Abstract

The increasing request for food sustainability is affecting the pasta sector in Italy. This phenomenon introduces different sources of uncertainties that, in turn, put pressure on all the stages of the supply chain, with a consequent emerging need for a higher level of coordination. Based on the Transaction Costs Theory approach, the paper is aimed at verifying whether contract design—revolving around the negotiation of contractual attributes with different functions in terms of safeguard, adaptability, and coordination—plays a crucial role in aligning sources of uncertainty surrounding transactions with the allocation of property and decision rights. To this aim, a sample of durum wheat producers is interviewed for expressing their preferences about some contractual features, such as price, production and quality rules, sustainable environmental techniques, and advisory services. Using a discrete choice analysis through a multinomial logit model, results reveal that, thanks to the presence of attributes able to ensure coordination and adaptability, contracts are able to steer towards elements of sustainability related to food quality and safety, whereas further efforts are needed to share environmental goals with farmers.

1. Introduction

Societal expectations regarding the environmental impact of food production patterns, as well as issues related to food safety and food security, are increasingly acknowledged by the civil society, now called upon to stimulate a change in food production and consumption patterns [1]. Due to several food scandals worldwide, consumers became increasingly suspicious and reacted with alarm to reports of diseases, or potential diseases, related to food [2,3]. Against this growing demand for transparency of productions related not only to food quality but also to the socio-environmental impact of food production, there is increasing evidence from the literature that firms have started to embed sustainability in their corporate strategy in many different ways, especially in the interaction with other supply chain actors [4,5]. As a consequence, the need for coordination and adaptation along the modern agri-food value chain further arose, and under these circumstances, transactions usually shifted from traditional spot markets to more complex contractual or hierarchical arrangements [6].

The Italian pasta supply chain represents an interesting case study, where several major retailers started providing own-label products to certify origin and to respond to new consumers’ preferences for 100% Italian grains semolina brands that embed the adoption of sustainable production practices [7,8]. Accordingly, contracts aimed to promote sustainability have gained momentum in the pasta sector to ensure typicality, quality, and territorial identity of the final products [9]. A question then arises on how production contracts, as a coordination instrument, can guarantee the socio-economic and environmental sustainability of pasta. This study addresses such a question from a Transaction Costs Theory (TCT) perspective. In this strand of the literature, the adoption of production contract is approached as a governance solution aiming to minimize transaction cost arrangement and organize the production and sales process between farmers and their customers. Thus, an important incentive for farmers to use contracts is to reduce transaction costs, such as search, measurement, and monitoring costs [10,11,12].

The present paper aims to open and look inside the “black box” of relational contracts, taking into account contractual term-functions (safeguarding, coordination, and adaptability). The preferences of farmers on contractual clauses are considered in terms of the allocation of decision and property rights to adapt to mutable transactional attributes, mainly uncertainty [13]. To this purpose, data coming from questionnaires submitted to durum wheat producers are analyzed, and a choice-based conjoint analysis is performed by means of a multinomial logit model, widely applied in the literature for analyzing choice preferences.

The article is organized as follows. Section 2 illustrates the theoretical framework and sets the conceptual framework to elaborate the research hypotheses. Section 3 describes the way data were obtained and the statistical method employed for the quantitative analysis. Results are then shown in Section 4 and discussed in light of the existing literature. Lastly, the paper ends with some final remarks.

2. Theoretical and Conceptual Framing

The role of contract farming (CF) has increased, with particular impact at the farm level [14]. Agribusiness firms requiring a consistent supply of high quality agricultural raw materials have widely adopted CF as the dominant approach to coordinate their supply chains [15]. CF helps farmers to connect to output markets and often provides incentives to improve access to knowledge, better technologies (e.g., highly productive varieties), productivity-enhancing inputs, and credit [16]. It also stimulates skill transfer and promotion of sanitary and phytosanitary standards so as to improve supply quantity and quality [17]. Flourishing literature has emerged analyzing CF as a way to help smallholder farmers in the least developed countries to overcome the challenges they face when trying to access more remunerative markets and their effects on welfare and farm income (see [18] for an exhaustive review). After Grosh [19] noted that this institution can help addressing risk and uncertainty, imperfect factor markets, and reluctance to adopt new technology, CF has been analyzed for many countries and across many crops as a tool for rural poverty alleviation [20].

A plethora of literature has investigated the effect of CF on high-value crops instead [21,22]. Previous works have shown that there are challenges in employing contracts in food chains such as rice, soybean, maize, and wheat [23]. However, information on CFs is not widely available in staple food chains; therefore, there is little evidence of their impact in low-value crops, which also contribute significantly to human health and agricultural sustainability [24].

2.1. Uncertainty and Relational Contracts

Credence attributes of food products are of growing importance because of the relevance of quality strategies [2] and of food sustainability [25]. These attributes increase the role of uncertainty due to the information asymmetry between seller and buyer (e.g., farmer and processor, retailer, and consumer). Environmental (in the sense that is “exogenous”, thus mainly related to market and quality) and behavioral uncertainties are widely considered as the most important determinant of governance structures in modern food chains [15,26]. Abebe et al. [27] highlight that these different types of uncertainty are relevant drivers for contract farming. According to Williamson [28], uncertainty tends to drive the choice of the governance structure and then of the very contract content in terms of its attributes. In order to disentangle this complex process, we refer to the recent development of TCT [13].

