Taxation and Enterprise Innovation: Evidence from China’s Value-Added Tax Reform

Abstract

1. Introduction

2. Policy Background and Theoretical Hypotheses

2.1. Policy Background: China’s VAT Reform in 2009

2.2. Theoretical Hypothesis

3. Empirical Strategy

3.1. Data and Variables

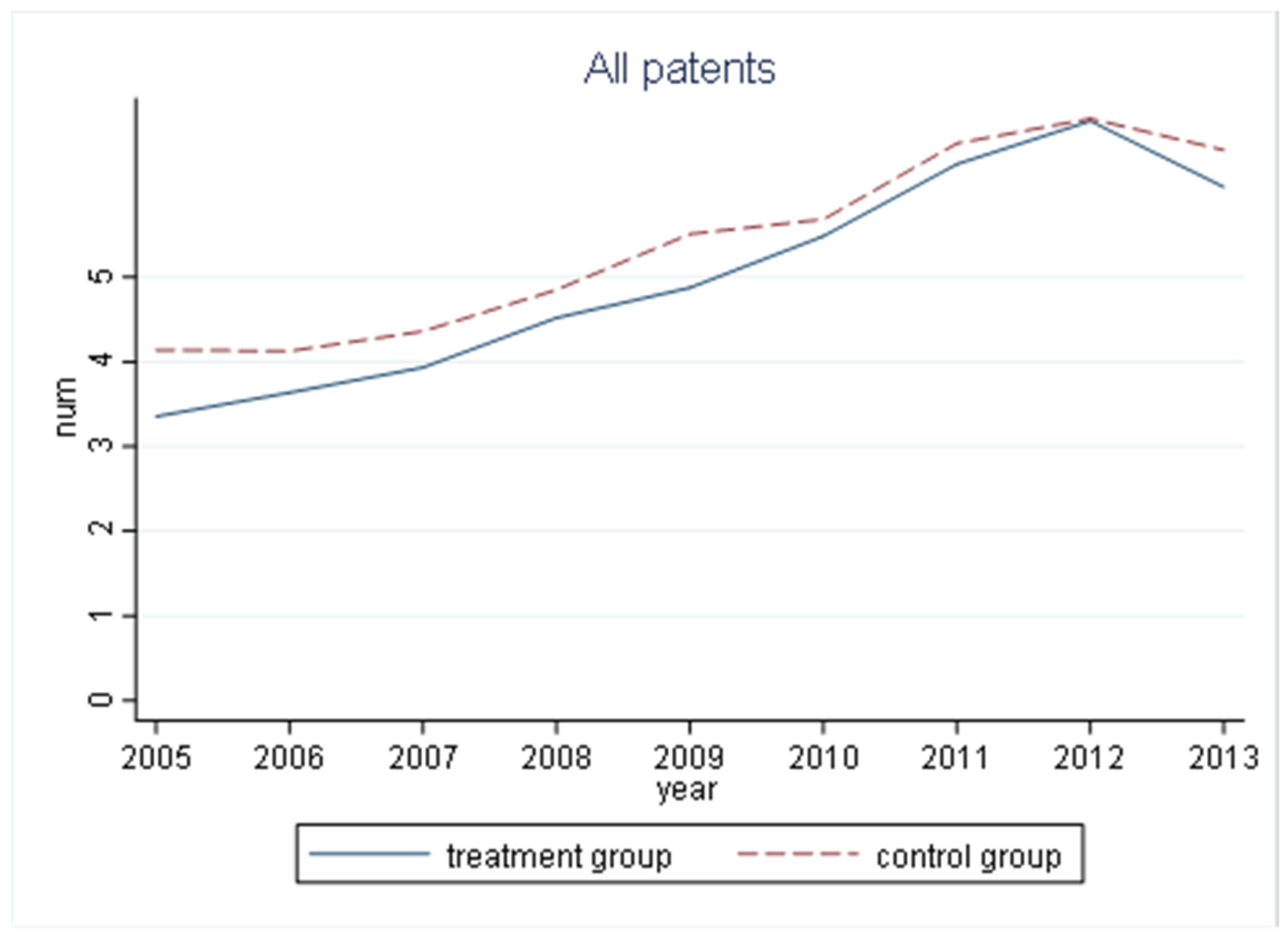

