The Impact of Higher Education on Economic Growth in ASEAN-5 Countries

Abstract

1. Introduction

2. Literature Review

2.1. Human Capital, Education, and Higher Education: A Measurement Issue

2.2. Education and Economic Growth: Modeling Issue

3. Methodology

3.1. Kink Regression

3.2. Ridge Kink Regression Estimator

3.3. Testing for the Time Series Kink Effect

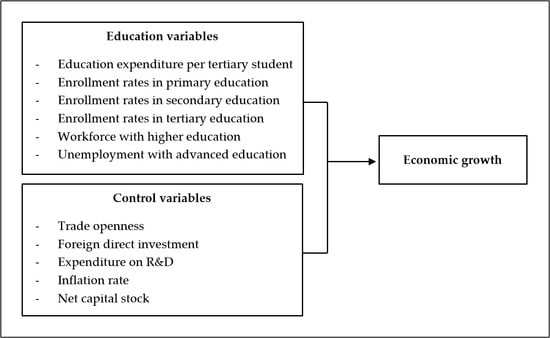

4. Data

5. Empirical Results and Discussion

5.1. Results of the Kink Effect Test

5.2. Main Results of Kink Ridge Kink Regression

5.3. Result at the ASEAN-5 Region Level

6. Conclusions

Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Statistic | lnGDP | lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | lnUNEM | lnWORK | lnOPEN | FDI | RD | INF | lnK |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Thailand | ||||||||||||

| Mean | 9.523 | 6.627 | 4.642 | 4.406 | 3.921 | 0.102 | 10.521 | 0.081 | 0.934 | −1.054 | 2.089 | 13.493 |

| Maximum | 9.803 | 7.355 | 4.663 | 4.484 | 4.135 | 0.475 | 10.582 | 0.196 | 1.480 | 0.098 | 5.469 | 13.984 |

| Minimum | 9.192 | 5.925 | 4.619 | 4.283 | 3.709 | −0.357 | 10.404 | −0.013 | −0.474 | −1.605 | −0.900 | 12.816 |

| Std. Dev. | 0.185 | 0.498 | 0.013 | 0.066 | 0.119 | 0.261 | 0.054 | 0.075 | 0.577 | 0.549 | 1.769 | 0.421 |

| ADF-Level | 0.985 | 0.984 | 0.112 | 0.999 | 0.813 | 0.865 | 0.898 | 0.101 | 0.307 | 0.912 | 0.277 | 0.999 |

| ADF-1st diff | 0.000 | 0.099 | 0.000 | 0.021 | 0.001 | 0.094 | 0.040 | 0.000 | 0.000 | 0.084 | 0.000 | 0.071 |

| Singapore | ||||||||||||

| Mean | 11.212 | 9.033 | 4.594 | 4.643 | 4.161 | 0.970 | 6.216 | 0.997 | 2.899 | 0.726 | 1.623 | 13.142 |

| Maximum | 11.490 | 9.139 | 4.624 | 4.683 | 4.494 | 1.423 | 6.735 | 1.239 | 3.364 | 0.954 | 6.628 | 13.747 |

| Minimum | 10.896 | 8.762 | 4.558 | 4.585 | 3.807 | 0.086 | 5.500 | 0.682 | 1.895 | 0.597 | −0.532 | 12.459 |

| Std. Dev. | 0.189 | 0.095 | 0.024 | 0.036 | 0.258 | 0.385 | 0.373 | 0.172 | 0.404 | 0.078 | 1.971 | 0.473 |

| ADF-Level | 0.999 | 0.639 | 0.893 | 0.977 | 0.999 | 0.941 | 0.999 | 0.303 | 0.903 | 0.690 | 0.109 | 0.990 |

| ADF-1st diff | 0.020 | 0.000 | 0.000 | 0.000 | 0.021 | 0.006 | 0.074 | 0.000 | 0.000 | 0.000 | 0.000 | 0.089 |

| Malaysia | ||||||||||||

| Mean | 9.923 | 7.155 | 4.613 | 4.388 | 3.536 | 1.038 | 7.860 | 0.411 | 0.943 | −0.135 | 2.240 | 12.978 |

| Maximum | 10.223 | 7.703 | 4.663 | 4.448 | 3.845 | 1.459 | 8.391 | 0.653 | 1.624 | 0.457 | 5.441 | 13.584 |

| Minimum | 9.659 | 6.731 | 4.571 | 4.332 | 3.219 | 0.337 | 7.232 | 0.175 | −2.870 | −0.757 | 0.583 | 12.212 |

| Std. Dev. | 0.178 | 0.260 | 0.031 | 0.042 | 0.201 | 0.419 | 0.372 | 0.153 | 1.030 | 0.398 | 1.196 | 0.506 |

| ADF-Level | 0.999 | 0.801 | 0.995 | 0.800 | 0.990 | 0.861 | 1.000 | 0.142 | 0.157 | 0.999 | 0.637 | 0.978 |

| ADF-1st diff | 0.094 | 0.000 | 0.015 | 0.002 | 0.006 | 0.000 | 0.100 | 0.008 | 0.000 | 0.009 | 0.000 | 0.100 |

| Indonesia | ||||||||||||

| Mean | 9.039 | 6.341 | 4.679 | 4.312 | 3.202 | 2.065 | 9.161 | −0.903 | 0.325 | −2.180 | 3.925 | 14.327 |

| Maximum | 9.339 | 6.772 | 4.700 | 4.488 | 3.596 | 2.653 | 9.681 | −0.655 | 1.070 | −0.355 | 8.200 | 14.914 |

