Abstract

The ICT sector has been recognized as a sector with great potential for the growth and development of the economy of the Republic of Serbia. This initiated the need to analyze the strategic aspect of the ICT sector intellectual capital concept. The purpose of the paper is to empirically test the impact of intellectual capital on business performance within the ICT sector. The research was conducted on a sample of 611 employees in ICT sector companies in the Republic of Serbia. The partial least squares method was used to model the structural equations for analysis of the primary data and testing of the hypotheses. The findings show a positive and statistically significant relationship between individual components of intellectual capital and the business performance of ICT companies, which confirms the hypotheses. Human capital proved to have the strongest influence on the business performance of ICT companies. This paper provides new scientific knowledge which can contribute to creating long-term strategies that shall focus on more sophisticated management of intellectual capital, compared to the traditional tasks of allocating resources of the organization. The findings may be of interest to other sectors stakeholders to provide deeper understanding on intellectual capital as an essential source of companies’ competitive advantage that can positively impact business performance.

1. Introduction

The notion of a new economy is connected to the strengthening of globalization trends and the rising importance of information and communication technologies where knowledge, intellectual property, information and experience are the most important assets [1]. In modern business conditions in extremely demanding markets, the information and communication technology sector is gaining an increasingly important role. The ICT sector has a great importance for countries’ economic growth, within the concept of the New Economy that is based on knowledge, high technology, developed infrastructure and innovations [2]. The business activities of such companies are increasingly focused on the possibilities of development and implementation of information and communication technologies in the business process, implementing “smart solutions”, provided by ICT companies in other industries [3]. In the last decade, the ICT sector has become one of the most dynamic sectors in the Republic of Serbia. In the period from 2010 to 2020, the Republic of Serbia recorded the highest employment growth (14.21%) in this sector [4] (pp. 11–12). According to the National Bank of Serbia [5], in the last five years, the export of ICT services has shown a growth of over 20% per year. The profitability index is six times higher in the ICT sector in relation to the average profitability index for the entire economy [6] (p. 87). In 2018, 2349 ICT companies operated in the Republic of Serbia with an annual turnover of one million dinars. Most of these were software companies (1483) which account for 63% of the total number. If we look at the size of programming companies, the total number of ICT companies is dominated by micro companies (less than 10 employees), of which there were 1086 (73.2%), small companies, 322 (21.7%), medium-sized companies, 68 (4.6%) and 7 large companies (0.5%), where there are more than 250 employees [6] (p. 72). In the first eight months of 2019, 229 programming companies were established, but in order for micro companies to grow into larger organizations, the most successful domestic companies need more than 10 years on average [7]. The analysis of Serbian exports of computer services in the period from 2007 to 2018 shows that export in 2007 was 62 million euros, whereas, in 2018, exports exceeded one billion euros, totaling to 1016 million euros, which constitutes an average annual growth of 30%. The share of the Republic of Serbia in the export of ICT services is about 0.3% of global exports. Further growth in exports requires ICT experts, which are now in short supply. In order to reach two billion euros of exports in ICT services, according to the most favorable work model, an additional 20,000 ICT experts are needed [7].

In the ICT sector, a dominant role is played by the intellectual capital that is based on the creativity, the initiative and the motivation of employees. The power of intellectual capital is its ability to develop ideas that create value. From the point of view of managers, knowledge management can be seen as a process of optimizing the efficient application of intellectual capital. In addition, intellectual capital is a key factor in building strategic advantage. Motivation directly affects organizational commitment, and employees must be enabled to develop professionally by creating an environment that encourages teamwork, workplace learning, creativity, innovation and initiative to implement business change and processes [8,9].

This study is one of the first to focus on measuring intellectual capital, from an intangible aspect, in Serbian ICT companies, which gives domestic practice new scientific knowledge about the impact of human, structural and relational capital on business performance. The need for this research arose from the justified belief that the impact of intellectual capital on the business performance in the ICT companies in the Republic of Serbia has not been explored by a holistic approach. In the previous surveys on intellectual capital conducted in the Republic of Serbia, financial performance was used as a parameter of business performance, based on the data taken from financial statements that could have narrowed the perception of business performance only to the financial component. Therefore, in this study, the use of non-financial indicators of business performance has been chosen to perform an analysis of the impact of intellectual capital on business performance, having in mind that “the tacitness of intellectual capital may not allow analysts to ever measure it using economic variables” [10]. This research generalizes and synthesizes the theoretical, methodological and empirical knowledge in the field, contributing to the development of an optimal structural model specification of intellectual capital. In the second part of the paper, entitled Literature Overview, the authors have provided an analysis of prevailing attitudes to the concept of intellectual capital and its impact on the business performance of companies. In the third part, the methodological framework of the research and the initial hypotheses are given. The fourth part covers the presentation of the empirical results of the research. The fifth part refers to the discussion of the findings in the context of studies conducted in different sectors on the foreign and domestic market, while, in the sixth part, the conclusion focuses on summarizing the concluding remarks and proposing directions of future research.

2. Literature Overview

In modern business studies we frequently encounter the term “high performance organizations”. It is used to denote organizations that achieve superior financial results over a sustained period of time, based on their ability to adapt and respond quickly to changes in the environment, maintain long-term orientation and integrate and harmonize management processes and structures for continuous improvement of competencies as key resources and success factors [11]. This includes satisfied customers and employees, a high level of individual initiative, productivity and innovation, harmonized systems for measuring performance and reward and strong leadership. Changes in the macroeconomic environment influence business activities and pose challenges to earnings management [12]. In order to successfully manage business performance, it is necessary to determine the critical success factors. They need to be measured through appropriate performance parameters, which can be tangible or intangible. The recent findings on goodwill creation have shown that return on equity, net income in previous years, retained earnings in prior years, valuable rights, marketing costs and investments into the plant are significant goodwill indicators in Slovakia and the Czech Republic [13,14].

There is no single and generally accepted definition of intellectual capital. A systematic approach to measuring and valorizing intellectual capital is becoming increasingly important for companies regardless of their activity, size, years of existence, ownership or geographical location. Intellectual capital is made up of human, structural and capital relationships with clients and other stakeholders [10]. Intellectual capital can be seen as the holistic ability of a company to coordinate, organize and use its own available knowledge in order to create future values [15]. Intellectual capital is the capital of a knowledge-based enterprise [16]. Lentjušenkova and Inga [17] point out that intellectual capital includes assets that include human capital, information and communication technologies, business procedures and intangible assets. The basic concepts of intellectual capital are defined as a sum of the company’s hidden assets that are not shown on its balance sheet [18]. The most commonly used and cited is the division of intellectual capital into human, structural and relational [19,20].

