Will Ending the One-Child Policy and Raising the Retirement Age Enhance the Sustainability of China’s Basic Pension System?

Abstract

1. Introduction

2. Literature Review

3. Model and Assumption

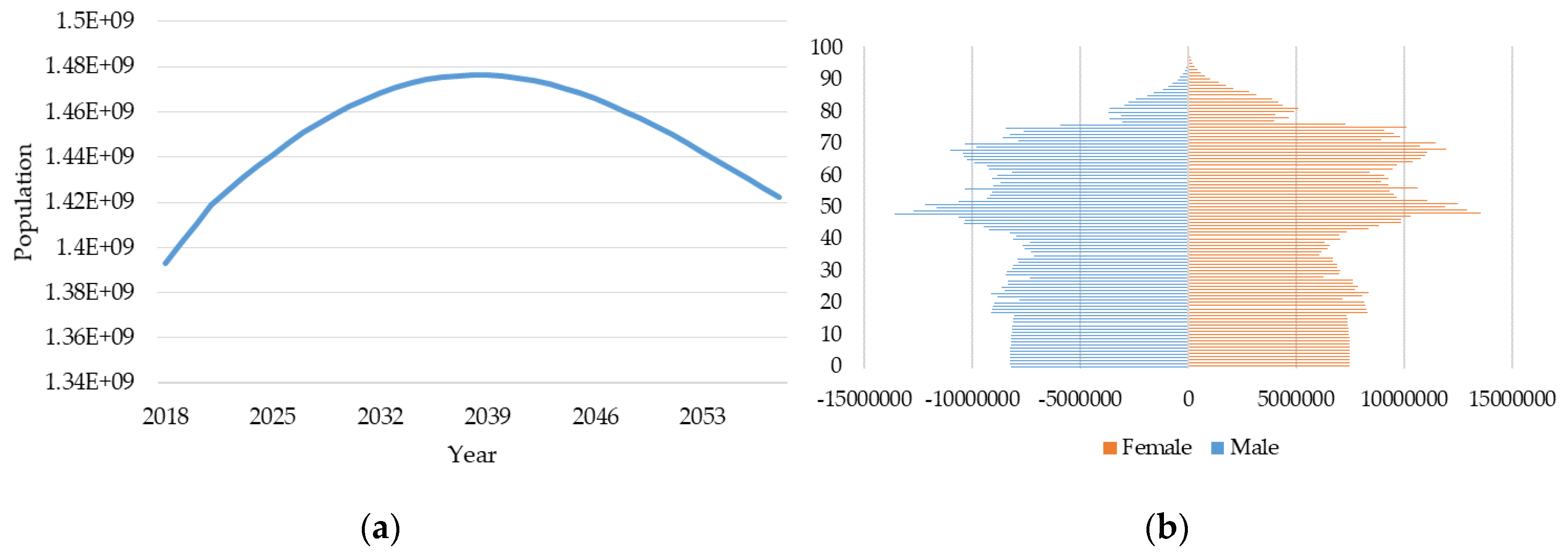

3.1. Population Model

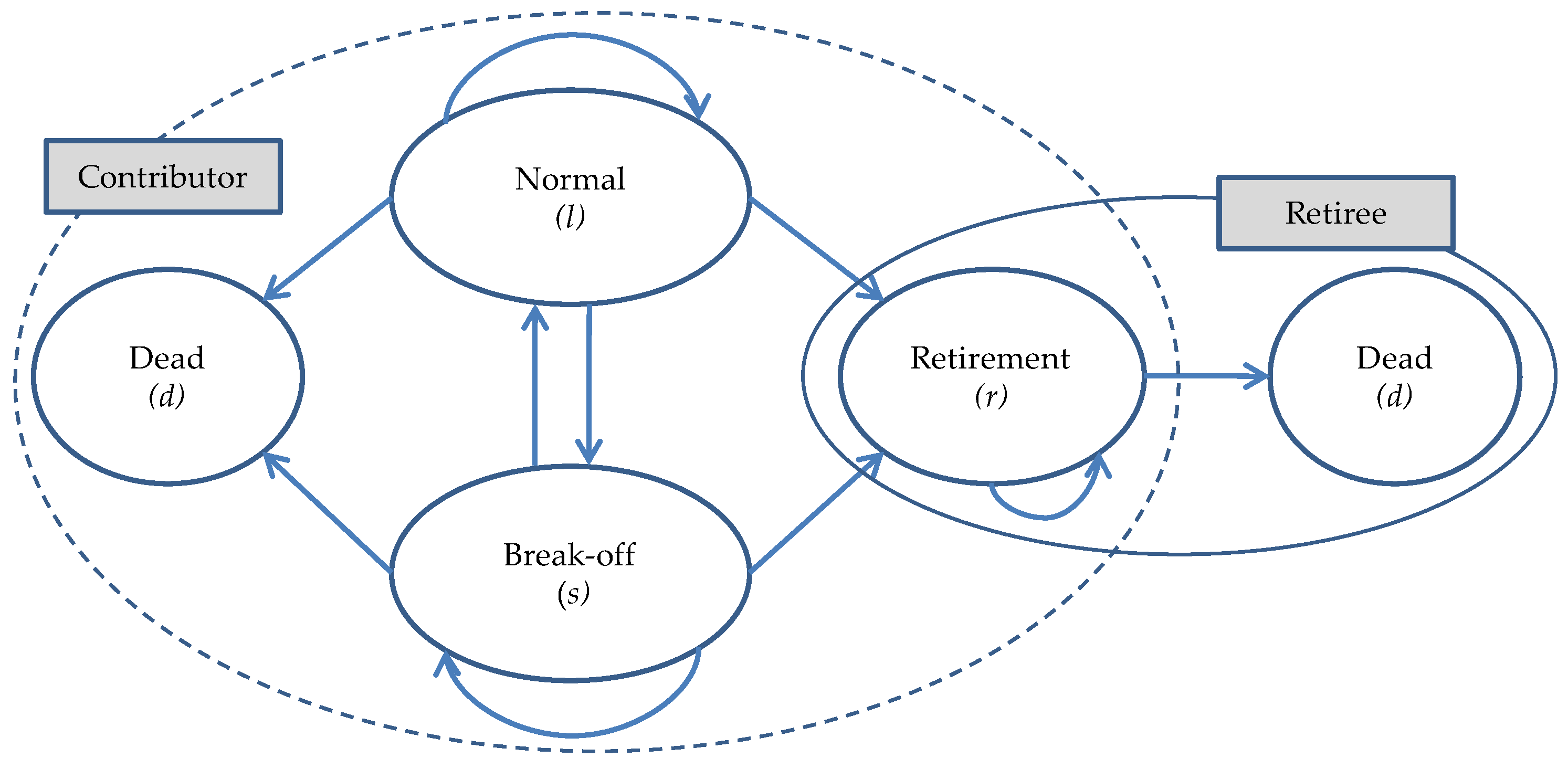

3.1.1. Markov Model for Contributors and Retirees

3.1.2. The Number of Participants in the Future

3.2. Inflow Model of CBPS

3.3. Expenditure Model of CBPS

- Type I: those retired at period 0;

- Type II: those employed at period 0;

- Type III: those who will join CBPS from period 1 to period t.

3.3.1. Expenditure Models for Type I

3.3.2. Expenditure Models for Type II

