1. Introduction

These days, sustainability assessment procedures, sustainability assessment indicators, and sustainability assessment models are seen by international reputed specialists as powerful decision-supporting tools able to foster sustainable development worldwide by addressing the main economic, financial, social, cultural, and environmental challenges. What is more, supporting decision-making and policy adoption by using sustainability assessment indicators, models, and procedures clearly implicates a broad economic, financial, social, and environmental context, which has the power to transcend the ideas related to the use of purely technical and/or scientific methods.

According to reputed specialists in sustainability assessment, “culture plays an important role in implementing sustainability principles and approaching sustainable development goals across different countries,” since the analysis of “the relationship between the value created by culture and the implementation of sustainable development goals of countries” becomes crucial at an international level these days [

1]. Also, it should be added that “the majority of attention” in sustainability assessment research “is devoted to composing and calculating the integrated cultural value index, which provides clear linkages between value created by culture and sustainable development goals” [

1]. Moreover, sustainability assessment addresses important issues such as entrepreneurship, which “is considered to be one of the most critical factors contributing to the successful performance of business, innovations, and growth of the economy,” as well as “the main driver of innovation and sustainable business” [

2]. Moreover, when describing the purpose of today’s researches on sustainability assessment and entrepreneurship, the focus is represented by assessing “the main traits that are deemed essential for the successful performance of a firm” as well as by presenting and developing different models able “to assess how entrepreneurs’ creativity, self-efficacy, and achievement motivation influence the performance of small firms through the role of entrepreneurial orientation (EO) as a mediating variable,” in like manner seeking “the insight of entrepreneurial traits on small-firm performance” [

2]. Furthermore, recent findings “show that self-efficacy and EO have a significant and positive association with the performance of a firm, while creativity and internal locus of control are fully mediated by EO,” which also leads, on the one hand, to the need “to examine the performance of a firm in terms of growth, sustainability, and financial performance,” and, on the other hand, to the need to provide “entrepreneurs with a different perspective of the entrepreneurial traits that contribute to successful firm performance … in the attempt to explore the entrepreneurial traits that significantly influence the effectiveness of the performance of firms” in general [

2].

Consequently, financial sustainability evaluation and forecasting represent crucial sustainability assessment traits, especially when addressing the organization’s need for financial stability [

3]. Nowadays, specialists point out very clearly that “the external shocks tolerant business with financial security and without signs of liquidity or solvency losses in the medium and long-term perspectives, determines mesoeconomic (sectoral) stability, which, in turn, serves as one of the prerequisites for sustainable development at the macro level” [

3]. In like manner, the organization’s “financial indicators taken into account to identify the different states of organizational performance and of financial security,” “along with the predefined scenarios (i.e., changes in the states of financial performance and the corresponding probabilities), the transitions among the states of financial security” must be thoroughly taken into consideration while performing procedures and applying methods specific to sustainability assessment [

3]. Thus, “the analysis of the prospective developments in the financial security” can imply—depending on the scenarios addressed by the specialist, either the strongly desired stability or the imminent decline in the economic environment indicated by “the transition to lower levels of financial security” [

3]. Therefore, in terms of sustainability assessment, companies “should re-consider the possibilities for improving their financial performance and revisit the probabilistic forecasts of the financial security level” in order to become more focused on ensuiring “a rational and effective controlling system” and an increased level of “attention to business entities’ solvency in the context of mechanisms ensuring their financial security” [

3].

However, specialists’ concern these days’ focuses mainly on several important sources of economic progress in order to ensure the continuous development of the world, introducing in their current analyses multiple ramifications and transformations addressing the creation and evolution of both small businesses and large businesses [

4,

5]. Moreover, it seems that a great accent is put by researchers on the impressive transformations suffered by different types of businesses deciding that tangible capital should be replaced in part or in total by intangible assets, since the role and scope of intangible assets became little by little to surpass individuals’ imagination [

6,

7]. Furthermore, current results obtained with the aid of thorough research processes, have stressed the challenges that those businesses that failed to understand in a timely manner that the intangible assets represent the future and that the power of imagination reveals and leads a truly evolving world based on the importance ensured by the intangible assets [

8,

9,

10].

The results of the analysis and the proposed model can be applied in sustainability analysis at different levels of management. The impacts of sustainability policies on the financial indicators can be estimated. Then, the proposed method can be applied to ascertain the possible effects of changes in financial indicators on the overall financial security level in the probabilistic setting.

This current study finds its starting point in the powerful belief that sustainability assessment—as one of the most complex types of appraisal methodologies existing at present—not only refers to interdisciplinary and multidisciplinary aspects, among which we can stress economic, financial, social, cultural and environmental issues, but also takes into consideration value-based elements such as the companies’ intangible assets, namely the discoveries, human resources, relationship with the customers, organizational capital, and reputation (“goodwill”). As a consequence, since assessing sustainability has lately become a common practice for all the companies that respect their position in the marketplace and seek to improve or maintain their place there, concepts such as “integrated assessment,” “sustainability assessment,” and “corporate social responsibility” have become extremely popular among specialists all around the world.

In this particular matter, our work presents a novel methodological framework for sustainability assessment that focuses on establishing important connections between the recognition and measurement of intellectual capital, the role of sustainability assessment tools, and the implications of corporate social responsibility, since, these days, the real “values” associated with a country or business profile may be found in their intangible assets. Thus, our study intends to highlight “new” and “improved” perspectives targeted to impact assessment focused toward key elements such as capital structure; intellectual assets; intellectual capital; intellectual property; evaluation; measuring; erosion of the tax base; aggressive tax planning; accounting; economic and financial analysis; performance indicators; integrated assessment; sustainability assessment; sustainability; corporate social responsibility; and sustainable development.

From a financial accounting point of view, intellectual capital (IC) should be reflected in the annual financial statements on intangible or intangible assets, following a professional recognition and valuation reasoning. As we will present below, IC creates many controversies, both in terms of recognition and, especially, in terms of its measurement. The world of accounting, with the pride and conservatism of over 500 years, seems both unprepared and unwilling to make concessions [

11]. The mere findings of specialists, which they consider obvious from the countless analyses and research undertaken, and according to which intellectual assets are worth about three to four times the book value of an enterprise [

12], cannot be reflected in accounting. Considered the fourth pillar of the Sustainable Competitiveness Pyramid, intellectual capital is the basis for the calculation of the Global Sustainable Competitiveness Index (GSCI), which aims to measure the competitiveness of countries in an integrated way. The almost 116 measurable indicators (more or less, depending on the model or method of calculation adopted) of a quantitative nature are derived from reliable sources made available annually by international bodies, including the World Bank (WB), the International Monetary Fund (IMF) and various United Nations (UN) agencies. The indicators are classified into five subgroups, as follows: Natural Capital, Social Capital, Resource Efficiency and Intensity, Intellectual Capital, Governance Efficiency and Social Cohesion, starting from the basic fundamentals, inevitably but favorably subjected to transformations induced by impact and influence, with the particular mention that the “Indicators used for the innovation capacity sub-index cover education levels, research and development performance indicators, infrastructure investment levels, employment indices and the balance of the agricultural–industrial services sectors” [

13]. (SolAbility is a Swiss-Korean joint venture founded in 2005, considered an advisory, independent think tank for sustainability, which annually publishes the Global Sustainable Competitiveness Index and presents the results of the studies on the website www.solability.com.) Intellectual capital has continued to remain in everyone’s attention, evolving and subject to, at the same time, a lot of interpretations, which only support its value and significance. Stewart (1997), Roos and Roos (1997) and Bontis (1996), were deeply concerned with identifying and measuring activities that generate “intellectual wealth” based on a “personal score” [

14,

15,

16,

17], while Petty and Guthrie (2000), and Guthrie, Ricceri and Dumay (2012) suggested some solutions for a dynamic and current accounting on “Intellectual Capital Accounting” [

18,

19]. Initially viewed from the inside, in the Competence-Based Theory [

20] or the Resource-Based View [

21], the approach from the outside to the inside is currently being tried according to Grant (1996), Lev (2001) and Kaufmann and Schneider (2004) [

22,

23,

24].

