Econometric Model for Readjusting Significance Threshold Levels through Quick Audit Tests Used on Sustainable Companies

Abstract

1. Introduction

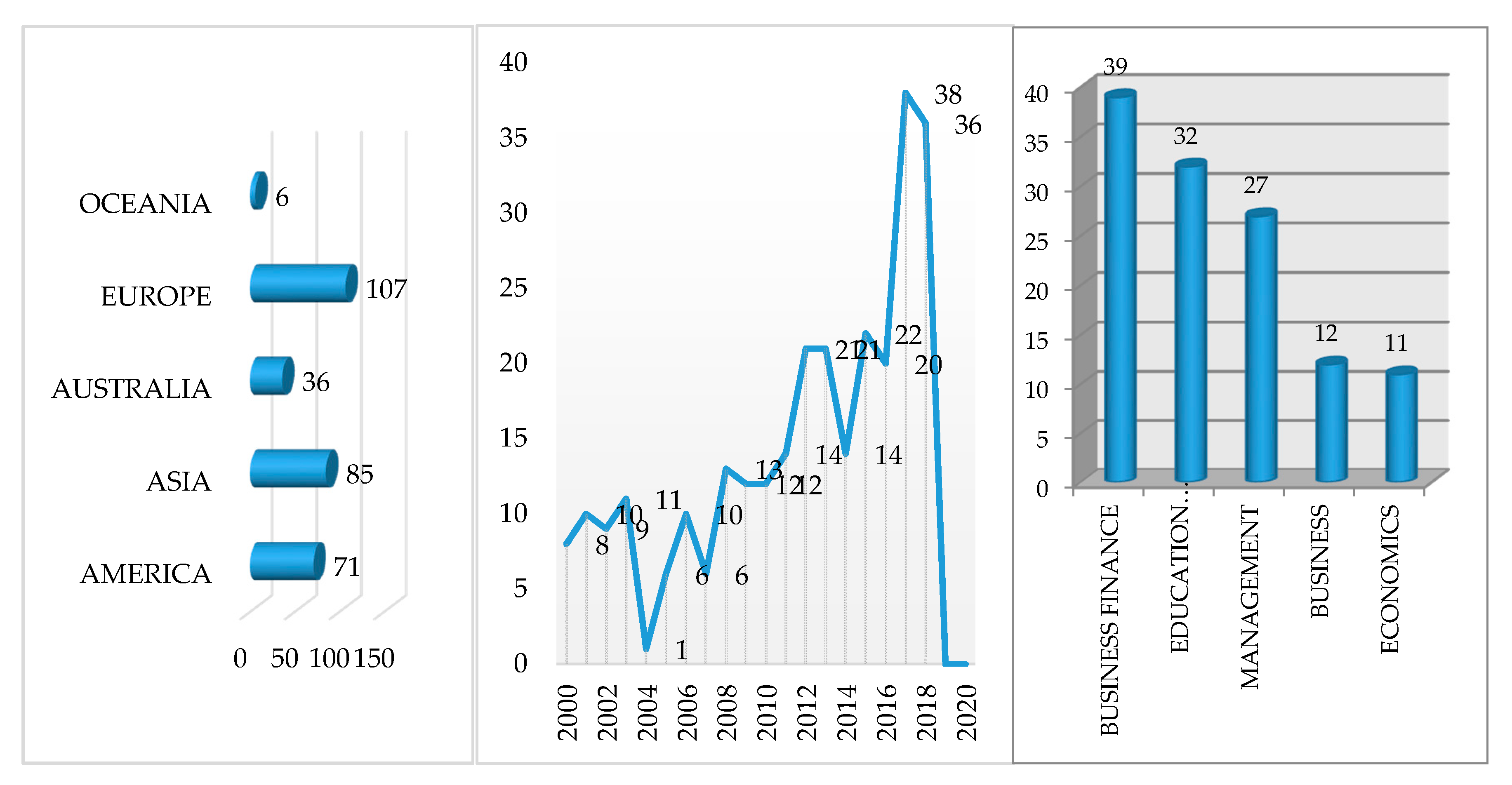

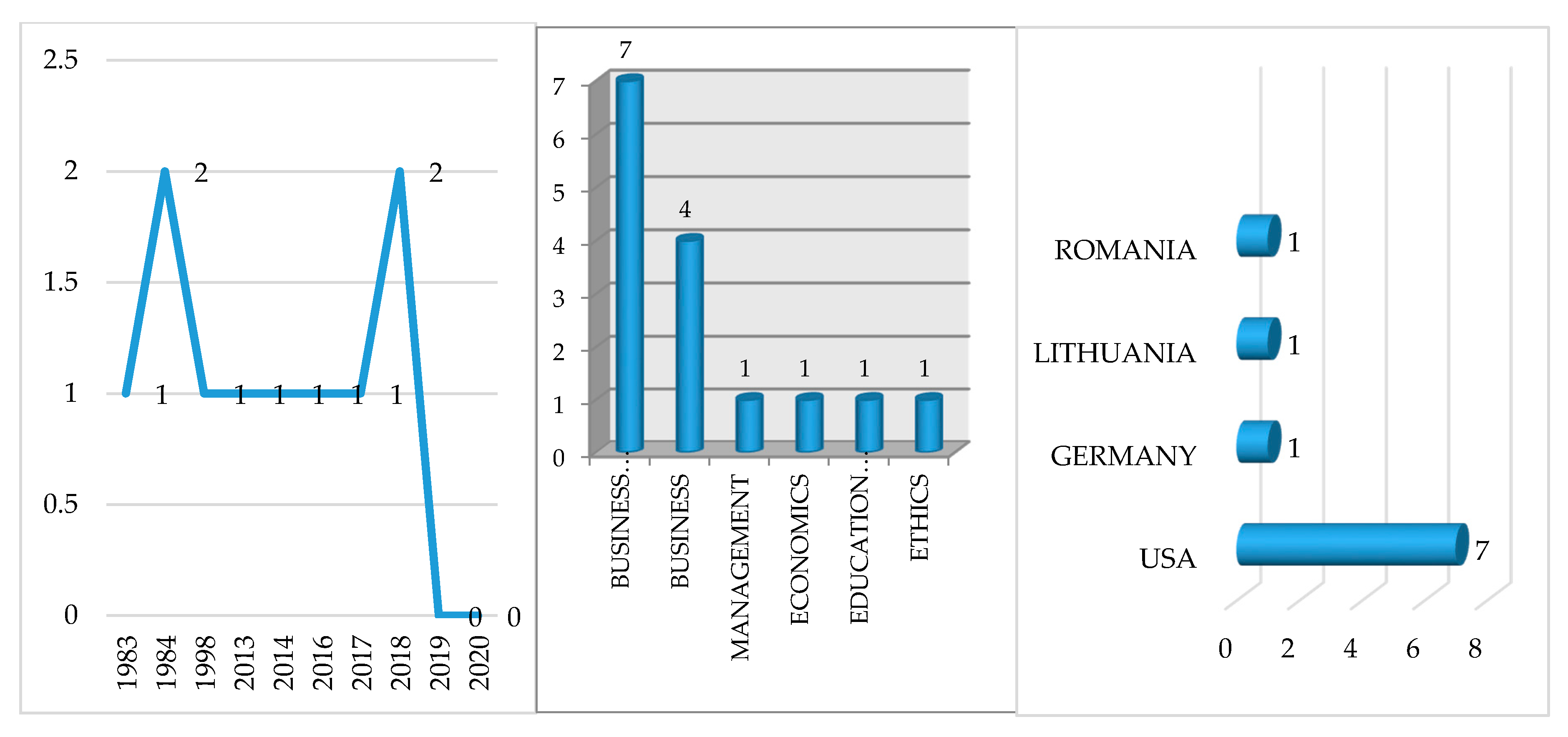

2. Theoretical Background

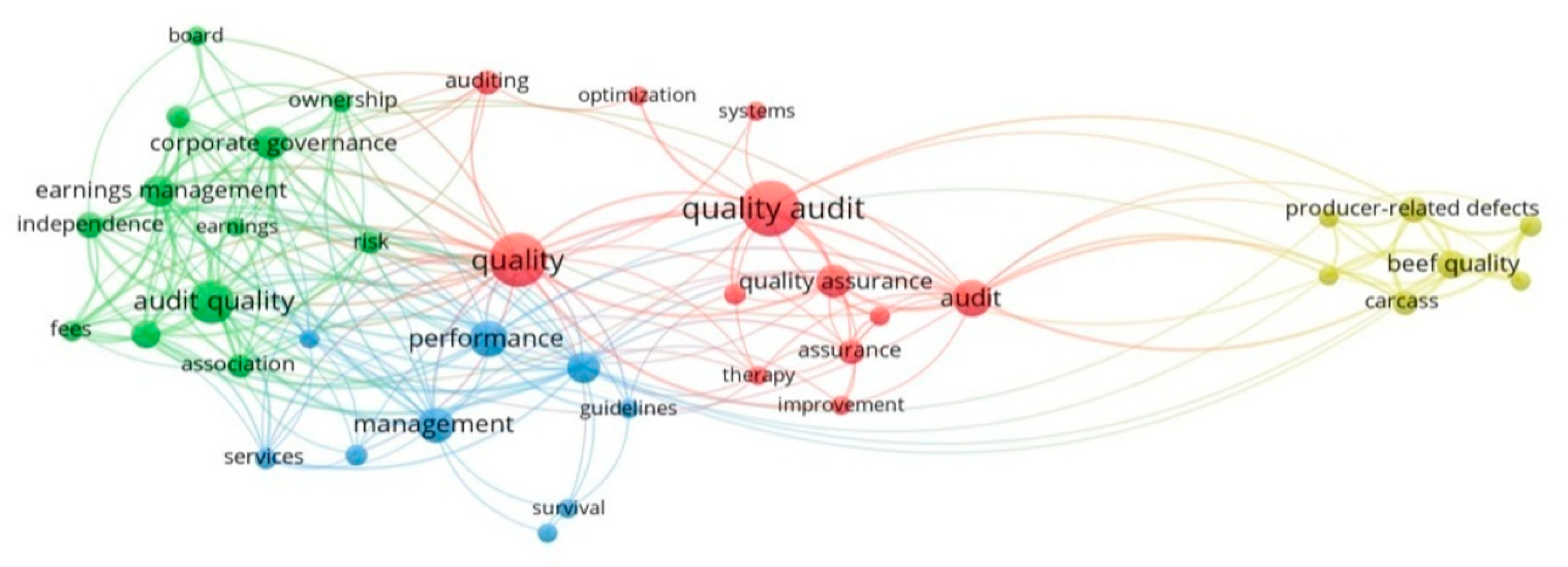

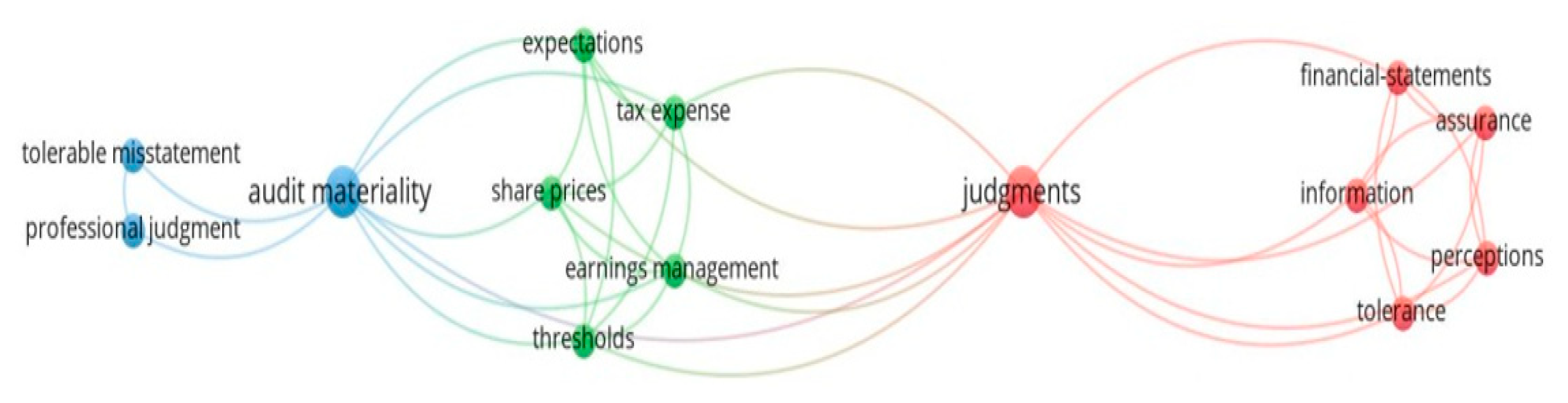

2.1. A Brief Overview of the Scientific Field

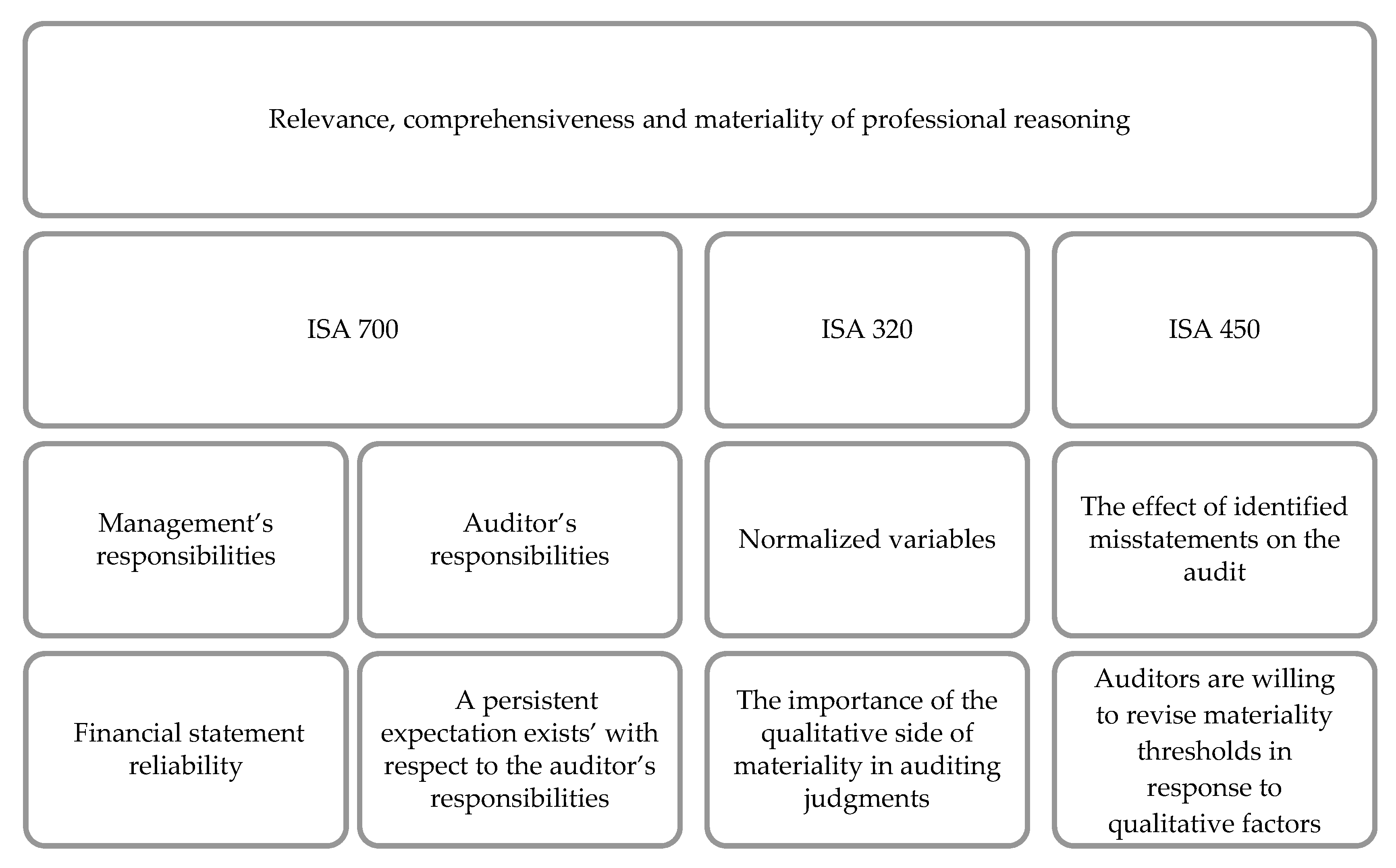

2.2. Audit Risk, Materiality and the Professional Judgment of the Auditor

3. Methodology

- O1. To demonstrate the causality relationships between the existence of continuous errors in financial reporting and the inconsistency of audit opinions;

- O2. To demonstrate the economic sustainability of companies that improve their performances based on audit;

- O3. To demonstrate the economic resilience during a period of crisis of companies whose economic sustainability is improved based on audit techniques.

