A Sustainability-Based Risk Assessment for P3 Projects Using a Simulation Approach

Abstract

:1. Introduction

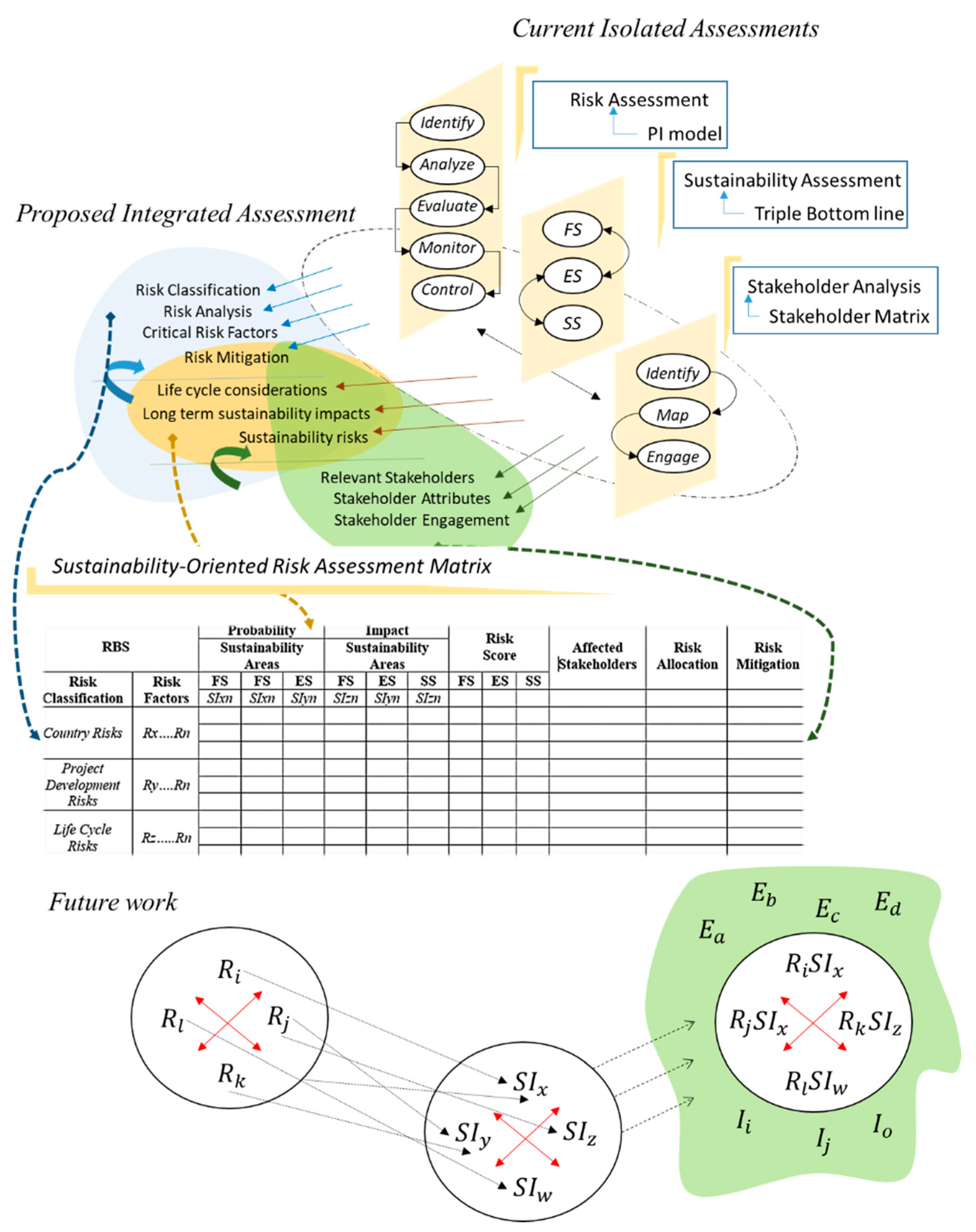

2. Integrating Risk and Sustainability for P3 Delivery

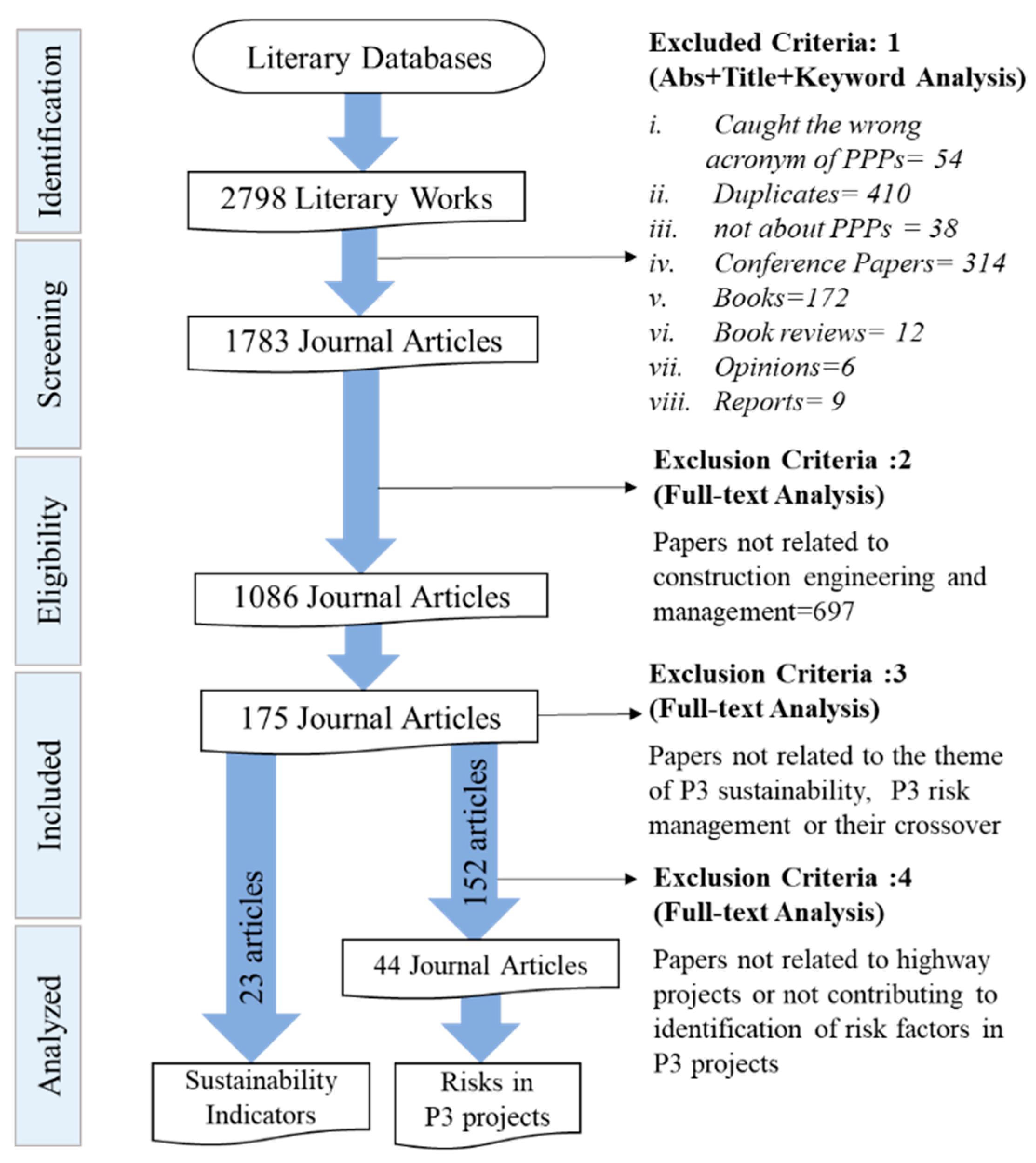

3. Selection of Sustainability Indicators and P3 Risk Factors

3.1. Sustainability Hierarchy

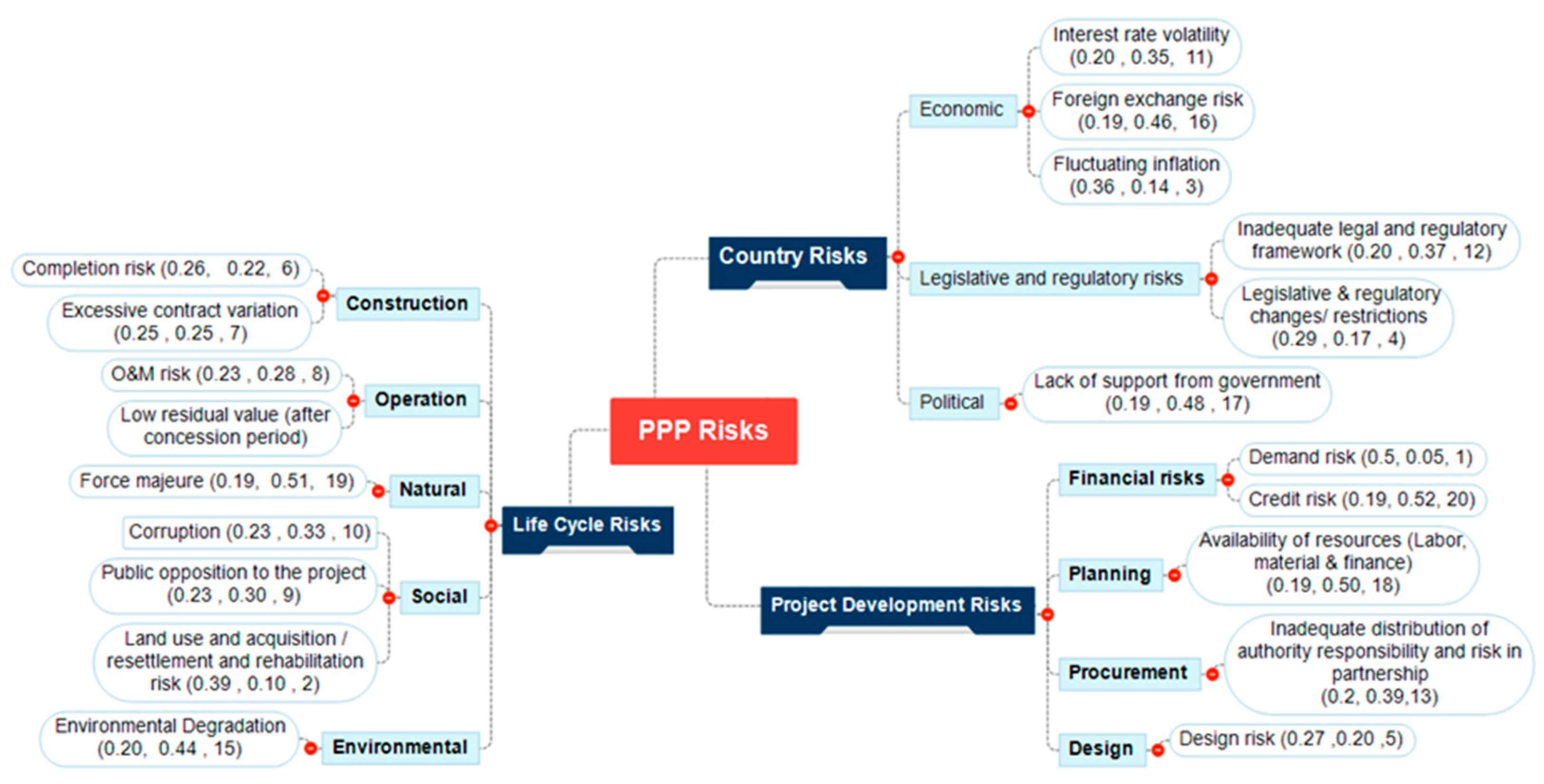

3.2. Critical Risks of P3

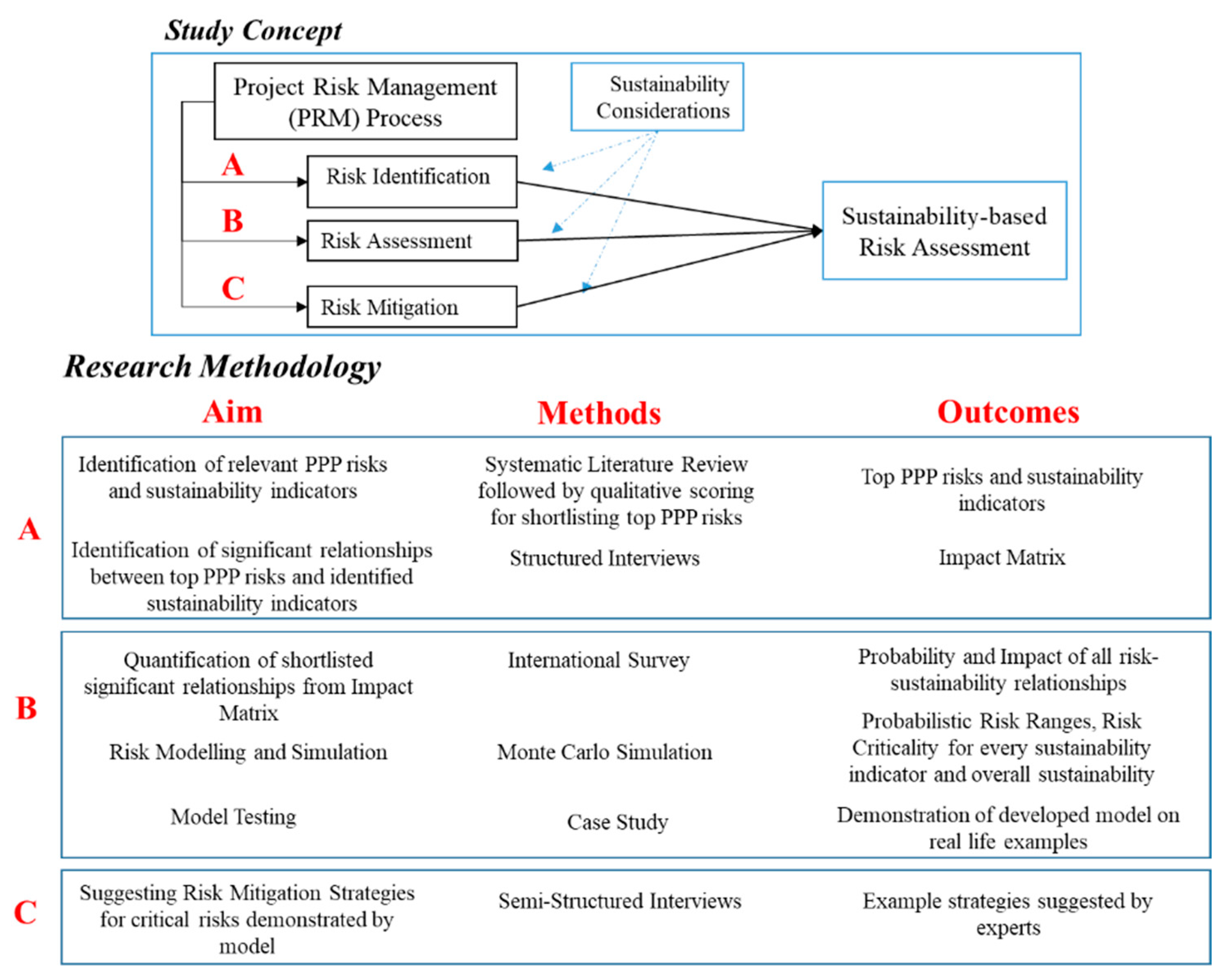

4. Research Methodology