- Individual pension = accumulated amount of private account/length of planned period

- In addition, the public pension is calculated as follows:

- Public pension = (years of contribution/100) × …

- (Average wage of individual contribution + average wage of all employees)/2

3.3.3. Expenditure Models for Type III

3.4. Balance Model of CBPS

4. Calibration

4.1. Participants in the Future

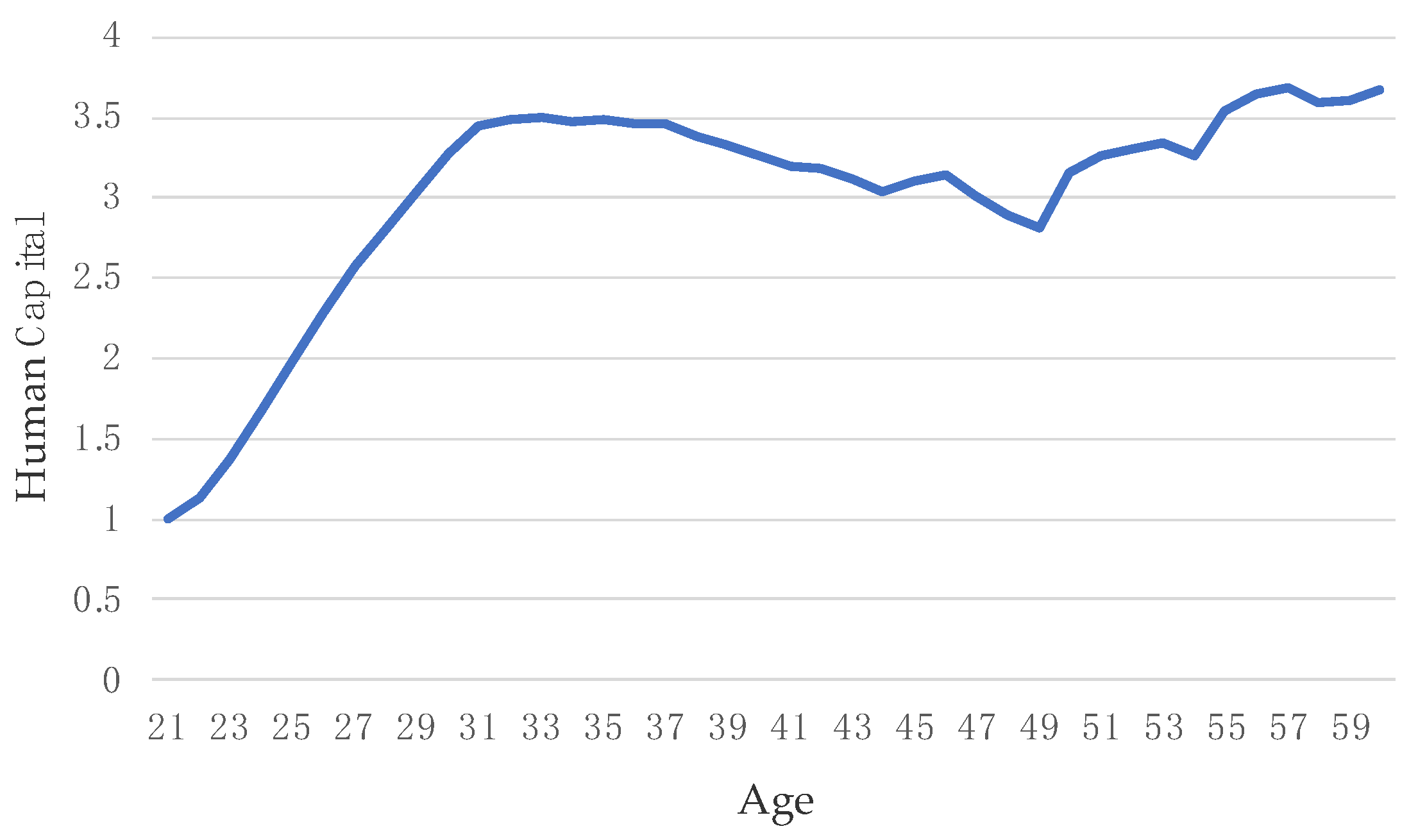

4.2. Wages

- . The human capital determines the difference in wages of individuals who are x years old and x + t years old in the same period.

- . The wages of individuals of the same age increase per year.

