1. Introduction

Environmental taxation is an important economic policy tool of central authorities, which supports the long-term sustainable development of society and the economy. Its definition may be relatively broad, though in general it is a tax whose impacts are primarily environmental, or it is a tax that significantly regulates the impacts of certain environmental activities [

1]. In general terms, the key environmental taxes include selective excise taxes, the most important of them being the fuel tax, which makes a significant part of the tax ratio. The problematic institutional conditions associated with high levels of corruption may limit the efforts to apply environmental taxation as a tool to achieve sustainable development goals as well as limit the achievement of the European Green Deal objectives.

Corruption usually disrupts the functioning of economic and social activities and thereby leads to their transfer to the shadow economy. Consequently, it may have destructive effects on economic development and the sources of long-term economic growth as such. Systemic corruption in particular, whose negative effects tend to fade away very slowly, has proved to have significant implications for the tax mix [

2]. The negative effects of corruption, such as ineffective government spending, may be reflected in the need for additional tax collection and an increase in the tax ratio. Environmental taxes, which by their nature may be taxes imposed on commodities with low price elasticity of demand, then appear to be the first in line and are thus a convenient and preferred option for increasing the tax ratio, especially when transitioning to the European Green Deal. If the effects of corruption in the sector of commodities burdened with environmental taxes can be identified and confronted with other sectors of the economy in general terms of corruption, it is possible to determine the impact of corruption on the use of environmental taxation from the perspective of long-term economic growth and development.

The aim of this article is to evaluate the impact of corruption and its implications on the size of the official and the shadow economy in the sector burdened with environmental excise tax and to confront the said impact with the sector not burdened with such a tax. The DSGE (Dynamic stochastic general equilibrium) model by Orsi et al. [

3] with the shadow economy is used and is significantly expanded by the authors to take the real tax mix and its individual taxes into account. Such an approach also makes it possible to separately examine selective excise (environmental) taxes and their effects on individual sectors of the economy.

The analysis is carried out on the example of the Czech Republic as it is a typical representative of the new members of the European Union from the former Eastern Bloc. The World Bank assigns the world’s economies to four income groups (low, lower-middle, upper-middle and high-income countries [

4]. Almost all of the former Eastern Bloc countries are included in the high-income countries group (except for Bulgaria, which is in the upper-middle group). The above stated can be also documented through specific indicators, which usually express the median position of the Czech Republic within the countries of the former Eastern Bloc. The Czech Republic reached the deficit state budget 21 times during the period between 1993–2019, but for the last four years, the state budget was two times in surplus. Moreover, public debt has increased from 13.2% of GDP in 1993 to 28.5% in 2019 [

5]. Tax revenues from the selective excise taxes have also increased more than four times to 168 billion CZK in 2019 [

6]. From the fiscal point of view, Czech Republic can be therefore perceived as the median member among the new European Union countries and former Eastern Bloc countries. On another note, it should be emphasized that the decline of economic activity and the COVID-19 crisis reopens the issue of public finance consolidation which will probably require a sharper increase of environmental taxes in context of the European Green Deal.

The Czech Republic is a country with a relatively high level of perceived corruption, but most of the elements of the institutional characteristics are otherwise comparable with the original members of the European Union [

7]. Central authorities also use selective excise taxation and especially its environmental component—the fuel tax—as a frequent tool for increasing tax revenues, while this tax accounts for almost half of corporate or personal income tax revenues.

The Corruption Perception Index (CPI) aggregates data that provide perceptions by businessmen and country experts of the level of corruption in the public sector (for a detailed methodology, see [

8]). The Czech Republic was ranked in the 19th position of all European member states in 2019, making it 8 points lower than the EU average [

9]. The results for 2020 were recently published, and the Czech Republic’s rating deteriorated again. Although it maintained the 19th position within the EU countries (thanks to Brexit), the value of the index fell by another 2 points, and the Czech Republic is now 10 points lower than the EU average. The country reached the deficit state budget 21 times during the period between 1993 and 2019, but for the last four years, the state budget was two times in surplus. Moreover, public debt has increased from 13.2% of GDP in 1993 to 28.5% in 2019 [