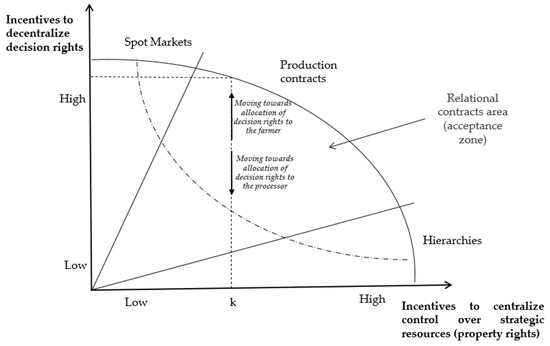

Contract farming entails different types of contracts. Figure 1 illustrates the differences among the governance structures in terms of decision and property rights. Property rights are about the residual claimant who, as a last resort, can transfer rights to use and determine the conditions under which such transfer can be performed. Decision rights are about how these rights are exercised, and/or about the procedures through which decision-makers can operate. Among the many governance structures, marketing contracts and production contracts can be easily distinguished by the combination of property and decision rights they set in the specific arrangement. Production contracts, for example, are characterized by the more pronounced allocation of decision rights on technology to the processor than in the case of a marketing contract. The latter, in turn, is more similar to a market exchange, even though some decision rights are centralized—e.g., the time of delivering.

Figure 1.

Linking transaction costs and relational contracts: the research idea development (adapted from Ménard [13]).

The more the strategic resources are pooled among the parties, the more centralization of the decision rights becomes efficient. The acceptance zone of the relational contracts is identified by a set of coordinates related to the incentives to centralize decision and property rights, in which the efficiency is achieved by adaptation.

Figure 1 shows that, for a given level of centralized control over strategic resources (k), the organizational efficiency can be achieved by choosing the adequate degree of centralization of decision rights. The approach of this study consists of the efficient combination of property and decision rights in a contract, achieved by adequately combining contractual terms.

2.2. Functions of Contractual Attributes

In earlier and even contemporary literature, contracts are generally regarded as a unidimensional construct, by which organizations protect themselves from a counterparty’s opportunism [29,30]. The increasing role of uncertainty surrounding transactions paved the road for going beyond such a monodimensional approach to the contract, since, due to future uncertainty and human bounded rationality, it is impossible to write a complete contract able to foresee all possible events in the future [31].

Mellewigt et al. [32] proposed a functional perspective that considers the contracts as serving three functions by means of their terms. In addition to a safeguard function to react to opportunistic behavior in the presence of specific investments, a coordination function is aimed at aligning expectations by specifying decision rights, while an adaptation function is aimed at coping with future exogenous contingencies. Thus, contracts serve as three functional instruments by limiting partners’ opportunism, aligning each other’s actions, and coping with future uncertainty. From the TCT perspective, while safeguard and coordination clauses are associated with the ex ante moment of the transaction, inherent risks due to the presence of uncertainty and the impossibility of forecasting all future contingencies create the need for adaptive contractual clauses, which help parties to deal with unexpected events [33]. To avoid being vulnerable to uncertainty, contractual adaptation clauses (referred to unforeseeable technological, social, environmental, and economic development) specify how to handle unanticipated events during the collaboration process [34].

2.3. Conceptualization and Research Hypotheses

Our conceptualization focuses on the role played by contractual attributes included in production contracts, given that both its design and negotiation are affected by:

- The type of rights involved by contractual terms;

- The source of uncertainty related to these terms;

- The type of function performed, depending on whether they are or not associated with the ex ante moment of a given transaction.

Since formal contracts are established ex ante and are incomplete, the contract capacity to safeguard the parties or establish coordination and adaptation roles is limited, mainly because future contingencies cannot be forecast [35]. Uncertainty intensifies contractual incompleteness, demanding mechanisms that bring adaptations. In addition to safeguard and coordination purposes to address contingent uncertainty related to appropriation and interdependence concerns, actors rely on adaptation rules as a mean to sign the contract balancing the gain (and the loss) from future uncertainty trade-off, with the possibility of adapting the governance structure during the life of the contract [36]. Thus, relational contracts become relevant for the minimization of risks and in driving the relationship among companies in the presence of several sources of uncertainty, since relational governance structures provide a flexible device and protection against opportunism, which are necessary for contexts demanding an efficient adaptation [37].

We posit that the choice of contract is based on the function that single contractual terms have in the allocation of decision rights (since property rights are often given), in order to economize transaction costs related to different forms of uncertainty. Table 1 shows the relationship between uncertainty, contractual attributes, and their functions.

Table 1.

Type of uncertainty, contractual attributes, and their functions.

Market uncertainty depends on the inability to predict the price of outputs due to rapid market changes [38] and implies the presence of contractual terms aimed at adapting to contingencies [39]. Therefore, in the presence of this form of uncertainty, our first hypothesis (H1) is the following:

Hypothesis 1 (H1).

Adaptive contractual terms related to price affect the likelihood of using contracts to centralize decision rights.

Technological uncertainty relates to the inability to predict and precisely control and, therefore, forecast practices and techniques used in the production process as well as the volume of production, because of the biological nature of production [15]. Moreover, it is well-known that agricultural products are themselves subject to climatic conditions and environmental accidents that are exacerbated by the intensive use of inputs [40]. In the presence of such heightened risks, the adoption of sustainable techniques combined with reduced use of chemical inputs in farming practices — aimed at conciliating biosphere regeneration capacity and productivity—brings more technological uncertainty related to the ability to manage a transition characterized by lower use of agrochemicals and monoculture [1]. In this case, both problems of coordination and adaptation between farmers and processors arise, because of the need to define both technical rules and responsibility and to adapt to engineering changes and uncontrollable factors, such as weather effects and pests. Accordingly, in the presence of technological uncertainty, we elaborate the following hypotheses:

Hypothesis 2 (H2).