IFRS 38, which deals with the issue of intangible assets, highlights the difficulties of not having criteria for identifying them, which affects the possibility of determining the value of certain rights, so that they are explicitly included in the sale or transfer situation, not offering the manner of licensing them [

25]. Such an intangible asset incorporates only possible assumptions or hypothetical estimates of potential economic benefits not found in accounting reports, which must be primarily characterized by accuracy and fidelity. A first impediment is the moment when it is estimated that they were obtained in the research/development processes. While referring only to the research stage, obviously they cannot be recognized. However, it is difficult to recognize the results, which means that the asset proves not only its technical feasibility, but also the existence of a path that certifies the stages of future sustainable developments, including the availability of resources to complete the development process. Particular attention must also be paid to the existence of a market that provides economic benefits to the developing entity, which must be able to make the most of it. It remains a sensitive point that, as a rule, proves to be extremely difficult to solve: that of quantifying the expenses included in all stages of research and development, which would also cover the risks to which the entity is exposed, investing without knowing how advantageous the final achievements will be. These costs are then added to those of the steps necessary to promote the product or service in question. Finally, it has been found that none of the costs corresponding to other internally generated intangible assets in the same research and development (R&D) process, incurred along the way, can be correctly delineated.

The weaknesses of the current international tax system, unreformed for almost a century, have been speculated on and exploited by multinational companies in aggressive tax planning, in general, by transferring profits to tax havens or countries with favorable tax regimes, jeopardizing the balance of the current tax system, which was built over time and based on consensus. Countries have been forced to react and take steps to protect the balance of the current tax system. Thus, in 1987 the Organisation for Economic Co-operation and Development (OECD) published the study

International tax avoidance and evasion: four related studies, which explained the classic mechanisms by which multinational companies, directly or indirectly, through more sophisticated schemes and multiple transactions, transferred their profits to tax havens or into jurisdictions with preferential tax regimes. In addition, in 1998 the OECD published the report

Harmful Tax Competition: An Emerging Global Issue, in which were presented, on the one hand, the criteria for identifying tax havens and, on the other hand, the way of deciding whether a preferential tax regime is harmful [

26,

27]. Under this pressure, the lack of consensus in the recognition and measurement of intangible assets in general and of IC in particular has been the main premise for their use in creative accounting and aggressive tax planning of multinational companies that have made the most of them. This is how they managed, step by step, to permanently refine their fiscal planning mechanisms and schemes.

The increasing risks, the magnitude of the phenomena that led to an erosion of the national tax bases, and also the transfer of profits required the presentation of a report in February 2013 [

26,

27]. It was recognized that recent developments in the growing importance of intellectual property as a determinant of value and the continuing evolution of information and communication technologies made the current international tax mechanisms inefficient, outdated, and unnecessary. The report presented, in an objective and exhaustive manner, the new mechanisms that contribute to the erosion of the tax base and the transfer of profits, highlighting the new problems identified. In 2013, international cooperation with the full involvement of the participating countries coordinated by the Committee on Fiscal Affairs (CAF) (which includes 44 countries: all OECD members, G20 countries, and countries in the process of joining the OECD) of the OECD and G20 countries finalized a unitary and coherent plan to combat the erosion of the tax base. The Base Erosion and Profit Shifting Project (BEPS) [

26,

27] plan recommends a thorough overhaul of existing tax mechanisms while adopting new consensual approaches, which means that taxation must be aligned with the economic essence, limiting the use of intangible assets, risk funds, or other transactions whose exposure is high, but it favors the transfer of profit, a situation that most often benefits multinationals. Taking advantage, on the one hand, of the existence of low-tax jurisdictions and, on the other hand, of a lack of rules and regulations on the recognition of the value of intangibles in conjunction with the establishment of ownership of existing intangible assets within organizations, multinationals have created structures that allow them to avoid taxing the profit, leading to the negative effects generated by the erosion of the tax base. The measures required by the BEPS plan require a review and adaptation of domestic and international tax legislation to minimize and even eliminate the negative effects of this type of “abuse” on tax avoidance, ensuring the normality of “withholding tax.”

The identification and definition of intangibles also creates difficulties in determining transfer prices, leading to divergences that the OECD has tried, if not to stop, then at least to put in a less conflicting relationship, formulating for this purpose a definition found also in Chapter IV—“Administrative Approaches to Avoiding and Resolving Transfer Pricing Disputes” of the guide

OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations, republished in 2017 after a careful review corresponding to the evolution of the BEPS action plan: “the word ‘intangible’ is intended to address something which is not a physical asset or a financial asset, which is capable of being owned or controlled for use in commercial activities, and whose use or transfer would be compensated had it occurred in a transaction between independent parties in comparable circumstances …” [

28,

29]. The definition tries to be neutral, the references being made so as not to be too exposed to speculations, precisely in order to be useful especially to taxpayers and tax authorities. The clarifications made in the guide have the role of limiting interpretations, the references being punctual: “As used in this paragraph, a financial asset is any asset that is cash, an equity instrument, a contractual right or obligation to receive cash or another financial asset or to exchange financial assets or liabilities, or a derivative. Examples include bonds, bank deposits, stocks, shares, forward contracts, futures contracts, and swap” [

28,

29].

While addressing the undeniable role and the crucial importance of each and every organization’ intellectual capital, it should be highlighted that the implications of creative and innovative ideas are absolutely immense for our bright future and continuous evolution. In the same time, the high importance of organizations’ intellectual capital is generated by the need to exploit intangible assets whose potential, although sometimes rather intuitive, is not always properly used and valued, since individuals do not really know, in all circumstances, how and in what form it could be capitalized [

30,

31]. Thus, without a doubt, specialists can only argue that “tangible assets embed intangibles”, case in which the real problems are beginning, accompanied by countless questions, referring to the way that they are capable to complete each other, the manner in which they can be valued, the extent to which the tangible assets may be embed in intangibles, to which an answer is sought and still awaited [

32,

33,

34]. Certainly, the flow of human capital that visionary societies do not hesitate to encourage brings benefits, especially when recognizing the contribution of those individuals with talents, abilities and skills able to generate value through innovations that become the main source of growth of wealth of any entity that accepts and promotes innovative spirit [

35]. Thus, even though there are certain risks associated with any type of organizational activities, human capital resources are the most precious resources that allow the development of science at an incredible level [

36].

2. Review of the Specialized Literature and Research Hypotheses

Considering the fact that “socioeconomic dynamics are causing an overcrowding and accelerated expansion of cities worldwide”, it should be pointed out that “commonly observed problems include pollution, mobility, vulnerability to extreme phenomena and more, which affect society due to the absence of urban planning”, thus, “achieving the sustainability of cities must be a priority for governments, since the well-being of a large part of the population depends on it, as well as the fight against climate change” [

37]. Most importantly, “creating knowledge and competencies for health promotion planning in the community” implicates, in fact, “strengthening competence and awareness in setting (…) core strategies” capable to generate worldwide sustainability, increase the role of environmental management performance and acknowledge the importance of discovering an integrated approach to determining the capacity of ecosystems to supply ecosystem services [

38].

Notably, sustainability assessment procedures, sustainability assessment indicators, and sustainability assessment models are strongly connected with sustainable growth and development, integrated sustainability assessment frameworks, effectiveness of economic, social and environmental partnerships due to improve individuals’ well-being, comparative and competitive sustainability levels, as well as sustainability policies and sustainability performance. For example, “measuring the comparative sustainability levels of cities, regions, institutions and projects is an essential procedure in creating sustainable urban futures”, in this way specialists being able to introduce “a new urban sustainability assessment model” [

39]. Or, for instance, “the importance of considering both economic and environmental metrics during the system optimization to provide bettered eco-efficiency performance solutions” in terms of sustainability assessment procedures, sustainability assessment indicators, and sustainability assessment models might lead to researchers focus on “the growing penetration of renewable sources into the global energy matrix and the electrification of the transport sector”, which will “constitute major challenges to the reliability and flexibility of energy services” [

40]. Also, “as cornerstones of a decarbonized economy, renewable energy systems must effectively integrate” different types of sustainability assessment procedures, sustainability assessment indicators, and sustainability assessment models, thus being capable to address the obstacles specific to organizations and countries sustainability, growth and performance [

40]. In this light, scientists, researchers and practitioners worldwide are all focused lately on proposing new economic-oriented optimization models “for improving sustainability in the energy and reserve market management of integrated systems”, and are fully absorbed in discovering new methods of programming models “to minimize sustainability costs”, ensure effectiveness and efficiency, and solve “global optimality” [

40]. Looking at barriers and facilitators for adopting sustainable management practices, it also becomes more than necessary to emphasize the role played by sustainability and different impact assessment instruments and methods in terms of agricultural development, since “soil is a fundamental resource, subject to severe and quick degradation processes because of the pressure of human activities”, particularly those regions “where agriculture is an important economic activity” [

41].

