1. Introduction

The economic crisis in 2008–2009 has led to an unprecedented increase in public debt. However, recovery has remained sluggish, raising serious concerns about the impact of public debt on economic growth. In their seminal paper, Reinhart and Rogoff [

1] argued that public debt to GDP ratio higher than 90% is harmful to economic growth. Their study inspired research on the debt threshold level in various countries and regions, and many studies found the support for the idea of non-linear debt–growth relationship and the existence of the threshold level above which debt becomes unsustainable and restricts output growth. However, the results of the research are contradictory in assessing the level of debt from which its impact on growth changes from positive to negative (see [

2,

3] for systematic review).

Nowadays, countries are facing a new crisis caused by the coronavirus (COVID-19), which leads to further rise in public borrowing. At the same time, debt levels remain high in many countries after dealing with the economic crisis in 2008–2009. The new borrowing of the countries should be consistent with fiscal spending and deficit plans; the government’s borrowing decisions should be carefully set to keep public debt on a sustainable path. This situation highlights the importance to examine what factors determine the level of public debt that still sustains growth? However, to our best knowledge, there is relatively scarce empirical evidence on this question. Review of research [

4] suggests that institutions shape the debt–growth nexus and debt threshold is higher for countries with better institutions. The state of the financial market [

5], country risk [

6], economic systems [

7], trade balance [

8] are confirmed as well as the factors shaping the impact of debt on growth.

The positive effect of debt is grounded on the Keynesian view that expansionary fiscal policy leads to a higher debt level, but it simultaneously stimulates the private demand and output growth through the mechanism of the fiscal multiplier. The question of how government debt affects the size of the fiscal multiplier raises debate in the literature. Nonetheless, empirical results suggest an inverse relationship between these two variables [

9,

10,

11,

12,

13,

14,

15,

16,

17]. The lower the expenditure multiplier, the weaker the positive impact of government spending and thus of public debt on the economy, and debt is less sustainable. Our research complements scarce empirical evidence on the heterogeneous debt–growth relationship by raising the assumption that the expenditure multiplier is shaping the impact of public debt on growth and we put forward a hypothesis that countries with a higher expenditure multiplier have a higher debt threshold level.

Immense empirical studies have examined the impact of public debt on output; however, Huidrom et al. [

18] point to the lack of systematic investigation on the channels through which public debt affects the fiscal multiplier. Contributing to a limited literature on this issue, this paper provides the theoretical background for how a fiscal multiplier may decline in response to growing public debt and in turn potentially lower the impact of public debt on economic growth. The fiscal multiplier determines the effectiveness of the fiscal policy but paradoxically gives no practical insights to its application, as there is no consensus in the literature on both the size of fiscal multiplier and the method of measuring it [

11]. In response to this, our research aims to provide some insights on the publicly available statistical indicators that might signal a relatively low/high fiscal multiplier and, at the same time, potentially unsustainable/sustainable growth stimulus through the use of borrowed funds.