Coordinating and adaptive contractual terms that refer to production techniques affect the likelihood of using contracts to centralize decision rights.

Hypothesis 3 (H3).

Coordinating and adaptive contractual terms that relate to sustainable cultivation techniques affect the likelihood of using contracts to centralize decision rights.

Hypothesis 4 (H4).

Coordinating and adaptive contractual terms that refer to the provision of technical assistance affect the likelihood of using contracts to centralize decision rights.

Both quality and technological uncertainties emerge in the presence of stringent food safety and quality standards. These latter imply increased coordination costs aimed at establishing targets and measurements due to the fact the food safety failures can have deleterious consequences to the agribusiness firm in terms of legal liability, reputational damage, consumer confidence, and future earnings [2,41]. Moreover, since agricultural products are increasingly valued for specific attributes, such products pose performance measurement difficulties as the seller has an informational advantage and may gain from quality cheating [42]. Therefore, we elaborate the fifth hypothesis when quality and technology are at stake, as follows:

Hypothesis 5 (H5).

Coordinating contractual terms related to quality thresholds affect the likelihood of using contracts to centralize decision rights.

Lastly, behavioral uncertainty emerges because contracting parties may act opportunistically. For instance, delays in payment and unfair practices jeopardize future transactions [43]. However, introducing higher levels of coordination and a fairer distribution of risk before the transactors are all avenues that could make contracts more viable for farmers [44,45]. As a consequence, the last hypothesis arises in the presence of this type of uncertainty:

Hypothesis 6 (H6).

Coordinating contractual terms that refer to the time of payment affect the likelihood of using contracts to centralize decision rights.

3. Materials and Methods

In order to assess the six hypotheses mentioned above, an ad hoc survey was carried out by administrating specific questionnaires to durum wheat farmers throughout Italy.

In more detail, from October 2019 to February 2020, farmers from several regions that represent the main areal of durum wheat production in Italy were interviewed using questionnaires specifically built for investigating their preferences as regards contractual terms. In particular, different potential contracts were proposed to farmers, characterized by six attributes (each one with three levels), reflecting different types of uncertainties (see Section 2). Attributes and levels were based on previous analyses of the most representative contracts used in the durum wheat supply chain in Italy (see [8] for more details). Moreover, the selected attributes and their levels were shared with key actors of the supply (sales managers of processing companies and farmers’ organizations) directly involved in negotiating contracts, to validate the experimental design and boost its robustness and reliability. In Table 2, we reported the list of attributes considered for this work, by distinguishing them according to the involved type of uncertainty. Moreover, the description of each attribute level was also reported.

Table 2.

Contractual attributes and levels of each one.

The questionnaires were derived from a discrete choice experiment. Given the set of attributes with the respective levels, a full factorial design would consist of 36 = 729 different contracts, obtained by combining the six attributes according to their three levels. However, this number of potential contracts was too complex to manage using a single experiment. As a consequence, a fractional factorial design was considered and contracts were randomly distributed into 18 choice sets, each one with three possible contracts. Hence, 54 different contracts were involved in the end.

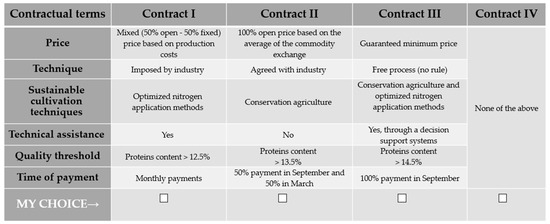

Choice sets were arranged into six blocks (each one with three choice sets) and each farmer had to face one of these blocks. Then, three choice situations arose, one for each choice set, in which the farmer had the possibility to specify his preference towards one of the three contracts, or, as an alternative, he could decide not to choose, by selecting the no-choice option, which corresponded to “none of the previous contracts”. As an example, Figure 2 shows a choice situation.

Figure 2.

Example of a choice set.

From a statistical point of view, in order to investigate the effects of contractual attributes on farmers’ preferences, we employed a multinomial logit model, in particular its extension for managing the no-choice option. This extension consisted of adding an extra dummy variable, equal to 1 in correspondence of the no-choice alternative, and 0 otherwise [46,47].

The multinomial logit model was broadly applied for analyzing choice preferences in many different contexts [48,49] and may be placed within the random utility modeling framework. In fact, if decision maker i (farmer in the present case) had to choose among J different alternatives (contracts in our context), he/she would select the one that maximizes his/her utility, namely Uij, with j = 1, …, J. As a consequence, the probability of choosing alternative k is

Pik = Prob (Uik > Uij, j ≠ k).

Utility Uik can be seen as the sum of two components—that is, Uik = Vik + εik. Deterministic component Vik, also known as representative utility, depends on parameters (to be estimated) related to observed explanatory variables, while random component εik captures the impact of all the unobserved variables not included in Vik.

The multinomial logit model assumes that the random component is independently, identically extreme value distributed. Then, the choice probability can be written in the following closed-form:

Often, representative utility Vik is linearly specified in terms of alternative attributes xk, then Vik = xkTβ, where parameter vector β represents the effects of the alternative attributes on choice process.

