Optimize the Banker’s Multi-Stage Decision-Making and the Mechanism of Pay Contract Influencing on Bank Default Risk in the Long-Term Model

Abstract

1. Introduction

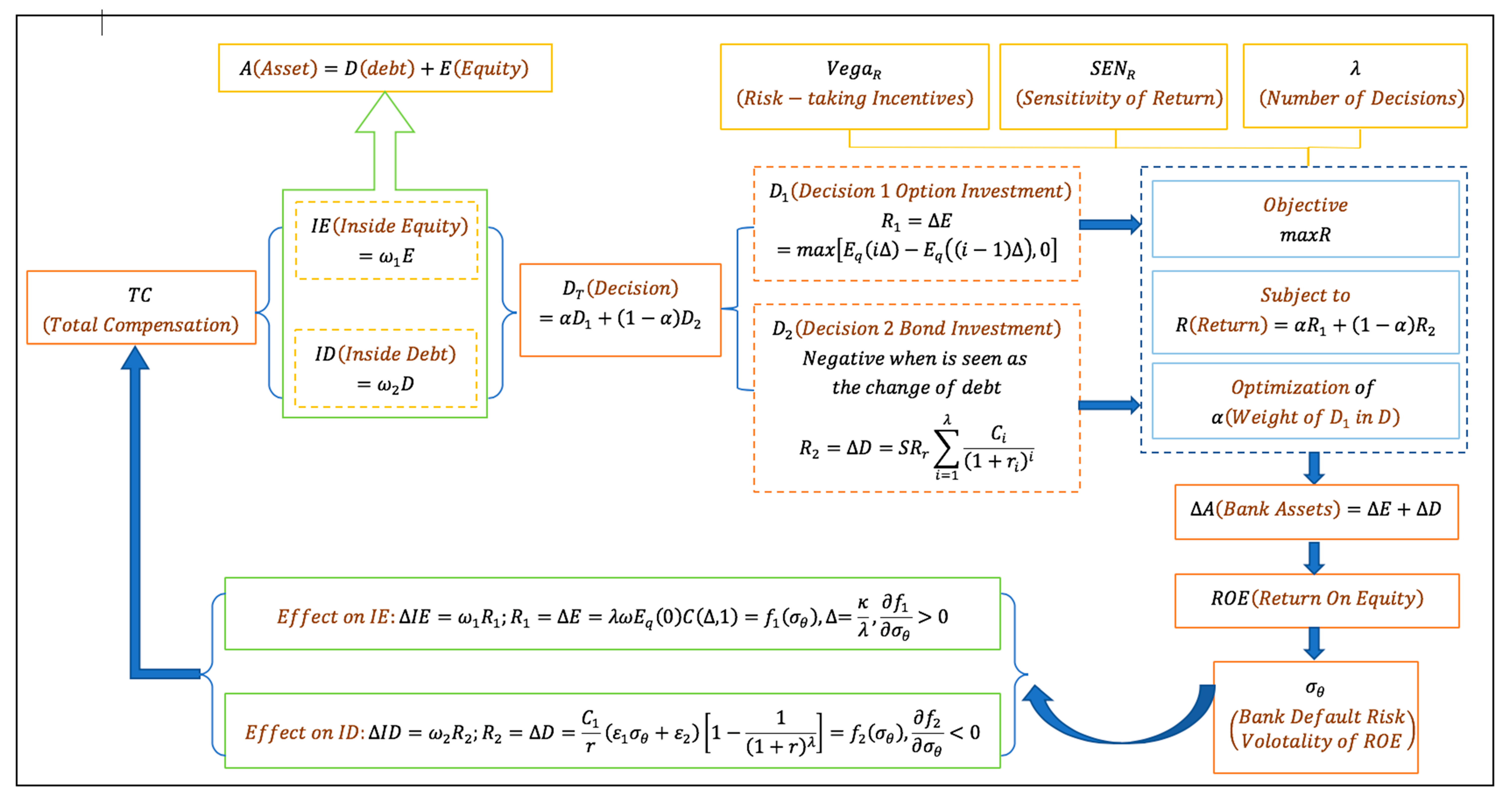

1.1. Research Background and Framework Diagram

1.2. Related Studies

1.3. Research Progress

2. Materials and Methods

2.1. Model Assumptions

“(a) The short-term interest rate is known and is constant through time. (b) The variance rate of the return on the stock is constant. (c) The stock pays no dividends or other distributions. (d) The option can only be excised at maturity. (e) There are no transaction costs in buying or selling the stock or the option. (f) It is possible to borrow any fraction of the price of a security to buy it or to hold it, at the short-term interest rate. (g) There are no penalties to short selling.”

