Abstract

The influences resulted from the strategy of sustainable development of a country represents a challenge for both the research and all those interested. This paper researches how the non-financial information is relevant in reflecting the sustainability of Romanian economic entities’ performances. In this context, reference is made to the Bucharest Stock Exchange (BVB) and to the extent that the economic entities listed at the stock exchange draft sustainable reports in compliance with the international reporting requirements. The hypotheses formulated are related to the specific characteristics of the economic entities listed on the BVB. The research was done on a sample consisting of all economic entities contained by the International Reporting System of Issuers (IRIS) platform of the BVB, the sustainable reporting was analysed through the Pearson correlation coefficient and the ANOVA test. Following the research, results were obtained that made it possible to validate/invalidate the hypotheses. One of the specific characteristics that has been noted refers to the size of the economic entity; this has been shown to influence the extent to which the sustainable report drafted complies with the requirements of the international reporting frame.

1. Introduction

Currently, there are many initiatives regarding the sustainability standards in all fields of activity. One of the most widespread reporting models at European level is Global Reporting Initiative (GRI), which introduces a set of standards accepted at global level regarding the sustainable reporting [1]. This reporting has been created by the International Council for Integrated Reporting (IIRC), whose main task is to develop the standards and implicitly assist the development of the environment for reporting the sustainability [2].

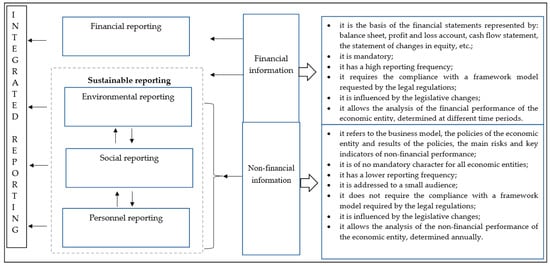

The impact of non-financial information on determining, reporting, and analysing the performance of an economic entity increases the public and political interest on this matter. The non-financial information is governed on the good practices existing in the business environment. They maintain the transparency and integrity of reporting entities, being the basic elements at a European level to transpose the sustainable reporting. The level of the non-financial performance is given by three types of reporting: social responsibility, environmental, and personnel responsibility [3]. Moreover, besides addressing these elements, at the entity level, it is required to present the business model, the entity’s policy, the results of applying the policies, the risks existing in the entity’s activity, and way of action to counteract the risks. These elements are detailed in Figure 1, which represents the author’s projection.

Figure 1.

Representation of the elements specific to integrated reporting.

The performance of the economic entity also involves additional explanations, if they are considered to be necessary, but without giving up the mandatory elements to be presented through the legal regulations in force [4].

The economic sustainability of the entity generally refers to its capacity to achieve profit from its activity [5]. Preserving the quality of life is the responsibility of economic sustainability, and to achieve this objective, a change is required regarding the unsustainable consumption models, but also regarding the production methods [6]. The sustainable lifestyle is subordinated to the living conditions, which is why the ecological economy is promoted, which comes as a result of implementing the economic sustainability. An ecological economy requires the creation of renewable resources and permanent monitoring of the emissions that cause a negative environmental impact [7]. The results of the economic entity are according to the economic sustainability, closely related to the environment and social sustainability [1].

The particularities of the sustainability and of the sustainable development strategy depend on the capacity of the economic entity to be sustainable. This is conditioned by the social and natural environment, in other words, it is required that the entity would make considerable efforts in order to be sustainable. The strategic sustainability implies that the higher management level would be as efficient as possible so that the risks involved would be minimised and removed as far as possible [8]. From this point of view, sustainability becomes a component of the entity’s strategy, an approach which implies that the sustainable elements would be objectives of the entity. Thus, a strategy of the sustainable development requires the management to take into account both short-term and long-term perspectives. Moreover, it is required that the sustainable development strategy would be correlated with the entity’s activities and be capable to adapt to the constantly changing environment [2]. This is possible only if the entity’s approach is responsible and takes into account the potential risks that may influence its strategy [9].

The reason why the entity must be open to new exploration horizons is that it allows it to access the capable strategy of exploiting the opportunities that arise. The strategy of sustainable development implies a clear purpose reflected in the culture and the desire for change [10]. All this is happening because sustainability involves a collaboration with those from the outside and to attract them as strategic partners of innovation. The transparency, openness, and orientation towards success in relation to the individuals interacting with the entity leads to acquiring the trust and mutual understanding. The entity must interact in order to collect new ideas and in order to acquire external opinions and make the required adjustments for sustainable development [11].

Sustainability is a process governed by change, allowing the use of the resources, the direction of investments and technological development. Through these aspects, institutional transformations are in harmony and lead towards increasing the human potential, aspirations, and needs both currently and in the future [12]. In this direction, the international economy has an important role, because major changes are required in terms of international economic relations created in order to ensure sustainability. This is seen as a way of approaching the business model in a broad sense and of creating value within the entity, supporting the planning of long-term goals [11].

