Dynamic Interrelationship and Volatility Spillover among Sustainability Stock Markets, Major European Conventional Indices, and International Crude Oil

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Data

3.2. Descriptive Statistics and Primary Analysis

3.3. Methodology and Model Specification

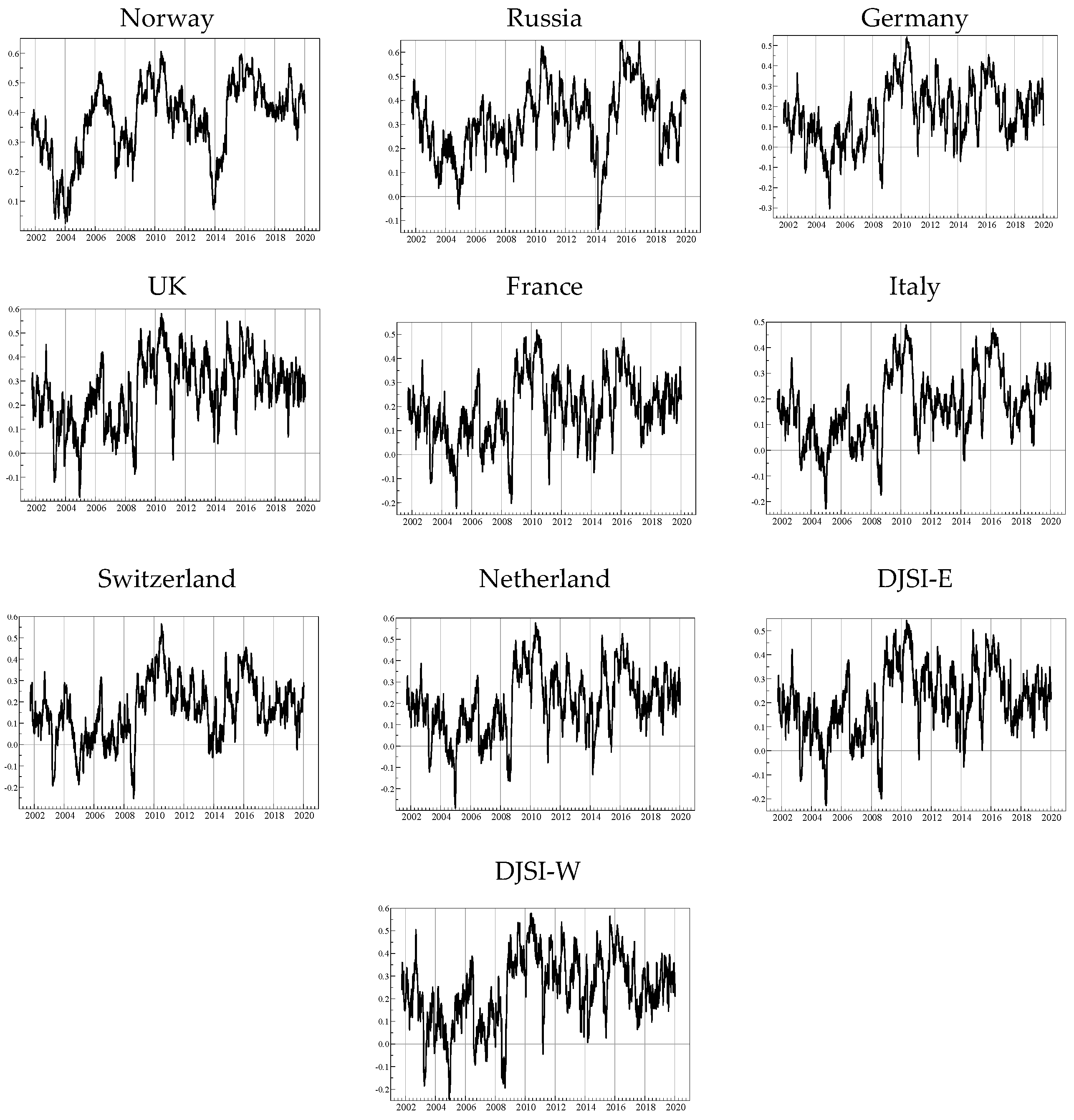

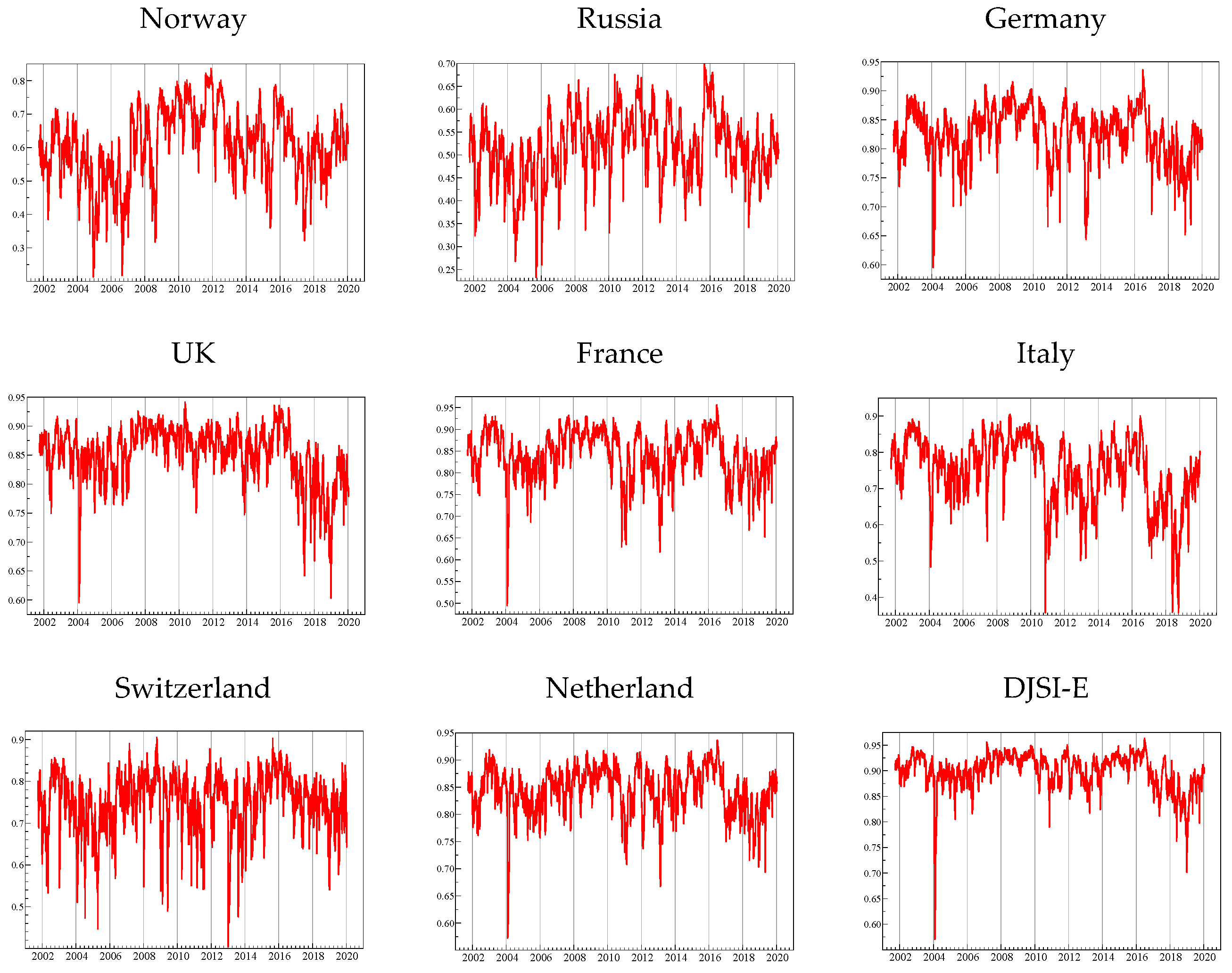

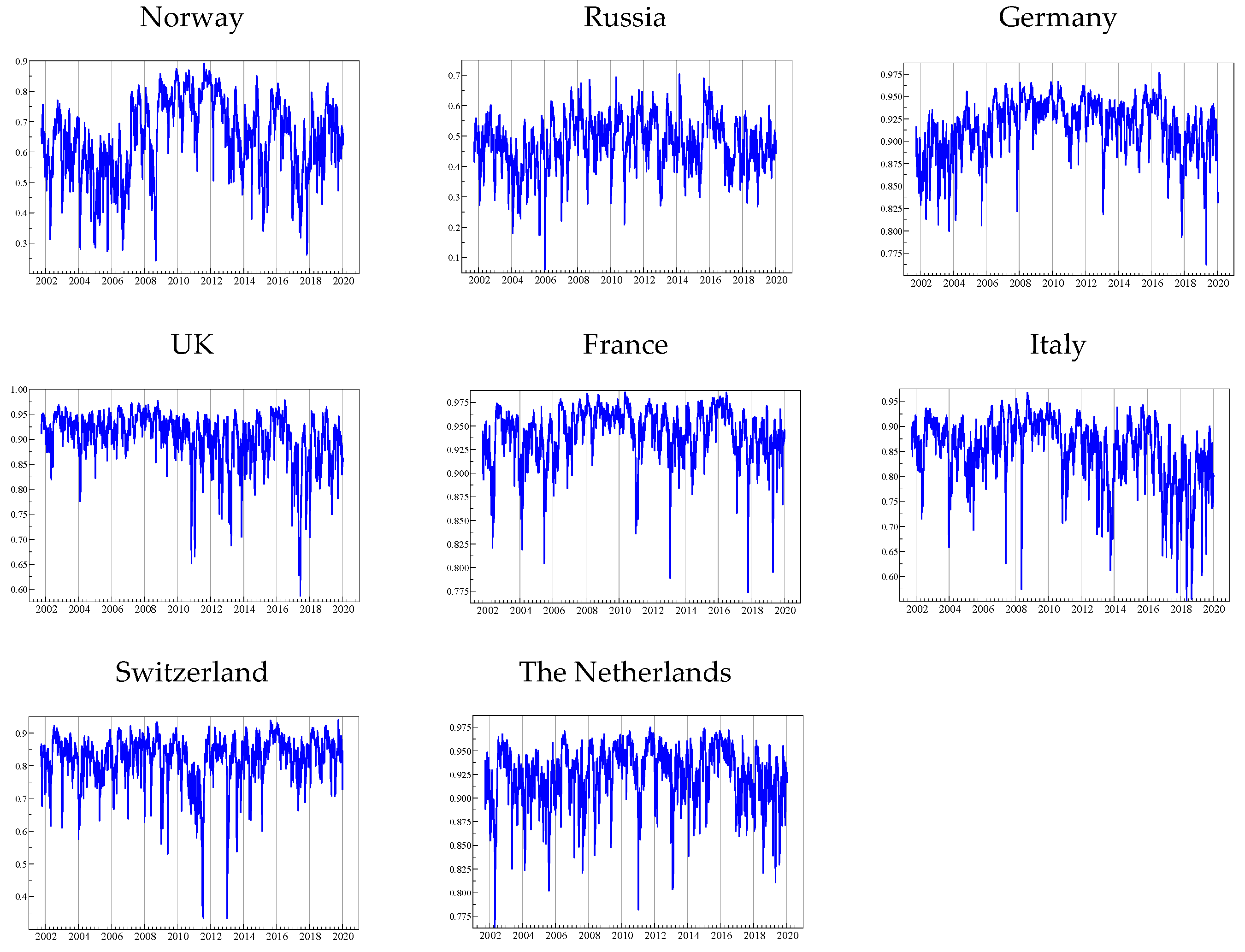

4. Empirical Results and Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Polat, O. Time-Varying Propagations between Oil Market Shocks and a Stock Market: Evidence from Turkey. Borsa Istanb. Rev. 2020, A, 100–110. [Google Scholar] [CrossRef]

- Mensi, W. Global financial crisis and co-movements between oil prices and sector stock markets in Saudi Arabia: A VaR based wavelet. Borsa Istanb. Rev. 2019, 19, 24–38. [Google Scholar] [CrossRef]