2.2. Model Setup

2.2.1. Compensation and Investment Decision

2.2.2. Decision of Option Investment

2.2.3. Decision of Bond Investment

2.2.4. The Banker’s Decision Return

3. Results

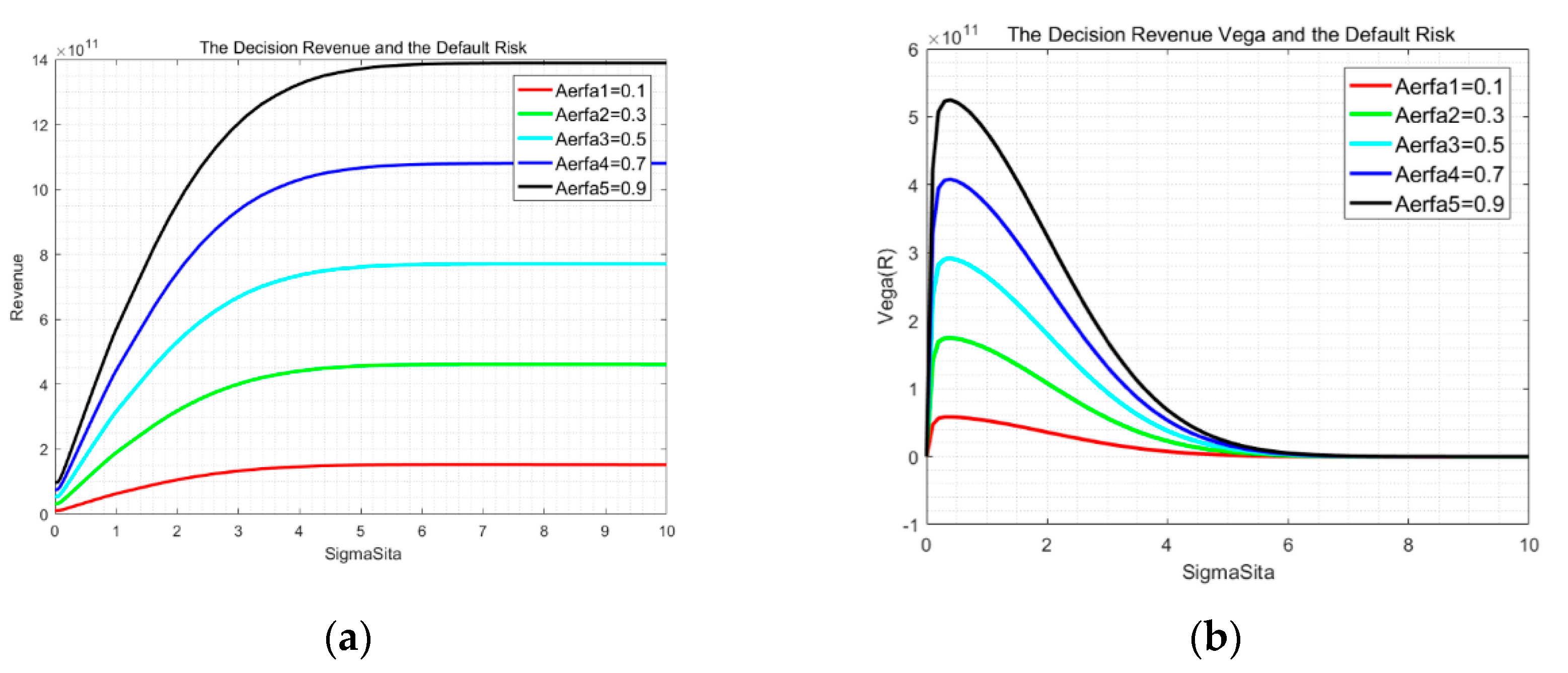

3.1. Decision Return Vega

3.2. The Sensitivity of Decision Return

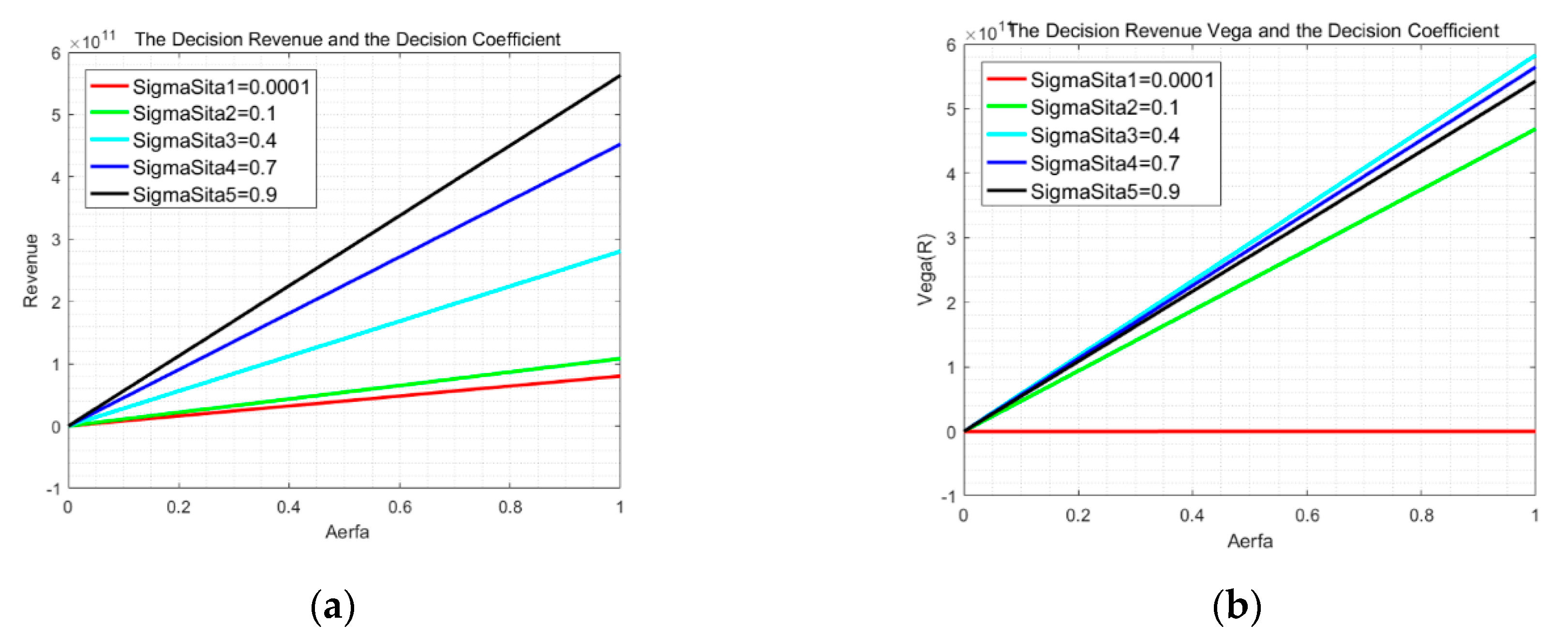