Sustainability and durability can be affected by inappropriate practices contrary to the market economy and free competition. Erosion of the tax base and the transfer of profits to tax havens or tax-friendly jurisdictions distort market economy mechanisms by disadvantaging local entities to the benefit of multinationals that practice aggressive tax planning with a significant impact on the world economy, causing huge losses to states, destabilizing essentially the foundations of the socioeconomic system. Through these unethical approaches, the states, especially developing ones, are deprived of important resources necessary for the implementation and development of health services, educational services, infrastructure, and more.

The BEPS action plan is a set of 15 actions aimed at reducing the phenomenon of artificial transfer of profits into jurisdictions where the tax system is favorable, by providing governments with valid instruments, both domestically and internationally, in order to counter practices for avoiding the payment of tax obligations, taking into account the taxation of profits where the economic activities generating profit are located and where the economic value is created. When the BEPS package was published in 2015, the OECD estimated that tax evasion practices cost governments between USD 100–240 billion a year, or between 4–10% of global corporate tax revenues. The evolution of the OECD/G20 initiative on BEPS, from the high-level political commitment in 2013 to the completion in 2015 of detailed actions to combat base erosion and profit shifting and to the establishment of an OECD/G20 Cooperation Framework on BEPS in 2016, followed by monitoring the proposed measures, their continuous improvement and adaptation, is an example of how multilateralism can be effective in the face of current global challenges.

For practical reasons, in order to increase the operability and the rapid capitalization of the results, the states committed themselves to implement in the period 2016–2019 a minimum representative package of four standards. The minimum package contains: five actions on abusive tax practices; six actions on the prevention of misuse of tax treaties; 13 actions on transfer pricing and country reporting, and 14 actions on dispute settlement mechanisms.

The OECD/G20 inclusive cooperation framework is constantly growing, from 82 existing members at the inaugural meeting in July 2016 in Kyoto, to over 130 members and 14 observers in December 2019, of which over 70% of countries and jurisdictions are non-OECD and non-G20, belonging to all geographical regions, totaling over 95% of global gross domestic product. They work together on an equal footing, both to implement the BEPS measures agreed upon in 2015 and to design new international tax rules. International organizations and regional tax organizations also play an important role in the cooperation framework, in particular, to support the implementation of the BEPS package in developing countries. The African Tax Administration Forum (ATAF), the consortium of 30 countries whose official language is or includes French, spread over four continents, with a suggestive name: Center for Meetings and Studies for Tax Administration Leaders (CREDAF) [

42], active in facilitating exchanges and applicability of good practice; the Inter-American Center for Tax Administration (CIAT); together with other international organizations such as the International Monetary Fund (IMF); the World Bank (WB); and the United Nations (UN) have been involved in BEPS, participating actively and responsibly as observers [

43,

44,

45].

In order to combat harmful regimes more effectively, Action 5 of the BEPS action plan [

26,

27,

28,

29] calls on the Forum on Harmful Tax Practices (FHTP) to review work on harmful tax practices, with a new emphasis on the substantial work obligation for any regime, giving priority to improving transparency, in particular, through the mandatory spontaneous exchange of decisions on preferential arrangements [

46]. Regarding Action 5 [

47], which is, in fact, the subject of our study, the following elements should be mentioned: (1) A key pillar of the BEPS is the alignment of the location of taxation with the location of the economic activity that generated the taxable income. (2) As mentioned above, intangible assets in general and intellectual property rights in particular have been the main vehicles for the transfer of income, which has in fact also allowed the tax base to be reduced; therefore, in accordance with the new standard for tax facilities related to intellectual property, tax benefits become limited, being proportional to the size of research and development activities carried out by the beneficiary taxpayer. (3) There is a demand that information on all tax decisions in risk categories be spontaneously changed in jurisdictions where those decisions may be relevant, and increasing transparency has been a key objective of the BEPS since its inception.

In order to ensure that the members of the BEPS Cooperation Framework meet their commitment to implement the four minimum standards, each member has been subject to an evaluation process by the OECD in accordance with the terms of reference and the methodology specific to each standard. The initial assessment, which determines whether a jurisdiction meets the minimum standard, takes place at the level of the relevant subsidiary body of the cooperation framework, with the final decision to be taken in plenary. Evaluations are adopted with the application of the minus-one consensus rule, in order to avoid a single jurisdiction being able to block consensus on the adoption or publication of a report. The evaluation of the implementation of Action 5 has been done annually, starting with 2016 [

46].

Following the evaluations carried out during the years 2016–2019: (a) it was established whether a fiscal regime was harmful or not; (b) the modification or abolition of some regimes was requested; (c) the aim was to limit in time the effects of harmful regimes and not to adopt new decisions that are not in accordance with the new standard; (d) it was decided that the regimes that do not charge taxes on mobile income from a geographical point of view, or charge them at a very low level, should not be considered harmful, provided that the requirement of the economic substance is complied with, in the sense that fiscal facilities are granted only if the activities for obtaining the income are provided by the taxpayer, with the necessary employees and operating expenses and are undertaken in jurisdiction; (e) it was established that the preferential tax regimes can no longer target only non-residents and foreign income in order to attract the tax base belonging to other countries [

43,

44,

45,

46].

In accordance with the aspects presented and the preliminary conclusions, in order to solve the problem under analysis, the authors will verify the following hypotheses:

Hypothesis (H1).

There were premises that allowed the intellectual property rights to be used for the transfer of income and the erosion of the tax base prior to the implementation of the BEPS plan.

Hypothesis (H2).

Jurisdictions have generally made efforts to comply with the requirements of Action 5 on the alignment of the location of taxation with the location of the economic activity that generated the taxable income and to increase transparency.

Hypothesis (H3).

The BEPS plan through the NEXUS method puts an end to disputes over the recognition and measurement of intellectual capital.

The analyzed hypotheses are closely related to the object of our study, namely, that there has been an important concern in the world of specialists and practitioners for the recognition and measurement of IC for several decades. These concerns could not be finalized with a unanimous or majority accepted solution. Moreover, the more heated and controversial these disputes became, the more determined these practitioners were to be the tax advisers of large multinational companies in the use of intangible assets, especially of intellectual property rights, in their aggressive transfer schemes of profit into tax havens or into jurisdictions with favorable tax regimes for these categories of assets, especially for non-residents. To save the balance of the tax system, nations reacted globally, coordinating their efforts.

The decisive involvement of the OECD/G20 on BEPS brings to the negotiating table both the Committee on Tax Affairs and all its subsidiary bodies, countries, and jurisdictions directly concerned, in this context on an equal footing, with express tasks not only related to the stages of monitoring and review, but also those aimed at completing the stages of implementation of the minimum standards, which all agreed were necessary. The procedures are much more complex and provide a better guarantee of the implementation of the BEPS plan; under the direct supervision of other international organizations and regional tax bodies, without neglecting the relevant views and observations of the members of the organizations responsible, as well as those of civil society these will become decisive elements in establishing the workflows necessary to eliminate the effects induced by the erosion of the tax base and the artificial change of the destination of the value of taxable profit.

Hypotheses H1 and H2 verify whether there are premises for the use of IP in the transfer of income and the reduction of the tax base, while Hypothesis H3 examines whether or not the solutions induced by Action 5 of the BEPS plan are able to resolve the IC recognition and measurement controversies.