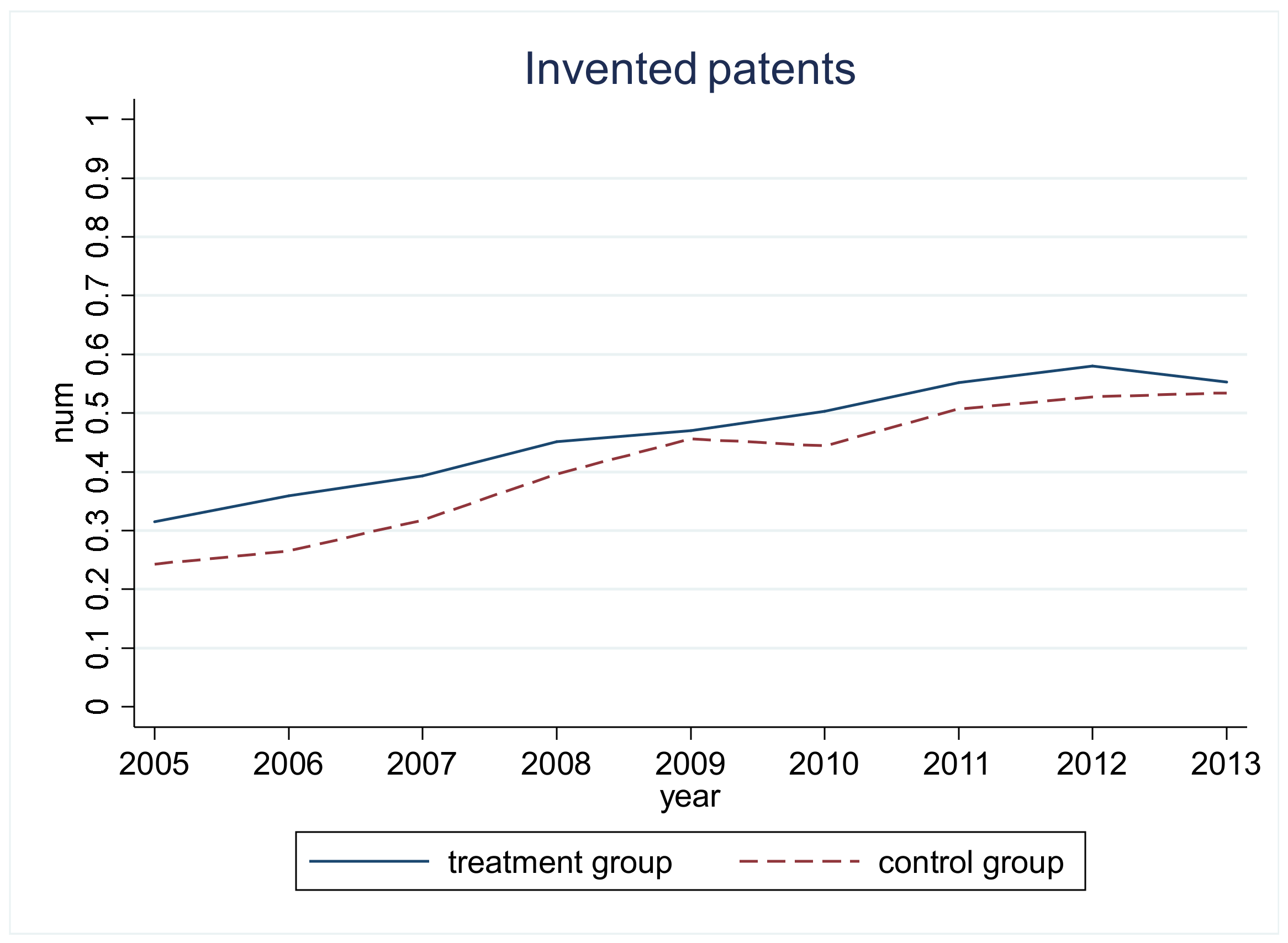

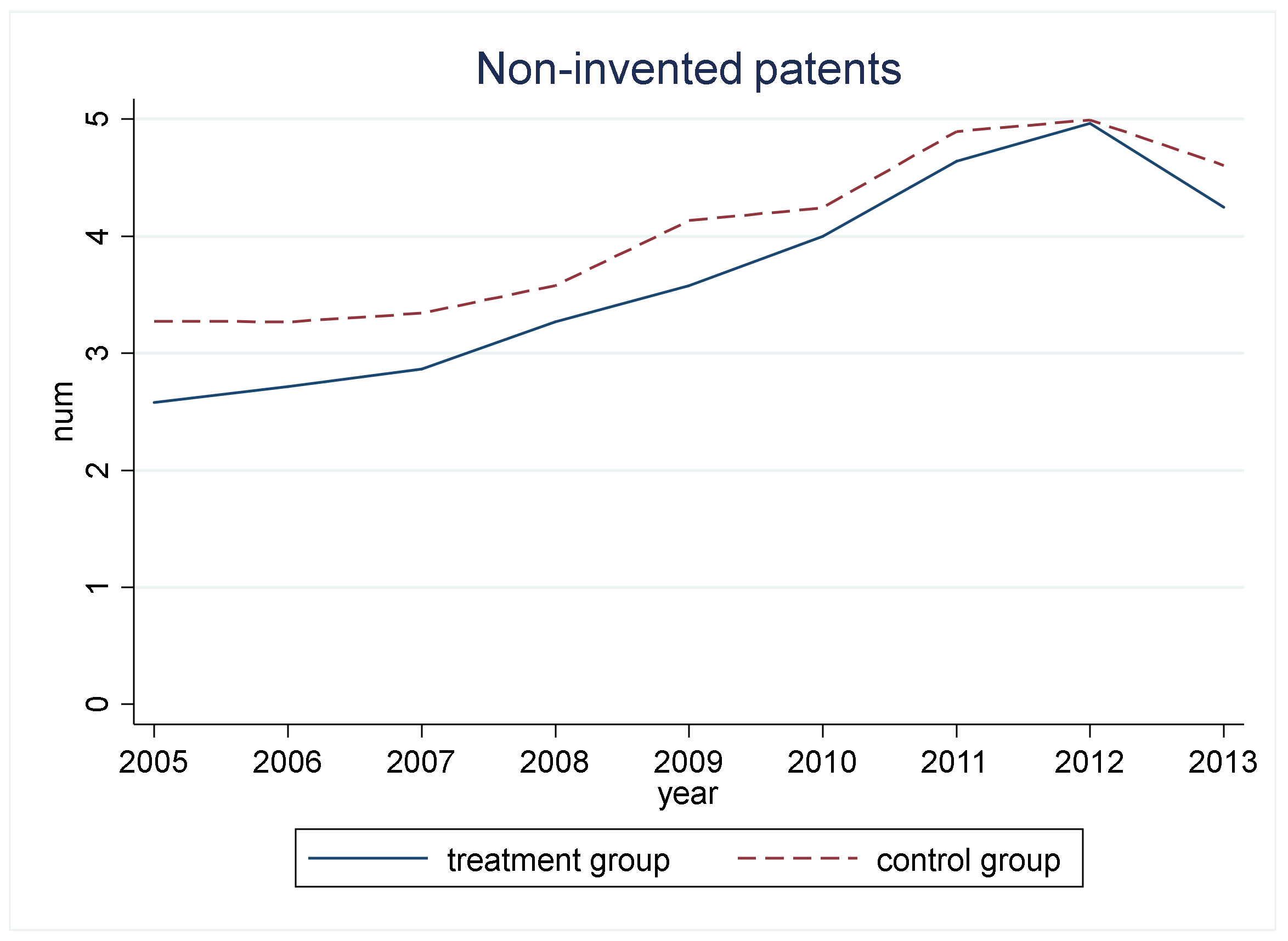

3.2. Typical Facts

3.3. Empirical Model

4. Empirical Results

4.1. Results of the Benchmark Model

4.2. Robustness

5. Further Discussion

5.1. Influence Mechanism

5.2. Innovative Pecking Order Effect

5.3. Heterogeneity Test

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Lerner, J. Boulevard of Broken Dreams: Why Public Efforts to Boost Entrepreneurship and Venture Capital Have Failed—And What to Do about It; Princeton University Press: Princeton, NJ, USA, 2009; ISBN 9781400831630. [Google Scholar]

