3.1.1. ARIMA Model Introduction

In this paper, the ARIMA model was used to analyze dynamic data of time series. No influence of other economic variables was considered in the model. Nevertheless, change rules of variables themselves were depended upon and an extrapolation mechanism was used for prediction. The model was proposed by Box–Jenkins in the early 1970s [

26]. The ARIMA model has been widely used in dynamic data analysis of time series since its birth, and has been fully tested in practice. In order to improve the prediction accuracy of the ARIMA model, scholars have made new attempts and explorations on improving the prediction accuracy of the ARIMA model from multiple angles and levels, such as Qin, Q.D., He, H.D., Li, L., and He, L.Y. (2020). In A Novel Decomposition-Ensemble Based Carbon Price Forecasting Model Integrated with Local Polynomial Prediction, computational economics, a carbon price forecasting model based on decomposition and combination was proposed. The model combines integrated empirical mode decomposition (EEMD) with local polynomial prediction (LPP), and decomposes the carbon price time series into N Intrinsic Mode Function. Finally, the EEMD-LPP and EEMD-ARIMA-LPP models are both good methods for carbon price prediction. According to the long-term research and practice of the ARIMA model, it can be concluded that the ARIMA model can predict the price with high accuracy. Therefore, based on the research of many scholars, this paper believes that the ARIMA model has a certain theoretical basis for carbon price prediction. The ARIMA model of time series can be divided into four types: autoregressive (AR) model, moving average (MA) model, autoregressive moving average (ARMA) model, and autoregressive integrated moving average (ARIMA) model.

The AR model stationary process y

t can be expressed as:

where, parameter φ

i (i = 1,2,⋯,p) is the coefficient of autoregressive model, p is the order of autoregressive model, u

t is white noise. Then, Formula (1) is called p-order autoregressive model, which is recorded as AR (p).

The stationary process y

t of MA model can be expressed as:

where, parameter θi (i = 1,2,⋯,q) is the coefficient of the moving average model, q is the moving average order, u

t is white noise. Then, Formula (2) is called the q-order moving average model, which is recorded as MA (q).

The stationary process y

t of ARMA model can be expressed as:

where, parameter φ

i (i = 1,2,⋯,p) And θi (i = 1,2,⋯,q) are the parameters of autoregressive moving average model; p and q are the order of autoregressive and moving average models, respectively; and u

t is white noise. Then, Formula (3) is called the autoregressive moving average model, which is recorded as ARMA (p, q). It can be seen that ARMA model is composed of AR model and MA model.

All of the above three models are modeled under the stationary state of time series. However, most economic and financial data encountered in practice are nonstationary time series. For a nonstationary time series, some numerical characteristics of time series change with time. In the process of in-depth study of the ARIMA model, scholars put forward their own views on the characteristics of time series imbalance and formed some research results, such as J. Nazarko, A. Jurczuk and other scholars, regarding load modeling in ARIMA models with a clustering approach [

27]. The randomness of nonstationary time series is different at each time point, so it is difficult to grasp the randomness of time series as a whole through known information of time series. If the random process y

t can be transformed into a stationary and reversible ARIMA (p, q) after d-order difference, then y

t is called a differential autoregressive moving average process of order (p, d, q), which is recorded as ARIMA (p, d, q).

3.1.2. Data Preprocessing

EU ETS is the largest carbon trading market in the world at present. EU ETS includes many carbon emission exchanges, among which the European Climate Exchange (ECX) is the leader of carbon trading market in Europe, and even the world, and is also the most active carbon emission contract exchange in the world [

28]. ECX mainly engages in greenhouse gas emission rights futures and options contracts, accounting for more than 80% of global trading volume, and has an important influence [

29,

30,

31]. BlueNext environment exchange, a market of EU ETS, mainly deals with carbon emission credits on the spot. As the first carbon emission reduction credit platform under Kyoto Mechanism, BlueNext environment exchange is the largest carbon emission credit spot trading market in the world, accounting for more than 90% of the global carbon emission credit spot trading market share [

