Environmental and Social Goals in Spanish SMEs: The Moderating Effect of Family Influence

Abstract

1. Introduction

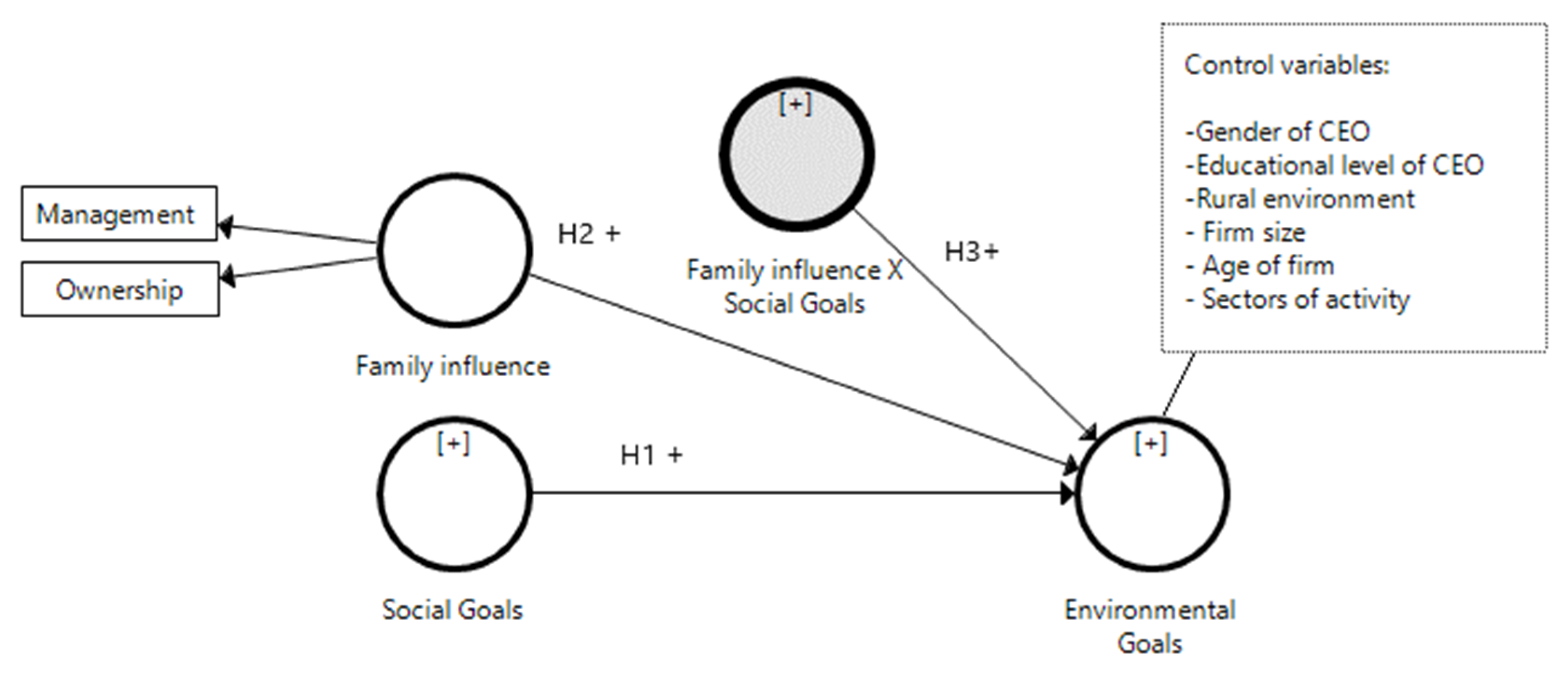

2. Conceptual Background and Hypotheses Development

2.1. Social and Environmental Goals

2.2. Family Influence and Environmental Goals

2.3. Family Influence Acts as a Moderator of the Relationship between Social and Environmental Goals

3. Materials and Methods

3.1. Data

