Abstract

The banking sector plays an important role in the development of any economy. The performance of the loans in bank portfolios is a critical issue for the banking sector. The increased number of nonperforming loans (NPLs) after the financial crisis of 2008 has questioned the robustness of many banks and the stability of the entire sector. Our study aims to present the most important aspects related to NPLs and to investigate some macroeconomic determinant factors affecting the rate of NPLs in Romania. Based on a set of data for the period 2009–2019, the analysis of NPLs was made using linear regression. The results showed that all selected independent variables (exchange rates of the most used currencies (EUR, USD and CHF), unemployment rate, and inflation rate) have a significant impact on the dependent variable NPL. The study reveals strong correlations between NPLs and the macroeconomic factors studied and that the Romanian economy is clearly connected to the quality of the loan portfolios. Additionally, an econometric analysis of the empirical causes of NPLs shows that the RON–CHF exchange rate has been the main factor in increasing the NPL ratio in the last 5 years in Romania.

1. Introduction

The connection between nonperforming loans (NPLs) and bank losses has been analysed by authors from around the world and is considered a very important chapter in banking literature. Rising NPLs are often referred to as the failure of banks to manage credit policy.

In the last two decades, there has been a significant increase in the volume of loans granted by banks [1]. This increase was due to the process of deregulation of financial markets and the development of information technologies in the banking field. These processes have led to improved financial intermediation [2,3].

However, the financial crisis is also the result of the high NPL rate in the banking sector. The financial crisis of 2008 started in the USA and spread all over the world because all countries had trade relations with the USA. That crisis has been labelled as a cause of default on mortgages and loans. Increasing the NPL rate is the main reason for reducing bank revenues and, implicitly, for decreasing profits or recording losses. The reason for the NPL separation is the low repayment capacity of debtors, coupled with a high interest rate. Since 2008, the year of the onset of the global financial crisis, NPL levels have risen significantly.

As the existence of nonperforming loans, being a special category of loans, cannot be ignored, it is necessary to manage and separate this type of loan to a special portfolio of nonperforming loans. The negative aspects and impact of these loans affect not only on the bank and its customers but also the economy on a macroeconomic level.

Bank practice has identified a multitude of causes generating nonperforming credits, grouped as follows, depending on the factors generating them:

- Macro level causes: political causes, economic causes, market causes, legislative causes, and competition causes.

- Causes generated by the loan beneficiaries: the weak management of the debtor companies.

- Causes independent of the customer’s activity: fraud, takeovers, failure to comply with the provisions of the loan.

- Causes entirely due to the fault of the bank: a mistaken analysis of the customer’s situation.

A flexible credit policy may also be the reason for a high volume of national credit, as happened in Romania. The bank sector serves the biggest part of the Romanian economy. The Romanian banks offer a large range of services to companies and individuals: conventional banking services, a variety of instruments for investments, and solutions for specialised financing. As the cornerstone of the national financial system and through its functions, the bank sector has special importance for the Romanian economy. The manner in which the bank sector develops its activity becomes an essential condition for the maintenance of financial stability and the insurance of sustainable economic development.

Therefore, it is clear why the NPL rate is crucial for banks. After the crisis in Romania in 2008, the unemployment rate increased significantly, the level of salaries of employees in state institutions decreased significantly—with a direct impact on NPLs (a large part of employees had contracted bank loans at that time)—and the inflation rate recorded significant changes. The exchange rates of RON–CHF, RON–EURO, and RON–USD almost doubled, affecting the repayment of loans (loans in progress and contracted before 2008) granted by banks in these currencies.

In this context, our study analyses the influence of certain macroeconomic factors from the category of the economic factors (the RON–CHF exchange rate, the RON–EUR exchange rate, the RON–USD exchange rate, the unemployment rate, the inflation rate) on the NPLs in the Romanian banking system. We mention that we chose the EUR, USD and CHF currencies due to their high proportion in Romanian foreign-currency credit granted to individuals and companies. Our paper compares the analysis before the initiation of the process of writing-off the unrecoverable NPLs (in 2014) and after 2014. Thus, the goal of this study is to present the most important aspects related to NPLs and to analyse the sensitivity of NPLs with respect to macroeconomic indicators in Romania. In particular, it uses regression analysis and a time series data set covering around 10 years (in the period 2009–2019) to examine the relationship between the nonperforming loan rate and some key macroeconomic variables that have changed significantly since 2008.

The paper is organised as follows. Section 2 offers a revision of the previous research on NPLs and influencing factors. Section 3 presents the data description and methodology used, including justification of the model used and tests developed. Section 4 shows the interpretation of the results based on the proposed model, compares the results of the models, and highlights similar results found in the literature. Section 5 presents the conclusions of our study, policy implications, and limitations.

2. Literature Review

There are many articles that have studied the links between the financial system and the economy. The most important examples are Bernanke and Gertler [4] and Bernanke, Gertler and Gilchrist [5] who developed the concept of the financial accelerator, arguing that credit markets are cyclical and that information asymmetry between creditors and debtors has an effect on amplifying and spreading shocks on the credit market. The Kiyotaki and Moore [6] model showed that if credit markets are imperfect, then relatively small shocks might be sufficient to explain business cycle fluctuations.

Competition has increased in the domestic and European banking markets, being strengthened by the deregulation process [7]. Banks have created permissive lending conditions to attract customers. Low interest rates, rising house prices and a stable economic environment characterised the precrisis period. This situation has led to the expansion of credit from both supply and demand. In our paper, we focus on the postcrisis period, characterised by high interest rates, falling house prices, and an unstable economic environment (rising unemployment, rising inflation, declining wages).

Several studies have examined the causes of NPLs and problem loans (e.g., Fernandez de Lis, Pagés and Saurina [8]; Boudriga, Taktak and Jellouli [9]; Espinoza and Prasad [10]).

An important number of studies in the literature on NPLs have focused exclusively on the role of macroeconomic or country-specific causes and have found that they have had the most significant effect. Espinoza and Prasad [10] tried to distinguish the determinants of NPLs for the Gulf Cooperative Council (GCC) banking system. The result of their study was that the NPL ratio increases when economic growth slows and risk aversion decreases, but also when interest rates rise. It is important to note that exchange rates and unemployment were not used as regressors due to the exchange rate regime and low and stable unemployment in the GCC countries.

