Detection of Financial Inclusion Vulnerable Rural Areas through an Access to Cash Index: Solutions Based on the Pharmacy Network and a CBDC. Evidence Based on Ávila (Spain)

Abstract

1. Introduction

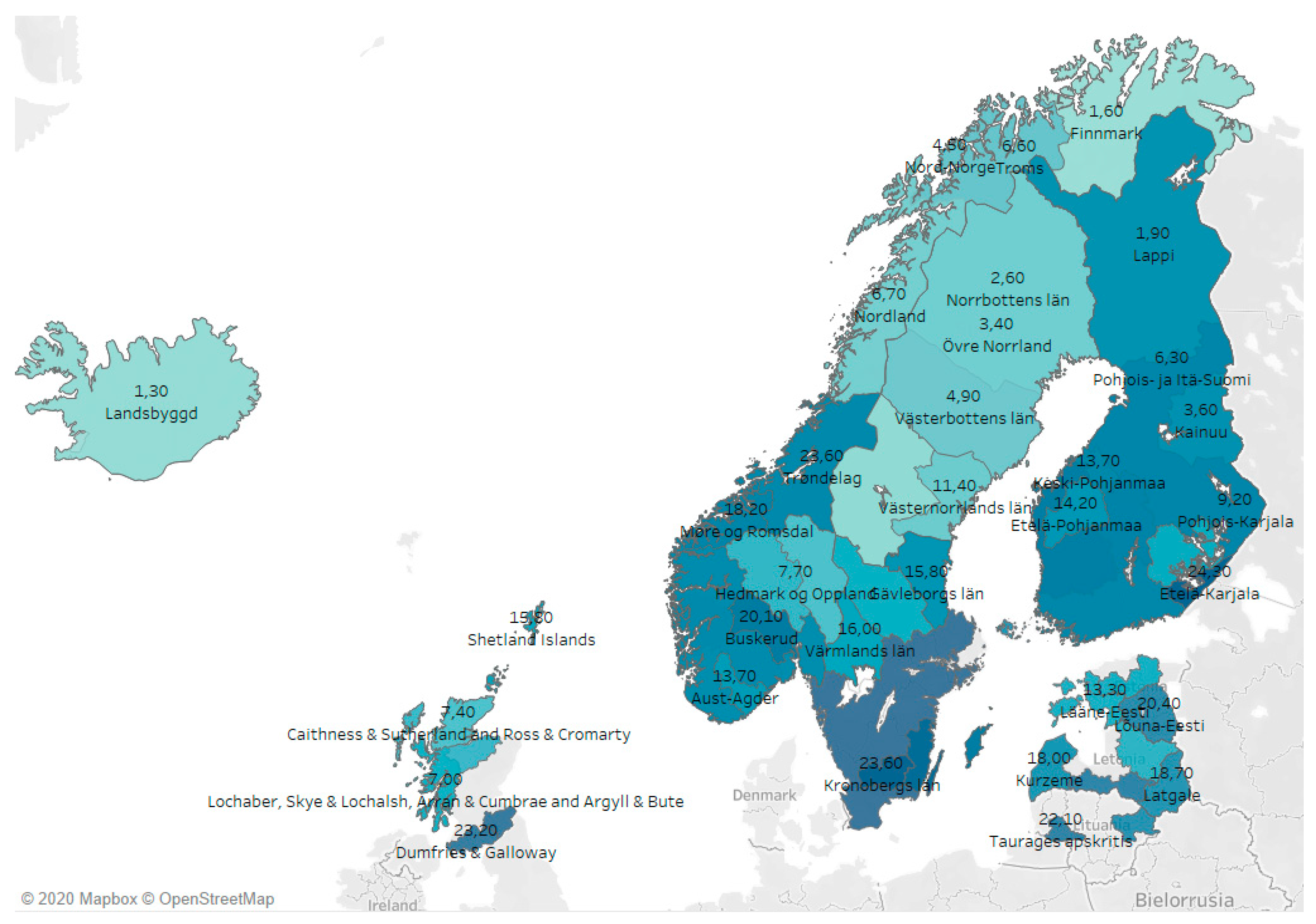

2. Advantages and Disadvantages Derived from the Elimination of Cash

3. Financial Inclusion and Use of Cash

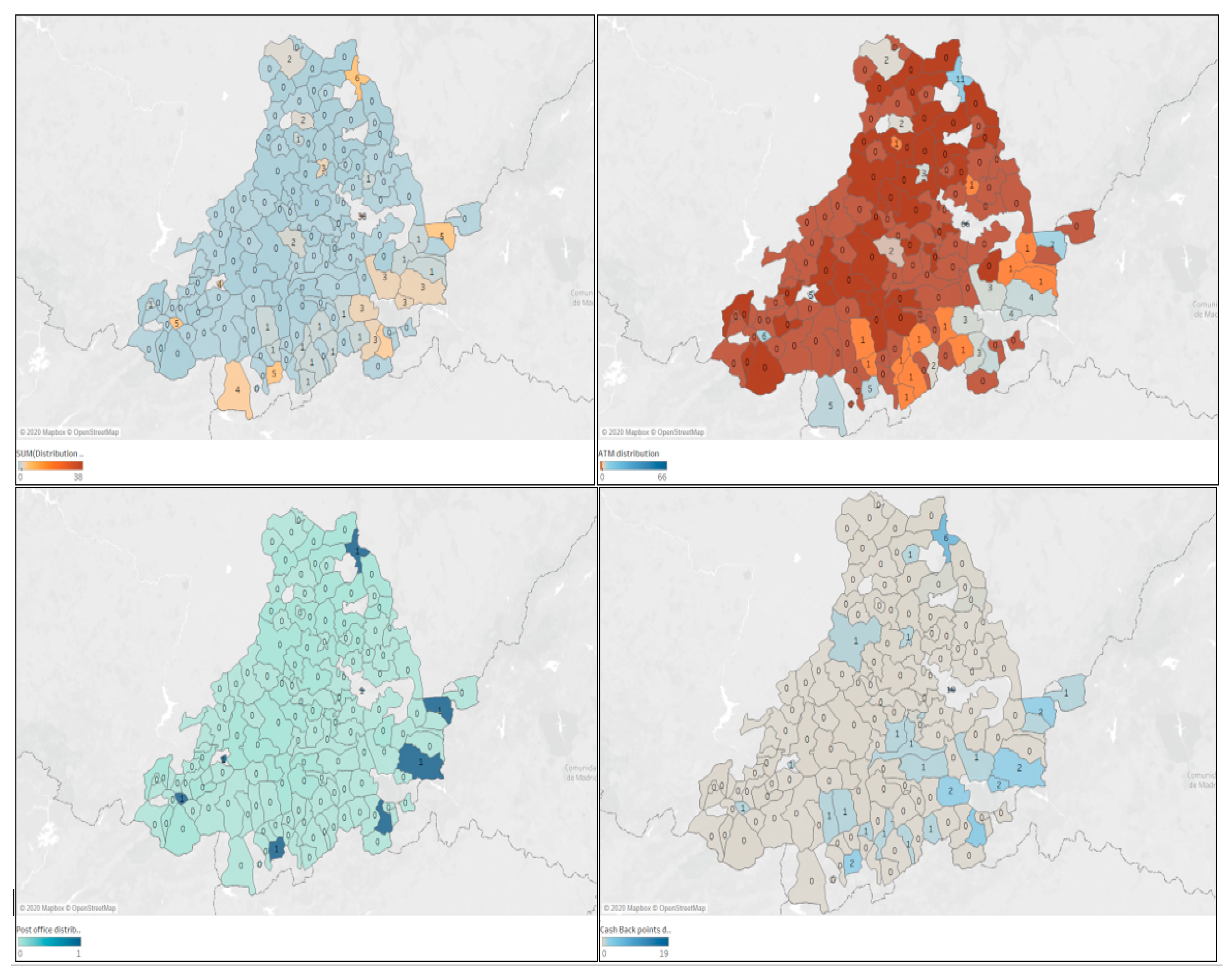

Methodology: Detection of Vulnerable Areas of Access to Cash

- All information related to banking services in the province of Ávila was analyzed and collected. This included bank offices, savings banks (this figure does not exist in the studies of the authors cited above), and ATMs that dispense cash. In this case, no distinction was made between free ATMs or fee-charging ATMs, and there was no penalty in the index, as other authors have included, when considering fee-charging ATMs (The reason for the non-differentiation was the following: In the Spanish banking system, clients of a bank can withdraw cash at ATMs of another bank or savings bank of which they are not clients with or without a commission, provided that the financial entity is part of the same means of payment system (for example, EURO 6000 or System 4B). However, if certain amounts are exceeded in the cash withdrawal (60, 80, or 100 euros), the client who withdraws money from a bank/savings bank of which he is not a client does not bear the commission. The cash withdrawal fee is borne by the customer’s bank/cashier, and if it exceeds the previous figures, the fee is not passed on to the customer. This is the reason why the withdrawal of cash is “free” or without commission or cost). Postal mail offices were also taken into account, since they provide banking services to citizens, and, additionally, businesses that offer “cashback” services were included, although, it should be noted that this is not a mode that is widely used in Spain, unlike in Anglo-Saxon areas of the world. The appendix presents tables with the data collected for each of the categories (see Table A1).

- Once all these data were collated, we proceeded to reflect them on a map. The territorial extension features the municipal term, which is the center of the population. This can be seen in the next section of results analysis.

