1. Introduction

Managing the Great Recession has been one of the biggest challenges in the history of the European Union (EU) [

1,

2]. After an initial response involving expansionary policies, the Eurozone economies failed to return to the desired stable growth pattern and moved to progressively adopt fiscal consolidation measures [

3,

4]. In the second quarter of 2011, the growth to which the Eurozone had returned after the 2008–2009 recession started to decline resulting in a new recession in 2012. The main factors that led to this economic contraction include financial imbalances due to the high degree of indebtedness of the economic agents, the risk of financial contagion, macroeconomic divergences in the Eurozone, the decrease in fiscal space, the rigidity of the monetary union, and the absence of economic policy tools to compensate for this rigidity [

5,

6]. Furthermore, the economic problems had an asymmetrical impact on the countries in the European Monetary Union (EMU). The case of Greece stood out due to the severity of its economic and financial situation [

7].

Over a decade after the beginning of the crisis, at the end of 2019 (before COVID-19 impact), Greece had lost more than 22% of its gross domestic product (GDP) and maintained an unemployment rate of about 17%. Meanwhile, in the Eurozone, after overcoming the impact of the crisis, the GDP was 9% higher than it was before the Great Recession and the unemployment rate was below 8%. Given the relevance of the economic and political crisis in Greece, as well as its duration and intensity, it is essential to heighten the knowledge regarding the real impact of the public policies employed. With this objective, this study empirically identifies the productive and distributional effects caused by the Economic Adjustment Programmes (EAPs) which conditioned financial assistance to Greece.

The literature provides a great deal of knowledge with respect to the reasons, strategies, and determinants that led to the decision of negotiating and approving the financial assistance plans and their conditionality [

8,

9,

10]. However, much less is known about the causal effects of these plans on the economy. This article makes three contributions to the literature. First, it empirically identifies the productive impact that the EAPs had on Greece. It identifies a long-term negative impact of 35.3% on the Greek GDP per capita. Second, the results provided by this article contribute to understanding the chronological dynamics of the impacts caused by the programmes. Most of the unsustainable negative impact was accumulated between 2010 and 2012. Third, it identifies a regressive effect caused by policies stemming from the application of the EAPs.

The rest of this article is structured as follows. The second section presents the development of the crisis to contextualise the characterisation of the EAPs and the financial assistance for Greece. The third section lays out the methodological details of the synthetic control method (SCM), as well as the data used. The fourth section shows the results obtained in the productive and distributional dimensions. Finally, the last section provides the conclusions and some public policy implications of this study.

2. Crisis and Financial Assistance for Greece

Since the creation of the Eurozone, its members have accumulated asymmetrical imbalances [

11,

12,

13]. The Greek economy, which has been a member of the EMU since 2001, experienced high growth, but also accumulated large imbalances. Between 2001 and 2007, Greece increased its GDP by 27% (Eurostat is the source for the data shown in this section), twice as much as the European average. However, the composition of the Greek productive structure conditioned its dependence on financing from abroad and on its growing current account deficit. The current account balance went from −6.9% of GDP in 2001 to −14% in 2007. Likewise, the labour costs and productivity showed imbalances. Compensation per employee increased 45% since the introduction of the Euro until 2007, tripling the growth of productivity per worker. The fiscal component was also imbalanced. Between 2001 and 2007, the Greek public deficit was between 5.5% and 8.8% of GDP per year, and public debt was always above 100% of GDP.

These vulnerabilities proved critical during the Great Recession. The restriction in financial flow kept the Greek banking system under a great deal of pressure. The contraction in aggregate demand took the country into recession in the third quarter of 2008. In the EU, the initial response to the recession consisted of expansionary policies and bank bailouts. These measures seemed to improve the situation in the Eurozone by mid-2009, but the imbalances had not been corrected and there were no common economic policy tools to compensate for them. As such, given the absence of autonomy to devalue their currency, in the event that the economic situation worsens, countries with competitive vulnerability and dependence on external financing were bound to face an internal devaluation process [

14,

15]. This was the case in Greece.

After the October 2009 elections, the new Greek government of George Papandreou (Panhellenic Socialist Movement, PASOK) recognised that the figures on public finances were much worse than those presented by the previous government [

16]. That year, the Greek GDP decreased by 4.3%; public deficit increased to an unsustainable 15.1%, and public debt rose to 126.6% of GDP. The economic crisis had turned into a sovereign debt crisis. The possibility of financial assistance to Greece was conditioned by its serious economic and financial situation, the lack of confidence in the political and economic management of the country, the existing tensions in other European countries, and the risk of contagion within the Eurozone itself [

8,

17,

18].

The challenge for the European governments was to stabilise the economic situation by avoiding the non-payment of public debt, the bankruptcy of the banking system, and the collapse of the Euro [

19]. All of these in a context of asymmetrical interdependence. The political and economic differences of the countries in the EU became apparent during the discussion and management of the crisis. The governments of countries with the best competitive positions and with less problems in their public accounts, led by the German position, aspired to limit moral hazard on a European scale and to keep the support of their national electorate, which were unfavourable to concessions to debtor countries. They argued that financial assistance should be granted in the form of loans subject to strict conditionality based on fiscal consolidation measures, internal devaluation, and structural reforms. Meanwhile, countries with the worst competitive position and serious problems in their public finances, an example of which was Greece, insisted that access to financial flow that would reduce the pressure of financing costs was necessary. This would make it easier to sustain public finances and the banking system, creating a base for economic recovery and the payment of debts. Thus, they opposed programmes with harsh adjustments and internal devaluation, given the depressive effect these would have on their damaged economies and the unpopularity of these reforms for their electorate [

20]. The plan that finally prevailed was the financial assistance subject to strict conditionality, which was more in line with the position advocated by governments of creditor countries and the previous experience of the International Monetary Fund (IMF) [

9,

21,

22].

