Assessing the Economy for the Common Good Measurement Theory Ability to Integrate the SDGs into MSMEs

Abstract

1. Introduction

2. Theoretical Framework

2.1. Corporate Sustainability and Integrated Reporting

2.2. Sustainable Development Goals and Economy for the Common Good

3. Methodology

4. Findings

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Engert, S.; Rauter, R.; Baumgartner, R.J. Exploring the integration of corporate sustainability into strategic management: A literature review. J. Clean. Prod. 2016, 112, 2833–2850. [Google Scholar] [CrossRef]

- Bos-Brouwers, H.E.J. Corporate sustainability, and innovation in SMEs: Evidence of themes and activities in practice. Bus. Strategy Environ. 2010, 19, 417–435. [Google Scholar] [CrossRef]

- Allen, C.; Nejdawi, R.; El-Baba, J.; Hamati, K.; Matternicht, G.; Wiedmann, T. Indicator-based assessments of progress towards the sustainable development goals (SDGs): A case study from the Arab region. Sustain. Sci. 2017, 12, 975–989. [Google Scholar] [CrossRef]

- Nilsson, M.; Lucas, P.; Yoshida, T. Towards an Integrated Framework for SDGs: Ultimate and Enabling Goals for the Case of Energy. Sustainability 2013, 5, 4124–4151. [Google Scholar] [CrossRef]

- Verboven, H.; Vanherck, L. Sustainability management of SMEs and the UN Sustainable Development Goals. Uwf UmweltWirtschaftsForum 2016, 24, 165–178. [Google Scholar] [CrossRef]

- Felber, C. Die Gemeinwohl-Ökonomie, 1st ed; Deuticke: Wien, Austria, 2010. [Google Scholar]

- Felber, C. Change Everything: Creating an Economy for the Common Good, 1st ed; Zen Books: Vienne, Austria, 2019. [Google Scholar]

- Felber, C.; Campos, V.; Sanchis, J.R. The Common Good Balance Sheet, an Adequate Tool to Capture Non-Financials? Sustainability 2019, 11, 3791. [Google Scholar] [CrossRef]

- Brundtland, G.; Khalid, M.; Agnelli, S.; Al-Athel, S.; Chidzero, B.; Fadika, L.; Singh, M. Our Common Future; Brundtland report; United Nations World Commission on Environment and Development: New York, NY, USA, 1987. [Google Scholar]

- Bansal, P. Envolving sustainability: A longitudinal study of corporate sustainable development. Strateg. Manag. J. 2005, 26, 197–218. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Lozano, R. A Holistic Perspective on Corporate Sustainability Drivers. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 32–44. [Google Scholar] [CrossRef]

- Jung, S.; Jung, H.B. Perfect or Imperfect Duties? Developing a Moral Responsibility Framework for Corporate Sustainability from the Consumer Perspective. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 326–340. [Google Scholar] [CrossRef]

- Elkington, J.; Rowlands, I.H. Cannibals With Forks: The Triple Bottom Line of 21st Century Business. Altern. J. 1999, 25, 42–53. [Google Scholar]

- International Standards Organisation. Quality Management and Quality Assurance; United Nations-Division of Production, Productivity, and Management: Brussels, Belgium, 1992. [Google Scholar]

- Dahlgaard-Park, S.M.; Zink, K.J. From total quality management to corporate sustainability based on stakeholder management. J. Manag. Hist. 2007, 13, 394–401. [Google Scholar]

- Hörisch, J.; Freeman, R.E.; Schaltegger, S. Applying stakeholder theory in sustainability management links, similarities, dissimilarities, and a conceptual framework. Organ. Environ. 2014, 27, 328–346. [Google Scholar] [CrossRef]

- Sulkowski, A.J.; Edwards, M.; Freeman, R.E. Shake your stakeholder: Firms leading engagement to cocreate sustainable value. Organ. Environ. 2018, 3, 223–241. [Google Scholar] [CrossRef]

- Gladwin, T.; Kennelly, J.; Krause, T. Shifting Paradigms for Sustainable Development: Implications for Management Theory and Research. Acad. Manag. Rev. 1995, 20, 874–907. [Google Scholar] [CrossRef]

