Organizational Capabilities for Family Firm Sustainability: The Role of Knowledge Accumulation and Family Essence

Abstract

1. Introduction

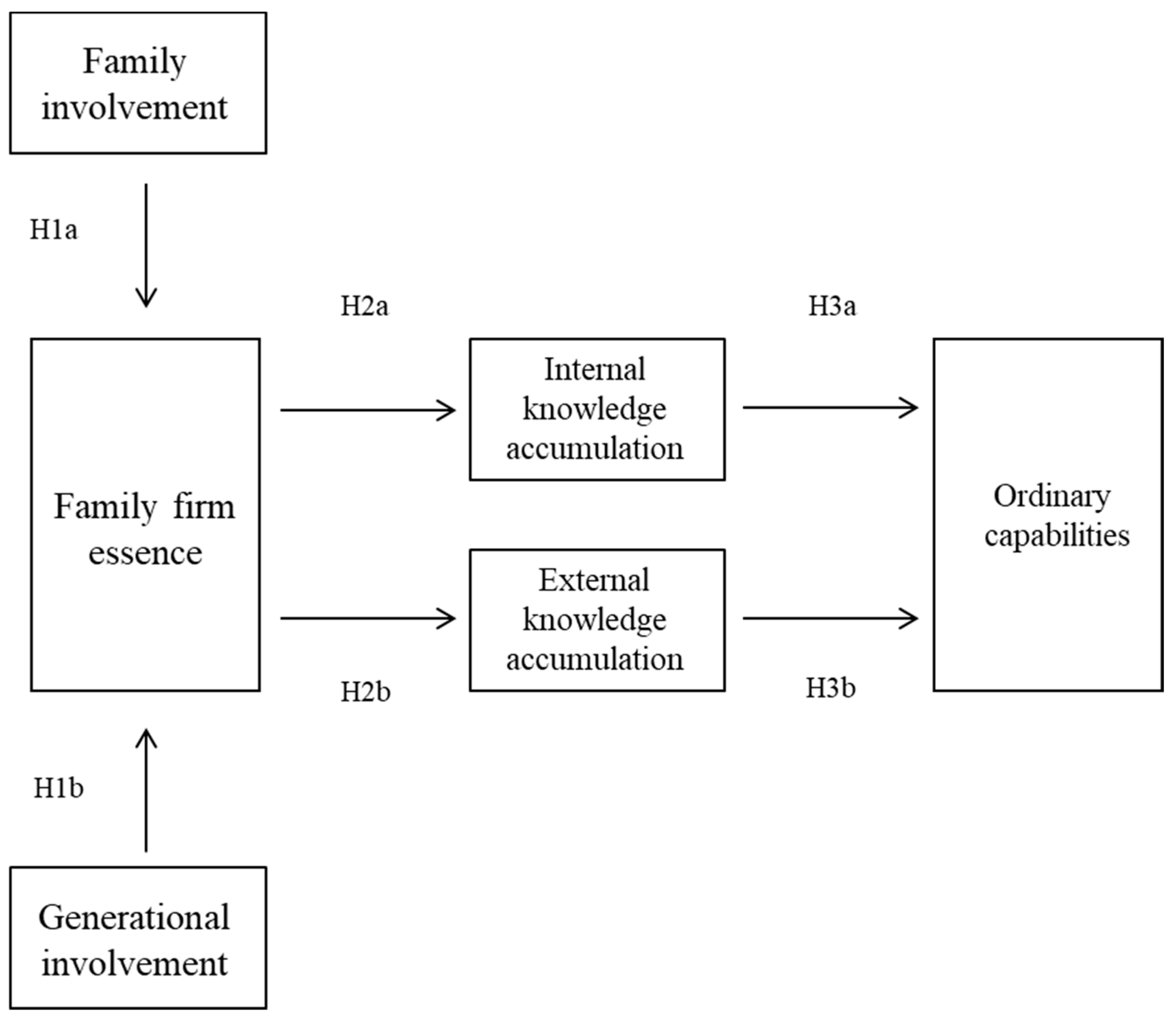

2. Theoretical Background and Hypotheses Development

2.1. Organizational Capabilities in Family Firms

2.2. Family Essence and Its Determinants

2.3. Knowledge Accumulation in Family Firms

2.4. Knowledge Accumulation and Organizational Capabilities

3. Methods

3.1. Sample and Data Collection

3.2. Measures

3.3. Statistical Method

4. Results

4.1. Measurement Model

4.2. Structural Model and Hypotheses Results

5. Discussion and Implications

5.1. Results Discussion

5.2. Contributions and Implications

5.3. Limitations and Future Research Avenues

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables |

|---|

| Familiness Family involvement in the boards: |

| Fin_1 What percentage of positions on the governance board is occupied directly and/or indirectly by family members are? |

