How Knowledge Acquisition Diversity Affects Innovation Performance during the Technological Catch-Up in Emerging Economies: A Moderated Inverse U-Shape Relationship

Abstract

1. Introduction

2. Theory and Hypotheses

2.1. Knowledge Acquisition Diversity (KAD) and Innovation Performance

2.2. Contingent Role of Technological Contexts

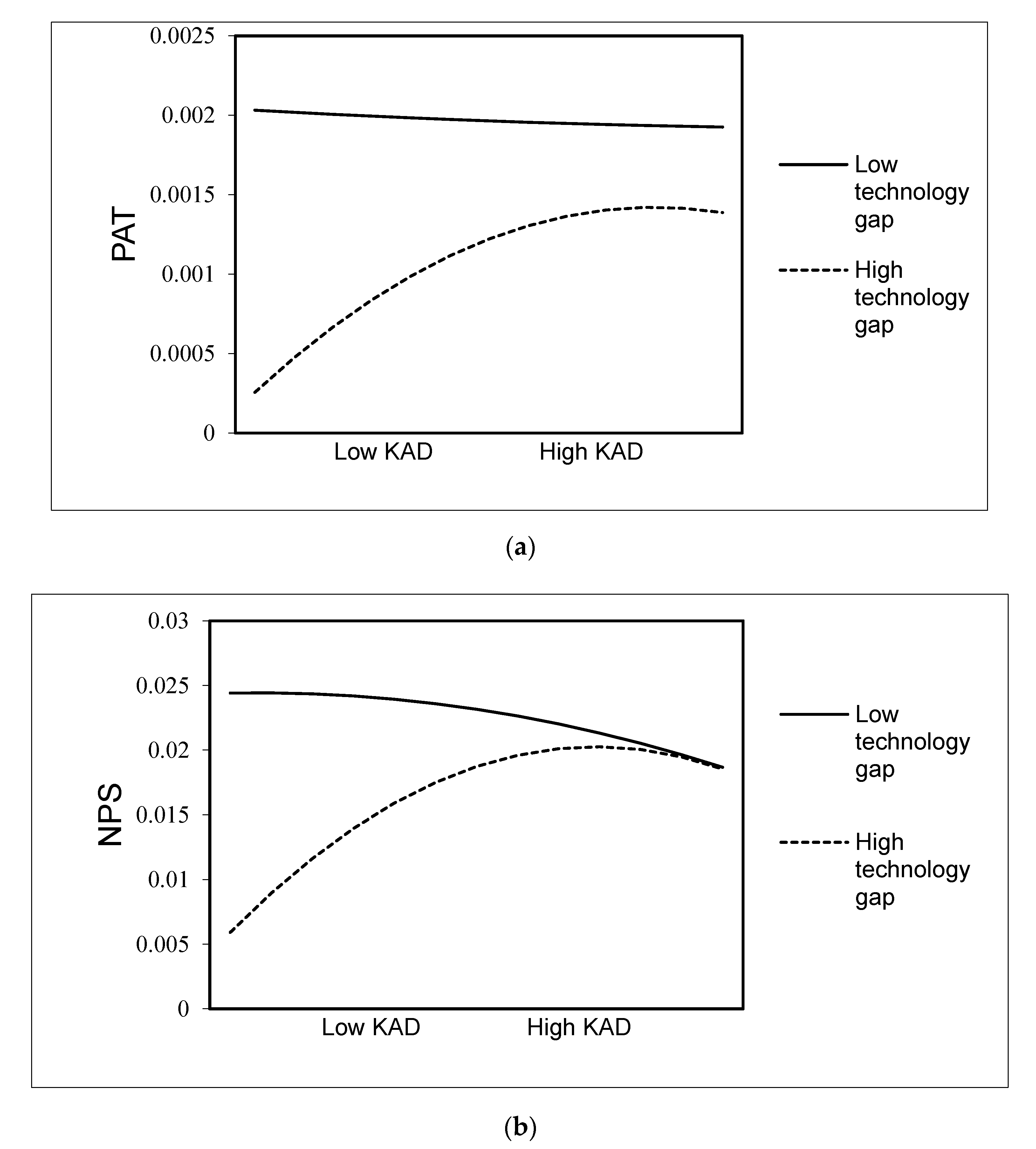

2.2.1. The Moderating Role of the Technology Gap

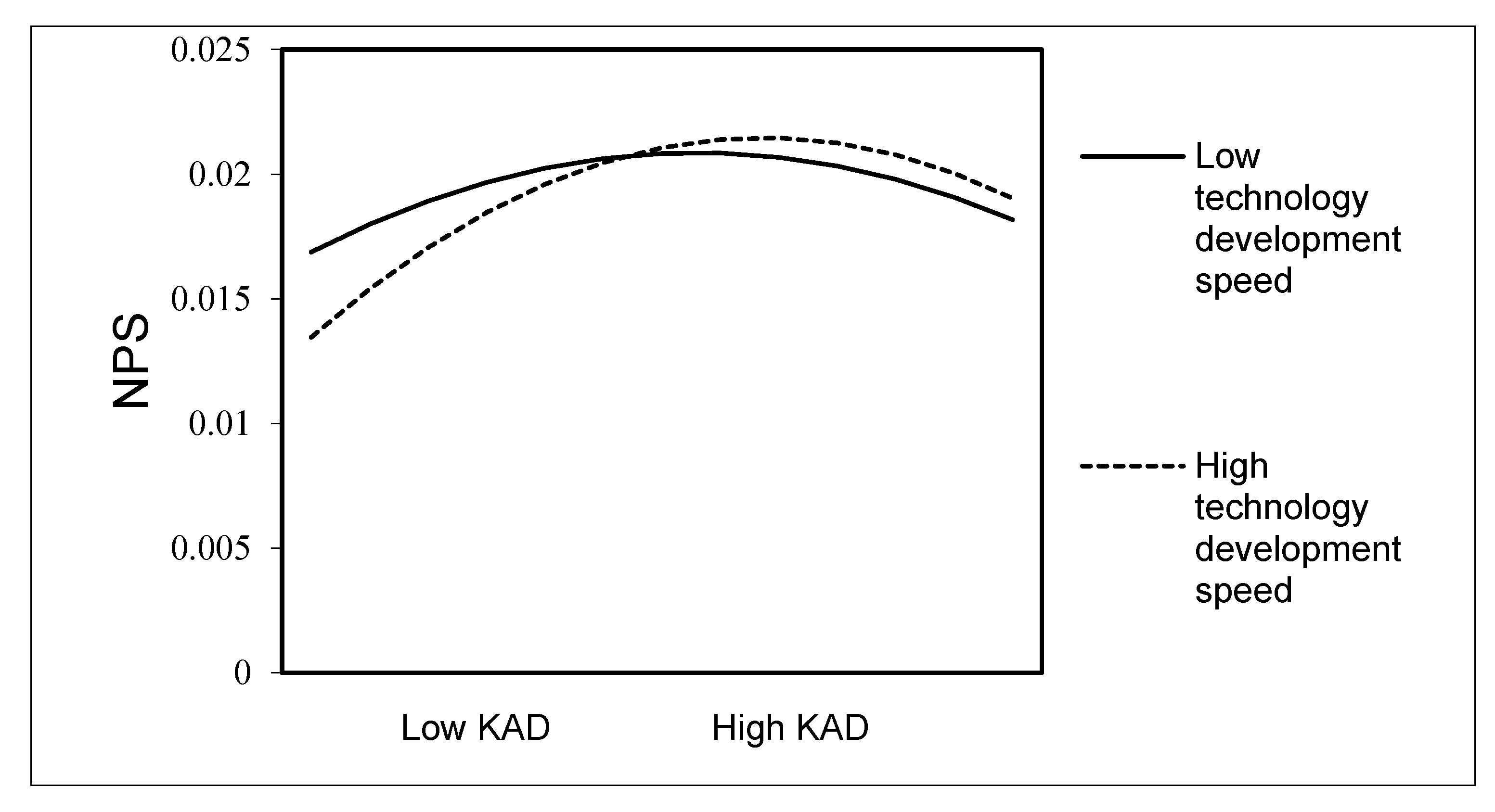

2.2.2. The Moderating Role of Technology Development Speed

3. Methods

3.1. Sample and Data

3.2. Variable Measurement

3.2.1. Dependent Variables

3.2.2. Independent Variable

3.2.3. Moderators

3.2.4. Control Variables

3.3. Modeling Procedure

4. Results

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Mathews, J.A. Competitive advantages of the latecomer firm: A resource-based account of industrial catch-up strategies. Asia Pac. J. Manag. 2002, 19, 467–488. [Google Scholar] [CrossRef]

- Liu, X.; Buck, T. Innovation performance and channels for international technology spillovers: Evidence from Chinese high-tech industries. Res. Policy 2007, 36, 355–366. [Google Scholar] [CrossRef]

- Guo, B. Technology acquisition channels and industry performance: An industry-level analysis of Chinese large-and medium-size manufacturing enterprises. Res. Policy 2008, 37, 194–209. [Google Scholar]

