Abstract

The present paper dwells on the role of green hydrogen in the transition towards climate-neutral economies and reviews the central challenges for its emancipation as an economically viable source of energy. The study shows that countries with a substantial share of renewables in the energy mix, advanced natural gas pipeline infrastructure, and an advanced level of technological and economic development have a comparative advantage for the wider utilization of hydrogen in their national energy systems. The central conclusion of this review paper is that a green hydrogen rollout in the developed and oil-exporting developing and emerging countries is not a risk for the rest of the world in terms of the increasing technological disparities and conservation of underdevelopment and concomitant socio-economic problems of the Global South. The targets anchored in Paris Agreement, but even more in the EU Green Deal and the European Hydrogen Strategy will necessitate a substantial rollout of RESs in developing countries, and especially in the countries of the African Union because of the prioritization of the African continent within the energy cooperation frameworks of the EU Green Deal and the EU Hydrogen Strategy. Hence, the green hydrogen rollout will bridge the energy transition between Europe and Africa on the one hand, and climate and development targets on the other.

1. Introduction

Hydrogen (H) is the simplest, lightest, and most widespread chemical element on earth. Hydrogen is not a source, but rather the carrier of energy. It does not exist separately and is found in compounds with other elements [1]. It can be obtained as molecular dihydrogen (H2) from water, biomass, and hydrocarbons [2,3]. To obtain pure hydrogen, it must be separated from its compounds. Hydrogen production is predicated on fossil fuels and electrolysis. Currently, hydrogen is mostly utilized in the chemical sector for the production of ammonia and refining the hydrocracking and desulphurization of fossil fuels [4].

Dependent on the underlying production technology of the colorless hydrogen, hydrogen is divided into eight categories, which are labeled by different colors. These are black, brown, grey, turquoise, blue, yellow, pink, and green hydrogen types. The black, brown, turquoise and blue hydrogen are based on fossil fuels. Yellow and pink hydrogen are produced using electrolysis. The used electricity is, however, generated in nuclear power plants. Green hydrogen is entirely electrolysis-based, whereby the required electricity originates from solar or wind energy [4,5].

All the eight shades of hydrogen, but especially the green one offers a realistic opportunity for the reduction of the greenhouse gas footprints of the hard-to-abate and/or hard-to-electrify sectors, such as the steel industry, chemicals, long-haul transport, shipping, and aviation [6,7]. In contrast to oil, natural gas, or coal-based hydrogen, only the uptake of the green hydrogen, which is generated by electrolysis triggered by renewable energy sources can lead to the real climate neutrality of the energy sector itself and the above-mentioned hard-to-electrify sectors.

Electrolysis is an established technology to produce hydrogen through water and electricity [6]. Hydrogen is easy to store and this feature makes hydrogen complementary to solar and wind energy in the energy mix. Hence, hydrogen could be a potential solution for the volatility and intermittence of wind and solar energy that necessitate a substantial portion of fossil fuels, especially natural gas, as back-up energy in the energy mixes of individual countries [8,9,10]. Green hydrogen can be easily stored for longer periods and stabilize wholesale electricity prices. In addition, the storage of surplus renewable energy could prevent zero or below-zero electricity prices and by doing so increasingly protect renewable energy producers from losses [7].

The notion of a hydrogen economy suggested in 1970 by the U.S. electrochemist John Bockris seemed to be a futurist vision for more than four decades [11,12]. In his recent article on the perspectives of hydrogen, Mike Scott concludes that “Now it looks like the future has arrived” and backs his opinion by the large-scale advances in terms of investments in the development of hydrogen infrastructure [13]. Currently, there are more than 170 operational hydrogen projects in 162 countries [2]. Global demand for pure hydrogen has increased from 20 million metric tons (Mt) in 1975 to 70 Mt in 2019 [5].

On 8 December 2020, seven leading green hydrogen developers, Saudi clean energy group ACWA Power, Australian energy project developer CWP Renewables, Chinese wind turbine producer Envision, Italian gas group Snam, Norwegian fertilizer producer Yara, and the energy giants Iberdrola and Ørsted launched the Green Hydrogen Catapult Initiative, which envisages a 50-fold scale-up of the production of green hydrogen before 2026 [14]. In absolute numbers, the surge of output implies the deployment of 25 gigawatts of green hydrogen and the reduction of the production costs of hydrogen below the threshold of 2 USD per kilogram [6]. In 2020 the global green hydrogen market had a turnover of 0.3 billion USD. Following the projections of the IEA, in the coming years, the global green hydrogen market is going to grow at exponential rates and reach the threshold of 10 billion USD in 2028. In 2050 hydrogen could cover 24% of global energy demand [15].

