Abstract

Current events have put us in front of new paradigms on which our life and its economic aspects seem to be based: the worldwide spread of contagion from COVID-19 threatens dramatic long-term changes in the economy, lifestyle, and social structures. Valuing virtuous behaviour through the transfer and sharing of risks among several actors allows us to achieve benefits for all. The COVID-19 pandemic leads us to experiment with new forms of public health protection, including through insurance instruments. The role of insurance companies, intrinsically linked with the protection of primary areas such as healthcare and welfare, therefore becomes more critical than ever in terms of securing the protection of people, families, and productive activities. This work endorses the design of a virtuous cycle of investments, which may be implemented starting with insurance companies; such a project would unfold through insurance policies’ contractual lines, securitisation schemes, investment policies, and socially responsible corporate strategies

1. Introduction

The current epidemiological scenario set in motion by the worldwide spread of contagion from COVID-19 (also called SARS-CoV-2) threatens dramatic long-term changes in the economy, lifestyle, and social structures. The chief economist of the International Monetary Fund Gita Gopinath recently stated in no uncertain terms that a great danger, caused by the “Great Lockdown”, looms over the stability of the world financial system.

The role of insurance companies, intrinsically linked with the protection of primary areas such as healthcare and welfare, therefore becomes more critical than ever in terms of securing the protection of people, families, and productive activities. In this context, the European Insurance and Occupational Pensions Authority (EIOPA), which is currently monitoring, together with the European Supervisory Authorities and the European Systemic Risk Board, the implications of the ongoing pandemic, issued a report on 17 March 2020 [1]. In this document, the organisation highlighted that, based on the latest stress tests, the insurance sector is “well capitalised and prepared to withhold severe but plausible shocks to the system”. While underlining that Solvency II directives may allow for the implementation of specific instruments aimed at facing the risks of this sector and, at the same time, protecting policy holders, the report ultimately claims that “insurance companies should take measures to preserve their capital position in balance with the protection of the insured”.

Insurance companies will thus be able to take a proactive role as regards the macroeconomic scenarios impacting on families and firms by creating products and services that will encourage economic recovery and, above all, by expanding their core business to strike a balance among profit, sustainability, and protection of social well-being. Mills [2] explored the theme of green insurance, underscoring the constant demand facing insurers to strengthen their resilience to catastrophes and, at the same time, to hone their ability to “play ahead” by taking a proactive stance with respect to climate change. The present circumstances are raising the same question, albeit with a much greater sense of urgency, given the extent to which contagion trends and mortality rates have come to play an increasingly dramatic role in economic forecasts. The future of the economy, as some very recent studies have aptly showed [3], seems closely linked to the dynamics of transmission of the SARS-CoV-2 virus. In short, epidemiological studies agree on forecasting recurrent outbreaks, which, following the initial pandemic phase, might reappear in the coming years. Taking this information into account, despite one’s trust in advancements in scientific research on drugs, therapies, and vaccines, procedures such as social distancing and the reorganisation of social and work dynamics will inevitably be required.

In this context, insurance companies will be called to face a great challenge that undermines public health and the integrity, let alone the stability, of businesses. The costs of insurance coverage for business risks, for example, could include “reward” mechanisms for those companies that correctly implement strategies protecting the health and well-being of the community. Doing so would engender a virtuous cycle, able to stimulate the correct fulfilment of the rules imposed on companies for the protection of health. It would also contribute to verifying investments, especially when it comes to the funds that states allocate to economic recovery.

As has already been the case with Environmental, Social, and Governance (ESG) risks [4,5,6] and consistent with an Enterprise Risk Management (ERM) approach, insurance companies will be able to expand the analysis of financial risks and returns in a Social Finance perspective, generating, that is, social impact with their products.

2. Welfare and Insurance Firms’ Current Role in ESG Investing: A Brief Overview

The economic model we propose links up with insurance companies’ core business, albeit featuring innovative characteristics: traditional risk transfer feeds a process aimed at safeguarding collective health and, in consequence, the entire “supply chain” of social well-being.

Current experiences of insurance companies pioneering the landscape of ESG investing are particularly interesting, even though they are yet to be fully developed. In recent years, welfare and insurance companies have promoted remarkable developments in sustainability strategies, especially when it comes to green economy initiatives. It should therefore not be surprising that some insurance companies regularly appear on international ESG evaluation lists, such as the Dow Jones Sustainability Index Europe and Dow Jones Sustainability Index World.

The proposal we advance in Section 6 is a wholly innovative business design; we believe that its effectiveness can be corroborated by the noticeable success of ESG investing activities currently undertaken by insurance companies.

In Italy, for example, a recent survey led by the Institute for the Supervision of Insurance (IVASS) [7] reported a remarkable growth in investments made by ESG-oriented insurance companies.

The European Insurance and Occupational Pension Authority (EIOPA) has also planned a series of initiatives aiming at steering insurance companies towards the correct implementation of sustainable finance parameters. In this context [8] the supervisory authority’s guidelines highlight not only that insurance companies and pension funds ought to deal with ESG risks as part of their core business, but also that they themselves implement a sustainable investment policy. The latter policies are identified and classified by a technical committee working alongside the European Commission, to which EIOPA, too, belongs.

