A Review of the Impact of Green Building Certification on the Cash Flows and Values of Commercial Properties

Abstract

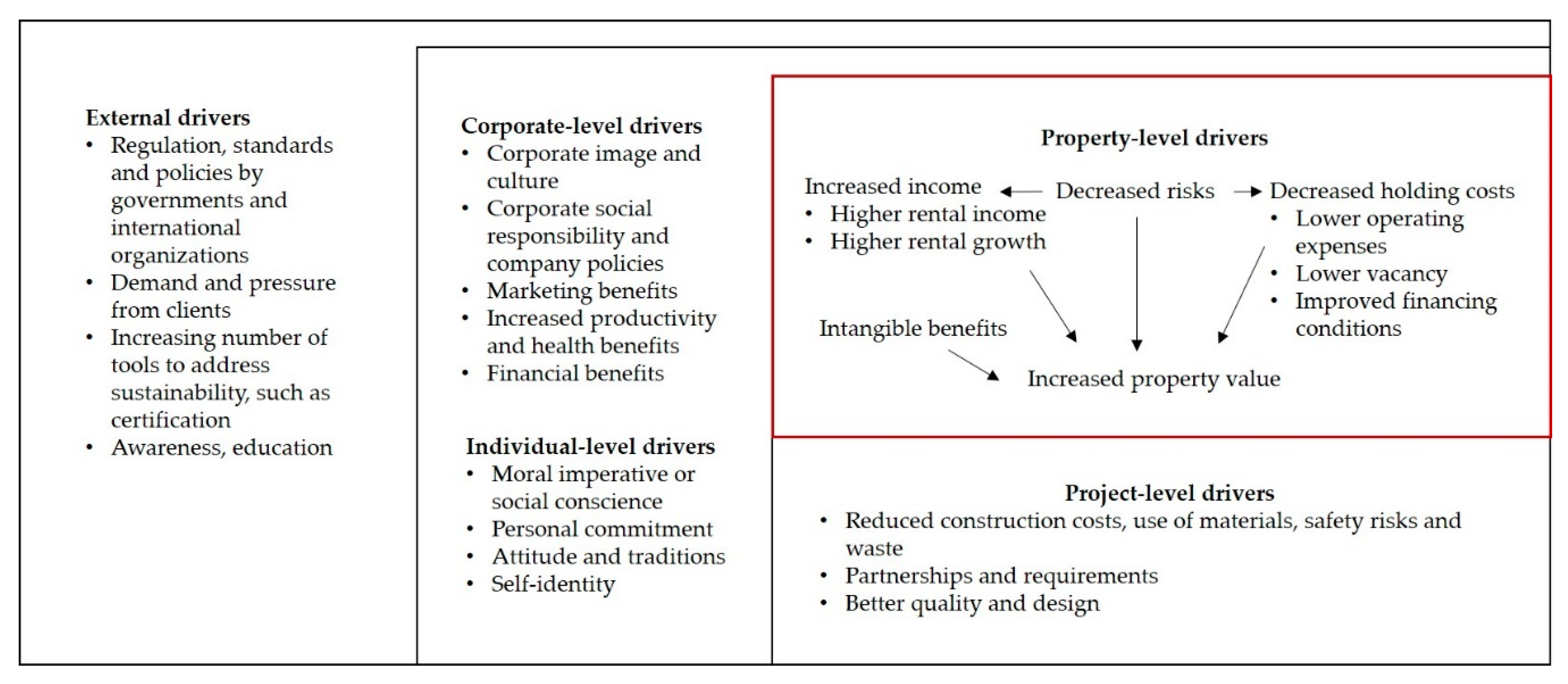

1. Introduction

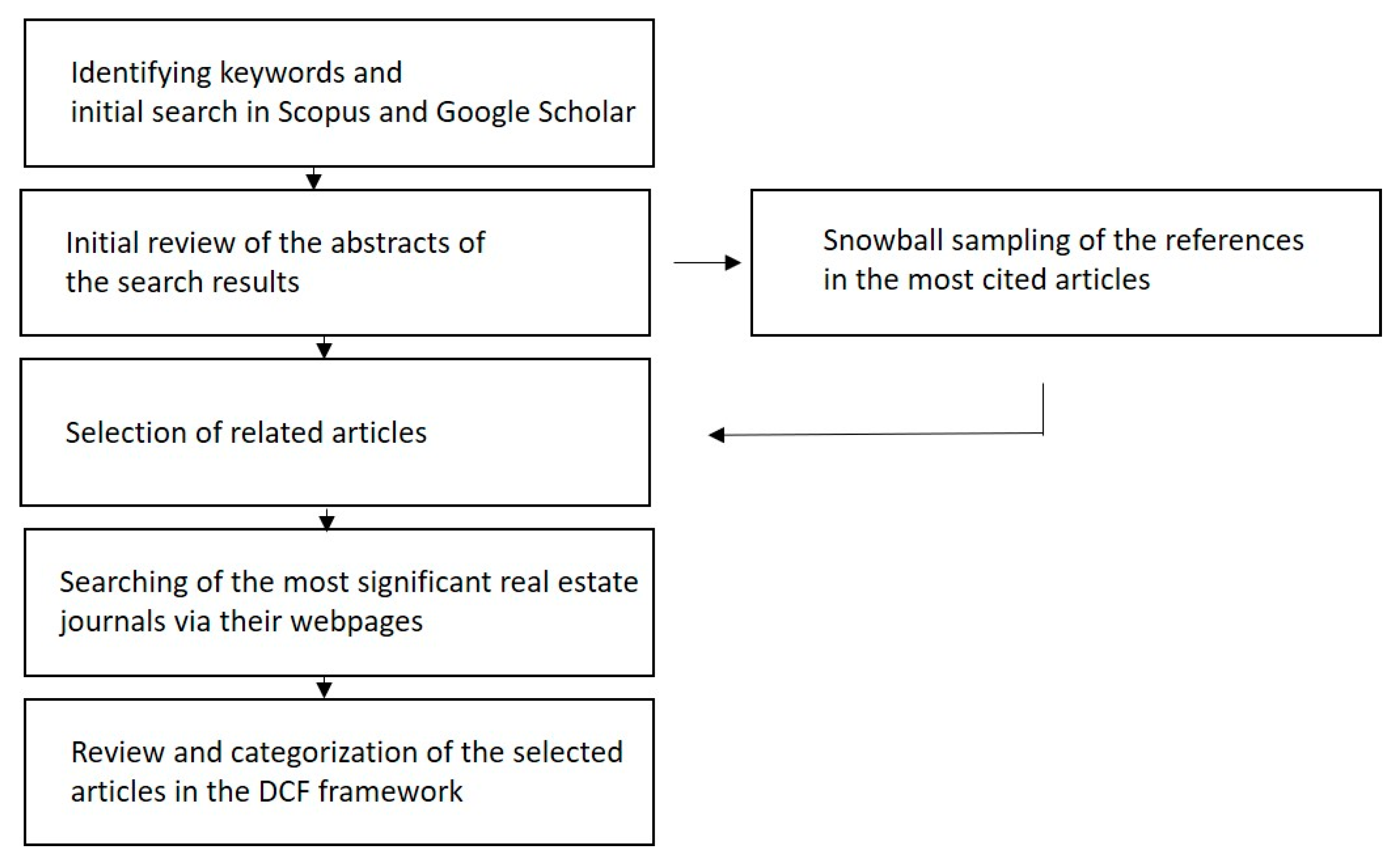