The findings of Bontis [10], Miller et al. [21], Bontis et al. [22], Do Rosário et al. [23], Joia and Malheiros [24], Sharabati et al. [25], Cheng-Ping et al. [26], Dženopoljac et al. [27], Chahal and Bakshi [28], Ramadan et al. [29] and Andreeva and Garanina [30] confirm that intellectual capital significantly determines the performance of companies in different sectors and that there is no single model that can be applied to all of them. In the previous studies conducted in the Republic of Serbia, based on financial parameters, human capital has positively affected ROA, ROE and ATO [31]. Dženopoljac, Janošević and Bontis [27] have concluded that a component of intellectual capital, capital employed efficiency, significantly affects financial performance. Pew Tan, Plowman and Hancock [32] have also proven a positive relationship between intellectual capital and financial performance. Russian managers of small innovative companies believe intellectual capital, especially structural and human capital, determines the business performance [33]. The findings of Cheng-Ping, Wen-Chih and Morrison [26] confirm that intellectual capital significantly affects the business performance of Taiwanese design companies. Chahal and Bakshi [28] point out that human, structural and relational capital positively impact the intellectual capital in Indian commercial banks.

- (a)

- Human Capital

Human capital is the basis of intellectual capital and it refers to “people’s abilities - professional experience, level of education and skills, managerial training and education methods and learning abilities - knowledge sharing, problem solving ability, management ability, training groups, entrepreneurship, leadership, development and training data” [34]. Bontis [10] views human capital through learning and education, experience and expertise and the innovation and creativity of employees. In order to analyze the relationship between human capital and work performance, Sveiby [19] has determined the basic elements of human capital: labor productivity and efficiency, seniority rate as the level of work experience of employees, level of employee education, investment rate in training and education of employees, average age of employees, knowledge and competencies that employees possess, number of professionals and subcontractors and fluctuation rate. In relation to the efficient use and utilization of human capital, Stewart measures the following indicators: average length of service, average level of education, percentage of employees with a high level of education, employment costs, IT literacy, employee training hours, employee satisfaction, employee turnover, added value per employee, innovation measures and development of new relationships with colleagues [35] (p. 314). Steenkamp and Kashyap [36] point out that human capital is manifested through professional development of employees, employee expertise, employee satisfaction and loyalty, innovation, work experience, level of formal education and number of employees. Each of these components positively affects business performance. Therefore, the first hypothesis is proposed:

Hypotheses 1 (H1):

There is a statistically significant and positive correlation between the human capital and business performance of ICT companies.

- (b)

- Structural Capital

Structural capital is created by the transformation of human capital and encompasses various intangible elements [37]. Structural capital is what remains in the organization when employees leave it, i.e., the most important element of intellectual capital, because it serves to convert employee knowledge into value for the organization [38]. Structural capital includes opportunities, routines, methods, procedures and methodologies built into the organization that enable the functioning of human capital. It implies the ability of the organization to adequately respond to changes in the environment [39], meet market needs [40], meet market demands [41] and accelerate the flow of knowledge through the organization [38]. The successful management of the structural capital increases its ability to provide value to customers/consumers through efficient management of resources and improvements in the level of organizational learning, as well as strengthening the reputation, identity and image of the company. Therefore, the second hypothesis is proposed:

Hypotheses 2 (H2):

There is a statistically significant and positive correlation between structural capital and the business performance of ICT companies.

- (c)

- Relational Capital

Relational capital is created through various relationships with external stakeholders [42]. Relational capital refers to the ability of an organization to, through the improvement of human and structural capital, achieve positive communication with external stakeholders in order to encourage the potential for creating added value [43]. Customer capital is the knowledge embedded in marketing channels and customer relationships that an organization develops during its business [22]. Relational capital is a business network between relationships with consumers and other external stakeholders, which can be used to: (1) gain new customers and develop relationships based on mutual trust, (2) gain knowledge of new markets and contacts that will enable them to sell products/services on these markets, (3) acquire information and new knowledge and information to be able to follow the new changes in the market, (4) carry out mutual exchange of knowledge and information that enable them to innovate in the industry in which they operate and (5) gain confidence in their own inventiveness through interaction with people who support them and think in a similar way as they do [44] (p. 157). Efficient management of relational capital contributes to differentiation in relation to the competition, higher demand and better business performance. Therefore, the third hypothesis is proposed:

Hypotheses 3 (H3):

There is a statistically significant and positive correlation between relational capital and the business performance of ICT companies.

3. Materials and Methods

The aim of the research is to investigate the influence of intellectual capital and its components on the business performance of companies in the ICT sector of the Republic of Serbia. The research objective is to determine the key constructs of intellectual capital that affect the business performance and examine the existence of statistically significant relations between intellectual capital constructs in relation to business performance constructs.

Empirical research is based on the work of researchers in this field [10,23,25,26,28,30,45,46]. An online survey was created according to questionnaires on intellectual capital [10,25]. The questionnaire consists of 90 statements about the parameters of intellectual capital (30 statements describing human capital, 30 statements describing structural capital and 30 statements describing relational capital) and 11 statements on the business performance of the company rated by the 5-point Likert scale: 1—I completely disagree to 5—I completely agree. The business performance of the company is analyzed according to eleven statements regarding leadership in the ICT sector, business prospects, the willingness to react quickly to the actions of competitors, the success rate in launching new products, overall business performance and success, employee productivity, process productivity, sales growth, profit growth, the market position of the company and the share of export profits in total company turnover. To confirm validity, the survey was pretested through a pilot survey conducted in July August 2020, where employees of ICT companies in several cities of the Republic of Serbia (Belgrade, Niš, Novi Sad, Zrenjanin, Kragujevac, Kraljevo, Subotica, Užice, etc.) were surveyed. On that occasion, the presidents of certain ICT clusters were consulted in order to improve the validity and accuracy of the existing survey. The research was conducted from July to the end of November 2020. The authors asked for the survey to be completed by the CEO/owner or one of their knowledgeable representatives. The size of the investigated sample was 611 ICT employees.

Descriptive statistics were applied in the research in order to systematize and describe the research sample (mean values, measures of asymmetry and flatness, etc.). The following tests have been applied in the research: Kolmogorov–Smirnov test and Shapiro–Wilk test for normality, Cronbach’s alpha for reliability, exploratory factor analysis (EFA) and partial least squares structural equation modeling (PLS-SEM) [47,48,49]. The EFA function serves to determine latent causality, in contrast to principal component analysis (PCA), which is basically data reduction [50,51,52]. Steger [53] indicates that the outcome of the analysis is mostly influenced by dimensionality, that the extraction method is less significant and that, in practice, the results of PCA and EFA are similar [54]. In the research, the authors applied the EFA, with the method of factorization of the main axes (principal axis factoring—PAF). Since the analysis of the structural model is complex and includes many constructs, indicators and/or model relationships and the path model included one or more formatively measured constructs and the method of partial least squares structural equation modeling (PLS-SEM) has been applied [49,55]. The advantages and importance of applying the PLS-SEM model is the ability to analyze samples with missing data, which do not have normal distribution [49,56,57], data that are burdened by intercorrelation, as well as models with a large number of independent variables and those in which there are several dependent variables [58]. Chronologically, EFA is the first generation of exploratory research, while the partial least squares (PLS) method is the second generation of applied methods [57]. The recommendation [58,59,60,61,62] is that the sample must be at least ten times the number of formative manifest variables or ten times greater than the number of pathways of the structural model that are directed toward the endogenous latent construct. The size of the investigated sample was therefore considered acceptable. The PLS-SEM model was created, which consists of a measured, i.e., external, model, comprising manifest variables, either formative or reflective, and the structural, i.e., internal, model, comprising latent variables. In measurement models in which reflective variables are present, the influence of the latent variable according to the manifest variables is measured. The formative measurement model measures the influence of manifest variables on the latent constructor [49,57,63,64]. Finally, the evaluation of the reflective and formative model, as well as the evaluation of the structural model, is performed according to certain reference values and rules [10,49,56,57,59,65,66,67,68,69,70,71,72,73,74,75]. The data were processed in SPSS (https://www.ibm.com/products/spss-statistics) (accessed on 20 August 2021), version 20 and Smart PLS software v.3.2.Ringle [69].

