions and Implications

This paper found that in the economic downturn cycle, compared with the low leverage ratio, the R&D investment density of highly leveraged firms was 5.6 percentage points lower, and the R&D investment loss caused by the leverage ratio reached 3.5 percentage points in extreme cases (based on the R&D spending) while the counter-cyclical monetary policy in 2016–2019 reduced the R&D investment loss by about 1.1 percentage points. Furthermore, in a competitive environment, monetary policy can completely offset the loss of R&D investment caused by leverage. However, for monopoly enterprises, due to the lack of innovation investment power, the impact of counter-cyclical monetary policy on enterprises’ R&D investment was diluted. After a strict hypothesis test and robustness test, this conclusion remained valid.

Combined with the actual situation of China’s economic cycle and the conclusions of this paper, the author puts forward the following suggestions. Firstly, the basic regression results of this paper affirm the promotion effect of counter-cyclical monetary policy on enterprise R&D investment. Therefore, the monetary authorities should fully consider the long-term results of the policy in the process of policy formulation and implementation. Secondly, compared with developed countries, China’s market economy is still imperfect. The government should give greater scope to the basic role of the market in resource allocation and strengthen market competition. However, it should be noted that competition also has a crowding-out effect on the enterprise innovation input. Therefore, we should not only give full play to market functions to promote enterprise competition but also avoid vicious competition, such as price war. Finally, in the heterogeneity test, it was found that state-owned enterprises lack sensitivity to counter-cyclical monetary policy and product market competition. The continuous promotion of mixed-ownership reform is helpful for improving the weak situation of policy regulation in the face of state-owned enterprises, but we should also pay attention to the positive role of state-owned nature in some special environments.

Author Contributions

Conceptualization, T.W. and H.Z.; formal analysis, T.W.; investigation, T.W.; resources, H.Z.; data curation, T.W.; writing—original draft preparation, T.W.; writing—review and editing, T.W. and H.Z.; supervision, H.Z.; project administration, T.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

All data needed to evaluate the conclusions in the paper may be requested from the authors.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Descriptive statistics in the heterogenous group.

Table A1.

Descriptive statistics in the heterogenous group.

| Variable Name | Description | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Technology intensive (with 4799 Obs) | |||||

| Lr | Corporate asset-liability ratio (%) | 42.3 | 19.8 | 1.7 | 135.2 |

| LNTa | Total enterprise assets (log) | 22.4 | 1.3 | 18.9 | 28.6 |

| Age | Enterprise age (based on the year of establishment) | 20.2 | 5.0 | 8.0 | 43.0 |

| TFP | Total factor productivity (calculation based on the OP method) | 9.2 | 1.1 | 6.0 | 13.6 |

| INDtr | Industry revenue (log) | 26.8 | 1.3 | 20.2 | 29.3 |

| INDfxa | Industry fixed assets (log) | 25.6 | 1.3 | 18.7 | 28.5 |

| RDd | R&D investment density (%) | 3.9 | 5.3 | 0.0 | 125.9 |

| Capital intensive (with 4513 Obs) | |||||

| Lr | Corporate asset-liability ratio (%) | 43.0 | 20.2 | 0.8 | 98.9 |

| LNTa | Total enterprise assets (log) | 22.4 | 1.3 | 19.1 | 28.5 |

| Age | Enterprise age (based on the year of establishment) | 20.2 | 5.0 | 8.0 | 43.0 |

| TFP | Total factor productivity (calculation based on the OP method) | 9.3 | 1.1 | 6.2 | 13.2 |

| INDtr | Industry revenue (log) | 26.8 | 1.3 | 19.3 | 29.3 |

| INDfxa | Industry fixed assets (log) | 25.5 | 1.3 | 18.5 | 28.5 |

| RDd | R&D investment density (%) | 3.8 | 4.7 | 0.0 | 72.8 |

| Labor intensive (with 3239 Obs) | |||||

| Lr | Corporate asset-liability ratio (%) | 43.7 | 20.2 | 1.1 | 103.3 |

| LNTa | Total enterprise assets (log) | 22.5 | 1.4 | 19.0 | 28.5 |

| Age | Enterprise age (based on the year of establishment) | 20.3 | 5.0 | 8.0 | 43.0 |

| TFP | Total factor productivity (calculation based on the OP method) | 9.3 | 1.2 | 5.8 | 13.4 |

