Optimal Green Operation and Information Leakage Decisions under Government Subsidy and Supply Uncertainty

Abstract

:1. Introduction

- (1)

- What are the optimal green operational decisions of the supplier and the two retailers with/without information leakage?

- (2)

- What is the supplier’s information leakage equilibrium?

- (3)

- How does a supplier’s information leakage behavior affect the two retailers’ ex ante payoffs, consumer surplus, and social welfare when the subsidy rate, supply uncertainty, supply correlation, and the two retailers’ forecast accuracies change?

- (1)

- We provide the GSC members’ equilibrium green operational decisions to help suppliers make green product investment decisions as well as information leakage decisions. We find that compared with the suppliers without information leakage behavior, the supplier can set a higher green product level and a higher wholesale price, leading to higher profit when information leakage behavior exists.

- (2)

- We point out that information leak (strategy L) is the unique equilibrium state of the supplier. In general, information leakage benefits R1 but hurts R2. The key parameters (e.g., the subsidy rate, supply uncertainty, supply correlation, and forecast accuracies) affect retailer 1 and retailer 2′ ex ante profit in the opposite direction.

- (3)

- However, the supplier’s information leakage behavior increases both consumer surplus and social welfare levels. Under certain conditions, the subsidy rate, supply uncertainty, supply correlation, and forecast accuracies, respectively, affect consumer surplus and social welfare in the same direction.

