Are Smart Cities Too Expensive in the Long Term? Analyzing the Effects of ICT Infrastructure on Municipal Financial Sustainability

Abstract

:1. Introduction

2. Literature Review: Smart Cities and FS

2.1. Smart Cities and Sustainability

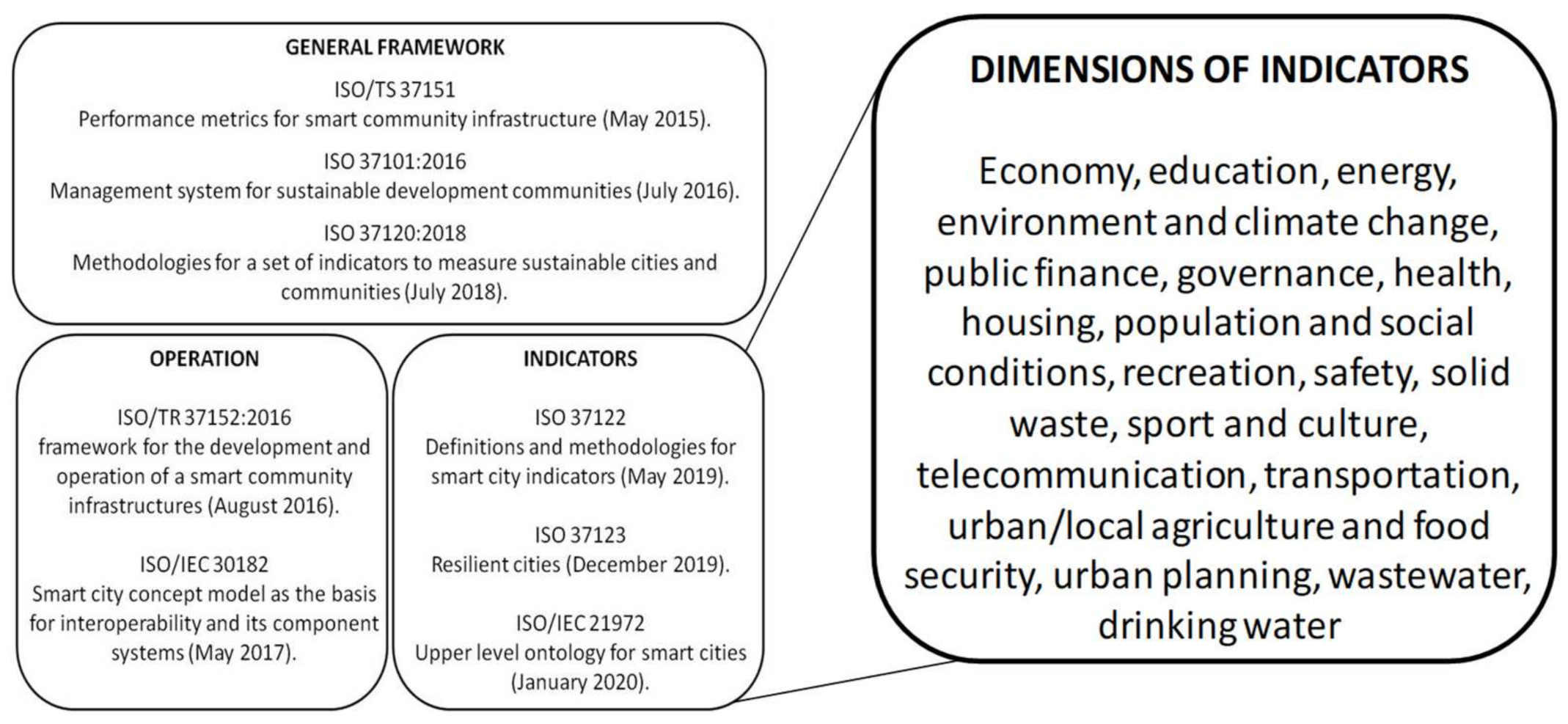

- ISO/TS 37151 defines the principles and requirements for performance metrics for a smart community infrastructure (May 2015).

- ISO 37101:2016 establishes the requirements for a management system for sustainable development communities (July 2016).

- ISO/TR 37152:2016 outlines the basic concept of a common framework for the development and operation of smart community infrastructures (August 2016).

- ISO/IEC 30182 describes and gives guidance for a smart city concept model as the basis for interoperability, along with its component systems (May 2017).

- ISO 37120:2018 defines and establishes methodologies for a set of indicators for city services and quality of life by which to measure sustainable cities and communities (July 2018).

- ISO 37122 specifies and establishes the definitions and methodologies for a set of indicators for smart cities (May 2019).

- ISO 37123 complements ISO 37122 for resilient cities (December 2019).

- ISO/IEC 21972 is the standard that establishes the general principles and guidelines for an upper-level ontology for smart cities (January 2020).