- Qin, X.; Du, D. Do external or internal technology spillovers have a stronger influence on innovation efficiency in China? Sustainability 2017, 9, 1574. [Google Scholar]

- Liu, J.; Lu, K.; Cheng, S. International R&D spillovers and innovation efficiency. Sustainability 2018, 10, 3974. [Google Scholar]

- Hu, A.G.; Jefferson, G.H.; Qian, J. R&D and technology transfer: Firm-level evidence from Chinese industry. Rev. Econ. Stat. 2005, 87, 780–786. [Google Scholar]

- Li, X.; Wu, G. In-house R&D, technology purchase and innovation: Empirical evidences from Chinese hi-tech industries, 1995–2004. Int. J. Technol. Manag. 2010, 51, 217–238. [Google Scholar]

- Sun, Y.; Du, D. Determinants of industrial innovation in China: Evidence from its recent economic census. Technovation 2010, 30, 540–550. [Google Scholar] [CrossRef]

- Wang, Y.; Roijakkers, N.; Vanhaverbeke, W. Learning-by-licensing: How Chinese firms benefit from licensing-in technologies. IEEE Trans. Eng. Manag. 2012, 60, 46–58. [Google Scholar] [CrossRef]

- Wang, Y.; Li-Ying, J. Licensing foreign technology and the moderating role of local R&D collaboration: Extending the relational view. J. Prod. Innovat. Manag. 2014, 32, 997–1013. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Admin. Sci. Quart. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Mu, Q.; Lee, K. Knowledge diffusion, market segmentation and technological catch-up: The case of the telecommunication industry in China. Res. Policy 2005, 34, 759–783. [Google Scholar] [CrossRef]

- Tether, B.S. Who co-operates for innovation, and why: An empirical analysis. Res. Policy 2002, 31, 947–967. [Google Scholar] [CrossRef]

- Chen, L.C. Learning through informal local and global linkages: The case of Taiwan’s machine tool industry. Res. Policy 2009, 38, 527–535. [Google Scholar] [CrossRef]

- Cantwell, J.; Janne, O. Technological globalisation and innovative centres: The role of corporate technological leadership and locational hierarchy. Res. Policy 1999, 28, 119–144. [Google Scholar] [CrossRef]

- Wang, Y.; Roijakkers, N.; Vanhaverbeke, W.; Chen, J. How Chinese firms employ open innovation to strengthen their innovative performance. Int. J. Technol. Manag. 2011, 59, 235–254. [Google Scholar] [CrossRef]

- Guo, B.; Li, Q.; Chen, X. Diversity of technology acquisition in technological catch-up: an industry-level analysis of Chinese manufacturing. Technol. Anal. Strateg. 2016, 28, 755–767. [Google Scholar] [CrossRef]

- Lungeanu, R.; Stern, I.; Zajac, E. When do firms change technology-sourcing vehicles? The role of poor innovative performance and financial slack. Strateg. Manag. J. 2016, 37, 855–869. [Google Scholar] [CrossRef]

- Zhang, S.; Yuan, C.; Wang, Y. The Impact of Industry–University–Research Alliance Portfolio Diversity on Firm Innovation: Evidence from Chinese Manufacturing Firms. Sustainability 2019, 11, 2321. [Google Scholar] [CrossRef]

- Park, K.; Lee, L. Linking the technological regime to the technological catch-up: Analyzing Korea and Taiwan using the U.S. patent data. Ind. Corp. Change 2006, 15, 715–753. [Google Scholar] [CrossRef]

- Castellani, D.; Zanfei, A. Technology gaps, absorptive capacity and the impact of inward investments on productivity of European firms. Econ. Innov. New Technol. 2003, 12, 555–576. [Google Scholar] [CrossRef]

- Lee, K.; Lim, C. Technological regimes, catching-up and leapfrogging: Findings from the Korean industries. Res. Policy 2001, 30, 459–483. [Google Scholar] [CrossRef]

- Guo, B.; Gao, J.; Chen, X. Technology strategy, technological context and technological catch-up in emerging economies: industry-level findings from Chinese manufacturing. Technol. Anal. Strateg. 2013, 25, 219–234. [Google Scholar] [CrossRef]

- Van de Vrande, V.; Vanhaverbeke, W.; Duysters, G. External technology sourcing: The effect of uncertainty on governance mode choice. J. Bus. Ventur. 2009, 24, 62–80. [Google Scholar] [CrossRef]

- Segarra-Ciprés, M.; Bou-Llusar, J.C. External knowledge search for innovation: The role of firms’ innovation strategy and industry context. J. Knowl. Manag. 2018, 22, 280–298. [Google Scholar] [CrossRef]

