5.1. Spatial Distribution Characteristics

Figure 2 reflects the spatial distribution of FD from 2005 to 2016 in China.

Figure 2 indicates that the overall level of FD in China presented a significant upward trend, and FD in the North China Plain and the eastern coastal areas is significantly greater than that of the central and western regions. These results show that FD has the characteristics of spatial clustering and spatial heterogeneity in China.

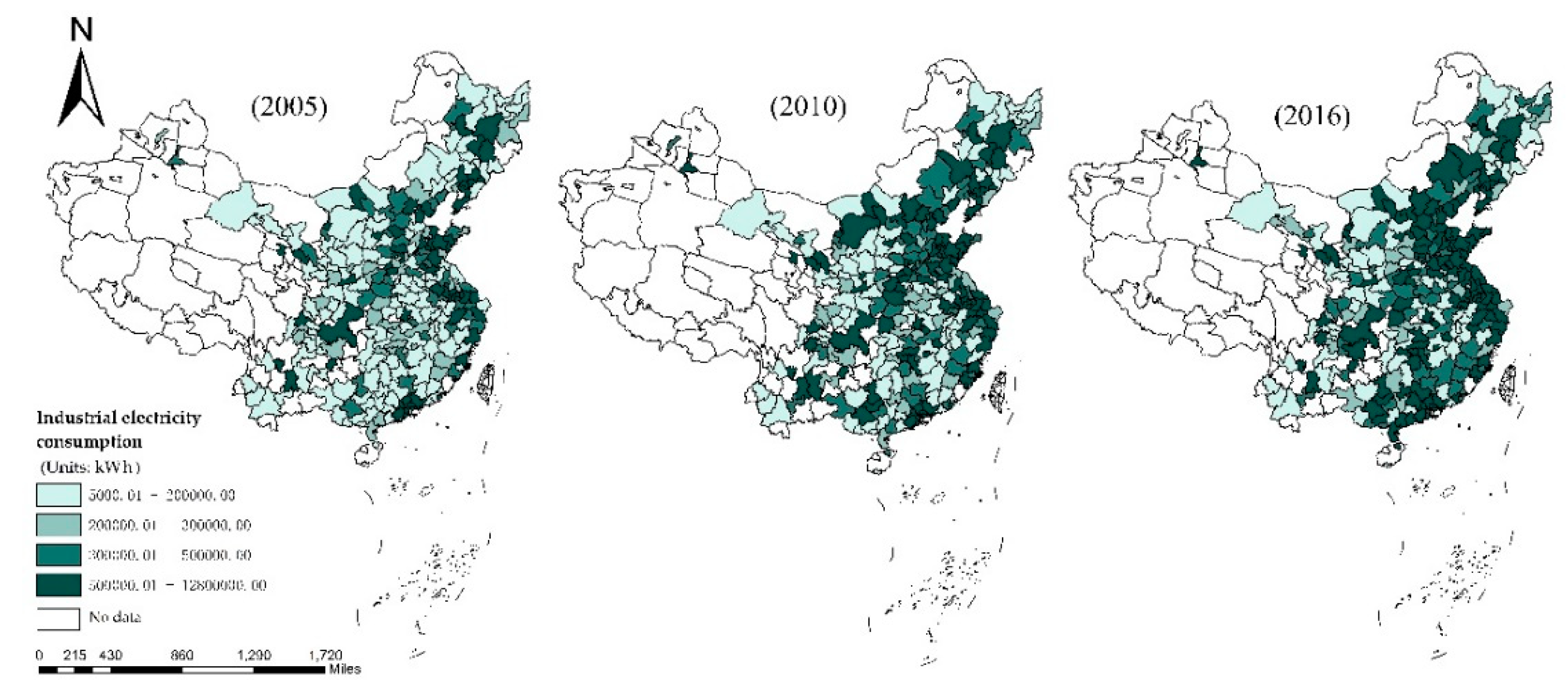

Figure 3 reflects the spatial distribution of EC from 2005 to 2016 in China.

Figure 3 indicates that the overall level of EC in China presented a significant upward trend, and EC in the eastern regions is significantly greater than that of the central and western regions.

Figure 3 shows that EC has spatial agglomeration characteristics in economically developed cities along the eastern seaboard.