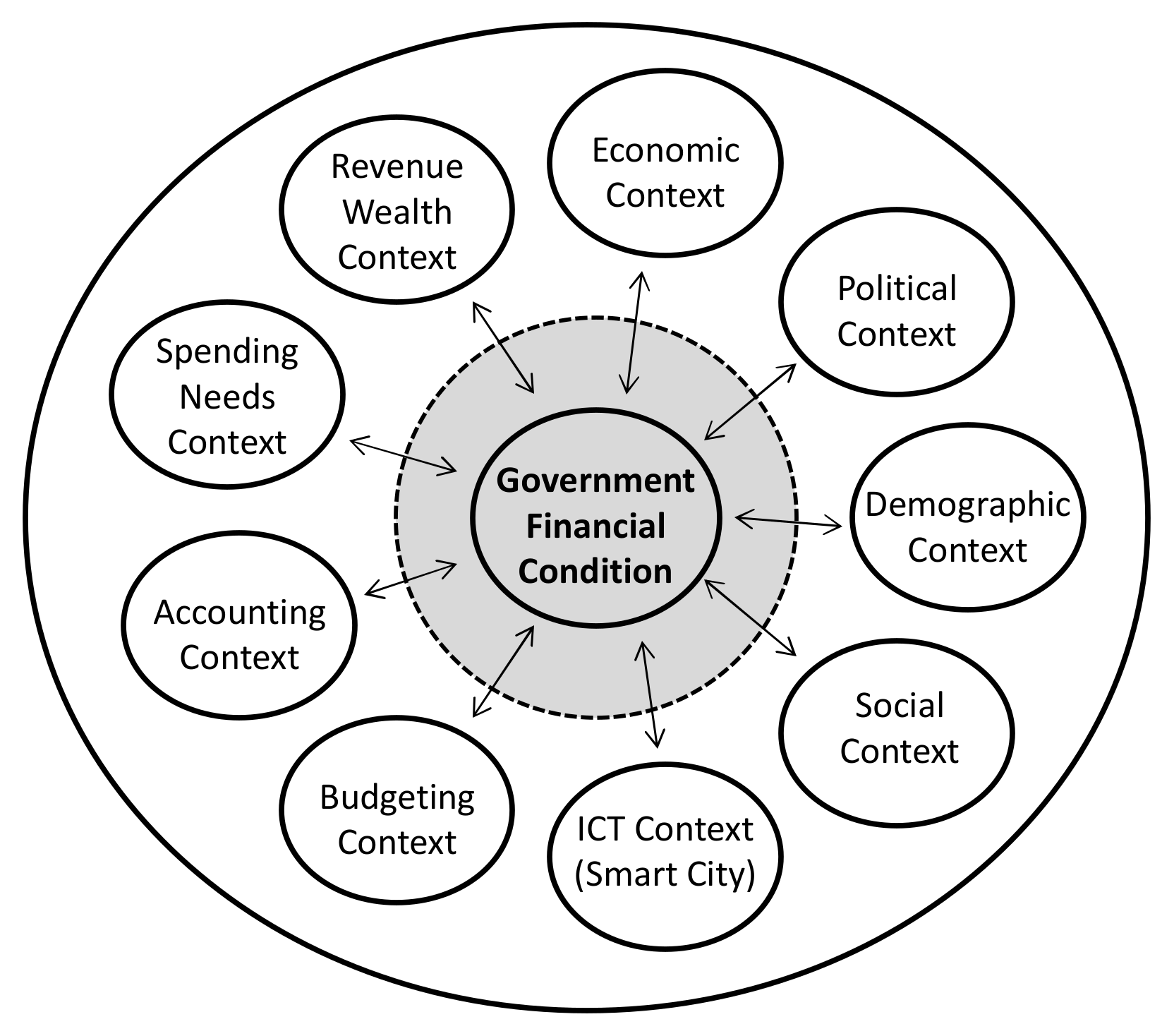

2.2. FS for Smart Cities

3. Research Design and Methods

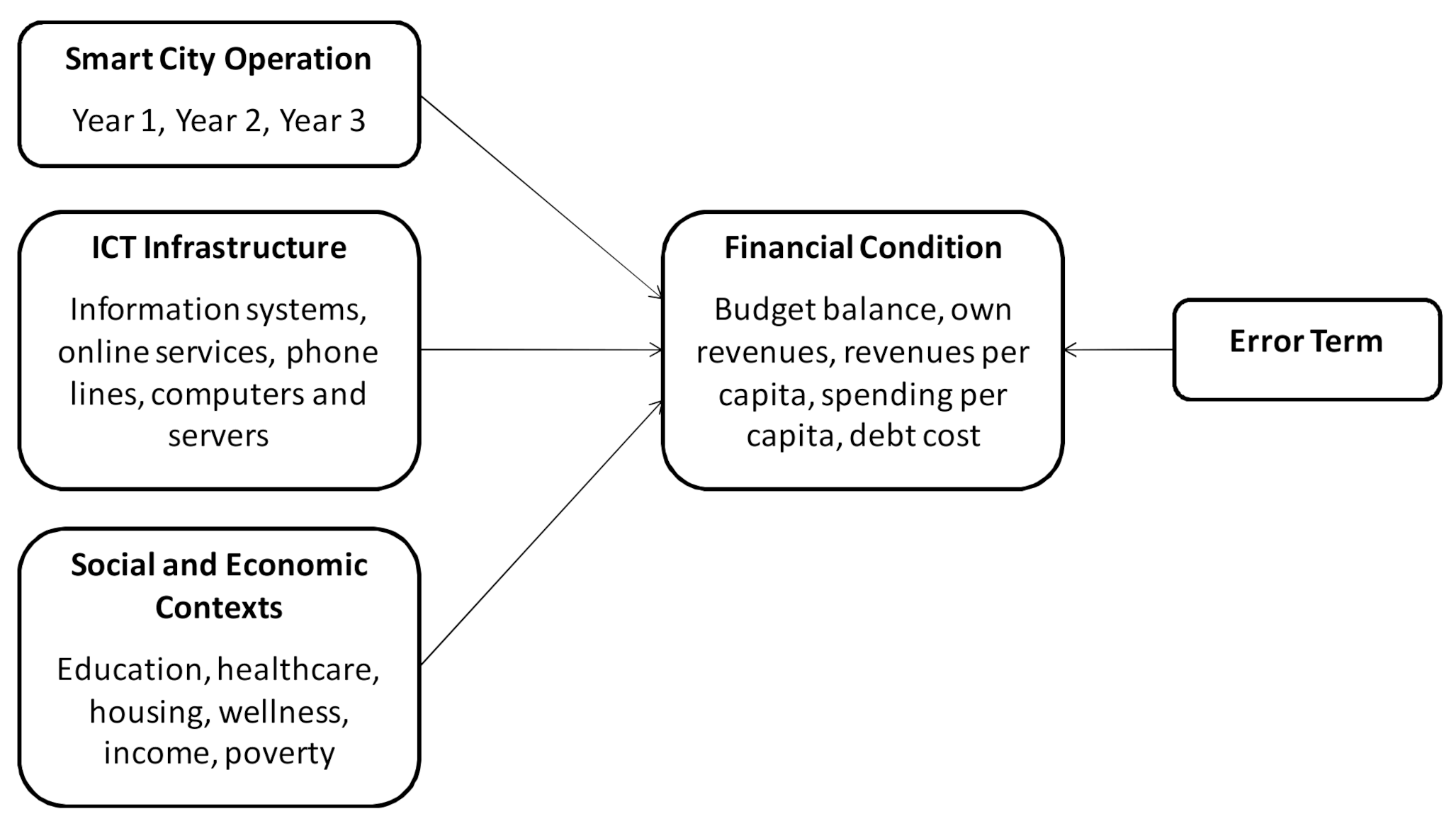

3.1. Panel Data Analysis

- FSit = Financial sustainability (i.e., the dependent variable) measured by five indicators;

- SMART CITYit = Year of smart city operation (2014, 2016, or 2018);

- ICTit = ICT infrastructure measured using seven indicators;

- SEContextit = Social and economic context measured by seven indicators;

- αi (i = 1…n) = Unknown intercept for each municipality (n entity-specific intercepts);

- μit (i = 1…n) = The error term.