2.1. The First EAP for Greece

Between December 2009 and January 2010, the main rating agencies downgraded the credit rating of Greece, and interests on Greek bonds increased significantly. The Greek government announced austerity and fiscal consolidation measures [

19]. However, these did not have enough credibility, and the cost of financing the Greek debt continued to increase. The annual interest on the long-term public debt went from 4.6% in October 2009 to 7.8% in April 2010. Given their inability to meet financing needs (in 2010, Greece needed to finance €60.8 billion to cover costs relating to debt maturity and to pay salaries and pensions [

10]), in April 2010, the Greek government requested financial assistance from the European Commission (EC), the European Central Bank (ECB), and the IMF [

23]. The negotiations of the assistance programme yielded a result that was more in line with the position of governments advocating for financial assistance subject to strict conditionality.

On 2 May 2010, the Eurogroup approved the EAP for Greece for the 2010–2013 period. Loans worth €110 billion were provided to Greece. Of this total, €80 billion were bilateral loans from members of the Eurozone, grouped by the EC through the Greek Loan Facility (GLF), while €30 billion came from the IMF. The overall objective of the programme was to permanently restore the credibility of Greece for investors [

23]. In the short term, the programme objectives were to restore confidence and to maintain the financial stability through fiscal consolidation and liquidity and stability policies for the banking system. In the medium term, the objectives set out to improve competitiveness and realise a structural change towards an export-led growth model.

Disbursement of this financing, which started on 18 May 2010, was to be completed in tranches, subject to the Greek government fulfilling the conditionality of the memorandum of understanding (MoU). The monitoring and evaluation of compliance with conditionality was to be carried out by the triad of institutions known as ‘Troika’, which is composed of the EC, ECB, and the IMF [

23]. This conditionality included fiscal adjustments until 2014, worth 14.5% of the Greek GDP. This aimed at transforming the primary balance deficit of 8.6% of GDP in 2009 into a primary surplus of 5.9% by 2014 and at reducing public debt starting in 2013, when it would reach a maximum of 149.6% of GDP.

The main fiscal measures included salary cuts for public employees; reduction in the number of public employees; cuts in pensions; reduction of investments and public consumption; reorganisation and reduction of local administration; increase in value added tax (VAT); increase in specific fuel, tobacco, and alcohol taxes; special levy on corporate profits; increased taxes on real estate; and the fight against tax fraud. Structural measures were also included to modernise and reform the pension and health system, as well as the tax administration; to strengthen liquidity lines for the banking system and the reform of the banking supervision system; to create the Financial Stability Fund with a capital of €10 billion in order to reinforce bank capitalisation; to increase flexibility of the labour market; to liberalise the transportation, gas, and electricity sectors; to eliminate administrative requirements and barriers for companies in order to promote competition; and to implement a privatisation plan for public assets [

23].

The Greek crisis intensified in 2010, with a 5.5% drop in their GDP, and increased social unrest due to the austerity measures included in the EAP. Meanwhile, in the Eurozone the GDP was growing above 2%, although not all countries shared this recovery. In Ireland, the serious problems with the banking system and their bailout led the Irish government to sign an EAP in December 2010 [

24]. During 2011, the economic situation of the Eurozone started to deteriorate reaching a new recession in 2012. The pressure on the most vulnerable economies was so intense that Portugal, in May 2011 [

25], and Spain, in July 2012 [

26], also signed financial assistance programmes conditioned by adjustment and fiscal consolidation policies.

2.2. The Second EAP for Greece

The most serious economic situation among the members of the EMU was experienced once again by Greece. In 2011, the Greek GDP fell by 9.1%, public deficit reached 10.3% of GDP, public debt rose to 172.1% of GDP, and the interest of the long-term public debt exceeded 20% per annum in December. High unemployment, lack of liquidity in the banking system, problems with the adoption of the first EAP measures, and the harshness of its conditionality weakened internal demand in the Greek economy even further [

27]. The position of the Greek government had also become weaker, both internally and externally. In November 2011, the failed referendum proposed by Papandreou regarding a second EAP marked the end of his government. In its place, a temporary technocratic government lead by Lucas Papademos was appointed to negotiate the conditions of the new programme for financial assistance [

28].

The second EAP was approved by the Eurogroup on 14 March 2012, without having completed the previous programme. It was agreed that financing for Greece would be provided for four years through the amounts not yet disbursed from the previous programme plus additional €130 billion. In total, with this second EAP, Greece was to receive €144.7 billion through the European Financial Stability Facility (EFSF) and €28 billion from the IMF [

29]. A decrease in interests from the previous programme, an extension of the period for loan repayment and, for the first time, a significant voluntary cut in the debt by private creditors were also included [

29]. This was all subject to a conditionality that continued and intensified the austerity approach adopted in the first plan.

Aside from continuing with measures from the previous EAP, financing through this second programme was conditioned by an additional effort in the fiscal adjustment. The objective was to achieve a primary surplus of 4.5% of GDP in 2014 and a public debt of 120% of GDP by 2020. To fulfil this objective, the following measures were expected: intensification of fiscal consolidation measures in terms of reducing public jobs and wages, cuts in social spending and public investment, restructuring of the public sector and closure of public entities, fight against tax evasion, and intensification of the privatisation process by reinforcing the role of the Hellenic Republic Asset Development Fund (HRADF) to obtain €50 billion. Likewise, they were looking to continue the internal devaluation process through flexibilisation measures of the labour market and salary reductions, highlighting a 22% reduction in the general minimum wage, with an additional 10% cut for people under 25 years of age. For the banking system, reinforcing the recapitalisation and resolution processes, which were estimated at €50 billion, was the priority. Furthermore, it was sought to focus on decreasing the number of barriers for businesses, especially in the service sector, and accelerating the liberalisation of sectors such as transportation and energy [

29].

2.3. The Third EAP for Greece

In June 2012, after the second programme was launched, Antonis Samaras (New Democracy, ND) was named as the new Greek Prime Minister. The harshness of the conditionality and the crisis in the Eurozone, despite the expansionary monetary policies adopted by the ECB [

3], were damaging Greece’s internal and external demand, respectively. The Greek GDP fell by 7.3% in 2012. The Greek economy had been experiencing a year-to-year drop in GDP for the last six years, until in 2014 the country showed a slight economic improvement with an annual increase of 0.7%. However, the accumulated dissatisfaction was so great that the elections of January 2015 were won by the coalition lead by Alexis Tsipras (Coalition of the Radical Left–Progressive Alliance, SYRIZA) [

30]. The new Prime Minister of Greece promised to end the austerity policies of both EAPs [

10].