- Xie, W.; White, S. From imitation to creation: The critical yet uncertain transition for Chinese firms. J. Technol. Manag. China 2006, 1, 229–242. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Hsu, J.Y.; Poon, J.P.; Yeung, H.W.C. External leveraging and technological upgrading among East Asian firms in the US. Eur. Plan. Stud. 2008, 16, 99–118. [Google Scholar] [CrossRef]

- Li, H.; Zhang, Y.A.; Lyles, M. Knowledge spillovers, search, and creation in China’s emerging market. Manag. Organ. Rev. 2013, 9, 395–412. [Google Scholar] [CrossRef]

- Urban, F.; Zhou, Y.; Nordensvard, J.; Narain, A. Firm-level technology transfer and technology cooperation for wind energy between Europe, China and India: From North–South to South–North cooperation? Energy Sustain. Dev. 2015, 28, 29–40. [Google Scholar] [CrossRef]

- Fu, X.; Pietrobelli, C.; Soete, L. The role of foreign technology and indigenous innovation in the emerging economies: Technological change and catching-up. World Dev. 2011, 39, 1204–1212. [Google Scholar] [CrossRef]

- Wang, Y.; Ning, L.; Li, J.; Prevezer, M. Foreign Direct Investment Spillovers and the Geography of Innovation in Chinese Regions: The Role of Regional Industrial Specialization and Diversity. Reg. Stud. 2014, 50, 805–822. [Google Scholar] [CrossRef]

- Liu, X.; Zou, H. The impact of greenfield FDI and mergers and acquisitions on innovation in Chinese high-tech industries. J. World Bus. 2008, 43, 352–364. [Google Scholar] [CrossRef]

- Zhou, Y.; Pan, M.; Urban, F. Comparing the International Knowledge Flow of China’s Wind and Solar Photovoltaic (PV) Industries: Patent Analysis and Implications for Sustainable Development. Sustainability 2018, 10, 1883. [Google Scholar] [CrossRef]

- Nicholls-Nixon, C.L.; Woo, C.Y. Technology sourcing and output of established firms in a regime of encompassing technological change. Strateg. Manag. J. 2003, 24, 651–666. [Google Scholar] [CrossRef]

- Arora, A.; Gambardella, A. Complementarity and external linkages: The strategies of the large firms in biotechnology. J. Ind. Econ. 1990, 38, 361–379. [Google Scholar] [CrossRef]

- Fagerberg, J.; Verspagen, B. Technology-gaps, innovation-diffusion and transformation: An evolutionary interpretation. Res. Policy 2002, 31, 1291–1304. [Google Scholar] [CrossRef]

- Katila, R.; Ahuja, G. Something old, something new: A longitudinal study of search behavior and new product introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar]

- Hu, A.G.; Jaffe, A.B. Patent citations and international knowledge flow: the cases of Korea and Taiwan. Int. J. Ind. Organ. 2003, 21, 849–880. [Google Scholar] [CrossRef]

- Narula, R.; Santangelo, G. Location, collocation and R&D alliances in the European ICT industry. Res. Policy 2009, 38, 393–403. [Google Scholar]

- Lee, K.; Lim, C.; Song, W. Emerging digital technology as a window of opportunity and technological leapfrogging: Catch-up in digital TV by the Korean firms. Int. J. Technol. Manag. 2005, 29, 40–63. [Google Scholar] [CrossRef]

- Bell, M.; Pavitt, K. The development of technological capabilities. Trade Technol. Int. Compet. 1995, 22, 69–101. [Google Scholar]

- Krishnan, V.; Bhattacharya, S. Technology selection and commitment in new product development: The role of uncertainty and design flexibility. Manag. Sci. 2002, 48, 313–327. [Google Scholar] [CrossRef]

- Kogut, B.; Zander, U. Knowledge of the Firm, Combinative Capabilities, and the Replication of Technology. Organ. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Duysters, G.; Lokshin, B. Determinants of alliance portfolio complexity and its effect on innovation performance of companies. J. Prod. Innovat. Manag. 2011, 28, 570–585. [Google Scholar] [CrossRef]

- Lin, J.Y. Effects on diversity of R&D sources and human capital on industrial performance. Technol. Forecast. Soc. 2014, 85, 168–184. [Google Scholar]

- Doranova, A.; Costa, I.; Duysters, G. Knowledge base determinants of technology sourcing in clean development mechanism projects. Energ. Policy 2010, 38, 5550–5559. [Google Scholar] [CrossRef]

- Findlay, R. Relative backwardness, direct foreign investment, and the transfer of technology: A simple dynamic model. Quart. J. Econ. 1978, 92, 1–16. [Google Scholar] [CrossRef]

