The Urbanisation Impacts on the Policy Effects of the Carbon Tax in China

Abstract

1. Introduction

2. Data

3. Method

3.1. Production Block

3.2. Income–Expenditure Block

3.3. Trade Block

3.4. Dynamic Block

3.5. Model Closure

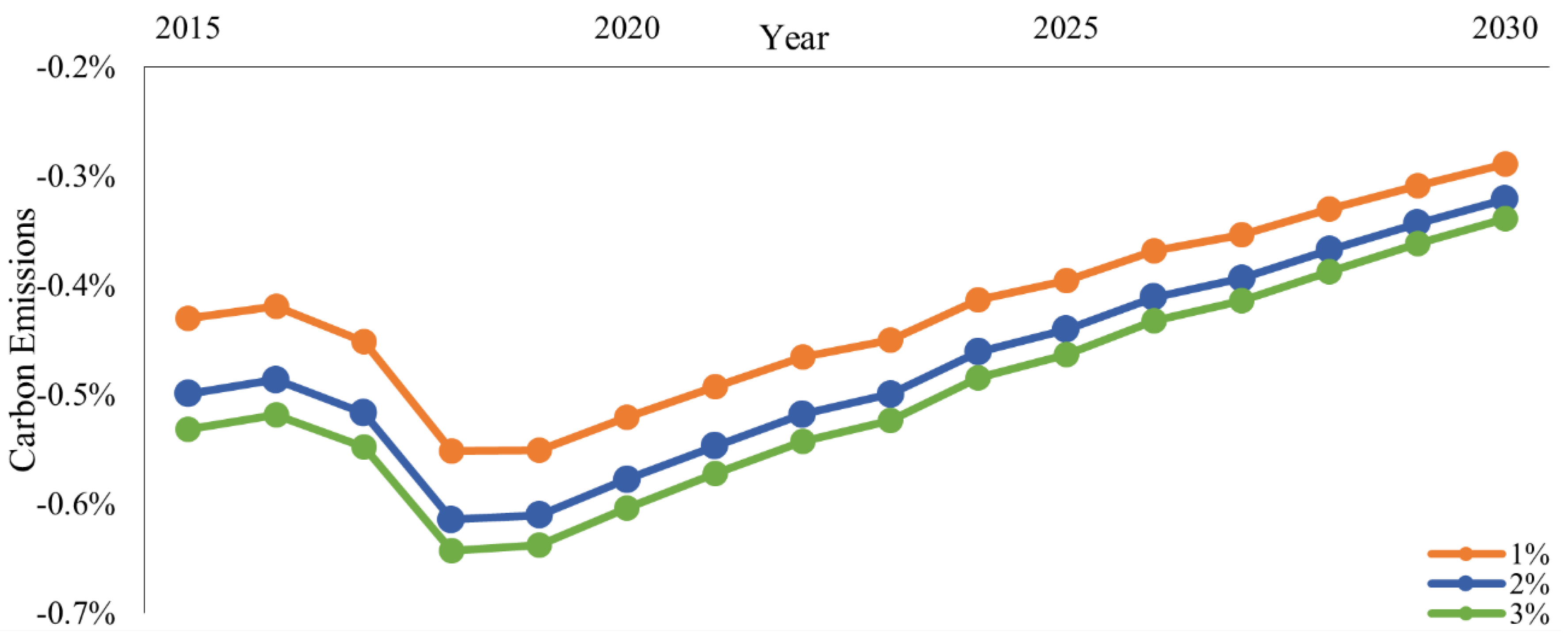

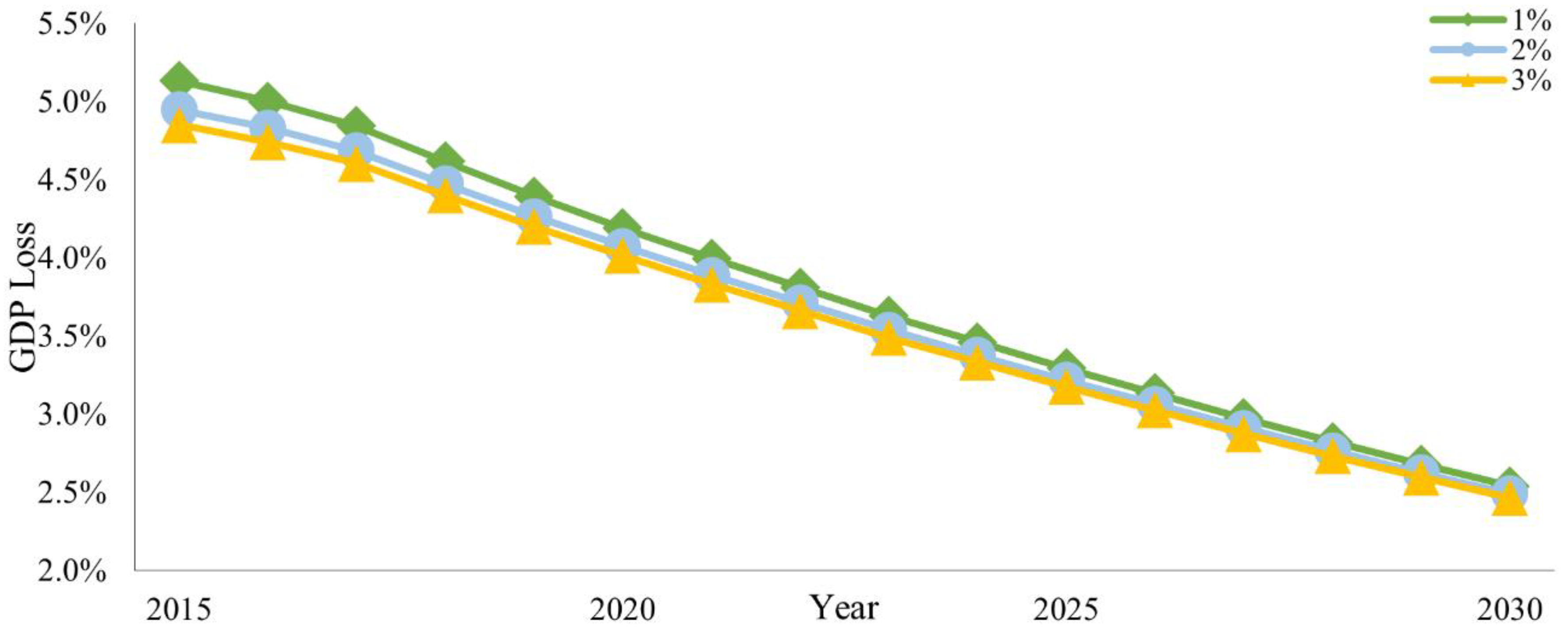

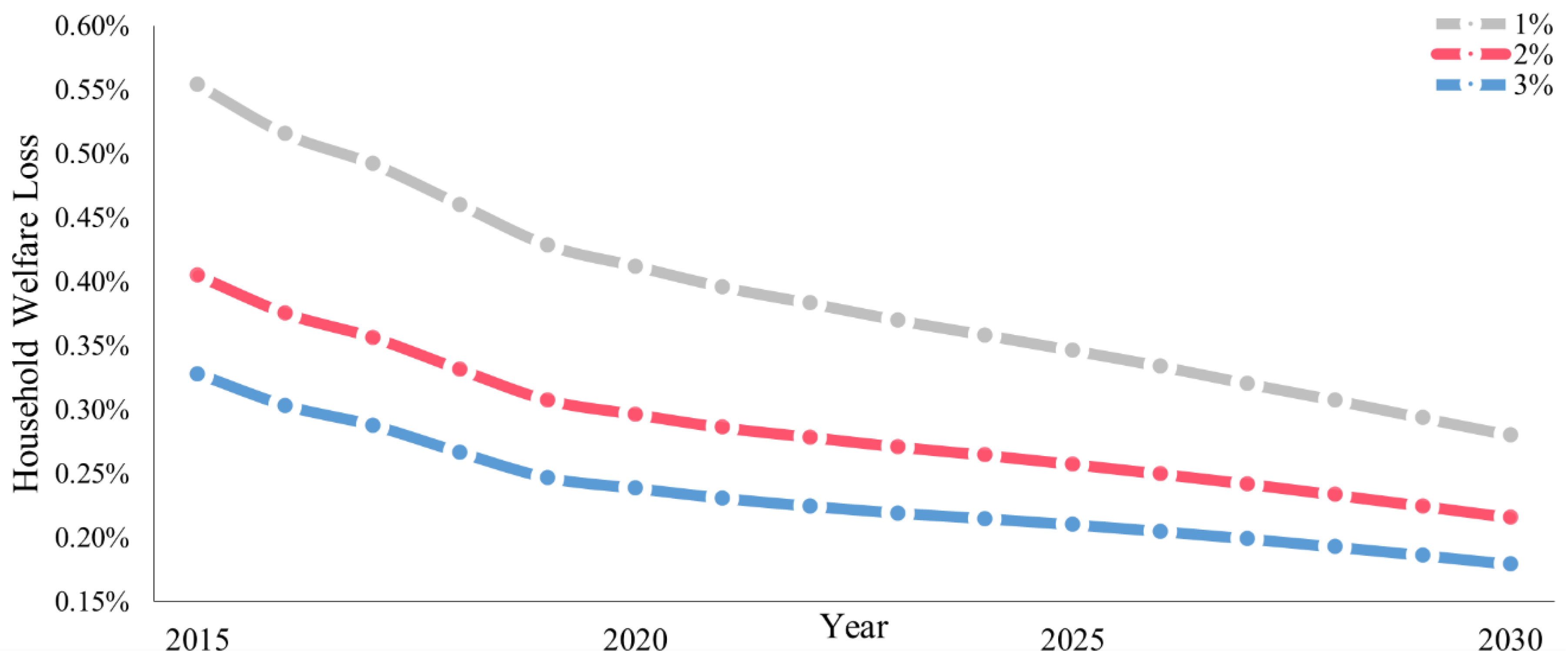

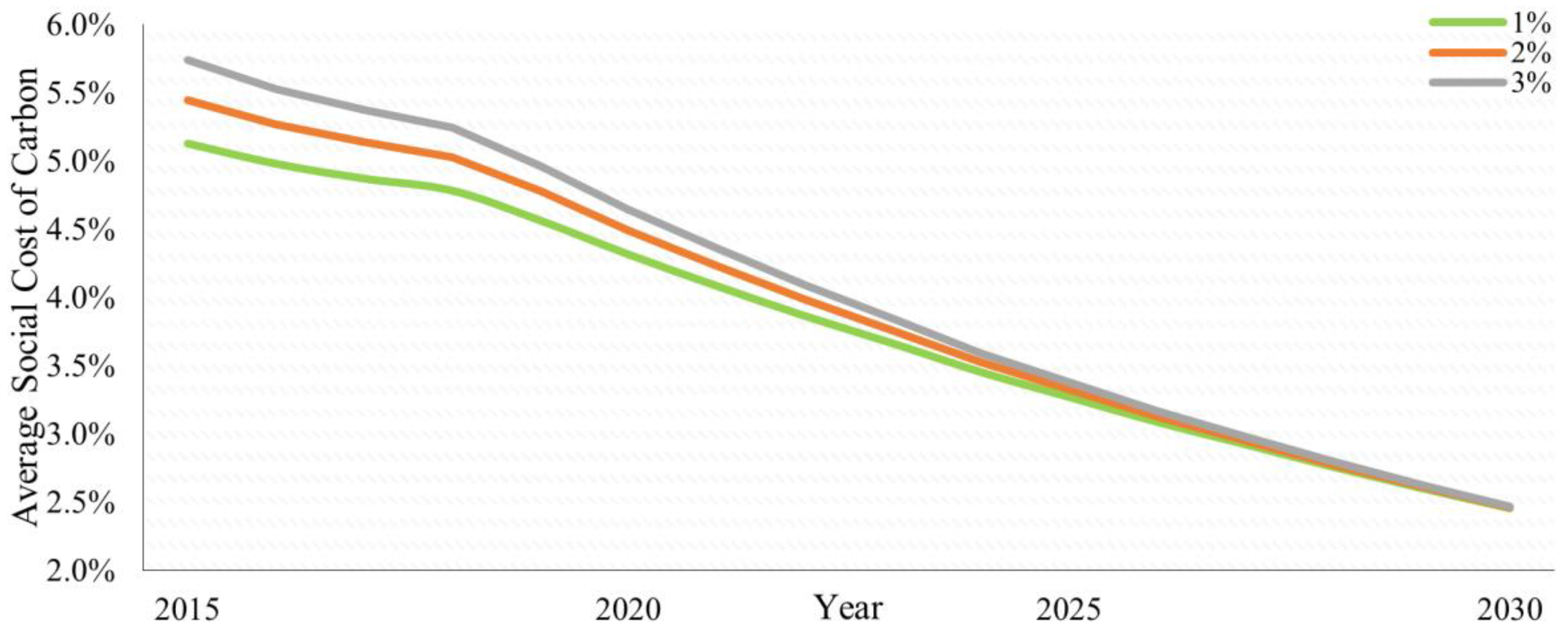

4. Results

5. Discussion

6. Conclusions

Supplementary Materials

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- NBS. China Statistical Yearbook 2017; China Statistics Press: Beijing, China, 2017. [Google Scholar]