| Minimum | 8.699 | 5.753 | 4.660 | 4.046 | 2.695 | 1.435 | 8.491 | −1.202 | −2.602 | −2.996 | 0.700 | 13.057 |

| Std. Dev. | 0.199 | 0.328 | 0.014 | 0.145 | 0.315 | 0.392 | 0.365 | 0.152 | 0.928 | 0.730 | 1.905 | 0.615 |

| ADF-Level | 0.999 | 0.987 | 0.498 | 0.999 | 0.999 | 0.186 | 0.925 | 0.951 | 0.126 | 0.123 | 0.170 | 0.981 |

| ADF-1st diff | 0.075 | 0.003 | 0.000 | 0.003 | 0.016 | 0.000 | 0.015 | 0.000 | 0.000 | 0.000 | 0.000 | 0.098 |

| Philippines | ||||||||||||

| Mean | 8.677 | 5.296 | 4.686 | 4.421 | 3.426 | 2.335 | 9.213 | −0.518 | 0.356 | −1.982 | 3.908 | 12.905 |

| Maximum | 9.050 | 5.844 | 4.728 | 4.483 | 3.573 | 2.708 | 9.267 | −0.124 | 1.185 | −1.492 | 8.260 | 13.332 |

| Minimum | 8.402 | 4.904 | 4.644 | 4.291 | 3.315 | 1.988 | 9.155 | −0.869 | −0.623 | −2.207 | 0.674 | 12.295 |

| Std. Dev. | 0.205 | 0.310 | 0.024 | 0.052 | 0.087 | 0.208 | 0.037 | 0.301 | 0.554 | 0.232 | 1.824 | 0.403 |

| ADF-Level | 0.845 | 0.918 | 0.680 | 0.987 | 0.925 | 0.230 | 0.613 | 0.815 | 0.528 | 0.976 | 0.272 | 0.980 |

| ADF-1st diff | 0.054 | 0.000 | 0.023 | 0.012 | 0.000 | 0.006 | 0.000 | 0.007 | 0.000 | 0.002 | 0.000 | 0.008 |

| Statistic | lnGDP | lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | lnUNEM | lnWORK | lnOPEN | lnFDI | lnRD | INF | lnK |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 9.695 | 6.908 | 4.642 | 4.438 | 3.664 | 1.277 | 8.576 | 0.043 | 1.117 | −0.884 | 2.719 | 13.338 |

| Median | 9.578 | 6.790 | 4.647 | 4.432 | 3.604 | 1.308 | 9.146 | 0.098 | 1.055 | −0.968 | 2.591 | 13.315 |

| Maximum | 11.490 | 9.139 | 4.728 | 4.683 | 4.494 | 2.708 | 10.582 | 1.239 | 3.364 | 0.954 | 8.260 | 14.914 |

| Minimum | 8.402 | 4.904 | 4.558 | 4.046 | 2.695 | −0.357 | 5.500 | −1.202 | −2.870 | −2.996 | −0.900 | 12.212 |

| Std. Dev. | 0.908 | 1.293 | 0.042 | 0.134 | 0.400 | 0.880 | 1.511 | 0.689 | 1.191 | 1.184 | 1.964 | 0.690 |

| Skewness | 0.609 | 0.441 | −0.177 | −0.089 | 0.040 | −0.070 | −0.411 | −0.040 | −0.256 | 0.039 | 0.534 | 0.520 |

| Kurtosis | 2.276 | 2.212 | 2.190 | 3.508 | 2.783 | 1.815 | 2.074 | 1.918 | 4.150 | 1.645 | 2.997 | 2.834 |

| LLC-Level | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) |

| Variable | lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | lnUNEM | lnWORK | lnOPEN | lnFDI | lnRD | INF | lnK |

|---|---|---|---|---|---|---|---|---|---|---|---|

| lnEXPSTU | 1.000 | ||||||||||

| lnPrimary | −0.820 | 1.000 | |||||||||

| lnSecondary | 0.911 | −0.861 | 1.000 | ||||||||

| lnTertiary | −0.048 | −0.023 | 0.166 | 1.000 | |||||||

| lnUNEM | 0.925 | −0.939 | 0.918 | −0.032 | 1.000 | ||||||

| lnWORK | 0.845 | −0.714 | 0.943 | 0.219 | 0.781 | 1.000 | |||||

| lnOPEN | −0.078 | 0.134 | 0.113 | 0.291 | −0.159 | 0.264 | 1.000 | ||||

| lnFDI | −0.601 | 0.458 | −0.462 | 0.211 | −0.600 | −0.373 | 0.227 | 1.000 | |||

| lnRD | 0.758 | −0.845 | 0.647 | −0.229 | 0.860 | 0.447 | −0.431 | −0.487 | 1.000 | ||

| lnINF | −0.289 | 0.283 | −0.110 | 0.401 | −0.348 | −0.011 | 0.843 | 0.401 | −0.447 | 1.000 | |

| lnK | 0.956 | −0.817 | 0.974 | 0.080 | 0.900 | 0.950 | 0.121 | −0.493 | 0.647 | −0.111 | 1.000 |

| Variable | lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | lnUNEM | lnWORK | lnOPEN | lnFDI | lnRD | INF | lnK |