3.2. Variable Measurement

3.3. Statistical Procedure

3.4. Statistical Controls for Bias

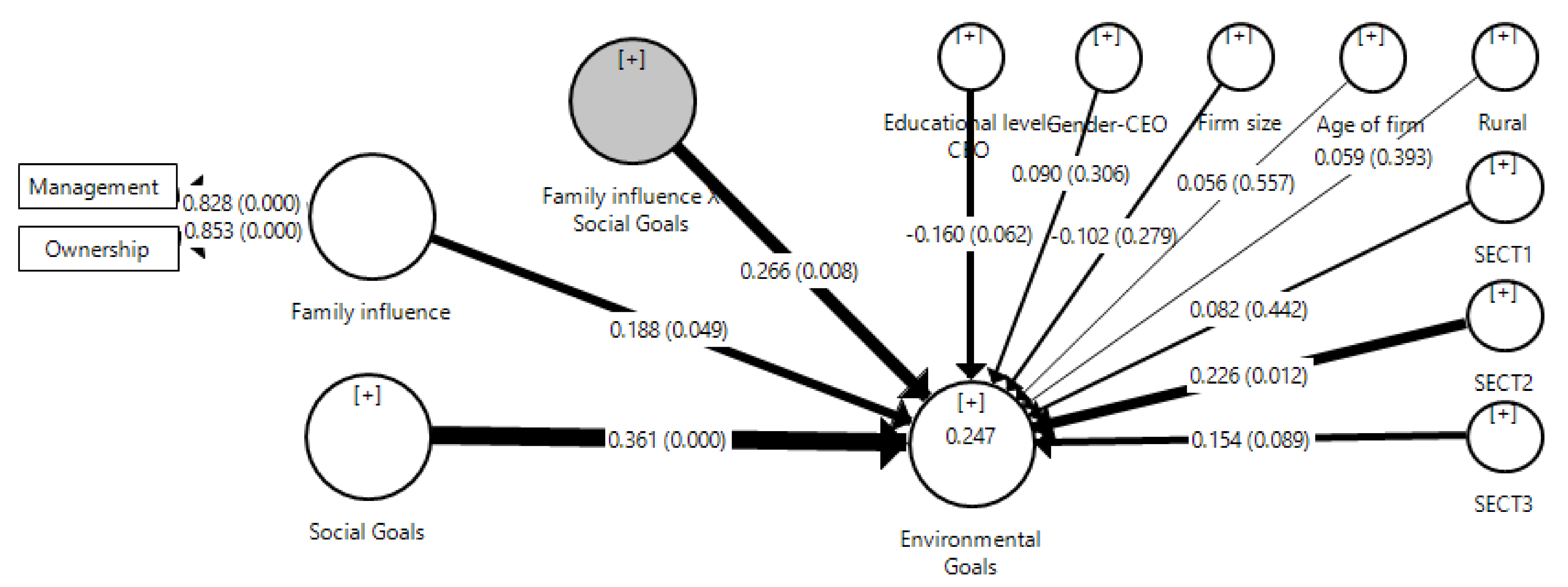

4. Results

4.1. Evaluation of the Measurement Model

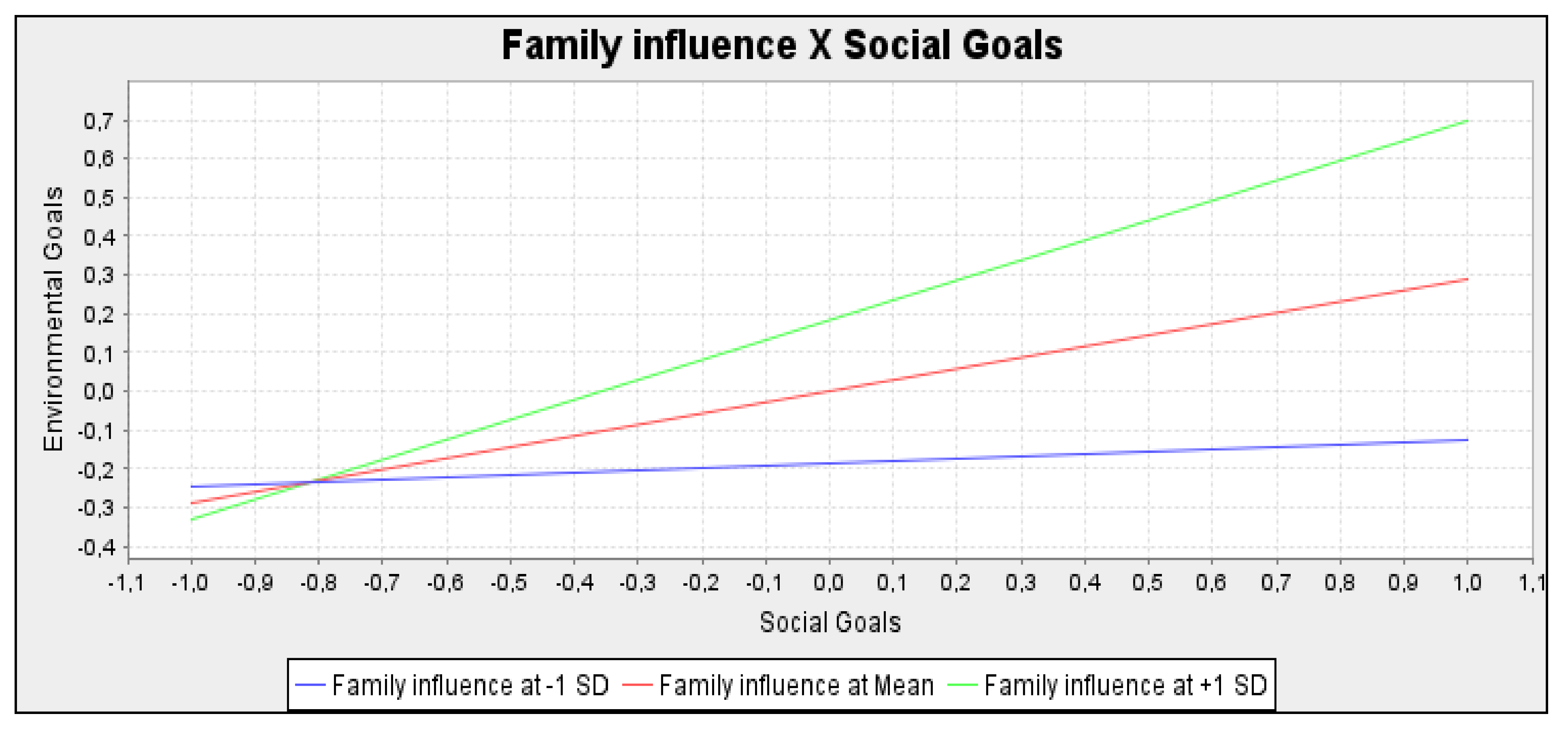

4.2. Evaluation of the Structural Model

4.3. Model Fit

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Assembly, G. Sustainable Development Goals (SDGs); United Nations: New York, NY, USA, 2015. [Google Scholar]