- Fisher, I. Theory of Interest: As Determined by Impatience to Spend Income and Opportunity to Invest It; Augustusm Kelly Publishers: Clifton, NJ, USA, 1930. [Google Scholar]

- Williams, J.B. The Theory of Investment Value; Harvard University Press: Cambridge, MA, USA, 1938. [Google Scholar]

- Basher, S.A.; Sadorsky, P. Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Econ. 2016, 54, 235–247. [Google Scholar] [CrossRef]

- Sadorsky, P. Modeling volatility and conditional correlations between socially responsible investments, gold and oil. Econ. Model. 2014, 38, 609–618. [Google Scholar] [CrossRef]

- Cortez, M.C.; Silva, F.; Areal, N. Socially responsible investing in the global market: The performance of US and European funds. Int. J. Finance Econ. 2012, 17, 254–271. [Google Scholar] [CrossRef]

- Sariannidis, N.; Giannarakis, G.; Zafeiriou, E.; Billias, I. The effect of crude oil price moments on socially responsible firms in Eurozone. Int. J. Energy Econ. Policy 2016, 6, 356–363. [Google Scholar]

- Kempf, A.; Osthoff, P. The effect of socially responsible investing on portfolio performance. Eur. Financ. Manag. 2007, 13, 908–922. [Google Scholar] [CrossRef]

- Giannarakis, G.; Lemonakis, C.; Sormas, A.; Georganakis, C. The effect of Baltic Dry Index, gold, oil and usa trade balance on dow jones sustainability index world. Int. J. Econ. Financ. Issues 2017, 7, 155. [Google Scholar]

- Knoepfel, I. Dow Jones Sustainability Group Index: A global benchmark for corporate sustainability. Corp. Environ. Strateg. 2001, 8, 6–15. [Google Scholar] [CrossRef]

- Schaeffer, R.; Borba, B.S.M.C.; Rathmann, R.; Szklo, A.; Castelo Branco, D.A. Dow Jones sustainability index transmission to oil stock market returns: A GARCH approach. Energy 2012, 45, 933–943. [Google Scholar] [CrossRef]

- Arai, M.; Lanz, D.; O’Connor, S.O.; Oulton, W.; Woll, L. 2018 Global Sustainable Investment Review. 2018. Available online: http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf (accessed on 15 December 2019).

- Hamilton, J.D. Oil and the macroeconomy since World War II. J. Polit. Econ. 1983, 91, 228–248. [Google Scholar] [CrossRef]

- Cunado, J.; De Gracia, F.P. Oil prices, economic activity and inflation: Evidence for some Asian countries. Q. Rev. Econ. Financ. 2005, 45, 65–83. [Google Scholar] [CrossRef]

- Cologni, A.; Manera, M. The asymmetric effects of oil shocks on output growth: A Markov–Switching analysis for the G-7 countries. Econ. Model. 2009, 26, 1–29. [Google Scholar] [CrossRef]

- Papapetrou, E. Oil prices and economic activity in Greece. Econ. Chang. Restruct. 2013, 46, 385–397. [Google Scholar] [CrossRef]

- Wang, Q.; Sun, X. Crude oil price: Demand, supply, economic activity, economic policy uncertainty and wars–From the perspective of structural equation modelling (SEM). Energy 2017, 133, 483–490. [Google Scholar] [CrossRef]

- Alquist, R.; Bhattarai, S.; Coibion, O. Commodity-price comovement and global economic activity. J. Monetary Econ. 2019. [Google Scholar] [CrossRef]

- Raghavan, M. An analysis of the global oil market using SVARMA models. Energy Econ. 2020, 86, 104633. [Google Scholar] [CrossRef]

- Jones, C.M.; Kaul, G. Oil and the stock markets. J. Financ. 1996, 51, 463–491. [Google Scholar] [CrossRef]

- Sadorsky, P. Oil price shocks and stock market activity. Energy Econ. 1999, 21, 449–469. [Google Scholar] [CrossRef]

- Basher, S.A.; Sadorsky, P. Oil price risk and emerging stock markets. Glob. Financ. J. 2006, 17, 224–251. [Google Scholar] [CrossRef]