4. Results

The results of the sample analysis show that the total sample is dominate accessd by SMEs (63.5%), followed by micro (24.5%) and large enterprises (11.9%). The percentage of lower-level managers is the largest (71.7%), with lower participation of middle-level managers (23.1%) and top managers (5.2%). The research sample included companies in the ICT sector located in 23 cities in the territory of the Republic of Serbia. The largest numbers of respondents are from ICT companies based in Belgrade (57.12%), Nis (11.62%) and Novi Sad (8.84%). This is not surprising, considering that the largest number of companies in the ICT sector is concentrated in Belgrade, as well as in larger cities in the Republic of Serbia.

Descriptive statistics presented in Table 1 shows that human capital is rated with a mean value of 3.50 (std. dev. 0.655). The survey item “Innovation and creativity of employees affect the market position of the ICT company” has been rated with the highest mean value of 3.74 (std. dev. 1.167), followed by “Experience and expertise of employees positively affect the market position of the ICT company” (mean 3.70, std. dev. 1.179), and “Learning and education of employees affect the profitability of the ICT company” (mean 3.68, std. dev. 1.234). The lowest rated survey items are “The ICT company launches a number of new products in compared to the competition” (mean 3.28, std. dev. 1.208), “Employees in the ICT company are able to constantly learn from each other” (mean 3.29, std. dev. 1.193) and “Employees they have been working in the ICT company for years (the turnover of employees is very low)” (mean 3.29, std. dev. 1.182).

Table 1.

Descriptive statistics of human capital variables (HC).

The mean value of structural capital is 3.42 (std. dev. 0.679). Descriptive statistics of the survey items of the structural capital construct in Table 2 show that the best rated survey items are: “Systems and programs of the company affect the profitability of the ICT company“ (mean 3.64, std. dev. 1.216), “Systems and programs of the company affect the market position of the ICT company” (mean 3.63, std. dev. 1.213) and “The ICT company is considered a leader in research” (mean 3.63, std. dev. 1.591). The lowest rated items are “The ICT company actively encourages and rewards creation in order to maximize profits” (mean 3.19, std. dev. 1.194), “The ICT company monitors its IPR portfolio” (mean 3.20, std. dev. 1.205) and “The ICT company continuously develops work processes” (mean 3.25, std. dev. 1.254).

Table 2.

Descriptive statistics of structural capital variables (SC).

The results show that the mean value for the relational capital is 3.46 (std. dev. 0.659). As can be seen from Table 3, the best rated items are “Knowledge of the customers affects the market position of the ICT company”, “It is important that the ICT company shares knowledge about customers with its partners”, “The ICT company’s relationship with customers and suppliers affects the market position of the company”, “The survey on the satisfaction of the ICT company’s clients shows that they are loyal and satisfied” and “The ICT company’s strategic alliances affect the company’s market position”, with a mean value of 3.68 (std. dev. 1.175), 3.66 (std. dev. 1.568), 3.65 (std. dev. 1.225), 3.62 (std. dev. 1.591) and 3.60 (std. dev. 1.190), respectively. The lowest rated items are variables “When it comes to new business, the ICT company’s customers in the last few years increasingly choose the company’s products compared to competitors” (mean 3.22, std. dev. 1.191), “The ICT company has different distribution channels” (mean 3.24, std. dev. 1.261), “The ICT company has many different strategic alliances (for research and development, production, marketing, distribution)” (mean 3.26, std. dev. 1.192).

Table 3.

Descriptive statistics of relational capital variables (RC).

Descriptive statistics of business performance (BP) construct variables are shown in in Table 4. The research results show that BP-1—Leadership in the ICT sector, BP-3—Willingness to react quickly to competitive moves and BP-5—Overall business performance and success are the best rated variables with an average score of 3.69 (std. dev. 1.562), 3.69 (std. dev. 1.257) and 3.59 (std. dev. 1.264), respectively. The lowest rated variables are BP-2—Future outlook 3.13 (std. dev. 1.162) and BP-4—Success rate in launching new products 3.20 (std. dev. 1.158). Descriptive statistics of business performance show that “Leadership in the ICT sector”, “Willingness to react quickly to competitive moves” and “Overall business performance and success” are the best rated items with a mean value of 3.69 (std. dev. 1.562), 3.69 (std. dev. 1.257) and 3.59 (std. dev. 1.264), respectively. The lowest rated variables are “Future outlook” (mean 3.13, std. dev. 1.162) and “Success rate in launching new products” (mean 3.20, std. dev. 1.158).

Table 4.

Descriptive statistics of business performance variables (BP).

The normality of the data distribution was tested using the Kolmogorov–Smirnov test and the Shapiro–Wilk test. The obtained values, for all dependent and independent variables, indicate that there is no normal distribution. However, the normality of data distribution is not a mandatory criterion, given that it is a large sample and that PLS-SEM is robust enough and does not require normality of data distribution [59,76]. Cronbach’s alpha was used for reliability testing. The results indicate that the reliability for each construct is acceptable (Cronbach’s alpha is greater than 0.9). EFA, the principal axis factoring method [62], was applied, elaborating the 90 statements on intellectual capital (30 statements describing human capital, 30 statements describing structural capital and 30 statements describing relational capital). The findings show that the Kaiser–Meyer–Olkin sample adequacy measure was satisfactorily high, and the Bartlett sphericity test was significant. Using the Cattell scree criterion, nine factors were retained and the ranking was performed based on a load limit of 0.4. To achieve a simple structure, the factors were rotated in the promax rotation [50,77], and Cronbach’s alpha reliability coefficient >0.7 [49,56,77].

In order to uncover the underlying structure of the 30 variables included in human capital, the first factor accounts for 27.349% of the variance in human capital, the second for 13.039% of the variance and the third for 6.741%, which cumulatively account for 47.129% of the variance. The first factor is classified as competences, training and development of employees (HC-1), the second factor as learning and development, productivity and teamwork (HC-2) and the third as innovation and creativity (HC-3).

In the second group of 30 input variables related to the structural capital construct, the first factor accounts for 27.107% of the variance in the structural capital model, the second for 11.685% of the variance and the third for 4.687%, which cumulatively account for 43.479% of the variance. The first factor is classified as organizational structure, processes and procedures (SC-1), the second factor as patents, licenses and copyrights (SC-2) and the third as leadership and organizational learning (SC-3). In the third group of 30 input variables related to the relational capital construct, the first factor accounts for 27.320% of the variance in the relational capital model, the second for 10.707% of the variance and the third for 5.313%, which cumulatively account for 43.339% of the variance. The first factor is classified as cooperation and customer knowledge (RC-1), the second factor as strategic alliances, customer and supplier loyalty (RC-2) and the third as relations with customers and suppliers (RC-3).