Generally, estimates of parameters collected in β are difficult to interpret, as they correspond to the difference in the utilities between two alternatives (i.e., two contracts that are identical but for a level of a particular attribute). Meaningful interpretations of parameter estimates can, therefore, be drawn by computing marginal effects, which report the effect of a particular attribute level directly on probability Pik, (instead of involving the utility). They can be obtained by transforming the coefficient estimates. In particular, in this work, we used the semi-elasticity, which expresses the percentage variation in Pik as a consequence of 1-unit change in attribute xk, other things being unchanged. It can be computed as the derivative of the logarithm of Pik (Equation (2)) with respect to xk and is equal to βk(1 − Pik).

4. Results

This section shows the results obtained on a final sample of 198 questionnaires, related to farmers who completely fulfilled the questionnaire. Since each farmer faced three choice situations, 594 choices were available, of which 124 (20.9%) consisted of the no-choice alternative. As regards the other situations, in which farmers chose one of the proposed contracts, we can observe Table 3, where the raw choice frequency (%) for each attribute level was reported. From this table, we can have an at-a-glance overview of farmers’ choices about the contractual terms, although we cannot assert with absolute certainty that the specific attribute level influenced the farmers’ choice. Rather, these frequencies can be seen as a simple description of the choice process carried out by our sample of farmers.

Table 3.

Raw choice frequency (%) for each attribute level, separated according to the involved type of uncertainty. Due to the no-choice option (chosen in 20.9% of the situations), the frequencies within each attribute did not sum up to 100%.

Overall, the sample resulted to be quite heterogeneous with respect to all the attribute levels, since, for each attribute, the final choices were almost equally spread over the three levels. However, a noteworthy difference among the choice frequencies can be observed as regards the price attribute, where little more than one choice out of three (35.9%) was towards contracts with a guaranteed minimum price, while a 100% open price was chosen in only 16.7% of the situations. Moreover, we observed a high propensity to choose contracts in which the production techniques were freely decided by farmers or, at most, in accordance with the industry (30.1% and 29.3%, respectively), as well as a high inclination to technical assistance, as less than one choice out of five (19.2%) consisted of contracts without technical assistance.

The multinomial logit model was estimated on the data at issue by means of the R package “mlogit”, version 1.0-3 [50]. The maximum likelihood estimates of the model parameters were reported in Table 4a. For each attribute, the estimated parameter of each level consisted of the difference between the utility of a contract with that level with respect to the utility of a contract including the reference level among its terms, other things (i.e., other attributes) being unchanged. Moreover, the marginal effects (absolute average variations) on the probability of choosing a contract were also reported (semi-elasticity). As results in Table 4a reported estimates of the effects of two levels (levels 2 and 3) with respect to the reference one (level 1), in Table 4b, we also reported the estimates of the effects between levels 2 and 3, in order to have, for each attribute, a complete picture of all the possible comparisons among attribute levels on the choice probability.

Table 4.

Parameter estimates from the multinomial logit model as regards farmers’ preferences for contractual attributes. Estimates with respect to the reference level (level 1) were reported in (a), while the comparisons between level 2 and level 3 were reported in (b).

As can be observed in Table 4a, estimates for price attribute revealed that the presence of a 100% opened price in a contract negatively affects the probability of choosing a contract with respect to a contract with the guaranteed minimum price, other things being equal. This effect was equal to −0.693 in terms of the difference between utilities, but considering marginal effects, a 100% opened price led to a relative average variation of −52.0% in the probability of choosing a contract. The same also applied for a mixed price, even if with a lower extent (parameter estimate equal to −0.334 and semi-elasticity equal to −25.1%). Moreover, comparing a mixed price with a 100% opened price gave a positive and significant estimate (equal to 0.358, corresponding to a relative average variation of 26.9% in the probability of choosing a contract, see Table 4b), confirming that a 100% opened price was considered as the worst one by farmers.

As far as the technique attribute was concerned, results showed that farmers significantly disliked contracts in which the technique was imposed by the industry, with respect to contracts where the technique was freely decided by farmers (semi-elasticity equal to −28.7%). Moreover, farmers were indifferent to a decision on the technique taken in collaboration with the industry with respect to contracts where they can freely decide. Finally, an imposed technique had a significant and negative effect (−31.8% on the probability of choosing the contract) even compared with contracts where it was decided in collaboration.

Furthermore, looking at the negative and significant parameter estimate related to the highest quality threshold (protein content greater than 14.5%), we can say that this threshold discouraged farmers from a potential choice with respect to the lowest threshold (protein content greater than 12.5%). Specifically, this level of quality attribute had a parameter estimate equal to −0.344, which led to an average decrease, ceteris paribus, equal to 25.8% on the probability of choosing a contract.

The presence of a technical assistance service positively impacted the probability of adopting a contract with respect to the option without technical assistance. As can be observed in Table 4a, the magnitude of this attribute was quite similar both in the case of simple technical assistance and through a decision support system (semi-elasticity equal to 25.1% and 29.2%, respectively).

Lastly, both contractual terms referred to the sustainable cultivation techniques, and the time of payment did not significantly affect the probability of signing a contract.

4.1. Discussion

The main purpose of the present paper is to investigate whether and how the presence of contractual attributes playing coordinating and/or adaptive functions affect the centralization of decision rights to address different sources of uncertainty. The empirical analysis allowed the confirmation of the majority of the hypotheses, which henceforth are discussed in light of the existing literature.