- Park, J.; Ratti, R.A. Oil price shocks and stock markets in the US and 13 European countries. Energy Econ. 2008, 30, 2587–2608. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Lahiani, A.; Nguyen, D.K. Return and volatility transmission between world oil prices and stock markets of the GCC countries. Econ. Model. 2011, 28, 1815–1825. [Google Scholar] [CrossRef]

- Awartani, B.; Maghyereh, A.I. Dynamic spillovers between oil and stock markets in the Gulf Cooperation Council Countries. Energy Econ. 2013, 36, 28–42. [Google Scholar] [CrossRef]

- Hamdi, B.; Aloui, M.; Alqahtani, F.; Tiwari, A. Relationship between the oil price volatility and sectoral stock markets in oil-exporting economies: Evidence from wavelet nonlinear denoised based quantile and Granger-causality analysis. Energy Econ. 2019, 80, 536–552. [Google Scholar] [CrossRef]

- Lv, X.; Lien, D.; Yu, C. Who affects who? Oil price against the stock return of oil-related companies: Evidence from the US and China. Int. Rev. Econ. Financ. 2020, 67, 85–100. [Google Scholar] [CrossRef]

- Nguyen, V.N.; Nguyen, D.T. Can Crude Oil Price be a Predictor of Stock Index Return? Evidence from Vietnamese Stock Market. Asian Econ. Financ. Rev. 2020, 10, 13–21. [Google Scholar] [CrossRef]

- Trabelsi, N. Tail dependence between oil and stocks of major oil-exporting countries using the CoVaR approach. Borsa Istanb. Rev. 2017, 17, 228–237. [Google Scholar] [CrossRef]

- Basher, S.A.; Haug, A.A.; Sadorsky, P. The impact of oil-market shocks on stock returns in major oil-exporting countries. J. Int. Money Financ. 2018, 86, 264–280. [Google Scholar] [CrossRef]

- Cunado, J.; de Gracia, F.P. Oil price shocks and stock market returns: Evidence for some European countries. Energy Econ. 2014, 42, 365–377. [Google Scholar] [CrossRef]

- Silvapulle, P.; Smyth, R.; Zhang, X.; Fenech, J.-P. Nonparametric panel data model for crude oil and stock market prices in net oil importing countries. Energy Econ. 2017, 67, 255–267. [Google Scholar] [CrossRef]

- Sarwar, S.; Khalfaoui, R.; Waheed, R.; Dastgerdi, H.G. Volatility spillovers and hedging: Evidence from Asian oil-importing countries. Resour. Policy 2019, 61, 479–488. [Google Scholar] [CrossRef]

- Filis, G.; Degiannakis, S.; Floros, C. Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. Int. Rev. Financ. Anal. 2011, 20, 152–164. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, C.; Yang, L. Oil price shocks and stock market activities: Evidence from oil-importing and oil-exporting countries. J. Comp. Econ. 2013, 41, 1220–1239. [Google Scholar] [CrossRef]

- Guesmi, K.; Fattoum, S. Return and volatility transmission between oil prices and oil-exporting and oil-importing countries. Econ. Model. 2014, 38, 305–310. [Google Scholar] [CrossRef]

- Boldanov, R.; Degiannakis, S.; Filis, G. Time-varying correlation between oil and stock market volatilities: Evidence from oil-importing and oil-exporting countries. Int. Rev. Financ. Anal. 2016, 48, 209–220. [Google Scholar] [CrossRef]

- Salisu, A.A.; Isah, K.O. Revisiting the oil price and stock market nexus: A nonlinear Panel ARDL approach. Econ. Model. 2017, 66, 258–271. [Google Scholar] [CrossRef]

- Vu, T.K.; Nakata, H. Oil price fluctuations and the small open economies of Southeast Asia: An analysis using vector autoregression with block exogeneity. J. Asian Econ. 2018, 54, 1–21. [Google Scholar] [CrossRef]

- Sariannidis, N.; Litinas, N.; Konteos, G.; Giannarakis, G. A GARCH examination of Macroeconomic effects on US stock market: A distinguish between the total market index and the sustainability index. SSRN Electron. J. 2009. [Google Scholar] [CrossRef]