Sustainable development is characterised as a complex operation with implications and aspects that cannot be neglected because they are necessary for a better understanding of the phenomenon. It has been proven over time that sustainability has aroused the interest for several fields of activity. Once things are clearly established, it should be noted that the financial reporting of an economic entity and the sustainability report should be included within an integrated report is not a sufficient thing, but their interaction is required. Even though some information may be provided independently of each other, through the business strategy, it is required to create a close link between the elements. In order to promote such a strategy, the entity must establish the relevance that the sustainability actions have for its activity, to establish its priorities, risks, opportunities, and impact by which sustainability influences the financial performance [2].

Adopting the integrated reports internationally in order to reflect the non-financial performance of economic entities had an impact firstly on the entities listed on the stock exchange, as they are considered to have the greatest interest for third parties. This was the reason why the Romanian economic entities are addressed, which are listed on the Bucharest Stock Exchange (BVB).

2. Literature review

A sustainable approach is a concept of development whereby all actions would be directed to the environment, socially correct, and economically possible [13]. In French literature, sustainability is associated with the term of social responsibility and sustainable development. By this, it may be said that social responsibility is given by the entity’s efforts for sustainability and sustainable development. Starting from these considerations, economic entities analyse the effects they have on the environment and act in this regard to contribute to the progress of society from all points of view, taking into account social, environmental, and personnel aspects [14].

From the studies carried out on the sustainable reporting, it has been proven that sustainability has three dimensions and they interact with each other [15]. The dimensions of sustainability refer to environmental, social and economic aspects. Moments of crisis appear in an economy, and the reasons for the crisis are in the hypothesis of the failure of markets, the hypothesis of the government and the hypothesis of a continued prosperity [16]. The conclusion of these hypotheses is given by the fact that the results of negative effects and implicitly the crisis is a consequence of the lifestyle and a new model of development should be used [17].

The sustainability development models involve the use of systematic tools for the development of future generations, provided that the use of resources is met [18]. It is considered that an increase of the interest for the non-financial information is due to credibility [19]. A new concept brought to bring together the sustainable reporting principles has been development in the form of integrated reporting [20].

The entities’ attention towards a promising future has a favourable impact on the community, a goal that may be reached through the fact that entities become sustainable [21]. To be able to meet this challenge, the entities act by integrating the sustainability policy into their own strategies in order to reach the desired performance. Some authors believe that sustainability may be truly integrated into the entity’s strategy and operations, if it goes through all the process stages to ensure the sustainability and develops new abilities to easily solve the challenges that have arisen [22]. Other authors consider that sustainability is the key towards a process consisting of several stages in order to achieve an environmental sustainability [23].

It is considered that sustainability is obtained after a long development process [24]. A process consisting of several stages is proposed and consists of: pre-conformation, conformation, post-conformation, integrated strategy and passion, and finally, the purpose [25]. Conformation is actually considered, and the opportunity the entity has as a result of submitting the legal regulations or voluntarily adopting certain rules of ethical conduct [13]. Adopting a minimum of standards regarding the economic, social, and environment field is insufficient, taking into account that the entities succeed to adopt the most exigent rules to comply with [26].

3. Methodology of the Research

In order to achieve the research, two research methods were used: qualitative and quantitative research, respectively. Through the qualitative research, we could collect and analyse data not represented by numbers, the former being of exploitation and understanding character. The processes are described without interfering with them and important characteristics of a subject are emphasised. In the qualitative research, the description was used to identify characteristics and establish existing links. Through quantitative research, we could collect and process the data and the results of processing the data could be emphasised. Through the data volume presented, processing the results was relevant. The goal of this paper aims to establish the relevance of the non-financial information included in the sustainable reports for assessing the performance of economic entities listed on BVB and included on the International Reporting System of Issuers (IRIS) platform.

Because all economic entities on the IRIS platform of the BVB elaborate integrated reports, we intend to verify to what extent these reports comply with the requirements of the IRC database. All this will be done through an index of presenting the information. Generally, the characteristics specific to the entities listed on the BVB refer to the market value, trust, visibility, image, etc. In this study, we started from identifying the non-financial information that allows tracing the characteristics specific to the entities listed on the BVB:

- Cs 1 – the dimension of economic entities;

- Cs 2 – the weight of individuals involved in drafting the sustainable report, in total, of employees;

- Cs 3 – the involvement of the same individual in decision-making and execution actions in terms of the sustainable reports;

- Cs 4 – the replacement of a decisional individual in the sustainable reporting period;

- Cs 5 – the percentage of external personnel who ensures the reporting.

Once the non-financial information is identified, based on which the characteristics specific to the entities listed on BVB have been created, two hypotheses were formulated:

Hypothesis 1 (H1):

The characteristics specific to the entities listed on the BVB, symbolised by Cs 1, Cs 2, and Cs 5, influence the extent to which the integrated report is drafted according to the reporting framework specific to the integrated reporting.