5]. Tax revenues from the selective excise taxes have also increased more than four times to 168 billion CZK in 2019 [

6]. From the fiscal point of view, Czech Republic can be therefore perceived as the median member among the new European Union countries and former Eastern Bloc countries. On another note, it should be emphasized that the decline of economic activity and the COVID-19 crisis reopens the issue of public finance consolidation, which will probably require a sharper increase of environmental taxes in the context of the European Green Deal. Even if that is the case, the conclusions drawn from the present analysis may be applied to other similar members of the European Union.

The effect of corruption is incorporated into the model by Orsi et al. [

3] by modelling its impact on individual components of the tax ratio. Born and Pfeifer [

10] follow a similar approach. The definition of corruption is based on its delineation by Transparency International (TI), whereby it is defined as “an abuse of entrusted power for private gain” [

11]. Other more or less similar definitions appear in the literature as well. As an illustration, reference may be made to the traditional definition established by Nye [

12], which defines it as “any behaviour which violates rules in order to increase private-regarding influence.” The level of corruption is related to the extent of the shadow economy. However, it is important to underline that corruption and the shadow economy are two separate phenomena, a more detailed assessment of which is provided by Achim and Borlea [

13], who present them as two separate concepts while illustrating their close interconnection. According to the paper by Feld and Schneider [

14], the shadow economy, in its narrower definition, represents all production of goods and services (whether legal or illegal) that is not included in the official estimates of gross domestic product. A demonstrably positive link between corruption and the shadow economy is described, e.g., by Dreher and Schneider [

2] and by Borlea, Achim and Miron [

15]. The interconnection between corruption and the shadow economy is further pointed out by Choi and Thum [

16], who concluded that any efforts to eradicate the shadow economy without tackling the principal problem of corruption would be counterproductive. Furthermore, Shahab, Pajooyan and Ghaffari [

17] have shown that the relation between corruption and the shadow economy depends on the corruption level: as corruption grows, its positive relation with the shadow economy is becoming more evident.

A number of publications inquire into the relation between corruption, shadow economy and environmental sustainability, including Ganda [

18] or Morse [

19]. Other authors focus on the link between corruption, shadow economy and pollution. Indeed, Biswas, Fazanegan and Thum [

20] confirmed that the relationship between the shadow economy and the levels of pollution are dependent on the levels of corruption. A similar conclusion was also reached by Wang et al. [

21]

The transmission of corruption to the tax burden is described for instance by Schneider [

22], Liu and Feng [

23] or in the already mentioned work by Born and Pfeifer [

10]. Through transmission to the tax ratio, corruption also leads to an increase in the shadow economy at the expense of the official economy [

24,

25]. Corruption affects the perception of the effective tax rate, and its influences may be understood as “additional taxation”, which must be implemented due to the lost revenues caused by corruption. In the presented paper, the corruption indicator is common to all stochastic tax rates, differing only in the relative significance of their impact made on the resulting perceived tax rate.

Regarding the relationship between environmental taxation and sustainability, the impact of taxation on economic growth needs to be taken into account in particular. Many studies show that the impact of taxation on economic growth is negative, especially in the case of direct taxes [

26], all the more so if they are progressive [

27]. Indirect taxes can even have a positive effect on economic growth, especially if they are used to finance productive government spending, which in certain circumstances may include environmental spending [

28]. The ideal situation is thus when environmental taxes have the character of indirect taxes, or excise taxes. Environmental taxes in the form of excise taxes must then be appropriately integrated into the tax mix so that taxation as a whole leads to the promotion of environmental activities and economic sustainability [

29], and at the same time motivates pollution producers to use innovative, environmentally friendly technologies [

30]. It has also been shown that there is a link between economic growth and the efficiency of environmental tax collection [

31], especially in the situation that the environment is considered an important part of the economic system [

32].