2. Literature Review

2.1. Information Leakage in an SC

2.2. Government Subsidies in a GSC

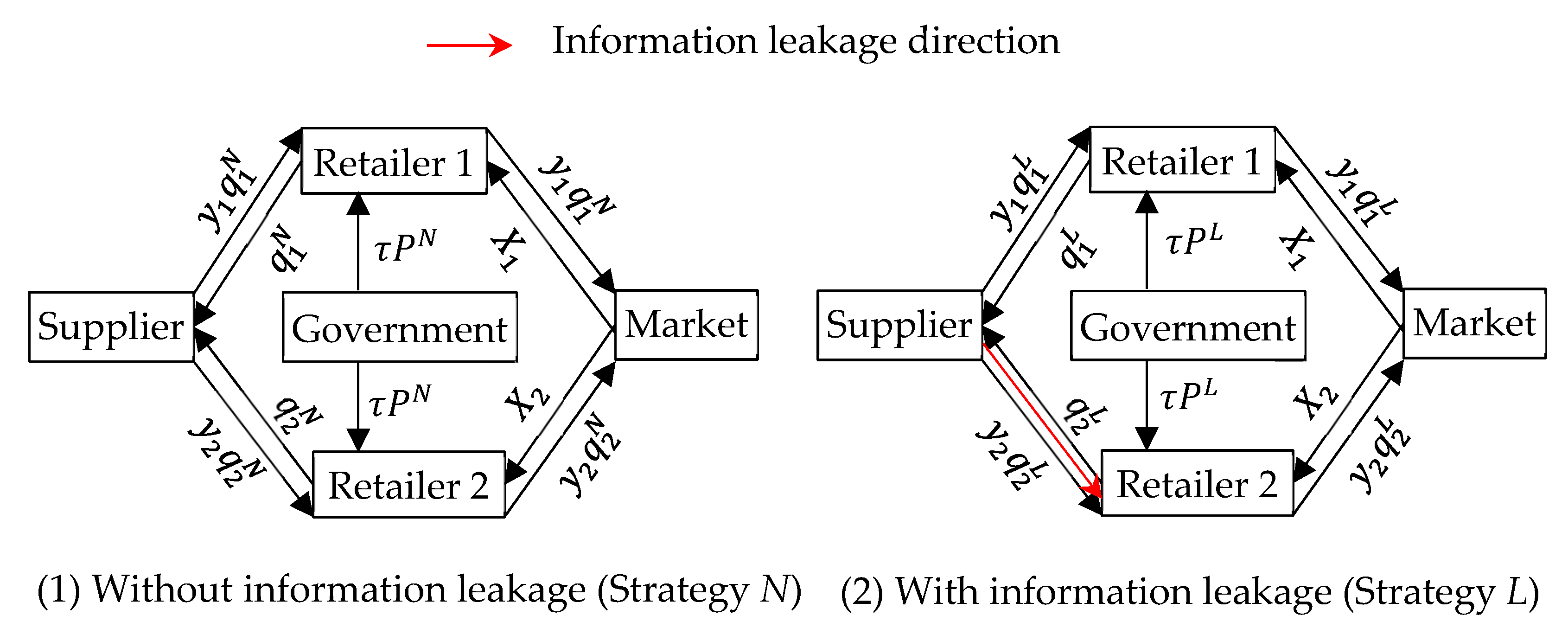

3. Model Descriptions

3.1. Supply Uncertainty

3.2. Demand Uncertainty

3.3. Government Subsidy

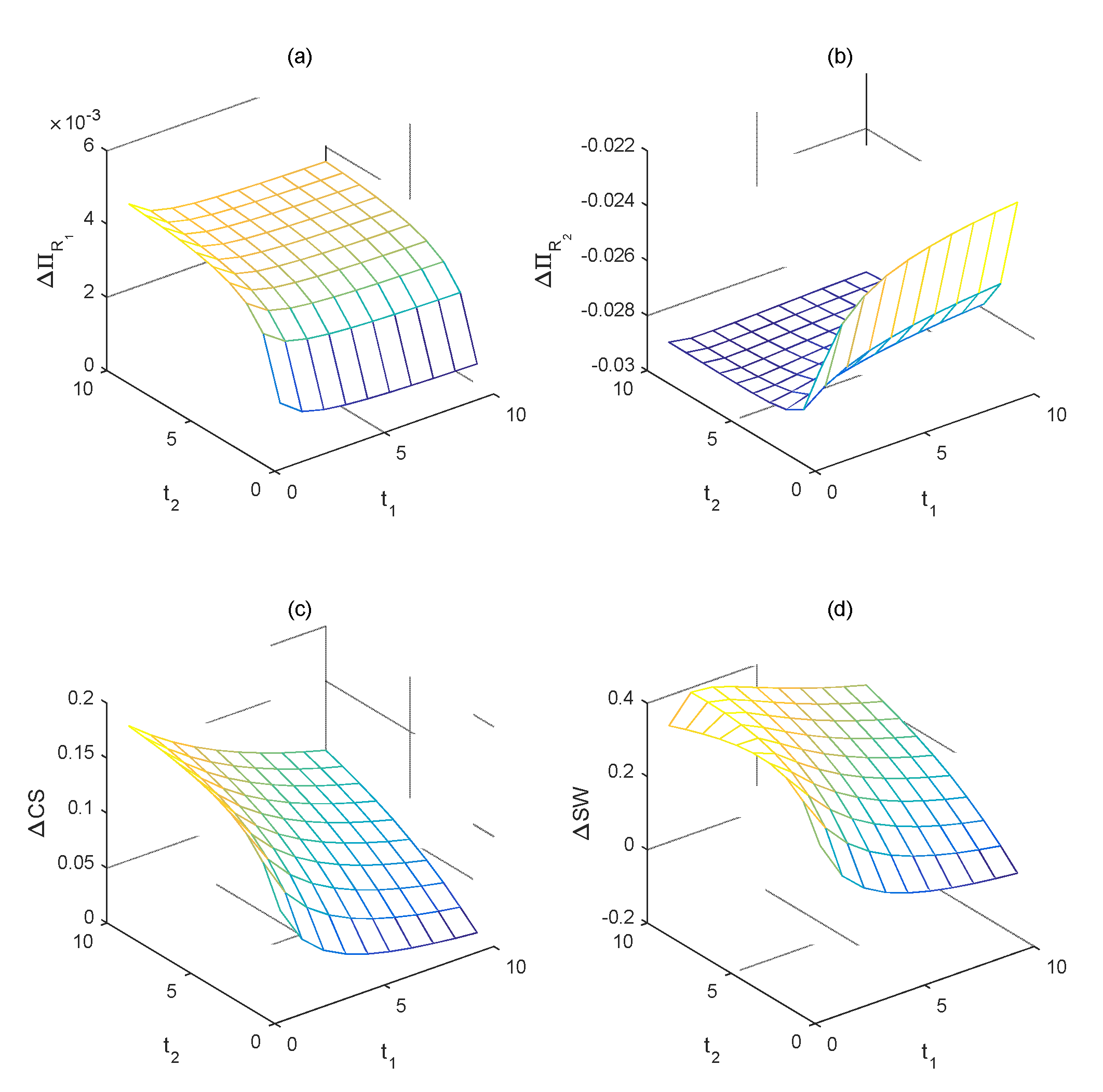

3.4. Sequence of Events

- The supplier simultaneously decides on and .

- R1 has access to forecast information and decides on .

- The supplier receives and decides whether to leak to R2 (L) or not (N).

- R2 has access to forecast information and decides on based on (if the supplier leaks).

- The supplier receives retailer . The supplier manufactures and distributes products.

- The two retailers sell all the available products from the supplier and gain a subsidy rate () per unit of products sold from the government.

- Both supply and demand variabilities are realized.

4. Optimal Green Operation Decisions

4.1. Optimal Green Operation Decisions under No Information Leakage

- (1)

- The supplier’s equilibrium decisions are:

- (2)

- The two retailers’ equilibrium decisions are:

- (1)

- The supplier’s ex ante payoff is:

- (2)

- The retailers’ ex ante payoffs are:

- (3)

- Total government subsidies are:

- (4)

- Consumer surplus and social welfare are:

4.2. Optimal Green Operation Decisions under Information Leakage

- (1)

- The supplier’s equilibrium decisions are:where ; .

- (2)

- The equilibrium decisions of the two retailers are:where:

- (1)

- The supplier’s ex ante profit is:

- (2)

- The retailers’ ex ante profits are:

- (3)

- The total subsidies from the government are:

- (4)

- The consumer surplus and social welfare are:

