Hybrid Decision Model for Evaluating Blockchain Business Strategy: A Bank’s Perspective

Abstract

Introduction

- (1)

- Trust: Establishes trust among diverse fields; transactions that are cleared can be traced and are immutable. The commercial ecosystem can implement cross-business system exchange and aim to reduce costs, shorten transaction settlement time, and accelerate cash flow while also establishing a reliable basis of network data;

- (2)

- Sharing: A blockchain is a form of open-source code. The encrypted decentralized network makes it easy for anyone to provide innovative application services. Sharing distributed ledgers creates a shared-value system;

- (3)

- Reliability: Distributed ledgers with time stamps are difficult to tamper with, and decentralized architecture helps lower the risk of system failures significantly.

- (1)

- It attempts to identify the crucial factors (criteria) for the banking sector to evaluate its long-term competitiveness regarding the blockchain business strategy selection;

- (2)

- This study hopes to explore the relative importance and the contextual relations among those crucial factors. It may bring in-depth understanding to this complicated problem;

- (3)

- The constructed model aims to identify the best alternative among a group of plausible blockchain businesses for a bank to illustrate the proposed novel approach.

2. Literature Review and Recent Developments

2.1. Key Aspects for the Banking Sector to Evaluate Blockchain Businesses

2.1.1. Policies and Regulations

- (1)

- Financial Supervision and Regulations

- (2)

- Government Licenses

- (3)

- Conflicting Risk among Regulations

2.1.2. External Market

- (1)

- Market Potential

- (2)

- Competitors’ Actions and Market Trend

- (3)

- Cooperative Alliances

2.1.3. Technological Capabilities

- (1)

- Application Scenario Deconstruction Capability

- (2)

- Cybersecurity

- (3)

- ID Authentication

- (4)

- System Reliability

2.1.4. Management and Finance

- (1)

- Top Management Support

- (2)

- Financial Consideration

- (3)

- Operational Risk

- (4)

