Abstract

The financial services industry is currently undergoing a major transformation, with digitization and sustainability being the core drivers. While both concepts have been researched in recent years, their intersection, often conceived as “green FinTech,” remains under-determined. Therefore, this paper contributes to this important discussion about green FinTech by, first, synthesizing the relevant literature systematically. Second, it shows the results of an empirical, in-depth analysis of the Swiss FinTech landscape both in terms of green FinTech startups as well as the services offered by the incumbents. The research results show that literature in this new domain has only emerged recently, is mostly characterized by a specific focus on isolated aspects of green FinTech and does not provide a comprehensive perspective on the topic yet. In addition, the results from the literature and the market analysis indicate that green FinTech has an impact along the whole value chain of financial services covering customer-to-customer (c2c), business-to-customer (b2c), and business-to-business (b2b) services. Today the field is predominantly captured by startup companies in contrast to the incumbents whose solutions are still rare.

1. Introduction

Sustainable finance and more specifically, climate-related finance gained increased importance on company, national and supranational levels over the past years. However, still, the implementation of the Paris Agreement and the achievement of the Sustainable Development Goals (SDGs) requires significant investments of at least $3 trillion per year globally and $1.4 trillion in developing countries [1,2]. Such huge investments will finally ensure that the Paris Agreement’s key objective of keeping the global average temperature increase below 2 °C can be met. The most straightforward way to finance this goal is to boost government spending, which inevitably burdens taxpayers or affects under-invested sectors. Private capital is an additional source to achieve this goal. The Paris Agreement includes a commitment to “[making] finance flows consistent with a pathway toward low greenhouse gas emissions and climate-resilient development” (United Nations Framework Convention on Climate Change (UNFCCC) 2015, p. 2, Article 2.1 (c)). In other words, the private sector should steer its investment efforts towards more sustainable goals, but, as studies show, it is still mostly invested in non-sustainable assets, while sustainable ones range only from 5% to 25% globally (www.hbr.org/2019/05/the-investor-revolution). Such sustainable investments not only contribute to the achievement of the Paris Agreement goals but also unleash cleaner, cheaper and more effective operations and may lead to technology-induced innovations beyond today’s value chains. Potential funding sources may come from companies and banks, but also from consumers. For example, in November 2019, the European Investment Bank decided to end financing for fossil fuel energy projects by the end of 2021. This fact will aid in pushing climate action and environmental sustainability strategies further and focus on support for clean energy and security. However, to achieve this goal, many challenges are ahead. Amongst them are low transparency for investors of companies with regard to their products and supply chains, a lack of financial products, etc.

Due to the enormous investments required to achieve the SDGs, one of the major levers for alleviating the impact of climate change is the financial system, which has been of fundamental as well as global importance ever since. The financial system, in general, has an essential function within the economy. It is channeling funds from those with surplus funds to those with shortages of funds [3]. “Banking really is at the nexus of the real economy” [4] (see also [5]) by, e.g., providing payments infrastructures, directing financial capital to economic activities and offering investment opportunities in companies. These essential functions of the financial system, besides sustainability, have been challenged in recent years by digitization being one of the core drivers of the financial system as the products and processes are digital by definition [6]. Banks, for example, have the highest IT investments across all industries, with 4.7 to 9.4% on average, whereas airlines spend only 2.6% of their revenues on IT [7]. While a high share (often up to 80%) of those expenditures is reserved for maintaining or adapting legacy systems, digitization describes a trend that is closely tied to innovation and covers all areas of financial processes ranging from payments and investments to financing. That is why it is often termed as the financial technology (FinTech) revolution [6]. While in its early phases, FinTech was primarily concentrated on innovations by startups like Ripple, Wealthfront or LendingClub, recently also the incumbent banks and the so-called big tech companies (Google, Amazon, Facebook, Apple; often called “GAFA”) as well as their Chinese counterparts Baidu, Alibaba, Tencent and Xiaomi (BATX) either started collaborating with these startups or are providing their own FinTech services. As part of this trend, various institutions and initiatives have emerged at the intersection of FinTech and climate change like the United Nations Task Force on Digital Financing of the Sustainable Development Goals (www.digitalfinancingtaskforce.org) as well as many startups focusing on areas such as robo-advisors for sustainable investments, payment tokens for peer-to-peer energy networks or blockchain solutions for sustainable supply chains [8]. These so-called “green FinTech” solutions are an emerging area with the purpose to alleviate climate change risks and which are relevant to policymakers, particularly in emerging and developing countries, as they pursue the implementation of the Paris Agreement and foster the achievement of the SDGs. Green FinTech connects all relevant participants in the value chain including consumers, (central) banks, insurers, non-banks (startups, big tech firms), (technology) providers, regulators, etc. In addition, as the financial system provides central functions also to other industries, it becomes also increasingly linked to other industries enabled by digitization like the energy sector providing digital infrastructures for peer-to-peer payments and many others. The potentials of such solutions are manifold and range from more transparent, blockchain-based supply chains for consumers to investment solutions that only consider sustainable companies and products. However, this outlined development is still in its infancy. So far, existing research has not provided a comprehensive overview on this topic, and there is still a lack of a framework for more detailed analysis of green FinTech solutions and their impact.

The aim of this paper is to analyze the state of the art in this young discipline and develop a framework based on a comprehensive literature analysis. The academic literature is then used in another step to map the incumbents and startups from the financial services industry against FinTech models and the environmental SDGs. For this, the paper is structured as follows: Section 2 describes the research methodology and defines the basic elements of the analysis. Section 3 provides an overview of existing research in the field of FinTech overall as well as in the context of climate change, specifically based on a systematic literature review. Section 4 provides a short introduction to the environmental sustainability efforts in Switzerland, coupled with locally relevant factors to combat climate change. Section 5 analyses and classifies the existing landscape of green FinTech startups and the incumbents’ solutions in Switzerland, while Section 6 discusses the results of literature review and market analysis. Finally, Section 7 summarizes the major findings.

2. Research Methodology

In order to analyze the impact of FinTech innovations in the context of climate change, a three-step research procedure was adopted.

In the first step, a literature review helped to analyze existing approaches and develop a classification model to provide a structured overview of innovations in this field (see Section 3). For this, a comprehensive literature analysis was conducted, from which major classification criteria for the comparison of approaches from startups and incumbents could be derived.

The second step focused on the collection of green FinTech solutions according to the classification model (see Section 5), which was derived from literature and which matched the following four criteria: (1) it supports the interaction of a customer with a financial institution or a non-financial institution, (2) it has a connection to a customer process in financial services (advisory, payments, investments, financing, non-life insurance life insurance, underwriting, claims management, and cross-processes) and/or indirect relation to financial services while being part of another industry’s ecosystem (e.g., peer-to-peer (p2p) payment in energy networks), (3) it is supported by IT and (4) it has an impact on one of the climate-related Sustainable Development Goals (SDGs), more specifically on the SDGs 7, 11, 12, 13, 14, 15 and 17. For this analysis, a wide variety of studies, databases, tweets, blogs and events was screened, and a total of 24 FinTech solutions from startups as well as 13 solutions from incumbents were identified and analyzed in more detail. The collection phase was conducted from September 2019 to November 2019, updated between May and June 2020, and afterward the solutions were analyzed. Finally, the solution approaches were then mapped to the classification model identified in the second step as part of the literature analysis.

In a third step, the green FinTech innovations were reviewed with practitioners from the financial services industry beginning in November 2019 to validate the results and reveal practical relevance. In this process, companies from various fields of the financial value chain were involved (e.g., banks, providers, etc.). This third step led to an iterative adaptation of the research results and findings.

For this research, Switzerland was chosen due to four interrelated reasons: (1) The country is ranked under the top five countries in IMD’s digital ranking [9], (2) Switzerland has one of the most developed financial systems in the world and is the biggest international hub with regard to the assets under management [9] and (3) is at the forefront of the sustainability movement with, for example, the World Wildlife Fund (WWF) and the United Nations (UN) headquarters in Gland and Geneva, respectively. (4) The authors have access to a large number of FinTech startups, incumbents and other organizations based in Switzerland.

3. Literature Review

This paper contributes to two rapidly developing categories of literature. The first area is related to the concept of FinTech. The other literature field is related to the interaction between FinTech and climate change issues, giving rise to “green FinTech” as a specific subdomain of FinTech.

