Lithium in the Green Energy Transition: The Quest for Both Sustainability and Security

Abstract

:1. Introduction

2. Research Gaps in the Lithium Socio-Environmental Literature

3. Projected Global Expansion of Lithium Mining and Processing

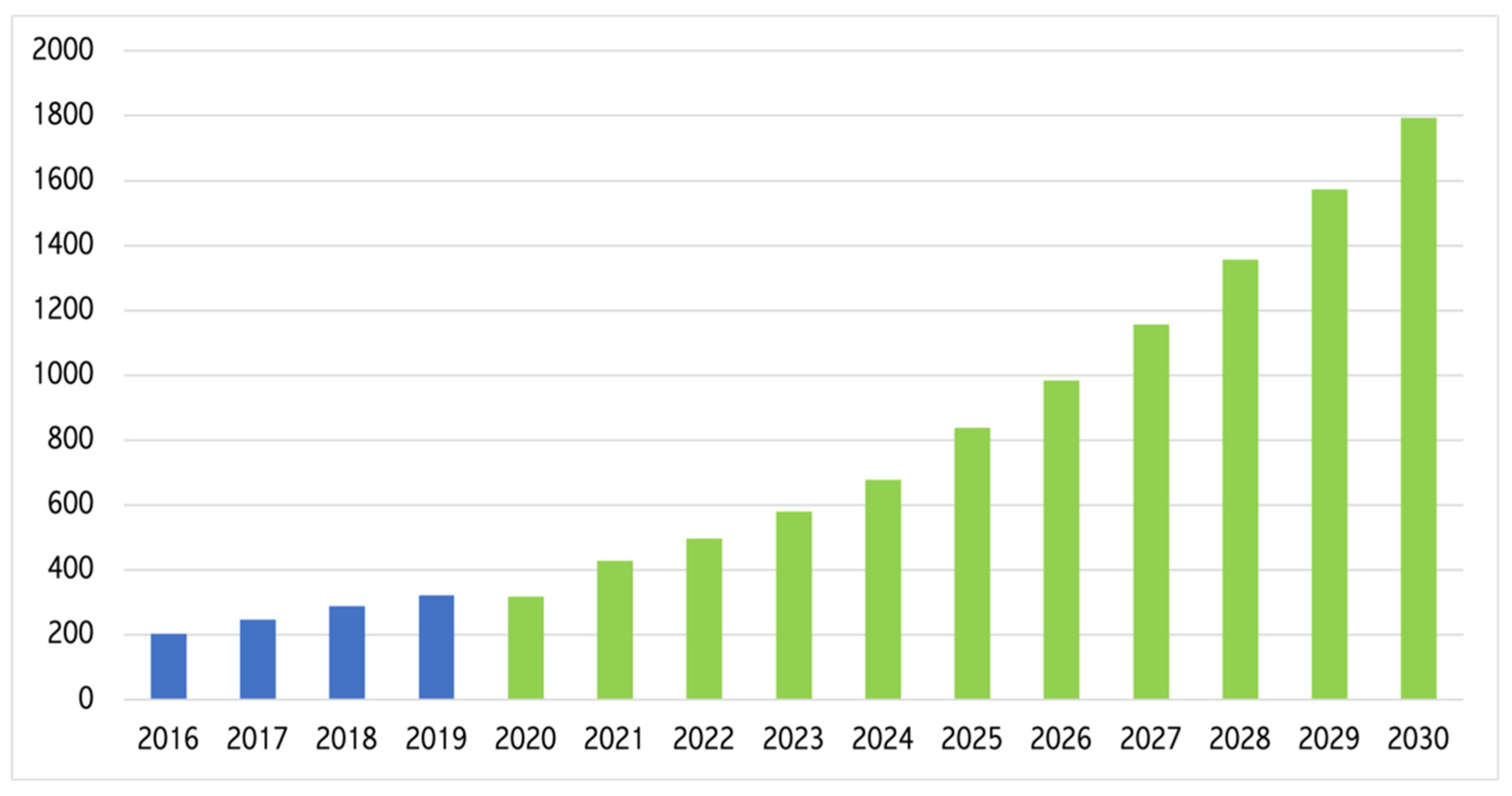

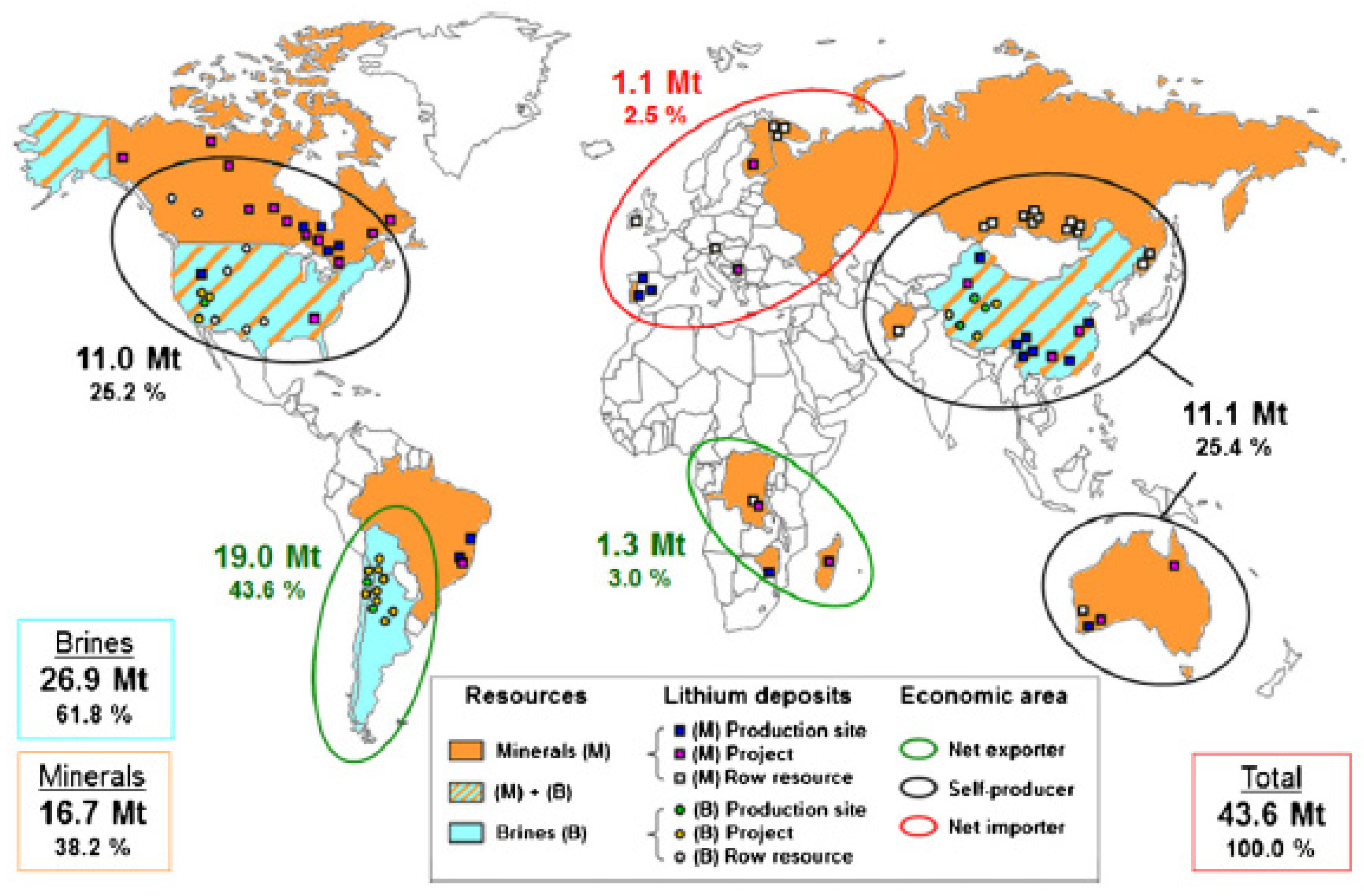

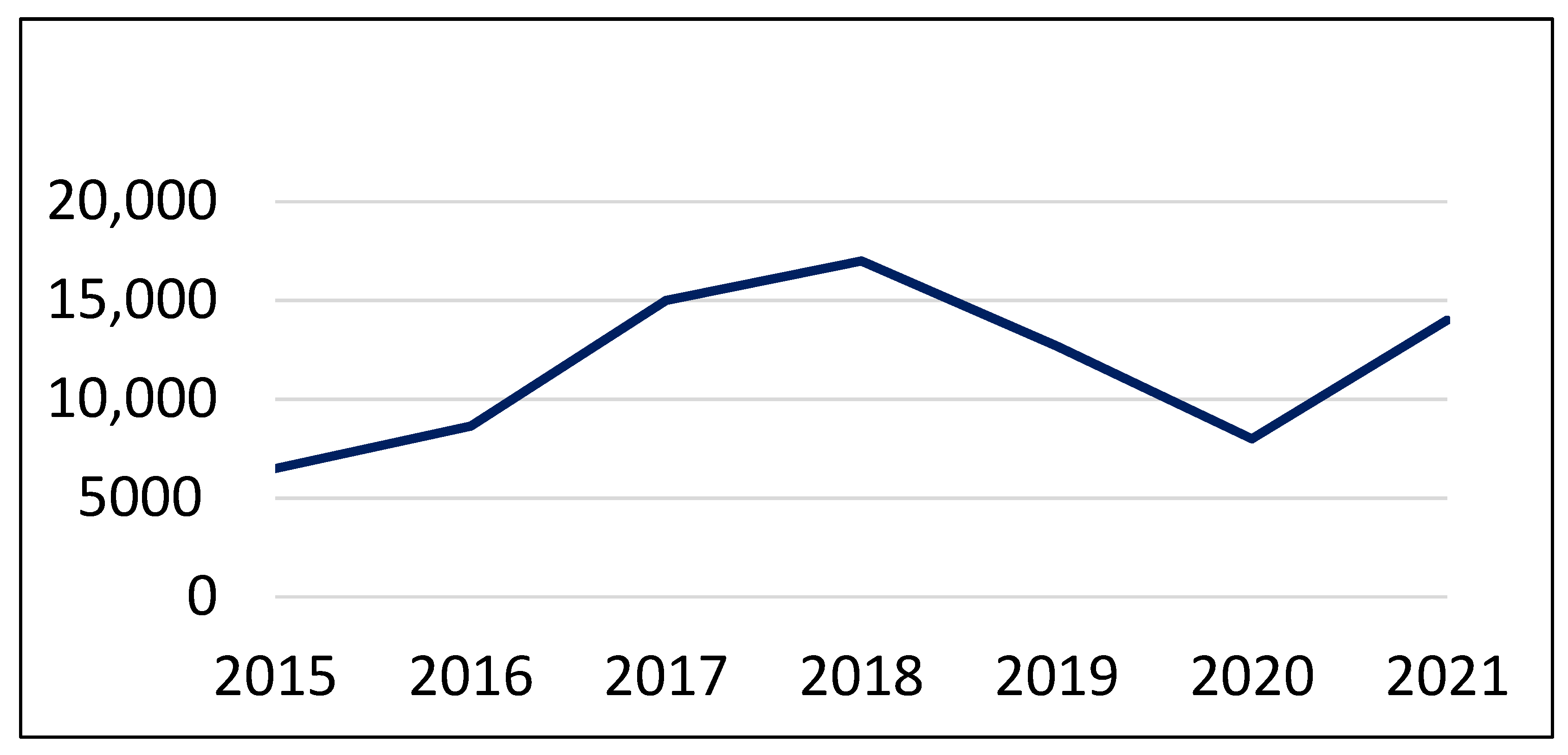

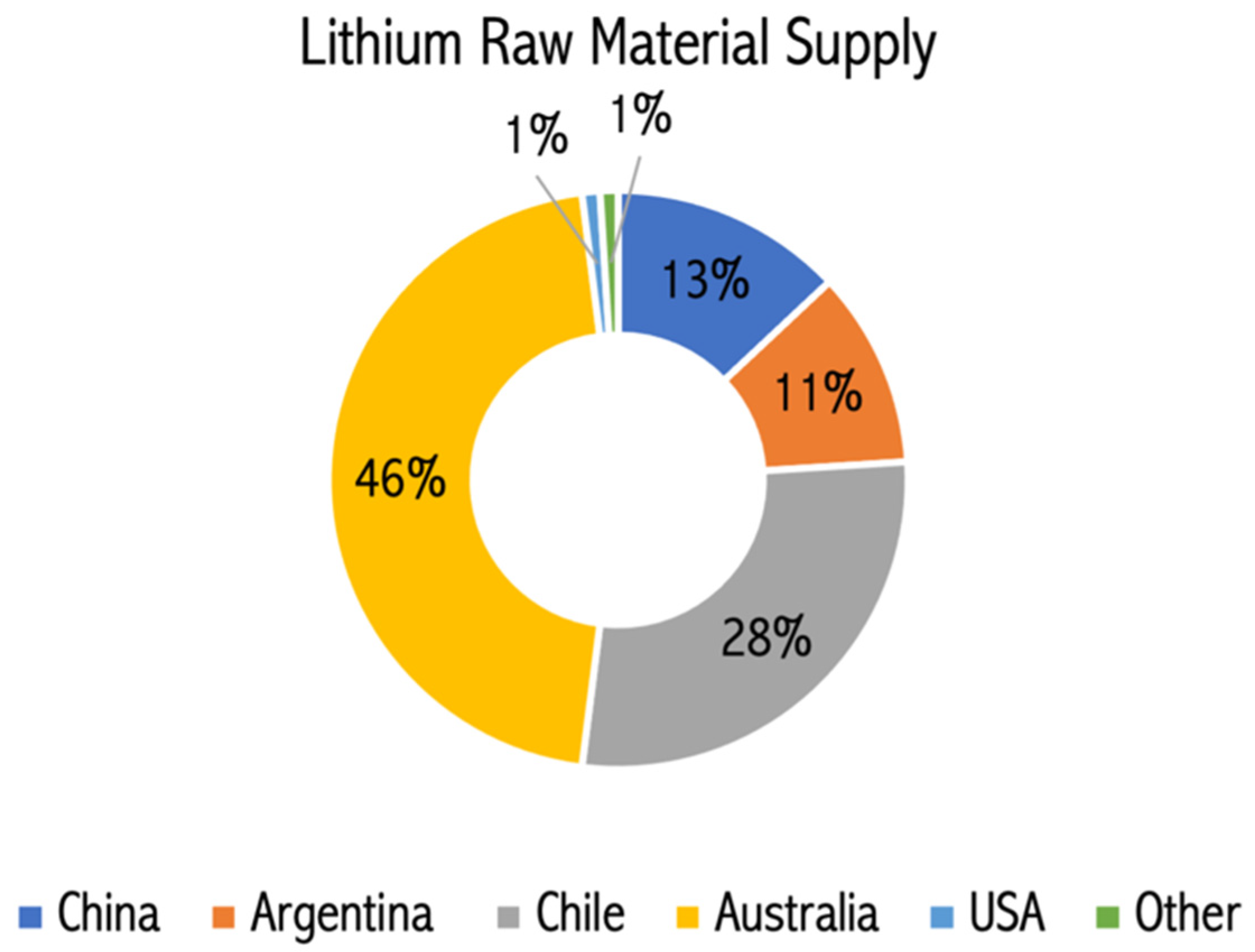

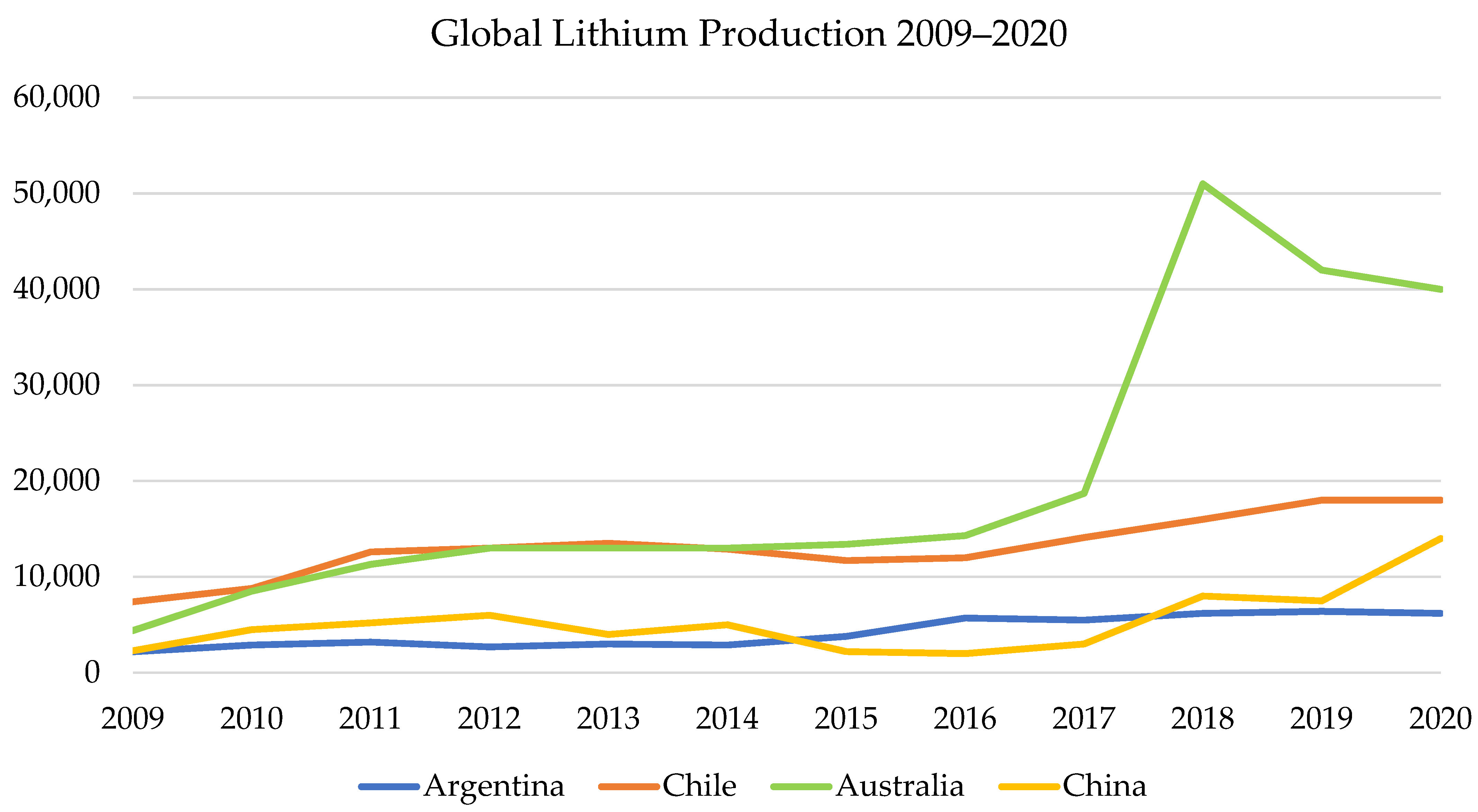

3.1. Expansion of Lithium Mining

3.2. Challenges of Lithium Mining

3.2.1. United States

3.2.2. China

3.2.3. Chile

3.2.4. Portugal

3.2.5. Australia

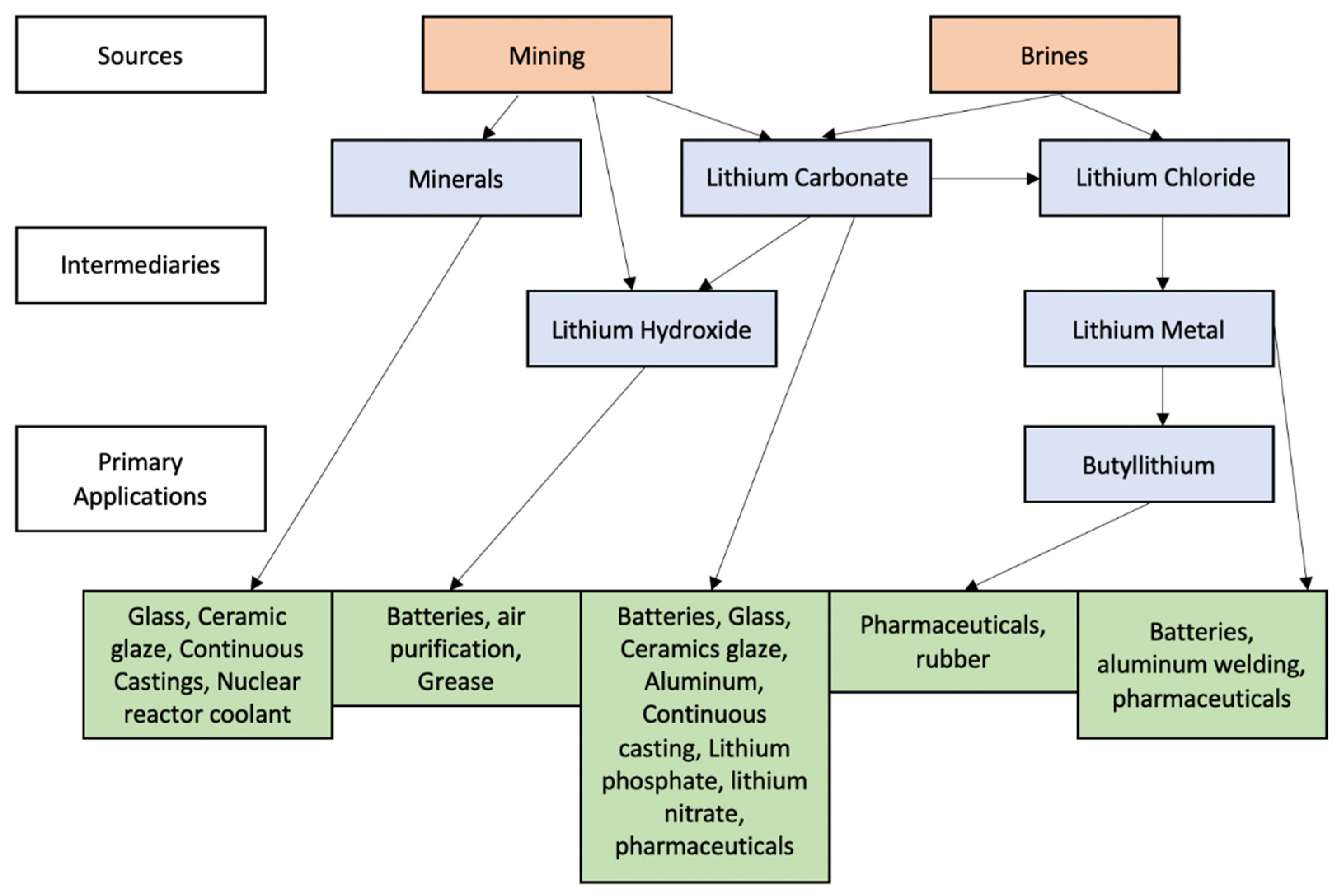

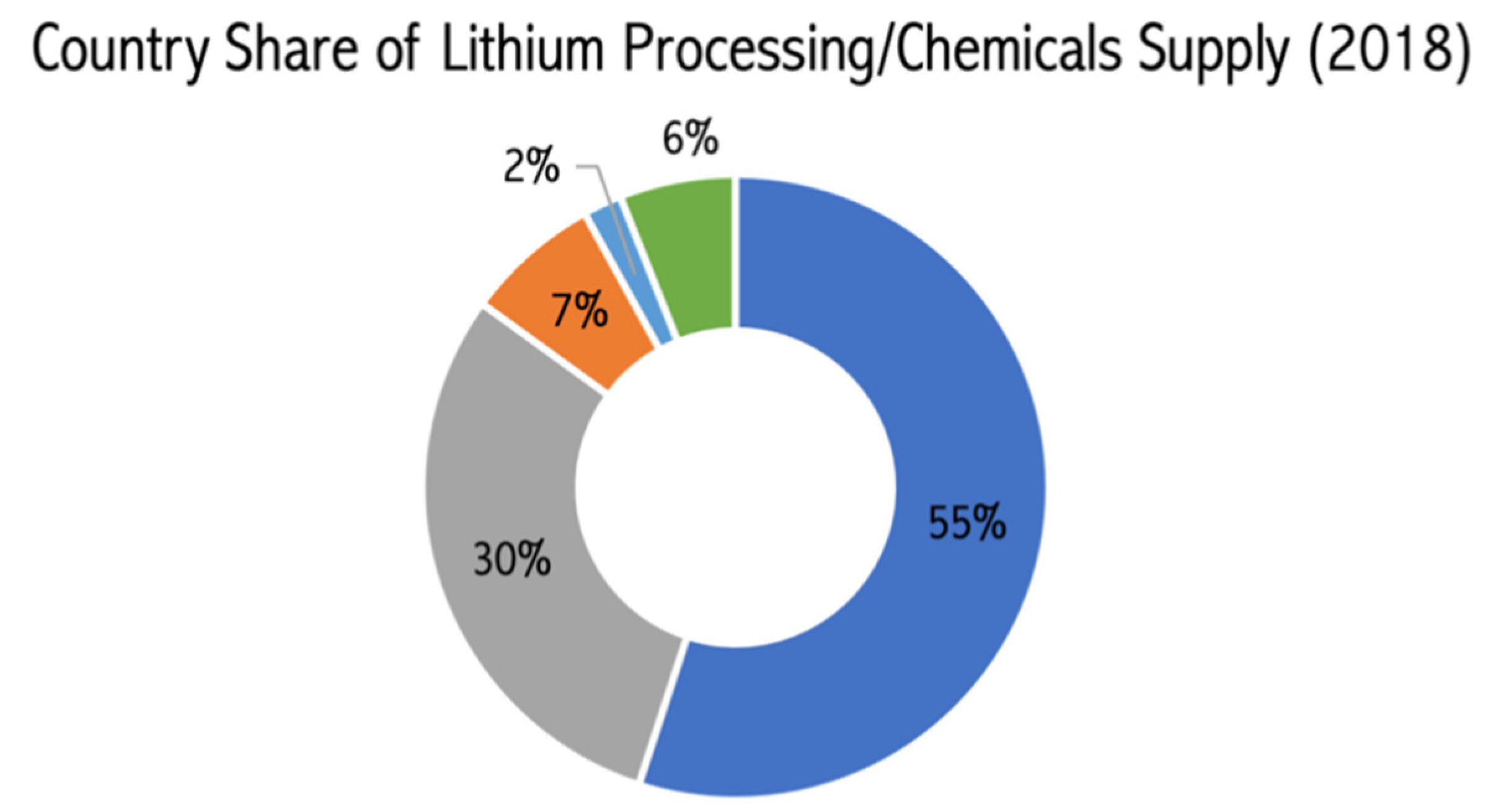

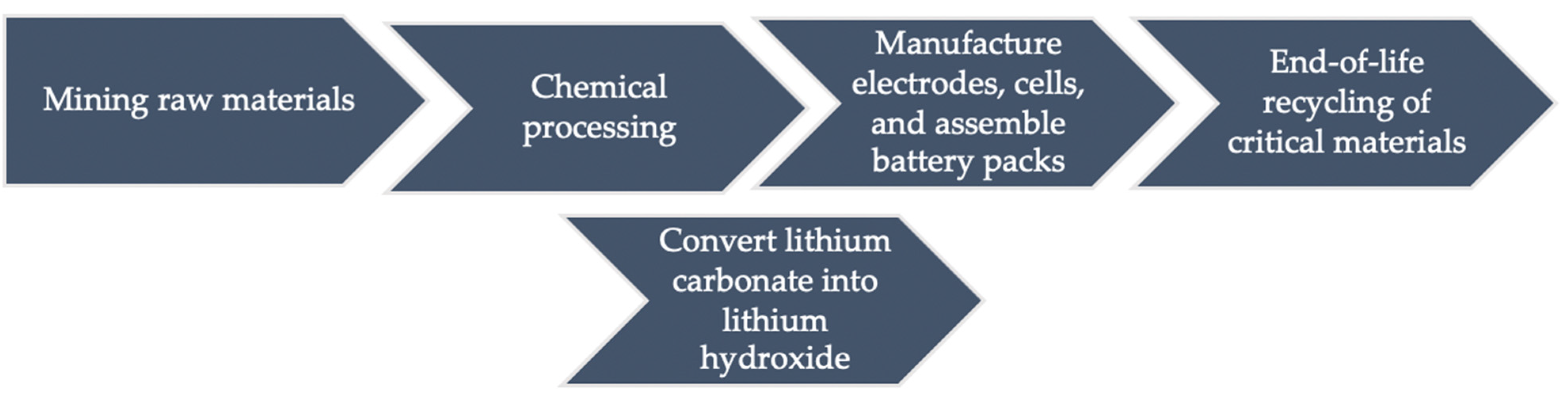