- Salzmann, O.; Ionescu-Somers, A.; Steger, U. The Business Case for Corporate Sustainability: Literature Review and Research Options. Eur. Manag. J. 2005, 23, 27–36. [Google Scholar] [CrossRef]

- Porter, M.; Kramer, M. Creating Shared Value. How to reinvent capitalism and unleash a wave of growth. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Dyllick, T.; Muff, K. Clarifying the Meaning of Sustainable Business: Introducing a Typology from Business-as-Usual to True Business Sustainability. Organ. Environ. 2016, 29, 156–174. [Google Scholar] [CrossRef]

- Crane, A.; Palazzo, G.; Spence, L.; Matten, D. Contesting the Value of Creating Shared Value. Calif. Manag. Rev. 2014, 56, 130–153. [Google Scholar] [CrossRef]

- Siew, R.Y. A review of corporate sustainability reporting tools (SRTs). J. Environ. Manag. 2015, 164, 180–195. [Google Scholar] [CrossRef]

- Waddock, S. Stakeholder performance implications of corporate responsibility. Int. J. Bus. Perform. Manag. 2003, 5, 114–124. [Google Scholar] [CrossRef]

- Dumay, J.; Bernardi, C.; Guthrie, J.; Demartini, P. Integrated reporting: A structured literature review. Account. Forum 2016, 40, 166–185. [Google Scholar] [CrossRef]

- Global Reporting Initiative. Sustainability Reporting Guidelines v3.1; GRI: Amsterdam, The Netherlands, 2011. [Google Scholar]

- Milne, M.; Gray, R. “W(h)ither Ecology? The Triple Bottom Line, the Global Reporting Initiative, and Corporate Sustainability Reporting. J. Bus. Ethics 2013, 118, 13–29. [Google Scholar] [CrossRef]

- Visser, W.; Tolhurst, N. The World Guide to CSR: A Country-by-Country Analysis of Corporate Sustainability and Responsibility, 1st ed; Routledge: London, UK, 2017. [Google Scholar]

- Ketola, T. Five leaps to corporate sustainability through a corporate responsibility portfolio matrix. Corp. Soc. Responsib. Environ. Manag. 2010, 17, 320–336. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis, 7th ed; Pearson New International Edition: Harlow, UK, 2018. [Google Scholar]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; General Assembly: New York, NY, USA, 2015; Available online: https://www.un.org/ga/search/view_doc.asp?symbol=A/RES/70/1&Lang=E (accessed on 29 January 2019).

- Scheyvens, R.; Banks, G.; Hughes, E. The Private Sector and the SDGs: The Need to Move Beyond Business as Usual. Sustain. Dev. 2016, 24, 371–382. [Google Scholar] [CrossRef]

- Verboven, H.; Vanherck, L. Sustainability as a management process for SMEs. Uwf UmweltWirtschaftsForum 2015, 23, 241–249. [Google Scholar] [CrossRef]

- Klaus, F.; Kroczak, A.; Facchinetti, G.; Egloff, S. Economy for the Common Good. DAS in Sustainable Business; Business School Lausanne: Lausanne, Switzerland, 2013; Available online: https://balance.ecogood.org/ecgreports/bsl-economy-of-the-common-good.pdf (accessed on 3 March 2019).

- Foti, V.T.; Scuderi, A.; Timpanaro, G. The Economy of the Common Good: The expression of a new sustainable economic model. Qual. Access Success 2017, 18, 206–214. [Google Scholar]

- Giesenbauer, B.; Müller-Christ, G. Die Sustainable Development Goals für und Durch KMU. Ein Leitfaden für Kleine und Mittlere Unternehmen; Universität Bremen: Bremen, Germany, 2018; Available online: File:///C:/Users/Anna/Downloads/Leitfaden%20SDGs%20f%C3%BCr%20und%20durch%20KMU%20-%20Giesenbauer%20M%C3%BCller-Christ%202018-08-08.pdf (accessed on 16 April 2019).

- European Economic and Social Committee. The Economy for the Common Good: A Sustainable Economic Model Oriented to Social Cohesion. 2016. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52015IE2060&from=EN (accessed on 29 July 2019).

