Institutional Quality, FDI, and Productivity: A Theoretical Analysis

Abstract

1. Introduction

2. The Model

2.1. Preferences

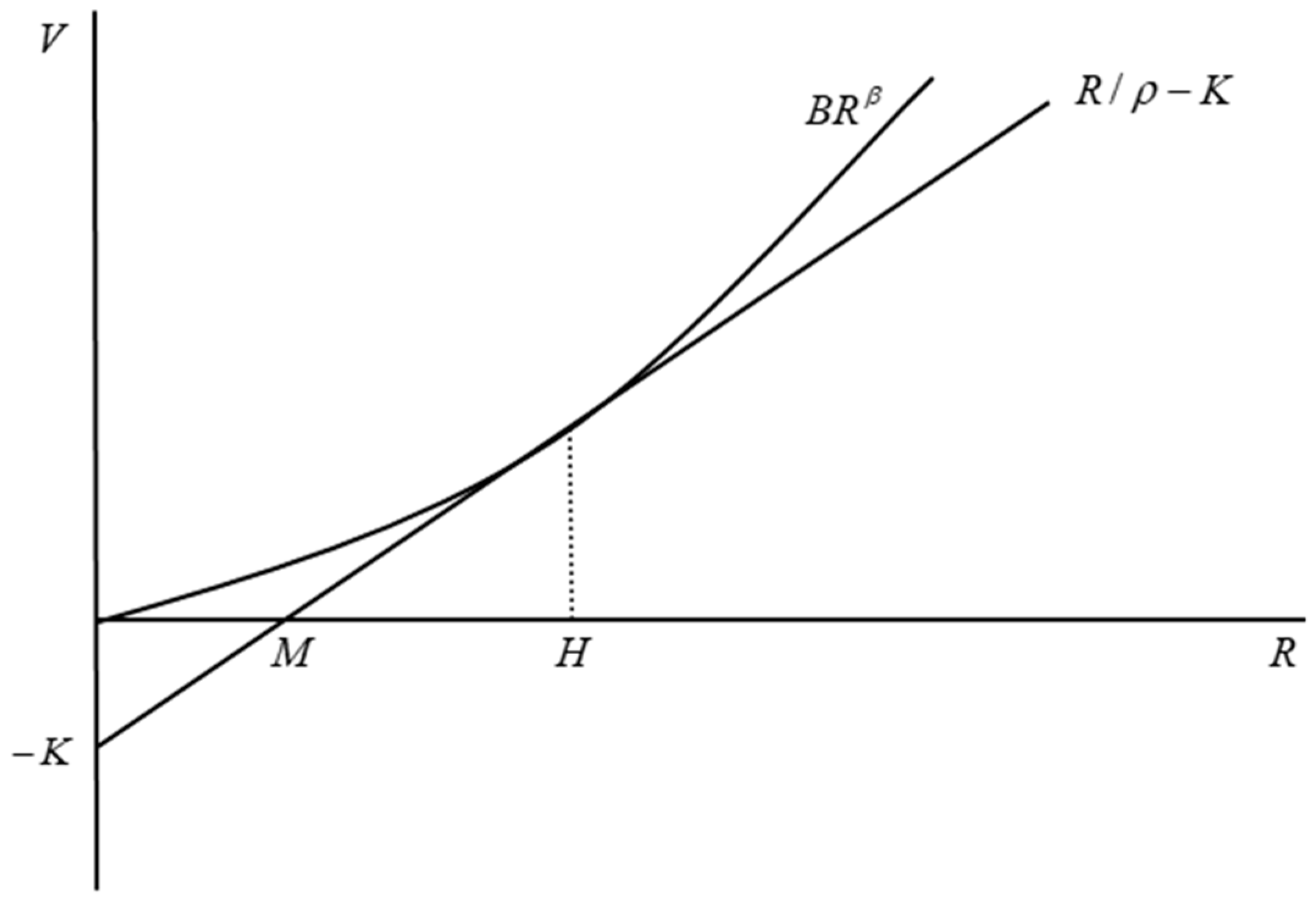

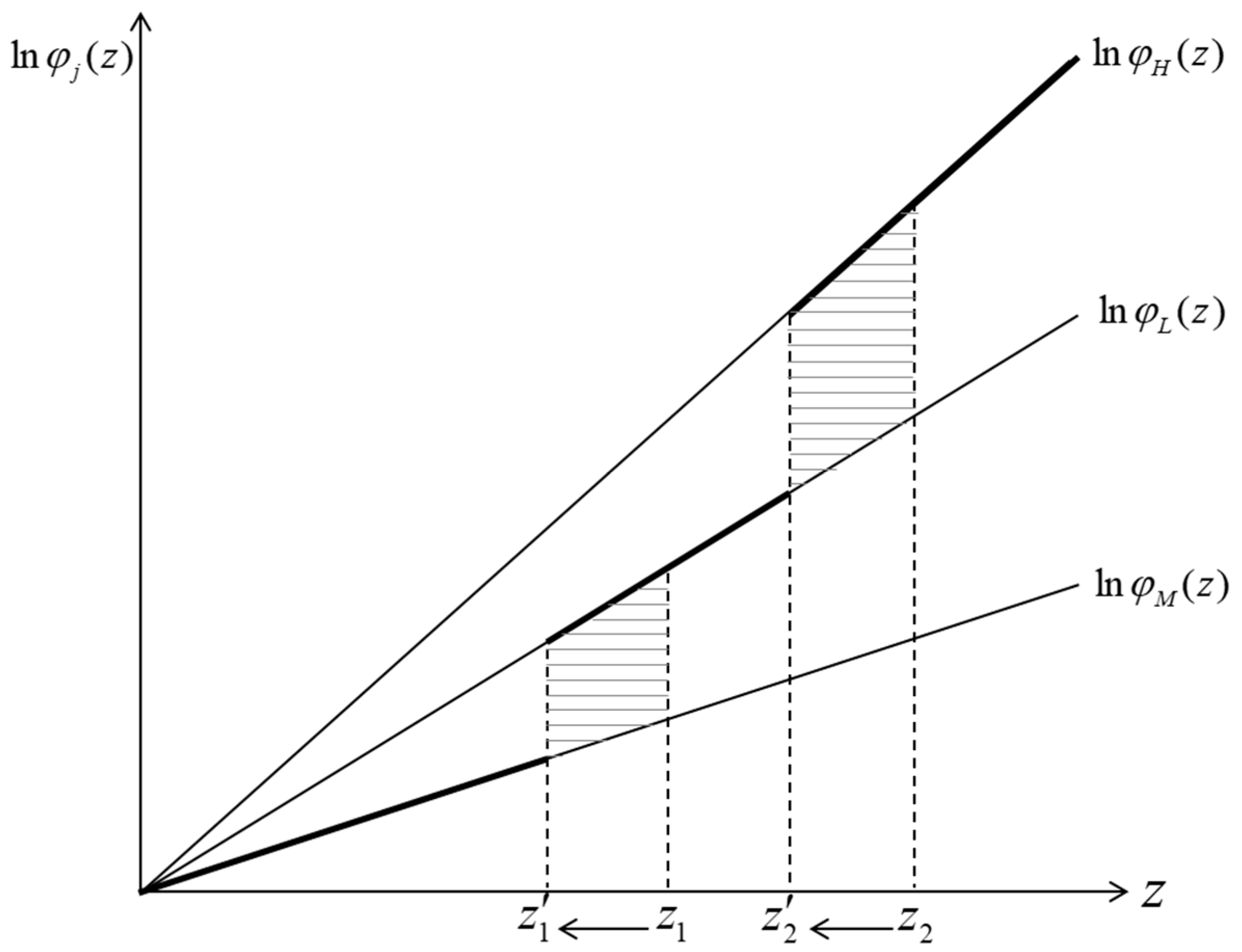

2.2. Technologies and Production Modes

2.3. Technologies and Labor Market

2.4. Institutionial Quality

2.5. Equilibrium

3. Effects of Institutional Quality

4. Numerical Simulations

4.1. Calibration

- -workers represent 70% of the population. US Economic Census reports that the ratio of production workers to total employees in manufacturing is about 70%. Initially, we choose .

- From the same source, we pick the non-production workers’ wage share in total value added from labor as .

- US Economic Census also reports industry statistics by employment size. We approximate multinationals’ total output share as that of establishments with 2500 or more employees: .