3.3. Lithium Processing

4. Alternative Technologies

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- UNESCO. Available online: https://unesco.org/themes/education-sustainable-development/what-is-sustainable-development/what-is-esd/sd (accessed on 28 June 2021).

- IEA. Energy Security: Reliable, Affordable, Access to All Fuels and Energy Sources. Available online: https://iea.org/topics/energy-security (accessed on 28 June 2021).

- Greim, P.; Solomon, A.A.; Breyer, C. Assessment of lithium criticality in the global energy transition and addressing policy gaps in transportation. Nat. Commun. 2020, 11, 1–11. [Google Scholar] [CrossRef]

- Al Root. Why Lithium Could be a New Risk for Tesla and Other Electric-Vehicle Makers. Barrons.com. 1 October 2020. Available online: https://www.barrons.com/articles/new-risk-tesla-other-electric-vehicle-makers-lithium-supply-batteries-51601498472 (accessed on 20 August 2021).

- Chen, T.; Jin, Y.; Lv, H.; Yang, A.; Liu, M.; Chen, B.; Xie, Y.; Chen, Q. Applications of Lithium-Ion Batteries in Grid-Scale Energy Storage Systems. Trans. Tianjin Univ. 2020, 26, 208–217. [Google Scholar] [CrossRef] [Green Version]

- Federal Register. “A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals.” 26 December 2017. Available online: https://www.federalregister.gov/documents/2017/12/26/2017-27899/a-federal-strategy-to-ensure-secure-and-reliable-supplies-of-critical-minerals (accessed on 20 September 2021).

- “Executive Order on Addressing the Threat to the Domestic Supply Chain from Reliance on Critical Minerals from Foreign Adversaries–The White House”. Available online: https://trumpwhitehouse.archives.gov/presidential-actions/executive-order-addressing-threat-domestic-supply-chain-reliance-critical-minerals-foreign-adversaries/ (accessed on 20 September 2021).

- The White House. “Executive Order on America’s Supply Chains.” 24 February 2021. Available online: https://www.whitehouse.gov/briefing-room/presidential-actions/2021/02/24/executive-order-on-americas-supply-chains/ (accessed on 20 September 2021).

- European Commission-European Commission. “Sustainable Batteries.” Text. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_20_2312 (accessed on 20 September 2021).