The term “FinTech” is an abbreviation for “financial technology”. It is believed that is was introduced in the early 1990s by Citicorp’s former chairman John Reed in the context of a newly founded “Smart Card Forum” consortium: “Speaking a language of cooperation between companies and across industries, (…) Citicorp has shed its historical insistence on calling its own technological tune. The harmony emanating from the Smart Card Forum has attracted about 30 dues-payers, including leaders from financial services and high technology. Another 30 have shown an interest in joining. Along with another Citicorp-initiated banking research project called Fintech, it tends to disarm any remaining criticism about Citicorp’s being arrogantly out of touch with market preferences” [10].

According to this very early quote, FinTech relates to innovative financial solutions enabled by IT. In addition, it is often used for startup companies that develop such solutions as well as incumbent financial services providers [6]. Literature has just recently analyzed this trend in more detail and depictted it as solutions that are characterized by (1) the application of IT in the financial services domain, (2) startups that provide services for financial processes, and (3) services covering all relevant financial services processes ranging from payments, investments and financing [6]. While FinTech originally focused more on banks, the term “InsurTech” or “Insurance Technology” closely relates to IT innovations in the insurance industry like digital brokers or peer-to-peer insurances [11].

Some publications use the term FinTech for both areas, an approach that this paper also follows in the following sections (e.g., [6,12]). While some publications see FinTech and InsurTech as a possibility to improve business and IT alignment [13], most of them focus on FinTech as an enabler of innovations for the financial services industry. Thus, the term is closely related to the term “financial innovation”, which is defined as the “(…) act of creating and then popularizing new financial instruments as well as new financial technologies, institutions and markets” [14]. Financial innovations distinguish five categories of innovation objects [14,15]: (1) products and services, (2) organizational structures (e.g., outsourcing of credit processing) and (3) processes (e.g., online credit application and processing). Since FinTech relies on IT as an enabler, (4) systems (e.g., blockchain as a new financial infrastructure) as well as (5) business models (e.g., crowdlending) [16,17] are also important categories. The dimensions innovation degree (e.g., radical or incremental) and innovation scope (e.g., intra- or inter-organizational) complement these five perspectives with a more comprehensive macro-level view [14,15,16,17].

One of the goals of this paper is to enhance the notion and definition of green FinTech. Green or climate-related goals are part of the broader term of “sustainability”, which is most commonly defined as a “development that meets the needs of the present without compromising the ability of future generations to meet their own needs” [18]. Sustainability comes with a long-term view touching on the three areas of economic prosperity, environmental protection, and social equity [19]. Sustainability in a broader context also involves economic prosperity and social equity, but this research focuses specifically on environmental protection and climate change as major goals of sustainability. The concept that a business can result in both financial and environmental benefits is in line with sustainability goals and related concepts like the circular economy, etc. [20,21]. According to Arena et al. [22], such innovations smartly combine impact objectives (e.g., impact on sustainable development) with business objectives (e.g., impact on revenues and/or costs).

The intersection of environmental protection and finance has been part of the discussion in the field of “green finance”. For example, Höhne et al. [23] propose the following definition for green Finance: “green finance is a broad term that can refer to financial investments flowing into sustainable development projects and initiatives, environmental products, and policies that encourage the development of a more sustainable economy. Green finance includes climate finance but is not limited to it. It also refers to a wider range of other environmental objectives, for example, industrial pollution control, water sanitation, or biodiversity protection. Mitigation and adaptation finance is specifically related to climate change-related activities: financial mitigation flows refer to investments in projects and programs that contribute to reducing or avoiding greenhouse gas emissions (GHGs), whereas adaptation financial flows refer to investments that contribute to reducing the vulnerability of goods and persons to the effects of climate change”. In addition, Zadek and Flynn [24] claim that “green finance is often used interchangeably with green investment. However, in practice, green finance is a wider lens, including more than investments. Most important is that it includes operational costs of green investments not included under the definition of green investment. Most obviously, it would include costs such as project preparation and land acquisition costs, both of which are not just significant, but can pose distinct financing challenges”.

While green finance has a broad view across banking and finance covering all fields from payments, investment to financing, the term “green FinTech” as a subarea has been developing rapidly in recent years and is more focused on topics that are discussed in the context of environmental protection and finance which are specifically based on technology innovations. Green FinTech, therefore, focuses on those FinTech-related innovations that address environmental protection and climate change. This fact considers the SDGs 7 (Affordable and Clean Energy), 11 (Sustainable Cities and Communities), 12 (Responsible Consumption and Production), 13 (Climate Action), 14 (Life Below Water), 15 (Life on Land), and 17 (Partnerships for the Goals) as one SDG, which generically has an impact on all SDGs. According to one of the very few definitions of the term from Arena et al. [22], green FinTech innovations are defined by a blended-value mission entailing the coexistence of impact objectives (e.g., increasing the flow of financial resources for sustainable development) and business objectives (e.g., safeguarding a financial return to be able to continue creating impact in the long run). However, as this discipline is still very young, a common definition that goes beyond the combination of sustainability and business benefits has not yet been established in the literature. Therefore, in order to analyze the existing theory in more detail, a literature analysis was undertaken, comprising five steps [25]: (1) definition of the scope of the analysis, (2) literature search, (3) selection of the final sample, (4) corpus analysis and (5) presentation of the findings.

In the first step, the relevant search terms were delineated and comprised “green FinTech”, “green financial technology,” and “green digital finance”, “sustainability AND FinTech”, “climate AND FinTech”. She second step is to select the online databases Association for Information Systems (AIS) Electronic Library, Business Source Complete, ScienceDirect and Google Scholar for the academic literature analysis. The AIS Electronic Library provides access to relevant literature of journals and conferences, which cannot be found in other databases like Business Source Complete. Business Source Complete and ScienceDirect, on the other hand, provide access to journals that are not part of AIS Electronic Library and complement it. With these four databases, a broad universe of academic literature can be covered and thus, the existing knowledge be identified. For the search itself, papers were excluded that provided work in progress papers from conference proceedings, panel introductions, papers that are not available in English, unavailable papers, teaching cases and pedagogical research papers. Each publication was downloaded and read through. In the third step, the selection of the final sample was performed.

The final sample comprised 92,717 papers, from which 193 papers were identified as relevant for further analysis after reading through the papers’ abstracts and keywords and after deleting doubles (see Table 1). In the next step, all 193 papers were analyzed in more detail. In an additional step, a backward and forward search was taken out. In the fourth step, each paper was classified according to descriptive elements like the title of the paper, author(s), publication outlet (journal or conference name), type of publication outlet (journal or conference), abstract, keyword, theories, methods (empirical), methods (non-empirical) and definitions. In the fifth step, the findings of the analysis are presented.

Table 1.

Literature search results.

The search terms delivered 3196 results in AIS Electronic Library, of which 49 results were determined to potentially be relevant for further inclusion into the research procedure. After analyzing their abstracts and introduction, 11 relevant papers were identified. The same methodology was applied to Business Source Complete with initial search results of 2550 papers, 36 relevant papers and a final sample of 16 papers. ScienceDirect had the biggest search output with 70,355 papers, from which 75 seemed to be relevant, and 18 were selected for further analysis. Finally, Google Scholar delivered 16,616 results. After a careful evaluation, 33 research papers were identified as relevant and 11 papers selected for the final analysis. In the literature search, all results were excluded (1) where green FinTech was not the core part, but the term was only mentioned, and (2) papers that could not be classified as research papers. Table 1 summarizes the final results of the literature analysis.

All these 56 papers will be analyzed in more detail in a next step. Table 2 summarizes the results of the literature analysis of the papers that are related to green FinTech and names the publication title, the paper title and the focus of the publication.

Table 2.

Results of the literature analysis.

The findings of the literature analysis of the 56 papers led to the following conclusions (see Table 3).

Table 3.

Clusters of the literature analysis.

First, most research has been conducted in the field of blockchain, tokens and cryptocurrencies, while fewer papers contribute to green FinTech in general or the use of IoT and smart cities/homes more specifically. Blockchain has been of great interest in recent years since the introduction of Bitcoin in 2008. For example, Nassiry [8] discusses the role of FinTech in unlocking green finance at the example of policy insights for developing countries by outlining three areas for the possible application of FinTech to green finance: blockchain applications for sustainability in general; specific blockchain use-cases for renewable energy, the decentralized electricity market, carbon credits as well as climate finance and innovations in financial instruments like green bonds.

Second, most of the papers that were identified in the literature analysis primarily focus on specific, very often isolated aspects of green FinTech. An example is the electronic marketplace supported by FinTech in the field of agricultural sustainability [26] or the analysis of the feasibility of the FinTech industry as an innovation platform for sustainable economic growth in Korea [33]. Most of these papers specifically research single aspects of FinTech like electronic marketplaces or certain industries or countries or technologies (e.g., IoT). Only a few papers develop a more comprehensive view like the paper on “sustainable supply chain finance: towards a research agenda,” which conducts a literature analysis and shows future areas of research for the field of sustainable supply chain finance [27].