- Liu, Y.; Mao, J. How do tax incentives affect investment and productivity? Firm-level evidence from China. Am. Econ. J. Econ. Policy 2019, 11, 261–291. [Google Scholar] [CrossRef]

- Liu, Q.; Lu, Y. Firm investment and exporting: Evidence from China’s value-added tax reform. J. Int. Econ. 2015, 97, 392–403. [Google Scholar] [CrossRef]

- Zhang, L.; Chen, Y.; He, Z. The effect of investment tax incentives: Evidence from China’s value-added tax reform. Int. Tax Public Financ. 2018, 25, 913–945. [Google Scholar] [CrossRef]

- Chen, Z.; Jiang, X.; Liu, Z.; Serrato, J.C.S.; Xu, D. Tax Policy and Lumpy Investment Behavior: Evidence from China’s VAT Reform; NBER Working Paper No. 26336; NBER: Cambridge, MA, USA, 2019. [Google Scholar]

- Aghion, P.; Bergeaud, A.; Lequien, M.; Melitz, M.J. The Heterogeneous Impact of Market Size on Innovation: Evidence from French Firm-Level Exports; Working Paper No. 24600; NBER: Cambridge, MA, USA, 2019. [Google Scholar]

- Hall, B.H. R & D Tax Policy during the 1980s: Success or Failure? Tax Policy Econ. 1993, 7, 1–36. [Google Scholar] [CrossRef]

- Bloom, N.; Griffith, R.; Van Reenen, J. Do R & D tax credits work? Evidence from a panel of countries 1979–1997. J. Public Econ. 2002, 85, 1–31. [Google Scholar] [CrossRef]

- Rao, N. Do tax credits stimulate R & D spending? The effect of the R & D tax credit in its first decade. J. Public Econ. 2016, 140, 1–12. [Google Scholar] [CrossRef]

- Agrawal, A.; Rosell, C.; Simcoe, T. Tax credits and small firm R & D spending. Am. Econ. J. Econ. Policy 2020, 12, 1–21. [Google Scholar] [CrossRef]

- Eaton, J.; Kortum, S.S.; Kramarz, F. An Anatomy of International Trade: Evidence from French Firms. Econometrica 2011, 79, 1453–1498. [Google Scholar] [CrossRef]

- Chan, J.M.L.; Manova, K. Financial development and the choice of trade partners. J. Dev. Econ. 2015, 116, 122–145. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous technological change. J. Polit. Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Coe, D.T.; Helpman, E. International R & D spillovers. Eur. Econ. Rev. 1995, 39, 859–887. [Google Scholar] [CrossRef]

- Coe, D.T.; Helpman, E.; Hoffmaister, A.W. North-south R & D spillovers. Econ. J. 1997, 107, 134–149. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Fledman, M.P. R & D Spillovers and the Geography of Innovation and Production. Am. Econ. Rev. 1996, 86, 630–640. [Google Scholar] [CrossRef]

- Coe, D.T.; Helpman, E.; Hoffmaister, A.W. International R & D spillovers and institutions. Eur. Econ. Rev. 2009, 53, 723–741. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. A Model of Growth through Creative Destruction. Econometrica 1992, 60, 323–351. [Google Scholar] [CrossRef]

- Griffith, R.; Redding, S.; Van Reenen, J. R and D and absorptive capacity: Theory and empirical evidence. Scand. J. Econ. 2003, 105, 99–118. [Google Scholar] [CrossRef]