Figure 4 and

Figure 5 reflects the spatial distribution of IEC and REC in China from 2005 to 2016.

Figure 4 and

Figure 5 show that the overall level of IEC and REC presented a significant upward trend, with IEC and REC in the eastern regions, central regions, and western regions decreasing sequentially.

Figure 4 shows that the cities with high IEC are concentrated in the North China Plain and the eastern coastal areas of China.

Figure 5 shows that REC has spatial agglomeration characteristics in the central regions and eastern coastal areas of China. These results show that REC and IEC have the characteristics of spatial clustering and spatial heterogeneity in China.

Therefore, in order to test whether EC, IEC, and REC are spatially dependent, we used global Moran’s I index to test the spatial autocorrelation characteristics of EC, IEC, and REC in the following chapters.

5.3. Spatial Regression Analysis

The Moran’s I index tests confirm that there is an obvious spatial autocorrelation in the EC, IEC, and REC of China. In this case, the least squares linear (OLS) regression model may bias the estimated results. Thereby, it is necessary to introduce the spatial panel regression model.

Prior to the regression analysis, the LM (Lagrange multiplier) and Robust LM tests were performed to determine which model is better, the spatial lag model (SLM) or the spatial error model (SEM). The results show that the results of LM-lag and LM-error are significant at the significance level of more than 1%. Meanwhile, the test results of Robust LM-lag and Robust LM-error are significant at the significance level above 5%. Since the SLM has a higher goodness of fit for regression results, it indicates that the SLM model is a better choice. In addition, Hausman’s results suggest that fixed effects should also be selected. Based on the above test results, this paper finally selected the spatial lag model (SLM) under the fixed effect to study the impact of FD on EC, IEC, and REC in China.

Table 3 shows the estimation results of SLM. Considering the robustness, the estimation results of SEM are also shown.

Table 3 shows that the spatial autocorrelation coefficients

of EC, IEC, and REC are significantly positive at the 1% significance level. This shows that China’s EC, IEC, and REC are spatially dependent. This is consistent with Moran I’s above conclusion. According to the estimation results of SLM, for every 1% increase in EC, IEC, and REC of adjacent cities, the EC, IEC, and REC in local cities increase by 0.065%, 0.076%, and 0.247%, respectively. Notably, REC has a greater spatial dependence than IEC. The reasons why the EC is spatially dependent can be explained as follows: (1) Local cities imitate and copy the economic development mode of neighboring cities. Therefore, EC has spatial dependence due to “imitation effect”. (2) Due to the continuous development of transportation systems, frequent trade, and similar consumption preferences between local cities and neighboring cities, the EC trend of local cities and neighboring cities is consistent. The reason for the spatial dependence of the IEC is that, due to the inter-regional industrial transfer and trade, IEC in local cities is inevitably affected by EC in surrounding cities. The reasons why the REC is spatially dependent can be explained as follows: (1) Local urban residents may be affected by the energy conservation awareness and green environmental protection behavior of residents among adjacent cities. (2) The spatial correlation of REC is also reflected in the strong dependence of some residents on the economic development of the surrounding cities. Urban residents in local cities may imitate the use of household appliances by urban residents in surrounding cities, resulting in the spatial autocorrelation of the REC. (3) The economic development of each city is closely linked. The economic development and energy policy of a city will also have an impact on neighboring cities. This estimation results provide a clear basis for the implementation of joint power-saving actions among cities.

In the results of SLM, the elasticity coefficients of FD to EC, IEC, and REC are 0.079, 0.061, and 0.244, respectively, which are significantly positive at the 1% significance level. The results show that FD is closely related to EC, IEC, and REC. From the perspective of the industrial sector, the main channel for Chinese enterprises to obtain external financing was bank loans for a long time [

47]. Bank loans allow companies to build new production lines, buy large equipment, expand production, and carry out more production activities, thus increasing IEC. Hence, FD provides support for the industrial sector to obtain external financing and expand investment scale. From the perspective of urban residents, as the level of FD increases, urban residents can obtain loans more conveniently and at a lower cost, thereby promoting urban residents’ purchase of durable consumer goods (such as household appliances, housing, and automobiles). The empirical results show that FD plays a critical role in promoting the growth of EC in China. Therefore, FD should be taken into consideration when the Chinese government formulates the future EC plan.