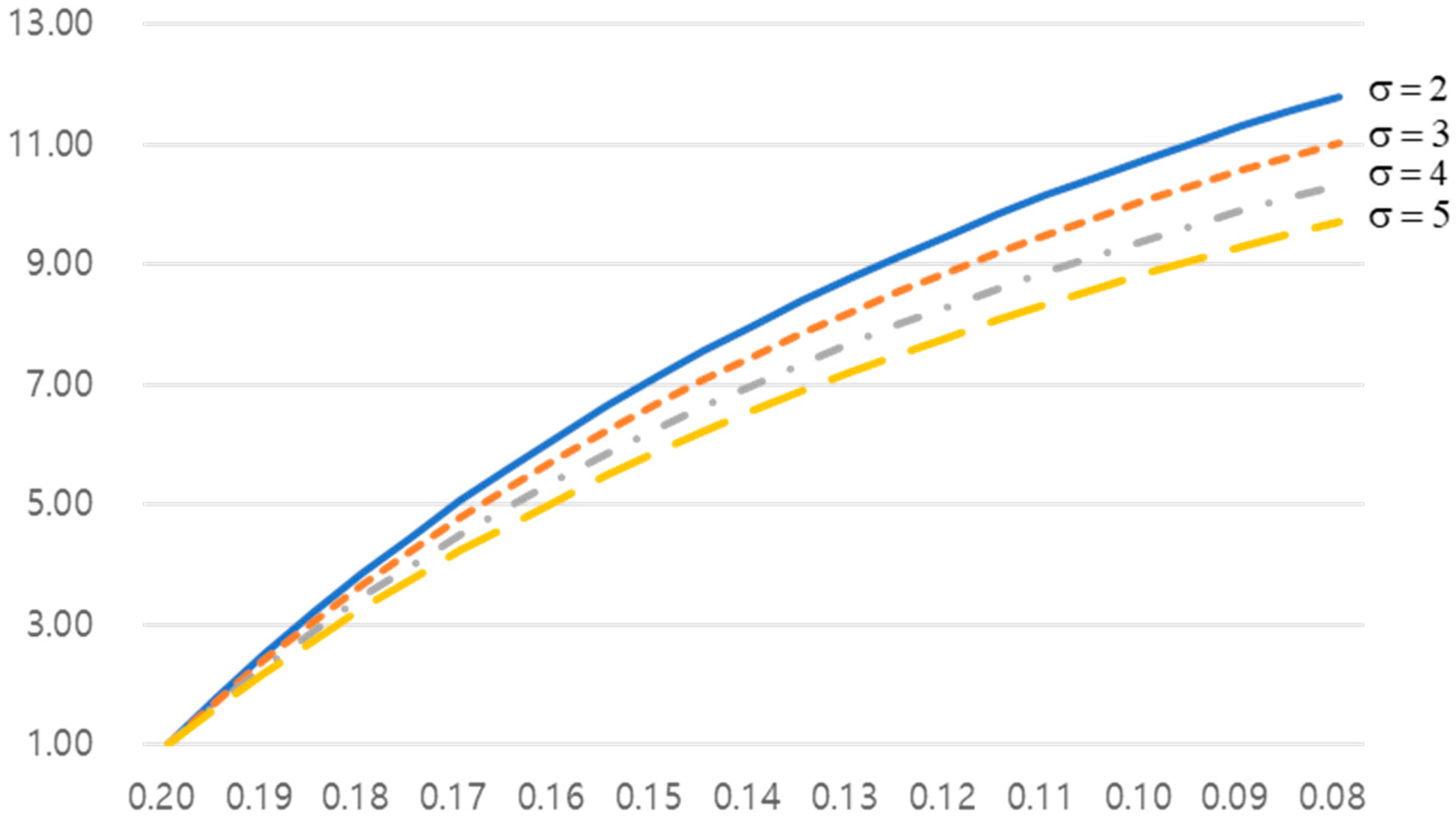

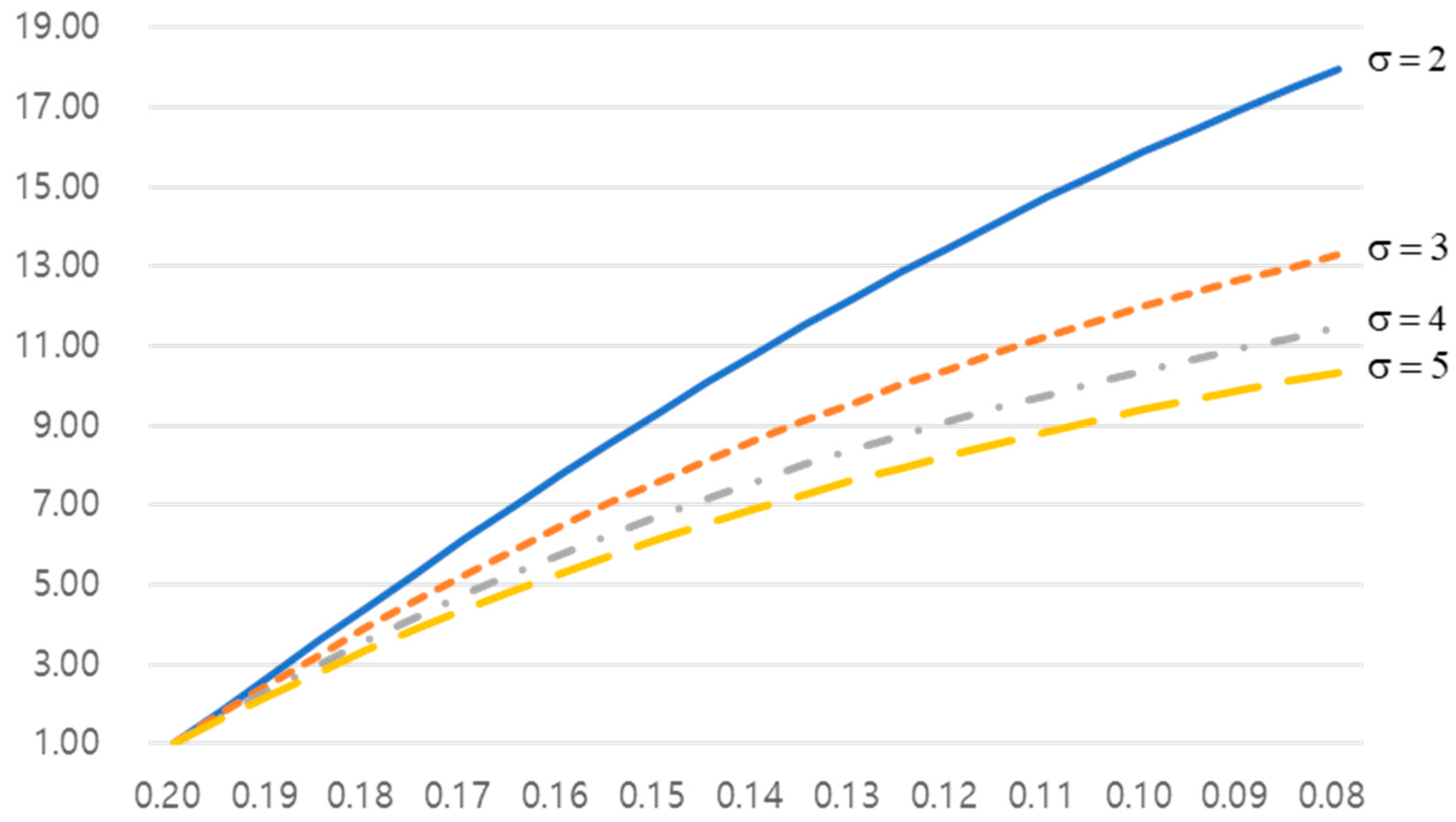

4.2. Effects on FDI

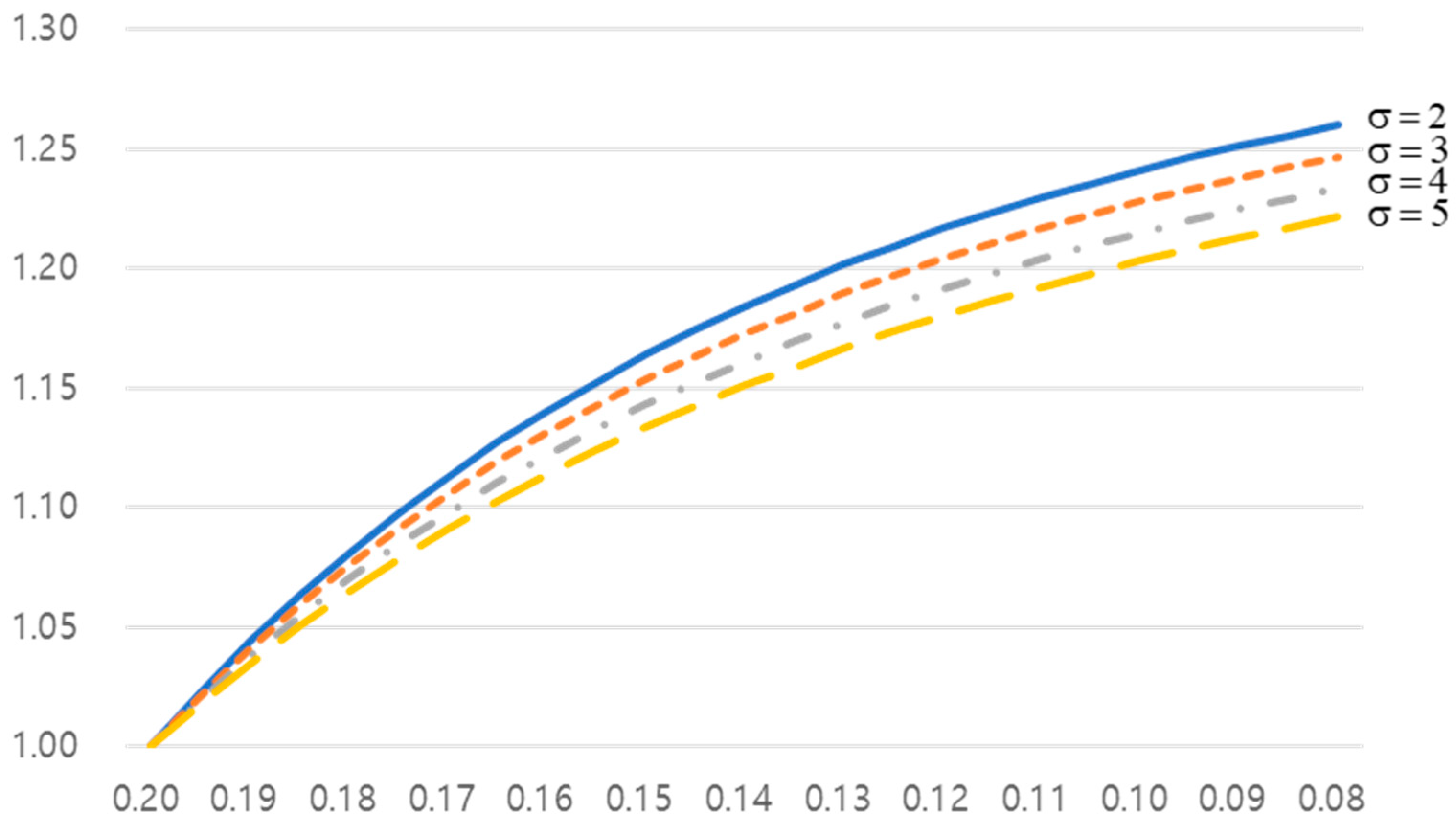

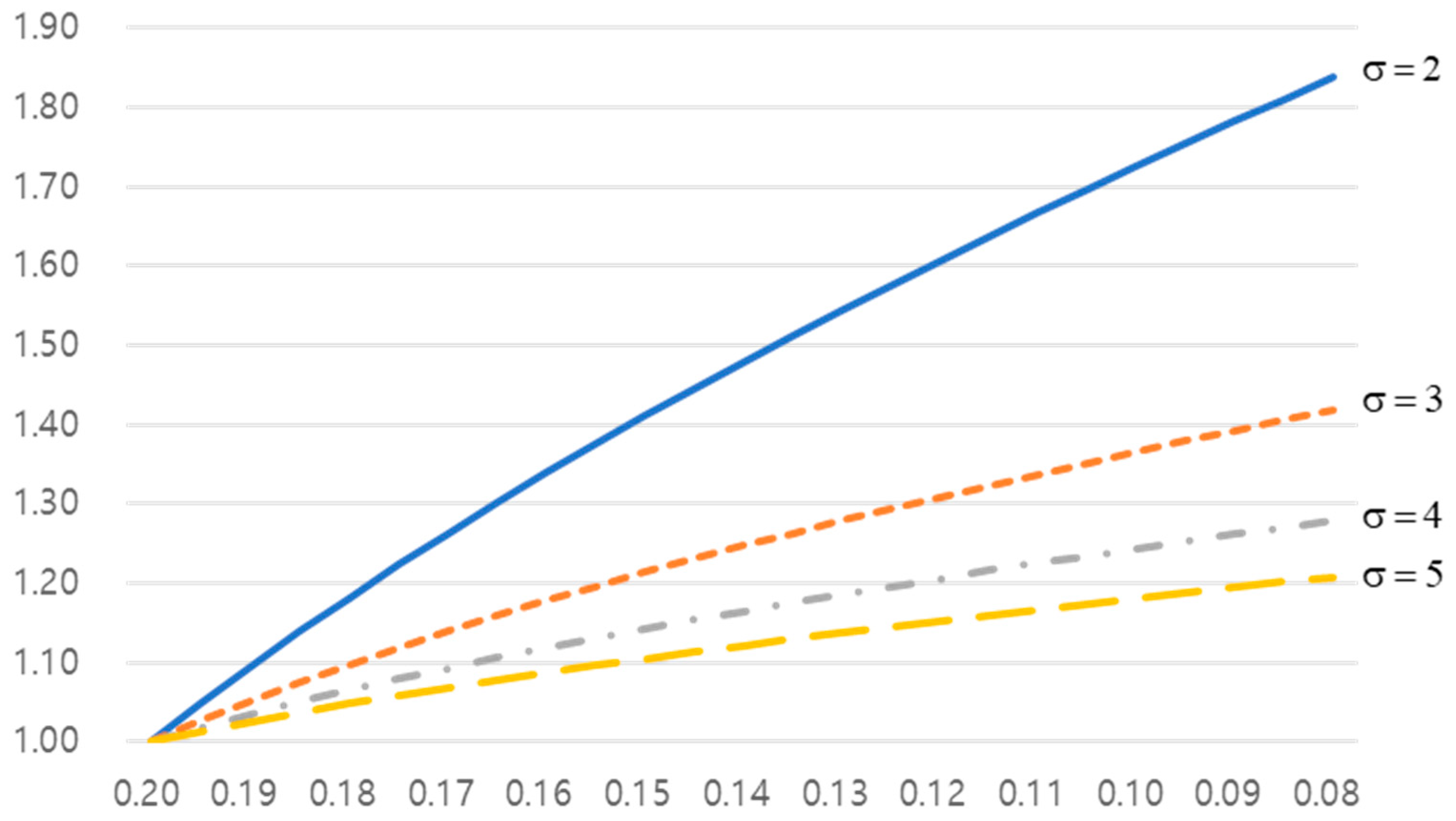

4.3. Effects on Productivity

4.4. Effects on Welfare

5. Conclusions

Funding

Conflicts of Interest

Appendix A

System of Equations

Appendix B

Simulated Effects of Institutonal Quality for Alternative Values of

| 0.200 | 0.483 | 0.041 | 1.664 | 6.097 | 0.700 | 0.973 | 0.643 | 0.499 | 0.107 | 1.000 | 1.000 | 1.000 | 1.000 |

| 0.195 | 0.464 | 0.073 | 1.674 | 5.849 | 0.679 | 0.950 | 0.651 | 0.508 | 0.191 | 1.782 | 1.023 | 1.049 | 1.857 |

