1. Introduction

Technological developments occur rapidly along with the industry 4.0 trend. Current technologies have succeeded in influencing people’s lifestyles, one of which is a transaction payment mechanism. Financial activities using chip-based electronic money have begun to occur in the community. Chip-based electronic money is expected to process payments faster and easier than conventional systems [

1,

2]. It is expected to be used by all levels of society but it has not been evenly distributed among Indonesian people as consumers. Consumer behavior towards payment instruments has various characteristics and is influenced by several factors inside and outside the community including financial literacy, practicality, and lifestyle [

3,

4,

5].

Financial literacy is one of the important things in the payment transaction process. Consumers with good financial literacy can choose effective and more profitable payment methods based on their respective financial considerations [

6,

7,

8]. Then, lifestyle is a pattern of life that is expressed in activities, interests, and opinions so that it becomes a routine. Lifestyle can be a reflection of consumption behavior, for example, a modern lifestyle will increase habits to be active in using technology products, including financial problems [

9,

10,

11]. Another factor is practicality, in the sense that the element of practicality on payment instruments has an important effect on people’s consumption behavior. There is a tendency to choose activities that are more practical in all community activities. Based on these three factors, chip-based electronic money can influence the people’s interest in using payment instruments [

4,

12,

13].

Several studies have been conducted on the use of electronic money and consumer interest factors. For example, Ramadhani and Nugroho (2019) [

14] analyzed the effect of electronic money on the amount of money circulating in Indonesia. The trend of electronic money in society has a significant effect on money circulation but has no significant effect on the inflation rate. Furthermore, Lim et al. (2019) [

15] conducted a study of behavioral interest in using electronic wallet transactions (e-wallet) through the Quick Response (QR) code among millennials by using the theory of acceptance and integrated use of the technology model. The literature study suggests five variables, namely facility conditions, effort expectations, performance expectations, social influence, and behavioral interest in the use of e-wallet transactions using QR codes. Similar studies were also conducted by Foon and Fah (2011) [

16] and Padashetty and Krishna (2013) [

17]. Igamo and Falianty (2018) [

18] examined aspects of the development of non-cash payment instruments, especially electronic money in Indonesia, using secondary data obtained from the Central Bureau of Statistics and Bank Indonesia. The use of electronic money for a financial transaction payment has an advantage that affects other payment instruments using an analysis of the Vector Error Correction Model (VECM). The results show that electronic money can increase private consumption spending as a measure of efficiency. Similar studies have also been carried out by Archana (2012) [

19] and Dash (2014) [

20].

Furthermore, Mensah and Jumah (2021) [

21] analyzed the use of electronic money and consumer spending behavior. An increase in spending affects the behavior of consumers who use electronic money significantly. Income and expenses also affect the use of electronic money. A similar analysis has also been carried out by Jack and Suri (2014) [

22]; Jack et al. (2010) [

23], and Robb & Woodyard (2011) [

24]. Yucha et al. (2020) [

25] conducted a comparative analysis between cash and digital payment systems regarding changes in consumer buying behavior towards goods. The result is that cash payments are quite dominant, but there is an increase in the percentage of digital payments in the online market. Such research has also been carried out by AL-Rawashdeh et al. (2012) [

26] and Govender et al. (2012) [

27]. Then Yang, et al. (2021) [

28] conducted an exploratory study on the effects of usability, ease of use, social influence, amenities, lifestyle compatibility, and trust on interest in using e-wallet. The study used a quantitative approach with a cross-sectional research design, and data were obtained from 501 respondents through Google Form. Data analysis was performed using partial least square structural equation modeling (PLS-SEM). The analysis results show that perceived benefits, ease of use, social influence, lifestyle, and trust have a significant positive effect on interest in using e-wallet. A similar analysis was also carried out by Gerrans et al. (2013) [

29]. Mondego and Gide (2020) [

30] conducted a study to identify more deeply the factors that influence consumer confidence in the mobile payment system (MPS) in Australia. The study used a quantitative approach based on data from a questionnaire survey of 200 respondents. Data analysis was performed using Partial Least Square Structural Equation Modeling (PLS-SEM). The analysis results show that behavioral and organizational factors have a significant effect on consumer trust, so they have an effect on the MPS system. However, the analysis results also show that technology, government, and personal factors have no significant effect on consumer confidence, and therefore they have no effect on the MPS system. Zhou (2021) [

31] and Lipscomb et al. (2018) [

32] also conducted a similar study.