4.3. Parameters in CBPS

5. Model Testing and Policy Analysis

5.1. Model Testing

5.2. Forecasting

5.3. Policy Analysis

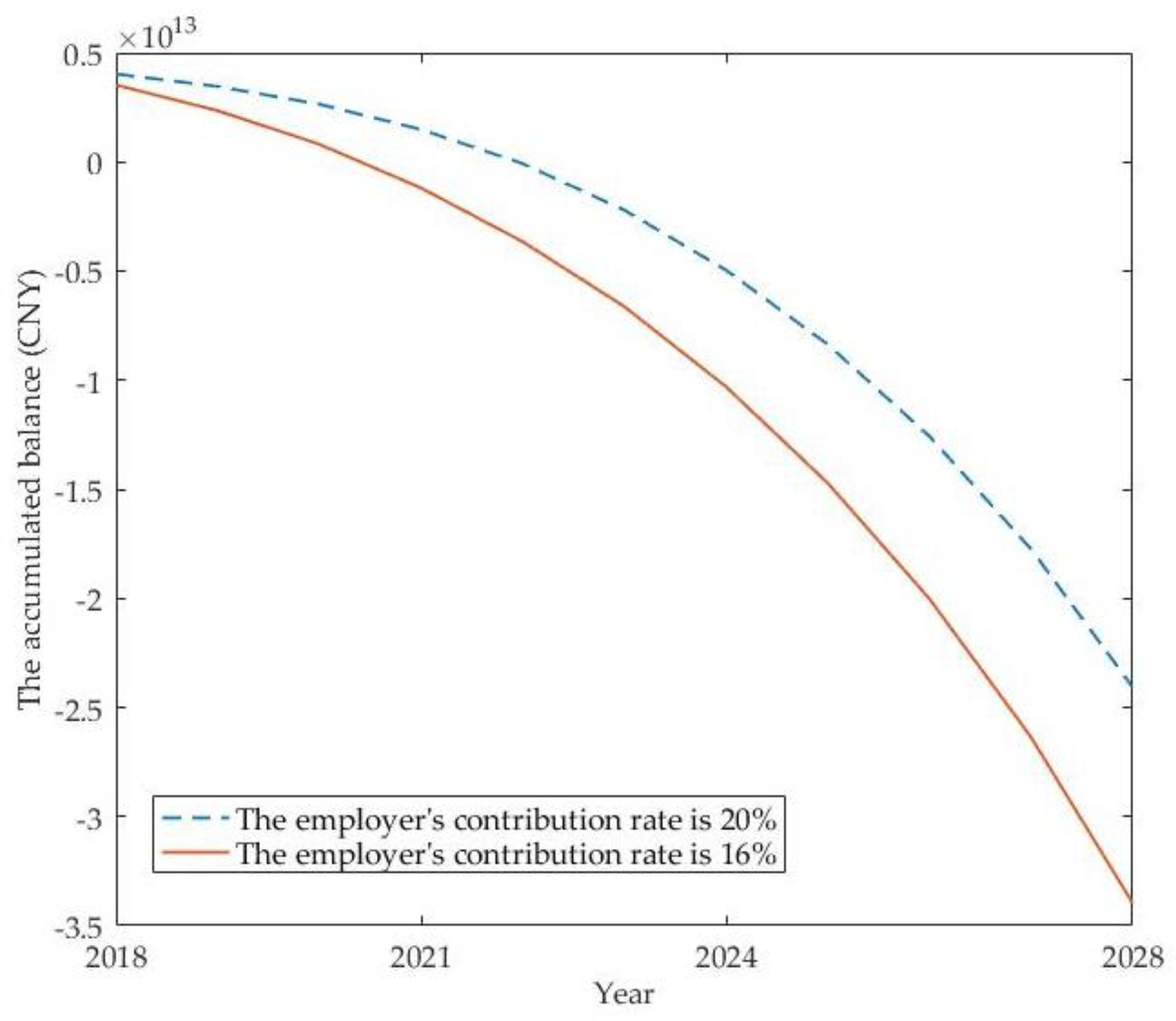

5.3.1. The Decline in Employer Contribution Rate

5.3.2. The End of One-Child Policy

- High fertility rate: 2 from 2019 to 2022 and 1.8 after 2022.

- Moderate fertility rate (baseline situation): 1.4 from 2019 to 2022 and 1.25 after 2022.

- Low fertility rate: 1.4 from 2019 to 2022 and 1.1 after 2022.