5. Information Leakage Decisions

5.1. The Supplier’s Information Leakage Decision

5.2. Information Leakage Preference from the Perspectives of Retailers, Consumer Surplus, and Social Welfare

5.2.1. Impact of Subsidy Rate ()

5.2.2. Impact of Supply Correlation ()

5.2.3. Impact of Supply Uncertainty ()

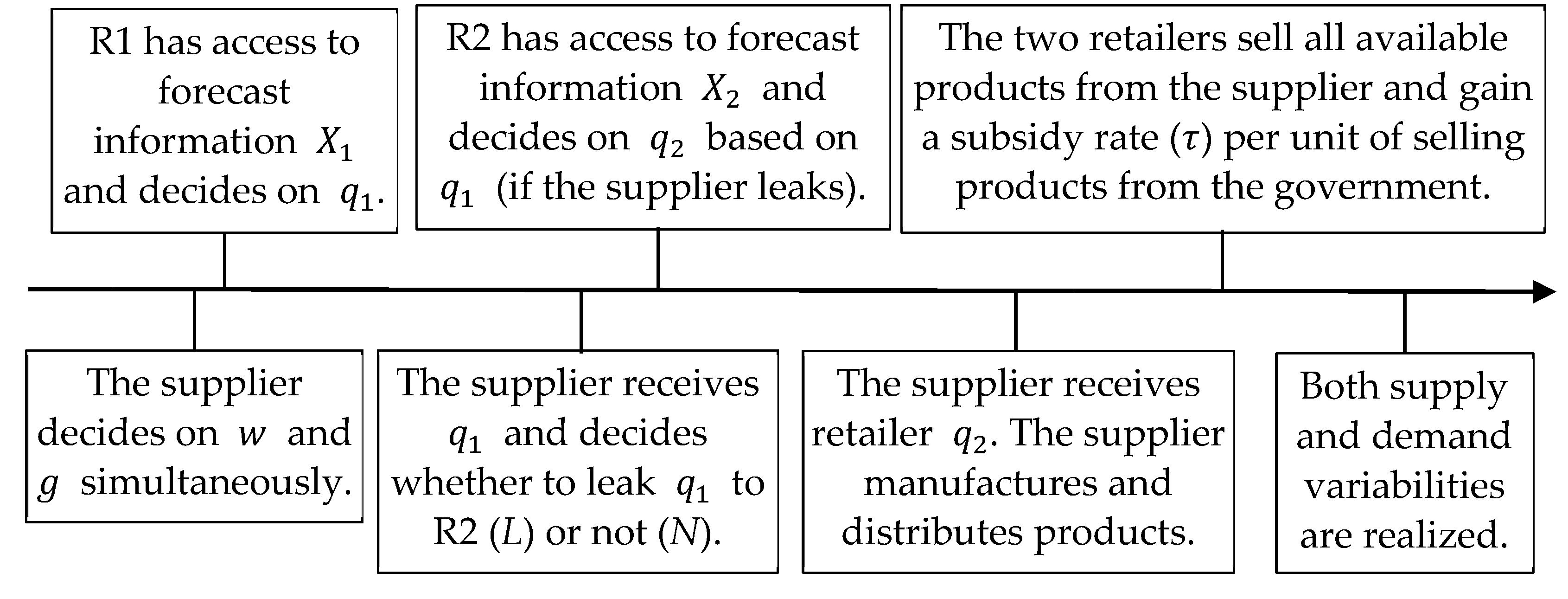

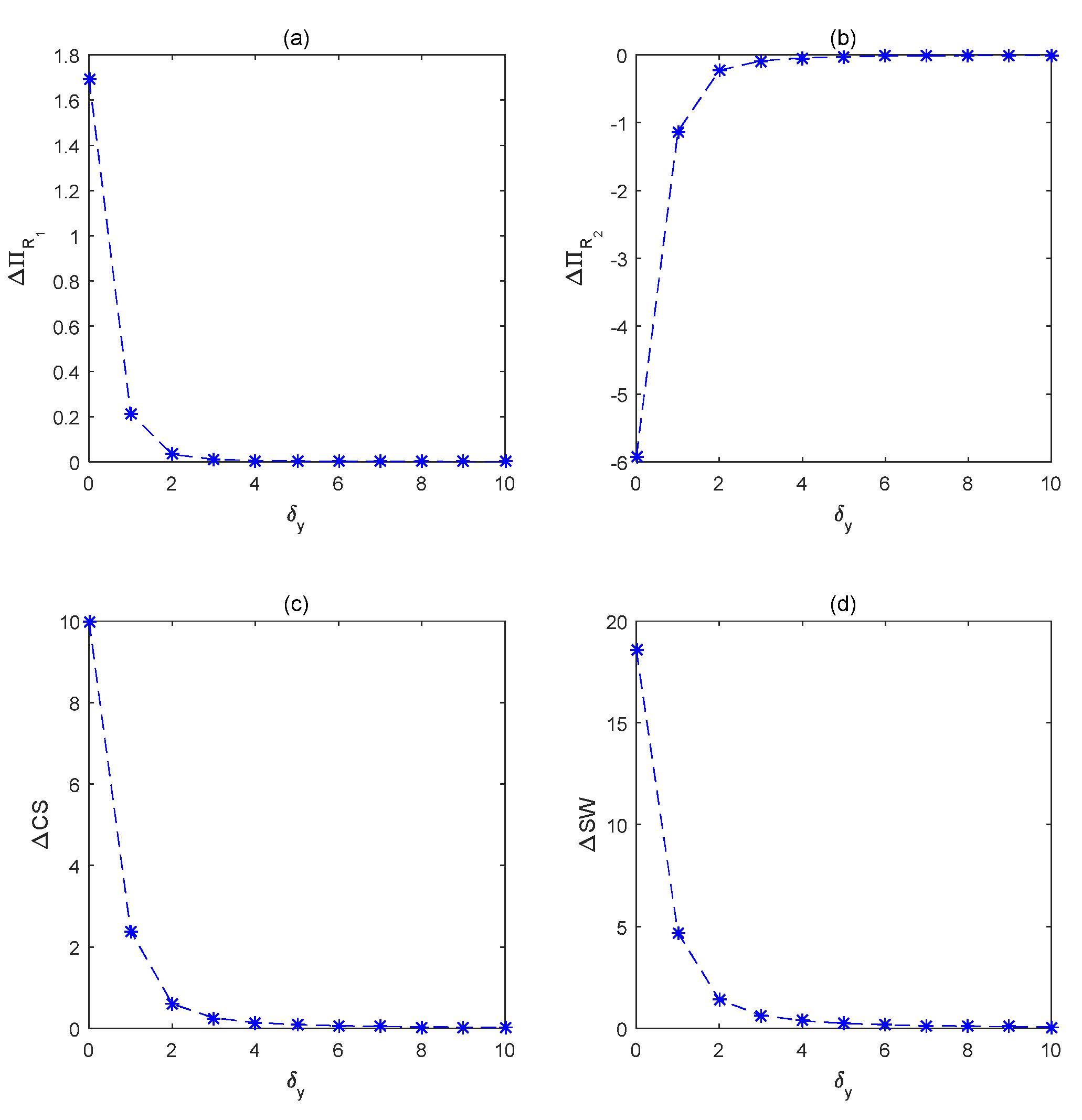

5.2.4. Impact of Forecast Accuracies (, and )

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Proof of Propositions

References

- Yang, R.; Tang, W.S.; Zhang, J.X. Technology improvement strategy for green products under competition: The role of government subsidy. Eur. J. Oper. Res. 2021, 289, 553–568. [Google Scholar] [CrossRef]

- Bian, J.S.; Zhang, G.Q.; Zhou, G.H. Manufacturer vs. Consumer Subsidy with Green Technology Investment and Environmental Concern. Eur. J. Oper. Res. 2020, 287, 832–843. [Google Scholar] [CrossRef]

- Kong, G.W.; Rajagopalan, S.; Zhang, H. Revenue Sharing and Information Leakage in a Supply Chain. Manag. Sci. 2013, 59, 556–572. [Google Scholar] [CrossRef]

- Zhou, J.; Fan, X.; Chen, Y.-J.; Tang, C.S. Information Provision and Farmer Welfare in Developing Economies. Manuf. Serv. Oper. Manag. 2020, 23, 230–245. [Google Scholar] [CrossRef]

- Dai, T.; Cho, S.-H.; Zhang, F. Contracting for On-Time Delivery in the U.S. Influenza Vaccine Supply Chain. Manuf. Serv. Oper. Manag. 2016, 18, 332–346. [Google Scholar] [CrossRef] [Green Version]