Khatimah et al. (2019) [

33] conducted a study to examine the correlation between consumer motivation to shop and social influence on interest in using electronic money as a means of payment. The data analyzed is the result of a survey of 249 respondents using e-money in Indonesia. Data analysis was performed using Partial Least Square Structural Equation Model (PLS-SEM). The analysis results show that consumers’ motivation to shop and social influences significantly affect the interest in using electronic money to pay.

Based on the description above, the research in this paper was carried out by referring to Yang, et al. (2021) [

28], Mondego and Gide (2020) [

30], and Khatimah et al. (2019) [

33], although their research did not specifically analyze the factors that influence financial literacy, practicality, and consumer lifestyle on the use of electronic money. Therefore, this paper intends to analyze the effect of financial literacy, practicality, and consumer lifestyle on the use of chip-based electronic money. The objective of this study is to identify to what extent the level of financial literacy, practicality, and consumer lifestyle can affect the use of chip-based electronic money. In this paper, the use of chip-based electronic money is analyzed using Structural Equation Modeling (SEM). It is a multivariate analysis method that can be used to describe the simultaneous linear relationship between the indicator observation variables and variables that cannot be directly measured by latent variables. The study results can be applied to increase the use of chip-based electronic money or the application of digital financial education programs from the government for the people of Indonesia by knowing the behavior of consumer interest in chip-based electronic money.

4. Result and Discussion

4.1. Model Measurement

The model is measured by testing the validity and reliability of the indicators forming the construct of the model. Validity testing begins with convergent validity with loading factor and AVE parameters, then discriminant validity begins with cross-loading parameters, while reliability testing begins with Cronbach alpha and composite reliability parameters.

4.1.1. Convergent Validity

A validity test is used to measure the validity or validity of a questionnaire. The convergent validity test aims to assess the correlation between the indicators used in a construct. Convergent validity conditions are met if the indicators used in the same construct are correlated with each other. In this study, the data used were obtained from a questionnaire with a total of 550 respondents. The data were used as input to test the validity of the indicators contained in the SEM model. SmartPLS 3.0 software was used to facilitate data processing.

Table 4 shows the results of testing the convergent validity of the SEM model of this study.

From

Table 4, all loading values of the indicators used are >0.6. Thus, it can be concluded that all indicators have met one of the requirements of convergent validity. The requirements for loading factor >0.6 that meet the criteria for exploratory research are shown in

Table 5.

From

Table 5, all AVE values are greater than the minimum required AVE value (>0.5). This shows that the data in this study has met the two conditions for convergent validity.

4.1.2. Discriminant Validity

The discriminant validity test aims to see the correlation between indicators in one construct with indicators from other constructs. Discriminant validity criteria are met if the indicators from different constructs are not correlated. This is tested with the criterion of the value of the measured construct indicator loading being greater than loading to other constructs or having a low cross-loading value. The SmartPLS 3.0 software shows the cross-loading parameter values of the indicators used in this study as shown in the

Table 6.

Based on the parameter values in

Table 6, all cross-loading values of the indicators used are not greater than the loading value to the construct. In this case, the loading value is labeled in yellow. Therefore, in this test it meets the criteria of discriminant validity.

4.1.3. Reliability

A reliability test is used to assess the consistency and reliability of an indicator in measuring a construct. In this study, reliability was tested using Cronbach’s alpha and composite reliability approaches, with criteria for Cronbach’s alpha and composite reliability >0.6 for exploratory research. SmartPLS 3.0 software is used to test the reliability of the SEM model under study.

Table 7 shows the composite reliability parameter value of the model.

Based on the results of

Table 7, all construct variables in this study have a composite reliability value that is greater than the minimum required value of 0.6. This shows that the variables in this study have met one of the requirements for the reliability of the Cronbach Alpha parameter value in

Table 8.

Based on the values in

Table 8, all construct variables have Cronbach alpha values greater than 0.6. Thus, it has exceeded the minimum value required for the Cronbach alpha parameter criteria. This shows that the variables in this study have met both reliability requirements

The results of the overall measurement model with three test parameters have met the test criteria. Fulfillment of model measurement criteria with validity and reliability parameters shows that the indicator variables used have good accuracy, consistency, and accuracy in measuring each construct in this study.