- Agusdinata, D.B.; Liu, W.; Eakin, H.; Romero, H. Socio-environmental impacts of lithium mineral extraction: Towards a research agenda. Environ. Res. Lett. 2018, 13, 123001. [Google Scholar] [CrossRef] [Green Version]

- Bini, M.; Capsoni, D.; Ferrari, S.; Quartarone, E.; Mustarelli, P. Rechargeable Lithium Batteries: Key Scientific and Technological Challenges. In Rechargeable Lithium Batteries–From Fundamentals to Applications; Woodhead Publishing Series in Energy: Sawston, UK, 2015; pp. 1–17. [Google Scholar]

- Huang, Y.; Shaibani, M.; Gamot, T.D.; Wang, M.; Jovanović, P.; Cooray, M.C.D.; Mirshekarloo, M.S.; Mulder, R.J.; Medhekar, N.V.; Hill, M.R.; et al. A saccharide-based binder for efficient polysulfide regulations in Li-S batteries. Nat. Commun. 2021, 12, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Speirs, J.; Contestabile, M.; Houari, Y.; Gross, R. The future of lithium availability for electric vehicle batteries. Renew. Sustain. Energy Rev. 2014, 35, 183–193. [Google Scholar] [CrossRef]

- Martin, G.; Rentsch, L.; Höck, M.; Bertau, M. Lithium market research–global supply, future demand and price development. Energy Storage Mater. 2017, 6, 171–179. [Google Scholar] [CrossRef]

- Liu, D.; Gao, X.; An, H.; Qi, Y.; Wang, Z.; Jia, N.; Chen, Z. Exploring behavior changes of the lithium market in China: Toward technology-oriented future scenarios. Resour. Policy 2020, 69, 101885. [Google Scholar] [CrossRef]

- Watari, T.; Nansai, K.; Nakajima, K. Review of critical metal dynamics to 2050 for 48 elements. Resour. Conserv. Recycl. 2020, 155, 104669. [Google Scholar] [CrossRef]

- Latham, E.; Kilbeg, B. Lithium Supply Is Set to Triple by 2025. Will It Be Enough? Spglobal. 24 October 2019. Available online: https://www.spglobal.com/en/research-insights/articles/lithium-supply-is-set-to-triple-by-2025-will-it-be-enough (accessed on 20 September 2021).

- Egbue, O.; Long, S. Critical Issues in the Supply Chain of Lithium for Electric Vehicle Batteries. Eng. Manag. J. 2015, 24, 52–62. [Google Scholar] [CrossRef]

- Peters, J.F.; Baumann, M.; Zimmermann, B.; Braun, J.; Weil, M. The environmental impact of Li-Ion batteries and the role of key parameters—A review. Renew. Sustain. Energy Rev. 2017, 67, 491–506. [Google Scholar] [CrossRef]

- Egbue, O. Assessment of Social Impacts of Lithium for Electric Vehicle Batteries. In Proceedings of the IIE Annual Conference, Orlando, FL, USA, 19–23 May 2012; pp. 1–7. [Google Scholar]

- Wang, Q.; Liu, W.; Yuan, X.; Tang, H.; Tang, Y.; Wang, M.; Zuo, J.; Song, Z.; Sun, J. Environmental impact analysis and process optimization of batteries based on life cycle assessment. J. Clean. Prod. 2018, 174, 1262–1273. [Google Scholar] [CrossRef]

- Romero, H.; Méndez, M.; Smith, P. Mining Development and Environmental Injustice in the Atacama Desert of Northern Chile. Environ. Justice 2012, 5, 70–76. [Google Scholar] [CrossRef]

- Peters, J.; Baumann, M.; Zimmerman, B.; Braum, A.; Weil, M. The Environmental Impact of Lithium. Renew. Sustain. Energy Rev. 2017, 67, 491–506. [Google Scholar] [CrossRef]

- Prior, T.; Wäger, P.A.; Stamp, A.; Widmer, R.; Giurco, D. Sustainable governance of scarce metals: The case of lithium. Sci. Total Environ. 2013, 461-462, 785–791. [Google Scholar] [CrossRef] [PubMed]

- International Energy Agency. The Role of Critical Minerals in Clean Energy Transitions. May 2021. Available online: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions (accessed on 15 June 2021).

- “Greenbushes Lithium Mine-Golden Dragon Capital.” 19 January 2019. Available online: https://web.archive.org/web/20190119121438/http:/www.goldendragoncapital.com/greenbushes-lithium-mine/ (accessed on 20 September 2021).

- “The Precious Mobile Metal-The Financialist.” 23 February 2016. Available online: https://web.archive.org/web/20160223144634/https:/www.thefinancialist.com/spark/the-precious-mobile-metal/ (accessed on 20 September 2021).

- Reuters Staff. “UPDATE 1-Plateau Energy Metals Peru Unit Finds Large Lithium Resources.” Reuters, 16 July 2018, sec. Precious Metals & Minerals. Available online: https://www.reuters.com/article/peru-lithium-idUSL1N1UC0XF (accessed on 20 September 2021).

- Dessemond, C.; Lajoie-Leroux, F.; Soucy, G.; Laroche, N.; Magnan, J.-F. Spodumene: The Lithium Market, Resources and Processes. Minerals 2019, 9, 334. [Google Scholar] [CrossRef] [Green Version]

- Emilsson, E.; Dahllöf, L. Lithium-Ion Vehicle Battery Production, IVL Swedish Environmental Research Institute Ltd. Available online: https://www.ivl.se/download/18.14d7b12e16e3c5c36271070/1574923989017/C444.pdf (accessed on 28 June 2021).

- International Energy Agency. Committed Mine Production and Primary Demand for Lithium, 2020–2030. Available online: https://www.iea.org/data--and-statistics/charts/committed-mine-production-and-primary-demand-for-lithium-2020 (accessed on 28 June 2021).

- Bowen, T.; Chernyakhovskiy, I.; Denholm, P.L. Grid-Scale Battery Storage: Frequently Asked Questions. National Renewable Energy Laboratory. Nrel.org. Available online: https://www.nrel.gov/docs/fy19osti/74426.pdf (accessed on 3 August 2021).

- Modified from Gonzales, A.; Sanhueza, C.; Roa, C. El Mercado del Litio y la Importancia de Chile. Comision Chilena del Cobre. Available online: https://www.cochilco.cl/Presentaciones/PPT%20Litio%20agosto%202020.pdf (accessed on 20 August 2021).

- Mohr, S.H.; Mudd, G.; Giurco, D. Lithium Resources and Production: Critical Assessment and Global Projections. Minerals 2012, 2, 65–84. [Google Scholar] [CrossRef]

- Kramer, D. Fears of a lithium supply crunch may be overblown. Phys. Today 2021, 74, 20–22. [Google Scholar]

- Jaskula, B. U.S. Geological Survey, Mineral Commodity Summaries; Lithium. January 2021. Available online: https://pubs.usgs.gov/periodicals/mcs2021/mcs2021-lithium.pdf (accessed on 28 June 2021).

- Grosjean, C.; Miranda, P.H.; Perrin, M.; Poggi, P. Assessment of world lithium resources and consequences of their geographic distribution on the expected development of the electric vehicle industry. Renew. Sustain. Energy Rev. 2012, 16, 1735–1744. [Google Scholar] [CrossRef]

- Riafrancos, T. The Rush to ‘Go Electric’ Comes with a Hidden Cost: Destructive Lithium Mining. The Guardian. 24 June 2021. Available online: https://www.theguardian.com/commentisfree/2021/jun/14/electric-cost-lithium-mining-decarbonasation-salt-flats-chile (accessed on 24 June 2021).

- Aquino, M. Plateau Energy Metals Seeks $600 Million for Delayed Peru Lithium Project. Reuters.com. 4 November 2020. Available online: https://www.reuters.com/article/peru-lithium-idUSL1N2HM0B3 (accessed on 24 June 2021).

- Garcia, D.A. Mexico Now Ready to Welcome Private Lithium Miners. Reuters.com. 2 June 2021. Available online: https://www.reuters.com/world/americas/exclusive-mexico-now-ready-welcome-private-lithium-miners-2021-06-02/ (accessed on 28 June 2021).

- Burton, M. Rio Tinto Readies to Ship Trial Lithium Plant to Serbia. Reuters.com. 1 August 2021. Available online: https://www.reuters.com/business/energy/rio-tinto-readies-ship-trial-lithium-plant-serbia-2021-08-01/ (accessed on 20 August 2021).

- Scheyder, E. To Go Electric, America Needs More Mines. Can It Build Them? Reuters.com. 1 March 2021. Available online: https://www.reuters.com/article/us-usa-mining-insight-idUSKCN2AT39Z (accessed on 28 June 2021).

- Bloomberg. Piedmont Lithium Soars After Tesla Metal Supply Deal. Bloomberg.com. 28 September 2020. Available online: https://www.bloomberg.com/news/articles/2020-09-28/piedmont-lithium-soars-after-tesla-metal-supply-deal (accessed on 28 June 2021).