- Wang, J.Y.; Blomström, M. Foreign investment and technology transfer: A simple model. Eur. Econ. Rev. 1992, 36, 137–155. [Google Scholar] [CrossRef]

- Haddad, M.; Harrison, A. Are there positive spillovers from direct foreign investment? Evidence from panel data for Morocco. J. Dev. Econ. 1993, 42, 51–74. [Google Scholar] [CrossRef]

- Li, W.; Guo, B.; Xu, G. Making the next move: When does the newness of experience matter in overseas sequential entries of multinational companies? Int. Bus. Rev. 2017, 26, 908–926. [Google Scholar] [CrossRef]

- Candi, M.; Van den Ende, J.; Gemser, G. Organizing innovation projects under technological turbulence. Technovation 2013, 33, 133–141. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Tabrizi, B.N. Accelerating adaptive processes. Product Innovation in the global computer industry. Admin. Sci. Quart. 1995, 40, 84–110. [Google Scholar] [CrossRef]

- Kim, L. Imitation to Innovation: The Dynamics of Korea’s Technological Learning; Harvard Business School Press: Boston, MA, USA, 1997. [Google Scholar]

- Ahuja, G.; Katila, R. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strateg. Manag. J. 2001, 22, 197–220. [Google Scholar] [CrossRef]

- Guo, B.; Pang, X.; Li, W. The role of top management team diversity in shaping the performance of business model innovation: A threshold effect. Technol. Anal. Strateg. 2018, 30, 241–253. [Google Scholar] [CrossRef]

- Leiponen, A.; Helfat, C.E. Innovation objectives, knowledge sources, and the benefits of breadth. Strateg. Manag. J. 2010, 31, 224–236. [Google Scholar] [CrossRef]

- Liu, X.; White, R.S. The relative contributions of foreign technology and domestic inputs to innovation Chinese manufacturing industries. Technovation 1997, 17, 119–125. [Google Scholar] [CrossRef]

- Buckley, P.J.; Wang, C.; Clegg, J. The Impact of Foreign Ownership, Local Ownership and Industry Characteristics on Spillover Benefits from Foreign Direct Investment in China. Int. Bus. Rev. 2007, 16, 142–158. [Google Scholar] [CrossRef]

- Fujimori, A.; Sato, T. Productivity and technology diffusion in India: The spillover effects from foreign direct investment. J. Policy Model. 2015, 37, 630–651. [Google Scholar] [CrossRef]

- Blomström, M.; Persson, H. Foreign investment and spillover efficiency in an underdeveloped economy: Evidence from the Mexican manufacturing industry. World Dev. 1983, 11, 493–501. [Google Scholar] [CrossRef]

- Liu, W.; Wei, Q.; Huang, S.-Q.; Tsai, S.-B. Doing Good Again? A Multilevel Institutional Perspective on Corporate Environmental Responsibility and Philanthropic Strategy. Int. J. Environ. Res. Public Health 2017, 14, 1283. [Google Scholar] [CrossRef] [PubMed]

- Guo, B.; Chen, X. Why are the industrial firms of emerging economies short-termistic in innovation? Industry-level evidence from Chinese manufacturing. Int. J. Technol. Manag. 2012, 59, 273–299. [Google Scholar] [CrossRef]

- Ferreras-Méndez, J.L.; Newell, S.; Fernández-Mesa, A.; Alegre, J. Depth and breadth of external knowledge search and performance: The mediating role of absorptive capacity. Ind. Market. Manag. 2015, 47, 86–97. [Google Scholar] [CrossRef]

- del-Corte-Lora, V.; Molina-Morales, F.X.; Vallet-Bellmunt, T.M. Mediating effect of creativity between breadth of knowledge and innovation. Technol. Anal. Strateg. Manag. 2016, 28, 768–782. [Google Scholar] [CrossRef]

- Kim, C.Y.; Lim, M.S.; Yoo, J.W. Ambidexterity in External Knowledge Search Strategies and Innovation Performance: Mediating Role of Balanced Innovation and Moderating Role of Absorptive Capacity. Sustainability 2019, 11, 5111. [Google Scholar] [CrossRef]

| Industries | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

|---|---|---|---|---|---|---|---|---|

| Food processing | 2.7 | 3.2 | 2.5 | 2.7 | 4.2 | 6.2 | 9.5 | 14.2 |

| Food production | 4.2 | 4.7 | 6.2 | 6.4 | 6.3 | 9.5 | 11.6 | 14.0 |

| Beverage production | 4.3 | 5.9 | 7.0 | 9.2 | 8.6 | 14.5 | 16.3 | 16.9 |

| Textile industry | 3.7 | 4.9 | 5.7 | 6.6 | 6.9 | 7.3 | 8.2 | 8.9 |

| Garments and other fiber products | 5.1 | 5.8 | 3.0 | 5.9 | 5.9 | 4.1 | 5.3 | 4.3 |