- Mensi, W.; Hammoudeh, S.; Al-Jarrah, I.M.W.; Sensoy, A.; Kang, S.H. Dynamic risk spillovers between gold, oil prices and conventional, sustainability and Islamic equity aggregates and sectors with portfolio implications. Energy Econ. 2017, 67, 454–475. [Google Scholar] [CrossRef]

- Balcilar, M.; Demirer, R.; Gupta, R. Do Sustainable Stocks Offer Diversification Benefits for Conventional Portfolios? An Empirical Analysis of Risk Spillovers and Dynamic Correlations. Sustainability 2017, 9, 1799. [Google Scholar] [CrossRef]

- Schröder, M. Is there a difference? The performance characteristics of SRI equity indices. J. Bus. Financ.Account. 2007, 34, 331–348. [Google Scholar] [CrossRef]

- Cortez, M.C.; Silva, F.; Areal, N. The performance of European socially responsible funds. J. Bus. Ethics 2009, 87, 573–588. [Google Scholar] [CrossRef]

- Managi, S.; Okimoto, T.; Matsuda, A. Do socially responsible investment indexes outperform conventional indexes? Appl. Financ. Econ. 2012, 22, 1511–1527. [Google Scholar] [CrossRef]

- Cheung, A.W.K. Do stock investors value corporate sustainability? Evidence from an event study. J. Bus. Ethics 2011, 99, 145–165. [Google Scholar] [CrossRef]

- Robinson, M.; Kleffner, A.; Bertels, S. Signaling sustainability leadership: Empirical evidence of the value of DJSI membership. J. Bus. Ethics 2011, 101, 493–505. [Google Scholar] [CrossRef]

- Roca, E. The effect on price, liquidity and risk when stocks are added to and deleted from a sustainability index: Evidence from the Asia Pacific context. J. Asian Econ. 2013, 24, 51–65. [Google Scholar] [CrossRef]

- Robecosam. DJSI Index Family. Available online: https://www.robecosam.com/csa/indices/djsi-index-family.html (accessed on 10 December 2019).

- Bein, M.A.; Tuna, G. Comparing spillover effects among emerging markets with a higher (lower) share of commodity exports: Evidence from the two major crises. Econ. Comput. Econ. Cybern. Stud. Res. 2016, 50, 265–284. [Google Scholar]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Lahiani, A.; Nguyen, D.K. World gold prices and stock returns in China: Insights for hedging and diversification strategies. Econ. Model. 2015, 44, 273–282. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Lahiani, A.; Lévy, A.; Nguyen, D.K. Forecasting the conditional volatility of oil spot and futures prices with structural breaks and long memory models. Energy Econ. 2012, 34, 283–293. [Google Scholar] [CrossRef]

- Bai, X.; Lam, J.S.L. A copula-GARCH approach for analyzing dynamic conditional dependency structure between liquefied petroleum gas freight rate, product price arbitrage and crude oil price. Energy Econ. 2019, 78, 412–427. [Google Scholar] [CrossRef]

- Franses, P.H.; Van Dijk, D. Forecasting stock market volatility using (non-linear) Garch models. J. Forecast. 1996, 15, 229–235. [Google Scholar] [CrossRef]

- Hung, J.-C.; Lee, M.-C.; Liu, H.-C. Estimation of value-at-risk for energy commodities via fat-tailed GARCH models. Energy Econ. 2008, 30, 1173–1191. [Google Scholar] [CrossRef]

- Caporin, M.; McAleer, M. Scalar BEKK and indirect DCC. J. Forecast. 2008, 27, 537–549. [Google Scholar] [CrossRef]

- Ashfaq, S.; Tang, Y.; Maqbool, R. Volatility spillover impact of world oil prices on leading Asian energy exporting and importing economies’ stock returns. Energy 2019, 188, 116002. [Google Scholar] [CrossRef]

- Ghosh, I.; Sanyal, M.K.; Jana, R. Co-movement and Dynamic Correlation of Financial and Energy Markets: An Integrated Framework of Nonlinear Dynamics, Wavelet Analysis and DCC-GARCH. Comput. Econ. 2020. [Google Scholar] [CrossRef]