- Aghion, P.; Bloom, N.; Blundell, R.; Griffith, R.; Howitt, P. Competition and innovation: An inverted-u relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Zilibotti, F. Distance to frontier, selection, and economic growth. J. Eur. Econ. Assoc. 2006, 4, 37–74. [Google Scholar] [CrossRef]

- Hashmi, A.R. Competition and innovation: The inverted-u relationship revisited. Rev. Econ. Stat. 2013, 95, 1653–1668. [Google Scholar] [CrossRef]

- Aghion, P.; Dechezleprêtre, A.; Hémous, D.; Martin, R.; van Reenen, J. Carbon taxes, path dependency, and directed technical change: Evidence from the auto industry. J. Polit. Econ. 2016, 124, 1–51. [Google Scholar] [CrossRef]

- Rauh, J.D. Investment and Financing Constraints: Evidence from the Funding of Corporate Pension Plans. J. Financ. 2006, 61, 33–71. [Google Scholar] [CrossRef]

- Hall, B.H.; Lerner, J. The financing of R & D and innovation. In Handbook of the Economics of Innovation; Elsevier: Amsterdam, The Netherlands, 2010; Volume 1, pp. 609–639. [Google Scholar]

- Li, D. Financial constraints, R & D investment, and stock returns. Rev. Financ. Stud. 2011, 24, 2974–3007. [Google Scholar] [CrossRef]

- Brown, J.R.; Martinsson, G.; Petersen, B.C. Do financing constraints matter for R & D? Eur. Econ. Rev. 2012, 56, 1512–1529. [Google Scholar] [CrossRef]

- Aghion, P.; Askenazy, P.; Berman, N.; Cette, G.; Eymard, L. Credit constraints and the cyclicality of R & D investment: Evidence from France. J. Eur. Econ. Assoc. 2012, 10, 1001–1024. [Google Scholar] [CrossRef]

- Borisova, G.; Brown, J.R. R & D sensitivity to asset sale proceeds: New evidence on financing constraints and intangible investment. J. Bank. Financ. 2013, 37, 159–173. [Google Scholar] [CrossRef]

- Mahlich, J.C.; Roediger-Schluga, T. The determinants of pharmaceutical R&D expenditures: Evidence from Japan. Rev. Ind. Organ. 2006, 28, 145–164. [Google Scholar] [CrossRef]

- Athukorala, P.C.; Kohpaiboon, A. Globalization of R & D by US-based multinational enterprises. Res. Policy 2010, 39, 1335–1347. [Google Scholar] [CrossRef]

- Yang, P.C.; Wee, H.M.; Liu, B.S.; Fong, O.K. Mitigating Hi-tech products risks due to rapid technological innovation. Omega 2011, 39, 456–463. [Google Scholar] [CrossRef]

- Barsh, J.; Capozzi, M. Managing innovation risk. IEEE Eng. Manag. Rev. 2010, 37, 86–89. [Google Scholar] [CrossRef]

- Lev, B.; Sougiannis, T. The capitalization, amortization, and value-relevance of R & D. J. Account. Econ. 1996, 21, 107–138. [Google Scholar] [CrossRef]

- Gorodnichenko, Y.; Schnitzer, M. Financial Constraints and Innovation: Why Poor Countries Don’t Catch Up. J. Eur. Econ. Assoc. 2013, 11, 1115–1152. [Google Scholar] [CrossRef]

- Claessens, S.; Tzioumis, K. Measuring firms’ access to finance. In Proceedings of the Conference: Access to Finance: Building Inclusive Financial Systems, Washington, DC, USA, 30–31 May 2006. [Google Scholar]

- Tong, T.W.; He, W.; He, Z.-L.; Lu, J. Patent Regime Shift and Firm Innovation: Evidence from the Second Amendment to China’s Patent Law. Acad. Manag. Proc. 2014, 2014, 14174. [Google Scholar] [CrossRef]

- Shu, P.; Steinwender, C. The impact of trade liberalization on firm productivity and innovation. Innov. Policy Econ. 2019, 19, 39–68. [Google Scholar] [CrossRef]