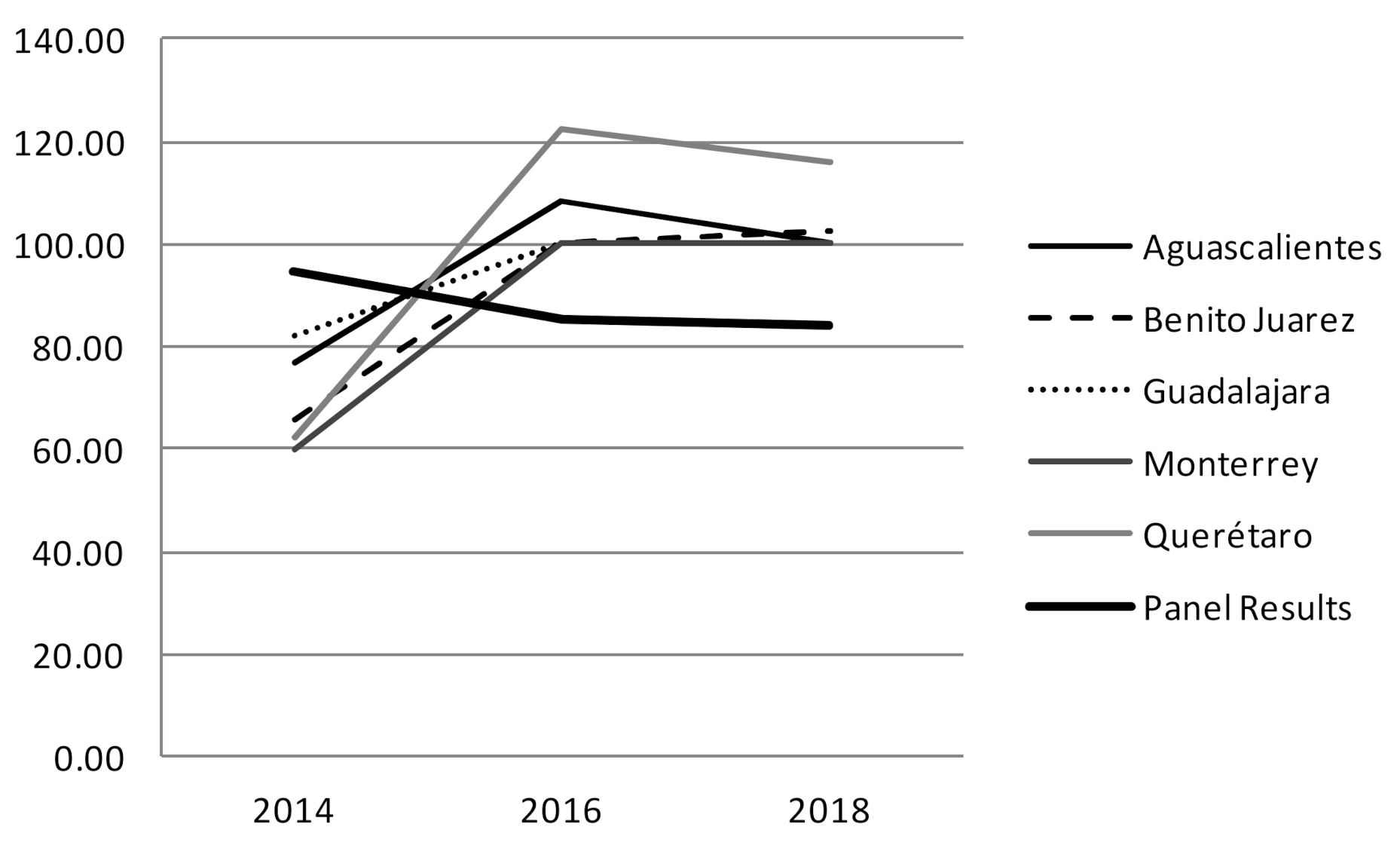

3.2. Comparison with Well-Known Smart City Examples

4. Analysis and Results

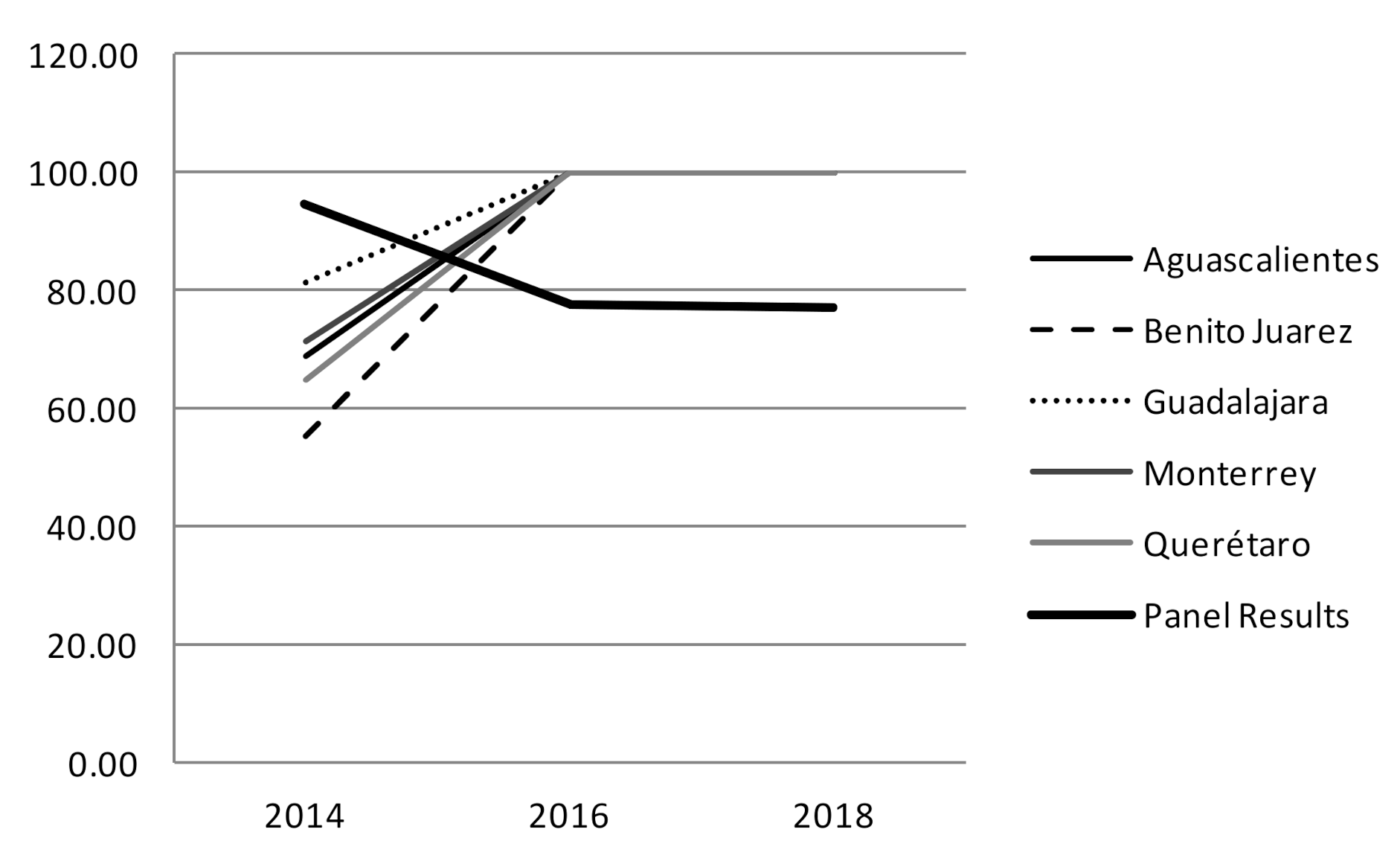

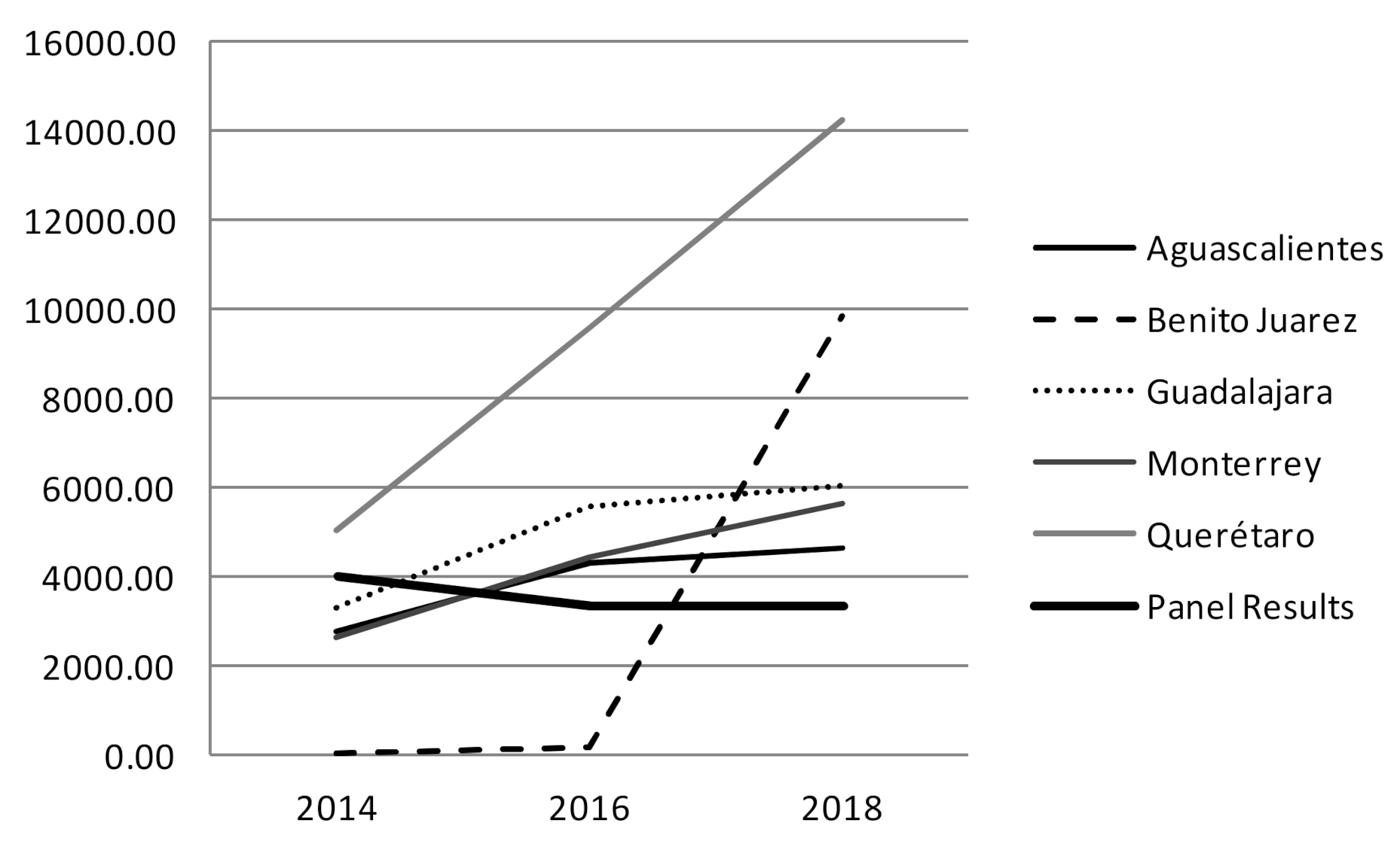

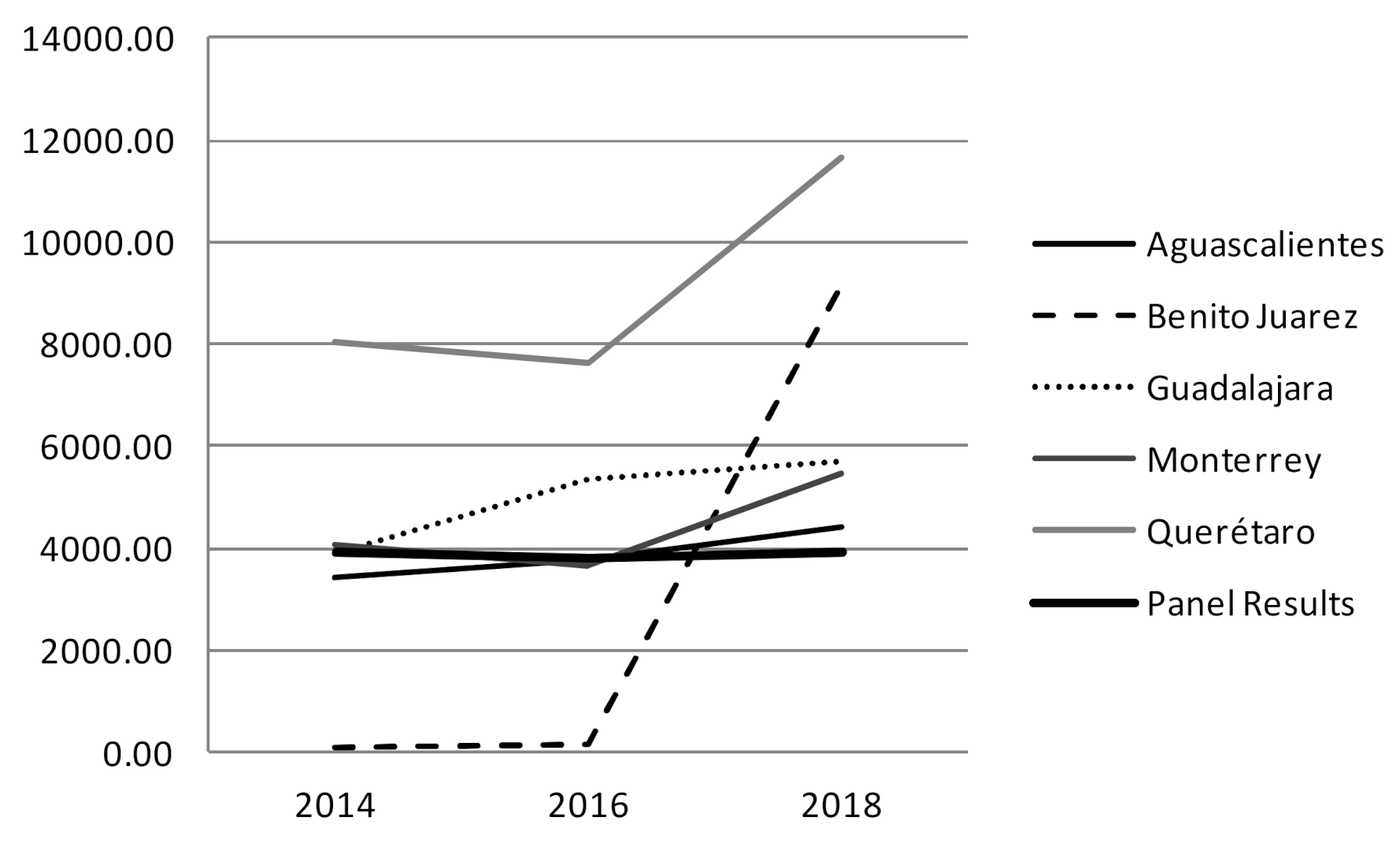

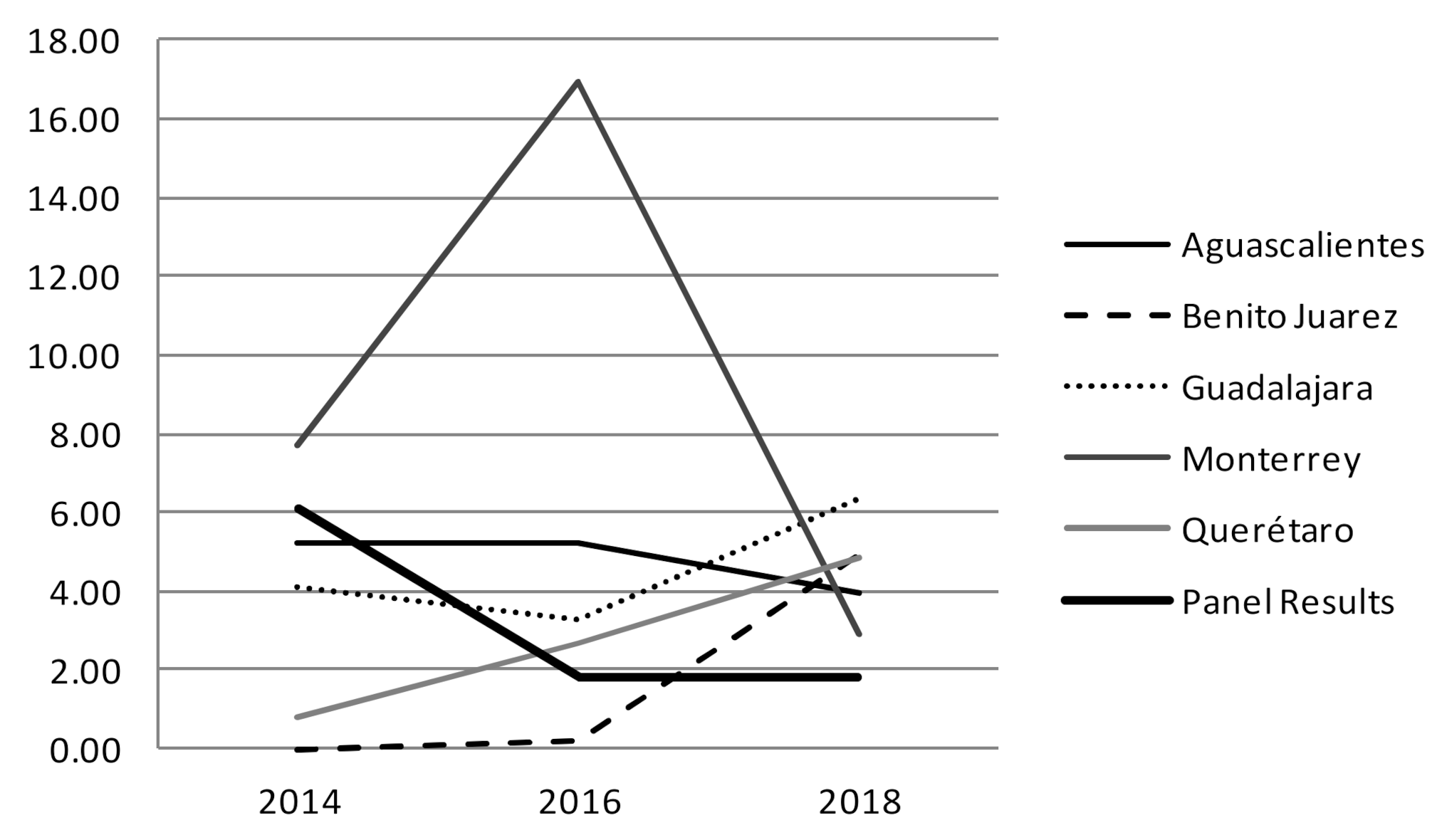

4.1. Are Smart Cities Too Expensive in the Long Term?

4.2. Are Investments in ICT Infrastructure Associated with the Financial Performance of Governments?

4.3. Does Context Influence the Financial Performance of Governments?

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Matus Ruiz, M.; Ramírez Autrán, R. (Eds.) Ciudades Inteligentes en Iberoamérica; Ejemplos de Iniciativas Desde el Sector Privado, la Sociedad Civil, el Gobierno y la Academia; INFOTEC Centro de Investigación e Innovación en Tecnologías de la Información y Comunicación: Ciudad de México, Mexico, 2016. [Google Scholar]

- Gasco-Hernandez, M. Criterios para Evaluación de Buenas Prácticas en el Ámbito del uso de las Tecnologías de la Información y las Comunicaciones (Criteria to Assess Good Practices Related to the Use of Information and Communication Technologies); Fundació Pi i Sunyer: Barcelona, Spain, 2009. [Google Scholar]

- Lombardi, P.; Giordano, S.; Farouh, H.; Yousef, W. Modelling the smart city performance. Innov. Eur. J. Soc. Sci. Res. 2012, 25, 137–149. [Google Scholar] [CrossRef]

- Neirotti, P.; De Marco, A.; Cagliano, A.C.; Mangano, G.; Scorrano, F. Current trends in Smart City initiatives: Some stylised facts. Cities 2014, 38, 25–36. [Google Scholar] [CrossRef] [Green Version]

- Cabaleiro, R.; Buch, E.; Vaamonde, A. Developing a Method to Assessing the Municipal Financial Health. Am. Rev. Public Adm. 2013, 43, 729–751. [Google Scholar] [CrossRef]