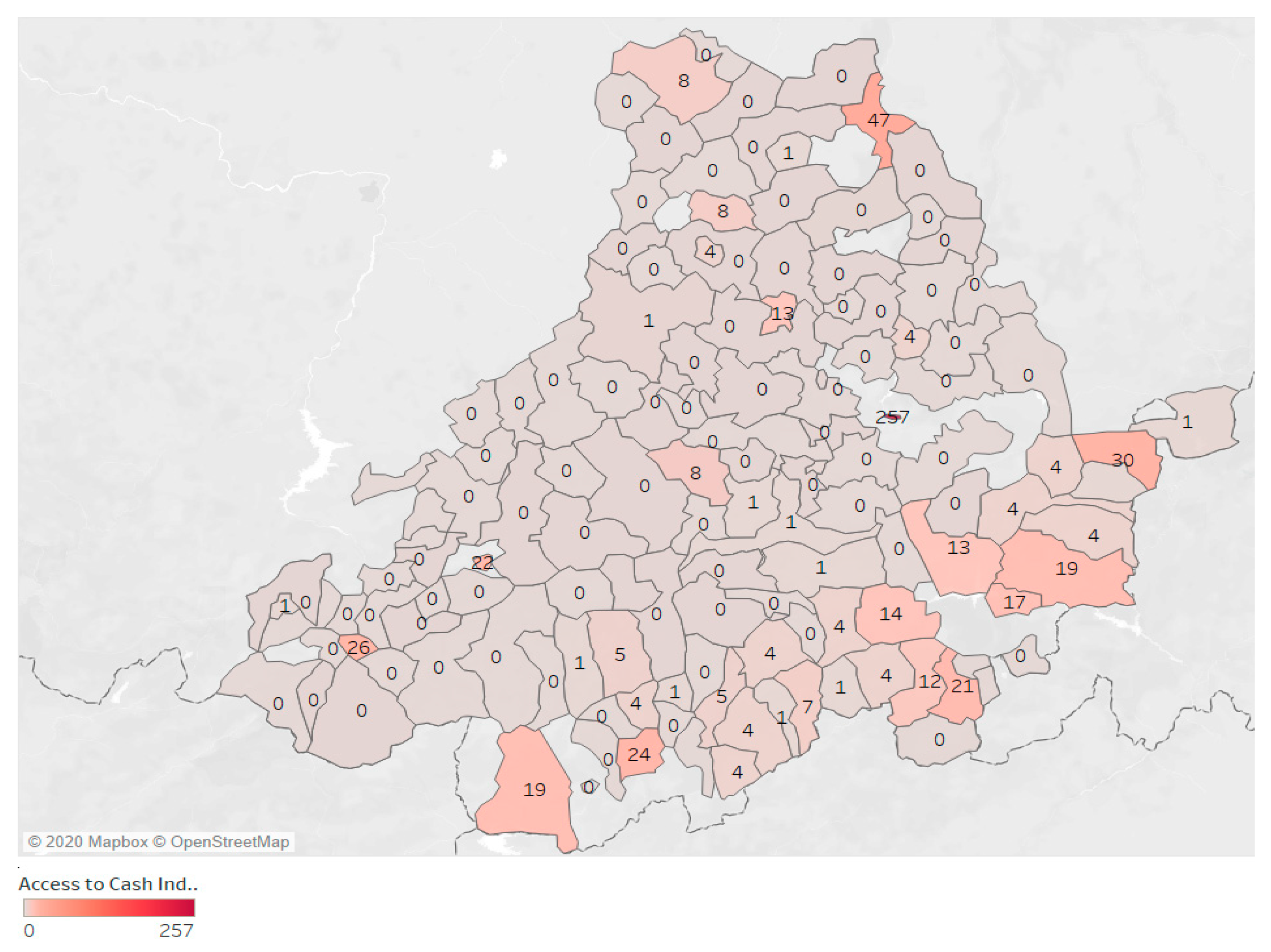

- Calculation of the access to cash index was carried out. Once the number of bank branches, ATMs, post offices, or cashback points found in each municipal term were quantified, we could calculate an index of access to cash in each of the municipalities in the province of Ávila.