| 0.190 | 0.446 | 0.103 | 1.685 | 5.637 | 0.660 | 0.928 | 0.660 | 0.518 | 0.270 | 2.518 | 1.044 | 1.095 | 2.722 |

| 0.185 | 0.429 | 0.133 | 1.696 | 5.454 | 0.640 | 0.906 | 0.668 | 0.527 | 0.344 | 3.211 | 1.063 | 1.139 | 3.588 |

| 0.180 | 0.412 | 0.161 | 1.708 | 5.293 | 0.621 | 0.885 | 0.676 | 0.536 | 0.414 | 3.865 | 1.081 | 1.182 | 4.450 |

| 0.175 | 0.397 | 0.187 | 1.720 | 5.152 | 0.603 | 0.865 | 0.684 | 0.545 | 0.480 | 4.482 | 1.098 | 1.223 | 5.303 |

| 0.170 | 0.382 | 0.213 | 1.733 | 5.027 | 0.585 | 0.844 | 0.691 | 0.554 | 0.543 | 5.066 | 1.113 | 1.263 | 6.143 |

| 0.165 | 0.368 | 0.237 | 1.746 | 4.916 | 0.568 | 0.824 | 0.699 | 0.563 | 0.602 | 5.619 | 1.127 | 1.302 | 6.967 |