- New Business Revenue

2.2. Mainstream Blockchain Business Models for Banks

2.3. Applications of MCDM Methods in Business Evaluation

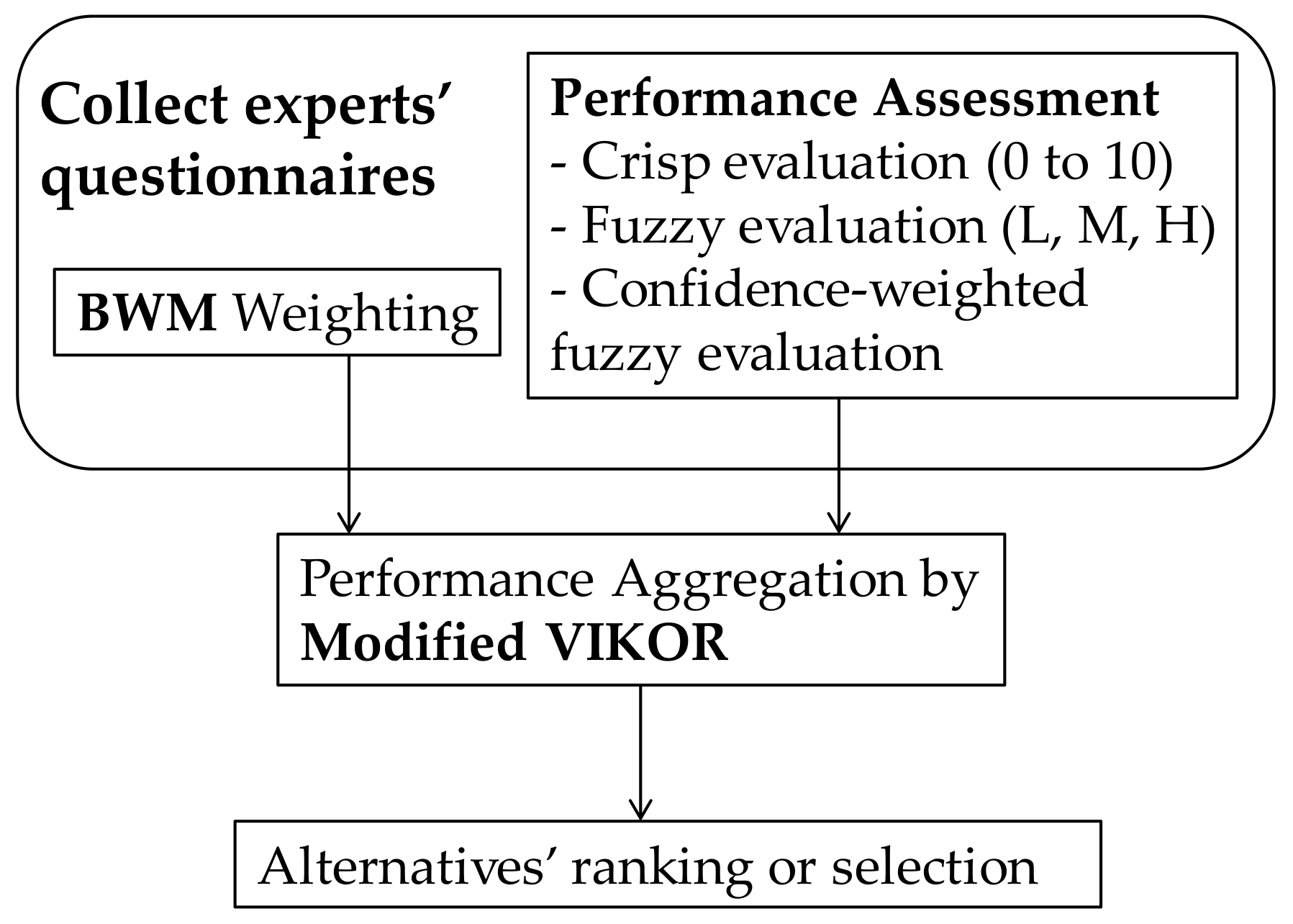

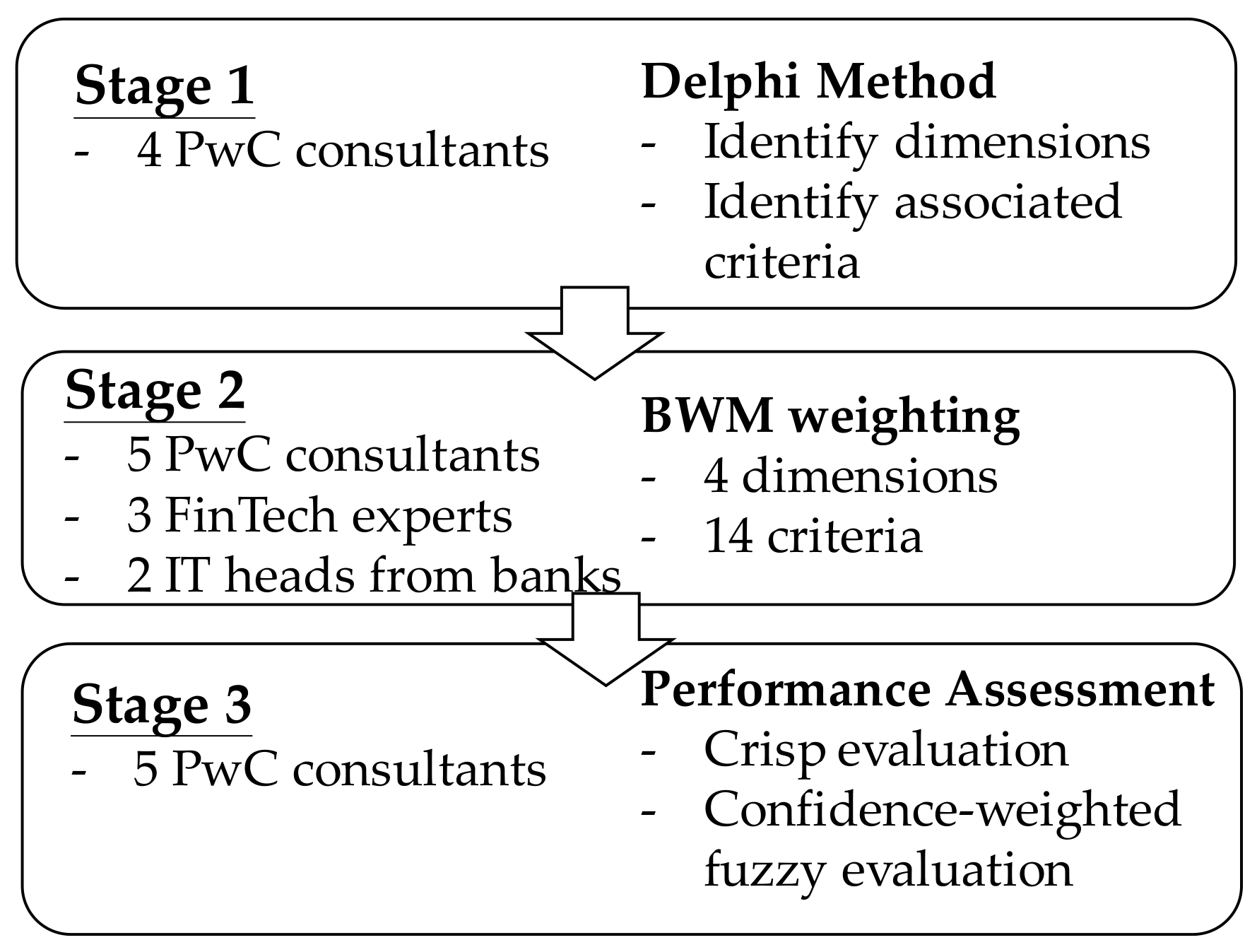

3. Hybrid Decision Model with Fuzzy Assessment

3.1. Best-Worst Method

3.2. Modified VIKOR Aggregation Function

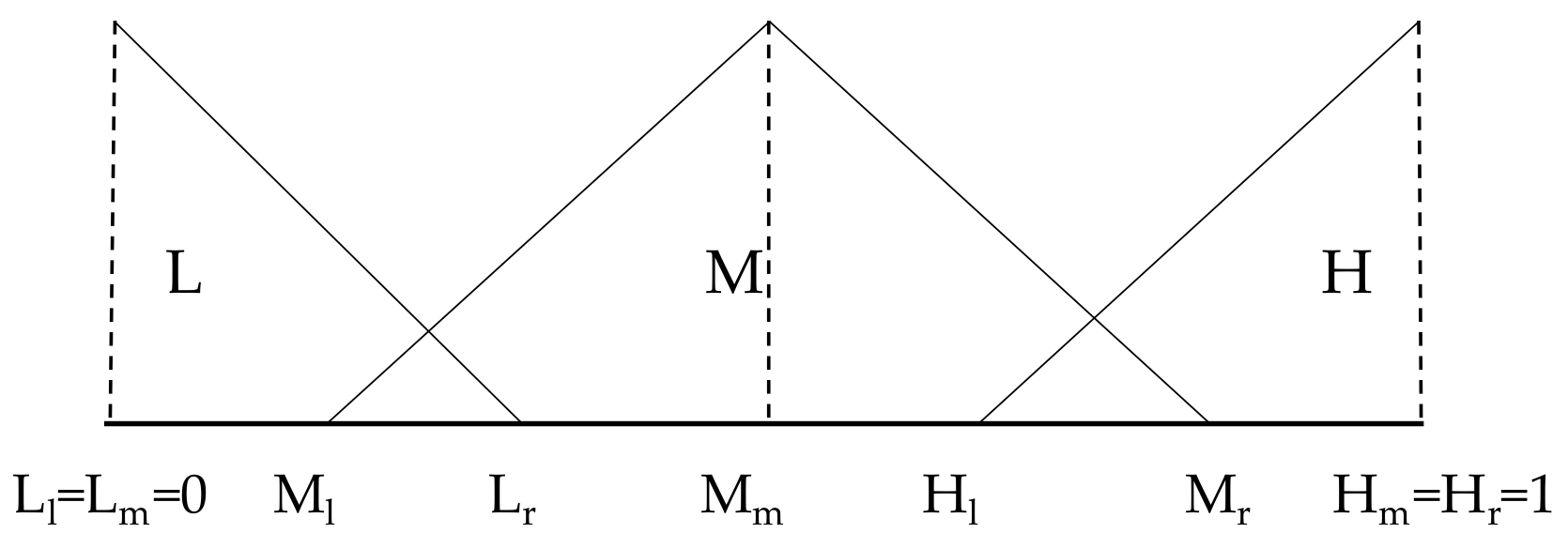

3.3. Confidence-Weighted Fuzzy Assessment

4. Results and Discussions

- Leading Payment (A);

- Participatory Payment (B);

- Participatory Cross-Border Trade (C);

- Participatory Supply Chain Finance (D);

- Participatory Insurance Claims (E).

5. Concluding Remarks

- (1)

- Clarify essential factors for banks to evaluate blockchain-based businesses;

- (2)

- Identity the relative importance of each criterion to selecting blockchain business model;

- (3)

- Take the E.Sun bank as an example to illustrate how to prioritize its blockchain business strategy;

- (4)

- Propose a novel confidence-based fuzzy assessment to transform domain experts’ knowledge into performance figures.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Best | Best-to-Others | Worst | Others-to-Worst | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| D1 | D2 | D3 | D4 | D1 | D2 | D3 | D4 | |||

| Expert 1 | D4 | 1 | 2 | 3 | 3 | D1 | 1/3 | 1/2 | 1/2 | 1 |

| Expert 2 | D2 | 3 | 1 | 8 | 2 | D3 | 1/5 | 1/8 | 1 | 1/7 |

| Expert 3 | D4 | 4 | 3 | 2 | 1 | D1 | 1 | 1/2 | 1/3 | 1/4 |

| Expert 4 | D1 | 1 | 3 | 1 | 2 | D2 | 1/3 | 1 | 1/2 | 1 |

| Expert 5 | D1 | 1 | 1 | 9 | 2 | D3 | 1/9 | 1/7 | 1 | 1/2 |

| Expert 6 | D1 | 1 | 2 | 1 | 3 | D4 | 1/4 | 1/2 | 1/3 | 1 |

| Expert 7 | D1 | 1 | 1 | 2 | 3 | D4 | 1/3 | 1/2 | 1 | 1 |

| Expert 8 | D3 | 2 | 4 | 1 | 3 | D2 | 1/3 | 1 | 1/5 | 1/4 |

| Expert 9 | D1 | 1 | 2 | 3 | 3 | D3 | 1/3 | 1/2 | 1 | 1 |

| Expert 10 | D1 | 1 | 2 | 2 | 1 | D3 | 1/3 | 1/2 | 1 | 1/2 |

| Best | D1 | Worst | D1 | Best | D2 | Worst | D2 | Best | D3 | Worst | D3 | Best | D4 | Worst | D4 | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | C2 | C3 | C1 | C2 | C3 | C4 | C5 | C6 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | C11 | C12 | C13 | C14 | |||||||||