The current health and economic emergencies have accelerated the activities of the three chief European supervisory authorities (EBA, EIOPA, and ESMA–ESA), which, in July 2020, launched a public audit of ESG standards. A large academic literature also testified to the centrality of the topic of ESG investments in insurance and beyond. Among the most recent studies, Kurtz [9] examined the ESG investments’ impact on public finance; Hoepner et al. [10], Andonov et al. [11], Himick et al. [12] then considered socially responsible investments of pension funds.

Furthermore, it is by virtue of their intrinsic ESG investment parameters that particular contractual profiles currently in place, such as personal pension products, have been widely promoted by supervisory authorities. In this sense, EIOPA is currently developing the so-called PanEuropean Pension Products (PEPPs) in the pension sector, which must mitigate investments by taking into account and successfully implementing ESG guidelines (see Rodrigues [13], Schelkle [14], Van Meerten et al. [15]).

During pandemic periods, actuarial management techniques allow for substantial and drastic intervention that guarantees the protection of individuals and communities by means of specific products. The burden of the risks assumed by an insurance company during a serious pandemic, however, must necessarily be transferred to bespoke instruments, such as re-insurance. In 2017, for instance, additional tools were made available to manage the risks linked with pandemics, namely, two types of pandemic bonds, maturing in 2020, issued by the World Bank: the one related to influenza and coronavirus pandemics and the other to diseases such as Ebola (see Erikson [16], Erikson et al. [17]). That said, the extent of the current pandemic has unquestionably demonstrated that certain business strategies can no longer be restricted to time-limited interventions, but must develop systemically, placing the economic and social value of collective well-being front and centre (see Gründl et al. [18], Frydman et al. [19], Macdonald [20], Palacios et al. [21]).

It is precisely with this objective in mind that we propose our model.

3. The Workplace Safety as a Social Value

Many large insurance groups have made sustainability one of their strategic objectives. This shows a growing interest in the intangible values that are becoming increasingly relevant to citizens in general and to those who make financial choices in particular. Among these, insurance choices, perhaps more than others, intrinsically contain values linked to protection, safety, and prudence. The ultimate goal that many large groups are beginning to place in their business strategies is, in a sense, to accompany civil society towards high quality of life standards. On this topic an interesting paper by Risi [22] explained amply how insurance companies, having by their very nature a long-term perspective in risk management, are increasingly interested in developing and promoting business based on events over long periods of time.

There are many testimonies of this growing interest, which is based on the consideration that any potential crisis that is not effectively assessed and managed, can with high probability cause serious effects, both financial and simply reputational. Then, speaking of reputation, there is growing sympathy for companies that support and pursue objectives related to the environment and public health [23].

The evolution of the risk landscape, especially in recent years, has implied a progressive change in the perception of global risks. An interesting document written on the occasion of the 15th edition of the World Economic Forum’s Global Risk Report [24] and dated 15 January, just before the pandemic linked to COVID-19 caused the very hard impact, as much disruptive as unpredictable. In this document, in which the global risks in terms of probability and impact are reported from 2007 to 2020, the convergence of both classifications towards environmental issues is evident.

In this same document, however, it was stated that the general consensus appears to be the widespread unpreparedness and weakness of many countries to manage a pandemic, which makes society and the economy vulnerable to possible pandemic events.

In the current COVID-19 pandemic that the whole world is experiencing, the role of insurance companies must be to implement resilience processes and to develop proactive actions (see, for example, [25]).

These measures can play fundamental roles in a world in shock, and for this reason, in fundamental transformation, in the protection of the company’s reputation, also giving it competitive advantages [26].

Again in the World Economic Forum’s Report [27], as early as 21 February, it was stated that the business capable of implementing actions of strategic, operational, and financial resilience to global risks will be stronger and better-positioned in the market and capable of a more reactive recovery.

In particular, it will be a necessity for companies and offices in general to develop careful workplace safety strategies, in a completely new vision of both the workplace and the organisation of work itself. Above all, these strategies will have to be encouraged and appropriately stimulated and innovated, even once the COVID-19 pandemic is over. This is an absolutely predictable risk: it is the opinion shared by epidemiologists, as mentioned in the previous section, that pandemics will be recurrent events.

The interconnections of the COVID-19 pandemic with the economy have shown how the weakness of measures to protect worker health threatens to have a severe impact on the welfare state in a broad and general sense. Being prepared for such events implies a “social value” that must be recognised as a category on a par with the categories of sustainability, environment, climate change, energy saving, and so on.

As in Thistlethwaite’s paper [28] the standards of insurability, understood as the insurer’s ability to model the event in question and its ability to price in a balanced way the insurer–insured relationship, are lacking in these cases. The use of past data to model future risks will be inaccurate and unreliable, which makes any assessment made at the time the contract is issued inaccurate and unreliable. It highlights the need for a dynamic contract design, which adapts virtuously to the real trend of the phenomenon under observation.