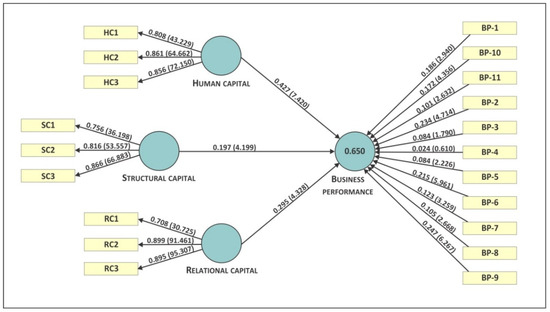

The PLS-SEM research model has the following structure: the first latent construct is human capital (three reflective variables), the second latent construct is structural capital (three reflective variables) and the third latent construct is relational capital and it consists of three reflective variables. The internal model consists of three latent exogenous constructs and one endogenous latent construct. The external model consists of 20 manifest variables and nine reflective variables: HC-1—competences, training and development of employees, HC-2—learning and development, productivity and teamwork, HC-3—innovation and creativity, SC-1—rganizational structure, processes and procedures, SC-2—patents, licenses and copyrights, SC-3—leadership and organizational learning, RC-1—cooperation and customer knowledge, RC-2—strategic alliances, customer and supplier loyalty and RC-3—relations with customers and suppliers and 11 formative variables: BP-1—leadership in the ICT sector, BP-2—prospects for future business, BP-3—willingness to react quickly to actions of competitors, BP-4—success rate in launching new products, BP-5—overall business performance and success, BP-6—employee productivity, BP-7—productivity of processes, BP-8—sales growth, BP-9—profit growth, BP-10—market position of the company and BP-11—share of export revenues in total company revenues.

The first step in evaluating a reflective measurement model is to evaluate the load reliability of the manifest variables. The preferred factor load is above 0.7 because it indicates that the construct describes more than 50% of the latent construct [10,49,77]. In the model obtained, there are no problematic factor loads, i.e., loads less than 0.7 and greater than 0.95, so this criterion is also met [49]. The obtained values of standardized factor loads for reflective measuring variables for which the factor loadings are greater than 0.7 are shown in Table 5 below.

Table 5.

Values of standardized factor loadings and results of analysis of reflective measurement model.

Values of standardized factor loads (outer loads) and reliability indicators have been further analyzed. The values of the Cronbach’s alpha coefficients of the variables of latent constructs are as follows: human capital has a value of 0.794, structural capital has a value of 0.747 and relational capital has a value of 0.790. Finally, the obtained Cronbach’s alpha coefficients of latent constructs indicate a high level of reliability [49,57,61].

The next step in evaluating a reflective measurement model is composite reliability (CR). According to Hair et al. [49], Sarstedt et al. [56], Hair et al. [57], Zlatković [74], Yildiz and Kitapci [77], Wong [78] and Kianto et al. [79], CR values are in the range of 0.855–0.879, which confirms composite reliability and means that the variables adequately represent the latent constructs.

Values for convergent validity (AVE values) are in the range of 0.663–0.709, which satisfies the criterion that AVE > 0.5 [40,47]. The results indicate that convergent validity is satisfied in all latent constructs. Discriminant validity analysis has been performed using Fornell–Larcker criteria and HTMT values. The values obtained confirm the discriminant validity of individual latent constructs.

The formative measurement model consists of formative variables that affect the latent construct of business performance. The assessment of the formative measurement model was performed using the collinearity indicators (VIF). The results of the reliability analysis of the formative latent construct examined by testing the collinearity between the manifest variables of the latent construct using the variance inflation coefficient (VIF) show that the values are in the range of 1.578–2.161, and it has been concluded that the formative measurement variables do not have a collinearity problem.

The results of the statistical significance of the factor weights (outer weights) of formative measurement variables (using the bootstrapping procedure, sig. 0.05) indicate that “Willingness to react quickly to activities of competitors” (BP-3) and “Success rate in launching new products” (BP-4) are not statistically significant. However, according to Wong [78] (p. 28), in a situation where a particular variable proves to be insignificant, external loadings should be verified. Thus, all the variables can be kept and can be interpreted as important.

As part of the analysis of the structural model, the conceptual model was examined and the connection between latent constructs has been analyzed. The results of collinearity between the latent constructs (VIF) range from 1.917–2.702 and the values obtained indicate that there is no collinearity problem in the model. The findings indicate that the strongest connection exists between human capital and business performance (0.427). The correlation between structural capital and BP is the weakest (0.197), while the mean values between relational capital and business performance are 0.295. In the model, the value of the adjusted coefficient of determination (R2 adjusted) indicates the percentage to which the independent (predictor) variables explain the dependent endogenous variable business performance. According to the interpretations [49,57,80,81,82], the obtained value of R2 = 0.650 can be classified into the category of moderate influence, indicating that 65% of the formative dependent latent variable is explained by predictor variables. In the continuation of the evaluation of the internal model, the predictive relevance of the model was calculated using the blindfolding procedure. The value of cross-valid redundancy was calculated using Stone–Geisser Q2 indicators. The results show that the obtained value is higher than zero [82], which proves a satisfactory level of predictive significance of the model. The value of Q2 = 0.251 indicates the medium predictive relevance of the PLS-path model. The coefficient of effect size (f2 effect size) shows that human capital has a medium effect size (f2 = 0.272), while structural and relational capitals have small effect sizes (0.041 and 0.116, respectively) [83]. Total effects are shown in Table 6.

Table 6.

Total effects.

The first hypothesis, that there is a statistically significant and positive correlation between human capital and the business performance of the company, is confirmed by the empirical relationship (β = 0.427; t = 7.740) which is statistically significant at the level of p < 0.05. The population falls within a confidence interval from 0.313 to 0.545 with a 97.5% probability. The second hypothesis, that there is a statistically significant and positive correlation between structural capital and business performance, is also confirmed. The empirical relationship is statistically significant and stable (β = 0.197; t = 4.199). The population is within the range of 0.107 to 0.291 with a 97.5% probability. The third hypothesis, that there is a statistically significant and positive correlation between relational capital and business performance, has also been confirmed due to a stable empirical relationship (β = 0.295; t = 4.328) and statistical significance at the level of 97.55% confidence and is in the interval from 0.151 to 0.428. The structural measurement model, the presentation of test results of hypotheses using PLS-SEM technique, is shown in Figure 1.

Figure 1.

Structural measurement model—presentation of test results of hypotheses using PLS-SEM technique.

