When Harmful Tax Expenditure Prevails over Environmental Tax: An Assessment on the 2014 Mexican Fiscal Reform

Abstract

1. Introduction

2. Literature Review on Environmental Fiscal Policy

3. Databases

4. Implementation of Environmental Taxation in Mexico

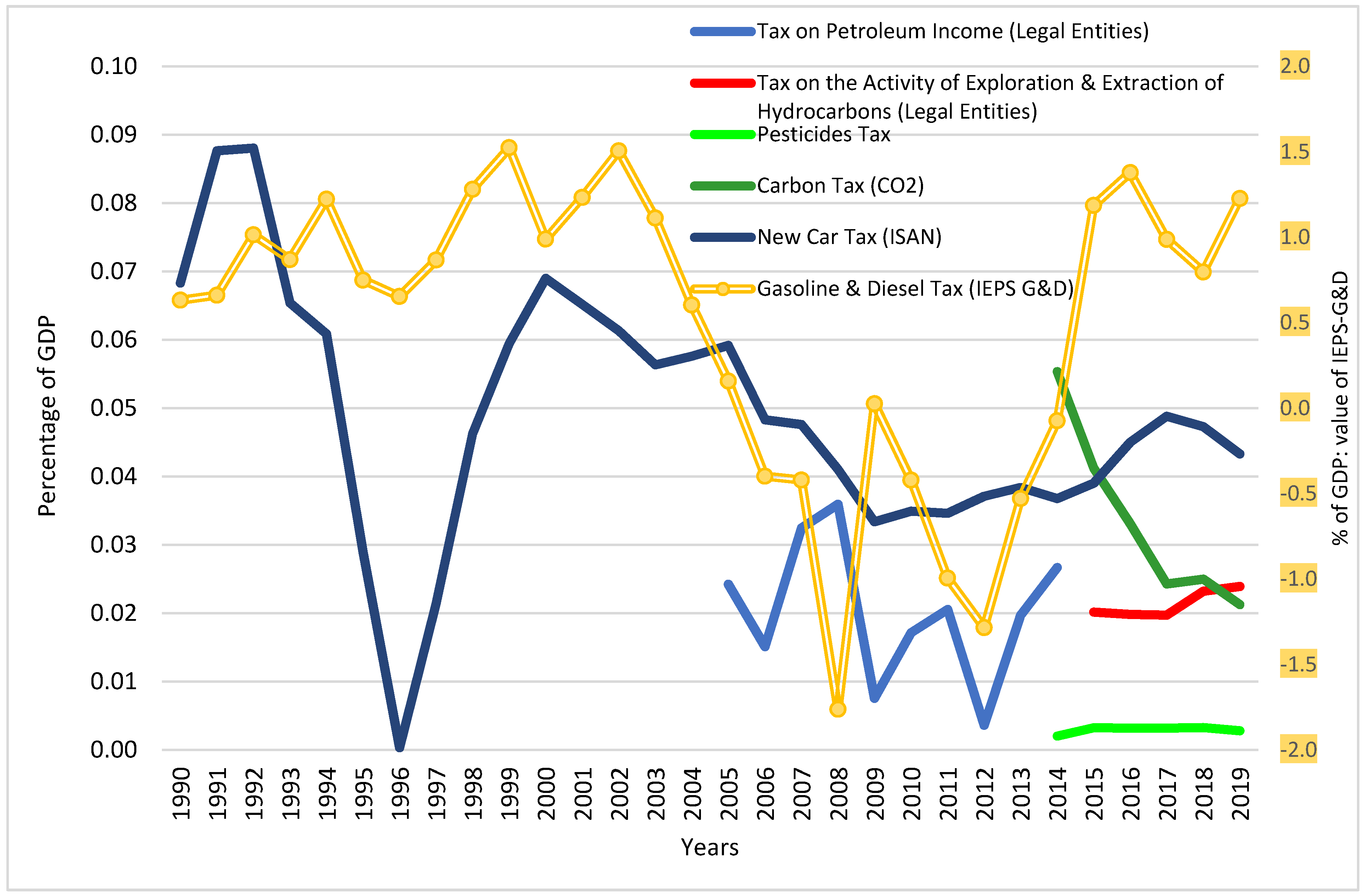

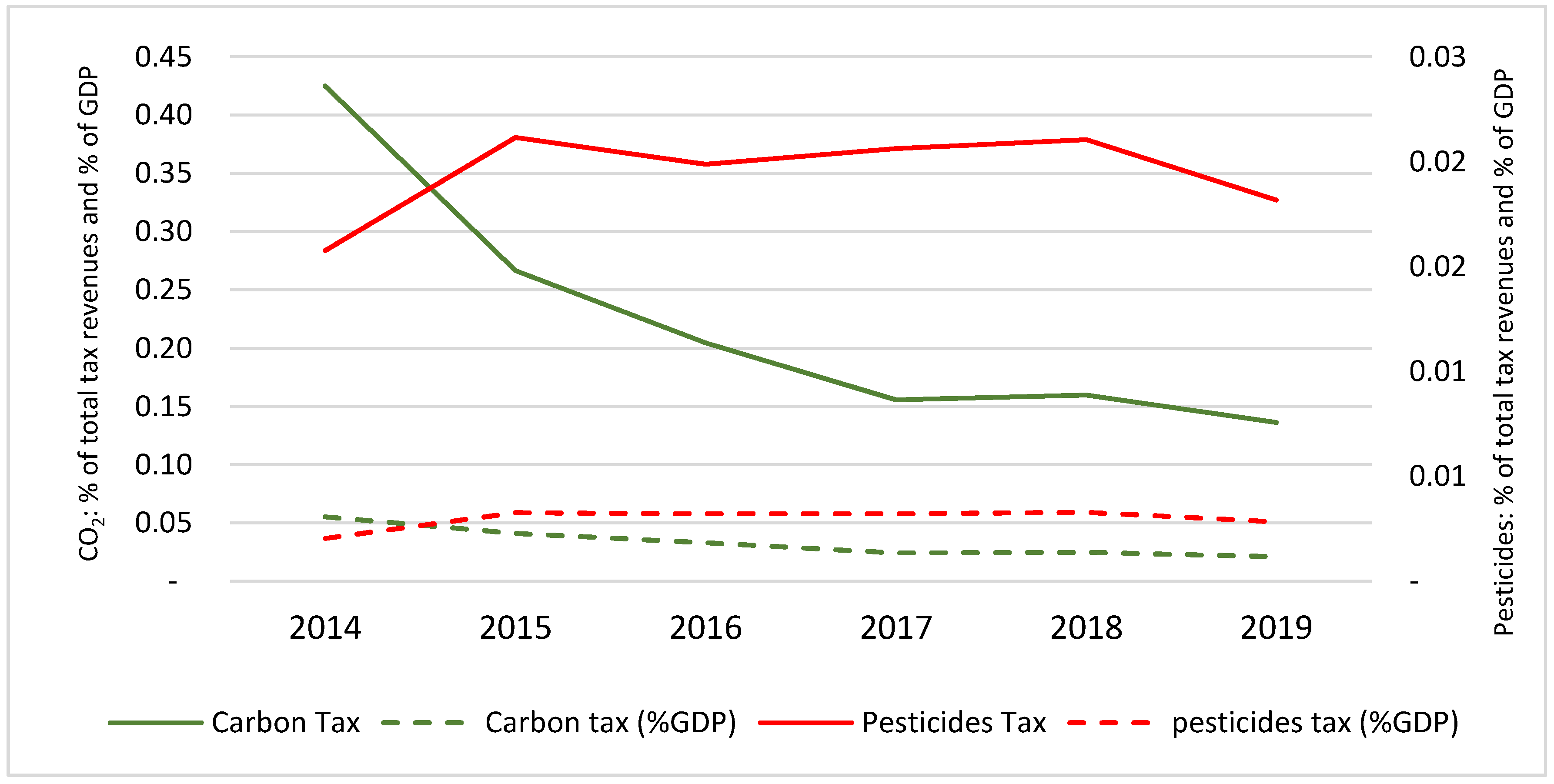

4.1. Environmental Tax and Environmental-Related Tax in Mexico

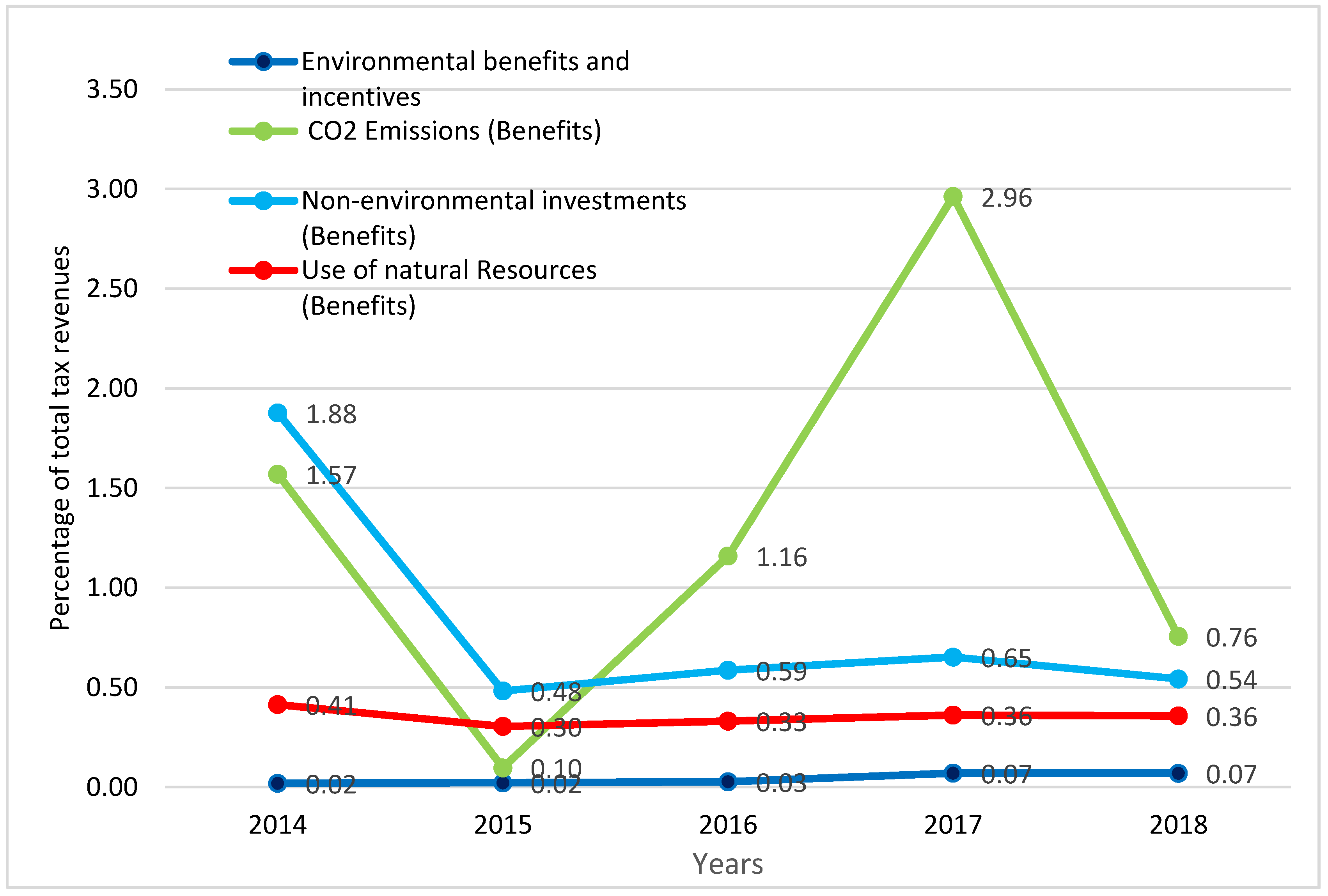

4.2. Environmental-Frienly and Environmental-Harmful Tax Expenditure in Mexico

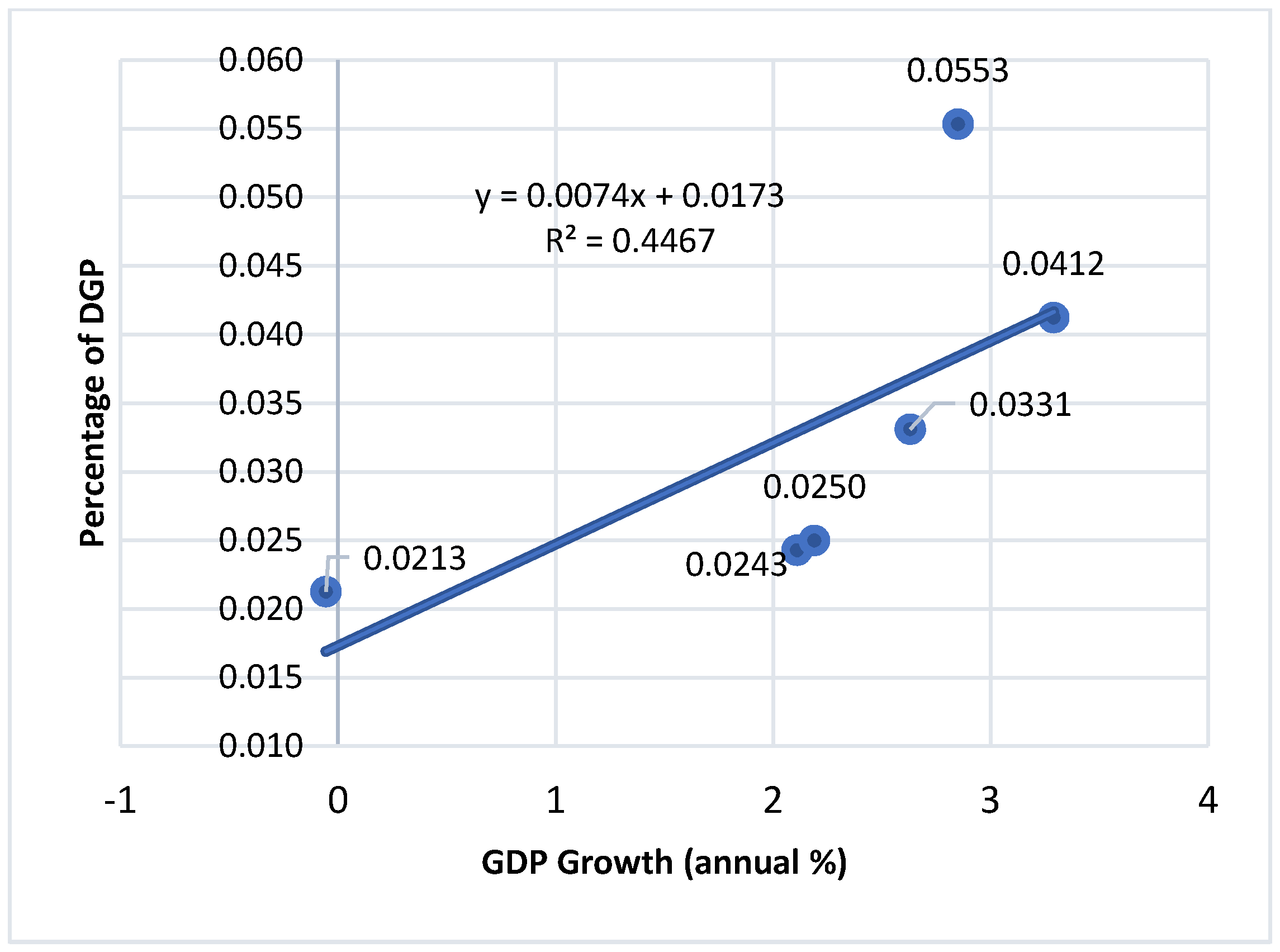

5. Results

6. Conclusions and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Stern, N. El Informe de Stern: La Verdad Sobre El Cambio Climático; Paidos Ibérica, S., Ed.; MONDE Diplomatique: Barcelona, Spain, 2007. [Google Scholar]

- Rockström, J.; Steffen, W.; Noone, K. Planetary Boundaries: Exploring the Safe Operating Space for Humanity. Ecol. Soc. 2009, 14, 32. [Google Scholar] [CrossRef]