3.3. Decision Return and the Decision Structure Coefficient

3.4. Decision Return and the Number of Stages

4. Discussion

4.1. A Case Study: John G. Stumpf of Wells Fargo & Co.

4.1.1. Data

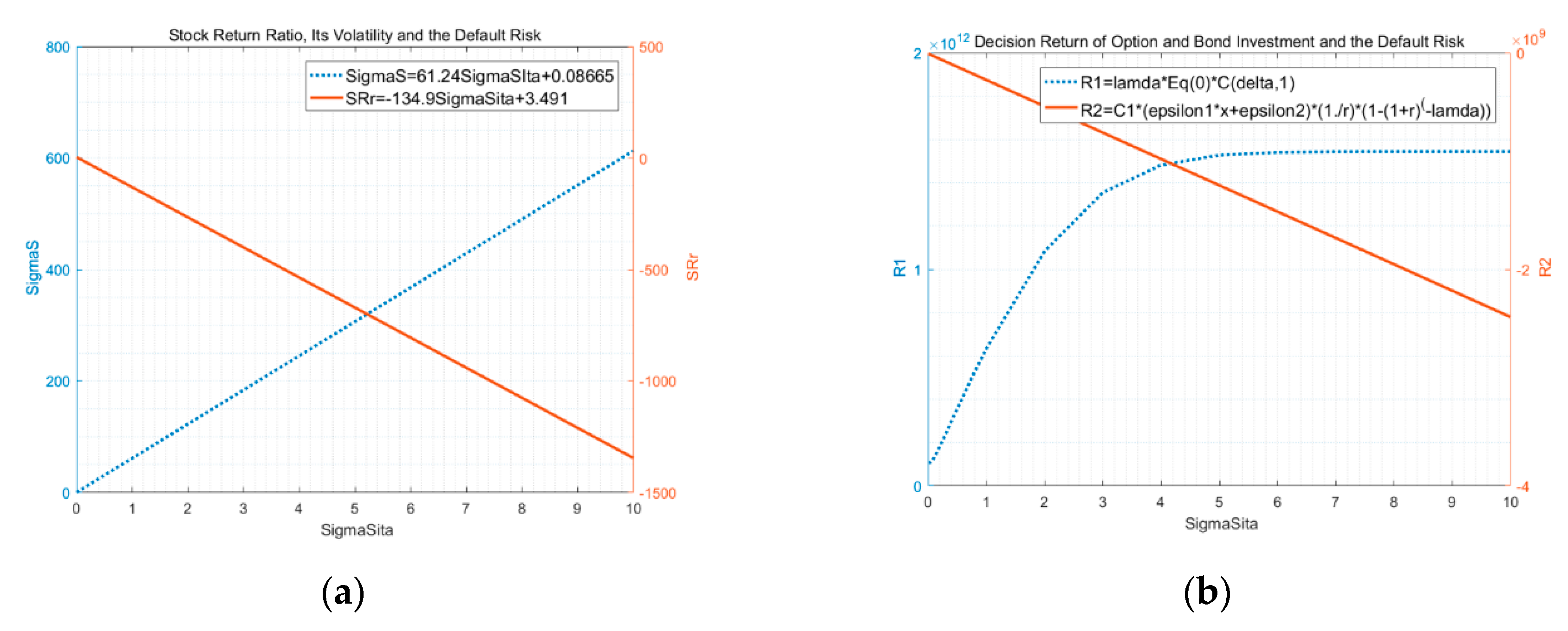

4.1.2. Curving Fitting Functions

4.2. Simulation Analysis

4.3. Robustness

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Decision | Definition | Long-Term Model | Relationship with Risk/Decision Structure/Number of Periods | |||

|---|---|---|---|---|---|---|

| From Predecessors or Intuition | From Theoretical Analysis | From Simulation or Empirical Results | Corresponding Figure | |||