5. Discussion

In order to draw valid conclusions, it is necessary to make comparisons with the results of previously conducted research by different authors in different countries and business sectors. The mean values obtained for the latent constructs of the intellectual capital of enterprises in the information and communication sector of the Republic of Serbia are as follows: human capital (3.50), structural capital (3.42) and relational capital (3.46). Human capital in the Republic of Serbia has been rated with a higher mean value in contrast to the studies conducted in Sweden [84], Malaysia [85], Iran [86] and Jordan [25]. However, the mean values obtained in the study for the ICT sector of Serbia are very similar to the mean values for the pharmaceutical industry of Jordan [25], which indicates that these sectors possess a high share of knowledge-based companies with good business performance. In both countries, these are knowledge- and capital-intensive sectors. The mean value of the latent construct human capital in the current study in the Republic of Serbia is higher than the value obtained in the studies conducted in Sweden [84], Iran [86], Malaysia [85] and Jordan [25]. The mean value of the latent construct structural capital in this study is higher than the values obtained in the studies in Sweden [84], Iran [86], Canada [21], Jordan [25] and Malaysia [87]. This shows that the organizational processes, structure, culture, patents and licenses recognized in ICT companies of the Republic of Serbia represent an important element of their intellectual capital [88]. The mean value of the latent relational capital construct obtained in this study is higher than the obtained values of the research conducted in Malaysia [87] and slightly higher than the value of the study conducted in Jordan [25]. Based on a comparative analysis of the Republic of Serbia and other countries, we can conclude that this component of intellectual capital is not given enough importance. The calculated mean value of business performance (3.45) in this empirical study shows that it is higher than the values obtained in the studies conducted in Iran [86], Malaysia [85] and Canada [21]. An analysis of the obtained R2 values shows that the Republic of Serbia has the highest value [10,22,25,89,90].

All three hypotheses were confirmed in this study, which is in line with the findings of Bontis, Chua Chong Keow and Richardson that have shown that human capital significantly affects business performance and relational capital has a significant impact on structural capital, while structural capital has a positive effect on business performance, regardless of industry [22]. Hassan [91] emphasizes that training and personal development are some of the basic tools and parameters that achieve and measure the increase in business performance. In ICT companies, training and development are seen as the main drivers of business performance [92]. Employee training and development are aimed at removing obstacles in solving tasks, as well as the application of new technologies. Given the dynamics in the software industry, employee training and development are “crucial for achieving appropriate performance and performing tasks in accordance with the set requirements” [93]. Training and development affect expertise and know-how. In the ICT sector, employees’ expertise and specific knowledge contribute to the firm’s competitive advantage [94,95]. Employee loyalty is reflected in the commitment of employees to the success of the organization. Bontis and Fitz-enz [96] point out that employee commitment has a positive effect on a company’s business performance. It is closely related to employee satisfaction. In companies in the ICT sector whose growth and development depend on the loyalty of their employees, bearing in mind that they employ narrowly specialized workers, more and more attention is paid to this factor. The findings are also in line with those of Seleim, Ashour and Bontis [45] confirming the significant relationship between human capital and business performance in Egyptian software companies. The findings confirm those of Wang and Chang [90] showing that the components of intellectual capital directly affect business performance in the ICT industry in Taiwan.

6. Conclusions

Research on intellectual capital and its components can be used to create a basic model of intellectual capital management in order to improve the business performance of the company. Every company is different and should grow and develop according to its own sector. Continuous development of knowledge, creativity and innovation is a starting point for the growth and success of these companies and an important means of achieving competitiveness, which is especially evident in the context of global and international business. Most companies in the ICT sector are micro and small enterprises. Their consolidation would improve the efficiency and profitability of business through economies of scale and the knowledge economy, which would improve the competitiveness of the domestic ICT sector in the international context. As with most domestic companies, the biggest constraint on future growth and development for ICT companies is limited sources of finance. The majority of ICT companies, especially those engaged mainly in software development, are characterized by low assets and high costs of human resources due to their specialized operations, which require a highly educated, professional and trained staff profile. Investing in human resources in the ICT sector should be a strategic commitment that leads to stable business and growth in profitability. The management of all three components of intellectual capital in order to increase business performance is crucial for ICT managers. It is up to the managers of ICT companies to constantly invest in the training and development of their employees. Only in that way can employees be more efficient in performing their tasks, more creative and innovative and ready to apply newly acquired knowledge and technologies in everyday business in order to ensure the achievement of set organizational goals. Furthermore, it is necessary that each company should have its own database in which they can accumulate, access and monitor all the necessary information in relation to market trends and competition. It is necessary to identify appropriate motivation and reward approaches for each employee, while respecting his/her specific traits, knowledge, skills, competencies and talents. In the ICT sector, employee expertise and the possession of specific knowledge can strongly contribute to a firm’s competitive advantage. ICT company management should regularly monitor all three components of intellectual capital when preparing their strategic organizational reports.

This research showed that companies in the ICT sector adequately manage intellectual capital because all the values of the intellectual capital constructs are in the rank of values reported in the findings of more developed countries, which was not expected considering the overall level of economic development. This has a significant impact on the business performance proving that the ICT sector can be competitive on the regional, European and global markets. The demand for experienced Serbian ICT staff is very high and there is a high outflow of human resources. In this way, the external brain drain of ICT experts and loss of qualified staff to MNC subsidiaries that are paying higher incomes can be prevented. The ICT sector is a dynamic sector and the skills of highly qualified staff with innovative potential should be enhanced. The development plans should include enhancing ICT’s strategic position through developing intellectual capital across the whole territory of the Republic of Serbia, not only in Belgrade. Other industry sectors can use these results and their managers can better understand the importance of nurturing components of intellectual capital by implementing development measures to create a model that will be functionally acceptable, taking into account the specifics of their sectors.

The limitations of the study include a relatively small number of companies from the ICT sector in Serbia, therefore they are hard to generalize, and further work needs to be performed to test the generalization of these results to other sectors. The subjectivity of the respondents cannot be neglected when surveying, especially in the segment of assessing the business performance of companies in which they are employed. The perceptions of the surveyed employees, particularly lower managers who were willing to take part in the study, can deviate from the perceptions of top managers. Future research should focus on more companies and extend the scope to other industry sectors, preferably surveying higher hierarchical levels. The findings may be of interest to other senior managers from other sectors in order to deepen their understanding on intellectual capital and monitor the transfer of individual knowledge into the organizational structure. Intellectual capital should be fostered and nurtured as a value-added service, in order to ensure better performance and competitive advantage of the organization in the market. In addition, since the simplistic model considers the impact of latent intellectual capital constructs on business performance, it is recommended that future research employ a more complex diamond model, which also analyzes the interrelationships of latent constructs, and gives managers a broader picture of the interdependencies between the parameters of intellectual capital.

Author Contributions

Conceptualization, N.L., M.C. and J.V.T.; methodology, N.L.; software, N.L.; validation, M.C., D.S. and J.V.T.; formal analysis, N.L.; investigation, N.L., J.R.-M., S.B. and M.V.; resources, N.L., J.R.-M., S.B. and M.V.; data curation, N.L.; writing—original draft preparation, N.L.; writing—review and editing, N.L., M.C. and J.V.T.; visualization, N.L., M.C. and J.V.T.; supervision, M.C., D.S. and J.V.T.; project administration, N.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Acknowledgments

This research was a part of the PhD thesis by Nemanja Lekić, entitled “The influence of intellectual capital on business performance of companies in the information and communication technologies sector of the Republic of Serbia”.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Stewart, T.A. Intellectual Capital: The New Wealth of Organizations; Doubleday/Currency: New York, NY, USA, 1997. [Google Scholar]

- Škuflić, L.; Vlahinić-Dizdarević, N. Koncept Nove ekonomije i značaj informacijsko–komunikacijske tehnologije u Republici Hrvatskoj. Ekon. Pregl. 2003, 54, 460–479. Available online: https://hrcak.srce.hr/25464 (accessed on 15 August 2021).