- Martínez-Alier, J.; Jusmet, J.R. Economía Ecológica y Política Ambiental, 3rd ed.; Fondo de Cultura Económica: Mexico City, Mexico, 2013. [Google Scholar]

- Secretaría de Mediio Ambiente y Recursos Naturales (SEMARNAT). Indicadores de Crecimiento Verde. Available online: https://apps1.semarnat.gob.mx:8443/dgeia/indicadores_verdes/indicadores/00_intros/intro.html (accessed on 10 October 2020).

- IPCC. Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change; IPCC: Geneva, Switzerland, 2018. [Google Scholar]

- International Monetary Fund (IMF). Fiscal Policies for Paris Climate Strategies—From Principle to Practice; International Monetary Fund: Washington, DC, USA, 2019; Volume 19, p. 1. [Google Scholar] [CrossRef]

- Krogstrup, S.; Oman, W. Macroeconomic and Financial Policies for Climate Change Mitigation; International Monetary Fund: Washington, DC, USA, 2019; Volume 19. [Google Scholar] [CrossRef]

- Schmidt, C.; Gebin, G.; Van Houten, F.; Van Close, C.; McGinty, D.B.; Arora, R.; Potocnik, J.; Ishii, N.; Bakker, P.; Kituyi, M.; et al. The Circularity Gap Report 2020. Circ. Econ. 2020, 3, 69. [Google Scholar]

- Elkins, P.; Barker, P. Carbon Taxes and Emissions Trading. J. Econ. Surv. 2001, 15, 325–376. [Google Scholar] [CrossRef]

- Georgescu-Roegen, N. Qué Puede Enserñar a Los Economistas La Termodinamica y La Biología? In De la Economía Ambiental a la Economía Ecológica; Aguilera, F., Alcántara, V., Eds.; Icaria: Barcelona, Spain, 1994; pp. 303–319. [Google Scholar]

- Naredo, J.M. Reíces Económicas Del Deterioro Ecológico y Social. Más Allá de Los Dogmas; Siglo XXI de España Editores: Madrid, Spain, 2006. [Google Scholar]

- Naredo, J.M. Fundamentos de La Economía Ecológica. In De la Economía Ambiental a la Economía Ecológica; Aguilera, F., Alcántara, V., Eds.; Icaria: Barcelona, Spain, 1994; pp. 235–252. [Google Scholar]

- Smith, R. Green Capitalism: The God That Failed; World Economics Association, College Publications: Norcross, GA, USA, 2016. [Google Scholar]

- Common, M.; Stagl, S. Introducción a La Economía, 1st ed.; Reverte: Barcelona, Spain, 2008. [Google Scholar]

- International Energy Agency (IEA). Data and Statistics. Available online: https://www.iea.org/data-and-statistics (accessed on 4 May 2021).

- Arlinghaus, J.; van Dender, K. The Environmental Tax and Subsidy Reform in Mexico; OECD: London, UK, 2017. [Google Scholar] [CrossRef]

- Neri, A.F. Tributos Ambientales En México: Una Revisión de Su Evolución y Problemas. Boletín Mex. Derecho Comp. 2005, 38, 991–1020. [Google Scholar]

- Azqueta, D.; Ramírez, A. Introducción a la Economía Ambiental; McGraw-Hill Interamericana: Madrid, Spain, 2007. [Google Scholar]

- Secretaria de Hacienda y Crédito Público (SHCP). Criterios Generales de Política Económica 2014; Gobierno de México: Mexico City, Mexico, 2013; p. 194.