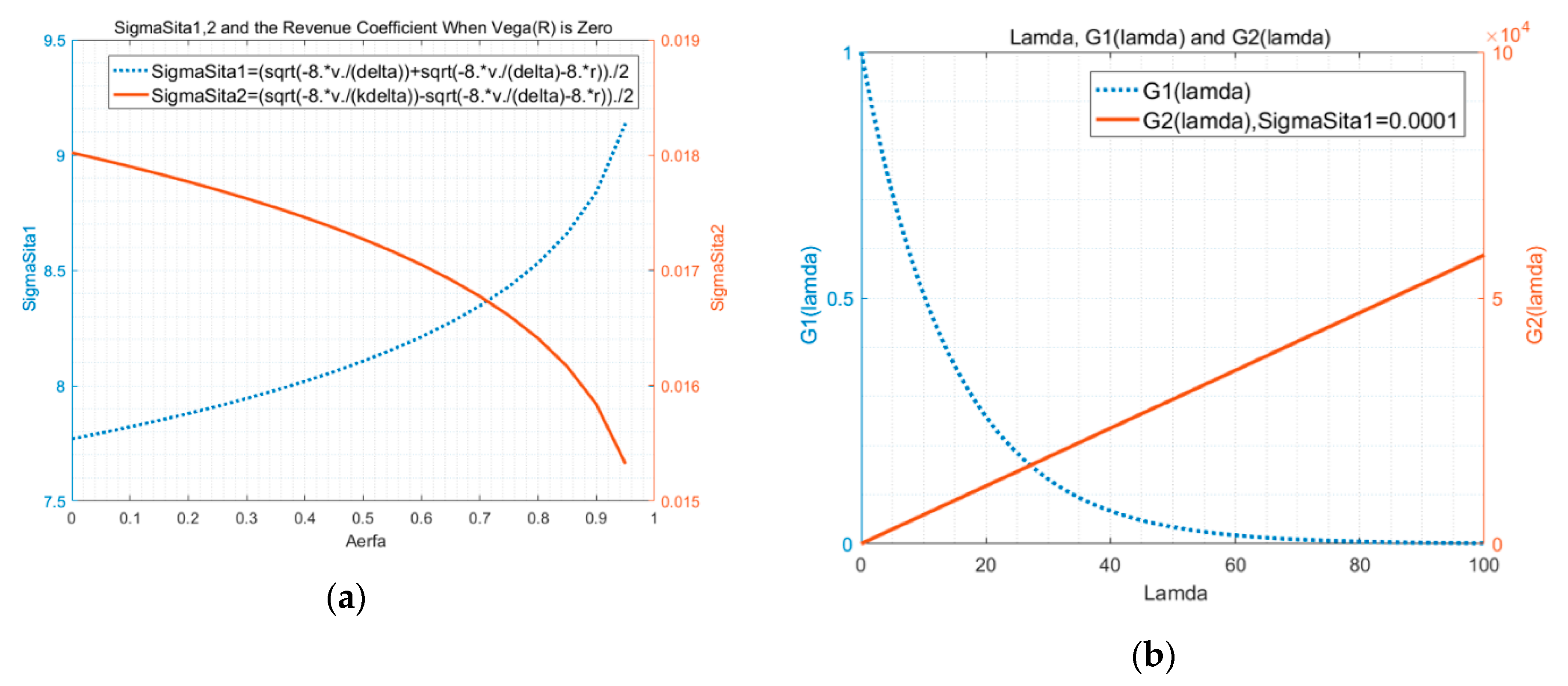

| Equation (12): | Proposition 1: | Corollary 1: is increased by in and decreased in and where Equation (44) | Figure 3a and Figure 5a | |||

| Return on decision of option investment | Equation (6): | Equation (30): | Equation (31): | Figure 2b | ||

| Return on decision of bond investment | Equation (9): | Equation (32): | Equation (33): | Figure 2b | ||

| Vega of return on decision | Equation (34): | Corollary 4: | Figure 3b and Figure 5b | |||