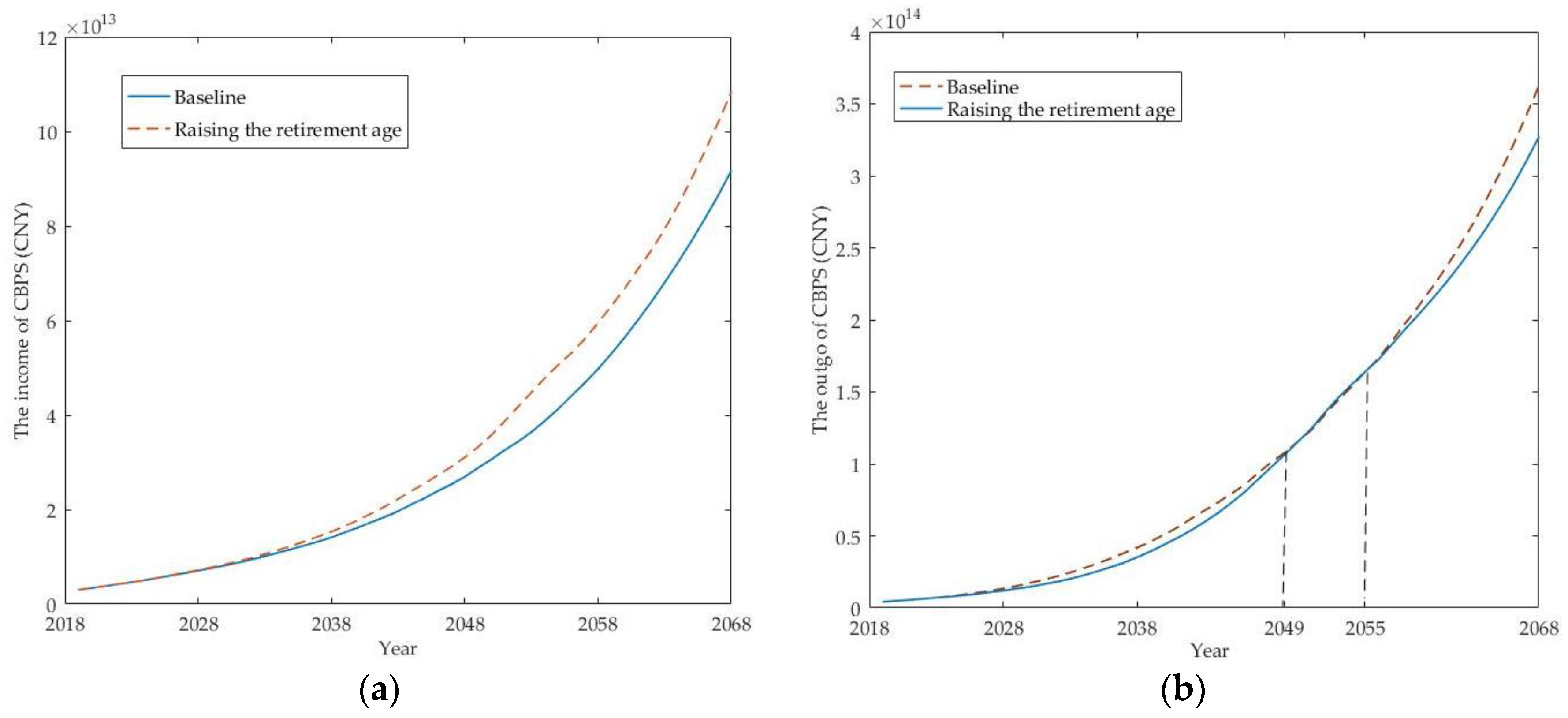

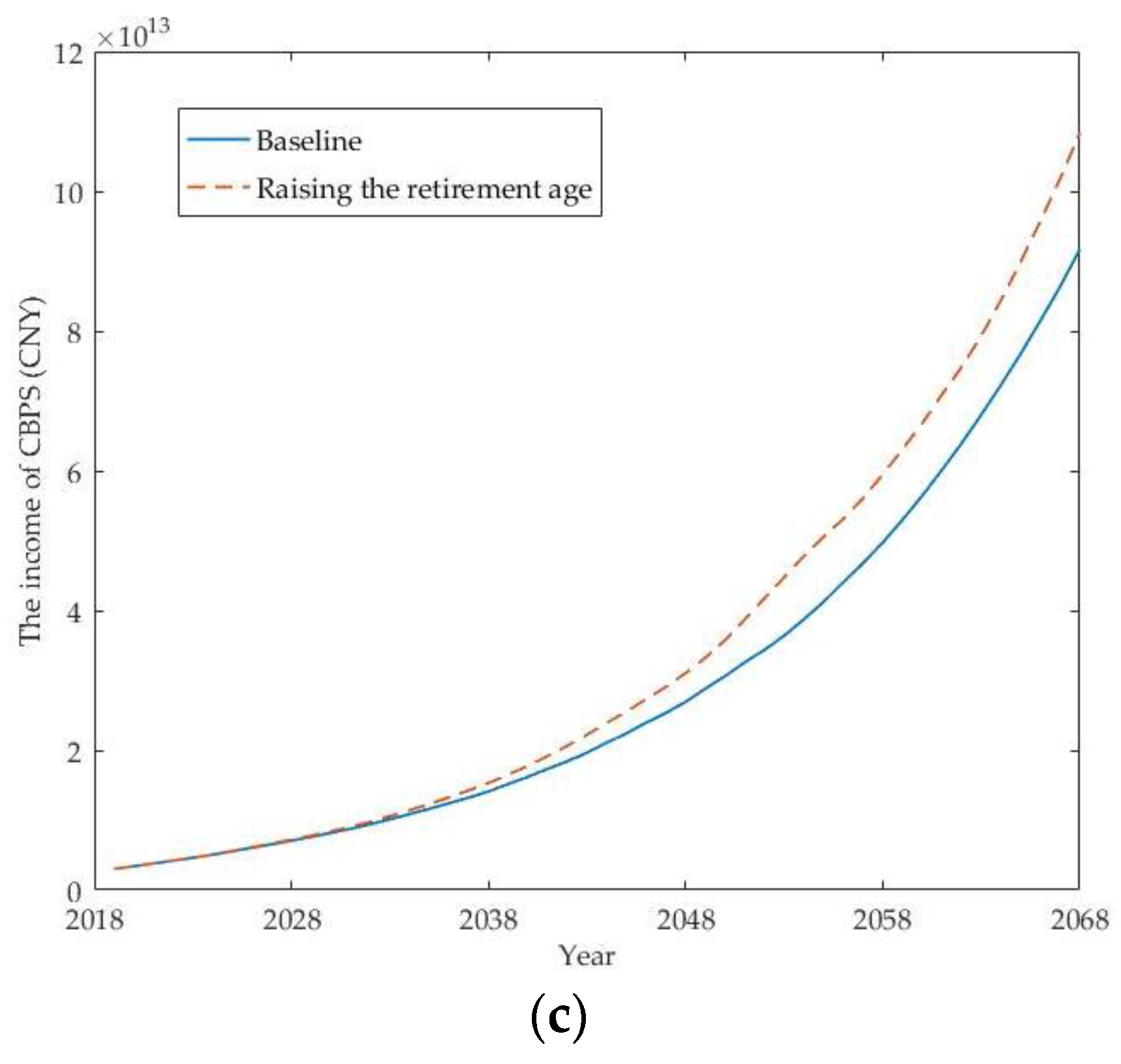

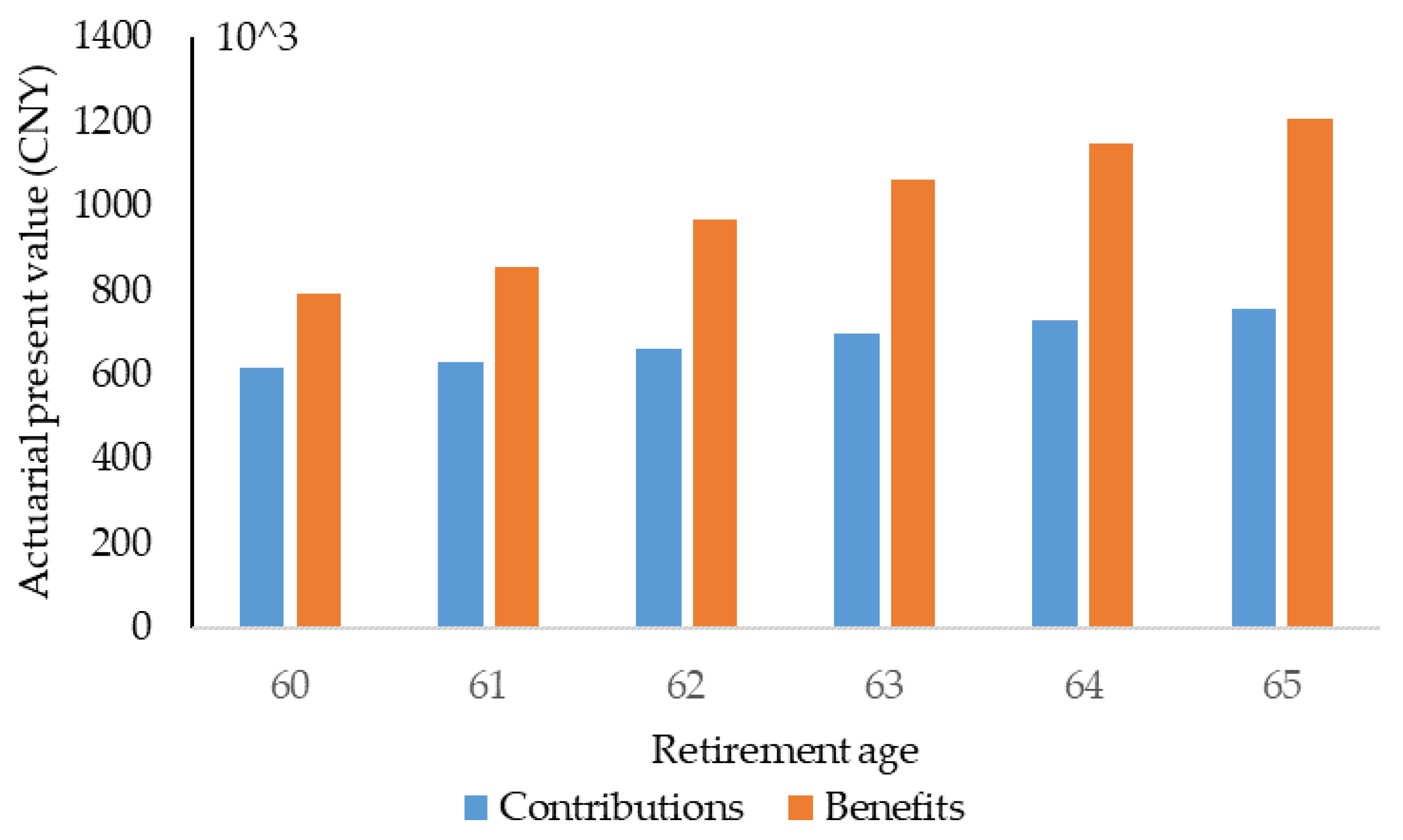

5.3.3. The Increase in Retirement Age

5.3.4. Comprehensive Analysis

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Age | ll | ls | lr | ld | sl | ss | sr | sd |

|---|---|---|---|---|---|---|---|---|

| 21 | 0.85463 | 0.14527 | 0.00000 | 0.00010 | 0.75794 | 0.24043 | 0.00000 | 0.00163 |

| 22 | 0.87759 | 0.12232 | 0.00000 | 0.00009 | 0.78286 | 0.21565 | 0.00000 | 0.00149 |

| 23 | 0.88040 | 0.11952 | 0.00000 | 0.00008 | 0.77670 | 0.22153 | 0.00000 | 0.00177 |

| 24 | 0.86935 | 0.13054 | 0.00000 | 0.00011 | 0.73936 | 0.25817 | 0.00000 | 0.00247 |

| 25 | 0.86049 | 0.13940 | 0.00000 | 0.00011 | 0.69870 | 0.29815 | 0.00000 | 0.00315 |

| 26 | 0.86177 | 0.13810 | 0.00000 | 0.00013 | 0.64215 | 0.35340 | 0.00000 | 0.00445 |

| 27 | 0.86705 | 0.13282 | 0.00000 | 0.00013 | 0.59016 | 0.40370 | 0.00001 | 0.00613 |