| Fin_2 What percentage of positions on the management board is occupied directly and/or indirectly by family members? |

| Generational involvement in the boards |

| Gin_1 How many generations are the owners of the company? |

| Gin_2 How many generations are active in the governance board? |

| Gin_3 How many generations are active in the management board? |

| Family firm essence |

| The family members working in the business: |

| Ffe_1 Do they feel loyalty to the company? |

| Ffe_2 Do they agree with the objectives of the company, its plans, and policies? |

| Ffe_3 Do they share the same values of the company? |

| Ffe_4 Are they concerned about the fate of the company? |

| Ffe_5 Are they willing to make great efforts to help the business succeed? |

| Internal knowledge accumulation |

| The family members working in the business: |

| Ika_1 Are they attending practical training in the family business? |

| Ika_2 Are they showing commitment to the family business? |

| External knowledge accumulation |

| The family members working in the business: |

| Eka_1 Are they attending academic courses and practical training outside the family firm? |

| Eka_2 Are they willing to hire non-family managers? |

| Ordinary capabilities |

| The company continuously developing: |

| Oca_1 Internal research and development activities? |

| Oca_2 Activities to identify changes in customer needs? |

| Oca_3 Processes to take advantage of technological developments? |

| Oca_4 Processes to the adaptation of the business model? |

| Oca_5 Asset management processes? |

| Oca_6 Job rotation activities, regular meetings at different levels, news/blogs newsletters, MFDs settings? |

| Oca_7 Adaptation processes of resources to seize new opportunities? |

| Control variables |

| Fage Age of the firm. |

| Fsiz Number of employees. |

| Find Industry. |

References

- Teece, D.J. The Foundations of Enterprise Performance: Dynamic and Ordinary Capabilities in an (Economic) Theory of Firms. Acad. Manag. Perspect. 2014, 28, 328–352. [Google Scholar] [CrossRef]

- Cepeda, G.; Vera, D. Dynamic capabilities and operational capabilities: A knowledge management perspective. J. Bus. Res. 2007, 60, 426–437. [Google Scholar] [CrossRef]

- Schriber, S.; Löwstedt, J. Reconsidering ordinary and dynamic capabilities in strategic change. Eur. Manag. J. 2020, 38, 377–387. [Google Scholar] [CrossRef]

- Arzubiaga, U.; Maseda, A.; Iturralde, T. Exploratory and exploitative innovation in family businesses: The moderating role of the family firm image and family involvement in top management. Rev. Manag. Sci. 2019, 13. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Family Firm. Institute Global Data Points. Available online: https://web.archive.org/web/20180310111300/http://www.ffi.org:80/?page=GlobalDataPoints (accessed on 25 March 2020).

- Chirico, F.; Salvato, C. Knowledge Integration and Dynamic Organizational Adaptation in Family Firms. Fam. Bus. Rev. 2008, 21, 169–181. [Google Scholar] [CrossRef]

- Chirico, F.; Nordqvist, M. Dynamic capabilities and trans-generational value creation in family firms: The role of organizational culture. Int. Small Bus. J. 2010, 28, 487–504. [Google Scholar] [CrossRef]

- Chirico, F.; Nordqvist, M.; Colombo, G.; Mollona, E. Simulating Dynamic Capabilities and Value Creation in Family Firms. Fam. Bus. Rev. 2012, 25, 318–338. [Google Scholar] [CrossRef]

- Barros, I.; Hernangómez, J.; Martin-Cruz, N. A theoretical model of strategic management of family firms. A dynamic capabilities approach. J. Fam. Bus. Strateg. 2016, 7, 149–159. [Google Scholar] [CrossRef]