As for H1, results highlight that farmers rely on adaptive contractual terms with the purpose of reducing market uncertainty. Opting for a guaranteed minimum price (not influenced by market trends) compared to an open or mixed price, producers of durum wheat address the increasing risks of price volatility and consequent rising pressures on their incomes [51,52]. Results confirm that much of the market uncertainty is reduced by the use of contracts with predetermined prices rather than the market prices [53], despite the fact that farmers may forego the opportunity of a potentially higher prices between the contracting date and delivery [54]. Therefore, in a scenario characterized by globalization of agri-food chains and declining of public resources for agriculture, farmers prefer fixed-price contracts or, in alternative, mixed-price contracts that open up the opportunity for adaptation [55,56].

With regard to H2, results reveal that farmers prefer to negotiate contractual terms to coordinate transfer of rights related to the production process with the industry or, as an alternative, to freely manage and adapt techniques to the contingencies. Empirical evidence confirms that the extreme variety of available technologies generates growing uncertainty about the cost/benefit of existing alternatives [57,58]. As a reaction, the need for adaptation to unpredictable technologies pushes parties to pool rights, designing in advance the possibilities for future events by means of contracts, in order to reduce misalignment costs [59].

As far as H3 is concerned, findings do not allow the confirmation of whether and how the introduction of terms that refer to sustainable cultivation techniques affects the decision to use contracts. Although contractual terms are used to adapt techniques and practices of production in order to increase farms’ performance in terms of environmental sustainability [60], the fact that contracts can be used to transfer liability of the environmental pollution from agribusiness firms to farmers could hinder the diffusion of these solutions [61]. Moreover, results could reveal that durum wheat producers are not willing to bear the cost of environmental-friendly techniques whether such an effort is not explicitly compensated (in terms of additional costs) or incentivized (in terms of additional value).

Findings allow the confirmation of H4 and show that farmers are willing to share their decision rights with the counterpart to stay updated and receive continuous information regarding the adaptation of technology to contingencies. In this regard, we confirm that the provision of decision support systems and the exchange of information represent the cornerstones of a strategy of knowledge transfer to adapt to unpredictable events, with mutual advantages for both suppliers and buyers [62]. Several global agri-food companies have started to offer agricultural advisory services, teaching farmers how to monitor and adapt the usage of resources and fertilizers, so as to improve production yield on an ongoing basis [63]. In the durum wheat sector, similar contractual terms that offer dedicated services of technical assistance have been recently introduced as well [8]. Moreover, such a service can also represent a valid instrument to reduce the likelihood of opportunistic behavior during the production process [40].

With regard to H5, results confirm that the contractual term that refers to quality affects the use of contracts in the durum wheat sector. As a reaction to the bilateral dependency among trading partners in order to ensure food quality [2], contractual terms that refer to the quality threshold satisfy the increasing need to address behavioral uncertainty by imposing tight coordination of decision rights between farmers and processors [64,65]. In this regard, it is not by chance that in our case farmers preferred scarcely stringent contractual terms imposing low protein content. In the wheat sector, due to the fact that cropping choices and cultivation practices directly affect the protein content and gluten quality, this source of uncertainty has, therefore, emerged, making millers wary of such conducts, since farmers may act opportunistically, by exploiting their informational advantage to cheat on the quality performance achieved [9,42,66].

Lastly, H6 must be rejected. A possible explanation could be that a contractual term that refers to time of payments is not able to trigger the use of contracts because of the role already played by the institutional environment to decrease this source of behavioral uncertainty. In detail, the Italian law (establishing mandatory periods of payment for sales contract of agricultural products since 2012) could represent a valid deterrent for opportunistic behavior and unfair trade practices [67].

4.2. Final Remarks and Limitations

Empirical evidence shed light on the role played by contractual attributes in order to affect farmers’ utility and their preferences in the durum wheat sector. The main contributions of the paper are henceforth reported. First, it confirms the importance of the design relational contracts, as a cornerstone of the transactional relationships between farmers and buyers (i.e., processors, manufacturers) at the core of hybrid arrangements. Second, it reveals that some contractual attributes may incentivize the centralization of decision rights, according to the sources of uncertainty they have to deal with. Since price, production rules, technical assistance, and quality thresholds are related to market, technological, and behavioral uncertainty, they are all elements that significantly stimulate the alignments of economic incentives and transactional attributes by means of contractual relationships. As a consequence, this paper confirms the growing role of the uncertainty in the modern agri-food sector, also in the presence of staple commodities traditionally entailing a low level of asset specificity. Third, the work puts emphasis on the different functions played by contractual attributes. Results highlight that both the coordinating and adaptive functions gain momentum since farmers tend, on the one hand, to share and jointly address the uncertainty surrounding transactions with the counterparts and, on the other hand, to pave the road for future continuous adaptation to unpredictable events.

In conclusion, this paper contributes to the debate on the role of the agri-food sector in contributing to the Sustainable Development Goals. It reveals that Italian producers of durum wheat are more willing to accept contractual clauses related to food quality rather than to the adoption of sustainable agronomic practices. In this regard, it must be noted that farmers usually bear costs to comply with high European Union standards for public, plant, and animal health and welfare rules (i.e., the so-called “cross-compliance”) in change of the public support of the Common Agricultural Policy. As a practical recommendation for managers and policymakers, it follows that contracts aimed at properly aligning economic incentives with the environment should better specify concrete and measurable socio-environmental targets/thresholds in their contractual clauses, so as to make easier the evaluation of costs and benefits for farmers, and to respond to future consumers’ expectations in terms of sustainability. Looking inside the “black box” of the contract, attention should also be paid to the coordinating and adaptive functions of contractual attributes to address, on the one hand, the contingent uncertainty related to interdependence concerns and, on the other hand, to adapt the governance structure to future uncertainty during the entire life of the contract. Therefore, much needs to be done in order to design production contracts that fix possible coordination and adaptation misalignments, so as to share risks and create opportunities for mutually advantageous benefits like hybrids arrangements usually do.