Third, another category of papers provides cases of green FinTech in certain areas. One example is a study on how a blockchain-enabled emission trading framework can improve the fashion apparel manufacturing industry [65]. Another example focuses on the question of how blockchain technology in irrigation systems can integrate photovoltaic energy generation systems [68]. Other cases are focusing on certain topics, such as smart cities or smart homes and the potential of green FinTech in these areas [80]. Most of these case studies are just single research cases and do not focus on developing a framework that would be possible from multi-case study settings.

Table 3 summarizes the results of the literature analysis of the 56 papers that are related to green FinTech. These papers can be classified into the four topical groups (1) FinTech and environmental sustainability, (2) blockchain, tokens, cryptocurrency and environmental sustainability, (3) Internet of things (IoT) and FinTech-enabled environmental sustainability and (4) smart cities, smart home and FinTech-enabled environmental sustainability. While all share FinTech-enabled environmental sustainability as the core topic, the four areas differ with regard to the applied technologies (e.g., blockchain, IoT, etc.) and the application areas (e.g., supply chains, energy infrastructure, etc.).

In addition to these differences, the analysis of the literature revealed five major patterns that can be mapped to the FinTech-related domains (see [17]):

- Provider type: One major category to distinguish green FinTech solutions from the literature analysis is the provider type. This can either be a banking solution (FinTech) or an insurance-related solution (InsurTech).

- Interaction type: The interaction type relates to the stakeholders who are involved in a green FinTech or InsurTech solution. For example, in the example of energy production, distribution and consumption, consumer-to-consumer (c2c), business-to-consumer (b2c) and business-to-business (b2b) interactions are relevant, while for peer-to-peer energy networks in which only consumers are involved, only c2c plays a relevant role (e.g., [36,39]).

- Direct financial processes: Direct financial processes are specific green FinTech processes like advisory, payments, investments, financing, non-life insurance, life insurance, underwriting, claims management and other cross-processes. Examples in this field are robo-advisors, which enable customers to invest in green asset classes (investments) through self-advice (advisory).

- Indirect financial processes: Very often, the literature uses green FinTech in the context of other industries like the energy sector, agricultural supply chains or the mobility sector to leverage FinTech. One example is a supply chain solution that includes digital financing possibilities for farmers in developing countries [26]. In these cases, FinTech supports such solutions by providing indirect financial processes, such aspayments, investments, etc.

- SDGs: The fourth and last category is the UN Sustainable Development Goals (https://www.un.org/sustainabledevelopment/sustainable-development-goals), which are often mentioned in the identified literature as a basis for the mapping to specific sustainability goals. An example is an analysis of the digital agendas and sustainability goals of smart city lighthouse initiatives from the European Commission, which are mapped against the SDGs [78].

These five criteria are used in the analysis of the green FinTech startups and incumbent solutions in Switzerland in Section 5 to map and compare these solutions. Before that, a closer look at the environmental sustainability landscape in Switzerland gives a closer look at the specific challenges of Switzerland in this context, which is necessary to understand the current landscape of existing startups and incumbent solutions.

4. Environmental Sustainability in Switzerland

Switzerland has committed itself to achieve the 17 Sustainable Development Goals (SDGs) by 2030 by adopting the 2030 Agenda. To this end, Switzerland implemented an action plan based on a specific Sustainable Development Strategy. The work is being coordinated by the National 2030 Agenda Working Group. This group is led by the Federal Office for Spatial Development (ARE) and the Swiss Agency for Development and Cooperation (SDC). Within the SDGs initiative, Switzerland pursues an active policy to alleviate the impact of climate change, thus contributing to the internationally recognized target of limiting global warming to significantly less than 2 °C. The applicable CO2 Act focuses on cutting Switzerland’s domestic emissions. Switzerland intends to lower domestic greenhouse gases by at least 20% from their 1990 levels by 2020 and by 50% by 2030, and on 28 August 2019, the Federal Council decided that Switzerland should reduce its greenhouse gas emissions to net zero by 2050. The following measures were introduced: CO2 levy, emissions trading, buildings, CO2 emissions regulations for vehicles, compensation for CO2 emissions, climate training and communication program, technology fund, sector agreements. The Environmental Protection Act (EPA, Art. 41a) and the CO2 Act (Art. 3 para. 4) enable the Swiss Confederation to conclude agreements with sectors of the economy. Until now, two agreements have been established: (1) voluntary industry solution for SF6, (2) target agreement of the Federal Department of the Environment, Transport, Energy and Communications (DETEC) waste-recycling plants CH for a reduction of CO2 emissions from the incineration of waste by 200,000 tons CO2 in 2020 as compared to the year 2010 as well as a total reduction of 1 million tons of CO2 over the period from 2010 to 2020. In addition, Switzerland identified three levers to combat climate change.

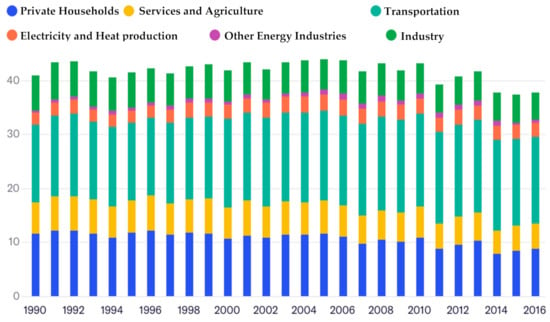

First, the largest emitter in Switzerland is transport (see Figure 1), which accounts for approximately one-third of all emissions. This is followed by buildings (heating), industry, agriculture and waste treatment. While no major progress has been made in transport, emissions from buildings and industry have fallen sharply from 1990 levels. Thus, transportation and buildings are still a huge lever for change.

Figure 1.

Unlocking future potentials in green FinTech: transportation and buildings are a main lever for change (https://www.bfs.admin.ch/bfs/en/home/statistics/territory-environment/environmental-accounting.html).

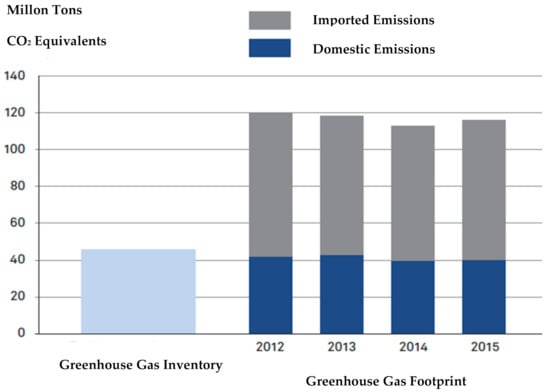

Second, Switzerland’s environmental footprint is significantly clouded by greenhouse gas emissions from imported goods and services (see Figure 2). Imported emissions account for approximately two-thirds of Switzerland’s total carbon footprint. For example, an analysis shows that the lions share of the environmental burden derives from the production of Swiss products from the mechanical, electrical and metal industries in foreign supply chains. Specifically, about 80% of the greenhouse gas emissions and 95% of the particulate emissions. Therefore, imported emission is a further huge lever for change.

Figure 2.

Imported emission is a huge lever for change (https://www.bfs.admin.ch/bfs/en/home/statistics/territory-environment/environmental-accounting.html).

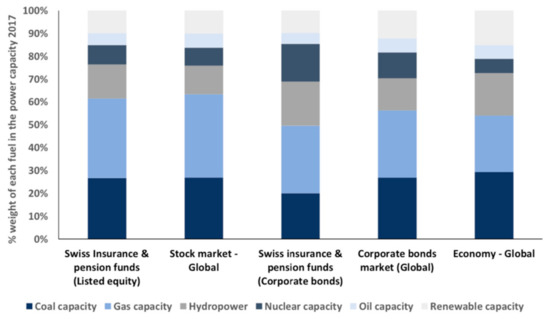

Third, climate tests in 2017 revealed that Swiss institutional investors are not invested in green energies yet (see Figure 3). Seventy-nine pension funds and insurance companies, representing 65% of the total capital market, participated in the first test in 2017. Around 60% of their exposure was in coal, oil and gas, while only 10% was in renewable energies. Today’s investment plans of the pension funds and insurance companies’ listed equity and corporate bonds portfolios are thus still on a 6 °C pathway. These results were confirmed by the same study in 2020 again, which also included banks and asset managers. Insurance, Therefore, changing these investment portfolios is thus an immense lever for change.