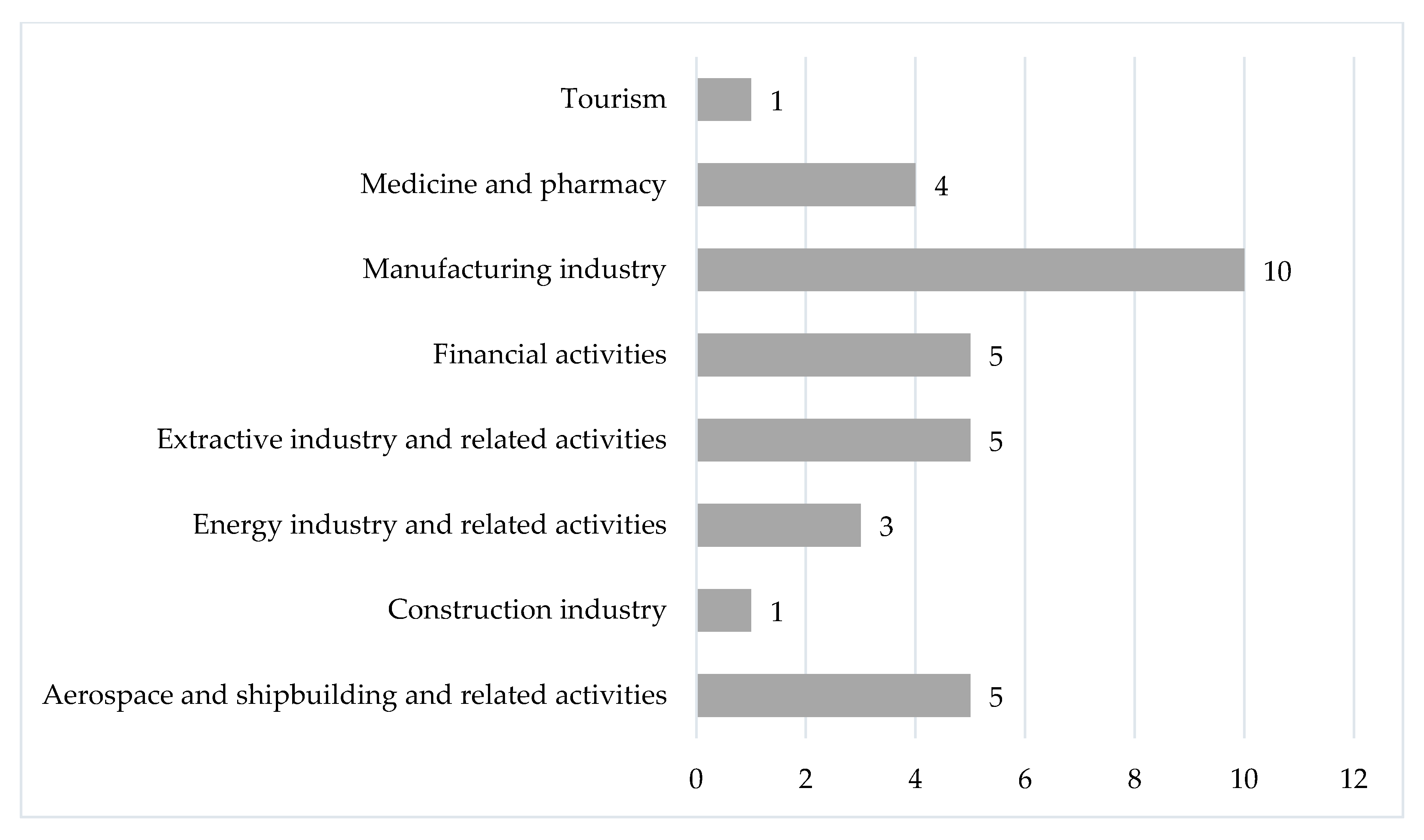

3.1. Sample

3.2. Measures

3.2.1. The Predicted Credit Worthiness Based on Maximizing the Gross Profit Rate in the Altman Model

- CW—credit worthiness;

- GP—gross profit;

- T—turnover.

- —the average credit worthiness;

- i—the number of analyzed companies, i ;

- t—the number of financial periods corresponding to the financial years from 2010 to 2018.

- —the average of the valid credit worthiness ratio;

- —the average of the invalid credit worthiness ratio.

3.2.2. The Representativity of the Operational Income Out of the Total Income

- L—the level of representativity of the operational income out of the total income;

- OI—operational income;

- TI—total income.

- —the average of the efficiency ratio;

- i—the number of analyzed companies, i ;

- t—the number of financial periods corresponding to the financial years from 2010 to 2018.

- —the average of the valid efficiency ratio;

- —the average of the invalid efficiency ratio.

3.2.3. The correlation of the Trend Curves of the Degree of Indebtedness and of the Amount of Total Expenditure in a Calendar Year

- Indeb—the expression in dynamics of the degree of indebtedness in connection with the sustainable use of resources that were reported based on the total expenditure indicator;

- TD* = = dynamics of debt accumulation;

- TE* = = the surplus of the sustainable usage of resources, which is shown by the dynamics of the total expenditure indicator.

- —the average of the indebtedness ratio in relationship with the sustainable use of resources;

- t—the number of financial periods corresponding to the financial years from 2010 to 2018.

- —the average efficiency valid ratio;

- —the average efficiency invalid ratio.

3.2.4. The Asset Liquidity Test

- L—the assets’ level of liquidity;

- CA—the value of the current assets;

- FA—the value of the fixed assets.

- —the average of the optimal liquidity ratio;

- i—the number of analyzed companies, i ;

- t—the number of financial periods corresponding to the financial years from 2010 to 2018.

- —the average valid liquidity ratio;

- —the average invalid liquidity ratio.

3.2.5. Limiting Mistakes and Fraud by Using Judicious Means of Establishing Provisions

- F—the limitation of mistakes and fraud based on the use of judicious means of establishing provisions;

- Pv—the level of the existing provisions at the end of the financial year;

- EQ—the value of the equities at the end of the financial year.

- —the average security ratio;

- i—the number of analyzed companies, i ;

- t—the number of financial periods corresponding to the financial years between 2010 and 2018.

- —the average valid security ratio;

- —the average invalid security ratio.

3.2.6. Human Resources Efficiency

- HRE—the expression in dynamics of the efficiency in using human resources, based on a uniform representation of the turnover in connection with the number of employees;

- = = the efficiency in using human resources at a certain moment in time;

- = = the efficiency in using human resources at a certain moment in time.

- —the average of the efficiency of human resources;

- i—the number of analyzed companies, i ;

- t—the number of financial periods corresponding to the financial years between 2010 and 2018.

- —the valid average of the efficiency in using human resources;

- —the invalid average of the efficiency in using human resources.