Could securitisation, in these scenarios, allow for prudent and forward-looking risk mitigation and transfer, in order to encourage virtuous behaviour, from the perspective of the common good and public health?

4. Workplace Safety and Insurance Incentives. New Realities and New Strategies

In light of the above, we propose a particular type of policy indexed to social health as a risk management tool for the insurance company. This proposal is applicable to generic forms of insurance contracts aiming to cover the risks of damage to the health of workers and office workers.

We are thinking about tools that can be configured in the field of the index-linked policies, contextualisable within the risk mitigation strategies for insurance companies with a view to sustainability. These instruments, which have no direct connection with the financial world, can be used to transfer risk to investors with the aim of encouraging activities aimed at improving the health system, specifically the pandemic aspects. These policies, making an important contribution to social health, can, if properly encouraged, be important flywheels to ensure good working conditions, which are essential prerequisites for the smooth running of the economy.

The impact of these optimum conditions in the workplace relies directly on the parameters of social health, and, for this reason, other investors, including institutional investors, can be involved in the virtuous management of the contract itself. The idea is based on the need to encourage the proper behaviour of companies [29] in the implementation and continuous maintenance of a procedural, organisational, and technological system designed to minimise the probability of transmission of contagion. This is when a pandemic is both in progress and, especially, when it is not (apparently) in progress. The incentive, seen as a bonus to be given to insured firms that pursue a careful policy of workplace protection, takes the form of a reduction in the required premium that the insurance company can get through the securitisation of the portfolio of policies.

The risk arising from the coverage of pandemic events within industrial and corporate entities in general, in light of the events linked to the COVID-19 pandemic, may be transferred in this way through a Special Purpose Company (SPC).

5. Derivatives and Securitisation: Hedging against Risks and Investment Opportunities

The evolution of derivatives has been very wide and diversified, and in recent years the attention of the markets to mortality/longevity derivatives, which explicitly present their source of risk in the unforeseen variations related to the phenomenon of human survival, has grown a lot. There are many examples of mortality derivatives that have been considered in the literature, from their structural design to pricing, many of which are currently on the financial markets. As one of the most common examples, the insurance market has already stimulated mortality/longevity-linked securities for transferring longevity risk to the capital market [30,31,32]. In particular, longevity derivatives consist of securities designed to hedge operators exposed to longevity risks, typically annuity providers and pension funds [33,34]. The cash flows associated with longevity derivatives are embodied in payments varying as the number of survivors of a given population cohort increases, compared to the estimated number.

Wanting to briefly report here in list form the most representative ones, as in [35], we recall:

Longevity bonds, as above, whose coupons are linked to the number of survivors of a given population: if the mortality rate of this group increases, the coupons decrease;

Survivor bonds, generally long-term;

Mortality-linked securities, if payments are linked to a mortality index;

Survivor swaps, traded between financial players exposed to longevity risk and a third party, where payments linked to the trend of the number of survivors of a specific population are exchanged with payments calculated on a predetermined parameter. The longevity swap insures financial/insurance products on the current estimate of life expectancy: if life expectancy increases significantly, the contract covers unexpected costs;

q–forward, a zero-coupon swap that allows switching an amount linked to the realised mortality rate at a certain age for an amount linked to a fixed mortality rate;

S-forwards and K-forwards, which work as q-forwards, even if the former are related to survival rates and the latter to a time-varying parametric mortality index [33];

Mortality options, a wide category of derivatives whose payoffs depend on the trend of the mortality phenomenon. Other more sophisticated and advanced products have been added to the market during the last decade, e.g., the Longevity Experience Options, that are call options on forward survival rates.

The main purpose of these mortality derivatives is to manage and control the risks arising from the randomness of the phenomenon of survival and, therefore, also the risk of longevity, which is relevant in the management of pension funds and annuity portfolios.

The tool of securitisation fits very well into this context. As explained in [36], for an investor the use of securitisation becomes a way to diversify portfolio risks. Reference is made in particular to cat bonds whose risks are not correlated with the portfolio assets and the traditional bond market. This makes it possible to include in the portfolio instruments that pursue risk-reward objectives. In [35] the authors deepened the aspect of the pricing of the risk related to the randomness of mortality by proposing structures for the assessment and securitisation of mortality risk.

6. The Insurance Product Design: The Health Securities

We will consider a generic insurance contract in which the “insured” counterparty is a firm. The insurance cover is generically referred to events related to the health of the worker/employee in the workplace. We will think about a premium adjustment in the form of a bonus policy for the insured who carefully and responsibly complies with workplace safety regulations. We will take care of a generic contract related to the health insurance of employees and/or workers without going into the details of pricing procedures, which will be developed following the appropriate procedures adopted by the company, but rather will envisage a securitisation scheme that, by transferring part of the risk to a third party in the role of investor, gives rise to a sum to be given to the insured in the form of compensation or deduction from the year’s premium.