- Lemon, K. Residents Push Back as Lithium Piedmont Aims to Expand Mining Plans in Gaston County. Wsoctv.com. 15 July 2021. Available online: https://www.wsoctv.com/news/local/residents-push-back-lithium-piedmont-aims-expand-mining-plans-gaston-county/cf3c4a54-ce15-4583-87e8-53ec09a1f0db/ (accessed on 28 July 2021).

- Leon, V. “They Told Us If You Don’t Sell, They Will Mine Around Us”: Neighbors Refuse to Sell to Piedmont Lithium. Spectrumlocalnews.com. 7 July 2021. Available online: https://spectrumlocalnews.com/nc/charlotte/news/2021/07/07/lithium-mine-in-gaston-county (accessed on 28 July 2021).

- Henderson, B. NC Once a Top Source of Lithium. Growing Demand Could Lead to a Mine Near Charlotte. The Charlotte Observer. 2 April 2019. Available online: https://www.charlotteobserver.com/news/business/article228475629.html (accessed on 20 July 2021).

- Scheyder, E. North Carolina County Slaps Moratorium on Mining as Piedmont Lithium Plans Project. Reuters.com. 9 August 2021. Available online: https://www.reuters.com/world/us/n-carolina-county-slaps-moratorium-mining-piedmont-lithium-plans-project-2021-08-06/ (accessed on 20 August 2021).

- Scheyder, E. In Push to Supply Tesla, Piedmont Lithium Irks North Carolina Neighbors. Reuters.com. 20 July 2021. Available online: https://www.reuters.com/business/energy/push-supply-tesla-piedmont-lithium-irks-north-carolina-neighbors-2021-07-20/ (accessed on 20 August 2021).

- Garside, M. Average Lithium Carbonate Price 2010 to 2020. Statista.com. February 2021. Available online: https://www.statista.com/statistics/606350/battery-grade-lithium-carbonate-price/ (accessed on 28 July 2021).

- Walker, P.; Rose, B. North America’s Only Working Lithium Mine is in Nevada. 8news.com. 23 February 2017. Available online: https://www.8newsnow.com/news/north-americas-only-working-lithium-mine-is-in-nevada/ (accessed on 20 August 2021).

- Gleeson, D. Albemarle to Double Capacity at Silver Peak Lithium Brine Operation. International Mining. Im-mining.com. 7 January 2021. Available online: https://im-mining.com/2021/01/07/albemarle-double-capacity-silver-peak-lithium-brine-operation/ (accessed on 20 July 2021).

- Ioneer. Mining and Processing. Available online: https://www.ioneer.com/rhyolite-ridge/mining-processing (accessed on 28 July 2021).

- Sonner, S. Wildflower and Lithium Mine Compete for Space in Nevada Desert. Christian Science Monitor. 4 June 2021. Available online: https://www.csmonitor.com/Environment/2021/0604/Wildflower-and-lithium-mine-compete-for-space-in-Nevada-desert (accessed on 1 July 2021).

- Associated Press. Old Documents Fuel Latest Bid to Halt Nevada Lithium Mine. Usnews.com. 9 April 2021. Available online: https://apnews.com/article/wildlife-deserts-land-management-reno-nevada-ed84df8c7906883bacd3a1c0086509bf (accessed on 8 August 2021).

- Scheyder, E. U.S. to List Nevada Flower as Endangered, Dealing Blow to Lithium Mine. Reuters.com. 3 June 2021. Available online: https://ecos.fws.gov/ecp/species/4217 (accessed on 8 August 2021).

- Morefield, J. “Tiehm’s Buckwheat History & Background”, July 2020–Carson City and Tonopah, NV. Available online: http://forestry.nv.gov/wp-content/uploads/2020/07/Tiehm-buckwheat-background-and-history-Final.pdf (accessed on 23 September 2021).

- Rowe, B. “Ioneer Tiehm’s Buckwheat Regulatory Workshop”, 20 July 2020, Carson City, NV, USA. Available online: http://forestry.nv.gov/wp-content/uploads/2020/07/INR_NDF_Workshop_Presentation_July20.pdf (accessed on 23 September 2021).

- Sonner, S. Federal Agency: Nevada Flower Near Mine Should be Protected. The Trumbell Times. Trumbelltimes.com. 5 June 2021. Available online: https://www.trumbulltimes.com/news/article/Endangered-status-proposed-for-Nevada-flower-at-16502762.php (accessed on 8 July 2021).

- US Fish and Wildlife Service. Endangered and Threatened Wildlife and Plants: Finding on a Petition to List Tiehms Buckwheat as Threatened or Endangered. Federal Register. 4 June 2021. Available online: https://www.federalregister.gov/documents/2021/06/04/2021-11700/endangered-and-threatened-wildlife-and-plants-finding-on-a-petition-to-list-the-tiehms-buckwheat-as (accessed on 8 July 2021).

- Lee, S. Miner Eyes Rebirth of Lithium Industry in Nevada Desert. Bloomberglaw.com. 24 June 2018. Available online: https://news.bloomberglaw.com/environment-and-energy/miner-eyes-rebirth-of-lithium-industry-in-nevada-desert (accessed on 8 July 2021).

- Scheyder, E. Lithium America Delays Nevada Mine Work After Environmentalist Lawsuit. Reuters.com. 11 June 2021. Available online: https://www.reuters.com/business/environment/exclusive-lithium-americas-delays-nevada-mine-work-after-environmentalist-2021-06-11/ (accessed on 8 July 2021).

- Kapoor, M.L. Nevada Lithium Mine Kicks Off a New Era of Western Extraction. High Country News. 18 February 2021. Available online: https://www.hcn.org/issues/53.3/indigenous-affairs-mining-nevada-lithium-mine-kicks-off-a-new-era-of-western-extraction (accessed on 8 July 2021).

- Penn, I.; Lipton, E. The Lithium Gold Rush: Inside the Race to Power Electric Vehicles. New York Times. 6 May 2021. Available online: https://www.nytimes.com/2021/05/06/business/lithium-mining-race.html (accessed on 20 August 2021).

- Rothberg, D. ‘We’re Just Somebody Little?’ Amid Plans to Mine Lithium, Indigenous, Rural Communities Find Themselves at the Center of the Energy Transition. Thenevadaindependent.com. 20 June 2021. Available online: https://thenevadaindependent.com/article/were-just-somebody-little-rural-indigenous-communities-on-the-frontlines-of-energy-transition-amid-plans-to-mine-major-lithium-deposit (accessed on 21 June 2021).

- Wick, B. Center for Biological Diversity. Photograph. 11 February 2021. Available online: https://biologicaldiversity.org/w/news/press-releases/federal-judge-overturns-trump-administrations-gutting-of-sage-grouse-protections-from-mining-2021-02-11/ (accessed on 20 August 2021).

- Reuters Staff. China’s Ganzizhou Rongda Lithium Restarts Spodumene After 5 Years. Reuters.com. 13 June 2019. Available online: https://www.reuters.com/article/china-metals-lithium/chinas-ganzizhou-rongda-lithium-restarts-spodumene-mine-after-5-years-idINL4N23K0UG (accessed on 28 July 2021).

- Denyer, S. Tibetans in Anguish as Chinese Mines Pollute Their Sacred Grasslands. Washington Post. 26 December 2016. Available online: https://www.washingtonpost.com/world/asia_pacific/tibetans-in-anguish-as-chinese-mines-pollute-their-sacred-grasslands/2016/12/25/bb6aad06-63bc-11e6-b4d8-33e931b5a26d_story.html (accessed on 20 August 2021).

- Reuters Staff. China’s Youngy to Build Plant as Part of $200 Million Investment in Sichuan. Reuters.com. 2 January 2020. Available online: https://www.reuters.com/article/us-china-lithium-youngy/chinas-youngy-to-build-lithium-plant-as-part-of-200-million-investment-in-sichuan-idUSKBN1Z10RJ (accessed on 10 July 2021).

- Benchmark Minerals. Lithium Monthly Pricing Change. 2018. Available online: https://www.benchmarkminerals.com/lithium/ (accessed on 20 August 2021).

- Franz, S. Is Fair Lithium from Chile Possible? Pv-magazine.com. 8 February 2020. Available online: https://www.pv-magazine.com/2020/02/08/is-fair-lithium-from-chile-possible/ (accessed on 29 July 2021).