- Tan, Y.; Tian, X.; Zhang, C.X.; Zhao, H. Privatization and Innovation: Evidence from a Quasi-Natural Experience in China. SSRN Electron. J. 2014. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Jacobson, L.S.; Lalonde, R.J.; Sullivan, D.G. Earnings losses of displaced workers. Am. Econ. Rev. 1993, 83, 685–709. [Google Scholar] [CrossRef]

- Petersen, M.A. Estimating standard errors in finance panel data sets: Comparing approaches. Rev. Financ. Stud. 2009, 22, 435–480. [Google Scholar] [CrossRef]

- Hall, B.; Griliches, Z.; Hausman, J.A. Patents and R & D: Is there a lag? Int. Econ. Rev. 1986, 27, 265–283. [Google Scholar]

- Lu, Y.; Yu, L. Trade liberalization and markup dispersion: Evidence from China’s WTO accession. Am. Econ. J. Appl. Econ. 2015, 7, 221–253. [Google Scholar] [CrossRef]

- Topalova, P. Factor immobility and regional impacts of trade liberalization: Evidence on poverty from India. Am. Econ. J. Appl. Econ. 2010, 2, 1–41. [Google Scholar] [CrossRef]

- Chetty, R.; Looney, A.; Kroft, K. Salience and taxation: Theory and evidence. Am. Econ. Rev. 2009, 99, 1145–1177. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 57, 1173–1182. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Powell, B. State development planning: Did it create an East Asian Miracle? Rev. Austrian Econ. 2005, 18, 305–323. [Google Scholar] [CrossRef]

- Melitz, M.J. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef]

- Greenaway, D.; Kneller, R. Firm heterogeneity, exporting and foreign direct investment. Econ. J. 2007, 117, F134–F161. [Google Scholar] [CrossRef]

- Ranjan, P.; Raychaudhuri, J. Self-selection vs. learning: Evidence from Indian exporting firms. Indian Growth Dev. Rev. 2011, 4, 22–37. [Google Scholar] [CrossRef]

- Song, Z.; Storesletten, K.; Zilibotti, F. Growing like China. Am. Econ. Rev. 2011, 101, 196–233. [Google Scholar] [CrossRef]

| Variable | Definition | Mean | Sd |

|---|---|---|---|

| Patents | |||

| patent | log (all patents + 1) | 1.325 | 1.094 |

| patent 2 | log (invented patents + 1) | 0.515 | 0.784 |

| patent 1 | log (non-invented patents + 1) | 1.075 | 1.065 |

| Firm’s variables | |||

| size | Log of a firm’s total assets | 11.533 | 1.568 |

| age | The age of enterprise | 2.318 | 0.671 |

| lique | Current assets/Current debt | 11.687 | 1527.231 |

| SA | SA Index | −2.776 | 0.459 |

| LBR | Operating income/employee | 6.113 | 1.169 |

| Variable | (1) Patent | (2) Patent | (3) Patent | (4) Patent |

|---|---|---|---|---|

| treat * post | 0.158 *** | 0.161 *** | 0.094 *** | 0.092 *** |

| (13.409) | (13.471) | (2.772) | (3.767) | |

| Size | 0.022 ** | 0.021 ** | −0.076 *** | −0.075 ** |

| (2.207) | (2.101) | (−2.620) | (−2.528) | |

| age | −0.129 *** | −0.129 *** | −0.084 *** | −0.088 *** |

| (−21.759) | (−21.479) | (−2.871) | (−2.994) | |

| lique | 0.000 | 0.000 | 0.000 *** | 0.000 *** |

| (1.026) | (0.756) | (11.125) | (8.554) | |

| SA | 0.571 *** | 0.580 *** | 1.148 *** | 1.097 *** |

| (15.106) | (15.145) | (11.331) | (10.894) | |

| LBR | 0.000 | 0.005 | 0.016 * | 0.022 ** |

| (0.072) | (1.245) | (1.701) | (2.417) | |

| Constant | 1.963 *** | 1.730 *** | 5.961 *** | 5.479 *** |

| (8.313) | (3.914) | (8.277) | (3.799) | |

| Year dummy | YES | NO | YES | NO |

| province dummy | YES | NO | YES | NO |

| Industry dummy province * Year industry * Year | YES NO NO | NO YES YES | YES NO NO | NO YES YES |