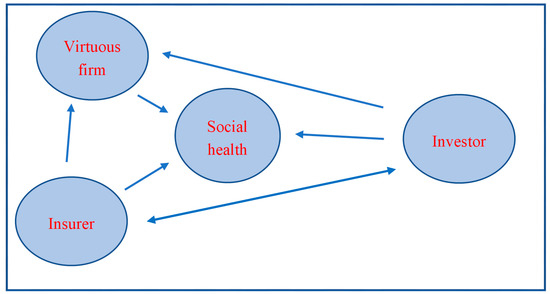

In this approach we identify the risk of infectious contagion, which can be managed by an insurance company by transferring it in part to other counterparts, so as to distribute part of the benefits to those who materially, through a capillary and careful management of safety at work, contribute to the improvement of the parameters related to social health. In Figure 1 we show in a schematic form the players involved in the operation and the dynamics of the flows between them.

Figure 1.

Players and relationships in a virtuous process of transfer and distribution of risks for social health protection.

Considering a portfolio of M contracts, the aim can be achieved through the securitisation activity, issuing securities that can be classified in the “new” category of health securities in the form of cat bonds completely unrelated to the risks of the business to which they refer. The insurer issues bonds, the foundation of which is an indicator closely linked to the health status of the population in relation to pandemic or simply infectious critical situations. The World Health Organization [37] deals in detail with indicators related to public health measurement, and the National Statistical Institutes produce several indices that can be used for this purpose.

The cat bonds are in the form of coupon-based health bonds with coupons at risk K and guaranteed principal; the bonds are negotiable in the market with payments connected to a specific parameter linked to the state of health of the population.

The confluence of coupon cash flow in the policy of reducing the premium required for insurance coverage is determined by defining a percentage to be paid to the virtuous company, both if the cash flow is positive for the insurer and if it is positive for the investor, both committed to the common goal of improving public health: the insurer, because he sees his reputation improve, and the investor, because he is actually the final recipient of all the actions so far of social health.

The underlying of the health security can be chosen from among the indicators measuring the impact of infectious diseases on the population. An example is the number of deaths due to infectious diseases related to a certain population. The reduction of this numerical indicator compared to what its expected value would have been based on historical data, is unequivocally a “good sign” of the general state of public health in relation to infectious and pandemic diseases.

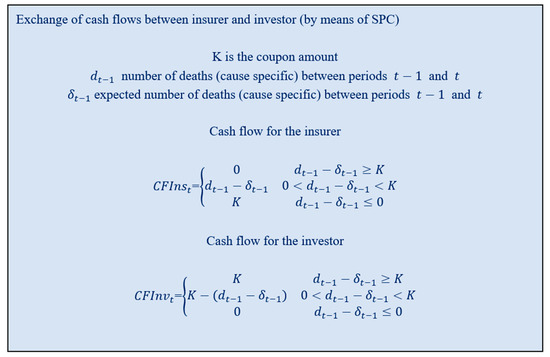

The securitisation activity will define the inflows for the investor and the insurer according to the states of nature that will occur, as shown in Figure 2. The strategy will determine the percentage of cash flow, %CFInst in Figure 2, that will directly benefit the insured, in the form of an amount deductible from the premium to be paid that is in terms of premium adjustment or other equivalent forms. In any case, the operation translates into a tangible recognition of the virtuous firm that will persevere in the careful protection of employees’ health, in an improvement of the reputation of the insured involved that will provide appropriate visibility, and, last but not least, in the improvement of the standard of living whose beneficiary is the investor sensitive to these issues. The purpose of Figure 2 is to show the cash flows arising from the securitisation carried out by the insurer. The transaction is based on the behaviour of an underlying asset, which must represent, in numerical and objective form, the health of a population with respect to a specific cause of infection (see Section 6). The number of deaths caused by infection may be chosen for this purpose. We have indicated with the number of deaths in the year (, ) and with the expected/forecasted number of deaths for the same cause in the same year. The difference can be interpreted as an indicator of how well the health protection system worked in that specific year.

Figure 2.

The cash flow exchange between insurer and investor by Special Purpose Company (SPC).

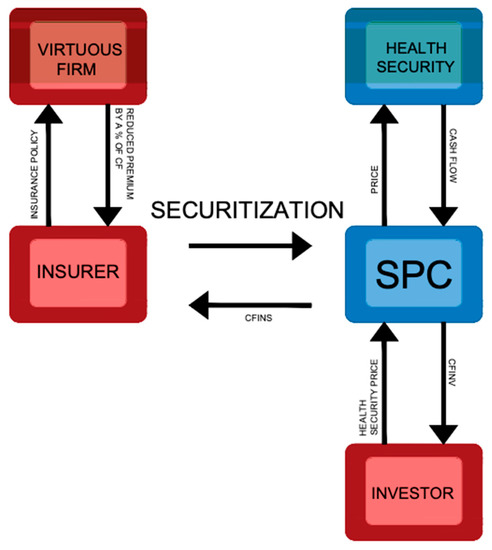

The cycle of investment involving firms, insurers, and investors is shown schematically in Figure 3: the whole cycle is underpinned by the securitisation strategy.

Figure 3.

The system of balance between the various counterparts of health securitisation.

The proposed model is based on the difference between actual deaths and expected deaths at the end of a given year, as this is the key information to implement the securitisation process. However, rebus sic stantibus, one could elaborate a scheme based on the ratio between and , rather than their difference:

According to this approach, the model could be calibrated on each reference unit, i.e., on each expected death.