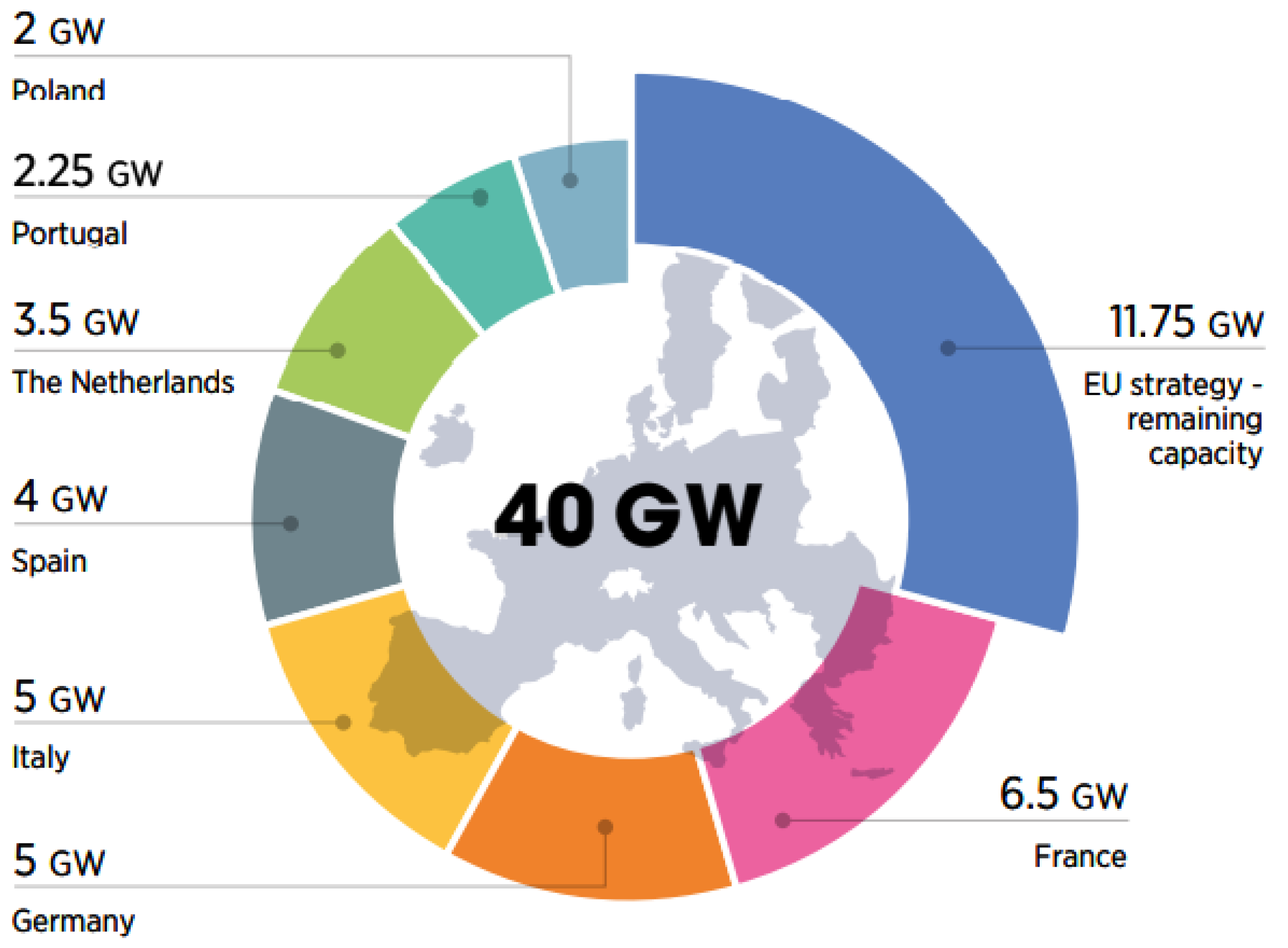

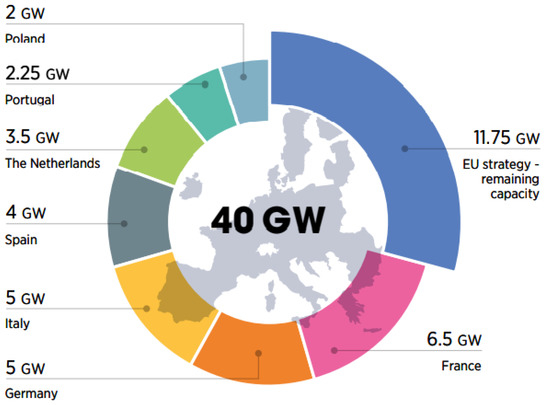

A trillion-dollar European Green Deal Package, adopted in 2019, lead to the skyrocketing interest of investors in green hydrogen [16]. In the subsequent EU Hydrogen Strategy released in 2020, green hydrogen is deemed to be the key driver of the EU’s carbon neutrality target by 2050 [17]. The hydrogen strategy of the EU is the most ambitious green hydrogen strategy worldwide, envisaging 40 GW of green hydrogen production by 2030 (Figure 1). This strategy is in line with the national hydrogen strategies of the individual EU member states, Austria, France, Germany, Italy, the Netherlands, Poland, Portugal, and Spain. In addition to the EU member states, Australia, Canada, Chile, Morocco, Norway, and Spain also have recently adopted their national hydrogen strategies [18,19]. The U.S. and Japan also adopted recently their national comprehensive renewable hydrogen plans and a number of countries are on the verge of doing this [20].

Figure 1.

Electrolyzer capacity targets in European hydrogen strategies, 2030. Source: IRENA (2021), p. 26.

The contemporary hydrogen production is mostly fossil-fuel-based [21]. This is grey, carbon-intensive hydrogen. According to International Energy Agency (IEA), only 0.1% of global hydrogen production can be attributed to water electrolysis. The inexorable growth of global demand for renewable hydrogen leads to the reduction of electrolyzer equipment [22]. In the past five years, the costs of electrolyzers have declined by more than 50%. According to Hydrogen Council and IEA, by 2030, green hydrogen production costs are going to decrease significantly. Dependent on the employed scenario the cost reductions will range between 30% and 70% [23]. This, in combination with the steadily decreasing production costs of renewables and public support for clean energy sources, contribute to an increasing interest in electrolytic hydrogen [24]. Analogously, hydrogen-based fuel cells are also becoming cheaper and more durable, and secure. Fuel cell technologies enable low carbon transition in the transport sector and can potentially contribute to energy supply security in remote areas [22].

The central issue within the respective national hydrogen strategies is the roadmap for the rollout of green hydrogen production capacities [25]. The reason for the pronounced importance of the green hydrogen rollout emanates from the fact that green hydrogen is the only zero-carbon hydrogen. Carbon capture and storage have a potential of 85–95% [6]. Since the market for hydrogen consists of large parts of plants, which produce conventional hydrogen as a by-product, it is necessary to initiate large-scale additions of green hydrogen capacities if a hydrogen economy shall provide fuel for a significant part of the national economies [26]. The major problem related to the expansion of green hydrogen is that under free-market conditions green hydrogen is currently not competitive. The current production costs of green hydrogen are relatively high across the entire value chain, i.e., from electrolysis to fuel cells, and include the lack of infrastructure for transport and storage [21]. The costs of electrolysis facilities, especially, have to decrease by 40% in the short- and by 80% in the long term [6].

To assure the competitiveness of green hydrogen in the long-term the provision of public support schemes is indispensable. Within the above-mentioned hydrogen strategies, promotion of the explicit electrolysis capacities and cost targets occupy the central position [6]. These schemes have been anchored in the national and regional hydrogen strategies that the paper dwells on in Section 3. Due to the grave repercussions of the energy transition triggered by the wider use of green hydrogen, in this paper, we envisage the assessment of the effects of increasing hydrogen in the energy mixes of the Global North on economic development and energy resilience of the Global South. This is the first study, which explicitly addresses the effects of the uptake of green hydrogen on the problems of development in the Global South.

