Sustainable Production Policy Impact on Palm Oil Firms’ Performance: Empirical Analysis from Indonesia

Abstract

:1. Introduction

2. Indonesian Palm Oil Industry

3. Data and Methods

3.1. Data

3.2. Empirical Framework

4. Results

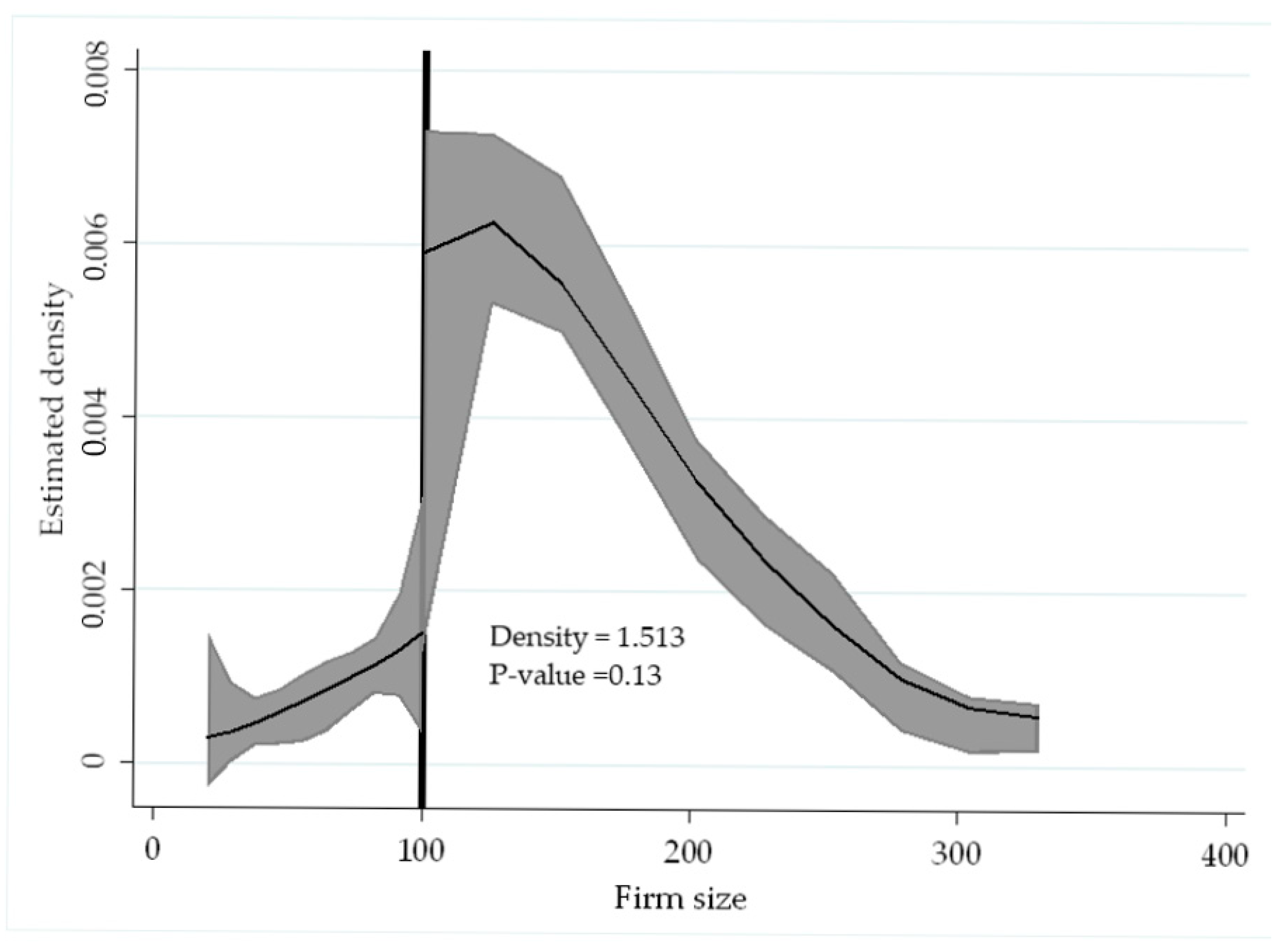

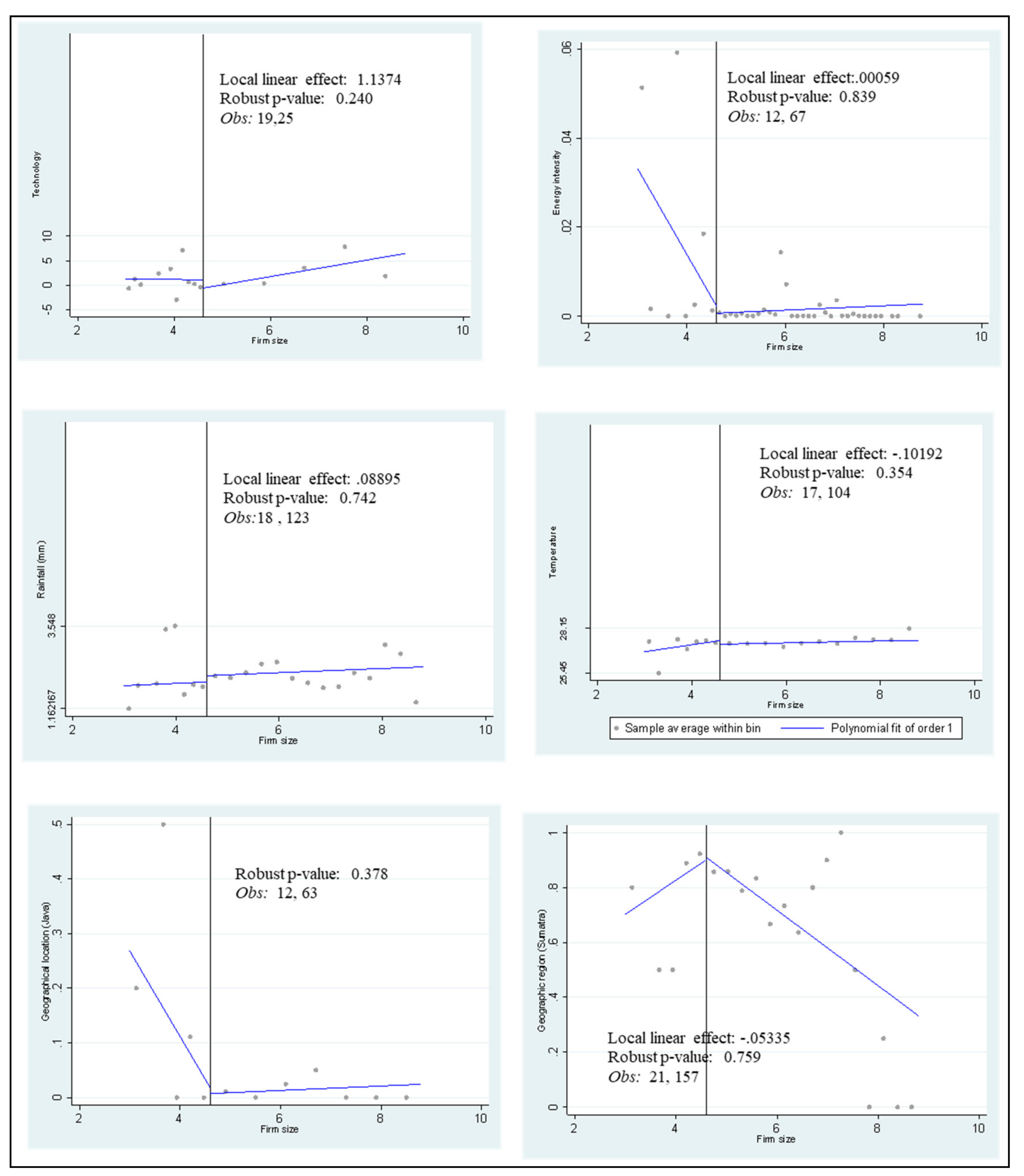

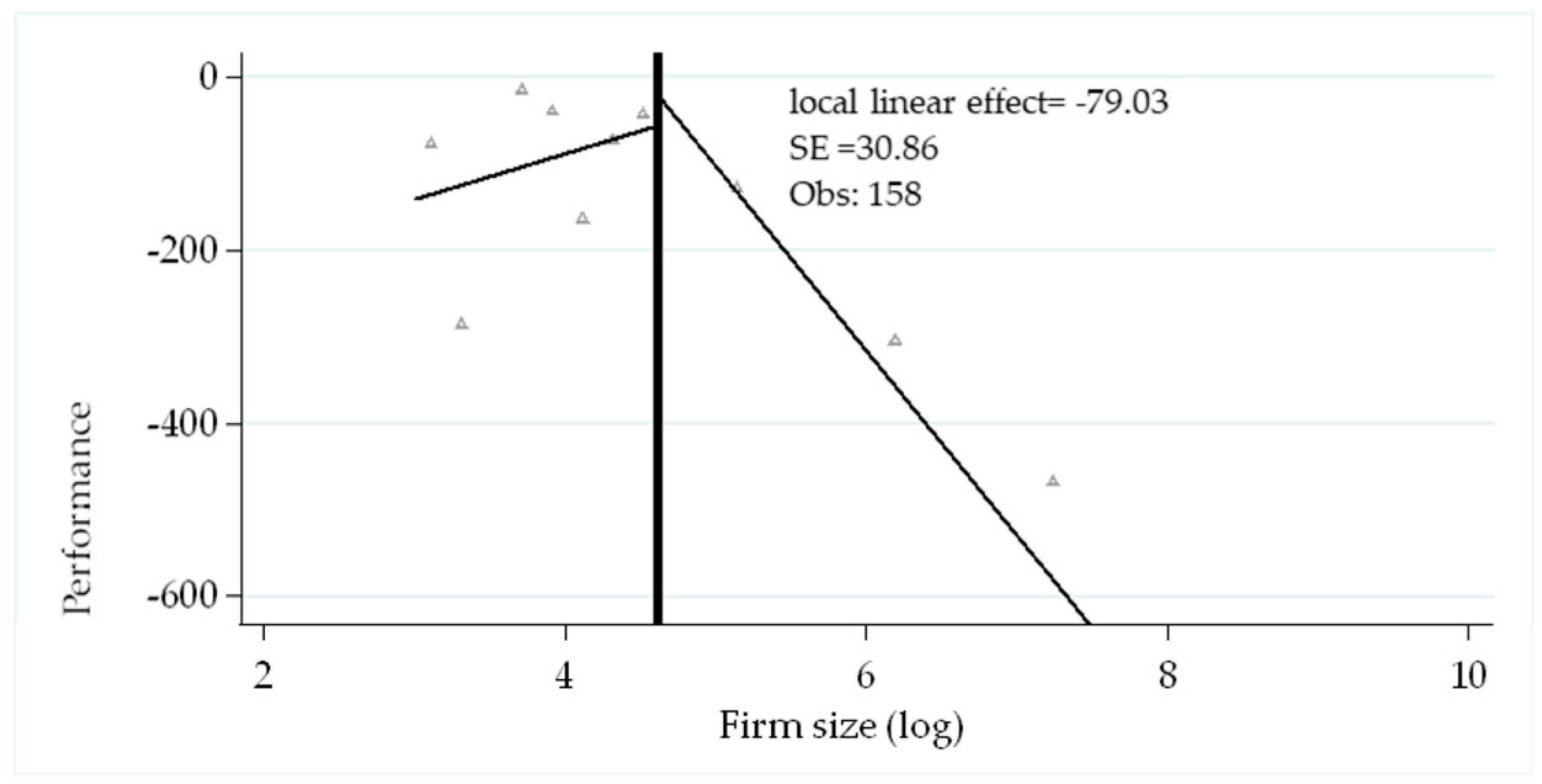

4.1. RD Analysis

4.2. DID Analysis

4.3. Robustness Check

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- United Nations. Sustainable Consumption and Production. Available online: https://wedocs.unep.org/handle/20.500.11822/9660 (accessed on 23 September 2020).

