Abstract

Offering environmental, social, and governance (ESG) assessment and certification can invite organizations to adapt their activities to accommodate environmental, social, and governance concerns. Prior research points to shortcomings in accurately monitoring and assessing organizational sustainability performance. This contribution aims to highlight the role of ESG indicators as motivating organizations to prioritize sustainability goals. Theory and research elucidate that the definition of specific goals guides the degree of effort organizations invest, the priorities they set, and the persistence they display in pursuing targeted outcomes. The extent to which performance assessments of rating agencies specify and integrate ESG concerns thus impacts the likelihood that organizations will address each of these sustainability targets. The likely impact of ESG indicators was examined by consulting ratings, rankings, and indexes from 130 rating agencies included in the Reporting Exchange Platform. We identified and categorized 237 unique indicators in over 600 corporate ESG indicators. Results reveal that themes covered are less well specified in the governance domain than in the environmental and social domain. Further, different dimensions are emphasized depending on which stakeholder is addressed (investors, consumers, companies). Taken together, we conclude that this makes it more difficult for organizations to adopt a holistic approach to the achievement of sustainability goals.

1. Introduction

There is general awareness among businesses that they are responsible for their impact on society. This is also reflected in the increasing priority that companies give to contributing to the United Nations Sustainable Development Goals (SDGs) [1]. Although the SDGs provide direction on the way forward and envision a clear universal package of objectives to strive for, at the same time extra effort is needed to achieve the set objectives. Integrating environmental, social, and governance (ESG) activities into the core business often proves a bridge too far [1,2].

Whether businesses succeed at putting their intentions into action seems difficult to evaluate (e.g., [3,4,5]). The ways in which organizations contribute to achieving the SDGs is inferred from organizational activities that allegedly express their engagement in corporate social responsibility (CSR). Practical efforts to assess the true commitment of businesses to the achievement of sustainability ambitions thus focus primarily on measuring outcomes related to an organization’s engagement in CSR—using so-called ESG criteria. Scientists and practitioners have questioned the added value of these measurements, as will be elaborated below. In particular, the abundance and complexity of indicators make it difficult to unambiguously evaluate the progress businesses make [3]. This stands in the way of consistent interpretation and comparability of these indicators as well as the organizational rankings and ratings resulting from them [3,4,5,6,7].

The abundance of criteria may thus reduce rather than enhance clarity for the outside world on how businesses are doing in terms of their sustainability efforts. In fact, they offer little insight [8] into what businesses actually do, or how corporate social responsibility is implemented in the organization. This makes it difficult to judge what makes an organization’s engagement in CSR successful, or how it can be improved. Consequently, despite all the measures and indicators available, it remains unclear to what extent CSR initiatives are integrated into business strategies, what organizational priorities might impede this, or how to make progress in achieving further integration.

Yet, such insight is indispensable because the extent to which an organization incorporates CSR in its core activities explains the diverging effects an organization’s CSR engagement can have on key outcomes such as employee engagement [9,10,11,12] and customer support [13,14]. The accumulation of uncertainties about an organization’s true engagement in CSR activities can also backfire [15,16]. Without any means to reliably evaluate whether stated CSR engagement reflect organizational reality, even legitimate efforts may seem strategic attempts at ‘image laundering’, also known as greenwashing [17,18].

The purpose of this contribution is to examine the likely impact of ESG indicators on organizational sustainability goals. This can reveal whether the nature and content of the ESG indicators currently used by rating agencies encourage organizations to adopt a holistic approach in their CSR activities—or work against this. We aim to consider the objectives specified by ESG indicators as organizational performance goals, building on insights from psychology into organizational behavior, specifically goal-setting theory [19]. Below, we first review prior research that highlights the limitations of ESG indicators as diagnostic tools for investors and other external stakeholders. We then explain how we complement current insights. Based on goal-setting theory, we argue that the nature and content of ESG indicators might also impact the definition and priorities set within the organization to specify its CSR strategy. For this purpose, we identify the range of domains and elaborateness of indicators considered. We also explore whether different dimensions are highlighted depending on the target audience (investors, consumers, companies) addressed. If these ratings are unbalanced or inconsistent, this impedes the clarity of organizational sustainability goals.

1.1. Monitoring Organization’s Impact on Society

Based on the definition set by the European Commission [20], corporate social responsibility (CSR) concerns the responsibility of organizations for their impact on society. Going beyond relevant mandatory requirements and collective agreements, businesses should aim to “have in place a process to integrate social, environmental, ethical, consumer, and human rights concerns into their business operations and core strategy in close collaboration with their stakeholders” [20]. In monitoring the extent to which businesses embrace their responsibility for their impact, increasing attention is paid to map not just the economic impact of businesses, but rather their environmental and social impact and their way of doing business in terms of their governance and general business conduct.

The need to monitor an organization’s impact and capture the progress of organizations in reaching the sustainability goals has resulted in a broad range of initiatives. There are several initiatives to stimulate the integration of sustainability goals into corporate reporting. These include the SDG Compass initiated by the GRI, UN Global Impact, and WBCSD, the GRI Sustainability Reporting Standards, the International Integrated Reporting Framework, among others [21,22,23]. Likewise, disclosure standards have been initiated to ensure that organizations manage adverse impacts following law and collective agreements. Examples are the Carbon Disclosure Standards, ISO International Standards related to the SDGs; the Ten Principles of the UN Global Compact, and the Greenhouse Gas Protocol [24,25,26,27]. Finally, multiple ratings and benchmarks aim to assess and capture the performance of businesses on environmental, social, and governance (ESG) criteria. These include REFINITIV’s ESG Indices and Diversity and Inclusion Index, Dow Jones Sustainability Indices, MSCI ESG Indexes, Vigeo Eiris ESG Indices and Ranking, and Bloomberg’s Gender-Equality Index [28,29,30,31,32,33].

The shift toward a greater understanding of the social impact of organizations was clearly necessary and has encouraged organizations to attend more to such outcomes. However, the proliferation of criteria, standards, and indexes has also placed increasingly heavy demands on organizations that want to demonstrate their concern with these issues. As ESG ratings and benchmarks typically rely on information from organizations, this results in reporting fatigue among organizations [7]. The lack of convergence between indicators further contributes to disproportionate demands on the documentation and reporting of organizations about their ESG performance.

1.2. ESG Indicators as Diagnostic Tools

Prior research has addressed how different disclosure strategies relate to organizational sustainability performance [34]. This has revealed that whilst high-performing organizations are motivated to provide a clear and comprehensive disclosure, low-performing organizations tend to tailor disclosures to mask their true performance and protect their legitimacy. In demonstrating that both voluntary disclosure and legitimacy concerns may drive reports provided, this research illustrates that different organizational motives are relevant to corporate reporting. Separating the wheat from chaff remains a challenge though, as other research suggests that central CSR reporting practices are mainly used as symbolic pledges expressing non-committal support for sustainability goals [35]. More specifically, this research showed that reporting practices such as releasing stand-alone CSR reports, using reporting guidance, and assuring information disclosed were not associated with higher disclosure quality.

Accordingly, other research efforts have tried to disentangle organizational motives from a proper assessment of CSR activities. These studies have identified reporting standards that offer objective and reliable evidence of actual organizational sustainability performance, and predict organizational value (e.g., in terms of stock returns); information that is relevant for investors. Research by Khan and colleagues highlights the added value of the Sustainability Accounting Standards Board (SASB), which provides industry-specific guidance on materiality [36]. Using such standards to distinguish between material versus immaterial sustainability issues has been put forward as a viable way to understand organizations’ actual performance. As material issues are more important for safeguarding stock returns than non-material issues, the use of the SASB seems helpful especially from the viewpoint of investors. Yet, other researchers have noted that more objectively verifiable indicators following the SASB or Global Reporting Initiative (GRI) standards are only used by a small proportion of all businesses [37,38].