- CEPAL. Panorama Fiscal de América Latina y el Caribe 2019: Políticas tributarias Para la Movilización de Recursos en el Marco de la Agenda 2030 Para el Desarrollo Sostenible. Available online: https://repositorio.cepal.org/handle/11362/44516 (accessed on 14 April 2021).

- Lorenzo, F. Inventario de Instrumentos Fiscales Verdes En América Latina; LC/W.723; CEPAL: Santiago, Chile, 2016. [Google Scholar]

- Beeks, J.C.; Lambert, T. Addressing Externalities: An Externality Factor Tax-Subsidy Proposal. Eur. J. Sustain. Dev. Res. 2018, 2, 1–19. [Google Scholar] [CrossRef]

- ECLAC; OXFAM. Tax Incentives in Latin America and the Caribbean; LC/TS.2019/50; ECLAC: Santiago, Chile; OXFAM: Nairobi, Kenya, 2019. [Google Scholar]

- Baumol, W.J. On Taxation and the Control of Externalities. Am. Econ. Rev. 1972, 62, 307–322. [Google Scholar]

- Stiglitz, J. La Economía del Sector Público; Antoni Bosch: Barcelona, Spain, 2000. [Google Scholar]

- Gago, A.; Labandeira, X.; López-Otero, X. Las Nuevas Reformas Fiscales Verdes; WP 05/2016; Economics for Energy: Vigo, Spain, 2016. [Google Scholar]

- Freire-González, J. Environmental Taxation and the Double Dividend Hypothesis in CGE Modelling Literature: A Critical Review. J. Policy Model. 2018, 40, 194–223. [Google Scholar] [CrossRef]

- Metcalf, G.E. On the Economics of a Carbon Tax for the United States. Brook. Pap. Econ. Act. 2019, 1, 405–484. [Google Scholar] [CrossRef]

- Nordhaus, W.D. Carbon Taxes to Move toward Fiscal Sustainability. In The Economists’ Voice 2.0; Columbia University Press: New York, NY, USA, 2010; Volume 7. [Google Scholar] [CrossRef]

- Milne, J.E. Environmental Taxes. In Elgar Encyclopedia of Environmental Law; Faure, M., Ed.; Edward Elgar Publishing: Cheltenham, UK, 2020; pp. 170–182. [Google Scholar]

- Aguilera, F.; Alcántara, V. De la Economía Ambiental a la Economía Ecológica; Icaria: Barcelona, Spain, 1994. [Google Scholar]

- Fanelli, J.M.; Jiménez, J.P.; López, I. La Reforma Fiscal Ambiental En América Latina; LC/W.683; CEPAL: Santiago, Chile, 2015. [Google Scholar]

- Barde, J.P. Reformas Tributarias Ambientales En Países de La Organización de Cooperación y Desarrollo Económicos (OCDE). In Política Fiscal y Medio Ambiente. Bases Para una Agenda Común; Acquatella, J., Bárcena, A., Eds.; Naciones Unidas: Santiago, Chile, 2005; pp. 65–88. [Google Scholar]

- Bosquet, B. Environmental Tax Reform: Does It Work? Ecol. Econ. 2000, 34, 19–32. [Google Scholar] [CrossRef]

- Ekins, P.; Speck, S. Environmental Tax Reform (ETR): A Policy for Green Growth; Illustrate; Ekins, P., Speck, S., Eds.; Oxford University Press: Oxford, UK, 2011. [Google Scholar]

- Gago, A.; Labandeira, X. Impuestos Ambientales y Reformas Fiscales Verdes En Perspectiva; 09/2010; Economics for Energy: Vigo, Spain, 2010. [Google Scholar]

- Banco Interamericano de Desarrollo (IBD); Cooperación Alemana (GIZ); Centro Interamericano de Administraciones Tributarias (CIAT). Modelo de Código Tributario del CIAT: Un Enfoque Basado En la Experiencia Iberoamericana; CIAT: Panama, Panama, 2015; p. 210. [Google Scholar]

- Doshi, T.K. Costs and Benefits of Market-Based Instruments in Accelerating Low-Carbon Energy Transition; Anbumozhi, V., Kalirajan, K., Kimura, F., Eds.; Springer: Singapore, 2018. [Google Scholar] [CrossRef]

- Andrew, J.; Kaidonis, M.A.; Andrew, B. Carbon Tax: Challenging Neoliberal Solutions to Climate Change. Crit. Perspect. Account. 2010, 21, 611–618. [Google Scholar] [CrossRef]

- Nordhaus, W.D. The Many Advantages of Carbon Taxes. Tax. Debate Clim. Policy Copenhagen. Growth 2009, 61, 64–70. [Google Scholar]

- Nordhaus, W.D. To Tax or Not to Tax: Alternative Approaches to Slowing Global WarmingNo Title. Rev. Environ. Econ. Policy 2007, 1, 26–44. [Google Scholar] [CrossRef]