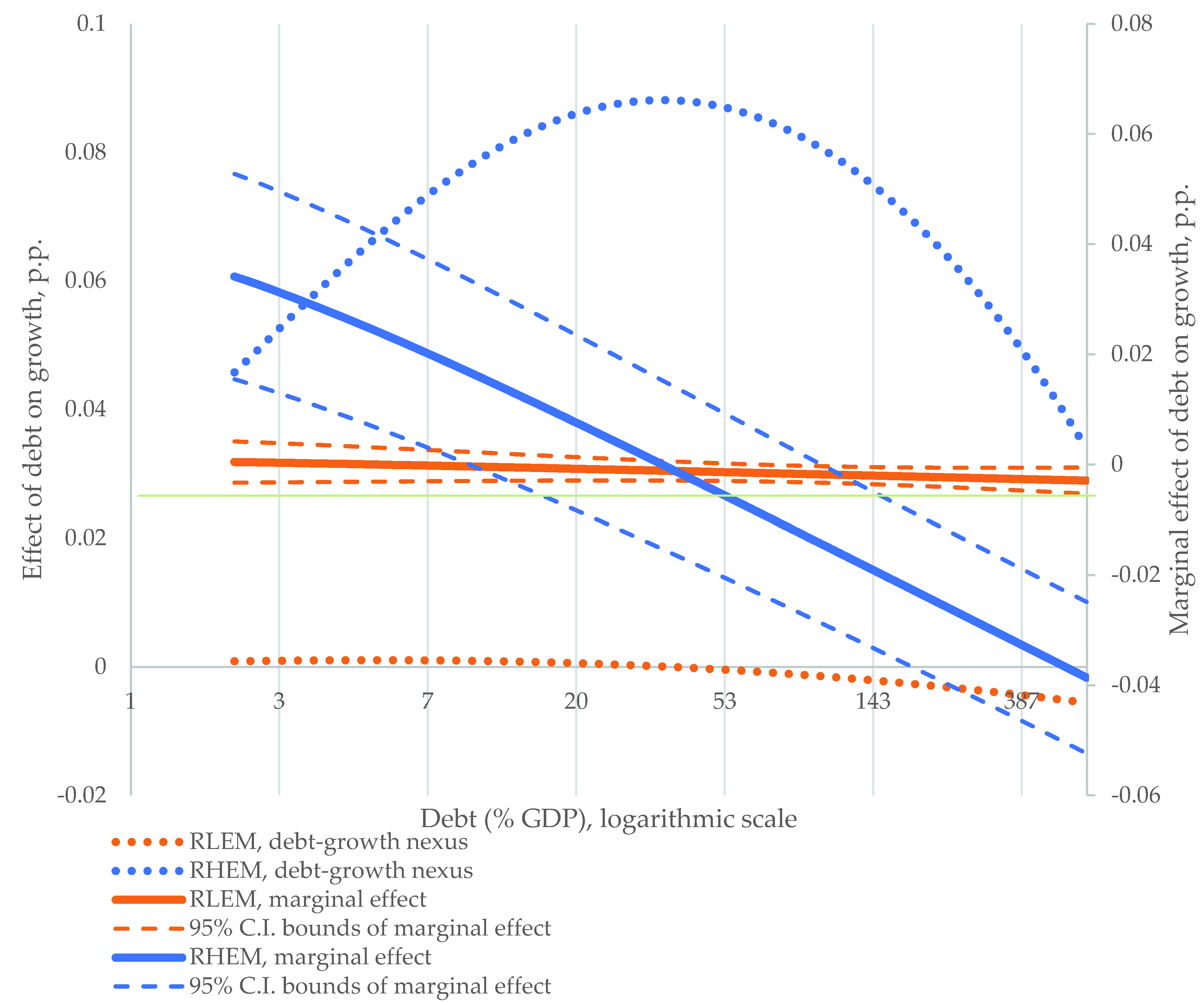

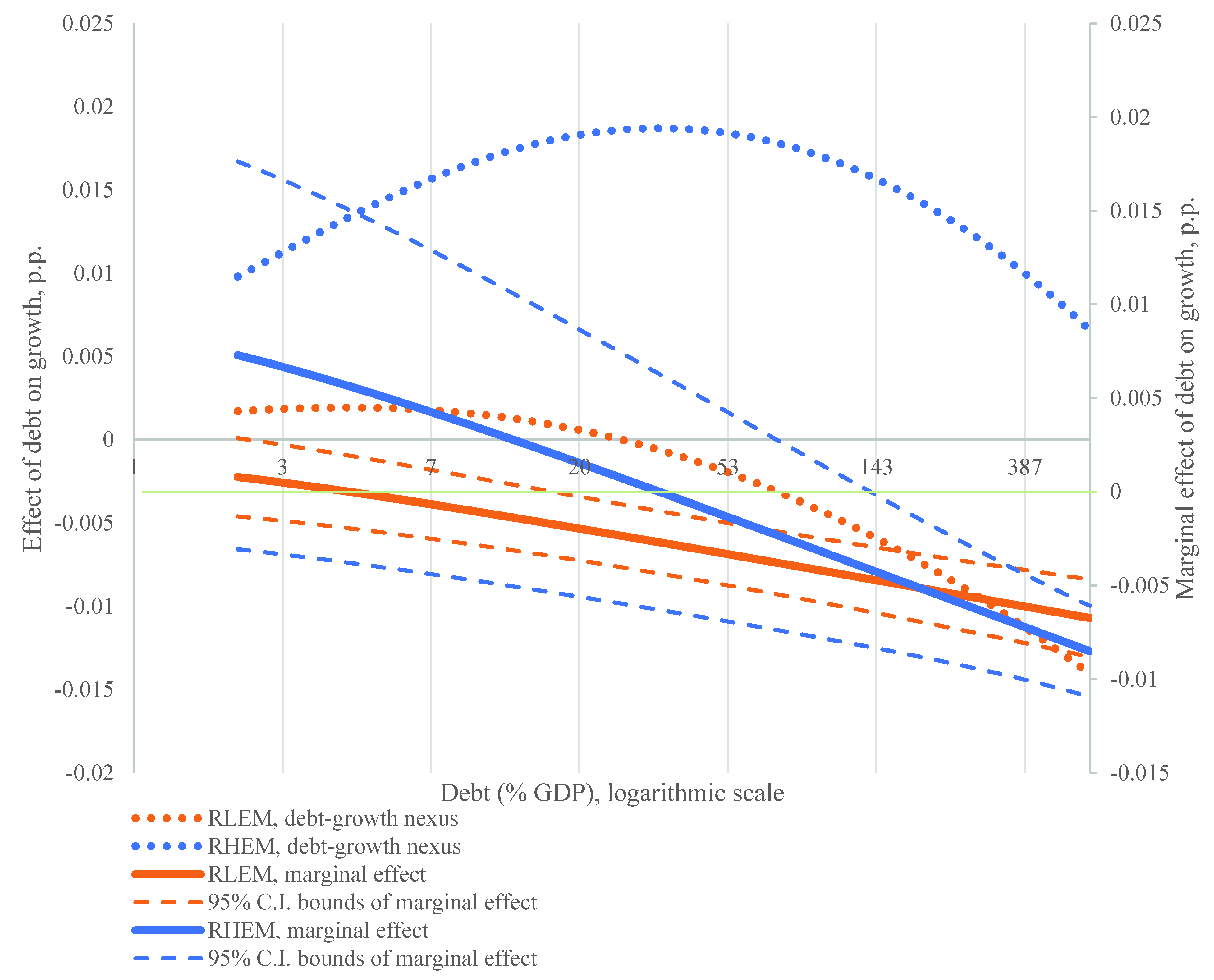

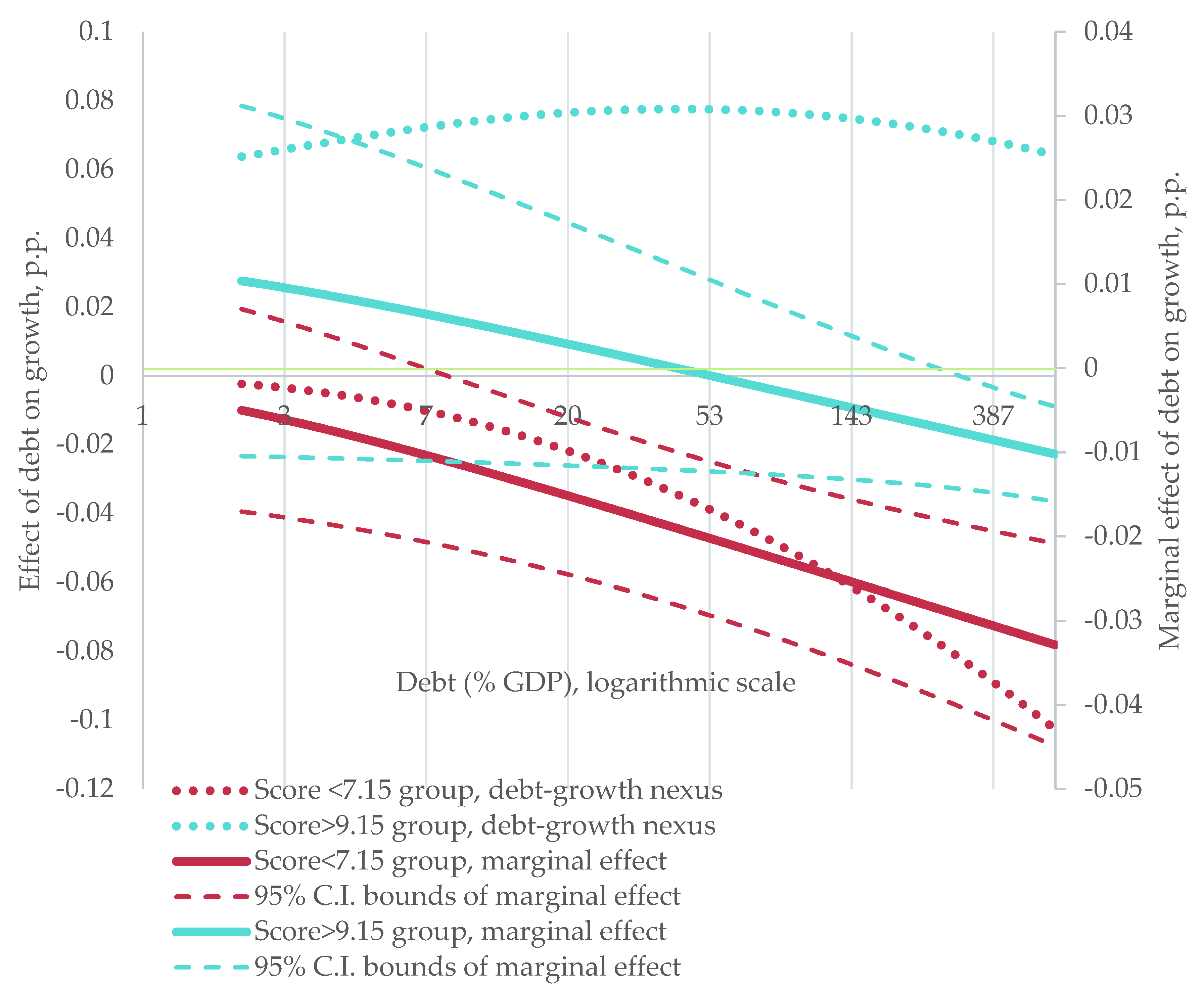

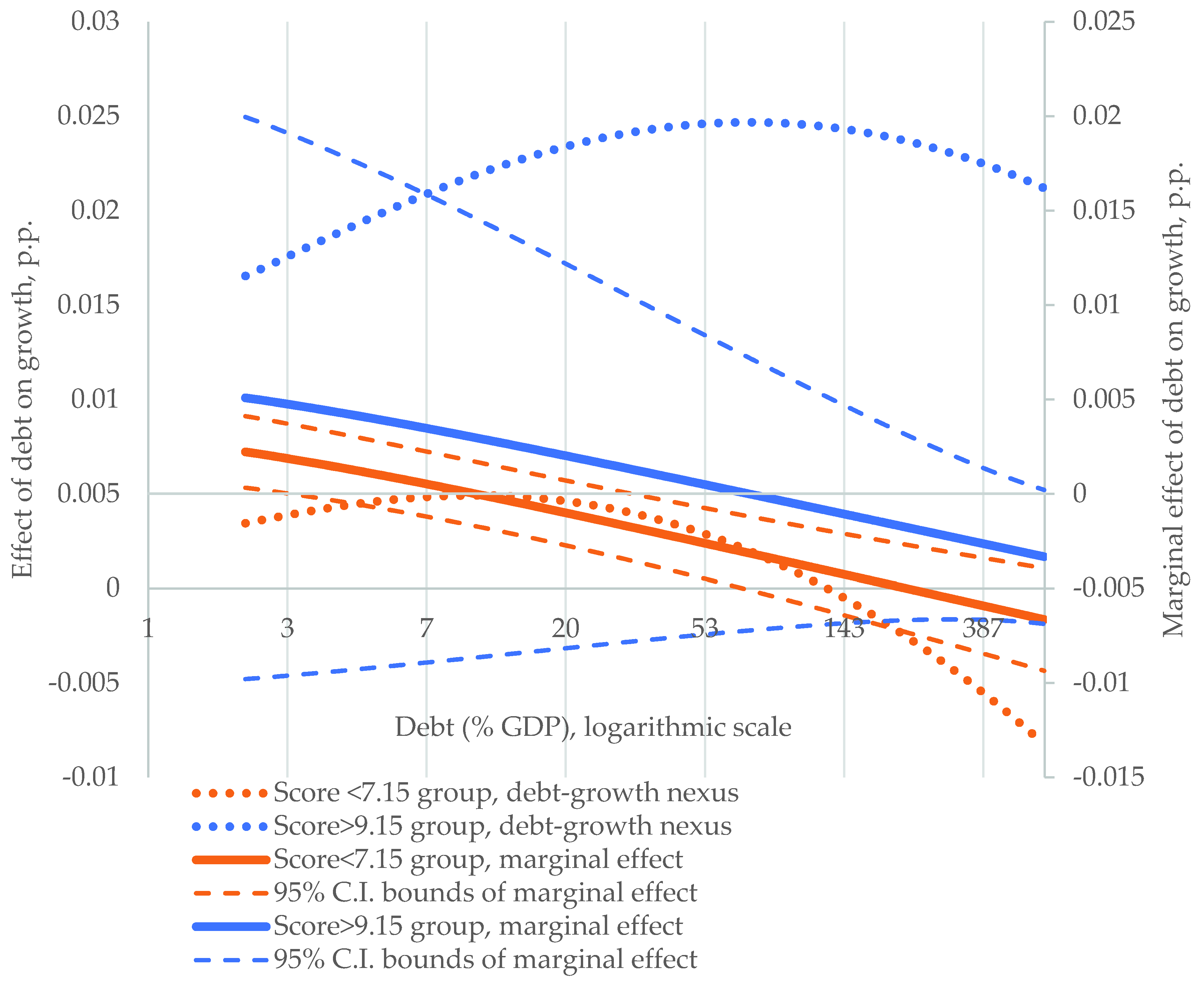

The empirical examination is based on the analysis of panel data and results indicate the positive debt threshold dependence on the expenditure multiplier, but irrespective of its size only low levels of public debt have positive and statistically significant links with economic growth. At the same time, the levels of public debt that hinder economic growth clearly depend on the indicators that reflect the size of the expenditure multiplier.

The rest of the paper is organised as follows:

Section 2 discusses channels through which public debt can potentially have an impact on sustainable economic growth and the fiscal multiplier; it presents a review of empirical evidence on the relationship between public debt and the fiscal multiplier.

Section 3 presents the methodology of the research, i.e., the model, data and estimation strategy.

Section 4 presents and discusses the estimation results. The last section concludes the paper.

3. Methods and Data

To examine the non-linear debt–growth relationship, we rely on Cobb–Douglas trans-log specification of the neo-classical growth Equation:

where

stands for the average yearly growth rate in country

i over the period from

t to

T.

is the per capita GDP at constant prices,

—debt, and

is the vector of growth controls.

and

are time-varying and country-specific effects, respectively, modelled including time dummies and estimating Equation (1) using LSDV.

is the idiosyncratic error term.

are parameters to be estimated. The estimated positive coefficient on

and negative on

would give empirical evidence of a debt–growth nexus in the form of an inverted U-shaped letter. The threshold debt level is equal to

. The marginal effect of debt on growth is calculated as

. Since the marginal effect depends on the value of

, it is conditional. Since not just the marginal effect is conditional but the standard error associated with it is conditional too, the standard errors are calculated, using formulas provided by Dawson (2014). This specification allows us to estimate which level of debt is sustainable, i.e., positively affects economic growth and the tipping point above which debt does not sustain growth. It also allows visualisation of whether the marginal effect of debt on growth is significant at different levels of indebtedness.

Estimating Equation (1), we have to select the span of the growth episode (

T) facing several trade-offs related to this selection.