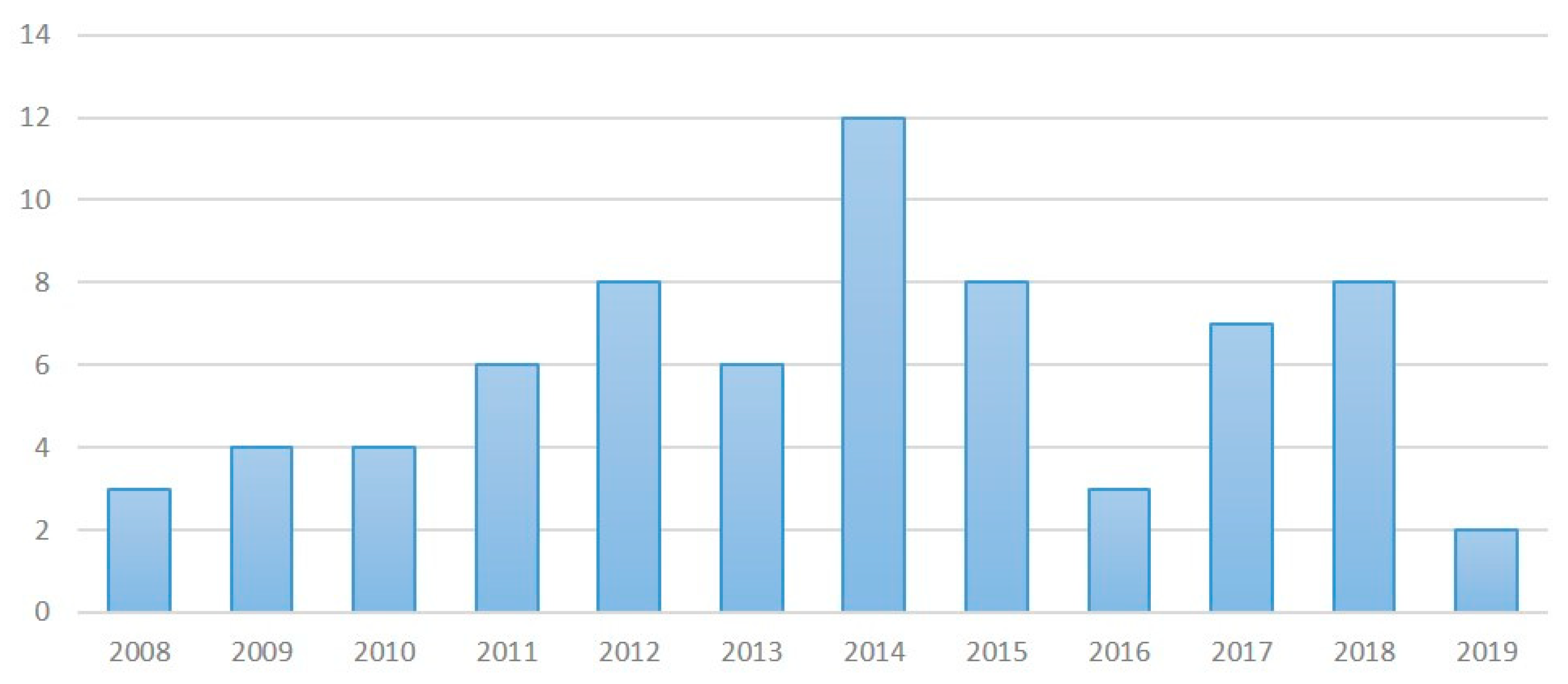

2. Methods

- green certificate

- energy performance certificate

- sustainability

- property value: property value

- cash flow parameters: sales price, rent, vacancy, occupancy, capitalization rate, risk