4.2. Evaluation of Structural Model

Evaluation of the structural model is done by looking at the R-Square value for each dependent variable as the predictive power of the structural model. In this case, changes in the value of R-Square can indicate certain latent variables that have a substantive effect on the dependent variable. In addition, the evaluation is done by assessing the level of significance through the bootstrapping procedure.

4.2.1. R-Square Value

The R-square of the latent variable is one of the measures used to assess the predictive power of the structural model. The R-square value talks about the percentage of variance of a variable in the model that is explained by other variables in the same model. R-squares values of 0.75, 0.50 and 0.25 can be used to conclude whether a model can be categorized as a strong, moderate, or weak model.

Table 9 shows the R-Square value of the latent variables contained in the SEM model.

From

Table 9, it can be seen that there are three R-square values in this study. Each R-Square value represents an indicator variable, each variable has different characteristics. The characteristics of these variables, namely:

- (1)

The R-square value of the Lifestyle variable is 0.508 or moderate. This shows that the variance of the Lifestyle variable can be explained by the variables in the model by 50.8% and the rest is explained by other variables outside the model.

- (2)

The R-square value of the Chip-Based Electronic Money Usage variable is 0.681 or is classified as strong. This shows that the variance of the Electronic Money Usage variable can be explained by the variables in the model by 68.1% and the rest is explained by other variables outside the model.

- (3)

The R-square value of the Practicality variable is 0.268 or classified as weak. This shows that the variance of the Practicality variable can be explained by the variables in the model by 26.8% and the rest is explained by other variables outside the model.