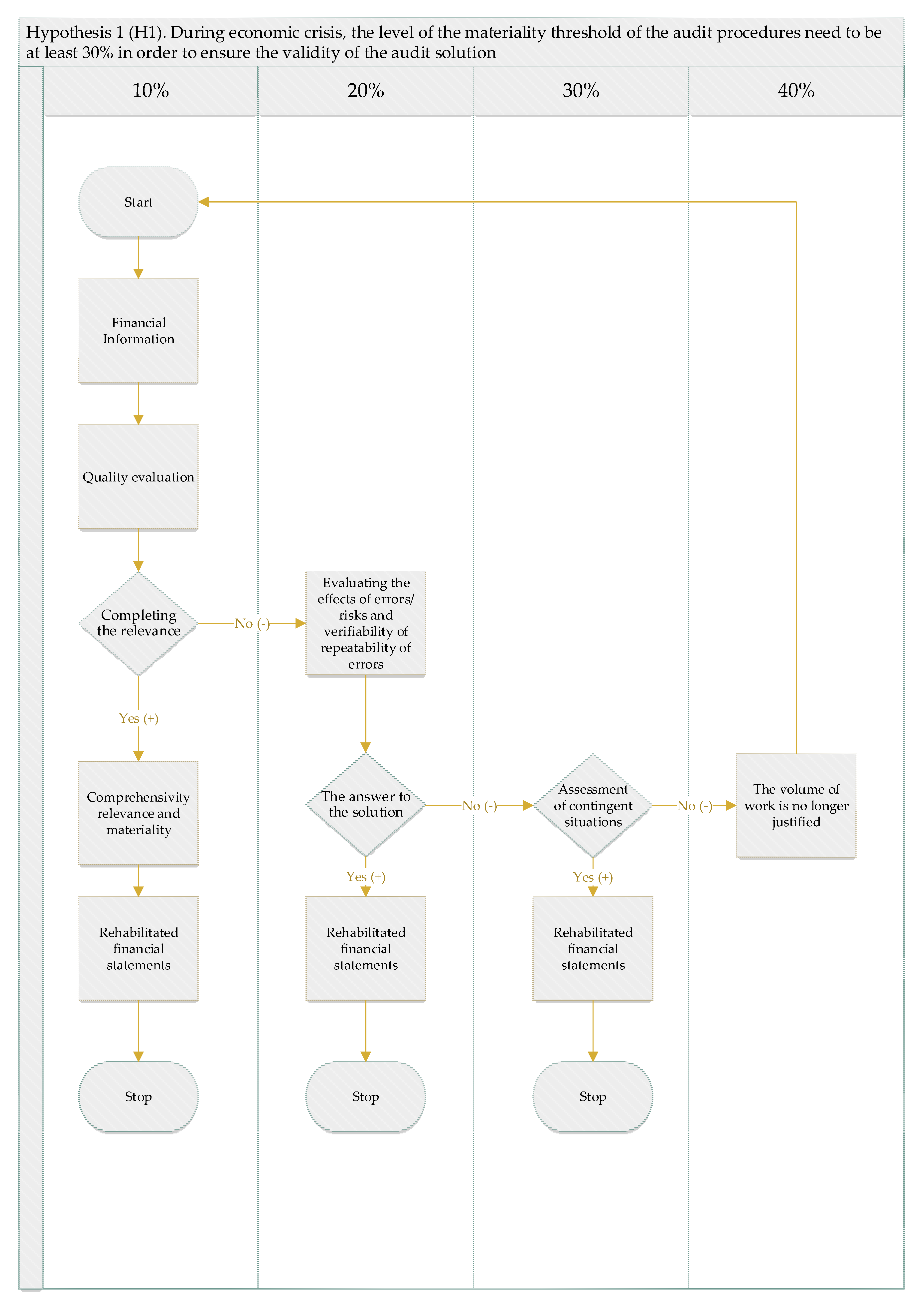

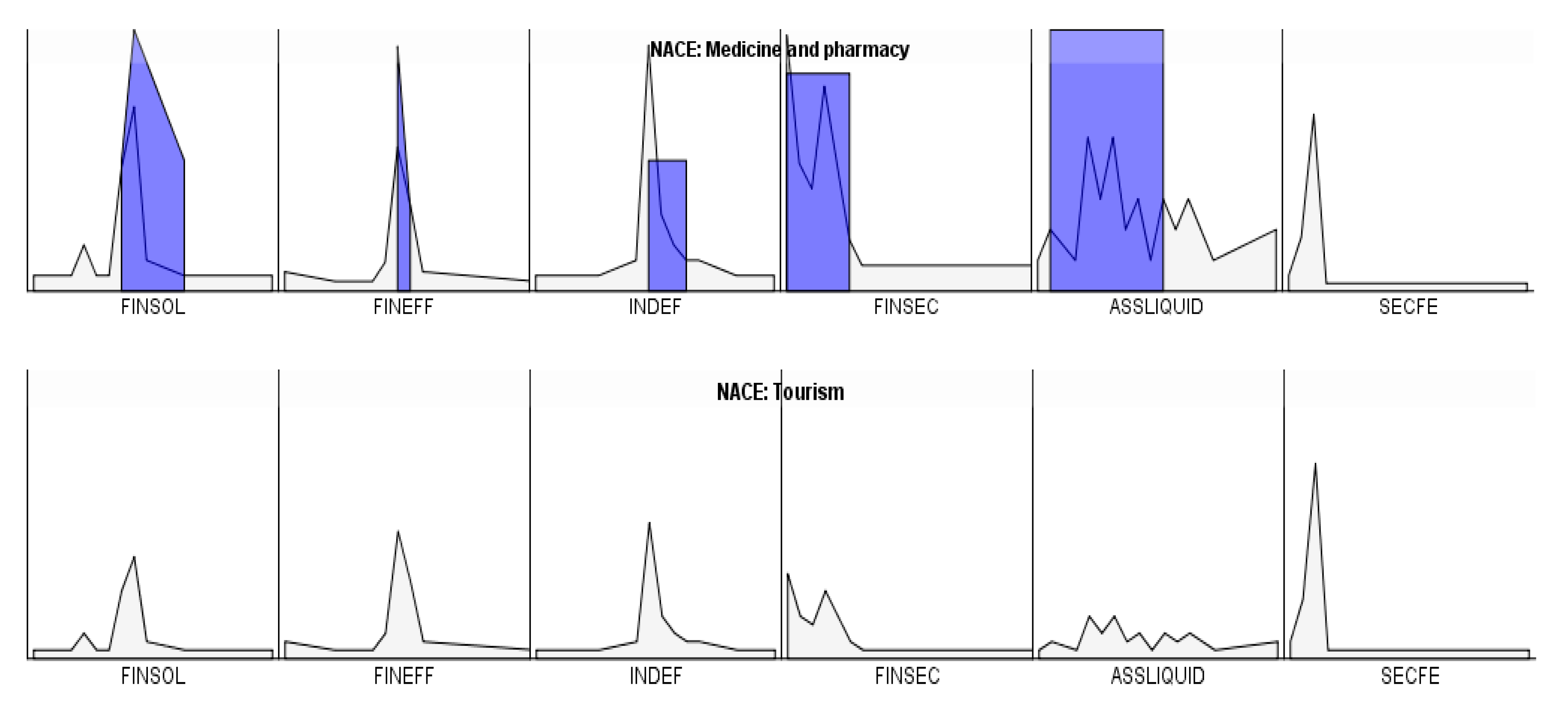

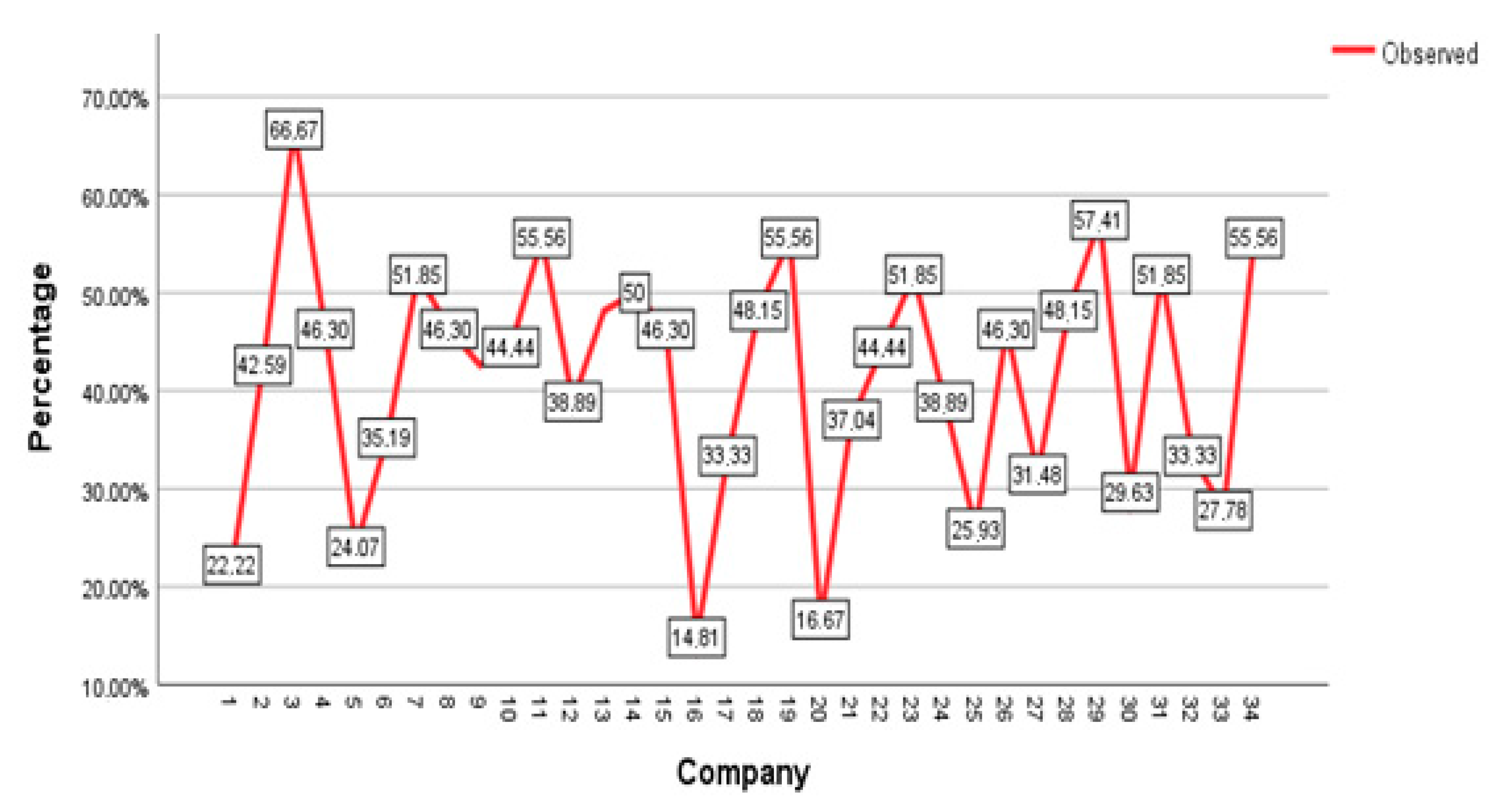

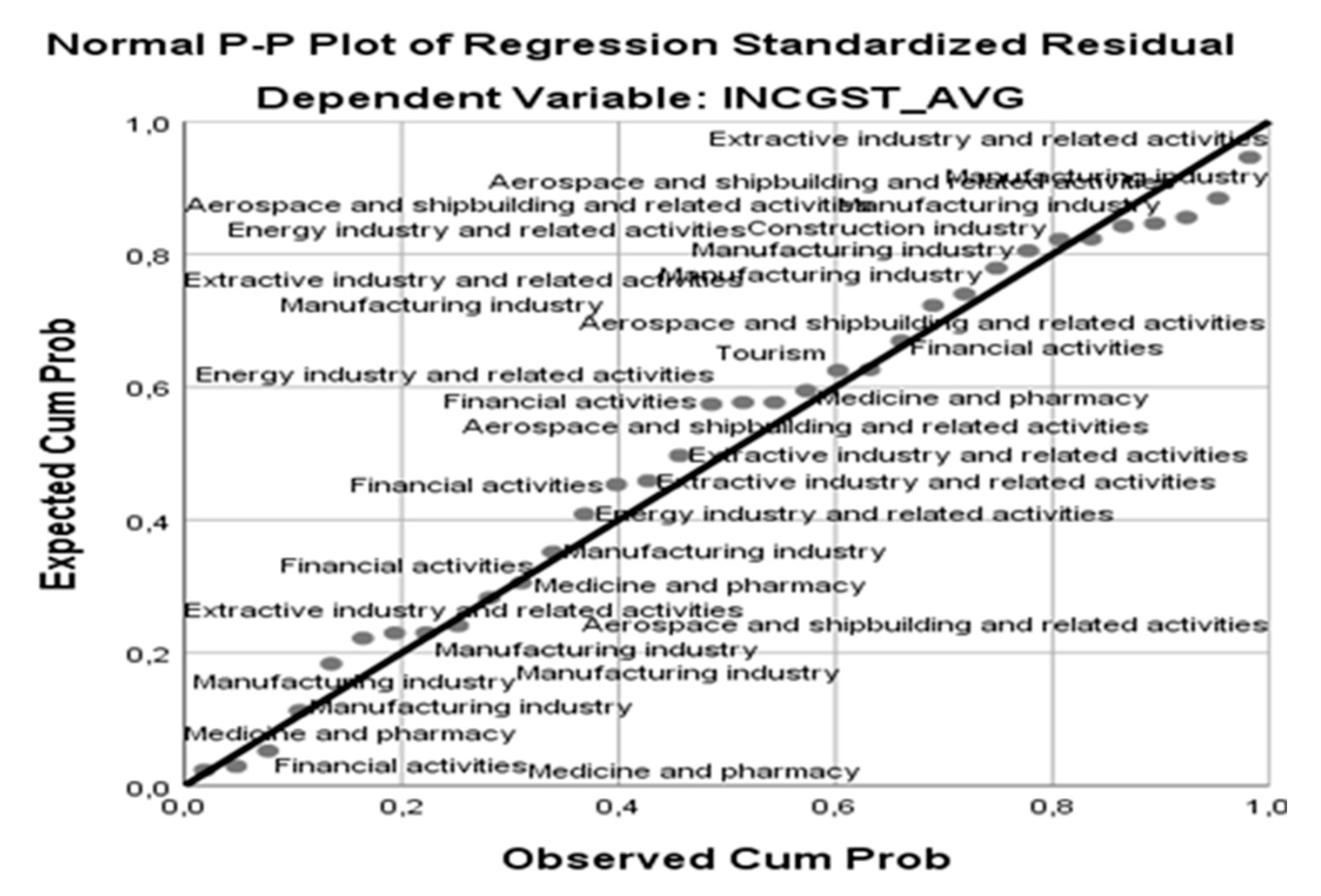

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Authors, Year | Main Concepts | Results | Relevance and Impact on the Research Field |

|---|---|---|---|

| Azzali et al., 2018 [40] | Materiality, internal control and quality audit | The study shows that the most important driver of global quality of audit is the capability to detect significant accounts, and the qualitative risk factors are very important for the significance as such. Moreover, the results show that companies use a range of items, such as the quantitative income statement factors and the balance sheet factors, in order to connect the subsidiaries, accounts and processes coherently with the materiality principle. Finally, it is found that three factors (i.e., identifying subsidiaries, identifying significant accounts and associating accounts with processes) often have a direct relation with Scoping, Planning and Risk Assessment Quality. | High impact of useful findings about the relevance of qualitative and quantitative factors in the assessment of significance. In spite of the fact that it has a regional impact (Italy), it can be adapted to other countries. |

| Commerford et al., 2018 [44] | Qualitative materiality, adjustment decisions and real earnings management | Results show that when auditors observe real earnings management, they perceive these operating decisions as aggressive. They make them perceive management as aggressive, as it ultimately leads to larger suggested adjustments on an unrelated audit difference. | Average impact of contributions made to the literature, showing that there is a connection between real earnings management and auditors’ response to management. |

| Vieira et al., 2018 [47] | Materiality and audit risk | The finding boils down to the developed Significance Control Index (ISC) that can be used in auditing and easily understood by both auditors and stakeholders. It offers, on the one hand, transparency, security and flexibility in the implementation process and, on the other hand, a greater accuracy in sorting objects, which are evaluated by public or private companies. | High impact given by the methodology used in the development of the ISC. |

| Choudhary et al., 2017 [38] | Auditor quantitative materiality judgments | The results show that looser materiality is associated with fewer audit hours and lower audit fees, thus supporting the construct validity of this measure. At the same time, looser significance judgments are associated with lower amounts of detected errors and a greater incidence of restatements, thus highlighting the importance of these decisions for financial reporting reliability. | High impact given by the results of this study, which links significance judgments with the financial reporting quality. This fact suggests the existence of a significant economic relationship between loose significance thresholds and the incidence of restatements. |

| Ramalho and Pais, 2015 [46] | Materiality and audit risks | As far as quantitative significance is concerned, it was found that there were partial decreases in the level of the significance index in both the planning and the execution, in spite of the fact that the same benchmarks continue to be mostly used with the total assets by auditors. In terms of qualitative significance, there is evidence that there have been changes since the 2008 financial crisis in terms of an increase in the number of factors and the use of qualitative and quantitative factors in determining the significance of the audit. | The high impact of this study lies in the analysis of the effects of the 2008 financial crisis. We are trying to analyze the effects of the current crisis caused by the COVID-19 pandemic. |

| Popa et al., 2013 [51] | Materiality and qualitative factors | The results indicate that there is a significant correlation between the level of significance and the business sectors that the audited companies are part of, the auditor’s experience in the field and the longevity of the relationship with the client. At the same time, the study emphasizes that there is no correlation between the level of significance and the stakeholders’ needs in the financial statements nor the management objectives. | High impact due to the fact that the study is based on a sample from Romania, determining the significance level in the audit by taking into consideration qualitative factors. |

| Budescu et al., 2012 [45] | Materiality thresholds and audit risks | The findings show that the reduction of significance may increase or jeopardize the effectiveness of the audit. The auditor’s work can be achieved through the quality of internal control and as well as by supplementing more traditional audit tests that produce evidence less likely to be biased toward management. | High impact due to the final results that highlight ways of streamlining the auditor’s activity. |