4.1. Sustainability-Based Risk Assessment Methodology

4.2. Data Collection

4.2.1. Structured Interviews

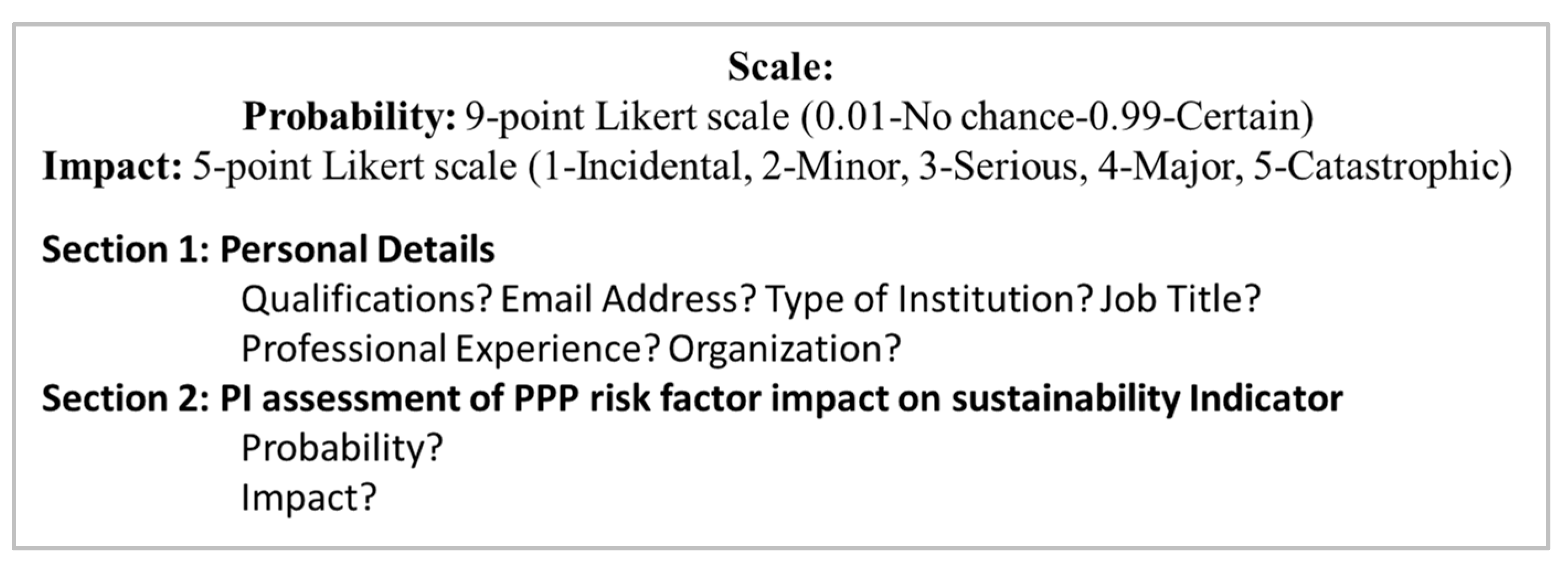

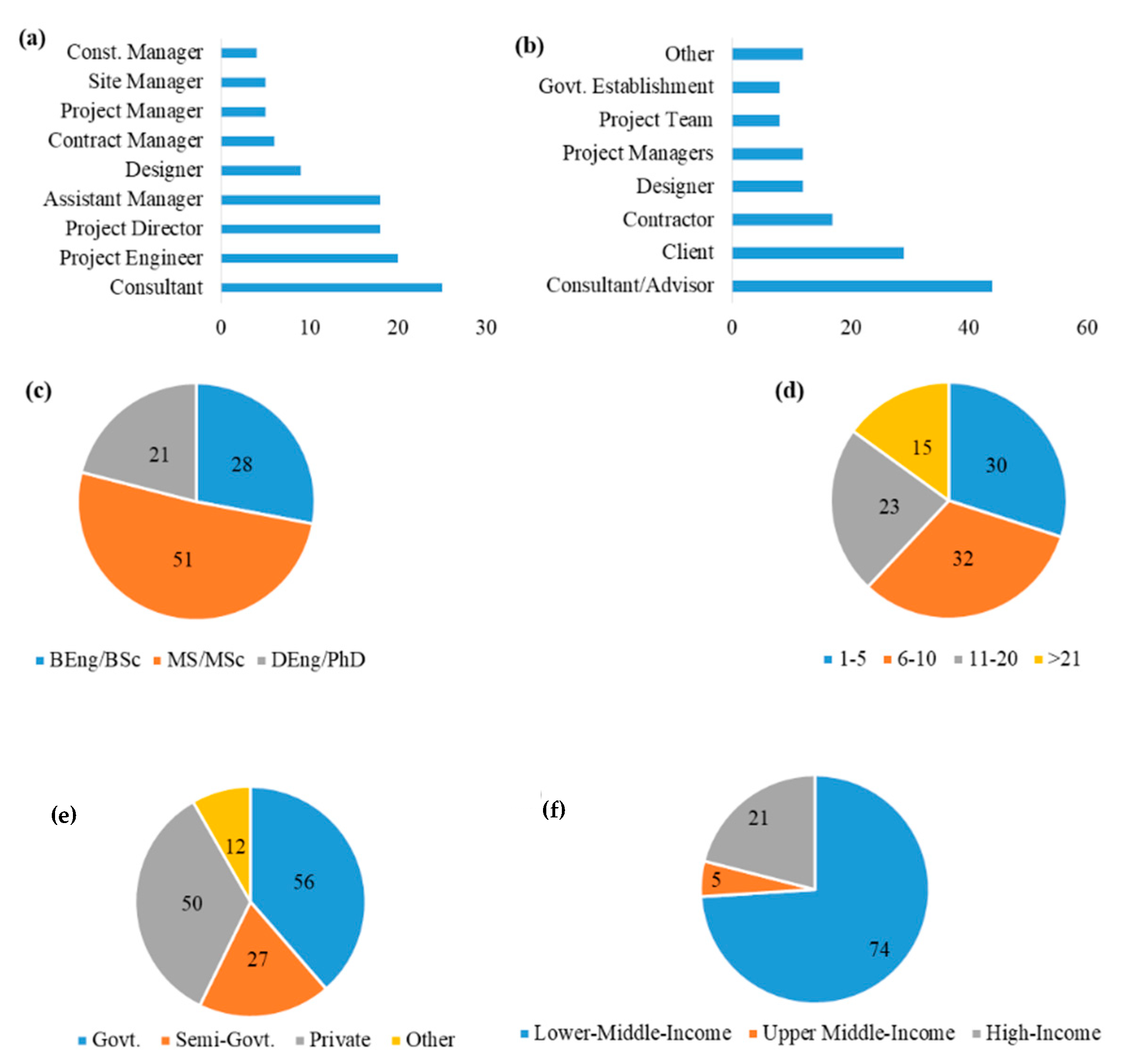

4.2.2. Questionnaire Survey

4.2.3. Semi-Structured Interviews

4.2.4. Case Study Development

5. Development and Implementation of the Model

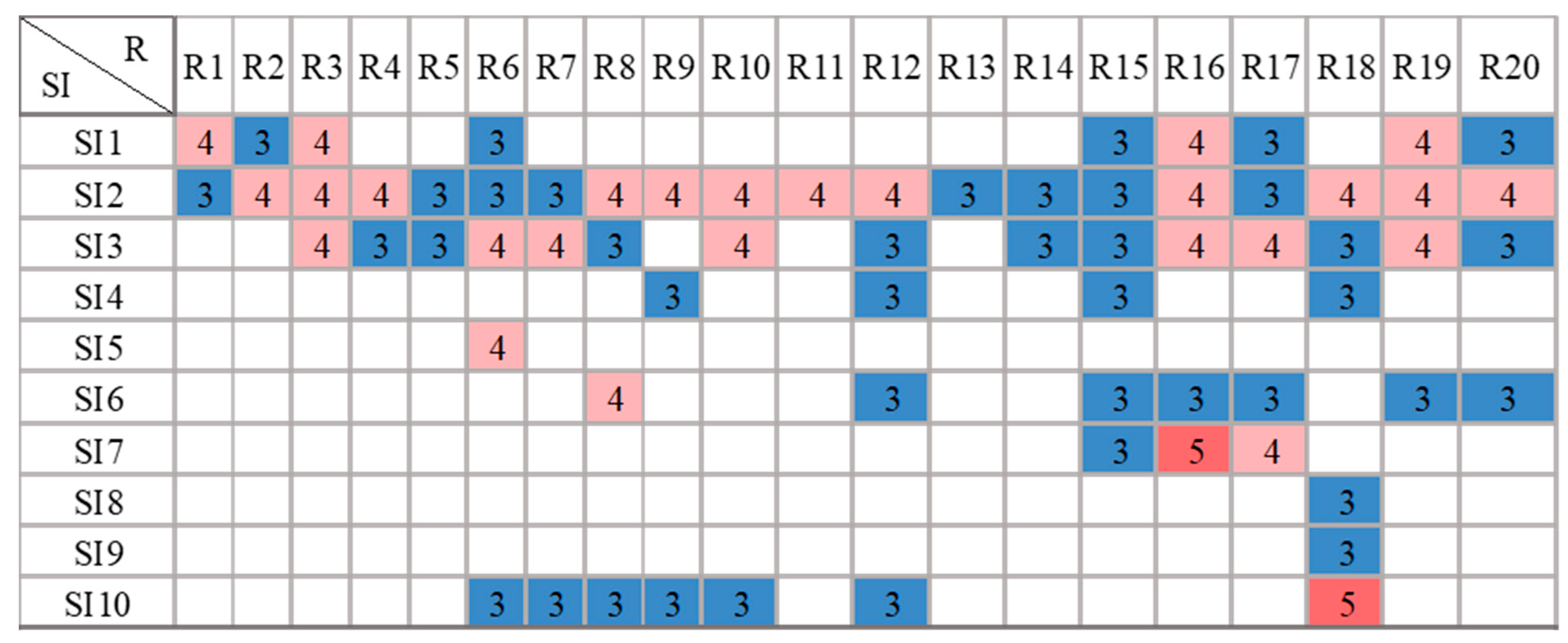

5.1. Impact Matrix for Significant Risk–Sustainability Relationships

5.2. Sustainability-Based Risk Assessment Model Development