The article proceeds as follows: Section 2 reviews the global state of play of the national hydrogen strategies and contemporary policies towards the rollout of hydrogen in the national or regional energy mixes. Section 3 discusses the repercussions of hydrogen uptake in the advanced economies on the economies of less developed countries. Section 4 analyzes the national and regional hydrogen strategies. Section 5 delves into the repercussions of these strategic roadmaps on the economies of the developing countries. Section 5 concludes.

2. Green Hydrogen Value Chain

Green hydrogen is produced through water electrolysis, whereby electrolysis is fueled by renewable electricity, mostly solar and wind. There are four established electrolyzer technologies. These are alkaline, proton exchange membrane (PEM), anion exchange membrane (AEM), and solid oxide electrolyzer cells (SOEC). The overwhelming majority of the installed electrolysis technology is alkaline and PEM [27]. SOEC and AEM are still at the research and development phase and are less efficient than alkaline or PEM.

Green hydrogen cannot take off without comprehensive, reasonably balanced and at the same time sophisticated support across the energy generation value chain. Green hydrogen is two to three times more expensive than blue hydrogen with carbon capture and storage, which is generated from fossil fuels. The central drivers of the costs of on-site green hydrogen production are the costs of renewable electricity, which is required to power the electrolyzer. Additionally, harnessing hydrogen for end users is also more expensive than using fossil fuels. For instance, hydrogen- or fuel-cell-driven vehicles are one-and-a-half to two times more expensive than conventional fossil-fuel-driven vehicles [7,8].

The second barrier for the uptake of the green hydrogen is the lack of pipeline infrastructure. The gross length of global hydrogen pipelines is just 5000 kilometers. For comparison, the length of natural gas pipelines is 3 million kilometers. Globally there are fewer than 500 hydrogen refueling stations and more than 200,000 gasoline and diesel refueling stations in the EU and in the US. The latest decision of the German supreme court allowed the use of the natural gas pipelines for hydrogen. This kind of conversion could contribute to the competitiveness of the hydrogen-based energy supply systems in Europe [7].

The third essential barrier on the way to green hydrogen rollout is that over the hydrogen value chain, a substantial share of energy is lost due to technical reasons. More than 30% of energy used for electrolysis lost. In addition, the conversion of hydrogen to ammonia leads to an up to 25% energy loss. The employment of hydrogen in fuel cells causes further energy losses of 40–50% [7,8].