Figure 3.

Changing investment portfolios are a huge lever for change (https://www.bafu.admin.ch/dam/bafu/en/dokumente/klima/fachinfo-daten/klimavertraeglichkeitsanalyse.pdf.download.pdf/EN_2ii_Out_of_the_fog_v0_full_report_October_2017.pdf).

This shows that the Swiss financial market not only continues to invest significantly in oil and coal production, but even expanded its investments in some parts compared to 2017 (https://www.bafu.admin.ch/bafu/en/home/topics/climate/info-specialists/climate-and-financial-markets.html). At the end of 2019, the total assets under management in Switzerland were close to 7 trillion Swiss francs, which were invested by private savings deposits at banks, insurance capital, pension funds, and savings of the elderly and survivors.

With regard to the financial system, Switzerland also actively participates in the work of international financial institutions and works on a consistent policy in this area at both the national and international levels. Currently, the primary instrument is the pilot test to analyze the climate alignment of financial portfolios, where Swiss pension funds and insurance companies can voluntarily test their portfolios for their compatibility with the internationally agreed climate goals. Currently, an explicit link to digital technology and FinTech is also established by a green FinTech Network. In contrast to the field of climate change, which is developed on a national level from various institutions and embedded in an international context, the area of FinTech is primarily shaped on the national level by the State Secretariat of International Finance (SIF) and has three focus areas. First, a regulatory sandbox, which allows startups to experiment with up to CHF 1 million. Second, a specific FinTech license for startups which allows them to operate without a full banking license. Moreover, third, the possibility of public deposits for non-banks. In addition, in March 2019, the Federal Council initiated the consultation on adapting federal law to the developments of distributed ledger technology (DLT). This consultation was confirmed in May 2020 and aimed to increase improved legal certainty, remove hurdles for DLT-based applications and limit risks of misuse. The adaptations made to the Swiss law aim to further improve the regulatory framework for DLT in Switzerland with a special focus on the financial sector. Finally, the Swiss National Bank (SNB) is part of the Central Banks and Supervisors Network for Greening the Financial System (NGFS). Nationwide, the SNB has not yet undertaken any specific steps in this direction.

5. The Green FinTech Landscape in Switzerland

Nowadays, the existing financial institutions from the insurance and banking industry are both investors in FinTech and InsurTech startups and cooperate with vendors from such innovative solutions. In some isolated parts, like payments (e.g., the mobile payment application Twint), the banks also introduced their own solutions. This is in line with the findings from previous research that radical innovations more frequently emerge from new market entrants rather than from the incumbents [82,83,84,85]. However, in recent years the incumbents also caught up in certain areas while at the same time, they either partner with the startups or offer their own solutions. Therefore, this paper looks at both the startups and the incumbents offering green FinTech solutions.

In order to identify the relevant startups and incumbent solutions in Switzerland, a variety of studies, databases, blogs, tweets, alerts and events were analyzed. A first and important source was collections of FinTech startups in Switzerland from which the Swisscom FinTech Map is the most comprehensive one and in November 2019 comprised 341 and for the update in June 2020 361 startups in total (www.swisscom.ch/en/business/enterprise/downloads/banking/monthly-fintech-startup-market-map.html). This map was complemented by other sources. The final analysis identified 24 green FinTech startups in Switzerland, which are briefly described in the following table (see Table 4).

Table 4.

The Swiss green FinTech startup landscape.

A more detailed analysis of the startups following the five criteria from the literature analysis in Section 3, which comprised the provider type, the interaction type, the direct financial processes, the indirect financial processes and the SDGs, shows that 22 of the startups are FinTechs and only 2 are InsurTechs (provider type, see Table 5). 15 of those are in the German-speaking area and 9 in the French-speaking region. In terms of the interaction type, most startups provide their services in b2b (13), followed by b2c (11) and c2c (2). With regard to direct financial processes, most startups support investment processes (15), followed by advisory and financing (6), payments, cross-process, non-life insurance (2) and claims management (1). Only seven startups support financial processes also indirectly through processes such as mobility, health, education and work, entertainment and communication, shopping and logistics, living and leisure (e.g., payment for e-vehicle charging). Finally, the analysis found that most startups contribute to the SDG 17 (12), followed by 7 (9), 13 (7), 11 and 15 (5), 12 (4) and 14 (2). In addition to these findings, a more in-depth analysis revealed the following results.

Table 5.

Classification of the Swiss green FinTech startup landscape.

First, the startups primarily focus on isolated areas of green FinTech such as payments, advisory or investments, but none of them has a comprehensive approach covering all financial processes. Surprisingly, InsurTech startups are still very rare, although the field of climate change and risk-related measures should be of great importance to the insurance industry. The two InsurTech startups CelsiusPro and RepRisk are both based in Zurich, and both are oriented on the b2b sector. Both provide non-life insurance, with CelsiusPro additionally providing advisory and claims management services. Amongst the two, CelsiusPro has dedicated itself more to climate actions, life on land and sustainable cities goals, while RepRisk mostly tries to engage in a strategic partnership with other counterparties.

Second, compared with all the 22 FinTech startups, Beedoo and 3rd Eyes cover the most SDGs. However, all of them focus on specific SDGs. They operate in the b2c and b2b domain, offering advisory, investments and financing services. The second FinTech startup that is also actively engaged in achieving a broader range of SDGs is Bloomio. It also offers b2c services with investments and financing services. The other two startups, My Drop in the Ocean and Energy Web, try to meet 4 and 3 SDG goals, respectively, and both are operating in the b2c market. However, the majority of the startups provide b2b services (12 startups), which primarily provide investment solutions to the clients (15 startups). In the b2c market, 11 startups are also predominantly investment solutions. The c2c area is only represented by Impaakt that provides advisory and investment solutions.

Third, regarding the relationship to other industries (indirect financial processes), the research shows that only a few of them have such a link. This is surprising as digital ecosystems are currently increasing across all industries, and especially in Switzerland, the areas of transport, buildings and (foreign) supply chains have a huge impact on Switzerland’s climate footprint (see Section 4). Interestingly, only 7 of the startups provide a connection between other sectors of the economy and the financial system by linking both areas through indirect green FinTech approaches. Examples include BitLumens, whichis developing a decentralized, blockchain-based micro power-grid, the clean energy platform blueyellow and the digital investment platform Bloomio. This is a clear sign that cross-industry digital ecosystems are only about to surface but have not yet emerged as a dominant pattern among the green FinTech startups.

Table 5 summarizes the findings of the green FinTech startup analysis in Switzerland along with the criteria identified in the literature analysis in Section 3, including the provider and interaction type, direct and indirect financial processes as well as the SDGs covered.

Apart from the green FinTech startup sector, the analysis also looked at the incumbents and found that some started to implement sustainability metrics in the form of climate-related measures in their portfolios. However, the analysis of these approaches reveals that those are still very rare (see Table 6) and identified only a handful (13 approaches in total) of “real” green FinTech and InsurTech solutions compared to the total set of 445 banks and insurance companies that operate in Switzerland. This means that currently, less than 5% of these firms provide green FinTech solutions. The analysis of the incumbent solutions reveals three major findings.

Table 6.

Classification of the Swiss green FinTech and InsurTech incumbents landscape.

First, most of the solutions provided by the incumbents are more frameworks or initial solutions to tap into this new field, rather than comprehensive approaches. In contrast to the startups, the incumbents cover the climate-related SDGs more comprehensively while the former ones focus on isolated SDGs. As expected, banks have the highest involvement in the green FinTech domain. For example, the GlobalanceBank wealth footprint initiative provides b2c and b2b services and tries to meet all SDG goals related to sustainable development. Lombard Odier, 1bank4all, Raiffeisen Bank, UBS and Zurcher Kantonal Bank, in most cases, provide investment solutions to the b2c sector and cover all climate-related SDGs.

Second, the two insurance companies are focusing on green InsurTech. These solutions are from SwissRe and Zurich Insurance with the Zurich Risk Advisor. SwissRe mostly provides investment solutions for the b2b sector and tries to meet all climate change SDG goals, while the Zurich Risk Advisor is focused on the b2c sector and is mostly concerned with pure climate change action. In addition, Zurich Insurance helps its customers and communities to become more resilient to natural disasters and extreme weather through both a responsible investment approach as well as a reduced own carbon footprint.