4. Data Collection and Analysis

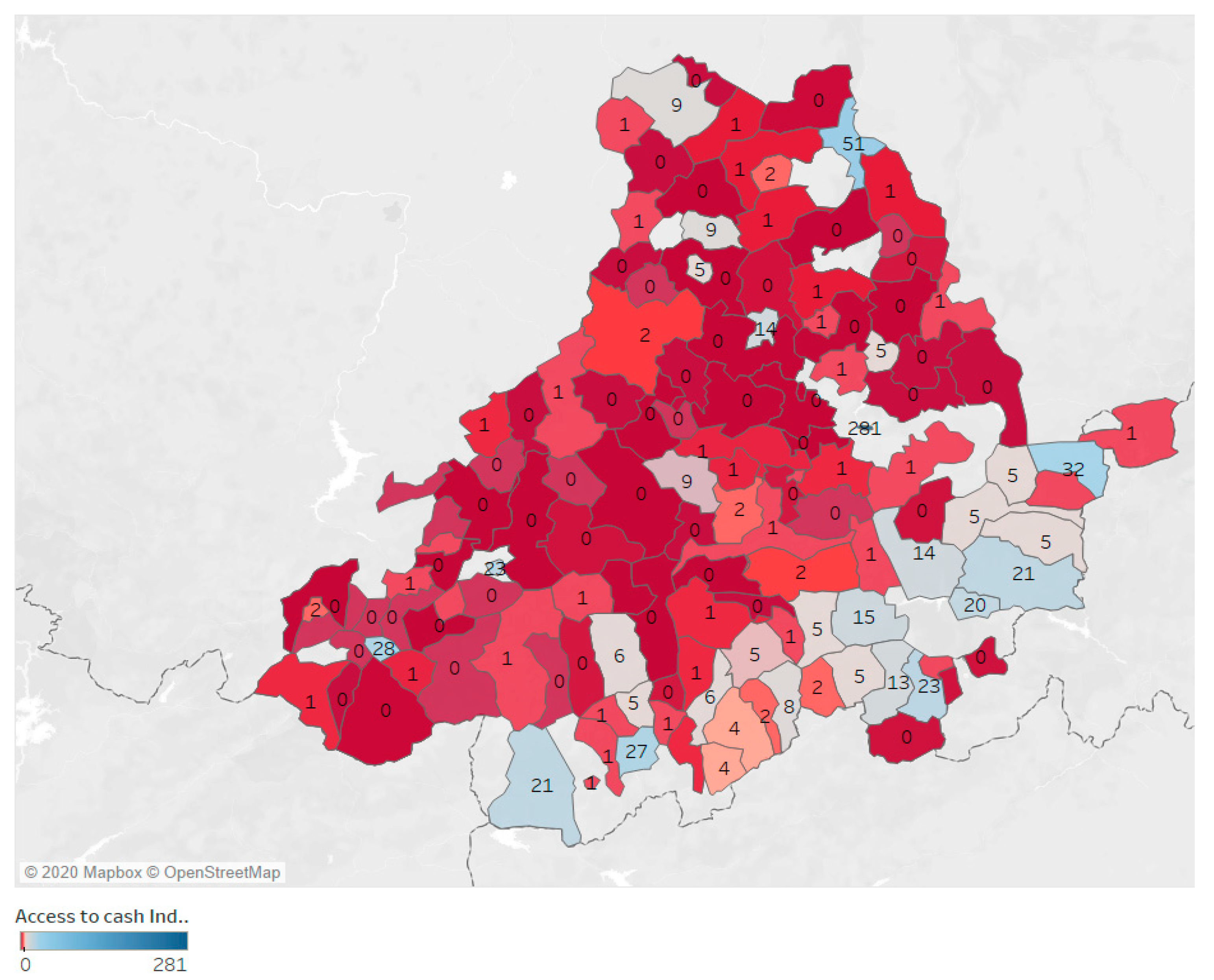

4.1. Cash Access Maps

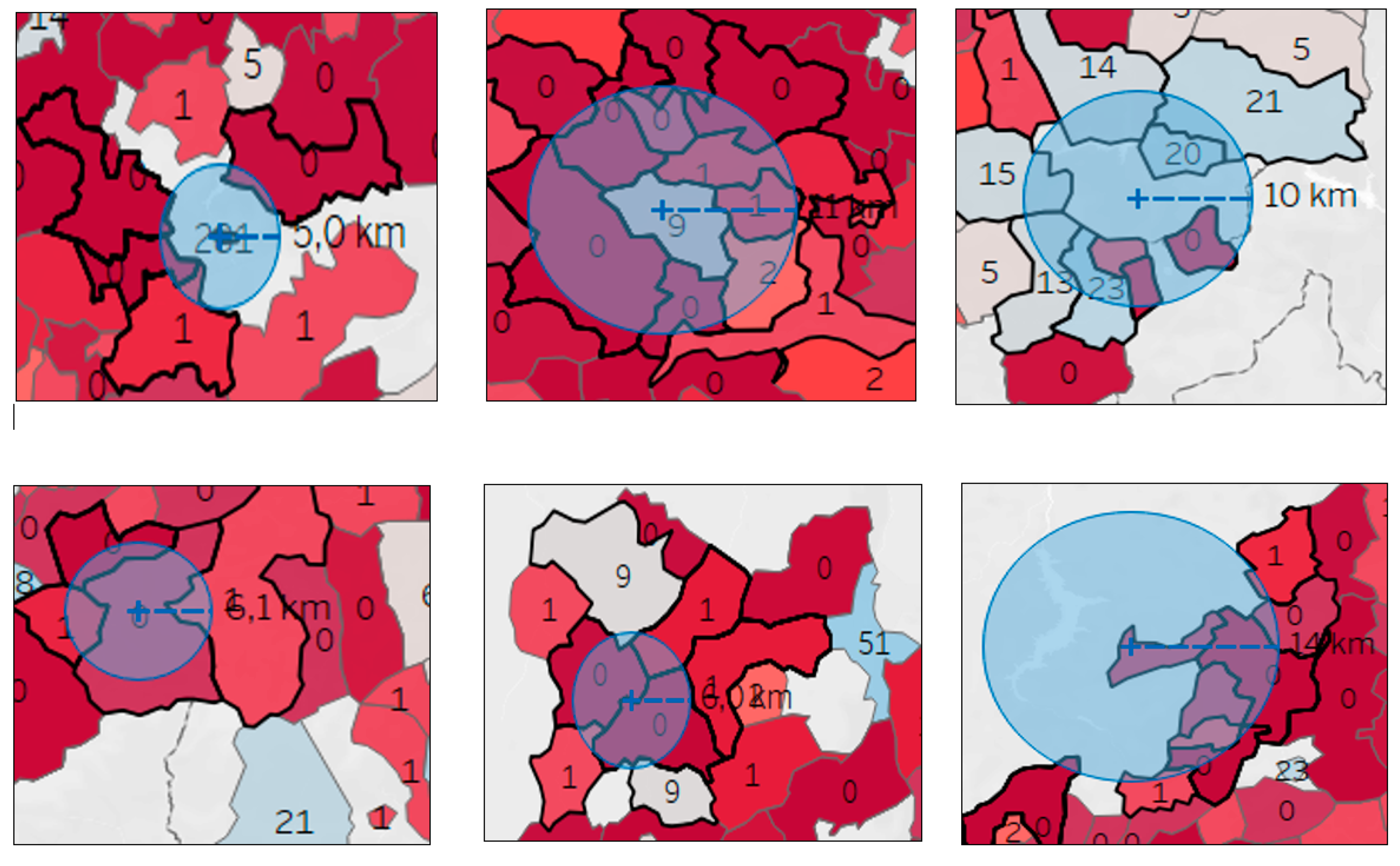

4.2. Access to Cash Index and the Detection of Vulnerable Areas

5. Proposal for Sustainable Solutions to Increase the Access to Cash Index in Vulnerable Areas

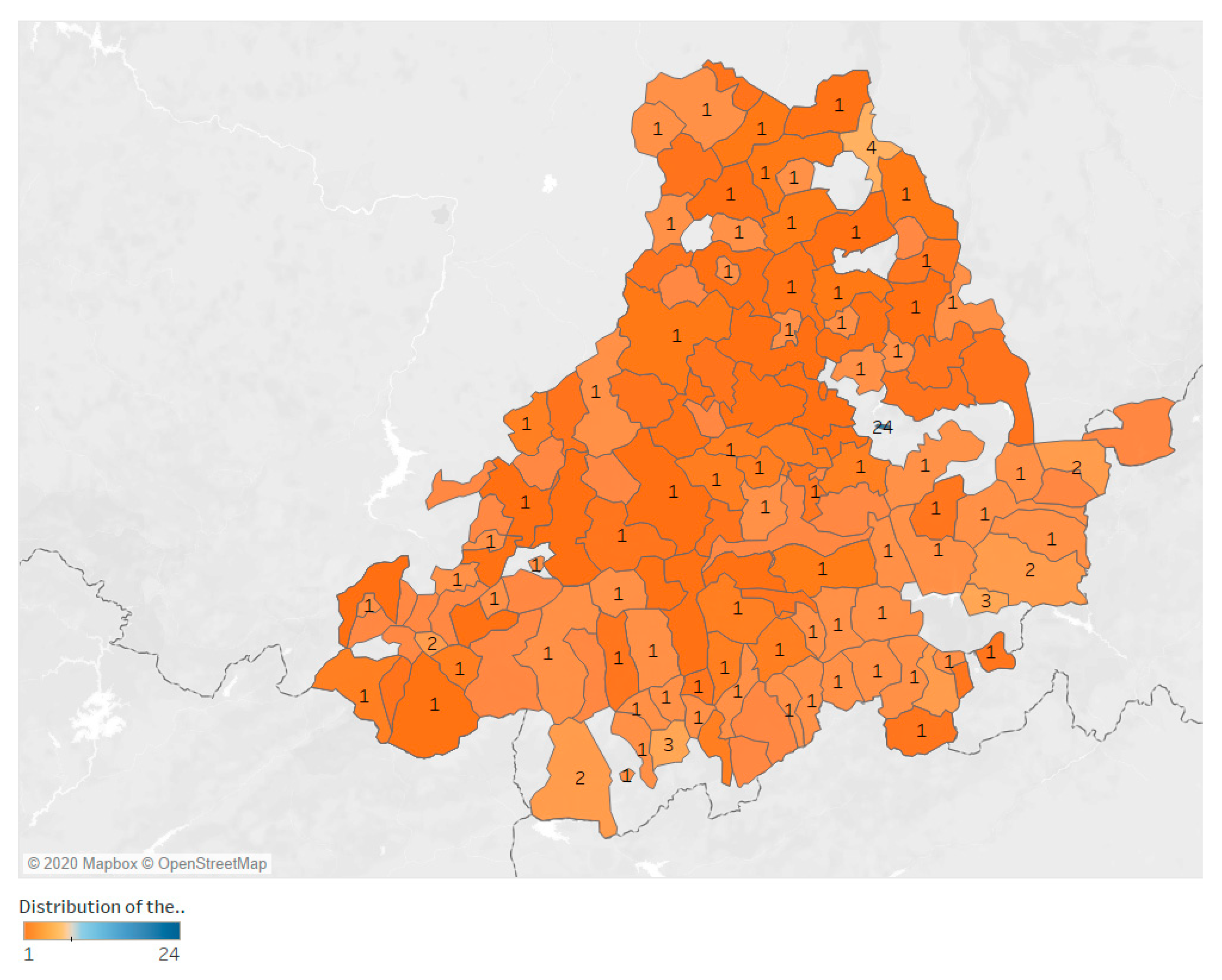

- In the short term, we recommend using the Spanish pharmacy network to provide access points for cash, given the extensive presence of the network in the territory.

- In the medium- to long-term, we recommend the possible implementation of a virtual currency backed by the Central Bank that is present on users’ mobile phones, with which they can make payments using digital cash (Like the Chinese virtual currency (CBDC) that is already operating in tests).

5.1. Expansion of Cashback Points through the Pharmacy Network

5.2. Implementation of a CBDC to Increase Access to Cash

6. Discussion of Results

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Municipality | Bank Branches | Post Offices | ATMs | Cash Back | Access Cash Index | Pharmacies | Access Cash Index (Pharmacies) |

|---|---|---|---|---|---|---|---|

| Adanero | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| La Adrada | 3 | 0 | 3 | 0 | 12 | 1 | 13 |

| Albornos | 0 | 0 | 0 | 0 | 0 | 0 | |

| Aldeanueva de Santa Cruz | 0 | 0 | 0 | 0 | 0 | 0 | |

| Aldeaseca | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| La Aldehuela | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Amavida | 0 | 0 | 0 | 0 | 0 | 0 | |

| El Arenal | 1 | 0 | 1 | 0 | 4 | 1 | 5 |

| Arenas de San Pedro | 5 | 1 | 5 | 2 | 24 | 3 | 27 |

| Arevalillo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Arévalo | 6 | 1 | 11 | 6 | 47 | 4 | 51 |

| Aveinte | 0 | 0 | 0 | 0 | 0 | 0 | |

| Avellaneda | 0 | 0 | 0 | 0 | 0 | 0 | |

| Ávila | 38 | 1 | 66 | 19 | 257 | 24 | 281 |

| El Barco de Ávila | 5 | 1 | 6 | 1 | 26 | 2 | 28 |

| El Barraco | 3 | 0 | 3 | 1 | 13 | 1 | 14 |

| Barromán | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Becedas | 1 | 0 | 0 | 0 | 1 | 1 | 2 |

| Becedillas | 0 | 0 | 0 | 0 | 0 | 0 | |

| Bercial de Zapardiel | 0 | 0 | 0 | 0 | 0 | 0 | |

| Las Berlanas | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Bernuy-Zapardiel | 0 | 0 | 0 | 0 | 0 | 0 | |

| Berrocalejo de Aragona | 0 | 0 | 0 | 0 | 0 | 0 | |

| Blascomillán | 0 | 0 | 0 | 0 | 0 | 0 | |

| Blasconuño de Matacabras | 0 | 0 | 0 | 0 | 0 | 0 | |

| Blascosancho | 0 | 0 | 0 | 0 | 0 | 0 | |

| El Bohodón | 0 | 0 | 0 | 0 | 0 | 0 | |

| Bohoyo | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Bonilla de la Sierra | 0 | 0 | 0 | 0 | 0 | 0 | |

| Brabos | 0 | 0 | 0 | 0 | 0 | 0 | |

| Bularros | 0 | 0 | 0 | 0 | 0 | 0 | |

| Burgohondo | 1 | 0 | 1 | 0 | 4 | 1 | 5 |

| Cabezas de Alambre | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Cabezas del Pozo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Cabezas del Villar | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Cabizuela | 0 | 0 | 0 | 0 | 0 | 0 | |

| Canales | 0 | 0 | 0 | 0 | 0 | 0 | |

| Candeleda | 4 | 0 | 5 | 0 | 19 | 2 | 21 |

| Cantiveros | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Cardeñosa | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| La Carrera | 0 | 0 | 0 | 0 | 0 | 0 | |

| Casas del Puerto | 0 | 0 | 0 | 0 | 0 | 0 | |

| Casasola | 0 | 0 | 0 | 0 | 0 | 0 | |

| Casavieja | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Casillas | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Castellanos de Zapardiel | 0 | 0 | 0 | 0 | 0 | 0 | |