- Linton, J.D.; Klassen, R.; Jayaraman, V. Sustainable supply chains: An introduction. J. Oper. Manag. 2007, 25, 1075–1082. [Google Scholar] [CrossRef]

- Rennings, K.; Rammer, C. The Impact of Regulation-Driven Environmental Innovation on Innovation Success and Firm Performance. Ind. Innov. 2011, 18, 255–283. [Google Scholar] [CrossRef]

- Ar, I.M. The impact of green product innovation on firm performance and competitive capability: The moderating role of managerial environmental concern. Procedia Soc. Behav. Sci. 2012, 62, 854–864. [Google Scholar] [CrossRef] [Green Version]

- Golicic, S.L.; Smith, C.D. A meta-analysis of environmentally sustainable supply chain management practices and firm performance. J. Supply Chain Manag. 2013, 49, 78–95. [Google Scholar] [CrossRef]

- Lee, K.-H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar]

- Price, S.; Pitt, M.; Tucker, M. Implications of a sustainability policy for facilities management organisations. Facilities 2011, 29, 391–410. [Google Scholar] [CrossRef]

- Schrettle, S.; Hinz, A.; Scherrer-Rathje, M.; Friedli, T. Turning sustainability into action: Explaining firms’ sustainability efforts and their impact on firm performance. Int. J. Prod. Econ. 2014, 147, 73–84. [Google Scholar] [CrossRef]

- Zhu, Q. Institutional pressures and support from industrial zones for motivating sustainable production among Chinese manufacturers. Int. J. Prod. Econ. 2016, 181, 402–409. [Google Scholar] [CrossRef]

- Indonesia-Investments Palm Oil. Available online: https://www.indonesia-investments.com/business/commodities/palm-oil/item166? (accessed on 16 August 2020).

- Glasbergen, P.; Schouten, G. Transformative Capacities of Global Private Sustainability Standards: A Reflection on Scenarios in the Field of Agricultural Commodities. J. Corp. Citizsh. 2015, 2015, 85–101. [Google Scholar] [CrossRef] [Green Version]

- Schouten, G.; Bitzer, V. The emergence of Southern standards in agricultural value chains: A new trend in sustainability governance? Ecol. Econ. 2015, 120, 175–184. [Google Scholar] [CrossRef]

- Schouten, G.; Hospes, O. Public and Private Governance in Interaction: Changing Interpretations of Sovereignty in the Field of Sustainable Palm Oil. Sustainability 2018, 10, 4811. [Google Scholar] [CrossRef] [Green Version]

- Indonesian Palm Oil Platform (InPOP) Indonesian Palm Oil Platform (InPOP) Newsletter. Available online: http://www.foksbi.id/en/news/read/06-16-2015-newsletter-jun-2015 (accessed on 30 June 2020).

- Schönhart, M.; Penker, M.; Schmid, E. Sustainable local food production and consumption: Challenges for implementation and research. Outlook Agric. 2009, 38, 175–182. [Google Scholar] [CrossRef]

- Delen, D.; Kuzey, C.; Uyar, A. Measuring firm performance using financial ratios: A decision tree approach. Expert Syst. Appl. 2013, 40, 3970–3983. [Google Scholar] [CrossRef]

- BizVibe Top 10 Indonesian Palm oil Companies. Available online: https://www.bizvibe.com/blog/food-beverages/top-10-indonesian-palm-oil-companies/ (accessed on 20 August 2020).

- McCarthy, J.F.; Gillespie, P.; Zen, Z. Swimming Upstream: Local Indonesian Production Networks in “Globalized” Palm Oil Production. World Dev. 2012, 40, 555–569. [Google Scholar] [CrossRef]

- Indonesian Sustainable Palm Oil the Progress of Ispo System. Available online: https://www.iscc-system.org/wp-content/uploads/2019/11/3_ISPO-Update-and-Outlook-compressed.pdf (accessed on 30 June 2020).

- Koh, L.P.; Wilcove, D.S. Is oil palm agriculture really destroying tropical biodiversity? Conserv. Lett. 2008, 1, 60–64. [Google Scholar] [CrossRef]

- Hidayat, N.K.; Offermans, A.; Glasbergen, P. Sustainable palm oil as a public responsibility? On the governance capacity of Indonesian Standard for Sustainable Palm Oil (ISPO). Agric. Hum. Values 2017, 35, 223–242. [Google Scholar] [CrossRef] [Green Version]

- Anderson, Z.R.; Kusters, K.; McCarthy, J.; Obidzinski, K. Green growth rhetoric versus reality: Insights from Indonesia. Glob. Environ. Chang. 2016, 38, 30–40. [Google Scholar] [CrossRef]

