1. Introduction

The emergence of the knowledge-based economy and the acceleration of the globalization phenomenon at an international level have been, in recent years, the catalysts that have led to rapid transformations within the organizational communication systems, materialized in the form of balancing quantitatively and qualitatively the financial and non-financial information that makes up the content of annual reports and sustainability reports published by companies. Thus, in the last decades, a series of organizational communication tools built around a few basic pillars of company activity have been substantiated and successively refined: for example, the “triple-bottom-line” reporting represents an intensely driven approach in the literature that simultaneously considers the economic dimension of the company, the social dimension and the concern for sustainable development by protecting the environment [

1]. Each of the three pillars—economic, social and environmental—is intended to contribute to increasing the degree of transparency of the companies and opening them up to communicate a block of relevant information from the perspective of the deep understanding, by the stakeholders, of the driving mechanisms and use of different categories of resources used by the company. The most recently developed holistic reporting formula is integrated reporting [

2,

3] which provides an elaborate sustainability reporting scheme, with a more focused structure and a broader set of guiding principles. Although such a model of reports was born under the impact of increasing the demands related to the transparency of the activities carried out by private companies, there are more and more voices supporting the efforts to transpose this type of reporting within public organizations and within those operating in the non-profit sector.

On the other hand, it is worth noting the tendency of developing certain certification systems of companies’ disclosure, able to add credibility to the information communicated to the most important categories of stakeholders. Such methods emerged for the first time in the economic domain, then manifested themselves in the field of environmental protection, and subsequently were issued in the fields of corporate social responsibility and occupational health and safety. The study of the literature led us to the conclusion that there are currently a number of reporting standards that have been imposed in international practice and which establish the general reporting framework for the sustainable-oriented companies, i.e, the GRI Sustainability Guidelines, AA1000 Series, ISO 14000 Series (14001), ISO 26000:2010, UNGlobal Compact Management Model, etc. A significant number of authors and practitioners in the field, as well as brand representatives of specialized institutions in managerial consulting, advocate for the recognition of the GRI standard, as the most used model by the corporations in the non-financial disclosure area. In order get a realistic picture of the speed and magnitude of the GRI standards’ adoption and putting into force in the international business practice, it is useful to call on some significant figures: according to GRI Data Base [

2,

4], a number of 13,942 of organizations from around the world have produced, from 1999 to present, about 55,678 sustainability reports that comply with the GRI guidelines.

On September 29, 2014, the European Council adopted the Directive 2014/95/EU which entered into force in November 2014. This is the first Directive on non-financial reporting by public-interest entities in the EU, which exceed 500 employees. Starting with January 2017, the provisions of this directive also apply in Romania through the order of the Ministry of Public Finance no. 1938/2016. The concrete ways in which the Directive 2014/95/EU bases the reporting of these categories of information are the following:

Either through a non-financial statement, presented as an appendix to the management report (management);

Either by drawing up a separate report (non-financial report), which will be made available to stakeholders within a reasonable period of time (maximum 6 months) from the reference date of releasing the balance sheet.