- Verboven, H.; Vanherck, L. Sustainability management of SMEs and the UN Sustainable Development Goals. UmweltWirtschaftsForum 2016, 24, 165–178. [Google Scholar] [CrossRef]

- Williams, A.; Whiteman, G.; Parker, J.N. Backstage Interorganizational Collaboration: Corporate Endorsement of the Sustainable Development Goals. Acad. Manag. Discov. 2019, 5, 367–395. [Google Scholar] [CrossRef]

- van Zanten, J.A.; van Tulder, R. Multinational enterprises and the Sustainable Development Goals: An institutional approach to corporate engagement. J. Int. Bus. Policy 2018, 1, 208–233. [Google Scholar] [CrossRef]

- European Commission. Annual Report on European SMEs 2018/2019; European Commission: Brussels, Belgium, 2019; ISBN 978-92-9202-641-7. [Google Scholar]

- King, A.A.; Lenox, M.J. Does it really pay to be green? An empirical study of firm environmental and financial performance. J. Ind. Ecol. 2001, 5, 105–116. [Google Scholar] [CrossRef]

- Miller, K.; Neubauer, A.; Varma, A.; Willians, E. First Assessment of the Environmental Assistance Programme for SMEs (ECAP); DG Environmental and Climate Action; EU: London, UK, 2011. [Google Scholar]

- Williamson, D.; Lynch-Wood, G.; Ramsay, J. Drivers of environmental behaviour in manufacturing SMEs and the implications for CSR. J. Bus. Ethics 2006, 67, 317–330. [Google Scholar] [CrossRef]

- Roberts, R.W. Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Account. Organ. Soc. 1992, 17, 595–612. [Google Scholar] [CrossRef]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Dahlsrud, A. How corporate social responsibility is defined: An analysis of 37 definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Porter, M.; Kramer, M. The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 79–92. [Google Scholar]

- Cohen, B.; Winn, M.I. Market imperfections, opportunity and sustainable entrepreneurship. J. Bus. Ventur. 2007, 22, 29–49. [Google Scholar] [CrossRef]

- Jenkins, H. A ‘business opportunity’ model of corporate social responsibility for small- and medium-sized enterprises. Bus. Ethics A Eur. Rev. 2009, 18, 21–36. [Google Scholar] [CrossRef]

- Aragón, C.; Narvaiza, L.; Altuna, M. Why and How Does Social Responsibility Differ Among SMEs? A Social Capital Systemic Approach. J. Bus. Ethics 2016, 138, 365–384. [Google Scholar] [CrossRef]

- Jenkins, H. A Critique of Conventional CSR Theory: An SME Perspective. J. Gen. Manag. 2004, 29, 37–57. [Google Scholar] [CrossRef]

- Leonidou, L.C.; Christodoulides, P.; Thwaites, D. External Determinants and Financial Outcomes of an Eco-friendly Orientation in Smaller Manufacturing Firms. J. Small Bus. Manag. 2016, 54, 5–25. [Google Scholar] [CrossRef]

- Fassin, Y. SMEs and the fallacy of formalising CSR. Bus. Ethics A Eur. Rev. 2008, 17, 364–378. [Google Scholar] [CrossRef]

- Vives, A. Social and Environmental Responsibility in Small and Medium Enterprises in Latin America. J. Corp. Citizsh. 2006, 21, 39–50. [Google Scholar] [CrossRef]

- Arend, R.J. Social and Environmental Performance at SMEs: Considering Motivations, Capabilities, and Instrumentalism. J. Bus. Ethics 2014, 125, 541–561. [Google Scholar] [CrossRef]

- Williams, S.; Schaefer, A. Small and Medium-Sized Enterprises and Sustainability: Managers’ Values and Engagement with Environmental and Climate Change Issues. Bus. Strateg. Environ. 2013, 22, 173–186. [Google Scholar] [CrossRef]

- Herrera Madueño, J.; Larrán Jorge, M.; Lechuga Sancho, M.P.; Martínez- Martínez, D. Motivaciones hacia la Responsabilidad Social en las PYMEs familiares. Rev. Empres. Fam. J. Fam. Bus. 2014, 4, 21–44. [Google Scholar] [CrossRef][Green Version]

- Herrera Madueño, J.; Larrán Jorge, M.; Lechuga Sancho, M.P.; Martínez-Martínez, D. Responsabilidad social en las pymes: Análisis exploratorio de factores explicativos. Rev. Contab. 2016, 19, 31–44. [Google Scholar] [CrossRef]

- López-Pérez, M.; Melero-Polo, I.; Vázquez-Carrasco, R.; Cambra-Fierro, J. Sustainability and Business Outcomes in the Context of SMEs: Comparing Family Firms vs. Non-Family Firms. Sustainability 2018, 10, 4080. [Google Scholar] [CrossRef]

- Kallmuenzer, A.; Nikolakis, W.; Peters, M.; Zanon, J. Trade-offs between dimensions of sustainability: Exploratory evidence from family firms in rural tourism regions. J. Sustain. Tour. 2018, 26, 1204–1221. [Google Scholar] [CrossRef]

- IEF. Red de Cátedras de Empresa Familiar La Empresa Familiar en España (2015); Instituto de la Empresa Familiar: Barcelona, Spain, 2016; ISBN 978-84-608-2119-9. Available online: https://www.iefamiliar.com/publicaciones/la-empresa-familiar-en-espana-2015/ (accessed on 9 November 2020).

