Creating a Comprehensive Method for the Evaluation of a Company

Abstract

1. Introduction

2. Literature Review

2.1. Neural Network Models

2.2. Company Specific Model

3. Materials and Methods

3.1. Data

- 2015: 488 companies in liquidation, 1464 active companies;

- 2016: 416 companies in liquidation, 1248 active companies;

- 2017: 354 companies in liquidation, 1062 active companies;

- 2018: 287 companies in liquidation, 862 active companies;

- 2019: 163 companies in liquidation, 489 active companies.

- AKTIVACELK (TOTAL A)—total assets are the result of past economic operations. This represents the future economic benefit of the company.

- STALAA (FIXED A)—fixed assets are long-term, fixed, and non-current, and include assets intended for company operations over the long term, specifically for a period longer than one year. They are consumed over time.

- OBEZNAA (CURRENT A)—current assets are characteristic of the operational cycle. As the name already suggests, current assets are in constant movement and constantly change form. Current assets include money, receivables from customers, materials, semi-finished products, work in progress, or products.

- Z (I)—inventories are current assets, i.e., short-term assets company consumed or extinguished as part of the activities of the company. They include materials, inventories of own production, and goods.

- KP (STR)—short-term receivables typically have a maturity of less than one year. In simple terms, they express the creditor’s right to demand the fulfilment of a specific commitment. The receivable expires with the fulfilment of the commitment.

- FA—financial assets include fixed assets and current assets. Fixed assets typically hold their value for a longer period of time and are not liquid, i.e., they cannot be quickly converted into money. Fixed assets include securities, bonds, debentures, certificates of deposits, fixed-term deposits, or loans granted to companies. In contrast, current assets serve to ensure the company’s activities, especially with regards to settling liabilities. Current assets are characterized by their high liquidity, whereby they are expected to be held for a period shorter than one year. Current financial assets include money in bank accounts, cash registers, cheques, stamps, clearing notes, or short-term securities and shares.

- VLASTNIJM—equity represents a company’s own sources of finance for the creation of capital. The main components are the contributions of the founders (owners and partners) to the basic equity of the company and those resources generated from business operations.

- HVML—profits or losses in past years, which form part of liabilities, specifically of equity. These are sources generated in past years after taxation. This therefore refers to money not transferred to funds or unallocated and paid. It consists of three parts: unallocated profits from past years, accumulated losses from past years, and other profits or losses from previous years.

- HVUO—profit or loss for the current accounting period, which is the sum of the operational and financial results for the accounting period and the economic result before taxation, with income tax deducted.

- CIZIZDROJE—borrowed capital, which in its nature is the company’s debt. The company has to repay it within a specified period of time. These are the liabilities of the company to other entities.

- KZ—short-term payables are due within one year and together with the company’s own resources they finance the normal operations of the company. They include mainly short-term bank loans, liabilities to employees and institutions, debts to suppliers or the tax authority.

- TZPZ—sales of goods sold, be it products or services. It is one of the main indicators of a company’s performance. In order to satisfy customers, companies often complement their portfolio with the products of other producers. The sales are recorded separately to differentiate the income from the core business from other income. Nevertheless, the sales of goods sold can also play a significant role in the business.

- TZPVVAS—sales of goods and services sold. Sales are defined as the sum of money received for goods sold or service provided. Unlike turnover, sales also include payments that were later returned.

- PRIDHODN—value added covering profit margin, sales, change in inventories of own production, or activation decreased by output consumption. This includes both profit margin and performance.

- MZDN—salary and wage costs usually consist of an employee’s gross wage and the employee’s and employer’s contributions to social and health insurance.

- OHANIM—depreciation of intangible and tangible fixed assets, which is a tool with which to gradually include the value of fixed assets into expenses, i.e., due to wear and tear.

- STAV (STATE)—indicates whether the company is active or in liquidation.

