Does the Choice of IJV under Institutional Duality Promote the Innovation Performance of Chinese Manufacturing Firms? Evidence from Listed Chinese Manufacturing Companies

Abstract

1. Introduction

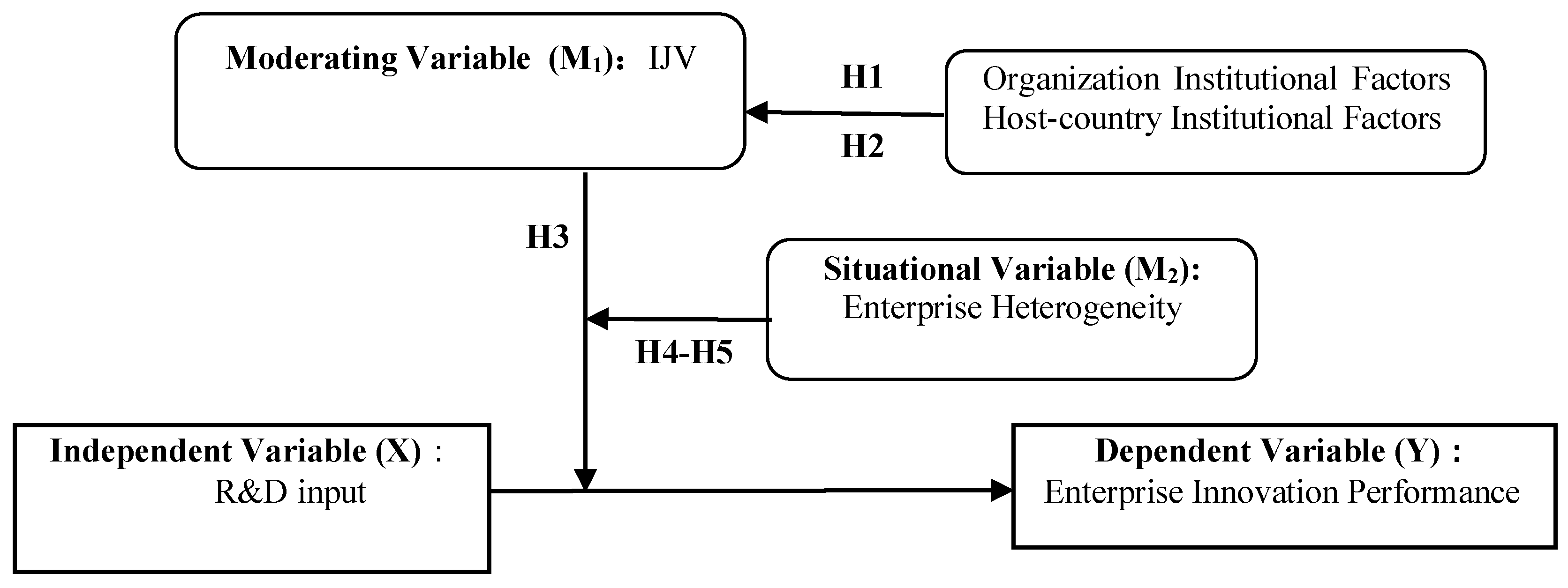

2. Literature Review and Hypotheses

2.1. The Choice of IJV under Institutional Duality

2.1.1. The Influence of Organization Institutional Factors on the IJV Choice

2.1.2. The Influence of Host-Country Institutional Factors on the IJV Choice

2.2. The Influence of IJV Choice on Firm Innovation Performance: A Perspective of the International Leapfrog Development Stage

2.3. The Influence of IJV Choice on Firm Innovation Performance: A Perspective of Firm Heterogeneity

2.3.1. The Perspective of Differences in Firm Ownership

2.3.2. The Perspective of Differences in Firm Internationalization Breadth

3. Research Methodology and Data

3.1. Sample Selection and Data Sources

3.2. Research Design

3.3. Variables and Data

3.3.1. Dependent Variables

3.3.2. Independent or Control Variables

3.3.3. Moderating Variables

3.3.4. Categorical Variables

4. Empirical Results

4.1. The Choice of IJV under Institutional Duality

4.2. The Influence of IJV Choice on Firm Innovation Performance

- (1)

- Control variables: (1) the coefficients of Lnsize in models 1 to 6 are significantly positive above the 1% level. This shows that, in the rapid development stage of China’s manufacturing industry, the visibility and authority of large-scale firms in the integration of social resources, government support and financial support, as well as the leading firms in the field of organization, provide favorable conditions for them to acquire strategic resources and promote innovation. (2) The coefficients of SP in models 1 to 6 are significantly negative above the 5% level. This shows that too much asset specificity resulting from the low capability accumulation of the professional field of Chinese firms at the current stage, to some extent, hampers the driving power of the transformation from traditional tangible asset investment to innovative intangible asset, and has a inhibiting effect on firm innovation. (3) The coefficients of FSTS are negative and insignificant in models 1 to 6. This also shows that, compared with the strong localization capabilities of mature MNEs, the early foreign marketing experience of Chinese manufacturing generated by export trade or technology introduction has no significant impact on firm innovation [69].