Nkusu [11] used a methodology similar to that of Espinoza and Prasad [10]. He tested an econometric model that explains NPLs using only macrovariables and found that a worsening of the macroeconomic environment (i.e., a higher unemployment rate) is closely related to the problems of repayment/nonrepayment of loans and improving the macroeconomic environment implies a decrease in nonperforming loans. In recent years, interest in nonperforming loans and their determinants has increased significantly as we encounter more data published at the banking level by each country and at the level of the aggregate banking system. Many NPL studies have been published, whose results reveal important information about the quality of loan portfolios and, in general, the fragility of banks. Many researchers view NPLs as financial pollution with huge effects on both economic development and social life (e.g., Gonzales-Hermosillo [12], Barseghyan [13], Zeng [14]).

In the studies of Baboučak and Jančar [15] for the Czech Republic and Hoggarth, Logan and Zicchino [16] for the United Kingdom, the VAR methodology was used. They found that the important factors influencing financial stability and the quality of the loan portfolio were the dynamics of inflation and interest rates. Baboučak and Jančar [15] found evidence of a positive correlation between NPLs, unemployment rates and consumer price inflation, while GDP growth decreases the NPL rate. They also found that the actual appreciation of the effective exchange rate did not have an exaggerated influence on the NPL ratio. Regarding the Greek banking market, Louzis, Vouldis and Metaxas [17] examined the effect of various macroeconomic factors on NPLs, studying each type of loan in the nine largest Greek banks. The authors found that the real GDP growth rate, unemployment rate and lending rates have a strong negative effect on the NPL level, interpreting them as a sign of poor banking management.

Vogiazas and Nikolaidou [18] investigated the determinants of nonperforming creditors in the Romanian banking sector during the Greek crisis (December 2001–November 2010) and found that inflation and external GDP information are proportional and influence the credit risks of the banking system in the country. Our study is distinguished from the previous ones by investigating the impact of the exchange rate of the most used currencies (EUR, USD and CHF) on the granting of credit in Romania and the impact of unemployment and inflation rates on nonperforming loans after the crisis of 2008 (i.e., in the period 2009–2019, when the effects of the crisis were visible in all sectors of activity and especially on the banking system). We also present the most important determinants used in the literature for studying nonperforming loans, considering that the continuous analysis of the quality of the loans is a repetitive action, with several stages that are more important, namely, the stages before granting the credit, the granting of credit stage and the postgrant stage. Many studies have analysed various factors that can influence NPLs. In the next subsections, we present these factors grouped into the major factors of influence.

2.1. NPLs and NPL Data Analytics

Previous studies have examined the economic determinants of the NPL: “Greater capitalization, liquidity risks, poor credit quality, greater cost inefficiency and banking industry size significantly increase NPLs, while greater bank profitability lowers NPLs” [19]. The following variables significantly impact the NPL level: GDP real growth, share price, exchange rate and interest rate [20]. The assumption is that the macroeconomic variables and also the variables specific to the banks have an impact on the loan quality, depending on the loan category. For example, the NPLs from the Greek bank system can be mainly explained by macroeconomic variables (GDP, unemployment, interest rates, and public debts) and by the quality of the management [17].

Studies from various countries have identified the following factors that determine NPLs: inflation rate, unemployment rate, GDP level, ROA, ROE, liquidity, capital adequacy, size of the bank, volume of the deposits and interest rate [21]. For the saving banks, the GDP, the nonguaranteed loans and the net margins of interest affect NPLs, while for the commercial banks, the factors that affect NPLs are the size of the banks, their capital ratios and the expansion of their branches [7].

Knowledge-sharing processes and innovation processes of Islamic banks are integral parts of the survival and progress of business organisations. Another article conducted an empirical evaluation of the Czech public START program (funded by the European Regional Development Fund), a program that supported new entrepreneurs through zero-interest loans and credit guarantees. The obtained findings could not support the hypothesis of a positive impact of the programme on a firm’s performance [22].

A model was created using latent variables of capital adequacy, operations, asset quality, size and profile of the countries in which they were based—this model can predict bank profitability. The study was conducted on the 100 largest banks between 2011 and 2015 [23].

2.2. NPLs and Macro Level Factors

Most studies considered macroeconomic factors as factors influencing NPLs.

The real GDP: Some authors have stated a negative relationship between GDP and NPLs [24,25]. Another study uses the data from the USA bank sector and takes into consideration real GDP per capita, inflation and total loans as independent variables, and the NPL ratio as a dependent variable. All the selected independent variables have a significant impact on the dependent variable, but, still, the values of the coefficients are not too high [26].

The economic growth: Another idea showed that NPLs affect the economy by slowing economic growth [27]. A study that analysed the situation in Hong Kong remarked that the NPL ratio grows together with the growth of the nominal interest rate but decreases once the inflation increases with economic growth [28].

The lending rate: Research on Italy found that the lending rate has a negative relationship with NPLs [24].

The unemployment rate: Some studies concluded that NPLs grow when the unemployment rate is high, while [29] showed that the unemployment rate has a negative impact on the quality of the bank loans [24]. NPLs increase when the unemployment rate grows and the debtors are confronted with difficulties related to the return of the loan [25].

The inflation: Inflation is positively connected to NPLs [29], while a lower inflation rate has a positive influence on the debtors’ financial conditions and, eventually, on the recovery of the loans, meaning that it presents a positive relationship between the inflation rate and NPLs [30].

The market competition: The economic development of the country results in market growth. Market competition compels enterprises to increase their activity, i.e., to concentrate it [31]. Rahman et al. [32] sustained that taking effective measures to increase bank competition can create a level playing field for other banks and may reduce strict collateral requirements for companies.

The exchange rate: The high number of NPLs leads to a depreciation of the exchange rate [27] and hence NPLs have, as a result, a depreciation of the exchange rate [29]. At the same time, some authors affirmed that a depreciation of the national currency can lead to more NPLs [33].

The boom/recession/expansion period in the economy: The quality of bank loans of Italian banks is lower during recession periods and higher during expansion periods. The internal factors that influence NPLs are efficiency, the indicator of income from interest to total assets, and the slow growth of loans. The external factors affecting NPLs are the GDP and the interest rates [34].

The governance indicators: The governance indicators are significant factors influencing NPLs [35]. Using techniques for the estimation of data, a study examined the determinant factors of NPLs in the Turkish bank system. The results of the study showed that the determinant factors of NPLs changed after the crisis and that the macroeconomic and political determinant factors have a higher significance [36].

The bank concentration: Bank concentration may reduce NPLs by enhancing market power and boosting bank profits so that high profits can provide a “buffer” against adverse shocks [37]. Çifter [38] examined the effect of bank concentration on nonperforming loans (NPLs) for ten Central and Eastern European (CEE) countries and concluded that the relationship between the concentration of banks and NPLs, with regard to CEE countries, is ambiguous.