- Hair, J.F.; Wolfinbarger, M.A.; Money, H.; Samouel, P.; Page, M.J. Essentials of Business Research Methods, 2nd ed.; Routledge: New York, NY, USA, 2015. [Google Scholar]

- Ploum, L.; Blok, V.; Lans, T.; Omta, O. Towards a validated competence framework for sustainable entrepreneurship. Organ. Environ. 2018, 3, 113–132. [Google Scholar] [CrossRef]

- Worthington, R.L.; Whittaker, T.A. Scale development research: A content analysis and recommendations for best practices. Couns. Psychol. 2006, 34, 806–838. [Google Scholar] [CrossRef]

- Hooper, D.; Coughlan, J.; Mullen, M. Structural Equation Modelling: Guidelines for Determining Model Fit. Electron. J. Bus. Res. Methods 2008, 6, 53–60. [Google Scholar]

- Hu, L.T.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Modeling Multidiscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Shevlin, M.; Miles, J. Effects of sample size, model specification, and factor loadings on the GFI in confirmatory factor analysis. Personal. Individ. Differ. 1998, 25, 85–90. [Google Scholar] [CrossRef]

- Sharma, S.; Mukherjee, S.; Kumar, A.; Dillon, W.R. A simulation study to investigate the use of cutoff values for assessing model fit in covariance structure models. J. Bus. Res. 2005, 58, 935–943. [Google Scholar] [CrossRef]

- Brown, T.A. Confirmatory Factor Analysis for Applied Research, 2nd ed.; Guilford Publications: New York, NY, USA, 2015. [Google Scholar]

- Mulaik, S.A.; James, L.R.; Van Alstine, J.; Bennett, N.; Lind, S.; Stilwell, C.D. Evaluation of goodness-of-fit indices for structural equation models. Psychol. Bull. 1989, 105, 430. [Google Scholar] [CrossRef]

- Akaike, H. A new look at the statistical model identification. In Selected Papers of Hirotugu Akaike; Springer: Ner York, NY, USA, 1974; pp. 215–222. [Google Scholar]

- Shrivastava, M.; Tamvada, J.P. Which green matters for whom? Greening and firm performance across age and size distribution of firms. Small Bus. Econ. 2019, 52, 951–968. [Google Scholar] [CrossRef]

- DeSimone, L.D.; Popoff, F. Eco-Efficiency: The Business Link to Sustainable Development, 1st ed.; The MIT Press: Massachusetts, UK, 2000. [Google Scholar]

- Howard_Grenville, J.; Davis, G.F.; Dyllick, T.; Miller, C.C.; Thau, S.; Tsui, A.S. Sustainable development for a better world: Contributions of leadership, management, and organizations. Acad. Manag. Discov. 2019, 5, 355–366. [Google Scholar] [CrossRef]

- Van Zanten, J.A.; Van Tulder, R. Multinational Enterprises and the Sustainable Development Goals: An Institutional Approach to Corporate Engagement. J. Int. Bus. Policy 2018, 1, 208–233. [Google Scholar] [CrossRef]

- Sachs, J.D.; Schmidt-Traub, G.; Mazzucato, M.; Messner, D.; Nakicenovic, N.; Rockström, J. Six transformations to achieve the sustainable development goals. Nat. Sustain. 2019, 2, 805–814. [Google Scholar] [CrossRef]