|---|---|---|---|---|---|---|---|---|---|---|---|

| lnEXPSTU | 1.000 | ||||||||||

| lnPrimary | 0.215 | 1.000 | |||||||||

| lnSecondary | 0.187 | 0.966 | 1.000 | ||||||||

| lnTertiary | 0.106 | 0.933 | 0.981 | 1.000 | |||||||

| lnUNEM | 0.176 | 0.621 | 0.668 | 0.678 | 1.000 | ||||||

| lnWORK | 0.131 | 0.876 | 0.949 | 0.967 | 0.796 | 1.000 | |||||

| lnOPEN | 0.523 | −0.507 | −0.617 | −0.663 | −0.313 | −0.618 | 1.000 | ||||

| lnFDI | 0.119 | 0.409 | 0.501 | 0.462 | 0.373 | 0.466 | −0.352 | 1.000 | |||

| lnRD | 0.224 | −0.126 | −0.085 | −0.044 | 0.332 | 0.056 | 0.362 | −0.297 | 1.000 | ||

| INF | 0.454 | 0.256 | 0.112 | 0.067 | 0.101 | 0.059 | 0.446 | −0.258 | 0.339 | 1.000 | |

| lnK | 0.121 | 0.920 | 0.968 | 0.988 | 0.741 | 0.979 | −0.635 | 0.421 | 0.033 | 0.140 | 1.000 |

| Variable | lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | lnUNEM | lnWORK | lnOPEN | lnFDI | lnRD | INF | lnK |

|---|---|---|---|---|---|---|---|---|---|---|---|

| lnEXPSTU | 1.000 | ||||||||||

| lnPrimary | 0.393 | 1.000 | |||||||||

| lnSecondary | 0.073 | 0.719 | 1.000 | ||||||||

| lnTertiary | 0.535 | 0.859 | 0.591 | 1.000 | |||||||

| lnUNEM | 0.687 | 0.749 | 0.331 | 0.868 | 1.000 | ||||||

| lnWORK | 0.568 | 0.889 | 0.568 | 0.975 | 0.911 | 1.000 | |||||

| lnOPEN | −0.654 | −0.806 | −0.444 | −0.955 | −0.897 | −0.947 | 1.000 | ||||

| lnFDI | 0.017 | 0.075 | 0.117 | 0.082 | 0.162 | 0.102 | 0.027 | 1.000 | |||

| lnRD | 0.487 | 0.896 | 0.536 | 0.966 | 0.862 | 0.973 | −0.947 | 0.010 | 1.000 | ||

| INF | 0.005 | 0.057 | 0.063 | 0.065 | 0.337 | 0.144 | −0.057 | 0.371 | 0.054 | 1.000 | |

| lnK | 0.678 | 0.859 | 0.466 | 0.932 | 0.959 | 0.974 | −0.939 | 0.142 | 0.931 | 0.181 | 1.000 |

| Variable | lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | lnUNEM | lnWORK | lnOPEN | lnFDI | lnRD | INF | lnK |

|---|---|---|---|---|---|---|---|---|---|---|---|

| lnEXPSTU | 1.000 | ||||||||||

| lnPrimary | −0.505 | 1.000 | |||||||||

| lnSecondary | 0.963 | −0.627 | 1.000 | ||||||||

| lnTertiary | 0.947 | −0.696 | 0.976 | 1.000 | |||||||

| lnUNEM | −0.822 | 0.719 | −0.824 | −0.900 | 1.000 | ||||||

| lnWORK | 0.792 | −0.604 | 0.837 | 0.860 | −0.687 | 1.000 | |||||

| lnOPEN | −0.724 | 0.599 | −0.807 | −0.808 | 0.704 | −0.787 | 1.000 | ||||

| lnFDI | 0.674 | −0.414 | 0.676 | 0.612 | −0.452 | 0.432 | −0.442 | 1.000 | |||

| lnRD | 0.211 | −0.372 | 0.304 | 0.304 | −0.136 | 0.196 | −0.077 | 0.213 | 1.000 | ||

| INF | −0.433 | 0.208 | −0.458 | −0.445 | 0.449 | −0.493 | 0.746 | −0.170 | 0.305 | 1.000 | |

| lnK | 0.977 | −0.608 | 0.985 | 0.959 | −0.816 | 0.777 | −0.757 | 0.729 | 0.312 | −0.380 | 1.000 |

| Variable | lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | lnUNEM | lnWORK | lnOPEN | lnFDI | lnRD | INF | lnK |

|---|---|---|---|---|---|---|---|---|---|---|---|

| lnEXPSTU | 1.000 | ||||||||||

| lnPrimary | 0.628 | 1.000 | |||||||||

| lnSecondary | 0.758 | 0.343 | 1.000 | ||||||||

| lnTertiary | 0.809 | 0.692 | 0.561 | 1.000 | |||||||

| lnUNEM | −0.803 | −0.405 | −0.445 | −0.733 | 1.000 | ||||||

| lnWORK | 0.037 | 0.024 | 0.032 | −0.053 | −0.249 | 1.000 | |||||

| lnOPEN | −0.878 | −0.601 | −0.782 | −0.669 | 0.764 | −0.123 | 1.000 | ||||

| lnFDI | 0.400 | 0.018 | 0.239 | 0.548 | −0.599 | 0.180 | −0.192 | 1.000 | |||

| lnRD | 0.610 | 0.310 | 0.403 | 0.829 | −0.639 | −0.091 | −0.351 | 0.788 | 1.000 | ||

| INF | −0.363 | −0.525 | −0.308 | −0.438 | 0.294 | 0.121 | 0.333 | −0.293 | −0.351 | 1.000 | |

| lnK | 0.904 | 0.461 | 0.843 | 0.719 | −0.818 | 0.144 | −0.955 | 0.357 | 0.482 | −0.277 | 1.000 |

| Variable | lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | lnUNEM | lnWORK | lnOPEN | lnFDI | lnRD | INF | lnK |