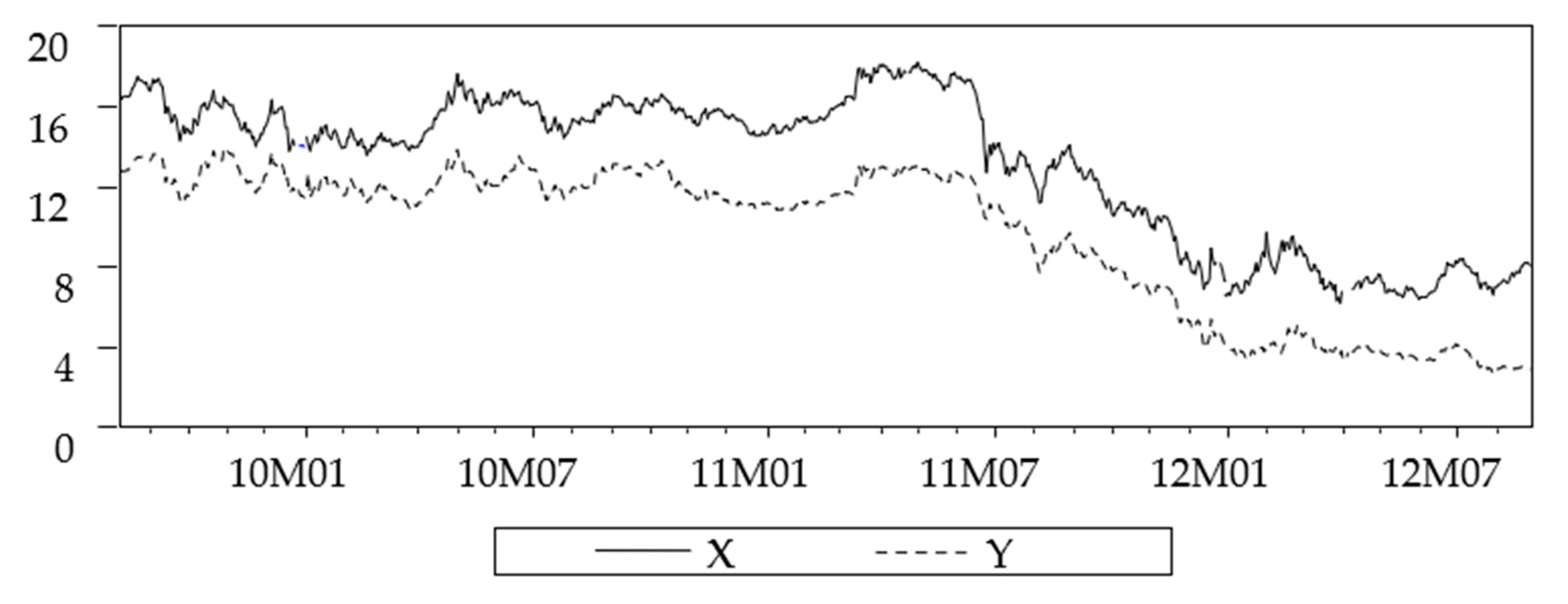

32]. Therefore, this paper selected futures settlement price data of EUA and CER due in December 2012 from ECX, and spot settlement price data of EUA and CER from BlueNext environment exchange as research samples. EU ETS has been trading since 2005, and the system is now in its second stage. Therefore, the research data were sourced from 7 August 2009 to 28 September 2012 and the data can be divided into simulation samples and prediction samples, respectively. The unit of the sample data was euro/ton carbon dioxide equivalent.