| Chen et al., 2010 [49] | Quality audit and client importance | Firstly, the results suggest that institutional auditors’ improvements lead to prioritizing of the costs by compromising quality over the economic benefits from important clients. Secondly, the impact of client importance in terms of audit decisions seems to be different for the individual auditor and for the office level. | Average impact based on the effects of the client’s importance on the auditor’s opinion. This may be a factor influencing the significance threshold in the audit. |

| Li, 2009 [48] | Auditor’s independence and client’s importance | Results show no significant statistical association between the audit fees, the non-audit fees, or the total fees and the going-concern opinions in 2001. Instead, in 2003 results show a positive association between the audit (and total) fees and the going-concern opinions. The non-audit fees continue to be separated from the going-concern opinions. | Average impact based on the relationship between the auditor’s independence and the client’s importance, which can influence significance in audit. |

| Ng and Tan, 2007 [11] | Qualitative materiality thresholds and audit adjustment decisions | The findings indicate that the improvement of the salience of a qualitative significance factor increases the auditors’ propensity to book the audit difference, but only for auditors with lower qualitative significance thresholds. At the same time, the findings suggest that the lack of attention given to the qualitative factor may, in part, explain why auditors waive such audit differences. | High impact given by the results of the study in terms of the ambiguities surrounding the materiality thresholds, which refer to the qualitative significance factors. |

References

- Tiron, T.A.; Cordos, G.S.; Fülöp, M.T. Stakeholders’ Perception about Strengthening the Audit Report. Afr. J. Account. Audit. Financ. 2018, 6, 43–69. [Google Scholar]

- Ionescu, B.; Ștefan; Feleagă, L.; Bătae, O.M. Stakeholder Prioritization in European Companies. In Proceedings of the 6th BASIQ International Conference on New Trends in Sustainable Business and Consumption, Messina, Italy, 4–6 June 2020; Pamfilie, R., Dinu, V., Tăchiciu, L., Pleșea, D., Vasiliu, C., Eds.; ASE: Bucharest, Romania, 2020; pp. 403–410. [Google Scholar]

- Bostan, I. Pro Sustainable Development: The Influence of the Law of Entropy on Economic Systems. Environ. Eng. Manag. J. 2016, 15, 2429–2432. [Google Scholar] [CrossRef]

- Siminică, M.; Cîrciumaru, D.; Cârstina, S.; Sichigea, M. The Impact of Economic and Financial Performance on Stock Exchange Performance of Manufacturing Companies Listed on the BVB. Economica 2017, 100, 108–115. [Google Scholar]

- Antohi, V.-M.; Zlati, M.L.; Ionescu, R.V.; Neculita, M.; Rusu, R.; Constantin, A. Attracting European Funds in the Romanian Economy and Leverage Points for Securing Their Sustainable Management: A Critical Auditing Analysis. Sustainability 2020, 12, 5458. [Google Scholar] [CrossRef]

- Cibotariu, I.-Ş. Conceptualization of Public Policy on Employment Stimulation in Romania. Eur. J. Law Public Adm. 2016, 3, 21–27. [Google Scholar] [CrossRef]

- Carp, M.; Georgescu, I.E. The Influence of Audit Opinion on the Degree of Real Earnings Management. The Case of Romanian Listed Companies. Audit Financ. 2019, 17, 666–679. [Google Scholar] [CrossRef]

- Bunget, O.; Blidişel, R.; Dumitrescu, A. The Financial Auditor’s Reaction to the Challenges of the Economic and Financial Crisis. Audit Financ. 2014, 12, 3–11. [Google Scholar]

- Bostan, I.; Grosu, V. The Social Effects of the Current Economic Crisis on the European Union Labour Market. Rev. Cercet. și Interv. Socială 2010, 31, 7–21. [Google Scholar]

- Morosan-Dănila, L.; Bordeianu, O.M. The Need for Change and Shaping the Post-COVID Business Environment in Romania. In Proceedings of the 16th Economic International Conference New Challenges and Opportunities for the Economy 4.0, Suceava, Romania, 7–8 May 2020; LUMEN Proceedings: Suceava, Romania, 2020; pp. 387–397. [Google Scholar]

- Ng, T.B.-P.; Tan, H.-T. Effects of Qualitative Factor Salience, Expressed Client Concern, and Qualitative Materiality Thresholds on Auditors’ Audit Adjustment Decisions; SSRN Scholarly Paper ID 980451; Social Science Research Network: Rochester, NY, USA, 2007. [Google Scholar]

- de Rooij, D. Materiality of Misstatements from the Perspective of the Users of the Financial Statements-Narrowing the Expectation Gap between Users and Auditors. 2009. Available online: https://repub.eur.nl/pub/15576/ (accessed on 24 September 2020).