Hypothesis 2 (H2):

The extent to which the integrated report is drafted according to the international reporting framework is not influenced by the specific characteristics, symbolised by Cs 3 and Cs 4.

Validating/invalidating the variables depended on the results of the models applied. The data is a part of the category of statistical data, published periodically by the economic entities concerned or by various bodies. The sources for the data acquisition are of official character, being subsequently processed in order to verify the validation or invalidation of the hypotheses.

The data were collected through various techniques, respectively concepts specific to an empirical research, establishing the various sources in order to collect as much data as possible and increased attention as to the data not to be wrong or incomplete, which would lead to erroneous results. In order to acquire accurate data, the quantitative research predominated in the case study. Through the data volume presented, processing the results was relevant. This was materialised in the data shown in the tables, discussions, and conclusions, the information being able to be analysed statistically.

4. Assessing the Sustainable Reporting of the Organisations listed on the Bucharest Stock Exchange (BVB). Case study

The role of integrated reports and implicitly non-financial reports is to facilitate the understanding by the financial capital suppliers of how the entity creates short-, medium-, and long-term value. This is done based on the resources of the economic entity, such as the financial and production capital, intellectual, human, and social capital and the natural capital, but also of the relations between these elements [27]. Therefore, it can be said that a sustainable relation consists of the environmental relation, the social responsibility relation, and other non-financial relations. Thus, we can look for the possible correlations between the non-financial reporting and the characteristics specific to the organisations listed on the (BVB). This sample consisting of part of the entities listed on the BVB, through the annual transparency statements presented. In this case, transparency is not seen only in terms of publishing the reports, but also in terms of their quality.

BVB has the main role in facilitating the cash flow towards capital investors to entrepreneurs that need capital in order to develop the business. The entities listed on the stock exchange enjoy more than the advantage of the access to the capital, enjoying the image improvement, permanent publicity, visibility in relation to customers, partnership, and prestigious advantages in the community. By their specificity and mutual characteristics, the entities listed on the stock exchange are those that mandatorily publish financial, governance, and social responsibility information as a sustainable report. These economic entities may be considered a landmark also through the conditions imposed by the listing on the stock exchange. The legislative causes, market requirements, and social expectations are added to these. The negative aspects that can prevent the entity from complying with the required rules should not be neglected either. The competition, the unavailability of data, the cost-benefit analyses or public perception can be interpreted as obstacles that cause negative effects. By confronting these causes, the content and its quality is outlined, by observing the organisational reporting practices. The consequence of this process is the creation of an improved image, a performance improvement and not last, the economic development. Thus, they can represent the reasons why the entities listed on the BVB can be considered a standard of transparency.

For the listed entities, BVB has launched a reporting system called International Reporting System of Issuers (Sistem Internațional de Raportare a Emitenților (IRIS)). It is a platform at the highest standards for the public and efficient public exposure of reports and announcements to the interested ones. The purpose of the platform is to standardise the reporting manner and to increase the market transparency degree by implementing a secure and credible system of communications that could permanently ensure the access to information. This actually involves an integrated format of reports, available and accessible to process the data [20].

The characteristics of the IRIS platform are mainly rendered by attributes such as flexibility, ease, and accessibility. Flexibility is given by the possibility to access the platform from any device that has access to the Internet. The easiness is given by the interface for presenting the information uploaded on the platform. Accessibility is given by the possibility to edit and review the ads online before they are uploaded to the platform [28].

IRIS is a platform that aims to increase the market transparency by providing a communication system characterised by rapidity, security, and reliability, all these in order to disseminate the issuers’ reports in a text format accessible to be processed for those uploading the documents [28]. It is able to provide the issuers with a mechanism at the highest international standards, which has a new, rapid, and efficient operating system in order to publicly disseminate the reports or certain announcements of interest in the economic entity. For investors, stock exchange data analysts, or distributors, the platform is an integrated information system, available in an accessible and workable format. The manner of uploading the reports takes the form of Microsoft Word, which can have additional documents attached also in another form such as PDF, which can consist of information such as tables, graphics shown in a special design, including holographic signed documents [28].

The main goal of this platform is to ensure a high level of standardisation in relation to the reporting manner. This product has the advantage to be easily integrated and processed, which turns it into an efficient system of determining the price. By designing and launching this product, BVB proves it makes efforts for the alignment to the highest standards and best market practices. It is worth appreciating the effort made to make available for the listed economic entities an efficient means of communication that allows the investors more complete and rapid information. By using the BVB channels, meaning the IRIS information distribution platform, the publication of reports and processing thereof on the financial portals, a global distribution will be ensured, where the investors of issuers listed on the BVB will be the centre of attention.