With this idea, the new government started negotiating a financial assistance programme to replace the previous one [

19]. By the end of 2014, the Greek debt was reaching 178.9% of GDP, with a public deficit of 3.6%. During the negotiations, the economic situation in Greece severely deteriorated. The annual interest rate on long-term public debt doubled between September 2014 and March 2015, exceeding 10% from that month to August. The Greek financial system was under severe liquidity strains, which peaked in June and July 2015 with the controls of capital, closure of banks, restrictions on the cash withdrawal to deal with capital flight, and the loss of liquidity from the ECB [

17,

28]. The Greek people rejected the strict conditionality of financial assistance in the referendum of 5 July 2015 proposed by Tsipras [

31]. Nevertheless, strong economic and financial pressure led the Greek government to accept a third EAP that maintained the principle of conditionality of the previous two [

7].

The Eurogroup approved the third EAP for Greece on 14 August 2015. This programme facilitated financing for Greece for the next three years with a loan of €86 billion through the European Stability Mechanism (ESM), subject to complying with a new set of measures. An additional fiscal adjustment to reach a primary surplus of 3.5% of GDP in 2018 was among the new conditions laid out in the MoU. This adjustment was based mainly on increasing VAT collection by 1% of GDP, reforming income tax to make it more progressive and improving its collection, eliminating tax deductions, modernising the tax administration, reinforcing measures against tax evasion and fraud, reforming and decreasing spending on pensions and health, reducing military spending, and reforming the social transfer system to save 0.5% of GDP by targeting the system on the most vulnerable population and establishing a guaranteed minimum income. Other relevant conditional measures, in this case directed towards the banking system, focused on the disposal of up to €25 billion to recapitalise banks and fight against the problem of non-performing loans. The flexibilisation of the labour market was also expanded. Other goals were to modernise the educational system, remove administrative barriers, and liberalise the goods and services markets, following recommendations from the Organisation for Economic Cooperation and Development (OECD), with special emphasis on the energy sector. Regarding privatisations, an influx of €6.4 billion until 2017 was expected from the Asset Development Plan of the HRADF and the creation of a new fund to obtain €50 billion from the privatisation process [

32].

After the third EAP, the new elections of September 2015 were won by Alexis Tsipras (SYRIZA). By the end of 2015 the Greek GDP had decreased by 0.4%. The crisis extended to 2016, when the GDP decreased by 0.2%. Nonetheless, starting in the third quarter of 2016, the Greek economy went back to a growth pattern. However, this growth was weak, without reaching 2% annually, and did not overcome the growth in the Eurozone until 2019.

3. Materials and Methods

The SCM is especially suitable for estimating the impact of an intervention or treatment that affects a unit or a small number of units, such as regions or countries, at an aggregate level [

33]. Recent examples where SCM was used for estimating the causal impact on issues relating to European integration include Puzzello and Gomis-Porqueras [

34] concerning the Euro, Born et al. [

35] on Brexit, and Campos, Coricelli, and Moretti [

36] on the integration of new members.

The SCM is used to identify the effect of an intervention or treatment by comparing, over the post-intervention period, the outcome of the aggregate treated unit with the outcome of the same unit had it not been subjected to the treatment. However, once the intervention has been carried out, it is impossible to observe the outcome that the treated unit would have had it not been subjected to it. As such, a counterfactual that is closest to this situation is estimated to compare and identify the effect of the intervention [

37]. To build the counterfactual, this quasi-experimental methodology selects a synthetic control as a weighted combination from a donor pool of comparable units not subjected to the intervention. This empirically driven selection is completed using a vector of characteristics or outcome predictor variables over the pre-intervention period, which may include pre-intervention observations from the outcome itself [

38]. According to Abadie, Diamond and Hainmueller [

38], the difference between the preintervention characteristics of the treated unit and the synthetic control is given by the vector X

1 – X

0W, where X

1 is the k x 1 vector of k characteristics of the treated unit, X

0 is the k × J vector of k characteristics of the J control units, and W is a weight matrix. The SCM selects the synthetic control choosing W* as the value of W that minimizes

during the pretreatment period, where v

m is a weight that reflects the relative importance assigned to the m-th variable. The formation of the synthetic control is then optimised by minimising the prediction error between the outcome of the treated unit and that of the counterfactual estimated in the pre-intervention period. The SCM estimator of the causal effect of the intervention or treatment, τ

1t, is given by the comparison of postintervention outcomes between the treated unit and the synthetic control, τ

1t = Y

1 – Y

0W* [

33,

37,

38].

This study considers Greece as the treated unit. The treatment or intervention is represented by the EAPs applied since 2010. Therefore, the start year of the intervention is 2010, when Greece signed the first MoU and started applying its measures. The considered pre-intervention period is from 1990 until 2009. The considered post-intervention evaluation period is from 2010 until 2017. The donor pool is composed of the 23 countries in the EU for which EAPs were not applied (Cyprus, Ireland, Portugal, and Spain were all excluded from the donor pool for having signed MoUs for EAPs between 2010 and 2013). The outcome considered as an indicator of economic performance is the GDP per capita, expressed in constant 2011 US

$. For outcome predictors during the pre-intervention period, the following indicators were used based on the literature [

36,

37,

39]: gross fixed capital formation as a percentage of GDP, annual rate of population growth, share of agriculture, forestry and fishing in GDP, share of industry in GDP, mean years of schooling for the population over 25 years, and the GDP per capita prior to the first EAP. All the predictor variables were considered for the entirety pre-intervention period, except for the GDP per capita. In this case, the values for a reduced pre-intervention period, 2000–2009, were taken into account as predictors to avoid overfitting problems). The data for GDP per capita was taken from the Penn World Table [

40,

41], while all the other predictor variables were taken from the World Development Indicators [

42], except the mean years of schooling which was obtained from Jordá and Alonso [

43].