- (green) premium

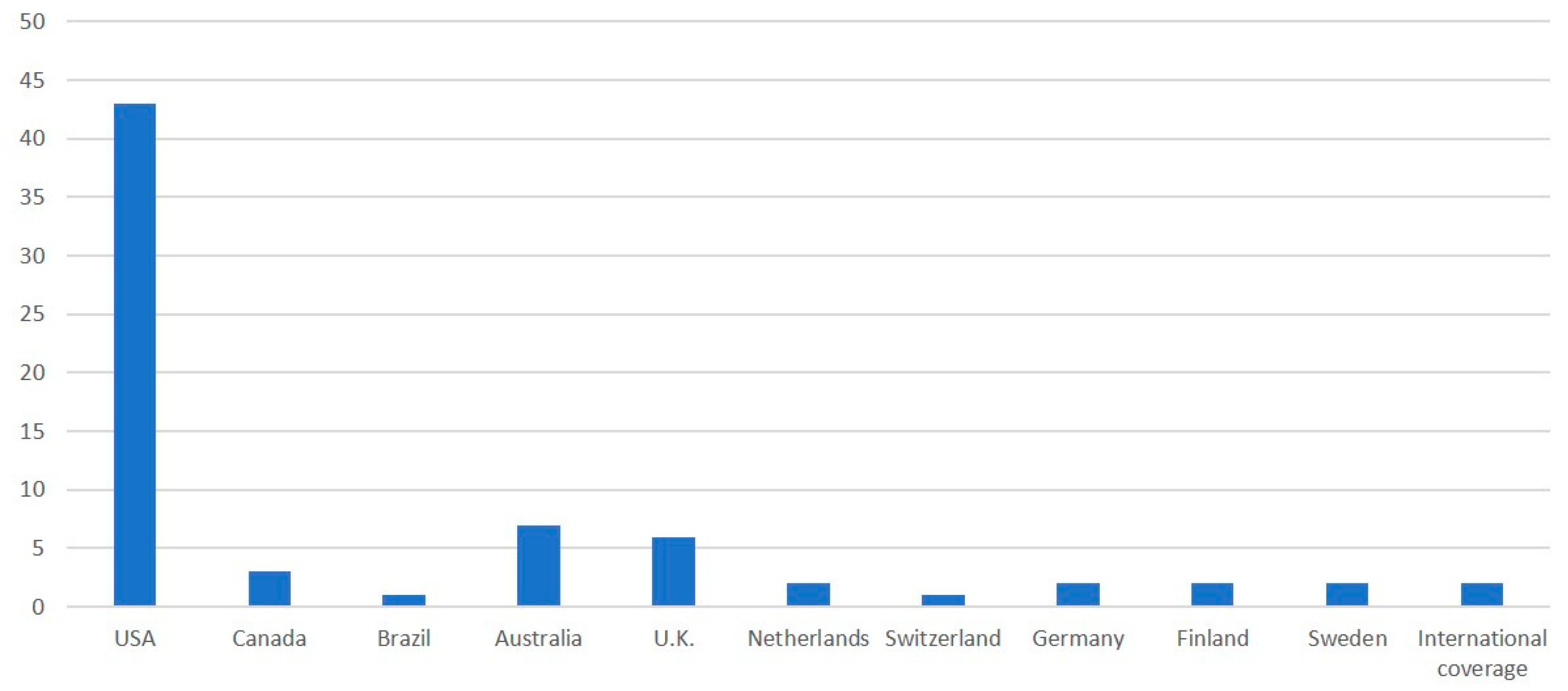

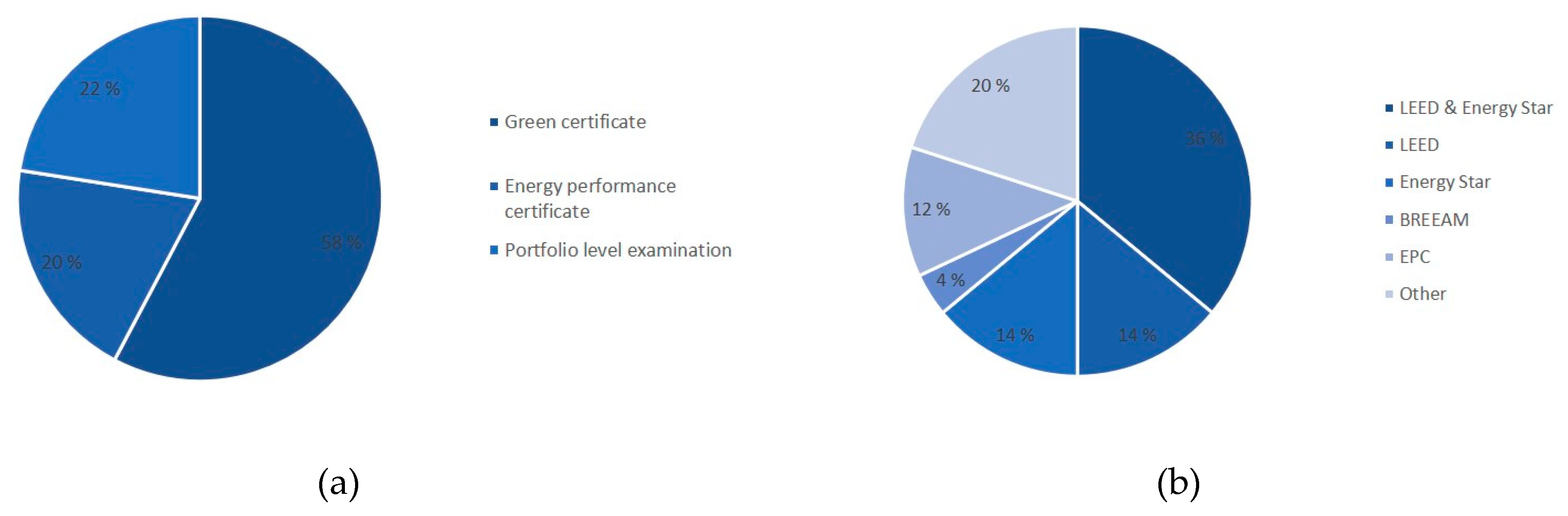

3. Countries of Origin, Property Types, Certification Types, and Research Approaches of the Reviewed Studies

4. The Impact of Certificates on the Financial Performance of Properties

4.1. Rental Premiums

4.2. Decreased Operating Expenses and Vacancy Rates

4.3. Decreased Risk

4.4. Other Benefits

4.5. Sales Price Premium

4.6. Cost Versus Value of Certificates

5. Discussion

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Research | Year | Country | Certificate Type | Rent Premium | Occupancy Premium | OPEX Effect | Sales Price Premium | Yield Effect |

|---|---|---|---|---|---|---|---|---|

| Bonde and Song [45] | 2013 | Sweden | EPC | 0.00% | ||||

| Chegut et al. [53] | 2014 | U.K. | BREEAM | 19.70% | 14.70% | |||

| Das and Wiley [68] | 2014 | USA | LEED | 16.40% | ||||

| Energy Star | 10.60% | |||||||

| Dermisi [69] | 2011 | USA | LEED | 23.00% | ||||

| Energy Star | 0.00% | |||||||

| Devine and Kok [54] | 2015 | USA | Energy Star | 3%–4% | 9.50% | 25.80% | ||

| USA | LEED | 10.20% | 4.00% | −14.30% | ||||

| Canada | Energy Star | 2.70% | ||||||

| Canada | LEED | 3.70% | 8.50% | −4.40% | ||||

| Dixon et al. [46] | 2014 | Australia | NABERS | 0.00% | ||||

| Eichholtz et al. [55] | 2010 | USA | Energy Star | 3.00% | 16.00% | |||

| LEED | 0.00% | 0.00% | ||||||

| Eichholtz et al. [56] | 2013 | USA | LEED | 7.90% | ||||

| Energy Star | 3.50% | 4.90% | ||||||

| LEED/Energy Star | 3.00% | 13.00% | ||||||

| Fuerst and McAllister [63] | 2009 | USA | LEED | 8.00% | ||||

| USA | Energy Star | 3.00% | ||||||

| Fuerst and McAllister [62] | 2009 | USA | LEED | 6.00% | 35.00% | |||

| USA | Energy Star | 6.00% | 31.00% | |||||

| Fuerst and McAllister [37] | 2011 | USA | LEED | 5.00% | 25.00% | |||

| Energy Star | 4.00% | 26.00% | ||||||

| Fuerst and McAllister [47] | 2011 | U.K. | EPC | 0.00% | 0.00% | |||

| Fuerst and van de Wetering [48] | 2013 | U.K. | EPC | 12.00% | ||||

| Fuerst and van de Wetering [52] | 2015 | U.K. | BREEAM | 23.00% | ||||

| Fuerst and McAllister [38] | 2011 | USA | Energy Star | 4.00% | 1.00% | 18.00% | ||