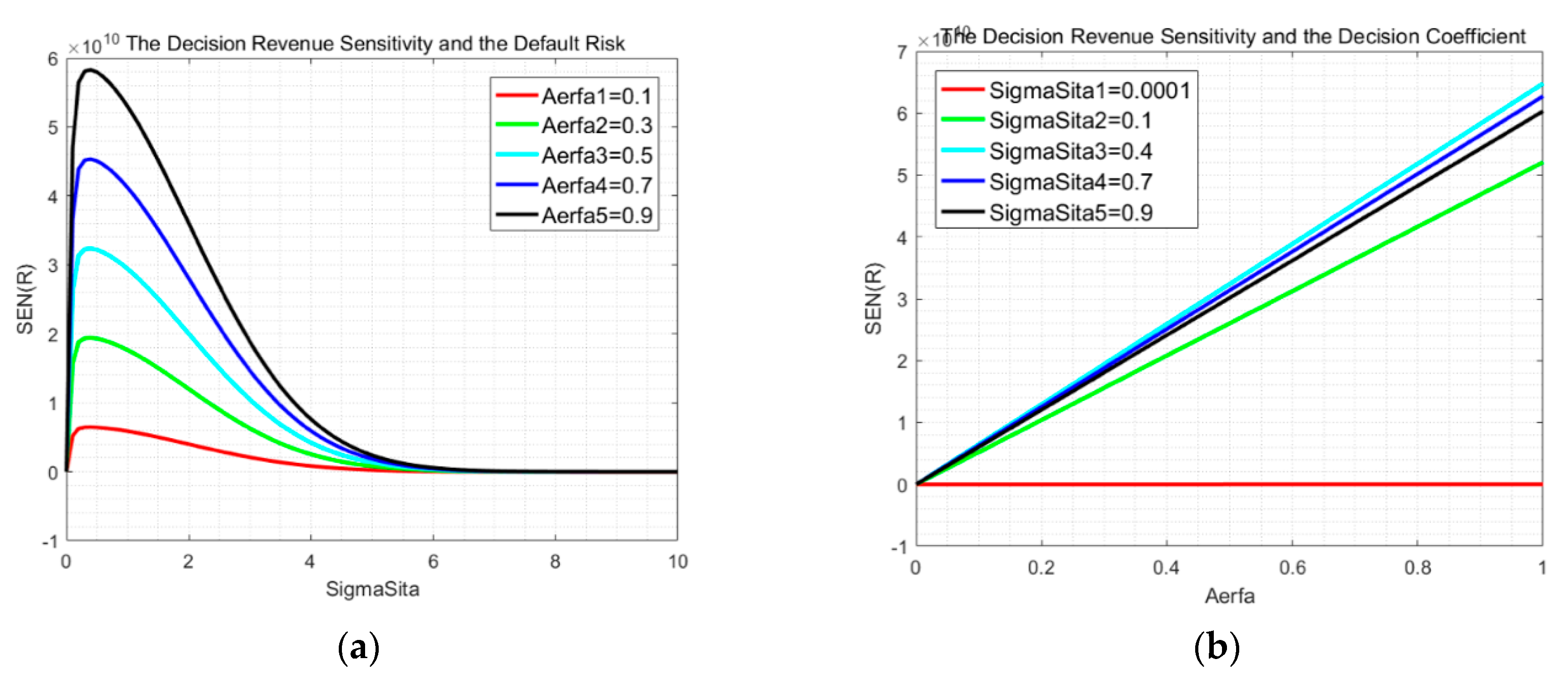

| Sensitivity of return on decision | Equation (48): | Corollary 2: | Figure 6a,b | |||

| Decision structure incentives | Equation (50): | Corollary 3: is increased when and decreased when where Equation (57) | Figure 4a,b | |||

References

- Jensen, M.C.; William, H.M. Theory of the firm: Managerial behavior, agency cost, and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Wang, T.C.; Lin, Y.L. Using a Multi-Criteria Group Decision Making Approach to Select Merged Strategies for Commercial Banks. Group Decis. Negot. 2009, 18, 519–536. [Google Scholar] [CrossRef]

- Riachi, I.; Schwienbacher, A. Securitization of corporate assets and executive compensation. J. Corp. Financ. 2013, 21, 235–251. [Google Scholar] [CrossRef]

- Li, H.; Henry, D.; Chou, H.I. Stock Market Mispricing, Executive Compensation and Corporate Investment: Evidence from Australia. J. Behav. Financ. 2011, 12, 131–140. [Google Scholar] [CrossRef]

- Latham, S.; Braun, M.R. To IPO or Not To IPO: Risks, Uncertainty and the Decision to Go Public. Brit. J. Manag. 2010, 21, 666–683. [Google Scholar] [CrossRef]

- Kokkinis, A. Exploring the effects of the ‘bonus cap’ rule: The impact of remuneration structure on risk-taking by bank managers. J. Corp. Law Stu. 2019, 19, 167–195. [Google Scholar] [CrossRef]

- Kim, M.S. Study on the Effects of CEO compensation in Investment and earnings management. Manag. Inf. Syst. Rev. 2015, 34, 179–196. [Google Scholar]

- Kang, S.H.; Kumar, P.; Lee, H. Agency and corporate investment: The role of executive compensation and corporate governance. J. Bus. 2006, 79, 1127–1147. [Google Scholar] [CrossRef]

- Huang, H.H.; Huang, H.; Shih, P.T. Real options and earnings-based bonus compensation. J. Bank. Financ. 2012, 36, 2389–2402. [Google Scholar] [CrossRef]

- Ho, P.H.; Huang, C.W.; Lin, C.Y.; Yen, J.F. CEO overconfidence and financial crisis: Evidence from bank lending and leverage. J. Financ. Econ. 2016, 120, 194–209. [Google Scholar] [CrossRef]