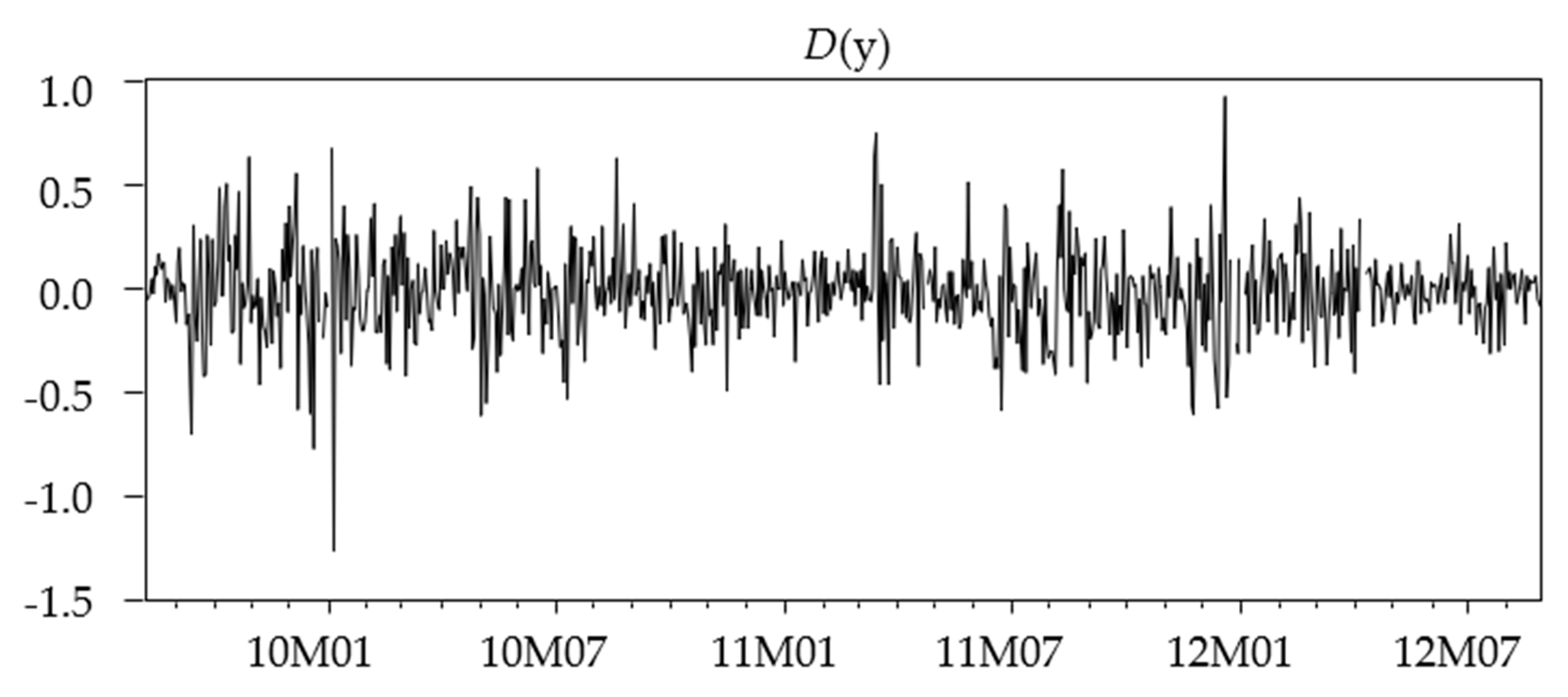

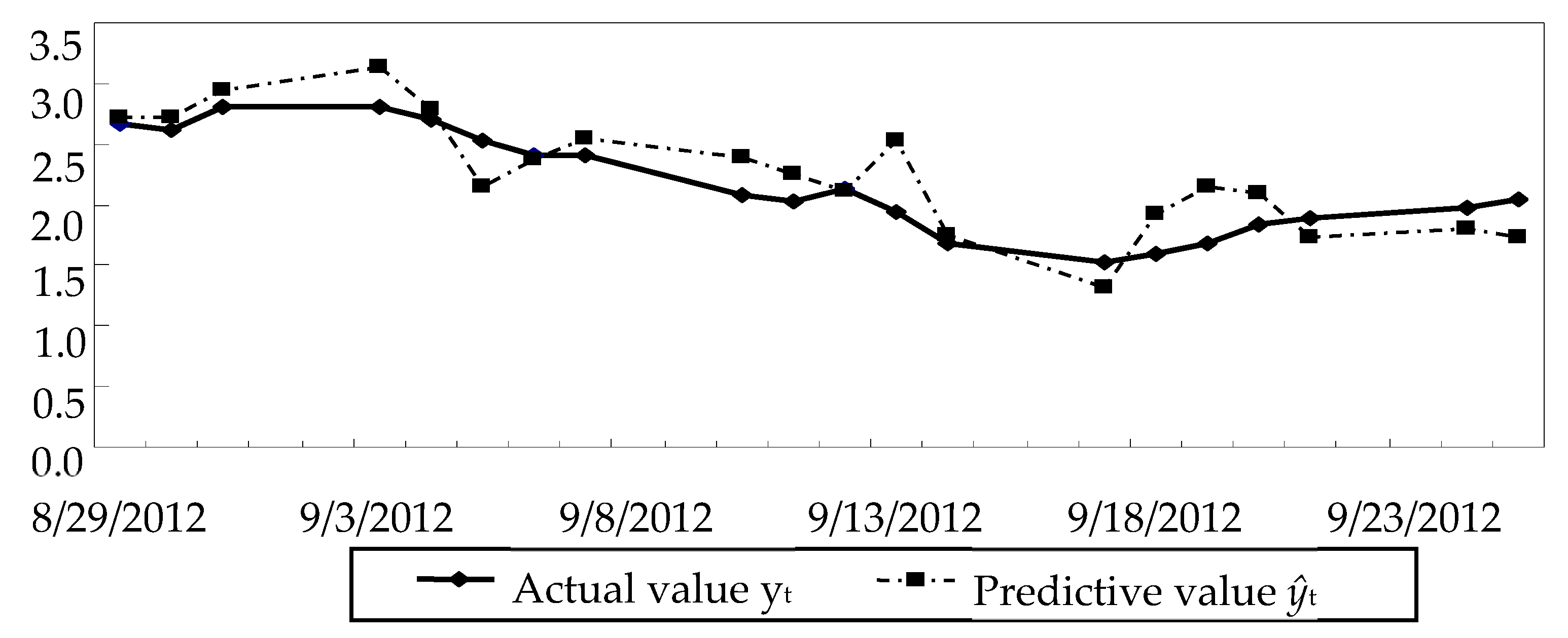

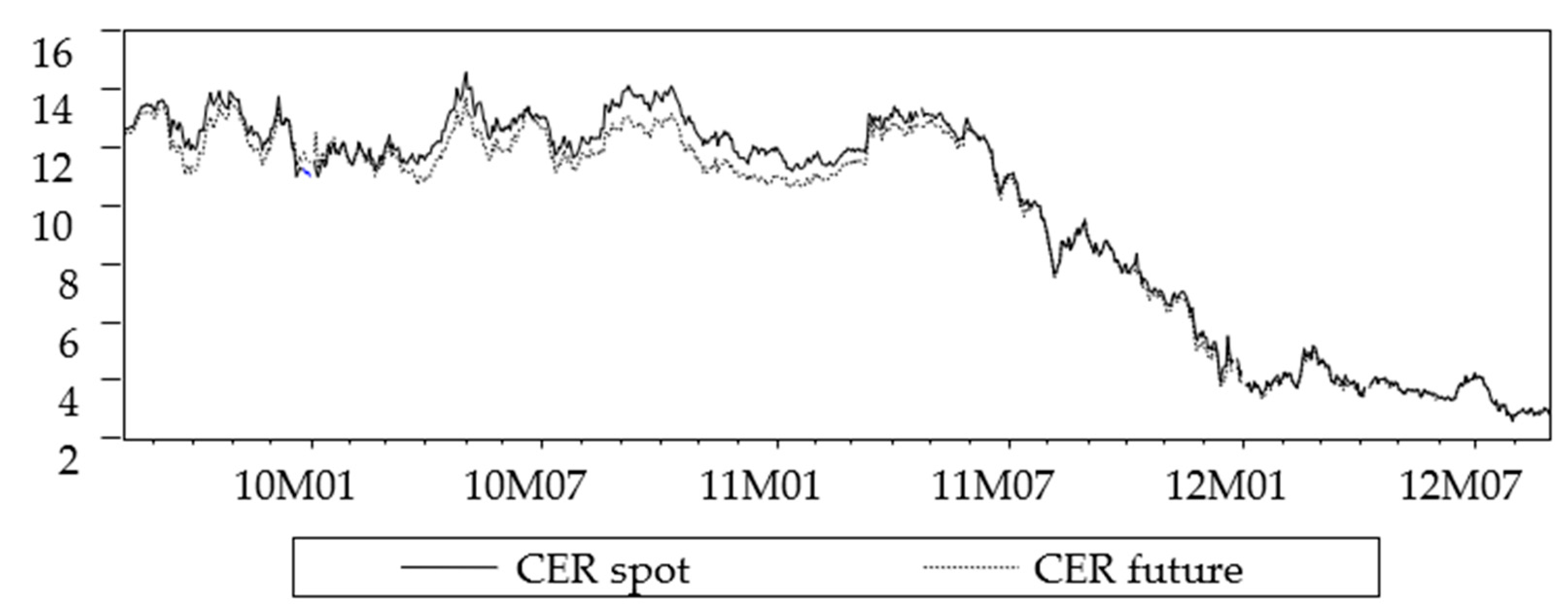

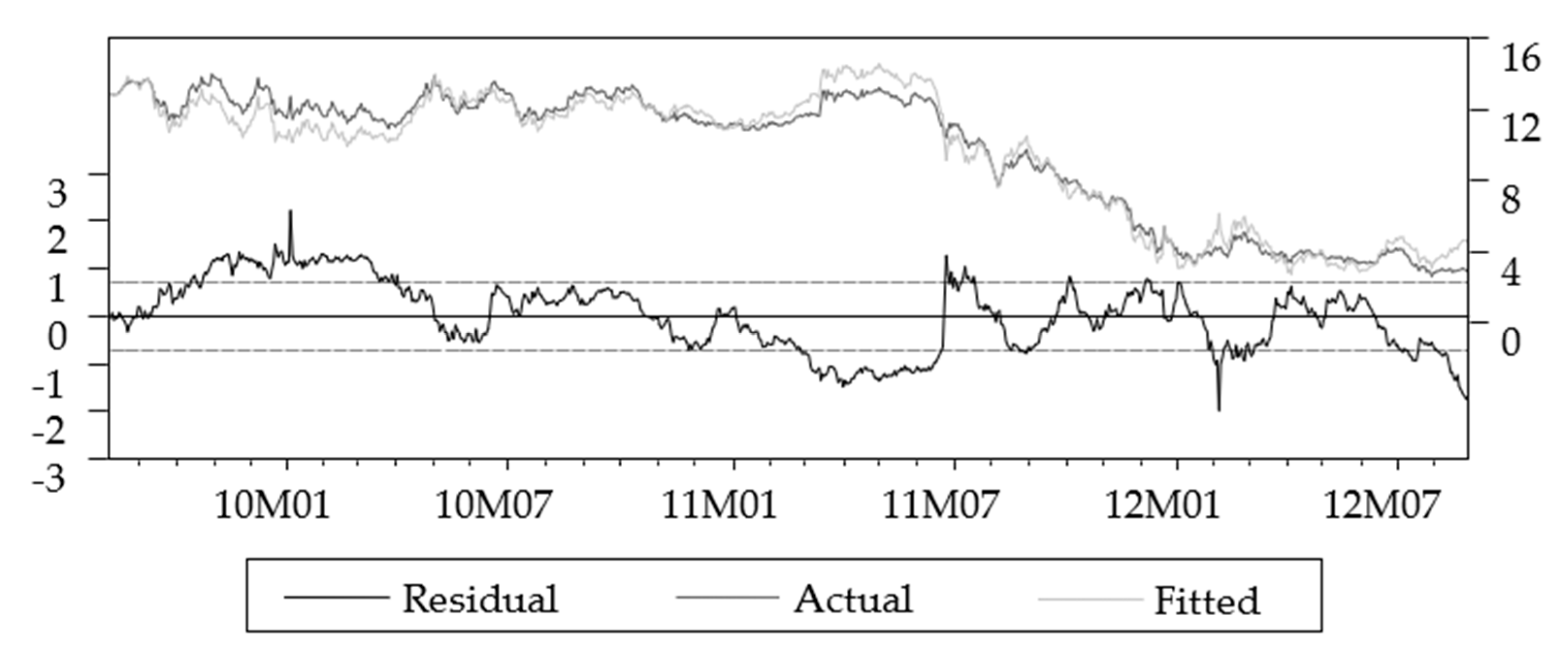

Taking the time series data of CER futures prices as an example, the ARIMA model was established to verify whether the model has a good prediction function for CER futures prices. Before the model construction, a CER futures price time series chart was drawn to make a prejudgment. The number of samples was 798, and the trend graph is shown in

Figure 1:

According to

Figure 1, the price of this series was in a stationary state before May 2011, but the price had a significant downward trend after June 2011. In general, the price showed a characteristic of volatility during the observation period, and it was initially judged that this series was nonstationary.

Before the ARIMA model was built, unit root test was carried out first. The purpose of unit root test is to test the stationarity of time series variables and avoid a pseudo regression of the model. Therefore, unit root test is very important, and the stationarity of time series is an important problem that must be considered when establishing a time series model. The reason why a unit root test is widely used is that most economic time series have a unit root after pair transformation. Currently, there are six methods for a unit root test: ADF (DF) test, PP test, DFGLS test, KPSS test, ERS test, and NP test. The widely used ADF test method was adopted in this paper.

If y

t has a p-order sequence correlation, the p-order autoregressive process can be used to correct the y

t. The model with trend term after it becomes stationary through difference is:

where, a is a constant term; δ

t is a linear trend function; and if η < 0, then y

t is stationary and if η = 0, then y

t has at least one unit root.