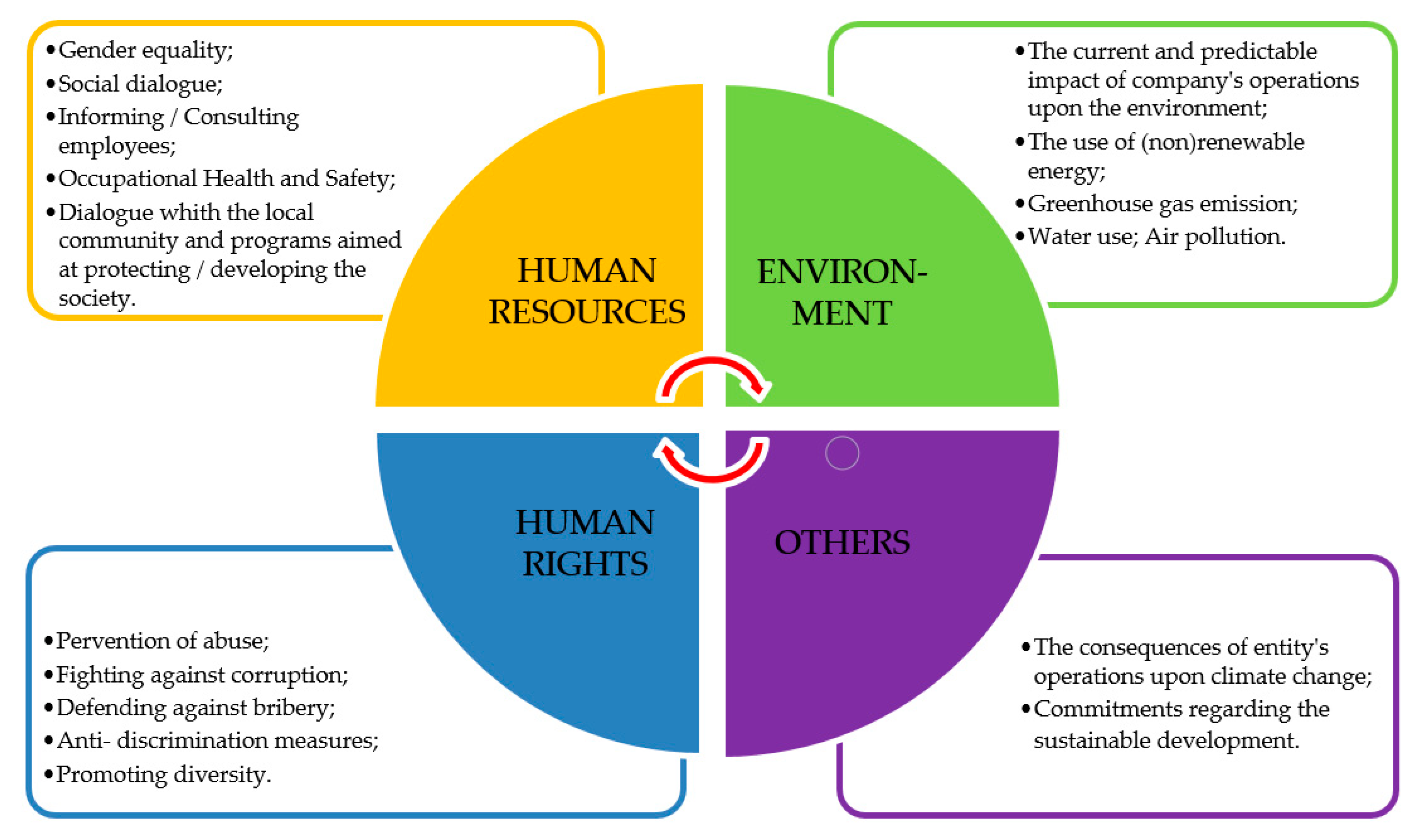

Regardless of the option chosen by each company, non-financial information will refer to: aspects related to environmental protection, social issues and human resources management (including elements related to occupational health and safety), the situation of respecting human rights and fighting corruption and the bribery phenomena, insofar as, the approach of these subjects is likely to provide an understanding of growth strategies, performances and impact that a company generates at the level of the community in which it operates, in terms of sustainable development [

2,

5] (

Figure 1).

The scope of Directive 2014/95/EU on non-financial reporting is determined by the size of organizations that will have to comply with this recommendation. It covers so-called “large companies and groups” as defined by the Directive 2013/34 / EU as follows [

2,

5]:

The phrase “large companies” is defined as those corporations that, at the date of publication of the balance sheet, exceed the limits set for at least two of the following criteria: (1) total balance sheet > 20,000,000 Euro; (2) net turnover > 40,000,000 Euro; (3) average number of employees > 250.

“Large groups” means the economic entities formed by the parent companies and the subsidiaries that, on a consolidated basis, exceed the limits for at least two of the following three criteria in the moment in which the parent company’s balance sheet is released: (1) total balance sheet > 20,000,000 Euro; (2) the net turnover > 40,000,000 Euro; (3) average number of employees > 250.