3.2. Methods

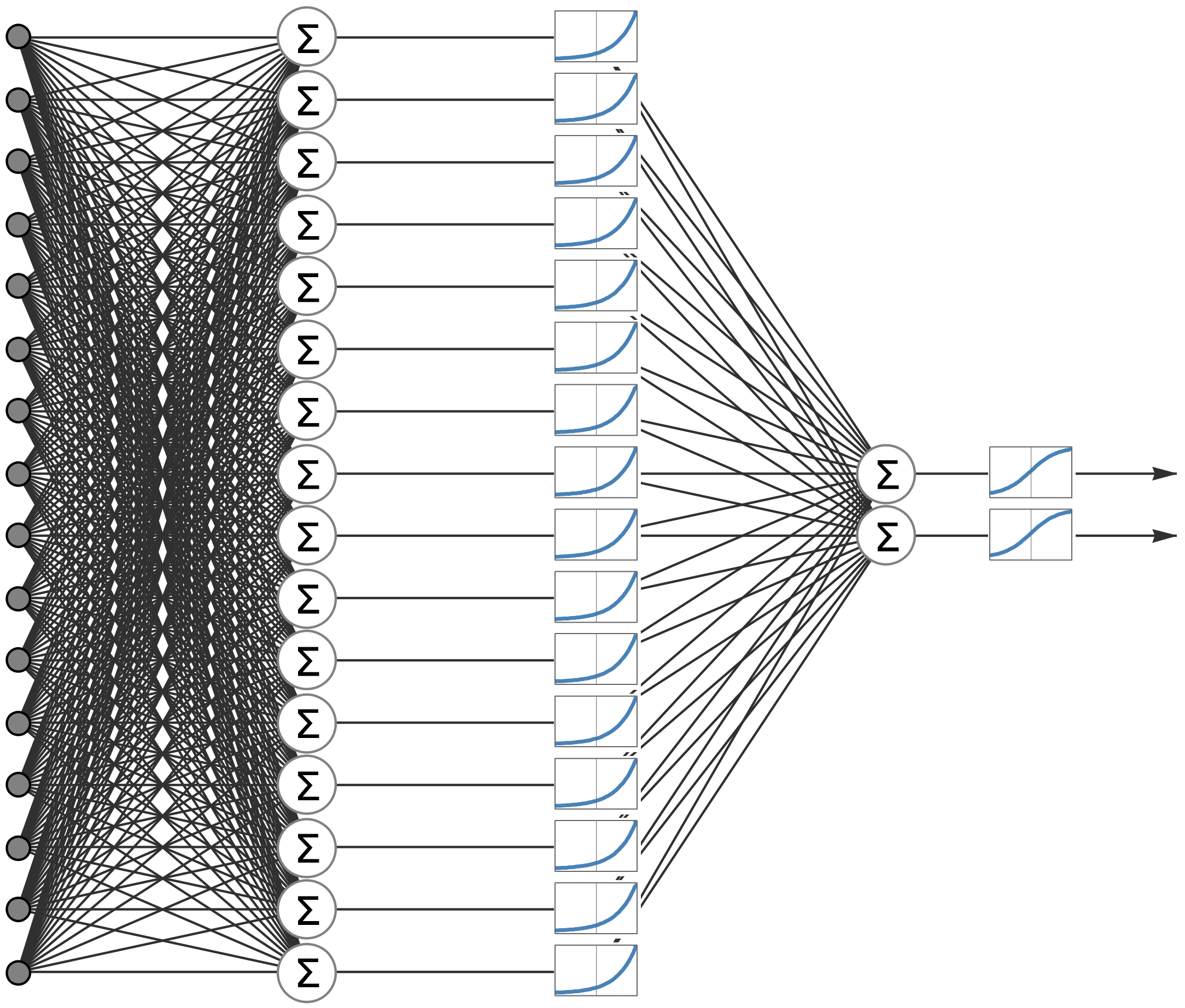

3.2.1. Statistica—Neural Networks

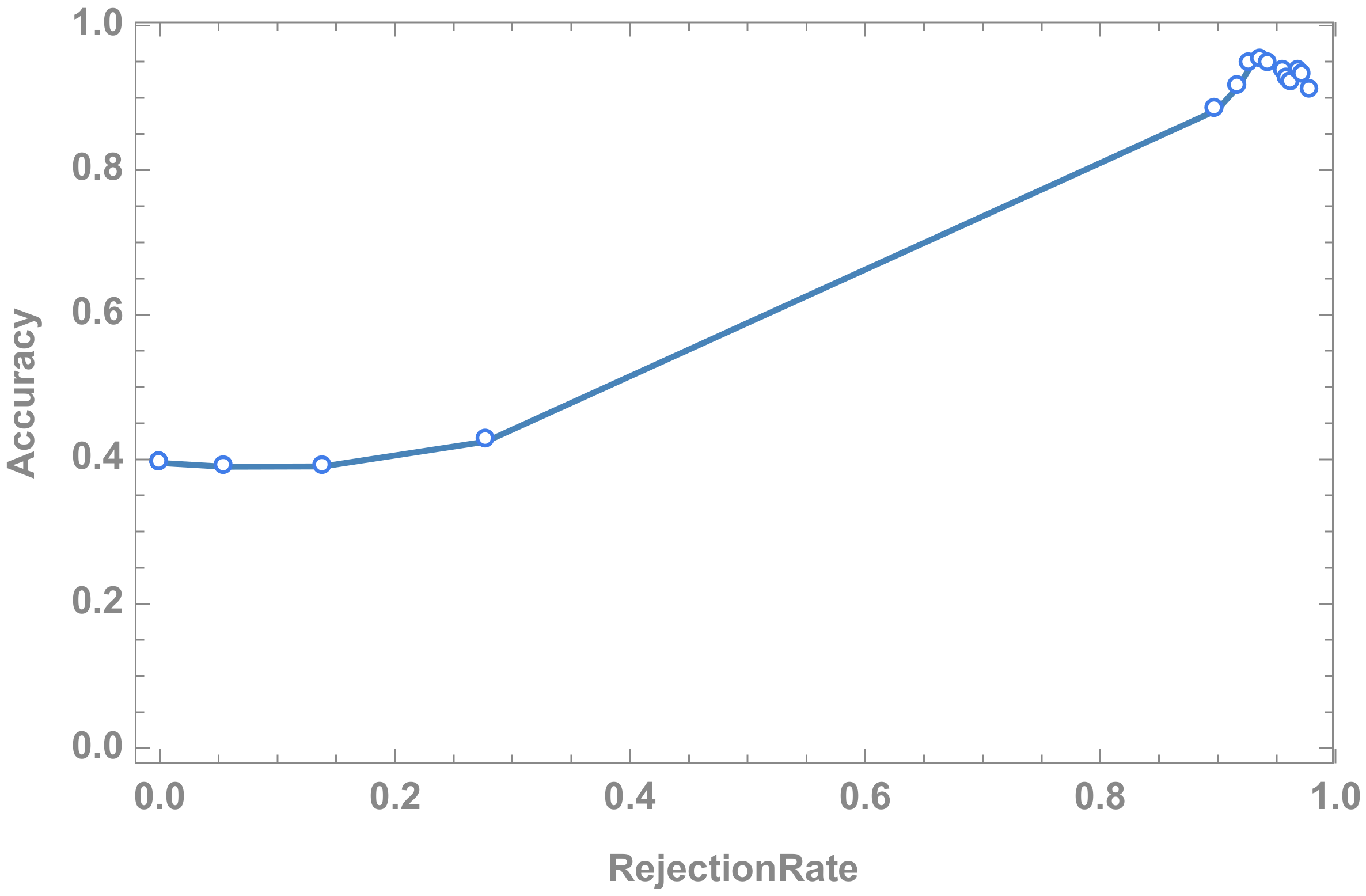

3.2.2. Mathematica—Neural Networks

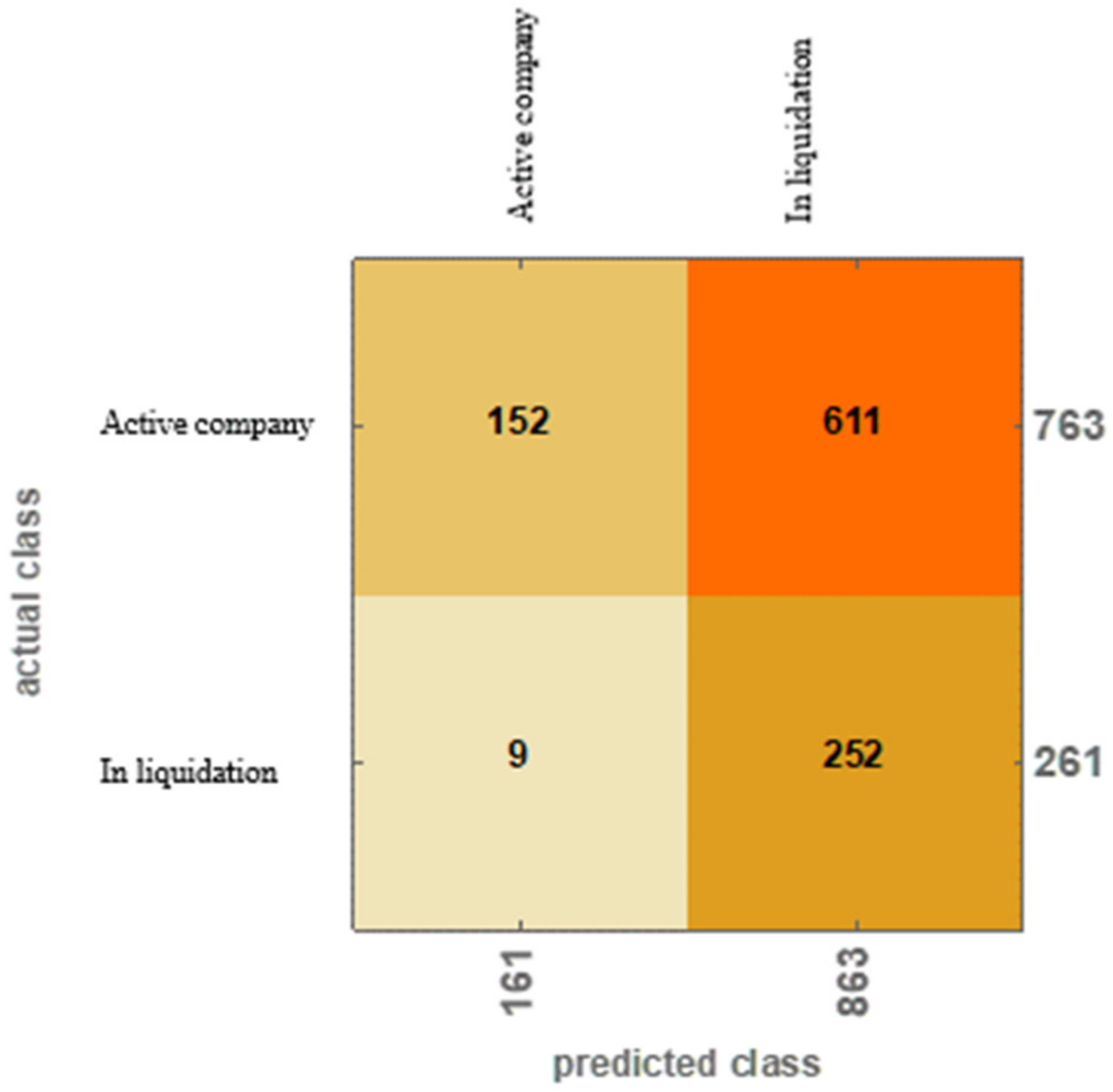

3.2.3. Mathematica—Logistic Regression

4. Results

4.1. Statistica—Neural Networks

- The company is able to survive potential financial distress.

- The company is not able to survive potential financial distress.