- Uning, R.; Latif, M.T.; Othman, M.; Juneng, L.; Mohd Hanif, N.; Nadzir, M.S.M.; Abdul Maulud, K.N.; Jaafar, W.S.W.M.; Said, N.F.S.; Ahamad, F.; et al. A Review of Southeast Asian Oil Palm and Its CO2 Fluxes. Sustainability 2020, 12, 5077. [Google Scholar] [CrossRef]

- Zaky, M.I.; Sri, H.; Ahmad, M.T.N. The Effects of the World Cpo Prices, Macroecomony, and Capital Structures on the Profitability of Palm Oil Companies. Russ. J. Agric. Socio Econ. Sci. 2019, 85. [Google Scholar] [CrossRef]

- Fan, L.; Pan, S.; Liu, G.; Zhou, P. Does energy efficiency affect financial performance? Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2017, 151, 53–59. [Google Scholar] [CrossRef]

- Kukalis, S. Agglomeration Economies and Firm Performance: The Case of Industry Clusters. J. Manag. 2009, 36, 453–481. [Google Scholar] [CrossRef]

- Douma, S.; George, R.; Kabir, R. Foreign and domestic ownership, business groups, and firm performance: Evidence from a large emerging market. Strateg. Manag. J. 2006, 27, 637–657. [Google Scholar] [CrossRef]

- Chen, W. The effect of investor origin on firm performance: Domestic and foreign direct investment in the United States. J. Int. Econ. 2011, 83, 219–228. [Google Scholar] [CrossRef]

- Wilden, R.; Gudergan, S.P.; Nielsen, B.B.; Lings, I. Dynamic Capabilities and Performance: Strategy, Structure and Environment. Long Range Plan. 2013, 46, 72–96. [Google Scholar] [CrossRef] [Green Version]

- Black, D.A.; Noel, B.J.; Wang, Z. On-the-job training, establishment size, and firm size: Evidence for economies of scale in the production of human capital. South. Econ. J. 1999, 66, 82–100. [Google Scholar] [CrossRef]

- Pons, M.; Bikfalvi, A.; Llach, J.; Palcic, I. Exploring the impact of energy efficiency technologies on manufacturing firm performance. J. Clean. Prod. 2013, 52, 134–144. [Google Scholar] [CrossRef]

- Chege, S.M.; Wang, D. The impact of technology transfer on agribusiness performance in Kenya. Technol. Anal. Strateg. Manag. 2020, 32, 332–348. [Google Scholar] [CrossRef]

- Mariyono, J. Improvement of economic and sustainability performance of agribusiness management using ecological technologies in Indonesia. Int. J. Product. Perform. Manag. 2019, 69, 989–1008. [Google Scholar] [CrossRef]

- Klassen, R.D.; McLaughlin, C.P. The Impact of Environmental Management on Firm Performance. Manag. Sci. 1996, 42, 1199–1214. [Google Scholar] [CrossRef]

- Paulson, N.; Katchova, A.L.; Enlow, S.J. Financial performance of publicly-traded agribusinesses. Agric. Financ. Rev. 2013, 73, 58–73. [Google Scholar]

- Ogishi, A.; Zilberman, D.; Metcalfe, M. Integrated agribusinesses and liability for animal waste. Environ. Sci. Policy 2003, 6, 181–188. [Google Scholar] [CrossRef]

- Thistlethwaite, D.L.; Campbell, D.T. Regression-discontinuity analysis: An alternative to the ex post facto experiment. J. Educ. Psychol. 1960, 51, 309. [Google Scholar] [CrossRef] [Green Version]

- Lee, D.S.; Lemieux, T. Regression discontinuity designs in economics. J. Econ. Lit. 2010, 48, 281–355. [Google Scholar] [CrossRef] [Green Version]

- Moscoe, E.; Bor, J.; Barnighausen, T. Regression discontinuity designs are underutilized in medicine, epidemiology, and public health: A review of current and best practice. J. Clin. Epidemiol. 2015, 68, 122–133. [Google Scholar] [CrossRef] [Green Version]