- Vlada Republike Srbije. Strategija Razvoja Industrije Informacionih Tehnologija za Period od 2017. do 2020. Godine. Available online: https://www.srbija.gov.rs/dokument/45678/strategije-programi-planovi-.php (accessed on 15 August 2021).

- Kleibrink, A.; Radovanović, N.; Kroll, H.; Horvat, D.; Kutlača, D.; Živković, L. The Potential of ICT in Serbia: An Emerging Industry in the European Context; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar] [CrossRef]

- Narodna Banka Srbije. Platni Bilans. 2020. Available online: https://www.nbs.rs/internet/cirilica/80/platni_bilans.html (accessed on 15 August 2021).

- Matijević, M.; Šolaja, M. ICT in Serbia—At a Glance, 2020; Vojvođanski IKT klaster: Novi Sad, Serbia, 2020; Available online: https://www.ict-cs.org/rs/multimedija/publikacije/ (accessed on 17 August 2021).

- Matijević, M. Perspektive IT Industrije. 2019. Available online: https://www.sito.rs/perspektive-it-industrije/ (accessed on 17 August 2021).

- Lekić, S.; Vapa-Tankosić, J.; Mandić, S.; Rajaković-Mijailović, J.; Lekić, N.; Mijailović, J. Analysis of the Quality of the Employee–Bank Relationship in Urban and Rural Areas. Sustainability 2020, 12, 5448. [Google Scholar] [CrossRef]

- Lekić, N.; Vukosavljević, D.; Vapa-Tankosić, J.; Lekić, S.; Mandić, S. Impact of motivational factors on organizational commitment of bank employees. Ekon. Teor. I Praksa 2021, 14, 1–22. [Google Scholar] [CrossRef]

- Bontis, N. Intellectual capital: An exploratory study that develops measures and models. Manag. Decis. 1998, 36, 63–76. [Google Scholar] [CrossRef]

- De Wall, A.A. The Characteristics of a High-Performance Organization; Center for Organizational Performance: Hilversum, The Netherlands, 2010; Available online: https://www.hpocenter.nl/wp-content/uploads/2013/07/Research-paper-The-characteristics-of-a-HPO-HPO-Center-January-20102.pdf (accessed on 17 August 2020).

- Kliestik, T.; Belas, J.; Valaskova, K.; Nica, E.; Durana, P. Earnings management in V4 countries: The evidence of earnings smoothing and inflating. Econ. Res.-Ekon. Istraživanja 2021, 34, 1452–1470. [Google Scholar] [CrossRef]

- Podhorska, I.; Valaskova, K.; Stehel, V.; Kliestik, T. Possibility of Company Goodwill Valuation: Verification in Slovak and Czech Republic. Manag. Marketing. Chall. Knowl. Soc. 2019, 14, 338–356. [Google Scholar] [CrossRef]

- Kliestik, T.; Kovacova, M.; Podhorska, I.; Kliestikova, J. Searching for Key Sources of Goodwill Creation as New Global Managerial Challenge. Pol. J. Manag. Stud. 2018, 17, 144–154. [Google Scholar] [CrossRef]

- Mouritsen, J.; Bukh, P.N.; Flagstad, K.; Thorbjørnsen, S.; Johansen, M.R.; Kotnis, S.; Larsen, H.T.; Nielsen, C.; Kjærgaard, I.; Krag, L.; et al. Intellectual Capital Statements—The New Guideline; Danish Ministry of Science, Technology and Innovation: Copenhagen, Denmark, 2003; Available online: https://pure.au.dk/ws/files/32340329/guideline_uk.pdf (accessed on 17 August 2021).

- Brennan, N.; Connell, B. Intellectual capital: Current issues and policy implications. J. Intellect. Cap. 2000, 1, 206–240. [Google Scholar] [CrossRef]

- Lentjušenkova, O.; Inga, L. The Transformation of the Organization’s Intellectual Capital: From Resource to Capital. J. Intellect. Cap. 2016, 17, 610–631. [Google Scholar] [CrossRef]

- Roos, G.; Roos, J. Measuring Your Company’s Intellectual Performance. Long Range Plan. 1997, 30, 413–426. Available online: http://capitalintelectual.egc.ufsc.br/wp-content/uploads/2016/05/1997-%E2%80%93-ROOS-y-ROOS-Measuring-your-company%E2%80%99s-Intellectual-performance.pdf (accessed on 17 August 2021). [CrossRef]

- Sveiby, K.E. The Intangible Assets Monitor. J. Hum. Resour. Costing Account. 1997, 2, 73–97. [Google Scholar] [CrossRef]

- Bontis, N. Assessing Knowledge Assets: A Review of the Models Used to Measure Intellectual Capital. Int. J. Manag. Rev. 2002, 3, 41–60. [Google Scholar] [CrossRef]

- Miller, M.; DuPont, B.D.; Fera, V.; Jeffrey, R.; Mahon, B.; Payer, B.M.; Starr, A. Measuring and reporting intellectual capital from a diverse Canadian industry perspective: Experiences, issues and prospects. In Proceedings of the OECD Symposium, Amsterdam, The Netherlands, 9–11 June 1999; Available online: https://www.oecd.org/industry/ind/1947855.pdf (accessed on 19 August 2021).

- Bontis, N.; Chua, C.K.W.; Richardson, S. Intellectual capital and business performance in Malaysian industries. J. Intellect. Cap. 2000, 1, 85–100. [Google Scholar] [CrossRef]

- Do Rosário Cabrita, M.; Bontis, N. Intellectual Capital and Business performance in the Portugese Banking Industry. Int. J. Technol. Manag. 2008, 43, 212–237. [Google Scholar] [CrossRef]

- Joia, L.A.; Malheiros, R. Strategic alliances and the intellectual capital of firms. J. Intellect. Cap. 2009, 10, 539–558. [Google Scholar] [CrossRef]

- Sharabati, A.A.A.; Jawad, S.N.; Bontis, N. Intellectual capital and business performance in the pharmaceutical sector of Jordan. Manag. Decis. 2010, 48, 105–131. [Google Scholar] [CrossRef]

- Cheng-Ping, S.; Wen-Chih, C.; Morrison, M. The Impact of Intellectual Capital on Business Performance in Taiwanese Design Industry. J. Knowl. Manag. Pract. 2010, 11. Available online: http://www.tlainc.com/jkmpv11n110.htm (accessed on 29 August 2021).