|---|---|---|---|---|---|---|---|---|---|---|---|

| lnEXPSTU | 1.000 | ||||||||||

| lnPrimary | −0.944 | 1.000 | |||||||||

| lnSecondary | 0.935 | −0.888 | 1.000 | ||||||||

| lnTertiary | −0.261 | 0.242 | −0.073 | 1.000 | |||||||

| lnUNEM | 0.474 | −0.379 | 0.643 | −0.016 | 1.000 | ||||||

| lnWORK | −0.812 | 0.876 | −0.649 | 0.290 | 0.078 | 1.000 | |||||

| lnOPEN | 0.792 | −0.842 | 0.672 | −0.204 | −0.089 | −0.966 | 1.000 | ||||

| lnFDI | 0.717 | −0.814 | 0.568 | −0.225 | −0.196 | −0.966 | 0.944 | 1.000 | |||

| lnRD | 0.928 | −0.963 | 0.822 | −0.355 | 0.384 | −0.856 | 0.782 | 0.781 | 1.000 | ||

| INF | −0.292 | 0.272 | −0.189 | 0.425 | −0.334 | 0.160 | 0.052 | −0.062 | −0.361 | 1.000 | |

| lnK | −0.083 | 0.251 | 0.158 | 0.234 | 0.742 | 0.637 | −0.568 | −0.686 | −0.274 | 0.012 | 1.000 |

References

- Volchik, V.; Oganesyan, A.; Olejarz, T. Higher Education as a Factor of Socio-Economic Performance and Development. J. Int. Stud. 2018, 11, 326–340. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Holland, D.; Liadze, I.; Rienzo, C.; Wilkinson, D. The Relationship between Graduates and Economic Growth across Countries; BIS Research Paper 110; Department for Business Innovation & Skills: London, UK, 2013. [Google Scholar]

- Gyimah-Brempong, K.; Paddison, O.; Mitiku, W. Higher Education and Economic Growth in Africa. J. Dev. Stud. 2006, 42, 509–529. [Google Scholar] [CrossRef]

- Holmes, C. Has the Expansion of Higher Education Led to Greater Economic Growth? Natl. Inst. Econ. Rev. 2013, 224, R29–R47. [Google Scholar] [CrossRef]

- Valero, A.; Van Reenen, J. The Economic Impact of Universities: Evidence from across the Globe. Econ. Educ. Rev. 2019, 68, 53–67. [Google Scholar] [CrossRef]

- Szarowská, I. Does Public R&D Expenditure Matter for Economic Growth? J. Int. Stud. 2017, 10, 90–103. [Google Scholar]

- Carrillo, M. Measuring and Ranking R&D Performance at the Country Level. Econ. Sociol. 2019, 12, 100–114. [Google Scholar]

- Keller, K.R. Investment in Primary, Secondary, and Higher Education and the Effects on Economic Growth. Contemp. Econ. Policy 2006, 24, 18–34. [Google Scholar] [CrossRef]

- Bilan, Y.; Mishchuk, H.; Roshchyk, I.; Kmecova, I. An Analysis of Intellecutal Potential and its Impact on the Social and Economic Development of European Countries. J. Compet. 2020, 12, 22. [Google Scholar] [CrossRef]

- Ganegodage, K.R.; Rambaldi, A.N. The Impact of Education Investment on Sri Lankan Economic Growth. Econ. Educ. Rev. 2011, 30, 1491–1502. [Google Scholar] [CrossRef]

- Mercan, M.; Sezer, S. The Effect of Education Expenditure on Economic Growth: The Case of Turkey. Procedia Soc. Behav. Sci. 2014, 109, 925–930. [Google Scholar] [CrossRef]

- Jin, L.; Jin, J.C. Internet Education and Economic Growth: Evidence from Cross-Country Regressions. Economies 2014, 2, 78–94. [Google Scholar] [CrossRef]

- Liao, L.; Du, M.; Wang, B.; Yu, Y. The Impact of Educational Investment on Sustainable Economic Growth in Guangdong, China: A Cointegration and Causality Analysis. Sustainability 2019, 11, 766. [Google Scholar] [CrossRef]

- Maneejuk, P.; Yamaka, W.; Sriboonchitta, S. Does the Kuznets Curve Exist in Thailand? A Two Decades’ Perspective (1993–2015). Ann. Oper. Res. 2019, 1–32. [Google Scholar] [CrossRef]

- Schultz, T.W. Investment in Human Capital. Am. Econ. Rev. 1961, 51, 1–17. [Google Scholar]

- Mincer, J. Schooling, Experience, and Earnings; Columbia University Press: New York, NY, USA, 1974. [Google Scholar]

- Solow, R.M. Technical Change and the Aggregate Production Function. Rev. Econ. Stat. 1957, 39, 312–320. [Google Scholar] [CrossRef]

- Lucas, R.E., Jr. On the Mechanics of Economic Development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Romer, P. Endogenous Technological Change. J. Political Econ. 1990, 99, S71–S102. [Google Scholar] [CrossRef]

- Mankiw, N.G.; Romer, D.; Weil, D.N. A Contribution to the Empirics of Economic Growth. Q. J. Econ. 1992, 107, 407–437. [Google Scholar] [CrossRef]

- Barro, R.J. Economic Growth in a Cross Section of Countries. Q. J. Econ. 1991, 106, 407–443. [Google Scholar] [CrossRef]

- Habibi, F.; Zabardast, M.A. Digitalization, Education and Economic Growth: A Comparative Analysis of Middle East and OECD Countries. Technol. Soc. 2020, 63, 101370. [Google Scholar] [CrossRef]