One of the BVB goals is that the IRIS platform would represent the key tool through the use of which the communication with the shareholders, analysis, and investors would be improved for the alignment to the international standards and increase the degree of transparency [28]. This platform brings the issuers listed on the BVB to the attention of investors. Of the entities listed on the BVB on the Regulated Market, after analysing the IRIS platform at the end of 2019, it was observed that it includes only a number of 15 economic entities, which periodically transmit the reports drafted [29,30,31,32,33,34,35,36,37,38,39,40,41,42,43]. The 15 economic entities included on the IRIS platform may be found in Table 1, which represents the author’s projection.

Table 1.

List of economic entities listed on the Bucharest stock exchange (BVB), included on the International Reporting System of Issuers (IRIS) platform.

Because most of the entities listed on the BVB are non-financial information within a sustainable report, our intention is to verify to what extent these reports comply with the information of the IRC database. This will be done on the sample of the 15 entities using the IRIS platform, through an index of presenting the information. In a broad sense, the sustainable report of the economic entities involves aspects such as environmental reporting, social and corporate responsibility, meaning elements that create value over time. By this case study, we want to find the possible correlations between the exposure of a sustainable report and the characteristics specific to the economic entities. If it is not subject to the legislation in force, the economic entity is not bound to draft a comprehensive report; however, when the information is relevant, many entities choose to draft the reports voluntarily. The supply of additional information by an economic entity attracts investors. Certain characteristics of the economic entity can influence the voluntary adoption of sustainable reports in compliance with the international reporting framework.

In order to test the possible correlations between the extent to which the sustainable report drafted meets the IIRC recommendations on the one hand, and the characteristics specific to the entities listed on the BVB, on the other hand, the following variable are used:

- The dependent variable (DI): The extent to which the entities’ report is presented in compliance with the IIRC, estimated by an index to present the information;

- Independent variable: The characteristics specific to the entities listed on the BVB.

The dependent variable is constituted based on the IIRC framework. In order to establish the index for presenting the information, elements from the IIRC have been taken into account and thus, six type of capitals (financial capital, natural capital, social capital, production capital, intellectual capital, human capital) are taken into account, content elements being considered the basis of the guiding principles, and information on auditing the report is added thereto, in terms of integrated reporting. The last aspect has been added and taken into account because, similar to the financial reports, integrated reports are also required to be comparable and credible and for this to be possible, it is required to ensure the integrated report [20]. Having said all this, it is desirable that the insurance opinion would be a positive one, because it will provide assurance of the basic models, methodologies, and procedures based on which the sustainable report has been created, rather than an opinion on the accuracy of information.

To constitute the dependent variable, it was verified whether the report the economic entity has published presents elements regarding: The presentation of the entity and external environment; The description of the business model; The governance; The opportunities and risks; The business strategy and resources the entity has; The entity’s performance; The basis for the elaboration and presentation of the report; Presentation of the report; The presence of the six types of capital; Auditing the integrated report.

Of what has been presented, each of the aforementioned elements is a binary variable. If a report has presented a certain element, the variable has taken the value 1, otherwise, the variable has the value 0. These principles have also been applied when it was verified whether the entity has presented information in relation to the six types of capital which by its activity could be applicable to the business model and variable is assigned thereto, and otherwise variable 0 has been assigned thereto. The same model has also been used in relation to the verification of the integrated report if this has been audited, receiving for the value of variable 1 in the favourable case also the value of the variable 0 otherwise. Table 2 presents the establishment of variables for six types of capital and the variable given to auditing the integrated report. Table 2 represents the author’s projection.

Table 2.

Determining the variables of the six types of capital and of auditing the integrated report.

To verify some characteristics specific to the entities listed on the BVB, the same principle was used, so that, for the specific characteristic CS 3, the value 0 was assigned if no change has been made, and the value 1 was assigned if change has been made. The same procedure was applied also in the case of the specific characteristic Cs 4, if this case is confirmed, the value of variable 1 is assigned, and if not, the value of variable 0 is assigned. For specific characteristics Cs 1, Cs 2, Cs 5, the data have been collected or the percentages have been calculated according to the information the economic entities provide. Thus, if an economic entity has presented all the content elements, whereto we add information regarding the six capitals and information on the drafted report audited as sustainable report, the entity was given the value score of 10, according to Table 3.

Table 3.

Dependently creating the variables.

One of the advantages of using an index for presenting the information there is that it measures and compares the information exposed in reports with the maximum level of information that could be exposed by the economic entity. The dependent variable assesses to what extent the reports analysed are drafted and presented according to the IIRC reporting framework.

The formula to calculate the dependent variable is:

DI = (d1+d2+d3+…)/(di1+di2+di3+…) where d = 1,m and di = 1,n

Where:

- DI = the index to present the information, DI [1,0]

- = 1, if the element is presented; = 0, if the element is not presented;

- m = the number of elements presented;

- n = the maximum number of elements analysed.