- (1)

- All risks are threats, and all sustainability impacts are positive benefits and opportunities.

- (2)

- All risks occur independently.

- (3)

- Data is not assumed to be normally distributed.

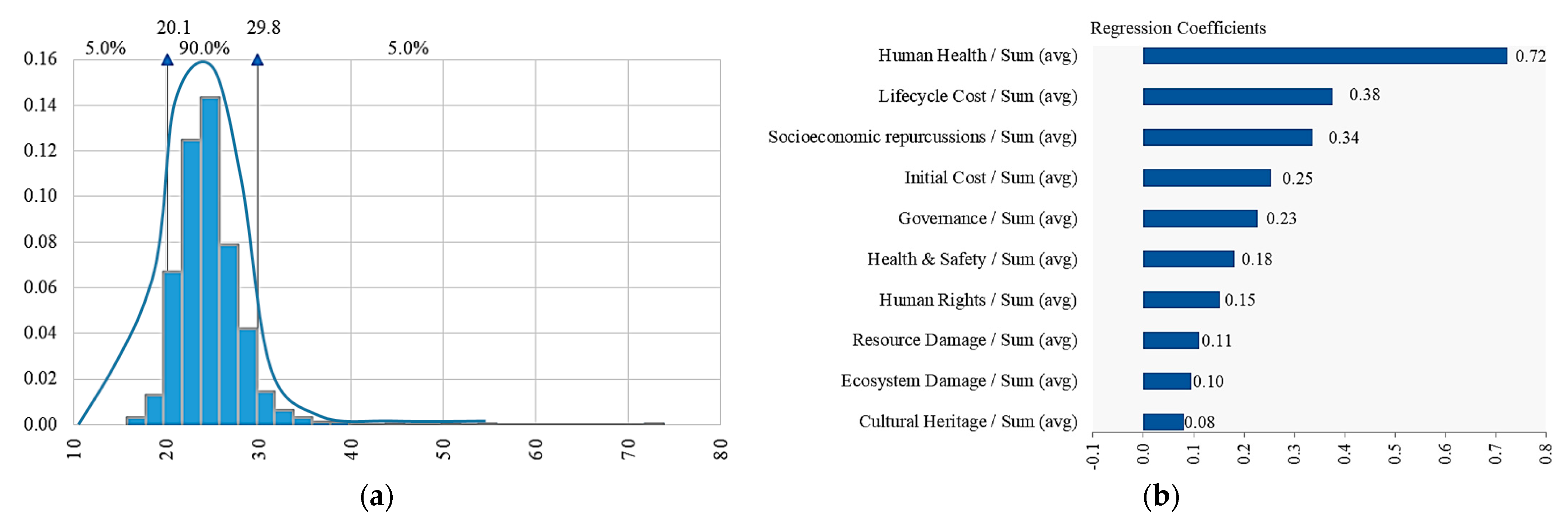

5.3. Probability-Impact Assessment

5.3.1. Statistical Characteristics of International Survey Data

5.3.2. Modeling and Simulation

6. Model Validation through Case Studies

6.1. Lahore-Islamabad Motorway Overlay and Modernization Project (M-2)

6.2. Lahore–Sialkot Motorway Project (M11)

7. Proposed Implementation Framework

8. Conclusions and Recommendations

Supplementary Materials

Author Contributions

Funding

Informed Consent Statement

Acknowledgments

Conflicts of Interest

References

- Tallaki, M.; Bracci, E. Risk allocation, transfer and management in public–private partnership and private finance initiatives: A systematic literature review. Int. J. Public Sect. Manag. 2021, 34, 709–731. [Google Scholar] [CrossRef]

