Financial Analysis of Habitat Conservation Banking in California

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data

2.2. Financial Analysis

3. Results

3.1. Descriptive Statistics

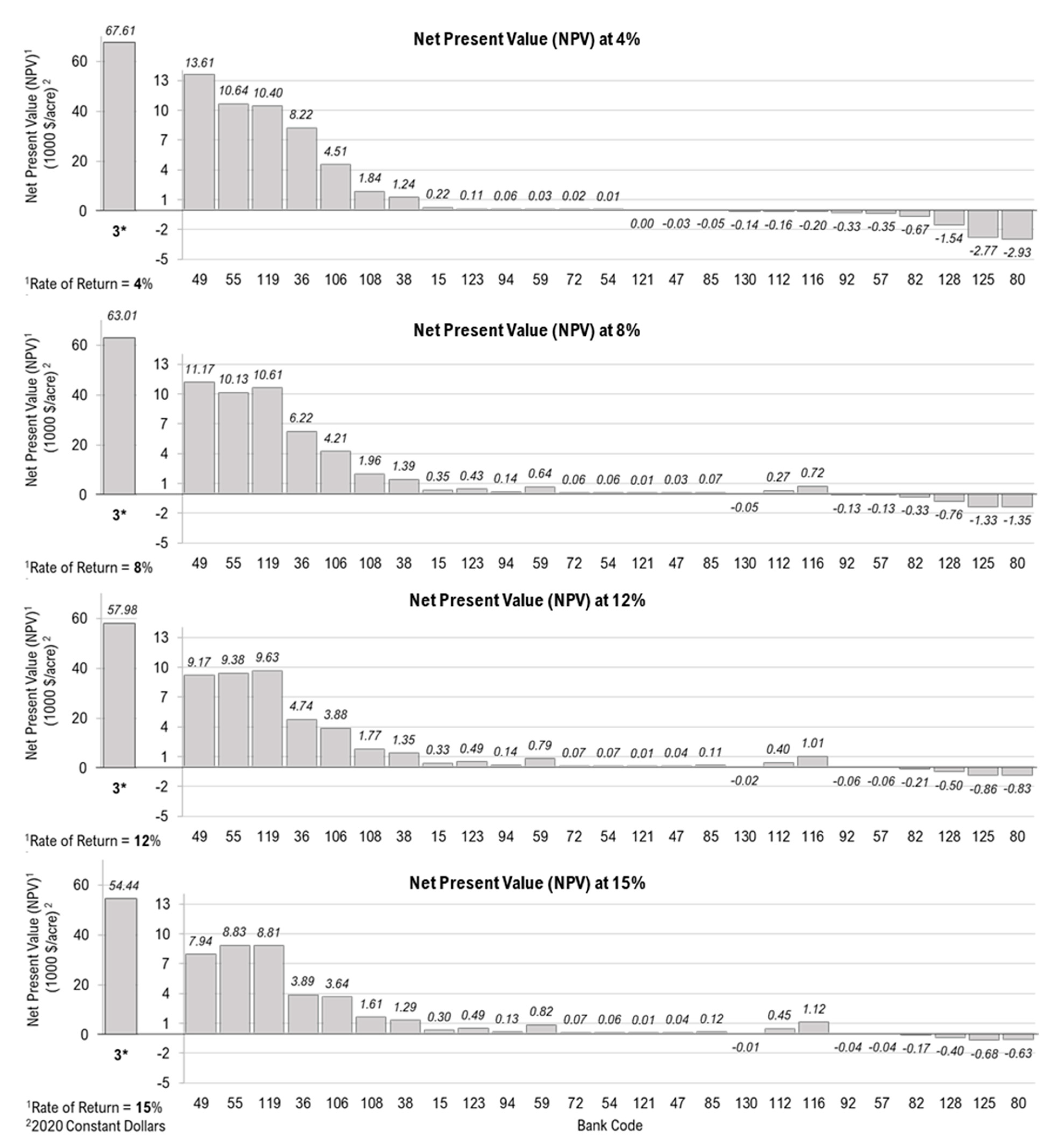

3.2. Financial Analysis of Habitat Conservation Banks in California

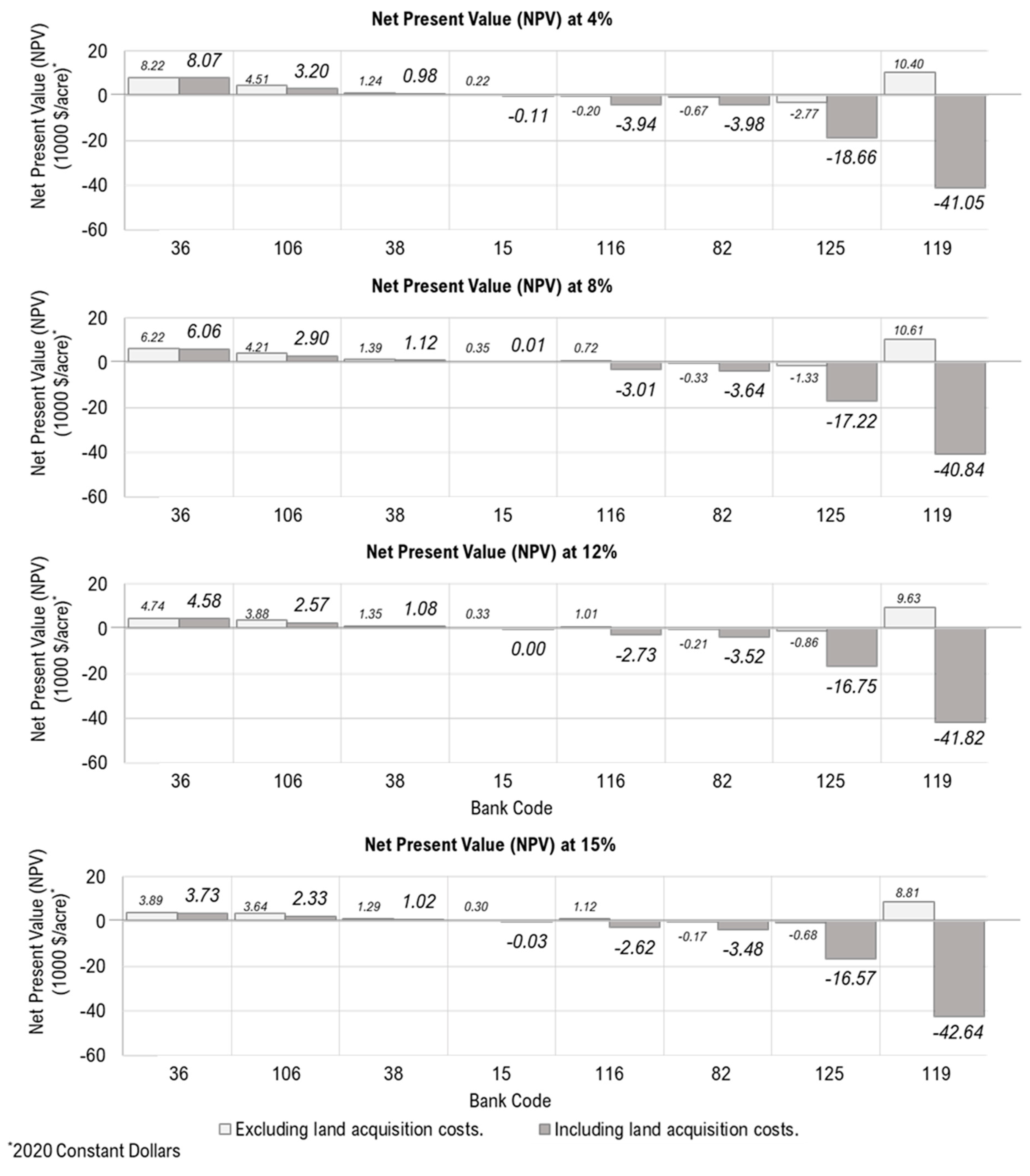

3.3. Financial Analysis of HCBs including Land Acquisition Costs

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- United States Department of Interior Fish and Wildlife Service (USFS). Guidance for the Establishment, Use and Operation of Conservation Banks; Fish and Wildlife Service, Interior: Washington, DC, USA, 2003; p. 19. Available online: https://www.fws.gov/endangered/esa-library/pdf/conservation_banking_guidance.pdf (accessed on 12 October 2018).