- (2)

- Explanatory variables: the coefficients of RDIN in models 1 to 6 are all significantly positive above the 5% level, indicating that R&D input has a significant promotion effect on firm innovation performance. The coefficients of the interaction terms IJV × RDIN in model 3 and model 6 are significantly negative above the 10% level. This shows that, in the stage of international leapfrog development, combined with the analysis of the influence of the above control variables on firm innovation, the accumulation of professional fields and the development of the internationalization capabilities of Chinese manufacturing firms at the current stage lags behind the needs of innovation and internationalization; that is to say, the lack of asset integration, cross-cultural management, joint governance and other capabilities generally leads to a premature IJV choice that produces a negative moderating effect on firm innovation, which is consistent with Hypothesis 3.

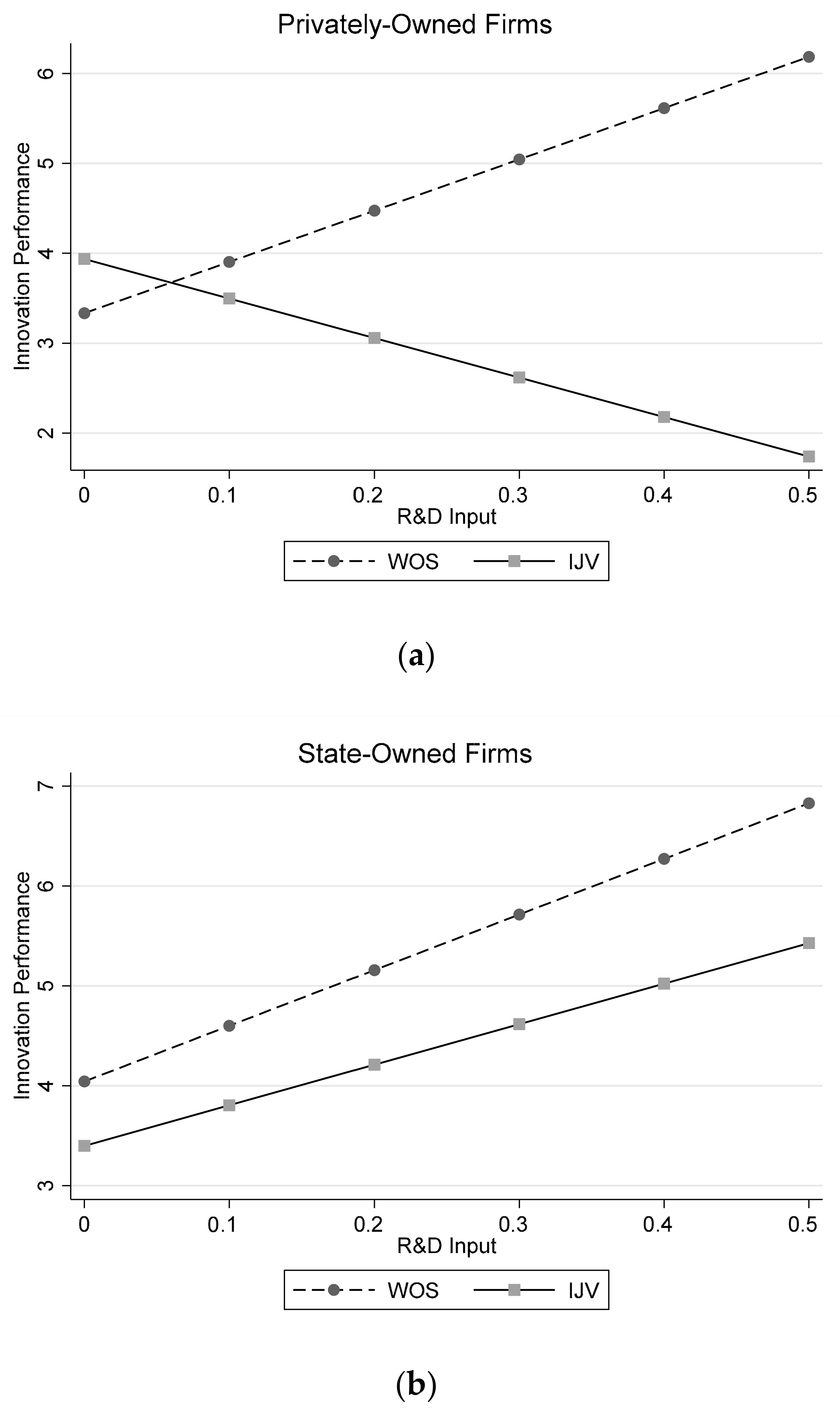

4.3. The Influence of IJV on Firms’ Innovation Performance: A Perspective of Firm Ownership Heterogeneity

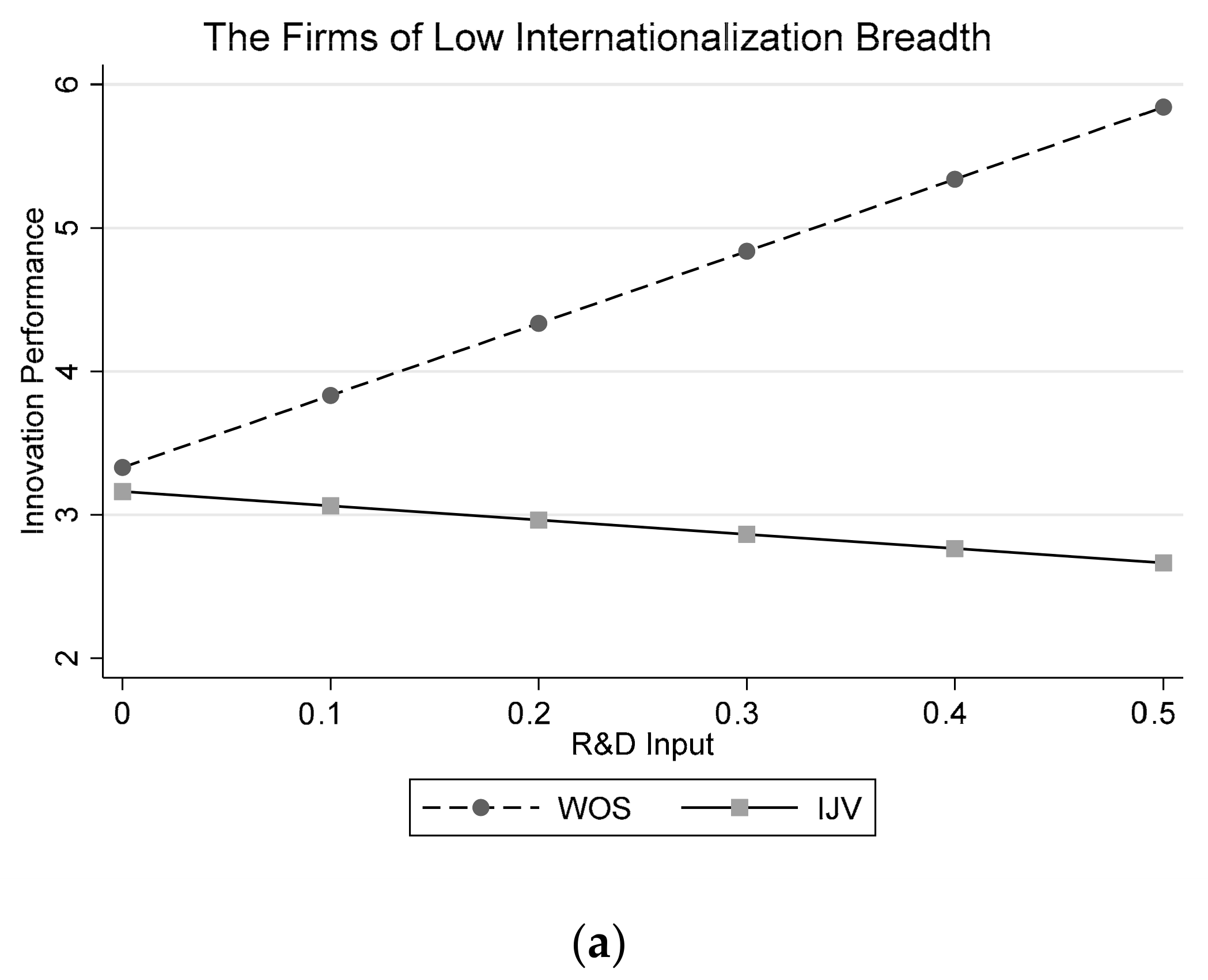

4.4. The Influence of IJV on Firm Innovation Performance: A Perspective of Firm Internationalization Breadth Heterogeneity

5. Conclusions and Implications