- Khalfaoui, R.; Sarwar, S.; Tiwari, A.K. Analysing volatility spillover between the oil market and the stock market in oil-importing and oil-exporting countries: Implications on portfolio management. Resour. Policy 2019, 62, 22–32. [Google Scholar] [CrossRef]

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Bein, M.A. Time-varying co-movement and volatility transmission between the oil price and stock markets in the Baltics and four European countries. Inž. Ekon. 2017, 28, 482–493. [Google Scholar] [CrossRef]

- Tang, X.; Snowden, S.; Höök, M. Analysis of energy embodied in the international trade of UK. Energy Policy 2013, 57, 418–428. [Google Scholar] [CrossRef]

- Mollick, A.V.; Assefa, T.A. US stock returns and oil prices: The tale from daily data and the 2008–2009 financial crisis. Energy Econ. 2013, 36, 1–18. [Google Scholar] [CrossRef]

- Tsai, C.-L. How do US stock returns respond differently to oil price shocks pre-crisis, within the financial crisis, and post-crisis? Energy Econ. 2015, 50, 47–62. [Google Scholar] [CrossRef]

| Panel A: Descriptive Statistics | |||||||||||

| NAME | BRENT | DJSI-W | DJSI-E | NOR | RUS | GER | UK | FRA | ITL | SWIS | NETH |

| Mean | 0.020 | 0.012 | 0.008 | 0.037 | 0.042 | 0.024 | 0.003 | 0.008 | −0.004 | 0.018 | 0.006 |

| Maximum | 17.895 | 8.246 | 9.294 | 10.802 | 19.987 | 10.797 | 9.647 | 10.595 | 10.877 | 9.426 | 10.028 |

| Minimum | −16.349 | −6.749 | −8.524 | −11.336 | −18.934 | −7.433 | −9.480 | −9.472 | −13.331 | −6.241 | −9.590 |

| Std Dev | 2.114 | 1.012 | 1.204 | 1.528 | 1.946 | 1.414 | 1.241 | 1.382 | 1.477 | 1.039 | 1.364 |

| Skewness | 0.050 | −0.203 | −0.135 | −0.545 | −0.339 | −0.002 | −0.213 | −0.007 | −0.207 | 0.017 | −0.071 |

| Kurtosis | 7.411 | 8.986 | 9.451 | 9.161 | 13.677 | 8.215 | 10.704 | 8.960 | 8.518 | 8.656 | 10.355 |

| J.B. | 3869a | 7155a | 8284a | 7780a | 22,749a | 5406a | 11,832a | 7059a | 6085a | 6359a | 10,755a |

| ARCH (5) | 72.2a | 264.4a | 2403a | 275a | 126.1a | 184.1a | 263.1a | 187.4a | 118a | 258.5a | 311.4a |

| (20) | 1547a | 5873a | 5133a | 7200a | 3344a | 4767a | 5151a | 4228a | 2523a | 5420a | 6945a |

| (20) Ljung | 13.7 | 34.9 | 19.4 | 16.2 | 25.1 | 11.2 | 28.6 | 22.1 | 22.2 | 12.9 | 15.0 |

| ADF | −28.5a | −3.0.3a | −31.1a | −29.8a | −28.8a | −30.1a | −32.1a | −31.6a | −29.7a | −30.8a | −30.6a |

| Panel B:Unconditional Correlations between Indices | |||||||||||

| BRENT | 1.000 | 0.263 | 0.247 | 0.414 | 0.310 | 0.197 | 0.291 | 0.230 | 0.224 | 0.186 | 0.238 |

| DJSI-W | 0.263 | 1.000 | 0.921 | 0.663 | 0.510 | 0.855 | 0.883 | 0.877 | 0.778 | 0.800 | 0.873 |

| DJSI-E | 0.247 | 0.921 | 1.000 | 0.710 | 0.486 | 0.912 | 0.934 | 0.959 | 0.871 | 0.854 | 0.939 |

| Panel A: GARCH (1,1) Estimation | ||||||||||||

| BRENT | DJSI-W | DJSI-E | NOR | RUS | GER | UK | FRA | ITL | SWIS | NETH | ||

| M Equation | M | 0.034 | 0.049a | 0.053a | 0.084a | 0.093a | 0.072a | 0.042a | 0.057a | 0.042a | 0.054a | 0.058a |