- Arzubiaga, U.; Diaz-Moriana, V.; Bauweraerts, J.; Escobar, O. Big data in family firms: A socioemotional wealth perspective. Eur. Manag. J. 2020. [Google Scholar] [CrossRef]

- Danes, S.M.; Stafford, K.; Haynes, G.; Amarapurkar, S.S. Family Capital of Family Firms. Fam. Bus. Rev. 2009, 22, 199–215. [Google Scholar] [CrossRef]

- Camisón-Zornoza, C.; Forés-Julián, B.; Puig-Denia, A.; Camisón-Haba, S. Effects of ownership structure and corporate and family governance on dynamic capabilities in family firms. Int. Entrep. Manag. J. 2020, 16, 1393–1426. [Google Scholar] [CrossRef]

- Wang, Y. Environmental dynamism, trust and dynamic capabilities of family businesses. Int. J. Entrep. Behav. Res. 2016, 22, 643–670. [Google Scholar] [CrossRef]

- Barros-Contreras, I.; Palma-Ruiz, J.M. Knowledge Accumulation and Its Effects on Organizational Effectiveness in Family Firms. In Intrapreneurship and Sustainable Human Capital. Studies on Entrepreneurship, Structural Change and Industrial Dynamics; Leitão, J., Nunes, A., Pereira, D., Ramadani, V., Eds.; Springer: Cham, Switzerland, 2020; pp. 155–167. ISBN 978-3-030-49410-0. [Google Scholar]

- Kang, T.; Baek, C.; Lee, J.-D. Effects of knowledge accumulation strategies through experience and experimentation on firm growth. Technol. Forecast. Soc. Chang. 2019, 144, 169–181. [Google Scholar] [CrossRef]

- Denford, J.S. Building knowledge: Developing a knowledge-based dynamic capabilities typology. J. Knowl. Manag. 2013, 17, 175–194. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Absorptive capacity, environmental turbulence, and the complementarity of organizational learning processes. Acad. Manag. J. 2009, 52, 822–846. [Google Scholar] [CrossRef]

- Serrano-Bedia, A.M.; López-Fernández, M.C.; Garcia-Piqueres, G. Analysis of the relationship between sources of knowledge and innovation performance in family firms. Innovation 2016, 18, 489–512. [Google Scholar] [CrossRef]

- Rondi, E.; De Massis, A.; Kotlar, J. Unlocking innovation potential: A typology of family business innovation postures and the critical role of the family system. J. Fam. Bus. Strateg. 2019, 10, 100236. [Google Scholar] [CrossRef]

- Forés, B.; Camisón, C. Does incremental and radical innovation performance depend on different types of knowledge accumulation capabilities and organizational size? J. Bus. Res. 2016, 69, 831–848. [Google Scholar] [CrossRef]

- Zollo, M.; Winter, S.G. Deliberate Learning and the Evolution of Dynamic Capabilities. Organ. Sci. 2002, 13, 339–351. [Google Scholar] [CrossRef]

- Chirico, F. Knowledge Accumulation in Family Firms. Int. Small Bus. J. Res. Entrep. 2008, 26, 433–462. [Google Scholar] [CrossRef]

- Gold, A.H.; Malhotra, A.; Segars, A.H. Knowledge Management: An Organizational Capabilities Perspective. J. Manag. Inf. Syst. 2001, 18, 185–214. [Google Scholar] [CrossRef]

- Nonaka, I.; Toyama, R.; Nagata, A. A firm as a knowledge-creating entity: A new perspective on the theory of the firm. Ind. Corp. Chang. 2000, 9, 1–20. [Google Scholar] [CrossRef]

- Easterby-Smith, M.; Prieto, I.M. Dynamic Capabilities and Knowledge Management: An Integrative Role for Learning? *. Br. J. Manag. 2008, 19, 235–249. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Chua, J.H.; Pearson, A.W.; Barnett, T. Family Involvement, Family Influence, and Family-Centered Non-Economic Goals in Small Firms. Entrep. Theory Pract. 2012, 36, 267–293. [Google Scholar] [CrossRef]

- Gibb Dyer, W. Examining the “Family Effect” on Firm Performance. Fam. Bus. Rev. 2006, 19, 253–273. [Google Scholar] [CrossRef]