| Expert 1 | C1 | 1 | 2 | 3 | C3 | 1/3 | 1/2 | 1 | C5 | 2 | 1 | 3 | C6 | 1/2 | 1/3 | 1 | C8 | 3 | 1 | 4 | 2 | C9 | 1/2 | 1/4 | 1 | 1/3 | C11 | 1 | 4 | 3 | 3 | C12 | 1/4 | 1 | 1/3 | 1/2 |

| Expert 2 | C1 | 1 | 2 | 3 | C3 | 1/3 | 1/2 | 1 | C5 | 3 | 1 | 2 | C4 | 1 | 1/3 | 1/2 | C7 | 1 | 2 | 4 | 2 | C9 | 1/5 | 1/4 | 1 | 1/3 | C11 | 1 | 2 | 3 | 5 | C14 | 1/8 | 1/8 | 1/5 | 1 |

| Expert 3 | C2 | 4 | 1 | 2 | C1 | 1 | 1/4 | 1/3 | C4 | 1 | 2 | 3 | C6 | 1/3 | 1/2 | 1 | C7 | 1 | 2 | 3 | 4 | C10 | 1/4 | 1/4 | 1/3 | 1 | C11 | 1 | 2 | 3 | 4 | C14 | 1/4 | 1/4 | 1/2 | 1 |

| Expert 4 | C2 | 3 | 1 | 1 | C1 | 1 | 1/3 | 1/2 | C6 | 7 | 1 | 1 | C4 | 1 | 1/5 | 1/7 | C10 | 1 | 7 | 2 | 1 | C8 | 1/5 | 1 | 1/3 | 1/7 | C13 | 1 | 3 | 1 | 9 | C14 | 1/7 | 1/3 | 1/9 | 1 |

| Expert 5 | C1 | 1 | 2 | 8 | C3 | 1/8 | 1/6 | 1 | C6 | 2 | 9 | 1 | C5 | 1/7 | 1 | 1/9 | C7 | 1 | 3 | 1 | 2 | C8 | 1/3 | 1 | 1/2 | 1 | C11 | 1 | 2 | 3 | 9 | C14 | 1/9 | 1/7 | 1/3 | 1 |

| Expert 6 | C1 | 1 | 2 | 3 | C3 | 1/3 | 1/2 | 1 | C4 | 1 | 3 | 2 | C5 | 1/3 | 1 | 1/2 | C7 | 1 | 5 | 3 | 2 | C8 | 1/5 | 1 | 1/3 | 1/2 | C13 | 3 | 2 | 1 | 4 | C14 | 1/2 | 1/3 | 1/4 | 1 |

| Expert 7 | C2 | 1 | 1 | 3 | C3 | 1/2 | 1/3 | 1 | C4 | 1 | 2 | 9 | C6 | 1/9 | 1/5 | 1 | C8 | 9 | 1 | 3 | 2 | C7 | 1 | 1/9 | 1/5 | 1/7 | C14 | 2 | 3 | 5 | 1 | C13 | 1/2 | 1/3 | 1 | 1/5 |

| Expert 8 | C1 | 1 | 4 | 3 | C3 | 1/4 | 1 | 1/2 | C4 | 1 | 2 | 3 | C6 | 1/3 | 1/2 | 1 | C7 | 1 | 4 | 2 | 4 | C10 | 1/4 | 1 | 1/3 | 1/2 | C14 | 2 | 3 | 5 | 1 | C13 | 1/2 | 1/3 | 1 | 1/5 |

| Expert 9 | C1 | 1 | 2 | 3 | C3 | 1/2 | 1/2 | 1 | C4 | 1 | 2 | 3 | C6 | 1/2 | 1 | 1 | C7 | 1 | 2 | 3 | 2 | C9 | 1/3 | 1/2 | 1 | 1/2 | C11 | 1 | 2 | 2 | 2 | C14 | 1/2 | 1/2 | 1 | 1 |

| Expert 10 | C2 | 2 | 1 | 2 | C3 | 1/2 | 1/2 | 1 | C6 | 2 | 2 | 1 | C4 | 1 | 1/2 | 1/2 | C7 | 1 | 1 | 2 | 2 | C9 | 1/2 | 1/2 | 1 | 1/2 | C11 | 1 | 2 | 2 | 3 | C14 | 1/3 | 1/2 | 1/2 | 1 |

Appendix B

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PwC_1 | 10 | 6 | 9 | 10 | 8 | 6 | 10 | 10 | 9 | 10 | 10 | 9 | 4 | 4 |

| PwC_2 | 7 | 9 | 5 | 9 | 7 | 8 | 8 | 7 | 8 | 7 | 8 | 6 | 6 | 9 |

| PwC_3 | 7 | 7 | 7 | 10 | 10 | 8 | 10 | 10 | 8 | 10 | 1 | 4 | 10 | 10 |

| PwC_4 | 10 | 10 | 8 | 9 | 6 | 4 | 8 | 10 | 10 | 10 | 9 | 6 | 9 | 2 |

| PwC_5 | 7 | 8 | 4 | 5 | 4 | 6 | 8 | 4 | 4 | 4 | 4 | 4 | 4 | 5 |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PwC_1 | 10 | 8 | 8 | 9 | 6 | 8 | 7 | 8 | 8 | 9 | 9 | 8 | 4 | 3 |

| PwC_2 | 8 | 7 | 7 | 6 | 7 | 7 | 7 | 7 | 8 | 7 | 7 | 8 | 7 | 6 |

| PwC_3 | 10 | 10 | 8 | 8 | 5 | 10 | 5 | 6 | 10 | 10 | 10 | 7 | 5 | 5 |

| PwC_4 | 7 | 7 | 5 | 9 | 5 | 6 | 4 | 10 | 10 | 10 | 4 | 5 | 8 | 3 |

| PwC_5 | 5 | 6 | 2 | 6 | 7 | 8 | 4 | 5 | 6 | 5 | 5 | 6 | 6 | 4 |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PwC_1 | 9 | 8 | 9 | 9 | 6 | 7 | 5 | 10 | 10 | 9 | 9 | 8 | 3 | 3 |

| PwC_2 | 8 | 7 | 7 | 6 | 7 | 7 | 7 | 7 | 8 | 7 | 7 | 8 | 7 | 6 |

| PwC_3 | 10 | 10 | 5 | 7 | 6 | 10 | 5 | 8 | 10 | 10 | 10 | 6 | 5 | 5 |

| PwC_4 | 9 | 8 | 7 | 6 | 4 | 5 | 7 | 9 | 9 | 9 | 6 | 5 | 5 | 4 |

| PwC_5 | 7 | 8 | 4 | 6 | 7 | 7 | 5 | 6 | 5 | 5 | 5 | 5 | 6 | 3 |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PwC_1 | 8 | 5 | 5 | 7 | 4 | 9 | 6 | 7 | 9 | 8 | 9 | 6 | 4 | 4 |