Third, OLZ AG and RobecoSAM, as investment managers, suggest FinTech investment solutions for both private and business customers trying to meet all climate change SDGs. In addition, Ethos also provides investment solutions and advice on green FinTech to business customers. In terms of sustainable investment providers, the other approaches are primarily investment products in sustainable products. The Responsibility Fair Trade Fund, UBS and Lombard Odier are placeholders for this category, while insurance companies and asset managers provide investment solutions for individual and professional investors. These are not specific green FinTech solutions and are not listed as such.

Table 6 summarizes the results of the incumbents’ analysis and supports the initial hypothesis that green FinTech is mostly developed through startups as the number of solutions is lower than the startups in this field although the total number of banks and insurance companies (246 banks and 199 insurance companies in 2019) exceeds the absolute number of FinTech and InsurTech startups in Switzerland. Banks, insurance companies and other financial institutions mostly try to achieve the SDGs either through green investments or supporting startups, and technology-induced innovations are still rare.

6. Discussion of the Results

The literature review demonstrated that the total number of papers in this field is still rare. The analysis identified 56 papers from which only 10 papers focused on general analysis and frameworks for green FinTech, while the majority analyzed either specific technologies (e.g., blockchain, IoT, FinTech applications, etc.) or sectoral domains (e.g., energy, mobility, agriculture, etc.). However, the literature analysis also showed that the topic has only recently received attention as most of the papers are from the last three years (2018 with 15 papers; 2019 with 18 papers; 2020 with 12 papers; which means a total of 45 papers from the 56 papers in the last 3 years) and only 8 papers were from 2016 and 2017. This is also an indication that the topic is only about to emerge. This is why a commonly accepted definition or a comprehensive analysis and framework is still non-existent. Based on the analysis in this paper, green FinTech can be defined as technology-enabled incremental or radical innovations (innovation degree) that can either be provided as intra- or inter-organizational solutions (innovation scope) by financial or non-financial institutions (provider type) and which can support c2c, b2c or b2b interactions (interaction type) indirect financial processes like advisory, payments, investments, financing, life, non-life, underwriting, claims management and cross-processes or indirect financial services in cross-industry ecosystems like mobility, energy, etc., leading to novel business models, products and services, processes, organizational forms or infrastructures (innovation object) and by this supporting specific environmental SDGs (7, 11, 12, 13, 14, 15, 17).

Although literature emerged only recently in this new domain, the same applies to the green FinTech startup and incumbent solutions. Clearly, from an overall perspective, the startups head the development of such solutions in terms of novelty of the approaches and their total number. While the startups primarily focus on specific, isolated areas like robo-advisors or blockchain-based p2p payment solutions for the energy sector, the incumbents’ approaches are more comprehensive in terms of SDG coverage. However, in sharp contrast to the incumbents, the startups already start to offer cross-industry solutions for other sectors like mobility, energy or supply chain finance solutions in various industries, which clearly underpins the trend toward cross-industry ecosystems that emerge in the context of digitization. These solutions are especially important in Switzerland, where transportation, buildings and (foreign) supply chains have a major impact on (inland, imported and exported) GHG emissions (see Section 4). Finally, the insurance sector is still very weak in providing green InsurTech solutions. Only two startups and two incumbents currently focus on this topic, although the potential is huge, having in mind that risk management for natural catastrophes is a big domain for insurers and reinsurers and calls for more sophisticated solutions, including external data sets like weather data, etc.

From an overall perspective, the analysis of the green FinTech landscape demonstrates the big potentials of these novel approaches to mitigate the impact of climate change (see Table 7). First, green FinTech holds the potential to transform the existing financial system in all areas, including payments, investments, financing, advice and insurance through sustainability by, e.g., directing capital in green investments, improve data for the evaluation of green companies, etc. Second, green FinTech may have a huge impact on the overall economy. As green FinTech enables the transformation of the financial system, this also has a significant impact on the economy as a whole, such as creating novel sustainable business models, startups, etc. Third, green FinTech solutions enable customers to directly engage in c2c transactions (e.g., in indirect financial processes, power selling and purchasing or mobility transactions) and thus enabling and optimizing these kinds of transactions. Without technology, these kinds of transactions are impossible, as the transaction costs are too high. Fourth, green FinTech provides the possibility of directly linking different cross-industry ecosystems. For example, the possibility to automatically connect business/sustainability services with payment, investment or financing services creates a powerful tool to link up firms from various industries in novel value chains. In this case, digital financial services are the connection “glue”. Fifth, data-driven models that connect novel external data and internal data may increase transparency about firms and value chains and thus enable better decisions. Additionally, insurers have the possibility to develop entirely new business models by connecting internal and external data sets for improved risk management decisions. Moreover, sixth, the innovation capabilities of the incumbent institutions are strengthened by the possibility to cooperate with startups that provide innovative solutions.

Table 7.

Potentials of green FinTech and InsurTech.

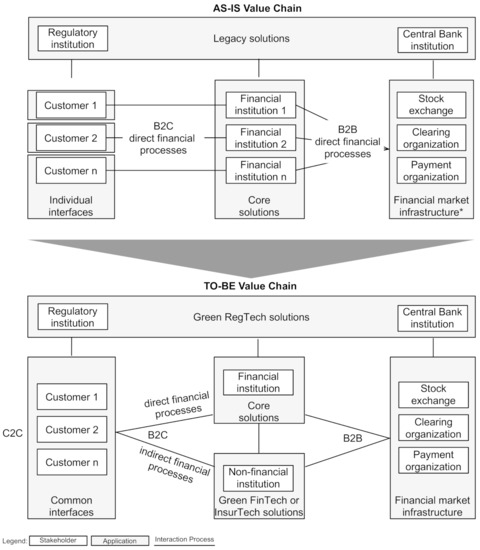

The analysis of the literature and the green FinTech landscape leads to conclusions regarding a potential future scenario of the financial services value chain, which is mainly driven by new actors entering the competitive landscape and by novel technology solutions complementing them (see Figure 4).

Figure 4.

AS-IS financial services value chain and scenario of a TO-BE value chain (according to [86]).

The AS-IS value chain of today is characterized by individual, isolated links from customers to financial institutions. For this, customers (b2c) typically use individual interfaces like banking or insurance apps or online banking websites to access the financial institutions’ services that operate on core (banking or insurance) solutions. These core applications support all core and partially also support processes of banks and insurance companies, such aspayments, investments, financing, life and non-life insurance as well as procurement, human resources, etc. These core applications are linked to the financial market infrastructure, which provides (b2b) services, such as the stock exchange, clearing and payments consisting of dedicated institutions. All these stakeholders are supervised by regulatory institutions and by central bank institutions, ensuring a common level playing field. Figure 4 summarizes the AS-IS value chain.

The green FinTech development may lead to potential transformations that affect all areas and can be summarized in a TO-BE value chain scenario, which shall not be understood as a normative model but as a potential solution approach based on the findings of this analysis. This is characterized by four major developments. First, customers increasingly use c2c business models and common digital interfaces (e.g., SDG-based multi-banking tools or robo-advisors based on open finance protocols). Second, the customer processes can either be direct (b2c) financial processes, such as payments, investments and financing or indirect (b2c) financial processes that support processes in other sectors, such as retail, mobility, energy, etc. With this, customers can access not only the incumbents’ applications but also non-financial institution services. Third, financial institutions are complemented by non-financial institutions like startups, big tech firms or companies from other industries, which widen the scope of potential services comparable to an app store like the ecosystem in which customers can pick and choose from various providers and link them if they are interoperable. Moreover, fourth, regulatory and central bank institutions use green regulatory technology (green RegTech) solutions to launch and monitor solutions for incumbents and non-financial firms along the value chain. For example, the Federal Conduct Authority in England plans to introduce novel solutions that allow the regulator to establish new regulations as code and supervise them electronically and automatically.

7. Conclusions

The financial services industry is currently undergoing a major transformation, with digitization and sustainability being the core drivers. While both concepts have been researched in recent years independently from each other, the intersection termed as “green FinTech” has only attracted limited research so far, although the field increasingly becomes relevant as the financial system is an important element for greening the global economy. This research at hand has focused on researching the state-of-the-art in this young domain by applying an in-depth analysis of literature as well as startups and incumbents in Switzerland. The literature analysis revealed that among the 56 identified papers, most approaches focus either on blockchain-related topics or on specific, isolated aspects of green FinTech, such as green investments. Currently, although literature on green FinTech has emerged rapidly, especially in the past three years, there is no mainstream literature basis yet.This also applies to the startup landscape, whose number increased just recently. However, the results of the analysis in Switzerland indicate that the number of startups is also still limited, and the incumbents are in their early phases of maturity development. From the observations of this research, at least four future fields of development and further research avenues can be identified.