Assuming that high-income countries are also characterized by lower levels of corruption, environmental taxes can support their further economic growth and provide additional resources to finance environmental activities from public sources. However, if a sudden increase in corruption appears and is perceived as additional taxation, further taxation through environmental taxes can lead to distortions and an overall reduction in production. Moreover, if a higher level of corruption also means a higher level of pollution and thus a higher need for resources to eliminate it, the logical solution is to introduce new or increase existing environmental taxes, which puts the economy in a vicious circle.

2. Theoretical Background and Methods

The starting point for the modelling of possible impacts of corruption on the tax system is the DSGE model with shadow economy based on the work by Orsi et al. [

3], and it is significantly expanded by the authors with the usual tax mix. One of the important changes made by the authors is the extension to include the implementation of the environmental (excise) tax, which levies taxes only on certain goods. The resulting model thus corresponds in its structure to the two-sector model of companies that produce goods that are subject only to the value-added tax (VAT) and goods that are also subject to the environmental (excise) tax. This aspect has also been represented in the modified consumption function, which includes both mentioned types of goods.

There are three types of representative agents in the model: companies, which represent the sector manufacturing goods and providing services; households, which consume the goods and services and provide the companies with production factors of labour and capital; and the government, which taxes economic entities. The government utilises tax revenues to finance the exogenously given government spending, which, however, does not enter into the decision-making of other entities. Government tax revenues are composed of the following taxes:

Personal income tax (determined by the tax rate ), which burdens the wages of households;

Corporate income tax, imposed on companies (determined by the tax rate ), which burdens the profits of companies;

Withholding tax (the dividend tax, determined by the tax rate ), which burdens the profits of companies after the taxation of personal income taxes;

Social security contributions (determined by the rate ), which burdens the wages of households and which are paid by companies;

Value added tax (determined by the tax rate ), which generally burdens all goods intended for final consumption;

Environmental (excise) tax (determined by the tax rate ), which burdens a specific part of goods intended for final consumption;

Penalties for government-identified activities carried out by companies in the shadow economy are given by

when

, which is defined as a surcharge on the original tax liability of companies, if this obligation has been avoided by activities carried out in the shadow economy. Incorporating the withholding tax, value added tax and the environmental tax is one of the main modifications of the original model of Orsi et al. [

3].

On one hand, companies and households can carry out their activities in the sector of the official economy (the relevant variables will be marked with the upper index

) and then in the sector of the shadow economy (marked with the use of the upper index

). The activities will be then divided into these sectors according to whether they relate to normal goods (the upper index

) or to goods that are subject to the excise (environmental) tax (the upper index

). Each company

utilises labour

and capital,

in the official economy to produce final goods

and

by using the technologies describable by the Cobb–Douglas production functions:

where parameters

and

express the share of the production factor of labour in the total product in the given sector, and

and

are temporary technological shocks. The term

expresses a permanent technological shock influencing solely workforce and which has the nature of a deterministic trend

, where

can be identified with the growth of the economy’s potential product.

In accordance with Orsi et al. [

3], companies can hide some of their production to avoid tax liability. Such tax evasion will result in two effects—a reduction in tax liability through a lower corporate income tax and an increase in profit from the sale of goods due to the possibility of not paying the value-added tax and the excise (environmental) tax. Companies can then produce a part of their output in the shadow economy, with the use of the Cobb-Douglas production function with production factors available in the shadow economy. The production functions are similar to Equation (1), and we use the superscripts

for distinguishing the production and production factors in the shadow economy. Temporary technological shocks denoted by

and

capture the differences in the productivity of both sectors. Due to the specific nature of the value-added tax and the excise tax, which directly influence the cost of goods and services, there will be assumed potential differences in the products of the official and the shadow economies, so these will not be homogeneous goods. Assuming perfectly competitive markets, companies will be price takers. The total revenues of the

company,

in the production sector of normal (

) and specific goods (

) are defined as follows:

where

for

are prices of individual items of the final production (without the value-added tax and the excise tax). The prices in the official market (without taxes) and the shadow market may vary and reflect, e.g., the risky surcharge or the seller’s attempt to gain a part of the hypothetical revenues from the unpaid tax. Labour and capital markets are perfectly competitive in this model. Companies therefore pay an interest