- Astrachan, J.H.; Shanker, M.C. Family businesses’ contribution to the US economy: A closer look. Fam. Bus. Rev. 2003, 16, 211–219. [Google Scholar] [CrossRef]

- Pistrui, D.; Welsch, H.; Roberts, J. The Emergence of Family Businesses in the Transforming Soviet Bloc: Family Contributions to Entrepreneurship Development in Romania. Fam. Bus. Rev. 1997, 10, 221–237. [Google Scholar] [CrossRef]

- Anderson, R.C.; Reeb, D.M. Founding-Family Ownership and Firm Performance: Evidence from the S&P 500. J. Financ. 2003, 58, 1301–1327. [Google Scholar]

- Williams, R.I.; Pieper, T.M.; Kellermanns, F.W.; Astrachan, J.H. Family Firm Goals and their Effects on Strategy, Family and Organization Behavior: A Review and Research Agenda. Int. J. Manag. Rev. 2018, 20, S63–S82. [Google Scholar] [CrossRef]

- Kotlar, J.; De Massis, A. Goal Setting in Family Firms: Goal Diversity, Social Interactions, and Collective Commitment to Family-Centered Goals. Entrep. Theory Pract. 2013, 37, 1263–1288. [Google Scholar] [CrossRef]

- Basco, R. “Where do you want to take your family firm?” A theoretical and empirical exploratory study of family business goals. BRQ Bus. Res. Q. 2017, 20, 28–44. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Chua, J.H.; Pearson, A.W.; Barnett, T. Family Involvement, Family Influence, and Family-Centered Non-Economic Goals in Small Firms. Entrep. Theory Pract. 2012, 36, 267–293. [Google Scholar] [CrossRef]

- Gomez-Mejia, L.R.; Cruz, C.; Berrone, P.; de Castro, J. The Bind that ties: Socioemotional wealth preservation in family firms. Acad. Manag. Ann. 2011, 5, 653–707. [Google Scholar] [CrossRef]

- Hernández-Perlines, F.; Rung-Hoch, N. Sustainable entrepreneurial orientation in family firms. Sustainability 2017, 9, 1212. [Google Scholar] [CrossRef]

- Hernández-Perlines, F.; Cisneros, M.A.I. The role of environment in sustainable entrepreneurial orientation. The case of family firms. Sustainability 2018, 10, 2037. [Google Scholar] [CrossRef]

- Cruz, C.; Larraza-Kintana, M.; Garcés-Galdeano, L.; Berrone, P. Are Family Firms Really More Socially Responsible? Entrep. Theory Pract. 2014, 38, 1295–1316. [Google Scholar] [CrossRef]

- Le Breton-Miller, I.; Miller, D. Family firms and practices of sustainability: A contingency view. J. Fam. Bus. Strateg. 2016, 7, 26–33. [Google Scholar] [CrossRef]

- Payne, D.M.; Raiborn, C.A. Sustainable Development: The Ethics Support the Economics. J. Bus. Ethics 2001, 32, 157–168. [Google Scholar] [CrossRef]

- Dixon, S.E.A.; Clifford, A. Ecopreneurship—A new approach to managing the triple bottom line. J. Organ. Chang. Manag. 2007, 20, 326–345. [Google Scholar] [CrossRef]

- Núñez-Cacho, P.; Molina-Moreno, V.; Corpas-Iglesias, F.A.; Cortés-García, F.J. Family Businesses Transitioning to a Circular Economy Model: The Case of “Mercadona”. Sustainability 2018, 10, 538. [Google Scholar]

- Fonseca, L.; Domingues, J.; Pereira, M.; Martins, F.; Zimon, D. Assessment of Circular Economy within Portuguese Organizations. Sustainability 2018, 10, 2521. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach, 2nd ed.; Cambridge University Press: Cambridge, UK, 2010; ISBN 9780521151740. [Google Scholar]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Gómez-Mejía, L.L.R.L.; Haynes, K.T.; Núñez-Nickel, M.; Jacobson, K.J.L.; Moyano-Fuentes, J. Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Adm. Sci. Q. 2007, 52, 106–137. [Google Scholar] [CrossRef]

- Terjesen, S.; Lepoutre, J.; Justo, R.; Bosma, N. Global Entrepreneurship Monitor. Report on Social Entrepreneurship. Executive Summary; Global Entrepreneurship Research Association: London, UK, 2012; Available online: https://www.gemconsortium.org/file/open?fileId=48437 (accessed on 10 November 2020).