- Navarro-Galera, A.; Rodríguez-Bolívar, P.; Alcaide-Muñoz, L.; López-Subires, M.D. Measuring the financial sustainability and its influential factors in local governments. Appl. Econ. 2016, 48, 3961–3975. [Google Scholar] [CrossRef]

- Giffinger, R. Smart City Concepts: Chances and Risks of Energy Efficient Urban Development. In Smart Cities, Green Technologies, and Intelligent Transport Systems. In Proceedings of the International Conference on Smart Cities and Green ICT Systems, SMARTGREENS 2015, VEHITS 2015, Lisbon, Portugal, 20–22 May 2015; Springer: Cham, Switzerland, 2016; pp. 3–16. [Google Scholar]

- Timeus k Vinaixa, J.; Pardo-Bosch, F. Creating business models for smart cities: A practical framework; Special issue: Management, Governance and Accountability for Smart Cities and Communities. J. Public Manag. Rev. 2020, 22, 726–745. [Google Scholar] [CrossRef] [Green Version]

- Adams, C.A.; Muir, S.; Hoque, Z. Measurement of Sustainability Performance in the Public Sector, Sustainable Accountable. Manag. Policy J. 2014, 5, 46–67. [Google Scholar]

- ESA. European System of Accounts 2010; Eurostat European Commission, Publications Office of the European Union: Luxembourg, 2013. [Google Scholar]

- IFAC. Reporting on the Long-Term Sustainability of an Entity’s Finances; IFAC: New York, NY, USA, 2013. [Google Scholar]

- IMF. Government Finance Statistics Manual 2014 (GFSM 2014); International Monetary Fund: Washington, DC, USA, 2014. [Google Scholar]

- UN. System of National Accounts 2008 (SNA 2008); United Nations: New York, NY, USA, 2009; Available online: https://unstats.un.org/unsd/nationalaccount/docs/sna2008.pdf (accessed on 12 May 2022).