| N | 103,254 | 103,254 | 103,254 | 103,254 |

| Adj.R2 | 0.107 | 0.111 | 0.045 | 0.069 |

| Estimation method | Pool-OLS | Pool-OLS | FE | FE |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variable | patent | patent | patent | patent | patent |

| treat * post | 0.080 ** | 0.090 ** | 0.127 *** | 0.084 ** | |

| (2.420) | (2.457) | (3.293) | (2.002) | ||

| treat * predict | −0.018 | ||||

| (−0.411) | |||||

| treat * post 2008 | 0.047 | ||||

| (1.258) | |||||

| size | 0.009 | −0.052 | −0.089 *** | −0.075 ** | −0.069 ** |

| (0.333) | (−1.592) | (−2.728) | (−2.539) | (−2.328) | |

| age | −0.111 *** | −0.070 ** | −0.063 ** | −0.088 *** | −0.092 *** |

| (−4.114) | (−2.224) | (−1.994) | (−2.993) | (−3.141) | |

| lique | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (8.349) | (8.352) | (8.018) | (8.545) | (8.574) | |

| SA | 0.661 *** | 1.054 *** | 1.124 *** | 1.098 *** | 1.088 *** |

| (6.956) | (9.458) | (10.286) | (10.902) | (10.812) | |

| LBR | 0.021 ** | 0.024 ** | 0.024 ** | 0.022 ** | 0.023 ** |

| (2.366) | (2.313) | (2.297) | (2.420) | (2.433) | |

| constant | 2.262 * | 4.453 *** | 6.467 *** | 4.708 *** | 4.675 *** |

| (1.923) | (3.117) | (8.666) | (3.650) | (3.617) | |

| province * Year industry * Year | YES YES | YES YES | YES YES | YES YES | YES YES |

| N | 100,406 | 85,056 | 82,353 | 103,254 | 103,254 |

| Adj.R2 | 0.065 | 0.068 | 0.084 | 0.069 | 0.069 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | lnK | patent | lev | patent |