- Saviotti, P.P.; Pyka, A.; Jun, B. Education, Structural Change and Economic Development. Struct. Chang. Econ. Dyn. 2016, 38, 55–68. [Google Scholar] [CrossRef]

- Hanushek, E.A.; Woessmann, L. How Much Do Educational Outcomes Matter in OECD Countries? Econ. Policy 2011, 26, 427–491. [Google Scholar] [CrossRef]

- Cohen, D.; Soto, M. Growth and Human Capital: Good Data, Good Results. J. Econ. Growth 2007, 12, 51–76. [Google Scholar] [CrossRef]

- Barro, R.J.; Lee, J.W. A New Data Set of Educational Attainment in the World, 1950–2010. J. Dev. Econ. 2013, 104, 184–198. [Google Scholar] [CrossRef]

- Wobst, P.H.S.A. The Impact of Increased School Enrollment on Economic Growth in Tanzania. Afr. Dev. Rev. 2005, 17, 274–301. [Google Scholar] [CrossRef]

- Lin, T.C. Education, Technical Progress, and Economic Growth: The Case of Taiwan. Econ. Educ. Rev. 2003, 22, 213–220. [Google Scholar] [CrossRef]

- Lin, T.C. The Role of Higher Education in Economic Development: An Empirical Study of Taiwan Case. J. Asian Econ. 2004, 15, 355–371. [Google Scholar] [CrossRef]

- Achim, M.V. The New Economy-Asking for New Education Approaches. Evidence for Romania and Other Post-communist European Countries. Procedia Econ. Finance 2015, 32, 1199–1208. [Google Scholar] [CrossRef]

- Zhu, X. The Effect of Education on Economic Growth—An Empirical Research Based on the EBA Model. J. Interdiscip. Math. 2014, 17, 67–79. [Google Scholar] [CrossRef]

- Abu, B.N.; Haseeb, M.; Azam, M. The Nexus between Education and Economic Growth in Malaysia: Cointegration and Toda-Yamamoto Causality Approach. Actual Probl. Econ. 2014, 162, 131–141. [Google Scholar]

- Sylwester, K. Income inequality, education expenditures, and growth. J. Dev. Econ. 2000, 63, 379–398. [Google Scholar] [CrossRef]

- Krueger, A.B.; Lindahl, M. Education for Growth: Why and for Whom? J. Econ. Lit. 2001, 39, 1101–1136. [Google Scholar] [CrossRef]

- Jalil, A.; Idrees, M. Modeling the Impact of Education on the Economic Growth: Evidence from Aggregated and Disaggregated Time Series Data of Pakistan. Econ. Model. 2013, 31, 383–388. [Google Scholar] [CrossRef]

- Marquez-Ramos, L.; Mourelle, E. Education and Economic Growth: An Empirical Analysis of Nonlinearities. Appl. Econ. Anal. 2019, 27, 21–45. [Google Scholar] [CrossRef]

- Hansen, B.E. Regression Kink with an Unknown Threshold. J. Bus. Econ. Stat. 2017, 35, 228–240. [Google Scholar] [CrossRef]

- Pipitpojanakarn, V.; Maneejuk, P.; Yamaka, W.; Sriboonchitta, S. Expectile and Quantile Kink Regressions with Unknown Threshold. Adv. Sci. Lett. 2017, 23, 10743–10747. [Google Scholar] [CrossRef]

- Maneejuk, N.; Ratchakom, S.; Maneejuk, P.; Yamaka, W. Does the Environmental Kuznets Curve Exist? An International Study. Sustainability 2020, 12, 9117. [Google Scholar] [CrossRef]

- Chen, Z.; Wu, Y. The Relationship between Education and Employment: A Theoretical Analysis and Empirical Test. Front. Econ. China 2007, 2, 187–211. [Google Scholar] [CrossRef]

- Abdullah, A.J. Education and Economic Growth in Malaysia: The Issues of Education Data. Procedia Econ. Finance 2013, 7, 65–72. [Google Scholar] [CrossRef]

- Birchler, K.; Michaelowa, K. Making Aid Work for Education in Developing Countries: An Analysis of Aid Effectiveness for Primary Education Coverage and Quality. Int. J. Educ. Dev. 2016, 48, 37–52. [Google Scholar] [CrossRef]

- Mason, R.; Brown, W.G. Multicollinearity Problems and Ridge Regression in Sociological Models. Soc. Sci. Res. 1975, 4, 135–149. [Google Scholar] [CrossRef]

- Hoerl, A.E.; Kennard, R.W. Ridge Regression: Biased Estimation for Nonorthogonal Problems. Technometrics 1970, 12, 55–67. [Google Scholar] [CrossRef]

- Weissfeld, L.A.; Sereika, S.M. A Multicollinearity Diagnostic for Generalized Linear Models. Commun. Stat. Theory Methods 1991, 20, 1183–1198. [Google Scholar] [CrossRef]

- Perez Melo, S.; Kibria, B.M. On Some Test Statistics for Testing the Regression Coefficients in Presence of Multicollinearity: A Simulation Study. Stats 2020, 3, 40–55. [Google Scholar] [CrossRef]

- Zhang, J.; Cheng, L. Threshold Effect of Tourism Development on Economic Growth Following a Disaster Shock: Evidence from the Wenchuan Earthquake, PR China. Sustainability 2019, 11, 371. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W. Co-integration and Error Correction: Representation, Estimation, and Testing. Econom. J. Econom. Soc. 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Radu, M. The Impact of Political Determinants on Economic Growth in CEE Countries. Procedia Soc. Behav. Sci. 2015, 197, 1990–1996. [Google Scholar] [CrossRef]