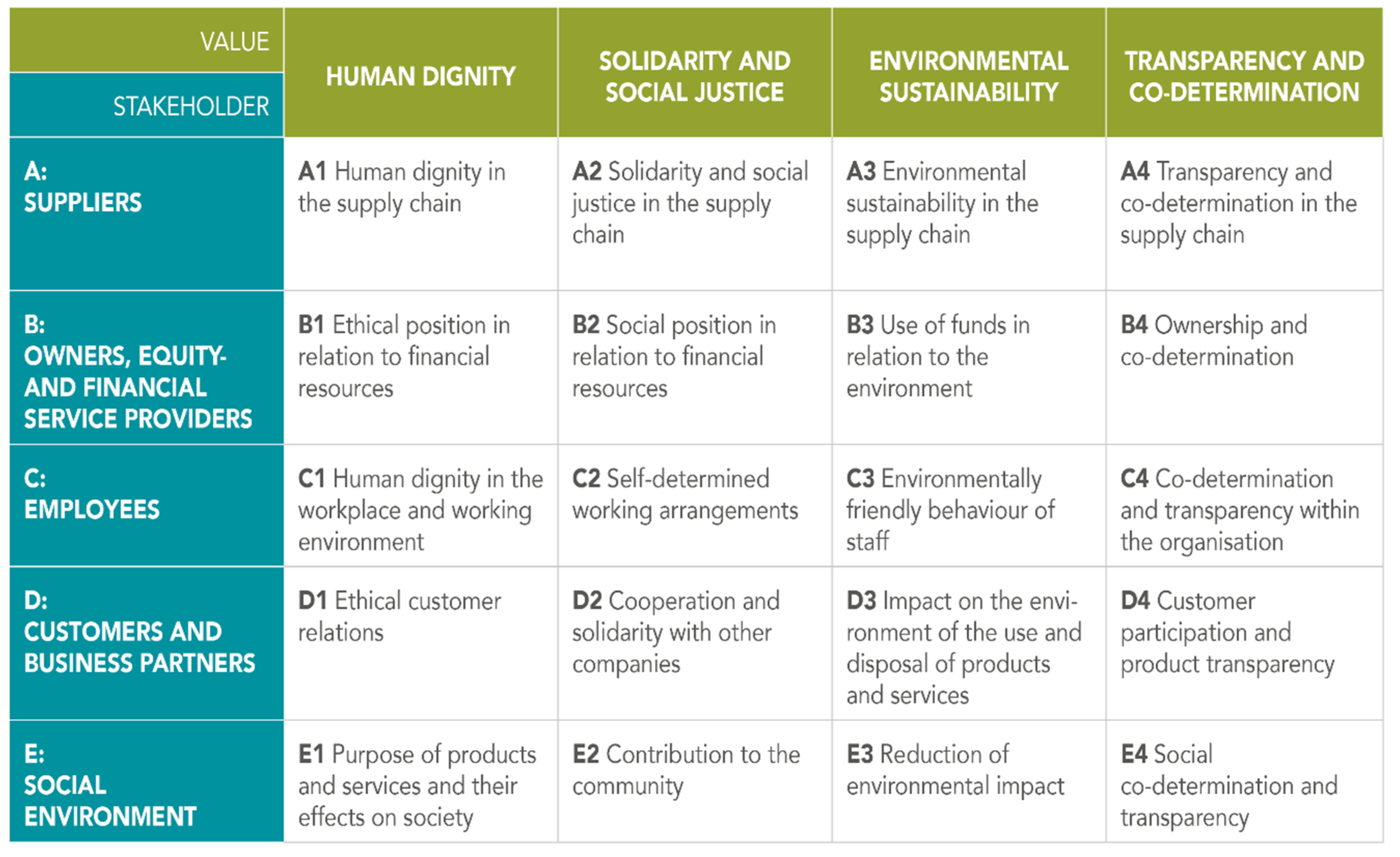

| Dimension | Items | Measurement Scales |

|---|---|---|

| Suppliers A | A1. Human dignity in the supply chain. A2. Solidarity and social justice in the supply chain. A3. Environmental sustainability in the supply chain. A4. Transparency and co-determination in the supply chain. | Absolute values (scores) |

| Owners, equity and financial service providers B | B1. Ethical position concerning financial resources. B2. Social position concerning financial resources. B3. Use of funds concerning the environment. B4. Ownership and co-determination. | Absolute values (scores) |

| Employees C | C1. Human dignity in the workplace and the working environment. C2. Self-determined working arrangements. C3. Environmentally friendly behavior of staff. C4. Co-determination and transparency within the organization. | Absolute values (scores) |

| Customers and business partners D | D1. Ethical customer relations. D2. Cooperation and solidarity with other companies. D3. Impact on the environment of the use and disposal of products and services. D4. Customer participation and product transparency. | Absolute values (scores) |

| Social environment E | E1. Purpose of products and services and their effects on society. E2. Contribution to the community. E3. Reduction of environmental impact. E4. Social co-determination and transparency. | Absolute values (scores) |