| LEED | 5.00% | 0.00% | 25.00% | |||||

| Energy Star + LEED | 9.00% | 28%-29% | ||||||

| Holtermans and Kok [39] | 2019 | USA | Energy Star | 1.50% | 6.20% | |||

| LEED | 1.90% | 15.50% | ||||||

| Energy Star + LEED | 3.40% | 20.10% | ||||||

| Kok and Jennen [138] | 2012 | Netherlands | EPC | 6.50% | ||||

| Kok et al. [51] | 2012 | USA | EBOM LEED | 7.00% | 2.00% | |||

| McGrath [65] | 2013 | USA | LEED + Energy Star | 0.36 bps | ||||

| Miller et al. [64] | 2008 | USA | LEED/Energy Star | 3.00% | 0.55 bps | |||

| Energy Star | 0.00% | 6.00% | ||||||

| LEED | 0.00% | 10.00% | ||||||

| Newell et al. [57] | 2014 | Australia | NABERS 5 star | 6.70% | 9.40% | |||

| Veld et al. [58] | 2014 | Netherlands | Dutch energy label | 0.00% | 0.00% | |||

| Ott and Hahn [59] | 2018 | Germany | Certified | 23.00% | 43.00% | |||

| Pivo [40] | 2008 | USA | Energy Star | 13.50% | ||||

| Pivo [49] | 2010 | Energy Star | 4.80% | 1.00% | −10.00% | 12.50% | ||

| Reichardt et al. [41] | 2012 | USA | Energy Star | 2.50% | 4.50% | |||

| USA | LEED | 2.90% | ||||||

| Reichardt [42] | 2014 | USA | Energy Star | 3.10% | 3.90% | |||

| USA | LEED | 7.00% | −5.40% | |||||

| Energy Star + LEED | 10.20% | |||||||

| Robinson et al. [43] | 2016 | USA | - | 9.30% | ||||

| Surmann et al. [71] | 2015 | Germany | EPC | 0.00% | ||||

| Szumilo and Fuerst [60] | 2017 | USA | Energy Star | 0.60% | ||||

| Szumilo [50] | 2014 | USA | Energy Star + LEED | 4.41% | 11.20% | |||

| Wiley et al. [44] | 2010 | USA | LEED | 15.2%–17.3% | 16.2%–17.9% | |||

| Energy Star | 7.3 %–8.9% | 10.2%–11% | ||||||

| Wiencke [61] | 2014 | Switzerland | 3.0% | 4.75% |

References

- UN. The Population Division of the Department of Economic and Social Affairs of the United Nations: 2018 Revision of World Urbanization Prospects. 2018. Available online: https://population.un.org/wup/ (accessed on 25 November 2019).

- Kammen, D.M.; Sunter, D.A. City-Integrated Renewable Energy for Urban Sustainability. Science 2016, 352, 922–928. [Google Scholar] [CrossRef] [PubMed]

- IEA. Towards a Zero-Emission, Efficient and Resilient Buildings and Construction Sector; 2018 Global Status Report; World Green Building Council: London, UK, 2018. [Google Scholar]

- Savills. Around the World in Dollars and Cents; Savills: London, UK, 2016. [Google Scholar]

- McKinsey Global Institute. Reinvesting Construction: A Route to Higher Productivity. 2017. Available online: https://www.mckinsey.com/~/media/McKinsey/Industries/Capital%20Projects%20and%20Infrastructure/Our%20Insights/Reinventing%20construction%20through%20a%20productivity%20revolution/MGI-Reinventing-Construction-Executive-summary.ashx (accessed on 25 November 2019).

- UN Environment Programme Finance Initiative. Responsible Property Investment. 2019. Available online: https://www.unepfi.org/investment/property/ (accessed on 25 November 2019).

- Pivo, G.; McNamara, P. Responsible Property Investing. Int. Real Estate Rev. 2005, 8, 128–143. [Google Scholar]

- Global Sustainable Investment Alliance. Global Sustainable Investment Review. 2018. Available online: https://www.ussif.org/files/GSIR_Review2018F(1).pdf (accessed on 25 November 2019).

- UN Environment Programme Finance Initiative. Responsible Property Investing: What the Leaders Are Doing? 2012. Available online: https://www.unepfi.org/fileadmin/documents/Responsible_Property_Investment_2_01.pdf (accessed on 28 March 2020).

- Lorenz, D.; Lützkendorf, T. Sustainability in Property Valuation: Theory and Practice. J. Prop. Invest. Financ. 2008, 26, 482–521. [Google Scholar] [CrossRef]

- Darko, A.; Zhang, C.; Chan, A.P.C. Drivers for Green Building: A Review of Empirical Studies. Habitat Int. 2017, 60, 34–49. [Google Scholar] [CrossRef]

- Falkenbach, H.; Lindholm, A.; Schleich, H. Review Articles: Environmental Sustainability: Drivers for the Real Estate Investor. J. Real Estate Lit. 2010, 18, 201–223. [Google Scholar]

- Sayce, S.; Ellison, L.; Parnell, P. Understanding Investment Drivers for UK Sustainable Property. Build. Res. Inf. 2007, 35, 629–643. [Google Scholar] [CrossRef]

- De Francesco, A.J.; Levy, D. The Impact of Sustainability on the Investment Environment. J. Eur. Real Estate Res. 2008, 1, 72–87. [Google Scholar] [CrossRef]

- Nousiainen, M.; Junnila, S. End-user Requirements for Green Facility Management. Facil. Manag. 2008, 6, 266–278. [Google Scholar] [CrossRef]

- Brown, N.; Malmqvist, T.; Wintzell, H. Owner Organizations’ Value-Creation Strategies through Environmental Certification of Buildings. Build. Res. Inf. 2016, 44, 863–874. [Google Scholar] [CrossRef]

- Qiu, Y.; Su, X.; Wang, Y.D. Factors Influencing Commercial Buildings to Obtain Green Certificates. Appl. Econ. 2017, 49, 1937–1949. [Google Scholar] [CrossRef]

- Braun, T.; Cajias, M.; Hohenstatt, R. Societal Influence on Diffusion of Green Buildings: A Count Regression Approach. J. Real Estate Res. 2017, 39, 1–37. [Google Scholar]

- Andelin, M.; Sarasoja, A.; Ventovuori, T.; Junnila, S. Breaking the Circle of Blame for Sustainable Buildings–Evidence from Nordic Countries. J. Corp. Real Estate 2015, 17, 26–45. [Google Scholar] [CrossRef]

- IPD Norden and KTI. Property valuation in the Nordic Countries. Written by IPD Norden and KTI Property Information (Finland) with Co-Operation in Royal Institution of Chartered Surveyors. 2012. Available online: https://kti.fi/en/property-valuation-in-the-nordic-countries/ (accessed on 23 November 2019).

- RICS. Discounted Cash Flow for Commercial Property Investments. RICS Guidance Note. 2010. Available online: https://www.rics.org/globalassets/rics-website/media/upholding-professional-standards/sector-standards/valuation/discounted-cash-flow-for-commercial-property-investments-1st-edition-rics.pdf (accessed on 1 October 2019).