| 28 | 0.87679 | 0.12304 | 0.00000 | 0.00016 | 0.55109 | 0.44093 | 0.00000 | 0.00798 |

| 29 | 0.88109 | 0.11874 | 0.00001 | 0.00017 | 0.52666 | 0.46534 | 0.00004 | 0.00796 |

| 30 | 0.88877 | 0.11102 | 0.00000 | 0.00021 | 0.50992 | 0.48211 | 0.00000 | 0.00797 |

| 31 | 0.89559 | 0.10421 | 0.00002 | 0.00018 | 0.49817 | 0.49361 | 0.00008 | 0.00814 |

| 32 | 0.90243 | 0.09739 | 0.00002 | 0.00016 | 0.49603 | 0.49378 | 0.00008 | 0.01010 |

| 33 | 0.90865 | 0.09106 | 0.00005 | 0.00023 | 0.50305 | 0.48558 | 0.00021 | 0.01116 |

| 34 | 0.91690 | 0.08278 | 0.00012 | 0.00019 | 0.49749 | 0.48979 | 0.00049 | 0.01222 |

| 35 | 0.92598 | 0.07361 | 0.00011 | 0.00030 | 0.50250 | 0.48356 | 0.00047 | 0.01347 |

| 36 | 0.93114 | 0.06832 | 0.00022 | 0.00032 | 0.49364 | 0.48995 | 0.00100 | 0.01542 |

| 37 | 0.93625 | 0.06316 | 0.00025 | 0.00034 | 0.49680 | 0.48432 | 0.00116 | 0.01772 |

| 38 | 0.93906 | 0.06015 | 0.00037 | 0.00041 | 0.49965 | 0.47797 | 0.00179 | 0.02059 |