T = 1 (i.e., using annual per capita GDP growth) allows maximisation of the sample size. Still, this strategy might lead to estimates that are highly affected by the cyclical patterns of economic fluctuations and endogeneity (since debt is lagged only by one period with respect to growth). These issues are usually addressed by setting

T equal to 5 and aiming to estimate the effect of the current level of debt (and the other left-hand-side variables) on the 5-year forward non-overlapping average per capita GDP growth rate. Aiming to mitigate the endogeneity bias in Equation (1), it is common in the empirical growth literature to use forward-looking averages. Since current growth rates (or the expected growth rate over the next year) affect debt, just like debt affects growth rates, averaged future values can, to some degree, prevent a reverse causality. Nevertheless, this strategy significantly reduces the sample size and introduces some uncertainty considering the first and last usable observations. As an alternative, we consider using 5-year overlapping growth periods. However, the usage of overlapping growth rates as the dependent variable creates a moving average structure in the error term. Following Panizza and Presbitero [

38], we use the Huber–White Sandwich correction, which yields almost identical results as Newey and West’s [

39] estimator, which allows modelling of the autocorrelation in the error term.

Our empirical analysis is based on an unbalanced panel of 138 countries from 1996 to 2016 (see

Appendix A). Our sample includes countries from different geographical regions representing different stages of development and covers the whole period (and all countries) for which the necessary statistical data were available. It allows us to increase the variation of public debt as well as other variables that may affect the debt–growth nexus. Following the survey on public debt and the economic growth relationship [

3,

40], the period is divided into one-, five- and ten-year overlapping intervals to study a short-, middle-, and long-run relationship between debt and growth.

Our research tests an assumption that the impact of public debt on economic growth depends on the size of the expenditure multiplier. However, the magnitude of the multiplier at a given moment is indefinite, and there is no consensus on its estimation [

11]. Our research applied a methodology similar to Batini et al. [

41], and the expected size of the expenditure multiplier was estimated following two steps. First, we assigned scores to the country based on how many characteristics are associated with a “large” multiplier. Second, summing the scores, we determined the likely level of the multiplier. Therefore, in this study, we split countries into two sub-samples according to whether economic indicators signal the higher or lower expected value of the multiplier.

Berti et al. [

42] focus on the impact that different assumptions about fiscal multipliers have on the projected dynamics of the public debt ratio. To group low or high multiplier level countries, they chose indicators of long-term sovereign bond spread, financial institutions’ credit growth, the unemployment rate, considering that these indicators are expected to have an impact on consumption and investment decisions and in that way reflect the expected size of the fiscal multiplier. In our study, we choose indicators that directly reflect consumption and investment volumes. Since the expenditure multiplier positively depends on the marginal propensity to consume, the marginal propensity to invest, and negatively on the tax rate and the marginal propensity to import, to approximate these variables, we used the share of consumption, the share of investment, the share of taxes, and the share of imports in GDP, respectively. Hubbard [

43] acknowledged that, over the long-run, the differences between marginal and average propensities tend to decrease. Here, we do not claim that the certain values of these indicators correspond to a high or low multiplier; the distribution is conditional, based on the cross-country comparison.

In the spirit of [

20,

44], we condition sample splitting on descriptive statistics of country characteristics. We assigned scores from 1 to 3 to each value of the indicator. The score reflects the potential indicator’s effect on the size of the multiplier in a way that a higher score is assigned if the multiplier is expected to be higher. The range of observed indicator’s values was divided into three intervals in such a way that one-third of all observations would fall in one of the intervals. The upper and lower thresholds for the indicator’s values are as follows:

For the share of consumption in GDP: <58.2%—Score 1 is assigned; from 58.2% up to 71.5%—Score 2; >71.5%—Score 3.

For the share of investment in GDP: <19.5%—Score 1 is assigned; from 19.5% up to 25.3%—Score 2; >25.3%—Score 3.

For the share of taxes in GDP: <13.4%—Score 3 is assigned; from 13.4% up to 19.8%—Score 2; >19.8%—Score 1.

For the share of imports in GDP: <27%—Score 3 is assigned; from 27% up to 46% of GDP—Score 2; >46%—Score 1.