- Zhang, L.; Wu, J.; Liu, H. Turning Green into Gold: A Review on the Economics of Green Buildings. J. Clean. Prod. 2018, 172, 2234–2245. [Google Scholar] [CrossRef]

- Warren-Myers, G. Is the Valuer the Barrier to Identifying the Value of Sustainability? J. Prop. Invest. Financ. 2013, 31, 345–359. [Google Scholar] [CrossRef]

- Lorenz, D.; Lützkendorf, T. Sustainability and Property Valuation: Systematisation of Existing Approaches and Recommendations for Future Action. J. Prop. Invest. Financ. 2011, 29, 644–676. [Google Scholar] [CrossRef]

- RICS. Sustainability and Commercial Property Valuation. Available online: http://jgoddardco.com/assets/rics-sustainability---the-valuation-of-commercial-property.pdf (accessed on 25 September 2019).

- Hoesli, M.; MacGregor, B.D. Property Investment; Pearson Education Limited: London, UK, 2000. [Google Scholar]

- Baum, A.E.; MacGregor, B.D. The Initial Yield Revealed: Explicit Valuations and the Future of Property Investment. J. Prop. Valuat. Invest. 1992, 10, 709–726. [Google Scholar] [CrossRef]

- Lützkendorf, T.; Lorenz, D. Sustainable Property Investment: Valuing Sustainable Buildings through Property Performance Assessment. Build. Res. Inf. 2005, 33, 212–234. [Google Scholar] [CrossRef]

- British Council of Offices. Change for the Good- Identifying Opportunities from Obsolescence. 2012. Available online: http://www.bco.org.uk/Research/Publications/Changefor2561.aspx (accessed on 2 February 2020).

- British Council of Offices. Mitigating Office Obsolescence: The Agile Future. 2017. Available online: http://www.bco.org.uk/Research/Publications/Mitigating_Office_Obsolescence.aspx (accessed on 2 February 2020).

- Fuerst, F.; Oikarinen, E.; Harjunen, O. Green Signalling Effects in the Market for Energy-Efficient Residential Buildings. Appl. Energy 2016, 180, 560–571. [Google Scholar] [CrossRef]

- Arcipowska, A.; Anagnostopoulos, F.; Mariottini, F.; Kunkel, S. Energy Performance Certificates across the EU; BPIE: Brussels, Belgium, 2014. [Google Scholar]

- CoStar. CoStar Webpages. 2019. Available online: https://www.costar.com/ (accessed on 12 November 2019).

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Vimpari, J.; Junnila, S. Value Influencing Mechanism of Green Certificates in the Discounted Cash Flow Valuation. Int. J. Strateg. Prop. Manag. 2014, 18, 238–252. [Google Scholar] [CrossRef]

- Christersson, M.; Vimpari, J.; Junnila, S. Assessment of Financial Potential of Real Estate Energy Efficiency investments–A Discounted Cash Flow Approach. Sustain. Cities Soc. 2015, 18, 66–73. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. Green Noise or Green Value? Measuring the Effects of Environmental Certification on Office Values. Real Estate Econ. 2011, 39, 45. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. Eco-Labeling in Commercial Office Markets: Do LEED and Energy Star Offices Obtain Multiple Premiums? Ecol. Econ. 2011, 70, 1220–1230. [Google Scholar] [CrossRef]

- Holtermans, R.; Kok, N. On the Value of Environmental Certification in the Commercial Real Estate Market. Real Estate Econ. 2019, 47, 685–722. [Google Scholar] [CrossRef]

- Pivo, G.; Fisher, J. Investment Returns from Responsible Property Investments: Energy efficient, Transit-Oriented and Urban Regeneration Office Properties in the U.S. from 1998–2007. 2008. Available online: http://reconnectingamerica.org/assets/Uploads/2008pivofisher.pdfa (accessed on 2 September 2019).

- Reichardt, A.; Fuerst, F.; Rottke, N.; Zietz, J. Sustainable Building Certification and the Rent Premium: A Panel Data Approach. J. Real Estate Res. 2012, 34, 99–126. [Google Scholar]

- Reichardt, A. Operating Expenses and the Rent Premium of Energy Star and LEED Certified Buildings in the Central and Eastern U.S. J. Real Estate Financ. Econ. 2014, 49, 413–433. [Google Scholar] [CrossRef]

- Robinson, S.; Simons, R.; Lee, E.; Kern, A. Demand for Green Buildings: Office Tenants’ Stated Willingness-to-Pay for Green Features. J. Real Estate Res. 2016, 38, 423–452. [Google Scholar]

- Wiley, J.; Benefield, J.; Johnson, K. Green Design and the Market for Commercial Office Space. J. Real Estate Financ. Econ. 2010, 41, 228–243. [Google Scholar] [CrossRef]

- Bonde, M.; Song, H. Is Energy Performance Capitalized in Office Building Appraisals? Prop. Manag. 2013, 31, 200–215. [Google Scholar] [CrossRef]

- Dixon, T.; Bright, S.; Mallaburn, P.; Gabe, J.; Regm, M. Do Tenants Pay Energy Efficiency Rent Premiums? J. Prop. Invest. Financ. 2014, 32, 333–351. [Google Scholar]

- Fuerst, F.; McAllister, P. The Impact of Energy Performance Certificates on the Rental and Capital Values of Commercial Property Assets. Energy Policy 2011, 39, 6608–6614. [Google Scholar] [CrossRef]

- Fuerst, F.; van der Wetering, J.; Wyatt, P. Is Intrinsic Energy Efficiency Reflected in the Pricing of Office Leases? Build. Res. Inf. 2013, 41, 373–383. [Google Scholar] [CrossRef]

- Pivo, G.; Fisher, J. Income, Value, and Returns in Socially Responsible Office Properties. J. Eur. Real Estate Res. 2010, 32, 243–270. [Google Scholar]

- Szumilo, N.; Fuerst, F. The Operating Expense Puzzle of U.S. Green Office Buildings. J. Sustain. Real Estate 2014, 5, 86–110. [Google Scholar]

- Kok, N.; Miller, N.; Morris, P. The Economics of Green Retrofits. J. Sustain. Real Estate 2012, 4, 4–22. [Google Scholar]

- Fuerst, F.; Van de Wetering, J. How does Environmental Efficiency Impact on the Rents of Commercial Offices in the UK? J. Prop. Res. 2015, 32, 193–216. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Kok, N. Supply, Demand and the Value of Green Buildings. Urban Stud. 2014, 51, 22–43. [Google Scholar] [CrossRef]