5.1. Discussion

5.2. Conclusions

5.3. Suggestions for Future Research

5.4. Research Limitations

Author Contributions

Funding

Conflicts of Interest

References

- Shen, R.; Mantzopoulos, V. China’s “Going Out” policy: Inception, evolution, implication. J. Bus. Behav. Sci. 2013, 25, 121–136. [Google Scholar]

- Hao, Y.; Guo, Y.; Guo, Y.; Wu, H.; Ren, S. Does outward foreign direct investment (OFDI) affect the home country’s environmental quality? The case of China. Struct. Chang. Econ. Dyn. 2020, 52, 109–119. [Google Scholar] [CrossRef]

- Deng, P. Chinese outward direct investment research: Theoretical integration and recommendations. Manag. Organ. Rev. 2013, 9, 513–539. [Google Scholar] [CrossRef]

- Wang, H.Y.; Miao, L. CCG’s Report on Chinese Enterprises Globalization (2018); Social Sciences Academic Press: Beijing, China, 2018. [Google Scholar]

- De Perea, J.G.A.; Ramirezgarcia, C.; Cubo-molina, A.D. Internationalization business models and patterns of SMEs and MNEs: A qualitative multi-case study in the agrifood sector. Sustainability 2019, 11, 2755. [Google Scholar] [CrossRef]

- Tung, R.L. The human resource challenge to outward foreign direct investment aspirations from emerging economies: The case of China. Int. J. Hum. Resour. Manag. 2007, 18, 868–889. [Google Scholar] [CrossRef]