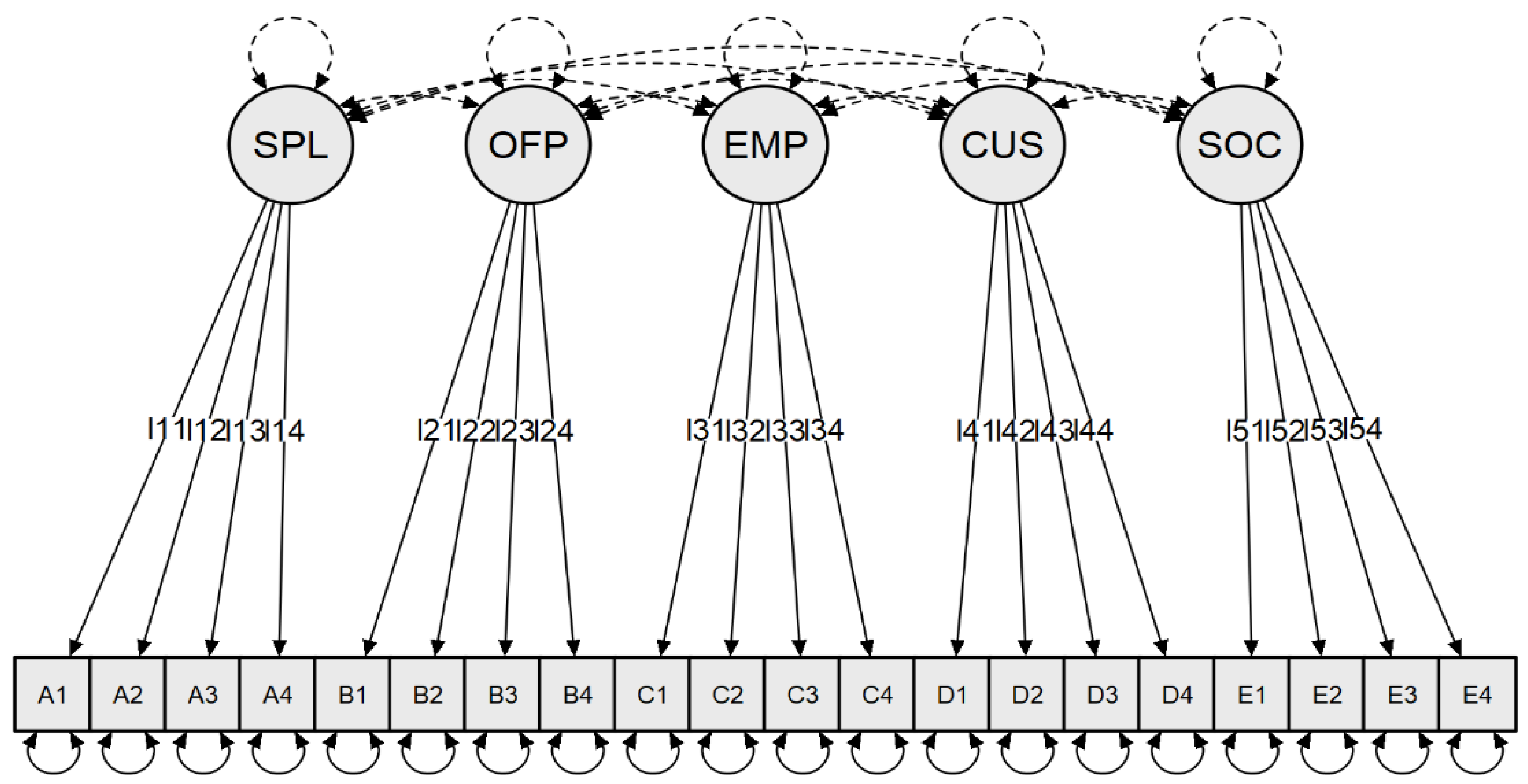

| Chi-Square Test |

|---|

| Chi-square = 1030.026 (p = 0.000) Degrees of freedom df = 170 |

| Absolute Fit Measures |

| Goodness of fit index (GFI) = 0.651 Root mean square error of approximation (RMSEA) = 0.157 90% Confidence Interval for RMSEA = (0.148; 0.166) Standardized root mean residual (SRMR) = 0.266 Normed Chi-square = 6.060 |