4.2.2. Significance Level

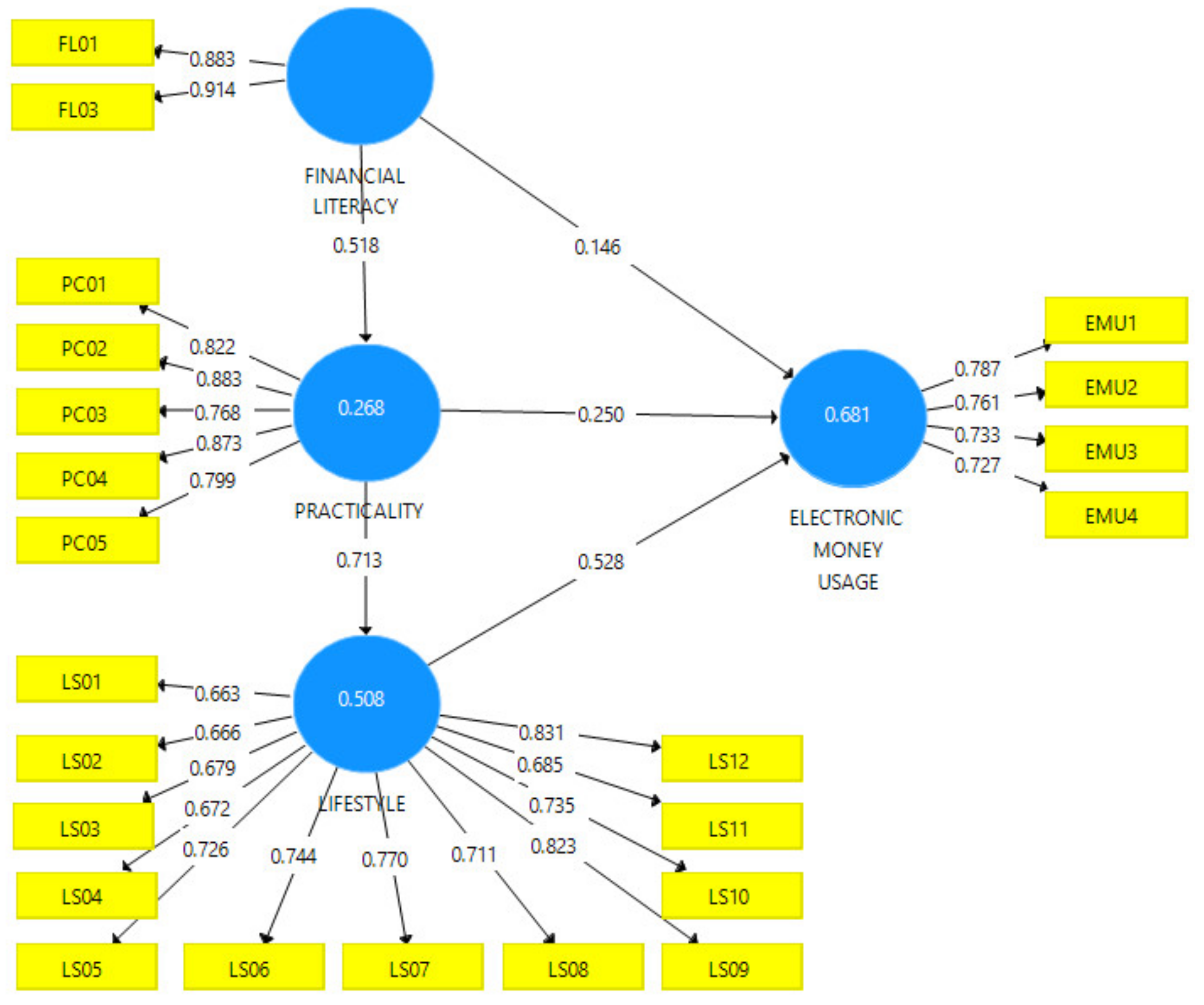

The final test of the evaluation of the structural model is done by looking at the level of significance through the bootstrapping procedure. The criterion for the significance value used is 5%. Before interpreting the significance test results, the output of the PLS algorithm and bootstrapping will first be displayed. The PLS algorithm output is used to see the magnitude of the path coefficient values between latent variables. In contrast, the bootstrapping output is used to see the magnitude of the t-statistical significance value. The following shows the output of the PLS algorithm and SEM bootstrapping using SmartPLS 3.0, as shown in

Figure 2.