- Miao, J.; Wu, X. Urbanization, socioeconomic status and health disparity in China. Health Place 2016, 42, 87–95. [Google Scholar] [CrossRef] [PubMed]

- Zhao, P.J.; Zhang, M. The impact of urbanisation on energy consumption: A 30-year review in China. Urban Clim. 2018, 24, 940–953. [Google Scholar] [CrossRef]

- Wang, S.; Fang, C.; Guan, X.; Pang, B.; Ma, H. Urbanisation, energy consumption, and carbon dioxide emissions in China: A panel data analysis of China’s provinces. Appl. Energy 2014, 136, 738–749. [Google Scholar] [CrossRef]

- Pablo-Romero, M.D.; Sánchez-Braza, A.; Anna, G. Relationship between economic growth and residential energy use in transition economies. Clim. Dev. 2018, 11, 338–354. [Google Scholar] [CrossRef]

- Pata, U.K. The effect of urbanization and industrialization on carbon emissions in Turkey: Evidence from ARDL bounds testing procedure. Environ. Sci. Pollut. Res. 2017, 25, 7740–7747. [Google Scholar] [CrossRef]

- Zhao, H.; Chen, Y.M. Research on relationship between urbanization process and carbon emission reduction in China. China Soft Sci. 2013, 3, 184–192. [Google Scholar]

- Ji, S.D.; Wu, H.; Wang, Z. Openness to trade, urbanization and carbon dioxide emissions-based on panel data of China’s urban bound co-integration analysis. Econ. Probl. 2013, 12, 31–35. [Google Scholar]

- Dong, X.Y.; Yuan, G.Q. China’s Greenhouse Gas emissions’ dynamic effects in the process of its urbanization: A perspective from shocks decomposition under long-term constraints. In Proceedings of the 2010 International Conference on Energy, Environment and Development (Iceed2010), Kuala Lumpur, Malaysia, 8–9 December 2011; Volume 5, pp. 1660–1665. [Google Scholar]