- Arifoğlu, K.; Deo, S.; Iravani, S.M.R. Consumption Externality and Yield Uncertainty in the Influenza Vaccine Supply Chain: Interventions in Demand and Supply Sides. Manag. Sci. 2012, 58, 1072–1091. [Google Scholar] [CrossRef]

- Jung, S.H. Offshore versus Onshore Sourcing: Quick Response, Random Yield, and Competition. Prod. Oper. Manag. 2019, 29, 750–766. [Google Scholar] [CrossRef]

- Liu, H.; Jiang, W.; Feng, G.; Chin, K.-S. Information leakage and supply chain contracts. Omega 2018, 90, 101994. [Google Scholar] [CrossRef]

- Chen, Y.; Ozer, O. Supply Chain Contracts that Prevent Information Leakage. Manag. Sci. 2016, 65, 5619–5650. [Google Scholar] [CrossRef]

- Huang, S.; Fan, Z.P.; Wang, N.N. Green subsidy modes and pricing strategy in a capital-constrained supply chain. Transp. Res. Part E-Logist. Transp. Rev. 2020, 136. [Google Scholar] [CrossRef]

- Ma, W.M.; Zhang, R.R.; Chai, S.W. What Drives Green Innovation? A Game Theoretic Analysis of Government Subsidy and Cooperation Contract. Sustainability 2019, 11, 5584. [Google Scholar] [CrossRef] [Green Version]

- Li, L. Information sharing in a supply chain with horizontal competition. Manag. Sci. 2002, 48, 1196–1212. [Google Scholar] [CrossRef]

- Zhang, H. Vertical information exchange in a supply chain with duopoly retailers. Prod. Oper. Manag. 2002, 11, 531. [Google Scholar] [CrossRef]