- Shahzad, K.; Pouw, T.; Rubbaniy, G.; El-Temtamy, O. Audit Quality during the Global Financial Crisis: The Investors’ Perspective. Res. Int. Bus. Financ. 2018, 45, 94–105. [Google Scholar] [CrossRef]

- Goh, B.W.; Lee, K.B.J.; Li, N.; Li, D. Are Disclosed Auditor Materiality Thresholds Informative of Firms’ Earnings Quality?—Evidence from the Revised ISA 700 Audit Report. proceedings of the 41st Annual Congress of the European Accounting Association, Milan, Italy, 30 May–1 June 2018; Research Collection School of Accountancy: Milan, Italy, 2018. Available online: https://ink.library.smu.edu.sg/soa_research/1767 (accessed on 24 September 2020).

- Lakis, V.; Masiulevičius, A. Acceptable Audit Materiality for Users of Financial Statements. J. Manag. 2017, 2, 117–125. [Google Scholar]

- Baldacchino, P.J.; Tabone, N.; Demanuele, R. Materiality Disclosures in Statutory Auditing: A Maltese Perspective. J. Account. Financ. Audit. Stud. 2017, 3, 116–157. [Google Scholar]

- Cucui, I.; Munteanu, V.; Niculescu, M.; Zuca, M. Audit Risk, Materiality and the Professional Judgement of Auditor. Recent Adv. Bus. Adm. 2010, 78–83. Available online: https://www.researchgate.net/publication/228470274_Audit_risk_materiality_and_the_professional_judgment_of_the_auditor (accessed on 30 August 2019).

- IFAC, International Standard on Auditing (ISA) 320, “Materiality in Planning and Performing an Audit”. Available online: https://www.ifac.org/system/files/downloads/a018-2010-iaasb-handbook-isa-320.pdf (accessed on 30 August 2019).

- International Accounting, Auditing and Ethics Audit and Assurance Faculty (ICAEW), Materiality in the Audit of Financial Statements. 2017. Available online: https://www.icaew.com/-/media/corporate/files/technical/iaa/materiality-in-the-audit-of-financial-statements.ashx (accessed on 24 September 2020).

- Messier, W.F., Jr.; Martinov-Bennie, N.; Eilifsen, A. A Review and Integration of Empirical Research on Materiality: Two Decades Later. Audit. J. Pract. Theory 2005, 24, 153–187. [Google Scholar] [CrossRef]

- Houghton, K.A.; Jubb, C.; Kend, M. Materiality in the Context of Audit: The Real Expectations Gap. Manag. Audit. J. 2011, 26, 482–500. [Google Scholar] [CrossRef]

- Domil, A.E.; Bogdan, O.; Caraiman, A. The Impact of the Accounting Policies on the Performance of the Accounting Information System. Quaestus 2019, 15, 27–34. [Google Scholar]

- Bogdan, O.; Burcă, V. Study on the Influence of CEO Duality on the Performance of Listed Entities. In Proceedings of the Emerging Trends in Marketing and Management International Conference, Bucharest, Romania, 25–27 June 2020; Buchar. Univ. Econ. Stud. Publ. House: Bucharest, Romania, 2020; p. 139. [Google Scholar]

- Burciu, A.; Kicsi, R.; Condratov, I. Environmental Issues on the Trade-Related Agenda. Evidences from Romania. In Proceedings of the 14th Economic International Conference: Strategies and Development Policies of Territories: International, Country, Region, City, Location Challenges, Suceava, Romania, 10–11 May 2018; LUMEN Proceedings: Suceava, Romania, 2018; pp. 156–165. [Google Scholar]

- Cosmulese, C.G.; Socoliuc, M.; Ciubotariu, M.S.; Mihaila, S.; Grosu, V. An Empirical Analysis of Stakeholders’ Expectations and Integrated Reporting Quality. Econ. Res. Ekon. Istraživanja 2019, 32, 3963–3986. [Google Scholar] [CrossRef]

- GRI. Global Reporting Initiative Sustainability Reporting Standards. 2020. Available online: https://www.globalreporting.org/standards/gri-standards-download-center/ (accessed on 17 August 2020).

- The International Integrated Reporting Council (IIRC). The International, Framework. Available online: https://integratedreporting.org/wp-content/uploads/2015/03/13-12-08-the-international-ir-framework-2-1.pdf (accessed on 3 October 2019).

- Edgley, C.; Jones, M.J.; Atkins, J. The Adoption of the Materiality Concept in Social and Environmental Reporting Assurance: A Field Study Approach. Br. Account. Rev. 2015, 47, 1–18. [Google Scholar] [CrossRef]

- Moroney, R.; Trotman, K.T. Differences in Auditors’ Materiality Assessments When Auditing Financial Statements and Sustainability Reports. Contemp. Account. Res. 2016, 33, 551–575. [Google Scholar] [CrossRef]

- Green, W.J.; Cheng, M.M. Materiality Judgments in an Integrated Reporting Setting: The Effect of Strategic Relevance and Strategy Map. Account. Organ. Soc. 2019, 73, 1–14. [Google Scholar] [CrossRef]

- Conceptual Framework for Financial Reporting. 2018. Available online: https://www.iasplus.com/en/standards/other/framework (accessed on 10 August 2019).

- Concepts Statement No. 8—Conceptual Framework for Financial Reporting—Chapter 1, The Objective of General Purpose Financial Reporting, and Chapter 3, Qualitative Characteristics of Useful Financial Information (a replacement of FASB Concepts Statements No. 1 and No. 2). Available online: https://www.fasb.org/jsp/FASB/Document_C/DocumentPage?cid=1176157498129 (accessed on 10 August 2019).

- The Australian Auditing Standard, Auditing Standard ASA 320- Materiality in Planning and Performing an Audit. Available online: https://www.auasb.gov.au/admin/file/content102/c3/ASA_320_Compiled_2015.pdf (accessed on 30 August 2019).

- AL-Qatamin, K.I.; Salleh, Z. Audit Quality: A Literature Overview and Research Synthesis. J. Bus. Manag. 2020, 22, 56–66. [Google Scholar]

- Blokdijk, H.; Drieenhuizen, F.; Simunic, D.A.; Stein, M.T. Factors Affecting Auditors’ Assessments of Planning Materiality. Audit. J. Pract. Theory 2003, 22, 297–307. [Google Scholar] [CrossRef]

- Nelson, M.W.; Smith, S.D.; Palmrose, Z. The Effect of Quantitative Materiality Approach on Auditors’ Adjustment Decisions. Account. Rev. 2005, 80, 897–920. [Google Scholar] [CrossRef]

- DeZoort, T.; Harrison, P.; Taylor, M. Accountability and Auditors’ Materiality Judgments: The Effects of Differential Pressure Strength on Conservatism, Variability, and Effort. Account. Organ. Soc. 2006, 31, 373–390. [Google Scholar] [CrossRef]

- Choudhary, P.; Merkley, K.; Schipper, K. Direct Measures of Auditors’ Quantitative Materiality Judgments: Properties, Determinants and Consequences for Audit Characteristics and Financial Reporting Reliability. 2017. Available online: https://intranet.weatherhead.case.edu/document-upload/docs/1505.pdf (accessed on 20 June 2020).