- Abbas, Q.; Nasir, Z.M. Endogenous Growth and Human Capital: A Comparative Study of Pakistan and Sri Lanka. Pak. Dev. Rev. 2001, 40, 987–1007. [Google Scholar] [CrossRef]

- Pritchett, L. Where Has All the Education Gone? World Bank Econ. Rev. 2001, 15, 367–391. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. Growth and Unemployment. Rev. Econ. Stud. 1994, 61, 477–494. [Google Scholar] [CrossRef]

- Aghion, P.; Akcigit, U.; Deaton, A.; Roulet, A. Creative Destruction and Subjective Well-Being. Am. Econ. Rev. 2016, 106, 3869–3897. [Google Scholar] [CrossRef] [PubMed]

- Fanati, L.; Manfredi, P. Population, Unemployment and Economic Growth Cycles: A Further Explanatory Perspective. Metroeconomica 2003, 54, 179–207. [Google Scholar] [CrossRef]

- Vo, D.H.; Ho, C.M. Does Financial Integration Enhance Economic Growth in China? Economies 2020, 8, 65. [Google Scholar] [CrossRef]

- Belloumi, M.; Alshehry, A.S. The Impact of International Trade on Sustainable Development in Saudi Arabia. Sustainability 2020, 12, 5421. [Google Scholar] [CrossRef]

- Wang, Q. Fixed-Effect Panel Threshold Model Using Stata. Stata J. Promot. Commun. Stat. Stata 2015, 15, 121–134. [Google Scholar] [CrossRef]

- Miao, K.; Li, K.; Su, L. Panel Threshold Models with Interactive Fixed Effects. J. Econ. 2020, 219, 137–170. [Google Scholar] [CrossRef]

| Variable | Variable | Description | Source |

|---|---|---|---|

| Dependent variable | GDP | Real GDP per capita | CEIC |

| Education variable | EXPSTU | Education expenditure per student refers to the average annual goverment expenditure per student in the tertiary level. It is calculated by dividing the total government expenditure on tertiary education by the number of students at the tertiry level (unit: US dollar) | National Statistical Office of Thailand; Department of statistics Singapore; Department of statistics Malaysia; Philippines Statistics Authority; the Central Bureau of Statistics, Indonesia; and International Labour Organization |

| Primary Secondary Tertiary | Primary, Secondary, and Tertiary stand for the enrollment rate of primary, secondary, and tertiary levels, respectively. The enrollment rate is measured by the ratio of total enrollment to the population having the age officially corresponds to the level of education (unit: % gross). | ||

| WORK | Workforce with education refers to the working-age population with a higher level of education (or university degree) who are in the labor force, that is, the number of a highly educated workforce (unit: thousand persons). | ||

| UNEM | Unemployment with higher education refers to the labor force with an advanced level of education who are unemployed. Advanced education consists of bachelor’s degree, master’s degree, and doctoral degree (unit: % of total unemployment). | World Bank | |

| Control variable | OPEN | Trade openness measures how much a country is engaged in the world trade. It is measured by the ratio of the sum of exports and imports to GDP (unit: times of GDP). | |

| FDI | Foreign direct investment (unit: % of GDP). | ||

| RD | Research and Development expenditure refers to gross domestic expenditure on research and development of, for example, business, non-profit organization, government, and education sector (unit: % of GDP). | CEIC | |

| INF | Inflation rate (unit: %). | ||

| K | Capital stock refers to the net capital stock, the market value of total fixed assets in the economy, reflecting the country’s overall wealth (unit: thousand US dollars). |

| Country | lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | lnUNEM | lnWORK |

|---|---|---|---|---|---|---|

| Thailand | 1.783 (0.491) | 8.540 (0.031) | 9.368 (0.021) | 19.496 (0.000) | 13.253 (0.000) | 7.2680 (0.110) |

| Singapore | 4.402 (0.766) | 0.825 (0.994) | 1.614 (0.584) | 12.886 (0.000) | 8.623 (0.021) | 1.012 (0.854) |

| Malaysia | 10.043 (0.541) | 10.354 (0.515) | 6.578 (0.744) | 6.610 (0.761) | 15.702 (0.051) | 2.886 (1.000) |

| Indonesia | 10.517 (0.261) | 5.861 (0.755) | 22.497 (0.021) | 27.494 (0.000) | 26.964 (0.000) | 5.548 (0.767) |

| Philippines | 0.942 (0.961) | 3.664 (0.641) | 12.139 (0.023) | 5.709 (0.343) | 15.348 (0.000) | 6.333 (0.294) |

| lnOPEN | lnFDI | lnRD | INF | lnK | ||

| Thailand | 1.598 (0.231) | 0.144 (0.911) | 6.423 (0.051) | 1.378 (0.522) | 21.033 (0.000) | |

| Singapore | 0.912 (0.999) | 0.386 (1.000) | 0.511 (1.000) | 0.645 (1.000) | 1.458 (0.601) | |

| Malaysia | 4.027 (0.866)) | 6.397 (0.735) | 9.949 (0.573) | 7.587 (0.675) | 12.511 (0.361) | |

| Indonesia | 3.762 (0.843) | 7.221 (0.643) | 10.588 (0.253) | 6.492 (0.658) | 29.739 (0.000) | |

| Philippines | 7.679 (0.197) | 8.020 (0.140) | 7.261 (0.211) | 4.133 (0.487) | 19.379 (0.000) |

| Variable | Thailand | Singapore | Malaysia | Indonesia | Philippines |

|---|---|---|---|---|---|

| Estimate | |||||

| intercept | 1.872 *** (0.125) | 4.713 *** (1.202) | 3.451 *** (1.311) | 10.370 *** (2.112) | 8.544 *** (2.184) |