This index will refer to the ratio of K to , which is a percentage substantially representing the quota of coupons for each expected death. The model can be reformulated bearing in mind that now the index can assume values between 0 and 1 or no less than 1.

Finally, this formalisation of the model can be particularly suitable for implementing the pricing process, especially when the amount of the available historical data will be enough to forecast the trend of the expected number of deaths over time.

7. The Underlying of the Health Security

In this section we intend to provide a practical indication on the choice of the underlying of the health security model we are proposing. In Section 5 and, in particular, in Figure 2, we introduce the cash flow of the insurer and of the investor, both based on the deviation between the real number of deaths (for a specific cause, likely pneumonia) in the year (, ) and the expected number of deaths (again due to pneumonia) in the same year. Both data can be easily obtained from the health statistics provided by the entities in charge.

In the following we will refer specifically to the Italian situation, which is a useful example to provide practical guidance on the determination of the cash flows of the derivative.

The seriousness of the health events linked to the COVID-19 pandemic in Italy has been decisively due to the fact that this was the first Western country to experience the extraordinary nature of this pandemic. This meant that Italy was probably the first country able to take a census not only at the national level but also in regional detail of the impact of COVID-19 on overall mortality. We can say that already today, close to the beginning and the peak of the pandemic experience, we have clarity in the statistical description of deaths due to COVID-19 in Italy and the impact of the virus on general mortality.

The documents currently available on the official website of the Istituto Nazionale di Statistica (Istat) [38] provide a very clear picture of what happened from 1 March to 15 May 2020 in the Italian regions and are continuously updated. Mortality data are catalogued according to the main causes of death (in order: circulatory system diseases, cancer, respiratory system diseases, dementia and Alzheimer’s disease, digestive system diseases, diabetes); in particular, among the main diseases of the respiratory system, data about pneumonia are particularly important in the context of this study. In fact, international bodies such as the World Health Organization (WHO) and Eurostat currently classify COVID-19 among the diseases of the respiratory system.

Istat provides data on deaths in Italy and also in regional detail, between 1 March to 15 May 2020, also allowing to compare what happened in this period, coinciding with the more intense severity of the virus spread, with what happened in the same time interval in previous years (for example, 2017).

For example, it is possible to observe [39] that Lombardy, the Italian region most affected by the pandemic, recorded in the period 1 March to 15 May that the number of deaths due to pneumonia was eight times higher than the deaths due to pneumonia in the same period of 2017. The phenomenon of deaths from COVID-19 was strongly differentiated among the Italian regions (for example, the impact was lower in the southern regions of the country) while there was substantial territorial and temporal stability for deaths from respiratory system diseases (and, in particular, from pneumonia) in 2017.

In the report produced by the Istituto Superiore di Sanità (ISS) and Istat in July 2020 [40] it was expressly stated that the data for cause of death provided by the tables are comparable and reproducible over time and among the different countries of the world, having resulted from a classification shared at the international level. We can therefore consider these data perfectly suitable to be used as the underlying data of the health derivative.

It is clear from the Istat notes that, in the analysis by region until 2019, deaths from respiratory system diseases always followed the distribution of deaths for all causes. The distribution of deaths for COVID-19, on the other hand, is quite different. It does not follow the regional mortality data for all causes and instead shows a very significant concentration in some regions, unlike others.

So let us get to some points fundamental to the description of the basis of the title, which we list here:

- (a)

- The available data are reproducible over time and comparable; they are therefore an objective and reliable source for studying the assessment of the deviation in mortality between deaths due to respiratory diseases, in particular pneumonia, and those due to a specific cause, in this case, COVID-19;

- (b)

- These are data that, using the same methodologies, will certainly be available in the future as the result of undesirable but possible other pandemics of the same or of other kinds as the COVID-19 one;

- (c)

- The analysis of these data will make it possible to highlight virtuous behaviours directly related to the territorial reality in which the phenomenon is studied, amplifying the effect of empowering the individual and the community towards the collective well-being.

As an example, we report some statistical evidence available from the Istat website [38], which we believe to be particularly significant, in order to illustrate how analytical and punctual the Istat activity is. In particular, we want to show that the statistical evidence, which is useful and necessary to identify threshold values for deaths by which to establish whether or not health protection behaviour has been virtuous, is available and immediately usable. The following Table 1 shows deaths due to respiratory system disease in general and pneumonia in particular, recorded from 1 March to 15 May 2017, differentiated by region. They are compared with deaths from COVID-19 in the same period of 2020.

Table 1.

Italian regional tables—mortality by cause. 1 March–15 May 2017, 1 March–15 May 2020. Source: Istat 2020 archive, Covid-19 integrated surveillance deaths.