(for production factors in the official economy) or

(for production factors in the shadow economy) for capital leasing (for which direct taxation is not assumed). Labour costs in the official market are determined by the wage rate per unit of work

(increased by the stochastic tax rate of social security insurance

); labour costs in the shadow economy are determined only by the wage rate

. The total costs of the company

,

in the production sector of normal (

) and specific goods (

) are defined as follows:

Each unit of net income of companies (defined as the difference between the final output, the costs of workforce and the leased capital) is taxed by the stochastic corporate tax rate

, which is common for both areas of production in the official economy sector. As an enrichment of the original model proposed by [

3], all tax rates are proportional to the perceived corruption factor referring to the corresponding tax. The corporate tax rate is thus proportional to

, where

represents a relative weight with respect to the overall perception of the corruption indicator,

. The increase in perceived corruption generally raises the effective tax rate. The profit after tax is then additionally taxed with withholding tax (dividend tax) at a given tax rate

. Since the dividends in the real economy are paid out only by some companies, the activities of the model companies will also be realised partly as companies dividing the profit (the share of these activities is determined by the parameter

), and partly as companies not dividing the profit.

The sector of the shadow economy is not easily monitorable by the government. Companies thus use the production factors in the shadow economy to hide a part of their production from taxation. In order to restrict tax evasion, the government and its financial authorities perform a review process in each period; each company acting in different parts within the shadow economy faces the probability

and

that it will be investigated and that its potential business in the shadow economy will be revealed, respectively. In such cases, it is forced to tax its net production in the shadow economy, appraised with usual prices of the official economy (production after deducing the wage and interest costs) by the tax rate

proportionally increased by the penalty factor

and additionally also pay the outstanding excise tax and value-added tax, proportionally increased by the penalty factor

or

(depending on which area of production is concerned). In this case, the additional taxation of profits through withholding tax and the additional assessment of the social security insurance rates are therefore not considered. This mechanism is similar to the mechanism presented by [

3]. The net revenues of companies from the generated production in the individual areas of production are over time

random quantities

and

, defined as

and

in the case of non-detection and

and

in the case of detection:

The optimal amount of the final output produced by the company

over time

in the sector of production of goods

for

is therefore the solution to the following static optimisation problem:

with respect to the technological constraints imposed by Equations (1) and (2) and the fact that capital and labour are supplied by households separately for the official and the shadow economy, and any further division into individual production areas is purely a decision of that company. The operator

indicates the operator of middle value conditioned by the information over time

. The solution to the optimisation problem describes the optimal demand for production factors in both sectors of the economy and the optimal amount of goods offered. These conditions can be laid down after algebraic adjustments have been made and by using the relationships to aggregate outputs and demands for production factors throughout the economy (based on the assumption that all companies use the same amount and combination of inputs and produce the same amount of output in equilibrium) as follows:

A part of the solution to the optimisation problem also includes the equations of technological limitation given by relationships (1), (2), (17) and (18).

As part of their decision-making, households aim to maximize the utility of consumption for the goods produced in the economy; in order to gain them, they supply their labour and available capital to companies. A representative household maximises the utility function in the form of the following:

where

is the inversion factor of intertemporal elasticity of substitution,

is the subjective discount factor,

is the disutility preference parameter for purchasing goods in the shadow economy (including, e.g., the costs of free time for searching a specific market), which ensures that the prices of goods (without taxes included) in the official and the shadow economy may differ. Parameter

is the inverse elasticity of substitution of consumption of individual goods originating from the shadow economy,

and

are scaling parameters of disutilities from labour activities. The parameters

and

are the inversion elasticity of substitution for the overall labour supply and the labour supply in the shadow economy. The expression

represents a temporary shock in the labour supply, which influences the marginal rate of substitution between consumption and free time. The preferences are specified in the utility function so that the utility of consumption is expressed relatively on the level of technology

. This ensures that the economy moves along the so-called Balanced Growth Path (BGP). The term

can therefore be interpreted as an exogenous component of consumption habits similar to [

3].