In this research, we complement these prior findings—which mainly assess the value of ESG indicators for investors and other external stakeholders. We take a different perspective, as we address the role of ESG indicators as externally imposed performance targets that may influence strategic priorities and goals set within organizations. We argue that the degree to which the indicators used specify ESG outcomes is not only relevant for external parties to assess progress made in achieving ESG goals. Based on organizational goal-setting theory, we posit that this also influences the clarity versus ambiguity of these outcomes as desired performance goals for organizations—and the likelihood that such goals are prioritized by organizational decision-makers.

2. Theoretical Background

2.1. Goal-Setting Theory

Goal-setting theory is an elaborate theory on human motivation and achievement (e.g., [19]). This theory specifies the impact of what is being pursued (i.e., goal orientation) as well as why this is being pursued (i.e., behavioral regulation) on the priorities people set and the efforts they invest in achieving set goals. The theory—and 35 years of research supporting it—highlights that goals serve multiple functions. First, goals have a selective function as they direct people’s attention towards activities relevant to pursuing it at the expense of alternative options. Second, goals have an energizing function, as they regulate effort and promote that enough energy is put into reaching set goals. Third, goals motivate people to persist on a task over time and to overcome difficulties in achieving progress [39]. Further, a meta-analysis of multiple studies revealed that more abstract and vague goals have less impact on everyday behavioral choices that determine group performance than more specific goals [40]. Presumably, this is the case because abstract goals make it less clear which activities contribute to the achievement of these goals, how progress can be monitored, or when further persistence is needed [39].

The set of ESG ratings and benchmarks currently available not only provide a standard by which the performance of businesses can be monitored and compared by external stakeholders. They can also define a set of goals within the organization that guide the priorities businesses set and the actions they should take to achieve these goals. As ESG indicators inform businesses on the outcomes that are considered important and specify what is expected from them by external stakeholders, they can provide businesses with tools and inspiration highlighting specific topics and targets to focus on. This way, they shape the goals of businesses in providing a direction towards the activities they invest in and focus their attention on [41]. Thus, the nature and content of ESG ratings and benchmarks have the potential to serve as a compass, showing businesses not only where they stand, but also where they are expected to be heading and what they should not let out of sight. However, if different stakeholders have conflicting interests, this can pull organizations in different directions making goal achievement less feasible.

In sum, based on theory and research on goal setting and motivation in organizations, we argue that the indicators that are assessed by ESG rating agencies—including the way these objectives are defined and specified—have implications for which CSR activities organizations attend to and prioritize. Prior studies offer preliminary support for the validity of our reasoning. For instance, companies that reported on specific goals they had set for minority and female leadership were found to outperform other companies in increasing minority and female representation among their leaders [42]. Further, in companies that specified the goal of supporting people with different sexual orientations, employees behaved more positively towards their gay and lesbian colleagues. In fact, specifying these goals that prompted employees to display such behaviors also resulted in more positive attitudes towards gay and lesbian individuals [43]. While this evidence was collected in the social domain, it does illustrate how the definition of specific performance goals may support organizations and the people in them to prioritize and work towards the achievement of these goals.

2.2. What Are Drawbacks of ESG Indicators?

Assessing how well CSR activities are embedded in the business structure and processes can help to understand an organization’s actual involvement in CSR [44]. This allows to differentiate between organizations that are truly involved with embedding SDGs into their core strategy, daily practices, and routines versus organizations that treat CSR in isolation, separate from their core business operations [44]. Consequently, ESG rating agencies should aim to examine whether CSR activities are addressed in isolation (separate from the other business activities) or whether these activities are integrated holistically, as part of a greater whole. Research into CSR embeddedness, calls into question whether this can be derived from corporate reporting [45]. By examining the differences between strategic (i.e., what organizations say) and operational (i.e., what organizations do) levels of corporate responsibility, they found clear differences in levels of engagement—despite similar accounts in corporate reports. Whereas the reporting on the CSR initiatives of a notoriously known sustainable organization implied innovative and integrated CSR engagement, on the operational level it was far less embedded and more elementary.

As ESG rating agencies rely heavily on the information made available by organizations [46], it is important to consider whether corporate reporting reflects the actual performance of organizations. Cho and colleagues have shown, for instance, that the Dow Jones Sustainability Index (DJSI) is much more susceptible to what organizations say (i.e., their voluntary environmental disclosure) than to what they do (i.e., their environmental performance) [8]. They demonstrated that the more extensive the environmental disclosure they provide, the more likely an organization is to be included in the DJSI and the more favorable their environmental reputation scores are. However, at the same time, they found that organizations that voluntarily disclose more environmental information, perform worse, as captured by Trucost, an organization specialized in quantifying environmental performance [8]. Thus, organizations appear to be praised for something they do not actually do. Other research by Cho and colleagues offers additional evidence for this conclusion [47]. This research revealed that the visible and voluntary environmental disclosure of U.S. oil and gas industry organizations stood in sharp contrast to their less visible but related and proactive political activities. In addition, the resulting ESG ratings and benchmarks can be subject to bias. A study of six major rating agencies (KLD, Sustainalytics, Moodys, RobecoSAM, MSCI, REFINITIV) demonstrated such bias as some agencies offer more positive assessment on all underlying ESG categories [5].

Additional problems that have been noted include a lack of standardization, credibility, transparency, and independence of these ratings [3]. Some have argued that ESG rating agencies should consider the discrepancy between corporate reporting and actual practices or should compensate for this promise–performance gap [48]. While different factors have been identified as causing such problems and different solutions have been proposed, reflections on why this is problematic have mainly addressed the perspective of external stakeholders (for an exception, see [49,50]). Given the questions raised about the accuracy of ESG ratings as actual performance indicators, it is worthwhile to consider them from the perspective of the organization and how these impact goal setting in organizations. Therefore, we examine ESG indicators as motivational targets that can encourage organizations to invest in the achievement of sustainability goals.

2.3. How Complete and Balanced Are ESG Indicators?

Going beyond the accuracy of ESG reporting and whether the provided information is true introduces another concern. If ESG indicators are considered as organizational goals that direct the investment of efforts and resources, it is important to assess how complete and balanced ESG indicators are. It can be a challenge to develop a set of indicators that can capture the entire range of sustainability efforts balancing environmental, social, and governance concerns in their assessment.

A systematic comparison of the assessment criteria used by several representative ESG rating agencies revealed that not all rating agencies assess the ESG dimensions in a balanced way [6]. In fact, some of the prominent rating agencies (among which REFINITIV, RobecoSAM, and Sustainalytics) assign different weights to these indicators to obtain an overall score. This indicates that these agencies do not consider the different environmental, social, and governance criteria to be equally important—however, it is not self-evident that there is consensus about the weights assigned. In addition, as these agencies are not being transparent about how these weights are defined, it is exceedingly difficult if not impossible to properly compare the resulting ESG ratings [6]. In fact, an examination of 709 indicators used by six major rating agencies to cover 65 categories revealed that these are difficult to compare due to fundamental differences in what they measure and how they assess this [5].

This limitation further complicates the use of such indicators as motivational goals to achieve. Another study comes to similar conclusions [51]. Although there are sustainable reporting guidelines that cover multiple dimensions (e.g., the GRI guidelines), these do not recognize potential integration and synergies, positive or negative, across the dimensions. From a goal-setting perspective, this lack of clarity about what requires attention to be able to improve, and lack of insight into important outcomes to achieve is problematic.

In sum, the abundance of ESG ratings and benchmarks contributes to businesses losing sight of what is important. There is only limited transparency on how these indicators come into being and how CSR dimensions are weighed in the assessment [6]. This offers quite some leeway in how the performance of businesses is being measured and introduces lack of clarity on how organizations can show their commitment to working towards sustainability goals. Add to this the variety of subjects that can exist in the separate ESG dimensions aggregated under the umbrella of corporate social responsibility, and the question arises whether and how the ESG ratings and benchmarks really contribute to focusing and prioritizing an organization’s engagement in CSR.