| Leather, furs, down and related products | 7.7 | 4.6 | 3.4 | 3.5 | 3.5 | 3.2 | 4.1 | 4.1 |

| Timber, bamboo, cane, palm fiber and straw products | 4.8 | 2.4 | 2.3 | 7.6 | 9.6 | 9.0 | 9.6 | 12.4 |

| Furniture manufacturing | 5.6 | 6.5 | 2.6 | 6.5 | 6.0 | 6.2 | 7.5 | 5.2 |

| Paper making and paper products | 7.3 | 10.1 | 10.3 | 12.8 | 7.2 | 18.1 | 20.7 | 23.1 |

| Printing and record medium reproduction | 4.6 | 3.1 | 3.4 | 4.7 | 6.4 | 7.7 | 7.6 | 8.1 |

| Culture, educational and sports goods | 3.5 | 3.4 | 2.0 | 2.4 | 3.0 | 3.1 | 3.4 | 3.6 |

| Raw chemical materials and chemical products | 6.9 | 9.4 | 10.1 | 16.6 | 17.1 | 19.3 | 27.3 | 29.9 |

| Medical and pharmaceutical products | 12.6 | 12.7 | 16.4 | 19.8 | 20.6 | 22.6 | 27.0 | 30.2 |

| Chemical fiber | 17.0 | 20.7 | 20.7 | 24.2 | 41.6 | 39.3 | 44.8 | 52.9 |

| Rubber products | 7.5 | 10.8 | 12.3 | 18.2 | 25.4 | 23.8 | 28.5 | 26.8 |

| Plastic products | 11.1 | 10.1 | 7.7 | 9.8 | 9.3 | 9.4 | 10.5 | 11.6 |

| Nonmetal mineral products | 2.3 | 2.3 | 3.0 | 4.5 | 5.9 | 7.5 | 8.3 | 9.3 |

| Smelting and pressing of ferrous metals | 7.3 | 11.3 | 13.8 | 25.9 | 29.8 | 34.7 | 45.6 | 59.0 |

| Smelting and pressing of nonferrous | 4.7 | 7.2 | 8.6 | 10.7 | 22.3 | 37.0 | 36.3 | 33.3 |

| Metal products | 5.5 | 6.9 | 6.7 | 7.7 | 9.5 | 9.7 | 13.0 | 16.5 |

| Ordinary machinery | 10.7 | 16.0 | 20.1 | 24.7 | 29.0 | 32.6 | 37.7 | 39.0 |

| Equipment for special purposes | 10.3 | 14.2 | 16.6 | 19.7 | 18.7 | 27.0 | 33.4 | 35.6 |

| Transport equipment | 31.3 | 44.5 | 57.9 | 63.2 | 66.8 | 84.7 | 94.8 | 89.9 |

| Electric equipment and machinery | 36.6 | 43.9 | 36.2 | 36.6 | 39.8 | 38.8 | 47.5 | 46.9 |

| Electronic and telecommunications equipment | 75.3 | 84.6 | 71.6 | 62.4 | 56.2 | 52.6 | 55.3 | 55.2 |

| Instruments, meters, cultural and office machinery | 9.9 | 18.2 | 13.4 | 19.5 | 18.3 | 19.4 | 26.5 | 24.1 |

| Averages | 11.6 | 14.1 | 14.0 | 16.6 | 18.4 | 21.1 | 24.6 | 26.0 |

| Industries | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

|---|---|---|---|---|---|---|---|---|

| Food processing | 0.15 | 0.17 | 0.16 | 0.48 | 0.19 | 0.47 | 0.40 | 0.58 |

| Food production | 1.84 | 1.49 | 1.15 | 1.98 | 1.03 | 1.88 | 1.44 | 1.55 |

| Beverage production | 0.95 | 1.08 | 1.47 | 1.88 | 1.90 | 1.47 | 1.38 | 1.57 |

| Textile industry | 0.15 | 0.25 | 0.20 | 0.26 | 0.44 | 0.63 | 1.48 | 1.81 |

| Garments and other fiber products | 0.27 | 0.42 | 0.10 | 0.25 | 0.43 | 0.27 | 0.35 | 0.37 |

| Leather, furs, down and related products | 0.09 | 0.06 | 0.10 | 0.12 | 0.12 | 0.14 | 0.22 | 0.38 |