First, although the term sustainability has developed already early in the 1980 s, precise concepts and definitions have just emerged recently. This is especially true for the field of green Finance and green FinTech. For example, the EU taxonomy for sustainable finance, developed by the technical expert group (TEG) on sustainable finance, contains recommendations relating to the overarching design of the taxonomy, as well as guidance on how companies and financial institutions can make disclosures using the taxonomy. This taxonomy contains screening criteria for 70 climate change mitigation and 68 climate change adaptation activities and, thereby, provides a major prerequisite for the development of FinTech and InsurTech solutions. However, the adoption of this taxonomy requires additional standards in order to enable interoperability and transparency across various institutions and industries. For example, Switzerland has just recently launched a new initiative for a green FinTech Network which shall improve conditions and foster this innovation in this novel field. This opens up novel fields of research, such as data taxonomies, technical standards for data exchange among institutions and novel ways of combining data from various institutions in accordance with data privacy regulations (e.g., confidential computing).

Second, a major driver of green FinTech is the availability, transparency and reliability of data. For example, if FinTech is applied to sustainable supply chain finance, data from firms must be trustworthy so that customers and collaborating providers can be sure that the data are reliable. This also applies to investors. However, very often today, evaluations of firms are usually based on data from company reports, in which the source and level of trustworthiness are not transparent. Providers like Bloomberg, for example, offer data that most often also stem from company websites and reports and, in addition, are often not fully available. In some cases, firms provide more data, others less. International standards for data reporting may, in the near future, enable a more homogeneous view across different companies and supply chains. Further research in this area may focus on data standards development and the role of blockchain technology in collaborating providers’ ecosystems. Blockchain, for example, may improve the transparency and trustworthiness of data by a common digital infrastructure that is tamper-proof and allows all stakeholders to share a joint set of data. Another research domain is the inclusion and combination of novel data sets from other sources than firm internal ones. Among the examples are data from space observations and sensor data, which monitor the environment in various dimensions (e.g., air pollution, biodiversity, etc.).

Third, climate change is often regarded as going hand-in-hand with “ecosystems,” in which various stakeholders create a value proposition that exceeds the sum of the contributions from the single parties involved [87]. An example is a blockchain-based sustainable supply chain for agricultural products in which farmers, manufacturers, wholesalers, retailers, and consumers are connected [88]. Another example are energy ecosystems [47,61,89]. In general, a “Business Ecosystem” is defined as an “economic community supported by a foundation of interacting organizations and individuals—the organisms of the business world. The economic community produces goods and services of value to customers, who themselves are members of the ecosystem. (…)” [90]. Because ecosystems increasingly develop towards digital ecosystems, various design options regarding strategic network types, business models, products/services, processes and organization and system-related aspects emerge and must be considered [91,92]. Thus, green FinTech solutions are important connectors as they can help to intertwine the stakeholders and processes. An example is a digital smart contract on a blockchain solution for peer-to-peer energy production, distribution and consumption grids. Therefore, further research may focus on the role of green FinTech in these novel digital ecosystems and their business models, which may not only concentrate on the financial services industry, but may also include other sectors.

Fourth, as climate change is an international effort, many solutions require international coordination. For example, if standardization and transparency of sustainability data shall be achieved on a global level, institutions from various countries must be involved. This is especially true in the case of financial data where, in some cases, security and/or privacy concerns may outweigh the sustainability impact. If blockchain technology shall be used for energy production, distribution and consumption or for food supply chains, international coordination is required on a technical and political level, which goes far beyond the responsibilities of today’s institutions like the UN or others. This may even require the setup of novel institutions like digital notaries to establish such new models in the future. Such developments hold great potential for further research, which may focus on the design of future value chains, including green FinTech. As has been shown with the scenario of a potential future value chain, green FinTech may impact at least four areas for which further research is required. Another field in this context is international policy development and alignment, which is required for digital ecosystems across national borders and jurisdictions. How can national laws be aligned for cross-border blockchain-based solutions that rely on data from financial institutions and firms from various countries?

Although this paper provides a first comprehensive overview of the field of green FinTech, it also holds some limitations and avenues for further research. First, while this research was limited to Switzerland, additional analyses may focus on other countries or even a global perspective (e.g., policy development and alignment). Some of the potential research directions have been outlined in this section. However, as shown in Section 4, Switzerland has some specific characteristics with regard to its environmental footprint and the relevance of the financial services industry. Among those factors are the high percentage of imported greenhouse gas emissions (approximately two-thirds) and the high importance of the banking sector, which manages approximately 25 percent of all assets worldwide. A transfer of the results to other countries has to, therefore, be considered under these special circumstances. For example, if a country primarily relies on exported greenhouse gas emissions, the case is very different. Another limitation is the qualitative approach to this research. Further research may focus on analyzing green FinTech startups from a global perspective and include other startups from other countries to compare and confirm the patterns which were identified and thus offers additional insights from a broader empirical data set. Another important area is the measurement of the impact of green FinTech on the environment based on real data. As the topic is still very young, the developments in the forthcoming years will lay the foundation for new and more data. Finally, green FinTech can also address solutions of central banks or other financial institutions, which are not the focus of this research but may also have a significant impact on climate change. However, despite these limitations, green FinTech seems to hold great potentials to achieve the Sustainable Development Goals as its development has only just begun.

Author Contributions

This research was conducted by T.P., C.H.H. and V.K., each providing individual contributions: T.P. contributed the conception and research framework, the analysis of the start-ups as well as the writing of the overall paper. C.H.H. contributed the structure of the paper and the writing of the overall paper. V.K. contributed to the analysis of the start-ups and the literature analysis. All authors have read and agreed to the published version of the manuscript.

Funding

This research received funding from the Green Digital Finance Alliance for which we would like to thank Marianne Haahr and Katherine A. Foster.

Acknowledgments

We would like to thank the Green Digital Finance Alliance for the very valuable input and feedback to this research.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Schmidt-Traub, G. Investment Needs to Achieve the Sustainable Development Goals, Understanding the Billions and Trillions; SDSN Working Paper, Version 2; Sustainable Development Solutions Network: New York, NY, USA, 2015; Available online: http://unsdsn.org/wp-content/uploads/2015/09/151112-SDG-Financing-Needs.pdf (accessed on 1 August 2018).

- Schmidt-Traub, G.; Sachs, J. Financing Sustainable Development: Implementing the SDGs through Effective Investment Strategies and Partnerships; Sustainable Development Solutions Network: New York, NY, USA, 2015; Available online: http://unsdsn.org/wp-content/uploads/2015/04/150408-SDSN-FinancingSustainable-Development-Paper.pdf (accessed on 1 August 2018).

- Saunders, A.; Cornett, M. Financial Institutions Management. A Risk Management Approach; McGraw-Hill Irwin: New York, NY, USA, 2010. [Google Scholar]

- Braswell, J.; Mark, R. Banking and financial activities in the real economy. In Handbook of Financial Data and Risk Information I: Principles and Context; Brose, M.S., Flood, M.D., Krishna, D., Nichols, B., Eds.; Cambridge University Press: Cambridge, UK, 2014; pp. 179–270. [Google Scholar]

- French, K.R.; Baily, M.N.; Campbell, J.Y.; Cochrane, J.H.; Diamond, D.W.; Duffie, D.; Kashyap, A.K.; Mishkin, F.S.; Rajan, R.G.; Scharfstein, D.S.; et al. The Squam Lake Report. Fixing the Financial System; Princeton University Press: Princeton, NJ, USA; Oxford, UK, 2010. [Google Scholar]

- Gomber, P.; Kauffman, R.J.; Parker Cand Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Gopalan, S.; Jain, G.; Kalani, G.; Tan, J. Breakthrough IT Banking. McKinsey Q. 2012, 26, 30–35. [Google Scholar]

- UN Environment Inquiry. Digital Finance and Citizen Action in Financing the Future of Climate-smart Infrastructure; Report; UN Environment Inquiry: Geneva, Switzerland, 2019. [Google Scholar]

- IMD. IMD Digital World Competitiveness Ranking. Report, IMD World Competitiveness Center. 2019. Available online: https://www.imd.org/globalassets/wcc/docs/release-2019/digital/imd-world-digital-competitiveness-rankings-2019.pdf (accessed on 23 October 2020).

- Kutler, J. Citibank is Shedding Individualistic Image. Am Bank. 1993. Available online: https://www.americanbanker.com/news/citibank-is-shedding-individualistic-image (accessed on 17 December 2020).