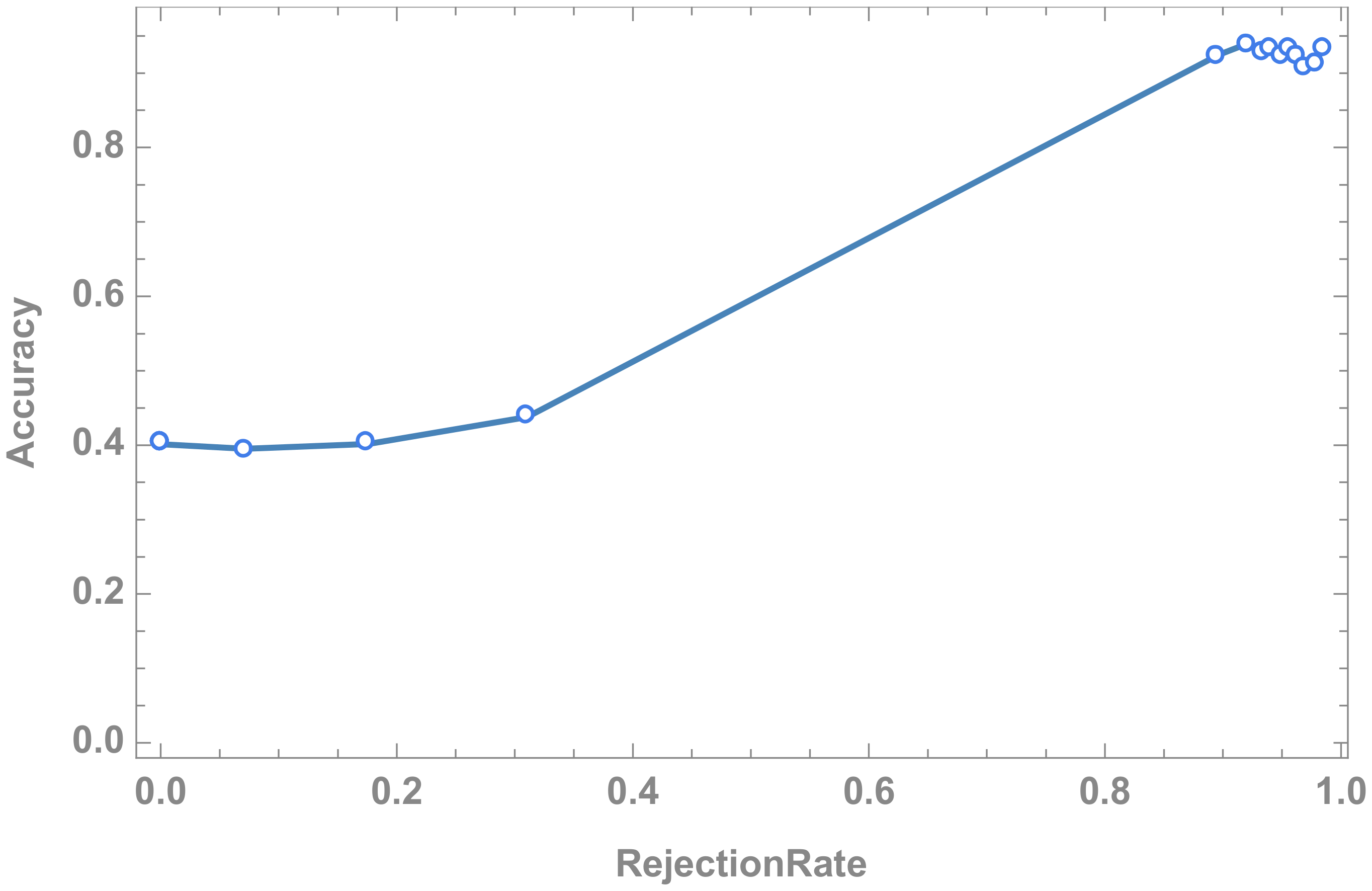

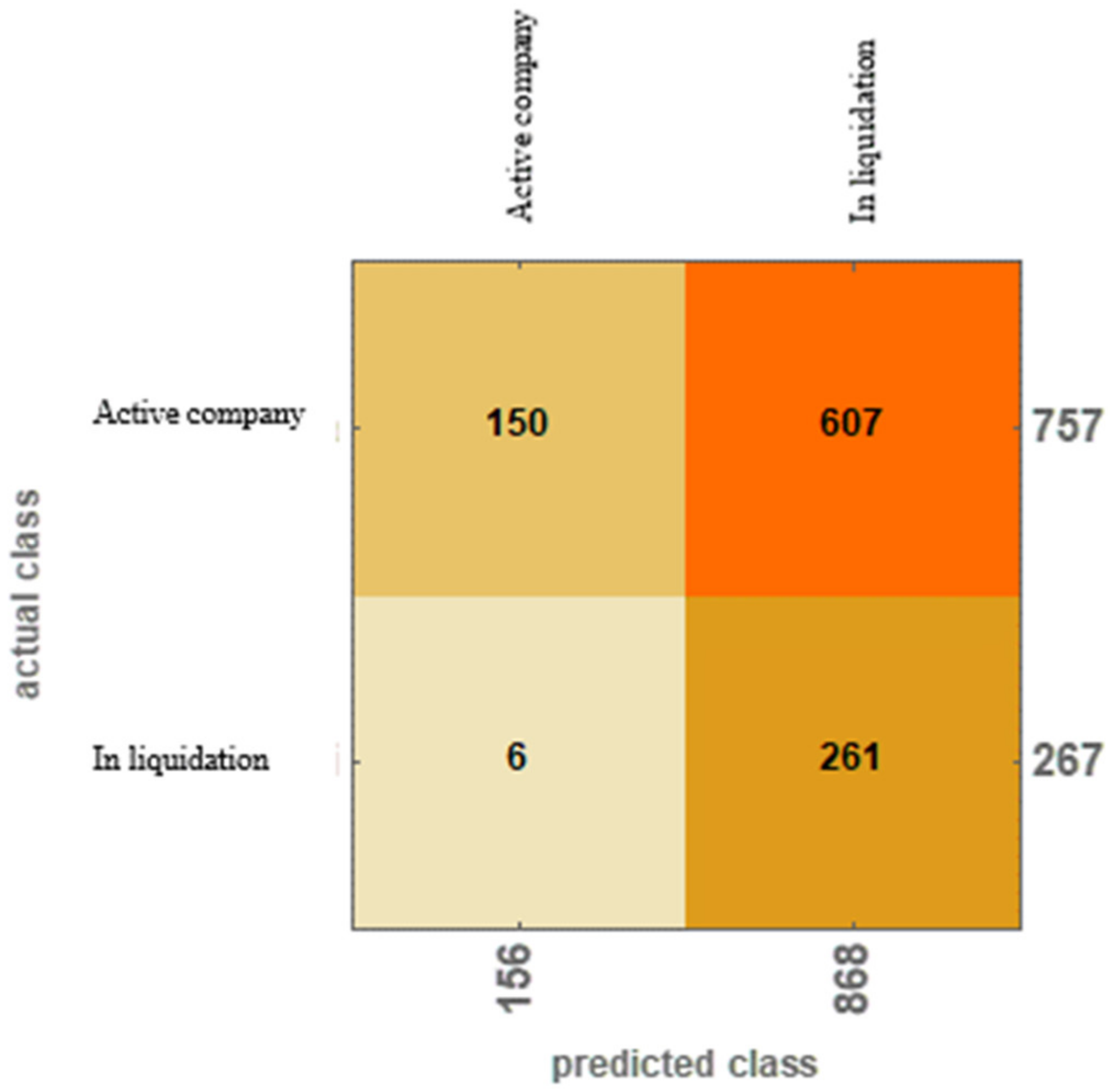

4.2. Mathematica—Neural Networks

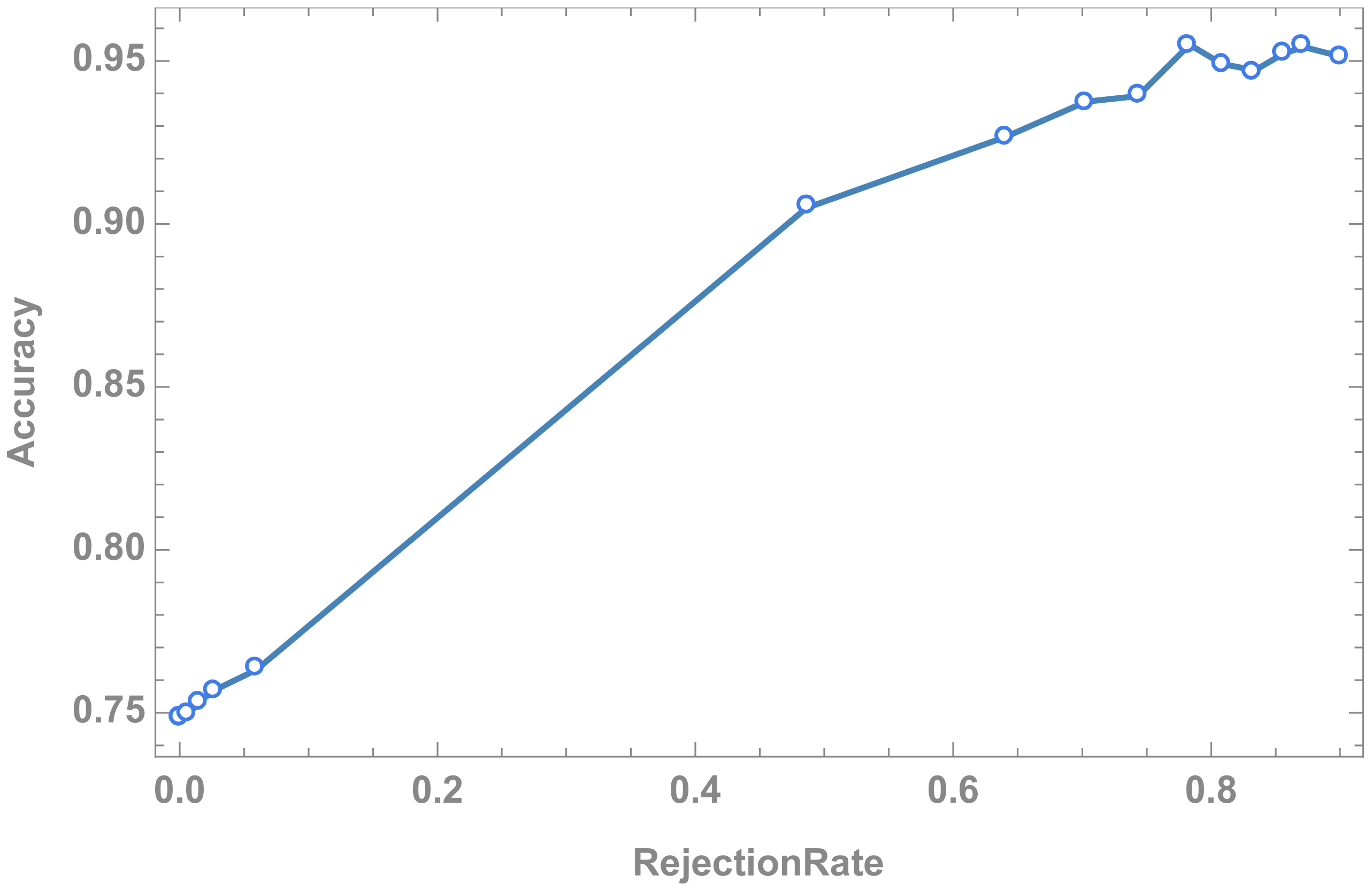

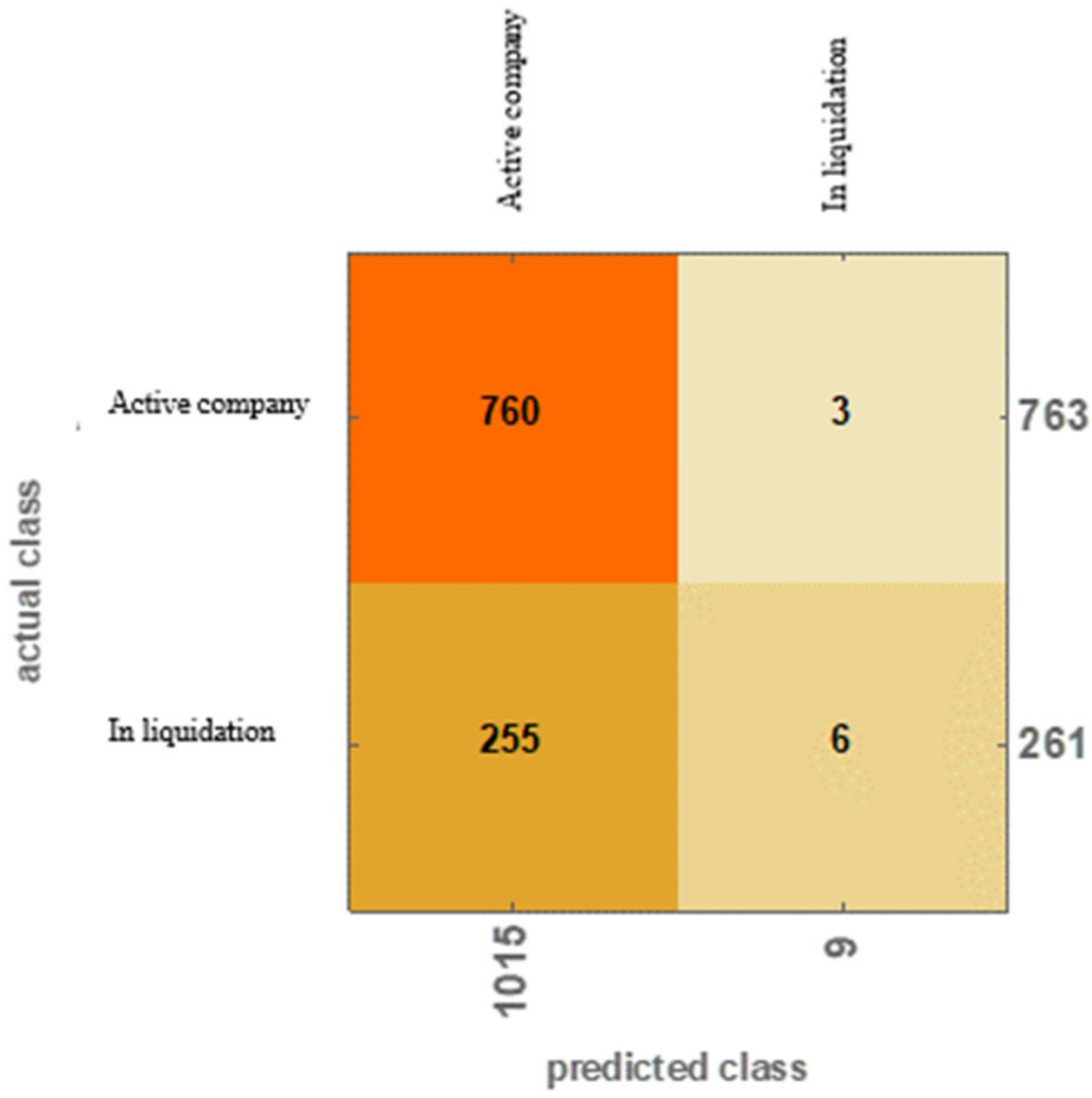

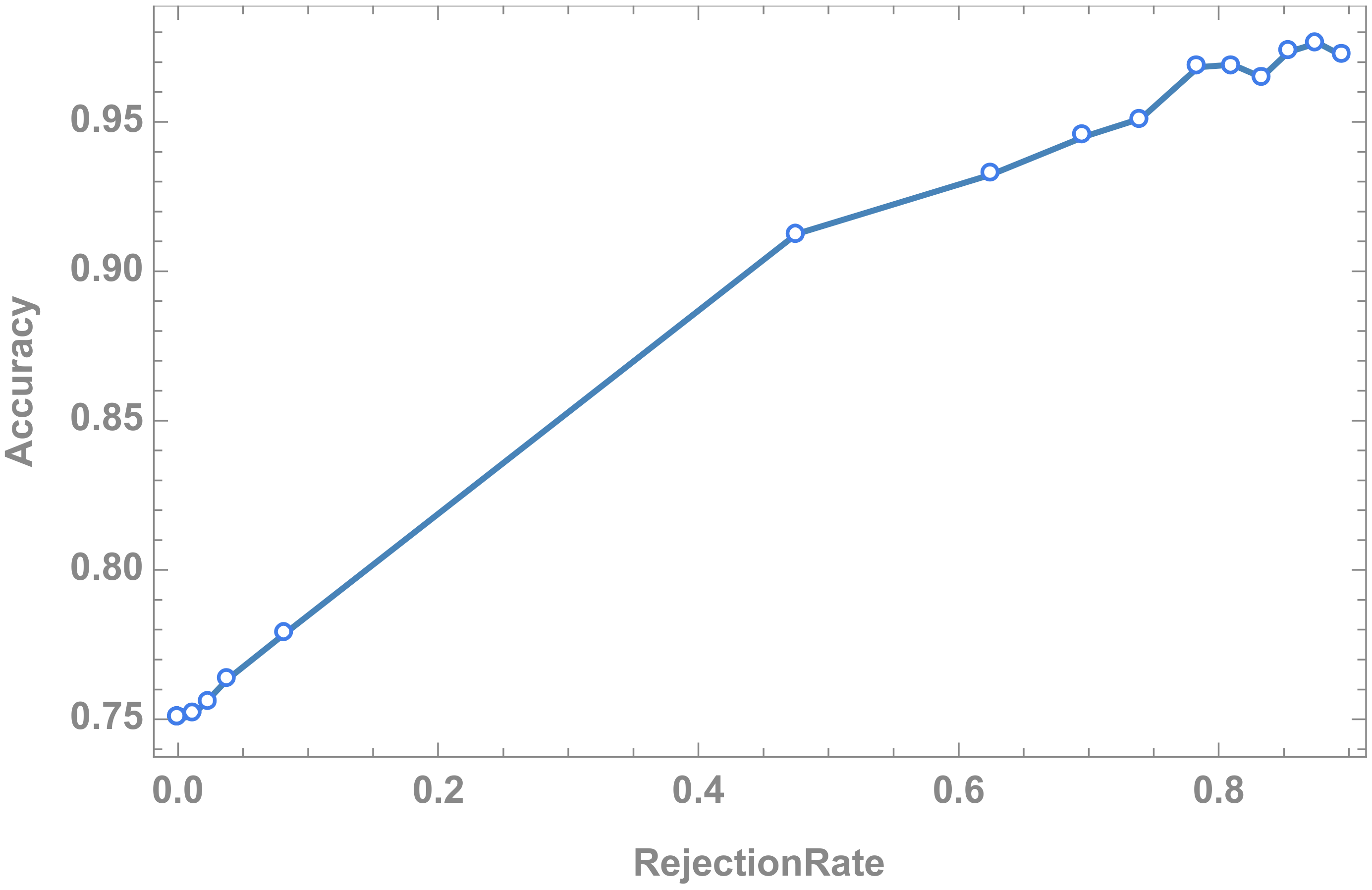

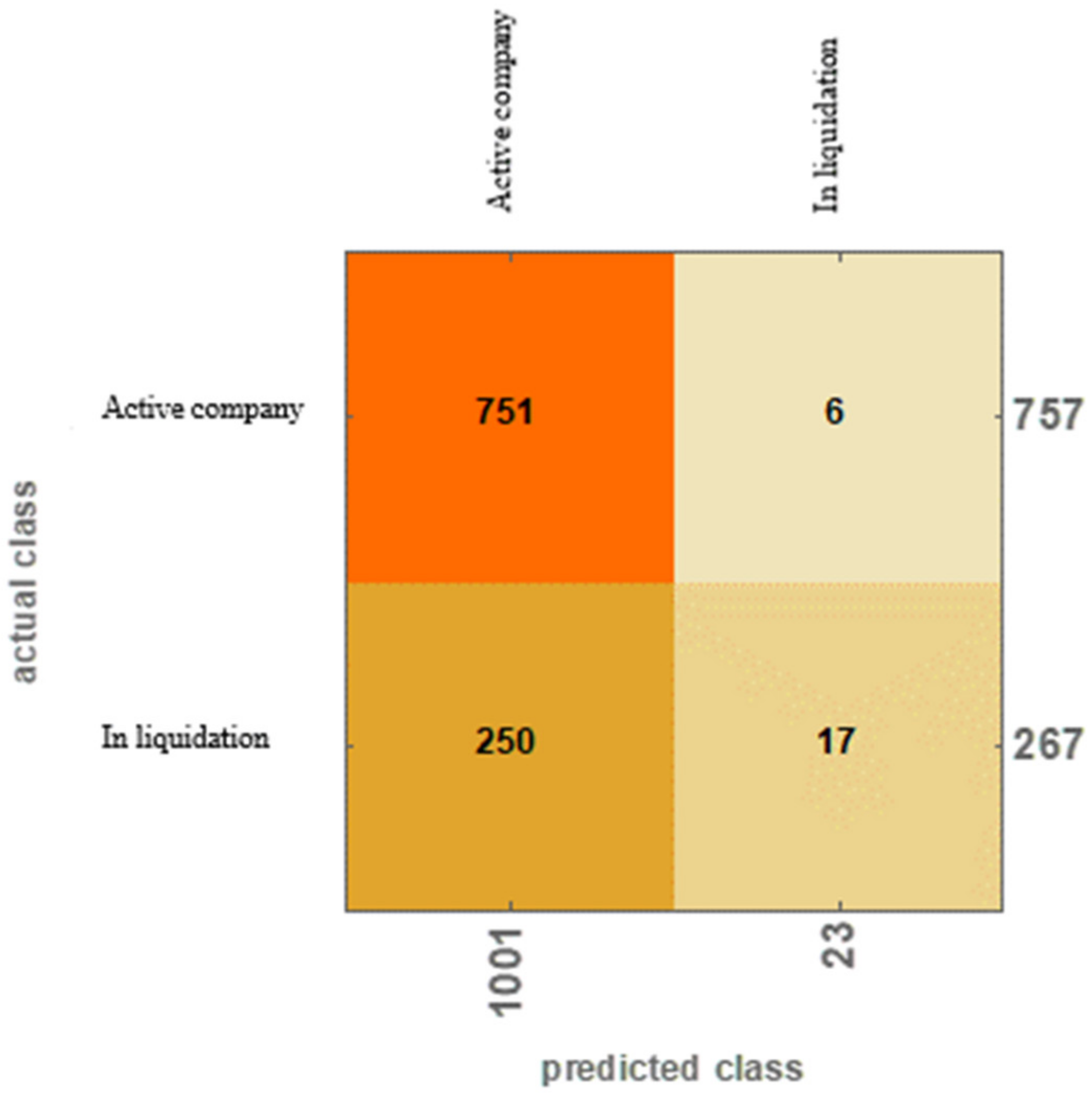

4.3. Mathematica—Logistic Regression

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Laaksonen, O.; Peltoniemi, M. The essence of dynamic capabilities and their measurement. Int. J. Manag. Rev. 2018, 20, 184–205. [Google Scholar] [CrossRef]