- Pearse, R.; Böhm, S. Ten Reasons Why Carbon Markets Will Not Bring about Radical Emissions Reduction. Carbon Manag. 2014, 5, 325–337. [Google Scholar] [CrossRef]

- Coelho, R.S. The High Cost of Cost Efficiency: A Critique of Carbon Trading; Universidade de Coimbra: Coimbra, Portugal, 2015. [Google Scholar]

- Böhm, S.; Misoczky, M.C.; Moog, S. Greening Capitalism? A Marxist Critique of Carbon Markets. Organ. Stud. 2012, 33, 1617–1638. [Google Scholar] [CrossRef]

- Groothuis, F. Tax as a Force for Good Rebalancing Our Tax Systems to Support a Global Economy Fit for the Future; The Association of Chartered Certified Accountants: London, UK, 2018. [Google Scholar]

- Smith, R. An Ecosocialist Path to Limiting Global Temperature Rise to 1.5 °C. Real-World Econ. Rev. 2019, 149. [Google Scholar]

- Nordhaus, W.D. El Casino Del Clima. Por Qué No Tomar Medidas Contra El Cambio Climático Conlleva Riesgo y Genera Incertidumbre, 1st ed.; Deusto: Barcelona, Spain, 2019. [Google Scholar]

- OECD. OECD Economic Surveys: Mexico 2019; OECD Publishing: Paris, France, 2019. [Google Scholar] [CrossRef]

- Best, R.; Burke, P.J.; Jotzo, F. Carbon Pricing Efficacy: Cross-Country Evidence. Environ. Resour. Econ. 2020, 77, 69–94. [Google Scholar] [CrossRef]

- Jiménez, J.P.; Podestá, A. Inversión, Incentivos Fiscales y Gastos Tributarios En América Latina; CEPAL: Santiago, Chile, 2009. [Google Scholar]

- CEPAL; Oxfam Internacional. Los Incentivos Fiscales a Las Empresas En América Latina y El Caribe. In Comisión Económica Para América Latina y el Caribe/Oxfam Internacional; Naciones Unidadas y Oxfam: Santiago, Chile, 2019; pp. 1–81. [Google Scholar]

- Ashiabor, H. Tax Expenditures and Environmental Policy; Edward Elgar Publishing: Cheltenham, UK, 2020. [Google Scholar] [CrossRef]

- Peláez Longinotti, F. Los Gastos Tributarios En Los Países Miembros del CIAT; 2219-780X; DT-06-2019; CIAT: London, UK, 2019. [Google Scholar]

- Agostini, C.; Jorratt, M. Política Tributaria Para Mejorar La Inversión y El Crecimiento En América Latina. In Consensos y Confictos en la Política Tributaria de América Latina; Gómez Sabaini, J.C., Jiménez, P., Martner, R., Eds.; Naciones Unidas: Santiago, Chile, 2017; pp. 229–251. [Google Scholar]

- Surrey, S.S.; Mcdaniel, P.R. Tax Expenditures and Tax Reform. Vand. L. Rev. 1985, 38, 1397–1414. [Google Scholar]

- OECD. Tax Expenditures in OECD Countries; OECD Publishing: Paris, France, 2010. [Google Scholar] [CrossRef]

- López Pérez, S.J.; Vence, X. Estructura y Evolución de Ingresos Tributarios y Beneficios Fiscales En México. Análisis Del Periodo 1990–2019 y Evaluación de La Reforma Fiscal de 2014. Trimest. Econ. 2021, 88, 373–417. [Google Scholar] [CrossRef]

- CIAT-Interamerican Center of Tax Administration. CIAT Data Tax Revenues. Available online: https://www.ciat.org/base-de-datos-de-recaudacion-bid-ciat/ (accessed on 4 May 2020).

- CIAT-Interamerican Center of Tax Administration. CIAT Data Tax Expeditures. Available online: https://www.ciat.org/gastos-tributarios/ (accessed on 4 May 2020).

- Secretaria de Hacienda y Crédito Público (SHCP). Nota Metodológica. Recaudación Del IEPS a Combustibles Fósiles; Estadísticas Oportunas de Finanzas Pública: Mexico City, Mexico, 2018; p. 3. [Google Scholar]

- Secretaria de Hacienda y Crédito Público (SHCP); Servicios de Administración Tributaria (SAT). Datos abiertos del SAT. Available online: http://omawww.sat.gob.mx/cifras_sat/Paginas/datos/vinculo.html?page=IngresosTributarios.html (accessed on 20 April 2020).