| 39 | 0.94039 | 0.05864 | 0.00050 | 0.00047 | 0.49556 | 0.47992 | 0.00261 | 0.02191 |

| 40 | 0.93309 | 0.06574 | 0.00068 | 0.00049 | 0.49382 | 0.47941 | 0.00360 | 0.02316 |

| 41 | 0.93850 | 0.06011 | 0.00082 | 0.00057 | 0.50950 | 0.46298 | 0.00445 | 0.02307 |

| 42 | 0.94005 | 0.05820 | 0.00113 | 0.00062 | 0.50980 | 0.45816 | 0.00625 | 0.02579 |

| 43 | 0.93781 | 0.06039 | 0.00120 | 0.00060 | 0.50734 | 0.45419 | 0.00726 | 0.03121 |

| 44 | 0.93427 | 0.06333 | 0.00157 | 0.00083 | 0.48147 | 0.46866 | 0.01078 | 0.03910 |

| 45 | 0.83349 | 0.07278 | 0.09273 | 0.00099 | 0.27621 | 0.27516 | 0.42243 | 0.02619 |

| 46 | 0.91394 | 0.06067 | 0.02438 | 0.00101 | 0.40522 | 0.39219 | 0.15931 | 0.04328 |

| 47 | 0.93032 | 0.06133 | 0.00724 | 0.00112 | 0.45130 | 0.43657 | 0.05695 | 0.05517 |

| 48 | 0.93977 | 0.05364 | 0.00540 | 0.00119 | 0.45080 | 0.44098 | 0.04425 | 0.06396 |

| 49 | 0.94059 | 0.05373 | 0.00394 | 0.00175 | 0.43647 | 0.46080 | 0.03496 | 0.06777 |

| 50 | 0.65188 | 0.05800 | 0.28844 | 0.00167 | 0.09661 | 0.12411 | 0.75741 | 0.02187 |

| 51 | 0.90594 | 0.06468 | 0.02752 | 0.00186 | 0.31975 | 0.41671 | 0.18588 | 0.07767 |

| 52 | 0.92773 | 0.06163 | 0.00879 | 0.00184 | 0.34389 | 0.49763 | 0.06597 | 0.09250 |

| 53 | 0.92894 | 0.06080 | 0.00789 | 0.00237 | 0.32010 | 0.51606 | 0.06332 | 0.10052 |

| 54 | 0.91843 | 0.07275 | 0.00667 | 0.00215 | 0.30672 | 0.53597 | 0.05690 | 0.10040 |

| 55 | 0.50985 | 0.05435 | 0.43390 | 0.00189 | 0.05214 | 0.09147 | 0.83271 | 0.02368 |

| 56 | 0.84429 | 0.05271 | 0.10077 | 0.00223 | 0.19373 | 0.29432 | 0.42343 | 0.08851 |

| 57 | 0.92097 | 0.04898 | 0.02684 | 0.00322 | 0.26167 | 0.43847 | 0.16313 | 0.13673 |

| 58 | 0.94414 | 0.03671 | 0.01598 | 0.00317 | 0.25210 | 0.50030 | 0.10868 | 0.13892 |

| 59 | 0.94620 | 0.04017 | 0.00969 | 0.00394 | 0.24076 | 0.53257 | 0.07314 | 0.15352 |

| 60 | 0.03196 | 0.04342 | 0.92153 | 0.00310 | 0.00617 | 0.04715 | 0.92728 | 0.01940 |

| 61 | 0.17245 | 0.18253 | 0.64166 | 0.00336 | 0.03069 | 0.35778 | 0.42889 | 0.18263 |

| 62 | 0.53000 | 0.14500 | 0.32000 | 0.00500 | 0.03488 | 0.63081 | 0.09302 | 0.24128 |

| 63 | 0.58182 | 0.11818 | 0.30000 | 0.00000 | 0.03795 | 0.64286 | 0.07366 | 0.24554 |

| 64 | 0.55556 | 0.13889 | 0.30556 | 0.00000 | 0.02609 | 0.74348 | 0.09565 | 0.13478 |

| 65 | 0.00000 | 0.00000 | 1.00000 | 0.00000 | 0.00000 | 0.00000 | 1.00000 | 0.00000 |