As opposed to the opening paper by Orsi et al. [

3],

presents the consumption index corresponding to the standard CES (Constant Elasticity of Substitution) specification of the utility function in the following form:

where

is a part of the consumption of specific goods in the overall consumption and

expresses the elasticity of substitution between both types of goods, whereas the consumer does not qualitatively differentiate in the basic consumption index between the consumption of specific goods gained from the official or the informal sector of the economy. Households supply their labour to companies in both parts of the economy as well as lend the capital they own. It is assumed that the capital stock held by households,

, evolves over time according to the following rule:

where

represents investments over time

and

is the capital depreciation rate. The effectiveness of transferring final goods to the physical capital is a random quantity determined by temporary shocks

. Capital is homogeneous, and households may decide at any point in time how much of it they lend to companies within the official economy (in the quantity

) and how much within the shadow economy (in the volume

). Households can avoid paying household income tax if they move their labour and capital supply from the official to the shadow economy, where income from the shadow economy in the volume

is not subject to the income tax at the rate

, including the corruption perception factor

. Based on these assumptions, the budget constraint of households at any point in time is determined as:

where the capital supplied in both sectors of the economy meets the condition

The procedure for solving the optimisation problem is analogous to that of the paper by Orsi et al. [

3]; it is complicated only by the existence of the composite consumption index and the need for optimisation across each of the types of goods. The problem of maximising the utility by households is therefore the problem of finding trajectories

,

,

,

,

,

,

, which will maximise the intertemporal utility function, determined by the Equation (27), in regard to the budget constraints determined by Equations (29)–(31). The solution to the optimisation problem (after algebraic adjustments and combinations with equations of budgetary constraints have been made) consists in relationships describing the optimal demand for goods in both sectors of the economy and the optimal supply of labour and capital in the sectors:

The government sector is modelled analogously to the procedure in Orsi et al. [

3], when at any time

the government regulates the tax rates to finance a given volume of government consumption,

. For reasons of simplicity, the government debt is left out, and it is assumed that public spending is selected so that it is balanced with tax revenues. The budget constraints of the government can be therefore written as follows:

where the first term on the right side of the equation gradually represents the total fiscal income from personal income taxation,

, from corporate income taxation,

, from withholding tax on profit share,

, from social security contributions,

, from value-added tax,

, and excise taxes,

. The government revenues are represented by the tax revenues and the revenues from additional assessment of taxes and assessed penalties. Specifically:

The resulting general equilibrium of the economy is then determined by the identity implying that the total production in the official and the shadow economy is divided at all times into household consumption, government spending and investments of companies. With regard to the number of endogenous variables in the model, it is necessary to add equations for all exogenous processes to complete it, i.e., those quantities not determined within the model. Productivity shocks, fiscal shocks (shocks in tax rates) and other exogenous quantities (apart from the level of corruption) are represented in the model as independent autoregressive processes.