An interesting observation can be made regarding the subsidiaries of large corporations and economic groups operating in Romania. According to Article 19 a, point 3, in conjunction with Article 29 a, point 4, stipulated in Directive 2013/34/EU, these economic entities are exempted from the obligation of non-financial reporting, if the presentation of the non-financial dimension of the activities carried out by them is realized within the report of the parent company or of another corporation that is part of the group. This phenomenon partially explains the very small number of corporations with more than 500 employees reporting non-financially in Romania so far. In other words, a fairly important segment of this statistical population of companies that exceed 500 employees is composed of subsidiaries of multinational corporations that report non-financially at group level and, for the moment, do not elaborate customized reports at the country level.

2. Literature Review and Hypotheses Development

As recently shown by the worldwide business environment, during periods of crisis, managers’ approaches towards sustainability turned into cautious and protective behaviours, which resulted in tendencies of diminishing concerns and investments in the area. In other words, it seemed that the unpredictability in economic operations could have limited the virtual positive outcomes potentially acquired by companies from a sustainable-oriented managerial policy (Giorgi et al. [

6], Cañón-de-Francia et al. [

7]). However, another stream of literature argue that the number of corporate social responsibility (CSR)/sustainability reports increased with the crisis, as an attempt to provide an appropriate response to the massive loss of confidence from various stakeholders—a psychosocial behaviour that seriously disturbed the business environment in moments of crisis. For instance, the studies conducted by Dias et al. [

8] and Garcia-Benau et al. [

9] on significant samples of listed companies from Spain and Portugal have exhibited moderate increases of report rates during the crisis, showing a positive facet of sustainability, viewed both as a convenient managerial tool aimed at alleviating the crisis’ negative consequences and as a real opportunity to validate company’s commitment to the sustainable development goals (Yelkikalan et al. [

10]).

Despite periods of crisis and economic growth, the business world is witnessing, during the last 20 years, a remarkable expansion in the process of CSR/sustainability reporting embracement. In line with this trend, OHS disclosures constituted a recently emerged research framework that drew a great deal of the attention from the scholars. Nevertheless, the OHS accounting and reporting issue remains strongly correlated with corporate CSR/sustainability reporting practices; which is why our research efforts within this paragraph were focused both on identifying some relevant determinants of sustainability reporting that were brought to the fore by the literature and on the research hypotheses whose development was aimed at supporting our future investigations. Thus, the factors that significantly impact the scope and the quality of sustainability disclosures have been comprehensively examined in the pre-existing literature. In our paper, we reviewed numerous recent studies on the subject that are frequently concentrated on the issue of reporting in one specific country: e.g., Poland (Dyduch et al. [

11]; Matuszak et al. [

12] Maj et al. [

13]), Germany (Verbeeten at el al. [

14]; Gamerschlag et al. [

15]); Spain (Reverte et al. [

16]; Sotorrío et all. [

17]); Sweden (Tagesson et al. [

18]); Serbia (Denčić-Mihajlov et al. [

19]; Egypt (Elfeky [

20]); Turkey (Kiliç et al. [

21]; Kuzey et al. [

22]); Malaysia (Ozigi et al. [

23]; Rahman et al. [

24]; Jaffar et al. [

25]); Indonesia (Roman Cahaya [

26]; Pravita Ariyani et al. [

27]), India (Kansal et al. [

28]; Joshi et al. [

29]); Jordan (Al-Hamadeen et al. [

30]) and China (Wang et al. [

31]; Gao [

32]). Additionally, a cross-regions research was focused on establishing the reporting profiles of forest companies originating from Europe, North America, Asia and Oceania, Latin America and Africa (Li et al. [

33]) and other three studies were designed themselves as synthetic reviews of relevant sustainability theories and practices around the Globe (Galant et al. [

34]; Habek et al. [

35]; Hahn et al. [

36]). Within these studies, authors often employ the content analysis method in order to construct their particular disclosure indexes as proxies for a realistic appraisal of the extent of sustainability/OHS disclosures. In order to fulfil our research aims, we made use of a very similar approach when we decided to substantiate the OHS reporting index—the dependent variable of our study—with the purpose of measuring the amplitude of the Romanian companies’ disclosure on health and safety in the workplace.