- Mittendorf, B. The Role of Audit Thresholds in the Misreporting of Private Information. Rev. Account. Stud. 2010, 15, 243–263. [Google Scholar] [CrossRef]

- Azzali, S.; Mazza, T.; Fornaciari, L.; Trinchera, L. Effects of Materiality Assessment on Internal Controls over Financial Reporting Maturity. Int. J. Bus. Manag. 2018, 13. [Google Scholar] [CrossRef]

- Acito, A.A.; Burks, J.J.; Johnson, W.B. Materiality Decisions and the Correction of Accounting Errors. Account. Rev. 2009, 84, 659–688. [Google Scholar] [CrossRef]

- Keune, M.B.; Johnstone, K.M. Materiality Judgments and the Resolution of Detected Misstatements: The Role of Managers, Auditors, and Audit Committees. Account. Rev. 2012, 87, 1641–1677. [Google Scholar] [CrossRef]

- Legoria, J.; Melendrez, K.D.; Reynolds, J.K. Qualitative Audit Materiality and Earnings Management. Rev. Account. Stud. 2013, 18, 414–442. [Google Scholar] [CrossRef]

- Commerford, B.P.; Hatfield, R.C.; Houston, R.W. The Effect of Real Earnings Management on Auditor Scrutiny of Management’s Other Financial Reporting Decisions. Account. Rev. 2018, 93, 145–163. [Google Scholar] [CrossRef]

- Budescu, D.V.; Peecher, M.E.; Solomon, I. The Joint Influence of the Extent and Nature of Audit Evidence, Materiality Thresholds, and Misstatement Type on Achieved Audit Risk. Audit. J. Pract. Theory 2012, 31, 19–41. [Google Scholar] [CrossRef]

- Ramalho, J.T.S.C.; Pais, C.A.F. Materialidade e Risco, Os Efeitos Da Crise de 2008; XVIII Congreso AECA Innovación e internacionalización: Factores de éxito para la pyme, Cartagena, Spain, 2015. Available online: https://ciencia.iscte-iul.pt/publications/materialidade-e-risco-os-efeitos-da-crise-de-2008--/24873 (accessed on 20 June 2020).

- de Vieira, F.S.; Gonçalves, L.M.; Duarte, S.M. O Problema Da Escolha de Objetos Em Trabalhos de Auditoria e Controle: Uma Proposta de Simplificação Com o Uso Do Índice de Significância Dos Controles (ISC). Rev. CGU 2018, 10, 788–816. [Google Scholar]

- Li, C. Does Client Importance Affect Auditor Independence at the Office Level? Empirical Evidence from Going-concern Opinions. Contemp. Account. Res. 2009, 26, 201–230. [Google Scholar]

- Chen, S.; Sun, S.Y.; Wu, D. Client Importance, Institutional Improvements, and Audit Quality in China: An Office and Individual Auditor Level Analysis. Account. Rev. 2010, 85, 127–158. [Google Scholar]

- Del Corte, J.M.; García, F.J.M.; Laviada, A.F. Effective Use of Qualitative Materiality Factors: Evidence from Spain. Manag. Audit. J. 2010, 25, 458–483. [Google Scholar]

- Popa, I.E.; Span, G.; Dumitru, M.; Dumitru, V.F.; Filip, C.L. Empirical Study on the Implications of Qualitative Factors in Making Decisions Related to the Materiality Level: The Case of Romania. Econ. Res. Ekon. Istraživanja 2013, 26, 43–58. [Google Scholar]

- Popa, I.E.; Tiron Tudor, A.; Şpan, G.A. Professional Reasoning–A Key Factor for the Improvement of the Quality of the Insurance Missions. Financ. Audit 2012, 10, 34–40. [Google Scholar]

- Robu, I.B.; Grosu, M.; Istrate, C. The Effect of the Auditors’ Rotation on the Accounting Quality in the Case of Romanian Listed Companies under the Transition to IFRS. Financ. Audit 2016, 14, 1–65. [Google Scholar]

- Bostan, I.; Peres, I.; Domil, A. Audit Conformable to the Annual Financial Statements of the European Community. 2009. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1325389 (accessed on 30 August 2020).

- Pereş, I.; Gherai, D.S.; Balaciu, D.E. Research on the Contribution of Supreme Audit Institutions to Government Efficiency and to Corruption Perception. Financ. Audit 2014, 4, 28–38. [Google Scholar]

- Eilifsen, A.; Messier, W.F. Materiality Guidance of the Major Public Accounting Firms. Audit. J. Pract. 2015, 34, 3–26. [Google Scholar]

- Ruhnke, K.; Pronobis, P.; Michel, M. Effects of Audit Materiality Disclosures: Evidence from Credit Lending Decision Adjustments. Betriebswirtschaftliche Forsch. Prax. BFuP 2018, 70, 440–471. [Google Scholar]

- Petrov, A.M. Organizational and Methodical Mechanism of Internal Audit of Settlements in Corporate Systems. Bull. Natl. Acad. Sci. Repub. Kazakhstan 2020, 2, 119–127. [Google Scholar]

- Strapuc, C.; Cosmulese, C.G.; Ciubotariu, M.-S. Using Accounting Documents in Financial-Fiscal Investigations. In Proceedings of the 34th IBIMA Conference, Madrid, Spain, 13–14 November 2019; pp. 8956–8969. [Google Scholar]

- Vlad, M.; Tulvinschi, M. The Internal Control System of the Credit Institutions. USV Ann. Econ. Public Adm. 2011, 10, 163–169. [Google Scholar]

- Socoliuc, M.; Mihalciuc, C.C.; Cosmulese, C.G. Tax Evasion in Romania–between Past and Present. In Proceedings of the 14th Economic International Conference: Strategies and Development Policies of Territories: International, Country, Region, City, Location Challenges, Suceava, Romania, 10–11 May 2018; LUMEN Proceedings: Suceava, Romania, 2018; pp. 406–412. [Google Scholar]

- Bostan, I.; Grosu, V. The Role of Internal Audit in Optimization of Corporate Governance at the Groups of Companies. Theor. Appl. Econ. 2010, 17, 89–110. [Google Scholar]

- Cosmulese, C.G.; Socoliuc, M.I. The Challenges of Internal Audit, Between Technological Development and New Skills. Eur. J. Account. Finianc. Bus. 2019, 11. Available online: http://www.accounting-management.ro/index.php?pag=showcontent&issue=21&year=2019 (accessed on 23 September 2019).

- Morosan, G. Financial Audit of Financial Control Versus—An Overall Analysis. Ecoforum J. 2013, 2, 7. Available online: http://ecoforumjournal.ro/index.php/eco/article/view/46 (accessed on 24 September 2019).

- Čular, M.; Slapničar, S.; Vuko, T. The Effect of Internal Auditors’ Engagement in Risk Management Consulting on External Auditors’ Reliance Decision. Eur. Account. Rev. 2020, 1–22. [Google Scholar] [CrossRef]

- Gold, A.; Gronewold, U.; Pott, C. The ISA 700 Auditor’s Report and the Audit Expectation Gap–Do Explanations Matter? Int. J. Audit. 2012, 16, 286–307. [Google Scholar] [CrossRef]

- Aqel, S. Auditors’ Assessments of Materiality between Professional Judgment and Subjectivity. Acta Univ. Danub. Œcon. 2011, 7, 72–88. Available online: https://www.ceeol.com/search/article-detail?id=554862 (accessed on 23 September 2019).

- Al-Shaer, H. Sustainability Reporting Quality and Post-audit Financial Reporting Quality: Empirical Evidence from the UK. Bus. Strategy Environ. 2020, 29, 2355–2373. [Google Scholar] [CrossRef]

- Manita, R.; Lahbari, H.; Elommal, N. The Impact of Qualitative Factors on Ethical Judgments of Materiality: An Experimental Study with Auditors. Int. J. Bus. 2011, 16, 231–243. [Google Scholar]

- Fernando, G.D.; Abdel-Meguid, A.M.; Elder, R.J. Audit Quality Attributes, Client Size and Cost of Equity Capital. Rev. Account. Financ. 2010, 9, 363–381. [Google Scholar] [CrossRef]

- Wang, C.-C.; Kung, F.-H.; Lin, K.-H. Does Audit Firm Size Contribute to Audit Quality? Evidence from Two Emerging Markets. Corp. Ownersh. Control. 2014, 11, 96–107. [Google Scholar] [CrossRef]

- Sattar, U.; Javeed, S.A.; Latief, R. How Audit Quality Affects the Firm Performance with the Moderating Role of the Product Market Competition: Empirical Evidence from Pakistani Manufacturing Firms. Sustainability 2020, 12, 4153. [Google Scholar] [CrossRef]

- Vîlsănoiu, D.; Buzenche, S. Determining Audit Materiality in the Banking Industry–a Knowledge Based Approach. Procedia Econ. Financ. 2014, 15, 935–942. [Google Scholar] [CrossRef]

- Salehi, M.; Komeili, F.; Gah, A.D. The Impact of Financial Crisis on Audit Quality and Audit Fee Stickiness: Evidence from Iran. J. Financ. Report. Account. 2019, 17, 201–221. [Google Scholar] [CrossRef]