| 0.160 | 0.354 | 0.261 | 1.760 | 4.816 | 0.551 | 0.805 | 0.706 | 0.572 | 0.658 | 6.143 | 1.141 | 1.339 | 7.775 |

| 0.155 | 0.341 | 0.284 | 1.774 | 4.726 | 0.535 | 0.786 | 0.714 | 0.581 | 0.712 | 6.640 | 1.153 | 1.375 | 8.563 |

| 0.150 | 0.328 | 0.305 | 1.788 | 4.645 | 0.519 | 0.767 | 0.721 | 0.590 | 0.762 | 7.111 | 1.164 | 1.411 | 9.332 |

| 0.145 | 0.316 | 0.326 | 1.803 | 4.571 | 0.503 | 0.748 | 0.728 | 0.599 | 0.810 | 7.560 | 1.175 | 1.445 | 10.080 |

| 0.140 | 0.304 | 0.347 | 1.818 | 4.504 | 0.488 | 0.730 | 0.735 | 0.607 | 0.856 | 7.986 | 1.184 | 1.479 | 10.808 |

| 0.135 | 0.293 | 0.366 | 1.833 | 4.442 | 0.473 | 0.712 | 0.742 | 0.616 | 0.899 | 8.392 | 1.193 | 1.512 | 11.515 |