Given the interplay between OHS disclosures and employee issues, our field of reference covered the following determinants of sustainability reporting extracted from the literature: company’s size measured by the number of employees, the ownership structure, the type of industry, the affiliation to a multinational corporation and the company’s visibility in the market. With the intention of validating the presumable impact exerted by the selected determinants upon the level of sustainability reporting, researchers usually draw up hypotheses that are going to form the subject of verification through the instrumentality of appropriate statistical methods such as correlation analysis and /or ANOVA, regression analysis etc. (Păun [

2]; Dyduch et al. [

11]; Matuszak et al. [

12] Rahman et al. [

24]; Gamerschlag et al. [

15]; Reverte et al. [

16]; Kiliç et al. [

21]; Kuzey [

22] Tagesson et al. [

18], Ozigi et al [

23]; Finstad et al. [

37], Rasool et al. [

38], Pravita Ariyani et al. [

27], Wang et al. [

31], Li et al. [

33]). Being aware of the valuable information provided by the statistical tools in the prior researches on the subject, we employed a very similar approach.

Thus, we developed the following hypotheses for our study:

Hypothesis 1 (H1). There is a positive association between the company size and the level of OHS disclosure;

Hypothesis 2 (H2). There is a positive relationship among company’s visibility on the market and the level of its OHS disclosure;

Hypothesis 3 (H3). There is a relationship between the ownership structure of the company and the OHS disclosure;

Hypothesis 4 (H4). The type of industry a company belongs to exerts a significant influence upon its OHS disclosure;

Hypothesis 5 (H5). A company’s affiliation to a parent multinational corporation has an important impact on the level of its OHS disclosure.

We believe that our study contributes to the literature by filling an important research gap that refers both to a proper selection of relevant determinants of OHS reporting in Romania and to a fair assessment of the scope achieved by the disclosure phenomenon in our country.

5. Discussion

The present study was focused on identifying the main determinants that exert significant impacts on the level of OHS disclosure among large corporations operating in the Romanian market. We have assessed the quality of health and safety disclosures within the framework of the new legislative constraints set forth by the implementation of Directive 2014/95/EU. The research adds the extant literature on the non-financial disclosure issue in Romania an empirical contribution on the reporting phenomenon within the OHS domain, which most likely represents the first approach with national coverage on the subject. Form among the most presumable factors to affect the quality of OHS disclosure put forward in CSR/sustainability/non-financial reports, we have chosen, based on the literature review outcomes, the following determinants: the company size; the market share; the ownership structure; the type of industry and the affiliation to a multinational parent corporation.

In respect with our first hypothesis H1 according to which the size of the reporting company is positively correlated with the quality of OHS disclosure, our findings seem to call in question the results put forward by the majority of studies currently undertaken. A closer look on the issue leads us to believe that this conclusion requires a wider vision. Thus, in line with the study conducted by Dyduch et al. [

11] we can rather state that the company’s size cannot be judged categorically as a determinant of the non-financial/OHS disclosure.

Hence, the majority of the researchers from the literature take into consideration two distinct proxies in order to measure the size of a reporting company–i.e., the turnover and the number of employees. While the first independent variable (the turnover) was strongly recommended by several studies (Hahn et al. [

36]; Tagesson et al. [

18]) as a key factor affecting the quality of the sustainability disclosure, the employment size creates the impression of an irrelevant association with the dependent variable. The review of the literature enabled us to identify other studies that employed the above-mentioned proxies in order to measure the corporation’s size. For instance, Tagesson et al. [

18], concluded that social disclosures are more likely to correlate with the number of employees, whereas other sections of sustainability reports would be associated with corporate turnover. In consonance with these findings, we chose the staff number as a proper dimension for measuring the size of the reporting company, having in mind the obvious interaction between health and safety at workplaces and human resources issues. However, our statistical analyses showed that the level of OHS disclosure in Romania is not significantly affected by the corporations’ number of employed persons. Furthermore, with regard to the hypothesis H1, we agree with Ozigi et al. [

22] according to which the disclosure on employee issues may present, more or less, country-specific archetypes since the reporting practices became compulsory in EU countries (Williams et al. [

61]). As far as our sample of 35 Romanian corporations is regard, the employment size does no significantly impact the level of disclosure in the OHS domain.