| PwC_2 | 6 | 7 | 6 | 7 | 6 | 6 | 6 | 7 | 8 | 7 | 7 | 8 | 7 | 5 |

| PwC_3 | 8 | 5 | 5 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 5 | 5 | 3 |

| PwC_4 | 7 | 7 | 7 | 6 | 3 | 3 | 5 | 4 | 4 | 3 | 2 | 2 | 4 | 5 |

| PwC_5 | 8 | 9 | 6 | 5 | 4 | 7 | 5 | 5 | 4 | 6 | 5 | 6 | 7 | 4 |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PwC_1 | 9 | 5 | 6 | 8 | 4 | 9 | 6 | 9 | 10 | 10 | 9 | 6 | 3 | 4 |

| PwC_2 | 8 | 7 | 7 | 6 | 7 | 7 | 7 | 7 | 8 | 7 | 7 | 8 | 7 | 6 |

| PwC_3 | 10 | 10 | 10 | 8 | 8 | 10 | 10 | 8 | 10 | 8 | 10 | 8 | 10 | 3 |

| PwC_4 | 9 | 9 | 8 | 3 | 2 | 2 | 5 | 4 | 3 | 3 | 4 | 3 | 3 | 4 |

| PwC_5 | 4 | 4 | 3 | 4 | 5 | 7 | 4 | 4 | 3 | 4 | 5 | 5 | 4 | 3 |

| Alternatives | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A | Fuzzy | H | M | H | H | H | M | H | H | H | H | H | H | L | L |

| (%) | 95 | 90 | 90 | 95 | 85 | 90 | 95 | 95 | 90 | 95 | 95 | 90 | 90 | 90 | |

| B | Fuzzy | H | H | H | H | M | H | M | H | H | H | H | H | L | L |

| (%) | 95 | 85 | 85 | 90 | 90 | 85 | 95 | 85 | 85 | 90 | 90 | 85 | 90 | 85 | |

| C | Fuzzy | H | H | H | H | M | M | M | H | H | H | H | H | L | L |

| (%) | 90 | 85 | 90 | 90 | 90 | 95 | 85 | 95 | 95 | 90 | 90 | 85 | 85 | 85 | |

| D | Fuzzy | H | M | M | M | L | H | M | M | H | H | H | M | L | L |

| (%) | 85 | 85 | 85 | 95 | 90 | 90 | 90 | 95 | 90 | 85 | 90 | 90 | 90 | 90 | |

| E | Fuzzy | H | M | M | H | L | H | M | H | H | H | H | M | L | L |

| (%) | 90 | 85 | 90 | 85 | 90 | 90 | 90 | 90 | 95 | 95 | 90 | 90 | 85 | 90 |

| Alternatives | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A | Fuzzy | H | H | M | H | H | H | H | M | H | M | H | M | M | H |

| (%) | 60 | 80 | 70 | 70 | 60 | 70 | 70 | 90 | 70 | 90 | 70 | 80 | 80 | 80 | |

| B | Fuzzy | H | H | H | M | H | H | H | H | H | H | H | H | H | M |

| (%) | 70 | 60 | 60 | 80 | 70 | 60 | 60 | 60 | 70 | 60 | 60 | 70 | 60 | 80 | |

| C | Fuzzy | H | H | H | M | H | H | H | H | H | H | H | H | H | M |

| (%) | 70 | 60 | 60 | 80 | 60 | 60 | 60 | 60 | 70 | 60 | 60 | 70 | 60 | 80 | |

| D | Fuzzy | M | H | M | H | M | M | M | H | H | H | H | H | H | L |

| (%) | 80 | 60 | 80 | 60 | 80 | 80 | 80 | 60 | 70 | 60 | 60 | 70 | 60 | 90 | |

| E | Fuzzy | H | H | H | M | H | H | H | H | H | H | H | H | H | M |

| (%) | 70 | 60 | 60 | 80 | 60 | 60 | 60 | 60 | 70 | 60 | 60 | 70 | 60 | 80 |

| Alternatives | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A | Fuzzy | M | M | M | H | H | H | H | H | H | H | L | M | H | H |

| (%) | 90 | 90 | 90 | 90 | 90 | 90 | 90 | 90 | 80 | 90 | 60 | 75 | 90 | 90 | |

| B | Fuzzy | H | H | H | H | M | H | M | M | H | H | H | M | M | M |

| (%) | 90 | 90 | 80 | 80 | 80 | 90 | 80 | 85 | 90 | 90 | 90 | 90 | 80 | 80 | |

| C | Fuzzy | H | H | M | M | M | H | M | H | H | H | H | M | M | M |

| (%) | 90 | 90 | 80 | 90 | 85 | 90 | 80 | 80 | 90 | 90 | 90 | 85 | 80 | 80 | |

| D | Fuzzy | H | M | M | H | H | H | H | H | H | H | H | M | M | L |

| (%) | 80 | 80 | 80 | 90 | 90 | 90 | 90 | 90 | 90 | 90 | 90 | 80 | 80 | 85 | |

| E | Fuzzy | H | H | H | H | H | H | H | H | H | H | H | H | H | L |

| (%) | 90 | 90 | 90 | 80 | 80 | 90 | 90 | 80 | 90 | 80 | 90 | 80 | 90 | 85 |

| Alternatives | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A | Fuzzy | H | H | H | H | M | L | H | H | H | H | H | M | H | L |

| (%) | 90 | 90 | 70 | 80 | 80 | 80 | 70 | 90 | 90 | 90 | 80 | 80 | 80 | 60 | |

| B | Fuzzy | M | M | M | H | M | M | L | H | H | H | L | M | H | L |

| (%) | 90 | 90 | 70 | 80 | 70 | 80 | 80 | 90 | 90 | 90 | 80 | 70 | 70 | 70 | |

| C | Fuzzy | H | H | M | M | L | M | M | H | H | H | M | M | M | L |

| (%) | 80 | 70 | 90 | 80 | 80 | 70 | 90 | 80 | 80 | 80 | 80 | 70 | 70 | 80 | |

| D | Fuzzy | M | M | M | M | L | L | M | L | L | L | L | L | L | M |

| (%) | 90 | 90 | 90 | 80 | 70 | 70 | 70 | 80 | 80 | 70 | 60 | 60 | 80 | 70 | |

| E | Fuzzy | H | H | H | L | L | L | M | L | L | L | L | L | L | L |

| (%) | 80 | 80 | 70 | 70 | 60 | 60 | 70 | 80 | 70 | 70 | 80 | 70 | 70 | 80 |

| Alternatives | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A | Fuzzy | H | H | M | M | M | M | H | M | M | M | M | M | M | M |

| (%) | 50 | 60 | 50 | 60 | 50 | 70 | 60 | 50 | 50 | 50 | 50 | 50 | 50 | 60 | |

| B | Fuzzy | M | M | L | M | H | H | M | M | M | M | M | M | M | M |

| (%) | 60 | 70 | 60 | 70 | 50 | 60 | 50 | 60 | 70 | 60 | 60 | 70 | 70 | 50 | |

| C | Fuzzy | H | H | M | M | H | H | M | M | M | M | M | M | M | L |

| (%) | 50 | 60 | 50 | 70 | 50 | 50 | 60 | 70 | 60 | 60 | 60 | 60 | 70 | 70 | |

| D | Fuzzy | H | H | M | M | M | H | M | M | L | M | M | M | H | L |

| (%) | 60 | 70 | 70 | 60 | 50 | 50 | 60 | 60 | 80 | 70 | 60 | 70 | 50 | 80 | |

| E | Fuzzy | M | M | L | M | M | M | M | M | L | M | M | M | M | L |

| (%) | 50 | 50 | 70 | 50 | 60 | 80 | 50 | 50 | 70 | 50 | 60 | 60 | 50 | 70 |

References

- Osho, G.S. How technology is breaking traditional barriers in the banking industry: Evidence from financial management perspective. Eur. J. Econ. Financ. Adm. Sci. 2008, 11, 15–21. [Google Scholar]