- Bohanec, M.; Kljajić Borštnar, M.; Robnik-Šikonja, M. Explaining machine learning models in sales predictions. Expert Syst. Appl. 2017, 71, 416–428. [Google Scholar] [CrossRef]

- Melo, L., Jr.; Nardini, F.M.; Renso, C.; Trani, R.; Macedo, J.A. A novel approach to define the local region of dynamic selection techniques in imbalanced credit scoring problems. Expert Syst. Appl. 2020, 152. [Google Scholar] [CrossRef]

- Klieštik, T.; Valášková, K.; Lazaroiu, G.; Kováčová, M.; Vrbka, J. Remaining financially healthy and competitive: The role of financial predictors. J. Compet. 2020, 12, 74–92. [Google Scholar] [CrossRef]

- Devi, S.S.; Radhika, Y. A survey on machine learning and statistical techniques in bankruptcy prediction. Int. J. Mach. Learn. Comput. 2018, 8. [Google Scholar] [CrossRef]

- Liu, J.; Wu, C. Company financial path analysis using Fuzzy C-means and its application in financial failure prediction. J. Bus. Econ. Manag. 2018, 19, 213–234. [Google Scholar] [CrossRef]

- Loprevite, S.; Raucci, D.; Rupo, D. Reporting KPIs and financial performance in the transition to mandatory disclosure: The case of Italy. Sustainability 2020, 12, 5195. [Google Scholar] [CrossRef]

- Da Costa, S.F.; Boente, D.R. Evaluation of financial performance of corporate sustainability index companies through data envelopment analysis. Rev. Ambiente Contab. 2011, 3, 75–99. [Google Scholar]

- Grandhi, S.; Wibowo, S. Sustainability performance evaluation of automotive manufacturing companies. In Proceedings of the 2016 IEEE 11th Conference on Industrial Electronics and Applications (ICIEA), Hefei, China, 5–7 June 2016; IEEE: New York, NY, USA, 2016; pp. 1725–1730. [Google Scholar]

- Hawrysz, L.; Maj, J. Identification of stakeholders of public interest organisations. Sustainability 2017, 9, 1609. [Google Scholar] [CrossRef]

- Lombardo, G.; Mazzocchetti, A.; Rapallo, I.; Tayser, N.; Cincotti, S. Assessment of the economic and social impact using SROI: An application to sport companies. Sustainability 2019, 11, 3612. [Google Scholar] [CrossRef]

- Hardinata, L.; Warsito, B. Bankruptcy prediction based on financial ratios using Jordan Recurrent Neural Networks: A case study in Polish companies. J. Phys. Conf. Ser. 2018, 1025, 012098. [Google Scholar] [CrossRef]

- Messai, A.S.; Gallali, M.I. Financial leading indicators of banking distress: A micro prudential approach-evidence from Europe. Asian Soc. Sci. 2015, 11, 78–90. [Google Scholar] [CrossRef]

- Chen, M.Y. Bankruptcy prediction in firms with statistical and intelligent techniques and a comparison of evolutionary computation approaches. Comput. Math. Appl. 2011, 62, 4514–4524. [Google Scholar] [CrossRef]

- Abdou, H.; Abd Allah, W.; Mulkeen, J.; Ntim, C.G.; Wang, Y. Prediction of financial strength ratings using machine learning and conventional techniques. Investig. Manag. Financ. Innov. 2017, 14, 194–211. [Google Scholar] [CrossRef]

- Vochozka, M. Formation of complex company evaluation method through neural networks based on the example of construction companies’ collection. AD ALTA J. Interdiscip. Res. 2017, 7, 232–239. [Google Scholar]

- Vochozka, M.; Vrbka, J. Estimation of the development of the Euro to Chinese Yuan exchange rate using artificial neural networks. In Proceedings of the SHS Web of Conferences: Innovative Economic Symposium 2018—Milestones and Trends of World Economy (IES2018), Beijing, China, 8–9 November 2018; Horak, J., Ed.; EDP Sciences: Les Ulis, France, 2019. [Google Scholar] [CrossRef]

- Kovacova, M.; Kliestikova, J. Modelling bankruptcy prediction models in Slovak companies. In Proceedings of the SHS Web of Conferences: Innovative Economic Symposium 2017—Strategic Partnership in International Trade, Ceske Budejovice, Czech Republic, 19 October 2017; Vachal, J., Vochozka, M., Horak, J., Eds.; EDP Sciences: Les Ulis, France, 2017; p. 39. [Google Scholar] [CrossRef]

- Sayari, N.; Mugan, C.S. Industry specific financial distress modeling. BRQ Bus. Res. Q. 2017, 20, 45–62. [Google Scholar] [CrossRef]

- Chen, H.L. Development of a stable corporate bankruptcy classification model: Evidence from Taiwan. Int. J. Econ. Sci. 2018, 7, 16–38. [Google Scholar] [CrossRef]

- Alaminos, D.; Castillo, A.; Fernández, M.Á. A global model for bankruptcy prediction. PLoS ONE 2016, 11. [Google Scholar] [CrossRef]

- Hu, H.; Sathye, M. Predicting financial distress in the Hong Kong growth enterprises market from the perspective of financial sustainability. Sustainability 2015, 7, 1186–1200. [Google Scholar] [CrossRef]

- Vochozka, M. Development of methods for comprehensive evaluation of business performance. Politická Ekon. 2010, 2010, 675–688. [Google Scholar] [CrossRef]

- Salinas, D.; Flunkert, V.; Gasthaus, J.; Januschowski, T. DeepAR: Probabilistic forecasting with autoregressive recurrent networks. Int. J. Forecast. 2020, 36, 1181–1191. [Google Scholar] [CrossRef]

- Lei, Z. Research and analysis of deep learning algorithms for investment decision support model in electronic commerce. Electron. Commer. Res. 2020, 20, 275–295. [Google Scholar] [CrossRef]

- Khashei, M.; Hajirahimi, Z. Performance evaluation of series and parallel strategies for financial time series forecasting. Financ. Innov. 2017, 3. [Google Scholar] [CrossRef]

- Kolupaieva, I.; Pustovhar, S.; Suprun, O.; Shevchenko, O. Diagnostics of systemic risk impact on the enterprise capacity for financial risk neutralization: The case of Ukrainian metallurgical enterprises. Oeconomia Copernic. 2019, 10, 471–491. [Google Scholar] [CrossRef]

- Lohmann, C.; Ohliger, T. The total cost of misclassification in credit scoring: A comparison of generalized linear models and generalized additive models. J. Forecast. 2019, 38, 375–389. [Google Scholar] [CrossRef]

- Gulsoy, N.; Kulluk, S. A data mining application in credit scoring processes of small and medium enterprises commercial corporate customers. Wiley Interdiscip. Rev. Data Min. Knowl. Discov. 2018, 9. [Google Scholar] [CrossRef]

- Atsalakis, G.S. Using computational intelligence to forecast carbon prices. Appl. Soft Comput. 2016, 43, 107–116. [Google Scholar] [CrossRef]

- Šestanović, T.; Arnerić, J. Neural network structure identification in inflation forecasting. J. Forecast. 2020. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, J.; Ji, S.; Meng, C.; Li, T.; Zheng, Y. Predicting and ranking box office revenue of movies based on big data. Inf. Fusion 2020, 60, 25–40. [Google Scholar] [CrossRef]

- Huber, J.; Müller, S.; Fleischmann, M.; Stuckenschmidt, H. A data-driven newsvendor problem: From data to decision. Eur. J. Oper. Res. 2019, 278, 904–915. [Google Scholar] [CrossRef]

- Cao, J.; Wang, J. Exploration of stock index change prediction model based on the combination of principal component analysis and artificial neural network. Soft Comput. 2020, 24, 7851–7860. [Google Scholar] [CrossRef]

- Kim, E.; Lee, J.; Shin, H. Champion-challenger analysis for credit card fraud detection: Hybrid ensemble and deep learning. Expert Syst. Appl. 2019, 128, 214–224. [Google Scholar] [CrossRef]

- Kim, J.; Kim, H.J.; Kim, H. Fraud detection for job placement using hierarchical clusters-based deep neural networks. Appl. Intell. 2019, 49, 2842–2861. [Google Scholar] [CrossRef]