- Dociu, M.; Dunarintu, A. The Socio-Economic Impact of Urbanization. Int. J. Acad. Res. Account. Financ. Manag. Sci. 2012, 2, 47–52. [Google Scholar]

- Deng, X.; Huang, J.; Rozelle, S.; Zhang, J.; Li, Z. Impact of urbanization on cultivated land changes in China. Land Use Policy 2015, 45, 1–7. [Google Scholar] [CrossRef]

- Xu, Q.; Dong, Y.-X.; Yang, R. Urbanization impact on carbon emissions in the Pearl River Delta region: Kuznets curve relationships. J. Clean. Prod. 2018, 180, 514–523. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Sab, C.N.B.C.; Fereidouni, H.G. Exploring the bi-directional long run relationship between urbanization, energy consumption, and carbon dioxide emission. Energy 2012, 46, 156–167. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Yi, W.-C.; Li, B.-W. The Impact of Urbanization on Carbon Emission: Empirical Evidence in Beijing. Energy Procedia 2015, 75, 2963–2968. [Google Scholar] [CrossRef]

- Wang, J.; Wu, Y.; Zhao, Y.; He, S.; Dong, Z.; Bo, W. The population structural transition effect on rising per capita CO2 emissions: Evidence from China. Clim. Policy 2019, 19, 1250–1269. [Google Scholar] [CrossRef]

- Fleurbaey, M.; Ferranna, M.; Budolfson, M.; Dennig, F.; Mintz-Woo, K.; Socolow, R.; Spears, D.; Zuber, S. The Social Cost of Carbon: Valuing Inequality, Risk, and Population for Climate Policy. Monist 2018, 102, 84–109. [Google Scholar] [CrossRef]

- Nordhaus, W.D. Revisiting the social cost of carbon. Proc. Natl. Acad. Sci. USA 2017, 114, 1518–1523. [Google Scholar] [CrossRef] [PubMed]

- UN. World Urbanization Prospects: The 2018 Revision, Online ed.; UN: New York, NY, USA, 2018. [Google Scholar]

- WB. DataBank: World Development Indicators; WB: Washington, DC, USA, 2020. [Google Scholar]

- NBS. China Energy Statistical Yearbook 2016; China Statistics Press: Beijing, China, 2016. [Google Scholar]

- Kalmaz, D.B.; Kirikkaleli, D. Modeling CO2 emissions in an emerging market: Empirical finding from ARDL-based bounds and wavelet coherence approaches. Environ. Sci. Pollut. Res. 2019, 26, 5210–5220. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Hooker, M.A. Testing for Cointegration—Power Versus Frequency of Observation. Econ. Lett. 1993, 41, 359–362. [Google Scholar] [CrossRef]

- Schwert, G.W. Tests for Unit Roots—A Monte-Carlo Investigation. J. Bus. Econ. Stat. 1989, 7, 147–159. [Google Scholar]

- Phillips, C.B.; Perron, P. Testing for a Unit-Root in Time-Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Elliott, G.; Rothenberg, T.J.; Stock, J.H. Efficient Tests for an Autoregressive Unit Root. Economic 1996, 64, 813. [Google Scholar] [CrossRef]

- Choi, I.; Chung, B.S. Sampling frequency and the power of tests for a unit root: A simulation study. Econ. Lett. 1995, 49, 131–136. [Google Scholar] [CrossRef]

- Mitić, P.; Ivanović, O.M.; Zdravković, A. A Cointegration Analysis of Real GDP and CO2 Emissions in Transitional Countries. Sustainability 2017, 9, 568. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smithc, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Sun, D.; Zhou, L.; Li, Y.; Liu, H.; Shen, X.; Wang, Z.; Wang, X. New-type urbanization in China: Predicted trends and investment demand for 2015–2030. J. Geogr. Sci. 2017, 27, 943–966. [Google Scholar] [CrossRef]