However, this paper has some limitations that must be taken into account and may represent a starting point for future research. First, the sample lacks representativeness, so findings cannot be properly generalized. Second, the paper focused on farmers’ preferences without investigating those of the counterpart, leaving room for interpretation of the possible reaction of buyers and processors in a negotiation process. Experimental auctions are at the forefront of the research in this field to address both issues, investigating real transaction in seller–buyer negotiation.

Author Contributions

Conceptualization, S.C. and G.M.; methodology, S.C., G.M. and S.D.S.; validation, S.C., G.M. and A.F.; formal analysis, S.D.S.; investigation, A.F. and G.P.; data curation, S.D.S.; writing—original draft preparation, S.C.; writing—review and editing, G.M. and S.D.S.; visualization, S.C., G.M. and S.D.S.; supervision, G.M.; project administration, G.M. and A.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Blasi, E.; Ruini, L.; Manotti, C. Technologies and new business models to increase sustainability in agro-food value chain Promote quality and reduce environmental footprint in durum wheat cultivation processes. Agro Food Ind. Hi-Tech 2017, 28, 52–55. [Google Scholar]

- Ménard, C.; Valceschini, E. New institutions for governing the agri-food industry. Eur. Rev. Agric. Econ. 2005, 32, 421–440. [Google Scholar] [CrossRef]

- Martino, G.; Perugini, C. Hybrid forms in food supply. In International Agri-Food Chains and Networks: Management and Organizations; Bijman, J., Omta, O., Trinekens, J., Wijnands, J., Wubben, E., Eds.; Wageningen Academic Publishers: Wageningen, The Netherlands, 2006; pp. 287–301. [Google Scholar]

- Formentini, M.; Taticchi, P. Corporate sustainability approaches and governance mechanisms in sustainable supply chain management. J. Clean. Prod. 2014, 112, 1920–1933. [Google Scholar] [CrossRef]

- Anh, N.H.; Bokelmann, W.; Thuan, N.T.; Nga, D.T.; Van Minh, N. Smallholders’ Preferences for Different Contract Farming Models: Empirical Evidence from Sustainable Certified Coffee Production in Vietnam. Sustainability 2019, 11, 3799. [Google Scholar] [CrossRef]

- Sykuta, M.; James, H.S. Organizational economics research in the US Agricultural sector and the contracting and organizations research institute. Am. J. Agric. Econ. 2004, 86, 756–761. [Google Scholar] [CrossRef]

- Carillo, F.; Caracciolo, F.; Cembalo, L. Do durum wheat producers benefit of vertical coordination? Agric. Food Econ. 2017, 5, 1–13. [Google Scholar] [CrossRef]

- Ciliberti, S.; Martino, G.; Frascarelli, A.; Chiodini, G. Contractual arrangements in the Italian durum wheat supply chain: The impacts of the “Fondo grano duro”. Econ. Agro-Aliment./Food Econ. 2019, 21, 235–254. [Google Scholar] [CrossRef]

- Rossi, V.; Meriggi, P.; Caffi, T.; Giosué, S.; Bettati, T. A Web-based Decision Support System for Managing Durum Wheat Crops. In Decision Support System; Devlin, G., Muyeen, S.M., Eds.; Intech: Rijeka, Croatia, 2010; pp. 1–26. [Google Scholar] [CrossRef]

- Allen, D.W.; Lueck, D. The Nature of the Farm; The MIT Press: Cambridge, MA, USA, 2004. [Google Scholar]

- Hobbs, J. Measuring the importance of transaction costs in cattle marketing. Am. J. Agric. Econ. 1997, 79, 1083–1095. [Google Scholar] [CrossRef]

- Fukunaga, K.; Huffman, W.E. The role of risk and transaction costs in contract design: Evidence from farmland lease contracts in U.S. agriculture. Am. J. Agric. Econ. 2009, 91, 237–249. [Google Scholar] [CrossRef]

- Ménard, C. Organization and governance in the agrifood sector: How can we capture their variety? Agribusiness 2018, 34, 142–160. [Google Scholar] [CrossRef]

- Wang, H.H.; Wang, Y.; Delgado, M.S. The transition to modern agriculture: Contract farming in developing countries. Am. J. Agric. Econ. 2014, 96, 1257–1271. [Google Scholar] [CrossRef]

- Mugwagwa, I.; Bijman, J.; Trienekens, J. Typology of contract farming arrangements: A transaction cost perspective. Agrekon 2020, 59, 169–187. [Google Scholar] [CrossRef]

- Da Silva, C.A.; Rankin, M. Contract farming for inclusive market access: Synthesis and findings from selected international experiences. In Contract Farming for Inclusive Market Access; Da Silva, C.A., Rankin, M., Eds.; FAO: Rome, Italy, 2013; Volume 1, pp. 1–18. [Google Scholar]

- Mishra, A.K.; Kumar, A.; Joshi, P.K.; Souza, A.D. Impact of contract farming on yield, costs and profitability in low-value crop: Evidence from a low-income country. Aust. J. Agric. Resour. Econ. 2018, 64, 589–607. [Google Scholar] [CrossRef]