4. Results and Findings

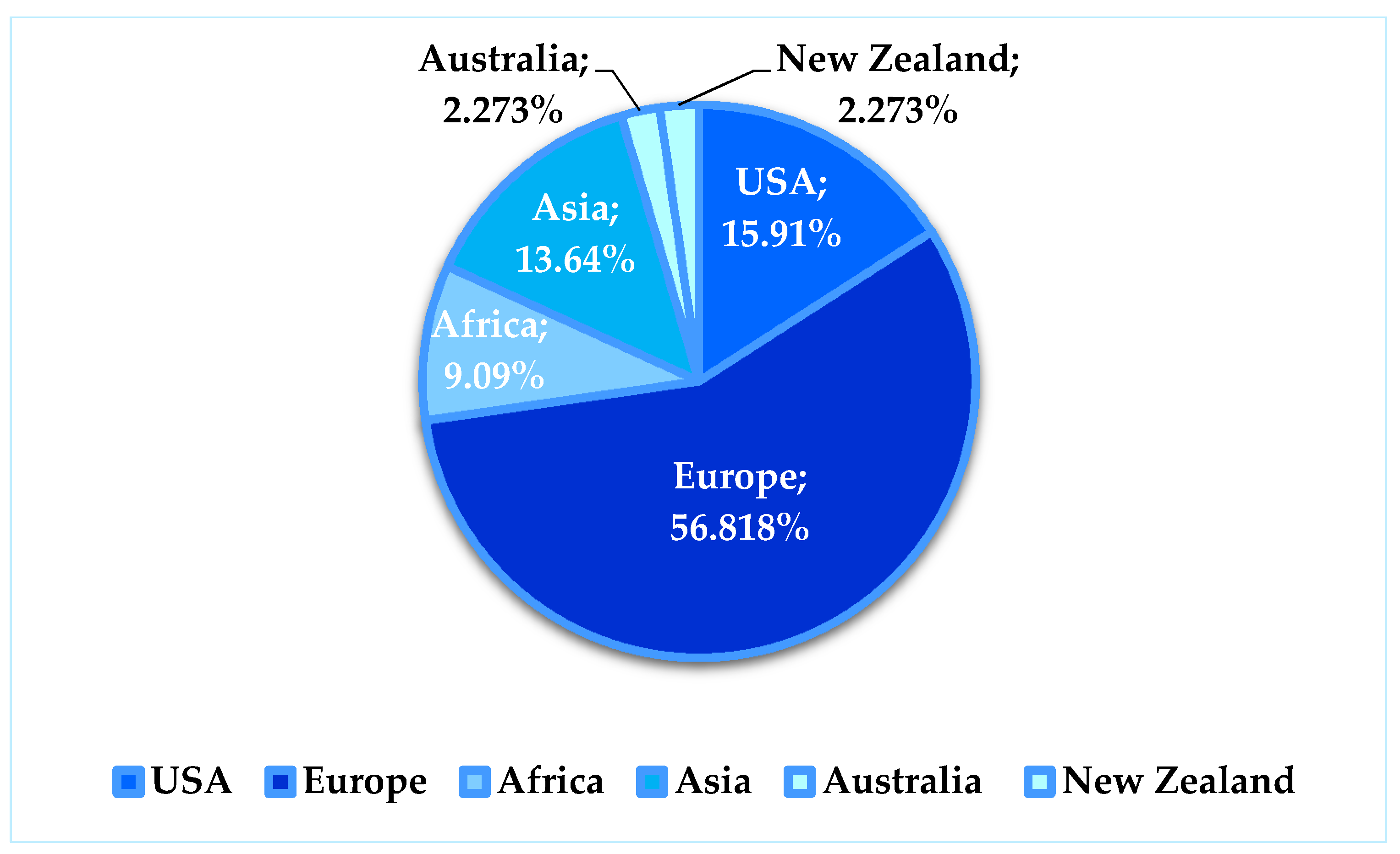

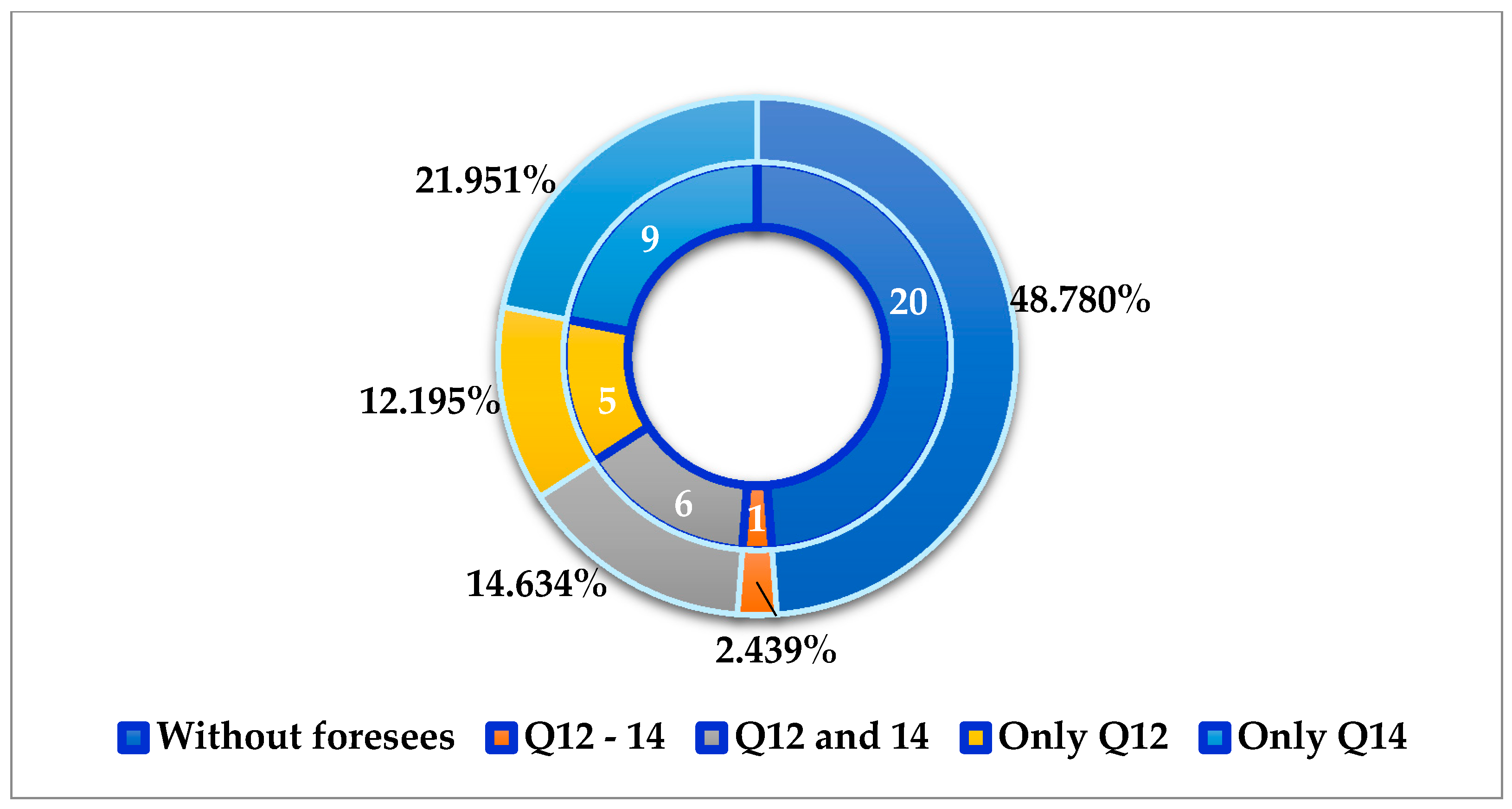

To evaluate Hypothesis H1 we analyzed the country profile [

28] of the selected countries regarding intangible property, questions 12, 13 and 14, and we assessed whether the domestic legislation included other regulations regarding: (a) transfer prices in transactions with controlled parties; (b) intangibles difficult to assess or capitalize or the tax treatment of transactions involving the transfer of intangibles.

Question 14 had a significant impact on the evaluation of Hypothesis H1: Are there any other rules outside transfer pricing rules that are relevant for the tax treatment of transactions involving intangibles?

From the analysis of the country profiles for the 44 states selected in the sample (

Figure 2) the authors noticed that: three of them did not yet have a completed profile; one had regulations for the three aspects analyzed; five had regulations for only the first aspect; nine for only the third aspect; and six of them for only aspects one and three. Of the total of 41 countries actually analyzed, 51.22% confirmed H1.