The hypothesis H2 which verified the correlation between OHS information and company’s visibility on the market was supported. The literature provides several proxies for corporate visibility: the media exposure of the company, the supply-chain position, the market share and other brand-related features (Michelon [

62]; Dura C. et al. [

63]; Wang et al. [

31]; Tan et al. [

64]; Hahn et al. [

36]). Our findings are consistent with the outcomes emphasized by Wang et al. [

31] and Tan et al. [

64]. Thus, the moderate positive link between the magnitude of OHS reporting and the market share of the reporting corporation can be interpreted as follows: companies with solid market positions tend to produce quality sustainability reports (within which the OHS component occupies a privileged place), in order to strengthen their successful corporate brand among consumers, business partners and even their own employees. The greater the company’s visibility on the market, the higher is the public scrutiny and the employee’s attention towards its operations.

In our research, we also put forward hypothesis H3 according to which there is an association between the ownership structure of the reporting company and the level of OHS disclosure. From statistical point of view, we rejected the hypothesis H3, but an in-depth analysis supported by the suggestive graphical representations generated by SPSS, showed some differences in the level of disclosures between private and public companies. Prior studies in the literature performed by Eng et al. [

65], Galo et al. [

66], Tagesson et al. [

18] demonstrated that majority state owned corporations are more likely to exhibit higher levels of sustainability/non-financial disclosures than the other categories. However, the literature stream contains also several researches that claim the opposite conclusion: Haniffa et al. [

67], Aman et al. [

68]. In the Romanian case, corporations in the public sector and those with mixed capital have higher values of the Global reporting index compared to private capital corporations. Although the non-financial reporting system was initially designed for private sector corporations, at present, the balance seems to be in favour of adopting at a higher quality level, good reporting practices by the public sector and by the firms with mixed capital. Thus, we concluded that the relationship with a wide range of stakeholders (including the general public and consumers paying taxes), but also the recent change of the legislative framework in our country and the careful monitoring by the regulatory bodies, were the factors that drove the corporations in the public domain to assume a higher level of responsibility for the sustainability of the activities carried out and also to raise the degree of attention paid to issues related to occupational safety and health.