2.3. NPL and Nonspecific Factors

There is still a group of factors that we have included in the group of nonspecific factors because their influence differs from country to country. This group of factors would be the factors that influence trust in internet banking (such as provided information, e-banking system, a bank’s website and bank characteristics). Another factor that falls into this group is perceived value. The results of the studies show that three components of perceived value (economic value, comfort value and emotional value) increase the intention to use banks that are only on the internet [39]. Another study contributed to the specialised literature on the correlation between ecological lending and credit risks and concluded that the institutional pressure of green credit policy has a positive effect on both the environmental performance and financial performance of banks [40]. Some authors combined the two large groups of factors in their studies. They found a positive relationship between GDP growth, inflation and bank performance, whereas a negative relationship between tax burden and performance [41]. The bad-management and moral-hazard hypotheses explain a significant part of NPLs [42].

3. Data and Methodology

3.1. The Dependent and Independent Variables

As defined in the literature, nonperforming loans are the loans that are delayed for a long period, according to the loan contract. According to Tesfaye [43], any loan that is not recovered in due time is known as nonperforming. The rate of nonperforming loans, according to the ABE definition, is calculated using the following formula: nonperforming exposures from loans and advances/exposures from loans and advances. According to the ABE definition, which was nationally implemented through Order 6/2014 of the National Bank of Romania, nonperforming exposures are the one of the following criteria: (1) there are significant exposures, with over 90 days’ delay from the recovery date, and (2) it is considered that lacking a real guarantee, it is improbable for the debtor to integrally return his debts, disregarding the existence of a certain sum or a certain number of delays in payment.

In this study, we used the rate of nonperforming loans (NPLs) from the Romanian bank system as a dependent variable. With regard to the independent variables, we used the following macroeconomic factors: RON–CHF exchange rate (RON_CHF), RON–EUR exchange rate (RON_EUR), RON–USD exchange rate (RON_USD), the unemployment rate (UR) and the harmonised index of consumer prices (HICP) inflation rate.

The variables used in this article were selected from the total of possible variables based on the criterion of impact on nonperforming loans of the population, and, moreover, these variables changed significantly during the analysed period compared to the other variables listed above. Thus, following the documentation at a series of banks in Romania, we found that

- the variable unemployment rate influences the outstanding loans of the individuals because the credited persons have fewer possibilities to repay the loan taken due to a lack of income, the unemployment benefits being small in Romania (below 100 euro/month). We have considered this variable in the study because of the consequences of the crisis, which led to more bankruptcies, the reduction of activity in many sectors, followed by staff lay-offs or a reduction of monthly salaries, both from the private and public sectors. This situation increased the unemployment rate and implicitly reduced the income of individuals. In Romania, the majority of active persons used real estate loans, mortgage loans or personal loans for purchasing buildings or other durable goods that were granted in CHF, EUR and USD, and the individuals that were laid off or had their salaries cut found it impossible to reimburse credits and this generated the increase in NPLs;

- the inflation rate influenced the level of outstanding loans by the fact that a high inflation rate reduces the purchasing power of the population, generating the decrease of the population’s real income because a great part of the income is used for consumption. Therefore, the reduction of the individuals’ incomes leads to a reduction in the ability to repay loans. Thus, inflation can negatively affect the debtor’s service capacity [44]. Inflation negatively affects the ability of debtors to repay creditors [11]. We expect a negative impact of inflation on NPLs as a rapid rise in prices exacerbates market frictions, forcing banks to exercise caution in lending [45].

- the RON–EUR, RON–USD and RON–CHF exchange rates significantly reduced the population’s income and influenced a decrease in the credit repayment capacity by the fact that during the analysed period, the RON–CHF, RON–EUR, and RON–USD exchange rates increased permanently. The reduction of the population’s income was generated by the fact that Romanian individuals received their salaries in RON and had to pay loans granted in EUR, USD and CHF. The increase in the exchange rate of these currencies generated an increase of monthly credit rate, and this situation made it impossible for individuals to pay their debts to banks.

3.2. Data

The study used an explanatory analysis and also an econometric analysis based on the data from 2009 until January 2019 in order to investigate the relationship between NPLs and the 5 macroeconomic factors selected and presented in Section 3.1. For each variable, 110 monthly values were considered. The data for our study were taken from the metadata database of the National Institute of Statistics of Romania (www.insse.ro), from the database of the National Bank of Romania (www.bnr.ro), and from the Eurostat database (https://ec.europa.eu/eurostat/data/database). For econometric analysis, we used the statistical package EViews.

A summary table of statistics for these variables is given below (Table 1).

Table 1.

Descriptive statistics for the considered variables (Source: authors’ estimations).

Analysing data presented in Table 1, we found that the average rate of NPLs is 13.04%, the maximum value being 22.52%. Related to the evolution of the exchange rate, we can see that the RON–CHF exchange rate increased by 52.86% in the period analysed, the RON–EUR exchange rate increased by 14.91%, and the RON–USD exchange rate increased by 50.70%. The average unemployment rate was 6.29%, and the maximum value of the inflation rate was 5.98%.

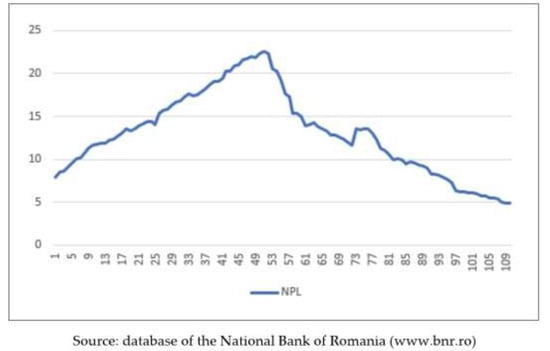

A graphic representation of the NPL rate with 110 values (calculated monthly, starting at 1 December 2009 until 31 January 2019) is presented in Figure 1. We observe that the trend increases for the period 2009–2014 and decreases between 2015 and 2019. This makes us think that there may be a structural break in the NPL ratio.

Figure 1.

The evolution of the NPL rate for the 2009–2019 period.

The novelty element in the general representation of banking activity from 2014 is the initiation of the process of writing-off the uncollectable nonperforming loans, following the recommendations of the National Bank of Romania, a process considered a necessary condition for the sustainable relaunch of credit. The year 2014 registered a significant decrease in nonperforming loans registered in the balance of the banks because of the operations of direct decrease in the value of unrecoverable loans, covered in a high percentage with adjustments for depreciation, that were made at the recommendation of the National Bank of Romania. Considering the limited efficiency of the techniques previously used by commercial banks in order to diminish the number of nonperforming loans—most often restructuration/rescheduling and foreclosure—the National Bank of Romania recommended the cleaning of portfolios in four stages:

- Writing-off the entirely provisioned nonperforming loan (the banks reserved their right to recover the loan).