| lnEXPSTU | 0.150 *** (0.036) | 0.059 (0.042) | 0.090 *** (0.026) | 0.033 (0.057) | 0.107 ** (0.044) |

| lnPrimary | −0.023 (0.035) | 0.065 (0.052) | 0.129 *** (0.035) | −0.061 (0.045) | −0.091 *** (0.031) |

| lnSecondary | 0.179 *** (0.042) | 0.078 ** (0.038) | 0.029 (0.026) | 0.280 *** (0.064) | 0.179 *** (0.036) |

| lnTertiary | 0.036 * (0.019) | 0.115 ** (0.047) | 0.079 ** (0.034) | 0.175 *** (0.059) | 0.091 ** (0.042) |

| lnUNEM | 0.191 *** (0.039) | −0.039 (0.049) | 0.179 *** (0.028) | −0.102 (0.064) | −0.2007 *** (0.034) |

| lnWORK | 0.180 *** (0.035) | 0.246 *** (0.052) | 0.078 ** (0.035) | 0.088 * (0.049) | −0.006 (0.023) |

| lnOPEN | −0.060 *** (0.022) | −0.013 (0.057) | −0.043 (0.036) | −0.101 (0.068) | −0.024 (0.415) |

| lnFDI | 0.027 (0.018) | 0.103 ** (0.040) | 0.014 (0.021) | 0.011 (0.042) | 0.024 (0.031) |

| lnRD | 0.090 ** (0.038) | 0.032 (0.039) | 0.134 *** (0.032) | 0.051 (0.041) | 0.218 *** (0.036) |

| INF | 0.036 (0.030) | 0.010 (0.039) | 0.003 (0.023) | 0.059 (0.046) | 0.003 (0.026) |

| lnK | 0.181 *** (0.039) | 0.157 *** (0.042) | 0.112 *** (0.022) | 0.139 *** (0.047) | 0.158 *** (0.030) |

| EBIC | −91.141 | −109.957 | −126.293 | −114.201 | −123.421 |

| 0.9874 | 0.9352 | 0.9665 | 0.9514 | 0.9689 | |

| McKinnon ADF test | 0.0211 | 0.0000 | 0.0001 | 0.0031 | 0.0000 |

| Thailand | Singapore | Malaysia | Indonesia | Philippines | |||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | Estimate | Variable | Estimate | Variable | Estimate | Variable | Estimate | Variable | Estimate |

| intercept | 4.929 *** (1.166) | intercept | 6.148 *** (2.255) | intercept | 3.581 *** (1.010) | intercept | 12.725 *** (1.194) | intercept | 12.694 *** (2.113) |

| lnEXPSTU | 0.174 *** (0.022) | lnEXPSTU | −0.057 (0.031) | lnEXPSTU | 0.092 *** (0.026) | lnEXPSTU | 0.041 (0.046) | lnEXPSTU | 0.100 *** (0.024) |

| −0.015 (0.026) | lnPrimary | 0.061 * (0.033) | lnPrimary | 0.127 *** (0.031) | lnPrimary | −0.055 (0.033) | lnPrimary | −0.079 *** (0.016) | |

| −0.020 (0.023) | lnSecondary | 0.071 *** (0.023) | lnSecondary | 0.034 (0.026) | 0.171 *** (0.043) | 0.093 *** (0.017) | |||

| 0.097 *** (0.022) | −0.019 (0.037) | lnTertiary | 0.079 ** (0.031) | 0.188 *** (0.045) | 0.061 *** (0.023) | ||||

| 0.081 *** (0.026) | 0.160 *** (0.033) | 0.061 *** (0.029) | 0.003 *** (0.001) | lnTertiary | 0.079 *** (0.021) | ||||

| 0.001 (0.024) | −0.126 *** (0.033) | −0.058 ** (0.025) | 0.171 *** (0.042) | −0.201 *** (0.022) | |||||

| 0.044 ** (0.022) | −0.016 (0.028) | lnWORK | 0.167 *** (0.023) | −0.024 (0.050) | −0.055 (0.015) | ||||

| 0.077 *** (0.023) | lnWORK | 0.156 *** (0.026) | lnOPEN | −0.044 (0.034) | −0.018 (0.018) | lnWORK | 0.017 (0.017) | ||

| −0.095 *** (0.022) | lnOPEN | −0.024 (0.033) | lnFDI | 0.015 (0.019) | lnWORK | 0.042 (0.048) | lnOPEN | −0.052 * (0.020) | |

| lnWORK | 0.098 *** (0.015) | lnFDI | 0.093 *** (0.029) | lnRD | 0.130 *** (0.029) | lnOPEN | −0.094 * (0.054) | lnFDI | 0.002 (0.021) |

| lnOPEN | −0.054 ** (0.024) | lnRD | 0.029 (0.027) | INF | 0.002 (0.021) | lnFDI | 0.006 (0.035) | lnRD | 0.127 *** (0.018) |

| lnFDI | 0.026 * (0.015) | INF | 0.048 * (0.028) | lnK | 0.103 *** (0.019) | lnRD | 0.041 (0.036) | INF | 0.011 (0.018) |

| 0.003 (0.028) | lnK | 0.133 *** (0.023) | INF | 0.067 * (0.039) | 0.125 *** (0.012) | ||||