| Cebreros | 3 | 1 | 4 | 2 | 19 | 2 | 21 |

| Cepeda la Mora | 0 | 0 | 0 | 0 | 0 | 0 | |

| Cillán | 0 | 0 | 0 | 0 | 0 | 0 | |

| Cisla | 0 | 0 | 0 | 0 | 0 | 0 | |

| La Colilla | 0 | 0 | 0 | 0 | 0 | 0 | |

| Collado de Contreras | 0 | 0 | 0 | 0 | 0 | 0 | |

| Collado del Mirón | 0 | 0 | 0 | 0 | 0 | 0 | |

| Constanzana | 0 | 0 | 0 | 0 | 0 | 0 | |

| Crespos | 1 | 0 | 1 | 0 | 4 | 1 | 5 |

| Cuevas del Valle | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Chamartín | 0 | 0 | 0 | 0 | 0 | 0 | |

| Diego del Carpio | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Donjimeno | 0 | 0 | 0 | 0 | 0 | 0 | |

| Donvidas | 0 | 0 | 0 | 0 | 0 | 0 | |

| Espinosa de los Caballeros | 0 | 0 | 0 | 0 | 0 | 0 | |

| Flores de Ávila | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Fontiveros | 2 | 0 | 2 | 0 | 8 | 1 | 9 |

| Fresnedilla | 0 | 0 | 0 | 0 | 0 | 0 | |

| El Fresno | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Fuente el Saúz | 0 | 0 | 0 | 0 | 0 | 0 | |

| Fuentes de Año | 0 | 0 | 0 | 0 | 0 | 0 | |

| Gallegos de Altamiros | 0 | 0 | 0 | 0 | 0 | 0 | |

| Gallegos de Sobrinos | 0 | 0 | 0 | 0 | 0 | 0 | |

| Garganta del Villar | 0 | 0 | 0 | 0 | 0 | 0 | |

| Gavilanes | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Gemuño | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Gil García | 0 | 0 | 0 | 0 | 0 | 0 | |

| Gilbuena | 0 | 0 | 0 | 0 | 0 | 0 | |

| Gimialcón | 0 | 0 | 0 | 0 | 0 | 0 | |

| Gotarrendura | 0 | 0 | 0 | 0 | 0 | 0 | |

| Grandes y San Martín | 0 | 0 | 0 | 0 | 0 | 0 | |

| Guisando | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Gutierre-Muñoz | 0 | 0 | 0 | 0 | 0 | 0 | |

| Hernansancho | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Herradón de Pinares | 0 | 0 | 0 | 0 | 0 | 0 | |

| Herreros de Suso | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Higuera de las Dueñas | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| La Hija de Dios | 0 | 0 | 0 | 0 | 0 | 0 | |

| La Horcajada | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Horcajo de las Torres | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| El Hornillo | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| El Hoyo de Pinares | 1 | 0 | 1 | 0 | 4 | 1 | 5 |

| Hoyocasero | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Hoyorredondo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Hoyos de Miguel Muñoz | 0 | 0 | 0 | 0 | 0 | 0 | |

| Hoyos del Collado | 0 | 0 | 0 | 0 | 0 | 0 | |

| Hoyos del Espino | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Hurtumpascual | 0 | 0 | 0 | 0 | 0 | 0 | |

| Junciana | 0 | 0 | 0 | 0 | 0 | 0 | |

| Langa | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Lanzahíta | 1 | 0 | 1 | 0 | 4 | 4 | |

| El Losar del Barco | 0 | 0 | 0 | 0 | 0 | 0 | |

| Los Llanos de Tormes | 0 | 0 | 0 | 0 | 0 | 0 | |

| Madrigal de las Altas Torres | 2 | 0 | 2 | 0 | 8 | 1 | 9 |

| Maello | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Malpartida de Corneja | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Mamblas | 0 | 0 | 0 | 0 | 0 | 0 | |

| Mancera de Arriba | 0 | 0 | 0 | 0 | 0 | 0 | |

| Manjabálago | 0 | 0 | 0 | 0 | 0 | 0 | |

| Marlín | 0 | 0 | 0 | 0 | 0 | 0 | |

| Martiherrero | 0 | 0 | 0 | 0 | 0 | 0 | |

| Martínez | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Mediana de Voltoya | 0 | 0 | 0 | 0 | 0 | 0 | |

| Medinilla | 0 | 0 | 0 | 0 | 0 | 0 | |

| Mengamuñoz | 0 | 0 | 0 | 0 | 0 | 0 | |

| Mesegar de Corneja | 0 | 0 | 0 | 0 | 0 | 0 | |

| Mijares | 1 | 0 | 2 | 0 | 7 | 1 | 8 |

| Mingorría | 1 | 0 | 1 | 0 | 4 | 1 | 5 |

| El Mirón | 0 | 0 | 0 | 0 | 0 | 0 | |

| Mironcillo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Mirueña de los Infanzones | 0 | 0 | 0 | 0 | 0 | 0 | |

| Mombeltrán | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Monsalupe | 0 | 0 | 0 | 0 | 0 | 0 | |

| Moraleja de Matacabras | 0 | 0 | 0 | 0 | 0 | 0 | |

| Muñana | 2 | 0 | 2 | 0 | 8 | 1 | 9 |

| Muñico | 0 | 0 | 0 | 0 | 0 | 0 | |

| Muñogalindo | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Muñogrande | 0 | 0 | 0 | 0 | 0 | 0 | |

| Muñomer del Peco | 0 | 0 | 0 | 0 | 0 | 0 | |

| Muñopepe | 0 | 0 | 0 | 0 | 0 | 0 | |

| Muñosancho | 0 | 0 | 0 | 0 | 0 | 0 | |

| Muñotello | 0 | 0 | 0 | 0 | 0 | 0 | |

| Narrillos del Álamo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Narrillos del Rebollar | 0 | 0 | 0 | 0 | 0 | 0 | |

| Narros de Saldueña | 0 | 0 | 0 | 0 | 0 | 0 | |

| Narros del Castillo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Narros del Puerto | 0 | 0 | 0 | 0 | 0 | 0 | |

| Nava de Arévalo | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Nava del Barco | 0 | 0 | 0 | 0 | 0 | 0 | |

| Navacepedilla de Corneja | 0 | 0 | 0 | 0 | 0 | 0 | |

| Navadijos | 0 | 0 | 0 | 0 | 0 | 0 | |

| Navaescurial | 0 | 0 | 0 | 0 | 0 | 0 | |

| Navahondilla | 0 | 0 | 0 | 0 | 0 | 0 | |

| Navalacruz | 0 | 0 | 0 | 0 | 0 | 0 | |

| Navalmoral de la Sierra | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Navalonguilla | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Navalosa | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Navalperal de Pinares | 1 | 0 | 1 | 0 | 4 | 1 | 5 |

| Navalperal de Tormes | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Navaluenga | 3 | 0 | 3 | 2 | 14 | 1 | 15 |

| Navaquesera | 0 | 0 | 0 | 0 | 0 | 0 | |

| Navarredonda de Gredos | 1 | 0 | 1 | 1 | 5 | 1 | 6 |

| Navarredondilla | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Navarrevisca | 1 | 0 | 1 | 0 | 4 | 1 | 5 |

| Las Navas del Marqués | 5 | 1 | 7 | 2 | 30 | 2 | 32 |

| Navatalgordo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Navatejares | 0 | 0 | 0 | 0 | 0 | 0 | |

| Neila de San Miguel | 0 | 0 | 0 | 0 | 0 | 0 | |

| Niharra | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Ojos-Albos | 0 | 0 | 0 | 0 | 0 | 0 | |

| Orbita | 0 | 0 | 0 | 0 | 0 | 0 | |

| El Oso | 0 | 0 | 0 | 0 | 0 | 0 | |

| Padiernos | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Pajares de Adaja | 0 | 0 | 0 | 0 | 0 | 0 | |

| Palacios de Goda | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Papatrigo | 1 | 0 | 0 | 0 | 1 | 1 | 2 |

| El Parral | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pascualcobo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pedro Bernardo | 1 | 0 | 1 | 0 | 4 | 4 | |

| Pedro-Rodríguez | 0 | 0 | 0 | 0 | 0 | 0 | |

| Peguerinos | 0 | 0 | 0 | 1 | 1 | 1 | |

| Peñalba de Ávila | 0 | 0 | 0 | 0 | 0 | 0 | |

| Piedrahíta | 4 | 1 | 5 | 1 | 22 | 1 | 23 |

| Piedralaves | 1 | 0 | 1 | 0 | 4 | 1 | 5 |

| Poveda | 0 | 0 | 0 | 0 | 0 | 0 | |

| Poyales del Hoyo | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Pozanco | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pradosegar | 0 | 0 | 0 | 0 | 0 | 0 | |

| Puerto Castilla | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Rasueros | 0 | 0 | 0 | 0 | 0 | 0 | |

| Riocabado | 0 | 0 | 0 | 0 | 0 | 0 | |

| Riofrío | 0 | 0 | 0 | 0 | 0 | 0 | |

| Rivilla de Barajas | 0 | 0 | 0 | 0 | 0 | 0 | |

| Salobral | 0 | 0 | 0 | 0 | 0 | 0 | |

| Salvadiós | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Bartolomé de Béjar | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Bartolomé de Corneja | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Bartolomé de Pinares | 1 | 0 | 1 | 0 | 4 | 1 | 5 |

| San Esteban de los Patos | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Esteban de Zapardiel | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Esteban del Valle | 1 | 0 | 1 | 1 | 5 | 1 | 6 |