The main advantages of using the SCM is that, considering the presence of unobserved time-varying confounders, it avoids endogeneity bias due to omitted variables; it is suitable to be applied in small samples of comparable aggregate units; it identifies the optimal counterfactual in a way that is transparent and empirically driven; and it provides an estimate that is more realistic than the usual linear regressions by not allowing extrapolation in the weighting when forming the counterfactual [

33,

39,

44].

However, for the use of SCM to provide an advantage over alternative methodologies it must be ensured that: the donor pool is composed of units that have not been the object of intervention, the outcome in the pre-intervention period is not affected by the intervention, the intervention does not generate spillover effects on untreated units that compose the donor pool, and the pre-intervention period is long enough as not to bias the estimate of the counterfactual [

33]. The following section discusses the results of the application of the SCM, along with a series of robustness tests to confirm that these necessary conditions for proper causal identification are being met.

4. Results

It is necessary to identify the optimal counterfactual to estimate the effect of the EAPs in Greece. The composition (and weights) of the optimal counterfactual,

Table 1 (synthetic control weights have been optimised according to the methodology explained in the previous section. Estimations carried out using synth_runner package for Stata [

45]), considering a donor pool of EU members (during the analysed period) that did not apply financial assistance programmes conditions to adjustment measures: United Kingdom (0.242); Malta (0.232); Croatia (0.222); France (0.178); Austria (0.077); Estonia (0.048); others (0.000).

Once the optimal counterfactual, called Synthetic Greece, was identified, the growth comparison of the GDP per capita of Greece and that of the counterfactual can be performed.

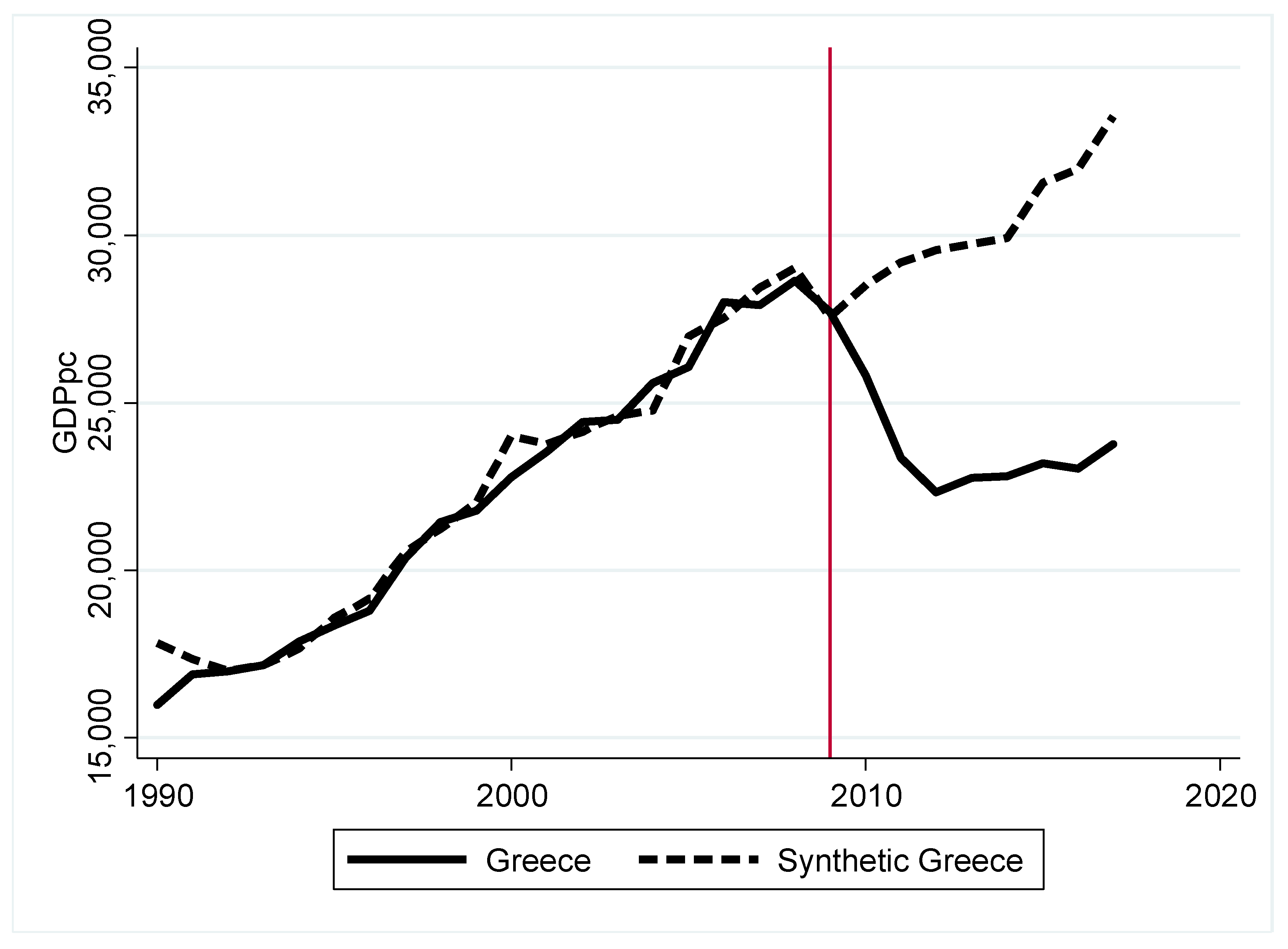

Figure 1 shows the series of GDP per capita between 1990 and 2017 for both cases. The vertical line in 2009 marks the last year before the application of the intervention. The graph shows a suitable adjustment of the GDP per capita series for Greece and Synthetic Greece over the pre-intervention period. This indicates a proper identification of the counterfactual through the predictors. Since 2010, once conditionality of the first EAP for Greece began to be applied, the series diverged. Greece experienced a severe drop in GDP per capita until 2013, when a small increase was maintained throughout 2017, except for the drop in GDP per capita in 2016. In comparison, the Greek counterfactual showed growth over these years, which intensified from 2014.