| INDtr | Industry revenue (log) | 26.9 | 1.3 | 21.1 | 29.3 |

| INDfxa | Industry fixed assets (log) | 25.6 | 1.3 | 18.8 | 28.5 |

| RDd | R&D investment density (%) | 3.7 | 4.6 | 0.0 | 76.4 |

| Non-state-owned enterprise (with 7695 Obs) | |||||

| Lr | Corporate asset-liability ratio (%) | 38.5 | 19.1 | 0.8 | 135.2 |

| LNTa | Total enterprise assets (log) | 22.1 | 1.1 | 18.9 | 27.8 |

| Age | Enterprise age (based on the year of establishment) | 19.8 | 5.0 | 9.0 | 43.0 |

| TFP | Total factor productivity (calculation based on the OP method) | 9.0 | 1.0 | 5.8 | 13.6 |

| INDtr | Industry revenue (log) | 26.8 | 1.3 | 19.3 | 29.3 |

| INDfxa | Industry fixed assets (log) | 25.5 | 1.3 | 19.1 | 28.5 |

| RDd | R&D investment density (%) | 4.7 | 5.3 | 0.0 | 125.9 |

| State-owned enterprises (SOEs) (with 4856 Obs) | |||||

| Lr | Corporate asset-liability ratio (%) | 49.9 | 19.6 | 1.0 | 103.7 |

| LNTa | Total enterprise assets (log) | 23.0 | 1.4 | 19.6 | 28.6 |

| Age | Enterprise age (based on the year of establishment) | 20.8 | 4.8 | 8.0 | 37.0 |

| TFP | Total factor productivity (calculation based on the OP method) | 9.7 | 1.2 | 6.2 | 13.1 |

| INDtr | Industry revenue (log) | 26.9 | 1.3 | 20.2 | 29.3 |

| INDfxa | Industry fixed assets (log) | 25.8 | 1.3 | 18.5 | 28.5 |

| RDd | R&D investment density (%) | 2.4 | 3.5 | 0.0 | 57.5 |

References

- Blanchard, O.; Cerutti, E.; Summers, L. Inflation and Activity—Two Explorations and their Monetary Policy Implications. In IMF Working Papers; International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

- Avram, A.; Benvenuto, M.; Avram, C.D.; Gravili, G. Assuring SME’s Sustainable Competitiveness in the Digital Era: A Labor Policy between Guaranteed Minimum Wage and ICT Skill Mismatch. Sustainability 2019, 11, 2918. [Google Scholar] [CrossRef] [Green Version]

- Hall, B.H.; Lerner, J. The Financing of R&D and Innovation. In Handbook of the Economics of Innovation; Elsevier: Amsterdam, The Netherlands, 2010; Volume 1. [Google Scholar]

- Holmstrom, B.; Tirole, J. Financial Intermediation, Loanable Funds and the Real Sector. Q. J. Econ. 1997, 112, 663–691. [Google Scholar] [CrossRef]

- Aghion, P.; Angeletos, G.M.; Banerjee, A.; Manova, K. Volatility and growth: Credit constraints and the composition of investment. J. Monet. Econ. 2010, 57, 246–265. [Google Scholar] [CrossRef] [Green Version]

- Aghion, P.; Askenazy, P.; Berman, N.; Cette, G.; Eymard, L. Credit Constraints and the Cyclicality of R&D Investment: Evidence from Micro Panel data. J. Eur. Econ. Assoc. 2012, 10, 1001–1024. [Google Scholar]

- Ahn, J.B.; Duval, R.A.; Sever, C. Macroeconomic Policy, Product Market Competition, and Growth: The Intangible Investment Channel. In IMF Working Papers; International Monetary Fund: Washington, DC, USA, 2020. [Google Scholar]

- Schmidt, K.M. Managerial Incentives and Product Market Competition. Rev. Econ. Stud. 1997, 64, 191–213. [Google Scholar] [CrossRef]

- Raith, M. Competition, Risk, and Managerial Incentives. Am. Econ. Rev. 2003, 93, 1425–1436. [Google Scholar] [CrossRef]

- Croitoru, A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle. Soc. Sci. Electron. Publ. 2012, 3, 90–91. [Google Scholar]

- Ramey, G.; Ramey, V. Cross-Country Evidence on the Link between Volatility and Growth. Am. Econ. Rev. 1995, 85, 1138–1151. [Google Scholar]