- Jain, A.; Seshadri, S.; Sohoni, M. Differential pricing for information sharing under competition. Prod. Oper. Manag. 2011, 20, 235–252. [Google Scholar] [CrossRef]

- Qian, Y.; Chen, J.; Miao, L.; Zhang, J. Information sharing in a competitive supply chain with capacity constraint. Flex. Serv. Manuf. J. 2012, 24, 549–574. [Google Scholar] [CrossRef]

- Wang, J.; Liu, Z.; Zhao, R. On the interaction between asymmetric demand signal and forecast accuracy information. Eur. J. Oper. Res. 2019, 277, 857–874. [Google Scholar] [CrossRef]

- Anand, K.S.; Goyal, M. Strategic Information Management Under Leakage in a Supply Chain. Manag. Sci. 2009, 55, 438–452. [Google Scholar] [CrossRef] [Green Version]

- Shamir, N. Cartel formation through strategic information leakage in a distribution channel. Mark. Sci. 2016, 36, 70–88. [Google Scholar] [CrossRef] [Green Version]

- Lu, J.Z.; Feng, G.Z.; Shum, T.H.; Lai, K.K. On the value of information sharing in the presence of information errors. Eur. J. Oper. Res. 2021, 294, 1139–1152. [Google Scholar] [CrossRef]

- Huang, S.; Chen, S.T.; Guan, X. Retailer information sharing under endogenous channel structure with investment spillovers. Comput. Ind. Eng. 2020, 142, 106346. [Google Scholar] [CrossRef]

- Bigerna, S.; Wen, X.G.; Hagspiel, V.; Kort, P.M. Green electricity investments: Environmental target and the optimal subsidy. Eur. J. Oper. Res. 2019, 279, 635–644. [Google Scholar] [CrossRef]

- Zhang, S.Z.; Yu, Y.M.; Zhu, Q.H.; Qiu, C.M.; Tian, A.X. Green Innovation Mode under Carbon Tax and Innovation Subsidy: An Evolutionary Game Analysis for Portfolio Policies. Sustainability 2020, 12, 1385. [Google Scholar] [CrossRef] [Green Version]

- Song, L.P.; Yan, Y.L.; Yao, F.M. Closed-Loop Supply Chain Models Considering Government Subsidy and Corporate Social Responsibility Investment. Sustainability 2020, 12, 2045. [Google Scholar] [CrossRef] [Green Version]

- Chen, J.-Y.; Dimitrov, S.; Pun, H. The impact of government subsidy on supply Chains’ sustainability innovation. Omega 2019, 86, 42–58. [Google Scholar] [CrossRef]

- Zhou, Q.; Yuen, K.F. Analyzing the Effect of Government Subsidy on the Development of the Remanufacturing Industry. Int. J. Environ. Res. Public Health 2020, 17, 3550. [Google Scholar] [CrossRef]

- Shao, L.; Yang, J.; Zhang, M. Subsidy scheme or price discount scheme? Mass adoption of electric vehicles under different market structures. Eur. J. Oper. Res. 2017, 262, 1181–1195. [Google Scholar] [CrossRef]

- Yu, Y.G.; Han, X.Y.; Hu, G.P. Optimal production for manufacturers considering consumer environmental awareness and green subsidies. Int. J. Prod. Econ. 2016, 182, 397–408. [Google Scholar] [CrossRef] [Green Version]

- Huang, W.; Zhou, W.; Chen, J.; Chen, X. The government’s optimal subsidy scheme under Manufacturers’ competition of price and product energy efficiency. Omega 2019, 84, 70–101. [Google Scholar] [CrossRef]

- Xu, C.Y.; Wang, C.X.; Huang, R.B. Impacts of horizontal integration on social welfare under the interaction of carbon tax and green subsidies. Int. J. Prod. Econ. 2020, 222. [Google Scholar] [CrossRef]

- Yu, J.J.; Tang, C.S.; Shen, Z.-J.M. Improving Consumer Welfare and Manufacturer Profit via Government Subsidy Programs: Subsidizing Consumers or Manufacturers? Manuf. Serv. Oper. Manag. 2018, 20, 752–766. [Google Scholar] [CrossRef]