- The integral forecasting and write-off of loans with a payment delay longer than 360 days.

- The integral forecasting and write-off of loans to companies in insolvency.

- An external audit of the provisions constituted according to IFRS and the guarantees.

The result of these activities was a decrease in the NPL rate from 20.4% in March to 13.9% in December 2014 (see Figure 1).

In our analysis, the dependent variable rate of NPLs is studied by considering as independent variables the exchange rates (RON–CHF, RON–EUR, RON–USD), the unemployment rate (UR) and the inflation rate (HICP), measured in the same statistic interval. As noted on the National Institute of Statistics of Romania website (www.insse.ro), we observe an upward trend of the inflation rate and a downward trend of the unemployment rate during the analysed period (starting on 1 December 2009 until 31 January 2019). From the National Bank of Romania website (www.bnr.ro), we observed an upward trend, with small oscillations for all three exchange rates (RON–CHF, RON–EUR, RON–USD).

The model chosen for studying the influence of the independent variables selected on the NPL rate is the multiple regression model, presented in the form of a linear relation:

where i = 1, …, n, yi represents the values of the explained variable Y, and x1i, x2i, …, xpi are the values of the independent variables X1, …, Xp. The coefficients β1, β2, …, βp are the parameters of the regression model, and ui are the values of the residual variable.

3.3. The Estimation of the Parameters and the Validation of the Regression Model

In this section, we made a univariate analysis of the series analysing the presence of unit roots through the augmented Dickey–Fuller (ADF) test in order to determine the order of integration of each series.

The results of the augmented Dickey–Fuller test is presented in Table 2.

Table 2.

Unit root test (source: authors’ estimations).

From the information provided in Table 2, we conclude that all the variables are first-order integrated, I(1).

4. Results and Discussion

4.1. Interpretation of the Obtained Results

In this section, we obtain the elements of the multiple regression model, as well as the values of certain indicators and tests for the appreciation of the validity and quality of the equation attached to the model. Therefore, after creating the group formed from the variables presented above, we defined the equation corresponding to the multiple regression model, with the rate of the nonperforming loans (NPLs) as the dependent variable and RON–CHF, RON–EUR, RON–USD, UR and HICP as independent variables, also defining the constant variable C, corresponding to the impact of other exogenous variables influencing NPLs, which are not considered in the present analysis. The estimation of the parameters in the equation of the regression model was made using the method of least squares.

The obtained values, representing, at the same time, the coefficients of the variables in the regression model and the results from the tests, are presented in Table 3.

Table 3.

Estimations results (source: authors’ estimations).

One of the most important assumptions of any time series model is that the underlying process is the same across all observations in the sample. It is, therefore, necessary to analyse carefully the time series data that include periods of violent change (as we observed for the NPL ratio, in Figure 1). A tool that is particularly useful in this regard is the Chow test. The null hypothesis for the test is that there is no breakpoint (i.e., that the data set can be represented with a single regression line). We assumed that there is no structural break between the first five years and the last five years of the period.

As the content of Table 4 confirms, the null hypothesis is rejected, i.e., the regression is not stable over the considered data sets. Because of this structural break, we will estimate the model for the 2009–2014 period (Section 4.3) and 2015–2019 period (Section 4.4) separately.

Table 4.

Regression stability test (Chow test; source: authors’ estimations).

4.2. An Overview of the Period 2009–2019

From Table 3, we find a linear relationship between NPLs and their explanatory factors, statistically significant at a significance level of 1% (Prob(F-statistic) = 0.000). The sign of each coefficient is the expected one, being positive. If each of the considered macroeconomic components increases, nonperforming loans will also increase. All the variables studied place the level of NPLs at 78.12% (R-squared = 0.7812).

Therefore, based on the values above, we can affirm that the model of linear multiple regression can be accepted for the correlation and interdependence between the NPL rate and the macroeconomic indicators: the exchange rate, the unemployment rate, and inflation. However, as we mentioned before, this regression is not stable, according to the Chow test, and because of that, we have split the 2009–2019 period into two parts and will study each part separately.

In the Coefficient column from the results presented in Table 3, we have the coefficients of the equation of the regression model. The Variable column shows the names of the variables to which the coefficient corresponds. Each parameter estimated in this manner measures the contribution of the independent variable to the dependent variable. Hence, the regression equation is

Additionally, another method to verify the reliability of the regression parameters is represented by the method of confidence intervals. The confidence intervals are presented in Table 5. We have intervals with a confidence coefficient of 90% and 95%. Therefore, we can affirm with a confidence of 95% that the growth of one percent in the unemployment rate leads to the growth of NPLs between 3.77% and 5.09%.

Table 5.

The confidence intervals (source: authors’ estimations).

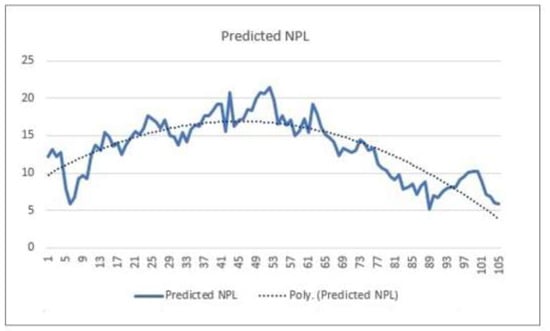

An evaluation obtained for the considered values of this formula is given in Figure 2.

Figure 2.

The graphic representation of the regression model for the 2009–2019 period.

As we can see, the trend line for the predicted NPL rate is described by a second-degree polynomial curve. This will sustain a separate study for each of the periods of 2009–2014 and 2015–2019.

4.3. A Model for the 2009–2014 Period

As we observed in Figure 1, NPL had an upward trend in the 2009–2014 period. The values of the regression model for this period are given in Table 6.

Table 6.

Estimation results for the 2009–2014 period (source: authors’ estimations).

Here, we have the elements of the multiple regression model and also the values of certain indicators and tests for the appreciation of the reliability and quality of the equation attached to this model.

Thus, based on the values of these tests, we can affirm that the correlation and interdependence between the NPL and the considered independent variables are represented very well by a model of linear multiple regression.