- Devine, A.; Kok, N. Green Certification and Building Performance: Implications for Tangibles and Intangibles. J. Portf. Manag. Spec. Real Estate Issue 2015, 41, 151–163. [Google Scholar]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Doing Well by Doing Good? Green Office Buildings. Am. Econ. Rev. 2010, 100, 2492–2509. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. The Economics of Green Building. Rev. Econ. Stat. 2013, 95, 50–63. [Google Scholar] [CrossRef]

- Dixon, T.; Bright, S.; Mallaburn, P.; Newell, G.; MacFarlane, J.; Walker, R. Assessing Energy Rating Premiums in the Performance of Green Office Buildings in Australia. J. Prop. Invest. Financ. 2014, 32, 352–370. [Google Scholar]

- Veld, H.O.; Vlasveld, M. The Effect of Sustainability on Retail Values, Rents, and Investment Performance: European Evidence. J. Sustain. Real Estate 2014, 6, 163–185. [Google Scholar]

- Ott, C.; Hahn, J. Green Pay Off in Commercial Real Estate in Germany: Assessing the Role of Super Trophy Status. J. Prop. Invest. Financ. 2018, 36, 104–124. [Google Scholar] [CrossRef]

- Szumilo, N.; Fuerst, F. Income Risk in Energy Efficient Office Buildings. Sustain. Cities Soc. 2017, 34, 309–320. [Google Scholar] [CrossRef]

- Wiencke, A. Willingness to Pay for Green Buildings: Empirical Evidence from Switzerland. J. Sustain. Real Estate 2014, 5, 111–130. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. New Evidence on the Green Building Rent and Price Premium. 2009. Available online: http://centaur.reading.ac.uk/19816/ (accessed on 15 September 2019).

- Fuerst, F.; McAllister, P. An Investigation of the Effect of Eco-Labeling on Office Occupancy Rates. 2009. Available online: http://centaur.reading.ac.uk/27001/1/0809.pdf (accessed on 15 September 2019).

- Miller, N.; Spivey, J.; Florance, A. Does Green Pay Off? J. Real Estate Portf. Manag. 2008, 14, 385–400. [Google Scholar]

- McGrath, K.M. The Effects of Eco-Certification on Office Properties: A Cap Rates-Based Analysis. J. Prop. Res. 2013, 30, 345–365. [Google Scholar] [CrossRef]

- Cajias, M.; Piazolo, D. Green Performs Better: Energy Efficiency and Financial Return on Buildings. J. Corp. Real Estate 2013, 15, 53–72. [Google Scholar] [CrossRef]

- Dermisi, S. Effect of LEED Ratings and Levels on Office Property Assessed and Market Values. Sustain. Real Estate 2009, 1, 23–47. [Google Scholar]

- Das, P.; Wiley, J.A. Determinants of Premia for Energy-Efficient Design in the Office Market. J. Prop. Res. 2014, 31, 64–86. [Google Scholar] [CrossRef]

- Dermisi, S.; McDonald, J. Effect of “Green” (LEED and ENERGY STAR) Designation on Prices/Sf and Transaction Frequency: The Chicago Office Market. J. Real Estate Portf. Manag. 2011, 17, 39–52. [Google Scholar]

- Bonde, M.; Song, H.S. Does Greater Energy Performance have an Impact on Real Estate Revenues? J. Sustain. Real Estate 2014, 5, 171–182. [Google Scholar]

- Surmann, M.; Brunauer, W.; Bienert, S. How does Energy Efficiency Influence the Market Value of Office Buildings in Germany and does this Effect Increase Over Time? J. Eur. Real Estate Res. 2015, 8, 243–266. [Google Scholar] [CrossRef]

- Newsham, G.R.; Veitch, J.A.; Hu, Y. Effect of Green Building Certification on Organizational Productivity Metrics. Build. Res. Inf. 2018, 46, 755–766. [Google Scholar] [CrossRef]

- Livingstone, N.; Ferm, J. Occupier Responses to Sustainable Real Estate: What’s Next? J. Corp. Real Estate 2017, 19, 5–16. [Google Scholar] [CrossRef]

- Robinson, S.; McAllister, P. Heterogeneous Price Premiums in Sustainable Real Estate? an Investigation of the Relation between Value and Price Premiums. J. Sustain. Real Estate 2015, 7, 1–20. [Google Scholar]

- Costa, O.; Fuerst, F.; Spenser, J. Robinson and Wesley Mendes-Da-Silva Are Green Labels More Valuable in Emerging Real Estate Markets? 2017. Available online: https://ssrn.com/abstract=2982381 (accessed on 2 November 2019).

- Oyedokun, T.B. Green Premium as a Driver of Green-Labelled Commercial Buildings in the Developing Countries: Lessons from the UK and US. Int. J. Sustain. Built Environ. 2017, 6, 723–733. [Google Scholar] [CrossRef]

- Jang, D.; Kim, B.; Kim, S.H. The Effect of Green Building Certification on Potential Tenants’ Willingness to Rent Space in a Building. J. Clean. Prod. 2018, 194, 645–655. [Google Scholar] [CrossRef]

- Robinson, S.; Simons, R.; Lee, E. Which Green Office Building Features do Tenants Pay for? A Study of Observed Rental Effects. J. Real Estate Res. 2017, 39, 467–492. [Google Scholar]

- Karhu, J.; Laitala, A.; Falkenbach, H.; Sarasoja, A. The Green Preferences of Commercial Tenants in Helsinki. J. Corp. Real Estate 2012, 14, 50–62. [Google Scholar] [CrossRef]

- Liu, C.; Liu, P. Is What’s Bad for the Goose (Tenant), Bad for the Gander (Landlord)? A Retail Real Estate Perspective. J. Real Estate Res. 2013, 35, 1–17. [Google Scholar]

- Szumilo, N.; Fuerst, F. Who Captures the “green Value” in the US Office Market? J. Sustain. Financ. Invest. 2015, 5, 65–84. [Google Scholar] [CrossRef]

- Ratcliffe, J.; Stubbs, M.; Keeping, M. Sustainability and property development. In Urban Planning and Real Estate Development, 3rd ed.; Anonymous, Ed.; Routledge: New York, NY, USA, 2009; p. 299. [Google Scholar]

- Janda, K.B.; Bright, S.; Patrick, J.; Wilkinson, S.; Dixon, T.J. The Evolution of Green Leases: Towards Inter-Organizational Environmental Governance. Build. Res. Inf. 2016, 44, 660–674. [Google Scholar] [CrossRef]

- Amiri, A.; Ottelin, J.; Sorvari, J. Are LEED-Certified Buildings Energy-Efficient in Practice? Sustainability 2019, 11, 1672. [Google Scholar] [CrossRef]

- Newsham, G.R.; Mancini, S.; Birt, B.J. Do LEED-Certified Buildings Save Energy? Yes, but…. Energy Build. 2009, 41, 897–905. [Google Scholar] [CrossRef]