- Basco, R. The family’s effect on family firm performance: A model testing the demographic and essence approaches. J. Fam. Bus. Strateg. 2013, 4, 42–66. [Google Scholar] [CrossRef]

- Arzubiaga, U.; Kotlar, J.; De Massis, A.; Maseda, A.; Iturralde, T. Entrepreneurial orientation and innovation in family SMEs: Unveiling the (actual) impact of the Board of Directors. J. Bus. Ventur. 2018, 33, 455–469. [Google Scholar] [CrossRef]

- Calabrò, A.; Torchia, M.; Jimenez, D.G.; Kraus, S. The role of human capital on family firm innovativeness: The strategic leadership role of family board members. Int. Entrep. Manag. J. 2021, 17, 261–287. [Google Scholar] [CrossRef]

- Zahra, S.A.; Neubaum, D.O.; Larrañeta, B. Knowledge sharing and technological capabilities: The modearating role of family involvement. J. Bus. Res. 2007, 60, 1070–1079. [Google Scholar] [CrossRef]

- Chirico, F.; Sirmon, D.G.; Sciascia, S.; Mazzola, P. Resource orchestration in family firms: Investigating how entrepreneurial orientation, generational involvement, and participative strategy affect performance. Strateg. Entrep. J. 2011, 5, 307–326. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A. Managing Resources: Linking Unique Resources, Management, and Wealth Creation in Family Firms. Entrep. Theory Pract. 2003, 27, 339–358. [Google Scholar] [CrossRef]

- Ensley, M.D.; Pearson, A.W. An Exploratory Comparison of the Behavioral Dynamics of Top Management Teams in Family and Nonfamily New Ventures: Cohesion, Conflict, Potency, and Consensus. Entrep. Theory Pract. 2005, 29, 267–284. [Google Scholar] [CrossRef]

- Gomez-Mejia, L.R.; Larraza-Kintana, M.; Makri, M. The Determinants of Executive Compensation in Family-Controlled Public Corporations. Acad. Manag. J. 2003, 46, 226–237. [Google Scholar] [CrossRef]

- Astrachan, J.H.; Klein, S.B.; Smyrnios, K.X. The F-PEC Scale of Family Influence: A Proposal for Solving the Family Business Definition Problem. Fam. Bus. Rev. 2002, 15, 45–58. [Google Scholar] [CrossRef]

- Chua, J.H.; Chrisman, J.J.; Sharma, P. Defining the Family Business by Behavior. Entrep. Theory Pract. 1999, 23, 19–39. [Google Scholar] [CrossRef]

- Gómez-Mejía, L.R.; Haynes, K.T.; Núñez-Nickel, M.; Jacobson, K.J.L.; Moyano-Fuentes, J. Socioemotional Wealth and Business Risks in Family-controlled Firms: Evidence from Spanish Olive Oil Mills. Adm. Sci. Q. 2007, 52, 106–137. [Google Scholar] [CrossRef]

- Gomez-Mejia, L.R.; Cruz, C.; Berrone, P.; De Castro, J. The Bind that Ties: Socioemotional Wealth Preservation in Family Firms. Acad. Manag. Ann. 2011, 5, 653–707. [Google Scholar] [CrossRef]

- Barach, J.A.; Ganitsky, J.B. Successful Succession in Family Business. Fam. Bus. Rev. 1995, 8, 131–155. [Google Scholar] [CrossRef]

- Helfat, C.E.; Finkelstein, S.; Mitchell, W.; Peteraf, M.A.; Singh, H.; Teece, D.J.; Winter, S.G. Dynamic Capabilities: Understanding Strategic Change in Organizations, 1st ed.; Wiley-Blackwell: Malden, MA, USA, 2008; ISBN 978-1405159043. [Google Scholar]

- Kusunoki, K.; Nonaka, I.; Nagata, A. Organizational Capabilities in Product Development of Japanese Firms: A Conceptual Framework and Empirical Findings. Organ. Sci. 1998, 9, 699–718. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A. Feuding Families: When Conflict Does a Family Firm Good. Entrep. Theory Pract. 2004, 28, 209–228. [Google Scholar] [CrossRef]

- Meso, P.; Smith, R. A resource-based view of organizational knowledge management systems. J. Knowl. Manag. 2000, 4, 224–234. [Google Scholar] [CrossRef]