Using software Eviews 6.0 to carry out ADF test [

33], the results are shown in

Table 1:

From the test results, under the three significance levels of 1%, 5%, and 10%, the MacKinnon critical values of the unit root test were −3.4385, −2.8650, and −2.5687, respectively, and the

t-test statistics of −0.1210 was greater than the corresponding critical value, so

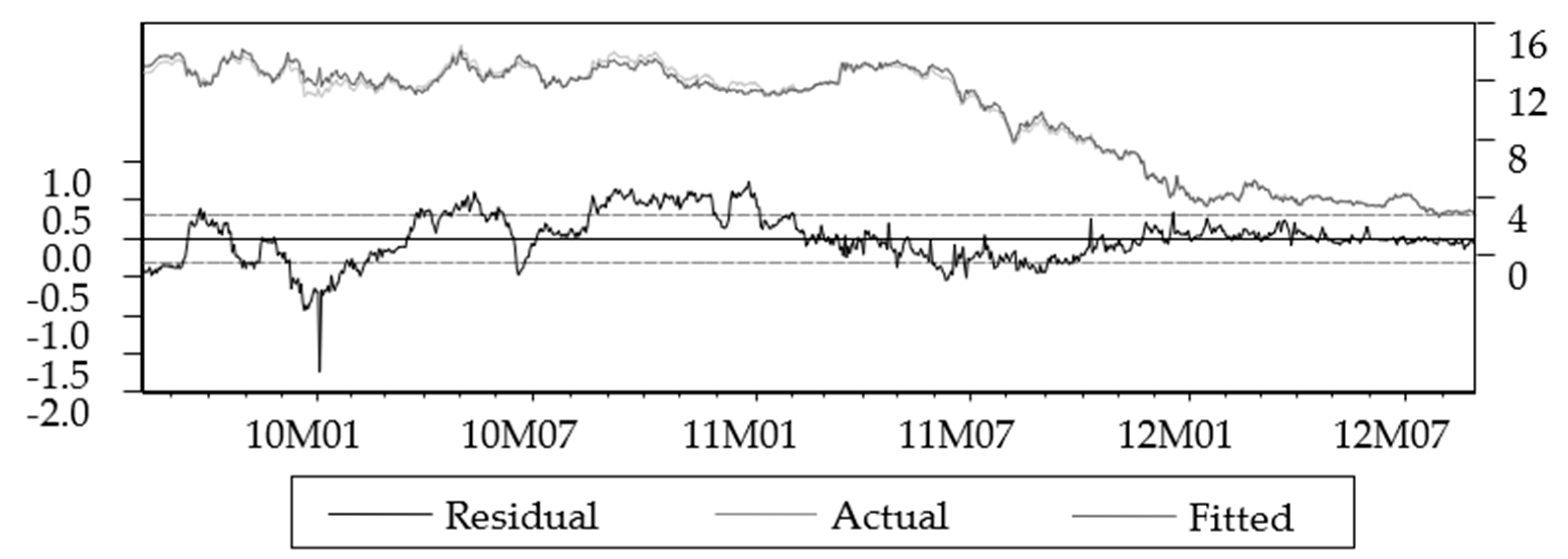

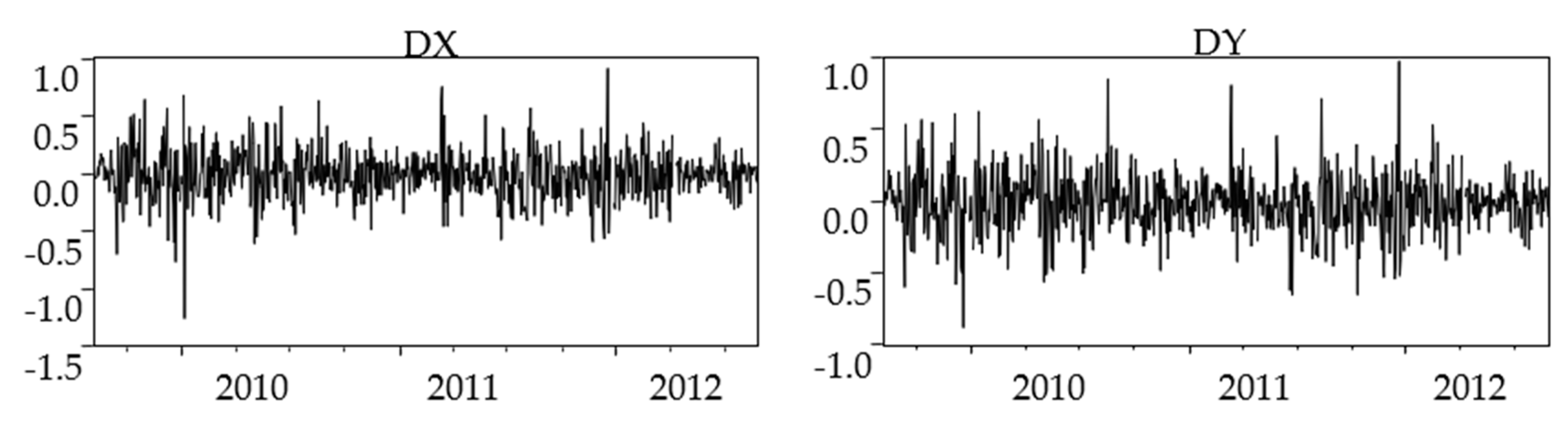