4. Discussion

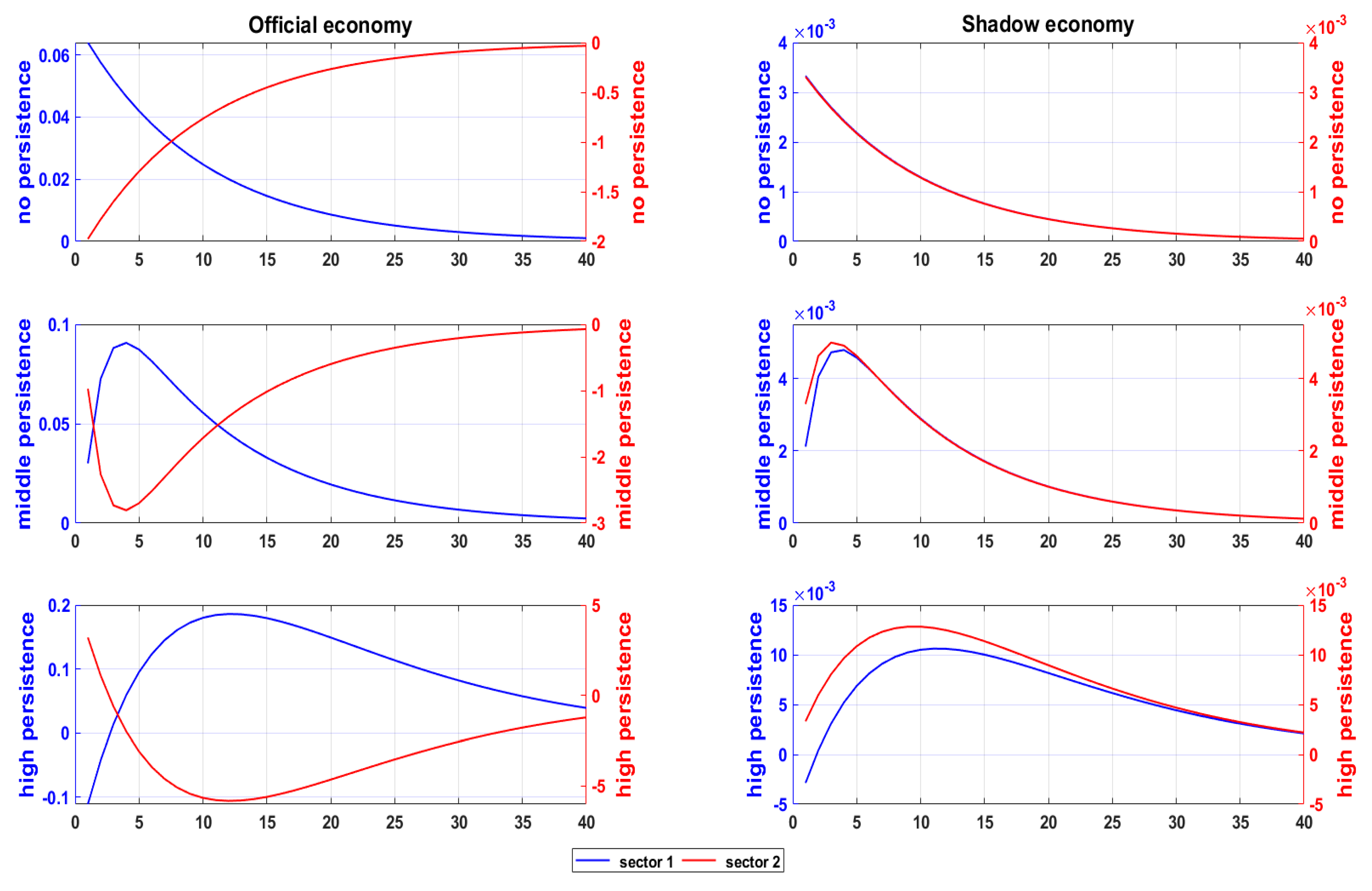

Taking a closer look at

Table 2 allows us to note that in the official economy sector, namely in the case of commodities burdened with environmental taxation, corruption is always hand in hand with a decline in economic performance. If the corruption in question remains sporadic, then the decline in economic performance is immediate, yet it gradually fades away over a period of about four years before returning to its original level. In the case of inertial corruption, however, while an immediate decline in economic performance occurs as well, it continues to deepen for the period of one year. It takes about five more years before the negative impact of corruption on the performance of the official economy fades away and the performance returns nearly to its original level. In the case of systemic corruption, which we refer to as State Capture type, there is conversely a short-term increase in economic performance, which nonetheless fades away after the period of one year. Over the next two years, the economy reaches a deep downswing in performance, which then takes a very long period of time to fade away and does not return to its original level even after a lengthy period of ten years.

This can be interpreted in the following way: corruption is very destructive for the sector burdened with environmental taxation, especially when it is systemic in nature. A more detailed analysis of the individual sources of economic growth revealed that the key factor damaged by corruption in the official economy is capital accumulation, which is reduced by almost one percent in the case of State Capture. This decline causes, above all, a decline in the performance of the economy as a whole. By contrast, the declining size of the workforce has a rather ambiguous effect on the long-term economic development, and corruption may even lead to an increase in job motivation and an increase in the workforce with the intention of compensating for unrealised spending caused by corruption. What is discussed here, however, is mainly the case of sporadic and non-inertial corruption.