- Tariq, S.; Zhang, X. Critical Analysis of the Private Sector Roles in Water PPP Failures. J. Constr. Eng. Manag. 2021, 147, 04021015. [Google Scholar] [CrossRef]

- Cheng, Z.; Wang, H.; Xiong, W.; Zhu, D.; Cheng, L. Public–private partnership as a driver of sustainable development: Toward a conceptual framework of sustainability-oriented PPP. Environ. Dev. Sustain. 2021, 23, 1043–1063. [Google Scholar] [CrossRef]

- Kumar, L.; Jindal, A.; Velaga, N.R. Financial risk assessment and modelling of PPP based Indian highway infrastructure projects. Transp. Policy 2018, 62, 2–11. [Google Scholar] [CrossRef]

- Grimsey, D.; Lewis, M. Public Private Partnerships: The Worldwide Revolution in Infrastructure Provision and Project Finance; Edward Elgar Publishing: Cheltenham, UK, 2007. [Google Scholar]

- Liu, J.; Love, P.E.D.; Sing, M.C.P.; Smith, J.; Matthews, J. PPP Social Infrastructure Procurement: Examining the Feasibility of a Lifecycle Performance Measurement Framework. J. Infrastruct. Syst. 2017, 23, 04016041. [Google Scholar] [CrossRef]

- Zou, P.X.; Wang, S.; Fang, D. A life-cycle risk management framework for PPP infrastructure projects. J. Financ. Manag. Prop. Constr. 2008, 13, 123–142. [Google Scholar] [CrossRef]

- Shrestha, A.; Chan, T.K.; Aibinu, A.A.; Chen, C.; Martek, I. Risk Allocation Inefficiencies in Chinese PPP Water Projects. J. Constr. Eng. Manag. 2018, 144, 10. [Google Scholar] [CrossRef]

- Silvius, G. Integrating sustainability into project risk management. In Global Business Expansion: Concepts, Methodologies, Tools, and Applications; IGI Global: Hershey, PA, USA, 2018; pp. 330–352. [Google Scholar]

- Yuan, J.; Li, W.; Guo, J.; Zhao, X.; Skibniewski, M.J. Social Risk Factors of Transportation PPP Projects in China: A Sustainable Development Perspective. Int. J. Environ. Res. Public Health 2018, 15, 1323. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ma, H.; Zeng, S.; Lin, H.; Zeng, R. Impact of Public Sector on Sustainability of Public–Private Partnership Projects. J. Constr. Eng. Manag. 2020, 146, 04019104. [Google Scholar] [CrossRef]

- Planning, S. Risk Management Planning, Sustainability Risks Management, and Risk Stakeholders. In Risk Management Strategies in Public-Private Partnerships; IGI Global: Hershey, PA, USA, 2017. [Google Scholar]

- Wang, Y.; Wang, Y.; Wu, X.; Li, J. Exploring the Risk Factors of Infrastructure PPP Projects for Sustainable Delivery: A Social Network Perspective. Sustainability 2020, 12, 4152. [Google Scholar] [CrossRef]

- Silvius, A.G.; Schipper, R.P. Sustainability in project management: A literature review and impact analysis. Soc. Bus. 2014, 4, 63–96. [Google Scholar] [CrossRef]

- Martens, M.L.; Carvalho, M.M. Key factors of sustainability in project management context: A survey exploring the project managers’ perspective. Int. J. Proj. Manag. 2017, 35, 1084–1102. [Google Scholar] [CrossRef]

- Aarseth, W.; Ahola, T.; Aaltonen, K.; Økland, A.; Andersen, B. Project sustainability strategies: A systematic literature review. Int. J. Proj. Manag. 2017, 35, 1071–1083. [Google Scholar] [CrossRef]

- Kivilä, J.; Martinsuo, M.; Vuorinen, L. Sustainable project management through project control in infrastructure projects. Int. J. Proj. Manag. 2017, 35, 1167–1183. [Google Scholar] [CrossRef]

- Yu, M.; Zhu, F.; Yang, X.; Wang, L.; Sun, X. Integrating Sustainability into Construction Engineering Projects: Perspective of Sustainable Project Planning. Sustainability 2018, 10, 784. [Google Scholar] [CrossRef] [Green Version]

- Anderson, D.R. The critical importance of sustainability risk management. Risk Manag. 2006, 53, 66. [Google Scholar]

- Diaz-Sarachaga, J.M.; Jato-Espino, D.; Castro-Fresno, D. Methodology for the development of a new Sustainable Infrastructure Rating System for Developing Countries (SIRSDEC). Environ. Sci. Policy 2017, 69, 65–72. [Google Scholar] [CrossRef] [Green Version]

- Shahriar, A.; Sadiq, R.; Tesfamariam, S. Risk analysis for oil & gas pipelines: A sustainability assessment approach using fuzzy based bow-tie analysis. J. Loss Prev. Process. Ind. 2012, 25, 505–523. [Google Scholar] [CrossRef]

- Qazi, A.; Shamayleh, A.; El-Sayegh, S.; Formaneck, S. Prioritizing risks in sustainable construction projects using a risk matrix-based Monte Carlo Simulation approach. Sustain. Cities Soc. 2021, 65, 102576. [Google Scholar] [CrossRef]

- Pinz, A.; Roudyani, N.; Thaler, J. Public–private partnerships as instruments to achieve sustainability-related objectives: The state of the art and a research agenda. Public Manag. Rev. 2018, 20, 1–22. [Google Scholar] [CrossRef]

- Javed, A.A.; Lam, P.T.; Chan, A.P. A model framework of output specifications for hospital PPP/PFI projects. Facilities 2013, 31, 610–633. [Google Scholar] [CrossRef]

- Fantozzi, F.; Bartocci, P.; D’Alessandro, B.; Arampatzis, S.; Manos, B. Public–private partnerships value in bioenergy projects: Economic feasibility analysis based on two case studies. Biomass Bioenergy 2014, 66, 387–397. [Google Scholar] [CrossRef]

- Patil, N.A.; Laishram, B. Public–private partnerships from sustainability perspective—A critical analysis of the Indian case. Int. J. Constr. Manag. 2016, 16, 161–174. [Google Scholar] [CrossRef]

- Atmo, G.; Duffield, C. Improving investment sustainability for PPP power projects in emerging economies: Value for money framework. Built Environ. Proj. Asset Manag. 2014, 4, 335–351. [Google Scholar] [CrossRef]

- Koppenjan, J.F. Public–Private Partnerships for green infrastructures. Tensions and challenges. Curr. Opin. Environ. Sustain. 2015, 12, 30–34. [Google Scholar] [CrossRef] [Green Version]

- Xiong, W.; Yuan, J.-F.; Li, Q.; Skibniewski, M.J. Performance objective-based dynamic adjustment model to balance the stakeholders’ satisfaction in PPP projects. J. Civ. Eng. Manag. 2015, 21, 539–547. [Google Scholar] [CrossRef]

- Love, P.; Liu, H.; Matthews, J.; Sing, C.P.; Smith, J. Future proofing PPPs: Life-cycle performance measurement and Building Information Modelling. Autom. Constr. 2015, 56, 26–35. [Google Scholar] [CrossRef]

- Agarchand, N.; Laishram, B. Sustainable infrastructure development challenges through PPP procurement process Indian perspective. Int. J. Manag. Proj. Bus. 2017, 10, 642–662. [Google Scholar] [CrossRef]