- Humphrey, A.A. The dilemma of institutional duality and multinational firms 1967–2017: Implications and future research. Multinatl. Bus. Rev. 2018, 26, 145–172. [Google Scholar]

- Nell, P.C.; Puck, J.F.; Heidenreich, S. Strictly limited choice or agency? Institutional duality, legitimacy, and subsidiaries’ political strategies. J. World Bus. 2015, 50, 302–311. [Google Scholar] [CrossRef]

- Hillman, A.J.; Wan, W.P. The determinants of MNE subsidiaries’ political strategies: Evidence of institutional duality. J. Int. Bus. Stud. 2005, 36, 322–340. [Google Scholar] [CrossRef]

- Kostova, T.; Roth, K. Adoption of an organizational practice by subsidiaries of multinational corporations: Institutional and relational effects. Acad. Manag. J. 2002, 45, 215–233. [Google Scholar]

- Lu, J.W.; Xu, D. Growth and survival of international joint ventures: An external-internal legitimacy perspective. J. Manag. 2006, 32, 426–448. [Google Scholar] [CrossRef]

- Luo, Y.; Xue, Q.; Han, B. How emerging market governments promote outward FDI: Experience from China. J. World Bus. 2010, 45, 68–79. [Google Scholar] [CrossRef]

- Luo, Y. Capability exploitation and building in a foreign market: Implications for multinational enterprises. Organ. Sci. 2002, 13, 48–63. [Google Scholar] [CrossRef]

- Prange, C.; Verdier, S. Dynamic capabilities, internationalization processes and performance. J. World Bus. 2011, 46, 126–133. [Google Scholar] [CrossRef]

- Brouthers, K.D.; Hennart, J.F. Boundaries of the firm: Insights from international entry mode research. J. Manag. 2007, 33, 395–425. [Google Scholar] [CrossRef]

- Meyer, K.E. Institutions, transaction costs, and entry mode choice in Eastern Europe. J. Int. Bus. Stud. 2001, 32, 357–367. [Google Scholar] [CrossRef]

- Brouthers, K.D.; Brouthers, L.E.; Werner, S. Transaction cost—Enhanced entry mode choices and firm performance. Strat. Manag. J. 2003, 24, 1239–1248. [Google Scholar] [CrossRef]

- Cui, L.; Jiang, F.; Stening, B.W. The entry-mode decision of Chinese outward FDI: Firm resources, industry conditions, and institutional forces. Thunderbird Int. Bus. Rev. 2011, 53, 483–499. [Google Scholar] [CrossRef]

- Wu, J.; Wang, C.; Hong, J.; Piperopoulos, P.; Zhuo, S. Internationalization and innovation performance of emerging market enterprises: The role of host-country institutional development. J. World Bus. 2016, 51, 251–263. [Google Scholar] [CrossRef]

- Florida, R. The globalization of R&D: Results of a survey of foreign-affiliated R & D laboratories in the USA. Res. Policy 1997, 26, 85–103. [Google Scholar]

- Wu, C.; Huang, F.; Huang, C.; Zhang, H.J.S. Entry mode, market selection, and innovation performance. Sustainability 2018, 10, 4222. [Google Scholar] [CrossRef]

- Tempel, A.; Edwards, T.; Ferner, A.; Mullercamen, M.; Wachter, H. Subsidiary responses to institutional duality: Collective representation practices of US multinationals in Britain and Germany. Hum. Relat. 2006, 59, 1543–1570. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhao, W.; Ge, J. Institutional duality and political strategies of foreign-invested firms in an emerging economy. J. World Bus. 2016, 51, 451–462. [Google Scholar] [CrossRef]

- Chung, C.C.; Xiao, S.S.; Lee, J.Y.; Kang, J. The interplay of top-down institutional pressures and bottom-up responses of transition economy firms on FDI entry mode choices. Manag. Int. Rev. 2016, 56, 699–732. [Google Scholar] [CrossRef]

- Cui, L.; Jiang, F. Ownership decisions in Chinese outward FDI: An integrated conceptual framework and research agenda. Asian Bus. Manag. 2009, 8, 301–324. [Google Scholar] [CrossRef]

- Li, J.; Xia, J.; Shapiro, D.; Lin, Z. Institutional compatibility and the internationalization of Chinese SOEs: The moderating role of home subnational institutions. J. World Bus. 2018, 53, 641–652. [Google Scholar] [CrossRef]

- Voss, H.; Buckley, P.J.; Cross, A.R. The impact of home country institutional effects on the internationalization strategy of Chinese firms. Multinatl. Bus. Rev. 2010, 18, 25–48. [Google Scholar] [CrossRef]

- Tang, J.; Tang, Z.; Cowden, B.J. Exploring the relationship between entrepreneurial orientation, ceo dual values, and sme performance in state—Owned vs. nonstate—Owned enterprises in china. Entrep. Theory Pract. 2017, 41, 883–908. [Google Scholar] [CrossRef]

- Deng, P. The internationalization of Chinese firms: A critical review and future research. Int. J. Manag. Rev. 2012, 14, 408–427. [Google Scholar] [CrossRef]