- Dameri, R.P.; Rosenthal-Sabroux, C. Smart City and Value Creation. In Smart City. How to Create Public and Economic Value with High Technology in Urban Space; Dameri, R.P., Rosenthal-Sabroux, C., Eds.; Springer International Publishing: Cham, Switzerland, 2014. [Google Scholar]

- Chapman, J.I. State and Local Fiscal Sustainability: The Challenges. Public Adm. Rev. 2008, 68, S115–S131. [Google Scholar] [CrossRef]

- Castelnovo, W.; Misuraca, G.; Savoldelli, A. Smart Cities Governance: The Need for a Holistic Approach to Assessing Urban Participatory Policy Making. Soc. Sci. Comput. Rev. 2016, 34, 724–739. [Google Scholar] [CrossRef]

- Caird, S.P.; Hallett, S.H. Towards evaluation design for smart city development. J. Urban Des. 2019, 24, 188–209. [Google Scholar] [CrossRef]

- Batty, M. Smart cities of the future. Eur. Phys. J. Spec. Top. 2012, 214, 481–515. [Google Scholar] [CrossRef] [Green Version]

- Anthopoulos, L.; Tsoukalas, I.A. The implementation model of a digital city. J. e-Gov. 2005, 2, 91–110. [Google Scholar]

- Yovanof, G.S.; Hazapis, G.N. An architectural framework and enabling wireless technologies for digital cities & intelligent urban environments. Wirel. Pers. Commun. 2009, 49, 445–463. Available online: https://link.springer.com/article/10.1007/s11277-009-9693-4 (accessed on 12 May 2022).

- Kanter, R.M.; Litow, S.S. Informed and Interconnected: A Manifesto for Smarter Cities; Working Paper; Harvard Business School General Management Unit: Boston, MA, USA, 2009; pp. 9–141. Available online: https://www.hbs.edu/faculty/Pages/item.aspx?num=36185 (accessed on 12 May 2022).