- Loureiro, A.L.D.; Miguéis, V.L.; Da Silva, L.F.M. Exploring the use of deep neural networks for sales forecasting in fashion retail. Decis. Support Syst. 2018, 114, 81–93. [Google Scholar] [CrossRef]

- Wei, C.C.; Cheng, Y.L. Six Sigma project selection using fuzzy multiple attribute decision-making method. Total Qual. Manag. Bus. Excell. 2020, 31, 1266–1289. [Google Scholar] [CrossRef]

- Mahdiraji, H.A.; Zavadskas, E.Z.; Skare, M.; Kafshgar, F.Z.R.; Arab, A. Evaluating strategies for implementing industry 4.0: A hybrid expert-oriented approach of BWM and interval valued intuitionistic fuzzy TODIM. Econ. Res. Ekon. Istraživanja 2020, 33, 1600–1620. [Google Scholar] [CrossRef]

- Li, Z.X.; Liu, J.Y.; Luo, D.K.; Wang, J.J. Study of evaluation method for the overseas oil and gas investment based on risk compensation. Pet. Sci. 2020, 17, 858–871. [Google Scholar] [CrossRef]

- Wang, Y.; Jin, X. Structural risk of diversified project financing of city investment company in China based on the best worst method. Eng. Constr. Archit. Manag. 2019. [Google Scholar] [CrossRef]

- De, G.; Tan, Z.; Li, M.; Huang, L.; Wang, Q.; Li, H. A credit risk evaluation based on intuitionistic fuzzy set theory for the sustainable development of electricity retailing companies in China. Energy Sci. Eng. 2019, 7, 2825–2841. [Google Scholar] [CrossRef]

- Wang, L.; Chen, Y.; Jiang, H.; Yao, J. Imbalanced credit risk evaluation based on multiple sampling, multiple kernel fuzzy self-organizing map and local accuracy ensemble. Appl. Soft Comput. 2020, 91. [Google Scholar] [CrossRef]

- Wu, Y.; Zhou, J. Risk assessment of urban rooftop distributed PV in energy performance contracting (EPC) projects: An extended HFLTS-DEMATEL fuzzy synthetic evaluation analysis. Sustain. Cities Soc. 2019, 47. [Google Scholar] [CrossRef]

- Liang, K.; He, J. Analyzing credit risk among Chinese P2P-lending businesses by integrating text-related soft information. Electron. Commer. Res. Appl. 2020, 40. [Google Scholar] [CrossRef]

- Li, Y.; Chen, W. Entropy method of constructing a combined model for improving loan default prediction: A case study in China. J. Oper. Res. Soc. 2019, 1–11. [Google Scholar] [CrossRef]

- Murè, S.; Comberti, L.; Demichela, M. How harsh work environments affect the occupational accident phenomenology? Risk assessment and decision making optimisation. Saf. Sci. 2017, 95, 159–170. [Google Scholar] [CrossRef]

- Zhao, J.; Fan, W.; Zhai, X. Identification of land-use characteristics using bicycle sharing data: A deep learning approach. J. Transp. Geogr. 2020, 82. [Google Scholar] [CrossRef]

- Sajnóg, A.R. Executive compensation and comprehensive income: Evidence from Polish listed companies. Oeconomia Copernic. 2019, 10, 493–509. [Google Scholar] [CrossRef]

- Lee, J.M.; Jeong, Y.K.; Woo, J.H. Development of an evaluation framework of production planning for the shipbuilding industry. Int. J. Comput. Integr. Manuf. 2018, 31, 831–847. [Google Scholar] [CrossRef]

- Hanine, M.; Boutkhoum, O.; Agouti, T.; Tikniouine, A. A new integrated methodology using modified Delphi-fuzzy AHP-PROMETHEE for geospatial business intelligence selection. Inf. Syst. E Bus. Manag. 2017, 15, 897–925. [Google Scholar] [CrossRef]

- Borges, L.A.; Tan, K.H. Incorporating human factors into the AAMT selection: A framework and process. Int. J. Prod. Res. 2016, 55, 1459–1470. [Google Scholar] [CrossRef]

- Ban, A.I.; Ban, O.I.; Bogdan, V.; Sabau Popa, D.C.; Tuse, D. Performance evaluation model of Romanian manufacturing listed companies by Fuzzy AHP and TOPSIS. Technol. Econ. Dev. Econ. 2020, 26, 808–836. [Google Scholar] [CrossRef]

- Yang, L.W.; Aggarwal, P.; Peracchio, L.; Johar, G.; Campbell, M.C. No small matter: How company size affects consumer expectations and evaluations. J. Consum. Res. 2019, 45, 1369–1384. [Google Scholar] [CrossRef]

- Kuo, K.C.; Kweh, Q.L.; Ting, I.W.K.; Azizan, N.A. Dynamic network performance evaluation of general insurance companies: An insight into risk management committee structure. Total Qual. Manag. Bus. Excell. 2015, 28, 542–558. [Google Scholar] [CrossRef]

- Hsu, Y.F.; Lee, W.P. Evaluation of the going-concern status for companies: An ensemble framework-based model. J. Forecast. 2020, 39, 687–706. [Google Scholar] [CrossRef]

- Petropoulos, A.; Siakoulis, V.; Stavroulakis, E.; Vlachogiannakis, N.E. Predicting bank insolvencies using machine learning techniques. Int. J. Forecast. 2020, 36, 1092–1113. [Google Scholar] [CrossRef]

- Ye, X.; Dong, L.; Ma, D. Loan evaluation in P2P lending based on Random Forest optimized by genetic algorithm with profit score. Electron. Commer. Res. Appl. 2018, 32, 23–36. [Google Scholar] [CrossRef]

- Salminen, J.; Yoganathan, V.; Corporan, J.; Jansen, B.J.; Jung, S.G. Machine learning approach to auto-tagging online content for content marketing efficiency: A comparative analysis between methods and content type. J. Bus. Res. 2019, 101, 203–217. [Google Scholar] [CrossRef]

- Qiao, W.; Yang, Z.; Kang, Z.; Pan, Z. Short-term natural gas consumption prediction based on Volterra adaptive filter and improved whale optimization algorithm. Eng. Appl. Artif. Intell. 2020, 87. [Google Scholar] [CrossRef]

- Ojstersek, R.; Buchmeister, B. The impact of manufacturing flexibility and multi-criteria optimization on the sustainability of manufacturing systems. Symmetry 2020, 12, 157. [Google Scholar] [CrossRef]

- Li, J.; Wu, F.; Li, J.; Zhao, Y. Research on risk evaluation of transnational power networking projects based on the Matter-element extension theory and granular computing. Energies 2017, 10, 1523. [Google Scholar] [CrossRef]

- Makridakis, S.; Spiliotis, E.; Assimakopoulos, V. The M4 Competition: 100,000 time series and 61 forecasting methods. Int. J. Forecast. 2020, 36, 54–74. [Google Scholar] [CrossRef]

- Gao, Y.; Fan, Y.; Wang, J.; Duan, Z. Evaluation of governmental safety regulatory functions in preventing major accidents in China. Saf. Sci. 2019, 120, 299–311. [Google Scholar] [CrossRef]

- Han, S.; Cao, B.; Fu, Y.; Luo, Z. A liner shipping competitive model with consideration of service quality management. Ann. Oper. Res. 2018, 270, 155–177. [Google Scholar] [CrossRef]

- Yazdani, M.; Pamucar, D.; Chatterjee, P.; Chakraborty, S. Development of a decision support framework for sustainable freight transport system evaluation using rough numbers. Int. J. Prod. Res. 2020, 58, 4325–4351. [Google Scholar] [CrossRef]

- Wang, R.; Li, Y. A novel approach for green supplier selection under a q-Rung orthopair fuzzy environment. Symmetry 2018, 10, 687. [Google Scholar] [CrossRef]

- Luo, X.; Wang, Z.; Lu, L.; Guan, Y. Supply chain flexibility evaluation based on matter-element extension. Complexity 2020, 2020, 8057924. [Google Scholar] [CrossRef]

- Castro, N.R.; Chousa, P.J. An integrated framework for the financial analysis of sustainability. Bus. Strategy Environ. 2006, 15, 322–333. [Google Scholar] [CrossRef]

- Maciková, L.; Smorada, M.; Dorčák, P.; Beug, B.; Markovič, P. Financial aspects of sustainability: An evidence from Slovak companies. Sustainability 2018, 10, 2274. [Google Scholar] [CrossRef]

- Rita, D.I.G.; Fernando, A.F.; Meidute-Kavaliauskiene, L. Proposal of a green index for small and medium-sized enterprises: A multiple criteria group decision-making approach. J. Clean. Prod. 2018, 196, 985–996. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á.; Rivera-Lirio, J.M. Measuring corporate environmental performance: A methodology for sustainable development. Bus. Strategy Environ. 2017, 26, 142–162. [Google Scholar] [CrossRef]

- Fatma, M.; Khan, I. An investigation of consumer evaluation of authenticity of their company’s CSR engagement. Total Qual. Manag. Bus. Excell. 2020, 1–18. [Google Scholar] [CrossRef]

- Schaefer, S.D.; Terlutter, R.; Diehl, S. Is my company really doing good? Factors influencing employees’ evaluation of the authenticity of their company’s corporate social responsibility engagement. J. Bus. Res. 2019, 101, 128–143. [Google Scholar] [CrossRef]