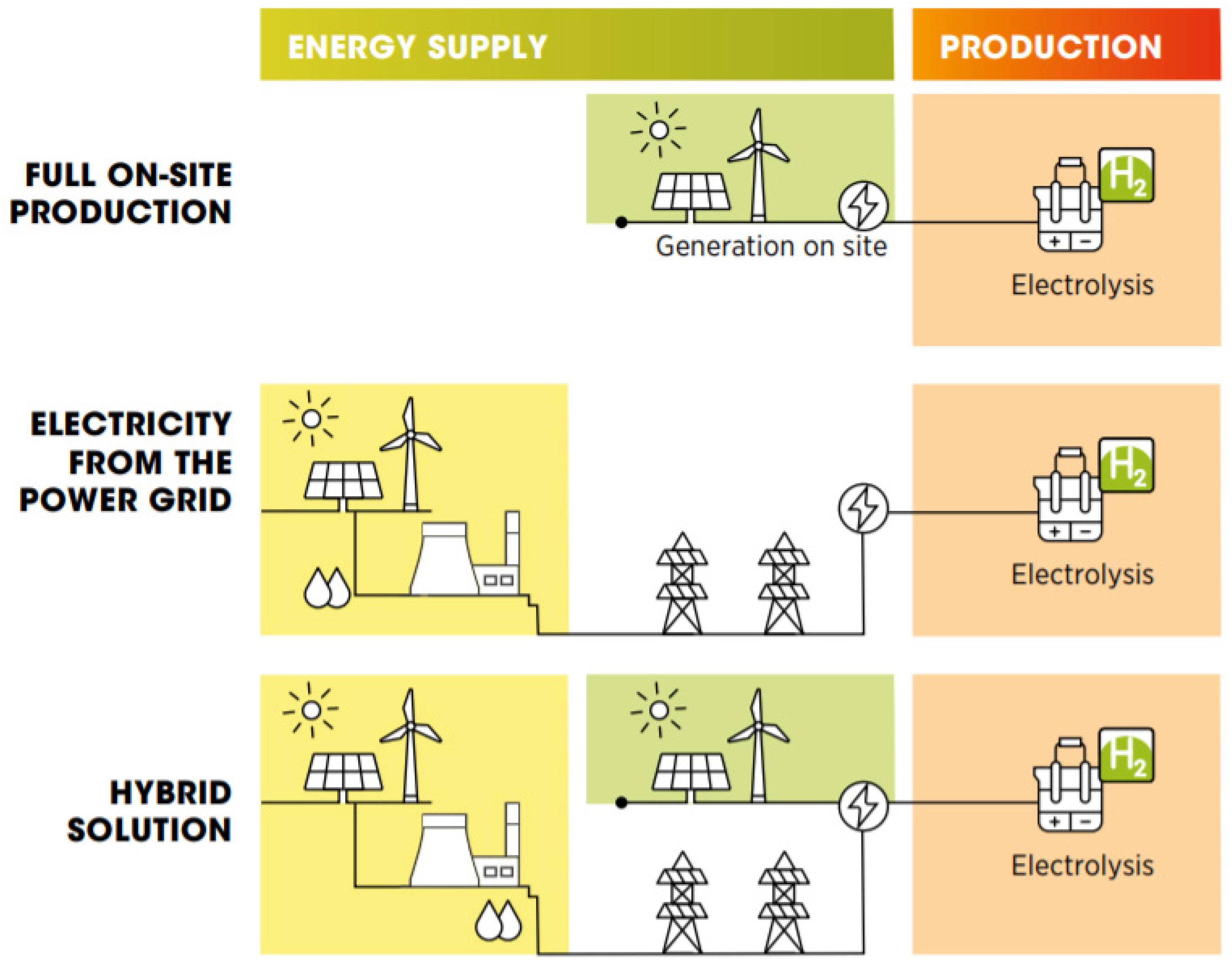

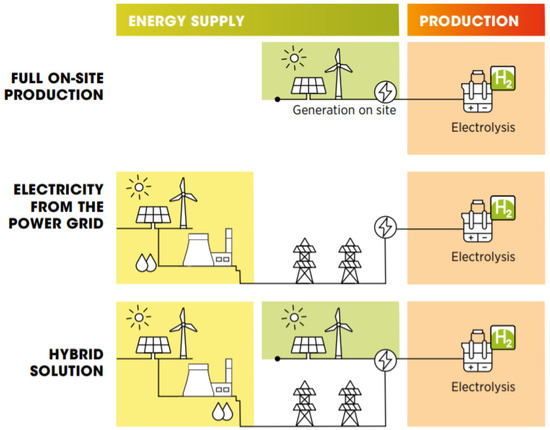

There are three production models for renewables-based hydrogen. These are full on-site production, electricity from the power grid, and a hybrid solution (Figure 2). In contrast to full on-site hydrogen production, connecting the electrolyzers to the power grid would enable the counteracting of the volatility of the wind and solar energy supply and stabilize hydrogen production.

Figure 2.

Production models. Source: IRENA (2021), p. 29.

Hence, sustainably low prices of the electricity from renewables are the prerequisite for a successful hydrogen economy. The second precondition for the gradual development of the hydrogen economy are reductions in the cost of electrolysis [6]. The fulfillment of these conditions would require substantial public support. According to IRENA’s report on public policies on green hydrogen, in order to achieve the threshold for market penetration nations have to employ an integrated energy sector development strategy epitomized in four pillars. These are: 1. Adopting national hydrogen strategies; 2. Formulation of policy priorities; 3. Establishment of a governance system and enabling policies; and 4. Creation of the system that identifies the origin of green hydrogen [8].

There are, nevertheless, no universal policies for the green hydrogen development. The concrete public support measures for the uptake of green hydrogen depend on the level of hydrogen sector development. To address this issue, IRENA proposed the “policy stage” concept in the context of the electrolysis and infrastructure deployment [9]. At the initial stage green hydrogen output is at the megawatt level; green hydrogen is used in niches, and is not competitive with grey hydrogen. There is no substantial pipeline infrastructure and hydrogen is transported by hydrogen tracks. The share of renewables in the energy mix is far below its potential. This phase is termed Stage 1 or the “technology readiness” phase.

At the second stage, economies of scale in hydrogen production come fully into their own. Electrolyzers are at the gigawatt level and the production of renewables is cheap and their share in the energy mix is significant. This leads to a production surplus during sunny and/or windy periods. Hydrogen is no more demanded only by niches. There is a large-scale demand for hydrogen in regions with hard to decarbonize sectors. This leads to the advancement of the hydrogen infrastructure and especially pipelines. At that stage, the countries with a dense gas pipeline infrastructure start to convert these pipelines for hydrogen. At the subsequent stage green hydrogen is fully comparable with grey hydrogen and the power sector is a zero or negative emission sector. Green hydrogen continues its expansion until the transition to a climate-neutral energy system is complete.

Hence, the ideal typical transition to green hydrogen is a process, which consists of two major phases. These are the first phase of the renewables rollout and the second stage is the uptake of the green hydrogen economy.

As shall be shown later, application of the subsidization schemes that have been applied to the rollout of the renewable sources, such as solar and wind energy for green hydrogen, could lead to allocative inefficiencies epitomized in the double subsidization of hydrogen-based electricity production.