- Lindskog, H. Smart communities initiatives. In Proceedings of the 3rd ISOneWorld Conference, Las Vegas, NV, USA, 14–16 April 2004; Available online: http://www.heldag.com/articles/Smart%20communities%20april%202004.pdf (accessed on 12 May 2022).

- Noori, N.; de Jong, M.; Janssen, M.; Schraven, D.; Hoppe, T. Input-Output Modeling for Smart City Development. J. Urban Technol. 2021, 28, 71–92. [Google Scholar] [CrossRef]

- Trencher, G.; Karvonen, A. Stretching “smart”: Advancing health and well-being through the smart city agenda. Local Environ. 2019, 24, 610–627. [Google Scholar] [CrossRef]

- Giffinger, R.; Fertner, C.; Kramar, H.; Kalasek, R.; PichlerMilanoviü, N.; Meijers, E. Smart Cities: Ranking of European Medium-Sized Cities; Centre of Regional Science (SRF), Vienna University of Technology: Vienna, Austria, 2007; Available online: http://www.smart-cities.eu/download/city_ranking_final.pdf (accessed on 12 May 2022).

- Bosch, P.; Jongeneel, S.; Rovers, V.; Neumann, H.M.; Airaksinen, M.; Huovila, A. CITYkeys Indicators for Smart City Projects and Smart Cities; CityKeys, European Commission: Brussels, Belgium, 2017; Available online: http://nws.eurocities.eu/MediaShell/media/CITYkeysD14Indicatorsforsmartcityprojectsandsmartcities.pdf (accessed on 25 January 2018).

- Hollands, R.G. Will the real smart city please stand up? Intelligent, Progressive, or Entrepreneurial? City 2008, 12, 303–320. [Google Scholar] [CrossRef]

- Komninos, N. Intelligent Cities and Globalization of Innovation Networks; Taylor & Francis: London, UK, 2008. [Google Scholar]

- Landry, C. The Creative Centre; Earthscan: Londres, UK, 2008. [Google Scholar]

- Pereira, G.V.; Luna-Reyes, L.F.; Gil-Garcia, J.R. Governance innovations, digital transformation and the generation of public value in Smart City initiatives. In Proceedings of the 13th International Conference on Theory and Practice of Electronic Governance, Athens, Greece, 23–25 September 2020; pp. 602–608. [Google Scholar]

- Gil, O.; Zheng, T.C. Smart cities through the lenses of public policy: The case of Shanghai. Rev. Española Cienc. Política 2015, 38, 63–84. [Google Scholar]

- Leydesdorff, L.; Etzkowitz, H. Can “The Public” Be Considered as a Fourth Helix in University-Industry-Government Relations? Report of the Fourth Triple Helix Conference. Sci. Public Policy 2003, 30, 55–61. [Google Scholar] [CrossRef]

- Toli, A.M.; Murtagh, N. The Concept of Sustainability in Smart City Definitions. Front. Built Environ. 2020, 6, 77. [Google Scholar] [CrossRef]

- Oberti, I.; Pavesi, A.S. The triumph of the smart city. TECHNE J. Technol. Archit. Environ. 2013, 5, 117–122. Available online: https://oaj.fupress.net/index.php/techne/article/view/4300 (accessed on 12 May 2022).

- Caragliu, A.; Del Bo, C.; Nijkamp, P. Smart cities in Europe. J. Urban Technol. 2011, 18, 65–82. [Google Scholar] [CrossRef]

- Aurigi, A.; Odendaal, N. From “Smart in the Box” to “Smart in the City”: Rethinking the Socially Sustainable Smart City in Context. J. Urban Technol. 2020, 28, 55–70. [Google Scholar] [CrossRef]

- Carli, R.; Dotoli, M.; Pellegrino, R.; Ranieri, L. Measuring and managing the smartness of cities: A Framework for classifying performance indicators. In Proceedings of the 2013 IEEE International Conference on Systems, Man, and Cybernetics, Manchester, UK, 13–16 October 2013. [Google Scholar]

- Monfaredzadeha, T.; Krueger, R. Investigating Social Factors of Sustainability in a Smart City. Procedia Eng. 2015, 118, 1112–1118. [Google Scholar] [CrossRef] [Green Version]

- Castillo, H.; Price, A.; Moobela, C.; Mathur, V. Assessing urban social sustainability: Current capabilities and opportunities for future research. Int. J. Environ. Cult. Econ. Soc. Sustain. 2007, 3, 39–48. [Google Scholar] [CrossRef]

- Martin, C.H.; Evans, J.; Karvonenc, A. Smart and sustainable? Five tensions in the visions and practices of the smart-sustainable city in Europe and North America. Technol. Forecast. Soc. Chang. 2018, 133, 269–278. [Google Scholar] [CrossRef]

- Monfaredzadeh, T.; Berardi, U. Beneath the smart city: Dichotomy between sustainability and competitiveness. Int. J. Sustain. Build. Technol. Urban Dev. 2015, 6, 140–156. [Google Scholar] [CrossRef]

- Haarstad, H. Constructing the sustainable city: Examining the role of sustainability in the ‘smart city’ discourse. J. Environ. Policy Plan. 2017, 19, 423–437. [Google Scholar] [CrossRef]

- Komninos, N. Smart City Governance and Financing. 2013. Available online: http://innovatv.it/video/2807981/nicos-komninos/finanziare-le-smart-city-soluzioni-confronto#.VLpqsv45DIU (accessed on 25 June 2015).

- Shen, L.Y.; Jorge Ochoa, J.; Shah, M.N.; Zhang, X. The application of urban sustainability indicators—A comparison between various practices. Habitat Int. 2011, 35, 17–29. [Google Scholar] [CrossRef]

- Cocchia, A. Smart and Digital City: A Systematic Literature Review. In Smart City. How to Create Public and Economic Value with High Technology in Urban Space; Dameri, R.P., Rosenthal-Sabroux, C., Eds.; Springer International Publishing: Cham, Switzerland, 2014. [Google Scholar]

- Albino, V.; Berardi, U.; Dangelico, R.M. Smart cities: Definitions, dimensions, performance, and initiatives. J. Urban Technol. 2015, 22, 3–21. [Google Scholar] [CrossRef]

- Da Silva de Santana, E.; Nunes, E.; Santos, L.B. The use of ISO 37122 as standard for assessing the maturity level of a smart city. Int. J. Adv. Eng. Res. Sci. 2018, 5, 309–315. [Google Scholar] [CrossRef]

- Huovilaa, A.; Bosch, P.; Airaksinen, M. Comparative analysis of standardized indicators for smart sustainable cities: What indicators and standards to use and when? Cities 2019, 89, 141–153. [Google Scholar] [CrossRef]

- Berne, R.; Schramm, R. The Financial Analysis of Governments; Prentice Hall: Englewood Cliffs, NJ, USA, 1986. [Google Scholar]

- Hendrick, R. Assessing and measuring the fiscal health of local governments. Focus on Chicago suburban municipalities. Urban Aff. Rev. 2004, 40, 78–114. [Google Scholar]

- Rodríguez Bolívar, M.P. Financial Sustainability in Public Administration. A synthesis of the Contributions for Improving Financial Sustainability. In Financial Sustainability in Public Administration; Rodríguez, M.P., Ed.; Palgrave Macmillan: Cham, Switzerland, 2017. [Google Scholar]

- Norcross, E.; Gonzalez, O. Ranking the States by Fiscal Condition; Mercatus Research, Mercatus Center at the George Mason University: Arlington, VA, USA, 2017. [Google Scholar]

- Wang, X.H.; Dennis, L.; Tu, Y.S. Measuring Fiscal Condition: A Study of US States. Public Budg. Financ. 2007, 27, 1–21. [Google Scholar] [CrossRef]

- Montesinos, V.; Dasí, R.M.; Brusca, I. A Framework for Comparing Financial Sustainability in EU Countries: National Accounts, Governmental Accounting and te Challenge of Harmonization. In Financial Sustainability of Public Sector Entities; Caruana, J., Brusca, I., Caperchione, E., Cohen, S., Cohen, F.M., Eds.; The Relevance of Accounting Frameworks; Palgrave MacMillan: Cham, Switzerland, 2019. [Google Scholar]

- Groves, S.M.; Valente, M.G.; Schulman, M. Evaluation Financial Condition: A Handbook for Local Government; International City/County Management Association (IMCA): Washington, DC, USA, 2003. [Google Scholar]

- Kavanagh, S.; Pisano, M.; Tang, S.Y.; McGrath, M.F.; Linkhart, D.; Hudson, M.; Colon, E. Financial Sustainability Index: A Self Assessment Tool for Financial Sustainability; Working Paper WP17MP2; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2017; Available online: https://www.gfoa.org/sites/default/files/pisano_wp17mp2_0.pdf (accessed on 15 July 2019).