- Lamport, L.; Shostak, R.; Pease, M. The Byzantine Generals problem. ACM Trans. Program. Lang. Syst. 1982, 4, 382–401. [Google Scholar] [CrossRef]

- Böhme, R.; Christin, N.; Edelman, B.; Moore, T. Bitcoin: Economics, technology, and governance. J. Econ. Perspect. 2015, 29, 213–238. [Google Scholar] [CrossRef]

- Cong, L.W.; He, Z. Blockchain disruption and smart contracts. Rev. Financ. Stud. 2019, 32, 1754–1797. [Google Scholar] [CrossRef]

- Time for Trust: How Blockchain Will Transform Business and the Economy. Available online: https://www.pwc.com/gx/en/industries/technology/publications/blockchain-report-transform-business-economy.html (accessed on 13 February 2021).

- Deloitte’s 2020 Global Blockchain Survey. Available online: https://www2.deloitte.com/us/en/insights/topics/understanding-blockchain-potential/global-blockchain-survey.html (accessed on 13 February 2021).

- Financial Blockchain Confirmation Service. Available online: https://www.fisc.com.tw/tc/business/Detail.aspx?caid=7c31a87d-2b5f-42bf-aafd-3c2405f64e8b (accessed on 14 February 2021).

- Early Lessons on Regulatory Innovations to Enable Inclusive FinTech: Innovation Offices, Regulatory Sandboxes, and RegTech. Available online: https://www.jbs.cam.ac.uk/wp-content/uploads/2020/08/2019-early-lessons-regulatory-innovations-enable-inclusive-fintech.pdf (accessed on 12 February 2021).

- Embedded Supervision: How to Build Regulation into Blockchain Finance. Available online: https://ideas.repec.org/p/bis/biswps/811.html (accessed on 14 February 2021).

- Gorkhali, A.; Li, L.; Shrestha, A. Blockchain: A literature review. J. Manag. Anal. 2020, 7, 321–343. [Google Scholar] [CrossRef]

- UBS CIO: Blockchain Technology Can Massively Simplify Banking. Available online: https://www.wsj.com/articles/BL-DGB-38501 (accessed on 12 February 2021).

- Build the Next Generation of Digital Trust Solutions. Available online: https://www.r3.com/ (accessed on 14 February 2021).

- What is Hyperledger? Available online: https://www.hyperledger.org/ (accessed on 14 February 2021).

- Blockchain: Center of Excellence. Available online: https://www.jpmorgan.com/insights/technology/blockchain (accessed on 14 February 2021).

- Mills, D.; Wang, K.; Malone, B.; Ravi, A.; Marquardt, J.; Chen, C.; Badev, A.; Brezinski, T.; Fahy, L.; Liao, K.; et al. Distributed ledger technology in payments, clearing, and settlement. Financ. Econ. Discuss. Ser. 2016, 95, 2016. [Google Scholar] [CrossRef]

- Hawlitschek, F.; Notheisen, B.; Teubner, T. The limits of trust-free systems: A literature review on blockchain technology and trust in the sharing economy. Electron. Commer. Res. Appl. 2018, 29, 50–63. [Google Scholar] [CrossRef]

- Fernandez-Vazquez, S.; Rosillo, R.; de la Fuente, D.; Priore, P. Blockchain in FinTech: A mapping study. Sustainability 2019, 11, 6366. [Google Scholar] [CrossRef]

- Garcia-Garcia, J.A.; Sanchez-Gomez, N.; Lizcano, D.; Escalona, M.J.; Wojdynski, T. Using blockchain to improve collaborative business process management: Systematic literature review. IEEE Access 2020, 8, 142312–142336. [Google Scholar] [CrossRef]

- Treleaven, P.; Brown, R.G.; Yang, D. Blockchain technology in finance. Computer 2017, 50, 14–17. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the FinTech revolution: Interpreting the forces of innovation, disruption and transformation in financial services. J. Manag. Inform. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Du, W.Y.; Pan, S.L.; Leidnerc, D.E.; Ying, W.C. Affordances, experimentation and actualization of fintech: A blockchain implementation study. J. Strateg. Inf. Syst. 2019, 28, 50–65. [Google Scholar] [CrossRef]

- Kimani, D.; Adams, K.; Attah-Boakye, R.; Ullahd, S.; Frecknall-Hughes, J.; Kim, J. Blockchain, business and the fourth industrial revolution: Whence, whither, wherefore and how? Technol. Forecast. Soc. Change 2020, 161, 120254. [Google Scholar] [CrossRef]

- Konstantinos, C.; Devetsikiotis, M. Blockchains and smart contracts for the internet of things. IEEE Access 2016, 4, 2292–2303. [Google Scholar] [CrossRef]

- Aitzhan, N.Z.; Svetinovic, D. Security and privacy in decentralized energy trading through multi-signatures, blockchain and anonymous messaging streams. IEEE Trans. Dependable Secur. Comput. 2018, 15, 840–852. [Google Scholar] [CrossRef]

- Li, X.Q.; Jiang, P.; Chen, T.; Luo, X.P.; Wen, Q.Y. A survey on the security of blockchain systems. Futur. Gener. Comp. Syst. 2020, 107, 841–853. [Google Scholar] [CrossRef]

- Lohmer, J.; Bugert, N.; Lasch, R. Analysis of resilience strategies and ripple effect in blockchain-coordinated supply chains: An agent-based simulation study. Int. J. Prod. Econ. 2020, 228, 107882. [Google Scholar] [CrossRef]

- Hojckova, K.; Ahlborg, H.; Morrison, G.M.; Sandén, B. Entrepreneurial use of context for technological system creation and expansion: The case of blockchain-based peer-to-peer electricity trading. Res. Policy 2020, 49, 104046. [Google Scholar] [CrossRef]

- Tornatzky, L.G.; Fleischer, M.; Chakrabarti, A.K. Processes of Technological Innovation; Lexington Books: Lanham, MD, USA, 1990. [Google Scholar]

- Nam, D.; Lee, J.; Lee, H. Business analytics adoption process: An innovation diffusion perspective. Int. J. Inf. Manag. 2019, 49, 411–423. [Google Scholar] [CrossRef]

- Daiy, A.K.; Shen, K.Y.; Huang, J.Y.; Lin, M.Y. A hybrid model for evaluating open banking business partners. Mathematics 2021, 9, 587. [Google Scholar] [CrossRef]

- Chang, V.; Baudier, P.; Zhang, H.; Xu, Q.W.; Zhang, J.Q.; Arami, M. How blockchain can impact financial service: The overview, challenges and recommendations from expert interviewees. Technol. Forecast. Soc. Change 2020, 158, 120166. [Google Scholar] [CrossRef] [PubMed]

- Vives, X. Digital Disruption in Banking. Annu. Rev. Financ. Econ. 2019, 11, 243–272. [Google Scholar] [CrossRef]