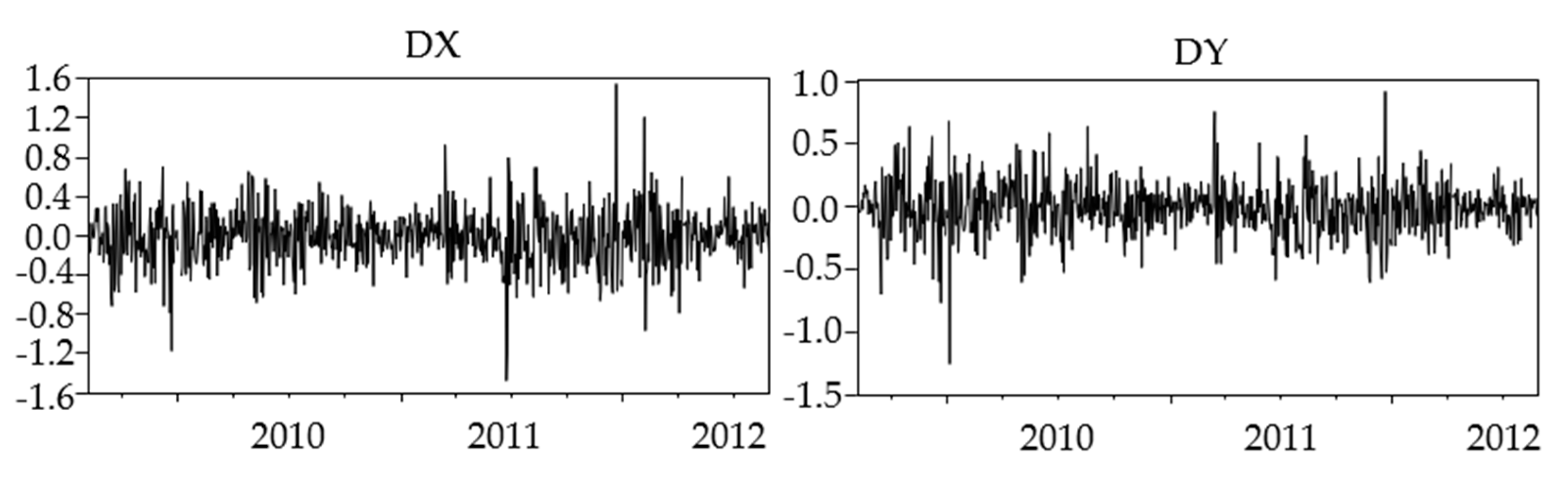

H0 could not be rejected, indicating that the CER futures price series had a unit root and was a nonstationary sequence. The first-order difference was applied to the CER futures price series, and the difference sequence is shown in

Figure 2. From the difference sequence figure, it can be seen that a price downward trend of the original sequence was eliminated after the first-order difference, and the difference sequence showed stationarity.