- Bellemare, M.F. Contract farming: Opportunity cost and trade-offs. Agric. Econ. 2018, 49, 279–288. [Google Scholar] [CrossRef]

- Grosh, B. Contract farming in Africa: An application of the new institutional economics. J. Afr. Econ. 1994, 3, 61–231. [Google Scholar] [CrossRef]

- Bellemare, M.F.; Novak, L. Contract Farming and Food Security. Am. J. Agric. Econ. 2016, 99, 357–378. [Google Scholar] [CrossRef]

- Oya, C. Contract farming in Sub-Saharan Africa: A survey of approaches, debates and issues. J. Agrar. Chang. 2011, 12, 1–33. [Google Scholar] [CrossRef]

- Otsuka, K.; Nakano, Y.; Takahashi, K. Contract farming in developed and developing Countries. Annu. Rev. Resour. Econ. 2016, 8, 353–376. [Google Scholar] [CrossRef]

- Swinnen, J.; Maertens, M. Globalization, privatization, and vertical coordination in food value chains in developing and transition countries. Agric. Econ. 2007, 37, 89–102. [Google Scholar] [CrossRef]

- Maertens, M.; Vande Velde, K. Contract-farming in Staple Food Chains: The Case of Rice in Benin. World Dev. 2017, 95, 73–87. [Google Scholar] [CrossRef]

- Formentini, M.; Romano, P. Towards supply chain collaboration in B2B pricing: A critical literature review and research agenda. Int. J. Oper. Prod. Manag. 2016, 36, 734–756. [Google Scholar] [CrossRef]

- Sadik-Zada, E.R.; Loewenstein, W.; Hasanli, Y. Commodity Revenues, Agricultural Sector and the Magnitude of Deindustrialization: A Novel Multisector Perspective. Economies 2019, 7, 113. [Google Scholar] [CrossRef]

- Abebe, G.K.; Bijman, J.; Kemp, R.; Omta, O.; Tsegaye, A. Contract farming configuration: Smallholders’ preferences for contract design attributes. Food Policy 2013, 40, 14–24. [Google Scholar] [CrossRef]

- Williamson, O.E. The economic institutions of capitalism. J. Econ. Issues 1985, 21, 528–530. [Google Scholar]

- Cao, Z.; Lumineau, F. Revisiting the interplay between contractual and relational governance: A qualitative and meta-analytic investigation. J. Oper. Manag. 2015, 33, 15–42. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, Y.; Fu, Y.; Zhang, W. Do prior interactions breed cooperation in construction projects? The mediating role of contracts. Int. J. Proj. Manag. 2017, 35, 633–646. [Google Scholar] [CrossRef]

- Williamson, O.E. Transaction-cost: The governance of contractual relations. J. Law Econ. 1979, 22, 223–261. [Google Scholar] [CrossRef]

- Mellewigt, T.; Decker, C.; Eckhard, B. What drives contract design in alliances? Taking stock and how to proceed. J. Bus. Econ. Manag. 2012, 82, 839–864. [Google Scholar] [CrossRef]

- Ambrozini, L.C.S.; Martinelli, D.P. Formal and relational contracts between organizations: Proposal of a model for analysis of the transactional and governance structure characteristics of comparative cases. Rev. Adm. 2017, 52, 374–391. [Google Scholar] [CrossRef]

- Schepker, D.J.; Oh, W.Y.; Martynov, A.; Poppo, L. The many futures of contracts moving beyond structure and safeguarding to coordination and adaptation. J. Manag. 2014, 1, 193–225. [Google Scholar] [CrossRef]

- Poppo, L.; Zenger, T. Do formal contracts and relational governance function as substitutes or complements? Strateg. Manag. J. 2002, 23, 707–725. [Google Scholar] [CrossRef]

- Lumineau, F.; Malhotra, D. Shadow of the contracts: How contract structure shapes interfirm dispute resolution. Strateg. Manag. J. 2011, 32, 532–555. [Google Scholar] [CrossRef]

- Baker, G.; Gibbons, R.; Murphy, K. Relational Contracts and the theory of the firm. Q. J. Econ. 2002, 117, 39–84. [Google Scholar] [CrossRef]

- Zheng, X.; Vukina, T.; Shin, C. The role of farmers’ risk aversion for contract choice in the U.S. hog industry. JAFIO 2008, 6, 1220. [Google Scholar] [CrossRef]

- Bijman, J.; Iliopoulos, C. Farmers’ cooperatives in the EU: Policies, strategies, and organization. Ann. Public Coop. Econ. 2014, 85, 497–508. [Google Scholar] [CrossRef]

- Roussy, C.; Ridier, A.; Chaib, K.; Boyet, M. Marketing contracts and risk management for cereal producers. Agribusiness 2018, 34, 616–630. [Google Scholar] [CrossRef]

- Raynaud, E.; Sauvée, L.; Valceschini, E. Alignment between quality enforcement devices and governance structures in the agro-food vertical chains. J. Manag. Gov. 2005, 9, 47–77. [Google Scholar] [CrossRef]

- Raynaud, E.; Sauvée, L.; Valceschini, E. Aligning branding strategies and governance of vertical transactions in agri-food chains. Ind. Corp. Chang. 2009, 18, 835–868. [Google Scholar] [CrossRef]

- Ochieng, D.O.; Veettil, P.C.; Qaim, M. Farmers’ preferences for supermarket contracts in Kenya. Food Policy 2017, 68, 100–111. [Google Scholar] [CrossRef]