- McDonald, B. Measuring the Fiscal Health of Municipalities; Working Paper WP17BM1; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2017. [Google Scholar]

- Aquino, A.C.; Cardoso, R.L. Accounting framework (re)interpretation to accommodate tensions from financial sustainability competing concepts. In Financial Sustainability of Public Sector Entities. The Relevance of Accounting Frameworks; Caruana, J., Brusca, I., Caperchione, E., Cohen, S., Manes Rossi, F., Eds.; Palgrave MacMillan: Cham, Switzerland, 2019; pp. 83–102. [Google Scholar]

- De Aquino, A.C.; Cardoso, R.L. Financial resilience in Brazilian municipalities. In Governmental Financial Resilience: International Perspectives on How Local Governments Face Austerity; Ileana Steccolini, I., Singh Jones, M.D., Saliterer, I., Eds.; Emerald Publishing Limited: Bingley, UK, 2017; Volume 27. [Google Scholar]

- Lima, D.V.D.; Aquino, A.C.B.D. Financial resilience of municipal civil servants’ pension funds. Rev. Contab. Finanças 2019, 30, 425–445. [Google Scholar] [CrossRef]

- Gupta, S.; Keen, M.; Shah, A.; Verdier, G. Digital Revolutions in Public Finance; International Monetary Fund: Washington, DC, USA, 2017. [Google Scholar]

- Ndou, V. E-Government for Developing Countries: Opportunities and Challenges. Electron. J. Inf. Syst. Dev. Ctries 2004, 18, 1–24. [Google Scholar] [CrossRef]

- Alawadhi, S.; Aldama-Nalda, A.; Chourabi, H.; Gil-Garcia, J.R.; Leung, S.; Mellouli, S.; Nam, T.; Pardo, T.A.; Scholl, H.J.; Walker, S. Building understanding of smart city initiatives. In Proceedings of the EGOV 2012, LNCS 7443, Kristiansand, Norway, 3–6 September 2012; Scholl, H.J., Janssen, M., Wimmer, M., Moe, C.E., Flak, L.S., Eds.; IFIP International Federation for Information Processing: Laxenburg, Austria, 2012; pp. 40–53. [Google Scholar]

- Leon, N. Attract and connect: The 22@Barcelona innovation district and the internationalization of Barcelona business. Innov. Organ. Manag. 2008, 10, 235–246. [Google Scholar] [CrossRef]

- INEGI. State and Municipal Government’s Public Finances Dataset; Instituto Nacional de Estadística y Geografía (INEGI): Aguascalientes, Mexico, 2021. Available online: https://www.inegi.org.mx/temas/finanzas/#Tabulados (accessed on 12 May 2022).

- CONAPO. Population Projections at the Municipal Level Dataset; Consejo Nacional de Población (CONAPO): Mexico City, Mexico, 2021. Available online: https://www.gob.mx/conapo/documentos/proyecciones-de-la-poblacion-de-los-municipios-de-mexico-2015-2030?idiom=es (accessed on 12 May 2022).

- INEGI. Municipal Government Census Dataset; Instituto Nacional de Estadística y Geografía (INEGI): Aguascalientes, Mexico, 2015. Available online: https://www.inegi.org.mx/programas/cngmd/2015/ (accessed on 12 May 2022).

- INEGI. Municipal Government Census Dataset; Instituto Nacional de Estadística y Geografía (INEGI): Aguascalientes, Mexico, 2017. Available online: https://www.inegi.org.mx/programas/cngmd/2017/ (accessed on 12 May 2022).

- INEGI. Municipal Government Census Dataset; Instituto Nacional de Estadística y Geografía (INEGI): Aguascalientes, Mexico, 2019. Available online: https://www.inegi.org.mx/programas/cngmd/2019/ (accessed on 12 May 2022).

- CONEVAL. Social and Poverty at the Municipal Level Dataset; Consejo Nacional de Evaluación de la Política de Desarrollo Social (CONEVAL): Mexico City, Mexico, 2021; Available online: https://www.coneval.org.mx/Medicion/Paginas/Pobreza-municipal.aspx (accessed on 12 May 2022).

- Chatfield, A.T.; Reddick, C.G. Customer agility and responsiveness through big data analytics for public value creation: A case study of Houston 311 on-demand services. Gov. Inf. Q. 2018, 35, 336–347. [Google Scholar] [CrossRef]

- Bifulco, F.; Tregua, M.; Amitrano, C.C.; D’Auria, A. ICT and sustainability in smart cities management. Int. J. Public Sect. Manag. 2016, 29, 132–147. [Google Scholar] [CrossRef]

- IFAC. Sustainability Framework 2.0. Professional Accountants as Integrators; International Federation of Accountants (IFAC): New York, NY, USA, 2012. [Google Scholar]

- EC. Fiscal Sustainability Report 2018; European Commission: Brussels, Belgium, 2018; Available online: https://ec.europa.eu/info/publications/economy-finance/fiscal-sustainability-report-2018_en (accessed on 12 May 2022).

| Dimension | Financial Indicator | Definition | Interpretation |

|---|---|---|---|

| Cash solvency: Ability of government to pay its immediate obligations with its own revenues (not including restricted transfers) | Own revenues | (Tax revenues + unrestricted revenues + other own revenue)/(Total revenues − financing − initial balance) | Higher values than average indicate solid cash solvency. |

| Budget solvency: Degree to which a government will end the fiscal year with a surplus or deficit (overall balance) | Budget balance | Total revenues/Total expenses | A ratio equal to or greater than 1 indicates solid budget solvency. A ratio of less than 1 indicates unstable budget solvency. |

| Long-run solvency: Ability of government to meet long-term spending commitments of public debt | Debt cost or debt obligation to total spending ratio | Debt cost/Total spending | Lower values than average indicate solid long-run solvency |

| Service-level solvency: Ability to meet citizens’ demands of services with actual levels of spending | Revenues per capita | Total revenues/Population | Higher values than average indicate solid service-level solvency |

| Spending per capita | Total spending/Population | Higher values than average indicate solid service-level solvency |

| Dimension | Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| Financial condition | Budget balance 1 | 5169 | 0.8683 | 0.2867 | 0.0922 | 2.5319 |

| Own revenues 1 | 5169 | 0.8317 | 0.2572 | 0.0922 | 1 | |

| Revenues per capita 2 | 5169 | 5067.7 | 7038.1 | 28.9 | 331,823.0 | |

| Spending per capita 2 | 5169 | 5634.1 | 7370.9 | 79.4 | 309,883.1 | |

| Debt cost 1 | 5169 | 0.0171 | 0.0349 | 0 | 0.4834 | |

| Smart city operation | Year 2014 as smart city | 5169 | 0.0517 | 0.2213 | 0 | 1 |