The data have been collected for each economic entity individually from the reports uploaded and available on the web pages of their own entities or from the web page of IIRC. Within the sample, the aim was to publish the reports starting with 2016 until now.

In order to perform the research and to establish the correlations between the dependant variable and independent variables, we used the Pearson correlation coefficient and the ANOVA test and used the SPSS and Excel applications in order to process the data.

In order to measure the connection between the quantitative variables, we used the Pearson correlation coefficient; this is a linear correlation coefficient likely to define the interdependence or connection between the variables. Should the value of the Pearson coefficient be close to 1 in the absolute value, the greater will be the linear relation between the two variables. Besides the Pearson correlation coefficient, the ANOVA test has also been used. Through it, the differences existing between variables will be tested and the hypotheses will be validated or invalidated. The advantage of using the ANOVA test consists in emphasising the significant differences between averages, but the results are present also if there are no significant differences between the averages.

In order to establish the Pearson correlation coefficient, the variables must have a normal distribution, this being a parametric coefficient. In order to establish the sample distribution, the Kolomogorov–Smirnov test was used. This is a non-parametric test of distribution equality, often used to compare a sample with the distribution of the reference probabilities or to compare two samples.

In our research, we applied the Kolmogorov–Smirnov test, and the results thereof are shown in Table 4, which represents the author’s projection.

Table 4.

Sample distribution.

Based on the results acquired, it may be said that the distribution is a normal one, the level of test significance being 0.39, greater than 0.05. The same thing may be also said in the case of calculating the normal parameters, meaning the average (0.77) and the standard deviation (0.28). The variation coefficient is of 36.36%, meaning greater than 35%, which results in a heterogeneous collectiveness.

In order to analyse the possible correlation between DI and the independent variables, the Pearson correlation coefficients and the ANOVA test have been used and the two previously formulated hypotheses have been taken into account: hypothesis 1: The characteristics specific to the entities listed on the BVB: Cs 1, Cs 2, and Cs 5 influence the extent to which the integrated report is drafted according to the reporting framework specific to the integrated reporting and hypothesis 2:

The extent to which the integrated report is drafted according to the international reporting framework is not influenced by the specific characteristics of Cs 3 and Cs 4.

In Table 5, the determination of the independent variables according to the dependent variable. Table 5 represents the author’s projection.

Table 5.

The determination of the independent variables according to the dependent variable.

Through the characteristic The dimension of the economic entity entity (Cs1), we refer to the number of employees; for the characteristics The percentage of individuals involved in drafting the sustainable report, to the total of employees (Cs2) and the Percentage of external personnel to provide reporting (Cs5) calculations based on the data acquired have been made; for the characteristics The involvement of the same individual in decisional and execution actions in terms of the sustainable reporting (Cs3) and the Replacement of a decision-making individual during the reporting period (Cs4), binary variables have been used. By using the Pearson correlation, in order to test the correlation between the dependent variable and qualitative independent variables, the following results shown in Table 6 resulted. Table 6 represents the author’s projection.

Table 6.

The results obtained as a result of the Pearson correlation coefficient application.

In order to interpret the results acquired, it is required to detail and specify the following explanations: a positive Pearson correlation coefficient implies the existence of a direct connection between the variables, and a coefficient of negative value involves an indirect connection between the variables. Regarding the value of the coefficient, if it is found in the 0–0.3 range, the connection is a weak one, a coefficient between 0.3–0.7 implies an average intensity connection, and a strong connection is achieved when the coefficient is within the 0.7–1 range.

Thus, a direct correlation has been identified only in the case of the entity’s dimension, the Pearson correlation coefficient is of 0.67, which proves a direct connection of average intensity. Regarding the level of significance it has, because it exceeds the 0.05 and 0.01 range, having a value of 0.78, we can say that the result is a statistically insignificant one.

The same reasoning was also applied for the other variables, which result in negative values, which implies the existence of an indirect connection between variables. Through the significance level, values leading to a statistically insignificant result arose, both in the case of Cs2—the percentage of individuals involved in drafting the sustainable report and in the case of Cs5—the percentage of external personnel to provide reporting.

In order to analyse the quantitative variables, Cs3—the involvement of the same individual in the decision-making and execution function in terms of integrated reporting, and Cs4—the replacement of a decision-making individual during the sustainable reporting period, in correlation with the dependent variable, the ANOVA test was used, according to Table 7, which represents the author’s projection.

Table 7.

The results obtained as a result of the ANOVA test application.

By the results observed in the table, we observe how the significance levels for both variables analysed exceed the value of 0.05. Therefore, the variable Cs3—the involvement of the same individual in the decision-making and execution function in terms of integrated reporting, nor Cs4—the replacement of a decision-making individual during the sustainable reporting period does not influence the extent to which drafting a sustainable report is achieved according to the international framework, this being expressed through the dependent variable.