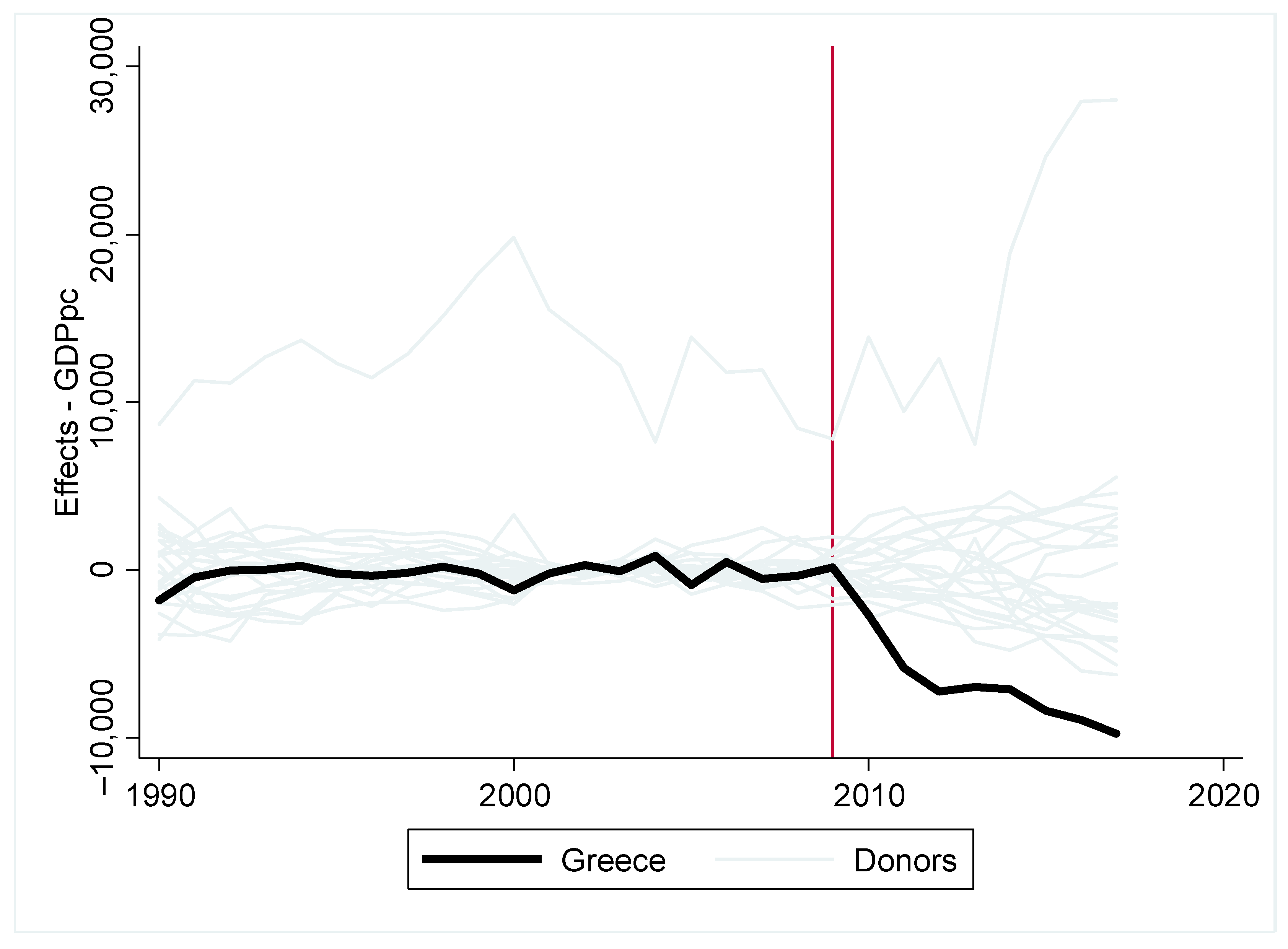

The causal effect of applying the EAP in Greece is estimated by calculating the difference between both series of GDP per capita, starting in 2010. The estimated impact,

Figure 2, is clearly negative for the entire post-intervention period. In 2017, the accumulated estimated effect on the Greek GDP per capita was a decrease of 2011 US

$ 9780.7. This represents 35.3% of the Greek GDP per capita in 2009, the year previous to the application of the first EAP.

The impact of the policies from the EAPs has not been homogeneous over time. Most of the negative impact on the Greek GDP per capita was concentrated in the period 2010–2012. Three quarters of the estimated loss of GDP per capita for the Greek economy caused by the application of the EAPs were accumulated over these three years. Greece performed slightly better than the counterfactual, in terms of GDP per capita, over the two-year period of 2013–2014. However, when compared with the counterfactual, the application of the third EAP, starting in 2015, led to a new downward trend of the Greek economy. This increased the negative effect on the Greek GDP per capita.

4.1. Robustness Tests

To test the reliability and robustness of the results, a series of placebo tests were performed. These considered that the intervention in 2010 was applied to each country in the donor pool instead of Greece. The estimated impact for Greece clearly and significantly differed from the estimates of the placebo tests for the donor pool countries (see

Figure 3). The p-values derived from the placebo tests (Abadie, Diamond, and Hainmueller [

39] and Galiani and Quistorff [

45] provided detailed information on the estimation and interpretation of p-values in the SCM) are lower than 0.01 for all the estimated years. This confirms that the estimated effect was caused by the intervention in Greece and not by a common shock effect in the EU due to the Great Recession and the debt crisis in the Eurozone.