- Almeida, P.; Kogut, B. Localization of Knowledge and the Mobility of Engineers in Regional Networks. Manag. Sci. 1999, 45, 905–917. [Google Scholar] [CrossRef]

- Lai, K.; Yeung, A.C.L.; Cheng, T.C.E. Configuring quality management and marketing implementation and the performance implications for industrial marketers. Ind. Mark. Manag. 2012, 41, 1284–1297. [Google Scholar] [CrossRef][Green Version]

- Gersick, K.E.; Davis, J.A.; McCollom Hampton, M.; Lansberg, I. Generation to Generation: Life Cycle of Family Business; Harvard Business Review Press: Cambridge, MA, USA, 1997; ISBN 978-0875845555. [Google Scholar]

- Zheng, W.; Yang, B.; McLean, G.N. Linking organizational culture, structure, strategy, and organizational effectiveness: Mediating role of knowledge management. J. Bus. Res. 2010, 63, 763–771. [Google Scholar] [CrossRef]

- Pérez-Pérez, M.; López-Férnandez, M.C.; Obeso, M. Knowledge, Renewal and Flexibility: Exploratory Research in Family Firms. Adm. Sci. 2019, 9, 87. [Google Scholar] [CrossRef]

- Lichtenthaler, U.; Lichtenthaler, E. A Capability-Based Framework for Open Innovation: Complementing Absorptive Capacity. J. Manag. Stud. 2009, 46, 1315–1338. [Google Scholar] [CrossRef]

- Jaffe, D.T.; Lane, S.H. Sustaining a Family Dynasty: Key Issues Facing Complex Multigenerational Business- and Investment-Owning Families. Fam. Bus. Rev. 2004, 17, 81–98. [Google Scholar] [CrossRef]

- López-Fernández, M.C.; Serrano-Bedia, A.M.; Pérez-Pérez, M.; Hernández-Linares, R.; Palma-Ruiz, M. A Review of the Academic Literature on Family Business in Spanish. In The Routledge Companion to Family Business; Kellermanns, F.W., Hoy, F., Eds.; Routledge: New York, NY, USA, 2017; pp. 522–548. ISBN 9781317419990. [Google Scholar]

- Instituto de Empresa Familiar. La Empresa Familiar en España, 1st ed.; IEF: Madrid, Spain, 2015; ISBN 978-84-608-2119-9. [Google Scholar]

- Arosa, B.; Iturralde, T.; Maseda, A. Ownership structure and firm performance in non-listed firms: Evidence from Spain. J. Fam. Bus. Strateg. 2010, 1, 88–96. [Google Scholar] [CrossRef]

- Basco, R.; Perez Rodriguez, M.J. Studying the Family Enterprise Holistically: Evidence for Integrated Family and Business Systems. Fam. Bus. Rev. 2009, 22, 82–95. [Google Scholar] [CrossRef]

- Sharma, P.; Carney, M. Value Creation and Performance in Private Family Firms. Fam. Bus. Rev. 2012, 25, 233–242. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A.; Barnett, T.; Pearson, A. An Exploratory Study of Family Member Characteristics and Involvement: Effects on Entrepreneurial Behavior in the Family Firm. Fam. Bus. Rev. 2008, 21, 1–14. [Google Scholar] [CrossRef]

- Zahra, S.A. Entrepreneurial Risk Taking in Family Firms. Fam. Bus. Rev. 2005, 18, 23–40. [Google Scholar] [CrossRef]

- Simon, M.; Shrader, R.C. Entrepreneurial actions and optimistic overconfidence: The role of motivated reasoning in new product introductions. J. Bus. Ventur. 2012, 27, 291–309. [Google Scholar] [CrossRef]

- Lindow, C.M.; Stubner, S.; Wulf, T. Strategic fit within family firms: The role of family influence and the effect on performance. J. Fam. Bus. Strateg. 2010, 1, 167–178. [Google Scholar] [CrossRef]

- Zellweger, T.M.; Kellermanns, F.W.; Eddleston, K.A.; Memili, E. Building a family firm image: How family firms capitalize on their family ties. J. Fam. Bus. Strateg. 2012, 3, 239–250. [Google Scholar] [CrossRef]