- Van Loo, R. Making innovation more competitive: The case of FinTech. UCLA Law Rev. 2018, 65, 232–279. [Google Scholar]

- Mao, S.H.; Zhu, M.; Wang, X.P.; Xiao, X.P. Grey–Lotka–Volterra model for the competition and cooperation between third-party online payment systems and online banking in China. Appl. Soft Comput. 2020, 95, 106501. [Google Scholar] [CrossRef]

- Borgogno, O.; Colangelo, G. Data sharing and interoperability: Fostering innovation and competition through APIs. Comput. Law Secur. Rev. 2019, 35, 105314. [Google Scholar] [CrossRef]

- Chik, W.B. Customary Internet-ional Law: Creating a body of customary law for cyberspace. Part 1: Developing rules for transitioning custom into law. Comput. Law Secur. Rev. 2010, 26, 3–22. [Google Scholar] [CrossRef]

- Fortune Business Insights, Market Research Report. Available online: https://www.fortunebusinessinsights.com/industry-reports/blockchain-market-100072 (accessed on 12 February 2021).

- Ghezzi, A.; Cavallo, A. Agile Business Model Innovation in Digital Entrepreneurship: Lean Startup Approaches. J. Bus. Res. 2020, 110, 519–537. [Google Scholar] [CrossRef]

- Wang, Y.; Xu, R.; Schwartz, M.; Ghosh, D.; Chen, X. COVID-19 and retail grocery management: Insights from a broad-based consumer survey. IEEE Eng. Manag. Rev. 2020, 48, 202–211. [Google Scholar] [CrossRef]

- Hernández-Murillo, R.; Llobet, G.; Fuentes, R. Strategic online banking adoption. J. Bank Finance 2010, 34, 1650–1663. [Google Scholar] [CrossRef]

- Zhao, Q.; Tsai, P.H.; Wang, J.L. Improving financial service innovation strategies for enhancing china’s banking industry competitive advantage during the fintech revolution: A hybrid mcdm model. Sustainability 2019, 11, 1419. [Google Scholar] [CrossRef]

- Kauffman, R.J.; Liu, J.; Ma, D. Innovations in financial IS and technology ecosystems: High-frequency trading in the equity market. Technol. Forecast. Soc. Change 2015, 99, 339–354. [Google Scholar] [CrossRef]

- Tapscott, D.; Tapscott, A. How blockchain will change organizations. MIT Sloan Manag. Rev. 2017, 58, 10–13. [Google Scholar] [CrossRef]

- Rana, R.L.; Giungato, P.; Tarabella, A.; Tricase, C. Blockchain applications and sustainability issues. Amfiteatru Econ. 2019, 21, 861–870. [Google Scholar] [CrossRef]

- Maesa, D.D.; Mori, P. Blockchain 3.0 applications survey. Parallel Distrib. Comput. 2020, 138, 99–114. [Google Scholar] [CrossRef]

- Taylor, P.J.; Dargahi, T.; Dehghantanha, A.; Parizi, R.M.; Choo, K.K.R. A systematic literature review of blockchain cyber security. Digit. Commun. Netw. 2020, 6, 147–156. [Google Scholar] [CrossRef]

- Jain, A.K.; Flynn, P.; Ross, A.A. Handbook of Biometrics; Springer: Berlin/Heidelberg, Germany, 2007; ISBN 978-0-387-71040-2. [Google Scholar]

- Renaud, K. Evaluating authentication mechanisms. In Security and Usability: Designing Secure Systems that People can Use; Cranor, L.F., Garfinkel, S., Eds.; O’Reilly Media Inc.: Sebastopol, CA, USA, 2005; pp. 103–128. ISBN 0-596-00827-9. [Google Scholar]

- Weir, C.S.; Douglas, G.; Richardson, T.; Jack, M. Usable security: User preferences for authentication methods in eBanking and the effects of experience. Interact. Comput. 2010, 22, 153–164. [Google Scholar] [CrossRef]

- Choi, H.; Park, J.; Kim, J. Consumer preferences of attributes of mobile payment services in South Korea. Telemat. Inform. 2020, 51, 101397. [Google Scholar] [CrossRef]

- Sabherwal, R.; Jeyaraj, A.; Chowa, C. Information system success: Individual and organizational determinants. Manag. Sci. 2006, 52, 1849–1864. [Google Scholar] [CrossRef]

- Bajaj, A. A study of senior information systems managers decision models in adopting new computing architectures. J. Assoc. Inf. Syst. 2000, 1, 1–58. [Google Scholar] [CrossRef][Green Version]

- Dong, L.; Neufeld, D.; Higgins, C. Top management support of enterprise systems implementations. J. Inf. Technol. 2009, 24, 55–80. [Google Scholar] [CrossRef]

- Kulkarni, U.R.; Robles-Flores, J.A.; Popovič, A. Business intelligence capability: The effect of top management and the mediating roles of user participation and analytical decision-making orientation. J. Assoc. Inf. Syst. 2017, 18, 516–541. [Google Scholar] [CrossRef]

- Wang, Y.M.; Wang, Y.S.; Yang, Y.F. Understanding the determinants of RFID adoption in the manufacturing industry. Technol. Forecast. Soc. Change 2010, 77, 803–815. [Google Scholar] [CrossRef]

- Gangwar, H.; Date, H.; Ramaswamy, R. Understanding determinants of cloud computing adoption using an integrated TAM-TOE model. J. Enterp. Inf. Manag. 2015, 28, 107–130. [Google Scholar] [CrossRef]

- Swan, M. Blockchain: Blueprint for a New Economy; O’Reilly Media, Inc.: Sebastopol, CA, USA, 2015; ISBN 978-1-491-92049-7. [Google Scholar]

- Pilkington, M. Blockchain technology: Principles and applications. In Research Handbook on Digital Transformations; Olleros, F.X., Zhegu, M., Eds.; Edward Elgar: Northampton, MA, USA, 2016; p. 225253. ISBN 978-1-78471-755-9. [Google Scholar]

- Lansiti, M.; Lakhani, K.R. The truth about blockchain. Harv. Bus. Rev. 2017, 95, 118–127. [Google Scholar]

- Clohessy, T.; Acton, T.; Godfrey, R.; Houston, M. Organisational Factors that Influence Adoption of Blockchain in Ireland. Available online: http://novoverse.nuigalway.ie/nui-galway-report-sheds-light-on-irish-blockchain-organisational-readiness/ (accessed on 9 April 2021).

- New IDC Spending Guide Sees Strong Growth in Blockchain Solutions Leading to $15.9 Billion Market in 2023. Available online: https://www.businesswire.com/news/home/20190808005064/en/New-IDC-Spending-Guide-Sees-Strong-Growth-in-Blockchain-Solutions-Leading-to-15.9-Billion-Market-in-2023 (accessed on 9 April 2021).