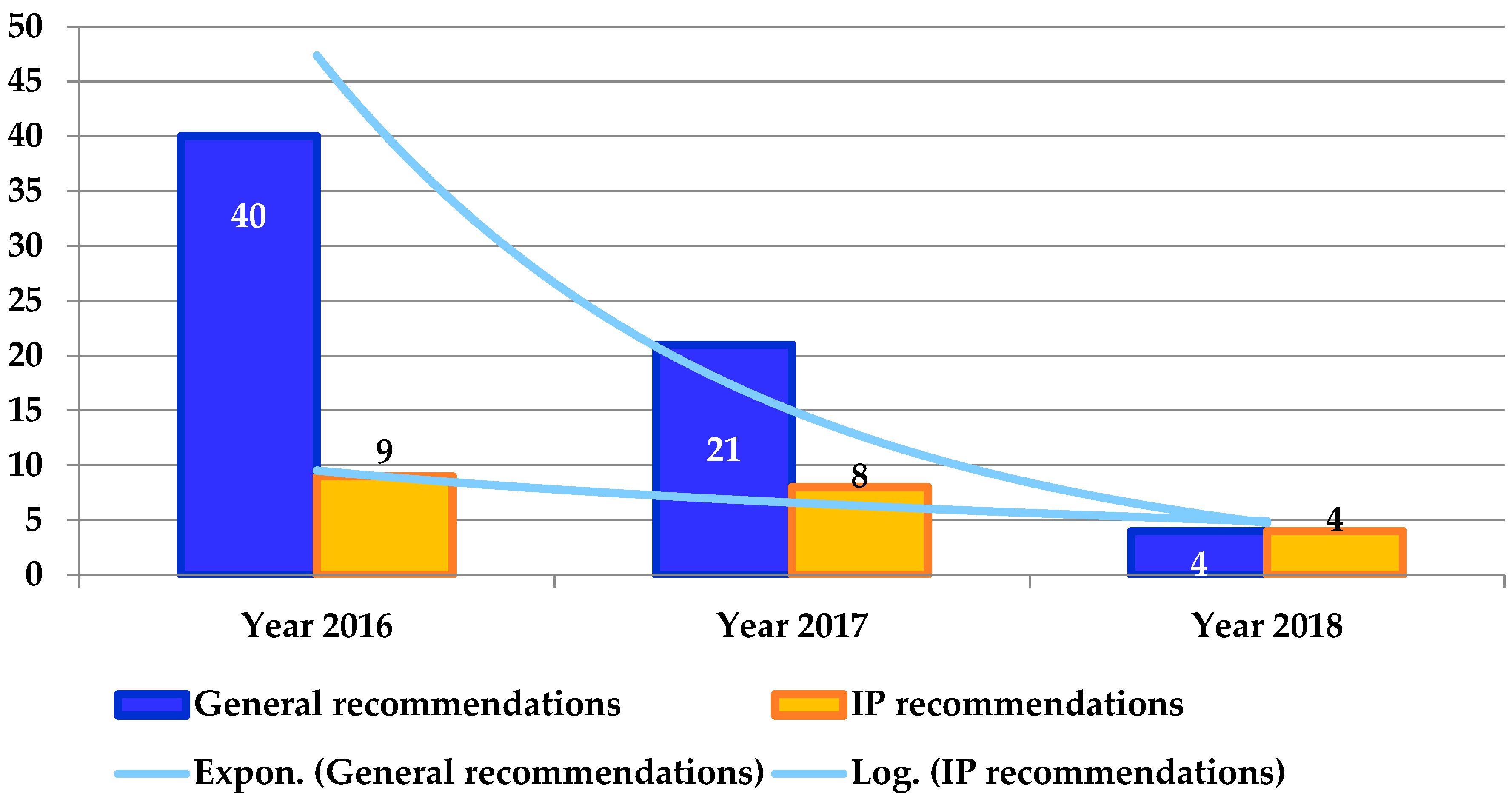

In order to evaluate Hypothesis H2, the authors analyzed the evolution in dynamics of the evaluations and recommendations made (compilation of recommendations made) for the selected countries in the sample for the three consecutive years subject to evaluation (2016, 2017, and 2018). The authors found that the trend was continuously decreasing for the periods evaluated, as shown in

Figure 3. Thus, the number of general recommendations on increasing transparency and exchange of information decreased from 40 in 2016 to eight in 2018. If one reported on the recommendations regarding the alignment of the economic substance of the fiscal facilities regarding the intellectual property rights, there was a decrease from nine recommendations in 2016 to four recommendations in 2018. In conclusion, the authors can say that the Hypothesis H2 is also verified.

Regarding the evaluation of Hypothesis H3, the authors must first provide some clarifications related to the NEXUS method (understood by specialists as a connection existing between two aspects, a connection or series of connections linking two or more things) and then clarify whether IC is an integral part of intellectual property rights. If so, once the jurisdictions of the extended cooperation framework have agreed upon the recognition and measurement of IP, with small exceptions, and the jurisdictions of the extended cooperation framework have been agreed upon, then Hypothesis H3 is verified. If the IC is not part of the IP, then the disputes will continue, Hypothesis H3 being rejected.

Regarding the NEXUS method, the countries agreed that the substantial activity requirement used to assess preferential regimes needs to be strengthened in order to realign the taxation of profits with the substantial activities that generate them. Several approaches were considered and a consensus was reached on the “NEXUS approach.” This approach was developed in the context of intellectual property regimes and allowed a taxpayer to benefit from an intellectual property regime only to the extent that the taxpayer has incurred qualified R&D expenditure that generated the IP revenue. In line with the agreement on the amended NEXUS approach for the IP regimes included in Action 5, the following should be emphasized: the consensus reached was based on the joint proposal made by Germany and the UK in response to concerns about the calculation of eligible R&D expenditure; establishing rules on the transitional period for organizations already benefiting from existing tax facilities; defining the methodology for identifying and tracking qualified research and development expenditures.

The FHTP initially considered three different methods of requesting the presence of substantial activities in an intellectual property regime. The first, which concerned value creation, required taxpayers to undertake a number of significant development activities. This approach had no more support than the other two. The second was a method of setting transfer pricing that would allow a scheme to benefit all IP revenues under three conditions, the taxpayer: (1) must hold a number of important functions in that jurisdiction; (2) must be the legal owner of the assets that generate tax benefits and use the assets in question; (3) must bear the economic risks associated with the assets that give the right to tax benefits. Several countries voted in favor of the transfer pricing approach, but many countries raised a number of objections to the transfer pricing approach. As a result, the FHTP did not select it. The third method was the NEXUS approach, adopted by the FHTP and supported by the G20. The NEXUS approach uses spending as a business representative and is based on the principle that intellectual property regimes are designed to encourage both research and development and growth and employment, so a substantial business requirement should be established for those taxpayers who have benefited from these schemes and have actually been involved in such activities and incurred real costs for their implementation. Moreover, the NEXUS approach extends this principle of involvement to the revenue generated after the creation and operation of the IP. Thus, instead of limiting jurisdictions to intellectual property regimes that provide benefits only directly to IP expenses, the NEXUS approach actually allows jurisdictions to provide benefits to IP revenue, but only as long as there is a NEXUS (link/connection) directly between the income receiving benefits and the expenses contributing to that income. Therefore, expenditure serves as an approximate indicator of substantial activities. The amount is not an indicator directly proportional to the volume of activities, but, rather, with the proportion of expenditures directly related to development activities. The NEXUS approach makes a proportional analysis of income, in which the ratio of income that can benefit from an intellectual property tax facility is the same as the ratio between the sum of eligible expenses and total expenses, so as to prevent a simple capital injection or expenses for substantial research and development activities by parties other than the taxpayer, making the subsequent income eligible for benefits under an IP scheme.

In order to understand the relationship between IC and IP, it is necessary to clarify the structure of intangibles in general and intellectual assets in particular, especially since there are many situations in which invisible assets incorporate knowledge for which it is not possible to apply legal protection measures, although it is a substantial sustainable competitive advantage, extremely valuable for any organization.

Thus, in order to have an overview of what is considered included in intangible assets, we will review some elements and aspects considered by Lev Baruch (2001) as defining and establishing a classification of them according to five categories, summarized in the following [

23].

1. Discoveries, as a result of the research and development activity, these being delimited by the Association of Chartered Certified Accountants in 2019 as follows [

49]: “Research is defined as the discovery and research of a contribution to the understanding of a scientific or technical problem. The development part consists in the implementation of this research, in order to improve a process or material, or a product already on sale.”