| Age | rr | rd | Age | rr | rd |

|---|---|---|---|---|---|

| 41 | 0.97575 | 0.02425 | 71 | 0.96806 | 0.03194 |

| 42 | 0.98830 | 0.01170 | 72 | 0.96310 | 0.03690 |

| 43 | 0.98209 | 0.01791 | 73 | 0.95697 | 0.04303 |

| 44 | 0.97702 | 0.02298 | 74 | 0.95318 | 0.04682 |

| 45 | 0.99574 | 0.00426 | 75 | 0.94776 | 0.05224 |

| 46 | 0.99525 | 0.00475 | 76 | 0.94279 | 0.05721 |

| 47 | 0.99395 | 0.00605 | 77 | 0.93871 | 0.06129 |

| 48 | 0.99497 | 0.00503 | 78 | 0.93138 | 0.06862 |

| 49 | 0.99320 | 0.00680 | 79 | 0.92154 | 0.07846 |

| 50 | 0.99722 | 0.00278 | 80 | 0.91088 | 0.08912 |

| 51 | 0.99533 | 0.00467 | 81 | 0.90527 | 0.09473 |

| 52 | 0.99519 | 0.00481 | 82 | 0.89749 | 0.10251 |

| 53 | 0.99543 | 0.00457 | 83 | 0.88268 | 0.11732 |

| 54 | 0.99436 | 0.00564 | 84 | 0.86553 | 0.13447 |

| 55 | 0.99508 | 0.00492 | 85 | 0.85774 | 0.14226 |

| 56 | 0.99310 | 0.00690 | 86 | 0.83706 | 0.16294 |

| 57 | 0.99223 | 0.00777 | 87 | 0.81914 | 0.18086 |

| 58 | 0.99153 | 0.00847 | 88 | 0.79904 | 0.20096 |

| 59 | 0.99092 | 0.00908 | 89 | 0.78832 | 0.21168 |

| 60 | 0.99163 | 0.00837 | 90 | 0.77597 | 0.22403 |

| 61 | 0.98948 | 0.01052 | 91 | 0.73368 | 0.26632 |

| 62 | 0.98779 | 0.01221 | 92 | 0.71470 | 0.28530 |

| 63 | 0.98577 | 0.01423 | 93 | 0.71448 | 0.28552 |

| 64 | 0.98497 | 0.01503 | 94 | 0.68311 | 0.31689 |

| 65 | 0.98356 | 0.01644 | 95 | 0.67688 | 0.32312 |

| 66 | 0.98134 | 0.01866 | 96 | 0.65587 | 0.34413 |

| 67 | 0.97979 | 0.02021 | 97 | 0.70186 | 0.29814 |

| 68 | 0.97593 | 0.02407 | 98 | 0.56842 | 0.43158 |

| 69 | 0.97566 | 0.02434 | 99 | 0.46429 | 0.53571 |

| 70 | 0.97087 | 0.02913 | 100 | 0.00000 | 1.00000 |

Appendix B

| Retirement Age | The Length of Planned Period (in Months) | Retirement Age | The Length of Planned Period (in Months) |

|---|---|---|---|

| 40 | 233 | 53 | 180 |

| 41 | 230 | 54 | 175 |

| 42 | 226 | 55 | 174 |

| 43 | 223 | 56 | 164 |

| 44 | 220 | 57 | 158 |

| 45 | 216 | 58 | 152 |

| 46 | 212 | 59 | 145 |

| 47 | 208 | 60 | 139 |

| 48 | 204 | 61 | 132 |

| 49 | 199 | 62 | 125 |

| 50 | 195 | 63 | 117 |

| 51 | 195 | 64 | 109 |

| 52 | 185 | 65 | 101 |

References

- McCarthy, F.D.; Zheng, K. Population aging and Pension Systems: Reform Options for China (May 1996). Available online: https://ssrn.com/abstract=636131 (accessed on 4 September 2020).

- Yang, Z.; Shi, C. Financial burden on pensions for employees in urban enterprises in China. Econ. Sci. 2016, 2, 42–52. (In Chinese) [Google Scholar]

- Zheng, S.; Liao, P. Actuarial model for urban public pension fund in China. Syst. Eng. Theory Pract. 2017, 31, 10–17. (In Chinese) [Google Scholar]

- Yu, H.; Shen, H. Analysis on the sustainability of China’s basic pension fund. In Proceedings of the 2011 2nd International Conference on Artificial Intelligence, Management Science and Electronic Commerce (AIMSEC), Zhengzhou, China, 8–10 August 2011; pp. 6553–6556. [Google Scholar] [CrossRef]

- Sun, L.; Su, C.; Xian, X. Assessing the Sustainability of China’s Basic Pension Funding for Urban and Rural Residents. Sustainability 2020, 12, 2833. [Google Scholar] [CrossRef]

- Zeng, Y.; Zhang, X.; Liu, L. From “selective two-child policy” to universal two-child policy: Will the payment crisis of China’s Pension System be solved? China Financ. Econ. Rev. 2017, 5, 1–17. [Google Scholar] [CrossRef]

- Fan, R. The Path to Select Chinese Progressive Delay Retirement Age Policy. Stud. Asian Soc. Sci. 2015, 2, 19–22. [Google Scholar] [CrossRef]

- Aaron, H. The social insurance paradox. Can. J. Econ. Political Sci. 1966, 33, 371–374. [Google Scholar] [CrossRef]

- Corbo, V. Policy challenges of population aging and pension systems in Latin America. Proc. Econ. Policy Symp. Jackson 2004, Aug, 257–280. [Google Scholar]

- Sin, Y. China: Pension Liabilities and Reform Options for Old Age Insurance; The World Bank Working Paper; The World Bank: Washington, DC, USA, 2005. [Google Scholar]

- Grech, A.G. Assessing the sustainability of pension reforms in Europe. J. Int. Comp. Soc. Policy 2013, 29, 143–162. [Google Scholar] [CrossRef]

- Verbič, M.; Majcen, B.; Nieuwkoop, R.V. Sustainability of the Slovenian Pension System: An analysis with an overlapping generations general equilibrium model. East. Eur. Econ. 2006, 44, 60–81. [Google Scholar]

- Barr, N.; Diamond, P. The economics of pensions. Oxf. Rev. Econ. Policy 2006, 22, 15–39. [Google Scholar] [CrossRef]

- Samwick, A.A. New evidence on pensions, social security, and the timing of retirement. J. Public Econ. 1998, 70, 207–236. [Google Scholar] [CrossRef]

- Breyer, F.; Hupfeld, S. On the fairness of early retirement provisions. Ger. Econ. Rev. 2010, 11, 60–77. [Google Scholar] [CrossRef]

- Fehr, H.; Kallweit, M.; Kindermann, F. Pension reform with variable retirement age: A simulation analysis for Germany. J. Pension Econ. Financ. 2012, 11, 389–417. [Google Scholar] [CrossRef]

- Conde-Ruiz, J.I.; Giménez, E.L.; Pérez-Nievas, M. Endogenous fertility-pension programs and intergenerational welfare. In Modeling and Control of Economic Systems 2001; Neck, R., Ed.; Elsevier Science: Amsterdam, The Netherlands, 2003; pp. 157–161. [Google Scholar]

- Serrano, F.; Eguía, B.; Ferreiro, J. Public pensions’ sustainability and population ageing: Is immigration the solution? Int. Labour Rev. 2011, 150, 63–79. [Google Scholar] [CrossRef]

- Zhao, Y.; Bai, M. Stressing testing the transition debt of pension plan in China. J. Quant. Tech. Econ. 2018, 4, 80–96. (In Chinese) [Google Scholar]

- Han, J.; Meng, Y. Decreased contribution rates increase public pension fund revenue: Evidence from China. J. Aging Soc. Policy 2019, 1–18. [Google Scholar] [CrossRef]