- Aghion, P.; Fedderke, J.; Howitt, P.; Viegi, N. Testing Creative Destruction in an Opening Economy: The Case of the South African Manufacturing Industries. Econ. Transit. 2013, 21, 419–450. [Google Scholar] [CrossRef]

- Aghion, P.; Farhi, E.; Kharroubi, E. Monetary Policy, Product Market Competition and Growth. Economica 2019, 86, 431–470. [Google Scholar] [CrossRef] [Green Version]

- Zulkhibri, M. Corporate Investment Behavior and Monetary Policy: Evidence from Firm-level Data for Malaysia. Emerg. Mark. Rev. 2013, 42, 269–290. [Google Scholar]

- Ottonello, P.; Winberry, T. Financial Heterogeneity and the Investment Channel of Monetary Policy. Econometrica 2020, 88, 2473–2502. [Google Scholar] [CrossRef]

- Gertler, M.; Gilchrist, S. Monetary Policy, Business Cycles and the Behavior of Small Manufacturing Firms. In NBER Working Papers; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar]

- Grosse-Rueschkamp, B.; Steffen, S.; Streitz, D. A capital structure channel of monetary policy. J. Financ. Econ. 2019, 133, 357–378. [Google Scholar] [CrossRef]

- Shen, J.; Yin, X. Credit expansion, state ownership and capital structure of Chinese real estate companies. J. Prop. Invest. Financ. 2016, 34, 263–275. [Google Scholar] [CrossRef]

- National Bureau of Statistics. National Data-Publications. Available online: https://data.stats.gov.cn/ (accessed on 10 April 2022).

- People’s Bank of China. Implementation Report of Monetary Policy. Available online: https://http://www.pbc.gov.cn/zhengcehuobisi/125207/125227/125957/index.html (accessed on 10 April 2022).

- Chen, Y.; Chen, W. Potential Growth Gap and the Reconstruction of Macroeconomic Policy Objectives. Econ. Res. J. 2021, 18, 14–31. [Google Scholar]

- Ioannidou, V.; Ongena, S.; Peydró, J.-L. Monetary Policy, Risk-Taking, and Pricing: Evidence from a Quasi-Natural Experiment. Rev. Financ. 2015, 1, 95–144. [Google Scholar] [CrossRef] [Green Version]

- Qian, N. Missing Women and the Price of Tea in China: The Effect of Sex-Specific Earnings on Sex Imbalance. Q. J. Econ. 2008, 123, 1251–1285. [Google Scholar] [CrossRef]

- Dai, M.; Yu, M.; Zhao, C. Export tightening, competition, and firm innovation: Evidence from the renminbi appreciation. Rev. Dev. Econ. 2018, 22, 263–286. [Google Scholar] [CrossRef] [Green Version]

- Feenstra, R.C.; Li, Z.; Yu, M. Exports and Credit Constraints Under Incomplete Information: Theory and Evidence from China. Rev. Econ. Stat. 2014, 96, 729–744. [Google Scholar] [CrossRef]

- General Office of the State Council. Documents of The State Council. Available online: http://www.gov.cn/zhengce/content/2013-02/04/content_5547.htm (accessed on 10 April 2022).

- Wang, Y.; Chen, L. Whether Mixed Ownership Reform Can Promote Enterprise Innovation? Res. Econ. Manag. 2017, 11, 112–121. [Google Scholar]

- Yang, X.; Yin, X. Who Has Been Effectively Controlled by Monetary Policy? Research on the Investment Behavior of Listed Companies. Account. Res. 2017, 4, 3–11. [Google Scholar]

- Avram, A.; Avram, C.D.; Avram, V. Research and development expenditures between discretionary costs and source for economic growth. Rom. J. Econ. 2014, 39, 49–66. [Google Scholar]

- Moran, P.; Queralto, A. Innovation, productivity, and monetary policy. J. Monet. Econ. 2018, 93, 24–41. [Google Scholar] [CrossRef] [Green Version]

- Li, Y. Are the State-Owned Enterprises Really Restrain Independent Innovation? J. Zhongnan Univ. Econ. Law 2017, 4, 1–10. [Google Scholar]

- Chen, L. Natural Monopoly and Mixed Ownership Reform: Based on the Natural Experiment and Cost Function Analysis Method. Econ. Res. J. 2018, 1, 81–96. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).