However, we observed direct correlations on both variants. In the case of the variable Cs3—the involvement of the same individual in the decision-making and execution function in terms of integrated reporting, with a value of 0.62, it is a matter of an average intensity connection, and in the case of variable Cs4—the replacement of a decision-making individual during the sustainable reporting period, with a value of 0.12, a low intensity connection, both of them expressed through the dependent variable.

5. Discussions and conclusions

With time, the subject of sustainabilty has been an intensly debated one and of permanent actuality and the economic entities have given an even bigger importance to the sustainable development which embraced numerous approaches. The risen interest in the sustainable reporting of the performance reflects through the non-financial information the economic entities provide. The complexity of the economic entities founds its answer in the drafting of the integrated report. Accomplishing as many sustainability elements as possible impose the economic entites to analyze in detail the interest indicators for the investors and to analyze at the international standards of integrated reporting IIRC.

This paper is an empirical research based on the direct observation of the reality. The methods used in the research have been both of qualitative order and quantitative order. It was decided to use the two research methods presented, because only in this way could the theoretical aspects be explained and the results obtained through the quantitative research could be interpreted. The research was carried out at the level of Romania, being focused on the entities listed on the Stock Exchange and included on the IRIS platform. Thus, we noticed that there are 84 economic entities listed on the BVB on the Regulated Market in Romania. In order to support the economic entities’ manner of reporting, BVB has launched an issuers’ platform represented by the IRIS system. Of all the economic entities listed, at the end of 2019, only 15 economic entities have joined this platform, choosing to periodically send the sustainable reports drafted. Thus, we focused our attention on the reports of the 15 economic entities, following the impact which the non-financial information has on the sustainable reports drafted periodically by them. The research started by formulating two hypotheses, and to find out whether they are validated or not, we used the results of the econometric models: the Pearson correlation coefficient and the ANOVA test. Following the analyses carried out, we may establish the validation or the invalidation of the hypotheses issued.

The hypothesis 1 (H1) is invalidated because not all the specific characteristics taken into account involve the existence of a direct connection between the variables. Only in the case of the characteristic Cs1—the dimension of the economic entity, the Pearson correlation coefficient is of 0.67, which proves a direct connection of average intensity. In the case of the characteristic Cs 2—the percentage of individuals involved in drafting the sustainable report, as well as in the case Cs 5—the percentage of external personnel to provide reporting, there is no correlation because negative values have been recorded, which involves the existence of an indirect connection between variables, according to the data shown in Table 6—the Pearson correlation test.

The hypothesis 2 (H2) is validated because through the results of the ANOVA test, significance levels are recorded for both the specific characteristics. Both for the characteristic Cs 3—the involvement of the same individual in decision-making and execution actions in terms of sustainable reports, as well as for Cs 4—the replacement of a decisional individual during the sustainable reporting period, according to the data in Table 7—the ANOVA test, the values registered exceed the 0.05 threshold, which proves that these two specific characteristics do not influence the extent to which the elaboration of a sustainable report is done according to the international framework.

By validating/invalidating the hypotheses, we observed that in terms of the economic entity’s dimension, the larger it is, the better it will comply with the requirements of the international reporting framework.

We considered that drafting a report should not be conditioned by the entity’s performance. This way of reporting the performance requires the improvement of the quality of all information, notably the improvement of non-financial information and leads to a much more efficient and productive allocation of the capital. Moreover, the tendency of the non-financial information to become standard is noted. We assess that the main limits of this study were related to the sample size and to choosing the independent variables. Possible future researches could take into account other variables that include the economic, legal, and cultural characteristics.

In conclusion, by means of this research, we wanted to identify the non-financial information that reflect the specific characteristics of the economic entities listed on the BVB and the analysis of the extent to which they are influenced in drafting the sustainable report, in compliance with the requirements of the international reporting framework. The results obtained are influenced by the lack of the obligation to meet the international reporting framework and the flexible way in which the principles and recommendations are addressed and can be taken from the framework. It is worth mentioning that a sustainable report containing a set of non-financial information is an element of novelty and an exercise involving training for the organisations involved in the reporting process.

Author Contributions

Conceptualization, M.M. and M.-M.B.-P.; methodology, M.-M.B.-P.; software, M.-M.B.-P.; validation, M.M. and M.-M.B.-P.; formal analysis, M.-M.B.-P.; investigation, M.-M.B.-P.; resources, M.-M.B.-P.; data curation, M.-M.B.-P.; writing—original draft preparation, M.-M.B.-P.; writing—review and editing, M.M.; visualization, M.M.; supervision, M.M.; project administration, M.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

This work was supported by the grant POCU380/6/13/123990, co-financed by the European Social Fund within the Sectorial Operational Program Human Capital 2014 – 2020.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Global Reporing Initiative (GRI). The GRI Sustenability Reporting Standards: The Future of Reporting. Available online: https://www.globalreporting.org/Pages/defaultaspx (accessed on 7 December 2019).