- Gulati, A.; Yasin, M.M. DECISION-SUPPORT IN COMMODITIES INVESTMENT - AN EXPERT-SYSTEM APPLICATION. Ind. Manag. Data Syst. 1994, 94, 23–27. [Google Scholar] [CrossRef]

- Grundy, B.D.; Li, H. Investor sentiment, executive compensation, and corporate investment. J. Bank. Financ. 2010, 34, 2439–2449. [Google Scholar] [CrossRef]

- Eisdorfer, A.; Giaccotto, C.; White, R. Capital structure, executive compensation, and investment efficiency. J. Bank. Financ. 2013, 37, 549–562. [Google Scholar] [CrossRef]

- Eastburn, R.W.; Boland, R.J., Jr. Inside banks’ information and control systems: Post-decision surprise and corporate disruption. Inf. Organ. 2015, 25, 160–190. [Google Scholar] [CrossRef]

- Bliss, R.T.; Rosen, R.J. CEO compensation and bank mergers. J. Financ. Econ. 2001, 61, 107–138. [Google Scholar] [CrossRef]

- Belkhir, M.; Boubaker, S. CEO inside debt and hedging decisions: Lessons from the US banking industry. J. Int. Financ. Mark. Inst. Money 2013, 24, 223–246. [Google Scholar] [CrossRef]

- Sheikh, S. CEO inside debt, market competition and corporate risk taking. Int. J. Manag. Financ. 2019, 15, 636–657. [Google Scholar] [CrossRef]

- Li, Z.F.; Lin, S.; Sun, S.; Tucker, A. Risk-adjusted inside debt. Glob. Financ. J. 2018, 35, 12–42. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, X.-Y. Impact of board gender composition on corporate debt maturity structures. Eur. Financ. Manag. 2019, 25, 1286–1320. [Google Scholar] [CrossRef]

- Merton, R.C. On the Pricing of Corporate Debt: The Risk Structure of Interests Rates. J. Financ. 1974, 29, 449–470. [Google Scholar]

- Abad-Segura, E.; Cortés-García, F.J.; Belmonte-Ureña, L.J. The Sustainable Approach to Corporate Social Responsibility: A Global Analysis and Future Trends. Sustainability 2019, 11, 5382. [Google Scholar] [CrossRef]

- Ma, T.; Jiang, M.; Yuan, X. Pay Me Later is Not Always Positively Associated with Bank Risk Reduction—From the Perspective of Long-Term Compensation and Black Box Effect. Sustainability 2020, 12, 35. [Google Scholar] [CrossRef]

- Ma, T.; Jiang, M.; Yuan, X. Cash Salary, Inside Equity or Inside Debt?—The Determinants and Optimal Value of Compensation Structure in a Long-term Incentive Model of Banks. Sustainability 2020, 12, 666. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Dividend Discount Model. Available online: https://www.investopedia.com/terms/d/ddm.asp (accessed on 10 January 2020).

- Jokivuolle, E.; Keppo, J.; Yuan, X. Bonus Caps, Deferrals and Bankers’ Risk-Taking. Manag. Sci. under review.

- Vuolteenaho, T. What Drives Firm-Level Stock Returns? J. Financ. 2002, 57, 233–264. [Google Scholar] [CrossRef]

- International Monetary Fund. Risk-taking by banks: The role of governance and executive pay. In Global Financial Stability Report: Risk-Taking, Liquidity, and Shadow Banking: Curbing Excess while Promoting Growth; IMF: Washington, DC, USA, 2014. [Google Scholar]

- Gopalan, R.; Milbourn, T.; Song, F.; Thakor, A.V. The Optimal Duration of Executive Compensation: Theory and Evidence. AFA 2012 Chicago Meetings Paper. Available online: http://ssrn.com/abstract=1656603 (accessed on 10 November 2019).