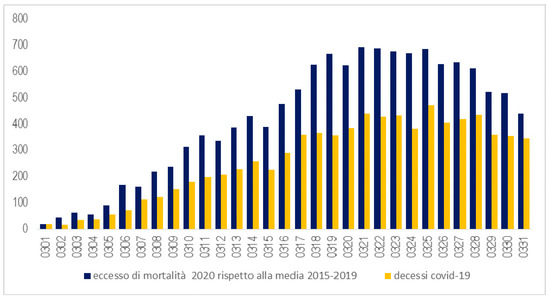

In Figure 4, again as an example, we report a representation of the impact of the COVID-19 epidemic on total mortality in the Italian provinces with high virus prevalence, relative to March. The analysis, conducted day by day, represents the total male mortality excess recorded in March 2020 compared with the average of the years 2015–2019 and with the COVID-19 deaths.

Figure 4.

Daily trend in March of the excess male mortality in 2020 compared to the average of 2015–2019 in blue and COVID-19 deaths in yellow. Absolute values of deaths. Provinces with high prevalence of COVID-19. Source: Istat 2020 archive, COVID-19 integrated surveillance deaths. Source: Istat Integrated municipal daily mortality database, ISS Integrated surveillance system COVID-19.

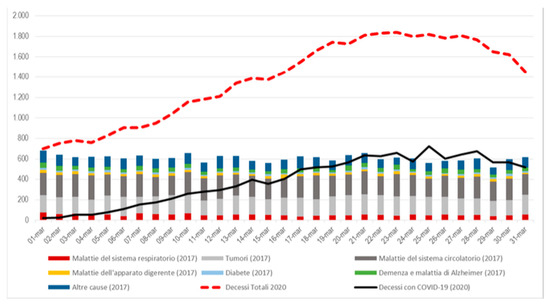

In Figure 5, again from the Istat archive, we report the comparison between daily deaths from the main causes of death in March 2017 and deaths from COVID-19 and all causes in March 2020, again with daily surveys and concerning the area with a high level of diffusion. Statistical surveys, of which Figure 5 provides an example, investigate the impact of pre-existing diseases on deaths from COVID. This would also make it possible to refine the predictive models of mortality for COVID conditional on the existence of other pathologies.

Figure 5.

Comparison between daily deaths from the main initial causes of death in March 2017 and deaths from COVID-19 (black line) and from all causes (dotted red line) in March 2020. COVID-19 High diffusion level area. Source: Istat Deaths and causes of death survey, Istat Integrated municipal daily mortality database, ISS surveillance register COVID-19.

The logic behind the behaviour of the two counterparts, insurer and investor, is that of betting on the performance of the indicator chosen as the underlying representative of the state of health of the considered community with respect to the pandemic. The insurer issues the security and receives the price, appropriately quantified, at the issue time. He bets on the positive trend of the index: in case of winning, he will receive the payoff that he is entitled to and allocate part of it to the reduction of the premium to be applied on the policy. This deduction should be seen in terms of improved reputation and competitiveness. The investor buys the title, thus participating in the project, and bets on the opposite event.

What follows is a simple example in order to give an applicative idea of the model we propose.

We will refer to the data in Table 1: this implies that we will consider what would have happened with a bond lasting two months and a half ( = 1 March, = 15 May 2020). Following the scheme proposed in Figure 2, we fix, always as an example, K = 100.

We will deal with three Italian geographical realities that stand out for different impacts of the pandemic: a “virtuous” region (Basilicata), in which the pandemic had no consequences; an “averagely virtuous” region (Campania), where the consequences to public health were serious and controllable; and finally a “non-virtuous” region (Lombardy), where the impact of the pandemic was devastating. Obviously the adjective “virtuous” is used here in the logic of bond issuance and is not a judgement on the management of the phenomenon, which, in the period we are considering, had mainly the characteristic of unpredictability.

In the case of Basilicata ), CFIns = 100, CFInv = 0. The proper performance of health prevention activities has worked well. By withholding the payoff equal to 30% of the same, the insurer will receive 70 and will allocate 30 to the discount that he will apply to the policy issued for a firm in this region.

In the case of Campania ), CFIns = 94, CFInv = 6. The insurer will collect 65.8 and allocate 28.2 to the premium applicable to a firm in this region.

Finally is the case of Lombardy ), for which CFIns = 0, CFInv = 100. The non-virtuous behaviour (in the sense clarified above) produces the absence of facilitations addressed to the firm in the issuing of the policy.

8. Conclusions

The recent financial crises, coupled with the ongoing global healthcare concerns, which represent a true breaking point for the global economic system and a threat to social stability itself, are calling into question, with increasing frequency, the relationship between market logic and public health.

This work endorses the design of a virtuous cycle of investments, which may be implemented starting with insurance companies; such a project would unfold through insurance policies’ contractual lines, securitisation schemes, investment policies, and socially responsible corporate strategies.

The securitisation model proposed here is consistent with sustainable finance frameworks, given that the underlying asset relates to public health and well-being. The approach informing the model also mirrors that employed by insurance companies operating in the Green Finance field and it is therefore consistent with key guidelines set by the UN’s Principles of Sustainable Insurance (PSI) [41], as it aims to integrate ESG investment cornerstones with insurance practices and to enhance consumers’ and investors’ awareness and engagement with regard to environmental and social themes.