- Lepoutre, J.; Justo, R.; Terjesen, S.; Bosma, N. Designing a global standardized methodology for measuring social entrepreneurship activity: The Global Entrepreneurship Monitor social entrepreneurship study. Small Bus. Econ. 2013, 40, 693–714. [Google Scholar] [CrossRef]

- Edward Freeman, R. Managing for stakeholders: Trade-offs or value creation. J. Bus. Ethics 2010, 96, 7–9. [Google Scholar] [CrossRef]

- Hechavarría, D.M.; Terjesen, S.A.; Ingram, A.E.; Renko, M.; Justo, R.; Elam, A. Taking care of business: The impact of culture and gender on entrepreneurs’ blended value creation goals. Small Bus. Econ. 2017, 48, 225–257. [Google Scholar] [CrossRef]

- Elkington, J. Enter the Triple Bottom Line. In The Triple Bottom Line Does It All Add Up; Henriques, A., Richardson, J., Eds.; Routledge: London, UK, 2004; pp. 1–26. ISBN 9781844070152. [Google Scholar]

- Sáez-Martínez, F.; Díaz-García, C.; González-Moreno, Á. Factors Promoting Environmental Responsibility in European SMEs: The Effect on Performance. Sustainability 2016, 8, 898. [Google Scholar] [CrossRef]

- Hechavarría, D.M. Mother nature’s son? The impact of gender socialization and culture on environmental venturing. Int. J. Gend. Entrep. 2016, 8, 137–172. [Google Scholar] [CrossRef]

- Cohen, B.; Smith, B.; Mitchell, R. Toward a sustainable conceptualization of dependent variables in entrepreneurship research. Bus. Strateg. Environ. 2008, 17, 107–119. [Google Scholar] [CrossRef]

- Buysse, K.; Verbeke, A. Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 2003, 24, 453–470. [Google Scholar] [CrossRef]

- Sharma, S.; Henriques, I. Stakeholder influences on sustainability practices in the Canadian forest products industry. Strateg. Manag. J. 2005, 26, 159–180. [Google Scholar] [CrossRef]

- Delmas, M.; Toffel, M.W. Stakeholders and environmental management practices: An institutional framework. Bus. Strateg. Environ. 2004, 13, 209–222. [Google Scholar] [CrossRef]

- Sarkis, J.; Gonzalez-Torre, P.; Adenso-Diaz, B. Stakeholder pressure and the adoption of environmental practices: The mediating effect of training. J. Oper. Manag. 2010, 28, 163–176. [Google Scholar] [CrossRef]

- Charan, P.; Murty, L.S. Secondary stakeholder pressures and organizational adoption of sustainable operations practices: The mediating role of primary stakeholders. Bus. Strateg. Environ. 2018, 27, 910–923. [Google Scholar]

- Darnall, N.; Henriques, I.; Sadorsky, P. Adopting proactive environmental strategy: The influence of stakeholders and firm size. J. Manag. Stud. 2010, 47, 1072–1094. [Google Scholar] [CrossRef]

- Masurel, E. Why SMEs invest in environmental measures: Sustainability evidence from small and medium-sized printing firms. Bus. Strateg. Environ. 2007, 16, 190–201. [Google Scholar] [CrossRef]

- Perrini, F.; Tencati, A. Sustainability and stakeholder management: The need for new corporate performance evaluation and reporting systems. Bus. Strateg. Environ. 2006, 15, 296–308. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a Theory of Stakeholder Identification and Salience: Defining the Principle of who and What Really Counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Gibson, K. Stakeholders and Sustainability: An Evolving Theory. J. Bus. Ethics 2012, 109, 15–25. [Google Scholar] [CrossRef]

- Lee, K.-H.; Herold, D.M.; Yu, A.-L. Small and Medium Enterprises and Corporate Social Responsibility Practice: A Swedish Perspective. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 88–99. [Google Scholar] [CrossRef]

- Hillman, A.J.; Keim, G.D. Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strateg. Manag. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Berman, S.L.; Wicks, A.C.; Kotha, S.; Jones, T.M. Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Acad. Manag. J. 1999, 42, 488–506. [Google Scholar]

- Baughn, C.C.; Bodie, N.L.; McIntosh, J.C. Corporate social and environmental responsibility in Asian countries and other geographical regions. Corp. Soc. Responsib. Environ. Manag. 2007, 14, 189–205. [Google Scholar] [CrossRef]

- DiSegni, D.M.; Huly, M.; Akron, S. Corporate social responsibility, environmental leadership and financial performance. Soc. Responsib. J. 2015, 11, 131–148. [Google Scholar] [CrossRef]

- Lampikoski, T.; Westerlund, M.; Rajala, R.; Möller, K. Green Innovation Games: Value-Creation Strategies for Corporate Sustainability. Calif. Manag. Rev. 2014, 57, 88–116. [Google Scholar] [CrossRef]

- Johnson, M.P.; Schaltegger, S. Two Decades of Sustainability Management Tools for SMEs: How Far Have We Come? J. Small Bus. Manag. 2016, 54, 481–505. [Google Scholar] [CrossRef]

- Chua, J.H.; Chrisman, J.J.; De Massis, A.; Wang, H. Reflections on family firm goals and the assessment of performance. J. Fam. Bus. Strateg. 2018, 9, 107–113. [Google Scholar] [CrossRef]

- Kotlar, J.; Fang, H.; De Massis, A.; Frattini, F. Profitability Goals, Control Goals, and the R&D Investment Decisions of Family and Nonfamily Firms. J. Prod. Innov. Manag. 2014, 31, 1128–1145. [Google Scholar]

- Sciascia, S.; Nordqvist, M.; Mazzola, P.; De Massis, A. Family Ownership and R&D Intensity in Small- and Medium-Sized Firms. J. Prod. Innov. Manag. 2015, 32, 349–360. [Google Scholar]

- Cabrera-Suárez, M.K. La influencia de la familia en la empresa familiar: Objetivos socioemocionales, stewardship y familiness. Rev. Empres. Fam. 2012, 2, 93–96. [Google Scholar] [CrossRef][Green Version]