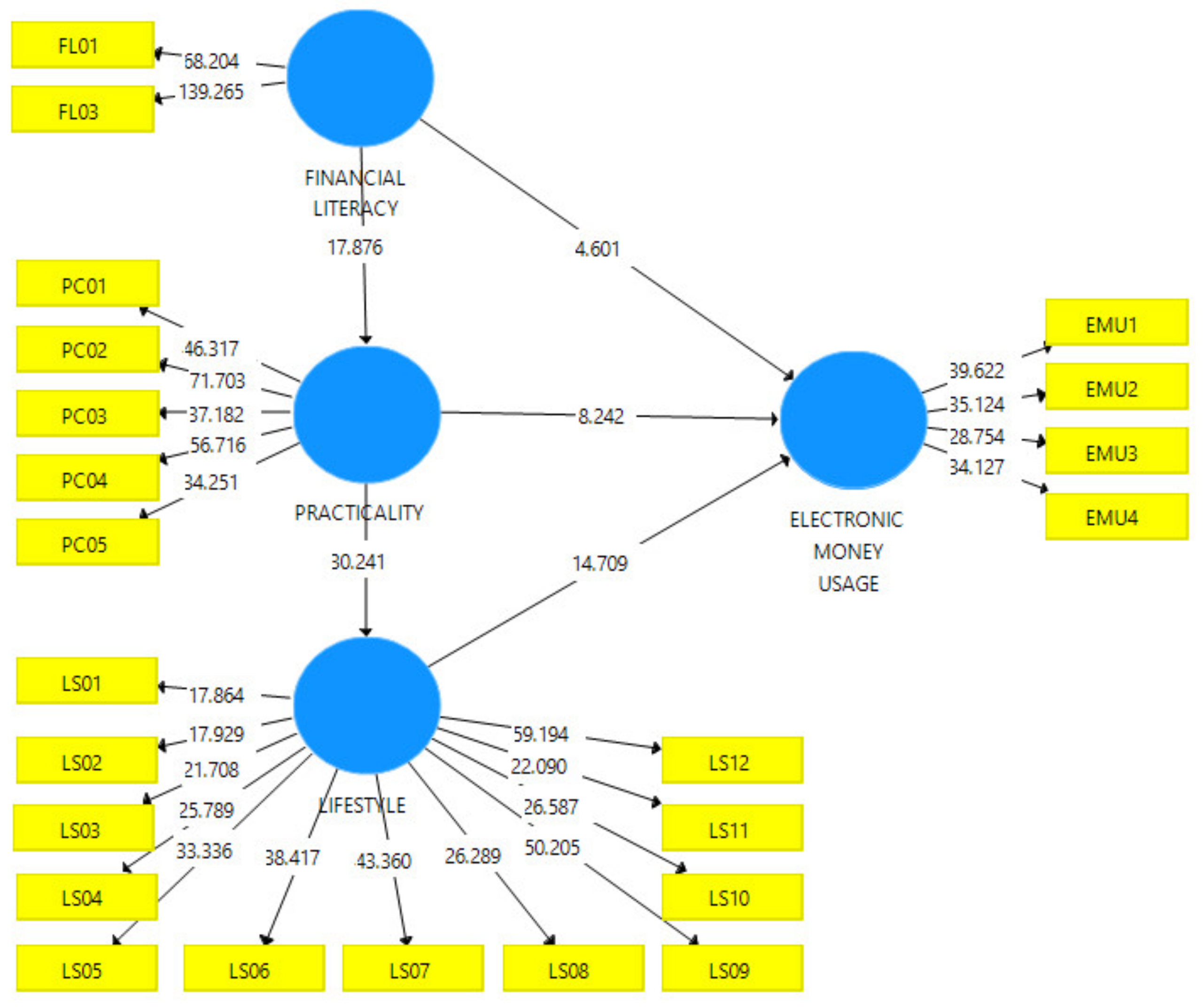

Figure 2 shows the magnitude of the path coefficient for each latent variable. Furthermore, the significance value can be seen through the bootstrap results given in

Figure 3.

Figure 3 shows the magnitude of the t-statistic value of the relationship of each latent variable. In

Figure 2 and

Figure 3, you can see the magnitude of the path coefficient value and the t-statistic value, but for a clearer analysis, it will be shown in

Table 10 and continued with hypothesis testing.

Based on the values of the path coefficient and

p-value given in

Table 10, it can be explained that:

Lifestyle towards Chip-Based Electronic Money Usage

Hypothesis 1 (H1). Lifestyle has a positive effect on Chip-Based Electronic Money Usage;

Based on the table, the p-value is 0.000, and the path coefficient is 0.528. Because p-value < 0.05, then H1 is accepted. Thus, Lifestyle has a positive effect on Chip-Based Electronic Money Usage.

Hypothesis 2 (H2). Financial Literacy has a positive effect on Chip-Based Electronic Money Usage;

Based on the table, the p-value is 0.000, and the path coefficient is 0.146. Because p-value < 0.05, then H2 is accepted. Thus, Financial Literacy has a positive effect on Chip-Based Electronic Money Usage.

- 2.

Practicality of Chip-Based Electronic Money Usage

Hypothesis 3 (H3). Practicality has a positive effect on Chip-Based Electronic Money Usage;

Based on the table, the p-value is 0.000, and the path coefficient is 0.25. Because p-value < 0.05, then H3 is accepted. Thus, Practicality has a positive effect on Chip-Based Electronic Money Usage.

- 3.

Financial Literacy on Practicality

Hypothesis 4 (H4). Financial Literacy has a positive effect on Practicality;

Based on the table, the p-value is 0.000, and the path coefficient is 0.518. Because p-value < 0.05, then H4 is accepted. Thus, Financial Literacy has a positive effect on practicality.

- 4.

Practicality to Lifestyle

Hypothesis 5 (H5). Practicality has a positive effect on Lifestyle;

Based on the table, the p-value is 0.000, and the path coefficient is 0.713. Because p-value < 0.05, then H5 is accepted. So, practicality has a positive effect on Lifestyle.

4.3. Mediation Effect Test

The mediation effect test aims to see the relationship between the independent and dependent variables through the connecting variable. This means that the influence of the independent variable on the dependent variable can occur directly and through the connecting variable or the media. The results of the mediation effect test can be seen in

Table 11 with the size of the

p-value, t-statistics, and the indirect effect value, as follows.

Based on the values of the mediating effect test results given in

Table 11, it can be explained that:

- (1)

Financial Literacy on Lifestyle through Practicality

Hypothesis 6 (H6). Financial Literacy affects Lifestyle through Practicality;

Based on the table, the p-value is 0.000, and the indirect effect is 0.369. This means that H6 is accepted, or Financial Literacy mediation model on Lifestyle through Practicality is accepted. Financial Literacy on Chip-Based Electronic Money Usage.