Hence, the regression equation is

From here, we can affirm that a growth of one unit in the RON–EUR exchange rate leads to a growth of the NPL rate by 9.5%. Our result is consistent with the study of Farhan et al. [46], who found that unemployment, inflation and exchange rates have a significant positive relationship with NPLs of the Pakistani banking sector. The findings obtained by Bock and Demyanets [27] imply that the exchange rate is one of the main determinants of NPLs.

Our results show that a growth of 1% in the unemployment rate will lead to a growth in the NPL rate by 2.55%. These are in line with the studies of Popa et al. [47], Ghosh [19], Makri et al. [48], Messai and Jouini [49] and Skarica [50]. This result is also reinforced by Louzis et al. [17], who found in their study that NPLs can be explained mainly by macroeconomic variables such as unemployment. The unemployment rate is one of the major determinants of NPLs, as stated by Nkusu [11]. According to Cifter’s [38] study, the unemployment rate is the most important macroeconomic factor for NPLs, and a percentage increase in the unemployment rate increases NPLs by 3.61 percentage points for the group of countries analysed by him. Using GMM and quarterly data of Euro-area banks in the 1990–2015 period, Anastasiou et al. [51] found that macrovariables such as unemployment and growth exert a strong influence.

A growth of 1% in the inflation rate will determine a growth of the NPL rate by 1.54%. This result is similar to the study of Charalambakis et al. [52], who found that the key factors that can explain the movements in NPLs are the unemployment rate and the inflation rate. The results of the study by Donath et al. [53] showed that the variation of NPLs had a positive correlation with inflation as well as unemployment rates, which is the result found in our study.

In Table 7, we have the confidence coefficients intervals of 90% and 95% for our model. Hence, we can say, with a confidence of 95%, that an increase of 1% in the unemployment rate leads to an increase in the NPL rate of between 1.33% and 3.75%.

Table 7.

The confidence intervals (source: authors’ estimations).

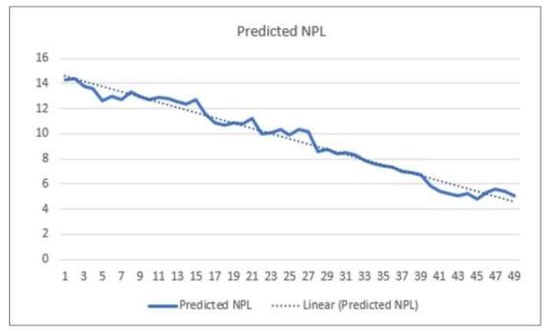

In Figure 3, we have the representation of the predicted NPL rate according to (3) for 61 values (calculated monthly, starting on 1 December 2009 until 31 December 2014). Here, the trend line for the predicted NPL rate is an upward linear one.

Figure 3.

The graphic representation of the regression model for the 2009–2014 period.

4.4. A Model for the 2015–2019 Period

We observed in Figure 1 that NPL had an upward trend in the 2009–2014 period. The NPL level started to decrease in June 2014. The novelty element in the general view on the bank activity in 2014 was the initiation of the write-off process for uncollectible NPLs, following the recommendations of the National Bank of Romania to credit institutions. We formulated below the model of multiple regression based only on the data from the period 2015–2019 (the years when the NPL rate decreased) in order to observe if the same independent variables have a stronger impact on the NPL, similar to the previously formulated model.

We used the same techniques as above to study the mentioned period. Hence, in order to formulate the regression model, we defined the rate of nonperforming loans (NPLs) as a dependent variable.

The independent variables that are taken in consideration are the same: the exchange rates (RON–CHF, RON–EUR, RON–USD), the unemployment rate (UR) and the inflation rate (HICP), measured in the same statistic interval (from 1 December 2009 to 31 January 2019).

Using the same technique that we have described above, with the help of the software EViews, we obtained the elements of the multiple regression model and also the values of certain indicators and tests for the appreciation of the reliability and quality of the equation attached to this model. The obtained values, representing the coefficients of the variables in the model of linear multiple regression and, at the same time, the results of the tests on the model, are presented in Table 8.

Table 8.

Estimations results (source: authors’ estimations).

We will further present the manner in which we use these values in the study of linear regression with the five considered explanatory variables. The R-squared statistic: In the present case, we can appreciate that 95.4% of the NPL rate value is explained by the five considered independent variables. S.E. of regression (S): The fact that we have a value of S = 0.69 in the present case is another confirmation of the fact that the regression model is representative of the relationships between the considered variables. Another confirmation of the obtained model is given by the Fisher test, F-statistic, and its associated probability, Prob(F-statistic). The econometric model of multiple regression using the NPL rate as a dependent variable is a correct one and can be used in the analyses of macroeconomic forecasts. The statistic of the Durbin–Watson test (Durbin–Watson stat): In the present case, the value of the test is 0.85, corresponding to a positive linear dependence, meaning that a general growth of the values of the independent variables leads to a growth of the NPL rate.

Thus, based on the values of these tests, we can affirm that the correlation and interdependence between the NPL rate and macroeconomic indicators—the exchange rate, the unemployment rate and inflation—is represented very well in the model of linear multiple regression.

Hence, the regression equation is

We observe that the signs of the coefficients are different in this case. This will give us the right to say that the model has not given us consistent estimates and we expect endogeneity for this five-year period of 2015–2019.

An evaluation of this formula, obtained for the values of the independent variables considered for the calculation period, e.g., for 49 values (calculated monthly, starting on 1 January 2015 until 31 January 2019), is represented in Figure 4. We can affirm that for a growth of one unit in the RON-CHF exchange rate, the NPL rate will increase by 2.22%, while a growth of one percent in the unemployment rate will lead to a growth of 2% in the NPL rate. At the same time, we observe that the influence of the constant variable is important. Therefore, the factors taken into consideration in our analysis have an important impact on the dependent variables, determining its decrease by 37.83 units.

Figure 4.

The graphic representation of the regression model for the 2015–2019 period.

Here, the trend line for the predicted NPL rate is a downward linear one. In order to establish the significance level for each coefficient, we use the values of the Prob. column from Table 9. Another method for the confirmation of the validity of the regression parameters is the method of confidence intervals. We obtained the following intervals.

Table 9.

The confidence intervals (source: authors’ estimations).

We obtained, as Table 9 shows, the intervals with a confidence coefficient of 90% and 95%. Therefore, in the example given, we can affirm with a confidence of 95% that an increase of 1% in the inflation rate leads to an increase of the NPL rate between 1.56% and 2.44%.