3. Central Challenges for the Rollout of the Green Hydrogen Economy

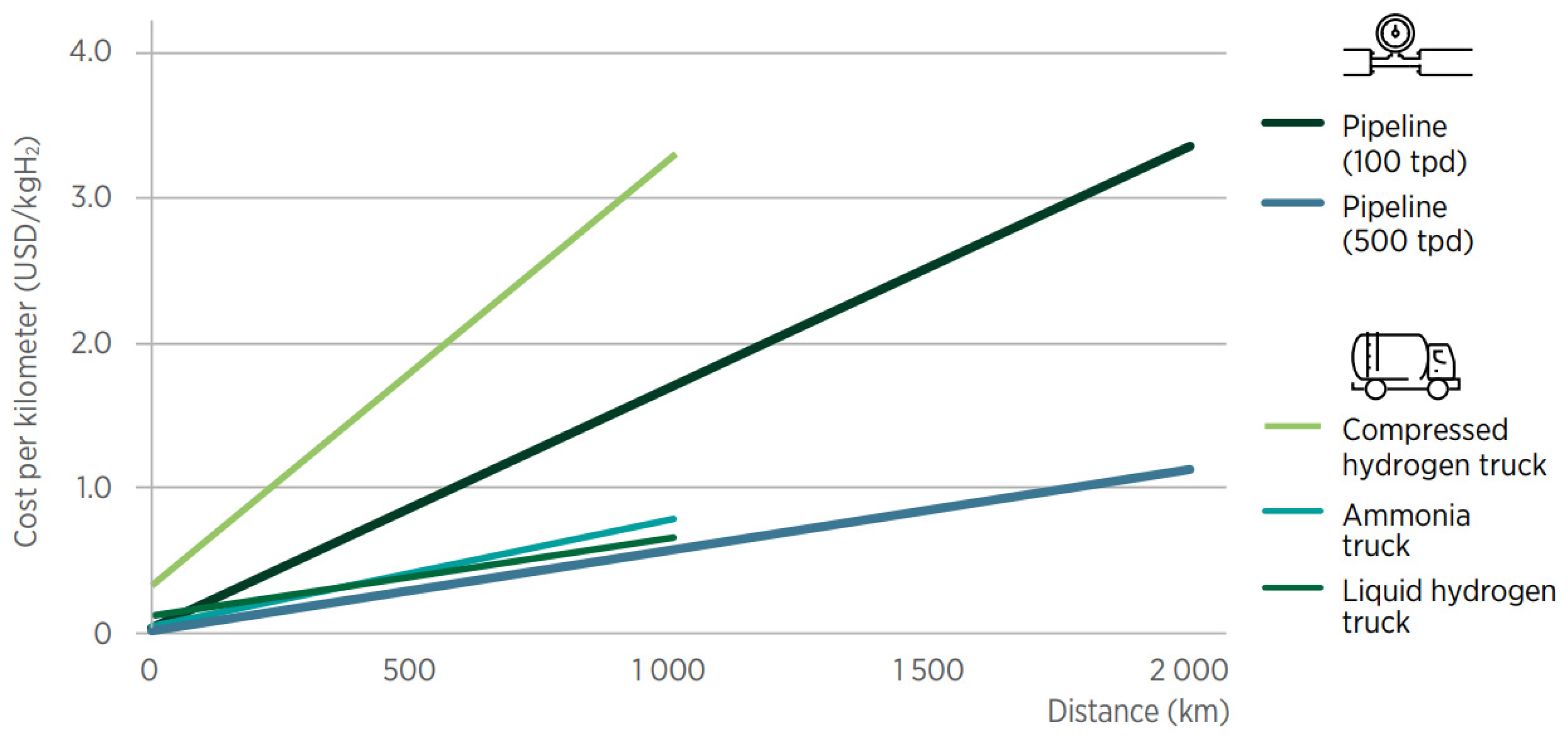

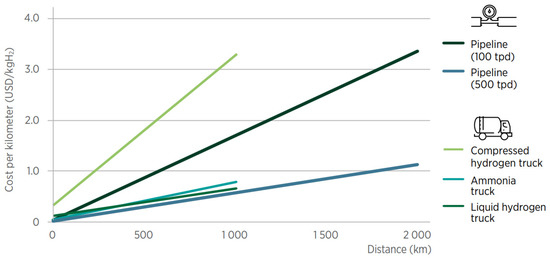

The central problem for the rollout of green hydrogen emanates from the relatively high production, conversion, transport, and storage costs of green hydrogen. Production costs depend on the price of the renewable electricity, costs of electrolysis and their capacities. Green hydrogen can achieve cost-competitiveness with blue hydrogen only if the operating hours per year exceed at least 3000 [27]. The conversion and transport costs of hydrogen are also important drivers of hydrogen; especially with increasing distance between the location of electrolysis and end demand site, the costs of transportation and conversion increase linearly (Figure 3).

Figure 3.

Costs for hydrogen transport as a function of distance by selected transport mode. Source: IRENA (2021) [27].

The employment of trucks for the transport of hydrogen makes sense only for short distances because trucks can carry relatively small amounts of hydrogen. The carrying capacity of trucks could be substantially increased if instead of hydrogen gas they could transport liquified hydrogen. This, however, would require additional conversion costs, which also have to be considered in calculations.

The cheapest transportation option for hydrogen is transportation via natural gas pipelines. Especially in the initial phases of infrastructure development and hydrogen technology proliferation long-distance hydrogen delivery plays a central role [28]. There are two possibilities for the utilization of the natural gas pipelines for the deliveries of hydrogen. These are hydrogen blending and the use of natural gas pipelines for pure hydrogen transport [29]. Construction of the pipeline infrastructure is very capital-intensive and would necessitate more investments than those for the construction of new gas pipelines [30]. Repurposing the existing natural gas pipeline infrastructure for the transportation of green hydrogen is deemed to be a relatively cost-effective transport option for large amounts of hydrogen. This would imply only 10–25% of the greenfield cost of new pipeline construction.

Cerniauskas et al. find that 80% of natural gas pipelines can be reassigned for hydrogen and reduce the hydrogen transportation costs by at least 60% [31].

There are three major fields of private and public investment in hydrogen. These are investments in hydrogen infrastructure, investments in research and development, and deployment [2].