- Braun, A.; Schreiber, F. The Current InsurTech Landscape: Business Models and Disruptive Potential; Report; University of St. Gallen: St. Gallen, Switzerland, 2017. [Google Scholar]

- Puschmann, T. Fintech. Bus. Inf. Syst. Eng. 2017, 59, 69–76. [Google Scholar] [CrossRef]

- Lee, T.; Kim, H.-W. An exploratory study on fintech industry in Korea: Crowdfunding case. In Proceedings of the 2nd International Conference on Innovative Engineering Technologies (ICIET’2015), Bangkok, Thailand, 7–8 August 2015. [Google Scholar]

- Tufano, P. Finanical innovation. In Handbook of the Economics of Finance’; Constantinides, G.M., Harris, M., Stulz, R.M., Eds.; Elsevier: Amsterdam, The Netherlands, 2003; pp. 307–335. [Google Scholar]

- Frame, W.S.; White, L.J. Technological Change, Financial Innovation and Diffusion in Banking; NYU Working Paper No. 2451/33549; Federal Reserve Bank of Atlanta: Atlanta, GA, USA; Leonard N. Stern School of Business, Department of Economics: New York, NY, USA, 2014. [Google Scholar]

- Gimpel, H.; Rau, D.; Röglinger, M. FinTech-Geschäftsmodelle im Visier. Wirtsch. Manag. 2016, 8, 38–47. [Google Scholar] [CrossRef]

- Haddad, C.; Hornuf, L. The Emergence of the Global Fintech Market: Economic and Technological Determinants; CESifo Working Paper Series No. 6131; University of Lille: Lille, France; University of Trier: Trier, Germany, 2016. [Google Scholar]

- Brundtland, G. Report of the World Commission on Environment and Development: Our Common Future; United Nations: New York, NY, USA, 1987. [Google Scholar]

- Elkington, J. Enter the triple bottom line. In The Triple Bottom Line: Does it All Add up? Henriques, A., Richardson, J., Eds.; Routledge: Abingdon, UK, 2013; pp. 23–38. [Google Scholar]

- Bocken, N.M.P.; Short, S.W.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Hultink, E.J. The Circular Economy: A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Arena, M.; Bengo, I.; Calderini, M.; Chiodo, V. Unlocking Finance for social Tech Start-ups: Is there a new Opportunity Space? Technol. Forecast. Soc. Chang. 2018, 127, 154–165. [Google Scholar] [CrossRef]

- Höhne, N.; Khosla, S.; Fekete, H.; Gilbert, A. Mapping of Green Finance Delivered by IDFC Members in 2011; Ecofys: Utrecht, The Netherlands, 2012. [Google Scholar]

- Zadek, S.; Flynn, C. South-Originating Green Finance: Exploring the Potential; The Geneva International Finance Dialogues; UNEP FI: Nairobi, Kenya; SDC: Nashville, TN, USA; IISD: Winnipeg, MB, Canada, 2013. [Google Scholar]

- Wolfswinkel, J.F.; Furtmueller, E.; Wilderom, C.P.M. Using Grounded Theory as a Method for rigorously reviewing Literature. Eur. J. Inf. Syst. 2013, 22, 45–55. [Google Scholar] [CrossRef]

- Anshari, M.; Almunawar, M.; Masri, M.; Hamdan, M. Digital Marketplace and FinTech to Support Agriculture Sustainability. Energy Procedia 2019, 156, 234–238. [Google Scholar] [CrossRef]

- Jia, F.; Zhang, T.; Chen, L. Sustainable supply chain Finance: Towards a research agenda. J. Clean. Prod. 2020, 243, 118680. [Google Scholar] [CrossRef]

- Thompson, B. Can Financial Technology Innovate Benefit Distribution in Payments for Ecosystem Services and REDD+? Ecol. Econ. 2017, 139, 150–157. [Google Scholar] [CrossRef]

- Knuth, S. “Breakthroughs” for a green economy? Financialization and clean energy transition. Energy Res. Soc. Sci. 2018, 41, 220–229. [Google Scholar] [CrossRef]

- Deng, X.; Huang, Z.; Cheng, X. FinTech and Sustainable Development: Evidence from China Based on p2p Data. Sustainability 2019, 11, 6434. [Google Scholar] [CrossRef]

- Hinson, R.; Lensink, R.; Mueller, A. Transforming agribusiness in developing countries: SDGs and the role of FinTech. Curr. Opin. Environ. Sustain. 2019, 41, 1–9. [Google Scholar] [CrossRef]

- Arner, D.; Buckley, R.; Zehzche, D.; Veidt, R. Sustainability, FinTech and Financial Inclusion. Eur. Bus. Organ. Law Rev. 2020, 21, 7–35. [Google Scholar] [CrossRef]

- Shin, Y.J.; Choi, Y. Feasibility of the Fintech Industry as an Innovation Platform for Sustainable Economic Growth in Korea. Sustainability 2019, 11, 5351. [Google Scholar] [CrossRef]

- Nassiry, D. The Role of Fintech in Unlocking Green Finance: Policy Insights for Developing Countries; ADBI Working Paper Series No. 883; Asian Development Bank Institute (ADBI): Tokyo, Japan, 2019. [Google Scholar]

- Sachs, J.; Woo, T.; Yoshino, N.; Taghizadeh-Hesary, F. Handbook of Green Finance Energy: Security and Sustainable Development; Springer: Singapore, 2019. [Google Scholar]

- Vogel, J.; Hagen, S.; Thomas, O. Discovering Blockchain for Sustainable Product-Service Systems to enhance the Circular Economy. In Proceedings of the 14th International Conference on Wirtschaftsinformatik, Siegen, Germany, 24–27 February 2019. [Google Scholar]

- Delliere, E.; Grange, C. Understanding and Measuring the Ecological Sustainability of the Blockchain Technology. In Proceedings of the International Conference on Information Systems, San Francisco, CA, USA, 13–16 December 2018. [Google Scholar]

- Tavares, E.; Meirelles, F.; Tavares, E.; Cunha, M.; Schunk, L. Blockchain in the Green Treasure: Different Investment Objectives. In Proceedings of the 25th Americas Conference on Information Systems, Cancún, Mexico, 15–17 August 2019. [Google Scholar]

- Kirpes, B.; Becker, C. Processing Electric Vehicle Charging Transactions in a Blockchain-based Information System. In Proceedings of the 24th Americas Conference of Information Systems, New Orleans, LA, USA, 16–18 August 2018. [Google Scholar]

- Esther, N.; Youngjin, Y.K. Blockchain Token Sale, Economic and Technological Foundations. Bus. Inf. Syst. Eng. 2019, 61, 745–753. [Google Scholar]

- Bechtis, D.; Tsolakis, N.; Bizakis, A.; Vlachos, D. A Blockchain Framework for Containerized Food Supply Chains. Comput. Aided Chem. Eng. 2019, 46, 1369–1374. [Google Scholar]

- Makre, A.; Sylvester, B. Decoding the Current Global Climate Finance Architecture. In Transforming Climate Finance and Green Investment with Blockchains; Academic Press: Cambridge, MA, USA, 2018; pp. 35–59. [Google Scholar]

- Howson, P.; Oakes, S.; Baynham-Herd, Z.; Swords, J. Cryptocarbon: The promises and pitfalls of forest protection on a blockchain. Geoforum 2019, 100, 1–9. [Google Scholar] [CrossRef]

- Venkatest, V.; Kang, K.; Wang, B.; Zhong, R.; Zhang, A. System architecture for blockchain based transparency of supply chain social sustainability. Robot. Comput. Integr. Manuf. 2020, 63, 101896. [Google Scholar] [CrossRef]

- Di Vaio, A.; Varriale, L. Blockchain technology in supply chain management for sustainable performance: Evidence from the airport industry. Int. J. Inf. Manag. 2020, 52, 102014. [Google Scholar] [CrossRef]

- Perrons, R.; Cosby, T. Applying blockchain in the geoenergy domain: The road to interoperability and standards. Appl. Energy 2020, 262, 114545. [Google Scholar] [CrossRef]

- Zhu, S.; Song, M.; Lim, M.; Wang, J.; Zhao, J. The development of energy blockchain and its implications for China’s energy sector. Resour. Policy 2020, 66, 101595. [Google Scholar] [CrossRef]

- Teufel, B.; Sentic, A.; Barmet, M. Blockchain energy: Blockchain in future energy systems. J. Electron. Sci. Technol. 2019, 17, 100011. [Google Scholar] [CrossRef]

- Franca, A.; Neto, J.; Goncales, R.; Almeida, C. Proposing the use of blockchain to improve the solid waste management in small municipalities. J. Clean. Prod. 2020, 244, 118529. [Google Scholar] [CrossRef]