4.5. Comparative Analysis for Periods Analysed

If we compare the influencing factors of the NFL rate analysed in this paper for both periods of 2009–2014 and 2015–2019, we may conclude that

- -

- in the period 2009–2014, an increase in the RON–CHF exchange rate of 1% leads to an increase in the NPL rate of 1.70%, while, in the period 2015–2019, the same increase leads to an increase in the NPL rate of 2.22%, which shows that after the recommendations of the National Bank of Romania, the credits granted in CHF still remain a generating factor of NPLs in Romania. This is explained by the fact that due to the increase in the RON–CHF exchange rate, many debtors, after paying the monthly rate of the credit for 8–10 years, have a debt higher than the initial value of the credit.

- -

- in the period 2009–2014, an increase in the RON–EUR exchange rate of 1% leads to an increase in the NPL rate of 9.50%, while in the period 2015–2019, the same increase leads to a decrease in the NPL rate of 5.69%, which shows that after the recommendations of the National Bank of Romania, the RON–EUR exchange rate is not a generating factor of NPLs in Romania.

- -

- in the period 2009–2014, an increase in the RON–USD exchange rate of 1% leads to an increase in the NPL rate of 2.40%, while in the period 2015–2019, the same increase leads to a decrease of NPL rate with 0.71%, which shows that after the recommendations of the National Bank of Romania, the RON–USD exchange rate is not a generating factor of NPLs in Romania.

- -

- in the period 2009–2014, an increase in the unemployment rate of 2.55% leads to an increase in the NPL rate of 2.40%, while in the period 2015–2019, the same increase leads to a decrease in the NPL rate of 2.00%, which shows that after 2014, the unemployment rate still remains a generating factor of NPLs in Romania.

- -

- in the period 2009–2014, an increase in the inflation rate of 1% leads to an increase in the NPL rate of 1.55%, while in the period 2015–2019, the same increase leads to a decrease in the NPL rate of 0.19%, which shows that after 2014, the inflation rate is not a generating factor of NPLs in Romania, especially due to the Romanian government’s efforts to maintain the inflation rate within the limits recommended by the European Union.

5. Conclusions

The present paper identifies several macroeconomic factors influencing the nonperforming loans rate in the Romanian banking system. The results are, in general, comparable to the results from other countries. The econometric analysis of the empirical determinants of the NPL rate presented in this paper shows that the exchange rate and the unemployment rate were the main causes for the growth of NPLs for both analysed periods of 2009–2014 and 2015–2019 (after 2014, what took place was the write-off of uncollectable NPLs at the recommendation of the National Bank of Romania). We applied in the present study an econometric model that helped us to identify the factors influencing the NPL rate in Romania, and we observed strong relations between the NPL rate and various macroeconomic factors. Our results are in general agreement with the literature because, from a macroeconomic perspective, the exchange rate, the unemployment rate and the inflation rate seem to be three supplementary factors affecting the NPL index, showing that the situation of the Romanian economy is clearly connected to the quality of loan portfolios. Related to the causes of nonperforming loans, after a literature review, we can conclude that nonperforming loans depend on several factors. We cannot make a list of all the causes because there are multiple causes, and these depend on macro-level factors and the specificity of each bank and its customers.

The writing-off process was individually transposed by a decrease of the number of banks registering NPL rates above the threshold for high risk, according to the ABE (up to 14% of the total number of Romanian credit institutions). The foreign currency loans continue to represent approximately 45% of total loans registered in Romania. An uncontrolled transaction of the exposure of RON to foreign currencies could have dramatic consequences on the situation of the foreign currency of the country and on the stability of the banking sector. The volatility of exchange rates, combined with the impact of the continued cutting of the workforce in Romania, along with the over-indebtedness of a significant part of the population, contribute to a growth of the causes for concern of the customers and the disturbance of the market, generating supplementary legislative and administrative pressure on the banks. In order to rectify the situation, during the last two years, Romanian banks have made new efforts in financial education and, supported by new regulations, mainly changed their position related to RON. The negative effects of COVID-19 on the Romanian economy are associated with expectations of increasing the probability of default in the real sector, as well as expectations of moderation of lending activity. In addition, the risk regarding uncertain and unpredictable legislative framework in the Romanian financial-banking field remains high, having the potential to put pressure on bank solvency and to limit access to the financing of potential borrowers.

The econometric analysis of the empirical causes of the NPL rate presented in this paper shows that the RON/CHF exchange rate has been the main factor in increasing the NPL ratio in the last 5 years in Romania. The coefficient of this explanatory variable is high from an economic point of view, proving that excessive credit in Swiss francs in the period 2006–2008 has significantly affected financial stability. High levels of NPLs are a legacy of the 2008 crisis.

The literature shows that the level of nonperforming loans must be at a low a level as possible because it affects the profitability of banks. For this aspect to become achievable, bank institutions must approach a prudent credit policy and create a connected environment between the present economic–financial context and the aspects related to the classification of risk.

Sustainable development needs to be applied in all the fields of activity, including the banking sector. Referring to the present context in the development of the credit system, we can easily observe the fact that credit operations are profitable and risky at the same time. In relation to international experience before the world crisis and to European experience in the recent past, we observed that a global strategy is more efficient in order to solve nonperforming loans. A multilateral strategy for solving nonpayment in the European bank system could combine more attentive supervision, institutional reforms for insolvency and the expansion of markets for the debts in difficulty. These measures need to be supported by an exchange of the fiscal regime and by reforms for the improvement of the access to information.

The problem of nonperforming loans is serious, and the recommended measures need to be applied as soon as possible. Some measures, such as stricter supervision, can be immediately implemented. Other measures, as the judicial reforms and the development of market infrastructure, will take more time to be implemented. As a result of our analysis performed on a period of ten years, 2009 to 2019, we can observe a series of transformations that have taken place in the evolution of nonperforming loans. The greatest challenge in fulfilling of the objectives of the sustainable development of banks is represented, on the one hand, by the understanding of the concept in relation to the business field, and, on the other hand, by the exclusive placement of sustainability within the exclusive responsibility of NGOs and governments. There is a need to understand that bank responsibility does not mean only philanthropic actions and sponsorships; there is more to it. The international bank community has proven, through the examples to be followed, that it understands the importance, necessity and reliability of sustainable development.

The limits of the present research refer to the focus on the influence of macroeconomic factors on the NPL rate without including nonspecific factors, such as the degree of implementation of e-banking (meaning internet banking and mobile banking), perceived value, and green credit policy.

The further directions of research may consist of studying the influence of some less quantifiable factors on the NPL rate, such as trust in banks, the e-banking system, ecological lending, and studying the competitive advantage of the Romanian banks entering into new business niches connected with sustainable development or integrating sustainable development into the banking sector.