| Incremental Fit Measures |

| Normed fit index (NFI) = 0.774 Non-normed fit index (NNFI) = 0.780 Comparative fit index (CFI) = 0.803 Relative non-centrality fit index (RNI) = 0.803 |

| Parsimony Fit Indices |

| Parsimony normed fit index (PNFI) = 0.693 Akaike (AIC) = 8221.429 |

| Factor | Indicator | Stand. Factor Loadings | AVE | Cronbach’s α | Composite Reliability |

|---|---|---|---|---|---|

| SPLM | A1 | 0.997 * | 0.969 | 0.993 | 0.992 |

| A2 | 0.996 * | ||||

| A3 | 0.970 * | ||||

| A4 | 0.974 * | ||||

| OFPM | B1 | 0.953 * | 0.897 | 0.976 | 0.972 |

| B2 | 0.989 * | ||||

| B3 | 0.883 * | ||||

| B4 | 0.959 * | ||||

| EMPL | C1 | 0.328 * | 0.344 | 0.565 | 0.607 |

| C2 | 0.916 * | ||||

| C3 | 0.124 | ||||

| C4 | 0.644 * | ||||

| CUST | D1 | 0.519 * | 0.330 | 0.631 | 0.644 |

| D2 | 0.810 * | ||||

| D3 | 0.355 * | ||||

| D4 | 0.519 * | ||||

| SOCENV | E1 | 0.473 * | 0.288 | 0.567 | 0.579 |

| E2 | 0.814 * | ||||

| E3 | 0.232 * | ||||

| E4 | 0.461 * |

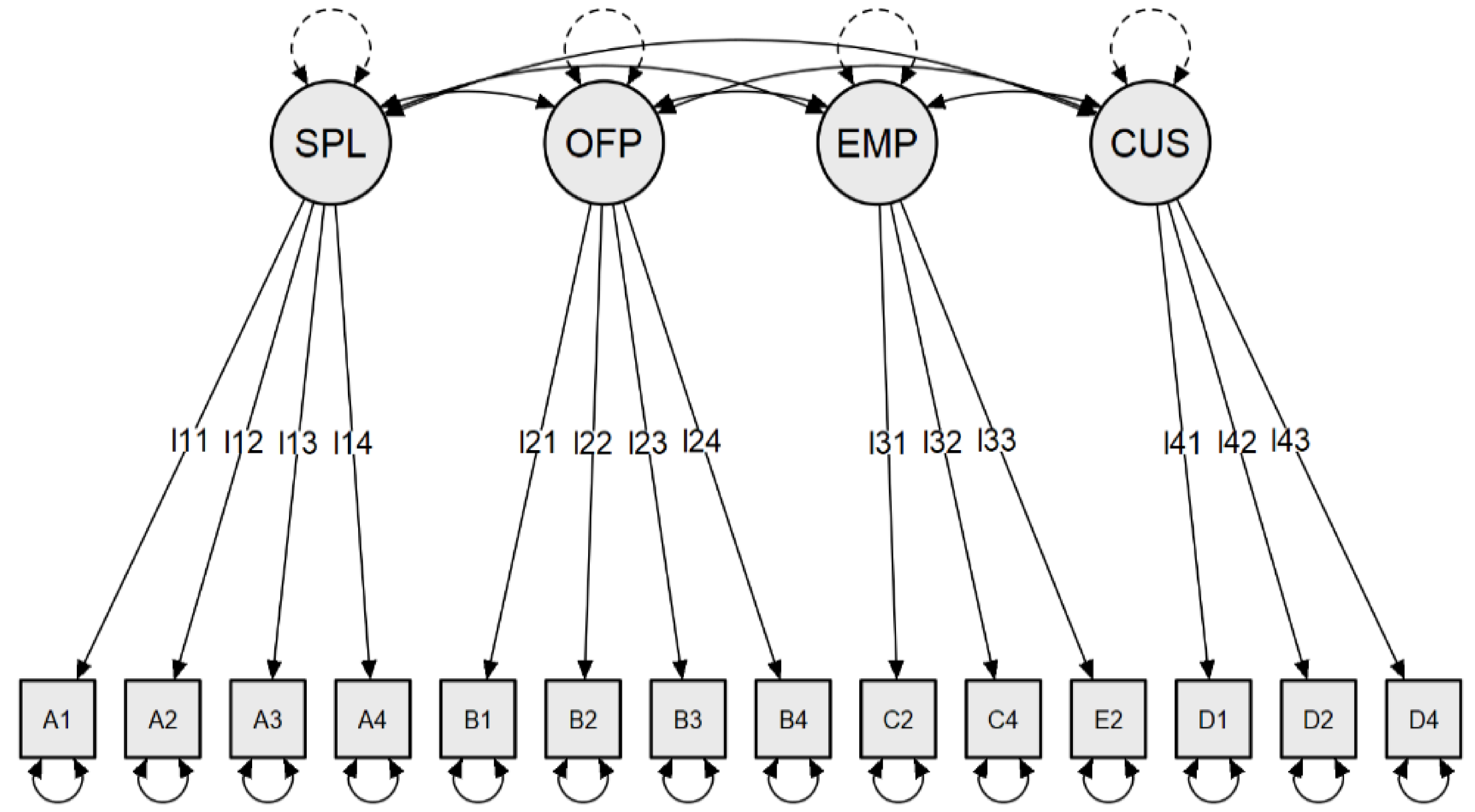

| Chi-Square Test |

|---|

| Chi-square = 129.249 (p = 0.000) Degrees of freedom df = 71 |

| Absolute Fit Measures |

| Goodness-of-fit index (GFI) = 0.943 Root mean square error of approximation (RMSEA) = 0.019 90% Confidence Interval for RMSEA = (0.005; 0.034) Standardized root mean residual (SRMR) = 0.047 Normed Chi-square = 1.820 |

| Incremental Fit Measures |

| Normed fit index (NFI) = 0.929 Non-normed fit index (NNFI) = 0.930 Comparative fit index (CFI) = 0.964 Relative non-centrality fit index (RNI) = 0.946 |

| Parsimony Fit Indices |

| Parsimony normed fit index (PNFI) = 0.725 Akaike (AIC) = 5168.071 |