- Basco, R.; Pérez Rodríguez, M.J. Ideal types of family business management: Horizontal fit between family and business decisions and the relationship with family business performance. J. Fam. Bus. Strateg. 2011, 2, 151–165. [Google Scholar] [CrossRef]

- Bryman, A.; Cramer, D. Quantitative Data Analysis with IBM SPSS 17, 18 & 19: A Guide for Social Scientists; Routledge: London, UK, 2011; ISBN 9780203180990. [Google Scholar]

- Campbell, D.T.; Fiske, D.W. Convergent and discriminant validation by the multitrait-multimethod matrix. Psychol. Bull. 1959, 56, 81–105. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Kortmann, S.; Gelhard, C.; Zimmermann, C.; Piller, F.T. Linking strategic flexibility and operational efficiency: The mediating role of ambidextrous operational capabilities. J. Oper. Manag. 2014, 32, 475–490. [Google Scholar] [CrossRef]

- Grewal, D.; Janakiraman, R.; Kalyanam, K.; Kannan, P.K.; Ratchford, B.; Song, R.; Tolerico, S. Strategic Online and Offline Retail Pricing: A Review and Research Agenda. J. Interact. Mark. 2010, 24, 138–154. [Google Scholar] [CrossRef]

- Harman, H.H. Modem Factor Analysis, 3rd ed.; University of Chicago Press: Chicago, IL, USA, 1976; ISBN 978-0226316529. [Google Scholar]

- Podsakoff, P.M.; Organ, D.W. Self-Reports in Organizational Research: Problems and Prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Holt, D.T.; Rutherford, M.W.; Kuratko, D.F. Advancing the Field of Family Business Research: Further Testing the Measurement Properties of the F-PEC. Fam. Bus. Rev. 2010, 23, 76–88. [Google Scholar] [CrossRef]

- Klein, S.B.; Astrachan, J.H.; Smyrnios, K.X. The F-PEC Scale of Family Influence: Construction, Validation, and Further Implication for Theory. Entrep. Theory Pract. 2005, 29, 321–339. [Google Scholar] [CrossRef]

- Rutherford, M.W.; Kuratko, D.F.; Holt, D.T. Examining the link between “Familiness” and performance: Can the F-PEC untangle the family business theory jungle? Entrep. Theory Pract. 2008, 32, 1089–1109. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Chua, J.H.; Litz, R.A. Comparing the Agency Costs of Family and Non-Family Firms: Conceptual Issues and Exploratory Evidence. Entrep. Theory Pract. 2004, 28, 335–354. [Google Scholar] [CrossRef]

- Arzubiaga, U.; Maseda, A.; Iturralde, T. Entrepreneurial orientation in family firms: New drivers and the moderating role of the strategic involvement of the board. Aust. J. Manag. 2019, 44, 128–152. [Google Scholar] [CrossRef]

- Zellweger, T.M.; Astrachan, J.H. On the Emotional Value of Owning a Firm. Fam. Bus. Rev. 2008, 21, 347–363. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Pieper, T.M.; Ringle, C. The Use of Partial Least Squares Structural Equation Modeling in Strategic Management Research: A Review of Past Practices and Recommendations for Future Applications. Long Range Plann. 2012, 45, 320–340. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D.W.; Boudreau, M.-C. Structural Equation Modeling And Regression: Guidelines For Research Practice. Commun. Assoc. Inf. Syst. 2000, 4, 1–79. [Google Scholar] [CrossRef]

- Peng, D.X.; Lai, F. Using partial least squares in operations management research: A practical guideline and summary of past research. J. Oper. Manag. 2012, 30, 467–480. [Google Scholar] [CrossRef]

- Landau, C.; Bock, C. Value Creation through Vertical Intervention of Corporate Centres in Single Business Units of Unrelated Diversified Portfolios—The Case of Private Equity Firms. Long Range Plann. 2013, 46, 97–124. [Google Scholar] [CrossRef]

- Moreno, A.M.; Casillas, J.C. Entrepreneurial Orientation and Growth of SMEs: A Causal Model. Entrep. Theory Pract. 2008, 32, 507–528. [Google Scholar] [CrossRef]

- Schuster, T.; Holtbrügge, D. Resource Dependency, Innovative Strategies, and Firm Performance in BOP Markets. J. Prod. Innov. Manag. 2014, 31, 43–59. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS 3; SmartPLS GmbH: Bönningstedt, Germany, 2015; Available online: http://www.smartpls.com (accessed on 2 February 2020).