Author Contributions

Conceptualization, T.H.; methodology, N.B.-M. and D.W.; validation, I.C.I. and D.W.; formal analysis, I.C.I. and N.B.-M.; investigation, I.C.I. and T.H.; resources, N.B.-M.; writing—original draft preparation, D.W., writing—review and editing, N.B.-M., D.W., and I.C.I. All authors have read and agreed to the published version of the manuscript.

Funding

This work was funded by the project “Excellence, Performance and Competitiveness in Research, Development and Innovation Activities at “Dunarea de Jos” University of Galati” (“EXPERT”), financed by the Romanian Ministry of Research and Innovation in the framework of Programme 1—Development of the National Research and Development System, subprogramme 1.2—Institutional Performance—Projects for Financing Excellence in Research, Development and Innovation, Contract no. 14PFE/17.10.2018.

Acknowledgments

This work was supported by the project “Excellence, Performance and Competitiveness in Research, Development and Innovation Activities at “Dunarea de Jos” University of Galati” (“EXPERT”), financed by the Romanian Ministry of Research and Innovation in the framework of Programme 1—Development of the National Research and Development System, subprogramme 1.2—Institutional Performance—Projects for Financing Excellence in Research, Development and Innovation, Contract no. 14PFE/17.10.2018. We also sincerely thank the anonymous reviewers and editors for their valuable comments and suggestions.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Cingolani, M. Finance Capitalism: A Look at the European Financial Accounts. Panoeconomicus 2013, 60, 249–290. [Google Scholar] [CrossRef]

- Panopoulou, M. Technological Change and Corporate Strategy in the Greek Banking Industry; Center of Planning and Economic Research: Athens, Greece, 2005. [Google Scholar]

- Rinaldi, L.; Sanchis-Arellano, A. Household Debt Sustainability, What Explains Household Non-Performing Loans? An Empirical Analysis; Working Paper Series 570; European Central Bank: Frankfurt, France, 2006. [Google Scholar]

- Bernanke, B.; Gertler, M. Agency Costs, Net Worth, and Business Fluctuations. Am. Econ. Rev. 1989, 79, 14–31. [Google Scholar]

- Bernanke, B.; Gertler, M.; Gilchrist, S. The Financial Accelerator in a Quantitative Business Cycle Framework; Working Paper No. 6455; NBER: Cambridge, MA, USA, 1998. [Google Scholar]

- Kiyotaki, N.; Moore, J. Credit chains. J. Political Econ. 1997, 105, 211–248. [Google Scholar] [CrossRef]

- Salas, V.; Saurina, J. Credit risk in two institutional regimes: Spanish commercial and savings banks. J. Financ. Serv. Res. 2002, 22, 203–224. Available online: https://link.springer.com/article/10.1023/A:1019781109676 (accessed on 17 May 2020). [CrossRef]

- Fernandez de Lis, S.; Martinez Pagés, J.; Saurina, J. Credit Growth, Problem Loans and Credit Risk Provisioning in Spain; Banco de Espana Working Paper 18; Bank of Spain: Madrid, Spain, 2000. [Google Scholar]

- Boudriga, A.; Taktak, N.; Jellouli, J. Bank Specific, Business and Institutional Environment Determinants of Nonperforming Loans: Evidence from MENA Countries. In Proceedings of the Economic Research Forum 16th Annual Conference, Cairo, Egypt, 9 January 2009. [Google Scholar]

- Espinoza, R.A.; Prasad, A. Nonperforming Loans in the GCC Banking System and Their Macroeconomic Effects; Working Paper WP/10/224; International Monetary Fund: Washington, DC, USA, 2010. [Google Scholar]

- Nkusu, M. Non-Performing Loans and Macrofinancial Vulnerabilities in Advanced Economies; WP/11/161, IMF Working Papers; IMF: Washington, DC, USA, 2011. [Google Scholar]

- Gonzales-Hermosillo, B. Developing indicators to provide early warnings of banking crises. Financ. Dev. 1999, 36, 36–39. [Google Scholar]

- Barseghyan, L. Non-performing loans, prospective bailouts, and Japan’s slowdown. J. Monet. Econ. 2010, 57, 873–890. [Google Scholar] [CrossRef]

- Zeng, S. Bank Non-Performing Loans (NPLS): A Dynamic Model and Analysis in China. Mod. Econ. 2012, 3, 100–110. [Google Scholar] [CrossRef]

- Babouček, I.; Jančar, M. Effects of Macroeconomic Shocks to the Quality of the Aggregate Loan Portfolio; Working Paper Series, No. 1; Czech National Bank: Praha, Czech, 2005. [Google Scholar]

- Hoggarth, G.; Logan, A.; Zicchino, L. Macro Stress Tests of UK Banks; BIS papers, No. 22; BIS: Basel, Switzerland, 2005. [Google Scholar]

- Louzis, D.P.; Vouldis, A.T.; Metaxas, V.L. Macroeconomic and bank-specific determinants of non-performing loans in Greece: A comparative study of mortgage, business and consumer loan portfolios. J. Bank. Financ. 2012, 36, 1012–1027. [Google Scholar] [CrossRef]

- Vogiazas, S.; Nikolaidou, E. Investigating the Determinants of Nonperforming Loans in the Romanian Banking System: An Empirical Study with Reference to the Greek Crisis. Econ. Res. Int. 2011, 2011, 1–13. [Google Scholar] [CrossRef]

- Ghosh, A. Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states. J. Financ. Stab. 2015, 20, 93–104. [Google Scholar] [CrossRef]

- Beck, R.; Jakubik, P.; Piloiu, A. Key Determinants of Non-performing Loans: New Evidence from a Global Sample. Open Econ. Rev. 2015, 26, 525–550. [Google Scholar] [CrossRef]

- Salas, V.; Saurina, J. Deregulation, market power and risk behaviour in Spanish banks. Eur. Econ. Rev. 2003, 47, 1061–1075. [Google Scholar] [CrossRef]

- Dvouletý, O. Effects of soft loans and credit guarantees on performance of supported firms: Evidence from the Czech Public Program START. Sustainability 2017, 9, 2293. [Google Scholar] [CrossRef]

- Gemar, P.; Gemar, G.; Guzman-Parra, V. Modeling the sustainability of bank profitability using partial least squares. Sustainability 2019, 11, 4950. [Google Scholar] [CrossRef]

- Bofondi, M.; Ropele, T. Macroeconomic Determinants of Bad Loans: Evidence from Italian Banks; Questioni di Economia e Finanza (Occasional Papers) No 89; Bank of Italy: Rome, Italy, 2011; Available online: https://www.bancaditalia.it/pubblicazioni/qef/2011_0089/index.html?com.dotmarketing.htmlpage.language=1 (accessed on 3 June 2020).