- (2)

Financial Literacy on Chip-Based Electronic Money Usage through Practicality and Lifestyle

Hypothesis 7 (H7). Financial Literacy affects Chip-Based Electronic Money Usage through Practicality and Lifestyle;

Based on the table, the p-value is 0.000, and the indirect effect is 0.195. This means that H7 is accepted, or the Financial Literacy mediation model on Chip-Based Electronic Money Usage through Practicality and Lifestyle is accepted.

- (3)

Financial Literacy on Chip-Based Electronic Money Usage through Practicality

Hypothesis 8 (H8). Financial Literacy affects Chip-Based Electronic Money Usage through Practicality;

Based on the table, the p-value is 0.000, and the indirect effect is 0.13. This means that H8 is accepted, or the Financial Literacy mediation model has an effect on Chip-Based Electronic Money Usage through accepted Practicality.

- (4)

Practicality of Chip-Based Electronic Money Usage through Lifestyle

Hypothesis 9 (H9). Practicality affects Chip-Based Electronic Money Usage through Lifestyle;

Based on the table, the p-value is 0.000, and the indirect effect is 0.376. This means that H9 is accepted, or the Practicality mediation model has an effect on Chip-Based Electronic Money Usage through Lifestyle is accepted.

5. Discussion

The analysis results can be used as a basis for discussion as follows:

Financial literacy has a significant positive effect on the interest in using chip-based electronic money. This means that the wider the person’s financial literacy, the higher the interest in using electronic money. This can be assumed because the wider the person’s financial literacy, the more likely that person will use technology that helps financial activities, i.e., chip-based electronic money.

Financial literacy has a significant positive effect on practicality in the use of chip-based electronic money. This means that the richer the understanding of a person’s financial literacy, the easier it is for that person to use chip-based electronic money. This can be assumed because if someone understands good financial literacy, someone will be easier to use chip-based electronic money which is basically practical. Thus, the practicality of access to chip-based electronic money is easy and not hampered.

Practicality in the use of chip-based electronic money has a significant positive effect on consumers’ lifestyles. This means that the existence of practical value in the use of chip-based electronic money affects consumer behavior in their financial lifestyle. This can be assumed because the practical value offered by chip-based electronic money allows consumers to prefer chip-based electronic money in transactions. Thus, it can shape the lifestyle of consumers who tend to prioritize chip-based electronic money for financial transactions.

Practicality has a significant positive effect on the use of chip-based electronic money. This means that the greater the value of practicality offered, the greater the person’s desire to use chip-based electronic money. This can be assumed because the easier and more practical the form of the product offered, the greater the person’s desire to use the product.

Consumer lifestyle has a significant positive effect on the use of chip-based electronic money. This means that the more advanced the person’s lifestyle makes the desire to use chip-based electronic money increases. In this study, it can be assumed that the more modern the person’s lifestyle is, it directly allows consumers to access the latest technology, one of which is chip-based electronic money. Thus, in this case, the lifestyle will affect the payment instrument chosen for transactions.

6. Conclusions

In this paper, research has been conducted on the analysis of the effect of financial literacy, practicality, and consumer lifestyle on the use of chip-based electronic money using the Structural Equation Model (SEM). Based on the analysis results, it can be concluded that the factors of financial literacy, practicality, and consumer lifestyle have a positive effect on the use of chip-based electronic money. The analysis results show that: (a) Financial literacy has a significant positive effect on interest in using chip-based electronic money with a path coefficient value of 14.8%; (b) Financial literacy has a significant positive effect on practicality in the use of chip-based electronic money with a path coefficient value of 51.2%; (c) Practicality in the use of electronic money has a significant positive effect on consumers’ lifestyles with a path coefficient value of 71.9%; (d) Practicality has a significant positive effect on the use of chip-based electronic money with a path coefficient value of 25.7%; and (e) Consumer lifestyle has a positive effect on the use of chip-based electronic money with a path coefficient value of 51.9%.

In this paper, the analysis of the effect of financial literacy, practicality, and consumer lifestyle on the use of chip-based electronic money only considers three influential factors. For further research, it is recommended for researchers to consider other factors which are more comprehensive.