- Frizzo-Barker, J.; Chow-White, P.A.; Adams, P.R.; Mentanko, J.; Green, S. Blockchain as a disruptive technology for business: A systematic review. Int. J. Inf. Manag. 2020, 51, 102029. [Google Scholar] [CrossRef]

- He, D.W.; Ho, C.Y.; Xu, L. Risk and return of online channel adoption in the banking industry. Pac. Basin Financ. J. 2020, 60, 101268. [Google Scholar] [CrossRef]

- Osmani, M.; El-Haddadeh, R.; Hindi, N.; Janssen, M.; Weerakkody, V. Blockchain for next generation services in banking and finance: Cost, benefit, risk and opportunity analysis. J. Enterp. Inf. Manag. 2020, 34, 884–899. [Google Scholar] [CrossRef]

- Guo, Y.; Liang, C. Blockchain application and outlook in the banking industry. Financ. Innov. 2016, 2, 1–12. [Google Scholar] [CrossRef]

- The Future of Financial Infrastructure. Available online: http://www3.weforum.org/docs/WEF_The_future_of_financial_infrastructure.pdf (accessed on 9 April 2021).

- Fintech and Financial Services: Initial Considerations. Available online: https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2017/06/16/Fintech-and-Financial-Services-Initial-Considerations-44985 (accessed on 9 April 2021).

- Tzeng, G.H.; Shen, K.Y. New Concepts and Trends of Hybrid Multiple Criteria Decision Making; CRC Press: Boca Raton, FL, USA, 2017; ISBN 978-1-4987-7708-7. [Google Scholar]

- Saaty, T.L. Decision making—The analytic hierarchy and network processes (AHP/ANP). J. Syst. Sci. Syst. Eng. 2004, 13, 1–35. [Google Scholar] [CrossRef]

- Gabus, A.; Fontela, E. World Problems, An Invitation to Further Thought within The Framework of DEMATEL; Battelle Geneva Research Centre: Geneva, Switzerland, 1972. [Google Scholar]

- Si, S.L.; You, X.Y.; Liu, H.C.; Zhang, P. DEMATEL technique: A systematic review of the state-of-the-art literature on methodologies and applications. Math. Probl. Eng. 2018, 2018, 3696457. [Google Scholar] [CrossRef]

- Chen, F.H.; Hsu, T.S.; Tzeng, G.H. A balanced scorecard approach to establish a performance evaluation and relationship model for hot spring hotels based on a hybrid MCDM model combining DEMATEL and ANP. Int. J. Hosp. Manag. 2011, 30, 908–932. [Google Scholar] [CrossRef]

- Opricovic, S.; Tzeng, G.H. Compromise solution by MCDM methods: A comparative analysis of VIKOR and TOPSIS. Eur. J. Oper. Res. 2004, 156, 445–455. [Google Scholar] [CrossRef]

- Huang, J.Y.; Shen, K.Y.; Shieh, J.C.P.; Tzeng, G.H. Strengthen financial holding companies’ business sustainability by using a hybrid corporate governance evaluation model. Sustainability 2019, 11, 582. [Google Scholar] [CrossRef]

- Wang, Y.L.; Shen, K.Y.; Huang, J.Y.; Luarn, P. Use of a refined corporate social responsibility model to mitigate information asymmetry and evaluate performance. Symmetry 2020, 12, 1349. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Antucheviciene, J.; Chatterjee, P. Multiple-criteria decision-making (MCDM) techniques for business processes information management. Information 2019, 10, 4. [Google Scholar] [CrossRef]

- Rezaei, J. Best-worst multi-criteria decision-making method. Omega 2015, 53, 49–57. [Google Scholar] [CrossRef]

- E.SUN Bank. Available online: https://www.esunbank.com.tw/bank/bank-en (accessed on 10 April 2021).

- Cathy Financial Holdings. Available online: https://www.cathayholdings.com/en/holdings/intro/intro/about (accessed on 10 April 2021).

- First Financial Holding. Available online: https://www.firstholding.com.tw/sites/firstholding/en/home (accessed on 10 April 2021).

| Dimensions | Criteria | References |

|---|---|---|

| Policies and Regulations (D1) | Financial Supervision and Regulations (C1) | [31,32,33] |

| Government Licenses (C2) | [34] | |

| Conflicting Risk among Regulations (C3) | [35,36] | |

| External Market (D2) | Market Potential (C4) | [37,38] |

| Competitors’ Actions and Market Trend (C5) | [38,39,40] | |

| Cooperative Alliances (C6) | [41,42] | |

| Technological Capabilities (D3) | Application Scenario Deconstruction Capability (C7) | [43,44,45] |

| Cybersecurity (C8) | [31,46] | |

| ID Authentication (C9) | [47,48,49,50] | |

| System Reliability (C10) | [43] | |

| Management and Finance (D4) | Top Management Support (C11) | [51,52,53,54,55,56,57,58,59,60] |

| Financial Consideration (C12) | [61,62] | |

| Operational Risk (C13) | [63,64] | |

| New Business Revenue (C14) | [64,65] |

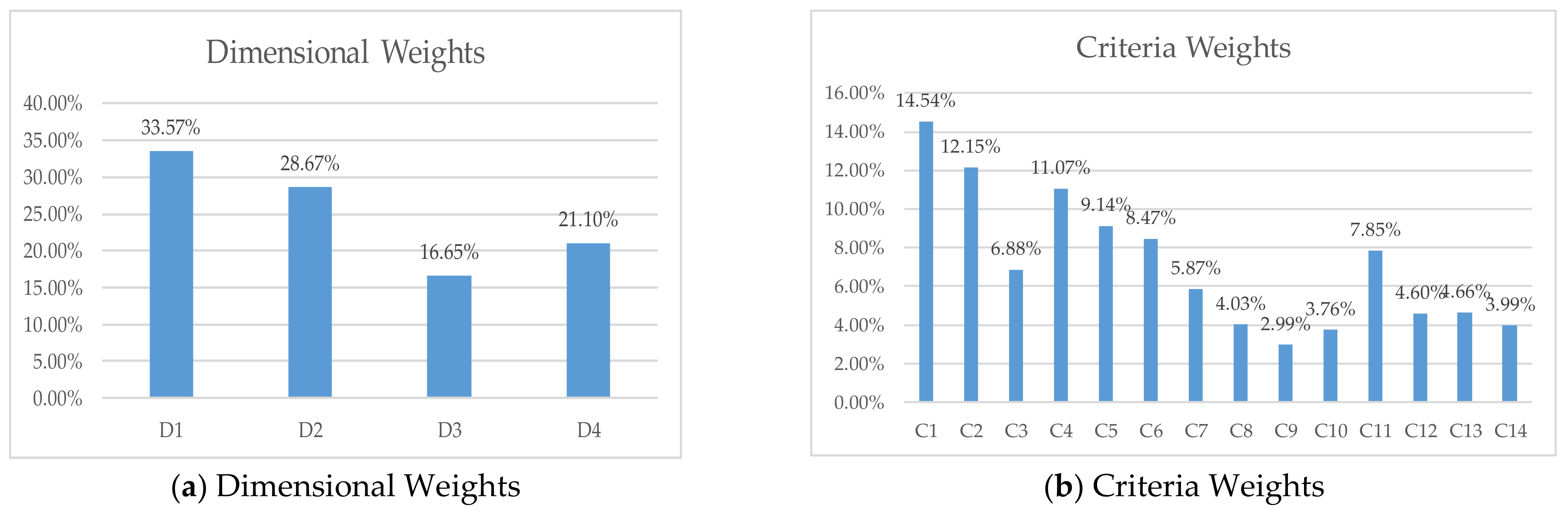

| Dimensional Weights | Criteria | Local Weights | Global Weights |

|---|---|---|---|

| Policies and Regulations (D1) = 33.57%) | Financial Supervision and Regulations (C1) | 43.30% | 14.54% |