We will complement the existing research on CSR reporting by analyzing the nature and focus of ESG ratings and benchmarks. Our research questions examine the balance and consistency of indicators used as externally imposed organizational performance targets. We address the following issues: First, we examine whether indicators address environmental, social as well as governance aspects of organizational performance. Second, we compare the abstractness versus concreteness of these three types of indicators and the underlying themes they represent. Third, we explore whether the issues and indicators that are highlighted offer a unified view of which goals are important or depend on the stakeholder group targeted by the ESG indicators.

3. Materials and Methods

The primary data source for the present study was an online database on ESG ratings, rankings, and indexes that we accessed via the Reporting Exchange platform. Initiated by the World Business Council for Sustainable Development (WBCSD) the Reporting Exchange was developed as a collaborative platform to help businesses and academics understand the reporting landscape. Their open database on ESG ratings, rankings, and indexes contains descriptive profiles of over 600 corporate ESG indicators from 130 rating agencies worldwide. It provides insight into the different strategies and tools rating agencies, such as FTSE Russell, Great Place to Work Institute, MSCI, RobecoSAM, and Sustainalytics have for evaluating a company’s ESG performance. The clustering of ESG indicators into rating, rankings, and indexes corresponds with previous research [3,46]. Detailed information on the Ratings, Rankings, and Indexes database can be found on The Reporting Exchange website under the following link: https://www.reportingexchange.com/.

In consulting the database, not only information on the type of indicator (i.e., rating, ranking, or index) could be retrieved, but also information on which dimensions (environmental, social, and/or governance) are assessed, what underlying themes are considered within these domains, and what the main target group (i.e., investors, consumers, or companies) of the different indicators is. The Reporting Exchange platform was consulted for this purpose throughout the summer of 2020. We first removed overlapping entries. Criteria for overlap were the use of the same indicator in a different country context and indicators with identical assessment criteria originating from the same rating agency (e.g., part of the same index family). This procedure allowed us to identify 237 unique ESG indicators in this database that were retained for further analysis. To examine how elaborate the diverse range of ESG ratings, rankings, and indexes are, we created an overview of the domains that are addressed by ESG indicators, investigated what kind of themes are covered within these different domains, and which target audience is generally considered. Frequently occurring themes per dimension were explored and visualized in NVivo.

4. Results

4.1. Consideration of the Different Domains

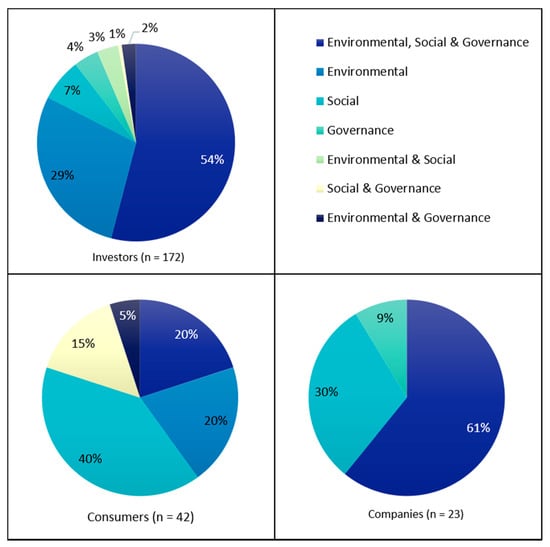

Some of the ESG ratings, rankings, and indexes are based on a particular environmental, social, or governance concern, such as energy management, human rights, or board structures, while others reflect a combination of multiple ESG concerns. An example of specific ratings is the ranking Best Companies to Work For by the Great Place to Work Institute, which exclusively focuses on the social domain by assessing employee’s view of a great workplace. In a similar vein, BBGI Group’s Clean Energy 100 benchmark index only offers investors insight into companies specialized in alternative energy. Examples of broader indexes are the Dow Jones Sustainability Indices by RobecoSAM and FTSE Russell’s ESG Ratings that capture overall organizational performance on environmental, social as well as governance concerns.