- Zubillaga, J.M.A. La Utilización Extrafiscal de Los Tributos y Los Principios de Justicia Tributaria; Servicio Editorial de la Universidad del País Vasco: Bilbao, Spain, 2001. [Google Scholar]

- Villela, L.; Lemgrumber, A.; Jorrat, M. Gastos Tributarios; CEPAL: Santiago, Chile, 2012; Volume 20. [Google Scholar]

- Secretaria de Gobernación (SEGOB). DECRETO Que Establece Los Estímulos Fiscales Para El Fomento de La Actividad Preventiva de La Contaminación Ambiental; Diario Oficial de la Federación (DOF): Mexico City, Mexico, 1981; p. 5. [Google Scholar]

- López Pérez, S.J.; Vence, X. Structure and Evolution of Tax Revenues and Tax Benefits in Mexico. Analysis of the 1990–2019 Period and Evaluation of the 2014 Fiscal Reform. Trimest. Econ. 2021, 88, 373–417. [Google Scholar] [CrossRef]

- OECD. The Political Economy of Environmentally Related Taxes; OECD Publishing: Paris, France, 2006. [Google Scholar] [CrossRef]

- Hernández, F.; Antón, A. El Impuesto Sobre Las Gasolinas. Una Aplicación Para El Ecuador, El Salvador y México; Estudios de Cambio Climático en América Latina; LC/W5978; CEPAL: Santiago, Chile, 2014. [Google Scholar]

- Elizondo, A.; Pérez-Cirera, V.; Strapasson, A.; Fernández, J.C.; Cruz-Cano, D. Mexico’s Low Carbon Futures: An Integrated Assessment for Energy Planning and Climate Change Mitigation by 2050. Futures 2017, 93, 14–26. [Google Scholar] [CrossRef]

- OECD. Effective Carbon Rates 2018: Pricing Carbon Emissions through Taxes and Emissions Trading; OECD Publishing: Paris, France, 2018. [Google Scholar] [CrossRef]

- Gómez Sabaíni, J.C.; Jiménez, J.P.; Morán, D. El Impacto Fiscal de La Explotación de Los Recursos Naturales No Renovables. In Consensos y Confictos en la Política Tributaria de América Latina; Gómez Sabaíni, J.C., Jiménez, J.P., Morán, D., Eds.; Naciones Unidas: Santiago, Chile, 2017; pp. 393–413. [Google Scholar]

- Altomonte, H.; Sánchez, R.J. Hacia Una Nueva Gobernanza de Los Recursos Naturales En América Latina y El Caribe; Libros de; Naciones Unidas: Santiago, Chile, 2016. [Google Scholar]

- OECD; CIAT; IDB; ECLAC. Revenue Statistics in Latin America and the Caribbean; OECD Publishing: Paris, France, 2020. [Google Scholar] [CrossRef]

- Cámara de Diputados del Congreso de la Union. Ley Del Impuesto Especial Sobre Producción y Servicios (LIEPS); DOF 09-12-2019; Cámara de Diputados del Congreso de la Union: Mexico City, Mexico, 2019; p. 148.

- Secretaria de Gobernación (SEGOB). DECRETO por el que se Reforman, Adicionan y Derogan Diversas Disposiciones de la Ley del Impuesto Sobre la Renta, de la Ley del Impuesto Especial Sobre Producción y Servicios, del Código Fiscal de la Federación y de la Ley Federal de Presupuesto y Responsabilidad Hacendaria; Diario Oficial de la Federación (DOF): Mexico City, Mexico, 2015; p. 48, Reforma 42: Ley del Impuesto Especial sobre Producción y Servicios. DOF 18-11-2015 (diputados.gob.mx). [Google Scholar]

- Banco Mundial. DataBank. Crecimiento del PIB (% Annual)—México. Available online: https:/datos.bancomundial.org/indicator/NY.GDP.MKTP.KD.ZG?locations=MX (accessed on 11 October 2021).

- Galindo, L.M.; Beltrán, A.; Ferrer Carbonell, J.; Alatorre, J.E. Potential Effects of a Carbon Tax on Gross Domestic Product in Latin American Countries: Preliminary and Hypothetical Estimates from a Meta-Analysis and Benefit Transfer Function; S.17-00590; LC/TS.2017/58; CEPAL: Santiago, Chile, 2017. [Google Scholar]

- Alatorre, J.E.; Beltrán, A.; Ferrer, J.; Galindo, L.M. Reformas Fiscales Ambientales e Innovación y Difusión Tecnológicas En El Contexto de Las Contribuciones Determinadas (CDN): Una Visión Desde América Latina Gracias Por Su Interés En Esta Publicación de La CEPAL; S.18-00469; LC/TS.2018/78; CEPAL: Santiago, Chile, 2018. [Google Scholar]

- Stavins, R.N. The Future of U S Carbon-Pricing Policy. Environ. Energy Policy Econ. 2019, 1, 25912. [Google Scholar]

- Cámara de Diputados del Congreso de la Union. Ley General de Cambio Climático; Cámara de Diputados del Congreso de la Union: Mexico City, Mexico, 2014; pp. 1–45.

- Cámara de Diputados del Congreso de la Union. Ley General Del Equilibrio Ecológico y La Protección Al Ambiente; Cámara de Diputados del Congreso de la Union: Mexico City, Mexico, 2021; pp. 1–138.