| 0.130 | 0.282 | 0.385 | 1.848 | 4.386 | 0.459 | 0.695 | 0.749 | 0.624 | 0.941 | 8.778 | 1.202 | 1.544 | 12.201 |

| 0.125 | 0.272 | 0.403 | 1.863 | 4.334 | 0.445 | 0.678 | 0.755 | 0.633 | 0.980 | 9.147 | 1.210 | 1.576 | 12.865 |

| 0.120 | 0.262 | 0.421 | 1.879 | 4.285 | 0.431 | 0.661 | 0.762 | 0.641 | 1.018 | 9.498 | 1.217 | 1.607 | 13.510 |

| 0.115 | 0.252 | 0.438 | 1.895 | 4.241 | 0.418 | 0.644 | 0.768 | 0.649 | 1.054 | 9.835 | 1.224 | 1.637 | 14.135 |

| 0.110 | 0.243 | 0.455 | 1.911 | 4.200 | 0.405 | 0.628 | 0.775 | 0.657 | 1.088 | 10.155 | 1.230 | 1.667 | 14.739 |

| 0.105 | 0.234 | 0.471 | 1.927 | 4.161 | 0.392 | 0.611 | 0.781 | 0.665 | 1.121 | 10.461 | 1.236 | 1.697 | 15.324 |

| 0.100 | 0.225 | 0.486 | 1.943 | 4.126 | 0.380 | 0.596 | 0.787 | 0.673 | 1.153 | 10.755 | 1.241 | 1.726 | 15.889 |

| 0.095 | 0.217 | 0.501 | 1.959 | 4.092 | 0.368 | 0.580 | 0.793 | 0.681 | 1.183 | 11.035 | 1.247 | 1.754 | 16.438 |

| 0.090 | 0.209 | 0.516 | 1.975 | 4.061 | 0.356 | 0.565 | 0.799 | 0.689 | 1.212 | 11.304 | 1.251 | 1.783 | 16.967 |

| 0.085 | 0.201 | 0.530 | 1.992 | 4.031 | 0.345 | 0.549 | 0.805 | 0.697 | 1.239 | 11.561 | 1.256 | 1.810 | 17.480 |

| 0.080 | 0.194 | 0.544 | 2.008 | 4.004 | 0.334 | 0.535 | 0.810 | 0.705 | 1.266 | 11.808 | 1.260 | 1.838 | 17.977 |

| 0.200 | 0.322 | 0.027 | 1.664 | 4.087 | 0.700 | 0.973 | 0.643 | 0.499 | 0.129 | 1.000 | 1.000 | 1.000 | 1.000 |

| 0.195 | 0.310 | 0.047 | 1.673 | 4.002 | 0.681 | 0.951 | 0.651 | 0.508 | 0.223 | 1.731 | 1.021 | 1.027 | 1.768 |

| 0.190 | 0.299 | 0.066 | 1.683 | 3.929 | 0.662 | 0.931 | 0.659 | 0.516 | 0.311 | 2.418 | 1.041 | 1.052 | 2.514 |

| 0.185 | 0.288 | 0.084 | 1.693 | 3.866 | 0.644 | 0.911 | 0.666 | 0.525 | 0.395 | 3.064 | 1.059 | 1.076 | 3.237 |

| 0.180 | 0.278 | 0.102 | 1.704 | 3.812 | 0.627 | 0.892 | 0.673 | 0.533 | 0.473 | 3.672 | 1.076 | 1.098 | 3.935 |

| 0.175 | 0.269 | 0.118 | 1.715 | 3.764 | 0.610 | 0.873 | 0.681 | 0.542 | 0.547 | 4.244 | 1.092 | 1.119 | 4.608 |

| 0.170 | 0.259 | 0.134 | 1.727 | 3.721 | 0.594 | 0.854 | 0.688 | 0.550 | 0.616 | 4.786 | 1.106 | 1.140 | 5.255 |

| 0.165 | 0.251 | 0.149 | 1.738 | 3.683 | 0.578 | 0.836 | 0.694 | 0.558 | 0.682 | 5.299 | 1.119 | 1.159 | 5.877 |

| 0.160 | 0.242 | 0.164 | 1.750 | 3.650 | 0.563 | 0.818 | 0.701 | 0.566 | 0.745 | 5.784 | 1.132 | 1.178 | 6.474 |

| 0.155 | 0.234 | 0.178 | 1.763 | 3.619 | 0.548 | 0.801 | 0.708 | 0.574 | 0.804 | 6.243 | 1.143 | 1.196 | 7.047 |

| 0.150 | 0.226 | 0.191 | 1.775 | 3.592 | 0.533 | 0.784 | 0.714 | 0.582 | 0.860 | 6.680 | 1.154 | 1.214 | 7.596 |

| 0.145 | 0.219 | 0.204 | 1.788 | 3.568 | 0.519 | 0.768 | 0.721 | 0.590 | 0.914 | 7.095 | 1.164 | 1.231 | 8.124 |

| 0.140 | 0.212 | 0.217 | 1.800 | 3.546 | 0.506 | 0.751 | 0.727 | 0.597 | 0.964 | 7.489 | 1.173 | 1.247 | 8.629 |

| 0.135 | 0.205 | 0.229 | 1.813 | 3.526 | 0.492 | 0.735 | 0.733 | 0.605 | 1.013 | 7.865 | 1.181 | 1.263 | 9.114 |

| 0.130 | 0.199 | 0.240 | 1.826 | 3.508 | 0.480 | 0.720 | 0.739 | 0.612 | 1.059 | 8.223 | 1.190 | 1.279 | 9.578 |

| 0.125 | 0.192 | 0.252 | 1.839 | 3.491 | 0.467 | 0.705 | 0.745 | 0.620 | 1.103 | 8.565 | 1.197 | 1.294 | 10.024 |

| 0.120 | 0.186 | 0.263 | 1.853 | 3.476 | 0.455 | 0.690 | 0.751 | 0.627 | 1.145 | 8.891 | 1.204 | 1.309 | 10.451 |

| 0.115 | 0.180 | 0.273 | 1.866 | 3.462 | 0.443 | 0.675 | 0.756 | 0.634 | 1.185 | 9.203 | 1.211 | 1.324 | 10.860 |

| 0.110 | 0.175 | 0.284 | 1.879 | 3.449 | 0.431 | 0.661 | 0.762 | 0.641 | 1.223 | 9.501 | 1.217 | 1.338 | 11.253 |

| 0.105 | 0.169 | 0.294 | 1.893 | 3.438 | 0.420 | 0.646 | 0.767 | 0.648 | 1.260 | 9.786 | 1.223 | 1.352 | 11.630 |