- Martínez Romero, M.J.; Rojo Ramírez, A.A. SEW: Looking for a definition and controversial issues. Eur. J. Fam. Bus. 2016, 6, 1–9. [Google Scholar] [CrossRef]

- Debicki, B.J.; Kellermanns, F.W.; Chrisman, J.J.; Pearson, A.W.; Spencer, B.A. Development of a socioemotional wealth importance (SEWi) scale for family firm research. J. Fam. Bus. Strateg. 2016, 7, 47–57. [Google Scholar] [CrossRef]

- Cennamo, C.; Berrone, P.; Cruz, C.; Gomez-Mejia, L.R. Socioemotional Wealth and Proactive Stakeholder Engagement: Why Family-Controlled Firms Care More About Their Stakeholders. Entrep. Theory Pract. 2012, 36, 1153–1173. [Google Scholar] [CrossRef]

- Zellweger, T.M.; Nason, R.S. A stakeholder perspective on family firm performance. Fam. Bus. Rev. 2008, 21, 203–216. [Google Scholar] [CrossRef]

- Bingham, J.B.; Gibb Dyer, W.; Smith, I.; Adams, G.L. A Stakeholder Identity Orientation Approach to Corporate Social Performance in Family Firms. J. Bus. Ethics 2011, 99, 565–585. [Google Scholar] [CrossRef]

- Tagiuri, R.; Davis, J.A. On the goals of successful family companies. Fam. Bus. Rev. 1992, 5, 43–62. [Google Scholar] [CrossRef]

- Classen, N.; Carree, M.; van Gils, A.; Peters, B. Innovation in family and non-family SMEs: An exploratory analysis. Small Bus. Econ. 2014, 42, 595–609. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Nastasi, A.; Pisa, S. A comparison of family and nonfamily small firms in their approach to green innovation: A study of Italian companies in the agri-food industry. Bus. Strateg. Environ. 2019, 28, 1434–1448. [Google Scholar] [CrossRef]

- Berrone, P.; Cruz, C.; Gomez-Mejia, L.R.; Larraza-Kintana, M. Socioemotional Wealth and Corporate Responses to Institutional Pressures: Do Family-Controlled Firms Pollute Less? Adm. Sci. Q. 2010, 55, 82–113. [Google Scholar] [CrossRef]

- Neubaum, D.O.; Dibrell, C.; Craig, J.B. Balancing natural environmental concerns of internal and external stakeholders in family and non-family businesses. J. Fam. Bus. Strateg. 2012, 3, 28–37. [Google Scholar] [CrossRef]

- Uhlaner, L.M.; Berent-Braun, M.M.; Jeurissen, R.J.M.; de Wit, G. Beyond Size: Predicting Engagement in Environmental Management Practices of Dutch SMEs. J. Bus. Ethics 2012, 109, 411–429. [Google Scholar] [CrossRef]

- Aragón-Amonarriz, C.; Arredondo, A.M.; Iturrioz-Landart, C. How Can Responsible Family Ownership be Sustained Across Generations? A Family Social Capital Approach. J. Bus. Ethics 2017, 159, 161–185. [Google Scholar] [CrossRef]

- Uhlaner, L.M.; van Goor-Balk, H.A.; Masurel, E. Family business and corporate social responsibility in a sample of Dutch firms. J. Small Bus. Enterp. Dev. 2004, 11, 186–194. [Google Scholar] [CrossRef]

- Deniz, M.C.; Cabrera-Suarez, M.K. Corporate Social Responsibility and Family Business in Spain. J. Bus. Ethics 2005, 56, 27–41. [Google Scholar] [CrossRef]

- Esparza Aguilar, J.L. Corporate social responsibility practices developed by Mexican family and non-family businesses. J. Fam. Bus. Manag. 2019, 9, 40–53. [Google Scholar] [CrossRef]

- Herrera Madueño, J.; Larrán Jorge, M.; Lechuga Sancho, M.P.; Martínez-Martínez, D. Evolución de la literatura sobre la responsabilidad social en pymes como disciplina científica. Rev. Eur. Dir. y Econ. la Empres. 2015, 24, 117–128. [Google Scholar] [CrossRef][Green Version]

- Marques, P.; Presas, P.; Simon, A. The Heterogeneity of Family Firms in CSR Engagement. Fam. Bus. Rev. 2014, 27, 206–227. [Google Scholar] [CrossRef]

- Van Gils, A.; Dibrell, C.; Neubaum, D.O.; Craig, J.B. Social Issues in the Family Enterprise. Fam. Bus. Rev. 2014, 27, 193–205. [Google Scholar] [CrossRef]

- Rus Rufino, S.; Trevinyo-Rodríguez, R.N. Hay que redefinir la empresa familiar. In Empresa Familiar: Análisis Estratégico; Corona, J., Ed.; Ediciones Deusto: Barcelona, Spain, 2017; pp. 89–117. ISBN 9788423427499. [Google Scholar]

- Dyer, G.W.; Whetten, D.A. Family firms and social responsibility: Preliminary evidence from the S & P 500. Entrep. Theory Pract. 2006, 30, 785–802. [Google Scholar]

- Sharma, P.; Sharma, S. Drivers of Proactive Environmental Strategy. Bus. Ethics Q. 2011, 21, 309–334. [Google Scholar] [CrossRef]

- Huang, Y.C.; Ding, H.B.; Kao, M.R. Salient stakeholder voices: Family business and green innovation adoption. J. Manag. Organ. 2009, 15, 309–326. [Google Scholar] [CrossRef]

- Campopiano, G.; De Massis, A. Corporate Social Responsibility Reporting: A Content Analysis in Family and Non-family Firms. J. Bus. Ethics 2015, 129, 511–534. [Google Scholar] [CrossRef]

- Reynolds, P.; Bygrave, W.; Autio, E. GEM 2003 Global Report; Babson College: Babson Park, MA, USA, 2004; Available online: https://www.gemconsortium.org/report/gem-2003-global-report (accessed on 10 November 2020).