| Factor | Indicator | Stand. Factor Loadings | AVE | Cronbach’s α | Composite Reliability |

|---|---|---|---|---|---|

| SPLM | A1 | 0.997 * | 0.969 | 0.993 | 0.992 |

| A2 | 0.996 * | ||||

| A3 | 0.970 * | ||||

| A4 | 0.974 * | ||||

| OFPM | B1 | 0.954 * | 0.897 | 0.976 | 0.972 |

| B2 | 0.988 * | ||||

| B3 | 0.884 * | ||||

| B4 | 0.960 * | ||||

| EMPL and SOC | C2 | 0.909 * | 0.572 | 0.793 | 0.797 |

| C4 | 0.654 * | ||||

| E2 | 0.680 * | ||||

| CUST | D1 | 0.689 * | 0.512 | 0.704 | 0.715 |

| D2 | 0.758 * | ||||

| D4 | 0.697 * |

| SPL | OFP | EMPL and SOC | CUST | |

|---|---|---|---|---|

| SPL | 0.969 | 0.165 | 0.040 | 0.149 |

| OFP | 0.406 * | 0.897 | 0.026 | 0.205 |

| EMPL&SOC | 0.201 * | 0.162 * | 0.572 | 0.271 |

| CUST | 0.386 * | 0.453 * | 0.521 * | 0.512 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ejarque, A.T.; Campos, V. Assessing the Economy for the Common Good Measurement Theory Ability to Integrate the SDGs into MSMEs. Sustainability 2020, 12, 10305. https://doi.org/10.3390/su122410305

Ejarque AT, Campos V. Assessing the Economy for the Common Good Measurement Theory Ability to Integrate the SDGs into MSMEs. Sustainability. 2020; 12(24):10305. https://doi.org/10.3390/su122410305

Chicago/Turabian StyleEjarque, Ana T., and Vanessa Campos. 2020. "Assessing the Economy for the Common Good Measurement Theory Ability to Integrate the SDGs into MSMEs" Sustainability 12, no. 24: 10305. https://doi.org/10.3390/su122410305

APA StyleEjarque, A. T., & Campos, V. (2020). Assessing the Economy for the Common Good Measurement Theory Ability to Integrate the SDGs into MSMEs. Sustainability, 12(24), 10305. https://doi.org/10.3390/su122410305