- PMI. A Guide to The Project Management Body of Knowledge (PMBOK Guide); Project Management Institute: Newton Square, PA, USA, 2017. [Google Scholar]

- Marchese, D.; Reynolds, E.; Bates, M.E.; Morgan, H.; Clark, S.S.; Linkov, I. Resilience and sustainability: Similarities and differences in environmental management applications. Sci. Total Environ. 2018, 613, 1275–1283. [Google Scholar] [CrossRef]

- Bocchini, P.; Frangopol, D.; Ummenhofer, T.; Zinke, T. Resilience and Sustainability of Civil Infrastructure: Toward a Unified Approach. J. Infrastruct. Syst. 2014, 20, 04014004. [Google Scholar] [CrossRef]

- Gray, P.; Wiedemann, P.M. Risk management and sustainable development: Mutual lessons from approaches to the use of indicators. J. Risk Res. 1999, 2, 201–218. [Google Scholar] [CrossRef]

- Park, J.; Seager, T.P.; Rao, P.S.C.; Convertino, M.; Linkov, I. Integrating Risk and Resilience Approaches to Catastrophe Management in Engineering Systems. Risk Anal. 2013, 33, 356–367. [Google Scholar] [CrossRef] [PubMed]

- Shen, L.; Tam, V.W.; Gan, L.; Ye, K.; Zhao, Z. Improving Sustainability Performance for Public-Private-Partnership (PPP) Projects. Sustainability 2016, 8, 289. [Google Scholar] [CrossRef] [Green Version]

- Heravi, G.; Hajihosseini, Z. Risk Allocation in Public–Private Partnership Infrastructure Projects in Developing Countries: Case Study of the Tehran–Chalus Toll Road. J. Infrastruct. Syst. 2012, 18, 210–217. [Google Scholar] [CrossRef]

- Ye, S.; Tiong, R.L.K. NPV-at-Risk Method in Infrastructure Project Investment Evaluation. J. Constr. Eng. Manag. 2000, 126, 227–233. [Google Scholar] [CrossRef]

- Jin, X.-H.; Doloi, H. Interpreting risk allocation mechanism in public–private partnership projects: An empirical study in a transaction cost economics perspective. Constr. Manag. Econ. 2008, 26, 707–721. [Google Scholar] [CrossRef]

- Xu, Y.; Chan, A.P.C.; Yeung, J.F.Y. Developing a Fuzzy Risk Allocation Model for PPP Projects in China. J. Constr. Eng. Manag. 2010, 136, 894–903. [Google Scholar] [CrossRef]

- Medda, F. A game theory approach for the allocation of risks in transport public private partnerships. Int. J. Proj. Manag. 2007, 25, 213–218. [Google Scholar] [CrossRef]

- Jin, X.-H.; Zhang, G. Modelling optimal risk allocation in PPP projects using artificial neural networks. Int. J. Proj. Manag. 2011, 29, 591–603. [Google Scholar] [CrossRef]

- Jin, X.-H. Model for Efficient Risk Allocation in Privately Financed Public Infrastructure Projects Using Neuro-Fuzzy Techniques. J. Constr. Eng. Manag. 2011, 137, 1003–1014. [Google Scholar] [CrossRef]

- Jin, X.-H. Neurofuzzy Decision Support System for Efficient Risk Allocation in Public-Private Partnership Infrastructure Projects. J. Comput. Civ. Eng. 2010, 24, 525–538. [Google Scholar] [CrossRef]

- Li, H.; Al-Hussein, M.; Lei, Z. Incentive genetic algorithm based time–cost trade-off analysis across a build–operate–transfer project concession period. Can. J. Civ. Eng. 2011, 38, 166–174. [Google Scholar] [CrossRef]

- Li, J.; Zou, P.X.W. Fuzzy AHP-Based Risk Assessment Methodology for PPP Projects. J. Constr. Eng. Manag. 2011, 137, 1205–1209. [Google Scholar] [CrossRef]

- Müller, A.B.; Avellán, T.; Schanze, J. Risk and sustainability assessment framework for decision support in’water scarcity–water reuse’situations. J. Hydrol. 2020, 591, 125424. [Google Scholar] [CrossRef]

- Sexton, K.; Linder, S.H. Integrated Assessment of Risk and Sustainability in the Context of Regulatory Decision Making. Environ. Sci. Technol. 2014, 48, 1409–1418. [Google Scholar] [CrossRef]

- Shiroyama, H.; Yarime, M.; Matsuo, M.; Schroeder, H.; Scholz, R.; Ulrich, A.E. Governance for sustainability: Knowledge integration and multi-actor dimensions in risk management. Sustain. Sci. 2012, 7, 45–55. [Google Scholar] [CrossRef]

- Arshad, H.; Thaheem, M.; Bakhtawar, B.; Shrestha, A. Evaluation of Road Infrastructure Projects: A Life Cycle Sustainability-Based Decision-Making Approach. Sustainability 2021, 13, 3743. [Google Scholar] [CrossRef]

- Linkov, I.; Satterstrom, F.; Kiker, G.; Batchelor, C.; Bridges, T.; Ferguson, E. From comparative risk assessment to multi-criteria decision analysis and adaptive management: Recent developments and applications. Environ. Int. 2006, 32, 1072–1093. [Google Scholar] [CrossRef]

- Akber, M.Z.; Thaheem, M.J.; Arshad, H. Life cycle sustainability assessment of electricity generation in Pakistan: Policy regime for a sustainable energy mix. Energy Policy 2017, 111, 111–126. [Google Scholar] [CrossRef]

- Patil, N.A.; Tharun, D.; Laishram, B. Infrastructure development through PPPs in India: Criteria for sustainability assessment. J. Environ. Plan. Manag. 2016, 59, 708–729. [Google Scholar] [CrossRef]

- Goedkoop, M.; Heijungs, R.; Huijbregts, M.; De Schryver, A.; Struijs, J.; Van Zelm, R. ReCiPe 2008: A Life Cycle Impact Assessment Method Which Comprises Harmonised Category Indicators at the Midpoint and the Endpoint Level. In Report I: Characterisation, 1st ed.; 2009; Volume 1, Available online: https://www.leidenuniv.nl/cml/ssp/publications/recipe_characterisation.pdf (accessed on 20 October 2021).