| 0.100 | 0.164 | 0.303 | 1.906 | 3.427 | 0.409 | 0.633 | 0.773 | 0.655 | 1.295 | 10.059 | 1.228 | 1.366 | 11.992 |

| 0.095 | 0.159 | 0.313 | 1.919 | 3.417 | 0.398 | 0.619 | 0.778 | 0.662 | 1.329 | 10.321 | 1.233 | 1.380 | 12.339 |

| 0.090 | 0.154 | 0.322 | 1.933 | 3.408 | 0.388 | 0.606 | 0.783 | 0.668 | 1.361 | 10.572 | 1.238 | 1.393 | 12.672 |

| 0.085 | 0.149 | 0.331 | 1.946 | 3.400 | 0.378 | 0.592 | 0.788 | 0.675 | 1.392 | 10.812 | 1.242 | 1.406 | 12.993 |

| 0.080 | 0.145 | 0.339 | 1.960 | 3.392 | 0.368 | 0.580 | 0.793 | 0.682 | 1.422 | 11.043 | 1.247 | 1.419 | 13.300 |

| 0.200 | 0.241 | 0.020 | 1.664 | 3.371 | 0.700 | 0.973 | 0.643 | 0.499 | 0.141 | 1.000 | 1.000 | 1.000 | 1.000 |

| 0.195 | 0.233 | 0.034 | 1.672 | 3.328 | 0.682 | 0.953 | 0.650 | 0.507 | 0.235 | 1.674 | 1.020 | 1.018 | 1.695 |

| 0.190 | 0.226 | 0.047 | 1.681 | 3.292 | 0.665 | 0.934 | 0.657 | 0.515 | 0.324 | 2.307 | 1.038 | 1.035 | 2.363 |

| 0.185 | 0.218 | 0.060 | 1.691 | 3.260 | 0.649 | 0.916 | 0.664 | 0.523 | 0.408 | 2.903 | 1.055 | 1.051 | 3.001 |

| 0.180 | 0.211 | 0.072 | 1.700 | 3.233 | 0.633 | 0.898 | 0.671 | 0.530 | 0.487 | 3.464 | 1.070 | 1.065 | 3.612 |

| 0.175 | 0.205 | 0.083 | 1.710 | 3.209 | 0.618 | 0.881 | 0.677 | 0.538 | 0.561 | 3.994 | 1.085 | 1.080 | 4.195 |

| 0.170 | 0.198 | 0.094 | 1.720 | 3.188 | 0.603 | 0.864 | 0.684 | 0.545 | 0.631 | 4.495 | 1.098 | 1.093 | 4.751 |

| 0.165 | 0.192 | 0.105 | 1.731 | 3.170 | 0.588 | 0.848 | 0.690 | 0.553 | 0.698 | 4.969 | 1.111 | 1.106 | 5.283 |

| 0.160 | 0.186 | 0.115 | 1.741 | 3.153 | 0.574 | 0.832 | 0.696 | 0.560 | 0.761 | 5.418 | 1.122 | 1.119 | 5.791 |

| 0.155 | 0.181 | 0.125 | 1.752 | 3.139 | 0.561 | 0.816 | 0.702 | 0.567 | 0.821 | 5.845 | 1.133 | 1.131 | 6.275 |

| 0.150 | 0.176 | 0.134 | 1.763 | 3.126 | 0.548 | 0.801 | 0.708 | 0.574 | 0.878 | 6.250 | 1.143 | 1.142 | 6.739 |

| 0.145 | 0.170 | 0.143 | 1.774 | 3.115 | 0.535 | 0.786 | 0.714 | 0.581 | 0.932 | 6.636 | 1.153 | 1.154 | 7.181 |

| 0.140 | 0.166 | 0.152 | 1.785 | 3.104 | 0.522 | 0.771 | 0.719 | 0.588 | 0.984 | 7.004 | 1.161 | 1.165 | 7.603 |

| 0.135 | 0.161 | 0.160 | 1.796 | 3.095 | 0.510 | 0.757 | 0.725 | 0.595 | 1.033 | 7.354 | 1.170 | 1.175 | 8.008 |

| 0.130 | 0.156 | 0.169 | 1.807 | 3.087 | 0.499 | 0.743 | 0.730 | 0.601 | 1.080 | 7.689 | 1.177 | 1.186 | 8.394 |

| 0.125 | 0.152 | 0.177 | 1.818 | 3.080 | 0.487 | 0.729 | 0.735 | 0.608 | 1.125 | 8.008 | 1.185 | 1.196 | 8.763 |

| 0.120 | 0.148 | 0.184 | 1.830 | 3.073 | 0.476 | 0.716 | 0.741 | 0.614 | 1.168 | 8.314 | 1.192 | 1.206 | 9.116 |

| 0.115 | 0.144 | 0.192 | 1.841 | 3.067 | 0.465 | 0.703 | 0.746 | 0.620 | 1.209 | 8.606 | 1.198 | 1.216 | 9.455 |

| 0.110 | 0.140 | 0.199 | 1.852 | 3.062 | 0.455 | 0.690 | 0.751 | 0.627 | 1.248 | 8.885 | 1.204 | 1.225 | 9.780 |

| 0.105 | 0.136 | 0.206 | 1.864 | 3.057 | 0.445 | 0.677 | 0.755 | 0.633 | 1.286 | 9.154 | 1.210 | 1.235 | 10.090 |

| 0.100 | 0.132 | 0.213 | 1.875 | 3.053 | 0.435 | 0.665 | 0.760 | 0.639 | 1.322 | 9.411 | 1.215 | 1.244 | 10.388 |

| 0.095 | 0.129 | 0.219 | 1.887 | 3.049 | 0.425 | 0.653 | 0.765 | 0.645 | 1.357 | 9.658 | 1.220 | 1.253 | 10.674 |

| 0.090 | 0.125 | 0.226 | 1.898 | 3.046 | 0.416 | 0.641 | 0.769 | 0.651 | 1.390 | 9.895 | 1.225 | 1.262 | 10.948 |

| 0.085 | 0.122 | 0.232 | 1.909 | 3.043 | 0.406 | 0.629 | 0.774 | 0.656 | 1.422 | 10.122 | 1.229 | 1.271 | 11.211 |

| 0.080 | 0.119 | 0.238 | 1.920 | 3.040 | 0.397 | 0.618 | 0.778 | 0.662 | 1.453 | 10.341 | 1.234 | 1.280 | 11.463 |

| 0.200 | 0.193 | 0.016 | 1.664 | 2.997 | 0.700 | 0.973 | 0.643 | 0.499 | 0.148 | 1.000 | 1.000 | 1.000 | 1.000 |

| 0.195 | 0.187 | 0.027 | 1.672 | 2.972 | 0.684 | 0.955 | 0.650 | 0.506 | 0.240 | 1.621 | 1.018 | 1.013 | 1.635 |