- Liu, W.; Agusdinata, D.B.; Myint, S.W. Spatiotemporal patterns of lithium mining and environmental degradation in the Atacama Salt Flat, Chile. Int. J. Appl. Earth Obs. Geoinf. 2019, 80, 145–156. [Google Scholar] [CrossRef]

- Kelly, J.C.; Wang, M.; Dai, Q.; Winjobi, O. Energy, GHG and Water Lifecycle Analysis of Lithium Carbonate and Lithium Hydroxide Monohydrate from Brine and Ore Resources and their Use in Lithium Ion Battery Cathodes and Lithium Ion Batteries. Resour. Conserv. Recycl. 2021, 174, 105762. [Google Scholar] [CrossRef]

- Lattanzio, R.K.; Clark, C.E. Environmental Effects of Battery, Electric and Internal Combustion Engine Vehicles; R46420; US Congressional Research Service: Washington, DC, USA, 2020.

- Attwood, J. Lithium Miners Are Hoing to Compete for New Licenses in Chile. Mining.com. 11 March 2021. Available online: https://www.mining.com/web/lithium-miners-are-going-to-compete-for-new-licenses-in-chile/#:~:text=Chile%2C%20the%20biggest%20supplier%20of,a%20bid%20to%20grow%20output (accessed on 30 July 2021).

- Casey, J. Companies Start Partnership for Sustainable Lithium Mining in Chile. Global Mining Review. 9 June 2021. Available online: https://www.globalminingreview.com/environment-sustainability/09062021/companies-start-partnership-for-sustainable-lithium-mining-in-chile/ (accessed on 30 July 2021).

- Moore, P. Chile’s SQM Outlines Major Expansion Plans for Lithium, Nitrate and Iodine Production. International Mining. Im-mining.com. 26 December 2020. Available online: https://im-mining.com/2020/12/26/chiles-sqm-outlines-massive-investment-lithium-nitrate-iodine-production-brine-caliche-operations/ (accessed on 30 July 2021).

- Jamasmie, C. Albemarle Moves Ahead with Expansions Despite Lithium Market Weakness. Mining.com. 5 November 2020. Available online: https://www.mining.com/albemarle-ahead-with-expansions-despite-lithium-market-weakness/#:~:text=Albemarle%20moves%20ahead%20with%20expansions%20despite%20lithium%20market%20weakness,-Cecilia%20Jamasmie%20%7C%20November&text=Delivering%20fourth%2Dquarter%20results%2C%20the,pandemic%20on%20the%20global%20economy. (accessed on 28 July 2021).

- Atwood, J.; Li, Y.Y. Top Lithium Miner to Boost Extraction in Search for Green Growth. Bloomberg.com. 10 June 2021. Available online: https://www.bloomberg.com/news/articles/2021-06-10/top-lithium-miner-to-boosts-extraction-in-seach-for-green-growth (accessed on 28 July 2021).

- Morse, I. Chile’s New Constitution Could Rewrite the Story of Lithium Mining. Quartz. Qz.com. 27 December 2020. Available online: https://qz.com/1948663/chiles-new-constitution-could-rewrite-the-fate-of-lithium-mining/#:~:text=As%20mining%20projects%20there%20expand,%2Da%2Dkind%20water%20cycle. (accessed on 28 July 2021).

- Scott, A. Europe is Poised to Begin Lithium Mining. Chemical and Engineering News. 2 June 2021. Available online: https://cen.acs.org/business/inorganic-chemicals/Europe-poised-begin-lithium-mining/99/i21#:~:text=European%20Lithium%20wants%20to%20start,in%20the%20next%20few%20years. (accessed on 28 July 2021).

- Demony, C.; Gonclaves, S. No Longer Dirty? EU Leaders Want to Challenge Perceptions of Lithium Mining. Reuters.com. 5 May 2021. Available online: https://www.reuters.com/business/environment/no-longer-dirty-eu-leaders-want-challenge-perceptions-lithium-mining-2021-05-05/ (accessed on 28 July 2021).

- Hernandez-Morales, A.; Mateus, S.D. Portugal to Scrap Lithium Mining Project. Politico.eu. 27 April 2021. Available online: https://www.politico.eu/article/portugal-lithium-mining-project-scrap/ (accessed on 28 July 2021).

- Jamasmie, C. Portugal May Delay Lithium Licenses Auction to 2022. Mining.com. 13 May 2021. Available online: https://www.mining.com/portugal-may-delay-lithium-licenses-auction-to-2022/ (accessed on 28 July 2021).

- Demony, C. Savannah Moves Closer to Portugal Lithium Mine with Preliminary Impact Study Approval. Reuters.com. 16 April 2021. Available online: https://www.reuters.com/article/portugal-lithium-savannah/savannah-moves-closer-to-portugal-lithium-mine-with-preliminary-impact-study-approval-idUSL8N2M94J8 (accessed on 28 July 2021).

- Carter, B. A Portuguese Village Pays the High Price of Low-Carbon Energy. Euronews.com. 23 April 2021. Available online: https://www.euronews.com/2021/04/23/portuguese-village-suffers-the-high-cost-of-low-carbon-energy (accessed on 28 July 2021).

- Sherwood, D. Chile, Once the World’s Lithium Leader, Loses Ground to Rivals. Reuters.com. 30 May 2019. Available online: https://www.reuters.com/article/us-chile-lithium-analysis/chile-once-the-worlds-lithium-leader-loses-ground-to-rivals-idUSKCN1T00DM (accessed on 28 July 2021).

- Editor. Snapshot: Key Lithium Mining Projects Around the World. Mining.com. 22 January 2021. Available online: https://www.mining.com/lithium-projects-key-to-the-race-to-secure-strategic-materials-report/ (accessed on 28 July 2021).

- Fitch Solutions. Asia Lithium Outlook: Australia to Hold the Reign on Concentrate Production. Fitchsolutions.com. 28 May 2021. Available online: https://www.fitchsolutions.com/mining/asia-lithium-outlook-australia-hold-reign-concentrate-production-28-05-2021 (accessed on 28 July 2021).

- John, D.G. The Global Rise of the Modern Plug-In Electric Vehicle: Public Policy, Innovation and Strategy; Elgar Publishing: Cheltenham, UK, 2021; p. 295. [Google Scholar]

- Bennett, S. The Rise of the Australian Greens. Research Paper No. 8. Parliament of Australia. Aph.gov.au. 22 September 2008. Available online: https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/rp0809/09rp08 (accessed on 28 July 2021).

- The Greens (WA). Consider Environment in the Lithium Boom. Greens.org.au. 29 May 2018. Available online: https://greens.org.au/wa/news/media-release/consider-environment-lithium-boom (accessed on 28 July 2021).

- Palandrani, P. Four Companies Leading the Rise of Lithium and Battery Technology. Globalxetts.com. 9 December 2020. Available online: https://www.globalxetfs.com/four-companies-leading-the-rise-of-lithium-battery-technology/ (accessed on 28 July 2021).

- Bloomberg, N.E.F. China Dominates the Lithium-Ion Battery Supply Chain, but Europe is On the Rise. Bloomberg.com. 16 September 2020. Available online: https://about.bnef.com/blog/china-dominates-the-lithium-ion-battery-supply-chain-but-europe-is-on-the-rise/ (accessed on 28 July 2021).

- Reuters Staff. Albemarle Says Chinese Lithium Output Dented by Cornovirus. Reuters.com. 2 February 2020. Available online: https://www.reuters.com/article/albemarle-results-idINL1N2AK10I (accessed on 28 July 2021).

- Baumgarten, S. US Albermarle Completes Acquisition of China’s Lithium Business. Icis.com. 3 January 2017. Available online: https://www.icis.com/explore/resources/news/2017/01/03/10067211/us-albemarle-completes-acquisition-of-china-lithium-business/ (accessed on 28 July 2021).

- Bloomberg, N.E.F. Tianqi’s Australian Lithium Plant Costs Double. Bnef.com. 17 December 2020. Available online: https://about.bnef.com/blog/tianqis-australian-lithium-plant-costs-double/#:~:text=On%20December%208%2C%20Tianqi%20announced,million%20and%20commission%20by%202018. (accessed on 28 July 2021).