- Turner, C.; Frankel, M. Energy Performance Og LEED for New Construction Buildings. NBI New Build. Inst. 2008, 4, 1–42. [Google Scholar]

- Chaney, A.; Hoesli, M.E.R. Transaction-Based and Appraisal-Based Capitalization Rate Determinants. Int. Real Estate Rev. 2015, 18, 1–43. [Google Scholar] [CrossRef]

- McAllister, P.; Nanda, A. Does Foreign Investment Affect U.S. Office Real Estate Prices? J. Portf. Manag. 2015, 41, 38–47. [Google Scholar] [CrossRef]

- Sivitanidou, R.; Sivitanides, P. Office Capitalization Rates: Real Estate and Capital Market Influences. J. Real Estate Financ. Econ. 1999, 18, 297–322. [Google Scholar] [CrossRef]

- Chervachidze, S.; Wheaton, W. What Determined the Great Cap Rate Compression of 2000–2007, and the Dramatic Reversal during the 2008–2009 Financial Crisis? J. Real Estate Financ. Econ. 2013, 46, 208–231. [Google Scholar] [CrossRef]

- Oikarinen, E.; Falkenbach, H. Foreign Investors’ Influence on the Real Estate Market Capitalization Rate -Evidence Form a Small Open Economy. Appl. Econ. 2017, 49, 3141–3155. [Google Scholar] [CrossRef]

- Sivitanides, P.; Southard, J.; Torto, R.; Wheaton, W. The Determinants of Appraisal Based Capitalization Rates. Real Estate Financ. 2001, 18, 27–37. [Google Scholar]

- Eichholtz, P.; Kok, N.; Yonder, E. Portfolio Greenness and the Financial Performance of REITs. J. Int. Money Financ. 2012, 31, 1911–1929. [Google Scholar] [CrossRef]

- Cajias, M.; Bienert, S. Does Sustainability Pay Off for European Listed Real Estate Companies? the Dynamics between Risk and Provision of Responsible Information. J. Sustain. Real Estate 2011, 3, 211–231. [Google Scholar] [CrossRef]

- Geiger, P.; Cajias, M.; Bienert, S. The Asset Allocation of Sustainable Real Estate: A Chance for a Green Contribution? J. Corp. Real Estate 2013, 15, 73–91. [Google Scholar] [CrossRef]

- Geiger, P.; Cajias, M.; Fuerst, F. A Class of its Own: The Role of Sustainable Real Estate in a Multi-Asset Portfolio. J. Sustain. Real Estate 2016, 8, 190–218. [Google Scholar]

- Newell, G.; Wen Peng, H.; Yam, S. Assessing the Linkages between Corporate Social Esponsibility and A-Reit Performance. Pac. Rim Prop. Res. J. 2011, 17, 370–387. [Google Scholar] [CrossRef]

- An, X.; Pivo, G. Green Buildings in Commercial Mortgage-Backed Securities: The Effects of LEED and Energy Star Certification on Default Risk and Loan Terms. Real Estate Econ. 2017. [Google Scholar] [CrossRef]

- Kaza, N.; Quercia, R.G.; Tian, C.Y. Home Energy Efficiency and Mortgage Risks. Cityscape 2014, 16, 279–298. [Google Scholar]

- Pivo, G. The Effect of Sustainability Features on Mortgage Default Prediction and Risk in Multifamily Rental Housing. J. Sustain. Real Estate 2014, 5, 149–170. [Google Scholar]

- Sah, V.; Miller, N.; Ghosh, B. Are Green REITs Valued More? J. Real Estate Portf. Manag. 2013, 19, 169–177. [Google Scholar]

- Cajias, M.; Geiger, P.; Bienert, S. Green Agenda and Green Performance: Empirical Evidence for Real Estate Companies. J. Eur. Real Estate Res. 2012, 5, 135–155. [Google Scholar] [CrossRef]

- Thompson, B.; Ke, Q. Whether Environmental Factors Matter: Some Evidence from UK Property Companies. J. Corp. Real Estate 2012, 14, 7–20. [Google Scholar] [CrossRef]

- Westermann, S.; Niblock, S.J.; Kortt, M.A. Corporate Social Responsibility and the Performance of Australian REITs: A Rolling Regression Approach. J. Asset Manag. 2018, 19, 222–234. [Google Scholar] [CrossRef]

- Westermann, S.; Niblock, S.J.; Kortt, M.A. Does it Pay to be Responsible? Evidence on Corporate Social Responsibility and the Investment Performance of Australian REITs. Asia Pac. J. Account. Econ. 2019, 1–18. [Google Scholar] [CrossRef]

- Newell, G.; Lin, L. Influence of the Corporate Social Responsibility Factors and Financial Factors on REIT Performance in Australia. J. Prop. Invest. Financ. 2012, 30, 389–403. [Google Scholar] [CrossRef]

- Hebb, T.; Hamilton, A.; Hachigian, H. Responsible Property Investing in Canada: Factoring both Environmental and Social Impacts in the Canadian Real Estate Market. J. Bus. Ethics 2010, 92, 99–115. [Google Scholar] [CrossRef]

- Fuerst, F. The Financial Rewards of Sustainability: A Global Performance Study of Real Estate Investment Trusts; SSRN Conference Papers; SSRN: New York, NY, USA, 2015. [Google Scholar]

- Kerscher, A.; Schäfers, W.Z. Corporate Social Responsibility and the Market Valuation of Listed Real Estate Investment Companies. Immobilienökonomie 2015, 1, 117–143. [Google Scholar] [CrossRef]

- Mariani, M.; Amoruso, P.; Caragnano, A.; Zito, M. Green Real Estate: Does it Create Value? Financial and Sustainability Analysis on European Green REITs. Int. J. Bus. Manag. 2018, 13. [Google Scholar] [CrossRef]

- Coën, A.; Lecomte, P.; Abdelmoula, D. The Financial Performance of Green Reits Revisited. J. Real Estate Portf. Manag. 2018, 24, 95–105. [Google Scholar]

- Cajias, M.; Fuerst, F.; McAllister, P.; Nanda, A. Do Responsible Real Estate Companies Outperform their Peers? Int. J. Strateg. Prop. Manag. 2014, 18, 11–27. [Google Scholar] [CrossRef]

- Brounen, D.; Marcato, G. Sustainable Insights in Public Real Estate Performance: ESG Scores and Effects in REIT Markets; Berkeley Lab.: Berkeley, CA, USA, 2018. [Google Scholar]

- Westermann, S.; Niblock, S.J.; Kortt, M.A. A Review of Corporate Social Responsibility and Real Estate Investment Trust Studies: An Australian Perspective. Econ. Pap. 2018, 37, 92–110. [Google Scholar] [CrossRef]

- Matisoff, D.C.; Noonan, D.S.; Flowers, M.E. Policy Monitor—Green Buildings: Economics and Policies. Rev. Environ. Econ. Policy 2016, 10, 329–346. [Google Scholar] [CrossRef]

- Aydin, E.; Correa, S.B.; Brounen, D. Energy Performance Certification and Time on the Market. J. Environ. Econ. Manag. 2019, 98, 102270. [Google Scholar] [CrossRef]

- Eichholtz, P.; Holtermans, R.; Kok, N.; Yönder, E. Environmental Performance and the Cost of Capital: Evidence from Commercial Mortgages and REIT Bonds. Available online: https://ssrn.com/abstract=2714317 (accessed on 25 September 2019).