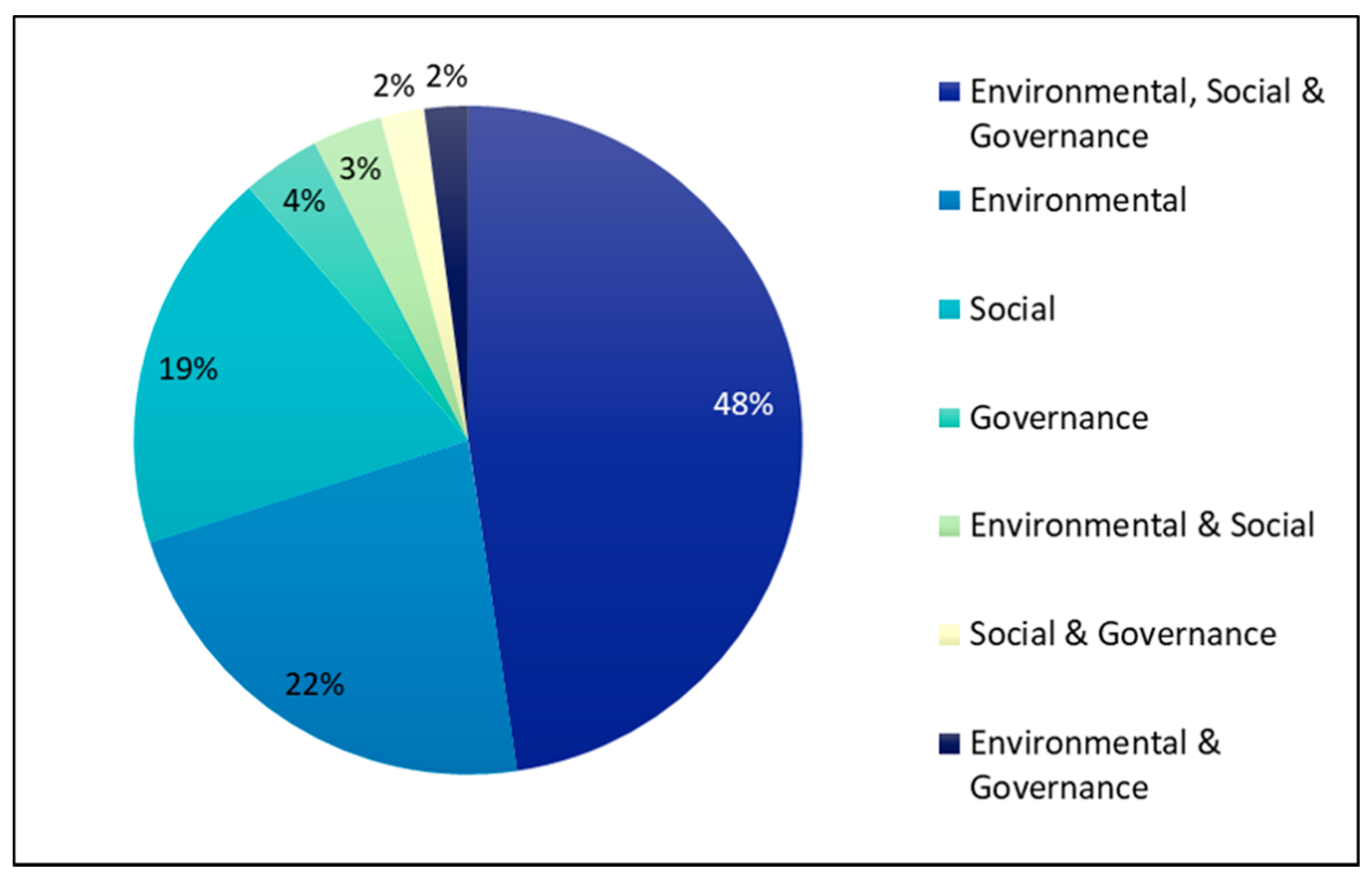

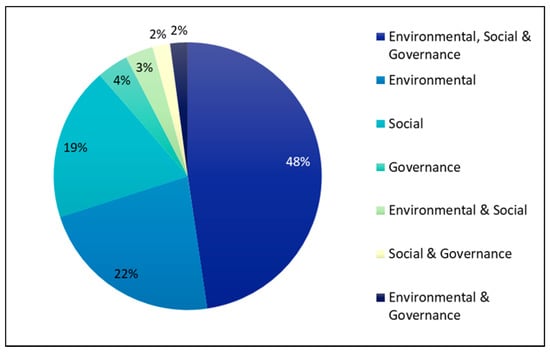

About half of the indicators (48%) consider all three dimensions conjointly, as these include environmental, social, and governance criteria (e.g., the Dow Jones Sustainability Index, Corporate Knights’ Best Corporate Citizen Ranking, and Sustainalytics Company ESG Reports). A few ratings (7%) combine two types of indicators. The remaining assessments focus exclusively on one of the dimensions. The first thing to notice here is that most of the agencies that focus on a specific indicator, pay attention to the environmental performance of businesses (22%, for instance, Bloomberg’s Clean Energy Indices and CDP’s Climate Performance Score Ranking); see Figure 1. Next, specific indicators attend to the social performance of businesses (19%), for instance, the prominent Best Companies to Work For Ranking by the Great Place to Work Institute. The least frequent are assessments specifically addressing the governance domain (4%). There are just a few examples of indicators that focus exclusively on how businesses are governed (e.g., the Transparency in Corporate Reporting Ranking by Transparency International and Institutional Shareholder Services’ QuickScore Rating). Thus, our first conclusion is that not all aspects of corporate social responsibility receive an equal amount of attention, with governance being addressed least frequently.

Figure 1.

Overview of which domains (environmental, social, governance) are covered by the environmental, social, and governance (ESG) indicators.

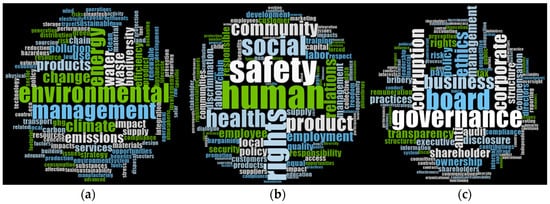

4.2. Recurring Themes within the ESG Domains

In managing their environmental impact, businesses are assessed on the overall life cycle and sustainability of their products and services; the efficient use and protection of (natural) resources; and the prevention and control of pollution and emissions (including climate change and GHG emissions). The evaluation of social responsibilities of businesses comprises employee working conditions (e.g., health and safety) and human capital development (e.g., training and education); labor rights, non-discrimination, and equal opportunity; human rights, community involvement, and philanthropy; and customer responsibility, product quality, and safety. Corporate governance is indicated by considering business conduct, business ethics, and governance structures; shareholders’ rights, board structure, and remuneration; the prevention of controversial practices, bribery, and corruption; and audit, disclosure, and transparency in reporting. For a graphical representation of the underlying themes found within each of these three domains and the relative frequencies of their mention, see Figure 2.

Figure 2.

Graphical representation of the underlying themes within: (a) the environmental domain; (b) the social domain; (c) the governance domain.

Comparing these three domains reveals that environmental concerns are most specific. Even if different methods may be used to calculate them, these can be compared most unambiguously between businesses and over time (e.g., percentage GHG emissions). In comparison, the social domain partially consists of specific concerns (e.g., accident numbers, absenteeism), and partially captures more abstract notions such as degree of community involvement. Finally, the governance concerns seem least specific. There appears no common currency to measure business ethics, or an agreed-upon metric to assess efforts made to prevent controversial practices.