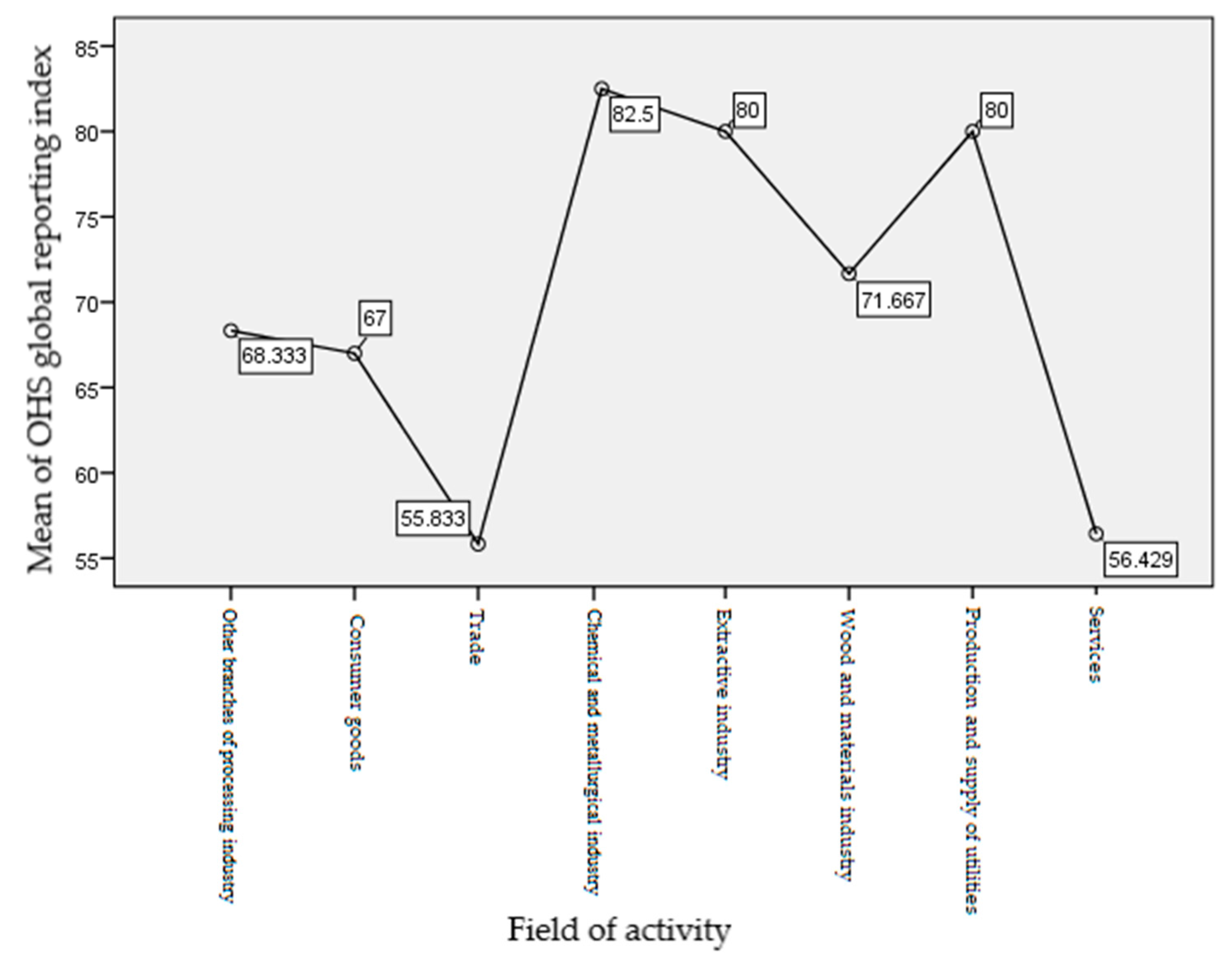

The next hypothesis H4 stipulated that there was a significant correlation among the industry (i.e., the economic sector) that incorporates the reporting company and its level of awareness regarding the sustainability/OHS disclosure. There is abundant literature which has previously discussed and proved the existence of the previously mentioned relationship: Sotorrío et all. [

17]; Reverte et al. [

16]; Aman et al. [

68]; Gamerschlag et al. [

15]; Tan et al. [

64] Kansal et al. [

28]; Jaffar et al. [

25] etc. Although the statistical significance of this hypothesis was not supported at the level of our sample, the highest means of the global OHS reporting index could be found within the so called “sensitive industries” susceptible of producing hazardous materials and increased OHS risks: chemical and metallurgical industry; extractive industry; the production and supply of utilities and son on. Thus, we considered that the trustworthy attitude demonstrated by the sustainable-oriented approach of managers of from these sectors is beneficial, given the high level of costs involved in neglecting OHS issues: the increased incidence of work-related injuries and occupational diseases, occupational stress and adjacent risks, low level of labour productivity and output, financial losses caused by lost work time as a result of accidents, the deterioration of the reputation and the image of the corporation etc. We acknowledge that other non-financial effects which are more difficult to quantify could have amplified the shortcomings borne by the large employers from the “sensitive industries” which would lack an adequate managerial vision in the field of safety and health at work.