- Gamarra, M.J.C.; Toombs, T.P. Thirty years of species conservation banking in the U.S.: Comparing policy to practice. Biol. Conserv. 2017, 214, 6–12. [Google Scholar] [CrossRef]

- Poudel, J.; Zhang, D.; Simon, B. Estimating the demand and supply of conservation banking markets in the United States. Land Use Policy 2018, 79, 320–325. [Google Scholar] [CrossRef]

- Fox, J.; Nino-Murcia, A. Status of Species Conservation Banking in the United States. Conserv. Biol. 2005, 19, 996–1007. [Google Scholar] [CrossRef]

- Sonter, L.J.; Barnes, M.; Matthews, J.W.; Maron, M. Quantifying habitat losses and gains made by U.S. Species Conservation Banks to improve compensation policies and avoid perverse outcomes. Conserv. Lett. 2019, 12, e12629. [Google Scholar] [CrossRef] [Green Version]

- Boisvert, V. Conservation banking mechanisms and the economization of nature: An institutional analysis. Ecosyst. Serv. 2015, 15, 134–142. [Google Scholar] [CrossRef] [Green Version]

- Regulatory In-Lieu Fee Banking Information System (RIBITS), Banks & Sites. Available online: https://ribits.ops.usace.army.mil/ords/f?p=107:158:15210655867020::NO::P158_CANNED_ID:CLEAR (accessed on 12 October 2018).

- Ferraro, P.J.; McIntosh, C.; Ospina, M. The effectiveness of the US endangered species act: An econometric analysis using matching methods. J. Environ. Econ. Manag. 2007, 54, 245–261. [Google Scholar] [CrossRef]

- Wätzold, F.; Lienhoop, N.; Drechsler, M.; Settele, J. Estimating optimal conservation in the context of agri-environmental schemes. Ecol. Econ. 2008, 68, 295–305. [Google Scholar] [CrossRef]

- Vatn, A. Markets in environmental governance. From theory to practice. Ecol. Econ. 2015, 117, 225–233. [Google Scholar] [CrossRef]

- Vaissière, A.C.; Levrel, H.; Scemama, P. Biodiversity offsetting: Clearing up misunderstandings between conservation and economics to take further action. Biol. Conserv. 2017, 206, 258–262. [Google Scholar] [CrossRef] [Green Version]

- Galik, C.S.; McAdams, D. Supply, demand, and uncertainty: Implications for prelisting conservation policy. Ecol. Econ. 2007, 137, 91–98. [Google Scholar] [CrossRef]

- Business and Biodiversity Offsets Program (BBOP). BBOP Principles on Biodiversity Offsets; Business and Biodiversity Offsets Program (BBOP): Washington, DC, USA, 2016; Available online: http://bbop.forest-trends.org/documents/files/bbop_principles.pdf (accessed on 12 October 2018).

- Business and Biodiversity Offsets Program (BBOP). Biodiversity Offsets: A User’s Guide; Business and Biodiversity Offsets Program (BBOP): Washington, DC, USA, 2016; Available online: https://www.cbd.int/financial/doc/wb-offsetguide2016.pdf (accessed on 12 October 2018).

- Santos, R.; Schroeter-Schlaack, C.; Antunes, P.; Ring, I.; Clemente, P. Reviewing the role of habitat banking and tradable development rights in the conservation policy mix. Environ. Conserv. 2015, 42, 294–305. [Google Scholar] [CrossRef]

- Wissel, S.; Wätzold, F. A conceptual analysis of the application of tradable permits to biodiversity conservation. Conserv. Biol. 2010, 24, 404–411. [Google Scholar] [CrossRef]

- Madsen, B.; Carroll, N.; Moore, B.K. State of Biodiversity Markets Report: Offset and Compensation Programs Worldwide. 2010. Available online: https://www.ecosystemmarketplace.com/wp-content/uploads/2015/09/sbdmr.pdf (accessed on 12 October 2018).

- Poudel, J.; Zhang, D.; Simon, B. Habitat conservation banking trends in the United States. Biodivers. Conserv. 2019, 28, 1629–1646. [Google Scholar] [CrossRef]

- Rea, C.M. Theorizing command-and-commodify regulation: The case of species habitat conservation banking in the United States. Theory Soc. 2017, 46, 21–56. [Google Scholar] [CrossRef]

- U.S. Fish and Wildlife Service. ECOS Environmental Conservation Online System. Available online: https://ecos.fws.gov/ecp/species-reports (accessed on 12 October 2018).

- U.S. Fish and Wildlife Service. Species Proposed for Listing. Available online: https://ecos.fws.gov/ecp0/reports/ad-hoc-species-report?status=P&header=Species+Proposed+for+Listing&fleadreg=on&fstatus=on&finvpop=on (accessed on 12 October 2018).