- Fischer, S.; Wollni, M. The role of farmers’ trust, risk and time preferences for contract choices: Experimental evidence from the Ghanaian pineapple sector. Food Policy 2018, 81, 67–81. [Google Scholar] [CrossRef]

- Klein, B. Why hold-ups occur: The self-enforcing range of contractual relationships. Econ. Inq. 1996, 36, 444–463. [Google Scholar] [CrossRef]

- Haaijer, R.; Kamakura, W.; Wedel, M. The ‘no-choice’ alternative in conjoint choice experiments. Int. J. Market. Res. 2001, 43, 93–106. [Google Scholar] [CrossRef]

- Vermeulen, B.; Goos, P.; Vandebroek, M. Models and optimal designs for conjoint choice experiments including a no-choice option. Int. J. Res. Mark. 2008, 25, 94–103. [Google Scholar] [CrossRef]

- Blandon, J.; Henson, S.; Islam, T. Marketing preferences of small-scale farmers in the context of new agrifood systems: A stated choice model. Agribusiness 2009, 25, 251–267. [Google Scholar] [CrossRef]

- Gelaw, F.; Speelman, S.; Van Huylenbroeck, G. Farmers’ marketing preferences in local coffee markets: Evidence from a choice experiment in Ethiopia. Food Policy 2016, 61, 92–102. [Google Scholar] [CrossRef]

- Croissant, Y. Mlogit: Multinolmial Logit Models, R Package Version 1.0–3.1. 2020. Available online: https://CRAN.R-project.org/package=mlogit (accessed on 16 June 2020).

- Cacchiarelli, L.; Sorrentino, A. Antitrust intervention and price transmission in pasta supply chain. Agric. Food Econ. 2016, 4. [Google Scholar] [CrossRef]

- Cacchiarelli, L.; Lass, D.; Sorrentino, A. cap Reform and Price Transmission in the Italian Pasta Chain. Agribusiness 2016, 32, 482–497. [Google Scholar] [CrossRef]

- Martinetz, S. Vertical Coordination of Marketing Systems: Lessons Learned from the Poultry, Egg and Pork Industries; United States Department of Agriculture, ERS: Washington, DC, USA, 2002. Available online: https://www.ers.usda.gov/publications/pub-details/?pubid=41419 (accessed on 29 June 2020).

- Sykuta, M.; Parcell, J. Contract structure and design in identity-preserved soybean production. Rev. Agric. Econ. 2003, 25, 332–350. [Google Scholar] [CrossRef]

- Zbaracki, M.J.; Bergen, M. When truces collapse: A longitudinal study of price-adjustment routines. Organ. Sci. 2010, 21, 955–972. [Google Scholar] [CrossRef]

- Susarla, A.; Barua, A.; Whinston, A.B. A transaction cost perspective of the “software as a service” business model. J. Manag. Inf. Syst. 2009, 26, 205–240. [Google Scholar] [CrossRef]

- Ryall, M.D.; Sampson, R.C. Formal contracts in the presence of relational enforcement mechanisms: Evidence from technology development projects. Manag. Sci. 2009, 55, 906–925. [Google Scholar] [CrossRef]

- Schnaider, P.S.B.; Ménard, C.; Saes, M.S.M. Heterogeneity of plural forms: A revised transaction cost approach. Manag. Decis. Econ. 2018, 39, 652–663. [Google Scholar] [CrossRef]

- Martino, G.; Polinori, P. An analysis of the farmers contractual preferences in process innovation implementation. Br. Food J. 2019, 121, 426–440. [Google Scholar] [CrossRef]

- Ruben, R.; Zuniga, G. How standards compete: Comparative impact of coffee certification schemes in Northern Nicaragua. Supply Chain Manag. 2011, 16, 98–109. [Google Scholar] [CrossRef]

- Huong, L.T.T.; Takahashi, Y.; Nomura, H.; Son, C.T.; Kusudo, T.; Yabe, M. Manure management and pollution levels of contract and non-contract livestock farming in Vietnam. Sci. Total Environ. 2020, 710, 136200. [Google Scholar] [CrossRef]

- Pagell, M.; Wu, Z. Building a more complete theory of sustainable supply chain management using case studies of 10 exemplars. J. Supply Chain Manag. 2009, 45, 37–46. [Google Scholar] [CrossRef]

- Borsellino, V.; Schimmenti, E.; Bilali, H.E. Agri-Food Markets towards Sustainable Patterns. Sustainability 2020, 12, 2193. [Google Scholar] [CrossRef]

- Ménard, C.; Klein, P.G. Organizational issues in the agrifood sector: Toward a comparative approach. Am. J. Agric. Econ. 2004, 86, 750–755. [Google Scholar] [CrossRef]

- Royer, A.; Ménard, C.; Gouin, D.M. Reassessing marketing boards as hybrid arrangements: Evidence from Canadian experiences. Agric. Econ. 2016, 47, 105–116. [Google Scholar] [CrossRef]

- Sartorius, K.; Kirsten, J. A framework to facilitate institutional arrangements for smallholder supply in developing countries: An agribusiness perspective. Food Policy 2007, 32, 640–655. [Google Scholar] [CrossRef]

- Ciliberti, S.; Frascarelli, A. L’obbligo dei contratti di cessione dei prodotti agricoli e alimentari: Una valutazione degli effetti dell’articolo 62 della legge n. 27/2012. Econ. Agro-Aliment./Food Econ. 2014, 25, 37–61. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).