| San García de Ingelmos | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Juan de Gredos | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Juan de la Encinilla | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Juan de la Nava | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| San Juan del Molinillo | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Juan del Olmo | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Lorenzo de Tormes | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Martín de la Vega del Alberche | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| San Martín del Pimpollar | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Miguel de Corneja | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Miguel de Serrezuela | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Pascual | 0 | 0 | 0 | 0 | 0 | 0 | |

| San Pedro del Arroyo | 3 | 0 | 3 | 1 | 13 | 1 | 14 |

| San Vicente de Arévalo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Sanchidrián | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Sanchorreja | 0 | 0 | 0 | 0 | 0 | 0 | |

| Santa Cruz de Pinares | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Santa Cruz del Valle | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Santa María de los Caballeros | 0 | 0 | 0 | 0 | 0 | 0 | |

| Santa María del Arroyo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Santa María del Berrocal | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Santa María del Cubillo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Santa María del Tiétar | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Santiago del Collado | 0 | 0 | 0 | 0 | 0 | 0 | |

| Santiago de Tormes | 0 | 0 | 0 | 0 | 0 | 0 | |

| Santo Domingo de las Posadas | 0 | 0 | 0 | 0 | 0 | 0 | |

| Santo Tomé de Zabarcos | 0 | 0 | 0 | 0 | 0 | 0 | |

| La Serrada | 0 | 0 | 0 | 0 | 0 | 0 | |

| Serranillos | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Sigeres | 0 | 0 | 0 | 0 | 0 | 0 | |

| Sinlabajos | 0 | 0 | 0 | 0 | 0 | 0 | |

| Solana de Ávila | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Solana de Rioalmar | 0 | 0 | 0 | 0 | 0 | 0 | |

| Solosancho | 0 | 0 | 0 | 1 | 1 | 1 | 2 |

| Sotalbo | 0 | 0 | 0 | 1 | 1 | 1 | |

| Sotillo de la Adrada | 4 | 1 | 4 | 3 | 21 | 2 | 23 |

| El Tiemblo | 3 | 0 | 4 | 2 | 17 | 3 | 20 |

| Tiñosillos | 1 | 0 | 0 | 1 | 2 | 1 | 3 |

| Tolbaños | 0 | 0 | 0 | 0 | 0 | 0 | |

| Tormellas | 0 | 0 | 0 | 0 | 0 | 0 | |

| Tornadizos de Ávila | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| La Torre | 0 | 0 | 0 | 0 | 0 | 0 | |

| Tórtoles | 0 | 0 | 0 | 0 | 0 | 0 | |

| Umbrías | 0 | 0 | 0 | 0 | 0 | 0 | |

| Vadillo de la Sierra | 0 | 0 | 0 | 0 | 0 | 0 | |

| Valdecasa | 0 | 0 | 0 | 0 | 0 | 0 | |

| Vega de Santa María | 0 | 0 | 0 | 0 | 0 | 0 | |

| Velayos | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Villaflor | 0 | 0 | 0 | 0 | 0 | 0 | |

| Villafranca de la Sierra | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Villanueva de Ávila | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Villanueva de Gómez | 0 | 0 | 0 | 0 | 0 | 0 | |

| Villanueva del Aceral | 0 | 0 | 0 | 0 | 0 | 0 | |

| Villanueva del Campillo | 0 | 0 | 0 | 0 | 0 | 0 | |

| Villar de Corneja | 0 | 0 | 0 | 0 | 0 | 0 | |

| Villarejo del Valle | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Villatoro | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Viñegra de Moraña | 0 | 0 | 0 | 0 | 0 | 0 | |

| Vita | 0 | 0 | 0 | 0 | 0 | 0 | |

| Zapardiel de la Cañada | 0 | 0 | 0 | 0 | 0 | 0 | |

| Zapardiel de la Ribera | 0 | 0 | 0 | 0 | 0 | 0 |

| Age | Frequency | Percentage | Valid Percentage | Accumulated Percentage |

|---|---|---|---|---|

| <18 | 8 | 1.6 | 1.6 | 1.6 |

| >65 | 16 | 3.1 | 3.1 | 4.7 |

| 18–24 | 68 | 13.3 | 13.3 | 18 |

| 25–34 | 174 | 3. 4 | 3. 4 | 52 |

| 35–44 | 114 | 22.3 | 22.3 | 74.2 |

| 45–54 | 60 | 11.7 | 11.7 | 85.9 |

| 55–64 | 72 | 14.1 | 14.1 | 100 |

| Total | 512 | 100 | 100 |

| Sex | Frequency | Percentage | Valid Percentage | Accumulated Percentage |

|---|---|---|---|---|

| Man | 226 | 44.1 | 44.1 | 44.1 |

| Woman | 284 | 55.5 | 55.5 | 99.6 |

| I prefer not to say | 2 | 0.4 | 0.4 | 100 |

| Total | 512 | 100 | 100 |

| Training Level (Studies) | Frequency | Percentage | Valid Percentage | Accumulated Percentage |

|---|---|---|---|---|

| Do not know, no answer | 8 | 1.6 | 1.6 | 1.6 |

| Primary | 10 | 2 | 2 | 3.5 |

| High school | 80 | 15.6 | 15.6 | 19.1 |

| No studies | 2 | 0.4 | 0.4 | 19.5 |

| University | 412 | 80.4 | 80.4 | 100 |

| Total | 512 | 100 | 100 |

| Current Main Occupation | Frequency | Percentage | Valid Percentage | Accumulated Percentage |

|---|---|---|---|---|

| Self-worker | 26 | 5.1 | 5.1 | 5.1 |

| Unemployed | 32 | 6.3 | 6.3 | 11.3 |

| Student | 66 | 12.9 | 12.9 | 24.2 |

| Retired | 22 | 4.3 | 4.3 | 28.5 |

| Do not know, no answer | 4 | 0.8 | 0.8 | 29.3 |

| Others | 22 | 4.3 | 4.3 | 33.6 |

| Active worker | 340 | 66.4 | 66.4 | 100 |

| Total | 512 | 100 | 100 |

| Income of the Family Unit | Frequency | Percentage | Valid Percentage | Accumulated Percentage |

|---|---|---|---|---|

| <€14,000 | 88 | 17.2 | 17.2 | 17.2 |

| €14,000,001-25,000 | 4 | 0.8 | 0.8 | 18 |

| €25,000.001-€ 35,000 | 166 | 32.4 | 32.4 | 50.4 |

| € 35,000.001-€ 50,000 | 104 | 20.3 | 20.3 | 70.7 |

| €50,000.001-€ 100,000 | 98 | 19.1 | 19.1 | 89.8 |

| >€100,000 | 52 | 10.2 | 10.2 | 100 |

| Total | 512 | 100 | 100 |

| Size of the Municipality of Residence | Frequency | Percentage | Valid Percentage | Accumulated Percentage |

|---|---|---|---|---|

| <1000 | 34 | 6.6 | 6.6 | 6.6 |

| 1000–10,000 | 36 | 7 | 7 | 13.7 |

| 10,000.1–50,000 | 112 | 21.9 | 21.9 | 35.5 |

| 50,000.1–100,000 | 330 | 64.5 | 64.5 | 100 |

| Total | 512 | 100 | 100 |

| Do you Know What a Virtual Currency Is? | Frequency | Percentage | Valid Percentage | Accumulated Percentage |

|---|---|---|---|---|

| No, I don’t know what a digital currency is. | 172 | 33.6 | 33.6 | 33.6 |

| Yes, I know what a digital currency is. | 340 | 66.4 | 66.4 | 100 |

| Total | 512 | 100 | 100 |

| If the European Central Bank Launched a Virtual Currency: | Frequency | Percentage | Valid Percentage | Accumulated Percentage |

|---|---|---|---|---|

| I would reduce the use of traditional cash | 220 | 43 | 43 | 43 |

| I would continue to use traditional cash (coins and bills) | 128 | 25 | 25 | 68 |

| I would substitute traditional cash for digital cash | 164 | 32 | 32 | 100 |

| Total | 512 | 100 | 100 |

| Age | Sex | Training Level (Studies) | Current Main Occupation | Income of the Family Unit | Size of the Municipality of Residence | |

|---|---|---|---|---|---|---|

| Variance | 1859 | 0.260 | 0.216 | 1448 | 1574 | 1357 |

| Skewness | 0.421 | −0.077 | −2066 | 1910 | 0.363 | −0.511 |

| Standard error of skewness | 0.131 | 0.131 | 0.131 | 0.131 | 0.131 | 0.131 |

| Kurtosis | −0.546 | −1676 | 7086 | 3217 | −0.678 | 0.526 |

| Kurtosis standard error | 0.261 | 0.261 | 0.261 | 0.261 | 0.261 | 0.261 |

References

- BOE-Boletín Oficial del Estado. Diario de sesión del Congreso de los Diputados de España, del día 24 de abril de 2020. 2020. Available online: http://www.congreso.es/public_oficiales/L14/CONG/BOCG/D/BOCG-14-D-73.PDF (accessed on 2 June 2020).

- BOE-Boletín Oficial del Estado. Tratado de Funcionamiento de la Unión Europea. 2020. Available online: https://www.boe.es/doue/2010/083/Z00047-00199.pdf (accessed on 2 June 2020).

- European Parliament. Financial Exclusion in Rural Areas. 2020. Available online: https://www.europarl.europa.eu/doceo/document/E-8-2017-005311_ES.html (accessed on 8 August 2020).

- Instituto Valenciano de Investigaciones Económicas. La Población Sin Acceso a Una Sucursal Bancaria en Su Municipio Aumenta un 34% Desde 2008. 2020. Available online: https://www.ivie.es/es_ES/la-poblacion-sin-acceso-una-sucursal-bancaria-municipio-aumenta-34-desde-2008/ (accessed on 3 July 2020).