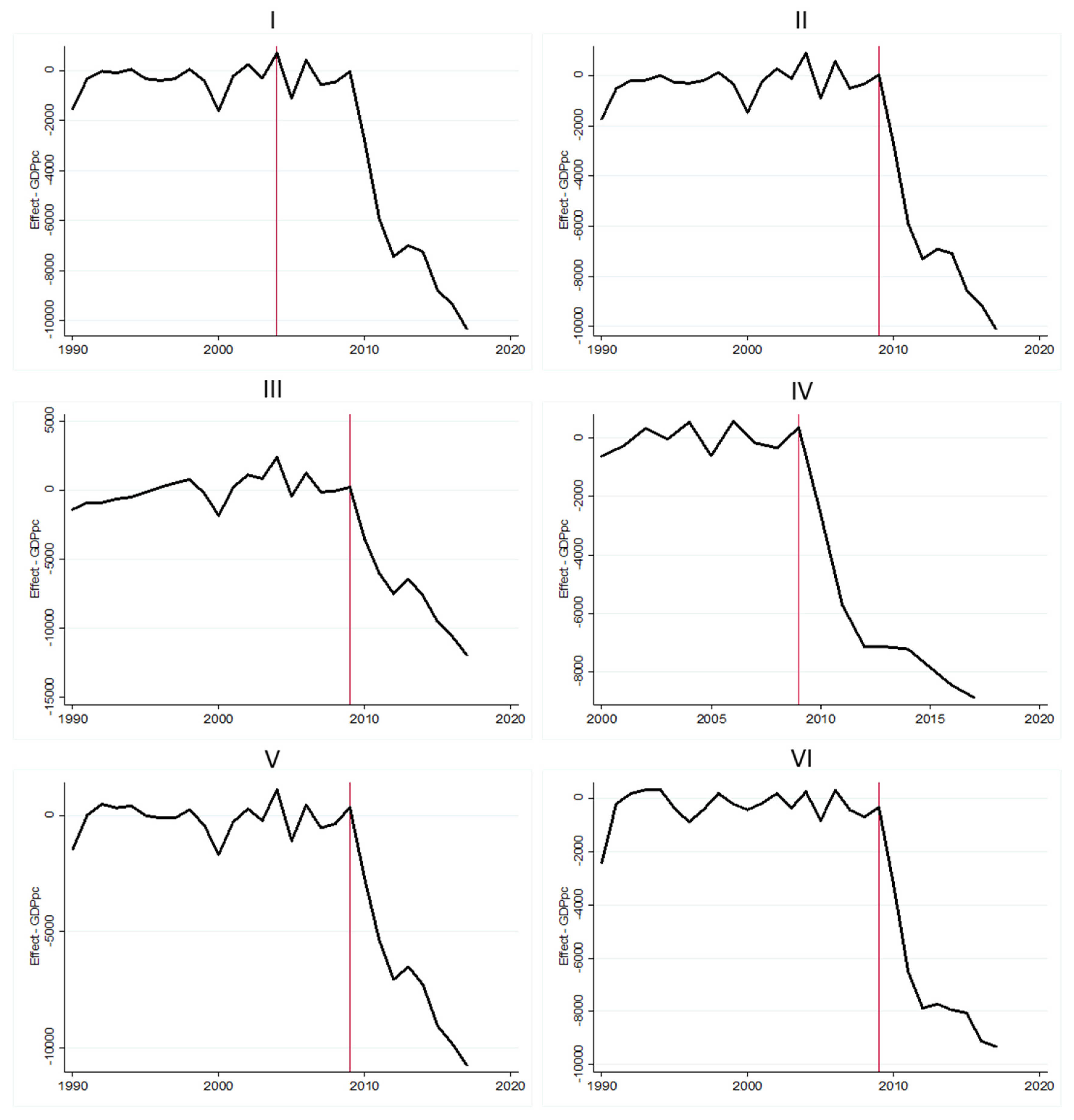

Additionally, a series of robustness tests were carried out to ensure that the necessary conditions, explained in the methodology section, for the proper causal identification of the EAP effect are met. The results from these tests are displayed in

Figure 4. First (I), an in-time placebo test was performed to check whether the Greek economy was able to anticipate the effect of the intervention. Therefore, this was considered to start in 2005, five years before the first real application of the EAPs. It was observed that the effect of the intervention could not be anticipated given that it only appeared from 2010 (likewise, in-time placebo tests considering that the intervention started in 2006–2009 were carried out. In all cases, the effect from the intervention appeared starting in 2010). Second (II), to verify that the estimated effect was not caused by the fiscal imbalances of Greece prior to the intervention, three new predictor variables were included: general government debt, general government final consumption expenditure, and public balance, all variables were measured as a percentage of GDP. The result shows a similar pattern to the one that was initially estimated, ruling out that the fiscal situation of Greece prior to 2010 could be the cause of the identified effect. Third (III), to ensure that there were no problems with overfitting, the use of previous observations of GDP per capita as predictor variable was reduced to the period 2007–2009. The obtained result reproduced the pattern of the other robustness tests, ruling out problems with overfitting. Fourth (IV), the pre-intervention period was cut down, considering the years from 2000 to 2009. Once again, the dynamics from the initial result were reproduced; despite it, as expected, by cutting down the pre-intervention period to form the synthetic control the precision of the SCM decreased and an underestimation of the effect was produced. Fifth (V), to verify that the Stable Unit Treatment Value Assumption (SUTVA) was not violated and that the intervention in Greece did not produce spillover effects on untreated units from the donor pool, the three countries that had the strongest trade and foreign direct investment (FDI) relations with Greece (France, Germany, and Italy) were excluded from the donor pool. The result reproduced the previously estimated pattern, ruling out problems with the estimated results due to spillover effects on untreated units from the donor pool. Finally (VI), to ensure that a purely European donor pool does not bias the results, a new donor pool composed of OECD countries that have not signed MoUs linked to adjustment programmes to receive financial assistance was considered. The obtained estimates follow the same pattern of the previous ones. As such, based on the results from all the robustness tests carried out, the reliability and robustness of the results obtained initially can be assured.

4.2. Distributional Effect

The previous results refer to the effect on production in per capita terms. However, the impact of the policies is not distributed homogeneously throughout the population. As such, once the existence of a highly significant impact of the EAPs on the Greek economy has been proven, it becomes just as relevant to know the way in which the impact is distributed.