- Cui, L.; Jiang, F. FDI entry mode choice of Chinese firms: A strategic behavior perspective. J. World Bus. 2009, 44, 434–444. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institution of Capitalism; Free Press: New York, NY, USA, 1998. [Google Scholar]

- Rindfleisch, A.; Heide, J.B. Transaction cost analysis: Past, present, and future applications. J. Mark. 1997, 61, 30–54. [Google Scholar] [CrossRef]

- Brouthers, K.D.; Brouthers, L.E.; Werner, S. Real options, international entry mode choice and performance. J. Manag. Stud. 2008, 45, 936–960. [Google Scholar] [CrossRef]

- Tallman, S.; Fladmoelindquist, K. Internationalization, globalization, and capability-based strategy. Calif. Manag. Rev. 2002, 45, 116–135. [Google Scholar] [CrossRef]

- Anderson, E.; Gatignon, H. Modes of foreign entry: A transaction cost analysis and propositions. J. Int. Bus. Stud. 1986, 17, 1–26. [Google Scholar] [CrossRef]

- Gatignon, H.; Anderson, E. The multinational corporation’s degree of control over foreign subsidiaries: An empirical test of a transaction cost explanation. J. Law Econ. Organ. 1988, 4, 305–336. [Google Scholar]

- Folta, T.B.; Miller, K.D. Real options in equity partnerships. Strat. Manag. J. 2002, 23, 77–88. [Google Scholar] [CrossRef]

- Meyer, K.E.; Nguyen, H.V. Foreign investment strategies and sub-national institutions in emerging markets: Evidence from Vietnam†. J. Manag. Stud. 2005, 42, 63–93. [Google Scholar] [CrossRef]

- Shirodkar, V.; Konara, P. Institutional distance and foreign subsidiary performance in emerging markets: Moderating effects of ownership strategy and host-country experience. Manag. Int. Rev. 2017, 57, 179–207. [Google Scholar] [CrossRef]

- Kostova, T.; Zaheer, S. Organizational legitimacy under conditions of complexity: The case of the multinational enterprise. Acad. Manag. Rev. 1999, 24, 64–81. [Google Scholar] [CrossRef]

- Wu, Z.; Salomon, R. Does imitation reduce the liability of foreignness? Linking distance, isomorphism, and performance. Strat. Manag. J. 2016, 37, 2441–2462. [Google Scholar] [CrossRef]

- Chao, M.C.; Kumar, V. The impact of institutional distance on the international diversity-performance relationship. J. World Bus. 2010, 45, 93–103. [Google Scholar] [CrossRef]

- Brouthers, K. Institutional, cultural and transaction cost influences on entry mode choice and performance. J. Int. Bus. Stud. 2002, 33, 203–221. [Google Scholar] [CrossRef]

- Shenkar, O. Cultural distance revisited: Towards a more rigorous conceptualization and measurement of cultural differences. J. Int. Bus. Stud. 2001, 32, 519–535. [Google Scholar] [CrossRef]

- Oh, K.; Ryu, Y.S. FDI, institutional quality, and bribery: An empirical examination in China. Sustainability 2019, 11, 4023. [Google Scholar] [CrossRef]

- Meyer, K.E.; Estrin, S.; Bhaumik, S.K.; Peng, M.W. Institutions, resources, and entry strategies in emerging economies. Strat. Manag. J. 2009, 30, 61–80. [Google Scholar] [CrossRef]

- Drejer, I.; Jorgensen, B.H. The dynamic creation of knowledge: Analysing public-private collaborations. Technovation 2005, 25, 83–94. [Google Scholar] [CrossRef]

- Casillas, J.C.; Morenomenendez, A.M. Speed of the internationalization process: The role of diversity and depth in experiential learning. J. Int. Bus. Stud. 2014, 45, 85–101. [Google Scholar] [CrossRef]

- Li, M.H.; Cui, L.; Lu, J. Varieties in state capitalism: Outward FDI strategies of central and local state-owned enterprises from emerging economy countries. J. Int. Bus. Stud. 2014, 45, 980–1004. [Google Scholar] [CrossRef]

- Shi, W.; Markoczy, L.; Stan, C.V. The continuing importance of political ties in China. Acad. Manag. Pers. 2014, 28, 57–75. [Google Scholar] [CrossRef]

- Cui, L.; Jiang, F. State ownership effect on firms’ FDI ownership decisions under institutional pressure: A study of Chinese outward-investing firms. J. Int. Bus. Stud. 2012, 43, 264–284. [Google Scholar] [CrossRef]

- Hong, J.; Wang, C.; Kafouros, M. The role of the state in explaining the internationalization of emerging market enterprises. Br. J. Manag. 2015, 26, 45–62. [Google Scholar] [CrossRef]

- Buckley, P.J.; Clegg, L.J.; Cross, A.R.; Liu, X.; Voss, H.; Zheng, P. The determinants of Chinese outward foreign direct investment. J. Int. Bus. Stud. 2007, 38, 499–518. [Google Scholar] [CrossRef]