- Tuttle, B.; Coller, M.; Plumlee, R.D. The Effect of Misstatements on Decisions of Financial Statement Users: An Experimental Investigation of Auditor Materiality Thresholds. Audit. J. Pract. Theory 2002, 21, 11–27. [Google Scholar] [CrossRef]

| Fit Statistics | Mean | Minimum | Maximum | |||

| Stationary R2 | 1000 | 1000 | 1000 | |||

| R2 | 1000 | 1000 | 1000 | |||

| RMSE | 7976 × 10−15 | 7976 × 10−15 | 7976 × 10−15 | |||

| MAPE | 1146 × 10−14 | 1146 × 10−14 | 1146 × 10−14 | |||

| MaxAPE | u3070 × 10−14 | 3070 × 10−14 | 3070 × 10−14 | |||

| MAE | 4807 × 10−15 | 4807 × 10−15 | 4807 × 10−15 | |||

| MaxAE | 1421 × 10−14 | 1421 × 10−14 | 1421 × 10−14 | |||

| Normalized BIC | −63.991 | −63.991 | −63.991 | |||

| Model | Number of Predictors | Model Fit statistics | Ljung-Box Q(18) | |||

| Stationary R2 | Statistics | DF | Sig. | |||

| INCGST_AVG-Model_1 | 9 | 1000 | 28,800 | 18 | 0.051 | |

| Model | Number of Outliers | |||||

| INCGST_AVG-Model_1 | 0 | |||||

| Indicator | Mean | Std. Deviation |

|---|---|---|

| INCGST_AVG | 41.4488% | 12.30927% |

| FINSOL | 7.5644% | 398.50609% |

| FINEFF | −2.3418% | 29.70878% |

| INDEF | −26.9715% | 277.31825% |

| FINSEC | 9.2783% | 129.47452% |

| ASSLIQUID | 10.3665% | 54.79392% |

| SECFE | 17.1440% | 141.01932% |

| INCGST_AVG | FINSOL | FINEFF | INDEF | FINSEC | ASSLIQUID | SECFE | ||

|---|---|---|---|---|---|---|---|---|

| Pearson Correlation | INCGST_AVG a | 1000 | 0.022 | −0.106 | −0.288 | −0.283 | 0.132 | 0.049 |

| FINSOL | 0.022 | 1000 | −0.274 | 0.102 | 0.144 | −0.012 | 0.002 | |

| FINEFF | −0.106 | −0.274 | 1000 | −0.225 | 0.124 | 0.111 | −0.408 | |

| INDEF | −0.288 | 0.102 | −0.225 | 1000 | 0.293 | 0.118 | 0.338 | |

| FINSEC | −0.283 | 0.144 | 0.124 | 0.293 | 1000 | −0.008 | −0.124 | |

| ASSLIQUID | 0.132 | −0.012 | 0.111 | 0.118 | −0.008 | 1000 | −0.220 | |

| SECFE | 0.049 | 0.002 | −0.408 | 0.338 | −0.124 | −0.220 | 1000 | |

| Sig. (1-tailed) | INCGST_AVG | - | 0.452 | 0.275 | 0.050 | 0.052 | 0.228 | 0.392 |

| FINSOL | 0.452 | - | 0.059 | 0.284 | 0.208 | 0.474 | 0.495 | |

| FINEFF | 0.275 | 0.059 | - | 0.101 | 0.243 | 0.266 | 0.008 | |

| INDEF | 0.050 | 0.284 | 0.101 | - | 0.047 | 0.253 | 0.025 | |

| FINSEC | 0.052 | 0.208 | 0.243 | 0.047 | - | 0.482 | 0.243 | |

| ASSLIQUID | 0.228 | 0.474 | 0.266 | 0.253 | 0.482 | - | 0.106 | |

| SECFE | 0.392 | 0.495 | 0.008 | 0.025 | 0.243 | 0.106 | - | |

| Model | R | R2 | Adjusted R2 | Std. Error of the Estimate | Change Statistics | |

| R2 Change | F Change | |||||

| 1 | 0.440 a | 0.194 | 0.014 | 12.22042% | 0.194 | 1080 |

| Model | Change Statistics | |||||

| df1 | df2 | Sig. F Change | ||||

| 1 | 6 | 27 | 0.399 | 1839 | ||

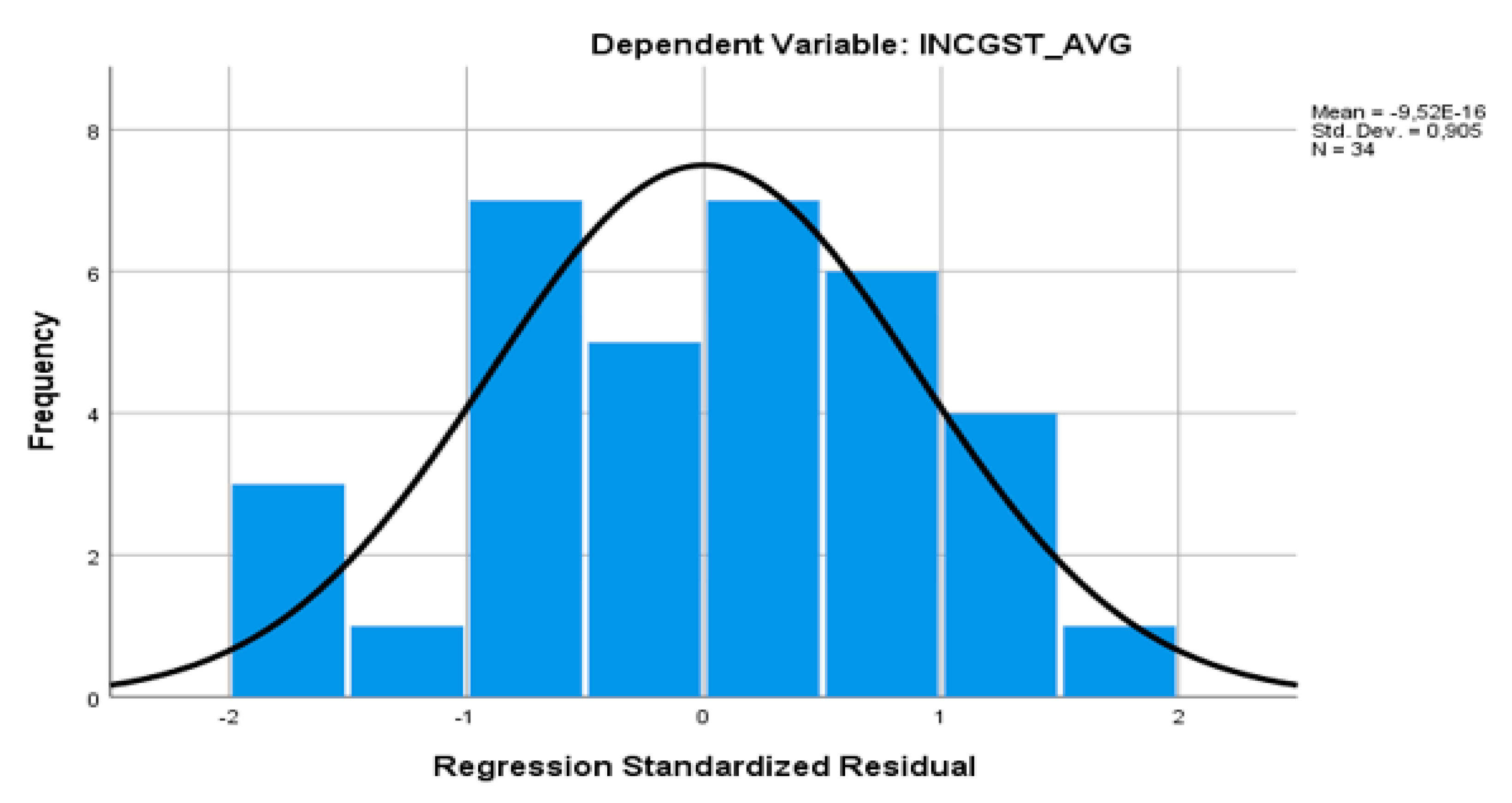

| Residuals statistics b | ||||||

| Predicted Value | 18.7185% | 52.5181% | 41.4488% | 5.41590% | 34 | |

| Residual | −24.30556% | 19.61656% | 0.00000% | 11.05379% | 34 | |

| Std. Predicted Value | −4197 | 2044 | 0.000 | 1000 | 34 | |

| Std. Residual | −1989 | 1605 | 0.000 | 0.905 | 34 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Grosu, V.; Mateș, D.; Zlati, M.-L.; Mihaila, S.; Socoliuc, M.; Ciubotariu, M.-S.; Tanasă, S.-M. Econometric Model for Readjusting Significance Threshold Levels through Quick Audit Tests Used on Sustainable Companies. Sustainability 2020, 12, 8136. https://doi.org/10.3390/su12198136

Grosu V, Mateș D, Zlati M-L, Mihaila S, Socoliuc M, Ciubotariu M-S, Tanasă S-M. Econometric Model for Readjusting Significance Threshold Levels through Quick Audit Tests Used on Sustainable Companies. Sustainability. 2020; 12(19):8136. https://doi.org/10.3390/su12198136

Chicago/Turabian StyleGrosu, Veronica, Dorel Mateș, Monica-Laura Zlati, Svetlana Mihaila, Marian Socoliuc, Marius-Sorin Ciubotariu, and Simona-Maria Tanasă. 2020. "Econometric Model for Readjusting Significance Threshold Levels through Quick Audit Tests Used on Sustainable Companies" Sustainability 12, no. 19: 8136. https://doi.org/10.3390/su12198136

APA StyleGrosu, V., Mateș, D., Zlati, M.-L., Mihaila, S., Socoliuc, M., Ciubotariu, M.-S., & Tanasă, S.-M. (2020). Econometric Model for Readjusting Significance Threshold Levels through Quick Audit Tests Used on Sustainable Companies. Sustainability, 12(19), 8136. https://doi.org/10.3390/su12198136