- Brown, G.M.; Shogren, J.F. Economics of the endangered species act. J. Econ. Perspect. 1998, 12, 3–20. [Google Scholar] [CrossRef] [Green Version]

- Innes, R.; Polasky, S.; Tschirhart, J. Takings, Compensation, and Endangered Species Protection on Private Land. J. Econ. Perspect. 1998, 12, 35–52. [Google Scholar] [CrossRef] [Green Version]

- Evans, D.J.; Che-Castaldo, J.P.; Crouse, D.; Davis, F.W.; Epanchin-Niell, R.; Flather, C.H.; Frohlich, R.K.; Goble, D.D.; Li, Y.; Male, T.D.; et al. Species Recovery in the United States: Increasing the Effectiveness of the Endangered Species Act; Issues in Ecology Report Number 20; Ecological Society of America: Washington, DC, USA, 2016; Available online: https://pearl.plymouth.ac.uk/bitstream/handle/10026.1/10108/IssuesInEcology20%20SpRecoveryInESA%202016.pdf?sequence=1&isAllowed=y (accessed on 12 October 2018).

- Boyd, J.; Epanchin-Niell, R.S. Private Sector Conservation Investments under the Endangered Species Act: A Guide to Return on Investment Analysis. Resources for the Future RFF DP 17-11. 2017, p. 39. Available online: https://media.rff.org/documents/RFF-DP-17-11.pdf (accessed on 12 October 2018).

- Lueck, D.; Michael, J. Preemptive habitat destruction under the Endangered Species Act. J. Law Econ. 2003, 46, 27–60. [Google Scholar] [CrossRef]

- Zhang, D. Endangered Species and Timber Harvesting: The Case of Red-Cockaded Woodpeckers. Econ. Inq. 2004, 42, 150–165. [Google Scholar] [CrossRef]

- Byl, J.P. Perverse incentives and safe harbors in the Endangered Species Act: Evidence from timber harvests near woodpeckers. Ecol. Econ. 2019, 157, 100–108. [Google Scholar] [CrossRef]

- Martin, S.; Brumbaugh, R. Entering a New Era: What Will RIBITS Tell Us About Mitigation Banking? Natl. Wetl. Newsl. 2011, 33, 16–26. [Google Scholar]

- National Mitigation Banking Association (NMBA). The Trusted Voice of the Mitigation Banking Industry. Available online: https://environmentalbanking.org/ (accessed on 12 October 2018).

- Donlan, C.J. Proactive Strategies for Protecting Species: Pre-Listing Conservation and the Endangered Species Act, 1st ed.; Univ of California Press: Oakland, CA, USA, 2015; p. 288. [Google Scholar]

- Daniel, H. The Role of Economics in Habitat Restoration. In Proceedings of the Salmon Habitat Restoration Cost Workshop; Pacific States Marine Fisheries Commission: Gladstone, OR, USA, 2000. [Google Scholar]

- Perman, R. Economic Appraisal 5: Performance Measures, Introduction to Topic 5: Project Performance Indicators and Decision Criteria. Available online: http://personal.strath.ac.uk/r.perman/Economic Appraisal 5.pdf (accessed on 18 August 2021).

- Wagner, J.E. Misinterpreting the internal rate of return in sustainable forest management planning and economic analysis. J. Sustain. For. 2012, 31, 239–266. [Google Scholar] [CrossRef]

- Klemperer, W.D. Forest Resource Economics and Finance, 1st ed.; McGraw-Hill Inc.: Blacksburg, VA, USA, 1996. [Google Scholar]

- Grimm, M.; Köppel, J. Biodiversity offset program design and implementation. Sustainability 2019, 11, 6903. [Google Scholar] [CrossRef] [Green Version]

- Grimm, M. Metrics and equivalence in conservation banking. Land 2021, 10, 565. [Google Scholar] [CrossRef]