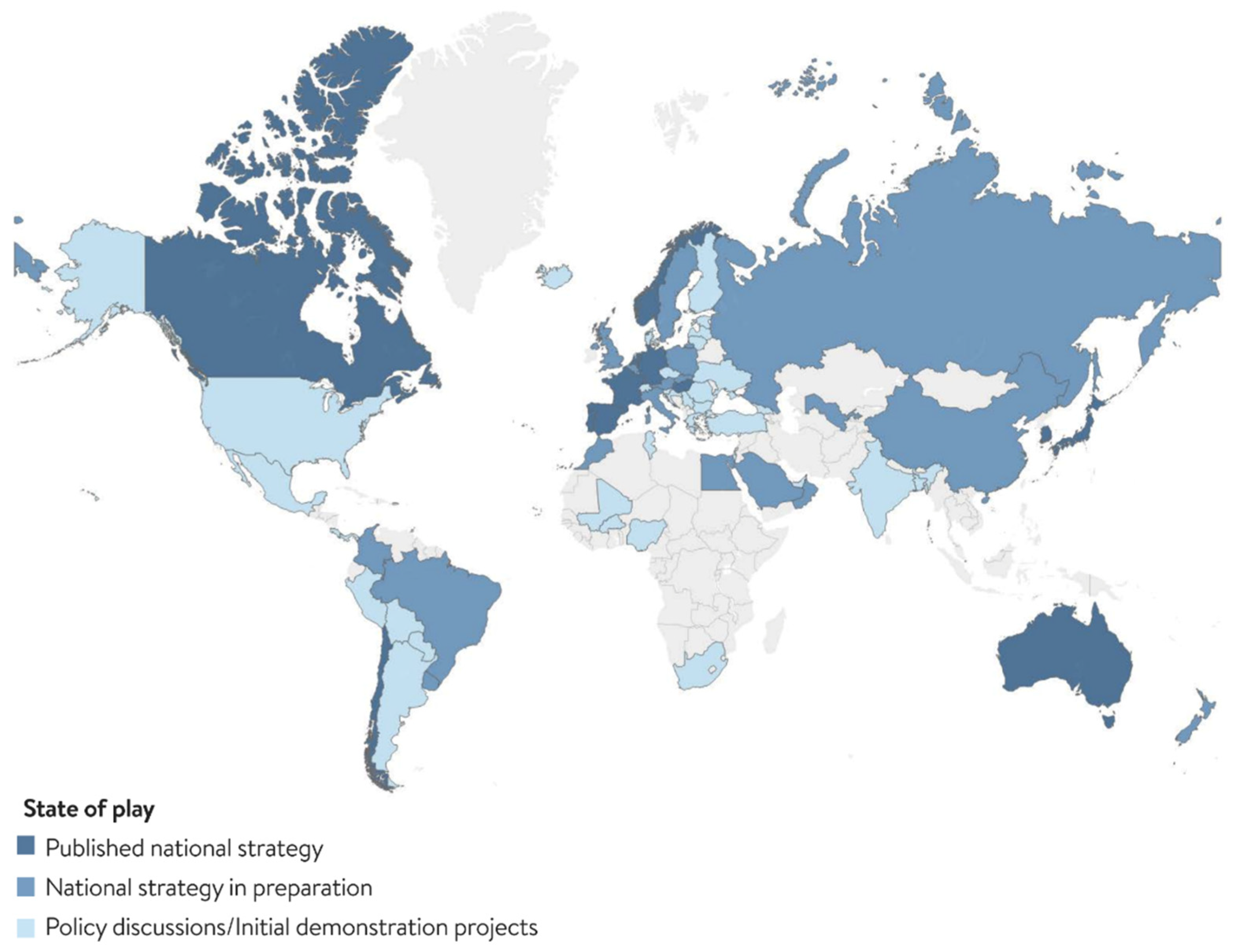

4. Global Implications of the National Hydrogen Strategies

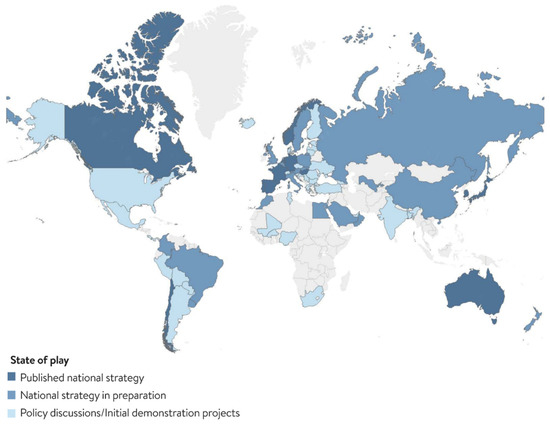

In 2017, Japan was the first country to propose a national hydrogen strategy and by doing so sparked interest in hydrogen in the Asian-Pacific region. In 2019, Australia and South Korea followed Japan’s lead in dealing with hydrogen economy development and put forward their own national hydrogen strategies. The pioneer in Europe in terms of hydrogen strategy was Germany, which adopted its comprehensive hydrogen strategy as first European country to do so and pushed the EU hydrogen strategy during its presidency of the EU Council. In Latin America Chile has been promoting hydrogen rollout perhaps more than any other country in the world and in 2020 these policies came into their own within the framework of the first adopted national hydrogen strategy in Latin America. At present, there are already 13 countries and one regional integration block which have adopted national hydrogen strategies. Besides the already-mentioned countries and the EU, these are France, Netherlands, Norway, Portugal, Spain, Hungary, Canada, and the UK. All of them adopted their national hydrogen strategies in 2020 and 2021. This was to a large extent catalyzed by the United Nations Climate Change Conference in Glasgow (COP26) between 31 October and 12 November 2021 [32]. Twenty further countries are currently preparing their hydrogen strategies. The majority of the countries currently pushing a hydrogen strategy are countries with advanced or emerging economies. There are also more than 30 countries where political discussions are taking place, including official statements on hydrogen economy and initial hydrogen projects.

Figure 4 is an overview map of the degree of activity in terms of hydrogen strategy development. The map shows clearly that there is a clear gap in terms of hydrogen economy development between Africa, the Middle East, Central Asia, and South East Asia on the one hand and the rest of the world on the other.

Figure 4.

Country activities with regards to hydrogen development policies. Source: World Energy Council, 2021 [31].

According to a report of UNEP, which was prepared a decade and half ago, due to the financial leeway and qualified engineering staff gap, the developing world has been unable to participate in the research, development and deployment (RDD) of hydrogen and related technologies, and the transition to hydrogen economy will take place later in these developing countries [1]. The geography of the adopted and planned hydrogen strategies vindicates that this expectation was plausible. Without massive financial and technical support for the development of the prerequisites for the hydrogen economy, Sub-Saharan Africa, Central Asia, and South-East Europe will not be able to advance the hydrogen economies. This could lead to even greater discrepancies between the level of per capita income of developing and advanced nations and aggravate the problem of poverty and undernutrition in the respective regions. As a possible solution, the experts of UNEP recommend the large-scale support of international organizations and especially international development agencies for the rollout of hydrogen in developing countries.

5. Green Hydrogen and Industrialization of Developing Areas

Electric power is deemed to be the central trigger and the durable driver of the “Second Industrial Revolution” that took place the last quarter of the 19th and first decades of the 20th centuries [33]—hence, the rollout of the famous GOERLO-Plan, the first Soviet plan for national economic recovery and modernization, which in its essence was a roadmap for a large-scale electrification in post-revolutionary Russia, i.e., the Soviet Union. The source of the electrification in the advanced economies was the combustion of the fossil fuels and nuclear power. These sources are capable of delivering electricity uninterruptedly, which is required for industrial processes. The central shortcoming of these energy sources is their environmental risks and their negative impact on environmental quality and the health status of human beings. In this regard, renewables offer a superior alternative to conventional energy sources. The central shortcoming of the renewable energy sources (RESs) is, however, their intermittency and their inability to provide sufficient electricity for industrial processes. This is why solar off-grid-based or solar-based electricity is mostly utilized for the consumptive electricity needs of households. Because of inadequate storage capacities, the surplus electricity from RESs in disproportionately sunny or windy phases cannot be made use of. Hence, the rollout of green hydrogen in developing areas could close this gap because there are a plenty of technical ways for hydrogen gas to store surplus energy. In addition, hydrogen is capable of generating energy for hard-to-electrify sectors, such as heavy industry, which is focal in terms of the rapid industrialization of the underdeveloped areas. The central merit of hydrogen is that in contrast to solar and wind energy projects, green hydrogen could really trigger industrial uptake in fossil-fuel-poor developing countries, which are more vulnerable to oil and gas price spikes than the rest of the world.

Nevertheless, the least developed areas are not capable of triggering the hydrogen rollout without massive investments in electrolyser capacity building and a surge in renewable energy generation. Furthermore, developing countries lack the advanced natural gas pipeline infrastructure and sufficient stock of human capital for the development of the hydrogen economy. In addition, developing countries, in contrast to the advanced ones, do not have sophisticated and seasoned hydrogen strategies. These are all comparative disadvantages of the Global South in terms of hydrogen. Their implications are the increasing technological disparity of the energy systems of the Global North and Global South and the aggravation of the economic underdevelopment of the developing areas.