| 0.190 | 0.181 | 0.036 | 1.680 | 2.951 | 0.668 | 0.937 | 0.656 | 0.513 | 0.326 | 2.206 | 1.035 | 1.025 | 2.241 |

| 0.185 | 0.176 | 0.046 | 1.688 | 2.932 | 0.653 | 0.921 | 0.662 | 0.521 | 0.408 | 2.756 | 1.051 | 1.037 | 2.818 |

| 0.180 | 0.171 | 0.054 | 1.697 | 2.917 | 0.638 | 0.904 | 0.669 | 0.528 | 0.484 | 3.276 | 1.065 | 1.048 | 3.367 |

| 0.175 | 0.166 | 0.063 | 1.706 | 2.903 | 0.624 | 0.888 | 0.675 | 0.535 | 0.557 | 3.767 | 1.079 | 1.058 | 3.890 |

| 0.170 | 0.161 | 0.071 | 1.715 | 2.891 | 0.611 | 0.873 | 0.680 | 0.542 | 0.626 | 4.232 | 1.091 | 1.068 | 4.388 |

| 0.165 | 0.157 | 0.079 | 1.724 | 2.881 | 0.597 | 0.858 | 0.686 | 0.548 | 0.691 | 4.673 | 1.103 | 1.078 | 4.862 |

| 0.160 | 0.153 | 0.087 | 1.734 | 2.872 | 0.584 | 0.843 | 0.692 | 0.555 | 0.753 | 5.092 | 1.114 | 1.087 | 5.315 |

| 0.155 | 0.148 | 0.094 | 1.743 | 2.864 | 0.572 | 0.829 | 0.697 | 0.561 | 0.812 | 5.489 | 1.124 | 1.096 | 5.746 |

| 0.150 | 0.144 | 0.101 | 1.753 | 2.857 | 0.560 | 0.815 | 0.702 | 0.568 | 0.868 | 5.868 | 1.134 | 1.105 | 6.158 |

| 0.145 | 0.141 | 0.108 | 1.762 | 2.851 | 0.548 | 0.802 | 0.708 | 0.574 | 0.921 | 6.229 | 1.143 | 1.113 | 6.550 |

| 0.140 | 0.137 | 0.114 | 1.772 | 2.846 | 0.537 | 0.788 | 0.713 | 0.580 | 0.972 | 6.574 | 1.151 | 1.122 | 6.926 |

| 0.135 | 0.134 | 0.120 | 1.782 | 2.841 | 0.526 | 0.775 | 0.718 | 0.586 | 1.021 | 6.903 | 1.159 | 1.130 | 7.284 |

| 0.130 | 0.130 | 0.127 | 1.792 | 2.837 | 0.515 | 0.763 | 0.723 | 0.592 | 1.067 | 7.218 | 1.167 | 1.138 | 7.627 |

| 0.125 | 0.127 | 0.133 | 1.801 | 2.833 | 0.505 | 0.750 | 0.727 | 0.598 | 1.112 | 7.518 | 1.174 | 1.145 | 7.955 |

| 0.120 | 0.124 | 0.138 | 1.811 | 2.830 | 0.495 | 0.738 | 0.732 | 0.604 | 1.154 | 7.806 | 1.180 | 1.153 | 8.268 |

| 0.115 | 0.121 | 0.144 | 1.821 | 2.828 | 0.485 | 0.726 | 0.737 | 0.609 | 1.195 | 8.082 | 1.186 | 1.160 | 8.569 |

| 0.110 | 0.118 | 0.149 | 1.831 | 2.825 | 0.475 | 0.714 | 0.741 | 0.615 | 1.234 | 8.347 | 1.192 | 1.167 | 8.856 |

| 0.105 | 0.115 | 0.155 | 1.841 | 2.823 | 0.466 | 0.703 | 0.746 | 0.620 | 1.272 | 8.602 | 1.198 | 1.174 | 9.132 |

| 0.100 | 0.112 | 0.160 | 1.851 | 2.822 | 0.456 | 0.692 | 0.750 | 0.626 | 1.308 | 8.845 | 1.203 | 1.181 | 9.396 |

| 0.095 | 0.110 | 0.165 | 1.861 | 2.820 | 0.448 | 0.681 | 0.754 | 0.631 | 1.342 | 9.080 | 1.208 | 1.188 | 9.650 |

| 0.090 | 0.107 | 0.170 | 1.870 | 2.819 | 0.439 | 0.670 | 0.758 | 0.636 | 1.376 | 9.305 | 1.213 | 1.195 | 9.893 |

| 0.085 | 0.105 | 0.175 | 1.880 | 2.818 | 0.430 | 0.659 | 0.762 | 0.642 | 1.408 | 9.522 | 1.217 | 1.202 | 10.128 |

| 0.080 | 0.102 | 0.179 | 1.890 | 2.818 | 0.422 | 0.649 | 0.766 | 0.647 | 1.439 | 9.731 | 1.222 | 1.208 | 10.353 |

References

- UNCTAD. World Investment Report; United Nations: New York, NY, USA, 2019. [Google Scholar]

- Wei, S.J. How Taxing is Corruption on International Investors? Rev. Econ. Stat. 2000, 82, 1–11. [Google Scholar] [CrossRef]

- Buchanan, B.G.; Quan, V.L.; Meenakshi, R. Foreign direct investment and institutional quality: Some empirical evidence. Int. Rev. Financ. Anal. 2012, 21, 81–89. [Google Scholar] [CrossRef]

- Bénassy-Quéré, A.; Coupet, M.; Mayer, T. Institutional Determinants of Foreign Direct Investment. World Econ. 2007, 30, 764–782. [Google Scholar] [CrossRef]

- Aizenman, J.; Spiegel, M. Institutional efficiency and the investment share of foreign direct investment. Rev. Int. Econ. 2006, 14, 683–697. [Google Scholar] [CrossRef]

- Knack, S.; Keefer, P. Institutions and economic performance: Cross-country tests using alternative institutional measures. Econ. Polit. Oxf. 1995, 7, 207–228. [Google Scholar] [CrossRef]

- Lee, J.Y.; Mansfield, E. Intellectual Property Protection and U.S. Foreign Direct Investment. Rev. Econ. Stat. 1996, 78, 181. [Google Scholar] [CrossRef]

- Gani, A. Governance and foreign direct investment links: Evidence from panel data estimations. Appl. Econ. Lett. 2007, 14, 753–756. [Google Scholar] [CrossRef]

- Daude, C.; Stein, E. The quality of institutions and foreign direct investment. Econ. Polit. Oxf. 2007, 19, 317–344. [Google Scholar] [CrossRef]

- Jensen, N.M. Democratic Governance and Multinational Corporations: Political Regimes and Inflows of Foreign Direct Investment. Int. Organ. 2003, 57, 587–616. [Google Scholar] [CrossRef]