The capital obtained via securitisation will allow insurers to expand the range of products linked to health-oriented activities; this will ultimately benefit the insurance business itself, often in trouble in times of crisis or low interest rates.

Firms, by virtue of the lower premiums to which they are entitled based on their responsible behaviour and performance, thus can benefit from cheaper access to insurance products.

Finally, institutional investors can invest, against risk transfer, in instruments that are not directly related to the financial market, thus obtaining clear benefits in terms of diversification.

Last, but not least, one can mention an overall reputational benefit for all parties involved.

The cumulative effect of such measures is for the various parties, such as insurance companies, businesses, and institutional investors, to create a joint strategy able to generate social and community value.

Future research endeavours may focus on insurance contracts’ analytic formalisation in terms of pricing, risk, and securitisation of procedures’ management, as well as the qualitative and quantitative investigation of the whole strategy’s broader socioeconomic implications.

Author Contributions

The whole paper is the result of a joint study of the two authors. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- EIOPA. EIOPA Statement on Actions to Mitigate the Impact of Coronavirus/COVID-19 on the EU Insurance Sector. Retrieved 3 May 2020. Available online: http://www.consob.it/documents/46180/46181/EIOPA+20-137.pdf/9881a57f-1f90-4dc5-a7dc-aa54d8b5ca1c (accessed on 25 June 2020).

- Mills, E. A Global Review of Insurance Industry Responses to Climate Change. Geneva Pap. Risk Insur. 2009, 34, 323–359. [Google Scholar] [CrossRef]

- Kissler, S.M.; Tedijanto, C.; Goldstein, E.; Grad, Y.H.; Lipsitch, M. Projecting the transmission dynamics of SARS-CoV-2 through the postpandemic period. Science 2020, 368, 860–868. [Google Scholar] [CrossRef] [PubMed]

- Generali Group Green Insurance-linked Securities Framework. Available online: https://www.generali.com/it/our-responsibilities/our-commitment-to-the-environment-and-climate/green-ILS-Framework (accessed on 3 May 2020).

- Aguinis, H.; Glavas, A. What we know and don’t know about corporate social responsibility: A review and research agenda. J. Manag. 2012, 38, 932–968. [Google Scholar] [CrossRef]

- Bannier, C.; Bofinger, Y.; Björn, R. Doing Safe by Doing Good: ESG Investing and Corporate Social Responsibility in the U.S. and Europe; Goethe University, Center for Financial Studies: Frankfurt, Germany, 2019. [Google Scholar]

- De Polis, S. Il ruolo del Settore Assicurativo a Sostegno della Transizione dalla Brown alla Green Economy. October 2019. Available online: https://www.ivass.it/media/interviste/documenti/interventi/2019/30-10-sdp-finanza-sostenibile/Sdp_finanza_sostenibile_30_10.pdf (accessed on 28 July 2020).

- EIOPA Susteinable Finance. Ensuring that Insurers and Pension Funds Operate in a Sustainable Manner. 2019. Available online: https://www.eiopa.europa.eu/browse/sustainable-finance_en (accessed on 28 July 2020).

- Kurtz, L. Three Pillars of Modern Responsible Investment. J. Invest. 2020, 29, 21–32. [Google Scholar] [CrossRef]

- Hoepner, A.G.F.; Schopohl, L. State Pension Funds and Corporate Social Responsibility: Do Beneficiaries’ Political Values Influence Funds’ Investment Decisions? J. Bus. Ethic. 2019, 165. [Google Scholar] [CrossRef]

- Andonov, A.; Hochberg, Y.V.; Rauh, J.D. Political representation and governance: Evidence from the investment decisions of pubLic pension funds. J. Finance 2018, 73, 2041–2086. [Google Scholar] [CrossRef]

- Himick, D.; Audousset-Coulier, S. Responsible Investing of Pension Assets: Links between Framing and Practices for Evaluation. J. Bus. Ethic. 2016, 136, 539–556. [Google Scholar] [CrossRef]

- Rodrigues, C.N. The Pan-European Pension Product and the Capital Markets Union: A Way to Enhance and Complete the Economic and Monetary Union? Da Costa Cabral, N., Rodrigues, C.N., Eds.; Springer Nature: Cham, Switzerland, 2019; Volume 48. [Google Scholar]

- Schelkle, W. EU Pension policy and financialisation: Purpose without power? J. Eur. Publ. Policy 2019, 26, 599–616. [Google Scholar] [CrossRef]

- Van Meerten, H.; Van Zanden, J.J. Pensions and the PEPP: The necessity of an EU approach. Eur. Co. Law 2018, 15, 66–72. [Google Scholar]

- Erikson, S. Global health futures? Reckoning with a pandemic bond. MAT 2019, 6. Available online: http://www.medanthrotheory.org/read/11401/global-health-futures (accessed on 28 July 2020). [CrossRef]

- Erikson, S.L.; Johnson, L. Will financial innovation transform pandemic response? Lancet Infect. Dis. 2020, 20, 529–530. [Google Scholar] [CrossRef]