- Ahl, A.; Yarime, M.; Goto, M.; Chorpa, S.; Kumar, N.; Tanaka, K.; Sagawa, D. Exploring blockchain for the energy transition: Opportunities and challenges based on a case study in Japan. Renew. Sustain. Energy Rev. 2020, 117, 109488. [Google Scholar] [CrossRef]

- Ahl, A.; Yarime, M.; Tanaka, K.; Sagawa, D. Review of blockchain-based distributed energy: Implications for institutional development. Renew. Sustain. Energy Rev. 2019, 107, 200–211. [Google Scholar] [CrossRef]

- Mihaylov, M.; Razo-Zapata, I.; Radulescu, R.; Nowe, A. Boosting the Renewable Energy Economy with NRGcoin. In Proceedings of the 4th International Conference on ICT for Sustainability, Thessaloniki, Greece, 16–18 May 2016. [Google Scholar]

- Sun, M.; Zhang, J. Research on the application of block chain big data platform in the construction of new smart city for low carbon emission and green environment. Comput. Commun. 2020, 149, 332–342. [Google Scholar] [CrossRef]

- Fadeyi, O.; Krejcar, O.; Maresova, P.; Kuca, K.; Brida, P.; Selamat, A. Opinions on Sustainability of Smart Cities in the Context of Energy Challenges Posed by Cryptocurrency Mining. Sustainability 2020, 12, 169. [Google Scholar] [CrossRef]

- Rana, L.; Giungato, P.; Tarabella, A.; Tricase, C. Blockchain Applications and Sustainability Issues. Amfiteatru Econ. 2019, 21, 861–870. [Google Scholar]

- Rkajnakova, E.; Svazas, M.; Navickas, V. Biomass blockchain as a factor of energetical sustainability development. Entrep. Sustain. Center 2019, 6, 1456–1467. [Google Scholar]

- Mengelkamp, E.; Notheisen, B.; Beer, C.; Dauer, D. A blockchain-based smart grid: Towards sustainable local energy markets. Comput. Sci. Resour. Dev. 2018, 33, 207–214. [Google Scholar] [CrossRef]

- Adams, R.; Kewell, B.; Parry, G. Blockchain for Good? Digital Ledger Technology and Sustainable Development Goals. In Handbook of Sustainability and Social Science Research; Springer: Cham, Switzerland, 2017; pp. 127–140. [Google Scholar]

- Sachin, Y.; Singh, S. Blockchain critical success factors for sustainable supply chain. Resour. Conserv. Recycl. 2019, 152, 104505. [Google Scholar]

- Sulkowski, A. Blockchain, Law, and Business Supply Chains: The Need for Governance and Legal Frameworks to Achieve Sustainability. Delaware J. Corp. Law 2018, 43, 303–345. [Google Scholar] [CrossRef]

- Truby, J. Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies. Energy Res. Soc. Sci. 2018, 44, 399–410. [Google Scholar] [CrossRef]

- Wu, J.; Tran, N.K. Application of Blockchain Technology in Sustainable Energy Systems: An Overview. Sustainability 2018, 10, 3067. [Google Scholar] [CrossRef]

- Nikolakis, W.; John, L.; Krishnan, H. How Blockchain Can Shape Sustainable Global Value Chains: An Evidence, Verifiability, and Enforceability (EVE) Framework. Sustainability 2018, 10, 3926. [Google Scholar] [CrossRef]

- Kouhizadeh, M.; Sarkis, J. Blockchain Practices, Potentials, and Perspectives in Greening Supply Chains. Sustainability 2018, 10, 3652. [Google Scholar] [CrossRef]

- Fu, B.; Shu, Z.; Liu, X. Blockchain Enhanced Emission Trading Framework in Fashion Apparel Manufacturing Industry. Sustainability 2018, 10, 1105. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2018, 57, 2117–2135. [Google Scholar] [CrossRef]

- Schletz, M.; Nassiry, D.; Lee, M. Blockchain and Tokenized Securities: The Potential for Green Finance; ADBI Working Paper Series; Asian Development Bank Institute: Tokyo, Japan, 2020. [Google Scholar]

- Enescu, F.M.; Bizon, N.; Onu, A.; Răboacă, M.S.; Thounthong, P.; Mazare, A.G.; Șerban, G. Implementing Blockchain Technology in Irrigation Systems That Integrate Photovoltaic Energy Generation Systems. Sustainability 2020, 12, 1540. [Google Scholar] [CrossRef]

- Gollhardt, T.; Paukstatd, U.; Blarr, M.; Chasin, F.; Becker, J. A Taxonomy of Consumer-Oriented Smart Energy Business Models. In Proceedings of the 27th European Conference on Information Systems, Stockholm, Sweden, 8–14 June 2019. [Google Scholar]

- Sasaki, H. Positioning of green information systems and technology from an ecosystem perspective. In Proceedings of the 22th Pacific Asia Conference on Information Systems, Yokohama, Japan, 26–30 June 2018. [Google Scholar]

- Savita, K.; Razip, M.; Shafee, K.; Mathiyazhagan, K. An Exploration on the Impact of Internet of Things (IoT) towards Environmental Sustainability in Malaysia. In Proceedings of the 22th Pacific Asia Conference on Information Systems, Yokohama, Japan, 26–30 June 2018. [Google Scholar]

- Airehrour, D.; Gutiérres, J.; Ray, K. Greening and Optimizing Energy Consumption of Sensor Nodes in the Internet of Things through Energy Harvesting: Challenges and Approaches. In Proceedings of the International Conference on Information Resources Management, Cape Town, South Africa, 18–20 May 2016. [Google Scholar]

- Brauer, B.; Ebermann, C.; Kolbe, L. An Acceptance Model for User-Centric Persuasive Environmental Sustainable IS. In Proceedings of the International Conference on Information Systems, Dublin, Ireland, 11–14 December 2016. [Google Scholar]

- Diestelmeier, L. Changing power: Shifting the role of electricity consumers with blockchain technology—Policy implications for EU electricity law. Energy Policy 2019, 128, 189–196. [Google Scholar] [CrossRef]

- Patil, A.; Tama, B.; Park, Y.; Rhee, K. Framework for Blockchain Based Secure Smart Green House Farming. In Advances in Computer Science and Ubiquitous Computing; Springer: Singapore, 2017; pp. 1162–1167. [Google Scholar]

- Rabe, W.; Kostka, G.; Stegen, K.S. China’s supply of critical raw materials: Risks for Europe’s solar and wind industries? Energy Policy 2017, 101, 692–699. [Google Scholar] [CrossRef]

- Vykoukal, J. Grid Technology as Green IT Strategy? Empirical Results from the Financial Services Industry. In Proceedings of the European Conference on Information Systems, Pretoria, South Africa, 7–9 June 2010. [Google Scholar]

- Martin, C.; Evans, J.; Karvonen, A.; Paskaleva, K.; Yang, D.; Linjordet, T. Smart-sustainability: A new urban fix? Sustain. Cities Soc. 2019, 45, 640–648. [Google Scholar] [CrossRef]

- Park, L.W.; Lee, S.; Chang, H. A Sustainable Home Energy Prosumer-Chain Methodology with Energy Tags over the Blockchain. Sustainability 2018, 10, 658. [Google Scholar] [CrossRef]

- Orecchini, F.; Santiangeli, A.; Zuccari, F.; Pieroni, A.; Suppa, T. Blockchain Technology in Smart City: A New Opportunity for Smart Environment and Smart Mobility. In Intelligent Computing & Optimization; Springer: Cham, Switzerland, 2018; pp. 346–354. [Google Scholar]

- Nagel, E.; Kranz, J.; Sandner, P.; Hopf, S. How Blockchain facilitates Smart City Applications- Development of a Multi-Layer Taxonomy. In Proceedings of the 27th European Conference on Information Systems, Stockholm, Sweden, 8–14 June 2019. [Google Scholar]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available online: http://bitcoin.org/bitcoin.pdf (accessed on 17 December 2020).

- Blakstad, S.; Allen, R. FinTech Revolution: Universal Inclusion in the New Financial Ecosystem; Palgrave Macmillan: Cham, Switzerland, 2018. [Google Scholar]

- Tao, J.; Azhgaliyeva, D. The Role of Green Fintech for Singapore: Risks and Benefits; National University of Singapore: Singapore, 2018. [Google Scholar]

- Weiblen, T.; Chesbrough, H.W. Engaging with startups to enhance corporate innovation. Calif. Manag. Rev. 2015, 57, 66–90. [Google Scholar] [CrossRef]