- Li, Z.; Dai, H.; Sun, L.; Xie, Y.; Liu, Z.; Wang, P.; Yabar, H. Exploring the impacts of regional unbalanced carbon tax on CO2 emissions and industrial competitiveness in Liaoning province of China. Energy Policy 2018, 113, 9–19. [Google Scholar] [CrossRef]

- Li, W.; Jia, Z. Carbon tax, emission trading, or the mixed policy: Which is the most effective strategy for climate change mitigation in China? Mitig. Adapt. Strat. Glob. Chang. 2017, 22, 973–992. [Google Scholar] [CrossRef]

- Guo, Z.; Liu, H. The impact of carbon tax policy on energy consumption and CO2 emission in China. Energy Sources Part B Econ. Plan. Policy 2016, 11, 725–731. [Google Scholar] [CrossRef]

- Guo, Z.; Zhang, X.; Zheng, Y.; Rao, R. Exploring the impacts of a carbon tax on the Chinese economy using a CGE model with a detailed disaggregation of energy sectors. Energy Econ. 2014, 45, 455–462. [Google Scholar] [CrossRef]

- Armington, S. A theory of demand for products distinguished by place of origin. Staff. Pap. Int. Monet. Fund 1969, 16, 159–178. [Google Scholar] [CrossRef]

- UN. World Population Prospects: The 2017 Revision. 2017. Available online: https://www.un.org/development/desa/publications/world-population-prospects-the-2017-revision.html (accessed on 20 March 2019).

- OECD. Air and Climate. 2017. Available online: https://stats.oecd.org/ (accessed on 20 October 2019).

- EIA. International Energy Outlook 2017. Available online: https://www.eia.gov/outlooks/archive/ieo17/ (accessed on 1 May 2020).

- OECD. GDP Long-Term Forecast. 2018. Available online: https://data.oecd.org/gdp/gdp-long-term-forecast.htm (accessed on 1 May 2020).

- Sue Wing, I. Computable General Equilibrium Models and Their Use in Economy-Wide Policy Analysis: Everything You Ever Wanted to Know (but Were Afraid to Ask); The MIT Joint Program on the Science and Policy of Global Change: Cambridge, MA, USA, 2004; pp. 1–48. [Google Scholar]

- Lu, Y.; Stern, D.I. Substitutability and the Cost of Climate Mitigation Policy. Environ. Resour. Econ. 2015, 64, 81–107. [Google Scholar] [CrossRef]

- Liu, F.; Liu, C. Regional disparity, spatial spillover effects of urbanisation and carbon emissions in China. J. Clean. Prod. 2019, 241, 118226. [Google Scholar] [CrossRef]

- Wang, Q.; Wu, S.-D.; Zeng, Y.-E.; Wu, B.-W. Exploring the relationship between urbanization, energy consumption, and CO2 emissions in different provinces of China. Renew. Sustain. Energy Rev. 2016, 54, 1563–1579. [Google Scholar] [CrossRef]

- He, J.K. Global low-carbon transition and China’s response strategies. Adv. Clim. Chang. Res. 2016, 7, 204–212. [Google Scholar] [CrossRef]

- Yao, X.; Kou, D.; Shao, S.; Li, X.; Wang, W.; Zhang, C. Can urbanization process and carbon emission abatement be harmonious? New evidence from China. Environ. Impact Assess. Rev. 2018, 71, 70–83. [Google Scholar] [CrossRef]

- Lin, B.; Zhu, J. Energy and carbon intensity in China during the urbanization and industrialization process: A panel VAR approach. J. Clean. Prod. 2017, 168, 780–790. [Google Scholar] [CrossRef]

- Yang, Y.; Liu, J.; Zhang, Y. An analysis of the implications of China’s urbanization policy for economic growth and energy consumption. J. Clean. Prod. 2017, 161, 1251–1262. [Google Scholar] [CrossRef]

- Liddle, B. The Energy, Economic Growth, Urbanization Nexus across Development: Evidence from Heterogeneous Panel Estimates Robust to Cross-Sectional Dependence. Energy J. 2013, 34, 223–244. [Google Scholar] [CrossRef]