- Menoufi, K.; Castell, A.; Navarro, L.; Pérez, G.; Boer, D.; Cabeza, L.F. Evaluation of the environmental impact of experimental cubicles using Life Cycle Assessment: A highlight on the manufacturing phase. Appl. Energy 2012, 92, 534–544. [Google Scholar] [CrossRef]

- Benoît-Norris, C.; Vickery-Niederman, G.; Valdivia, S.; Franze, J.; Traverso, M.; Ciroth, A.; Mazijn, B. Introducing the UNEP/SETAC methodological sheets for subcategories of social LCA. Int. J. Life Cycle Assess. 2011, 16, 682–690. [Google Scholar] [CrossRef]

- Ahmad, T.; Thaheem, M.J. Developing a residential building-related social sustainability assessment framework and its implications for BIM. Sustain. Cities Soc. 2017, 28, 1–15. [Google Scholar] [CrossRef]

- Ahmad, T.; Thaheem, M.J. Economic sustainability assessment of residential buildings: A dedicated assessment framework and implications for BIM. Sustain. Cities Soc. 2018, 38, 476–491. [Google Scholar] [CrossRef]

- Fitch, G.J.; Odeh, I.; Kautz, F.; Ibbs, C.W. System Dynamics Models for the Valuation of Real Options in P3 Concession Project Agreements. J. Infrastruct. Syst. 2018, 24, 13. [Google Scholar] [CrossRef]

- Shen, L.Y.; Li, H.; Li, Q.M. Alternative Concession Model for Build Operate Transfer Contract Projects. J. Constr. Eng. Manag. 2002, 128, 326–330. [Google Scholar] [CrossRef]

- Ahmad, Z.; Thaheem, M.J.; Maqsoom, A. Building information modeling as a risk transformer: An evolutionary insight into the project uncertainty. Autom. Constr. 2018, 92, 103–119. [Google Scholar] [CrossRef]

- Ullah, F.; Ayub, B.; Siddiqui, S.Q.; Thaheem, M.J. A review of public-private partnership: Critical factors of concession period. J. Financ. Manag. Prop. Constr. 2016, 21, 269–300. [Google Scholar] [CrossRef]

- Bilal, M.; Khan, K.I.A.; Thaheem, M.J.; Nasir, A.R. Current state and barriers to the circular economy in the building sector: Towards a mitigation framework. J. Clean. Prod. 2020, 276, 123250. [Google Scholar] [CrossRef]

- Krumpal, I. Determinants of social desirability bias in sensitive surveys: A literature review. Qual. Quant. 2013, 47, 2025–2047. [Google Scholar] [CrossRef]

- Noy, C. Sampling Knowledge: The Hermeneutics of Snowball Sampling in Qualitative Research. Int. J. Soc. Res. Methodol. 2008, 11, 327–344. [Google Scholar] [CrossRef]

- Roumboutsos, A.; Anagnostopoulos, K.P. Public–private partnership projects in Greece: Risk ranking and preferred risk allocation. Constr. Manag. Econ. 2008, 26, 751–763. [Google Scholar] [CrossRef]

- Vose, D. Risk Analysis: A Quantitative Guide; John Wiley & Sons: New York, NY, USA, 2008. [Google Scholar]

- Milligan, G.W.; Cooper, M.C. A study of standardization of variables in cluster analysis. J. Classif. 1988, 5, 181–204. [Google Scholar] [CrossRef]

- Hosmer, D.W.; Lemesbow, S. Goodness of fit tests for the multiple logistic regression model. Commun. Stat. Theory Methods 1980, 9, 1043–1069. [Google Scholar] [CrossRef]

- Schmidt, R.; Voigt, M.; Mailach, R. Latin Hypercube Sampling-Based Monte Carlo Simulation: Extension of the Sample Size and Correlation Control. In Uncertainty Management for Robust Industrial Design in Aeronautics; Springer: Cham, Switzerland, 2019; pp. 279–289. [Google Scholar]

- Dillman, D. Constructing the Questionnaire. Mail and Internet Surveys; John Wiley & Sons: New York, NY, USA, 2000. [Google Scholar]

- Patrício, L.D.; Ferreira, J.J. Blockchain security research: Theorizing through bibliographic-coupling analysis. J. Adv. Manag. Res. 2020, 18, 1–35. [Google Scholar] [CrossRef]

- Tahir, H.M.; Khan, S.Y.; Arshad, M. Motorway (M 2): A Threat to the Wild Animals. Pak. J. Zool. 2013, 45, 1447–1451. [Google Scholar]

| Sustainability Area | Code | Indicators |

|---|---|---|

| Financial Sustainability (FS) | I1 | Initial cost |

| I2 | Life-cycle cost | |

| Social Sustainability (SS) | I3 | Socio-economic repercussions |

| I4 | Health and safety | |

| I5 | Cultural heritage | |

| I6 | Governance | |

| I7 | Human rights | |

| Environmental Sustainability (ES) | I8 | Resource damage |

| I9 | Ecosystem damage | |

| I10 | Human health |

| Sr. No. | Degree | Relevant Experience | Area of Expertise | Country | Background |

|---|---|---|---|---|---|

| 1 | PhD | 6 years | Sustainability Assessment | Pakistan | Academia |

| 2 | PhD | 12 years | Sustainability Assessment /Roads/P3s | Pakistan | Academia |

| 3 | MS | 8 years | Risk Management/Roads /P3s | Pakistan | Industry |

| 4 | PhD | 9 years | P3s/Risk Management | Pakistan | Academia |

| 5 | MS | 28 years | P3s/Roads/ Risk Management | Pakistan | Industry |

| Sr. No. | Relevant Experience (yrs.) | Relevant Organization | Designation in Organization |

|---|---|---|---|

| 1 | 16 | Private Sector | Manager P3 projects |

| 2 | 8 | Private Sector | Asst. Manager P3 projects |

| 3 | 15 | Public Sector | Director P3 |

| 4 | 28+ | Public Sector | General Manager P3 |

| 5 | 16 | Public Sector | Manager Planning |

| 6 | 10 | Public Sector | Deputy Director P3 |

| Project Name | M2 (Lahore-Islamabad Motorway Overlay and Modernization) | M11 (Construction of Lahore-Sialkot Motorway) |

|---|---|---|

| Budget | Approx. PKR 46 Billion | Approx. PKR 44 Billion |

| The financial mix of the project | PKR 25.78 billion from debt PKR 11.05 billion and PKR 9.18 billion from toll during construction | PKR 12.6 billion from debt PKR 6.8 billion and PKR 1.4 billion from toll during construction, and PKR 18 billion and PKR 5 billion from Govt. of Pakistan (GOP) contribution and GOP loan respectively. |

| Financial Close | December 2014 | December 2015 |

| Project Timeline | Construction period 3 years (including 6 months financial close period), Operations period 17 years (including 7 years debt repayment period) | Financial close period 6 months, Construction period 2.5 years, Operations period 22 years (including 8 years debt repayment period) |

| Length | 367 Km | 90 Km |

| Project Status | In the operations phase since 2016 | In the operations phase since 2020 |

| Expected Financial Profit to Government | NHA revenue share PKR 209 Billion GOP taxes PKR 57 billion | GOP taxes worth PKR 28.65 billion |

| Concessionaire | M/s Motorway Operation & Rehabilitation Engineering (Private) Limited—a subsidiary of M/s Frontier Works Organization (FWO), Pakistan | M/s Motorway Overlay and Rehabilitation Engineering Company (MORE)-a consortium of FWO, Bin Nadeem Associates (BNA), and Zeeruk International |

| Concession Period | 20 Years | 20 Years |

| SI | No. of Risks | Probability Distribution Statistics | Risk Ranking | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Min | Mean | Max | 5% | 95% | SD | 1 | 2 | 3 | 4 | 5 | ||