2. Human resources, which analyzes the involvement of human capital in the value created within the entity. The problem is sensitive, it being difficult to quantify the extent to which their contribution is found in the company’s activity, the only concrete data being the number of employees and the expenses associated with their payment and reward. Other information is not found in any form of reporting.

3. The relationship with the customers is a constant challenge for each company, it being expressed by their loyalty and constant attachment to a particular brand. It is the extent that the value of a brand, which is, in fact, associated with an intangible asset, translates into a competitive advantage. The condition that the value of this type of intangible asset is found in the balance sheet is that it has loyal buyers over time. Not all companies find the right market value in the balance sheet.

We found the definition of customer loyalty and also of brand loyalty, both being relevant in the loyalty relationship that any company wants to maintain and develop in relation to the potential buyer, in an accounting dictionary updated in 2019 [

50]; specifically: “Customer loyalty is positively linked to customer satisfaction, because happy customers constantly favor brands that meet their needs. Loyal customers buy exclusively the products or services of a company and are not willing to change their preferences over a competitive company.” At the same time [

50]: “Brand loyalty results from the constant effort of a company to provide the same product, each time, with the same success rate. Organizations pay special attention to customer service, seeking to maintain their current existing base by increasing customer loyalty. Often, they offer loyalty programs and rewards for the most loyal customers, as an expression of appreciation for doing repeated business with them.”

4. Organizational capital is defined as “the value that allows human capital to function for the infrastructure, processes, and databases of the unsupported organization” [

51]. Here are included the competitive advantage (represented by everything that contributes to increasing the value of an entity and differentiating it from the competition, including the evaluations made public by the company’s analysts, but especially the existence of independent evaluations by financial institutions or those that ensure compliance, skills) and trade secrets [

52].

Council Directive 2016/943/EU, 2016, p. 2, states that these “intellectual property rights, trade secrets allow creators and innovators to derive profit from their creation or innovation,” making the classification of trade secrets conditional on the impossibility of being “patentable” [

53].

5. The reputation (“good will”) that a business manages to shape, consolidating it over time with full responsibility. In a way, it belongs to the category of quantifiable assets, being found in the accounting reports as the difference between the value of an acquisition and the fair value of the assets or liabilities that are counted on the date of that acquisition or, as the case may be, of a merger. It practically translates into projected economic benefits, which cannot be treated individually and explicitly recognized in the balance sheet.

In large corporations there is a practice that managers see as necessary, important, and mobilizing of all energies: it is the Corporate Mission Statement, which outlines the policies that the president and managers propose at the beginning of a new stage. This includes the values that underlie the company, the management’s emphasis on integrity, which is considered a key principle in any working group in order to gain greater respect and give confidence to stakeholders. All of this is established on the basis of customer orientation, whose requirements and expectations must take precedence, while urging a receptive attitude to change, being open to new technologies and innovations. This also includes ensuring a climate of trust, tolerance and respect for employees, so that they have all the determination and motivation to perfect their activity, to “keep up” with everything that is new, continuing to contribute to the growth and performance of the company. For entities, establishing and maintaining at a very high level the quality of relationships with customers, suppliers, employees, partners, and the local, national and, as the case may be, international community, is the foundation of their image and, consequently, of their value.

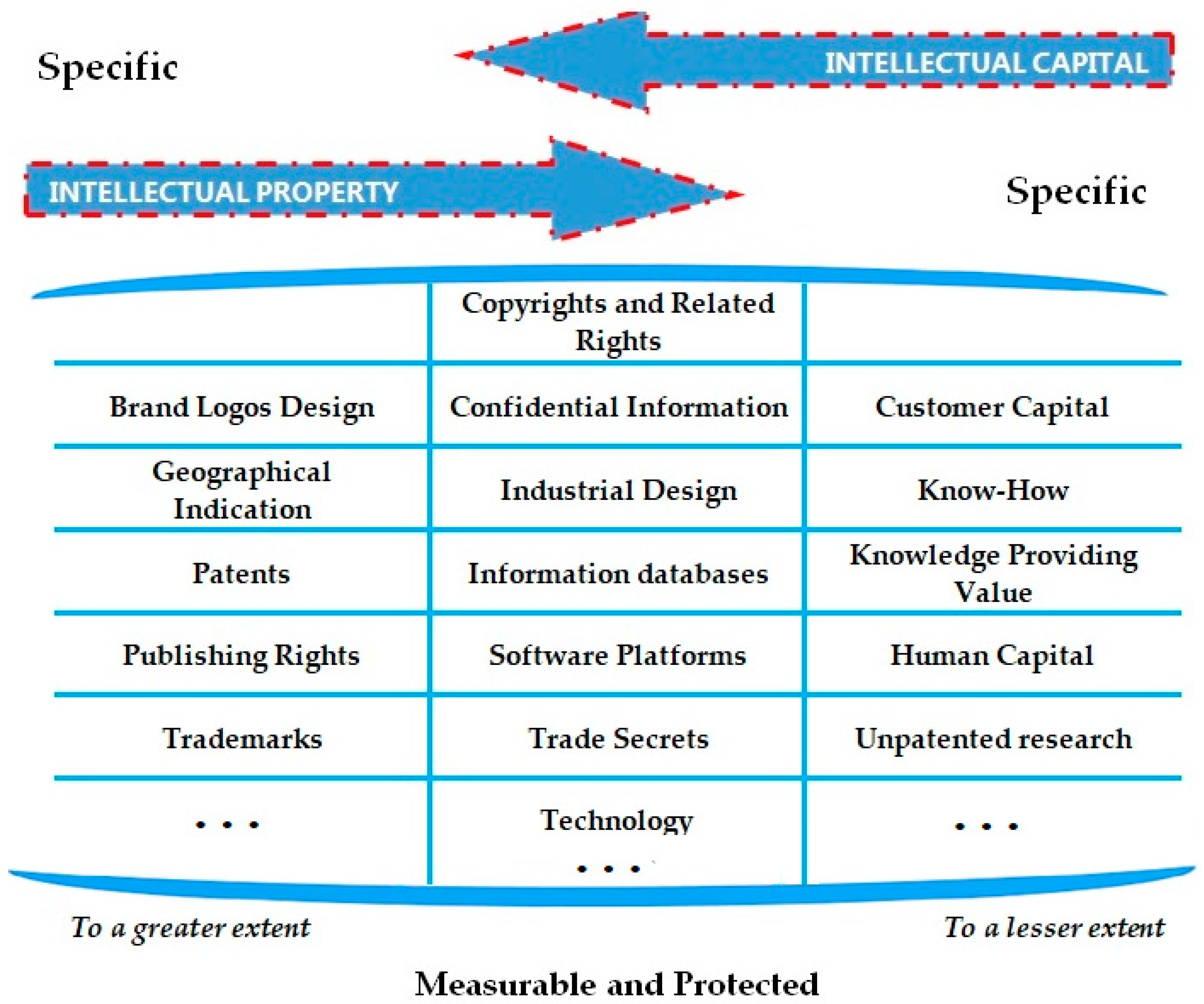

There can be confusion, which is excusable for most laymen. In our research, we observed, emphasized, and analyzed the clear differences between “intellectual property” and “intellectual capital,” which true managers know and nuance in their attempts to justify achievements, and also by their continuing need to take early action to avoid disrupting processes of legitimation. They also capitalize on the potential IC, which less visible from the point of view of shareholders, who, however, must be constantly informed and motivated in order to get financially involved in their own interest. The motivations are clearly supported by the need to accept the costs and risks that must be constantly weighed against the potential benefits, in the event of a favorable context, and also the potential for changes, modifications, novelties, discoveries, which often allow renewals, improvements, innovations or inventions. Their applicability can even be immediate in products, processes, or services that, in an “upward knowledge economy,” can lead to performance by ensuring the competitiveness of the entity willing to take this path. Nevertheless, it is equally important that the process of maximizing the value of the company’s intellectual capital be constantly analyzed through a responsible assessment of the strengths and weaknesses of each aspect, including those relating to the registered intellectual property regime. This will ensure a balance of dependence between the rules of intellectual property law and other strategies, continously paying attention to the evaluation and re-evaluation of utility, degree of functionality, and applicability in repeated and uninterrupted attempts to meet the standards of intellectual property protection, while extending protection to shareholders and to consumers, maintaining and developing a fair business in the market. On the other hand, current changes can redefine the business world. Some businesses, severely affected by the effects of the pandemic, disappear, others lose ground, others seek survival solutions by reorienting or transferring their activity into the online environment. Others, on the contrary, are favored by the type of business they conduct, gaining enormously, taking advantage of virtually any opportunity allowed them, including access to the diversification of research and development activities.