- Vrbka, J.; Nica, E.; Podhorská, I. The application of Kohonen networks for identification of leaders in the trade sector in Czechia. Equilib. Q. J. Econ. Econ. Policy 2019, 14, 739–761. [Google Scholar] [CrossRef]

- Král, P.; Musa, H.; Lazaroiu, G.; Mišanková, M.; Vrbka, J. Comprehensive assessment of the selected indicators of financial analysis in the context of failing companies. J. Int. Stud. 2018, 11, 282–294. [Google Scholar] [CrossRef]

- Vochozka, M.; Vrbka, J.; Suler, P. Bankruptcy or success? The effective prediction of a company’s financial development using LSTM. Sustainability 2020, 12, 7529. [Google Scholar] [CrossRef]

- Machová, V.; Vochozka, M. Analysis of business companies based on artificial neural networks. In Proceedings of the SHS Web of Conferences: Innovative Economic Symposium 2018—Milestones and Trends of World Economy (IES2018), Beijing, China, 8–9 November 2018; Horak, J., Ed.; EDP Sciences: Les Ulis, France, 2019. [Google Scholar] [CrossRef]

- Vrbka, J. The use of neural networks to determine value based drivers for SMEs operating in the rural areas of the Czech Republic. Oeconomia Copernic. 2020, 11, 325–346. [Google Scholar] [CrossRef]

- Horák, J.; Vrbka, J.; Šuleř, P. Support vector machine methods and artificial neural networks used for the development of bankruptcy prediction models and their comparison. J. Risk Financ. Manag. 2020, 13, 60. [Google Scholar] [CrossRef]

- Khasaev, G.; Vochozka, M.; Vrbka, J. Creating a Comprehensive Enterprise Evaluation Method, 1st ed.; Institute of Technology and Business: Ceske Budejovice, Czech Republic, 2018. [Google Scholar]

- Wöhe, G.; Kislingerová, E. Úvod do Podnikového Hospodářství, 2nd ed.; Beck: Prague, Czech Republic, 2007. [Google Scholar]

- Tsai, C.H.F.; Wu, J.W. Using neural network ensembles for bankruptcy prediction and credit scoring. Expert Syst. Appl. 2008, 34, 2639–2649. [Google Scholar] [CrossRef]

- Wilson, R.L.; Sharda, R. Bankruptcy prediction using neural networks. Decis. Support Syst. 1994, 11, 545–557. [Google Scholar] [CrossRef]

- Boritz, J.E.; Kennedy, D.B. Effectiveness of neural network types for prediction of business failure. Expert Syst. Appl. 1995, 9, 503–512. [Google Scholar] [CrossRef]

- Angelini, E.; Tollo, G.; Roli, A. A neural network approach for credit risk evaluation. Q. Rev. Econ. Financ. 2008, 48, 733–755. [Google Scholar] [CrossRef]

- Zhang, G.; Hu, M.Y.; Patuwo, B.E.; Indro, D.C. Artificial neural networks in bankruptcy prediction: General framework and cross-validation analysis. Eur. J. Oper. Res. 1999, 116, 16–32. [Google Scholar] [CrossRef]

| Samples | Minimum | Maximum | Average | Standard Deviation |

|---|---|---|---|---|

| AKTIVACELK | −2001 | 62,924,684 | 89,298 | 1,037,658 |

| OBEZNAA | −1519 | 32,066,562 | 48,783 | 559,746 |

| STALAA | −19,065 | 30,832,576 | 39,870 | 495,025 |

| Z | −373 | 4,164,875 | 13,496 | 103,764 |

| KP | −1868 | 27,683,668 | 26,142 | 424,387 |

| FM | −23,376 | 4,610,658 | 7193 | 80,064 |

| VLASTNIJM | −20,871,611 | 53,318,744 | 43,077 | 773,114 |

| HVML | −18,657,836 | 39,090,531 | 11,005 | 535,924 |

| HVUO | −5,031,681 | 7,010,019 | 4806 | 127,604 |

| CIZIZDROJE | −8587 | 27,125,364 | 45,364 | 520,891 |

| KZ | −8587 | 26,176,367 | 28,057 | 369,745 |

| TZPZ | −11 | 3,372,651 | 9112 | 78,647 |

| TZPVVAS | −1193 | 92,212,227 | 96,906 | 1,308,452 |

| PRIDHODN | −2,160,473 | 13,303,713 | 23,397 | 208,063 |

| MZDN | 0 | 1,920,798 | 9017 | 43,568 |

| OHANIM | −13,839 | 2,146,145 | 3838 | 36,008 |

| Samples | Min. (Train.) | Max. (Train.) | Average (Train.) | Standard Deviation (Train.) | Min. (Test.) | Max. (Test.) | Average (Test.) | Standard Deviation (Test.) | Min. (Valid.) | Max. (Valid.) | Average (Valid.) | Standard Deviation (Valid.) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AKTIVACELK | −2001 | 62,924,684 | 85,699 | 995,670 | −1399 | 5,419,395 | 79,260 | 375,678 | −321 | 48,470,016 | 116,150 | 309,332 |

| OBEZNAA | −689 | 32,066,562 | 46,138 | 516,132 | −1519 | 4,458,330 | 44,486 | 234,466 | −321 | 27,682,348 | 65,439 | 161,293 |

| STALAA | −19,065 | 30,832,576 | 39,014 | 499,926 | −333 | 2,007,039 | 33,784 | 164,955 | 0 | 20,625,440 | 49,959 | 163,193 |

| Z | −373 | 4,164,875 | 13,132 | 100,012 | −279 | 634,107 | 11,201 | 46,962 | 0 | 3,894,244 | 17,490 | 46,988 |

| KP | −821 | 27,683,668 | 23,521 | 411,152 | −1868 | 4,087,444 | 26,036 | 195,643 | −680 | 19,177,446 | 38,499 | 116,031 |

| FM | −23,376 | 3,820,141 | 6836 | 63,946 | −3473 | 1,059,744 | 7488 | 52,474 | −11,017 | 4,610,658 | 8567 | 19,823 |

| VLASTNIJM | −1,263,105 | 53,318,744 | 46,459 | 803,321 | −191,129 | 5,049,100 | 42,148 | 271,226 | −20,871,611 | 21,370,915 | 28,200 | 193,525 |

| HVML | −3,055,902 | 39,090,531 | 15,244 | 576,419 | −342,118 | 3,332,485 | 11,173 | 120,859 | −18,657,836 | 1,754,167 | −8973 | 85,248 |

| HVUO | −1,202,515 | 1,753,194 | 3902 | 46,143 | −280,592 | 4,879,530 | 8502 | 157,652 | −5,031,681 | 7,010,019 | 5335 | 29,910 |

| CIZIZDROJE | −8587 | 9,605,513 | 38,475 | 267,832 | −8587 | 2,452,195 | 35,848 | 154,754 | −1063 | 27,125,364 | 87,075 | 162,638 |

| KZ | −8587 | 7,970,386 | 24,258 | 201,193 | −8587 | 2,045,211 | 22,790 | 111,291 | −862 | 26,176,367 | 51,079 | 90,336 |

| TZPZ | −11 | 3,372,651 | 9331 | 85,744 | 0 | 1,029,872 | 7257 | 43,046 | 0 | 1,494,572 | 9945 | 77,333 |

| TZPVVAS | −1193 | 34,417,158 | 76,957 | 635,917 | 0 | 11,652,032 | 93,041 | 541,500 | 0 | 92,212,227 | 193,989 | 393,845 |

| PRIDHODN | −27041 | 3,457,583 | 20,735 | 105,858 | −18,524 | 6,386,285 | 27,412 | 218,533 | −2,160,473 | 13,303,713 | 31,827 | 89,016 |

| MZDN | 0 | 1,920,798 | 8704 | 42,814 | 0 | 340,050 | 9152 | 32,254 | 0 | 1,057,816 | 10,346 | 35,200 |

| OHANIM | −13,839 | 1,085,482 | 3359 | 23,770 | 0 | 305,706 | 3720 | 19,150 | 0 | 2,146,145 | 6198 | 19,501 |

| Function | Definition | Range |

|---|---|---|

| Identity | a | |

| Logistic sigmoid | (0;1) | |

| Hyperbolic tangent | (−1;+1) | |

| Exponential | ||

| Sine |

| Index | Network | Training Performance | Test. Performance | Valid. Performance | Training Algorithm | Error Function | Activation of Hidden Layer | Output Activation Function |

|---|---|---|---|---|---|---|---|---|

| 1 | MLP 16-13-2 | 80.60606 | 80.07813 | 81.83594 | BFGS (Quasi-Newton) 29 | Sum of squares | Tanh | Logistic |

| 2 | MLP 16-5-2 | 79.68652 | 79.68750 | 82.42188 | BFGS (Quasi-Newton) 26 | Sum of squares | Tanh | Logistic |

| 3 | MLP 16-6-2 | 81.29572 | 80.37109 | 82.91016 | BFGS (Quasi-Newton) 115 | Entropy | Logistic | Softmax |

| 4 | MLP 16-16-2 | 80.68966 | 80.95703 | 82.22656 | BFGS (Quasi-Newton) 32 | Sum of squares | Exponential | Logistic |

| 5 | MLP 16-6-2 | 81.60920 | 82.81250 | 83.39844 | BFGS (Quasi-Newton) 320 | Sum of squares | Tanh | Exponential |