- Meng, Q.C.; Wang, Y.T.; Zhang, Z.; He, Y.Y. Supply chain green innovation subsidy strategy considering consumer heterogeneity. J. Clean. Prod. 2021, 281, 16. [Google Scholar] [CrossRef]

- Li, Y.N.; Tong, Y.; Ye, F.; Song, J.J. The choice of the government green subsidy scheme: Innovation subsidy vs. product subsidy. Int. J. Prod. Res. 2020, 58, 4932–4946. [Google Scholar] [CrossRef]

| Authors | Supply Uncertainty | Supply Correlation | Product Green Level | Government Subsidy | Information Leakage | Competition |

|---|---|---|---|---|---|---|

| This paper | √ | √ | √ | √ | √ | √ |

| Yang et al. [1] | √ | √ | ||||

| Bian et al. [2] | √ | √ | ||||

| Li [12] | √ | √ | ||||

| Zhang [13] | √ | √ | ||||

| Jain et al. [14] | √ | √ | √ | |||

| Qian et al. [15] | √ | √ | ||||

| Wang et al. [16] | √ | √ | ||||

| Anand and Goyal [17] | √ | √ | ||||

| Kong et al. [3] | √ | √ | ||||

| Liu et al. [8] | √ | √ | ||||

| Chen and Ozer [9] | √ | √ | ||||

| Shamir [18] | √ | √ | ||||

| Lu et al. [19] | √ | √ | ||||

| Huang et al. [20] | √ | √ | ||||

| Bigerna et al. [21] | √ | √ | ||||

| Zhang et al. [22] | √ | √ | ||||

| Song et al. [23] | √ | √ | ||||

| Chen et al. [24] | √ | √ | ||||

| Zhou and Yuen [25] | √ | √ | ||||

| Shao et al. [26] | √ | √ | ||||

| Yu et al. [27] | √ | √ | ||||

| Li et al. [32] | √ | √ | ||||

| Huang et al. [28] | √ | √ | √ | |||

| Xu et al. [29] | √ | √ | √ | |||

| Yu et al. [30] | √ | √ | √ | |||

| Huang et al. [10] | √ | √ | √ |

| Variables | Descriptions |

|---|---|

| Demand variability and (a random variable) | |

| , | Demand forecast information (signals) |

| Retailer i’s order quantity under strategy; (a decision variable) | |

| , | Supplier’s wholesale price and green level of product under strategy (decision variables) |

| Yield variability factor, , i = 1,2 (a random variable) | |

| , | The ex ante payoffs of supplier and retailer i under strategy |

| , | Consumer surplus and social welfare under strategy |

| Parameters | Descriptions |

| Supply uncertainty, and | |

| Supply correlation, and | |

| Subsidy rate | |

| Green preference of the consumer | |

| The investment cost coefficient of green technology | |

| Potential market size | |

| , | Forecast accuracy |

| Indices | Descriptions |

| Subscript | , , and represent supplier, retailer i and retailer j, respectively |

| Superscript | L (or N) means supplier leaks (or does not leak) R1′s order quantity to R2; * denotes that the value is “optimal” |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, J.; Shang, J. Optimal Green Operation and Information Leakage Decisions under Government Subsidy and Supply Uncertainty. Sustainability 2021, 13, 13514. https://doi.org/10.3390/su132413514

Wu J, Shang J. Optimal Green Operation and Information Leakage Decisions under Government Subsidy and Supply Uncertainty. Sustainability. 2021; 13(24):13514. https://doi.org/10.3390/su132413514

Chicago/Turabian StyleWu, Junjian, and Jennifer Shang. 2021. "Optimal Green Operation and Information Leakage Decisions under Government Subsidy and Supply Uncertainty" Sustainability 13, no. 24: 13514. https://doi.org/10.3390/su132413514

APA StyleWu, J., & Shang, J. (2021). Optimal Green Operation and Information Leakage Decisions under Government Subsidy and Supply Uncertainty. Sustainability, 13(24), 13514. https://doi.org/10.3390/su132413514