- Dženopoljac, V.; Janoševic, S.; Bontis, N. Intellectual capital and financial performance in the Serbian ICT industry. J. Intellect. Cap. 2016, 17, 373–396. [Google Scholar] [CrossRef]

- Chahal, H.; Bakshi, P. Measurement of Intellectual Capital in the Indian Banking Sector. J. Decis. Mak. 2016, 41, 61–73. [Google Scholar] [CrossRef]

- Ramadan, B.; Dahiyat, S.; Bontis, N.; Al-dalahmeh, M. Intellectual Capital, Knowledge Management and Social Capital within the ICT Sector in Jordan. J. Intellect. Cap. 2017, 18, 437–462. [Google Scholar] [CrossRef]

- Andreeva, T.; Garanina, T. Intellectual Capital and Its Impact on the Financial Performance of Russian Manufacturing Companies. Foresight STI Gov. 2017, 11, 31–40. [Google Scholar] [CrossRef]

- Komnenić, B.; Pokrajčić, D. Intellectual capital and corporate performance of MNCs in Serbia. J. Intellect. Cap. 2012, 13, 106–119. [Google Scholar] [CrossRef]

- Pew Tan, H.; Plowman, D.; Hancock, P. Intellectual Capital and Financial Returns of Companies. J. Intellect. Cap. 2007, 8, 76–95. [Google Scholar] [CrossRef]

- Tovstiga, G.; Tulugurova, E. Intellectual capital practices and performance in Russian enterprises. J. Intellect. Cap. 2007, 8, 695–707. [Google Scholar] [CrossRef]

- Petty, R.; Guthrie, J. Intellectual capital literature review: Measurement, reporting and management. J. Intellect. Cap. 2000, 1, 155–176. [Google Scholar] [CrossRef]

- Stewart, T.A. The Wealth of Knowledge: Intellectual Capital and the Twenty-First Century Organization; Nicholas Brealey: London, UK, 1997. [Google Scholar]

- Steenkamp, N.; Kashyap, V. Importance and contribution of intangible assets; SME managers’ perceptions. J. Intellect. Cap. 2010, 11, 368–390. [Google Scholar] [CrossRef]

- Edvinsson, L. Developing intellectual capital at Skandia. Long Range Plan. 1997, 30, 366–373. [Google Scholar] [CrossRef]

- Edvinsson, L.; Sullivan, P. Developing a Model for Managing Intellectual Capital. Eur. Manag. J. 1996, 14, 356–364. [Google Scholar] [CrossRef]

- Grantham, C.; Nichols, L.; Schonberner, M. A Framework for Management of Intellectual Capital in the Health Care Industry. J. Health Care Financ. 1997, 23, 1–19. [Google Scholar]

- Saint-Onge, H. Tacit Knowledge: The Key to the Strategic Alignment of Intellectual Capital. Strategy Leadersh. 1996, 24, 10–16. [Google Scholar] [CrossRef]

- Bontis, N. There’s a price on your head: Managing intellectual capital strategically. Ivey Bus. Q. 1996, 60, 40–47. [Google Scholar]

- Janoševic, S.; Dženopoljac, V. Impact of intellectual capital on financial performance of Serbian companies. Actual Probl. Econ. 2012, 133, 554–564. Available online: https://www.researchgate.net/publication/287702499_Impact_of_intellectual_capital_on_financial_performance_of_Serbian_companies (accessed on 19 August 2021).

- Marti, J.M.V. ICBS—Intellectual Capital Benchmarking System. J. Intellect. Cap. 2001, 2, 148–165. [Google Scholar] [CrossRef]

- Burns, P. Entrepreneurship and Small Business: Start-Up, Growth and Maturity, 3rd ed.; Palgrave Macmillan: New York, NY, USA, 2011. [Google Scholar]

- Seleim, A.; Ashour, A.; Bontis, N. Human Capital and Organizational Performance: A Study of Egyptian Software Companies. Manag. Decis. 2007, 45, 789–901. [Google Scholar] [CrossRef]

- Bontis, N.; Janošević, S.; Dženopoljac, V. Intellectual capital in Serbia’s hotel industry. Int. J. Contemp. Hosp. Manag. 2015, 27, 1365–1384. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory, 2nd ed.; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Churchill, G.A. A paradigm for developing better measures of marketing constructs. J. Mark. Res. 1979, 16, 64–73. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Subotić, S. Pregled metoda za utvrđivanje broja faktora i komponenti (u EFA i PCA). Primenj. Psihol. 2013, 6, 203–229. [Google Scholar] [CrossRef]

- Worthington, R.L.; Whittaker, T.A. Scale development research: A content analysis and recommendations for best practices. Couns. Psychol. 2006, 34, 806–838. [Google Scholar] [CrossRef]

- Kahn, J.H. Factor analysis in counseling psychology research, training, and practice: Principles, advances, and applications. Couns. Psychol. 2006, 34, 684–718. [Google Scholar] [CrossRef]

- Steger, M.F. An illustration of issues in factor extraction and identification of dimensionality in psychological assessment data. J. Personal. Assess. 2006, 86, 263–272. [Google Scholar] [CrossRef] [PubMed]

- Velicer, W.F.; Jackson, D.N. Component Analysis versus Common Factor Analysis: Some Issues in Selecting an Appropriate procedure. Multivar. Behav. Res. 1990, 25, 1–28. [Google Scholar] [CrossRef] [PubMed]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling; Sage: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial least squares structural equation modeling. In Handbook of Market Research; Homburg, C., Klarmann, M., Vomberg, A., Eds.; Springer: Heidelberg, Germany, 2017; pp. 1–40. [Google Scholar] [CrossRef]

- Hair, J.; Hollingsworth, C.L.; Randolph, A.B.; Chong, A.Y.L. An updated and expanded assessment of PLS-SEM in information systems research. Ind. Manag. Data Syst. 2017, 117, 442–458. [Google Scholar] [CrossRef]

- Komšić, J. Mjerenje Reputacije Turističke Destinacije na Društvenim Medijima i Zadovoljstva Turista. Doktorski rad, Sveučilište u Rijeci, Fakultet za Menadžment u Turizmu i Ugostiteljstvu: Opatija, Croatia, 2018. Available online: https://urn.nsk.hr/urn:nbn:hr:191:941056 (accessed on 20 August 2021).

- Barclay, D.; Higgins, C.; Thompson, R. The partial least squares (PLS) approach to causal modelling: Personal computer adaptation and use as an illustration. Technol. Stud. 1995, 2, 285–309. [Google Scholar]

- Hair, J.F.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Nunnally, J.C.; Bernstein, I.H. Psychometic Theory, 3rd ed.; McGraw-Hill: New York, NY, USA, 1994. [Google Scholar]

- Onyekachi, A.M.; Olanrewaju, S.O. A Comparison of Principal Component Analysis, Maximum Likelihood and the Principal Axis in Factor Analysis. Am. J. Math. Stat. 2020, 10, 44–54. [Google Scholar] [CrossRef]

- Fosnot, C.T. Constructivism, Theory, Perspectives, and Practice; Teachers College Press: New York, NY, USA, 1996. [Google Scholar]

- Von Glasersfeld, E. An Exposition of Constructivism: Why Some Like it Radical. In Facets of Systems Science; Klir, G.J., Ed.; Plenum: New York, NY, USA, 1991; pp. 229–238. Available online: http://www.vonglasersfeld.com/127 (accessed on 20 August 2021).