- Cruz, C.; Justo, R. Portfolio Entrepreneurship as a Mixed Gamble: A Winning Bet for Family Entrepreneurs in SMEs. J. Small Bus. Manag. 2017, 55, 571–593. [Google Scholar] [CrossRef]

- Ruiz-Palomo, D.; Diéguez-Soto, J.; Duréndez, A.; Santos, J.A.C. Family Management and Firm Performance in Family SMEs: The Mediating Roles of Management Control Systems and Technological Innovation. Sustainability 2019, 11, 3805. [Google Scholar] [CrossRef]

- European Commission. User Guide to the SME Definition; Publications Office of the European Union: Luxembourg, 2005; ISBN 978-92-79-45322-9. [Google Scholar]

- EU Commission. Recommendation 2003/361/EC of 6 May 2003 concerning the definition of micro, small and medium-sized enterprises. Off. J. 2003, 20, 2003. [Google Scholar]

- Griffiths, M.D.; Gundry, L.K.; Kickul, J.R. The socio-political, economic, and cultural determinants of social entrepreneurship activity. J. Small Bus. Enterp. Dev. 2013, 20, 341–357. [Google Scholar] [CrossRef]

- Hechavarría, D.M. The impact of culture on national prevalence rates of social and commercial entrepreneurship. Int. Entrep. Manag. J. 2015, 12, 1025–1052. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Partial Least Squares Structural Equation Modeling: Rigorous Applications, Better Results and Higher Acceptance. Long Range Plan. 2013, 46, 1–12. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Smith, D.; Reams, R.; Hair, J.F. Partial least squares structural equation modeling (PLS-SEM): A useful tool for family business researchers. J. Fam. Bus. Strateg. 2014, 5, 105–115. [Google Scholar] [CrossRef]

- Ringle, C.; Wende, S.; Becker, J. Smart PLS 3; SmartPLS GmbH: Boenningstedt, Germany, 2015. [Google Scholar]

- Podsakoff, P.M.P.; MacKenzie, S.B.S.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Bagozzi, R.; Yi, Y. Assessing Construct Validity in Organization Research. Adm. Sci. Q. 1991, 36, 421–458. [Google Scholar] [CrossRef]

- Kock, N. Common Method Bias: A Full Collinearity Assessment Method for PLS-SEM. In Partial Least Squares Path Modeling; Springer International Publishing: Cham, Germany, 2017; pp. 245–257. [Google Scholar]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Sarstedt, M.; Mooi, E. A Concise Guide to Market Research: The Process, Data, and Methods Using IBM SPSS Statistics; Springer: Berlin, Germany, 2014. [Google Scholar]

- Hair, J.F.J.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); SAGE Publications: Thousand Oaks, CA, USA, 2013; ISBN 1483321452. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- MacKenzie, S.B.; Podsakoff, P.M.; Jarvis, C.B. The problem of measurement model misspecification in behavioral and organizational research and some recommended solutions. J. Appl. Psychol. 2005, 90, 710–730. [Google Scholar] [CrossRef] [PubMed]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2014, 43, 115–135. [Google Scholar] [CrossRef]

- Stone, M. Cross-validatory choice and assessment of statistical predictions. J. R. Stat. Soc. Ser. B 1974, 36, 111–147. [Google Scholar] [CrossRef]

- Geisser, S. A predictive approach to the random effect model. Biometrika 1974, 61, 101–107. [Google Scholar] [CrossRef]

- Chin, W.W. The Partial Least Squares Approach to Structural Equation Modeling; Marcoulides, G.A., Ed.; Psychology Press: New York, NY, USA, 1998; ISBN 9780805826777. [Google Scholar]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Laurence Erlbaum Associates: Hove, UK; London, UK, 2013. [Google Scholar]

- Falk, R.; Miller, N. A Primer for Soft Modeling; University of Akron Press: Akron, OH, USA, 1992; ISBN 9780962262845. [Google Scholar]

- Henseler, J.; Sarstedt, M. Goodness-of-fit indices for partial least squares path modeling. Comput. Stat. 2012, 28, 565–580. [Google Scholar] [CrossRef]

- Henseler, J.; Dijkstra, T.K.; Sarstedt, M.; Ringle, C.M.; Diamantopoulos, A.; Straub, D.W.; Ketchen, D.J.; Hair, J.F.; Hult, G.T.M.; Calantone, R.J. Common Beliefs and Reality About PLS: Comments on Ronkko and Evermann (2013). Organ. Res. Methods 2014, 17, 182–209. [Google Scholar] [CrossRef]

- Hu, L.; Bentler, P. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. A Multidiscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Hoogendoorn, B.; Guerra, D.; van der Zwan, P. What drives environmental practices of SMEs? Small Bus. Econ. 2015, 44, 759–781. [Google Scholar] [CrossRef]

- Lepoutre, J.; Heene, A. Investigating the Impact of Firm Size on Small Business Social Responsibility: A Critical Review. J. Bus. Ethics 2006, 67, 257–273. [Google Scholar] [CrossRef]