- Eurostat. Population Density by NUTS 3 Region: Spain. 2020. Available online: https://ec.europa.eu/eurostat/web/products-datasets/-/demo_r_d3dens (accessed on 8 August 2020).

- Eurostat. Population Density by NUTS 3 Region: Europe. 2020. Available online: https://appsso.eurostat.ec.europa.eu (accessed on 8 August 2020).

- Sarma, M. Index of Financial Inclusion—A measure of financial sector inclusiveness. In Centre for International Trade and Development, School of International Studies Working Paper; Jawaharlal Nehru University: Delhi, India, 2012. [Google Scholar]

- Citibank. Outstanding Leaders in Financial Inclusion: Ecuador. 2020. Available online: https://seepnetwork.org/files/galleries/1433_SPANISH-FINAL-RFR-compressed.pdf (accessed on 8 August 2020).

- Solo, T.M. Financial exclusion in Latin America—or the social costs of not banking the urban poor. Environ. Urban 2008, 20, 47–66. [Google Scholar] [CrossRef]

- Le, T.H.; Chuc, A.T.; Taghizadeh-Hesary, F. Financial inclusion and its impact on financial efficiency and sustainability: Empirical evidence from Asia. Borsa Istanb. Rev. 2019, 19, 310–322. [Google Scholar] [CrossRef]

- Yin, X.; Xu, X.; Chen, Q.; Peng, J. The Sustainable Development of Financial Inclusion: How Can Monetary Policy and Economic Fundamental Interact with It Effectively? Sustainability 2019, 11, 2524. [Google Scholar] [CrossRef]

- World Bank. Inclusión Financiera Es Un Factor Clave Para Reducir la Pobreza e Impulsar la Prosperidad. 2020. Available online: https://www.bancomundial.org/es/topic/financialinclusion/overview (accessed on 1 July 2020).

- United Nations. La Guía de los Vagos Para Salvar el Mundo. 2020. Available online: https://www.un.org/sustainabledevelopment/es/takeaction/ (accessed on 3 June 2020).

- Martin-Oliver, A. Financial exclusion and branch closures in Spain after the Great Recession. Reg. Stud. 2019, 53, 562–573. [Google Scholar] [CrossRef]

- Akhalumeh, P.; Ohiokha, F. Nigeria’s cashless economy: The imperatives. Int. J. Manag. Bus. Stud. 2012, 22, 31–36. [Google Scholar]

- Storti, C.C.; De Grauwe, P. 13 Monetary policy in a cashless society. In Technology and Finance: Challenges for Financial Markets, Business Strategies and Policy Makers; Routledge: London, UK, 2003; Volume 17, p. 250. [Google Scholar]

- Warwick, D.R. Toward a cashless society. Futurist 2004, 38, 38–42. [Google Scholar]

- Garcia-Swartz, D.; Hahn, R.; Layne-Farrar, A. The Move Toward a Cashless Society: Calculating the Costs and Benefits. Rev. Netw. Econ. 2006, 5. [Google Scholar] [CrossRef][Green Version]

- Papadopoulos, G. Electronic Money and the Possibility of a Cashless Society. SSRN Electron. J. 2007. [Google Scholar] [CrossRef]

- Khan, J.; Craig-Lees, M. “Cashless” Transactions: Perceptions of Money in Mobile Payments. Int. Bus. Econ. Rev. 2009, 1. [Google Scholar]

- Lorenz, W. Moving Away from Cash. Card Technol. Today 2009, 21, 12–14. [Google Scholar] [CrossRef]

- Bonhage, B. Eurocheque: Creating a ‘Common Currency’ European Infrastructure for the Cashless Mass Payments System. In Materializing Europe; Badenoch, A., Fickers, A., Eds.; Palgrave Macmillan: London, UK, 2010. [Google Scholar]

- Parihar, M. ‘Cashless Society’—A Financial ‘Paradigm Shift’ Through Social Networking. SSRN Electron. J. 2011. [Google Scholar] [CrossRef]

- Alawiye-Adams, A. Evaluating the systemic transition to a cashless economy in Nigeria. SSRN Electron. J. 2012. [Google Scholar] [CrossRef]

- Akinola, O.S. Cashless society, problems and prospects, data mining research potentials. Int. J. Comput. Sci. Telecommun. 2012, 3, 49–55. [Google Scholar]

- Feige, E. The Myth of the Cashless Society: How Much of America’s Currency Is Overseas? The Usage, Costs and Benefits of Cash: Theory and Evidence from Macro and Micro Data; MPRA Paper No. 42169; Deutsche Bundesbank, Eurosystem: Munich, Germany, 2012. [Google Scholar]

- Hasan, I.; De Renzis, T.; Schmiedel, H. Retail Payments and Economic Growth. SSRN Electron. J. 2012, 1–37. [Google Scholar] [CrossRef]

- Ezuwore-Obodoekwe, C.N.; Eyisi, A.S.; Emengini, S.E.; Chukwubuzo, A.F. A Critical Analysis of Cashless Banking Policy in Nigeria. IOSR J. Bus. Manag. 2014, 16, 30–42. [Google Scholar] [CrossRef]

- Krüger, M.; Seitz, F. Costs and Benefits of Cash and Cashless Payment Instruments: Overview and Initial Estimates; Deutsche Bundesbank: Frankfurt, Germany, 2014. [Google Scholar]

- McLeay, M.; Radia, A.; Thomas, R. El Dinero En La Economía Moderna: Una Introducción. Rev. Econ. Inst. 2015, 17, 333. [Google Scholar] [CrossRef]

- Tee, H.; Ong, H. Cashless Payment and Economic Growth. Financ. Innov. 2016, 2, 16. [Google Scholar] [CrossRef]

- Engert, W.; Fung, B.; Hendry, S. Is a Cashless Society Problematic? Staff DiscussionPaper/Document d’analysedu personnel2018-12; Bank of Canada: Ottawa, ON, Canada, 2018. [Google Scholar]

- Masciandaro, D.; Cillo, A.; Borgonovo, E.; Caselli, S.; Rabitti, G. Cryptocurrencies, Central Bank Digital Cash, Traditional Money: Does Privacy Matter? SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Fabris, N. Cashless Society—The Future of Money or a Utopia? J. Cent. Bank. Theory Pract. 2019, 8, 53–66. [Google Scholar] [CrossRef]

- Arvidsson, N. The Future of Cash in Sweden. In Building a Cashless Society; Springer: Berlin/Heidelberg, Germany, 2019; pp. 75–84. [Google Scholar] [CrossRef]

- Gómez-Fernández, N.; Albert, J. ¿Es la Eurozona un área óptima para suprimir el efectivo? Un análisis sobre la inclusión financiera y el uso de efectivo. Cuad. Econ. 2019, 43. [Google Scholar] [CrossRef]

- European Central Bank. Dictamen Sobre las Limitaciones a los Pagos en Efectivo, en Respuesta a la Solicitud del Banco de España, en Nombre de la Secretaría de Estado de Hacienda; European Central Bank: Frankfurt, France, 2019; p. 1. [Google Scholar]

- Náñez Alonso, S. Activities and Operations with Cryptocurrencies and Their Taxation Implications: The Spanish Case. Laws 2019, 8, 16. [Google Scholar] [CrossRef]

- Goh, Y.Y.; Leong, S.H.; Pang, M.W.; Yew, S.K.; Yow, Z.L. The Effects of Cashless Payments on Corruption. Bachelor’s Thesis, Universiti Tunku Abdul Rahmanutar, Kampar, Malaysia, April 2019. [Google Scholar]

- Náñez Alonso, S.; Echarte Fernández, M.; Sanz Bas, D.; Kaczmarek, J. Reasons Fostering or Discouraging The Implementation Of Central Bank-Backed Digital Currency: A Review. Economies 2020, 8, 41. [Google Scholar] [CrossRef]

- Bank for International Settlements. BIS Annual Economic Report, 24 June 2020; Werner Druck & Medien AG: Basel, Switzerland, 2020. [Google Scholar]

- Humbani, M.; Wiese, M. A cashless society for all: Determining consumers’ readiness to adopt mobile payment services. J. Afr. Bus. 2018, 19, 409–429. [Google Scholar] [CrossRef]

- Immordino, G.; Russo, F.F. Cashless payments and tax evasion. Eur. J. Political Econ. 2018, 55, 36–43. [Google Scholar] [CrossRef]

- Cohen, N.; Rubinchik, A.; Shami, L. Towards a cashless economy: Economic and socio-political implications. Eur. J. Political Econ. 2020, 61, 101820. [Google Scholar] [CrossRef]

- Lombardi, M. Italy: A Cashless Society? 2018. Available online: http://tesi.luiss.it/21905/1/204071_LOMBARDI_MARIO_ITALY%20CASHLESS%20SOCIETY_%20.pdf (accessed on 24 August 2020).

- World Bank. How to Measure Financial Inclusion. 2020. Available online: https://www.worldbank.org/en/topic/financialinclusion/brief/how-to-measure-financial-inclusion (accessed on 15 June 2020).

- World Bank. Global Findex. 2020. Available online: https://globalfindex.worldbank.org/ (accessed on 15 June 2020).

- International Monetary Fund. Financial Access Survey 2019. 2020. Available online: https://data.imf.org/?sk=E5DCAB7E-A5CA-4892-A6EA-598B5463A34C (accessed on 15 June 2020).