- The International Integrated Reporting Council (IIRC). Sustainable Development Goals Disclosure Recommendations. Available online: https://integratedreporting.org/the-iirc-2/>acc (accessed on 5 December 2019).

- Albu, N.; Albu, C.N.; Dumitru, M.; Dumitru, V.F. Plurality or convergence in sustainability reporing standards? Amfiteatru Econ. 2013, XV, 513–527. [Google Scholar]

- Błażejowski, M.; Kwiatkowski, J.; Gazda, J. Sources of Economic Growth: A Global Perspective. Sustainability 2019, 11, 275. [Google Scholar] [CrossRef]

- Jovovic, R.; Draskovic, M.; Delibasic, M.; Jovovic, M. The concept of sustainable regional development—Institutional aspects, policies and prospects. J. Int. Stud. 2017, 10, 255–266. [Google Scholar] [CrossRef] [PubMed]

- Nechita, E. Analysis of the Relationship between Accounting and Sustainable Development. The Role of Accounting and Accounting Profession on Sustainable Development. Audit Financ. 2019, XVII, 520–536. [Google Scholar] [CrossRef]

- Li, S.; Zhang, J.; Ma, Y. Financial Development, Environmental Quality and Economic Growth. Sustainability 2015, 7, 9395–9416. [Google Scholar] [CrossRef]

- Massoudi, M.; Vaidya, A. Simplicity and Sustainability: Pointers from Ethics and Science. Sustainability 2018, 10, 1303. [Google Scholar] [CrossRef]

- Yevdokimova, M.; Zamlynskyi, V.; Minakova, S.; Biriuk, O.; Ilina, O. Evolution of corporate social responsibility applied to the concept of sustainable development. J. Secur. Sustain. 2019, 8, 473–480. [Google Scholar] [CrossRef]

- Dobrovic, J.; Lambovska, M.; Gallo, P.; Timkova, V. Non-financial indicators and their importance in small and medium-sized enterprises. J. Compet. 2018, 10, 41–55. [Google Scholar]

- United Nations. Transforming our world: The 2030 Agenda for Sustainable Development. Available online: https://sustainabledevelopment.un.org/content/documents/21252030%20Agenda%20for%20Sustainable%20Development%20web.pdf (accessed on 23 November 2019).

- Ulewicz, R.; Blaskova, M. Sustainable development and knowledge management from the stakeholders’ point of view. Pol. J. Manag. Stud. 2018, 18, 363–374. [Google Scholar] [CrossRef]

- Kot, S. Sustainable Supply Chain Management in Small and Medium Enterprises. Sustainability 2018, 10, 1143. [Google Scholar] [CrossRef]

- Dima, I.C.; Man, M. Modelling and Simulation in Management. Econometric Models Used in the Management of Organizations; Springer International Publishing: Basel, Switzerland, 2015. [Google Scholar]

- Danciu, V. The sustainable company: New challenges and strategies for more sustainability. Theor. Appl. Econ. 2013, XX, 4–24. [Google Scholar]

- Ferrero-Ferrero, I.; Fernández-Izquierdo, M.Á.; Muñoz-Torres, M.J. The Effect of Environmental, Social and Governance Consistency on Economic Results. Sustainability 2016, 8, 1005. [Google Scholar] [CrossRef]

- Bogeanu-Popa, M.M.; Man, M. Considerations Regarding the Way of Management of the Environmental Accounting within the Organization’s Economic System. In Proceedings of the 33rd International Business Information Management Conference (33rd IBIMA), Granada, Spain, 10–11 April 2019; Volume 34. [Google Scholar]

- Păunescu, C.F.; Man, M. Aspects regarding the Binomial Social Accounting—Social Performance within Social Responsibility of Romanian Organizations. In Proceedings of the 34th International Business Information Management Conference (34th IBIMA), Madrid, Spain, 13–14 November 2019; Volume 34, pp. 3966–3978. [Google Scholar]

- Dima, S.; Popa, A.; Farcane, N. Financial and Non-Financial Information in the Framework of Sustenability and Integrated Reporting. Audit Financiar 2015, XIII, 21–33. [Google Scholar]

- Eccles, R.G.; Krzus, M.P.; Rogers, J.; Serafeim, G. The need for sector specific materiality and sustainability reporting standards. J. Appl. Corp. Financ. 2012, 24, 65–71. [Google Scholar] [CrossRef]

- Abdullah, N.H.N.; Darsono, J.T.; Respati, H.; Said, J. Improving accountability and sustainability through value creation and dynamic capabilities: An empirical study in public interest companies. Pol. J. Manag. Stud. 2019, 19, 9–21. [Google Scholar]

- Thompson, N.A.; Eijkemans, R. Why Do Sustainable Ventures Fail to Attract Management Talent? Sustainability 2018, 10, 4319. [Google Scholar] [CrossRef]