- Gründl, H.; Regele, F. Pandemic Insurance through Pandemic Partnership Bonds: A Fully Funded Insurance Solution in a Public Private Partnership; Leibniz Institute for Financial Research SAFE: Frankfurt, Germany, 2020. [Google Scholar]

- Frydman, R.; Phelps, E.S. Insuring the Survival of Post-Pandemic Economies; The Center on Capitalism and Society, Columbia University: New York, NY, USA, 2020. [Google Scholar]

- Macdonald, D. COVID-19 and the Canadian Workforce: Reforming EI to Protect More Workers; Canadian Centre for Policy Alternatives: Ottawa, ON, Canada, 2020. [Google Scholar]

- Palacios, R.J.; Robalino Aguirre, D.A. Integrating Social Insurance and Social Assistance Programs for the Future World of Labour; IZA—Institute of Labor Economics: Bonn, Germany, 2020. [Google Scholar]

- Risi, D. Time and Business Sustainability: Socially Responsible Investing in Swiss Banks and Insurance Companies. Bus. Soc. 2019, 1–31. [Google Scholar] [CrossRef]

- Revelli, C. Socially Responsible Investing (SRI): From mainstream to margin? Res. Int. Bus. Finance 2017, 39, 711–717. [Google Scholar] [CrossRef]

- World Economic Forum the Global Risks Report 2020. Available online: https://www.weforum.org/reports/the-global-risks-report-2020 (accessed on 3 May 2020).

- Marsh, Building Resilience for Sustainable Growth: An Integrated Approach to Crisis Management. Available online: https://www.marsh.com/ae/en/services/marsh-risk-consulting/building-resilience-for-sustainable-growth.html (accessed on 3 May 2020).

- Moe, T.L.; Pathranaraku, P. An integrated approach to natural disaster management: Public project management and its critical success factors. Disaster Prev. Manag. 2006, 15, 396–413. [Google Scholar] [CrossRef]

- World Economic Forum. This is the Impact of the Coronavirus on Business. Available online: https://www.weforum.org/agenda/2020/02/why-is-coronavirus-a-global-business-risk (accessed on 3 May 2020).

- Thistlethwaite, J. The Climate Wise Principles: Self-Regulating Climate Change Risks in the Insurance Sector. Bus. Soc. 2012, 51, 121–147. [Google Scholar] [CrossRef]

- Politecnico di Torino. Rapporto-Emergenza Covid-19: Imprese Aperte, Lavoratori Protetti, Politecnico di Torino. 17 April 2020. Available online: https://www.diario-prevenzione.it/doc20bis/POLITECNICO%20TORINO%20PROGETTO%20FINALE%20PDF%20v2%2020042020.pdf (accessed on 3 May 2020).

- Blake, D.; Cairns, A.J.; Dowd, K.; MacMinn, R. Longevity Bonds: Financial Engineering, Valuation, and Hedging. J. Risk Insur. 2006, 73, 647–672. [Google Scholar] [CrossRef]

- Blake, D.; Cairns, A.J.; Dowd, K. Living with mortality: Longevity bonds and other mortality-linked securities. Br. Actuar. J. 2006, 12, 153–228. [Google Scholar] [CrossRef]

- D’Amato, V.; Di Lorenzo, E.; Haberman, S.; Sagoo, P.; Sibillo, M. De-risking strategy: Modeling longevity spread buy-in. Insur. Math. Econ. 2018, 79, 124–136. [Google Scholar] [CrossRef]

- Li, J.S.-H.; Zhou, K. Q-Forward. The Actuary Magazine Retrieved 2 May 2020. Available online: https://theactuarymagazine.org/tag/q-forward/ (accessed on 2 May 2020).

- Tan, C.I.; Li, J.; Li, S.-H.; Balasooriya, U. Parametric Mortality Indexes: From Index Construction to Hedging Strategies. Insur. Math. Econ. 2014, 59, 285–299. [Google Scholar] [CrossRef]

- Cairns, A.; Blake, D.; Dowd, K. Pricing Death: Frameworks for the Valuation and Securitization of Mortality Risk. ASTIN Bull. 2006, 36, 79–120. [Google Scholar] [CrossRef]

- Lin, Y.; Cox, S.H. Securitization of Mortality Risks in Life Annuities. J. Risk Insur. 2005, 72, 227–252. [Google Scholar] [CrossRef]

- World Health Organization. World Health Statistics 2019: Monitoring Health for the SDGs, Sustainable Development Goals. Available online: https://www.who.int/gho/publications/world_health_statistics/en/ (accessed on 3 May 2020).

- ISTAT Decessi e Cause di Morte: Cosa Produce l’Istat. 2020. Available online: https://www.istat.it/it/archivio/240401 (accessed on 31 July 2020).

- ISTAT Dettagli Sulla Derivazione dei Dati. 2020. Available online: Nota_mortalità-per-causa_regionale-1marzo_15Maggio-_2017_2_2020.pdf (accessed on 31 July 2020).

- Available online: https://www.istat.it/it/files/2020/07/Report_ISS_Istat_Inglese.pdf (accessed on 31 July 2020).

- The Principles UNEP FI Principles. Available online: https://www.unepfi.org (accessed on 30 August 2020).

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).