- Sundaram, P.K.; Yermack, D.L. Pay me later: Inside debt and its role in managerial compensation. J. Financ. 2007, 62, 1551–1588. [Google Scholar] [CrossRef]

| Classification | Notations | Definition | Notations | Definition | Notations | Definition | Notations | Definition | Notations | Definition |

|---|---|---|---|---|---|---|---|---|---|---|

| Bank | the bank asset | the bank equity | the bank debt | return on equity | volatility of ROE | |||||

| Compensation | total long-term compensation | inside equity | inside debt | the fraction of equity | the fraction of debt | |||||

| Decision | the banker’s decision-making | option investment | bond investment | the fraction of | return on | |||||

| Option investment | return on | the time interval | the executive’s tenure | the bank equity | number of decision stages | |||||

| Black and Scholes call option price | strike price of the call option | standard cumulative normal distribution | standard normal density | the risk-free rate | ||||||

| Bond investment | return on | cash flow for period | the stock return ratio | slope in Equation (23) | intercept in Equation (23) | |||||

| slope in Equation (21) | intercept in Equation (21) | slope in Equation (22) | intercept in Equation (22) | volatility of stock return ratio | ||||||

| Optimization | Vega of decision return | sensitivity of decision return | decision structure incentives | minimum point of | maximum point of | |||||

| option investment | bond investment | for the monotonicity of | For the monotonicity of | part of expression of | ||||||

| optimal default risk | optimal decision structure | sum of squares due to error | coefficient of determination | root mean square error |

| Year | Age | ||||||

|---|---|---|---|---|---|---|---|

| 2007 | 53 | 99,539.5094 | 2.41 | - | 0.2443 | - | 47,432,000,000 |

| 2008 | 54 | 124,660.0419 | 0.7 | 1.46205 | 0.0324 | 0.022451 | 70,949,000,000 |

| 2009 | 55 | 139,771.0888 | 1.76 | 0.5618 | 0.1574 | 0.007813 | 105,846,000,000 |

| 2010 | 56 | 163,078.1502 | 2.23 | 0.11045 | 0.1486 | 0.0000387 | 119,155,000,000 |

| 2011 | 57 | 145,037.5867 | 2.85 | 0.1922 | 0.167 | 0.000169 | 130,189,000,000 |

| 2012 | 58 | 180,002.6125 | 3.4 | 0.15125 | 0.1792 | 0.0000744 | 145,953,000,000 |

| 2013 | 59 | 238,675.2002 | 3.95 | 0.15125 | 0.1908 | 0.0000673 | 154,646,000,000 |

| 2014 | 60 | 283,438.5322 | 4.17 | 0.0242 | 0.1829 | 0.0000312 | 166,075,000,000 |

| 2015 | 61 | 276,808.1324 | 4.18 | 0.00005 | 0.1735 | 0.0737 | 171,567,000,000 |

| 2016 | 62 | 276,437.767 | 4.03 | 0.01125 | 0.1602 | 0.0000884 | 175,820,000,000 |

| Curving Fitting | a | b | c | |

|---|---|---|---|---|

| Corresponding Equation | (20) | (21) | (22) | |

| Fit slope | ||||

| Fit intercept | ||||

| Goodness of fit | 0.03544 | 3.188 | 3.953 | |

| 0.9799 | 0.7413 | 0.6791 | ||

| 0.977 | 0.7043 | 0.6333 | ||

| 0.07116 | 0.6748 | 0.7515 | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, T.; Jiang, M.; Yuan, X. Optimize the Banker’s Multi-Stage Decision-Making and the Mechanism of Pay Contract Influencing on Bank Default Risk in the Long-Term Model. Sustainability 2020, 12, 1400. https://doi.org/10.3390/su12041400

Ma T, Jiang M, Yuan X. Optimize the Banker’s Multi-Stage Decision-Making and the Mechanism of Pay Contract Influencing on Bank Default Risk in the Long-Term Model. Sustainability. 2020; 12(4):1400. https://doi.org/10.3390/su12041400

Chicago/Turabian StyleMa, Tianyi, Minghui Jiang, and Xuchuan Yuan. 2020. "Optimize the Banker’s Multi-Stage Decision-Making and the Mechanism of Pay Contract Influencing on Bank Default Risk in the Long-Term Model" Sustainability 12, no. 4: 1400. https://doi.org/10.3390/su12041400

APA StyleMa, T., Jiang, M., & Yuan, X. (2020). Optimize the Banker’s Multi-Stage Decision-Making and the Mechanism of Pay Contract Influencing on Bank Default Risk in the Long-Term Model. Sustainability, 12(4), 1400. https://doi.org/10.3390/su12041400