| STATE-Active Company | STATE-In Liquidation | STATE-All | ||

|---|---|---|---|---|

| 1.MLP 16-13-2 | In total | 3605.000 | 1180.000 | 4785.000 |

| Correct | 3366.000 | 491.000 | 3857.000 | |

| Wrong | 239.000 | 689.000 | 928.000 | |

| Correct (%) | 93.370 | 41.610 | 80.606 | |

| Wrong (%) | 6.630 | 58.390 | 19.394 | |

| 2.MLP 16-5-2 | In total | 3605.000 | 1180.000 | 4785.000 |

| Correct | 3173.000 | 640.000 | 3813.000 | |

| Wrong | 432.000 | 540.000 | 972.000 | |

| Correct (%) | 88.017 | 54.237 | 79.687 | |

| Wrong (%) | 11.983 | 45.763 | 20.313 | |

| 3.MLP 16-6-2 | In total | 3605.000 | 1180.000 | 4785.000 |

| Correct | 3342.000 | 548.000 | 3890.000 | |

| Wrong | 263.000 | 632.000 | 895.000 | |

| Correct (%) | 92.705 | 46.441 | 81.296 | |

| Wrong (%) | 7.295 | 53.559 | 18.704 | |

| 4.MLP 16-16-2 | In total | 3605.000 | 1180.000 | 4785.000 |

| Correct | 3222.000 | 639.000 | 3861.000 | |

| Wrong | 383.000 | 541.000 | 924.000 | |

| Correct (%) | 89.376 | 54.153 | 80.690 | |

| Wrong (%) | 10.624 | 45.847 | 19.310 | |

| 5.MLP 16-6-2 | In total | 3605.000 | 1180.000 | 4785.000 |

| Correct | 3358.000 | 547.000 | 3905.000 | |

| Wrong | 247.000 | 633.000 | 880.000 | |

| Correct (%) | 93.148 | 46.356 | 81.609 | |

| Wrong (%) | 6.852 | 53.644 | 18.391 |

| Networks | 1.MLP 16-13-2 | 2.MLP 16-5-2 | 3.MLP 16-6-2 | 4.MLP 16-16-2 | 5.MLP 16-6-2 | Average |

|---|---|---|---|---|---|---|

| OHANIM | 1.308595 × 1000 | 1.468598 × 1000 | 1.323919 × 1000 | 1.582637 × 1000 | 7.928272 × 1072 | 1.585654 × 1072 |

| HVML | 1.010474 × 1000 | 1.015973 × 1000 | 1.245737 × 1000 | 1.168420 × 1000 | 3.082680 × 1067 | 6.165360 × 1066 |

| OBEZNAA | 9.954667 × 10−1 | 1.003993 × 1000 | 1.026690 × 1000 | 1.058820 × 1000 | 4.113185 × 1056 | 8.226370 × 1055 |

| STALAA | 9.995890 × 10−1 | 1.018402 × 1000 | 1.292808 × 1000 | 1.123080 × 1000 | 2.293233 × 1042 | 4.586465 × 1041 |

| TZPZ | 1 | 1 | 1 | 2 | 24964065 | 4992814 |

| PRIDHODN | 1.551961 | 1.607718 | 1.358550 | 1.650881 | 1.410158 | 1.515854 |

| MZDN | 1.491636 | 1.580681 | 1.327548 | 1.625454 | 1.396413 | 1.484346 |

| Z | 1.301731 | 1.468255 | 1.313886 | 1.580672 | 1.390054 | 1.410920 |

| TZPVVAS | 1.113755 | 1.247744 | 1.274090 | 1.463114 | 1.309567 | 1.281654 |

| CIZIZDROJE | 1.029132 | 1.211809 | 0.999301 | 1.218696 | 1.532301 | 1.198248 |

| KZ | 1.008645 | 1.037475 | 1.371138 | 1.172502 | 1.205429 | 1.159038 |

| FM | 1.031896 | 1.128158 | 1.295458 | 1.016487 | 1.196161 | 1.133632 |

| KP | 0.996484 | 0.996250 | 1.043844 | 1.027617 | 1.326953 | 1.078230 |

| HVUO | 1.041176 | 1.124296 | 1.139508 | 1.002963 | 1.067543 | 1.075097 |

| AKTIVACELK | 0.997329 | 1.011214 | 1.236124 | 1.009652 | 1.032320 | 1.057328 |

| VLASTNIJM | 0.996238 | 1.004995 | 1.188120 | 1.007831 | 1.027016 | 1.044840 |

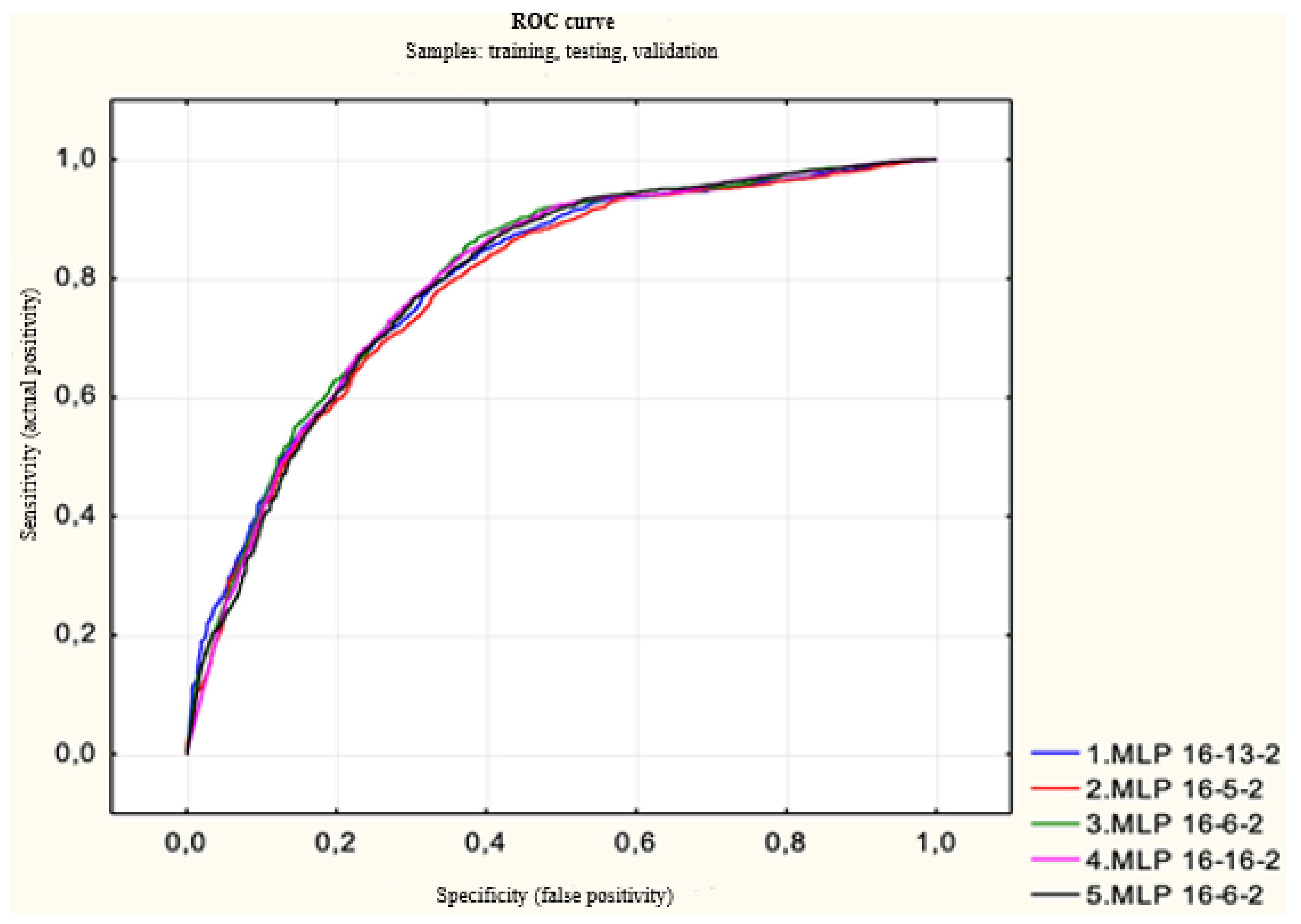

| 1.MLP 16-13-2 | 2.MLP 16-5-2 | 3.MLP 16-6-2 | 4.MLP 16-16-2 | 5.MLP 16-6-2 | |

|---|---|---|---|---|---|

| ROC curve | 0.795669 | 0.785252 | 0.801758 | 0.797702 | 0.794925 |

| ROC threshold | 0.546617 | 0.704045 | 0.863423 | 0.738250 | 0.848838 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Horak, J.; Krulicky, T.; Rowland, Z.; Machova, V. Creating a Comprehensive Method for the Evaluation of a Company. Sustainability 2020, 12, 9114. https://doi.org/10.3390/su12219114

Horak J, Krulicky T, Rowland Z, Machova V. Creating a Comprehensive Method for the Evaluation of a Company. Sustainability. 2020; 12(21):9114. https://doi.org/10.3390/su12219114

Chicago/Turabian StyleHorak, Jakub, Tomas Krulicky, Zuzana Rowland, and Veronika Machova. 2020. "Creating a Comprehensive Method for the Evaluation of a Company" Sustainability 12, no. 21: 9114. https://doi.org/10.3390/su12219114

APA StyleHorak, J., Krulicky, T., Rowland, Z., & Machova, V. (2020). Creating a Comprehensive Method for the Evaluation of a Company. Sustainability, 12(21), 9114. https://doi.org/10.3390/su12219114