| Government Licenses (C2) | 36.20% | 12.15% | |

| Conflicting Risk among Regulations (C3) | 20.50% | 6.88% | |

| External Market (D2) = 28.67%) | Market Potential (C4) | 38.60% | 11.07% |

| Competitors’ Actions and Market Trend (C5) | 31.87% | 9.14% | |

| Cooperative Alliances (C6) | 29.53% | 8.47% | |

| Technological Capabilities (D3) = 16.65%) | Application Scenario Deconstruction Capability (C7) | 35.25% | 5.87% |

| Cybersecurity (C8) | 24.21% | 4.03% | |

| ID Authentication (C9) | 17.95% | 2.99% | |

| System Reliability (C10) | 22.58% | 3.76% | |

| Management and Finance (D4) = 21.10%) | Top Management Support (C11) | 37.21% | 7.85% |

| Financial Consideration (C12) | 21.80% | 4.60% | |

| Operational Risk (C13) | 22.09% | 4.66% | |

| New Business Revenue (C14) | 18.90% | 3.99% |

| Low (Ll, Lm, Lr) | Moderate (Ml, Mm, Mr) | High (Hl, Hm, Hr) | |

|---|---|---|---|

| PwC Expert 1 | (0.0, 0.0, 0.5) | (0.4, 0.6, 0.7) | (0.7, 1.0, 1.0) |

| PwC Expert 2 | (0.0, 0.0, 0.5) | (0.4, 0.5, 0.7) | (0.7, 1.0, 1.0) |

| PwC Expert 3 | (0.0, 0.0, 0.5) | (0.4, 0.6, 0.8) | (0.7, 1.0, 1.0) |

| PwC Expert 4 | (0.0, 0.0, 0.5) | (0.4, 0.5, 0.8) | (0.7, 1.0, 1.0) |

| PwC Expert 5 | (0.0, 0.0, 0.5) | (0.4, 0.7, 0.8) | (0.7, 1.0, 1.0) |

| Each fuzzy semantic scale will multiple 10 to be in line with the crisp performance spectrum. | |||

| Global | Conventional Fuzzy Assessment | Global | Confidence-Based Fuzzy Assessment | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Criteria | Weights | A | B | C | D | E | Weights | A | B | C | D | E |

| C1 | 14.54% | 16.00% | 22.00% | 10.00% | 24.00% | 15.33% | 14.54% | 36.10% | 36.30% | 31.60% | 40.77% | 34.27% |

| C2 | 12.15% | 22.67% | 22.00% | 10.00% | 29.33% | 22.00% | 12.15% | 37.60% | 38.63% | 34.30% | 47.17% | 42.63% |

| C3 | 6.88% | 28.67% | 31.33% | 28.00% | 42.00% | 31.33% | 6.88% | 46.60% | 49.57% | 46.87% | 53.17% | 47.87% |

| C4 | 11.07% | 15.33% | 22.67% | 35.33% | 28.67% | 37.33% | 11.07% | 32.10% | 37.60% | 46.53% | 45.57% | 53.10% |

| C5 | 9.14% | 22.00% | 29.33% | 37.33% | 52.00% | 44.67% | 9.14% | 42.30% | 50.67% | 57.13% | 63.60% | 62.20% |

| C6 | 8.47% | 36.67% | 16.67% | 23.33% | 32.00% | 30.00% | 8.47% | 50.13% | 37.83% | 43.50% | 47.73% | 44.67% |

| C7 | 5.87% | 10.00% | 42.67% | 34.67% | 36.00% | 28.67% | 5.87% | 30.70% | 59.83% | 52.17% | 49.53% | 48.53% |

| C8 | 4.03% | 22.67% | 21.33% | 15.33% | 36.67% | 30.00% | 4.03% | 34.57% | 39.90% | 34.43% | 51.97% | 49.60% |

| C9 | 2.99% | 15.33% | 15.33% | 15.33% | 39.33% | 39.33% | 2.99% | 34.27% | 30.83% | 32.10% | 49.67% | 49.43% |

| C10 | 3.76% | 22.67% | 15.33% | 15.33% | 30.00% | 30.00% | 3.76% | 34.57% | 33.00% | 34.80% | 46.50% | 49.03% |

| C11 | 7.85% | 30.00% | 30.00% | 22.00% | 30.00% | 30.00% | 7.85% | 47.57% | 46.53% | 40.13% | 45.93% | 46.53% |

| C12 | 4.60% | 35.33% | 28.00% | 28.00% | 42.67% | 36.67% | 4.60% | 50.87% | 44.50% | 46.37% | 56.73% | 52.87% |

| C13 | 4.66% | 37.33% | 36.00% | 42.67% | 45.33% | 44.67% | 4.66% | 51.53% | 55.13% | 59.97% | 64.93% | 61.50% |

| C14 | 3.99% | 44.67% | 58.00% | 67.33% | 75.33% | 76.00% | 3.99% | 56.80% | 70.37% | 74.03% | 80.57% | 80.63% |

| S | 24.18% | 26.66% | 25.27% | 35.91% | 32.17% | S | 40.95% | 43.74% | 43.79% | 50.91% | 49.14% | |

| R | 3.10% | 3.20% | 3.91% | 4.75% | 4.13% | R | 5.25% | 5.28% | 5.22% | 5.93% | 5.88% | |

| Q | = 0.9 (Rank) | 22.07% (1st) | 24.32% (3rd) | 23.14% (2nd) | 32.79% (5th) | 29.36% (4th) | = 0.9 (Rank) | 37.38% (1st) | 39.89% (2nd) | 39.94% (3rd) | 46.41% (5th) | 44.81% (4th) |

| Q | = 0.8 (Rank) | 19.96% (1st) | 21.97% (3rd) | 21.00% (2nd) | 29.68% (5th) | 26.56% (4th) | = 0.8 (Rank) | 33.81% (1st) | 36.05% (2nd) | 36.08% (3rd) | 41.91% (5th) | 40.49% (4th) |

| The final ranking is based on the aggregated performance gap index Q, the smaller the better. | ||||||||||||

| Crisp Assessment | Conventional Fuzzy | Confidence-Based Fuzzy | |

|---|---|---|---|

| SAW | |||

| = 1.0) | |||

| = 0.9) | |||

| = 0.8) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, N.-P.; Shen, K.-Y.; Liang, C.-J. Hybrid Decision Model for Evaluating Blockchain Business Strategy: A Bank’s Perspective. Sustainability 2021, 13, 5809. https://doi.org/10.3390/su13115809

Chen N-P, Shen K-Y, Liang C-J. Hybrid Decision Model for Evaluating Blockchain Business Strategy: A Bank’s Perspective. Sustainability. 2021; 13(11):5809. https://doi.org/10.3390/su13115809

Chicago/Turabian StyleChen, Nien-Ping, Kao-Yi Shen, and Chiung-Ju Liang. 2021. "Hybrid Decision Model for Evaluating Blockchain Business Strategy: A Bank’s Perspective" Sustainability 13, no. 11: 5809. https://doi.org/10.3390/su13115809

APA StyleChen, N.-P., Shen, K.-Y., & Liang, C.-J. (2021). Hybrid Decision Model for Evaluating Blockchain Business Strategy: A Bank’s Perspective. Sustainability, 13(11), 5809. https://doi.org/10.3390/su13115809