| W | 0.018b | 0.013a | 0.016a | 0.035a | 0.079a | 0.022a | 0.022a | 0.023a | 0.014a | 0.019a | 0.019a | |

| V Equation | ARCH | 0.046a | 0.09a | 0.109a | 0.089a | 0.092a | 0.084a | 0.117a | 0.103a | 0.08a | 0.098a | 0.104a |

| GARCH | 0.951a | 0.895a | 0.88a | 0.893a | 0.885a | 0.904a | 0.869a | 0.886a | 0.916a | 0.882a | 0.884a | |

| Panel B: DCC equations for Brent with each stock market indices | ||||||||||||

| RHO | – | 0.241a | 0.206a | 0.344a | 0.349a | 0.159a | 0.265a | 0.187a | 0.163a | 0.159a | 0.195a | |

| A | – | 0.023a | 0.02a | 0.012a | 0.017a | 0.018a | 0.02b | 0.02a | 0.015a | 0.017a | 0.021a | |

| B | – | 0.967a | 0.97a | 0.985a | 0.978a | 0.974a | 0.97b | 0.97a | 0.98a | 0.975a | 0.969a | |

| Df | – | 7.818a | 7.657a | 8.558a | 6.849a | 7.533a | 7.854a | 7.688a | 7.742a | 8.227a | 7.863a | |

| Panel C: DCC equations for DJSI–W with DJSI–E and European countries indices | ||||||||||||

| RHO | – | – | 0.902a | 0.599a | 0.525a | 0.823a | 0.855a | 0.840a | 0.755a | 0.754a | 0.844a | |

| A | – | – | 0.03a | 0.027a | 0.018b | 0.027a | 0.033a | 0.038a | 0.032a | 0.042a | 0.033a | |

| B | – | – | 0.952a | 0.963a | 0.965b | 0.957a | 0.943a | 0.947a | 0.957a | 0.924a | 0.947a | |

| Df | – | – | 7.737a | 8.668a | 6.433a | 7.591a | 7.866a | 7.939a | 7.212a | 7.925a | 7.995a | |

| Panel D: DCC equations for DJSI–E with European countries indices | ||||||||||||

| RHO | – | – | – | 0.653a | 0.480a | 0.916a | 0.911a | 0.944a | 0.857a | 0.832a | 0.927a | |

| A | – | – | – | 0.037a | 0.027a | 0.037a | 0.062a | 0.052a | 0.049a | 0.051a | 0.052a | |

| B | – | – | – | 0.953a | 0.941a | 0.947a | 0.912a | 0.929a | 0.933a | 0.918a | 0.923a | |

| Df | – | – | – | 8.104a | 6.519a | 6.917a | 7.941a | 7.655a | 6.558a | 7.19a | 7.42a | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maraqa, B.; Bein, M. Dynamic Interrelationship and Volatility Spillover among Sustainability Stock Markets, Major European Conventional Indices, and International Crude Oil. Sustainability 2020, 12, 3908. https://doi.org/10.3390/su12093908

Maraqa B, Bein M. Dynamic Interrelationship and Volatility Spillover among Sustainability Stock Markets, Major European Conventional Indices, and International Crude Oil. Sustainability. 2020; 12(9):3908. https://doi.org/10.3390/su12093908

Chicago/Turabian StyleMaraqa, Basel, and Murad Bein. 2020. "Dynamic Interrelationship and Volatility Spillover among Sustainability Stock Markets, Major European Conventional Indices, and International Crude Oil" Sustainability 12, no. 9: 3908. https://doi.org/10.3390/su12093908

APA StyleMaraqa, B., & Bein, M. (2020). Dynamic Interrelationship and Volatility Spillover among Sustainability Stock Markets, Major European Conventional Indices, and International Crude Oil. Sustainability, 12(9), 3908. https://doi.org/10.3390/su12093908