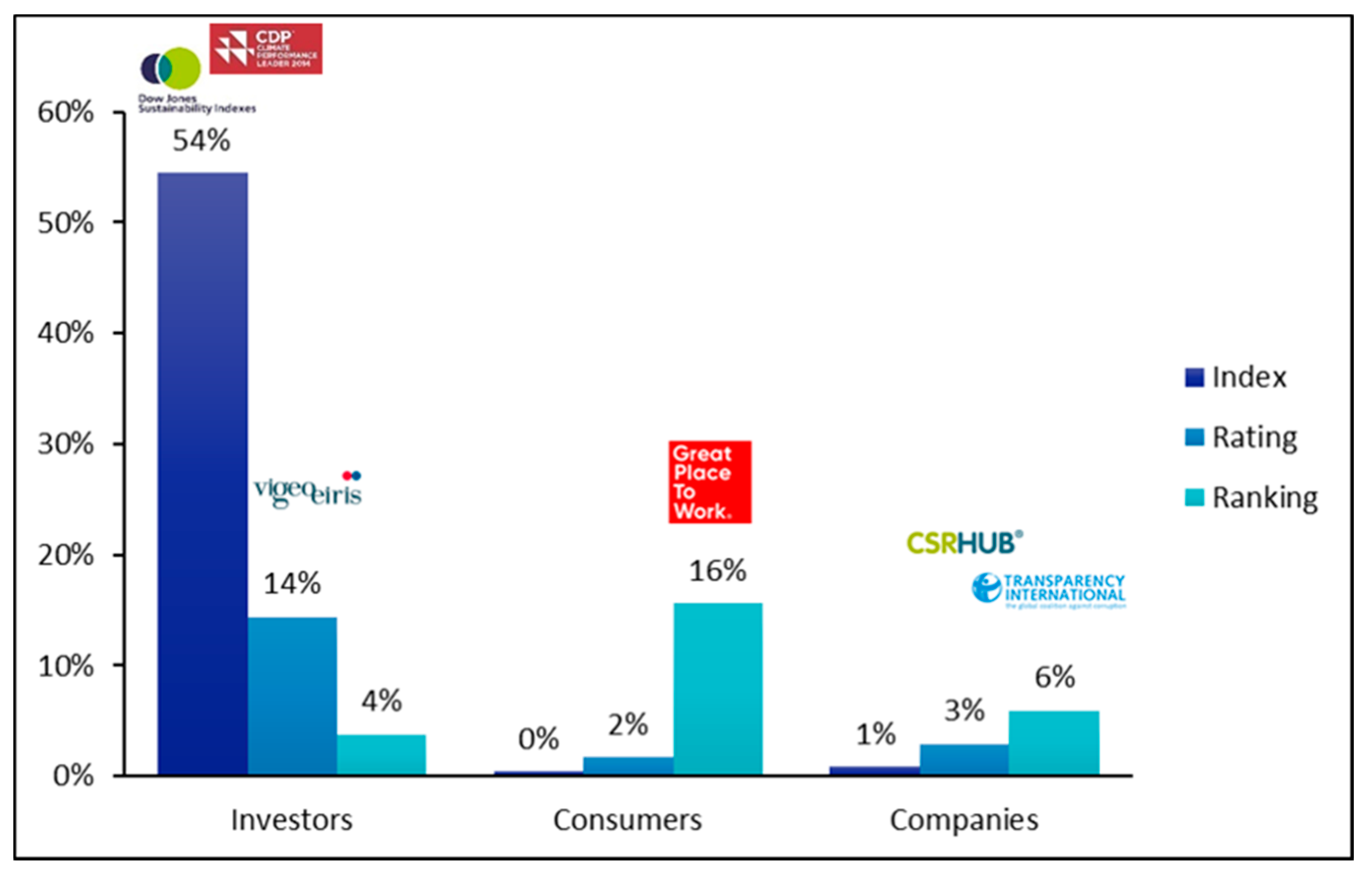

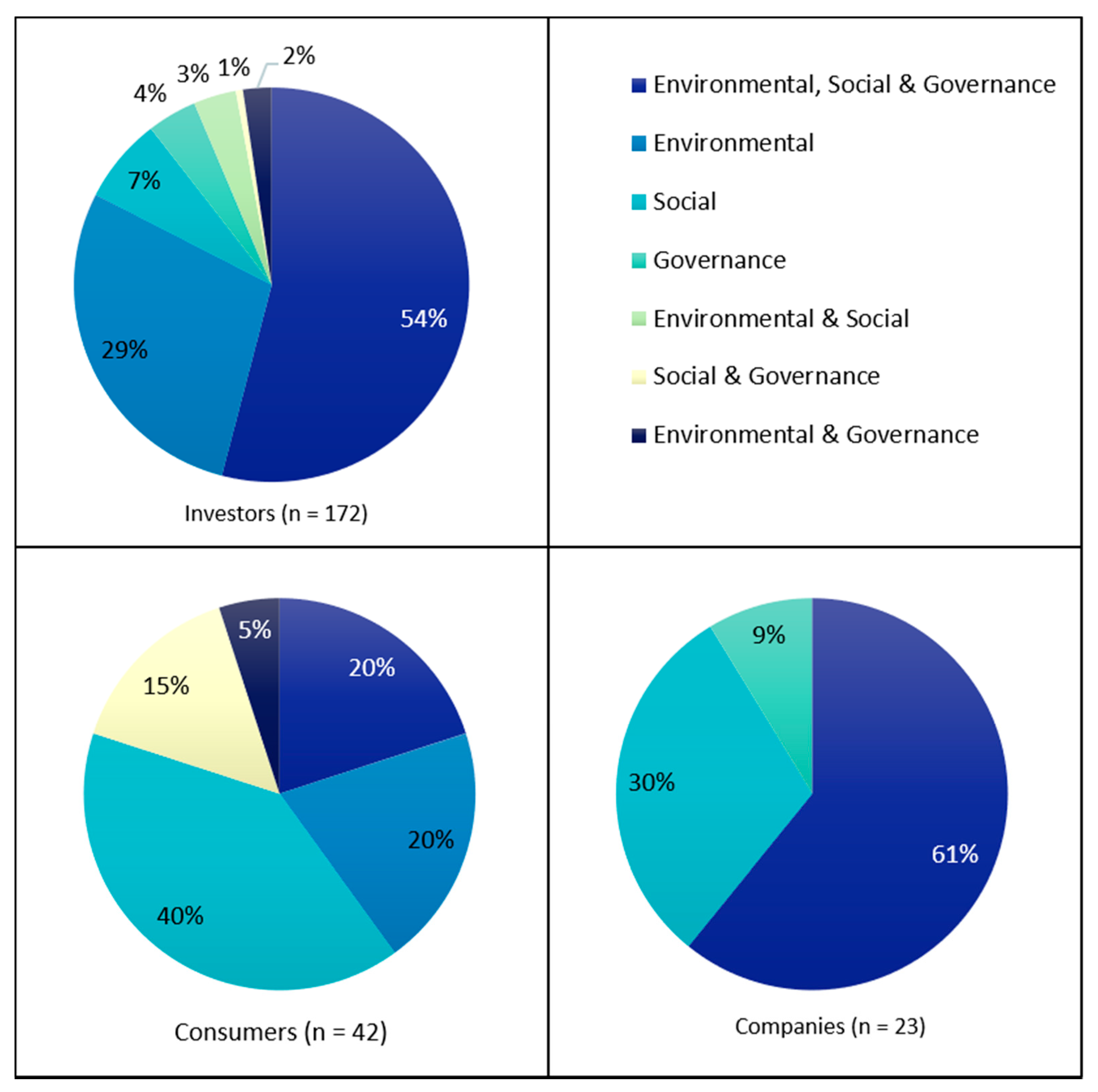

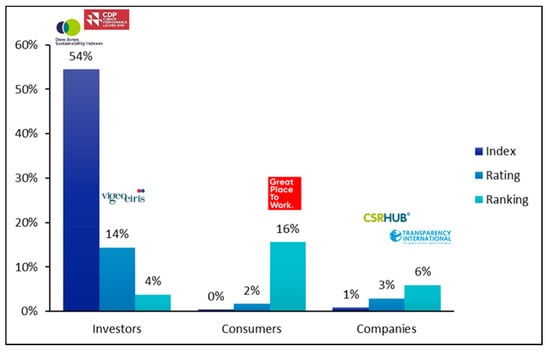

4.3. Consideration of the Different Stakeholders

Most rating agencies (72%) address investors as their main target audience. Consumers (18%) and companies (10%) are addressed less often (Figure 3). In the current landscape of ESG ratings and benchmarks, our prior analysis (Figure 1) revealed that not all dimensions receive the same amount of attention. Further, this seems to be driven by which target group the ESG ratings and benchmarks provide information to. In the majority of cases, where the primary target audience comprises investors, the predominant focus on the environmental dimension (29%) stands out the most (Figure 4). By contrast, the indicators that target companies never focus on environmental concerns alone. When comparing this to the ESG indicators that primarily inform consumers, a different picture emerges. Here, much more emphasis is placed on the social dimension (60%).

Figure 3.

Overview of which target audience (investors, consumers, companies) is considered by rating agencies broken down by indicator type (index, rating, ranking).

Figure 4.

Overview of which domains (environmental, social, governance) is covered by the ESG indicators broken down by target audience type (investors, consumers, companies).

Apparently, rating agencies assume that companies are not specifically interested in the environmental performance of others they do business with. However, this limits opportunities to make supply chain choices favoring companies that prioritize attending to their environmental responsibilities. Likewise, the underlying assumption seems to be that consumers have a particular interest in knowing about the social responsibilities of different companies. This limits opportunities to make consumer choices contingent on the environmental behavior or the governance of different companies.

5. Discussion

This paper covers a comparative descriptive analysis of public information on environmental, social, and governance (ESG) rating criteria to examine the nature and focus of ESG ratings and benchmarks. First, our analysis reveals that not all aspects of corporate social responsibility receive an equal amount of attention from rating agencies. Second, the underlying themes within each dimension varies considerably ranging from concrete (environment) to more abstract concerns (governance). Third, the consideration of specific assessments depends on the target audience that is addressed. Together these findings do not indicate a balance of different types of concerns, which limits the influence of rating agencies in fostering the achievement of the sustainable development goals (SDGs).

We found that half of the indicators assess a combination of environmental, social, and governance criteria. As each of the ESG dimensions in themselves already covers a diverse range of concerns, what does this mean for goal setting? It is particularly challenging to conclude how to improve the organization from a single judgment combining such dissimilar dimensions. This is especially problematic considering that ESG rating agencies are not sufficiently transparent about how ESG assessments come into being and which environmental, social, or governance concerns weigh more heavily in establishing a final rating [6]. By not revealing the aspects that receive specific attention, what ESG ratings specifically stand for, and what it means (not) to meet the criteria that are assessed, businesses are kept in the dark about what needs to be done.

Closer examination of the ESG ratings and benchmarks that focus exclusively on environmental, social, or governance concerns in their assessment, highlight that less attention is devoted to corporate governance. This is in line with prior research, revealing that governance ratings showed a modest correlation with overall ratings (0.30), while this relation was more visible for environmental (0.53) and social (0.42) ratings [5]. Although there is less emphasis on governance issues, this does not imply that these are less important. The discrepancy between stated and achieved sustainability goals addressed in the introduction, not only raises questions about the accuracy of corporate ratings provided. It also highlights that the effectiveness of efforts in the environmental or social domain crucially depends on whether the quality of the governance makes it likely that such initiatives are genuine and systematically followed through. For instance, in an organization known for corruption and bribery, corporate information about environmental and social achievements should be treated with more suspicion. If such information on governance is lacking, the value of ratings addressing the environmental or social performance of the organization is much less clear. Indeed, prior research has pointed to the importance of considering internal governance mechanisms on organizational CSR engagement [51,52,53,54,55,56].