In the SLM results, the elastic coefficients of economic growth (PGDP) to EC, IEC, and REC are 0.866, 0.914, and 0.534, respectively, which are significant at the 1% significance level. At present, urban economic development is increasingly dependent on EC, and the proportion of EC in the final energy consumption continues to rise. Overall, compared with other variables, PGDP has the greatest impact on EC, IEC, and REC. Therefore, from the perspective of economic development, supporting power supply is the foundation of economic development. At present, economic development still depends on energy consumption. To promote economic growth while reducing fossil energy consumption, green electricity (such as hydropower, wind power, solar photovoltaic cells, etc.) must be promoted and used to reduce dependence on fossil energy. Green electricity not only has the same effect as thermal power, but also helps to improve air quality and promote environmental sustainability.

The results of SLM, the elasticity coefficients of industrial structure (IS) to EC, IEC, and REC are −0.182, −0.229, and 0.084, respectively, which are significant at the 1% significance level. This indicates that the larger the ratio of tertiary industry to secondary industry, the less electricity China’s cities use. In China, the EC of different industries varies greatly [

44]. From 2005 to 2016, the EC of the secondary industry was the largest, accounting for more than 70%, while that of other industries was less than 30%. The EC structure in the developed countries is more reasonable, with transportation, construction, and manufacturing each consuming about one third of the electricity. At present, the secondary industry is energy-intensive. Therefore, in terms of the experience of developed countries, through the upgrading of the industrial structure, specifically, vigorously develop the tertiary industry and reduce the development of the secondary industry, which promotes the reduction of electricity consumption [

44].

Population size (POP) has a significant role in promoting EC, IEC, and REC. In the SLM results, for each 1% increase in population size, EC, IEC, and REC increased by 0.865%, 0.868%, and 0.871%, respectively. The urban population is the main end user. The growth of urban population will directly drive the growth of REC, which is in line with the reality. Electricity is an important force supporting the urbanization process [

45]. The urbanization process requires the construction of large-scale urban infrastructure, housing, and transportation systems, which will promote the rapid development of energy-intensive industries, thus increasing the electricity consumption in the industrial and residential sectors [

46]. In addition, the urbanization process has increased the urban population, making more people concentrated in the city, which promotes the increase in EC.

In the results of SLM, the elastic coefficients of electricity intensity (EI) on EC, IEC, and REC are 0.858, 0.987, and 0.045, respectively, which are significantly positive at the 1% significance level. This result shows that the reduction of EI can effectively inhibit the rapid growth of EC [

48,

49]. China’s energy endowment determines the energy structure dominated by fossil fuels, especially coal energy [

50,

51]. Efficient use of electricity can indirectly reduce coal consumption and further reduce pollutant emissions [

44]. Notably, the impact of EI on IEC is greater than that of REC. Since China has set energy-intensity restriction targets in the “Eleventh Five-Year Plan” and “Twelfth Five-Year Plan”, various local governments have adopted measures to reduce EC per unit of GDP. For example, local governments have vigorously supported and developed low-energy enterprises and imposed rectification requirements and restrictions on high-energy enterprises. The secondary industry is an energy-intensive industry in China, which accounts for a large proportion compared with other industries. Therefore, the improvement of industrial electricity utilization efficiency promotes the reduction of IEC.

5.4. Region-Scale Analysis

China is a vast country with diverse natural environments and different levels of economic development in different regions. In order to compare the impact of FD on EC, IEC, and REC in different regions of China, this paper divided 278 prefecture-level cities into three regions: eastern, central, and western. There are 113 cities in the eastern regions, 108 in the central regions, and 57 in the western regions.

Table 4,

Table 5 and

Table 6 reports the estimated results of the impact of FD on EC, IEC, and REC in different regions via SLM. Considering the robustness, the estimation results of the impact of FD on EC, IEC, and REC in different regions via SEM are also shown.