- Perdinan, P.; Boer, R.; Kartikasari, K. Linking Climate Change Adaptation Options for Rice Production and Sustainable Development in Indonesia (Keterkaitan Opsi-opsi Adaptasi Perubahan Iklim Untuk Produksi Beras Nasional Dan Pembanguan Berkelanjutan Di Indonesia). Agromet 2008, 22, 94–108. [Google Scholar] [CrossRef]

- Siegert, F.; Ruecker, G.; Hinrichs, A.; Hoffmann, A. Increased damage from fires in logged forests during droughts caused by El Nino. Nature 2001, 414, 437–440. [Google Scholar] [CrossRef] [PubMed]

- Talib, B.A.; Darawi, Z. An economic analysis of the Malaysian palm oil market. Oil Palm Ind. Econ. J. 2002, 2, 19–27. [Google Scholar]

- Sulistyanto, A.I.; Akyuwen, R. Factors affecting the performance of Indonesia’s crude palm oil export. In Proceedings of the 2011 International Conference on Economics and Finance Research, Singapore, 26–28 February 2011. [Google Scholar]

- Cattaneo, M.D.; Jansson, M.; Ma, X. Lpdensity: Local polynomial density estimation and inference. arXiv 2019, arXiv:1906.06529. [Google Scholar]

- Calonico, S.; Cattaneo, M.D.; Titiunik, R. Optimal data-driven regression discontinuity plots. J. Am. Stat. Assoc. 2015, 110, 1753–1769. [Google Scholar] [CrossRef]

- Syakriah, A. Climate Change brings Worst Drought to Indonesia Since 2015. Available online: https://www.thejakartapost.com/news/2019/11/22/climate-change-brings-worst-drought-to-indonesia-since-2015.html (accessed on 15 August 2020).

| Variable | Definition | Units |

|---|---|---|

| Dependent variable | ||

| Performance | Value of net profit | IDR millions |

| Independent variable | ||

| Firms characteristics | ||

| N. of employees | Number of employees in a firm | - |

| Medium firms | If number of employees 20 ≥ 99 | - |

| Large firms | If number of employees 100 ≥ | - |

| Domestic capital | Percentage of capital owned by Indonesian private individuals | % |

| Foreign capital | Percentage of capital owned by Foreign investors | % |

| Location | If located in the industrial area (=1) | - |

| Technology | Quantity of electricity generated from palm oil mill effluent | million / Kwh |

| Energy efficiency | Ratio of total electricity use to operating revenues | kwh/IDR |

| Land expansion | Value of land purchased by firms | IDR thousand |

| Export | If firm export products (=1) | - |

| Provincial characteristics | ||

| Population | Total number of people | thousands |

| Rainfall | Quantity of annual rainfall | million mm |

| Temperature | Average annual temperature | ℃ |

| Education | Number of higher-educational institutions | |

| Water supply | Quantity of cleaned water distributed | million m3 |

| Agricultural land | Total area of arable land | million ha |

| REDD+ | If located in a province that implemented REDD+ program (=1) | |

| Geographical region | ||

| Java | If located in Java island (=1). | |

| Papua | If located in Papua province (=2). | |

| Sulawesi | If located in Sulawesi island (=3). | |

| Kalimantan | If located in Kalimantan island (=4). | |

| Sumatra | If located in Sumatera island (=5). | |

| All n = 406 | Medium n = 33 | Large n = 373 | Difference Large-Medium | |||||

|---|---|---|---|---|---|---|---|---|

| Mean | 2010 | 2015 | 2010 | 2015 | 2010 | 2015 | 2010 | 2015 |

| 162 | −196.90 | 62.04 | −81.75 | 170.83 | −207.10 | 108.79 | −125.35 * | |

| (473.1) | (395) | (−81.86) | (115.362) | (492.08) | (409.17) | |||

| Mean change between 2010 and 2015 | −358.90 | −143.79 | −377.93 | −234.14 | ||||

| (471.10) | (122.88) | (490.17) | ||||||

| Variable | All | Medium | Large | Mean Difference between Medium and Large (Large-Medium) | ||||

|---|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | |||

| Firms characteristics | ||||||||

| N. of employees | 217.56 | 375.76 | 87.77 | 120.73 | 229.05 | 388.34 | 141.28 | *** |

| Domestic capital | 68.88 | 44.53 | 83.70 | 36.79 | 67.57 | 44.94 | −16.13 | *** |