Unfortunately, of the three dimensions, the concerns addressed in the governance domain also appear the most abstract and vague. As noted in the introduction this reduces the likelihood that governance goals impact everyday behavioral choices, because it is not clear which activities contribute to the achievement of these goals or how progress can be monitored. The ambition of rating agencies in striving for accuracy of their judgments implies that the criteria being evaluated need to be specific. However, at the psychological level, the adverse effect may be that this implicitly prioritizes outcomes that can be measured unambiguously over more abstract and subjective outcomes. The difficulty to objectify and get a grip on governance structures and internal operations might explain why there is less specific attention to governance concerns in the ratings provided. The unfortunate implication of this is that businesses are not stimulated to think about internal procedures and practices in terms of their business conduct, business ethics, and governance structures. Although high-quality governance would contribute to the likelihood that CSR activities are integrated into strategic decisions as well as day-to-day business structure and processes, the risk of current rating practices is that most attention goes to the activities that can be measured most easily.

Most rating agencies consider investors as their primary target audience. Although this is not altogether surprising, it is worth noting that the nature of the target that rating agencies have in mind appears to shape what is being measured. Supporting previous observations [3], this communicates implicit assumptions about the interest of different target audiences in specific indicators. It also influences which priorities are highlighted by businesses addressing these audiences. Clearly investors—putting up the funds needed for businesses to operate—are considered as a key target group. However, an unintended side effect is that businesses are invited to assign priority to activities that figure prominently in the information provided to investors. This raises the question how the composition of such ratings may direct organizational change towards more sustainable business practices. This observation makes it even more pressing to ensure that the information provided to investors by rating agencies accurately reflects the range of activities businesses can undertake to contribute to achieving the SDGs. The current investigation suggests that there is a lack of balance in the extent to which different dimensions are highlighted as relevant performance goals.

5.1. Theoretical and Practical Implications

An underlying problem with the increasingly complex landscape of ESG ratings and benchmarks is that they can shift the locus of control from internal to external. Let us revisit the definition of corporate social responsibility, which implies that businesses should integrate ESG concerns into their business operations and core strategy [20]. Research on behavioral regulation and motivation views integrated actions as fully internalized behaviors that have become a central part of one’s identity [57,58]. A supportive context that facilitates internalization consists of a meaningful rationale to engage in the behaviors (why is it important?), acknowledgment of potential conflicting pressures and tensions (why is it difficult?), and minimizing pressure and conveying choice (promoting ownership and control) [59]. How does this apply to the role that is reserved for ESG rating agencies? Although the proliferation of ESG ratings and benchmarks may have encouraged organizations to pay more attention to CSR issues, they can have unintended consequences on experience of control. Additionally, the broad range of issues to attend to makes it tempting to prioritize outcomes that seem most important for final ratings (e.g., environment) while being less preoccupied with desired outcomes that are emphasized less by rating agencies (e.g., governance). In striving for high ratings, organizations are prompted to do what is needed to ‘tick the boxes.’ Instead of considering the sustainability goals they want to achieve, rating agencies can thus drive organizations to comply with whatever is being measured. Whereas internally endorsed and emergent goals are associated with task orientation and focus on growth and contribution, externally imposed goals trigger a focus on the achievement of specific outcomes, regardless of the way this is achieved [58]. Given the strong emphasis on assessing how organizations are performing on certain ESG criteria, the resulting ESG indicators can become a dominant driver for an organization’s course of action, as an external source of motivation. The strong brand recognition of some of these ratings and benchmarks further steers organizations away from considering how they can make the biggest difference as they are tempted to narrowly focus on the criteria that can earn them external approval. This way, the focus on ESG ratings and benchmarks promotes controlled instead of autonomous motivation for engaging in CSR. This type of extrinsic reinforcement undermines intrinsic motivation [60,61] and can encourage businesses to implement decoupled organizational programs as opposed to integrated forms of responsible behavior [62].

The pressure on organizations to disclose their actual efforts and to accurately assess their true performance also has the drawback that this easily elicits a defensive response where organizations are motivated to document what they do well. Research on CSR disclosure already points in this direction as organizations tend to report only about their positive CSR practices and not about the potential negative impact [63]. Supporting organizations to complete their transformation and to confront remaining challenges requires a different approach where rating agencies help organizations identify specific areas for further improvement without punishing them for lack of progress. Here, rating agencies could also think of recognizing the potential conflict of interests between different stakeholders. Such a different approach would also pre-empt legitimacy concerns and invite organizations to engage in more spontaneous disclosure. When employees perceive that their organization strives for a positive impact out of a strong sense of purpose, this positively affects employees’ psychological well-being [64] and work engagement [65]. Conversely, when the motivation of an organization to engage in CSR is perceived to be externally regulated, this can have downstream effects on employee motivation and engagement [66,67,68,69].

5.2. Future Research Directions

Despite considerable effort to develop ESG indicators, it remains difficult to assess whether organizations truly integrate social, environmental, and governance concerns into their business strategy and operations. Numerous studies have illustrated that corporate reporting on CSR can be at odds with an organization’s actual strategies and practices [8,45,47,70,71]. Hence, our investigation shifted the question to whether and how standards developed to assess organizational performance can function as motivational goals that guide the organization’s sustainability efforts. Future research might further examine the extent to which strategic decisions in organizations aim to accommodate external ratings rather than expressing organizational sustainability goals. For instance, sustainability officers may be surveyed about the range of sustainability initiatives their organization is involved in and indicate which of these initiatives is also captured by external ratings. Further, they may report which stakeholder group they aim to target with these initiatives. This is an avenue of research we are currently pursuing.

In hindsight, the reporting–performance discrepancy might be explained by assuming that in these cases CSR is not fully embedded in the organization. However, this is usually not self-evident. Research showed that times of crisis can reveal an organization’s true nature [72]. During the global financial crisis, in many companies, CSR commitment, especially concerning social and governance issues, was found not to hold. Although times of crisis may highlight priorities and hence provide valuable insights, there should also be other ways of assessing whether CSR is fully embedded into corporate strategy. Without consistency between policies and actions, all that remains is “window dressing” that has negligible impact on employees’ attitudes and behaviors—and is unlikely to persist [15,17,73]. If this is the case, corporate reporting is not very informative and might primarily offer a cloak of invisibility hiding practices that are socially irresponsible. Prior research has demonstrated that such a disguise can cover up unethical behaviors and can systematically mislead the public [74,75,76].

6. Conclusions

ESG rating agencies play an increasingly influential role in steering businesses forward to a sustainable future. By assessing the nature and focus of ESG ratings and benchmarks we highlighted that in their current state these ratings do not encourage organizations to adopt a holistic approach to the achievement of sustainability goals. To fulfill their promise to serve as a compass, ESG rating agencies must provide businesses a better understanding of where they stand, but also where they are expected to be heading and what they should not let out of sight.

Author Contributions

Conceptualization, E.M.V. and N.E.; methodology, E.M.V.; validation, E.M.V.; investigation, E.M.V.; data curation, E.M.V.; writing—original draft preparation, E.M.V.; writing—review and editing, N.E.; visualization, E.M.V.; supervision, N.E. All authors have read and agreed to the published version of the manuscript.

Funding

This study is part of the research program Sustainable Cooperation—Roadmaps to Resilient Societies (SCOOP). The authors are grateful to the Netherlands Organization for Scientific Research (NWO) and the Dutch Ministry of Education, Culture, and Science (OCW) for generously funding this research in the context of its 2017 Gravitation Program (grant number 024.003.025).

Acknowledgments

We thank the anonymous reviewers for the helpful comments on the previous draft of this paper and Isabella Klaassens for her assistance with the literature review.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- PricewaterhouseCoopers. Available online: https://www.pwc.com/gx/en/services/sustainability/sustainable-development-goals/sdg-challenge-2019.html (accessed on 15 October 2020).