| I1 | 9 | 0.76 | 3.04 | 7 | 1.6 | 4.66 | 1.39 | R20 | R16 | R19 | R15 | R17 |

| I2 | 20 | 3.37 | 7.29 | 12.24 | 5.12 | 9.73 | 0.92 | R3 | R20 | R19 | R17 | R16 |

| I3 | 15 | 1.85 | 5.04 | 10.7 | 3.18 | 7.18 | 1.22 | R20 | R3 | R18 | R16 | R8 |

| I4 | 4 | 0.04 | 1.47 | 5.26 | 0.57 | 2.67 | 0.67 | R18 | R9 | R9 | R15 | R12 |

| I5 | 1 | 0.02 | 0.37 | 2.27 | 0.01 | 0.92 | 0.29 | R6 | R6 | |||

| I6 | 7 | 0.41 | 2.73 | 6.51 | 1.46 | 4.17 | 0.82 | R8 | R16 | R19 | R20 | R17 |

| I7 | 3 | 0.01 | 1.18 | 3.35 | 0.299 | 2.15 | 0.57 | R16 | R17 | R15 | ||

| I8 | 1 | 0.02 | 0.37 | 6.95 | 0.01 | 1.08 | 0.42 | R18 | ||||

| I9 | 1 | 0.002 | 0.45 | 1 | 0.005 | 0.99 | 0.35 | R18 | ||||

| I10 | 7 | 0.516 | 2.67 | 55.01 | 1.11 | 5.03 | 2.66 | R10 | R18 | R7 | R8 | R9 |

| TS | 15.7 | 24.6 | 73.8 | 20.1 | 28.3 | 3.67 | I10 | I2 | I3 | I1 | I6 | |

| Indicator | Regression Equations | Eq. No. |

|---|---|---|

| TS | (7) | |

| IC | (8) | |

| LCC | (9) | |

| SER | (10) | |

| H&S | (11) | |

| Gov | (12) | |

| HR | (13) | |

| HH | (14) |

| SI | Case Study 1 (M-2) | Case Study 2 (M-11) | Risk Ranges | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sum | SD | Sum | SD | Min | Mean | Max | |||||||

| IC | 6 | 0.25 | 1.39 | 0.66 | 3.96 | 5.8 | 0.25 | 1.39 | 0.66 | 3.83 | 0.76 | 3.04 | 7 |

| LCC | 13.5 | 0.38 | 0.92 | 1.52 | 20.5 | 13.9 | 0.38 | 0.92 | 1.52 | 21.1 | 3.37 | 7.29 | 12.2 |

| SER | 10.1 | 0.34 | 1.22 | 1.02 | 10.3 | 9.5 | 0.34 | 1.22 | 1.02 | 9.72 | 1.85 | 5.04 | 10.7 |

| H&S | 3.1 | 0.18 | 0.67 | 0.98 | 3.06 | 2.1 | 0.18 | 0.67 | 0.99 | 2.07 | 0.04 | 1.47 | 5.26 |

| CH | 0.7 | 0.08 | 0.29 | 1.01 | 0.71 | 0.7 | 0.08 | 0.29 | 1.01 | 0.71 | 0.02 | 0.37 | 2.27 |

| GN | 5 | 0.23 | 0.82 | 1.03 | 5.15 | 4.4 | 0.23 | 0.82 | 1.03 | 4.52 | 0.41 | 2.73 | 6.51 |

| HR | 2 | 0.15 | 0.57 | 0.97 | 1.93 | 2 | 0.15 | 0.57 | 0.97 | 1.93 | 0.01 | 1.18 | 3.35 |

| RD | 0.9 | 0.11 | 0.42 | 0.96 | 0.87 | 0.5 | 0.11 | 0.42 | 0.96 | 0.48 | 0.02 | 0.37 | 6.95 |

| ED | 0.9 | 0.1 | 0.35 | 1.05 | 0.94 | 0.5 | 0.1 | 0.35 | 1.05 | 0.52 | 0.002 | 0.45 | 1 |

| HH | 5.2 | 0.72 | 2.66 | 0.99 | 5.17 | 4.4 | 0.72 | 2.66 | 0.99 | 4.37 | 0.52 | 2.67 | 55.01 |

| TS | 48 | - | 3.67 | - | 50.3 | 42 | - | 3.67 | - | 43.4 | 15.7 | 24.6 | 73.8 |

| Risk Relevant to Project | Relevant Sustainability Indicator | Suggested Mitigations |

|---|---|---|

| Accident due to negligence and poor workmanship | Health and Safety (H&S) | S1-Performance monitoring and procedural control system over project life-cycle S2-Design adherence to safety standards S3-Design requirements for access to people and animals |

| Corruption | Human Rights (HR) | S4-Strong accountability system |

| Frequent toll changes and public opposition | Governance (GOV) | S5-Translation of organizational experiences into policy procedures |

| Cultural Heritage (CH) | S6-Guarantee on toll rate S7-Additional revenue streams S8-Better relationship management with the local community and government | |

| Lack of confidence in local resources | Ecological Damage (ED) | E1-Recycle and reuse waste material (asphalt) E2-Proper hydrological studies before design |

| Human Health Damage (HH) | E3-Environment and safety controls/Strict EPA criteria | |

| Availability of resources | Life Cycle Cost-(LCC) | F1-Innovative design techniques F2-Alternative construction techniques or resources locally available F3-Appointing QA/QC inspector |

| Air Pollution and Risk of raised soil toxins | Ecological Damage (ED) | E4-Environmental monitoring over life-cycle |

| Resource Damage (RD) | E5-Implementation and safeguard of environmental policies E6-Appointing environmental specialists in the project team E7-Tree plantation E8-Selection of environment-friendly materials |

| Risk Relevant to Project | Relevant Sustainability Indicator | Suggested Mitigations |

|---|---|---|

| Financial Risk | Initial Cost (IC) | F1-Prioritization of projects with lesser political risks F2-Government investment to ensure support (VGF) F3-Selection of the appropriate P3 model F4-Appointing financial experts |

| Unsafe Roads | Health and Safety (H&S) | S1-Performance monitoring and procedural control system over project life-cycle S2-Design innovation (use of intelligent transportation system) S3-Design adherence to safety standards S4-Road Surveillance at night S5-Emergency response service dedicated to every road section with clear roles and responsibility structure |

| Lack of sufficient petrol stations and rest areas causing social disapproval | Socio-Economic Risk (SER) | S6-Public feedback mechanisms S7-Conducting detailed socio-economic impact assessment |

| Health and Safety (H&S) | S8-Design requirements for managing access and estimating user requirements properly | |

| Hurting Public Sentiment | Cultural Heritage (CH) | S7-Conducting detailed socio-economic impact assessment S9-Better relationship management with the local community and government S10-Considering social factors in selecting road alignment |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bakhtawar, B.; Thaheem, M.J.; Arshad, H.; Tariq, S.; Mazher, K.M.; Zayed, T.; Akhtar, N. A Sustainability-Based Risk Assessment for P3 Projects Using a Simulation Approach. Sustainability 2022, 14, 344. https://doi.org/10.3390/su14010344

Bakhtawar B, Thaheem MJ, Arshad H, Tariq S, Mazher KM, Zayed T, Akhtar N. A Sustainability-Based Risk Assessment for P3 Projects Using a Simulation Approach. Sustainability. 2022; 14(1):344. https://doi.org/10.3390/su14010344

Chicago/Turabian StyleBakhtawar, Beenish, Muhammad Jamaluddin Thaheem, Husnain Arshad, Salman Tariq, Khwaja Mateen Mazher, Tarek Zayed, and Naheed Akhtar. 2022. "A Sustainability-Based Risk Assessment for P3 Projects Using a Simulation Approach" Sustainability 14, no. 1: 344. https://doi.org/10.3390/su14010344

APA StyleBakhtawar, B., Thaheem, M. J., Arshad, H., Tariq, S., Mazher, K. M., Zayed, T., & Akhtar, N. (2022). A Sustainability-Based Risk Assessment for P3 Projects Using a Simulation Approach. Sustainability, 14(1), 344. https://doi.org/10.3390/su14010344