The national income distribution data provided by the World Income Inequality Database, developed by the United Nations University World Institute for Development Economics Research, allowed for calculating the GDP per capita for each quintile of the population, sorted from the lowest to the highest income (from Q1 to Q5). To calculate this value, the proportion of national income of each quintile was multiplied by the GDP of the country and divided by the population that comprised each quintile (20% of the total population). Similar to the way in which the impact on the GDP per capita of the Greek economy was estimated, it is possible to estimate the distributional impact by applying the SCM considering the GDP per capita of each quintile as an outcome for the distribution analysis. Given data availability, in this case, the considered pre-intervention period was 1995–2009 and the donor pool included 16 EU countries (being Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Hungary, Italy, Luxembourg, Netherlands, Poland, Romania, Slovak Republic, Sweden, and United Kingdom), in which no EAPs were applied. Abiding by the characteristics laid out in the methodology section for the post-intervention period and the predictor variables.

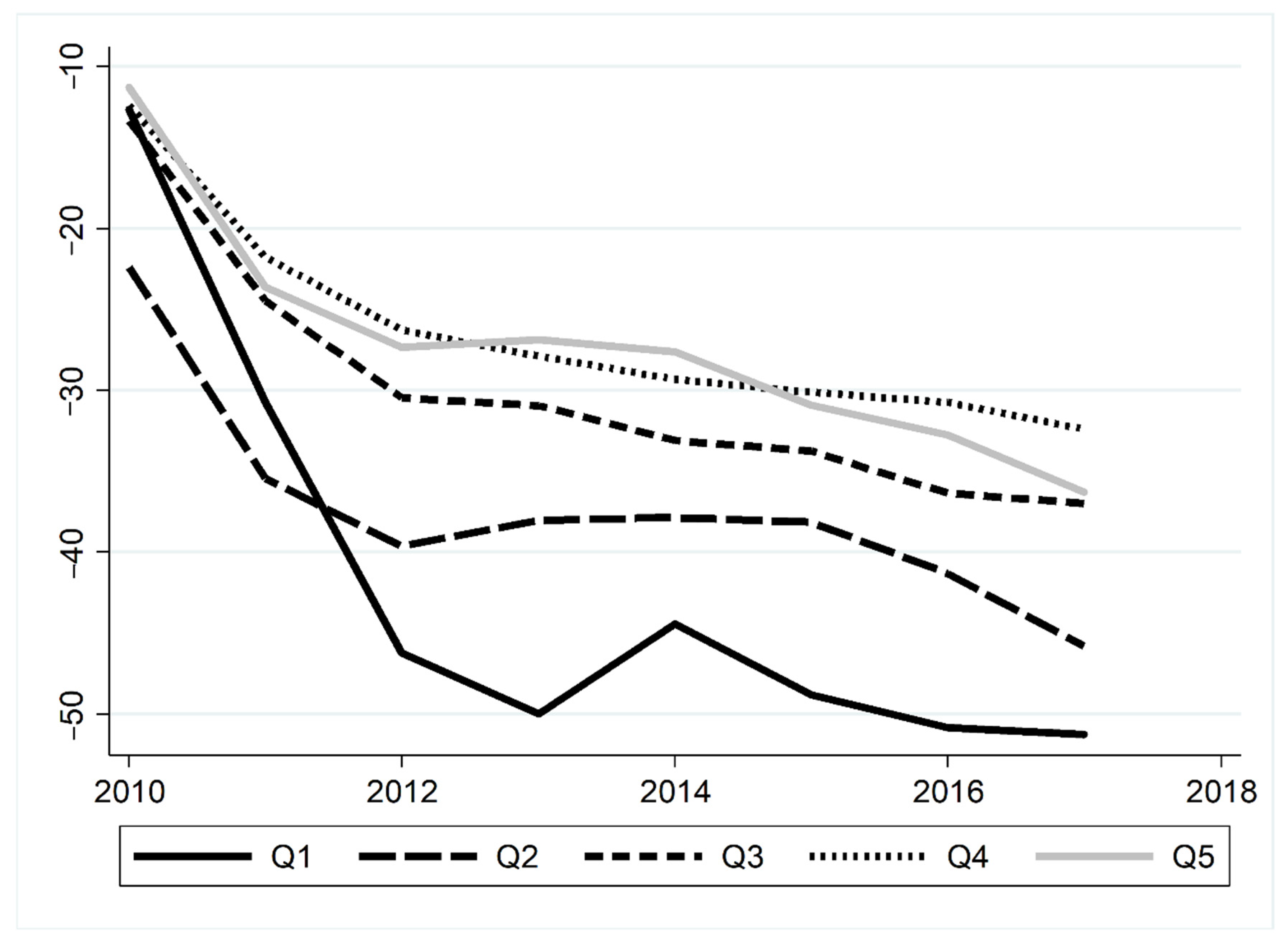

The results from the distributional impact analysis,

Figure 5, show a regressive effect caused by the application of the EAPs. Even though all quintiles were negatively affected by the program measures, the relative negative effect was more intense in the population quintiles with lower incomes. For all quintiles, most of the negative impact was accumulated between 2010 and 2012, after which the increase in negative impact was lower.

The quintile of the Greek population with the lowest income (Q1) experienced a more intense relative negative effect due to the application of EAPs. Until 2017, it accumulated a loss of about 51.3% of its GDP per capita for the year prior to the application of the first EAP. The second lowest income quintile (Q2) experienced the greatest negative relative impact in 2010 and 2011. Since 2012, after Q1 surpassed it in terms of negative relative impact, this quintile remained the second most negatively affected. Specifically, the cumulative estimated impact for this quintile in 2017 was a 45.9% decrease of its GDP per capita in 2009. The intermediate or third quintile in terms of income (Q3) accumulated a 37% decrease relative to its average 2009 income as a result of the EAPs. The second highest income quintile (Q4) was the only one for which the observed negative impact was less than that estimated for the whole of Greece. Until 2017, on average, an individual in this quantile accumulated a loss caused by EAPs equivalent to 32.4% of its GDP per capita in 2009. Finally, the quintile of the population with the highest income (Q5) experienced a negative impact slightly higher than the estimated for the country as a whole. By 2017, it accumulated an estimated decrease of 36.2% in GDP per capita as a result of applying the EAPs.