- Cajias, M.; Fuerst, F.; Bienert, S. Can Investing in Corporate Social Responsibility Lower a Company’s Cost of Capital? Stud. Econ. Financ. 2014, 31, 202–222. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Kok, N. The Price of Innovation: An Analysis of the Marginal Cost of Green Buildings. J. Environ. Econ. Manag. 2019, 98, 102248. [Google Scholar] [CrossRef]

- Bond, S.; Devine, A. Certification Matters: Is Green Talk Cheap Talk? J. Real Estate Financ. Econ. 2016, 52, 117–140. [Google Scholar] [CrossRef]

- Dwaikat, L.N.; Ali, K.N. Green Buildings Cost Premium: A Review of Empirical Evidence. Energy Build. 2016, 110, 396–403. [Google Scholar] [CrossRef]

- Kats, G. Green Building Costs and Financial Benefits. 2003. Available online: http://staging.community-wealth.org/sites/clone.community-wealth.org/files/downloads/paper-kats.pdf (accessed on 2 August 2019).

- Kats, G. Greening our Built World: Costs, Benefits, and Strategies; Island Press: Washington, DC, USA, 2010. [Google Scholar]

- Matthiessen, L.; Morris, P. Costing Green: A Comprehensive Cost Data Base and Budgeting Methodology. 2004. Available online: https://legacy.azdeq.gov/ceh/download/greencost.pdf (accessed on 2 August 2019).

- Matthiessen, L.; Morris, P. Cost of Green Revisited: Reexamining the Feasibility and Cost Impact of Sustainable Design in the Light of Increased Market Adoption. Davis Langdon Manag. Consult. 2007. [Google Scholar] [CrossRef]

- Rehm, M.; Ade, R. Construction Costs Comparison between ‘green’ and Conventional Office Buildings. Build. Res. Inf. 2013, 41, 198–208. [Google Scholar] [CrossRef]

- Cespedes-Lopez, M.; Mora-Garcia, R.; Perez-Sanchez, V.R.; Perez-Sanchez, J. Meta-Analysis of Price Premiums in Housing with Energy Performance Certificates (EPC). Sustainability 2019, 11, 6303. [Google Scholar] [CrossRef]

- Fuerst, F.; Kontokosta, C.; McAllister, P. Determinants of Green Building Adoption. Environ. Plan. B Plan. Des. 2014, 41, 551–570. [Google Scholar] [CrossRef]

- Kok, N.; McGraw, M.; Quigley, J.M. The Diffusion Over Time and Space of Energy Efficiency in Building. Ann. Reg. Sci. 2012, 48, 541–564. [Google Scholar] [CrossRef]

- Qiu, Y.; Tiwari, A.; Wang, Y.D. The Diffusion of Voluntary Green Building Certification: A Spatial Approach. Energy Effic. 2015, 8, 449–471. [Google Scholar] [CrossRef]

- Qiu, Y.; Yin, S.; Wang, Y. Peer Effects and Voluntary Green Building Certification. Sustainability 2016, 8, 632. [Google Scholar] [CrossRef]

- Cadman, D. The Vicious Cirlcle of Blame. 2000. Available online: http//:www.upstreamstrategies.co.uk (accessed on 21 November 2019).

- Warren-Myers, G. The Value of Sustainability in Real Estate: A Review from a Valuation Perspective. J. Prop. Invest. Financ. 2012, 30, 115–144. [Google Scholar] [CrossRef]

- Darko, A.; Chan, A.P.C. Review of Barriers to Green Building Adoption. Sustain. Dev. 2017, 25, 167–179. [Google Scholar] [CrossRef]

- Olaussen, J.O.; Oust, A.; Solstad, J.T. Energy Performance Certificates—Informing the Informed or the Indifferent? Energy Policy 2017, 111, 246–254. [Google Scholar] [CrossRef]

- Robinson, S.; Sanderford, A.R. Green Buildings: Similar to Other Premium Buildings? J. Real Estate Financ. Econ. 2016, 52, 99–116. [Google Scholar] [CrossRef]

- Lützkendorf, T.; Lorenz, D. Capturing Sustainability-Related Information for Property Valuation. Build. Res. Inf. 2011, 39, 256–273. [Google Scholar] [CrossRef]

- Kok, N.; Jennen, M. The Impact of Energy Labels and Accessibility on Office Rents. Energy Policy 2012, 46, 489–497. [Google Scholar] [CrossRef]

| Cash Flow Parameter | Effect | Range | Mean | Median | References |

|---|---|---|---|---|---|

| Rental income | Increased | 0.0%–23.0% | 6.3% | 4.6% | [37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62] |

| Occupancy | Increased | 0.9%–17.0% | 6.0% | 4.3% | [40,41,44,51,54,63,64] |

| Operating costs | Inconclusive | −14.3%–25.8% | −0.4% | −4.9% | [40,42,49,50,54] |

| Yield (risks) | Decreased | 0.36%–0.55%-point | 0.46%-point | 0.46%-point | [64,65] |

| Sales price | Increased | 0%–43.0% | 14.8% | 14.1% | [37,38,39,40,45,47,49,53,55,56,57,58,59,61,62,66,67,68,69,70,71] |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Leskinen, N.; Vimpari, J.; Junnila, S. A Review of the Impact of Green Building Certification on the Cash Flows and Values of Commercial Properties. Sustainability 2020, 12, 2729. https://doi.org/10.3390/su12072729

Leskinen N, Vimpari J, Junnila S. A Review of the Impact of Green Building Certification on the Cash Flows and Values of Commercial Properties. Sustainability. 2020; 12(7):2729. https://doi.org/10.3390/su12072729

Chicago/Turabian StyleLeskinen, Niina, Jussi Vimpari, and Seppo Junnila. 2020. "A Review of the Impact of Green Building Certification on the Cash Flows and Values of Commercial Properties" Sustainability 12, no. 7: 2729. https://doi.org/10.3390/su12072729

APA StyleLeskinen, N., Vimpari, J., & Junnila, S. (2020). A Review of the Impact of Green Building Certification on the Cash Flows and Values of Commercial Properties. Sustainability, 12(7), 2729. https://doi.org/10.3390/su12072729