- Duanmu, J.L. Firm heterogeneity and location choice of Chinese multinational enterprises (MNEs). J. World Bus. 2012, 47, 64–72. [Google Scholar] [CrossRef]

- Sapienza, H.J.; Autio, E.; George, G.; Zahra, S.A. A Capabilities perspective on the effects of early internationalization on firm survival and growth. Acad. Manag. Rev. 2006, 31, 914–933. [Google Scholar] [CrossRef]

- Hitt, M.A.; Bierman, L.; Uhlenbruck, K.; Shimizu, K. The importance of resources in the internationalization of professional service firms: The good, the bad, and the ugly. Acad. Manag. J. 2006, 49, 1137–1157. [Google Scholar] [CrossRef]

- Makino, S.; Delios, A. Local knowledge transfer and performance: Implications for alliance formation in Asia. J. Int. Bus. Stud. 1996, 27, 905–927. [Google Scholar] [CrossRef]

- Kafouros, M.; Buckley, P.J.; Clegg, J. The effects of global knowledge reservoirs on the productivity of multinational enterprises: The role of international depth and breadth. Res. Policy 2012, 41, 848–861. [Google Scholar] [CrossRef]

- Barkema, H.G.; Vermeulen, F. International expansion through start-up or acquisition: A learning perspective. Acad. Manag. J. 1998, 41, 7–26. [Google Scholar]

- Lewbel, A. Constructing instruments for regressions with measurement error when no additional data are available, with an application to patents and R&D. Econometrica 1997, 65, 1201–1214. [Google Scholar]

- Cornaggia, J.; Mao, Y.; Tian, X.; Wolfe, B. Does banking competition affect innovation. J. Financ. Econ. 2015, 115, 189–209. [Google Scholar] [CrossRef]

- Hsu, C.; Boggs, D.J. Internationalization and performance: Traditional measures and their decomposition. Multinatl. Bus. Rev. 2003, 11, 23–50. [Google Scholar] [CrossRef]

- World Bank. The Worldwide Governance Indicators (WGI). Available online: http://info.worldbank.org/governance/wgi/index.aspx#home (accessed on 15 July 2020).

- Tihanyi, L.; Griffith, D.A.; Russell, C.J. The effect of cultural distance on entry mode choice, international diversification, and Mne performance: A meta-analysis. J. Int. Bus. Stud. 2005, 36, 270–283. [Google Scholar] [CrossRef]

- Hoskisson, R.O.; Johnson, R.A. Research notes and communications corporate restructuring and strategic change: The effect on diversification strategy and R & D intensity. Strat. Manag. J. 1992, 13, 625–634. [Google Scholar]

- Kyungsuk, L.; Taewoo, R. Proactive divestiture and business innovation: R&D input and output performance. Sustainability 2020, 12, 3874. [Google Scholar]

- Allen, L.; Pantzalis, C. Valuation of the operating flexibility of multinational corporations. J. Int. Bus. Stud. 1996, 27, 633–653. [Google Scholar] [CrossRef]

- Hitt, M.A.; Hoskisson, R.E.; Kim, H. International diversification: Effects on innovation and firm performance in product-diversified firms. Acad. Manag. J. 1997, 40, 767–798. [Google Scholar]

- Child, J.; Rodrigues, S.B. The internationalization of Chinese Firms: A case for theoretical extension? Manag. Organ. Rev. 2005, 1, 381–410. [Google Scholar] [CrossRef]

| Variable | Mean | SD | Lnpat | RDIN | IJV | Lnsize | SP | FSTS | IP | CD |

|---|---|---|---|---|---|---|---|---|---|---|

| Lnpat | 3.902 | 1.864 | 1 | 0.172 *** | −0.113 * | 0.447 *** | −0.187 *** | −0.267 *** | −0.102 | −0.049 |

| RDIN | 0.073 | 0.079 | 0.035 | 1 | −0.022 | −0.199 *** | −0.174 *** | 0.001 | −0.143 ** | 0.089 |

| IJV | 0.255 | 0.437 | −0.119 * | 0.053 | 1 | 0.074 | −0.101 | 0.084 | −0.164 ** | −0.012 |

| Lnsize | 21.88 | 1.142 | 0.440 *** | −0.178 *** | 0.066 | 1 | −0.139 ** | −0.372 *** | −0.122 * | 0.015 |

| SP | 0.235 | 0.133 | −0.221 *** | −0.139 ** | −0.086 | −0.114 * | 1 | 0.128 ** | −0.033 | 0.064 |

| FSTS | 0.300 | 0.268 | −0.235 *** | −0.044 | 0.090 | −0.357 *** | 0.078 | 1 | −0.052 | 0.041 |

| IP | 10.93 | 1.533 | −0.014 | −0.070 | −0.192 *** | −0.103 | −0.056 | −0.026 | 1 | −0.190 *** |

| CD | 3.208 | 1.889 | −0.030 | 0.159 ** | 0.019 | 0.006 | 0.023 | 0.080 | −0.023 | 1 |

| Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Owner | 1.132 *** | 1.216 *** | |