| Year 2016 as smart city | 5169 | 0.0172 | 0.1301 | 0 | 1 | |

| Year 2018 as smart city | 5169 | 0.0172 | 0.1301 | 0 | 1 | |

| ICT infrastructure | Number of information systems 3 | 5169 | 1.8806 | 6.0822 | 0 | 46 |

| Number of online services offering information 3 | 5169 | 0.7512 | 3.0370 | 0 | 24 | |

| Number of online services enabling interactions 3 | 5169 | 0.1451 | 1.2526 | 0 | 24 | |

| Number of online services enabling transactions 3 | 5169 | 0.0373 | 0.4372 | 0 | 15 | |

| Phone lines per 10,000 inhabitants 3 | 5169 | 0.0523 | 0.4532 | 0 | 12.4611 | |

| Computers per 10,000 inhabitants 3 | 5169 | 0.1713 | 0.9297 | 0 | 17.9464 | |

| Servers per 10,000 inhabitants 3 | 5169 | 0.0048 | 0.0795 | 0 | 3.3326 | |

| Social and economic contexts | Percentage of pop. with education deficiencies 4 | 2131 | 0.2206 | 0.1091 | 0 | 0.6780 |

| Percentage of pop. without health care access 4 | 2131 | 0.1491 | 0.0851 | 0 | 0.6797 | |

| Percentage of pop. without social security access 4 | 2131 | 0.6602 | 0.1946 | 0.0602 | 1 | |

| Percentage of pop. with adequate housing access 4 | 2131 | 0.1422 | 0.1385 | 0 | 0.9252 | |

| Percentage of pop. under minimum income to guarantee basic wellness 4 | 2131 | 0.5600 | 0.2159 | 0 | 1 | |

| Income per capita 4 | 2131 | 2968.5 | 2030.0 | 330.6 | 50,374.0 | |

| Percentage of pop. in poverty 4 | 2131 | 0.6165 | 0.3449 | 0.0000 | 1.8901 |

| Fixed Effects | Random Effects | ||||||

|---|---|---|---|---|---|---|---|

| Budget Balance | Own Revenues | Revenues per Capita | Spending per Capita | Debt Cost | Spending per Capita | Debt Cost | |

| Year 2014 as a smart city | 0.0439 *** | 0.0744 **** | −7.88 | −337.89 | 0.0341 **** | −346.64 | 0.0339 **** |

| Year 2016 as a smart city | −0.0511 *** | −0.0965 **** | −706.70 * | −440.55 | −0.0089 | −697.14 * | −0.0091 |

| Year 2018 as a smart city | −0.0645 **** | −0.1017 **** | −677.51 | −324.45 | −0.0085 | 72.84 | −0.0061 |

| Information systems | 0.0024 **** | 0.0029 **** | 9.40 | −1.28 | 0.0001 | −6.04 | 0.0000 |

| Online services offering information | 0.0006 | 0.0000 | 7.02 | 4.15 | 0.00001 | −4.06 | −0.0001 |

| Online services enabling interactions | 0.0027 | 0.0032 ** | 8.64 | −9.43 | 0.0007 | −16.72 | 0.0006 |

| Online services enabling transactions | 0.0189 **** | 0.0081 ** | 36.26 | −38.14 | −0.0024 | −58.74 | −0.0027 |

| Phone lines per 10,000 inhabitants. | 0.0146 * | 0.0217 **** | 249.70 | 187.32 | −0.0001 | 170.82 | −0.0003 |

| Computers per 10,000 inhabitants | 0.0081 | 0.0033 | 63.32 | 124.26 | −0.0015 | 105.67 | −0.0018 |

| Servers per 10,000 inhabitants | 0.0085 | 0.0319 | 1071.13 | 768.84 | 0.0031 | 785.20 | 0.0032 |

| Percentage of pop. w/educ. access | 0.0730 ** | 0.0294 | 579.45 | 248.03 | −0.0132 | 258.12 | −0.0129 |

| Percentage of pop. w/health care access | −0.0410 | −0.0338 | −4370.73 **** | −4497.92 **** | 0.0334 **** | −4705.58 **** | 0.0305 *** |

| Percentage of pop. w/housing access | −0.0213 | −0.0003 | 1224.47 ** | 1534.36 *** | 0.0149 * | 1401.25 *** | 0.0140 * |

| Percentage of pop. under min. income | 0.0828 *** | 0.0954 **** | −3881.45 **** | −4188.98 **** | 0.0126 | −4349.00 **** | 0.0116 |

| Income per capita | 0.000002 | 0.000002 ** | 0.22 **** | 0.20 **** | 0.000001 | 0.21 **** | 0.000001 * |

| Percentage of pop. in poverty | −0.1043 **** | −0.1058 **** | 301.39 | 741.23 | −0.0118 | 737.03 | −0.0125 |

| Percentage of pop. with no access to social security | −0.0367 * | −0.0498 **** | 2813.57 **** | 3079.17 **** | −0.0210 *** | 3328.71 **** | −0.0192 *** |

| Constant | 0.9034 **** | 0.8741 **** | 4033.27 **** | 4268.03 **** | 0.0268 **** | 4352.74 **** | 0.0291 **** |

| Number of observations (groups) | 2131 (3) | 2131 (3) | 2131 (3) | 2131 (3) | 2131 (3) | 2131 (3) | 2131 (3) |

| R2 within/between | 0.1125/0.9921 | 0.2394/0.9992 | 0.1097/0.6399 | 0.1131/0.9830 | 0.1202/0.1847 | 0.1094/0.8872 | 0.1174/0.1348 |

| F(28, 2100) (Prob. > F) | 9.54 (0.0000) | 23.61 (0.0000) | 9.24 (0.0000) | 9.57 (0.0000) | 10.25 (0.0000) | 348.34 (0.0000) | 277.22 (0.0000) |

| F(2, 2100) (Prob. > F) | 1225.4 (0.00) | 2230.0 (0.0000) | 85.82 (0.0000) | 15.86 (0.0000) | 5.13 (0.0060) | n.a. | n.a. |

| Hausman test (Prob. > Chi2(27)) | 4304.15 (0.0) | 20,951.44 (0.0) | 270.70 (0.0000) | 34.08 (0.1638) | 10.30 (0.9984) | n.a. | n.a. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Puron-Cid, G.; Gil-Garcia, J.R. Are Smart Cities Too Expensive in the Long Term? Analyzing the Effects of ICT Infrastructure on Municipal Financial Sustainability. Sustainability 2022, 14, 6055. https://doi.org/10.3390/su14106055

Puron-Cid G, Gil-Garcia JR. Are Smart Cities Too Expensive in the Long Term? Analyzing the Effects of ICT Infrastructure on Municipal Financial Sustainability. Sustainability. 2022; 14(10):6055. https://doi.org/10.3390/su14106055

Chicago/Turabian StylePuron-Cid, Gabriel, and J. Ramon Gil-Garcia. 2022. "Are Smart Cities Too Expensive in the Long Term? Analyzing the Effects of ICT Infrastructure on Municipal Financial Sustainability" Sustainability 14, no. 10: 6055. https://doi.org/10.3390/su14106055

APA StylePuron-Cid, G., & Gil-Garcia, J. R. (2022). Are Smart Cities Too Expensive in the Long Term? Analyzing the Effects of ICT Infrastructure on Municipal Financial Sustainability. Sustainability, 14(10), 6055. https://doi.org/10.3390/su14106055