| Foreign capital | 18.95 | 36.84 | 12.96 | 32.96 | 19.48 | 37.14 | 6.52 | |

| Location | 0.26 | 0.44 | 0.17 | 0.38 | 0.27 | 0.44 | 0.10 | ** |

| Technology | 1.11 | 5.44 | 0.85 | 3.87 | 1.13 | 5.56 | 0.28 | |

| Energy efficiency | 0.00 | 0.00 | 0.01 | 0.02 | 0.00 | 0.01 | −0.01 | *** |

| Land expansion | 781.01 | 5695.00 | 206.21 | 1477.90 | 832.00 | 5923.76 | 625.79 | |

| Export | 0.11 | 0.31 | 0.17 | 0.38 | 0.10 | 0.30 | −0.06 | |

| Provincial characteristics and macro factors | ||||||||

| Population | 8197.18 | 5982.37 | 10,026.80 | 7659.27 | 8035.31 | 5789.49 | −1991.49 | *** |

| Rainfall | 3.06 | 5.62 | 2.03 | 1.76 | 3.15 | 5.83 | 1.13 | |

| Temperature | 22.36 | 10.33 | 21.09 | 11.54 | 22.47 | 10.22 | 1.38 | |

| Education | 130.89 | 128.33 | 200.15 | 227.66 | 124.76 | 113.77 | −75.39 | *** |

| Water supply | 99,972.25 | 108,887.80 | 133,025.50 | 124,716.30 | 97,047.97 | 106,979.00 | −35,977.53 | ** |

| Agricultural land | 1,393,866 | 551,102.10 | 1,249,167 | 473,780.50 | 1,406,668 | 555,892.20 | 157,501 | ** |

| REDD+ | 0.59 | 0.49 | 0.42 | 0.50 | 0.60 | 0.49 | 0.18 | ** |

| Geographical region | ||||||||

| Java | 0.02 | 0.13 | 0.09 | 0.29 | 0.01 | 0.10 | −0.08 | *** |

| Papua | 0.01 | 0.11 | - | - | 0.01 | 0.12 | ||

| Sulawesi | 0.03 | 0.18 | 0.06 | 0.24 | 0.03 | 0.17 | −0.03 | |

| Kalimantan | 0.15 | 0.35 | 0.03 | 0.17 | 0.16 | 0.36 | 0.13 | *** |

| Sumatra | 0.79 | 0.41 | 0.82 | 0.39 | 0.79 | 0.41 | −0.03 | |

| N | 406 | 23 | 373 | |||||

| Coef. | S.E | ||

|---|---|---|---|

| Treatment dummy (pre-policy) | −69.774 | 48.991 | |

| Treatment dummy (post-policy) | −79.030 | ** | 30.861 |

| N | 406 | ||

| Variables | 1 | 2 | 3 | 4 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. | S.E | Coef. | S.E | Coef. | S.E | Coef. | S.E | |||||

| Post_ISPO | −119.03 | *** | 16.00 | −166.64 | *** | 34.60 | −89.08 | * | 41.33 | −253.47 | *** | 40.04 |

| Large firm | 14.46 | 14.60 | 121.02 | ** | 40.50 | 74.98 | *** | 14.92 | 129.81 | * | 46.89 | |

| Post_ISPO * Large firm | −74.79 | ** | 21.20 | −234.67 | ** | 69.78 | −112.87 | ** | 27.08 | −250.09 | ** | 84.92 |

| N. of employees | 0.37 | ** | 0.09 | |||||||||

| Post_ISPO * N. of employees | −0.86 | ** | 0.23 | |||||||||

| REDD+ | −113.32 | * | 42.22 | |||||||||

| Post_ISPO * REDD+ | 135.05 | * | 54.79 | |||||||||

| Domestic capital | 0.03 | ** | 0.01 | 0.03 | 0.05 | −0.10 | 0.09 | 0.03 | 0.04 | |||

| Foreign capital | −0.28 | *** | 0.03 | 0.14 | 0.26 | 0.09 | 0.17 | 0.17 | 0.25 | |||

| Industrial zone | 5.33 | 2.69 | 17.91 | 18.51 | 36.01 | 22.34 | 14.18 | 16.79 | ||||