| (0.393) | (0.418) | ||

| SP | −1.925 | −2.440 * | |

| (1.305) | (1.401) | ||

| FSTS | 1.653 ** | 1.669 ** | |

| (0.648) | (0.684) | ||

| EP | 8.115 ** | 8.504 ** | |

| (3.398) | (3.556) | ||

| Law | −0.017 ** | −0.019 ** | |

| (0.009) | (0.009) | ||

| CD | −0.003 | 0.018 | |

| (0.095) | (0.100) | ||

| Constant | −3.157 ** | −0.241 | −3.955 ** |

| (1.429) | (1.232) | (1.744) | |

| Observations | 243 | 243 | 243 |

| chi2 | 28.56 | 30.98 | 46.10 |

| r2_p | 0.103 | 0.112 | 0.167 |

| ll | −123.7 | −122.5 | −115.0 |

| LRtest −2[L(red) − L(full)]∽χ2 based on Model 1 | 17.54 *** | ||

| LRtest −2[L(red) − L(full)]∽χ2 based on Model 2 | 15.12 *** | ||

| Overall Prediction Accuracy | 70.43% | 73.04% | 77.31% |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 |

|---|---|---|---|---|---|---|---|---|---|

| OLS Regression | Tobit Regression | IV (2sls) | |||||||

| RDIN | 2.981 ** | 3.077 ** | 5.065 *** | 3.267 ** | 3.374 ** | 5.225 *** | −0.143 | 0.209 | 9.915 * |

| (1.392) | (1.382) | (1.753) | (1.414) | (1.401) | (1.772) | (2.833) | (2.794) | (5.873) | |

| IJV | −0.522 ** | −0.141 | −0.558 ** | −0.199 | −0.680 *** | −0.663 *** | |||

| (0.248) | (0.323) | (0.252) | (0.328) | (0.245) | (0.249) | ||||

| IJV × RDIN | −4.915 * | −4.610 * | −13.163 ** | ||||||

| (2.691) | (2.728) | (6.042) | |||||||

| Lnsize | 0.708 *** | 0.734 *** | 0.731 *** | 0.714 *** | 0.743 *** | 0.740 *** | 0.641 *** | 0.668 *** | 0.752 *** |

| (0.104) | (0.104) | (0.103) | (0.106) | (0.105) | (0.105) | (0.112) | (0.111) | (0.124) | |

| SP | −1.803 ** | −2.023 ** | −2.019 ** | −1.970 ** | −2.207 *** | −2.196 *** | −2.383 *** | −2.565 *** | −2.000 ** |

| (0.830) | (0.831) | (0.826) | (0.846) | (0.844) | (0.838) | (0.848) | (0.835) | (0.910) | |

| FSTS | −0.430 | −0.318 | −0.356 | −0.423 | −0.304 | −0.338 | −0.557 | −0.410 | −0.303 |

| (0.416) | (0.416) | (0.414) | (0.422) | (0.421) | (0.419) | (0.438) | (0.434) | (0.448) | |

| IP | −0.011 | −0.039 | −0.037 | −0.006 | −0.036 | −0.034 | 0.016 | −0.018 | 0.007 |

| (0.071) | (0.071) | (0.071) | (0.072) | (0.073) | (0.072) | (0.071) | (0.071) | (0.073) | |

| CD | −0.093 | −0.093 | −0.101 * | −0.097 | −0.098 * | −0.104 * | −0.021 | −0.022 | −0.070 |

| (0.058) | (0.058) | (0.057) | (0.059) | (0.058) | (0.058) | (0.059) | (0.058) | (0.065) | |

| _cons | −13.737 *** | −14.024 *** | −14.028 *** | −14.327 *** | −14.663 *** | −14.644 *** | −11.876 *** | −12.119 *** | −14.373 *** |

| (2.657) | (2.641) | (2.627) | (2.711) | (2.690) | (2.671) | (2.753) | (2.709) | (3.060) | |

| Year | yes | yes | yes | yes | yes | yes | yes | yes | yes |

| N | 243 | 243 | 243 | 243 | 243 | 243 | 243 | 243 | 243 |

| F/chi2 | 6.573 | 6.549 | 6.445 | 95.06 | 99.93 | 102.8 | 11.72 | 11.43 | 10.19 |

| R2/PseudoR2 | 0.332 | 0.345 | 0.354 | 0.095 | 0.100 | 0.103 | 0.229 | 0.255 | 0.227 |

| Adj. R2/ll | 0.281 | 0.292 | 0.299 | −451.3 | −448.8 | −447.4 | 0.209 | 0.233 | 0.200 |

| First Stage F Value | 16.39 | 14.32 | 12.01 | ||||||

| Sargan-Hansen test [p-Value] | 0.7833 | 0.6506 | 0.4461 | ||||||

| Variable | OLS Regression | Tobit Regression | ||||||

|---|---|---|---|---|---|---|---|---|

| Private Firms | State-Owned Firms | Private Firms | State-Owned Firms | |||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| RDIN | 2.105 | 5.702 ** | 4.840 ** | 5.570 * | 2.124 | 5.774 ** | 5.562 ** | 5.783 * |