- Jiménez, G.; Salas, V.; Saurina, J. Determinants of collateral. J. Financ. Econ. 2006, 81, 255–281. [Google Scholar] [CrossRef]

- Saba, I.; Kouser, R.; Azeem, M. Determinants of Non-Performing Loans: Case of US Banking Sector. Rom. Econ. J. 2012, 15, 125–136. [Google Scholar]

- Bock, R.; Demyanets, A. Bank Asset Quality in Emerging Markets: Determinants and Spillovers; Working Paper 12/71; IMF: Washington, DC, USA, 2012; Available online: https://www.imf.org/~/media/Websites/IMF/imported-full-text-pdf/external/pubs/ft/wp/2012/_wp1271.ashx (accessed on 3 June 2020).

- Gerlach, S.; Peng, W.; Shu, C. Macroeconomic Conditions and Banking Performance in Hong Kong SAR: A Panel Data Study; BIS papers No. 22; Bank for International Settlements: Basel, Switzerland, 2005; Available online: https://www.bis.org/publ/bppdf/bispap22x.pdf (accessed on 3 June 2020).

- Klein, N. Non-Performing Loans in CESEE: Determinants and Impact on Macroeconomic Performance; IMF Working Paper (P/13/72); IMF European Department: Pairs, France, 2013; Available online: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Non-Performing-Loans-in-CESEE-Determinants-and-Impact-on-Macroeconomic-Performance-40413 (accessed on 17 May 2020).

- Abid, L.; Ouertani, M.N.; Zouari-Ghorbel, S. Macroeconomic and Bank-specific Determinants of Household’s Non-performing Loans in Tunisia: A Dynamic Panel Data. Procedia Econ. Financ. 2014, 13, 58–68. [Google Scholar] [CrossRef]

- Ginevičius, R. Determining market concentration. J. Bus. Econ. Manag. 2007, 8, 3–10. [Google Scholar] [CrossRef]

- Rehman, R.U.; Zhang, J.; Ahmad, M.I. Political system of a country and its non-performing loans: A case of emerging markets. Int. J. Bus. Perform. Manag. 2016, 17, 241. [Google Scholar] [CrossRef]

- Chaibi, H.; Ftiti, Z. Credit risk determinants: Evidence from a cross-country study. Res. Int. Bus. Financ. 2015, 33, 1–16. [Google Scholar] [CrossRef]

- Quagliariello, M. Banks’ riskiness over the business cycle: A panel analysis on Italian intermediaries. Appl. Financ. Econ. 2007, 17, 119–138. [Google Scholar] [CrossRef]

- Anastasiou, D.; Bragoudakis, Z.; Malandrakis, I. Non-Performing Loans, Governance Indicators and Systemic Liquidity Risk: Evidence from Greece. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- Vuslat, U. The Determinants of Nonperforming Loans before and After the Crisis: Challenges and Policy Implications for Turkish Banks. Emerg. Mark. Financ. Trade 2017, 54, 1–15. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Levine, R. Bank concentration, competition, and crises: First results. J. Bank. Financ. 2006, 30, 1581–1603. [Google Scholar] [CrossRef]

- Çifter, A. Bank concentration and non-performing loans in Central and Eastern European countries. J. Bus. Econ. Manag. 2015, 16, 117–137. [Google Scholar] [CrossRef]

- Ahn, S.J.; Lee, S.H. The Effect of Consumers’ Perceived Value on Acceptance of an Internet-Only Bank Service. Sustainability 2019, 11, 4599. [Google Scholar] [CrossRef]

- Cui, Y.; Geobey, S.; Weber, O.; Lin, H. The impact of green lending on credit risk in China. Sustainability 2018, 10, 2008. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Huizinga, H. Determinants of commercial bank interest margins and profitability: Some international evidence. World Bank Econ. Rev. 1999, 13, 379–408. [Google Scholar] [CrossRef]

- Berger, A.; DeYoung, R. Problem loans and cost efficiency in commercial banks. J. Bank. Financ. 1997, 21, 849–870. Available online: https://www.sciencedirect.com/science/article/pii/S0378426697000034 (accessed on 18 June 2020). [CrossRef]

- Tesfaye, T. Determinants of Banks Liquidity and Their Impact on Financial Performance: Empirical Study on Commercial Banks in Ethiopia. Ph.D. Thesis, Addis Ababa University, Addis Ababa, Ethiopia, 2012. [Google Scholar]

- Erdinc, D.; Abazi, E. The Determinants of NPLs in Emerging Europe, 2000–2011. J. Econ. Political Econ. 2014, 1, 112–125. [Google Scholar]

- Boyd, J.; Levine, R.; Smith, B. The impact of inflation on financial market performance. J. Monet. Econ. 2001, 47, 221–248. [Google Scholar] [CrossRef]

- Farhan, M.; Sattar, A.; Chaudhry, A.; Khalil, F. Economic Determinants of Non-Performing Loans: Perception of Pakistani Bankers. Eur. J. Bus. Manag. 2012, 4, 87–99. [Google Scholar]

- Popa, I.D.; Cepoia, C.O.; Anghela, D.G. Liquidity-threshold effect in non-performing loans. Financ. Res. Lett. 2018, 27, 124–128. [Google Scholar] [CrossRef]

- Makri, V.; Tsagkanos, A.; Bellas, A. Determinants of non-Performing loans: The case of eurozone. Panoeconomicus 2014, 2, 193–206. [Google Scholar] [CrossRef]

- Messai, A.; Jouini, F. Micro and macro determinants of non-performing loans. Int. J. Econ. Financ. Issues 2013, 3, 852–860. [Google Scholar]

- Skarica, B. Determinants of non-performing loans in Central and Eastern European countries. Financ. Theory Pract. 2014, 38, 37–59. [Google Scholar] [CrossRef]

- Anastasiou, D.; Louri, H.; Tsionas, M. Determinants of non-performing loans: Evidence from Euro-area countries. Financ. Res. Lett. 2016, 18, 116–119. [Google Scholar]

- Charalambakis, E.; Dendramis, Y.; Tzavalis, E. On the Determinants of NPLs: Lessons from Greece; Working Paper; Bank of Greece: Athens, Greece, 2017; ISSN 1109-6691. [Google Scholar]

- Donath, L.; Cerna, V.; Oprea, I. Macroeconomic determinants of bad loans in Baltic countries and Romania. SEA Pract. Appl. Sci. 2014, 4, 71–80. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).