The last hypothesis, H5 argued that the reporting company’s affiliation to a multinational corporation is significantly impacting its level of disclosure in the OHS area. Surprisingly, we found that this determinant also encountered as “the presence of reporting company’s in foreign markets” or “the level of its internationalization” is under-researched in the literature. The most relevant studies on the subject were conducted by Freedman et al. [

69]; Reverte [

16] and Kolk et al. [

70]. According to these authors, the affiliation of the reporting company to a multinational was initially believed to have a positive effect upon the disclosure consistency. Thus, the wider variety of stakeholders’ demands, the multiplicity of legislative requirements, the cultural diversity as well as the heterogeneity of values embraced by customers and employees, would drive companies with international operations to disclose a larger volume of information. Furthermore, in the Romanian case, there were a number of empirical studies in the literature that showed that large multinational corporations played the spearhead role in introducing CSR/sustainability best practices in our country (Dura et al. [

63]; Băleanu et al. [

45]; Filip et al. [

46]; Iamandi et al. [

47]). However, the research conducted for our sample of 35 Romanian corporations allowed us to highlight a turning point in this process. Thus, as the corporations with domestic capital complied with the Directive 2014/95/EU and, at the same time, understood the benefits of sustainability reporting for the transparency and image of their operations, the percentage of the domestic companies that consolidated their integrated management systems for their business increased significantly, while internal reporting procedures have begun to prove their functionality. Of course, in this context, the so-called “ripple effect” that causes the appearance of mimicry in the sphere of non-financial reporting should not be neglected, but even such an evolution is likely to highlight that CSR /sustainability reporting begins to germinate among local corporations, and OHS issues receive due attention in this context [

2,

63].

The authors are aware that the study presented in the present paper is not free of limitations. Firstly, the sample size used in order to lay foundations for the empirical research on OHS disclosure in Romania companies does not exceed 35 domestic firms, an overwhelming part of them falling into the large corporation’s category. Although the selection procedure and the limited volume of the total population were largely documented within the

Section 3.3, we cannot overlook that our research provides little information on OHS disclosures among small and medium sized enterprises (SME) originating from Romania. Secondly, the way of constructing the Global reporting index which constituted the dependent variable was affected, more or less, by the authors’ subjectivity, as the content analysis relied merely on the rationale and the experience gained by the researchers in their previous work. However, we kept under control, as far as possible, the subjective judgements that could intervene in the process of interpreting the conclusions that were drew up from the content analysis, by using the GRI 403 standard as a disclosure benchmark while evaluating the substance of the OHS section of each sustainability/non-financial report.

Despite its inherent limitations, we believe that our study enriches the literature in several ways. Firstly, it presents on overview of the reporting practices in the OHS area, a crucial component of labour-related sustainability disclosure, which is under-researched by the literature at this moment. Secondly, it examines on empirical basis, a set of determinants which affect the level and the quality of OHS disclosures by the Romanian companies. Finally, the study provides insights into the disclosure practices in Romania, being among the very few attempts of presenting the dimension accomplished by the reporting phenomenon in our country.

6. Conclusions

Our research showed that an increasing number of the managers of the local corporations are in the awareness stage regarding the understanding of the role of the human resource as a pivotal element of the capital of any organization. These local managers demolish the old myth according to which employees’ health and safety efforts were viewed exclusively as a cost-generating legal obligation and make the transition to a new approach in managerial thinking, based on investing in promoting OHS as a generator of multiple benefits for employees, for the company and the local community in which it operates.

While a new approach regarding the disclosure of sustainability/non-financial information is still in the making, we strongly recommend the Romanian managers to prepare and release the reports on a regular basis. Besides, taking into consideration the lack of consistency with the international reporting standards, we believe that achieving a higher level of compliance with the benchmarks represents another top priority in the near future. In this respect, the external assurance of sustainability/non-financial reporting represents a strategy that must be adopted by the Romanian corporations in order to increase the robustness, the confidence and the reliance of disclosed data.

As far as the SME sector is concerned, although it was initially estimated that the Directive 2014/95/EU would have a strong knock-on effect on the small enterprises operating in the supply chain of large corporations, we found that this was not the case in Romania, at least for the first few years following the transposition of the European guidelines into the national legislation. Therefore, there is still a lot to do by the government, the community and the stakeholders in order to join forces and to advocate for wider dissemination of the sustainable principles within the Romanian business environment.