- EY. Why Sustainable Development Goals Should Be in Your Business Plan. Available online: https://www.ey.com/en_gl/assurance/why-sustainable-development-goals-should-be-in-your-business-plan (accessed on 11 November 2020).

- Windolph, S.E. Assessing corporate sustainability through ratings: Challenges and their causes. J. Environ. Sustain. 2011, 1, 37–57. [Google Scholar] [CrossRef]

- Chatterji, A.K.; Durand, R.; Levine, D.I.; Touboul, S. Do ratings of firms converge? Implications for managers, investors and strategy researchers. Strat. Manag. J. 2016, 37, 1597–1614. [Google Scholar] [CrossRef]

- Berg, F.; Kölbel, J.F.; Rigobon, R. Aggregate Confusion: The Divergence of ESG Ratings. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Fernández-Izquierdo, M.Á.; Ferrero-Ferrero, I.; Rivera-Lirio, J.M.; Muñoz-Torres, M.J. Rating the raters: Evaluating how ESG rating agencies integrate sustainability principles. Sustainability 2019, 11, 915. [Google Scholar] [CrossRef]

- Mooij, S. The ESG rating and ranking industry; Vice or virtue in the adoption of responsible investment? J. Environ. Investig. 2017, 8, 331–367. [Google Scholar] [CrossRef]

- Cho, C.H.; Guidry, R.P.; Hageman, A.M.; Patten, D.M. Do actions speak louder than words? An empirical investigation of corporate environmental reputation. Account. Organ. Soc. 2012, 37, 14–25. [Google Scholar] [CrossRef]

- Glavas, A. Corporate social responsibility and employee engagement: Enabling employees to employ more of their whole selves at work. Front. Psychol. 2016, 7, 796. [Google Scholar] [CrossRef] [PubMed]

- Glavas, A.; Godwin, L.N. Is the perception of ‘goodness’ good enough? Exploring the relationship between perceived corporate social responsibility and employee organizational identification. J. Bus. Ethics 2013, 114, 15–27. [Google Scholar] [CrossRef]

- Glavas, A.; Kelley, K. The effects of perceived corporate social responsibility on employee attitudes. Bus. Ethics Q. 2014, 24, 165–202. [Google Scholar] [CrossRef]

- Scheidler, S.; Edinger-Schons, L.M.; Spanjol, J.; Wieseke, J. Scrooge posing as Mother Teresa: How hypocritical social responsibility strategies hurt employees and firms. J. Bus. Ethics 2019, 157, 339–358. [Google Scholar] [CrossRef]

- Becker-Olsen, K.L.; Cudmore, B.A.; Hill, R.P. The impact of perceived corporate social responsibility on consumer behavior. J. Bus. Res. 2006, 59, 46–53. [Google Scholar] [CrossRef]

- Ellen, P.S.; Webb, D.J.; Mohr, L.A. Building corporate associations: Consumer attributions for corporate socially responsible programs. J. Acad. Mark. Sci. 2006, 34, 147–157. [Google Scholar] [CrossRef]

- Ellemers, N.; Kingma, L.; van de Burgt, J.; Barreto, M. Corporate social responsibility as a source of organizational morality, employee commitment and satisfaction. J. Organ. Moral Psychol. 2011, 1, 97–124. [Google Scholar]

- van Marrewijk, M. Concepts and definitions of CSR and corporate sustainability: Between agency and communion. J. Bus. Ethics 2003, 44, 95–105. [Google Scholar] [CrossRef]

- Chopova, T.V. Doing Good in Business: Examining the Importance of Morality in Business Contexts. Ph.D. Thesis, Utrecht University, Utrecht, The Netherlands, 11 November 2020. [Google Scholar]

- Laufer, W.S. Social accountability and corporate greenwashing. J. Bus. Ethics 2003, 43, 253–261. [Google Scholar] [CrossRef]

- Latham, G.P.; Locke, E.A. Self-regulation through goal setting. Organ. Behav. Hum. Decis. Process. 1991, 50, 212–247. [Google Scholar] [CrossRef]

- European Commission. Available online: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:52011DC0681 (accessed on 15 October 2020).

- SDG Compass. Available online: https://sdgcompass.org/ (accessed on 15 October 2020).

- Global Reporting. Available online: https://www.globalreporting.org/standards (accessed on 15 October 2020).

- Integrated Reporting. Available online: https://integratedreporting.org/resource/international-ir-framework/ (accessed on 15 October 2020).

- Carbon Disclosure Project. Available online: https://www.cdp.net/en (accessed on 15 October 2020).

- International Organization for Standardization. Available online: https://www.iso.org/publication/PUB100429.html (accessed on 15 October 2020).

- United Nations. Available online: https://www.unglobalcompact.org/what-is-gc/mission/principles (accessed on 15 October 2020).

- Greenhouse Gas Protocol. Available online: https://ghgprotocol.org/ (accessed on 15 October 2020).

- Refinitiv. Available online: https://www.refinitiv.com/en/financial-data/indices/esg-index (accessed on 15 October 2020).

- Refinitiv. Available online: https://www.refinitiv.com/en/financial-data/indices/diversity-and-inclusion-index (accessed on 15 October 2020).

- S&P Global. Available online: https://www.spglobal.com/esg/csa/indices/ (accessed on 15 October 2020).

- MSCI. Available online: https://www.msci.com/esg-indexes (accessed on 15 October 2020).

- Vigeo Eiris. Available online: https://vigeo-eiris.com/solutions-for-investors/esg-indices-ranking/ (accessed on 15 October 2020).

- Bloomberg. Available online: https://www.bloomberg.com/gei (accessed on 15 October 2020).

- Hummel, K.; Schlick, C. The relationship between sustainability performance and sustainability disclosure—Reconciling voluntary disclosure theory and legitimacy theory. J. Account. Public Policy 2016, 35, 455–476. [Google Scholar] [CrossRef]

- Michelon, G.; Pilonato, S.; Ricceri, F. CSR reporting practices and the quality of disclosure: An empirical analysis. Crit. Perspect. Account. 2015, 33, 59–78. [Google Scholar] [CrossRef]

- Khan, M.; Serafeim, G.; Yoon, A. Corporate sustainability: First evidence on materiality. Account. Rev. 2016, 91, 1697–1724. [Google Scholar] [CrossRef]

- Busco, C.; Consolandi, C.; Eccles, R.G.; Sofra, E. A preliminary analysis of SASB reporting: Disclosure topics, financial relevance, and the financial intensity of ESG materiality. J. Appl. Corp. 2020, 32, 117–125. [Google Scholar] [CrossRef]

- Miller, K.C.; Fink, L.; Proctor, T.Y. Current trends and future expectations in external assurance for integrated corporate sustainability reporting. J. Leg. Ethical Regul. Issues 2017, 20, 1–17. [Google Scholar]

- Locke, E.A.; Latham, G.P. Building a practically useful theory of goal setting and task motivation: A 35-year odyssey. Am. Psychol. 2002, 57, 705–717. [Google Scholar] [CrossRef] [PubMed]

- Kleingeld, P.A.; van Mierlo, H.H.; Arends, L.L. The effect of goal setting on group performance: A meta-analysis. J. Appl. Psychol. 2011, 96, 1289–1304. [Google Scholar] [CrossRef] [PubMed]

- Tenbrunsel, A.E.; Wade-Benzoni, K.A.; Messick, D.M.; Bazerman, M.H. Understanding the influence of environmental standards on judgments and choices. Acad. Manag. J. 2000, 43, 854–866. [Google Scholar] [CrossRef]

- Motel, L. Increasing diversity through goal-setting in corporate social responsibility reporting. Equal. Divers. Incl. Int. J. 2016, 35, 328–349. [Google Scholar] [CrossRef]

- Madera, J.M.; King, E.B.; Hebl, M.R. Enhancing the effects of sexual orientation diversity training: The effects of setting goals and training mentors on attitudes and behaviors. J. Bus. Psychol. 2013, 28, 79–91. [Google Scholar] [CrossRef]