- Végső, T. Comparative Analysis of the Changes in Cash Demand in Hungary. Financ. Econ. Rev. 2020, 19, 90–118. [Google Scholar] [CrossRef]

- Chaveesuk, S.; Vanitchatchavan, P.; Wutthirong, P.; Nakwari, P.; Jaikua, M.; Chaiyasoonthorn, W. The Acceptance Model toward Cashless Society in Thailand. In Proceedings of the 9th International Conference on Information Communication and Management, Prague, Czech Republic, 23–26 August 2019; pp. 190–195. [Google Scholar]

- Athique, A. A Great Leap of Faith: The Cashless Agenda in Digital India. New Media Soc. 2019, 21, 1697–1713. [Google Scholar] [CrossRef]

- Hastomo, A.; Aras, M. Influence of Cashless Society Socialization toward Trust Transaction Culture in Jakarta, Indonesia. Humaniora 2018, 9, 1–13. [Google Scholar] [CrossRef]

- Kadar, H.H.B.; Sameon, S.S.B.; Din, M.B.M.; Rafee, P.A.B.A. Malaysia towards Cashless Society. In International Symposium of Information and Internet Technology; Springer: Cham, Germany, 2018; pp. 34–42. [Google Scholar]

- Gas, S. Mobile Money, Cashless Society and Financial Inclusion: Case Study on Somalia and Kenya. SSRN Electron. J. 2017. [Google Scholar] [CrossRef]

- Moon, W. A Coinless Society as a Bridge to a Cashless Society: A Korean Experiment. In Cash in East Asia; Springer: Berlin/Heidelberg, Germany, 2017; pp. 101–105. [Google Scholar] [CrossRef]

- Omotoso, K.; Muyiwa, A. Prospects of Nigeria’s ICT infrastructure for e-commerce and cashless economy. Br. J. Econ. Manag. Trade 2016, 13, 1–10. [Google Scholar] [CrossRef]

- Burikoko, T. Mapping Mobile Money in Rwanda: The Mvisa Project. In Proceedings of the International Conference “InterCarto/InterGIS”, Braunschweig, Germany, 10–14 March 1997; Volume 1, p. 145. [Google Scholar] [CrossRef][Green Version]

- Evans, J.; Tischer, D.; Davies, S. Geographies of Access to Cash: Identifying Vulnerable Communities in a Case Study of South Wales; Personal Finance Research Centre (PFRC), University of Bristol: Bristol, UK, 2020. [Google Scholar]

- Tischer, D.; Evans, J.; Davies, S. Mapping the Availability of Cash a Case Study of Bristol’s Financial Infrastructure; Personal Finance Research Centre (PFRC), University of Bristol: Bristol, UK, 2019. [Google Scholar]

- Delaney, L.; O’Hara, A.; Finlay, R.; Reserve Bank of Australia. Cash Withdrawal Symptoms. 2019. Available online: https://www.rba.gov.au/publications/bulletin/2019/jun/pdf/cash-withdrawal-symptoms.pdf (accessed on 24 August 2020).

- Swedish Government. ‘Secured Access to Cash’, Media Release. 16 April 2020. Available online: https://www.riksbank.se/en-gb/payments--cash/the-riksbanks-task-in-relation-to-payments/secure-access-to-cash---report-from-the-riksbank-committee/ (accessed on 24 August 2020).

- Cadete de Matos, J.; D’Aguiar, L. Assessing Financial Inclusion in Portugal from the Central Bank’s Perspective. In Proceedings of the Bank of Morocco—CEMLA—IFC Satellite Seminar at the ISI World Statistics Congress on “Financial Inclusion”, Marrakech, Morocco, 14 July 2017; Available online: https://www.bis.org/ifc/publ/ifcb47a.pdf (accessed on 24 August 2020).

- Community Access to Cash Pilots. 2020. Available online: https://communityaccesstocashpilots.org/ (accessed on 24 August 2020).

- Ceeney, N. UK Finance Responds to the Launch of the Community Access to Cash Pilots Initiative, UK Finance. 2020. Available online: https://www.ukfinance.org.uk/press/press-releases/uk-finance-responds-launch-community-access-cash-pilots-initiative (accessed on 24 August 2020).

- Lowman, J. Association of Convenience Stores Welcomes New Community Access to Cash Initiative. 2020. Available online: https://www.acs.org.uk/news/acs-welcomes-new-community-access-cash-initiative (accessed on 24 August 2020).

- Vana, P.; Lambrecht, A.; Bertini, M. Cashback Is Cash Forward: Delaying a Discount to Entice Future Spending. J. Mark. Res. 2018, 55, 852–868. [Google Scholar] [CrossRef]

- Datta, S.K.; Singh, K. Variation and determinants of financial inclusion and their association with human development: A cross-country analysis. IIMB Manag. Rev. 2019, 31, 336–349. [Google Scholar] [CrossRef]

- Consulting, C. Acta Sanitaria: España Cuenta Con la Red de Farmacias Comunitarias Más Grande de Europa. 2020. Available online: https://www.actasanitaria.com/espana-cuenta-con-la-red-de-farmacias-comunitarias-mas-grande-de-europa/ (accessed on 15 June 2020).

- Jorge, J.; Chivite, M.P.; Salinas, F. La transformación digital en el sector cooperativo agroalimentario español: Situación y perspectivas. CIRIEC España Rev. Econ. Pública Soc. Coop. 2019, 95, 39–70. [Google Scholar] [CrossRef]

- Jorge Vázquez, J. La economía colaborativa en la era digital: Fundamentación teórica y alcance económico. In Economía Digital y Colaborativa: Cuestiones Económicas y Jurídicas; Náñez, S.L., Ed.; Università degli Studì Suor Orsola Benincasa: Naples, Italy, 2019. [Google Scholar]

- Sánchez Cano, J. El Bitcoin y Su Demanda Exponencial de Energía. Panor. Econ. 2019, 14, 85. [Google Scholar] [CrossRef]

- Dolader-Retamal, C.; Bel-Roig, J.; Muñoz-Tapia, J.L. La Blockchain: Fundamentos, Aplicaciones y Relación Con Otras Tecnologías Disruptivas. Econ. Ind. 2017, 405, 33–40. [Google Scholar]

- Slattery, T. Taking a Bit Out of Crime: Bitcoin and Cross-Border Tax Evasion. Brooklyn J. Int. Law 2014, 39, 829. [Google Scholar]

- Campbell-Verduyn, M. Bitcoin, Crypto-Coins, and Global Anti-Money Laundering Governance. Crime Law Soc. Chang. 2018, 69, 283–305. [Google Scholar] [CrossRef]

- Diez de los Rios, A.; Zhu, Y. CBDC and Monetary Sovereignty, No 2020-5; Staff Analytical Notes from Bank of Canada; Bank of Canada: Ottawa, ON, Canada, 2020.

- Schuh, S.; Stavins, J. Why are (Some) Consumers (Finally) Writing Fewer Checks? The Role of Payment Characteristics. SSRN Electron. J. 2009, 34, 1745–1758. [Google Scholar] [CrossRef][Green Version]

- Arango, C.; Huynh, K.; Sabetti, L. How Do You Pay? The Role of Incentives at the Point-of-Sale; Bank of Canada Working Paper 2011-23; Bank of Canada: Ottawa, ON, Canada, 2011. [Google Scholar]

- Von Kalckreuth, U.; Schmidt, T.; Stix, H. Choosing and Using Payment Instruments: Evidence from German Microdata. Empir. Econ. 2013, 46, 1019–1055. [Google Scholar] [CrossRef]

- Wang, X.; He, G. Digital Financial Inclusion and Farmers’ Vulnerability to Poverty: Evidence from Rural China. Sustainability 2020, 12, 1668. [Google Scholar] [CrossRef]

- Náñez Alonso, S.L. The Tax Incentives in the IVTM and “Eco-Friendly Cars”: The Spanish Case. Sustainability 2020, 12, 3398. [Google Scholar] [CrossRef]

- Náñez Alonso, S.L.; Reier Forradellas, R. Tax Incentives in Rural Environment as Economic Policy and Population Fixation. Case study of Castilla-León Region. In Business, Economics and Science Common Challenges; Bernat, T., Duda, J., Eds.; Filodiritto Editore: Bologna, Italy, 2020; pp. 205–210. [Google Scholar] [CrossRef]

- Engert, W.; Fung, B. A Uniform Currency in a Cashless Economy; Staff Analytical Note/Note Analytique du Personnel—2020-7; Bank of Canada: Ottawa, ON, Canada, 2020; p. 5.