Considering the estimated effects on the quintiles, the EAPs had a regressive impact on Greece. Most of the relative negative impacts were estimated on the quintiles of the Greek population with the lowest income, with an especially intense negative impact on the bottom 20%.

4.3. Discussion

Previous investigations on this issue present two limitations. First, they used methodologies based on assumptions that do not constitute the best possible strategy for causal identification. Second, they excluded relevant EAP aspects from the analysis by exclusively specific policies. This research addresses these problems by assessing the impact of the EAPs on the Greek economy using the SCM. It is a quasi-experimental methodology that provides an optimised counterfactual with an empirical base, which allows analysing the impact of the applied set of measures as a condition for receiving the financial assistance. Therefore, the impact assessment considers the joint effect of fiscal measures, financial stability policies, structural changes, and other regulatory measures adopted as part of the EAPs.

Among the authors who have analysed this issue, Gechert, Horn, and Paetz [

46] considered that the negative impact of the policies in the short- and long-term was considerably underestimated. However, Górnicka et al. [

47] estimated lower fiscal multipliers for European economies, contradicting the negative effect found by Gechert, Horn, and Paetz [

46]. Meanwhile, Paulus, Figari, and Sutherland [

48] estimated the negative effect for Greece caused by fiscal austerity measures to be 2.68% on the aggregate demand. For their part, Alesina, Favero, and Giavazzi [

49] found a considerably more intense negative effect on Greece. They estimated that between 2010 and 2014, the GDP decreased by about 4% to 7% yearly, due to fiscal measures applied as part of the first two EAPs. Comparing with previous literature, the estimated negative effect caused by EAPs on the Greek GDP per capita of 35.3% is considerably higher. Applying a quasi-experimental approach, the negative effects of the austerity programs in Greece seems to be significantly higher and unsustainable than the previous results.

In terms of distributional impact, Andriopoulou, Kanavitsa, and Tsakloglou [

50] and Kaplanoglou and Rapanos [

51] analysed the increase of poverty and vulnerability caused by austerity policies in Greece. The estimated regressive impact in this research shows a complimentary result. Matsaganis and Leventi [

52] found that the population with the lowest income quintile in Greece experienced a decreased of 34% in their income. The results obtained in this study are significantly higher in negative terms for the lowest income quintile.

Important implications can be derived from this research. The results suggest the need to review and improve the conditionality linked to financial assistance, to avoid an excess in its application leading to a depressive vicious circle with regressive consequences in terms of income distribution, appears to be clear. Conditionality with intense negative effects in the short-term could result, as in the Greek case, in long-term negative effects that make it impossible to achieve the stability and sustainable growth objectives of the programmes. Meanwhile, to prevent further imbalances and not rely on asymmetric negotiations on financial assistance and EAPs, the Eurozone should develop new institutional mechanisms to mitigate the rigidities and asymmetries caused by the monetary union. The mechanisms created so far do not seem sufficient to successfully respond to these needs.

However, some limitations of this research should be considered. First, the reliability of the results depends on the quality of the donor pool. As the donor pool in the distributional analysis is smaller, the reliability of the estimated distributional impact is lower than in the estimated productive impact. Second, the proportion of national income for each quintile was used to calculate the GDP distribution by quintile, allowing for calculating GDP per capita for each quintile. It was used due to the unavailability of comparable data for the donor pool in terms of GDP distribution. Although it could be the best methodological option among those available, it should be considered that national income and GDP differ, and the chosen assumption constitutes a limitation in the research. Third, the impact of EAPs will be lasting in the long term and this could quantitatively and qualitatively alter the productive and distributional impacts in the future. So, it will be necessary to evaluate the effect of EAPs in the (very) long term.

5. Conclusions

During the debt crisis in 2010, those who defended the approach of financial assistance to Greece subject to strict fiscal austerity and structural measures argued that it would allow the country to access financial flows for a period long enough to avoid bankruptcy. It would allow to put in place measures to return to fiscal sustainability, besides facilitating the structural reform of the economy that, via an internal devaluation, would lead to an improvement in competitiveness as well as to future sustainable growth driven by the increase in the external demand [

6,

15].

At the same time, those who criticised the conditional approach linked to strict austerity policies argued that the intensity required of Greece for fiscal and salary adjustments would increase inequality and could have depressing effects by sinking domestic demand. This would prevent Greece from achieving fiscal sustainability and economic growth, thereby creating a vicious circle in the Greek economy [

1,

9,

14].

This research has evaluated the causal productive and distributional effect of the EAPs for Greece. It performed a quasi-experimental analysis by applying the SCM making three contributions to the literature. First, it identifies the productive effect caused by EAPs estimating a long-term negative impact on the Greek GDP per capita of 35.3%. This result supports the arguments given by those who criticised the strict approach adopted in the Greek case. Second, it provides empirical evidence regarding the chronological distribution of the unsustainable impact by showing that around 75% of the negative effect occurred between 2010 and 2012, with the application of the first EAP and the start of the second. Over the course of 2013 and 2014, the Greek economy experienced a small improvement in relation to the estimated counterfactual. However, it experienced a new loss with respect to the counterfactual in 2015, coinciding with the third EAP. The third contribution is the causal identification of a regressive distributional impact. The Greek population with lower incomes suffered greater negative effect of the EAPs. Until 2017, due to the EAPs, the quintile of the population with the lowest incomes had decreased their GDP per capita by just over 50%. Over the same period of time, the impact experienced by the second quintile with lower incomes was a decrease of 45.9% of their GDP per capita. The estimated relative impacts for the other three quintiles were between 32.4% and 37% decrease in their GDP per capita. Demonstrating the unfulfillment of the distributional objective that the effect of the adjustment be distributed equally throughout the Greek society [

23].

The evaluation of the causal effects derived from the applied EAPs in the EU is essential to identify successes and failures. This would allow the consolidation of the identified best practices in public policy and avoid the repeated application of failed policies. A process to identify the best practices is desirable anytime, anywhere, but it is even more pertinent in the EMU nowadays, where the economic crisis caused by the coronavirus pandemic (COVID-19) has reopened the debate on financial assistance and conditionality.