From the perspective of IEC: (1)

Table 5 reflects that

in eastern, central, and western China are 0.097, 0.248, and 0.084, respectively, which are significant at the 1% significance level. The estimated results reflect that IEC is spatially dependent in eastern, central, and western China. Moreover,

Table 5 shows that IEC has a stronger spatial dependence in the central regions than in the eastern and western regions. (2) The impact of FD on IEC is heterogeneous in different regions of China. In SLM (1a) and SLM (3a), the elastic coefficients of FD on IEC are 0.073 and 0.306, respectively, which are significant at the 1% significance level.

Table 5 reflects that FD can promote the IEC of cities in the eastern and western regions, which is similar to the conclusion of the national sample. Meanwhile, the effect of FD on IEC is not significant in the central regions. (3) The estimation results of the control variables are similar to the national sample.

From the perspective of REC: (1)

Table 6 reflects that

in eastern, central and western China are 0.122, 0.411, and 0.153, respectively, which are significant at the 1% significance level. The estimated results reflect that IEC is spatially dependent in eastern, central, and western China. Moreover,

Table 6 shows that REC has a stronger spatial dependence in the central regions than that of the eastern and western regions. (2) The impact of FD on REC is heterogeneous in different regions of China. In SLM (1a), SLM (2a), and SLM (3a), the elastic coefficients of FD on REC are 0.260, 0.085, and 0.381, respectively, which are significant at the 1% significance level.

Table 5 reflects that FD can promote the IEC in different regions, which is similar to the conclusion of the national sample. In particular, FD has a greater impact on REC in the western regions than in other regions. (3) Except for the indicators of IS and EI, the estimated results of the remaining control variables are similar to the national sample.

5.5. City-Scale Analysis

As a high-end service industry, the development of the financial industry depends on the city scale. The bigger the city, the more abundant the capital and the more diversified the market. In order to test the influence of FD on urban EC under a different city scale, the urban population at the end of the year is selected to represent the city scale. According to the population size in 2016 as the standard for dividing the city size, the city size is divided into four categories: megacities with a population of more than 2 million, large cities with a population of 1 million to 2 million, medium-sized cities with a population of 500,000 to 1 million, and small cities with a population of less than 500,000 [

52]. There are 60 megacities, 93 large cities, 86 medium cities, and 39 small cities in China.

Table 7,

Table 8 and

Table 9 report the estimated results of the impact of FD on EC, IEC, and REC in different urban sizes via SLM. Considering the robustness, the estimation results of the impact of FD on EC, IEC, and REC in different urban sizes via SEM are also shown.

From the perspective of IEC: (1)

Table 8 reflects that

in small cities, medium-sized cities, large cities, megacities are 0.259, 0.103, 0.145, and 0.166, respectively, which are significant at the 1% significance level. The estimation results reflect the spatial dependence of IEC in different urban sizes. Moreover,

Table 8 shows that IEC has a stronger spatial dependence in small cities than in other types of cities. (2) The impact of FD on IEC is heterogeneous in different urban sizes of China. In SLM (1a), SLM (3a), and SLM (4a), the elastic coefficients of FD on REC are 0.081, 0.046, and 0.090, respectively, which are significant at the 10% significance level.

Table 8 reflects that FD can promote IEC for small cities, large cities, and megacities, but not for medium-sized cities. In particular, FD has a greater impact on IEC in megacities than in other urban sizes. The reason is that there are more abundant financial services and resources in megacities. (3) The estimation results of the control variables are similar to the national sample.

From the perspective of REC: (1)

Table 9 reflects that 𝜌 in small cities, medium-sized cities, large cities, and megacities are 0.667, 0.382, 0.528, and 0.106, respectively, which are significant at the 1% significance level. The estimation results reflect the spatial dependence of REC in different urban sizes. In particular,

Table 9 shows that REC has a stronger spatial dependence in small cities than in other types of cities. (2) FD can promote REC in different urban sizes. The impact of FD on REC is heterogeneous in different urban sizes of China. In SLM (1a), SLM(2a), SLM (3a), and SLM (4a), the elastic coefficients of FD on REC are 0.29, 0.119, 0.352, and 0.279, respectively, which are significant at the 1% significance level. In particular, FD has a greater impact on REC in large cities than in other urban sizes. (3) Except for the indicators of IS and EI, the estimation results of the remaining control variables are similar to the national sample.