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, G.V. Partial least squares structural equation modeling (PLS-SEM). Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Chin, W.W. The Partial Least Squares Approach for Structural Equation Modeling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates, Inc.: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Tenenhaus, M.; Vinzi, V.E.; Chatelin, Y.-M.; Lauro, C. PLS path modeling. Comput. Stat. Data Anal. 2005, 48, 159–205. [Google Scholar] [CrossRef]

- Miller, D.; Amore, M.D.; Le Breton-Miller, I.; Minichilli, A.; Quarato, F. Strategic distinctiveness in family firms: Firm institutional heterogeneity and configurational multidimensionality. J. Fam. Bus. Strateg. 2018, 9, 16–26. [Google Scholar] [CrossRef]

- Nosé, L.; Korunka, C.; Frank, H.; Danes, S.M. Decreasing the Effects of Relationship Conflict on Family Businesses. J. Fam. Issues 2017, 38, 25–51. [Google Scholar] [CrossRef]

- Sciascia, S.; Mazzola, P.; Chirico, F. Generational Involvement in the Top Management Team of Family Firms: Exploring Nonlinear Effects on Entrepreneurial Orientation. Entrep. Theory Pract. 2013, 37, 69–85. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A.; Sarathy, R.; Murphy, F. Innovativeness in family firms: A family influence perspective. Small Bus. Econ. 2012, 38, 85–101. [Google Scholar] [CrossRef]

- Chua, J.H.; Chrisman, J.J.; Bergiel, E.B. An Agency Theoretic Analysis of the Professionalized Family Firm. Entrep. Theory Pract. 2009, 33, 355–372. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic Capabilities: What Are They? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Adler, P.S.; Kwon, S. Social Capital: Prospects for a New Concept. Acad. Manag. Rev. 2002, 27, 17–40. [Google Scholar] [CrossRef]

- Chua, J.H.; Chrisman, J.J.; Steier, L.P.; Rau, S.B. Sources of Heterogeneity in Family Firms: An Introduction. Entrep. Theory Pract. 2012, 36, 1103–1113. [Google Scholar] [CrossRef]

- Daspit, J.J.; Long, R.G.; Pearson, A.W. How familiness affects innovation outcomes via absorptive capacity: A dynamic capability perspective of the family firm. J. Fam. Bus. Strateg. 2019, 10, 133–143. [Google Scholar] [CrossRef]

- Astrachan, J.H. Strategy in family business: Toward a multidimensional research agenda. J. Fam. Bus. Strateg. 2010, 1, 6–14. [Google Scholar] [CrossRef]

- Hofstede, G. Culture’s Consequences: Comparing Values, Behaviors, Institutions and Organizations Across Nations, 2nd ed.; Sage Publications, Inc.: Thousand Oaks, CA, USA, 2001; ISBN 0803973233. [Google Scholar]

- Cruz, C.; Nordqvist, M. Entrepreneurial orientation in family firms: A generational perspective. Small Bus. Econ. 2012, 38, 33–49. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A. Corporate Entrepreneurship in Family Firms: A Family Perspective. Entrep. Theory Pract. 2006, 30, 809–830. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Sharma, P.; Steier, L.P.; Chua, J.H. The Influence of Family Goals, Governance, and Resources on Firm Outcomes. Entrep. Theory Pract. 2013, 37, 1249–1261. [Google Scholar] [CrossRef]