| Technology | 0.05 | 2.19 | −3.72 | 2.41 | −4.19 | ** | 1.15 | −3.48 | 2.30 | |||

| Energy intensity | −3162.11 | 1770.72 | −46.56 | 661.26 | 54.71 | 511.44 | −82.24 | 585.26 | ||||

| Population | 0.00 | 0.00 | −0.01 | 0.01 | 0.00 | 0.00 | −0.01 | 0.01 | ||||

| Rainfall | −1.13 | 0.10 | −4.28 | ** | 1.17 | −3.74 | *** | 0.48 | −3.52 | 1.24 | ||

| Temperature | 2.13 | 0.33 | 0.82 | 1.60 | 0.74 | 1.28 | 3.57 | ** | 2.22 | |||

| Education | 0.31 | 0.07 | 0.05 | 0.14 | 0.04 | 0.08 | −0.02 | 0.08 | ||||

| Water | −0.14 | 0.05 | 0.22 | ** | 0.09 | 0.14 | ** | 0.04 | 0.25 | 0.28 | ||

| Agricultural land | 0.45 | 11.23 | −65.34 | 70.23 | −41.16 | 43.54 | −29.69 | 32.00 | ||||

| Papua | 35.19 | 35.19 | 23.07 | 186.50 | −74.11 | 217.80 | ||||||

| Sulawesi | 28.30 | 13.83 | −29.95 | −29.95 | −25.84 | 78.61 | −99.69 | 90.44 | ||||

| Kalimantan | 67.31 | 32.60 | 5.36 | 5.36 | 5.74 | 125.02 | −90.35 | 146.41 | ||||

| Sumatera | 43.19 | 21.68 | −14.58 | −14.58 | 3.34 | 89.85 | −76.42 | 125.66 | ||||

| Constant | −62.31 | 31.19 | 165.56 | 174.11 | 79.03 | 63.71 | 203.14 | 135.31 | ||||

| Adj-R2 | 0.46 | 0.16 | 0.25 | 0.17 | ||||||||

| N | 158 | 406 | 406 | 406 | ||||||||

| (1) | (2) | |||||

|---|---|---|---|---|---|---|

| Type of firms | Coef. | S.E | Coef. | S.E | ||

| Post_ISPO | −134.57 | ** | 32.23 | −225.81 | *** | 28.61 |

| Large firm | 88.65 | 45.43 | 135.71 | ** | 48.66 | |

| Post_ISPO * Large firm | −201.17 | * | 80.66 | −263.73 | ** | 86.97 |

| Land expansion in 2010 | 0.04 | *** | 0.00 | - | - | - |

| Post_ISPO * Land expansion in 2010 | −0.05 | *** | 0.00 | - | - | - |

| Export | - | - | - | −27.62 | - | 63.34 |

| Post_ISPO*Export | - | - | - | −145.62 | - | 106.51 |

| Other control variables | Yes | Yes | ||||

| Adj-R2 | 0.27 | 0.17 | ||||

| N | 406 | 406 | ||||

| Performance | Test 1 | Test 2 |

|---|---|---|

| Standard | −63.07 * | 49.23 |

| (38.2) | (43.56) | |

| Conventional | −12.79 | −11.04 |

| (−33.5) | (41.87) | |

| N | 406 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kunene, N.; Chung, Y.C.Y. Sustainable Production Policy Impact on Palm Oil Firms’ Performance: Empirical Analysis from Indonesia. Sustainability 2020, 12, 8750. https://doi.org/10.3390/su12208750

Kunene N, Chung YCY. Sustainable Production Policy Impact on Palm Oil Firms’ Performance: Empirical Analysis from Indonesia. Sustainability. 2020; 12(20):8750. https://doi.org/10.3390/su12208750

Chicago/Turabian StyleKunene, Noxolo, and Yessica C.Y. Chung. 2020. "Sustainable Production Policy Impact on Palm Oil Firms’ Performance: Empirical Analysis from Indonesia" Sustainability 12, no. 20: 8750. https://doi.org/10.3390/su12208750

APA StyleKunene, N., & Chung, Y. C. Y. (2020). Sustainable Production Policy Impact on Palm Oil Firms’ Performance: Empirical Analysis from Indonesia. Sustainability, 12(20), 8750. https://doi.org/10.3390/su12208750