The need for cooperation, including the acquisition of technologies produced in distant countries and even the decentralization of activities, which, until recently, was one of the preferred variants, especially by multinationals, has come to be questioned. However, confrontation with the dynamic process of knowledge remains, which can neither be delimited by borders nor stopped by the pandemic, the research and the development keeping its particularly important place in a world based on knowledge, expertise, diversity, novelty and so on, all of theese beeing sustained by a lot of innovation. This trend cannot be stopped, further generating new forms of “free consolidation,” supported by the same tempting acquisitions, such as successful “start-ups” or “spin-offs,” associations in joint ventures, or other forms such as public and private sector-specific arrangements, which may include sponsorships or grants.

The most difficult for any entity continues to be the lack of important tools to measure the knowledge represented by intellectual capital, because intellectual property rights are legally limited, being precisely defined without being equivalent to those of intellectual capital. This would imply the existence of integrated strategies, derived from an understanding of the usefulness, effectiveness, and efficiency of the embedded technology, which is often difficult to identify as far as what form and what percentage, what generated the valuable idea, the market conditions in which that entity operates, including its spread. All are the result of research and development, possibly individual work or team work, which is difficult to customize but especially commensurate. It requires a fair understanding of alternative strategies without being able to concretely identify the initiator and rightful owner of the idea, which, however, becomes controllable precisely in order to extract the maximum value that we generically call “intellectual capital.”

Intellectual property is most often found in quantifiable and identifiable forms in accounting situations such as patents, trademarks, rights to publish or use designs, rights to use information databases, rights to use dedicated or wider software products with multiple applicability, different types of industrial design, various types of technologies or know-how, all having either pre-established prices, whether or not negotiable, depending on the economic, technical, not infrequently social and political context.

Instead, intellectual capital is particularly subtle, usually included in structural capital, based on best practices embedded in usable research, in human capital that is invaluable through the added value of creativity. This obviously contributes substantially to the growth of value and the performance of certain entities without neglecting the essential baggage of relational capital, identifiable in the knowledge of suppliers and customers directly involved in those activities, including information on market needs and offers, which contributes to understanding what is necessary to remain on the market, especially competitors. The favorable context that brings together the three components at a given time and at a certain stage, in close correspondence, generates that value or wealth, which is of maximum interest to shareholders, without the source and extent of their contribution, for more or less clear reasons, to allow their “patenting,” so that it is expressed through concrete values.

Also here, at the border between IP and IC, the following elements can be successfully mentioned: trade secrets, confidential information, sometimes with predefined costs, other times agreed upon by the parties, depending on their level of importance to the requesting entity.

Nick Bontis’ “exploratory” study of intellectual capital, which reviewed several “conceptual measures and models of intellectual capital and its impact on business performance,” is also notable for its determination to explicitly exclude intellectual property (IP) from the definition of intellectual capital (IC), which is why it does not even consider it relevant in the performance of an entity, arguing that: “intellectual property is represented by assets that include copyrights, patents, semiconductor surveying rights and various design rights. They also include trademarks and services. Conducting an intellectual property audit is not a new idea” [

14,

33].

In this respect, the authors consider, together with many researchers of IC, that the approach is restrictive and unjustified, especially since IP is, in fact, that part that we cannot dissociate from IC, but whose visible and measurable nature has already been attested by copyrights, trademarks, etc., thus assigning, in each case, a concrete value, as mentioned not only in the reference works of many authors, but in “professional reports” such as those of one of the four well-known firms for accounting and auditing, PricewaterhouseCoopers, or the well-established American investment and securities trading company, New York-based Morgan Stanley, established in 1935, almost a hundred years ago.

From their point of view, IP is considered “the most tangible part of the IC,” the rest falling into the important category of intangibles, which adds value to an organization, ensuring favorable market positions, but with a clear disadvantage generated by the nonexistence of a unanimously accepted unit of measurement. On the other hand, the tendency to clearly delimit IP from IC is not acceptable because there is an indisputable relationship between the two through the indestructible link between them, both involving human, structural, and relational capital. It is important that both can be found in measurable forms that consequently ensure their efficient management. Regardless of the approach, IP is an integrated part of the IC of any entity, not only conceptually but also managerially. According to Smith and Hansen (2002), the strategic role of IP is part of a company’s capabilities, especially if it is in the form of know-how, in which case the strategic management of IP contributes substantially to increasing the performance of a company [

54], according to Quinn et al. (1996), who, in turn, assigned a decisive role to “advanced skills” that allow efficient execution, provided that the rules of a discipline are correctly applied, thus contributing to solving the type of complex problems found in the real world, being in fact also the most profitable and widespread level of professional qualification that generates value [

55,

56]. Often dissociating IP from IC, companies face the disadvantage of not understanding the connection and close interdependence between them, only managing to produce a “fracture” between the strategic elements to which the two actually contribute to progress and performance.

An intuitive, highly suggestive description of IC and IP, in line with the above, suggests that IC and IP actually occupy a common area of common interference, measurable and protected, to a greater or smaller extent (see, in this matter,

Figure 4, From intellectual property to intellectual capital).

5. Conclusions

In particular, “the development of any sector involves respecting the principles of sustainability, which means economic, social and environmental development” and every action taken by individuals in every field of activity is very important “for ensuring sustainable development” [

57]. For instance, “promoting organic agriculture through the use of green marketing techniques is useful for improving human, environmental and economic health, in the context of sustainable development” [

57]. Also, another example refers to “the social, economic, and environmental impact of ecological beekeeping in Romania” as well as “the main economic, social, and environmental effects of apiculture practices in Romania”, which are capable to encourage sustainability and competitiveness [

58]. In addition, another relevant case takes into consideration “the quality of life in Romania and the European Union”, with a clear emphasis on “the components of the quality of life and the development of indicators on quality of life in different countries”, since specialists have shown lately a profound concern towards the powerful “links between education, employment and quality of life” [

59].

On top of that, since the activities that takes place on the global markets as well as the dynamics of the actions specific the transnational companies tend to be reflected as a general rule in an open global market, researchers have successfully demonstrated that the economic and financial developments in a specific country may influence and may also be influenced by the developments taking place in other countries [

60]. In this regard, an adequate example might take into consideration the case of Romania’s labor market which is affected by the current economic and financial trends – especially the ones specific to other European Union countries [

60]. Under these circumstances, several specific phenomenon could be encountered in the case of Romania’s labor market in times of economic, financial and social crisis, namely: the rising unemployment as a direct consequence of reducing the volume of activity of many organizations; the increasing migration trends which led, over time, to the decline of the active population of Romania; the changes in the external migration trends, which became, in time, unpredictable and directly linked to the economic and social development of Romania; the immigration policies of developed countries, which are strongly connected to the development of the worldwide economic, financial, social, and political trends [

60].

On the whole, overcoming all the challenges faced by our society these days’, in order to ensure more sustainable, responsible and competitive activities, calls for the implementation of precise and tenacious instruments, measures and policies aimed at creating: a responsible and secure economic, financial, political and social environment [

61]; new jobs while taking into consideration the trends—especially in those countries in which there could be encountered an increase in the number of the aging population; a decrease the migration trend of specialists—especially the young and talented ones; or a decrease in the number of individuals deciding temporary to leave a country in order to work abroad [

60].