- Chen, X.; Yang, Z. Stochastically Assessing the Financial Sustainability of Individual Accounts in the Urban Enterprise Employees’ Pension Plan in China. Sustainability 2019, 11, 3568. [Google Scholar] [CrossRef]

- Zhai, Z.; Zhang, X.; Jin, Y. Demographic consequences of an immediate transition to a universal two-child policy. Popul. Res. 2014, 38, 3–17. (In Chinese) [Google Scholar]

- Qi, M.; Dai, M.; Zheng, Y. Discuss the impact and tendency of the universal two-child policy on China’s birth rate fluctuation. China Popul. Resour. Environ. 2016, 9, 1–10. (In Chinese) [Google Scholar]

- Kulish, M.; Kent, C.; Smith, K. Aging, retirement, and savings: A general equilibrium analysis. BE J. Macroecon. 2010, 10, 1–32. [Google Scholar] [CrossRef]

- Liao, P. Does China’s social pension system enhance the participants’ welfare? J. World Econ. 2016, 11, 147–171. (In Chinese) [Google Scholar]

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|---|---|

| Actual population | 13,409 | 13,474 | 13,540 | 13,607 | 13,678 | 13,746 | 13,827 | 13,901 | 13,954 |

| Estimated population | 13,328 | 13,406 | 13,482 | 13,560 | 13,632 | 13,715 | 13,788 | 13,838 | 13,908 |

| Accuracy rate | 99.4% | 99.5% | 99.6% | 99.7% | 99.7% | 99.8% | 99.7% | 99.6% | 99.7% |

| Description | Value |

|---|---|

| Mortality rate | 1.2 times the value in Table 1, China Life Insurance Mortality Table (2010–2013) |

| Fertility rate | The fertility rate is 1.4 from 2019 to 2022 and 1.25 after 2022 |

| Population structure at period 0 | The tabulation on the 2010 Population Census of China |

| Urbanization rate | The urbanization rate in 2018 was 58.52%, which will increase 1% per year from 2019 to 2030 and then remain unchanged. |

| Unemployment rate | 4.14% |

| Average growth rate of wages | 7.7% for 2018–2020, 6.6% for 2021–2025, and 5.7% after 2025 |

| Interest rate | 2.84% before 2017 and 8.13% after 2017 |

| Funeral favor | 60% of the national average wage |

| Public pension growth rate | 5% after 2018 |

| (0.1 Billion CNY) | Actual Income 1 | Simulated Income | Ratio | Actual Expenditure | Simulated Expenditure | Ratio |

|---|---|---|---|---|---|---|

| 2009 | 9534.0 | 10,924.7 | 114.59% | 8894.4 | 8965.7 | 100.80% |

| 2010 | 11,110.0 | 12,211.2 | 109.91% | 10,554.9 | 10,888.1 | 103.20% |

| 2011 | 13,956.0 | 14,199.8 | 101.75% | 12,765.0 | 13,249.9 | 103.80% |

| 2012 | 16,467.0 | 16,184.8 | 98.29% | 15,561.8 | 16,049.5 | 103.10% |

| 2013 | 18,634.0 | 18,324.3 | 98.34% | 18,470.4 | 19,644.0 | 106.40% |

| 2014 | 20,434.0 | 20,844.6 | 102.01% | 21,754.7 | 23,435.2 | 107.70% |

| 2015 | 23,016.0 | 23,617.4 | 102.61% | 25,812.7 | 28,030.7 | 108.60% |

| 2016 | 26,768.0 | 27,158.3 | 101.46% | 31,853.8 | 32,310.4 | 101.40% |

| 2017 | 33,403.0 | 31,453.2 | 94.16% | 38,051.5 | 37,027.4 | 97.30% |

| (0.1 Billion CNY) | Income | Expenditure | Gap in Single Year |

|---|---|---|---|

| 2018 | 35,288.4 | 42,417.6 | −7129.2 |

| 2023 | 59,106.1 | 80,415.9 | −2,1309.8 |

| 2028 | 88,826.7 | 152,188.6 | −6,3361.8 |

| 2033 | 126,820.4 | 274,725.0 | −147,904.7 |

| 2038 | 177,121.9 | 459,464.7 | −282,342.9 |

| 2043 | 246,078.1 | 729,378.4 | −483,300.3 |

| 2048 | 336,225.5 | 1,076,058.5 | −739,833.0 |

| 2053 | 452,095.0 | 1,534,990.1 | −1,082,895.1 |

| 2058 | 617,958.4 | 2,093,026.2 | −1,475,067.9 |

| Accumulated Balance (0.1 Billion CNY) | |

|---|---|

| 2018 | 40,323.2 |

| 2019 | 34,605.7 |

| 2020 | 26,469.1 |

| 2021 | 14,911.0 |

| 2022 | −769.2 |

| 2023 | −22,079.0 |

| 2024 | −49,565.3 |

| 2025 | −83,610.6 |

| 2026 | −125,697.6 |

| 2027 | −177,370.3 |

| 2028 | −240,732.2 |

| Entry Year | Contributions (CNY) | Benefits (CNY) |

|---|---|---|

| 2018 | 61,710 | 79,420 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liao, P.; Su, H.; Pamučar, D. Will Ending the One-Child Policy and Raising the Retirement Age Enhance the Sustainability of China’s Basic Pension System? Sustainability 2020, 12, 8172. https://doi.org/10.3390/su12198172

Liao P, Su H, Pamučar D. Will Ending the One-Child Policy and Raising the Retirement Age Enhance the Sustainability of China’s Basic Pension System? Sustainability. 2020; 12(19):8172. https://doi.org/10.3390/su12198172

Chicago/Turabian StyleLiao, Pu, Hui Su, and Dragan Pamučar. 2020. "Will Ending the One-Child Policy and Raising the Retirement Age Enhance the Sustainability of China’s Basic Pension System?" Sustainability 12, no. 19: 8172. https://doi.org/10.3390/su12198172

APA StyleLiao, P., Su, H., & Pamučar, D. (2020). Will Ending the One-Child Policy and Raising the Retirement Age Enhance the Sustainability of China’s Basic Pension System? Sustainability, 12(19), 8172. https://doi.org/10.3390/su12198172