- Zhang, X.; Guo, Z.; Zheng, Y.; Zhu, J.; Yang, J. A CGE Analysis of the Impacts of a Carbon Tax on Provincial Economy in China. Emerg. Mark. Financ. Trade 2015, 52, 1372–1384. [Google Scholar] [CrossRef]

- Van de Poel, E.; O’Donnell, O.; van Doorslaer, E. Is there a health penalty of China’s rapid urbanization? Health Econ. 2012, 21, 367–385. [Google Scholar] [CrossRef] [PubMed]

- Chen, H.; Liu, Y.; Li, Z.; Xue, D. Urbanization, economic development and health: Evidence from China’s labor-force dynamic survey. Int. J. Equity Health 2017, 16, 1–8. [Google Scholar] [CrossRef] [PubMed]

- Lee, J.W. Lagged effect of exports, industrialization and urbanization on carbon footprint in Southeast Asia. Int. J. Sustain. Dev. World Ecol. 2019, 26, 398–405. [Google Scholar] [CrossRef]

| Dependent Variable | Tau-Statistic | p-Value | Z-Statistic | p-Value |

|---|---|---|---|---|

| −6.67 | 0.0004 ** | −90.63 | <0.0001 ** | |

| −7.54 | <0.0001 ** | −41.45 | <0.0001 ** | |

| −5.02 | 0.0035 ** | −46.74 | <0.0001 ** |

| Dependent Variable | Independent Variable | Coefficient | p-Value |

|---|---|---|---|

| −0.43 | <0.0001 ** | ||

| 1.01 | 0.0002 ** | ||

| 0.47 | 0.0052 ** | ||

| 0.18 | 0.0772 | ||

| 3.51 | 0.0083 ** | ||

| −0.017 | 0.1152 | ||

| −0.28 | 0.0170 ** | ||

| 0.58 | <0.0001 ** | ||

| 0.35 | 0.0110 ** | ||

| 0.0031 | 0.8946 | ||

| −0.59 | 0.6690 | ||

| 0.68 | 0.0001 ** | ||

| −0.37 | 0.0342 ** | ||

| 0.25 | 0.2804 | ||

| −0.19 | 0.5291 | ||

| 2.10 | 0.0005 ** |

| Year | CO2 | GDP | Year | CO2 | GDP | Year | CO2 | GDP |

|---|---|---|---|---|---|---|---|---|

| 2015 | −0.22% | 4.75% | 2021 | −0.32% | 3.67% | 2027 | −0.25% | 2.68% |

| 2016 | −0.21% | 4.62% | 2022 | −0.30% | 3.49% | 2028 | −0.24% | 2.53% |

| 2017 | −0.24% | 4.48% | 2023 | −0.30% | 3.31% | 2029 | −0.23% | 2.40% |

| 2018 | −0.35% | 4.27% | 2024 | −0.28% | 3.14% | 2030 | −0.21% | 2.27% |

| 2019 | −0.35% | 4.06% | 2025 | −0.27% | 2.98% | |||

| 2020 | −0.33% | 3.86% | 2026 | −0.26% | 2.83% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, S. The Urbanisation Impacts on the Policy Effects of the Carbon Tax in China. Sustainability 2021, 13, 6749. https://doi.org/10.3390/su13126749

Chen S. The Urbanisation Impacts on the Policy Effects of the Carbon Tax in China. Sustainability. 2021; 13(12):6749. https://doi.org/10.3390/su13126749

Chicago/Turabian StyleChen, Shuyang. 2021. "The Urbanisation Impacts on the Policy Effects of the Carbon Tax in China" Sustainability 13, no. 12: 6749. https://doi.org/10.3390/su13126749

APA StyleChen, S. (2021). The Urbanisation Impacts on the Policy Effects of the Carbon Tax in China. Sustainability, 13(12), 6749. https://doi.org/10.3390/su13126749