- Vanham, D.; Leip, A.; Galli, A.; Kastner, T.; Bruckner, M.; Uwizeye, A.; van Dijk, K.; Ercin, E.; Dalin, C.; Brandão, M.; et al. Environmental footprint family to address local to planetary sustainability and deliver on the SDGs. Sci. Total Environ. 2019, 693, 133642. [Google Scholar] [CrossRef]

- Rosati, F.; Faria, L.G.D. Addressing the SDGs in sustainability reports: The relationship with institutional factors. J. Clean. Prod. 2019, 215, 1312–1326. [Google Scholar] [CrossRef]

- Zimon, D.; Tyan, J.; Sroufe, R. Drivers of sustainable supply chain management: Practices to alignment with un sustainable development goals. Int. J. Qual. Res. 2020, 14, 219–236. [Google Scholar] [CrossRef]

- Anbarasan, P. Sushil Stakeholder Engagement in Sustainable Enterprise: Evolving a Conceptual Framework, and a Case Study of ITC. Bus. Strateg. Environ. 2018, 27, 282–299. [Google Scholar] [CrossRef]

- Memili, E.; Fang, H.C.; Koc, B.; Yildirim-Öktem, Ö.; Sonmez, S. Sustainability practices of family firms: The interplay between family ownership and long-term orientation. J. Sustain. Tour. 2018, 26, 9–28. [Google Scholar] [CrossRef]

- Hofstede, G. Culture’s Consequences: Comparing Values, Behaviors, Institutions and Organizations across Nations; Sage: Thousand Oaks, CA, USA, 2001. [Google Scholar]

- Astrachan, J.H.; Klein, S.B.; Smyrnios, K.X. The F-PEC Scale of Family Influence: A Proposal for Solving the Family Business Definition Problem. Fam. Bus. Rev. 2002, 15, 45–58. [Google Scholar] [CrossRef]

- Garrigos-Simon, F.; Botella-Carrubi, M.; Gonzalez-Cruz, T. Social Capital, Human Capital, and Sustainability: A Bibliometric and Visualization Analysis. Sustainability 2018, 10, 4751. [Google Scholar] [CrossRef]

- Kraus, S.; Burtscher, J.; Vallaster, C.; Angerer, M. Sustainable Entrepreneurship Orientation: A Reflection on Status-Quo Research on Factors Facilitating Responsible Managerial Practices. Sustainability 2018, 10, 444. [Google Scholar] [CrossRef]

- Kraus, S.; Kallmuenzer, A.; Stieger, D.; Peters, M.; Calabrò, A. Entrepreneurial paths to family firm performance. J. Bus. Res. 2018, 88, 382–387. [Google Scholar] [CrossRef]

- González-Cruz, T.F.; Cruz-Ros, S. When does family involvement produce superior performance in SME family business? J. Bus. Res. 2016, 69, 1452–1457. [Google Scholar] [CrossRef]

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Age of firm | (I) | ||||||||||

| 2 | Education level of CEO | 0.04 | (I) | |||||||||

| 3 | Gender of CEO | −0.14 | −0.10 | (I) | ||||||||

| 4 | Family influence | 0.04 | 0.04 | 0.18 | 0.84 | |||||||

| 5 | Family influence x Social goals | 0.08 | 0.03 | −0.05 | 0.01 | (I) | ||||||

| 6 | Environmental goals | 0.02 | −0.15 | 0.09 | 0.19 | 0.18 | (I) | |||||

| 7 | Social goals | −0.12 | −0.02 | −0.18 | −0.05 | −0.15 | 0.24 | (I) | ||||

| 8 | Rural | −0.04 | 0.11 | 0.02 | 0.02 | 0.10 | 0.02 | −0.13 | (I) | |||

| 9 | Sector 1 | 0.19 | −0.14 | −0.10 | 0.20 | 0.18 | 0.11 | −0.08 | 0.21 | (I) | ||

| 10 | Sector 2 | 0.09 | 0.13 | 0.12 | −0.13 | −0.17 | 0.09 | 0.00 | −0.00 | −0.24 | (I) | |

| 11 | Sector 3 | −0.07 | −0.08 | 0.08 | 0.06 | −0.03 | 0.06 | −0.13 | −0.05 | −0.11 | −0.24 | (I) |

| 12 | Firm size | 0.21 | 0.07 | −0.05 | −0.07 | −0.06 | −0.06 | 0.18 | 0.08 | −0.10 | 0.07 | 0.01 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rojas, A.; Lorenzo, D. Environmental and Social Goals in Spanish SMEs: The Moderating Effect of Family Influence. Sustainability 2021, 13, 1998. https://doi.org/10.3390/su13041998

Rojas A, Lorenzo D. Environmental and Social Goals in Spanish SMEs: The Moderating Effect of Family Influence. Sustainability. 2021; 13(4):1998. https://doi.org/10.3390/su13041998

Chicago/Turabian StyleRojas, Alvaro, and Daniel Lorenzo. 2021. "Environmental and Social Goals in Spanish SMEs: The Moderating Effect of Family Influence" Sustainability 13, no. 4: 1998. https://doi.org/10.3390/su13041998

APA StyleRojas, A., & Lorenzo, D. (2021). Environmental and Social Goals in Spanish SMEs: The Moderating Effect of Family Influence. Sustainability, 13(4), 1998. https://doi.org/10.3390/su13041998