- Aguinis, H.; Glavas, A. Embedded versus peripheral corporate social responsibility: Psychological foundations. Ind. Organ. Psychol. 2013, 6, 314–332. [Google Scholar] [CrossRef]

- Kujala, J.; Rehbein, K.; Toikka, T.; Enroth, J. Researching the gap between strategic and operational levels of corporate responsibility. Balt. J. Manag. 2013, 8, 142–165. [Google Scholar] [CrossRef]

- Diez-Cañamero, B.; Bishara, T.; Otegi-Olaso, J.R.; Minguez, R.; Fernández, J.M. Measurement of corporate social responsibility: A review of corporate sustainability indexes, rankings and ratings. Sustainability 2020, 12, 2153. [Google Scholar] [CrossRef]

- Cho, C.H.; Laine, M.; Roberts, R.W.; Rodrigue, M. The frontstage and backstage of corporate sustainability reporting: Evidence from the Arctic National Wildlife Refuge Bill. J. Bus. Ethics 2018, 152, 865–886. [Google Scholar] [CrossRef]

- Fassin, Y.; Buelens, M. The hypocrisy-sincerity continuum in corporate communication and decision making: A model of corporate social responsibility and business ethics practices. Manag. Decis. 2011, 49, 586–600. [Google Scholar] [CrossRef]

- Clementino, E.; Perkins, R. How do companies respond to environmental, social and governance (ESG) ratings? Evidence from Italy. J. Bus. Ethics 2020, 1–19. [Google Scholar] [CrossRef]

- More Transparency, More Efficiency, More Impact. Available online: https://econsense.de/app/uploads/2018/06/econsense-Discussion-Paper_econsense-Discussion-Paper-on-Sustainability-Ratings-and-Rankings_2012.pdf (accessed on 30 November 2020).

- Lozano, R.; Huisingh, D. Inter-linking issues and dimensions in sustainability reporting. J. Clean. Prod. 2011, 19, 99–107. [Google Scholar] [CrossRef]

- Jizi, M.I.; Salama, A.; Dixon, R.; Stratling, R. Corporate governance and corporate social responsibility disclosure: Evidence from the US banking sector. J. Bus. Ethics 2014, 125, 601–615. [Google Scholar] [CrossRef]

- Godos-Díez, J.L.; Cabeza-García, L.; Alonso-Martínez, D.; Fernández-Gago, R. Factors influencing board of directors’ decision-making process as determinants of CSR engagement. Rev. Manag. Sci. 2018, 12, 229–253. [Google Scholar] [CrossRef]

- Crifo, P.; Escrig-Olmedo, E.; Mottis, N. Corporate governance as a key driver of corporate sustainability in France: The role of board members and investor relations. J. Bus. Ethics 2019, 159, 1127–1146. [Google Scholar] [CrossRef]

- Kalev, A.; Dobbin, F.; Kelly, E. Best practices or best guesses? Assessing the efficacy of corporate affirmative action and diversity policies. Am. Sociol. Rev. 2006, 71, 589–617. [Google Scholar] [CrossRef]

- Peters, G.F.; Romi, A.M. Does the voluntary adoption of corporate governance mechanisms improve environmental risk disclosures? Evidence from greenhouse gas emission accounting. J. Bus. Ethics 2014, 125, 637–666. [Google Scholar] [CrossRef]

- Deci, E.L.; Ryan, R.M. The “what” and “why” of goal pursuits: Human needs and the self-determination of behavior. Psychol. Inq. 2000, 11, 227–268. [Google Scholar] [CrossRef]

- Gagne, M.; Deci, E.L. Self-determination theory and work motivation. J. Organ. Behav. 2005, 26, 331–362. [Google Scholar] [CrossRef]

- Deci, E.L.; Eghrari, H.; Patrick, B.C.; Leone, D.R. Facilitating internalization: The self-determination theory perspective. J. Personal. 1994, 62, 119–142. [Google Scholar] [CrossRef] [PubMed]

- Deci, E.L. Intrinsic motivation, extrinsic reinforcement, and inequity. J. Personal. Soc. Psychol. 1972, 22, 113–120. [Google Scholar] [CrossRef]

- Deci, E.L.; Koestner, R.; Ryan, R.M. A meta-analytic review of experiments examining the effects of extrinsic rewards on intrinsic motivation. Psychol. Bull. 1999, 125, 627. [Google Scholar] [CrossRef] [PubMed]

- Weaver, G.R.; Treviño, L.K.; Cochran, P.L. Integrated and decoupled corporate social performance: Management commitments, external pressures, and corporate ethics practices. Acad. Manag. J. 1999, 42, 539–552. [Google Scholar] [CrossRef]

- Scalet, S.; Kelly, T.F. CSR rating agencies: What is their global impact? J. Bus. Ethics 2010, 94, 69–88. [Google Scholar] [CrossRef]

- Parmar, B.L.; Keevil, A.; Wicks, A.C. People and profits: The impact of corporate objectives on employees’ need satisfaction at work. J. Bus. Ethics 2019, 154, 13–33. [Google Scholar] [CrossRef]

- van Tuin, L.; Schaufeli, W.B.; van den Broeck, A.; van Rhenen, W. A Corporate purpose as an antecedent to employee motivation and work engagement. Front. Psychol. 2020, 11, 2402. [Google Scholar] [CrossRef]

- Donia, M.B.L.; Ronen, S.; Sirsly, C.A.T.; Bonaccio, S. CSR by any other name? The differential impact of substantive and symbolic CSR attributions on employee outcomes. J. Bus. Ethics 2019, 157, 503–523. [Google Scholar] [CrossRef]

- Donia, M.B.L.; Sirsly, C.A.T. Determinants and consequences of employee attributions of corporate social responsibility as substantive or symbolic. Eur. Manag. J. 2016, 34, 232–242. [Google Scholar] [CrossRef]

- Evans, W.R.; Goodman, J.M.; Davis, W.D. The impact of perceived corporate citizenship on organizational cynicism, OCB, and employee deviance. Hum. Perform. 2010, 24, 79–97. [Google Scholar] [CrossRef]

- McShane, L.; Cunningham, P. To thine own self be true? Employees’ judgments of the authenticity of their organization’s corporate social responsibility program. J. Bus. Ethics 2012, 108, 81–100. [Google Scholar] [CrossRef]

- Adams, C.A. The ethical, social and environmental reporting-performance portrayal gap. Account. Audit. Account. J. 2004, 17, 731–757. [Google Scholar] [CrossRef]

- Ylönen, M.; Laine, M. For logistical reasons only? A case study of tax planning and corporate social responsibility reporting. Crit. Perspect. Account. 2015, 33, 5–23. [Google Scholar] [CrossRef]

- Fehre, K.; Weber, F. Challenging corporate commitment to CSR: Do CEOs keep talking about corporate social responsibility (CSR) issues in times of the global financial crises? Manag. Res. Rev. 2016, 39, 1410–1430. [Google Scholar] [CrossRef]

- Treviño, L.K.; Weaver, G.R.; Gibson, D.G.; Toffler, B.L. Managing ethics and legal compliance: What works and what hurts. Calif. Manag. Rev. 1999, 41, 131–151. [Google Scholar] [CrossRef]

- Loughran, T.; McDonald, B.; Yun, H. A wolf in sheep’s clothing: The use of ethics-related terms in 10-K reports. J. Bus. Ethics 2009, 89, 39–49. [Google Scholar] [CrossRef]

- MacLean, T.L.; Behnam, M. The dangers of decoupling: The relationship between compliance programs, legitimacy perceptions, and institutionalized misconduct. Acad. Manag. J. 2010, 53, 1499–1520. [Google Scholar] [CrossRef]

- Behnam, M.; MacLean, T.L. Where is the accountability in international accountability standards?: A decoupling perspective. Bus. Ethics Q. 2011, 21, 45–72. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).