- Grimm, M. Conserving biodiversity through offsets? Findings from an empirical study on conservation banking. J. Nat. Conserv. 2020, 57, 125871. [Google Scholar] [CrossRef]

| Bank Code | Estd. 3 (Year) | Targeted Species 1 | Total Area 3 (A, Acres) | Land Cost 2 (x, $/ac) 5 | Credit Produced 3 (#) | Annual Cost 3 (C, $/ac) 5 | Credit Sold 3 (#) | Avg. Sale Time (t, years) | Revenue/Credit Price 4 (R, $/ac) 5 |

|---|---|---|---|---|---|---|---|---|---|

| 3 | 2007 | BGF | 23 | 79 | 145.19 | 18 | 2.5 | 78,579.97 | |

| 47 | 2006 | WDH | 1815 | 2826 | 6.43 | 981 | 4.5 | 159.65 | |

| 49 | 1999 | CTS/VPH | 808 | 1109 | 13.50 | 275 | 5.5 | 17,309.77 | |

| 54 | 2004 | RFH | 1810 | 179 | 5.55 | 68 | 3.5 | 166.08 | |

| 55 | 2007 | MSH | 621 | 840 | 43.43 | 379 | 2.5 | 12,936.61 | |

| 57 | 2007 | GGS | 1067 | 1074 | 18.58 | 7 | 2.5 | 125.75 | |

| 59 | 2001 | GGS | 299 | 545 | 57.91 | 292 | 2.0 | 1595.84 | |

| 72 | 2005 | GGS | 1295 | 2323 | 4.93 | 1028 | 4.0 | 172.00 | |

| 80 | 2011 | BOL | 22 | 26 | 127.92 | 1 | 1.5 | 280.16 | |

| 85 | 2012 | BGF | 147 | 257 | 10.19 | 112 | 1.0 | 216.67 | |

| 92 | 2007 | VEB | 627 | 491 | 15.77 | 66 | 0 | 67.10 | |

| 94 | 2005 | VPH | 640 | 1288 | 10.15 | 628 | 4.5 | 371.82 | |

| 108 | 2005 | GGS | 188 | 10,372 | 47.70 | 3012 | 4.5 | 3611.91 | |

| 112 | 2007 | VEB | 498 | 611 | 35.14 | 115 | 0.5 | 735.47 | |

| 121 | 2000 | VEB | 728 | 310 | 1.35 | 116 | 7.0 | 42.20 | |

| 123 | 2008 | MSH1 | 429 | 1025 | 34.64 | 220 | 3.0 | 1092.92 | |

| 128 | 2010 | GGS | 1630 | 79 | 62.37 | 31 | 0.5 | 17.85 | |

| 130 | 2009 | VPH | 775 | 1346 | 7.32 | 48 | 1.0 | 41.30 | |

| 15 | 2001 | VFS | 573 | 337 | 302 | 20.07 | 302 | 5.0 | 881.11 |

| 36 | 1997 | MSH2 | 3058 | 156 | 3438 | 3.51 | 2842 | 7.5 | 11,151.84 |

| 38 | 2008 | SKF | 684 | 268 | 1192 | 25.09 | 508 | 2.5 | 2065.09 |

| 82 | 2001 | CTS/VPH | 530 | 3308 | 268 | 27.56 | 42 | 0 | 16.10 |

| 106 | 2009 | CSS | 566 | 1306 | 641 | 10.47 | 115 | 2.5 | 5262.85 |

| 116 | 2012 | VEB | 216 | 3737 | 31 | 76.27 | 31 | 0.5 | 1741.43 |

| 119 | 2006 | VEB | 38 | 51,450 | 43 | 184.37 | 12 | 4.0 | 17,564.00 |

| 125 | 2006 | VEB | 34 | 15,892 | 30 | 116.96 | 13 | 4.0 | 177.21 |

| Mean | 735 [712] 6 | [9557] 6 | 1182 [743] 6 | 42.78 [58.04] 6 | 349 [483] 6 | 2.9 | 6014.72 [4857.45] 6 | ||

| Sum | 19,120 [5699] 6 | 30,173 [5944] 6 | 9085 [3895] 6 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Poudel, J.; Pokharel, R. Financial Analysis of Habitat Conservation Banking in California. Sustainability 2021, 13, 12441. https://doi.org/10.3390/su132212441

Poudel J, Pokharel R. Financial Analysis of Habitat Conservation Banking in California. Sustainability. 2021; 13(22):12441. https://doi.org/10.3390/su132212441

Chicago/Turabian StylePoudel, Jagdish, and Raju Pokharel. 2021. "Financial Analysis of Habitat Conservation Banking in California" Sustainability 13, no. 22: 12441. https://doi.org/10.3390/su132212441

APA StylePoudel, J., & Pokharel, R. (2021). Financial Analysis of Habitat Conservation Banking in California. Sustainability, 13(22), 12441. https://doi.org/10.3390/su132212441