This picture changes, nevertheless, if we consider that advanced countries, and especially Europe, cannot achieve the envisaged surge of green hydrogen in its energy mix (up to 24 percent by the year 2050) without imports of renewable electricity or hydrogen imports from overseas. Due to the solar and wind abundance in large parts of Africa and Asia, Europe is interested in the large-scale rollout of RESs in developing countries. This kind of bridging of the energy transition between advanced and developing countries is anchored in the EU Green Deal and the European Hydrogen Strategy, whereby energy sector cooperation with Africa and the members of the African Union has been given priority. By supporting RESs and green hydrogen exports from Africa to the EU developing African countries’ comparative advantage in the generation of solar and wind electricity translates in the long-term to a comparative advantage in the production and export of green hydrogen. This is the central explanation for the recent projections of PWC and the Word Bank, which indicate that the African continent and large parts of the non-African developing countries will be the potential exporters of green hydrogen and produce it with a significant cost advantage. Hence, despite substantial comparative short-term disadvantages in promoting hydrogen, especially for the fossil-fuel importing developing countries, hydrogen could imply a substantial improvement of the trade balance and also an increase in energy security and resilience.

In addition, the green hydrogen rollout will contribute to the food security of the Global South. The experience of developing countries with hydrogen for the production of fertilizers confirms this expectation. Developing countries, such as Egypt, India, Turkey, Costa Rica, and Zimbabwe have made substantial advances in terms of their food sovereignty due to the production of green hydrogen [22]. In 1958 India installed 106.0 MW, Zimbabwe installed 1975 74.6 MW, and Egypt installed 1960 115.0 MW electrolyzer capacities. These and many other electrolysis-based hydrogen production projects were mostly supported by international development institutions, in the first line the World Bank, to support food security and the domestic production of fertilizers. The IGSAS fertilizer project in Turkey and the Fauji fertilizer project in Pakistan the 1980s were financed by the World Bank. As a natural-gas-abundant country, Malaysia has extensively employed alkaline electrolyzers to fuel domestic manufacturing. The polysilicon plant Sarawak in Indonesia exhibits the largest current 25 MW electrolyser worldwide [32].

6. Conclusions

The central conclusion of this review is that a green hydrogen rollout in the developed and oil-exporting developing and emerging economies is not a risk for the rest of the world in terms of the increasing technological disparities and conservation of underdevelopment and concomitant socioeconomic problems of the Global South. The targets, anchored in the Paris Agreement, but even more in the EU Green Deal and the European Hydrogen Strategy, will give positive impulses for the rollout of RESs in developing countries, and especially in the countries of the African Union because of the prioritization of the African continent within the energy-cooperation frameworks of the EU Green Deal and the EU Hydrogen Strategy. Hence, the green hydrogen rollout will bridge the energy transition between Europe and Africa on the one hand, and climate and development targets on the other.

In addition to this long-term, bird’s eye perspective, based on the literature analysis, it can be concluded that the countries with a sizeable share of renewables in their energy mixes, whereby renewables are overwhelmingly sustainable without subsidies, have a cost advantage in green hydrogen production. In addition, countries with an advanced gas pipeline infrastructure will be able to make use of the existing natural gas pipelines for the unfolding hydrogen infrastructure. Hence, advanced countries with large solar and wind energy generation capacities and gas pipeline infrastructure are currently more capable of developing green hydrogen infrastructure with amenable costs.

According to the scholars of the Energy Sector Management Assistance Program (ESMAP) of the World Bank Group, developing areas with sizeable infrastructure for the production of natural gas and natural-gas-pipeline networks have a comparative advantage for the unfolding of green hydrogen. They mention explicitly Argentina, China, Europe, the Gulf Cooperation Council countries, Japan, Indonesia, Malaysia, North America, and Thailand as countries with favorable starting conditions for the unfolding of a hydrogen economy [22].

What are the implications of the prohibitive green hydrogen costs in a number of advanced, transition, and developing countries? Should these countries subsidize green hydrogen despite existence of cheaper alternatives? Such a strategy does not make sense economically and is not sustainable. Public policies in these countries must focus on the rollout of renewable energy sources and trigger a large-scale subsidization of hydrogen at the more advanced stages of renewable energy sector development.

Fossil-fuel-abundant developing and transition economies, on contrary, should follow a strategy which differs from that of the oil and gas importing countries. The development of the infrastructure for nonrenewable hydrogen and the advancement of solar and wind parks could lead to accelerated pathways of energy transition in this group of countries because of the complementarity of the infrastructure for green and nonrenewable hydrogen. The same holds also for countries that rely predominantly on nuclear energy in their energy mixes and are capable of producing pink hydrogen. The development of the infrastructure for pink hydrogen and rising shares of renewable energy sources could serve as a fruitful soil for surging green hydrogen in long-term energy mixes.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- UNEP. The Hydrogen Economy. A Non-Technical Review. 2006. Available online: https://www.unep.org/resources/report/hydrogen-economy-non-technical-review (accessed on 4 November 2021).

- Ochu, E.; Woodall, C.M.; Braverman, S.; Smith, G.; Friedmann, J. Hydrogen Fact Sheet: Policy Support and Investments in Low-Carbon Hydrogen. Available online: https://www.energypolicy.columbia.edu/sites/default/files/pictures/HydrogenProduction_CGEP_FactSheet3_052521.pdf (accessed on 4 November 2021).

- Kalamaras, C.M.; Efstathiou, A.M. Hydrogen Production Technologies. Current State and Future Developments. Hindawi Publishing Corporation Conference Papers No. 690627. 2013. Available online: https://downloads.hindawi.com/archive/2013/690627.pdf (accessed on 4 November 2021).

- Bhagwat, S.R.; Olczak, M. Green Hydrogen: Bridging the Energy Transition in Africa and Europe; European University Institute: Florence, Italy, 2020; Available online: https://africa-eu-energy-partnership.org/wp-content/uploads/2021/04/AEEP_Green-Hydrogen_Bridging-the-Energy-Transition-in-Africa-and-Europe_Final_For-Publication_2.pdf (accessed on 4 November 2021).

- Noussan, M.; Rimondi, P.P.; Scita, R.; Hafner, M. The Role of Green and Blue Hydrogen in the Energy Transition—A Technological and Geopolitical Perspective. Sustainability 2021, 13, 298. [Google Scholar] [CrossRef]

- IRENA. Green Hydrogen Cost Reduction: Scaling up Electrolysers to Meet the 1.5 °C Climate Goal; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020; Available online: https://irena.org/publications/2020/Dec/Green-hydrogen-cost-reduction (accessed on 4 November 2021).