| Timber, bamboo, cane, palm fiber and straw products | 0.20 | 0.16 | 0.09 | 0.59 | 0.50 | 1.52 | 1.19 | 1.19 |

| Furniture manufacturing | 2.75 | 1.90 | 1.18 | 0.44 | 0.47 | 0.68 | 2.19 | 2.58 |

| Paper making and paper products | 0.12 | 0.12 | 0.22 | 0.19 | 0.24 | 0.27 | 0.43 | 0.79 |

| Printing and record medium reproduction | 0.18 | 0.19 | 0.44 | 0.89 | 0.60 | 0.46 | 0.93 | 0.70 |

| Culture, educational and sports goods | 3.28 | 2.81 | 2.42 | 1.41 | 2.60 | 2.20 | 2.47 | 2.52 |

| Raw chemical materials and chemical products | 0.41 | 0.43 | 0.72 | 0.92 | 1.17 | 1.33 | 1.45 | 1.86 |

| Medical and pharmaceutical products | 1.26 | 1.44 | 1.94 | 2.54 | 3.64 | 3.05 | 3.70 | 4.38 |

| Chemical fiber | 0.16 | 0.14 | 0.46 | 0.49 | 0.50 | 0.97 | 1.37 | 1.43 |

| Rubber products | 0.47 | 0.49 | 0.46 | 0.59 | 0.70 | 0.58 | 0.87 | 1.50 |

| Plastic products | 0.67 | 1.94 | 0.64 | 0.79 | 0.69 | 0.90 | 1.13 | 1.44 |

| Nonmetal mineral products | 0.33 | 0.31 | 0.41 | 0.79 | 0.95 | 1.14 | 1.26 | 1.27 |

| Smelting and pressing of ferrous metals | 0.24 | 0.34 | 0.36 | 0.43 | 0.51 | 0.78 | 1.15 | 1.42 |

| Smelting and pressing of nonferrous | 0.33 | 0.61 | 0.68 | 0.90 | 1.25 | 1.65 | 2.00 | 2.54 |

| Metal products | 0.77 | 0.99 | 1.07 | 1.59 | 2.69 | 1.72 | 1.93 | 3.00 |

| Ordinary machinery | 0.60 | 0.67 | 1.18 | 1.79 | 2.23 | 2.61 | 3.04 | 3.50 |

| Equipment for special purposes | 0.75 | 0.99 | 1.51 | 1.86 | 2.09 | 2.75 | 3.68 | 5.26 |

| Transport equipment | 0.54 | 1.08 | 1.75 | 2.19 | 2.64 | 3.34 | 4.26 | 4.19 |

| Electric equipment and machinery | 2.58 | 4.26 | 4.42 | 4.61 | 4.81 | 3.79 | 4.62 | 5.78 |

| Electronic and telecommunications equipment | 1.96 | 3.20 | 3.28 | 3.13 | 4.07 | 4.97 | 6.07 | 5.80 |

| Instruments, meters, cultural and office machinery | 1.42 | 2.37 | 1.57 | 2.79 | 1.77 | 2.39 | 3.07 | 6.04 |

| Averages | 0.86 | 1.07 | 1.08 | 1.30 | 1.47 | 1.61 | 2.00 | 2.44 |

| Variables | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Patent intensity (PAT) | 0.001 | 0.001 | |||||||||||

| 2. New product sale intensity (NPS) | 0.018 | 0.018 | 0.600 | ||||||||||

| 3. Knowledge acquisition diversity (KAD) | 0.236 | 0.026 | −0.087 | 0.075 | |||||||||

| 4. Knowledge acquisition diversity2 (KAD2) | 0.584 | 0.040 | 0.143 | −0.119 | −0.649 | ||||||||

| 5. Industry competition 1 | 6.524 | 0.785 | 0.299 | 0.357 | 0.357 | −0.158 | |||||||

| 6. Firm size 1 | 6.947 | 0.385 | 0.024 | 0.284 | −0.064 | 0.100 | 0.037 | ||||||

| 7. R&D intensity | 0.014 | 0.009 | 0.534 | 0.578 | 0.275 | −0.234 | 0.344 | 0.100 | |||||

| 8. Technological complexity | 0.049 | 0.045 | −0.162 | 0.034 | 0.026 | −0.191 | −0.102 | −0.112 | 0.3460 | ||||

| 9. State ownership | 0.235 | 0.250 | −0.202 | −0.039 | 0.255 | −0.188 | 0.2040 | 0.053 | −0.051 | 0.081 | |||

| 10. Export ratio | 0.229 | 0.223 | 0.064 | −0.137 | −0.589 | 0.434 | −0.239 | 0.059 | −0.196 | −0.214 | −0.443 | ||