- Nachmany, M.; Fankhauser, S.; Townshend, T.; Collins, M.; Matthews, A.; Pavese, C.; Rietig, K. The Globe Climate Legislation Study: A Review of Climate Change Legislation in 66 Countries; GLOBE International and Grantham Research Institute: London, UK, 2014. [Google Scholar]

- Stahel, W.R. Policy for Material Efficiency—Sustainable Taxation as a Departure from the Throwaway Society. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2013, 371, 20110567. [Google Scholar] [CrossRef] [PubMed]

- Rosas-Flores, J.A.; Bakhat, M.; Rosas Flores, D.; Zayasm, J.L. Distributional Effects of Subsidy Removal and Implementation of Carbon Taxes in Mexican Households. Energy Econ. 2017, 61, 21–28. [Google Scholar] [CrossRef]

- OECD; World Bank; United Nations Environment Programme. Financing Climate Futures Rethinking Infrastructure; OECD Publishing: Paris, France, 2018. [Google Scholar]

- Sterner, T. The Carbon Tax in Sweden. In Standing up for a Sustainable World; ElgarOnline: Cheltenham, UK, 2020; pp. 59–67. [Google Scholar] [CrossRef]

- Edenhofer, O.; Flachsland, C.; Kalkuhl, M.; Knopf, B.; Pahle, M. Options for a Carbon Pricing Reform; Mercator Research Institute on Global Commons and Climate Change (MCC): Berlin, Germany, 2019; pp. 1–9. [Google Scholar]

- Bogacheva, O.V.; Fokina, T.V. Tax Expenditures Management in OECD Countries; OECD Publishing: Paris, France, 2017; Volume 61. [Google Scholar] [CrossRef][Green Version]

- Klenert, D.; Schwerhoff, G.; Edenhoofer, O.; Mattauch, L. Environmental Taxation, Inequality and Engel’s Law: The Double Dividend of Redistribution. Environ. Resour. Econ. 2018, 71, 605–624. [Google Scholar] [CrossRef]

- Vence, X.; López Pérez, S.D.J. Taxation for a Circular Economy: New Instruments, Reforms, and Architectural Changes in the Fiscal System. Sustainability 2021, 13, 4581. [Google Scholar] [CrossRef]

| Periods/Environmental Taxes | (In Millions of Pesos) | (In % Total Tax Income of Country) | (In % of GDP) | GDP (% Annual Growth) | |||

|---|---|---|---|---|---|---|---|

| Pesticides | CO2 | Pesticides | CO2 | Pesticides | CO2 | ||

| 2014 | 358.61 | 9670.35 | 0.016 | 0.425 | 0.002 | 0.055 | 2.85 |

| 2015 | 606.93 | 7648.51 | 0.021 | 0.267 | 0.003 | 0.041 | 3.59 |

| 2016 | 647.24 | 6657.74 | 0.020 | 0.205 | 0.003 | 0.033 | 2.63 |

| 2017 | 705.24 | 5325.17 | 0.021 | 0.156 | 0.003 | 0.024 | 2.11 |

| 2018 | 775.06 | 5883.55 | 0.021 | 0.160 | 0.003 | 0.025 | 2.19 |

| 2019 | 687.00 | 5153.20 | 0.018 | 0.136 | 0.003 | 0.021 | −0.055 |

| Taxes | Revenues as % of GDP | Tax Expenditure as % GDP | Benefits as % of Total Revenues | Environmental Benefits as % of Revenue | Environmental Harmful Benefits as % of Revenue |

|---|---|---|---|---|---|

| Corporate Income Tax | 3.7 | 0.6 | 3.9 | 0.07 | 0.69 |

| Personal income tax | 3.4 | 0.9 | 5.8 | 0.0 | 0.0 |

| VAT | 3.7 | 1.5 | 9.5 | 0.0 | 0.35 |

| Special tax on production and services (IEPS) | 1.7 | 0.2 | 1.5 | 0.0 | 0.61 |

| Other | 3.1 | 0.0 | 0.0 | 0.0 | 0.0 |

| Total | 15.6 | 3.24 | 20.70 | 0.07 | 1.66 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

López Pérez, S.d.J.; Vence, X. When Harmful Tax Expenditure Prevails over Environmental Tax: An Assessment on the 2014 Mexican Fiscal Reform. Sustainability 2021, 13, 11269. https://doi.org/10.3390/su132011269

López Pérez SdJ, Vence X. When Harmful Tax Expenditure Prevails over Environmental Tax: An Assessment on the 2014 Mexican Fiscal Reform. Sustainability. 2021; 13(20):11269. https://doi.org/10.3390/su132011269

Chicago/Turabian StyleLópez Pérez, Sugey de Jesús, and Xavier Vence. 2021. "When Harmful Tax Expenditure Prevails over Environmental Tax: An Assessment on the 2014 Mexican Fiscal Reform" Sustainability 13, no. 20: 11269. https://doi.org/10.3390/su132011269

APA StyleLópez Pérez, S. d. J., & Vence, X. (2021). When Harmful Tax Expenditure Prevails over Environmental Tax: An Assessment on the 2014 Mexican Fiscal Reform. Sustainability, 13(20), 11269. https://doi.org/10.3390/su132011269