- Chin, W.W. The partial least squares approach for structural equation modeling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Bontis, N. Managing Organizational Knowledge by Diagnosing Intellectual Capital: Framing and Advancing the State of the Field. Int. J. Technol. Manag. 1999, 18, 433–462. [Google Scholar] [CrossRef]

- Tenenhaus, M.; Esposito Vinzi, V.; Chatelin, Y.M.; Lauro, C. PLS path modeling. Comput. Stat. Data Anal. 2005, 48, 159–205. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Will, A. SmartPLS 2.0 M3; University of Hamburg: Hamburg, Germany, 2005; Available online: http://www.smartpls.de (accessed on 20 August 2021).

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS 3; SmartPLS GmbH: Bönningstedt, Germany, 2015; Available online: http://www.smartpls.com (accessed on 20 August 2021).

- Götz, O.; Liehr-Gobbers, K.; Krafft, M. Evaluation of structural equation models using the partial least squares (PLS) Approach. In Handbook of Partial Least Squares: Concepts, Methods and Applications; Esposito Vinzi, V., Chin, W.W., Henseler, J., Wang, H., Eds.; Springer Handbooks of Computational Statistics Series; Springer: Berlin/Heidelberg, Germany, 2010; pp. 691–711. [Google Scholar] [CrossRef]

- Henseler, J.; Fassott, G. Testing moderating effects in PLS path models: An illustration of available procedures. In Handbook of Partial Least Squares: Concepts, Methods and Applications; Esposito Vinzi, V., Chin, W.W., Henseler, J., Wang, H., Eds.; Springer Handbooks of Computational Statistics Series; Springer: Berlin/Heidelberg, Germany, 2010; pp. 713–735. [Google Scholar] [CrossRef]

- Henseler, J.; Hubona, G.S.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data Syst. 2016, 116, 1–19. [Google Scholar] [CrossRef]

- Černe, K.; Etinger, D. IT as a part of intellectual capital and its impact on the performance of business entities. Croat. Oper. Res. Rev. 2016, 7, 389–408. [Google Scholar] [CrossRef]

- Zlatković, M. Intellectual capital and organizational effectiveness: PLS-SEM approach. Industrija 2018, 46, 145–169. [Google Scholar] [CrossRef]

- Aguirre-Urreta, M.I.; Rönkkö, M. Statistical Inference with PLSc Using Bootstrap Confidence Intervals. MIS Q. 2018, 42, 1001–1020. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Smith, D.; Reams, R.; Hair, J.F. Partial Leas Squares Structural Equation Modeling (PLS-SEM): A Useful Tool for family business researcher. J. Fam. Bus. Strategy 2014, 5, 105–115. [Google Scholar] [CrossRef]

- Yildiz, O.; Kitapci, H. Exploring Factors Affecting Consumers’ Adoption of Shopping via Mobile Applications in Turkey. Int. J. Mark. Stud. 2018, 10, 60–75. [Google Scholar] [CrossRef][Green Version]

- Wong, K.K.K. Partial least squares structural equation modeling (PLS-SEM) techniques using SmartPLS. Mark. Bull. 2013, 24, 1–32. Available online: http://marketing-bulletin.massey.ac.nz/v24/mb_v24_t1_wong.pdf (accessed on 20 August 2021).

- Kianto, A.; Sáenz, J.; Aramburu, N. Knowledge-based human resource management practices, intellectual capital and innovation. J. Bus. Res. 2017, 81, 11–20. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Plan. 2013, 46, 1–12. [Google Scholar] [CrossRef]

- Chin, W.W. PLS-Graph User’s Guide Version 3.0. C.T.; Bauer College of Business, University of Houston: Houston, TX, USA, 2001. [Google Scholar]

- Chin, W.W. How to Write Up and Report PLS Analyses. In Handbook of Partial Least Squares: Concepts, Methods and Applications; Esposito Vinzi, V., Chin, W.W., Henseler, J., Wang, H., Eds.; Springer: Berlin/Heidelberg, Germany, 2010; pp. 655–699. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 1988. [Google Scholar]

- Berglund, R.; Grönvall, T.; Johnson, M. Intellectual Capital’s Leverage on Market Value. Master’s Thesis, Lund School of Economics and Management Lund University, Lund, Sweden, 2002. Available online: https://lup.lub.lu.se/luur/download?func=downloadFile&recordOId=1341958&fileOId=2433109 (accessed on 20 August 2021).

- Sofian, S.; Tayles, M.E.; Pike, R.H. Intellectual Capital: An Evolutionary Change in Management Accounting Practice; Working Paper Series 04/29; Bradford University School of Management: Bradfor, UK, 2004; Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.571.8491&rep=rep1&type=pdf (accessed on 23 August 2021).

- Moslehi, A.; Mohagharl, A.; Badie1, K.; Lucas, C. Introducing a toolbox for IC measurement in the Iran insurance industry. Electron. J. Knowl. Manag. 2006, 4, 169–180. Available online: http://www.ejkm.com (accessed on 23 August 2021).

- Bin Ismail, M. The Influence of Intellectual Capital on the Performance of Telekom Malaysia (Telco). Unpublished Doctoral Dissertation, Business & Advanced Technology Centre, University of Technology Malaysia: Skunda, Malaysia, 2005. Available online: https://studylib.net/doc/14553197/the-influence-of-intellectual-capital-on-the-performance- (accessed on 23 August 2021).

- Lekić, N.; Vapa-Tankosić, J.; Rajaković-Mijailović, J.; Lekić, S. Analysis of structural capital as a component of intellectual capital. Oditor 2020, 6, 33–54. [Google Scholar] [CrossRef]

- Bollen, L.; Vargauwen, P.; Schnieders, S. Linking intellectual capital and intellectual property to company performance. Manag. Decis. 2005, 43, 1161–1185. [Google Scholar] [CrossRef]

- Wang, W.Y.; Chang, C. Intellectual Capital and Performance in Causal Models: Evidence from the Information Technology Industry in Taiwan. J. Intellect. Cap. 2005, 6, 222–236. [Google Scholar] [CrossRef]

- Hassan, S. Impact of HRM Practices on Employee’s Performance. Int. J. Acad. Res. Account. 2016, 6, 15–22. [Google Scholar] [CrossRef]

- Rukumba, S.; Iravo, M.A.; Kaigiri, A. Influence of training and development on performance of telecommunication industry in Kenya. J. Hum. Resour. Leadersh. 2019, 4, 22–31. Available online: https://www.iprjb.org/journals/index.php/JHRL/article/view/855 (accessed on 20 August 2021). [CrossRef]

- Eronimus, A.; Rajeswari, T. Impact of Training Practises on Employee Performance in Software Industry—A Study on HOV Service Limited in Chennai. Train. Dev. J. 2017, 8, 89–94. [Google Scholar] [CrossRef]

- Dayasindhu, N. Embeddedness, knowledge transfer, industry clusters and global competitiveness: A case study of the India software industry. Technovation 2002, 22, 555–560. [Google Scholar] [CrossRef]

- Lekić, N.J.; Vukosavljević, D.D. The importance of human resources in the development of ICT enterprises. Kult. Polisa 2021, XVIII, 293–305. [Google Scholar] [CrossRef]

- Bontis, N.; Fitz-enz, J. Intellectual Capital ROI: A Causal Map of Human Capital Antecedents and Consequents. J. Intellect. Cap. 2002, 3, 223–247. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).