| Advantages of Eliminating Cash | Disadvantages of Eliminating Cash |

|---|---|

| Greater ease of the central bank to apply monetary policy. | Absolute dependence on electronic means for payments: network outages, power outages etc. |

| Higher collection of the state, when “transactions” from the underground economy emerge. | Increase in inequality I: Exclusion of unprofitable clients for financial institutions. |

| Crime reduction: Money laundering crimes, tax evasion and other illegal activities such as drug or arms trafficking. | Increase in inequality II: Difficulty in making transactions on the part of the elderly, people with disabilities, poor people with problems accessing bank accounts, etc. |

| Technological innovation: new means of payment and official virtual currencies. | Privacy problems: access to data and customer transactions when everything is registered. |

| Greater physical security for businesses, avoiding robberies since they do not have cash on their premises. | Security problems: Hacking and theft of customer data. |

| Cost savings in issuing banknotes and coins. | Financial instability problems. |

| Study | Country | Year | Author/s | Results/Conclusions |

|---|---|---|---|---|

| Comparative Analysis of the Changes in Cash Demand in Hungary. | Hungary | 2020 | [49] | The realistic goal for Hungary should primarily be to decelerate the expansion, as experiences show that a nominal decrease in cash volume requires the long-term and concurrent existence of several factors. |

| ¿Es la Eurozona un área óptima para suprimir el efectivo? Un análisis sobre la inclusión financiera y el uso de efectivo. | Eurozone | 2019 | [36] | Possible proposals that advocate the total elimination of cash in the Eurozone should be carried out gradually and with strong public support for sectors of the population with lower levels of income and education. |

| The Acceptance Model toward Cashless Society in Thailand. | Thailand | 2019 | [50] | The acceptance of the cashless society in Thailand is high, and the industry is encouraged to try to continue in this direction. |

| Building a Cashless Society: The Swedish Route to the Future of Cash Payments | Sweden | 2019 | [35] | consumers […] are seemingly more interested in using electronic services than cash. The laws and the system governing cash handling stimulate a reduction of cash. Demographics: Young people prefer electronic payments vs. elderly, who have a higher tendency to use cash. The alternatives to cash that are likely to become more attractive for consumers. |

| A great leap of faith: The cashless agenda in Digital India | India | 2019 | [51] | The author shows concern about the rapid expansion of electronic money and the effects it can have on society, beyond the economic analysis of inclusion and use. |

| Influence of Cashless Society Socialization toward Trust Transaction Culture in Jakarta, Indonesia | Indonesia | 2018 | [52] | People in Jakarta will not be too significant to trust the non-cash transaction system. It can be found that the heterogeneous Jakarta community with educational, occupational, and social levels is the factor determining the use of cash or not. |

| Malaysia Towards Cashless Society. | Malaysia | 2018 | [53] | Consumers these days trust more on the cashless transaction. A cashless society, with all its benefits and drawbacks, is undeniably maturing in Malaysia. |

| Mobile money, cashless society and financial inclusion: case study on Somalia and Kenya. | Somalia and Kenya | 2017 | [54] | The dissimilarity in the infrastructure, regulation, economic, social structure and political conditions can have great impact on the success and failure of the Mobile Money services. The success of mobile money operator means many unbanked people is reached, poor people get new financial service options and therefore their life will get better. |

| A Coinless Society as a Bridge to a Cashless Society: A Korean Experiment. In Cash in East Asia | South Korea-east Asia | 2017 | [55] | Korea is well equipped with cashless payments. Korea has a high potential to realize not only a coinless society but also a cashless society. |

| Prospects of Nigeria’s ICT Infrastructure for E-Commerce and Cashless Economy. | Nigeria | 2016 | [56] | Cashless policy needs to be fully implemented while public-private sectors collaboration and partnership should be strengthened especially at the national level. Education should be inculcated in the school curriculum right from the primary education to the tertiary institutions in order to increase the knowledge base and develop human capacity of the economy. |

| Mapping mobile money in Rwanda: The Mvisa project. | Rwanda | 2016 | [57] | The goal of mVISA is to meet the needs of underserved and unbanked Rwandans by providing relevant, affordable and accessible financial services. It will allow clients to easily access their bank’s account via their phone and encourage non- account holders mainly rural folks to become bankable. The general public needs to know where to find an mVisa agent who can pay real cash withdrawn or transferred from remote accounts. |

| Infrastructure that Allows Access to Cash | Score by Type of Infrastructure Present in the Municipality | Explanation of the Awarded Score |

|---|---|---|

| Bank Branches/Savings bank | 1 | Opening hours limit, they only deliver cash to clients of the bank or cashier, generally with time limits for this type of operations, in some cases with cost per operation of cash and not to any client. |

| ATM | 3 | Available 24 h, available to anyone, not just customers. No cost (withdrawal fee) for clients. When you are not a customer of that entity, but you withdraw a certain amount in cash or more, the cash withdrawal operation is free (without commission). |

| Post Office | 2 | Opening hours limit. They operate with many entities. |

| Cash Back Point | 1 | Opening hours limit. It involves making a purchase in the business. |

| Number of Bank Branches | Number of Municipalities and Bank Branches | % of Municipalities (with Bank Branches) |

|---|---|---|

| 0 branches | 214 | 86.3 |

| 1 branch | 17 | 6.9 |

| 2 branches | 3 | 1.2 |

| 3 branches | 5 | 2.0 |

| 4 branches | 6 | 2.4 |

| 5 branches | 3 | 1.2 |

| More than 5 branches | 2 | 0.8 |

| Number of ATMs | Number of Municipalities and ATMs | % of Municipalities (ATMs) |

|---|---|---|

| 0 ATMs | 217 | 87.5 |

| 1 ATM | 13 | 5.2 |

| 2 ATMs | 4 | 1.6 |

| 3 ATMs | 4 | 1.6 |

| 4 ATMs | 3 | 1.2 |

| 5 ATMs | 3 | 1.2 |

| More than 5 ATMs | 4 | 1.6 |

| Number of Post Offices | Number of Municipalities and Post Offices | % of Municipalities (Post Offices) |

|---|---|---|

| 0 offices | 240 | 96.8 |

| 1 or more offices | 8 | 3.2 |

| Number of Points with Cash Back | Number of Municipalities and Cash Back Points | % of Municipalities (Cash Back) |

|---|---|---|

| 0 cashback points | 221 | 89.1 |

| 1 cashback point | 19 | 7.7 |

| 2 cashback points | 4 | 1.6 |

| 3 cashback points | 1 | 0.4 |

| 4 cashback points | 0 | 0.0 |

| 5 cashback points | 0 | 0.0 |

| More than 5 cashback points | 2 | 0.8 |

| Pharmacy | Number of Municipalities and Pharmacies | % of Municipalities (Pharmacies) |

|---|---|---|

| 0 pharmacies | 156 | 62.9 |

| 1 pharmacy | 83 | 33.5 |

| 2 pharmacies | 5 | 2.0 |

| 3 or more pharmacies | 4 | 1.6 |

| 1. Do you Know What a Virtual Currency Is? | Frequency | Percentage |

|---|---|---|

| No, I don’t know what a digital currency is. | 172 | 33.6 |

| Yes, I know what a digital currency is. | 340 | 66.4 |

| 2. If the European Central Bank launched a virtual currency, would you continue to use traditional cash, would you reduce it use in favor of digital or would you replace traditional cash with digital? | Frequency | Percentage |

| I Would reduce the use of traditional cash | 220 | 43 |

| I would continue to use traditional cash (coins and bills) | 128 | 25 |

| I would substitute traditional cash for digital cash | 164 | 32 |

| Total | 512 | 100 |

| Sex | Age | Training Level (Studies) | ||||||

|---|---|---|---|---|---|---|---|---|

| Sex | Total | Percentage | Age Range (years) | Total | Percentage | Training level (studies) | Total | Percentage |

| Man | 78 | 60.9 | <18 | 0 | 0 | Primary | 2 | 1.6 |

| Woman | 48 | 37.5 | 18–24 | 18 | 14.1 | High school | 30 | 23.4 |

| 25–34 | 24 | 18.8 | University | 2 | 1.6 | |||

| 35–44 | 26 | 20.3 | No studies | 92 | 71.9 | |||

| 45–54 | 14 | 10.9 | Do not know, no answer | 2 | 1.6 | |||

| 55–64 | 38 | 29.7 | ||||||

| >65 | 8 | 6.3 | ||||||

| Current Main Occupation | Income of the Family Unit | Size of the Municipality of Residence | ||||||

|---|---|---|---|---|---|---|---|---|

| Total | Percentage | Total | Percentage | Total | Percentage | |||

| Active worker | 74 | 57.8 | <€14,000 | 44 | 34.4 | <1000 | 20 | 15.6 |

| Self-Worker | 12 | 9.4 | €14,000,001–25,000 | 36 | 28.1 | 1000–10,000 | 6 | 4.7 |

| Student | 18 | 14.1 | €25,000.001–€35,000 | 22 | 17.2 | 10,000.1–50,000 | 26 | 20.3 |

| Retired | 10 | 7.8 | €35,000.001–€50,000 | 14 | 10.9 | 50,000.1–100,000 | 76 | 59.4 |

| Unemployed | 6 | 4.7 | €50,000.001–€100,000 | 12 | 9.4 | |||

| Others | 6 | 4.7 | >€100,000 | 0 | 0.0 | |||

| Do not know, no answer | 2 | 1.6 | ||||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Náñez Alonso, S.L.; Jorge-Vazquez, J.; Reier Forradellas, R.F. Detection of Financial Inclusion Vulnerable Rural Areas through an Access to Cash Index: Solutions Based on the Pharmacy Network and a CBDC. Evidence Based on Ávila (Spain). Sustainability 2020, 12, 7480. https://doi.org/10.3390/su12187480

Náñez Alonso SL, Jorge-Vazquez J, Reier Forradellas RF. Detection of Financial Inclusion Vulnerable Rural Areas through an Access to Cash Index: Solutions Based on the Pharmacy Network and a CBDC. Evidence Based on Ávila (Spain). Sustainability. 2020; 12(18):7480. https://doi.org/10.3390/su12187480

Chicago/Turabian StyleNáñez Alonso, Sergio Luis, Javier Jorge-Vazquez, and Ricardo Francisco Reier Forradellas. 2020. "Detection of Financial Inclusion Vulnerable Rural Areas through an Access to Cash Index: Solutions Based on the Pharmacy Network and a CBDC. Evidence Based on Ávila (Spain)" Sustainability 12, no. 18: 7480. https://doi.org/10.3390/su12187480

APA StyleNáñez Alonso, S. L., Jorge-Vazquez, J., & Reier Forradellas, R. F. (2020). Detection of Financial Inclusion Vulnerable Rural Areas through an Access to Cash Index: Solutions Based on the Pharmacy Network and a CBDC. Evidence Based on Ávila (Spain). Sustainability, 12(18), 7480. https://doi.org/10.3390/su12187480