| (1.927) | (2.306) | (2.230) | (3.081) | (1.876) | (2.239) | (2.158) | (2.947) | |

| IJV | −0.152 | 0.603 | −0.763 * | −0.645 | −0.117 | 0.648 | −0.858 ** | −0.822 |

| (0.345) | (0.438) | (0.411) | (0.538) | (0.336) | (0.425) | (0.400) | (0.522) | |

| IJV × RDIN | −10.097 *** | −1.510 | −10.230 *** | −0.465 | ||||

| (3.743) | (4.371) | (3.631) | (4.218) | |||||

| _cons | −8.017 ** | −7.795 ** | −20.003 *** | −20.222 *** | −7.713 ** | −7.492 ** | −21.584 *** | −21.645 *** |

| (3.862) | (3.772) | (4.887) | (4.956) | (3.761) | (3.660) | (4.748) | (4.779) | |

| Control | yes | yes | yes | yes | yes | yes | yes | yes |

| Year | yes | yes | yes | yes | yes | yes | yes | yes |

| N | 147 | 147 | 96 | 96 | 147 | 147 | 96 | 96 |

| F/chi2 | 1.887 | 2.273 | 4.795 | 4.497 | 31.26 | 38.98 | 71.88 | 71.89 |

| R2/PseudoR2 | 0.199 | 0.242 | 0.529 | 0.529 | 0.056 | 0.0697 | 0.170 | 0.170 |

| Adj. R2/ll | 0.094 | 0.136 | 0.418 | 0.412 | −263.8 | −260.0 | −175.0 | −175.0 |

| Inter-group difference | 0.057 * | 0.035 ** | ||||||

| Variable | OLS Regression | Tobit Regression | ||||||

|---|---|---|---|---|---|---|---|---|

| Low Internationalization Breadth | High Internationalization Breadth | Low Internationalization Breadth | High Internationalization Breadth | |||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| RDIN | 1.973 | 5.027 ** | 16.845 *** | 16.021 *** | 2.283 | 4.999 ** | 16.970 *** | 16.204 *** |

| (1.512) | (2.124) | (5.389) | (5.813) | (1.515) | (2.117) | (4.761) | (5.078) | |

| IJV | −0.649 ** | −0.168 | −0.200 | −0.471 | −0.734 *** | −0.295 | −0.168 | −0.419 |

| (0.275) | (0.361) | (0.543) | (0.867) | (0.277) | (0.364) | (0.480) | (0.757) | |

| IJV × RDIN | −6.023 ** | 3.747 | −5.407 * | 3.476 | ||||

| (2.970) | (9.305) | (2.976) | (8.122) | |||||

| _cons | −10.190 *** | −10.218 *** | −19.417 *** | −19.487 *** | −11.075 *** | −11.045 *** | −19.786 *** | −19.849 *** |

| (3.231) | (3.201) | (6.967) | (7.036) | (3.264) | (3.225) | (6.153) | (6.144) | |

| Control | yes | yes | yes | yes | yes | yes | yes | yes |

| Year | yes | yes | yes | yes | yes | yes | yes | yes |

| N | 181 | 181 | 62 | 62 | 181 | 181 | 62 | 62 |

| F/chi2 | 4.351 | 4.418 | 2.531 | 2.354 | 72.76 | 76.02 | 40.15 | 40.33 |

| R2/PseudoR2 | 0.326 | 0.343 | 0.494 | 0.496 | 0.102 | 0.106 | 0.157 | 0.158 |

| Adj. R2/ll | 0.251 | 0.265 | 0.299 | 0.285 | −320.7 | −319.1 | −107.5 | −107.4 |

| Inter-group difference | 0.015 ** | 0.013 ** | ||||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, C.; Bo, S.; Wan, X.; Ji, M.; Chen, M.; Zhang, S. Does the Choice of IJV under Institutional Duality Promote the Innovation Performance of Chinese Manufacturing Firms? Evidence from Listed Chinese Manufacturing Companies. Sustainability 2020, 12, 6869. https://doi.org/10.3390/su12176869

Wu C, Bo S, Wan X, Ji M, Chen M, Zhang S. Does the Choice of IJV under Institutional Duality Promote the Innovation Performance of Chinese Manufacturing Firms? Evidence from Listed Chinese Manufacturing Companies. Sustainability. 2020; 12(17):6869. https://doi.org/10.3390/su12176869

Chicago/Turabian StyleWu, Chong, Siyi Bo, Xing Wan, Min Ji, Meihua Chen, and Shifan Zhang. 2020. "Does the Choice of IJV under Institutional Duality Promote the Innovation Performance of Chinese Manufacturing Firms? Evidence from Listed Chinese Manufacturing Companies" Sustainability 12, no. 17: 6869. https://doi.org/10.3390/su12176869

APA StyleWu, C., Bo, S., Wan, X., Ji, M., Chen, M., & Zhang, S. (2020). Does the Choice of IJV under Institutional Duality Promote the Innovation Performance of Chinese Manufacturing Firms? Evidence from Listed Chinese Manufacturing Companies. Sustainability, 12(17), 6869. https://doi.org/10.3390/su12176869