- IRENA. Hydrogen from Renewable Power Technology Outlook for the Energy Transition; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2018. [Google Scholar]

- Sadik-Zada, E.R.; Gatto, A. Energy Security Pathways in South East Europe: Diversification of the Natural Gas Supplies, Energy Transition, and Energy Futures. In From Economic to Energy Transition. Energy, Climate and the Environment; Mišík, M., Oravcová, V., Eds.; Palgrave Macmillan: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Eichman, J.; Harrison, K.; Peters, M. Novel Electrolyzer Applications: Providing More Than Just Hydrogen; National Renewable Energy Laboratory: Golden, CO, USA, 2014. [Google Scholar]

- Baker McKenzie. Shaping Tomorrow’s Global Hydrogen Market. Vie De-Risked Investments. 2020. Available online: https://www.bakermckenzie.com/-/media/files/insight/publications/2020/01/hydrogen_report.pdf?la=en (accessed on 4 November 2021).

- Renssen, S. The Hydrogen Solution? Nat. Clim. Chang. 2020, 10, 799–801. [Google Scholar] [CrossRef]

- Goldman Sachs. Green Hydrogen. The Next Transformational Driver of the Utilities Industry. Equity Research. 2020. Available online: https://www.goldmansachs.com/insights/pages/gs-research/green-hydrogen/report.pdf (accessed on 4 November 2021).

- Scott, M. Green Hydrogen. The Fuel of the Future, Set for 50-Fold Expansion. Forbes. 2020. Available online: https://www.forbes.com/sites/mikescott/2020/12/14/green-hydrogen-the-fuel-of-the-future-set-for-50-fold-expansion/?sh=3392b87e6df3 (accessed on 4 November 2021).

- Coleman, K. Green Hydrogen Catapult. Race to Zero. 2020. Available online: https://racetozero.unfccc.int/green-hydrogen-catapult/ (accessed on 4 November 2021).

- Shan, R.; Signore, S.R.; Smith, B.T. Analysis of Hydropower Pllnat Revenues for Independent System Operator New England (ISO-NE); No. ORNL/SPR-2019/1294; Oak Ridge National Lab (ORNL): Oak Ridge, TN, USA, 2019. [Google Scholar]

- Deign, J. So What Exactly Is Green Hydrogen? Available online: https://www.greentechmedia.com/articles/read/green-hydrogen-explained (accessed on 4 November 2021).

- EU. A Hydrogen Strategy for Climate-Neutral Europe; European Commission: Brussels, Belgium, 2020; Available online: www.hydrogen_strategy.pdf (accessed on 4 November 2021).

- Bridle, R. Should Governments Subsidize Hydrogen? Global Subsidies Initiative. International Institute for Sustainable Development. 2021. Available online: https://www.iisd.org/gsi/subsidy-watch-blog/should-governments-subsidize-hydrogen (accessed on 4 November 2021).

- IRENA. Green Hydrogen: A Guide to Policy Making; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020; Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Nov/IRENA_Green_hydrogen_policy_2020.pdf (accessed on 4 November 2021).

- Nagashima, M. Japan’ Hydrogen Society Ambition: 2020 Status and Perspectives. IFRI. 2020. Available online: https://www.ifri.org/sites/default/files/atoms/files/nagashima_japan_hydrogen_2020.pdf (accessed on 4 November 2021).

- IRENA. Hydrogen: A Renewable Energy Perspective; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- ESMAP. Green Hydrogen in Developing Countries; International Bank of Reconstruction and Development/The World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Hydrogen Council. Path to Hydrogen Competitiveness—A Cost Perspective; Hydrogen Council Report: Brussels, Belgium, 2020. [Google Scholar]

- IEA. The Future of Hydrogen. Seizing Today’s Opportunities; Report Prepared by the IEA for the G20, Japan; International Energy Agency: Paris, France, 2019. [Google Scholar]

- BWMI. Die Nationale Wasserstoffstrategie; German Federal Ministry for Economics Affairs and Energy (BMWI): Berlin, Germany, 2020. [Google Scholar]

- Velazquez Abad, A.; Doods, P.E. Production of Hydrogen. In Encyclopedia of Sustainable Technologies; Abraham, M.A., Ed.; Elsevier: Amsterdam, The Netherlands, 2017; pp. 293–304. [Google Scholar]

- IRENA. Green Hydrogen Supply. A Guide to Policy Making; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021; Available online: https://irena.org/-/media/Files/IRENA/Agency/Publication/2021/May/IRENA_Green_Hydrogen_Supply_2021.pdf (accessed on 4 November 2021).

- Cerniauskas, S.; Grube, T.; Praktiknjo, A.J.; Stolten, D.; Robinius, M. Future hydrogen markets for transportation and industry: The impact of CO2 taxes. Energies 2019, 12, 4707. [Google Scholar] [CrossRef] [Green Version]

- Cerniauskas, S.; Chavez Junko, A.J.; Grube, T.; Robinius, M.; Stolten, D. Options of natural gas pipeline reassignment for hydrogen: Cost assessment for a Germany case study. Int. J. Hydrog. Energy 2020, 45, 12095–12107. [Google Scholar] [CrossRef] [Green Version]

- Guidehouse. European Hydrogen Backbone. Utrecht, The Netherlands. 2020. Available online: https://gasforclimate2050.eu/wp-content/uploads/2020/07/2020_European-Hydrogen-Backbone_Report.pdf (accessed on 4 November 2021).

- World Energy Council. Hydrogen on the Horizon: Ready, Almost Set, Go? National Hydrogen Strategies. World Energy Council Working Paper. 2021. Available online: https://www.worldenergy.org/assets/downloads/Working_Paper_-_National_Hydrogen_Strategies_-_September_2021.pdf (accessed on 4 November 2021).

- Buttler, A.; Spliethof, H. Current Status of Water Electrolysis for Energy Storage, Grid Balancing and Sector Coupling via Power-to-Gas and Power-to-Liquids: A Review. Renew. Sustain. Energy Rev. 2018, 82, 2440–2454. [Google Scholar] [CrossRef]

- Rosenberg, N. The Role of Electricity in Industrial Revolution. Energy J. 1998, 19, 7–24. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).