- Zhang, K.H. Does foreign direct investment promote economic growth? Evidence from East Asia and Latin America. Contemp. Eon. Policy 2001, 19, 175–185. [Google Scholar] [CrossRef]

- Makki, S.S.; Somwaru, A. Impact of FDI and trade on economic growth: Evidence from developing countries. Am. J. Agric. Econ. 2004, 86, 795–801. [Google Scholar] [CrossRef]

- Liu, Z. Foreign direct investment and technology spillovers: Theory and evidence. J. Dev. Econ. 2008, 85, 176–193. [Google Scholar] [CrossRef]

- Bernard, A.; Jensen, B. Exceptional exporter performance: Cause, effect, or both? J. Int. Econ. 1999, 47, 1–25. [Google Scholar] [CrossRef]

- Aw, B.; Chung, S.; Roberts, M. Productivity and Turnover in the Export Market: Micro-level Evidence from the Republic of Korea and Taiwan (China). World Bank Econ. Rev. 2000, 14, 65–90. [Google Scholar] [CrossRef]

- Clerides, S.; Lach, S.; Tybout, J. Is Learning by Exporting Important? Micro-Dynamic Evidence from Colombia, Mexico, and Morocco. Q. J. Econ. 1998, 113, 903–947. [Google Scholar] [CrossRef]

- Helpman, E.; Melitz, M.J.; Yeaple, S.R. Export Versus FDI with Heterogeneous Firms. Am. Econ. Rev. 2004, 94, 300–316. [Google Scholar] [CrossRef]

- Girma, S.; Gorg, H.; Strobl, E. Exports, international investment, and plant performance: Evidence form a non-parametric test. Econ. Lett. 2004, 83, 317–324. [Google Scholar] [CrossRef][Green Version]

- Roy, A.D. Some thoughts on the distribution of earnings. Oxf. Econ. Pap. 1951, 3, 135–146. [Google Scholar] [CrossRef]

- Melitz, M.J. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef]

- Grossman, G.M.; Maggi, G. Diversity and Trade. Am. Econ. Rev. 2000, 90, 1255–1275. [Google Scholar] [CrossRef]

- Grossman, G.M. The Distribution of Talent and the Pattern and Consequences of International Trade. J. Polit. Econ. 2004, 112, 209–239. [Google Scholar] [CrossRef]

- Yeaple, S.R. A simple model of firm heterogeneity, international trade, and wages. J. Int. Econ. 2005, 65, 1–20. [Google Scholar] [CrossRef]

- Rossi-Hansberg, E.; Garicano, L.; Antràs, P. Offshoring in a Knowledge Economy. Q. J. Econ. 2006, 121, 31–77. [Google Scholar] [CrossRef]

- Costinot, A.; Vogel, J. Matching and Inequality in the World Economy. J. Polit. Econ. 2010, 118, 747–786. [Google Scholar] [CrossRef]

- Helpman, E.; Itskhoki, O.; Redding, S. Inequality and Unemployment in a Global Economy. Econometrica 2010, 78, 1239–1283. [Google Scholar] [CrossRef]

- Blanchard, E.; Willmann, G. Trade, education, and the shrinking middle class. J. Int. Econ. 2016, 99, 263–278. [Google Scholar] [CrossRef]

- Jung, J. Technology, skill, and growth in a global economy. Econ. Theory 2019, 68, 609–641. [Google Scholar] [CrossRef]

- Jung, J. Introducing Roy-like worker assignment into computable general equilibrium models. Appl. Econ. Lett. 2020, 27, 503–510. [Google Scholar] [CrossRef]

- Brunetti, A.; Weder, B. Investment and institutional uncertainty: A comparative study of different uncertainty measures. Weltwirtsch. Arch. 1998, 134, 513–533. [Google Scholar] [CrossRef]

- Julio, B.; Yook, Y. Policy uncertainty, irreversibility, and cross-border flows of capital. J. Int. Econ. 2016, 103, 13–26. [Google Scholar] [CrossRef]

- Dixit, A. Entry and Exit Decisions under Uncertainty. J. Polit. Econ. 1989, 97, 620–638. [Google Scholar] [CrossRef]

- Dixit, A. Investment and Hysteresis. J. Econ. Perspect. 1992, 6, 107–132. [Google Scholar] [CrossRef]

- Dixit, A. Irreversible investment with uncertainty and scale economies. J. Econ. Dyn. Control 1995, 19, 327–350. [Google Scholar] [CrossRef]

- Pindyck, R.S. Irreversible Investment, Capacity Choice, and the Value of the Firm. Am. Econ. Rev. 1988, 78, 969–985. [Google Scholar] [CrossRef]

- Pindyck, R.S. Irreversibility, Uncertainty, and Investment. J. Econ. Lit. 1991, 29, 1110–1148. [Google Scholar] [CrossRef]

- Dixit, A.; Pindyck, R. Investment Under Uncertainty, 1st ed.; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Yi, K.M. Can Vertical Specialization Explain the Growth of World Trade? J. Polit. Econ. 2003, 111, 52–102. [Google Scholar] [CrossRef]

- Markusen, J. Multinational Firms and the Theory of International Trade, 1st ed.; MIT Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Girma, S. Absorptive Capacity and Productivity Spillovers from FDI: A Threshold Regression Analysis. Oxf. Bull. Econ. Stat. 2005, 67, 281–306. [Google Scholar] [CrossRef]

- Ubeda, F.; Pérez-Hernández, F. Absorptive Capacity and Geographical Distance Two Mediating Factors of FDI Spillovers: A Threshold Regression Analysis for Spanish Firms. J. Ind. Compet. Trade 2017, 17, 1–28. [Google Scholar] [CrossRef]

- Pearce, D.W.; Barbier, E.B.; Markandya, A. Blueprint for a Green Economy, 1st ed.; Earthscan Publications Ltd.: London, UK, 1989. [Google Scholar]

- World Bank. Expanding the Measure of Wealth: Indicators of Environmentally Sustainable Development; World Bank: Washington, DC, USA, 1997. [Google Scholar]

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jung, J. Institutional Quality, FDI, and Productivity: A Theoretical Analysis. Sustainability 2020, 12, 7057. https://doi.org/10.3390/su12177057

Jung J. Institutional Quality, FDI, and Productivity: A Theoretical Analysis. Sustainability. 2020; 12(17):7057. https://doi.org/10.3390/su12177057

Chicago/Turabian StyleJung, Jaewon. 2020. "Institutional Quality, FDI, and Productivity: A Theoretical Analysis" Sustainability 12, no. 17: 7057. https://doi.org/10.3390/su12177057

APA StyleJung, J. (2020). Institutional Quality, FDI, and Productivity: A Theoretical Analysis. Sustainability, 12(17), 7057. https://doi.org/10.3390/su12177057