| 11. Technology gap | 0.228 | 0.226 | −0.176 | 0.161 | 0.443 | −0.305 | 0.227 | 0.024 | 0.2090 | 0.2270 | 0.4900 | −0.682 | |

| 12. Technology development speed | 0.433 | 1.182 | 0.025 | 0.027 | −0.035 | −0.023 | −0.076 | 0.063 | 0.113 | 0.066 | −0.151 | 0.176 | −0.159 |

| Variables | NPS (Fixed Effects 1) | PAT (Fixed Effects 1) | ||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |

| Knowledge acquisition diversity (KAD) | 1.3907 ** (0.3083) | 0.0434 (0.0322) | 0.0798 ** (0.0218) | 0.0065 * (0.0026) |

| Knowledge acquisition diversity2 (KAD2) | −2.8459 ** (0.6659) | −2.5795 ** (0.4484) | −0.1566 * (0.0481) | −0.1220 * (0.0479) |

| KAD × Technology gap | 0.5115 * (0.1607) | 0.0344 ** (0.0075) | ||

| KAD2 × Technology gap | −6.8503 * (2.0689) | −0.5787 * (0.1682) | ||

| KAD × Technology development speed | 0.0228 + (0.0119) | 0.0010 (0.0016) | ||

| KAD2 × Technology development speed | −0.4070 ** (0.1133) | −0.0214 (0.0354) | ||

| Moderators | ||||

| Technology gap | −0.0010 (0.0114) | −0.0016 (0.0010) | ||

| Technology development speed | 0.0001 (0.0003) | 0.00003 (0.00003) | ||

| Control variables | ||||

| Industry competition | 0.0065 ** (0.0014) | 0.0042+ (0.0025) | 0.0008 ** (0.0002) | 0.0005 ** (0.0001) |

| Firm size | −0.0096 * (0.0043) | −0.0102 (0.0062) | 0.0006 ** (0.0001) | 0.0004 (0.0003) |

| R&D intensity | 0.8552 ** (0.1663) | 0.7055 *** (0.1019) | 0.0808 ** (0.0139) | 0.0599 *** (0.0060) |

| Technological complexity | −0.1391 ** (0.0336) | −0.1200 ** (0.0276) | −0.0077 ** (0.0017) | −0.0054 *** (0.0007) |

| State ownership | −0.0052 ** (0.0014) | −0.0029 + (0.0013) | −0.0002 (0.0002) | 0.0001 (0.0002) |

| Export ratio | 0.0005 (0.0012) | 0.0018 (0.0011) | −0.0030 ** (0.0006) | −0.0029 ** (0.0005) |

| Industry dummies | included | included | included | included |

| Constant | −0.1291 *** (0.0372) | 0.0209 (0.0010) | −0.0181 *** (0.0028) | 0.0016 *** (0.0000) |

| Number of obs. | 208 | 208 | 208 | 208 |

| F | 90.6 *** | 109.09 *** | 4368.92 *** | 5444.04 *** |

| R2 | 0.4332 | 0.4901 | 0.5155 | 0.5866 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Q.; Guo, J.-J.; Liu, W.; Yue, X.-G.; Duarte, N.; Pereira, C. How Knowledge Acquisition Diversity Affects Innovation Performance during the Technological Catch-Up in Emerging Economies: A Moderated Inverse U-Shape Relationship. Sustainability 2020, 12, 945. https://doi.org/10.3390/su12030945

Li Q, Guo J-J, Liu W, Yue X-G, Duarte N, Pereira C. How Knowledge Acquisition Diversity Affects Innovation Performance during the Technological Catch-Up in Emerging Economies: A Moderated Inverse U-Shape Relationship. Sustainability. 2020; 12(3):945. https://doi.org/10.3390/su12030945

Chicago/Turabian StyleLi, Qiang, Jing-Jing Guo, Wei Liu, Xiao-Guang Yue, Nelson Duarte, and Carla Pereira. 2020. "How Knowledge Acquisition Diversity Affects Innovation Performance during the Technological Catch-Up in Emerging Economies: A Moderated Inverse U-Shape Relationship" Sustainability 12, no. 3: 945. https://doi.org/10.3390/su12030945

APA StyleLi, Q., Guo, J.-J., Liu, W., Yue, X.-G., Duarte, N., & Pereira, C. (2020). How Knowledge Acquisition Diversity Affects Innovation Performance during the Technological Catch-Up in Emerging Economies: A Moderated Inverse U-Shape Relationship. Sustainability, 12(3), 945. https://doi.org/10.3390/su12030945