| treat * post | 0.051 * | 0.091 *** | −0.014 ** | 0.091 *** |

| (1.883) | (2.607) | (−2.063) | (2.609) | |

| lnK | 0.012 ** | |||

| (2.101) | ||||

| lev | −0.075 ** | |||

| (−2.091) | ||||

| size | 0.836 *** | −0.083 *** | −0.008 | −0.075 ** |

| (23.024) | (−2.754) | (−0.589) | (−2.542) | |

| age | 0.067 *** | −0.088 *** | 0.002 | −0.087 *** |

| (2.916) | (−3.000) | (0.444) | (−2.989) | |

| lique | −0.000 | 0.000 *** | 0.000 *** | 0.000 *** |

| (−1.175) | (8.867) | (3.315) | (8.683) | |

| SA | −0.126 | 1.097 *** | 0.023 | 1.098 *** |

| (−1.272) | (10.831) | (0.773) | (10.907) | |

| LBR | 0.035 *** | 0.022 ** | −0.004 *** | 0.022 ** |

| (4.012) | (2.353) | (−2.592) | (2.375) | |

| Constant | 0.079 | 4.674 *** | 0.670 *** | 4.745 *** |

| (0.107) | (3.601) | (2.852) | (3.675) | |

| province * year | YES | YES | YES | YES |

| Industry * year | YES | YES | YES | YES |

| N | 102,802 | 102,802 | 103,245 | 103,245 |

| Adj.R2 | 0.158 | 0.069 | 0.044 | 0.069 |

| (1) | (2) | |

|---|---|---|

| Variables | Patent 2 | Patent 1 |

| treat * post | −0.007 | 0.112 *** |

| (−0.280) | (3.357) | |

| size | −0.135 *** | −0.060 ** |

| (−6.268) | (−2.121) | |

| age | −0.009 | −0.061 ** |

| (−0.436) | (−2.237) | |

| lique | 0.000 *** | 0.000 *** |

| (8.973) | (3.193) | |

| SA | 1.082 *** | 0.867 *** |

| (13.670) | (8.987) | |

| LBR | 0.016 ** | 0.023 *** |

| (2.409) | (2.646) | |

| Constant | 4.921 *** | 3.688 *** |

| (5.574) | (3.644) | |

| province * Year | YES | YES |

| Industry * Year | YES | YES |

| N | 103,254 | 103,254 |

| Adj.R2 | 0.079 | 0.065 |

| (1) | (2) | |

|---|---|---|

| Variables | Subsidy | Subsidy |

| Patent 2 | −0.062 | |

| (−1.108) | ||

| Patent 1 | 0.068 ** | |

| (2.070) | ||

| size | −0.568 | −0.171 |

| (−1.201) | (−0.966) | |

| age | 0.890 *** | 1.314 *** |

| (2.755) | (3.415) | |

| LBR | −0.068 | 0.052 |

| (−1.148) | (1.094) | |

| SA | 0.156 | −0.080 |

| (0.235) | (−0.159) | |

| SOE | −0.126 | −0.552 * |

| (−0.292) | (−1.706) | |

| IMR | −8.386 * | −13.587 *** |

| (−1.875) | (−3.228) | |

| Constant | 18.886 * | 6.706 |

| (1.838) | (1.456) | |

| province * Year | YES | YES |

| Industry * Year | YES | YES |

| N | 33,319 | 51,369 |

| Adj. R2 | 0.156 | 0.120 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | patent_exp | patent_nonexp | patent_SOE | patent_nonSOE |

| Treat * post | 0.112 ** | −0.083 | −0.115 | 0.096 ** |

| (2.326) | (−1.078) | (−0.773) | (2.390) | |

| size | −0.036 | −0.081 | −0.218 ** | −0.052 |

| (−0.714) | (−1.574) | (−2.197) | (−1.531) | |

| age | 0.026 | −0.161 *** | −0.044 | −0.144 *** |

| (0.548) | (−3.186) | (−0.637) | (−4.352) | |

| lique | 0.000 | 0.000 | 0.000 | 0.000 *** |

| (0.122) | (0.221) | (0.143) | (7.663) | |

| SA | 1.094 *** | 1.048 *** | 1.294 *** | 1.058 *** |

| (6.964) | (5.543) | (4.144) | (8.792) | |

| LBR | 0.030 ** | 0.014 | 0.016 | 0.024 ** |

| (2.241) | (0.859) | (0.567) | (2.289) | |

| Constant | 4.303 *** | 7.310 *** | 5.859 *** | 4.221 *** |

| (4.388) | (5.115) | (2.921) | (3.977) | |

| province * year | YES | YES | YES | YES |

| Industry * year | YES | YES | YES | YES |

| N | 62,585 | 40,669 | 13,228 | 87,250 |

| Adj.R2 | 0.083 | 0.100 | 0.166 | 0.068 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ding, K.; Xu, H.; Yang, R. Taxation and Enterprise Innovation: Evidence from China’s Value-Added Tax Reform. Sustainability 2021, 13, 5700. https://doi.org/10.3390/su13105700

Ding K, Xu H, Yang R. Taxation and Enterprise Innovation: Evidence from China’s Value-Added Tax Reform. Sustainability. 2021; 13(10):5700. https://doi.org/10.3390/su13105700

Chicago/Turabian StyleDing, Ke, Helian Xu, and Rongming Yang. 2021. "Taxation and Enterprise Innovation: Evidence from China’s Value-Added Tax Reform" Sustainability 13, no. 10: 5700. https://doi.org/10.3390/su13105700

APA StyleDing, K., Xu, H., & Yang, R. (2021). Taxation and Enterprise Innovation: Evidence from China’s Value-Added Tax Reform. Sustainability, 13(10), 5700. https://doi.org/10.3390/su13105700