- Ballard, H. IGO Weeks Away from Tianqi Lithium Lift-Off. Australiammining.com. 22 June 2021. Available online: https://www.australianmining.com.au/news/igo-weeks-away-from-tianqi-lithium-lift-off/ (accessed on 28 July 2021).

- Patterson, S.; Ramkumar, A. America’a Battery-Powered Car Hopes Ride on Lithium. One Producer Paves the Way. Wall Street Journal. 9 March 2021. Available online: https://www.wsj.com/articles/americas-battery-powered-car-hopes-ride-on-lithium-one-producer-paves-the-way-11615311932 (accessed on 28 July 2021).

- Reuters Staff. China’s General Lithium to Launch 60,000 Ton Spodumene Converter by the End of 2020. Reuters.com. 12 April 2021. Available online: https://www.reuters.com/article/china-metals-lithium/chinas-general-lithium-to-launch-60000-t-spodumene-converter-by-end-2020-idUSL3N21U1DJ (accessed on 28 July 2021).

- Thompson, B. Why Albemarle is Hot for Lithium Hydroxide Plants in Australia. Financial Review. 29 November 2018. Available online: https://www.afr.com/companies/why-albemarle-is-hot-for-lithium-assets-in-australia-20181129-h18j17 (accessed on 28 July 2021).

- Albermarle. An Insider’s View: The Kemerton Lithium Hydroxide Processing Plant. Albemarle.com. Available online: https://www.albemarle.com/blog/an-insiders-view-the-kemerton-lithium-hydroxide-processing-plant-- (accessed on 28 July 2021).

- Haselgrove, S. Albemarle to Kick Off Kemerton Expansion in 2021. Australianmining.com. 9 November 2020. Available online: https://www.australianmining.com.au/news/kemerton-expansion-to-kick-off-in-2021/ (accessed on 28 July 2021).

- Lucas, J. Kemerton Lithium Refinery Owner, Albemarle, Plans to Dump Tailings in WA Wheatbelt. Abc.net. 8 June 2020. Available online: https://www.abc.net.au/news/2020-07-08/plan-to-dump-lithium-tailings-in-wa-wheatbelt/12431872 (accessed on 28 July 2021).

- Young, E. Lithium Giant Will ‘Get Rid of Biggest Headache’ in Controversial South West Dump. The Sydney Morning Herald. 24 June 2019. Available online: https://www.smh.com.au/national/lithium-giant-will-get-rid-of-biggest-headache-in-controversial-south-west-waste-dump-20190621-p5204y.html (accessed on 28 July 2021).

- Vanstone, K. Innovative Extraction Techniques Targeting North American Lithium Deposits. Investingnews.com. 24 June 2020. Available online: https://investingnews.com/innspired/direct-lithium-extraction-driving-us-lithium-supply/ (accessed on 28 July 2021).

- Wayland, M. GM Moves to Secure Critical US-Sourced Lithium for Electric Vehicle Batteries. Cnbc.com. 2 July 2021. Available online: https://www.cnbc.com/2021/07/02/gm-moves-to-secure-critical-us-sourced-lithium-for-electric-vehicles.html (accessed on 28 July 2021).

- Hall, K.; Beggin, R. GM Forms Strategic Investment for US-Sourced Lithium as Part of EV Push. The Detroit News. 2 July 2021. Available online: https://www.detroitnews.com/story/business/autos/general-motors/2021/07/02/gm-forms-strategic-investment-u-s-sourced-lithium/7838531002/ (accessed on 28 July 2021).

- Warren, I. Techno-Economic Analysis of Lithium Extraction from Geothermal Brines. National Renewable Energy Laboratory. Golden, Colorado. NREL/TP-5700-79178. May 2021. Available online: https://www.nrel.gov/docs/fy21osti/79178.pdf (accessed on 30 July 2021).

- Gerber, K. Why the EU Needs Geothermal Lithium for Sustainable EV Battery Value Chain. LiCAP Technologies Inc. 3 February 2020. Available online: https://www.linkedin.com/pulse/why-eu-needs-geothermal-lithium-sustainable-ev-value-gerber-phd-/ (accessed on 30 July 2021).

- Price, M.L. Energy Secretary Says US Wants ‘Responsible’ Lithium Mining. Usnews.com. 10 June 2021. Available online: https://www.usnews.com/news/business/articles/2021-06-10/energy-secretary-says-us-wants-responsible-lithium-mining (accessed on 30 June 2021).

- Kumagai, J. Lithium-Ion Battery Recycling Finally Takes Off in North America and Europe. Spectrum.ieee.org. 5 January 2021. Available online: https://spectrum.ieee.org/lithiumion-battery-recycling-finally-takes-off-in-north-america-and-europe (accessed on 30 July 2021).

- Lee, A. China Giant Ganfeng Says Lithium May Rally to Boom-Time High. Bloomberg.com. 24 June 2021. Available online: https://www.bloomberg.com/news/articles/2021-06-24/china-giant-ganfeng-says-lithium-could-return-to-boom-time-highs (accessed on 30 July 2021).

- Fortum. Lithium-Ion Battery Recycling Technology. Fortum.com. Available online: https://www.fortum.com/products-and-services/fortum-battery-solutions/recycling/lithium-ion-battery-recycling-technology (accessed on 7 July 2021).

- Greenberg, J. Fact Check: Is Biden Ignoring the ‘Negative Environmental Impacts’ of Lithium Mining. Austin American Statesman. 10 June 2021. Available online: https://www.statesman.com/story/news/politics/politifact/2021/06/10/joe-biden-administration-lithium-mining-not-ignoring-impact/7638695002/ (accessed on 20 July 2021).

- Stone, M. As Electric Vehicles Take Off, We’ll Need to Recycle Their Batteries. Nationalgeographic.com. 28 May 2021. Available online: https://www.nationalgeographic.com/environment/article/electric-vehicles-take-off-recycling-ev-batteries (accessed on 30 July 2021).

- Herrington, R. Mining our green future. Nat. Rev. Mater. 2021, 6, 456–458. [Google Scholar] [CrossRef]

- National Academies of Sciences, Engineering and Medicine. NRC Assessment of Technologies for Improving Light-Duty Vehicle Fuel Economy—2025–2035; National Academies Press: Washington, DC, USA, 2021. [Google Scholar]

| Country | Lithium Resources (Metric Tonnes) | Lithium Reserves (Metric Tonnes) |

|---|---|---|

| Portugal | 270,000 | 60,000 |

| Spain | 300,000 | n/a |

| Brazil | 470,000 | 95,000 |

| Zimbabwe | 500,000 | 220,000 |

| Mali | 700,000 | n/a |

| Peru | 880,000 | n/a |

| Serbia | 1,200,000 | n/a |

| Czechia | 1,300,000 | n/a |

| Mexico | 1,700,000 | n/a |

| Germany | 2,700,000 | n/a |

| Canada | 2,900,000 | 530,000 |

| Congo | 3,000,000 | n/a |

| China | 5,100,000 | 1,500,000 |

| Australia | 6,400,000 | 4,700,000 |

| United States | 7,900,000 | 750,000 |

| Chile | 9,600,000 | 9,200,000 |

| Argentina | 19,300,000 | 1,900,000 |

| Bolivia | 21,000,000 | n/a |

| World total | 86,000,000 | --- |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Graham, J.D.; Rupp, J.A.; Brungard, E. Lithium in the Green Energy Transition: The Quest for Both Sustainability and Security. Sustainability 2021, 13, 11274. https://doi.org/10.3390/su132011274

Graham JD, Rupp JA, Brungard E. Lithium in the Green Energy Transition: The Quest for Both Sustainability and Security. Sustainability. 2021; 13(20):11274. https://doi.org/10.3390/su132011274

Chicago/Turabian StyleGraham, John D., John A. Rupp, and Eva Brungard. 2021. "Lithium in the Green Energy Transition: The Quest for Both Sustainability and Security" Sustainability 13, no. 20: 11274. https://doi.org/10.3390/su132011274

APA StyleGraham, J. D., Rupp, J. A., & Brungard, E. (2021). Lithium in the Green Energy Transition: The Quest for Both Sustainability and Security. Sustainability, 13(20), 11274. https://doi.org/10.3390/su132011274