It is clear that “green and sustainable finance, corporate social responsibility and financial and non-financial performance are attracting widespread interest due to the challenging times that the business environment is currently facing” [

61]. Research has shown that “green and sustainable finance, corporate social responsibility, and intellectual and human capital have become central issues in measuring organizations’ success, competitive advantage and influence on the marketplace” [

61]. In the same time, other already published scientific papers have successfully managed “to address the relationship between corporate social responsibility, intellectual capital and performance, providing valuable insights and relevant evidence from a Romanian business environment” [

61]. For instance, “in order to identify the factors that have influenced the Romanian companies’ level of compliance required by the Directive 2013/34/EU with respect to publishing, alongside the annual financial statements for 2017, a report containing non-financial information regarding environmental, social, and personal aspects, and business ethics”, the groundbreaking study entitled “Corporate Social Responsibility, Corporate Governance and Business Performance: Limits and Challenges Imposed by the Implementation of Directive 2013/34/EU in Romania” carefully focused on the following key steps: firstly on analyzing “whether there are statistical associations between the level of compliance and the legal forms of organization, the forms of ownership of capital, the branch of activity, the number of employees, the turnover, and the company location”; secondly on evaluating “the meaning and intensity of these associations with the help of non-parametric correlation coefficients”; thirdly, on identifiying and presenting “the economic and social causes of the results obtained”; and fourthly, on proposing “measures that can contribute to increasing the degree of compliance” [

62]. What is more, the rigorous scientific work entitled “Corporate Social Responsibility, Corporate Governance and Business Performance: Limits and Challenges Imposed by the Implementation of Directive 2013/34/EU in Romania” accurately highlighted “the need to enhance corporate governance and corporate social responsibility in order to create an appropriate balance between sustainability, competitiveness, productivity, and businesses’ financial and non-financial performance, while taking into consideration the benefits brought by the tangible value of businesses (such as, cash flow and earnings) as well as the intangible value of businesses (such as, brand, customer experience, intellectual capital, organizational culture and reputation)” [

62].

The researches carried out in this scientific work focusing, in particular, on sustainability assessment, the OECD/G20 inclusive framework for BEPS and the disputes over the recognition, and the measurement of intellectual capital allowed, on the one hand, the verification of the hypotheses attesting to the existence of legal premises that favored the transfer of income in jurisdictions favorable to the taxation of intellectual property rights and other intangible assets difficult to assess. The results are in line with studies conducted and published by the OECD in 1998 [

63,

64] and in 2013 [

26,

27]. On the other hand, our study confirmed the concern and tendency of jurisdictions to comply with the requirements of the BEPS plan for the abolition of harmful tax regimes, which encourages increased transparency and the spontaneous exchange of information, being in accordance with the results of the annual evaluations carried out by the inclusive framework of BEPS.

Following the analyses, it was found that the number of general recommendations and those related to the alignment of the economic substance on IP were continuously decreasing, with the premise that, in the following assessments, all harmful articles that favor the transfer of income and reduction where the revenues were obtained for tax reasons should be completely abolished. The result is in line with the concerns of the OECD and G20 and also of other international bodies concerned with reforming the tax system after a century so that corporate income tax is paid where revenue is generated and tax facilities are granted only to entities that have contributed directly and only in that jurisdiction to the achievement and capitalization of income-generating results [

27,

28,

29,

43,

44,

45,

46].

The answer to the decades-old concerns about the definition and valuation of IC and its components can be provided by the NEXUS method proposed by the BEPS plan, which can put an end to the countless disputes over the valuation and financial reporting of IC. It was found that, although the modified NEXUS method used expenditures as representation for the evaluation of research and development and, moreover, extended this principle of involvement to the revenues obtained after the creation and operation of IP, it did not provide a reasonable solution for evaluating IC. IC does not fully identify with IP, as there is a significant transition area between the two that made it difficult to delimit the reporting category. Moreover, the eligible costs used in the NEXUS approach were not quantified on the structural elements of IP or IC, which allowed the partial verification of Hypothesis H3, but without ending the disputes.

All in all, when acknowledging the crucial importance of the meaningful relationship that exists between competitiveness and sustainability, reputed specialists rigorously refer in their studies to all the instruments and methods specific to the financial diagnosis of the company [

65]. What is more, when acknowledging the crucial importance of the meaningful relationship that exists between competitiveness and sustainability, well known specialists encourage a modern and visionary approach [

66]. Furthermore, it should be emphasized that “the OECD Guidelines for Multinational Enterprises (“the Guidelines”), adopted in 1976,” which are, in fact, considered “the most comprehensive international standard on responsible business conduct (RBC),” constantly “provide recommendations on expected business behavior in the key areas in which business activity impacts people and the environment”, have annually very promptly referred to the “evolving economic contexts, increasingly complex supply chains and growing expectations from society on business responsibilities” [

67]. Therefore, it should be pointed out that, in particular, the OECD 2019 and 2020 Guidelines for Multinational Enterprises have shown “a growing interest on the application of OECD RBC standards and tools to environmental impacts,” and especially on sensible and stringent matters such as “climate change and biodiversity loss” [

67]. In like manner, the OECD 2019 and 2020 Guidelines for Multinational Enterprises as well as The 2030 Agenda for Sustainable Development have notably contributed “to the implementation of the Sustainable Development Goals”, being, on the one hand, extremely focused on sustainability assessment, economic and financial analysis, performance indicators, integrated assessment, sustainable development, corporate social responsibility, quality and life value, and, on the other hand, calling “for a robust involvement of the private sector in global development efforts” [

67].

Nevertheless, “the implementation of RBC standards is essential for the private sector”, in order to be able “to maximize its contribution to the Sustainable Development Goals (SDGs)” [

67]. Thus, for instance, “the implications of digitalization for responsible business conduct are manifold”, since different organizations need to take into account the fact that “new digital tools can accelerate development, and enable businesses to strengthen their efforts to act responsibly”, “as it relates to responsible supply chain management (e.g. blockchain technology to manage supply chains, machine learning and analytics to track risk)” [

67]. At the same time, for example, “the digital transformation can also lead to business causing or contributing to human rights and other social and environmental harms in new ways (e.g. risk of bias and discrimination in the use of artificial intelligence, and human rights risks associated with surveillance technology and the misuse of online content platforms to spread disinformation and empower the black market)” [

67].

Essentially, it is believed that “IP rights aim to stimulate innovation by enabling inventors to appropriate the returns on their investments”, and, in the same time, “IP also plays an important role in the creation, dissemination and use of new knowledge for further innovation, as contained in the inventions disclosed in patent documents” [

68]. In particular, reputed international organisms have pointed out in their works and discourses the fact that “the changing landscape of innovation, the globalization of markets and the fragmentation of production value chains, as well as the emergence of new players are changing the way market actors use IP rights and policy-makers understand rights and their role”, currently stressing the fact that “the context in which IP currently operates is very different from the one in which IP rights were conceived”, and also lately the “IP systems are undergoing continuous changes as they seek to optimize the balance between private and social benefits to contribute to economic growth and the welfare of societies” [

68].

In conclusion, all the important organizations worldwide as well as their leaders strongly believe that “knowledge will be the pivotal factor in corporate growth and development”, taking into account that “companies therefore depend on being able to measure, manage and develop their knowledge and expertise” [

69]. Moreover, according to researchers “to be able to face conditions with ever-changing markets and technologies” companies will have to “develop the capabilities and competencies necessary for adaptation and realignment with their environment”, since “the human resources and the company’s management, strategy and organization are essential elements” [

69]. Furthermore, “knowledge becomes the main asset of the company”, which will implicate that “in the knowledge-based society, management and control of a company will focus on the company’s knowledge resources and the use of these” [

69].

Taking into consideration all the elements described and argued above, it seems that for our society “the ability to measure the knowledge and expertise of a company—its intellectual capital—and the development of this” [

69]. On the whole, our society has to focus these days “on intellectual capital accounts as a tool to measure, manage and report corporate intellectual capital”, since “the intellectual capital accounts illustrate the scope of the intellectual resources and competencies of a company and the consequences of the management activities to manage and develop these” [

69]. Also, specialists have pointed out that “the development of intellectual assets reports and increased attention to narrative reporting has also focused attention on key performance indicators (KPI) and management, boards and investors have all been pressing for such information” [

70], since our society tends to become more focused on the role and the importance of several key factors, such as: the companies’ capital structure; the values and potential of intellectual assets—with a clear emphasis on intellectual capital and intellectual property; the evaluation and measuring methods capable to show the positive influence of intellectual capital and intellectual property on accounting and economic and financial analysis; the power of understanding and correctly using performance indicators, thus ensuring integrated assessment, sustainability assessment, sustainable development, corporate social responsibility, and good governance.