- Man, M.; Măcriș, M. Integration of Corporative Governance into organisation’s Social Responsability System. Pol. J. Manag. Stud. 2015, 11, 100–114. [Google Scholar]

- Bogeanu-Popa, M.M.; Man, M. The impact of the durable development’s demands regarding the economic entities’ non-financial reporting within the banking system. In Proceedings of the Competitiveness and Stability in the Knowledge-Based Economy (iCOnEc 2019), Craiova, Romania, 25–26 October 2019; Volume 11, p. 13. [Google Scholar]

- Venter, E.R.; Gordon, E.A.; Street, D.L. The role of accounting and the accountancy profession in economic development: A research agenda. J. Int. Financ. Manag. Account. 2018, 29, 195–218. [Google Scholar] [CrossRef]

- Ruzek, W. The Informal Economy as a Catalyst for Sustainability. Sustainability 2015, 7, 23–34. [Google Scholar] [CrossRef]

- Rensburg, R.; Botha, E. Is Integrated Reporting the silver bullet of financial communication? A stakeholder perspective from South Africa. Public Relat. Rev. 2014, 40, 144–152. [Google Scholar] [CrossRef]

- Bursa de Valori București. Comunicat de Presă IRIS. Available online: http://www.bvb.ro/press/2016/comunicat_presa_IRIS%2013062016.pdf (accessed on 19 December 2019).

- Banca Transilvania. Rezultate Financiare Pentru Anul 2018. Available online: https://www.bancatransilvania.ro/actionari/rezultate-financiare/ (accessed on 17 December 2019).

- BRD-Groupe Societe Generale. Rezultate Financiare Pentru Anul 2018. Available online: https://www.brd.ro/despre-brd/investitori-si-actionari/comunicare-financiara/rezultate-financiare (accessed on 18 December 2019).

- Bursa de Valori Bucuresti. Raport Consolidat al Administratorilor BVB Pentru Anul 2018. Available online: https://www.bvb.ro/infocont/infocont19/BVB_20190424181451Raport-anual-BVB-2018.pdf (accessed on 23 December 2019).

- Electrica. Raport Anual 2018. Available online: https://www.electrica.ro/wp-content/uploads/2019/04/ELSA_RO_RAPORT_ANUAL_Web_2018.pdf (accessed on 17 December 2019).

- Fondul Proprietatea. Raport Anual 2018. Available online: https://www.fondulproprietatea.ro/ro/relatii-cu-investitorii/rezultate-financiare/rapoarte-anuale (accessed on 19 December 2019).

- Nuclearelectrica. Raport Anual 2018. Available online: https://www.nuclearelectrica.ro/wp-content/uploads/2019/02/SNN_RO_Raport-Anual-CA-2018.pdf (accessed on 17 December 2019).

- OMV Petrom. Situații Financiare Pentru Anul Încheiat la 31 Decembrie 2018. Available online: https://www.omvpetrom.com/pbd_download/766/995/4.Situa%C5%A3iile%20financiare%20individuale%20conform%20OMFP%20nr.%2028442016%20pentru%202018.pdf (accessed on 10 December 2019).

- Romgaz. Rapoarte Anuale. Available online: https://www.romgaz.ro/ro/rapoarte-anuale (accessed on 20 December 2019).

- SIF Banat Crișana. Raportare Continua. Available online: http://www.sif1.ro/ro/informatii-pentru-investitori/raportare-financiara/rezultate-financiare/ (accessed on 27 December 2019).

- SIF Moldova. Raportări Periodice. Available online: http://www.sifm.ro/raportari/anuale/2018/AUDITATE/1.%20Raport%20CA%202018%20sit%20fin%20INDIVIDUALE.pdf (accessed on 23 December 2019).

- SIF Muntenia. Raport Anual 2018. Available online: http://www.sifmuntenia.ro/informatii-pentru-investitori/raportari-periodice/raportari-periodice-ifrs/situatii-ifrs-separate/situatii-ifrs-separate-2017/ (accessed on 18 December 2019).

- SIF Oltenia. Raportare Continuă. Available online: https://www.sifolt.ro/ro/raportari/2018/anual/raportari.html (accessed on 17 December 2019).

- SIF Transilvania. Situații Financiare 2018. Available online: https://www.siftransilvania.ro/ro/rapoarte/raporte-periodice/situatii-financiare-anul-2018 (accessed on 18 December 2019).

- Transelectrica. Raportul Anual 2018. Available online: https://www.google.com/search?q=transelectrica+raport+anual+2018&oq=Transelectrica+raport+&aqs=chrome.2.69i57j0l7.9587j0j4&sourceid=chrome&ie=UTF-8 (accessed on 27 December 2019).

- Transgaz. Raport Anual 2018. Available online: http://www.transgaz.ro/ro/raport-anual-2018 (accessed on 20 December 2019).

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).