If corruption affects the sectors of the official economy that are not subject to environmental taxation, then different effects can be observed as compared to the sector with prevalent commodities that are subject to environmental taxation. Corruption does not lead to a decline in the economy but actually to a slight increase in its performance, and it is clear that the effect of increased workforce described above prevails over the effect of reduced capital accumulation. These “positive” effects, however, fade away relatively quickly over a period of 2–5 years. An exception is the situation of persistent corruption, which has a short-term negative effect but with a more boomerang-positive effect in the next period. However, this effect gradually subsides as well.

In the case of the shadow economy, similar trends can be observed both in the sector burdened with environmental taxation and in other sectors. The courses of changes in production based on modelled corruption shocks are developed similarly timewise. The increased level of corruption leads to an increase of the shadow economy in almost all cases, while the increase is more permanent when corruption is more persistent, and its cessation occurs only after 1–4 years, depending on the degree of persistence. Higher production in the shadow economy then remains more or less stable even in the long run. The aforementioned growth of the shadow economy is approximately and quantitatively comparable both in the case of sectors with environmental taxation and in the case of sectors without it.

For the analysis to be complete, it is necessary to summarize the impacts of the corruption shock on the economy as a whole. As a result of corruption, part of the activities in the official part of the economy shift from the sector burdened with environmental taxes to the sector that is not burdened with these taxes. Another part of the production burdened with the environmental tax is shifting from the official to the shadow economy. Overall, output declines, as the growth in the shadow economy and in the official economy sector burdened with environmental taxes is not able to sufficiently compensate for the much larger decline in production caused by corruption in the official economy sector burdened with environmental taxes. These effects are most significant in the case of State Capture.

5. Conclusions

The above analysis implies that regardless of whether a particular sector is burdened with environmental taxation or not, in case of corruption, the size of the shadow economy always increases, and these negative effects are of a more permanent nature, especially in the case when the phenomenon of State Capture is considered.

Significant differences in terms of the use of environmental taxation can be found in the case of an analysis of the situation in the official economy as there are relatively different trends in both types of sectors. If environmental taxation is not applied, then lower, non-systemic corruption has a positive effect on the size of production, and the effect of increased workforce motivation clearly dominates, suppressing the effect of reduced capital accumulation. This can in turn eliminate some of the negative aspects associated with the growth of the shadow economy. In the sector burdened with environmental taxation, however, it is shown that corruption has an almost unequivocally negative effect on the production of the economy even in the long run. It is therefore clear that—in a sense—environmental taxation may become a limit in the implementation of long-term economic growth and development policies, especially in countries with high, inertial and systemic corruption. Especially in the situation when the tax burden already includes environmental taxes, the corruption may be perceived as another additional taxation by economic agents, which leads to the decline in capital accumulation that is not offset by an increase in the workforce. The objectives of environmental sustainability and economic development are therefore brought into conflict, making it harder to find the optimum in achieving the sustainable development goals.

To put it simply, with economies struggling with higher, persistent and systemic corruption, as is the case of most post-communist members of the European Union, implementing environmental taxation is more counterproductive and achieving the objectives of the European Green Deal is more problematic. Corruption then becomes an impediment to sustainability.

It should be noted here that the limits of this research can be perceived in the relative complexity of the expanded DSGE model, and using a different model could bring in another perspective on the phenomena, leading to validation of the results and possibly broader generalization of their implications. In particular, the Bayesian estimation comes to mind as an alternative model that could be contrasted to this research and would definitely serve as a valid starting point for future studies. However, it would be necessary to gather all the data necessary for the calibration. In this sense, our choice of methodology remains well-suited. To some extent, the environmental tax burden indicator used may also be a limitation. The use of an alternative to approximation through excise taxes also seems appropriate in further research.