| 0.065 ** (0.026) | 0.150 *** (0.033) | 0.109 *** (0.014) | |||||||

| INF | 0.037 (0.024) | 0.087 * (0.045) | |||||||

| 0.131 *** (0.018) | |||||||||

| 0.106 ** (0.026) | |||||||||

| EBIC | −132.882 | −115.463 | −132.551 | −122.991 | 132.229 | ||||

| 0.9952 | 0.9878 | 0.9987 | 0.9854 | 0.9913 | |||||

| McKinnon ADF test | [0.0015] | [0.0000] | [0.0020] | [0.0051] | [0.0000] | ||||

| lnEXPSTU | lnPrimary | lnSecondary | lnTertiary | UNEM | lnWORK | |

|---|---|---|---|---|---|---|

| ASEAN-5 | 6.380 (0.091) | 4.612 (0.231) | 8.263 (0.000) | 6.131 (0.055) | 14.181 (0.000) | 3.421 (0.544) |

| lnOPEN | lnFDI | lnRD | INF | lnK | ||

| ASEAN-5 | 12.980 (0.000) | 12.988 (0.000) | 7.340 (0.000) | 5.327 (0.451) | 4.597 (0.511) |

| Panel Kink Regression | Panel Linear Regression | ||||||

|---|---|---|---|---|---|---|---|

| Variable | Ridge-Fixed Effect | Fixed Effect | Pooled OLS | Ridge-Fixed Effect | Fixed Effect | Pooled OLS | |

| intercept | 8.947 ** (0.981) | 6.311 ** (1.235) | 7.554 ** (1.556) | intercept | 7.183 *** (1.244) | 5.5241 *** (2.1254) | 6.351 *** (2.3121) |

| 0.066 *** (0.027) | 0.031 (0.031) | 0.022 (0.004) | lnEXPSTU | 0.038 * (0.015) | 0.042 * (0.016) | 0.040 * (0.017) | |

| 0.186 *** (0.031) | 0.201 *** (0.038) | 0.239 *** (0.054) | lnPrimary | 0.443 *** (0.156) | 0.459 *** (0.211) | 0.598 ** (0.306) | |

| lnPrimary | 0.059 (0.140) | 0.024 (0.145) | 0.022 (0.137) | lnSecondary | 0.058 (0.216) | 0.097 (0.331) | 0.066 (0.354) |

| 0.128 (0.174) | 0.094 (0.201) | 0.084 (0.214) | lnTertiary | 0.685 *** (0.031) | 0.703 *** (0.058) | 0.689 *** (0.042) | |

| 0.894 *** (0.130) | 0.944 *** (0.208) | 0.997 *** (0.258) | lnUNEM | 0.579 *** (0.218) | 0.504 ** (0.225) | 0.588 ** (0.301) | |

| 0.051 *** (0.011) | 0.031 *** (0.014) | 0.028 * (0.017) | lnWORK | 0.256 *** (0.026) | 0.121 *** (0.043) | 0.116 ** (0.053) | |

| 0.749 *** (0.020) | 0.541 *** (0.103) | 0.587 *** (0.233) | lnOPEN | 0.459 (0.341) | 0.368 (0.368) | 0.549 (0.401) | |

| 0.874 (0.753) | 0.778 (0.711) | 0.651 (0.783) | lnFDI | 0.148 (0.161) | 0.012 (0.222) | 0.034 (0.235) | |

| −1.265 *** (0.194) | −1.002 *** (0.201) | −1.115 ** (0.241) | lnRD | 1.443 *** (0.254) | 1.511 *** (0.268) | 1.124 *** (0.254) | |

| lnWORK | 0.301 *** (0.021) | 0.416 *** (0.103) | 0.497 *** (0.201) | INF | −0.001 (0.002) | −0.001 (0.003) | −0.001 (0.002) |

| −0.402 * (0.231) | −0.398 * (0.264) | −0.518 * (0.298) | lnK | 0.031 (0.035) | 0.026 (0.042) | 0.013 (0.051) | |

| 0.738 ** (0.326) | 0.722 ** (0.268) | 0.601 (0.401) | |||||

| 0.048 (0.084) | 0.059 (0.089) | 0.068 (0.101) | |||||

| 0.756 ** (0.251) | 0.561 ** (0.259) | 0.439 (0.278) | |||||

| 0.405 * (0.199) | 0.428 * (0.214) | 0.305 (0.206) | |||||

| 0.958 *** (0.215) | 1.205 *** (0.365) | 1.358 *** (0.554) | |||||

| INF | −0.089 (0.100) | −0.115 (0.121) | −0.126 (0.189) | ||||

| lnK | 0.395 * (0.235) | 0.348 * (0.254) | 0.331 (0.267) | ||||

| EBIC | −439.350 | −412.896 | −359.35 | −408.880 | −398.684 | −304.68 | |

| 0.9944 | 0.9901 | 0.9899 | 0.9874 | 0.9887 | 0.9543 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maneejuk, P.; Yamaka, W. The Impact of Higher Education on Economic Growth in ASEAN-5 Countries. Sustainability 2021, 13, 520. https://doi.org/10.3390/su13020520

Maneejuk P, Yamaka W. The Impact of Higher Education on Economic Growth in ASEAN-5 Countries. Sustainability. 2021; 13(2):520. https://doi.org/10.3390/su13020520

Chicago/Turabian StyleManeejuk, Paravee, and Woraphon Yamaka. 2021. "The Impact of Higher Education on Economic Growth in ASEAN-5 Countries" Sustainability 13, no. 2: 520. https://doi.org/10.3390/su13020520

APA StyleManeejuk, P., & Yamaka, W. (2021). The Impact of Higher Education on Economic Growth in ASEAN-5 Countries. Sustainability, 13(2), 520. https://doi.org/10.3390/su13020520