- Cruz, C.; Larraza-Kintana, M.; Garcés-Galdeano, L.; Berrone, P. Are Family Firms Really More Socially Responsible? Entrep. Theory Pract. 2014, 38, 1295–1316. [Google Scholar] [CrossRef]

| Construct and Indicator | Factor Loading | t-Statistic | Composite Reliability | AVE | Cronbach’s Alpha |

|---|---|---|---|---|---|

| Family involvement | 0.923 | 0.858 | 0.836 | ||

| Fin_1 | 0.911 | 7.323 | |||

| Fin_2 | 0.941 | 11.453 | |||

| Generational involvement | 0.971 | 0.919 | 0.956 | ||

| Gin_1 | 0.917 | 10.780 | |||

| Gin_2 | 0.982 | 11.108 | |||

| Gin_3 | 0.976 | 11.283 | |||

| Family firm essence | 0.855 | 0.542 | 0.789 | ||

| Ffe_1 | 0.752 | 8.072 | |||

| Ffe_2 | 0.703 | 7.493 | |||

| Ffe_3 | 0.719 | 8.478 | |||

| Ffe_4 | 0.701 | 6.605 | |||

| Ffe_5 | 0.800 | 10.046 | |||

| Internal knowledge accumulation | 0.856 | 0.748 | 0.664 | ||

| Ika_1 | 0.879 | 13.154 | |||

| Ika_2 | 0.850 | 11.401 | |||

| External knowledge accumulation | 0.807 | 0.676 | 0.524 | ||

| Eka_1 | 0.850 | 8.997 | |||

| Eka_2 | 0.794 | 8.191 | |||

| Ordinary capabilities | 0.911 | 0.596 | 0.885 | ||

| Oca_1 | 0.720 | 13.391 | |||

| Oca_2 | 0.883 | 30.783 | |||

| Oca_3 | 0.799 | 16.324 | |||

| Oca_4 | 0.786 | 17.345 | |||

| Oca_5 | 0.613 | 5.387 | |||

| Oca_6 | 0.719 | 9.811 | |||

| Oca_7 | 0.851 | 20.550 | |||

| Control variables | --- | --- | --- | ||

| Fage | 0.024 | 0.417 | |||

| Fsiz | 0.202 | 2.463 | |||

| Find | 0.018 | 0.335 |

| Construct | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| 1. Ordinary capabilities | 0.772 | |||||

| 2. Internal knowledge accumulation | 0.282 | 0.865 | ||||

| 3. External knowledge accumulation | 0.424 | 0.132 | 0.822 | |||

| 4. Family firm essence | 0.082 | 0.478 | 0.016 | 0.736 | ||

| 5. Generational involvement | 0.045 | −0.033 | 0.089 | −0.107 | 0.959 | |

| 6. Family involvement | −0.270 | 0.148 | −0.272 | 0.255 | 0.044 | 0.926 |

| Hypotheses | Path Coefficient | t-Value | Outcome |

|---|---|---|---|

| (H1a) Family involvement → Family firm essence | 0.260 | 2.395 *** | Supported |

| (H1b) Generational involvement → Family firm essence | −0.118 | 1.669 † | Not supported |

| (H2a) Family firm essence → Internal knowledge accumulation | 0.478 | 5.644 *** | Supported |

| (H2b) Family firm essence → External knowledge accumulation | 0.016 | 0.230 | Not supported |

| (H3a) Internal knowledge accumulation → Ordinary capabilities | 0.231 | 2.232 *** | Supported |

| (H3b) External knowledge accumulation → Ordinary capabilities | 0.393 | 4.178 *** | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Barros-Contreras, I.; Palma-Ruiz, J.M.; Torres-Toukoumidis, A. Organizational Capabilities for Family Firm Sustainability: The Role of Knowledge Accumulation and Family Essence. Sustainability 2021, 13, 5607. https://doi.org/10.3390/su13105607

Barros-Contreras I, Palma-Ruiz JM, Torres-Toukoumidis A. Organizational Capabilities for Family Firm Sustainability: The Role of Knowledge Accumulation and Family Essence. Sustainability. 2021; 13(10):5607. https://doi.org/10.3390/su13105607

Chicago/Turabian StyleBarros-Contreras, Ismael, Jesús Manuel Palma-Ruiz, and Angel Torres-Toukoumidis. 2021. "Organizational Capabilities for Family Firm Sustainability: The Role of Knowledge Accumulation and Family Essence" Sustainability 13, no. 10: 5607. https://doi.org/10.3390/su13105607

APA StyleBarros-Contreras, I., Palma-Ruiz, J. M., & Torres-Toukoumidis, A. (2021). Organizational Capabilities for Family Firm Sustainability: The Role of Knowledge Accumulation and Family Essence. Sustainability, 13(10), 5607. https://doi.org/10.3390/su13105607