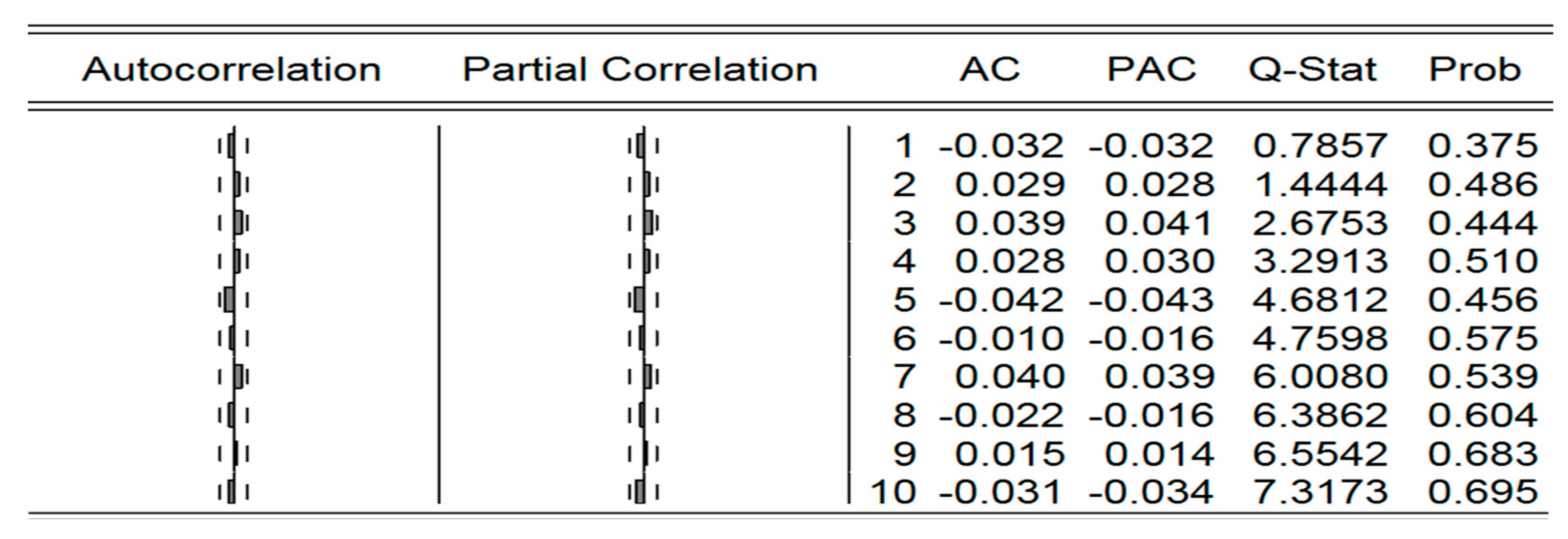

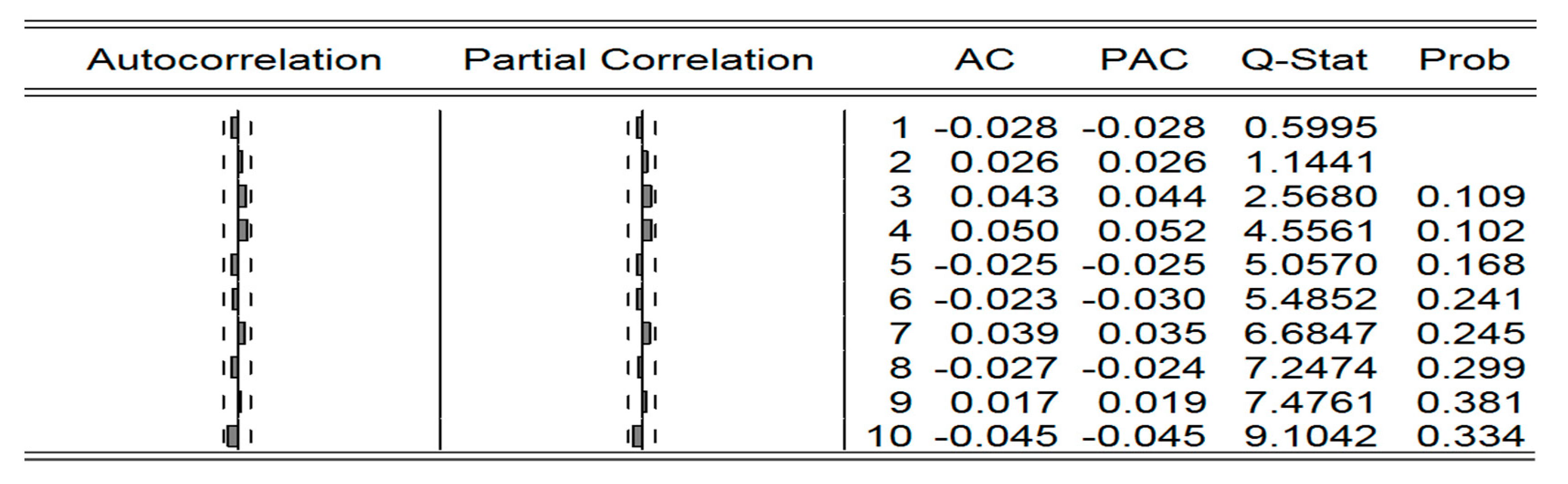

Then, the ADF test with intercept term was carried out for D (y), and the lag order (

p = 4) was determined by SIC criterion. The test results are shown in

Table 2:

Table 2 shows that the t statistics value of D (y) was −28.9171, which was less than any value under the given significance level. Therefore, the original hypothesis was rejected and the difference sequence of CER futures price had no unit root and was a stationary sequence, that is, the Y sequence was integrated of order 1, Y~

I(1).