The total score, ranging from 4 up to 12, was calculated by summing up scores of separate indicators. Scores were estimated only if data were available on all four indicators. The total score was firstly calculated for each year and then averaged (min. 4.83, max. 11.56). According to the ranking used in this study, a higher total score indicates a higher value of the multiplier. The country is considered as a having relatively low expenditure multiplier (subsample RLEM) if the score is below the median level, i.e., 8.15 (see

Table A1 in

Appendix A). Otherwise, a country is considered as having relatively high expenditure multiplier (subsample RHEM, see

Table A2 in

Appendix A).

Table 1 shows the descriptive statistics of variables used to determine the size of the multiplier.

Table 2 presents all variables used in the regression analysis.

5. Conclusions

The economic theory explains the growth stimulative effect of public debt through the impact of expansionary fiscal policy, the effectiveness of which is directly related to the size of the fiscal multiplier. It follows that the multiplier shapes the impact of both public expenditure and debt on growth. The empirical studies mostly concentrate on the relationship between debt level and the size of the fiscal multiplier, while the strand of empirical research on heterogeneous debt impact on output, as far as we know, mostly ignores the determinants of the fiscal multiplier as possible explanatory variables determining the debt tipping point, above which a growth-suppressive effect occurs. The overwhelming empirical evidence confirms that this negative impact becomes more pronounced at higher debt levels, with no consensus on what debt to GDP ratio becomes harmful to economy or what factors drive that ratio.

There are relatively few studies evaluating the factors that determine why in some countries the negative impact on economic growth is manifested as a lower debt ratio while in others as a higher debt-to-GDP ratio. It is generally confirmed that the institutional environment determines the marginal impact of debt on economic growth and the size of the debt threshold. Studies on other potential factors of the heterogeneous impact of debt on economic growth are very limited. Contributing to this limited literature, our research tests the hypothesis that the expenditure multiplier is shaping the impact of public debt on growth. As the growth effect of public debt depends on the size of the expenditure multiplier, this paper raises the assumption that indicators shaping the size of the expenditure multiplier (marginal propensities to consume and invest, marginal propensity to import, and tax rate) can serve as factors, explaining what debt to GDP ratios become harmful to economic growth.

Estimates confirm the research hypothesis and show that a negative marginal effect of debt on growth starts to manifest, showing a lower debt-to-GDP ratio when the multiplier is lower and vice-versa. We do not find robust evidence that public debt has a positive effect on growth since the debt to GDP interval with a statistically significant and positive effect on growth is very narrow with respect to the expenditure multiplier. As in other studies (see a review of results in references [

3,

4]), our empirical estimations provide evidence that the non-linear debt–growth relationship is in the form of an inverted U-shaped letter. Our estimates suggest that the size of the expenditure multiplier may be another potential source of heterogeneous debt-to-growth ratios relationship.

The estimated debt threshold levels shed some light on the sources of heterogeneity in a debt–growth relationship. They support the assumption that the sustainable growth effect of public debt may vary with the size of the expenditure multiplier and suggest detrimental effects to occur at a higher debt to GDP ratios if macroeconomic indicators (consumption, investments, taxes, and import shares in GDP) are more favorable to a higher value of the expenditure multiplier in a country. These statements allow us to conclude that the same level of debt can be sustainable and unsustainable. It depends on the size of the expenditure multiplier: countries with a relatively high expenditure multiplier can borrow more and debt remains sustainable for growth; in countries with a relatively low multiplier, even a small debt ratio can become unsustainable.

As the size of the expenditure multiplier is indefinite at any given time, fiscal policymakers, when considering whether the level of public debt is on a sustainable path, should pay attention to available macroeconomic indicators, which may in part provide information on the potential magnitude of the multiplier effect. However, in order to provide practical guidance to policy makers, more detailed further research is needed, namely: (a) whether all of the indicators analysed are equally important in respect to the heterogeneity of debt effects since the assumption that all are equally important could be seen as the limitation of our study, (b) to examine whether there is threshold level of consumption, investment, taxes or imports (as share in GDP) above/below which negative debt impact on growth is more likely to occur.

The main limitation of our specification in the research is an assumption that just an expenditure multiplier is affecting the debt–growth nexus. Further research could develop a specification that would allow us to examine the interaction between the institutional framework and expenditure multiplier as a source of the heterogeneous debt–growth relationship.